- Privacy Policy

- Disclosures

- Do Not Sell My Information

Guide on How To Use United’s TravelBank

by The Frugal Tourist | Jan 6, 2024 | American Express , Travel , United | 22 comments

ADVERTISER DISCLOSURE: The Frugal Tourist is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as MileValue.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Additionally, the content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. All information about the Hilton Honors American Express Aspire Card has been collected independently by The Frugal Tourist. The card details on this page have not been reviewed or provided by the card issuer.

In this blog post, I will walk you through the steps on how to fund and use United’s TravelBank.

Since some credit cards provide travel credits that expire within a year, depositing money in United’s TravelBank is a viable option to utilize those credits so they won’t go to waste.

Funds diverted into United’s TravelBank have a 5-year lifespan, offering some level of longevity and a lot of flexibility, especially since travel is not expected to pick up again anytime soon.

Whether you have plans this year or in the near future, funding your United TravelBank with free cash from your credit cards is a wallet-friendly strategy that can potentially save you a few hundred dollars when the time comes that you need to book your next flight.

United TravelBank

According to United, your TravelBank funds can either be used alone or in combination with select forms of payment only when booking United or United Express flights .

Therefore, we are unable to use United TravelBank to purchase flight itineraries that include segments on partner airlines such as Air Canada, Lufthansa, etc.

I was also unsuccessful in tapping my TravelBank reserves to pay for taxes when booking an award ticket or paying additional fees to cover the airfare difference when redeeming a voucher or rebooking a travel credit.

However, I did not encounter any roadblocks when I booked paid United tickets, even if the airfare was Basic Economy .

Terms and Conditions

The information below was taken from United.com

- Passengers can select from six purchase amount options, and once purchased, the value remains valid for five years from the date it is deposited in your TravelBank account.

- Purchases are not refundable and are limited to $5,000 per day per MileagePlus account.

- This purchase is also subject to all of the TravelBank terms and conditions .

- United has the right to terminate this promotion or to change the promotion’s terms and conditions, rules, regulations, policies and procedures, benefits, and/or conditions of participation, in whole or in part, at any time, with or without notice.

Guide on How to Fund United’s TravelBank

Access United TravelBank by clicking the button below. You will need to log in to your United Mileage Plus Account to purchase.

Do not have a United membership yet?

It is free and easy to register. Click the button below to enroll in United’s Mileage Plus Program.

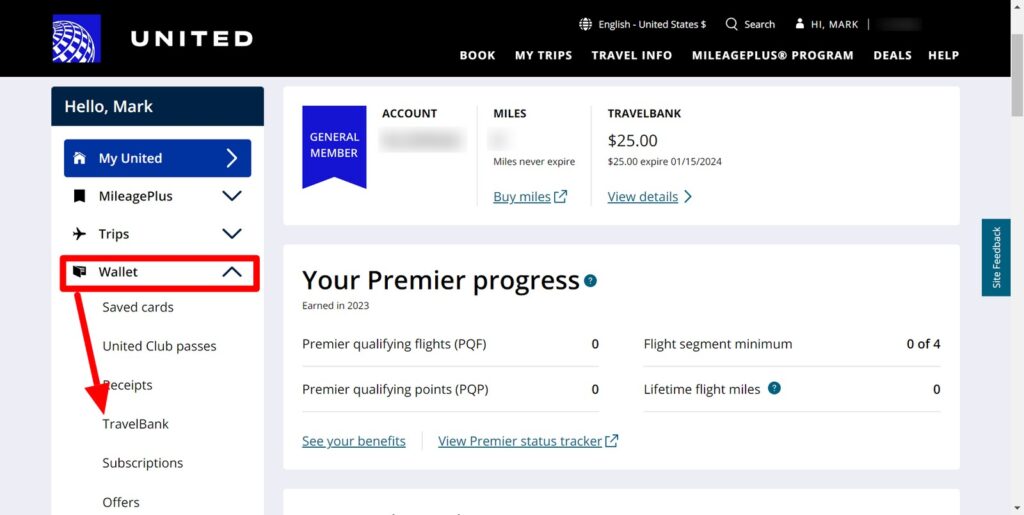

After logging in, you will see your United Mileage Account, any United miles you have available for redemption, and your TravelBank Cash Balance.

Plus Points – a points system that passengers can utilize to upgrade their flights – will also show up, but we will not go over that in this post. You can read more about this program here.

Select the amount of travel cash you want to purchase.

As previously stated, there are six possible amounts that you can elect to deposit to your TravelBank.

The next page will ask for you to type in your Payment Information.

In this case, you would want to use a credit card that provides an Airline Credit.

I will list these credit cards in one of the sections below.

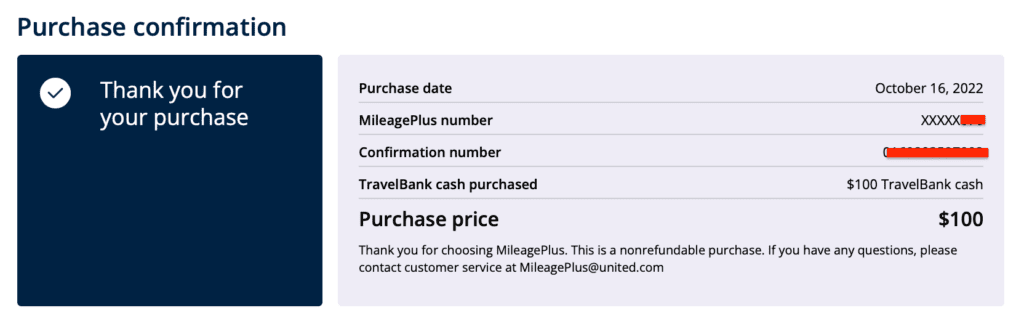

You will then get confirmation that your purchase was successful. A receipt will be emailed immediately after as well.

In this example, I used my The Business Platinum Card® from American Express to buy $100 worth of travel cash in United’s TravelBank.

Guide on How to Use Your United Travel Bank Cash

Thankfully, we are generously given five years to spend our travel cash.

Once you are ready to book your flight, log back on to your United.com profile and enter your travel details.

United TravelBank purchased using certain IHG Credit Cards has a shorter lifespan. Please check the terms of your IHG Credit Cards for the most current UnitedTravel Bank policy.

Select your particular flight, verify your personal information, and pick your seat.

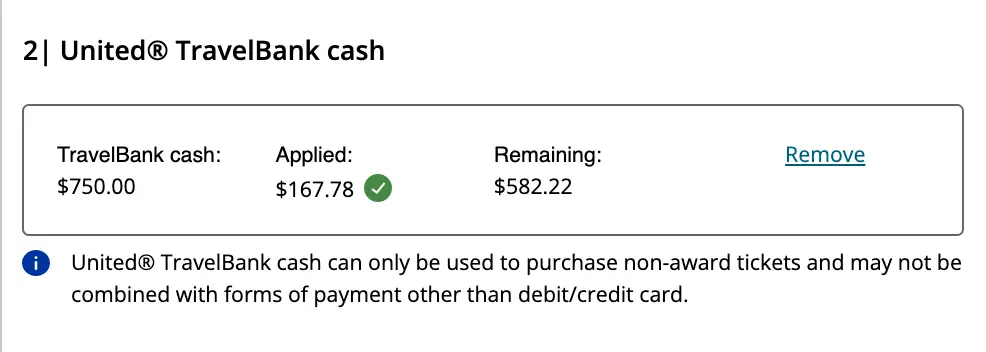

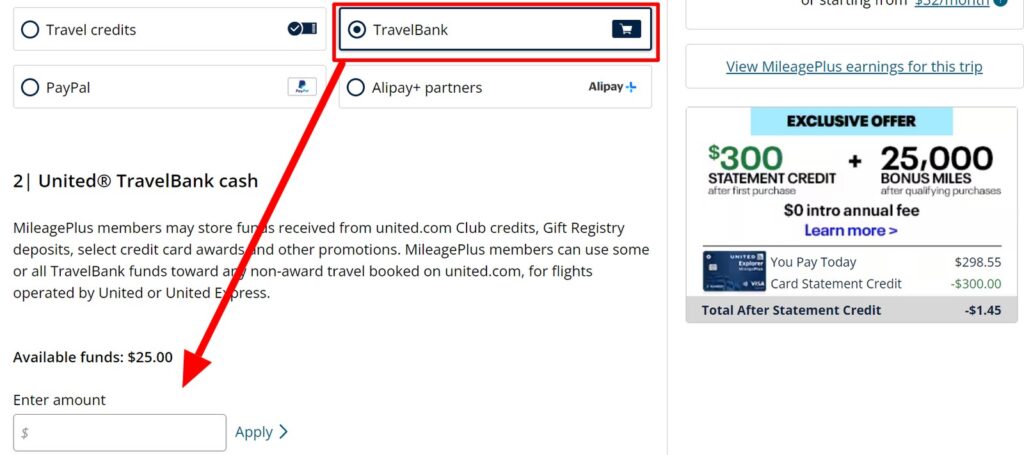

Afterward, you will be directed to the Payment Page.

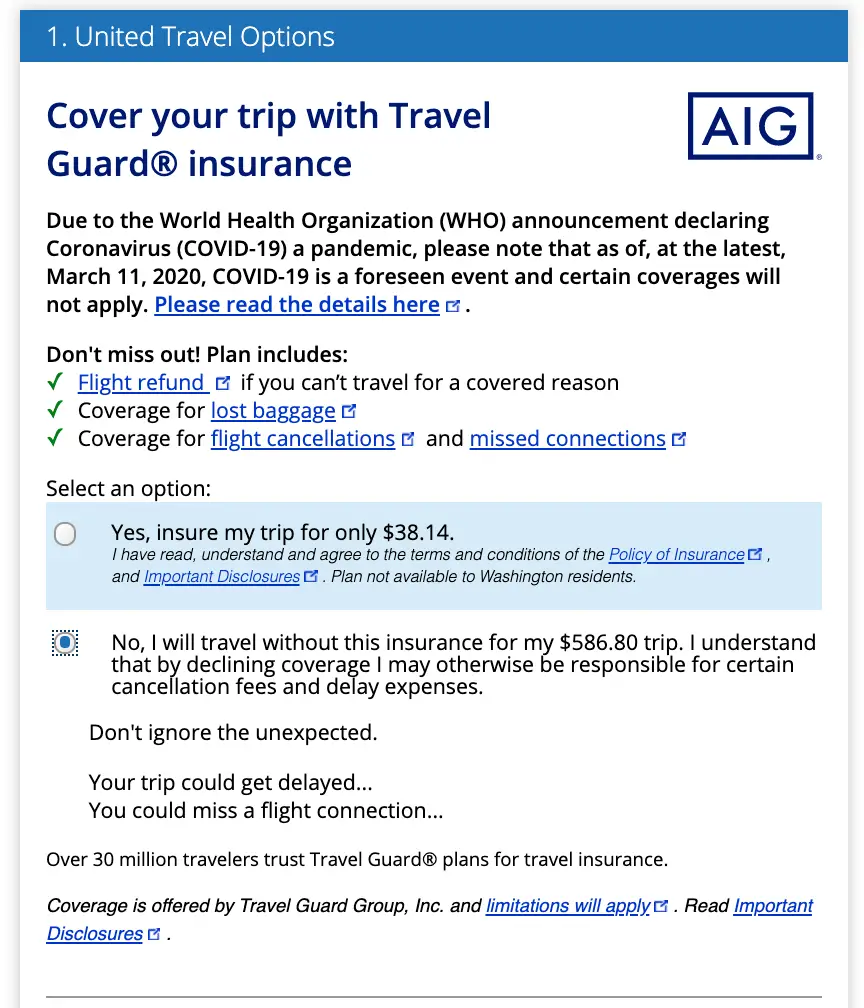

Next, United will offer you travel insurance (select yes/no), priority boarding, and miles for purchase.

Regardless of whether you decide or decline to purchase these additional bells and whistles, the payment section comes right after.

You have the following payment options:

- Pay In Full

- Pay Monthly

- Travel Certificates and United TravelBank Cash (if this option does not appear, then the ticket you’re buying is not a permitted purchase using travel cash.)

- Other Forms of Payments (PayPal, etc)

- Debit / Credit Card

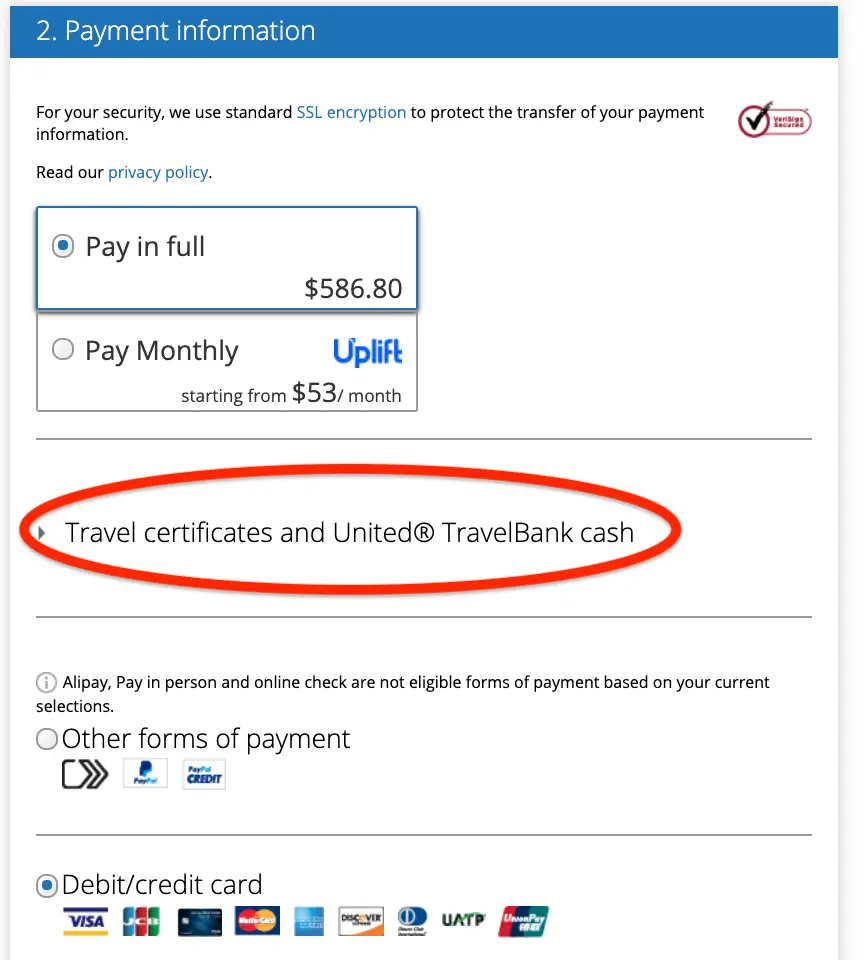

Select “Travel Certificates and United TravelBank Cash.”

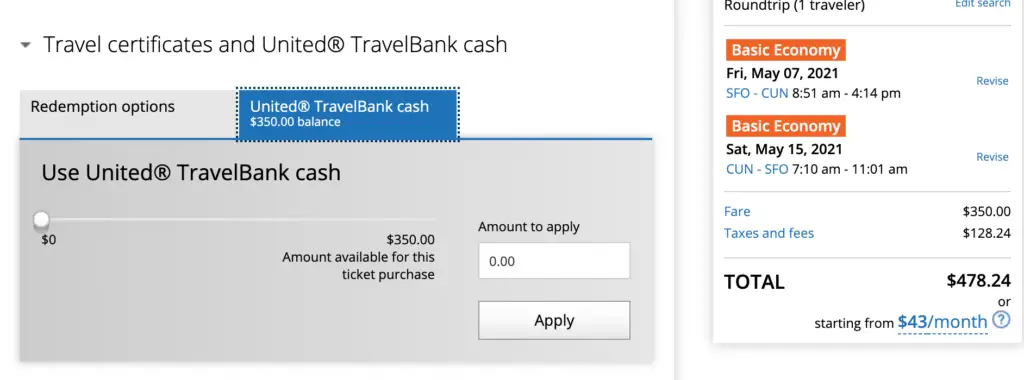

As you can see, my $100 travel bank deposit is already reflected in my account.

Next, enter the amount you want to use for the flight you wish to book.

It is not necessary to spend your entire stash of United travel cash if you have other plans to spend it later.

Once you have a final amount in mind, click apply.

In this example, I decided to spend $75 of the $100 currently in my United TravelBank.

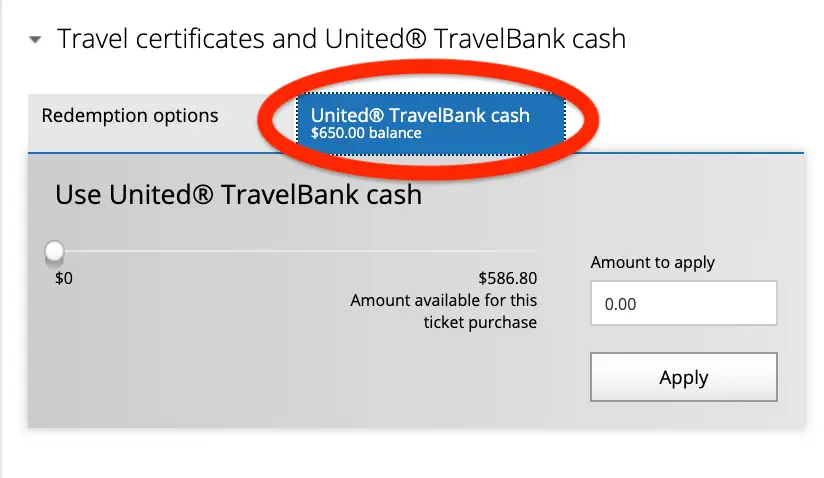

After your travel cash is deducted, the total amount you still owe will automatically be calculated.

Continue with your purchase by selecting the mode of payment you want to use for the remaining balance.

I highly recommend paying a portion of the flight with a credit card that offers travel protections, such as the Chase Sapphire Preferred® Card or the Chase Sapphire Reserve®.

Alternatively, you can purchase travel insurance to cover your entire trip.

Where Do I Find My TravelBank Account?

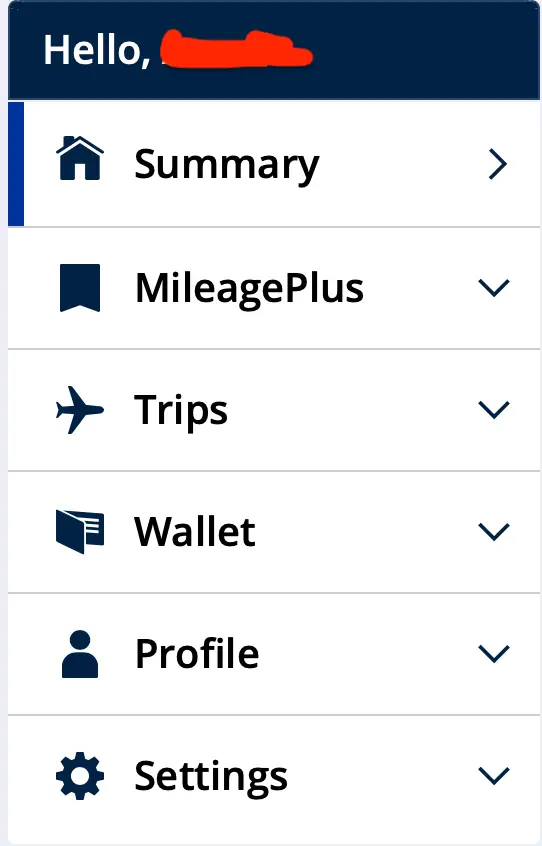

United has recently updated its website. You can find your United TravelBank account information and balance by navigating to your United Wallet on the app and the computer.

Troubleshooting Potential Issues

Issue 1: united travelbank does not show up.

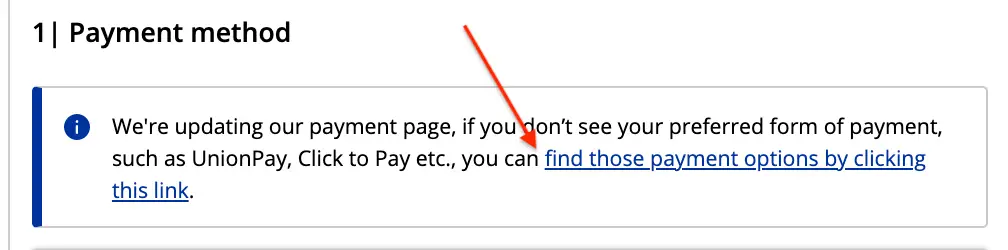

A few readers have expressed that they are having difficulty locating the TravelBank option on United’s website.

It appears that United’s site is currently updating its payment page. When you see the notice below under “Payment Method, ” click the “find those payment options…” link.

This link will direct you to the “United Travel Options” section, where you can add travel insurance to your purchase. Make your selection.

Afterward, you will be directed to “Payment Information,” where the TravelBank option appears.

Click “Travel Certificates and United TravelBank Cash” and select Travel Cash as your mode of payment.

Type the amount you would like to spend.

As suggested, charge a small portion of your airfare on a credit card that provides travel insurance, like the Chase Sapphire Preferred® Card or the Chase Sapphire Reserve®.

You may also elect to purchase travel insurance for additional coverage.

Issue 2: United TravelBank Keeps On Freezing

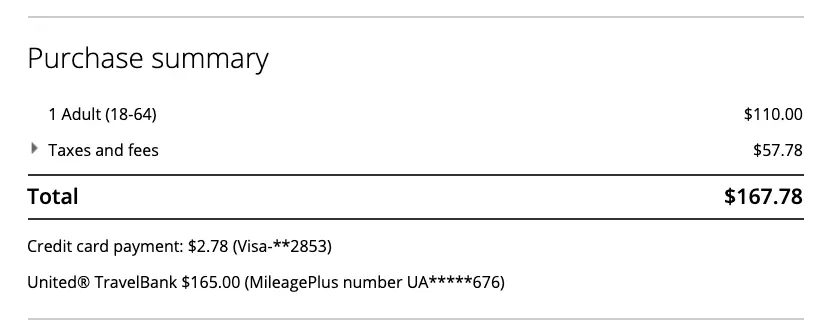

While booking a plane ticket to Cabo costing $167.78 recently, I found the United website struggling to process my TravelBank payment, ultimately freezing the payment page.

After attempting various troubleshooting strategies, I eventually made it work by typing a whole number into the TravelBank box.

In this case, I redeemed $165 of my TravelBank credits towards the purchase of this ticket and used a credit card that gives travel protections ( Chase Sapphire Reserve® ) to cover the remaining amount ($2.78).

Issue 3: TravelBank is Unable to Add a New Credit Card (Payment Error)

United.com can only save a certain number of credit cards on your profile.

If the website is not allowing you to add another credit card to your United TravelBank account, you will need to log in to your main United.com account, go to “Wallet,” remove the credit cards that you no longer use, and then add the ones you would like saved.

Once your new credit card is linked, note the last four digits of your card and its expiration date so you can easily find it on your list of saved cards when you try to purchase United TravelBank funds again.

Issue 4: Unable to Purchase

As mentioned above, your United TravelBank funds can either be used alone or in combination with select forms of payment when booking United or United Express flights only.

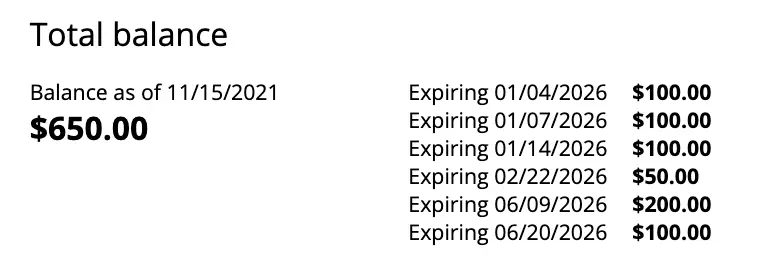

When Do United TravelBank Funds Expire?

As of this update, TravelBank funds appear to expire after five years.

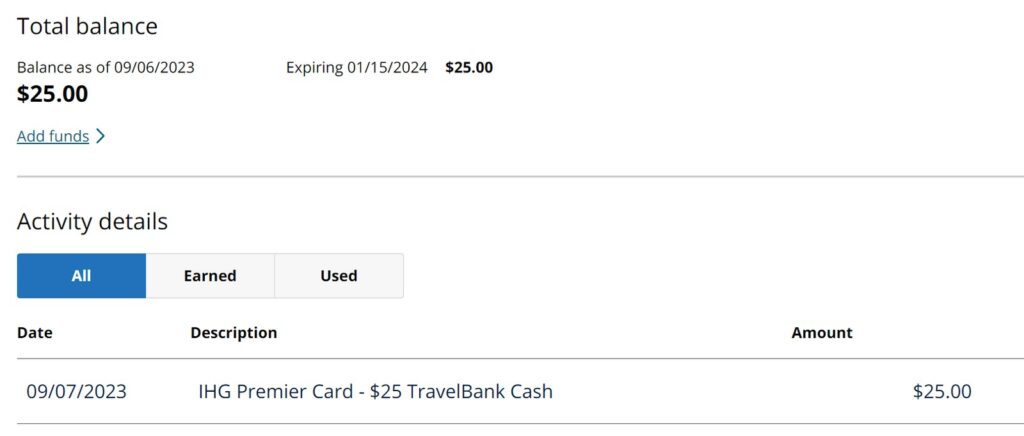

The screenshot below, captured from my TravelBank account, supports this assertion.

While the money deposited in our United TravelBank accounts has a 5-year validity, it can be forfeited if no activity is recorded in our TravelBank accounts for 18 consecutive months.

Therefore, ensure that you either add money to your TravelBank or use your TravelBank funds to purchase tickets at least once every 18 months.

Heads Up: United also stipulated that any re-deposited funds originating from canceled tickets purchased with TravelBank money do not qualify as an eligible activity. In short, any re-deposited funds will NOT reset the expiration date.

United may also change the expiration date of subsequent deposits or discontinue the program altogether. Only time will tell.

For now, this option to convert our credit card airline credits to some form of flexible currency is available, so certainly consider this method if you are running out of ways to redeem your expiring credits.

Which Credit Cards to Use?

You should only purchase TravelBank funds when you anticipate no other eligible travel-related purchases for the remainder of the year.

Chase Credit Cards

Chase sapphire reserve® (csr).

The Chase Sapphire Reserve (CSR) comes with a $300 travel credit that resets every year on the card member’s anniversary date and does not roll over onto the following year; therefore, you either use it or lose it.

I do not recommend using your CSR travel credits to purchase funds on United’s TravelBank, given that Chase provides an extensive array of valuable avenues to redeem this credit.

In addition to the traditional airfare purchase, you can also trigger the travel credit when paying for public transit, ride-sharing services, parking, hotels, campgrounds, cruises, etc.

Citi Credit Cards

Citi prestige® credit card.

This card is no longer available to new applicants.

This credit card comes with a $250 travel credit, which can now be conveniently spent on groceries, restaurants, and take-out.

Like the Chase Sapphire Reserve, this credit resets every calendar year and likewise does not roll over.

I do not suggest using your Citi Prestige travel credits to purchase United TravelBank funds because of other beneficial spending options you have at your disposal.

American Express Credit Cards

American express® credit cards with airline fee credits.

- The Platinum Card® from American Express ($200 Annual Airline Credit)

- The Business Platinum Card® from American Express ($200 Annual Airline Credit)

- Hilton Honors American Express Aspire Card ($50 Quarterly Airline Credit)

American Express’s airline fee credit is challenging to redeem compared to Chase’s and Citi’s more flexible identical offerings.

In the past several years, consumers consistently find themselves jumping through hoops in search of effective methods to capitalize on these generous offers.

First and foremost, Chase and Citi do not require activation – their credits apply to all airlines and other forms of travel.

Whereas Amex’s airline fee credit will not work unless you activate it.

Plus, it can only be used on one airline you pre-select, ideally at the beginning of the year.

Even though there are data points (DP) that Amex has been lenient in allowing the preferred airline to be changed via chat as of late, there is no way to predict until when they will allow this.

AMEX Airline Fee Credit Restrictions

AMEX has strict restrictions on what fees qualify under this credit.

Technically, only incidental purchases, such as seat assignments, baggage fees, change fees, lounge access fees, and food/beverage inflight purchases, are eligible.

As such, traditional expenses such as award fees, plane tickets, upgrades, and gift cards do not qualify.

But occasionally, we see additional methods that temporarily open up that trigger this airline fee credit – and for now, United TravelBank is one of them.

While no language explicitly states this particular purchase will not qualify, I have to underscore that Amex can undoubtedly claw back this credit at any moment if they deem that TravelBank is not eligible. So, just be aware of that possibility.

Hence, please utilize this tactic only if you do not anticipate using your airline fee credit throughout the rest of the year.

Steps in Selecting Your Airline With Amex

Before you go ahead with your purchase, follow the steps below on selecting your preferred airline, as AMEX does not make it simple to locate where to activate this benefit.

To optimize this TravelBank strategy, make sure that the airline you selected is United.

Go to AmericanExpress.com, then log in to your account.

Select the particular AMEX credit card that currently offers an airline fee credit.

- The Platinum Card® from American Express

- The Business Platinum Card® from American Express

- Hilton Honors American Express Aspire Card

On the main page, click “More, ” then select “ Benefits .”

On the Benefits page, scroll down to locate “ Airline Fee Credit. ”

This is where you can also change your selected airline for the year.

It bears repeating that you’re technically not allowed to change your preferred airline mid-year, so choose wisely.

With that said, there are data points from people reporting that they have successfully modified their airline choice by contacting AMEX through chat, but this is YMMV (your mileage might vary).

As of this writing, you can use your airline fee credit with the following U.S. carriers:

While on the Benefits page, enroll in all the offers available to you even if you are not sure you will use them.

It is practically money you had already paid for when you paid your annual fee, so you might as well take advantage of it.

At any rate, maximizing this airline fee credit is a fantastic way to offset the steep annual fees Amex charges on their ultra-premium cards.

Add funds to your travel credit using your AMEX card.

If you are unsure how much airline credit you have left, AMEX generates a tracker under this benefit to display your remaining funds.

Periodically check your Amex credit card to see if the airline fee credit was successfully triggered.

If not, Amex has likely terminated this redemption method.

Final Thoughts

Indeed, United’s TravelBank is a wonderful addition to the dwindling menu of possible purchases that can activate Amex’s elusive airline credit.

Being fully aware that this method is temporary, I try to take advantage of it while it’s still possible, especially when I am on the verge of running out of redemption alternatives for my Amex airline fee credit.

I hope that Amex follows Chase’s and Citi’s lead and relaxes this benefit, making it much easier to redeem in the future.

Until then, we will have to adjust to American Express’ policies.

Ultimately, I am glad that United’s TravelBank provides us with another fantastic alternative for using our travel credits.

Not only does it prolong the shelf-life of our funds, but it also affords us the flexibility we genuinely need.

EDITORIAL DISCLOSURE – Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. The content has not been reviewed, approved, or otherwise endorsed by any of the entities included within the post.

Related posts:

22 comments.

Bank of America Premium card also include benefits of $100 incidental travel credits, can I use it to purchase United Travel Bank fund too?

Hi Angie, I am not familiar with Bank of America rules but upon checking what qualifies under “incidental”, I got the following info: Get up to $100 in Airline Incidental Statement Credits annually for qualifying purchases such as seat upgrades, baggage fees, in-flight services, and airline lounge fees – automatically applied to your card statement.

It seems to me that this is similar to Amex. I would suggest purchasing the lowest allowed denomination of $50 to see if it would trigger it but if you have anticipated travel in the near future, I suggest redeeming the credits there instead.

Hi, I booked the ticket and when I entered the payment page, there is no Travel Bank part, I got 200+ dollars in travel bank and cannot seem to use it. Why is this? I can only see “Travel certificates” instead of “Travel certificates and United Travel Bank Cash”. What should i do?

Hi Tristan, thanks for asking. Sorry about that. Not all purchases in United.com are eligible. I wonder if the ticket you are purchasing includes a partner airline. From the Terms and Conditions: “TravelBank Cash is valid for air travel purchases on United and United Express® flights and as otherwise permitted by United. After a TravelBank Award is issued, a service charge may be imposed for each change or cancellation requested by the Member.”

I have encountered this exact problem and I am definitely booking a United airline airfare (from LAX – EWR): any more update on this?

HI Cindy, I had updated the post with hopefully a potential solution to your problem. Jump to the section “What to do? United Travel Bank Does Not Show Up”. I tried your route (LAX-EWR) and the steps I outlined worked in making Travel bank re-appear! Good luck and please let me know if it worked for you too!

Thank you for this post and the very detailed instructions!!! Really helpful as I’ll be using this as long as we can get that $200 credit from Amex Plat!

Thank you Tony for the kind feedback. I am glad you found it useful. Please feel free to ask questions anytime.

Great information, thank you!

Thank you so much!

Its unfortunate you can’t use your Travel Bank just to upgrade your seat. Or pay for the bundles upon checkout

I am sorry! Sadly, it is just not as flexible 🙁 But United might make some changes in the future that will allow us to use it for incidentals.

Newbie to United Travel Funds.

Is it possible to use it for booking a ticket for anyone else, any restrictions?

You can book it for anyone else. When they cancel though, the travel credits will be under their account.

This article saved me 30mins! I was typing a non-whole number to use my United Travel Bank and it would NOT take it. Apparently, it needs to be a WHOLE NUMBER. Thanks for the tip!

Glad you found it useful!

Can you combine miles and a travel bank balance? I have 33k miles I need to use and $600 in travel bank credits.

Unfortunately, you can not mix miles and travel bank balance. I’d use the travel bank first if you find cheap tickets as those expire. United miles do not expire.

Hi, how long does the Amex Airline Credit usually take? It’s been a week now and my credits have not shown up yet.

HI Kunal. It’s been about 10 days, on average, for me.

I wanted to add that you Travel Bank does not come up as an option to pay if your flight involves a leg operated by a partner airline (eg. Swiss Air).

I called United to see if they could book the ticket but it errored out for the representative and he gave me that as the reason.

This might be helpful to incorporate in your article.

HI Stephanie, thank you for sharing. That’s correct. Apologies that it was not clear in the article. Yes, it is sadly for United and United Express flights only. I highlighted that part of the article and added additional language under Troubleshooting so it’s much clearer. Thanks so much again for the feedback and Safe travels!

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

JOIN OUR FREE FACEBOOK TRAVEL MILES AND POINTS COMMUNITY!

TRAVEL MILES AND POINTS

- $15 Discount On $300+ Mastercard Gift Cards At Office Max / Depot

- Transfer American Airlines Business Credit Card Miles to AAdvantage Accounts

- $15 Discount On $300+ Visa Gift Cards At Office Max / Depot

- Earn 5X Chase Points Per Dollar: Staples Fee-Free Visa Gift Cards

- Earn 5X Travel Points: Staples Fee-Free Mastercard Gift Cards

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

United TravelBank Card: Closed to Applications, Replaced by United Gateway

What’s on This Page

The bottom line, pros and cons, detailed review, compare to other cards, benefits and perks, drawbacks and considerations, how to decide if it's right for you.

The card was suited to those who didn't travel much, but who flew United when they did travel. But it did not offer flexibility or traditional airline-card perks.

Rewards rate

Bonus offer

$150 in United TravelBank cash after you spend $1,000 on purchases in the first 3 months from account opening.

Ongoing APR

APR: 15.99%-22.99% Variable APR

Cash Advance APR: 24.99%, Variable

Balance transfer fee

Either $5 or 5% of the amount of each transfer, whichever is greater.

Foreign transaction fee

- Earn 2% in TravelBank cash per $1 spent on tickets purchased from United.

- Earn 1.5% in TravelBank cash per $1 spent on all other purchases

- No foreign transaction fees

- Enjoy 25% back as a statement credit on purchases of food, beverages and Wi-Fi onboard United®-operated flights when you pay with your United TravelBank Card.

- TravelBank cash is easy to use. $1 in TravelBank cash = $1 when used toward the purchase of a United ticket.

- Your TravelBank cash accumulates in your United TravelBank account on United.com.

- $0 Annual fee

High rewards rate

No annual fee

No foreign transaction fee

» This card is no longer available.

The United℠ TravelBank Card is no longer accepting applications. United Airlines and Chase have introduced a new credit card with no annual fee, the United Gateway℠ Card , which effectively takes the place of the TravelBank Card. Read our review of the United Gateway℠ Card , or explore other United Airlines credit card options . Below is our review of the United℠ TravelBank Card from when the card was still on the market.

If you fly United Airlines, the United℠ TravelBank Card might be tempting because of its annual fee of $0 . But it ultimately might not be worthwhile for most United flyers because of all that it lacks as an airline card.

The card has its own rewards currency that you can use to book free United flights. And its rewards rate is decent for both United spending and all other spending. It’s kind of like a cash-back card, where you can spend the cash only at United.

But you won't get free checked bags or early boarding like you do with many airline cards. And you won’t earn United MileagePlus miles, the airline’s frequent-flyer miles that have a chance at returning huge value.

If you want a card like this one, just get a true cash-back card . Then, you can spend your cash rewards on anything, not just United flights. Otherwise, ante up for a United card with an annual fee that comes with useful airline perks. There’s a good option in the United℠ Explorer Card .

» MORE: How to choose an airline credit card

United℠ TravelBank Card : Basics

Card type: Airline .

Annual fee: $0 .

2% in TravelBank cash per $1 spent on tickets purchased from United.

1.5% in TravelBank cash per $1 spent on all other purchases.

Sign-up bonus: $150 in United TravelBank cash after you spend $1,000 on purchases in the first 3 months from account opening.

Foreign transaction fee: None.

Interest rate: The ongoing APR is 15.99%-22.99% Variable APR .

Noteworthy perks:

25% back as a statement credit on purchases of food, beverages and Wi-Fi onboard United-operated flights when you pay with your card.

No foreign transaction fees.

Trip cancellation/interruption insurance.

Rental car insurance.

Purchase protection.

» MORE: Benefits of United Airlines credit cards

Simple rewards earning

With a typical airline card, you earn frequent flyer miles or points with every purchase. You then redeem those rewards for free flights or seat upgrades. But frequent flyer programs can be exceedingly complicated. The number of miles you’ll need for a particular flight depends on an array of factors. On top of that, the flight you want might not have award seats available. And your preferred travel dates might be “blacked out” — that is, reserved for paying customers.

The United℠ TravelBank Card eliminates the whole idea of miles. Instead, you earn “TravelBank cash,” which is redeemable for travel with United on a simple dollar-for-dollar basis.

The card earns 2% back on United purchases and 1.5% back on everything else. A $500 United flight, for example, would earn $10 in TravelBank cash. A $500 purchase elsewhere would earn $7.50.

Simple rewards redemption

When booking a flight with United, you can pay some or all of the fare with your accumulated TravelBank cash rewards. Consider a ticket that costs $400. If you had at least $400 in TravelBank cash, you could use it to pay the entire fare. If you had only $50 in rewards accumulated, you could apply it to the fare and reduce the cost to $350.

Some travel credit cards have annual fees measured in hundreds of dollars, while the typical airline card often charges a fee of close to $100 per year. This card has an annual fee of $0 .

Sign-up bonus

For a simple credit card with an annual fee of $0 , it’s a pleasant surprise to have a sign-up bonus: $150 in United TravelBank cash after you spend $1,000 on purchases in the first 3 months from account opening.

» MORE: NerdWallet's best airline cards

The United℠ TravelBank Card is light on flash compared with most travel cards, but it comes with minor perks:

In-flight discount: 25% back as a statement credit on purchases of food, beverages and Wi-Fi onboard United-operated flights when you pay with the card.

No foreign transaction fees: Travel cards generally don’t charge a fee — 3% is common — for making purchases abroad. This United card doesn’t, either. And it uses the Visa network, which is widely accepted abroad.

Travel-related insurances: Trip cancellation/interruption insurance and secondary rental car insurance are nice-to-haves on an airline card.

Purchase protection: Covers new purchases made with the card for 120 days against damage or theft, up to $500 per claim and $50,000 per account.

How it compares with other United cards

The United℠ TravelBank Card is one of three co-branded consumer United Airlines credit cards. Its siblings pack more perks.

Here’s how they compare on key features:

Business owners, even those with side gigs, might consider the United℠ Business Card .

» MORE: Full review of the United℠ Business Card

No checked bags or early boarding

At $35 per bag each way when you don't prepay, fees for first checked bags add up in a hurry, especially when you’re traveling with others on your itinerary. That’s why typical airline cards are so valuable. But this card has no checked-bag-fee waivers, so you’ll have to pay. And you won’t get boosted toward the front of the boarding line, because the card lacks a priority boarding perk. That could hurt you when looking for overhead bin space.

» MORE: Airline credit cards that offer free checked bags

The logical solution is the United℠ Explorer Card . It offers:

2 MileagePlus miles per dollar spent on purchases from United.

2 miles per dollar spent on restaurant purchases and hotel stays.

1 mile per dollar spent on all other purchases.

First checked bag free for you and a companion on your reservation, if you use the card to purchase your ticket.

Two United Club one-time use passes per year.

Global Entry/TSA Precheck statement credit every four years.

25% off in-flight purchases.

Sign-up bonus: Limited-time offer: Earn 60,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open.

It has an annual fee of $0 intro for the first year, then $95 .

» MORE: Full review of the United℠ Explorer Card

You won’t earn United MileagePlus miles with this card. That keeps things simple, but you also lose the potential to reap outsize value by scoring a great awards seat — like a business-class international fare worth thousands of dollars — for relatively little spending.

Fewer benefits

Some airline cards give you perks at the airport. They might reimburse you the application cost of Global Entry or TSA Precheck to get through security lines quicker, or get you free or discounted passes to an airport lounge.

This card offers none of those.

» MORE: Cards that offer airport lounge access

Limited reward redemptions

Redeeming rewards is relatively simple, but you’re still locked into United Airlines. That's limiting compared with general travel credit cards , which allow you to apply rewards to a wide range of travel-related expenses.

An option for those looking to avoid an annual fee is the Bank of America® Travel Rewards credit card .

1.5 points per dollar spent.

3 points per dollar spent on eligible travel booked through the Bank of America® Travel Center.

A value of 1 cent per point when redeemed for travel credit and a little over half a cent per point for cash.

A sign-up bonus.

The Bank of America® Travel Rewards credit card isn't tied to an airline or hotel chain. Book travel any way you want, with no restrictions and no blackout dates, and then use points to wipe out the cost on your statement. Bank of America® also has one of the broadest definitions of "travel" of any major issuers. You can use points to get credit for airfare, hotel stays, cruises, car rentals, campgrounds, art galleries, amusement parks, carnivals, circuses, aquariums and zoos.

» MORE: Full review of the Bank of America® Travel Rewards credit card

The United℠ TravelBank Card offers a simpler way to earn free flights on United Airlines for casual flyers committed to that airline. But honestly, you’re better off with a cash-back credit card .

If you spread your flying among a number of carriers or want more flexibility, consider a general travel credit card . United loyalists are likely to get more value from the United℠ Explorer Card .

Information related to the United℠ TravelBank Card has been collected by NerdWallet and has not been reviewed or provided by the issuer of this card.

This card earns bonus rewards in multiple categories, including dining and travel. You can transfer points on a 1:1 basis to about a dozen hotel and airline programs, including United, or you can use them to book travel through Chase at 1.25 cents per point. However, you won't get any airline-specific perks. Annual fee: $95 .

Looking For Something Else?

Methodology.

NerdWallet reviews credit cards with an eye toward both the quantitative and qualitative features of a card. Quantitative features are those that boil down to dollars and cents, such as fees, interest rates, rewards (including earning rates and redemption values) and the cash value of benefits and perks. Qualitative factors are those that affect how easy or difficult it is for a typical cardholder to get good value from the card. They include such things as the ease of application, simplicity of the rewards structure, the likelihood of using certain features, and whether a card is well-suited to everyday use or is best reserved for specific purchases. Our star ratings serve as a general gauge of how each card compares with others in its class, but star ratings are intended to be just one consideration when a consumer is choosing a credit card. Learn how NerdWallet rates credit cards.

About the author

Gregory Karp

Travel on Point(s)

- Playing Around With The IHG Card United TravelBank Perk

- January 3, 2024

- Mark Ostermann

Travel on Point(s) is an independent, advertising-supported website. This site is part of an affiliate sales network and receives compensation for sending traffic to partner sites like Cardratings.com. This compensation does not impact how or where products appear on this site. Travel on Point(s) has not reviewed all available credit card offers on this site. Reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any partner entities.

IHG Card United TravelBank Credit

If you have been following along then you know I decided to update my old IHG Mastercard to the IHG Premier card . It just made too much sense for me not to. If you want more info on why you can read my full breakdown . One of the perks that comes with the IHG Premier card, and IHG Business card as well, is the IHG card United TravelBank credit perk. I finally got around to getting mine set up so I thought I would share the process of getting your yearly United TravelBank credits locked in. I'll also go over all the details on the perk and how to maximize it.

Table of Contents

Update 1/3/24: This is now reset and ready to be used. Pay attention to the details on a potential double dip if you don't have an immediate use, or how to lock it in for longer, below.

What Is The IHG Card United TravelBank Credit?

The IHG card United Travel bank credit allows you to earn up to $50 in United TravelBank Cash each calendar year. It is broken into two different $25 credits throughout the calendar year, which is a little annoying. Here is how they divide up the credits, which you may notice will overlap for a few days:

- This credit will be valid through July 15th

- This credit will be valid through January 15th

How To Register Your IHG Card For Your TravelBank Credit

Now that we know when we get this IHG card United TravelBank credit on our IHG Premier and IHG Business card, how do we go about earning them? Here is a step by step process:

- Log into your United account to grab your United Mileageplus number

- Next you need to link your IHG and United accounts HERE .

- Once you open the link you will be prompted to log into your IHG account.

- If you have an eligible card it will ask for your United Mileagplus number and last name. Enter your info hit submit.

- It may take up to two weeks for your registration to take effect.

- TravelBank Cash can only be used on United® or United Express® purchases and cannot be refunded or exchanged to be used for reservations at IHG® Hotels & Resorts or other purchases.

- Unfortunately you can only get the credit on one IHG card even if you carry both the Premier and the Business cards.

Even though it says it can take up to two weeks for your $25 to show up mine was in my United account within seconds.

What About In The Future?

It appears that after your initial activation the credit should automatically hit your account in the future. This could take a few days after the first of January and first of July.

Where To Find Your United TravelBank Balance

Once you have the programs linked you will want to head back over to your United Mileageplus account and locate your TravelBank balance. Here is how you do that.

When logged into your United account go to the My United section. Once you are there you can see the TravelBank balance at the ToP of your account page. To get a more detailed look you click on

- Then the Wallet drop down

- Las select TravelBank

After opening the TravelBank section you get a little more of a breakdown of your credits. If you use the United TravelBank for your Amex airline incidentals credit you will see those in here too. It will give you the expiration date for each credit as well.

How To Redeem Your United TravelBank Balance

Now that we know how to activate our IHG Card United TravelBank credit, how to maximize it (in theory) and where it is located in our United account, how do we actually go about using it? It is pretty simple.

When you go to pay for a flight just select your TravelBank credit on the payment screen and then enter how much you want to use. You can pay for the rest of your flight, if there is anything left over, with your favorite travel rewards credit card. Hopefully it is one with great travel protections like the Chase Sapphire Reserve or Chase Sapphire Preferred . You do not, and should not, need to use your IHG Premier or IHG Business card to pay the remainder of the flight.

IHG Card United TravelBank Credit: ToP Thoughts

I had not given the IHG card United TravelBank credit much thought in the past since I don't often fly United and I didn't have a Premier card before. After diving into the perk a bit I like how easy it is to set up and use. I ended up using it within the first week of getting my card, but more on that in a future article. Even if you don't have an immediate use for the United TravelBank credit you can hopefully turn it into a United travel credit that extends the life and usefulness of this perk.

What value do you give the IHG card United TravelBank credit? Let us know over in the ToP Facebook Group .

- Join Facebook Group

Recent Posts

(1 new) current transfer bonus list & history of transfer bonus offers, marriott loses airline transfer partner, us passport renewals online & 10 most expensive expat cities, (new sale) massive discount on thrifty traveler premium, $100 clear sign up bonus, what should i buy at dell 75k offers are hanging around & more, dell is 12x (or 12%) back on rakuten today burn those amex business platinum credits, top posts & pages.

- A New Amex Pop-Up Like Change For 5/24 Cards (YMMV)

- Burn Amex CLEAR Credits & Get $100 Travel Credit

- Easy Money Maker: $10 Apple Pay Amex Offer

- SURPRISE! Chase Sapphire Referrals Remain at 75,000 Points

Current Point Transfer Bonuses I wanted to put together a bookmarkable page that will be

ToP Roundup In this series I will share articles I found interesting from all over

Thrifty Traveler Premium Sale If you love booking award travel, you know that sometimes you

ToP Weekly Review I hope everyone had a great week! Welcome to our ToP weekly

Dell 12% Back On Rakuten We don’t normally post about individual store’s rates on shopping

SIGN UP TO RECEIVE ToP TIPS STRAIGHT TO YOUR INBOX

We promise to keep things short, sweet, and packed with awesome insights!

Please turn on JavaScript in your browser

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Dream, discover, book with Chase Travel

Go further when you book with Chase Travel

Competitive rates.

Take advantage of competitive rates at thousands of hotels and resorts, with no booking fees.

Seamless booking

Smoothly plan and book your whole trip, from coveted hotels and convenient flights to cars and must-do local experiences.

Premium benefits

Make the most of your card rewards. Access exclusive benefits and earn and redeem like never before.

Find inspiration

Don’t just dream it. Discover your next adventure with help from fresh trip recommendations and curated picks for unforgettable stays.

Get rewarded

Earn and redeem Ultimate Rewards points with your eligible Chase card, including Chase Sapphire, Freedom, Ink Business credit cards and more.

- ATM locations

- ATM locator

Estás ingresando al nuevo sitio web de U.S. Bank en español.

U.s. bank visa ® platinum card, enjoy a low intro apr for 21 billing cycles*.

For a limited time, get our best rate: 0% intro APR * on purchases and balance transfers † for 21 billing cycles . After that, the APR is variable, currently $ .

Get a decision in as little as 60 seconds.

Mobile Carrier Terms 1

0% intro APR

For a limited time, get a special 0% introductory APR * on purchases and balance transfers † for 21 billing cycles . After that the APR is variable, currently $ .

Great benefits

Enjoy great benefits with no annual fee .

Your credit score

View your credit score anytime, anywhere in the mobile app or online banking. It's easy to enroll, easy to use and free to U.S. Bank customers. 2

Additional benefits

Pay over time with a u.s. bank extendpay ® plan. 3.

Receive a new cardmember $0 fee offer* on ExtendPay Plans opened in the first 60 days after account opening. 3

Auto pay & due date choice

Avoid interest and late fees with automatic payments that put you in control. Pick a payment due date that works for your schedule. 4

ID Navigator Powered by NortonLifeLock ™

Get tools to help keep you informed of threats that may affect your identity. 5

Cell phone protection

Get up to $600 reimbursement if your cell phone is stolen or damaged when you pay your monthly cell phone with your card. 6

Apply for the card that earned NerdWallet’s Best-Of Award for 2021.

Nerdwallet 2021

Awarded Best 0% Intro APR and Balance Transfer Credit Card

Balance transfer calculator

See how much you could save with a 0% balance transfer for 21 billing cycles..

Enter your estimated balance transfer amount and current APR.

Calculator assumes a minimum payment of either $40 or 1% of your new balance (whichever is greater) and a 30-day billing cycle. This calculator is for illustrative purposes only.

Frequently asked questions

What credit score is needed to apply for the u.s. bank visa® platinum credit card.

U.S. Bank credit score requirements vary by product. In general, our credit card products are for established credit with a credit score in the good to excellent range.

Is the U.S. Bank Visa Platinum Credit Card good for balance transfers or paying for a large purchase?

The U.S. Bank Visa Platinum Credit Card typically offers our best and longest introductory APR offer on purchases and balance transfers.

Does my U.S. Bank Visa Platinum Credit Card have an annual fee?

There is no annual fee on the U.S. Bank Visa Platinum Credit Card.

What is U.S. Bank ExtendPay®?

U.S. Bank ExtendPay ® Plans provide a payment option that allows you to divide eligible credit card purchases into affordable monthly payments with no interest* – just a fixed monthly fee.

How will I know if I am eligible for a U.S. Bank ExtendPay® Plan?

If your credit card account is eligible for a U.S. Bank ExtendPay ® Plan, you’ll receive a notification via email, or you’ll see ExtendPay Plan options when viewing your card account details or eligible transactions online. The only purchases eligible for an ExtendPay Plan are those that were made within 60 days prior to signing up for ExtendPay, are over $100, and are less than your purchase balance when you sign up for ExtendPay.

ExtendPay Plan eligibility may change based on your credit card account activity.

Looking for a credit card with different benefits?

Compare all credit cards..

Use our comparison tool to compare benefits like rewards, APR and welcome offers for up to three cards.

Build or reestablish credit.

Build credit for the future with the U.S. Bank Secured Visa ® Card.

U.S. Bank may change APRs, fees and other account terms in the future based on your experience with U.S. Bank National Association and its affiliates as provided under the Cardmember Agreement and applicable law.

* The 0% introductory APR applies to purchases and is valid for the first 21 billing cycles. The 0% introductory APR applies to balance transfers made within 60 days of account opening and is valid for the first 21 billing cycles. The introductory rate does not apply to cash advances. Thereafter, the APR may vary. The current undiscounted variable APR for Purchases and Balance Transfers is $ based on your creditworthiness. The variable APR for Cash Advances is 29.99%. Cash Advance fee: 5% of each advance amount, $10 minimum. Convenience Check fee: 5% of each check amount, $5 minimum. Cash Equivalent fee: 5% of each cash amount, $10 minimum. Balance Transfer fee: 5% of each transfer amount, $5 minimum. There is a $1 minimum interest charge where interest is due. Annual fee: $0. Foreign Transaction fee: 3% of each foreign purchase transaction or foreign ATM advance transaction in U.S. Dollars. 3% of each foreign purchase transaction or foreign ATM advance transaction in a Foreign Currency. U.S. Bank ExtendPay ® Fees: A monthly fee not to exceed 1.6% of the original principal amount in a U.S. Bank ExtendPay ® Plan or U.S. Bank ExtendPay ® Loan. This fixed fee is disclosed upon enrollment and charged each month that you owe the applicable ExtendPay balance. ExtendPay Fees are calculated based upon the original principal amount, Purchase APR, and other factors. When you make a payment, the amount up to your Minimum Payment is applied first to the monthly payment obligation for ExtendPay Plans and ExtendPay Loans if any, and then to non-Fixed Payment Program balances in the order of the lowest to highest APR. Any amount over your Minimum Payment is applied to balances in the order of highest to lowest APR.

† Balance Transfers transactions from other U.S. Bank National Association accounts are not permitted. You may cancel a balance transfer request within 10 days of account opening by calling 800-285-8585.

By clicking Apply, you authorize your wireless carrier to use or disclose information about your account and your wireless device, if available, to us or our service provider for the duration of your business relationship, solely to help us identify you or your wireless device and to prevent fraud. See our Privacy Policy for how we treat your data.

Free credit score access, alerts and Score Simulator through TransUnion's CreditView ™ Dashboard are available to U.S. Bank online and mobile banking customers only. Alerts require a TransUnion database match. It is possible that some enrolled members may not qualify for the alert functionality. The free VantageScore ® credit score from TransUnion ® is for educational purposes only and not used by U.S. Bank to make credit decisions.

From time to time we may offer to you the benefit of our U.S. Bank ExtendPay® Plans, which allow you to pay off balances in fixed monthly payments over time and still avoid paying interest charges on new Purchases. You may designate up to 50% of your credit card line ($100 minimum) in eligible credit card purchases and pay in monthly installments with just a small fixed monthly fee. Only Purchase balances are eligible for ExtendPay Plans. Transactions identified as Advances or Balance Transfers (as defined in your Cardmember Agreement), and any interest or fees, including Annual Fee, do not apply. The only Purchases that will appear as "Eligible Purchases" in the enrollment process are Purchases that were made within 60 days prior to signing up for an ExtendPay Plan, are over $100, and are less than your Purchase balance when you sign up for an ExtendPay Plan. Any unpaid balance remaining on an ExtendPay Plan after the chosen pay-back period will be subject to the APR and minimum payment calculation for purchases outlined in the Cardmember Agreement.

Not all payment due dates may be available. If approved, please call the number on the back of your card for further information.

No one can prevent all cybercrime or all identity theft.

Certain terms, conditions and exclusions apply. In order for coverage to apply, you must pay your monthly cellular wireless bill with your Platinum Card. Please visit usbank.com/cellphoneprotection to view your Guide to Benefits and for further card benefit details including full terms and conditions.

The Contactless Symbol and Contactless Indicator are trademarks owned by and used with the permission of EMVCo, LLC.

The creditor and issuer of this card is U.S. Bank National Association, pursuant to a license from Visa U.S.A. Inc., and the card is available to United States residents only.

© 2017-2024 and TM, NerdWallet, Inc. All Rights Reserved.

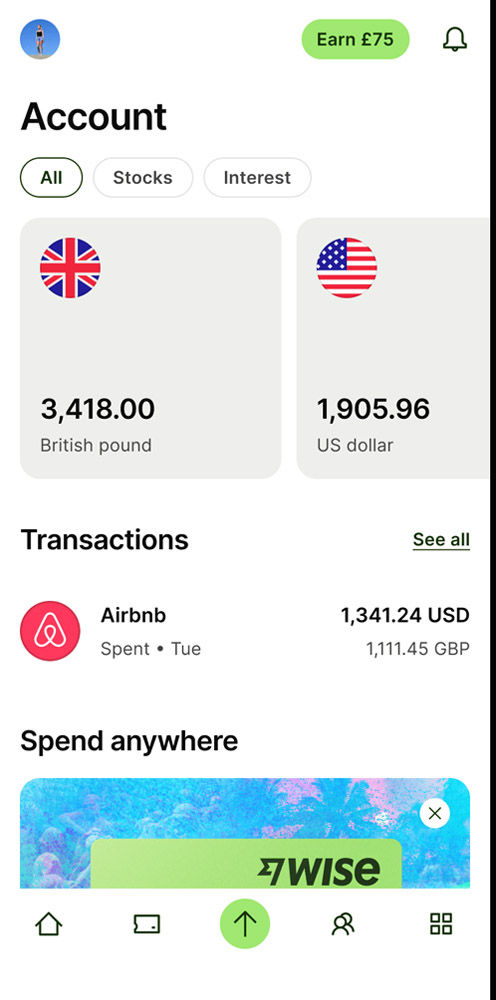

Find out more about sending money to your location of choice.

Read our range of money transfer and banking guides.

Reviews and comparisons of the best money transfer providers, banks, and apps.

Unlock efficient global money movement for your business.

Compare the best ways to send money from Russia to United States

Get the best deals when you transfer from Russia to United States . Find the cheapest , fastest , and most reliable providers with the best RUB to USD exchange rates.

Read on for the best deals, expert information, and all you need to send money to United States from Russia.

- Over 16 million customers

- Multi-currency account available

- No hidden fees

- Most transfers instant or same-day

- Earn rewards on every transaction

- Special FX rate & no fees on first transfer

Overall best choice: Wise

We tested & reviewed dozens of money transfer providers, and Wise scored highly.

Wise appeared in 53.8% of Russia to United States searches, and was the top rated company out of 3 that support RUB to USD.

So for a great mix of cost, speed & features, make your Russia to United States transfer using Wise.

How to get the best deal on your Russia to United States transfer

Don't pay more than you have to. Use our live comparison tool to make sure you aren't missing the best rates to send money from Russia to United States.

Select the provider that offers you the best value & service for your needs

Follow the steps & make your transfer. Your funds will soon be on their way to your chosen country & currency.

Summary of recent searches

Important things to consider before sending money from russia to united states.

Don't settle for the first option. Always compare ways to send money from Russia to United States to find out about fees, speed, and reliability.

Our analysis included 3 providers that operate between Russia and United States .

Through this, you get a comprehensive view of all the options you have in Russia when you need to send money to United States.

The exchange rate determines how many RUB the recipient will get in United States when you send money from Russia.

Today, the average exchange rate between Russian Ruble and US Dollar is 0.011255.

The RUB-USD rate fluctuates constantly, so timing your transfer can help you save a lot of money on fees.

Sometimes, waiting a day or two can help you get more USD for the same amount of Russian Rubles.

When sending money from Russia to United States, the best way to save on fees is to use a Bank Transfer with Instarem.

This is 0% cheaper than the second-best option in the market.

Making sure your funds are safe when transferring from Russia to United States is really important.

Always choose providers that are regulated by financial authorities.

If you don’t know what the key regulatory bodies for money transfers are between Russia and United States, please refer to our directory of financial regulators worldwide .

Some services have limits on how much you can transfer, both minimum and maximum thresholds.

Different services might offer better rates or lower fees for different transfer amounts.

For example, we recommend using Wise if you need to send large amounts of RUB to United States.

There are different ways to receive money in United States. You can do a direct bank deposit, cash pickup, or use a mobile wallet.

If you want a direct transfer to your bank account, Wise offers the best service for bank transfers between Russia and United States.

And if you need cash right away, check if cash pickup is an option for transfers between Russia and United States.

Mobile wallet services and payment apps like PayPal , Xoom , and CashApp are popular too, but they come with more limitations and higher costs compared to money transfer providers like Instarem.

When you're sending or receiving money between Russia and United States, you have to be ready to show some ID .

The exact documents you need might vary. Usually, you will have to show a government ID like a passport or driver's license.

If you're making a big transaction between Russia and United States, a provider may ask you for proof of address or may want to know where your money comes from.

That’s why we suggest Wise in this case. They know how to handle large RUB-USD transfers and will help you get things done fast.

There might be tax implications to consider when sending money from Russia to United States.

Some RUB-USD transfers may need to be reported to tax authorities, especially for larger amounts.

When in doubt, please contact a tax professional in Russia or United States.

Cheapest way to send money to United States from Russia: Wise

Data collected over the past six months shows that Wise is 0% cheaper than the second-best option.

The ₽208.48 transfer cost represents the most common fee for RUB to USD international transfers, based on data from the past six months.

If you want to secure the best rates on a RUB to United States transfer, make sure you pick Wise to send your money online.

*The most common fee applied to RUB-USD by Wise, based on data from the past six months.

Fastest way to send money from Russia to United States: Wise

Our data shows that Wise came up as the fastest way to send money from Russia to United States in 68.4% of searches. This makes them well suited to urgent RUB to USD money transfers.

The 'fastest' way to send money is defined by the overall speed of sending money from Russia to United States - this includes deposit, transfer and withdrawal timeframes and often differs per currency.

When speed matters, Wise is your best choice at the moment. This service emerged as the quickest way to send money to United States from Russia in 68.4% of the searches on MoneyTransfers.com over the past six months.

Need to send over $10,000?

Opt for a service proven with large transfers when size matters. For transfers over $10,000, your best bet is Wise .

While Wise may not always be the cheapest or fastest way to send RUB from Russia to United States, it’s the provider that will keep you safe and relaxed while your money moves into USD.

Understanding the costs involved when moving money from Russia to United States

When calculating the costs of money transfers between Russia and United States, here's what really matters:

The Mid-Market Rate: Today, the RUB-USD mid-market rate equals to 0.011255 USD per Russian Ruble.

The RUB-USD average exchange rate for the past three months has been 0.0109 USD per Russian Ruble, with a high of 0.0114 and a low of 0.0106.

When looking to send money, we'd recommend Wise. On average Wise is 0% away from the average mid-market rate. Fees may be added on top, but they're still the cheapest provider on average from RUB to USD.

How to find the best exchange rate for Russian Ruble to US Dollar

Timing is essential for sending money between RUB and USD. The exchange rate you secure impacts how much USD you get for your RUB.

Let's dive into some interesting recent trends.

Over the past six months, the exchange rate from RUB to USD has seen some fluctuation. On average, it stood at 0.0109.

During this period, the highest value recorded was 0.0114, while the lowest was 0.0106.

Wise, which is our recommended service to send money online from Russia to United States offers an exchange rate that is only 0% above the mid-market rate.

Want to secure the best RUB-US Dollar exchange rates?

Sign up for our rate alerts and we'll tell you when it's the best time to move your money from Russia to United States!

Payment methods available to fund your Russia to United States transfer

Bank transfers.

Bank transfers are often the default option for sending money from Russia to United States.

By using a money transfer company such as Wise for transfers from Russia to United States, you can send money via a bank transfer while benefitting from lower fees and more favorable exchange rates.

On average, Wise is the cheapest provider for bank transfers from the 3 we tested when sending RUB to United States.

With an average fee of RUB118.81 to send money from Russia to United States, Wise offers a great combination of competitive exchange rates and lower fees.

Debit and prepaid cards

Sending money from Russia to United States with a debit or a prepaid card is very simple with Instarem .

Instarem is a leader in debit card payments for transfers from Russia to United States, competing among a total of 3 active money transfer companies on this route.

Credit cards

When it comes to credit card transfers from Russia to United States, Instarem emerges as our top choice of the 3 companies offering this service.

Fee alert: using a credit card to transfer money often results in a fee being charged by your card issuer. That's why we recommend bank transfer or debit card instead.

How we analyze the market

We track the cost, speed, and product offerings of the leading money transfer services available between United States and Russia.

Our comparison engine and algorithms evaluate providers based on over 25 factors , including transfer fees, ease of use, exchange rates, mobile apps, transfer times & customer support.

We also consider how these services are rated on platforms like TrustPilot, AppStore, and Google Play, giving you a comprehensive view of what to expect.

This thorough analysis helps you get the best available deal - every time you want to move money from Russia to United States.

We also provide unbiased and detailed reviews of all the top money transfer companies. You can use these reviews to send RUB to USD.

For a deeper understanding of our commitment to integrity and transparency, we invite you to read our editorial policy document.

Money transfer company reviews

Related transfer routes, send money from russia, send money to united states, how much money can be transferred from russia to united states.

The amount of USD you can receive from Russia will vary depending on which provider you use. Some providers specialize in smaller transfers, while others are more suited to large transfers.

You should also check if there are any government regulations around how many USD can be received in United States before making your transfer.

Are there any tax implications to sending money from Russia to United States?

Each country will have its own set of tax laws and rules for receiving money from abroad. US Dollars or Russian Rubles sent for business purposes between could be taxed as foreign income. If you’re looking to receive a large amount of US Dollars from abroad, you should check how much you can receive in United States without paying taxes. If you're not sure how the tax process works locally, contact your local tax office or speak to a tax professional.

Can I send money from Russia to United States with MoneyTransfers.com?

No. MoneyTransfers.com is a comparison website aiming to match you with the best money transfer providers to transfer money online between Russia, United States, and many other countries.

What are the typical transfer fees for sending Russian Rubles to United States through various providers?

Transfer fees can vary significantly depending on your chosen provider. That's why you should compare the fees of different services to ensure you get the best deal when sending Russian Rubles to United States.

Our data shows that the cheapest way to send money online between Russia and United States is Instarem.

Over the past six months, the most common transfer fee applied by Instarem for RUB to USD transactions has been ₽208.48. This is 0% less than the second-best option available.

How long does it take to send money from Russia to United States?

The delivery time for international transfers can vary. Some services offer instant or same-day transfers, while others might take several business days. The speed may also depend on the RUB and USD transaction volumes.

According to our data, the fastest way to send money online between Russia and United States is Wise.

Over the past six months, Wise emerged as the fastest service in 68.4% of the searches performed by our users and staff.

What is the best exchange rate I can get for sending money from Russia to United States?

Exchange rates fluctuate frequently. To get the best rate for converting RUB to USD, compare the rates offered by different providers against the mid-market rate. Right now, the RUB to USD is 0.011255.

Are there any minimum or maximum transfer amounts for sending money from Russia to United States?

Providers often set minimum and maximum transfer limits. These can vary significantly, so it’s worth checking what limits apply for transfers from Russia to United States before proceeding.

Can I schedule regular transfers between Russia and United States?

Many services allow you to set up scheduled, recurring transfers. This can be especially useful for regular financial commitments across borders.

Destination guides

Recommendations, tools & resources, contributors.

Giovanni Angioni

Current credit card transfer bonuses: 20% bonus when transferring Chase points to Aeroplan

If you truly want to maximize your points and miles, periodic transfer bonuses can offer lucrative opportunities for fantastic award redemptions . You can sometimes get significantly more value from your rewards by transferring them to a specific airline or hotel partner during one of these bonuses.

However, these are limited-time offers.

We've compiled the transfer bonuses for the major programs with transferable rewards to make tracking these offers easier. Just note that transfer bonuses are sometimes targeted, so some may not be available to you.

American Express Membership Rewards transfer bonus

American Express has one active transfer bonus right now.

Amex is offering a 15% bonus when you transfer American Express Membership Rewards points to Avianca LifeMiles through the month of June. Since you can typically transfer Membership Rewards points to Avianca at a 1:1 ratio, this transfer bonus raises the value of 1,000 Membership Rewards points to 1,150 LifeMiles.

Just note that this bonus is being granted by Avianca, so you won't see it reflected in your American Express account.

How to earn American Express Membership Rewards points

You'll need Membership Rewards points to maximize Amex transfer bonuses. If you're looking to earn some of these valuable points, the following Amex cards could be useful additions to your wallet:

- The Platinum Card® from American Express : Earn 80,000 Membership Rewards points after you spend $8,000 on your new card in your first six months of card membership.

- American Express® Gold Card : Earn 60,000 Membership Rewards points after you spend $6,000 in your first six months of card membership.

- The Business Platinum Card® from American Express : Earn 150,000 Membership Rewards points after you spend $20,000 on eligible purchases with your card in the first three months of card membership.

Check the CardMatch tool to see if you're targeted for an even higher welcome offer (subject to change at any time).

You can also earn extra Membership Rewards points when you enroll in Amex Offers and shop with Rakuten .

Based on TPG's June 2024 valuations , Membership Rewards points are worth 2 cents each, and our tests indicate that they transfer instantly to most of Amex's transfer partners.

Related: How to redeem American Express Membership Rewards for maximum value

Chase Ultimate Rewards transfer bonus

This summer, you can transfer Chase Ultimate Rewards points to Air Canada Aeroplan with a 20% bonus. Since Ultimate Rewards points typically transfer to Aeroplan at a 1:1 ratio, this bonus means that 1,000 Ultimate Rewards points would turn into 1,200 Aeroplan points.

If you're an Aeroplan® Credit Card holder, you can stack the current transfer bonus with the 10% bonus you'd normally get when transferring 50,000 or more Chase points. So if you transferred 50,000 points to Aeroplan, you'd get a 30% bonus, for a total of 65,000 Aeroplan points.

This Chase Ultimate Rewards transfer bonus expires July 31.

How to earn Chase Ultimate Rewards points

If you want to earn more Chase Ultimate Rewards points, the following Chase cards could make good additions to your wallet:

- Chase Sapphire Reserve® : Earn 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening.

- Chase Sapphire Preferred® Card : Earn 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening.

- Ink Business Preferred® Credit Card : Earn 100,000 bonus points after you spend $8,000 on purchases in the first three months of account opening.

If you have one (or more) of the above cards, you can combine your Ultimate Rewards points in a single account . Then, you can effectively convert the cash-back earnings on the following cards into fully transferable Ultimate Rewards points:

- Chase Freedom Flex℠ : Earn $200 cash back after spending $500 on purchases in the first three months of account opening.

- Chase Freedom Unlimited® : Earn an additional 1.5% cash back on everything you buy in the first year (on up to $20,000 spent), worth up to $300 cash back.

- Ink Business Cash® Credit Card : Earn up to $750 bonus cash back: $350 after you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months from account opening.

- Ink Business Unlimited® Credit Card : Earn $750 bonus cash back after you spend $6,000 on purchases in the first three months from account opening.

According to TPG's June 2024 valuations, Chase Ultimate Rewards points are worth 2.05 cents each when maximized with travel partners. Most Ultimate Rewards transfers will process instantly.

Related: How to redeem Chase Ultimate Rewards points for maximum value

Capital One miles transfer bonus

Capital One does not have any active transfer bonuses at this time.

How to earn Capital One miles

For future transfer bonuses, the following Capital One cards are good options to consider:

- Capital One Venture X Rewards Credit Card : Earn 75,000 bonus miles when you spend $4,000 on purchases in the first three months from account opening.

- Capital One Venture X Business : Earn 150,000 bonus miles after spending $30,000 in the first three months from account opening.

- Capital One Venture Rewards Credit Card : Earn 75,000 bonus miles when you spend $4,000 on purchases in the first three months from account opening.

- Capital One Spark Miles for Business : Earn 50,000 bonus miles after spending $4,500 on purchases in the first three months of account opening.

TPG's June 2024 valuations peg Capital One miles at 1.85 cents apiece, and most transfers from Capital One will process instantly.

For more details, check out our guides to the Capital One transfer partners and how to transfer Capital One miles to airline partners .

Citi ThankYou Rewards transfer bonus

Citi ThankYou Rewards members currently have access to a transfer bonus to Cathay Pacific Asia Miles . ThankYou points normally transfer to Asia Miles at a 1:1 ratio, but with this bonus, you'll receive 15% more miles when you transfer points through July 20.

How to earn Citi ThankYou Rewards points

These Citi credit cards could make useful additions to your wallet for earning Citi ThankYou Rewards points:

- Citi Strata Premier℠ Card (see rates and fees ): Earn 70,000 bonus points after you spend $4,000 on purchases with your card within three months of account opening. A higher offer may be available through citi.com.

- Citi Rewards+® Card (see rates and fees ): Earn 20,000 bonus points after you spend $1,500 within three months of account opening. Plus, earn 5 bonus ThankYou Rewards points per dollar spent on hotels, car rentals and attractions on the Citi travel portal through Dec. 31, 2025. (Note: You must pair this card with a premium Citi ThankYou card to access a full-fledged, transferable ThankYou points account.)

As of June 2024, TPG values Citi ThankYou Rewards points at 1.8 cents each. However, note that some Citi transfers will not process instantly , so be sure to factor in the transfer time if you're trying to book an award with scarce availability.

Marriott Bonvoy transfer bonus

Marriott Bonvoy is not running any transfer bonuses at this time.

How to earn Marriott Bonvoy points

If you're looking to earn more Marriott Bonvoy points , the following Marriott Bonvoy cards may be of interest:

- Marriott Bonvoy Brilliant® American Express® Card : Earn 95,000 Marriott Bonvoy bonus points after using your card to spend $6,000 on purchases in the first six months of card membership.

- Marriott Bonvoy Bevy™ American Express® Card : Earn 85,000 Marriott Bonvoy bonus points after using your card to spend $5,000 on purchases in the first six months of card membership.

- Marriott Bonvoy Boundless® Credit Card : Earn three free night awards (each night valued at up to 50,000 points) after spending $3,000 in the first three months of account opening. Certain hotels have resort fees.

- Marriott Bonvoy Business® American Express® Card : Earn five free night awards after you use your new card to make $8,000 in eligible purchases within the first six months of card membership. The redemption level is up to 50,000 Marriott Bonvoy points for each bonus free night award at hotels participating in Marriott Bonvoy. Resort fees may apply.

- Marriott Bonvoy Bold® Credit Card : Earn 30,000 Marriott Bonvoy bonus points after spending $1,000 on eligible purchases in the first three months from account opening.

Per TPG's June 2024 valuations, Marriott Bonvoy points are worth 0.85 cents each. Before transferring points, review our tests of Marriott transfer times since some airlines take a few days (or even weeks) to receive the points.

Related: Marriott Bonvoy program: How to redeem points for hotel stays, airfare and more

Should you transfer points?

We only recommend transferring points or miles if you have a short-term plan to use them. Many programs have implemented devaluations over the last few years, so any speculative transfers could be a losing proposition.

Transfers are irreversible, and you don't want to be stuck with thousands of points or miles in a program you have little use for.

If you don't have a specific redemption in mind but still want to earn points or miles, you're likely better off earning rewards through credit card welcome bonuses and everyday spending.

Bottom line

When a program with a transferable currency offers a transfer bonus, it is important to run the numbers to determine whether it is worthwhile.

Generally, you won't want to transfer your points or miles without a specific redemption in mind. After all, a large part of the value of transferable points and miles comes from their flexibility — which you'll give up the moment you convert them to a partner's currency. However, a transfer bonus can help you get more value from your points and miles if you use a partner program frequently or plan to redeem soon.

Ukraine war latest: Putin arrives in North Korea; Russian forces 'move closer to key supply route'

Vladimir Putin has arrived in North Korea for a two-day visit - his first in more than two decades. Elsewhere, the UK's Ministry of Defence says Russian forces are moving closer to a key Ukrainian supply route in the eastern Donetsk region.

Tuesday 18 June 2024 22:59, UK

- Putin arrives in North Korea - his first visit in 24 years

- Russian region hit in wave of attacks

- Ukrainian village 'falls under Russian control as Moscow's forces move closer to key supply route'

- Countries remove names from Ukraine peace summit documents

- NATO chief's nuclear comments prompt Kremlin response

- Your questions answered: Are there any signs of an underground resistance in Russia?

- Analysis: Putin's visit to North Korea is a diplomatic two-fingers to West

- Listen to the Daily above and tap here to follow wherever you get your podcasts

That's all of our live coverage on the conflict for now.

We'll bring you any major developments overnight, and we'll be back with our regular updates in the morning.

More details about Vladimir Putin's arrival in North Korea have started coming through...

The Russian president arrived in the country for the first time in 24 years earlier this evening, and was greeted by North Korean leader Kim Jong Un.

The two men had a brief conversation and then left Pyongyang Airport in the same car.

Now, Korean Central News Agency has reported that the pair shared their "pent up inmost thoughts" with each other and "opened their minds".

The North Korean state news organisation said the conversation was "friendly" and came as their relationship "entered a course of new comprehensive development".

It added that Putin's visit was important in "powerfully propelling the cause of building a powerful country".

Of course, the Korean Central News Agency's original reporting is in Korean, so there may be some discrepancies in the translation.

The destruction of Russian targets in border regions "really matters", Volodymyr Zelenskyy has said as he praised world leaders for their determination to protect Ukraine,

Delivering his nightly address, the Ukrainian president said: "The destruction of Russian terrorists' positions and launchers by our forces, our warriors, near the border really matters.

"We witness the world's determination opening new prospects for restoring our security. Among other things, this includes the security of Kharkiv."

His comments come after Ukraine claimed responsibility for an overnight drone attack on a Russian oil facility.

The strike caused a massive blaze in Russia's Rostov region and marked the latest long-range attack by Kyiv's forces on a border region.

Ukraine has in recent months stepped up aerial assaults on Russian soil, targeting refineries and oil terminals, in an effort to slow down the Kremlin's war effort.

At the same time, Moscow's army has been pressing hard along the front line in eastern Ukraine, where a shortage of troops and ammunition has made defenders vulnerable.

As we have been reporting this evening, Vladimir Putin has arrived in North Korea for the first time in 24 years to begin a two-day visit.

The Russian president was greeted by North Korea's leader Kim Jong Un, with the men seen laughing and hugging as they had a conversation near Putin's plane.

A red carpet was rolled out for his arrival as well.

The US has said it is concerned about the "deepening" cooperation between Russia and the North Korea.

The Pentagon voiced concern about the growing ties between Moscow and Pyongyang as Vladimir Putin arrived in North Korea for his first visit in 24 years.

"The deepening cooperation between Russia and the DPRK is something that should be of concern, especially to anyone that's interested in maintaining peace and stability on the Korean Peninsula," Major General Patrick Ryder, a Pentagon spokesperson, told reporters.

DPRK is an abbreviation for North Korea's official name, the Democratic People's Republic of Korea.

We have just received the first photos of Vladimir Putin arriving in North Korea.

The Russian president was greeted by the country's leader Kim Jong Un as he left his plane.

The pair hugged and had a brief conversation before leaving in the same car.

We are starting to get more details about Vladimir Putin's arrival in North Korea.

As the Russian president touched down, he was greeted by the country's leader Kim Jong Un.

The two men had a brief conversation next to Putin's motorcade, before leaving Pyongyang Airport in the same car.

As we told you in our last post, Vladimir Putin has arrived in North Korea for his first visit in 24 years.

The Russian president's plane touched down in Pyongyang around 2.45am local time (6.45pm UK time) after a stopover in Russia's far east.

He was reportedly greeted by North Korea's leader Kim Jong Un.

Here's a quick look at what is expected to take place during his two-day visit...