Travel, Tourism & Hospitality

Tourism in Malaysia - statistics & facts

Slow but steady recovery, visit malaysia 2026, key insights.

Detailed statistics

GDP direct contribution from tourism Malaysia 2013-2022

Tourism receipts value Malaysia 2014-2023

Tourist arrivals to Malaysia 2014-2023

Editor’s Picks Current statistics on this topic

Further recommended statistics.

- Basic Statistic Value of international tourism spending APAC 2022, by country

- Premium Statistic GDP direct contribution from tourism Malaysia 2013-2022

- Premium Statistic Tourism industry direct contribution as share of GDP Malaysia 2013-2022

- Premium Statistic Tourist arrival growth in Malaysia 2013-2022

Value of international tourism spending APAC 2022, by country

Value of international tourism expenditure in the Asia-Pacific region in 2022, by country or territory (in billion U.S. dollars)

Gross domestic product direct contribution from tourism in Malaysia from 2013 to 2022 (in billion Malaysian ringgit)

Tourism industry direct contribution as share of GDP Malaysia 2013-2022

Direct contribution of the tourism industry as a share of the gross domestic product (GDP) in Malaysia from 2013 to 2022

Tourist arrival growth in Malaysia 2013-2022

Year on year growth of tourist arrivals to Malaysia from 2013 to 2022

Inbound tourism

- Premium Statistic Tourist arrivals to Malaysia 2014-2023

- Premium Statistic Number of tourist arrivals in Malaysia 2022, by country of residence

- Premium Statistic Inbound tourism expenditure of visitors in Malaysia 2015 to 2022

- Premium Statistic Inbound tourism expenditure of visitors in Malaysia 2022, by product

Tourist arrivals to Malaysia from 2014 to 2023 (in millions)

Number of tourist arrivals in Malaysia 2022, by country of residence

Number of tourist arrivals in Malaysia in 2022, by country of residence (in 1,000s)

Inbound tourism expenditure of visitors in Malaysia 2015 to 2022

Inbound tourism expenditure of visitors in Malaysia from 2015 to 2022 (in billion Malaysian ringgit)

Inbound tourism expenditure of visitors in Malaysia 2022, by product

Inbound tourism expenditure of visitors in Malaysia in 2022, by product (in billion Malaysian ringgit)

Domestic tourism

- Premium Statistic Number of domestic visitors in Malaysia 2014-2023

- Premium Statistic Number of domestic tourism trips in Malaysia 2014-2023

- Premium Statistic Average length of stay on domestic tourism trips Malaysia 2014-2023

- Premium Statistic Domestic tourism expenditure in Malaysia 2014-2023

- Premium Statistic Average expenditure on domestic tourism trips Malaysia 2014-2023

- Premium Statistic Domestic tourism expenditure of visitors in Malaysia 2023, by category

Number of domestic visitors in Malaysia 2014-2023

Number of domestic visitors in Malaysia from 2014 to 2023 (in millions)

Number of domestic tourism trips in Malaysia 2014-2023

Number of domestic tourism trips in Malaysia from 2014 to 2023 (in million)

Average length of stay on domestic tourism trips Malaysia 2014-2023

Average length of stay on domestic tourism trips in Malaysia from 2014 to 2023 (in days)

Domestic tourism expenditure in Malaysia 2014-2023

Domestic tourism expenditure in Malaysia from 2014 to 2023 (in billion Malaysian ringgit)

Average expenditure on domestic tourism trips Malaysia 2014-2023

Average expenditure on domestic tourism trips in Malaysia from 2014 to 2023 (in Malaysian ringgit)

Domestic tourism expenditure of visitors in Malaysia 2023, by category

Domestic tourism expenditure of visitors in Malaysia in 2023, by category (in billion Malaysian ringgit)

Hotel industry

- Premium Statistic Value added by the accommodation services industry in Malaysia 2017-2022

- Premium Statistic Number of hotels in Malaysia 2013-2022

- Premium Statistic Number of hotel rooms available Malaysia 2022, by state

- Premium Statistic Average occupancy rates of hotels in Kuala Lumpur, Malaysia 2013-2022

- Premium Statistic Number of foreign hotel guests in Kuala Lumpur, Malaysia 2013-2022

Value added by the accommodation services industry in Malaysia 2017-2022

Value added by the accommodation services industry in Malaysia from 2017 to 2022 (in billion Malaysian ringgit)

Number of hotels in Malaysia 2013-2022

Number of hotels in Malaysia from 2013 to 2022

Number of hotel rooms available Malaysia 2022, by state

Number of hotel rooms available in Malaysia in 2022, by state (in 1000s)

Average occupancy rates of hotels in Kuala Lumpur, Malaysia 2013-2022

Average occupancy rates of hotels in Kuala Lumpur, Malaysia from 2013 to 2022

Number of foreign hotel guests in Kuala Lumpur, Malaysia 2013-2022

Number of foreign hotel guests in Kuala Lumpur, Malaysia from 2013 to 2022 (in millions)

Economic impact

- Premium Statistic Gross value added tourism industries (GVATI) Malaysia 2013-2022

- Premium Statistic Share of GVATI in Malaysia 2022, by sector

- Premium Statistic Number of employees in tourism industry Malaysia 2013-2022

- Premium Statistic Tourism receipts value Malaysia 2014-2023

- Premium Statistic Breakdown of tourist expenditure Malaysia 2022

Gross value added tourism industries (GVATI) Malaysia 2013-2022

Gross value added tourism industries (GVATI) in Malaysia from 2013 to 2022 (in billion Malaysian ringgit)

Share of GVATI in Malaysia 2022, by sector

Share of gross value added of tourism industries (GVATI) in Malaysia in 2022, by sector

Number of employees in tourism industry Malaysia 2013-2022

Number of people employed in the tourism industry in Malaysia from 2013 to 2022 (in millions)

Total value of tourism receipts in Malaysia from 2014 to 2023 (in billion Malaysian ringgit)

Breakdown of tourist expenditure Malaysia 2022

Breakdown of tourist expenditure in Malaysia in 2022

Consumer behavior

- Premium Statistic Common issues about traveling among Malaysians 2023

- Premium Statistic Perceived level of safety when traveling with COVID-19 among Malaysians 2023

- Premium Statistic Main reasons for domestic travels Malaysia 2023

Common issues about traveling among Malaysians 2023

Most common concerns about traveling among tourists in Malaysia as of January 2023

Perceived level of safety when traveling with COVID-19 among Malaysians 2023

Perceived level of safety when traveling during COVID-19 among tourists in Malaysia as of January 2023

Main reasons for domestic travels Malaysia 2023

Main reasons for undertaking domestic trips in Malaysia in 2023

Further reports

Get the best reports to understand your industry.

- Tourism and hotel industry in Singapore

- Travel and tourism in Indonesia

- Tourism industry in Thailand

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

- The Star ePaper

- Subscriptions

- Manage Profile

- Change Password

- Manage Logins

- Manage Subscription

- Transaction History

- Manage Billing Info

- Manage For You

- Manage Bookmarks

- Package & Pricing

Malaysia is among the top trending tourist destinations in Asia

- Asia & Oceania

Monday, 17 Jun 2024

Related News

China's stimulus-led stock rally pulls Asia and Europe higher; oil falls

Reservoir link energy subsidiary to collaborate with ad terra asia on ccus, opensignal: malaysia ranks 2nd in asia pacific for 5g download speed.

Malaysia received 20.14 million international arrivals in 2023.

It has been two years since Malaysia reopened to international tourists. The tourism sector, which took a hit when the borders were closed from 2020 to 2022 due to the Covid-19 pandemic, has yet to fully recover.

However, the tourism industry continues to show positive signs of recovery as tourist arrivals doubled over the past year.

Based on statistics from Tourism Malaysia, the country received 20.14 million international arrivals in 2023, as opposed to 10.07 million in 2022, and generated RM71.3bil in tourism revenue. The 100% increase in tourist arrivals is an encouraging sign, even if it is still 22.8% lower than 2019’s 26.1 million.

For 2024, Tourism Malaysia is aiming to achieve 27.3 million tourist arrivals with a total expenditure of RM102.7bil.

If the industry’s growth last year up until Q1 of 2024 is anything to go by, this ambitious venture may just be realised.

High ranking

According to the fifth annual report by Mastercard Economics Institute (MEI), Malaysia’s tourism recovery is on track, with certain categories – such as shopping and dining – recording numbers higher than pre-pandemic levels.

The report draws on a unique analysis of aggregated and anonymised Mastercard transaction data, including Mastercard SpendingPulse and third-party data sources, to provide comprehensive insights into the travel industry across 74 markets, 13 of which are in the Asia Pacific region (APAC).

Entitled Travel Trends 2024: Breaking Boundaries, the report also analyses key tourism trends for 2024 and beyond.

APAC destinations, as per the report, are trending worldwide. By measuring the change in share of tourism transactions over 12 months (ending March 2024), MEI is able to determine the top 10 trending tourism destinations worldwide – and APAC countries make up half of the list.

Malaysia places 6th on the list, ranking second if taking only the APAC destinations into consideration. It places ahead of Australia (7th), South Korea (8th) and Indonesia (10th).

Meanwhile, Japan takes the top spot, with a growth of 0.9%. Travellers from Asia made up 79.4% of the country’s total passenger traffic by the end of 2023. It also received 3,081,600 international visitors in March 2024.

Longer stays

Aside from receiving more visits, APAC countries – excluding Australia and New Zealand (ANZ) – have also been seeing longer stays and higher spending by tourists.

As of March 2024, travellers to APAC are extending their trips by an average of 1.2 days. This sums up to a total duration of 7.4 days, which compares to the 2019 average of 6.1 days. Affordability of the destinations, warm weather and favourable exchange rates are the top reasons for the extended stays by tourists from outside APAC, such as the Americas and Europe.

Both worldwide and in Asean, travellers are extending by approximately one more day of vacation per trip. Looking at Malaysia specifically, tourists are spending an average of 6.4 days – this shows positive growth, when compared to the average 5.6 days seen pre-Covid-19.

When it comes to shopping in Asean markets, tourism spending on casual apparel sees a substantial increase for the period of April 2023 to March 2024. Malaysia recorded a 73.8% increase during the 12 months than the same period last year, but luxury apparel shopping by tourists here saw a lower increase of 47.1%.

There is an even greater boost on tourism dining in Asean markets, with Malaysia recording the highest increase in casual dining, totalling 82.8%. It also recorded a 50.4% increase in fine dining.

Interestingly, Thailand is the only Asean market that recorded a higher increase in fine dining compared to casual dining, at 42.5% compared to 41.6%, respectively. As a side note, the Thai capital Bangkok currently has more than 30 Michelin-starred restaurants.

Thailand is expected to return to its pre-pandemic economic levels by the end of 2024. It has been receiving a higher number of visitors from Asean (19.9% above 2019 levels as of February 2024) countries, South Asia (21.6%) and Europe (1.8%).

Visa exemptions in APAC for tourists from China will undoubtedly boost tourism in countries like Thailand, Singapore and Malaysia as well. Especially as outbound travel from mainland China, which now stands at 80.3% of 2019 levels, continues to recover – unimpeded by Chinese tourists’ preference for domestic trips post-pandemic.

Experience-focused travels

Like most travellers worldwide, Chinese tourists are also prioritising experiences, spending 10% on this in 2024 compared to 7% in 2023.

Spending on experiences and nightlife currently makes up 12% of tourism sales, the highest point in the last five years, with Australian tourists being the highest spenders worldwide. Their spending is higher than the global average of 12%, as they spend one of every five dollars (19%) in these categories.

“Consumers in the Asia Pacific region have an intense desire and willingness to travel and are becoming increasingly savvy to ensure they get the best value and unforgettable experiences from their trips,” David Mann, chief economist, Asia Pacific, Mastercard, said in a statement.

He added that “businesses targeting tourism dollars need to review their current strategies, and shift them if necessary, to maintain their appeal to travellers”.

MEI also reported that nine out of 10 of the highest spending days of all time for the cruise and airline industries, respectively, were recorded during the first three months of 2024. Cruise transactions across the globe also saw an 11.8% growth in March 2024 compared to 2019.

Malaysia may capitalise on this growing interest in cruises by introducing more enticing cruise packages that let tourists experience the best of what the country has to offer.

Meanwhile, MEI’s analysis of flight booking data shows that the top summer destination is Munich, bolstered by the German city’s hosting of the month-long UEFA 2024 football championship (June 14 to July 14). Tokyo places second, while Bali (Indonesia) places sixth and Bangkok places seventh.

For Asean travellers, specifically those from Malaysia, Bali is also one of the top three destinations for the period of June to August 2024, alongside Shanghai (China) and Hanoi (Vietnam).

Meanwhile, Kuala Lumpur is among the top three destinations for Singaporean travellers, alongside Bangkok and Perth (Australia).

Related stories:

Tags / Keywords: Singapore , Malaysia , Thailand , Bangkok , China , Tourism Malaysia , Mastercard , Tourism Recovery , Australia , Travel , Trends , tourism

Found a mistake in this article?

Report it to us.

Thank you for your report!

Managing heart health risks

Next in travel.

Trending in Lifestyle

Air pollutant index, highest api readings, select state and location to view the latest api reading.

- Select Location

Source: Department of Environment, Malaysia

Others Also Read

Best viewed on Chrome browsers.

We would love to keep you posted on the latest promotion. Kindly fill the form below

Thank you for downloading.

We hope you enjoy this feature!

- A Land of Opportunities

- Sustainability Agenda

- Investment Statistics

- MIDA Insights

- Building Technology

- Life Sciences & Medical Technology

- Chemicals & Advanced Materials

- Machinery & Metal

- Electrical & Electronics

- Paper, Printing and Publishing

- Food Technology

- Transportation Technology

- Wood-Based and Furniture

- Business Services

- Logistics Services

- Education Services

- Oil & Gas

- Green Technology

- Healthcare Services

- Regional Establishment

- Hospitality (Hotels & Tourism)

- Research & Development (R&D)

- Other Services

- Investor Highlights

- Setting Up Business

- Business Facilitation

- Annual Media Conference (AMC)

- Announcement/ Media Release

- e-Newsletter

- Featured Articles

- Investment News

- Media Gallery

- Publications

- Advertise with Us

- Our Principles

- Board Members

- Client Charter

- e-Integrity

- Links to Agency Partners

- Procurement

- Forms & Guidelines

- Our Global Offices

- Our State Offices

- Staff Directory

- Government Representatives

- Information Centre

- Enquiry and Client Feedback

- Survey Centre

- e-Participation

This site is mobile responsive

- A Land of Opportunities Reasons to invest

- Sustainability Agenda Commitment towards sustainability

- MIDA Insights Latest news, updates and insights

- Investment Statistics Make informed decisions

- Chemicals & Advanced Materials

- Hospitality (Hotels & Tourism)

- Investor Highlights They came from all over, but made Malaysia their home. Find out more about their investment journey here.

- Setting Up Business Helpful guidelines to get started in Malaysia

- Business Facilitation MIDA offers dedicated support and facilities. Count on us!

- Resources Gain an advantage through our valuable resources including useful links, guides, reports, statistics and publications on choosing Malaysia for your business ventures

Revitalising Tourism and Hospitality Under the National Tourism Policy 2020-2030

Globally, countries are still experiencing a decline in tourism expenditures. The United Nations World Tourism Organisation (UNWTO) World Tourism Barometer shows that the number of tourist arrivals recorded in 2020 was 399 million people compared to 1.47 billion people in 2019, a decrease of 74.0 per cent. 1

Domestic Tourism

Malaysia has not been exempted from this downward trend, as international borders remain partially closed. The Covid-19 pandemic resulted in a decrease of 83.4 per cent of inbound tourists in 2020. Tourist arrivals to Malaysia only came in at 4.3 million people compared to 26.1 million people in the previous year. 2

Nonetheless, Malaysia is among the countries with the highest percentage of fully vaccinated individuals in the world, with 98 per cent of the country’s adult population and over 78 per cent of the national population having completed their vaccination doses. This is expected to play a role in reviving the tourism industry as the willingness to travel increases. 3

Local tourism resumed shortly after the country ended its multiple lockdowns indicating that the demand for domestic travel will continue to grow and will recover relatively fast because of the growing in-country spending. Seasoned vacationers who are unable to travel abroad are diverting their money locally.

The disruption in demand caused overall internal tourism consumption in 2020 to plummet by 71.2 per cent compared to a growth of 6.8 per cent in the previous year. However, domestic tourism continues to play a significant role contributing 73.8 per cent to internal tourism consumption. 4

2022 a Turning Point for Inbound Tourism

According to the UNWTO Panel of Experts, 61 per cent of tourism professionals see better prospects for 2022. While 58 per cent expect a rebound in 2022, (mostly during the third quarter), only 42 per cent foresee a potential rebound in 2023. Most experts (64 per cent) now expect international arrivals to return to pre-pandemic levels in 2024 or later, up from 45 per cent in an earlier survey. 6

As domestic travel is keeping the Malaysian travel sector afloat, the industry needs to reinvent itself while waiting for international tourism to resume. Therefore, it is timely for the government to introduce new policies to revive the industry.

National Tourism Policy 2020-2030

In response, the Government launched the National Tourism Policy (NTP) 2020-2030 on 23 December 2020 to ensure the continuity of the country’s tourism industry, while targeting to make Malaysia a global top 10 tourism destination in both arrivals and receipts.

Key approaches in achieving the NTP’s agenda are harnessing public-private sector partnerships and embracing digitalisation to drive innovation and competitiveness towards sustainable and inclusive development in line with the Twelfth Malaysia Plan (12MP), National Ecotourism Plan 2.0 and the 17 United Nations Sustainable Development Goals (UNSDGs).

The policy would be implemented through six (6) main strategic thrusts, including the transformation of governance, creating an inclusive tourism investment zone, and intensifying digitisation in the tourism sector.

In addition, the core thrusts involve enriching tourists’ experience and satisfaction, strengthening commitment to sustainable tourism and increasing human capital capacity in all tourism sub-sectors. 7

Special Tourism Investment Zone (STIZ)

To ensure that the strategic thrusts can be implemented objectively and effectively, six (6) sub-committees have been established. MIDA has been appointed to lead the Investment Sub-Committee.

One of the key objectives of the Jawatankuasa Kecil Pelaburan (JKP) is to develop Special Tourism Investment Zones (STIZ) through public-private partnerships and formulate strategies to attract local and international investors to STIZs which have been identified for the promotion of high-value tourism development. Currently, MIDA and the Ministry of Tourism, Arts and Culture Malaysia (MoTAC) are conducting roadshows to engage stakeholders and authorities throughout Malaysia in identifying potential STIZs.

Essentially, the STIZs aim to enhance Malaysia’s tourism ecosystem. Beyond offering accommodation facilities, other required facilities in STIZs include banking, commercial, logistics, hospitals, and retirement homes.

Public-private partnerships are crucial in transforming Malaysia’s tourism industry and the designation of STIZs will create a pro-investment environment while sending welcoming signals to international and homegrown investors.

The strategy of designating certain areas as special zones to induce private investments is not new and has been used by the Government before. This policy has been highly successful in increasing foreign direct investment, employment and industrial capacity in Malaysia’s manufacturing sector.

Likewise, STIZs will function similarly to existing special manufacturing zones, but focus specifically on the tourism sector. The introduction of STIZs aims to encourage high quality investment in Malaysia’s tourism sector, in line with the transformation strategies of the NTP.

Practising Sustainable and Responsible Tourism

Promoting Malaysia as the next ‘Top of the Mind Ecotourism Destination in the World’, NTP incorporates elements of the UNSDGs. 8 The UNSDGs are benchmarks for the sustainable growth of Malaysia’s tourism industry, tourism’s role in promoting inclusive development, and responsible consumption and practices. 9

In practising good governance, it is important to ensure a balance between development, protection and preservation of the country’s treasures including the environment, culture and heritage. 10 The involvement of the private sector in providing infrastructure and facilities without compromising Environmental, Social and Governance (ESG) concerns is important in developing STIZs.

In the long term, the tourism and hospitality sectors will need to look at structural changes that support the transition to low-carbon practices and sustainability. 11 Preparing for alignment with the UNSDG and ESG aspects will encourage hotel and tourism project operators to make more sustainable investments, particularly in clean or green technology.

Embracing Smart Tourism

The Government has pushed for the adoption of digitalisation and innovation among hospitality players to gain a better competitive edge. These include creating virtual experiences, providing flexible cancellation policies and rolling out campaigns that encourage advance trip planning or booking.

Under the NTP, MoTAC in close consultation with industry associations has formulated and implemented the Tourism Recovery Plan (TRP). Through the TRP, MoTAC aims to revitalise domestic tourism by offering more creative and attractive travel packages through digital platforms, as well as incentives and promotions in the form of rebate vouchers, e-vouchers, and cashback through e-wallets and discounts.

Another recovery strategy under the TRP is embracing technologies such as cashless payment, online booking, contactless transaction, and contactless check-in to deliver a secure, seamless and contactless travel experience for tourists in the post-pandemic era.

To support technology-related investments in this industry, MIDA encourages companies to tap onto the Automation Capital Allowance incentive which aims to promote the quick adoption of automation specifically for labour-intensive industries and to spur automation initiatives.

In achieving the objectives of NTP, MIDA welcomes quality investments that involve high value and innovative tourism products and services that align with Malaysia’s environmental policies and legal requirements. MIDA also encourages companies to invest in modern and higher standard infrastructure and facilities to build up the resilience and long term competitiveness of the tourism sector. This is in line with MIDA’s theme for this year, “Rebuilding a sustainable economy through quality investment and strategic investment supply chain development in 2022”.

For more information on the Automation Capital Allowance and other MIDA initiatives under NTP, contact MIDA’s Healthcare, Education and Hospitality Division.

1&2 https://www.dosm.gov.my/v1/index.php/index.php?r=column/cthemeByCat&cat=111&bul_id=SXp2ZUF0TGx2OTU0YXo2YXZ1QUMydz09&menu_id=TE5CRUZCblh4ZTZMODZIbmk2aWRRQT09

3 https://www.theedgemarkets.com/article/nrc-proposes-reopening-malaysias-borders-early-march-without-compulsory-quarantine

4 https://www.dosm.gov.my/v1/index.php/index.phpr=column/cthemeByCat&cat=111&bul_id=SXp2ZUF0TGx2OTU0YXo2YXZ1QUMydz09&menu_id=TE5CRUZCblh4ZTZMODZIbmk2aWRRQT09

6 https://www.unwto.org/news/tourism-grows-4-in-2021-but-remains-far-below-pre-pandemic-levels

7 National Tourism Policy 2020-2030, Executive Summary

8 https://www.tourism.gov.my/media/view/tourism-malaysia-promotes-ecotourism-at-expo-2020-dubai#:~:text=Promoting%20Malaysia%20as%20the%20next,of%20sustainable%20and%20responsible%20tourism

9 National Tourism Policy2020-2030, Executive Summary

10 https://www.thestar.com.my/news/nation/2020/12/23/pm-covid-19-caused-over-rm100bil-in-tourism-losses

11 https://www.mida.gov.my/wp-content/uploads/2021/03/MIDA-IPR-2020_FINAL_March4.pdf

Explore other related content to further explore MIDA’s insights.

Malaysia Tourism Revenues

Tourism revenues in malaysia increased to 71308.50 myr million in 2023 from 28228.30 myr million in 2022. tourism revenues in malaysia averaged 45589.97 myr million from 1998 until 2023, reaching an all time high of 86143.50 myr million in 2019 and a record low of 238.70 myr million in 2021. source: tourism malaysia, markets, gdp, labour, prices, money, trade, government, business, consumer, housing, taxes, climate.

KUALA LUMPUR (June 24): Malaysia welcomed over 7.56 million foreign tourists in the first four months of the year, marking a growth of 27.5% compared to the same period last year.

Tourism, Arts and Culture Minister Datuk Seri Tiong King Sing noted that this achievement places Malaysia as the second-highest recipient of foreign tourists in Asean, behind Thailand with 12 million tourists and ahead of Vietnam with 6.2 million, Singapore with 5.71 million, and Indonesia with 4.1 million during the same period.

"In addition, during the first quarter, Malaysian tourism contributed RM22.23 billion to the national coffers, reflecting a 66% increase compared to the first quarter of 2023. In 2023, total tourism revenue amounted to RM71.31 billion, up from RM28.23 billion in 2022," Tiong said in a written parliamentary reply to Yeo Bee Yin (PH-Puchong).

Tiong said that the ministry has implemented a comprehensive strategy to further boost the tourism sector. This includes active participation in international tourism exhibitions, conducting roadshows in key markets such as Australia, China, Europe, India, Japan, Korea, the Gulf and Nordic countries.

Furthermore, the ministry is leveraging digital channels, such as social media to enhance visibility among tourists and travel agents in target markets, while also tailoring tourism products to specific segments and market demands, as well as improving accessibility with increased flight frequencies and seating capacity.

"The ministry has also engaged in discussions with the Ministry of Home Affairs and the Immigration Department to streamline entry processes for foreign tourists, potentially introducing visa-on-arrival (VOA), multiple-entry visas, eVisas and transit visas," Tiong added.

Responding to a separate query from Datuk Seri Ismail Sabri Yaakob (BN-Bera), Tiong said that Chinese and Indian tourist arrivals to Malaysia have risen significantly since the implementation of the visa liberalisation programme, which allows visa-free entry for 30 days for citizens of both countries.

The number of Chinese tourists visiting Malaysia more than tripled to 1.12 million from December 2023 to April 2024, compared to 332,144 tourists during the same period the previous year.

Meanwhile, Indian tourist arrivals also increased by 82.3% year-on-year to 380,737 for the same period, compared to 208,907 tourists previously.

For more Parliament stories, click here .

Copyright © 1999- 2024 The Edge Communications Sdn. Bhd. 199301012242 (266980-X). All rights reserved

- Client log in

« Back to previous page

Malaysia tourism and leisure sector report 2019/2020.

Tourism and leisure contributed MYR 84.1bn (5.9% of GDP) directly to Malaysia’s economy in 2018, making it a priority sector for the government which has allocated a single ministry – the Ministry of Tourism and Culture (“MOTAC”) – to coordinate policy for this sector. Malaysia’s favourable location in the ASEAN region, a short flight away from China and India, makes it a prime destination for tourists from these large countries who share cultural and historical links with Malaysia. Chinese tourists, in particular, are currently the primary driver of growth in the tourism and leisure sector, and tourist arrivals from China grew at a CAGR of 10.4% from 2013 to 2018 even as Chinese tourists spent more per trip than any other major source of tourist arrivals.

This report provides a complete and detailed analysis of the tourism sector for Malaysia. EMIS Insights presents in-depth business intelligence in a standard format across countries and regions, providing a balanced mix between analysis and data.

What this report allows you to do:

- Understand the key elements at play in the tourism sector in Malaysia

- Access forecasts for growth in the sector

- View passenger traffic for the sector in Malaysia

- Crystallise the forces both driving and restraining this sector in Malaysia

- Ascertain Malaysia’s position in the global sector

- Build a complete perspective on sector dynamics, investment and employment

- Assess market share by type of tourism (e.g. business, leisure, inbound, outbound)

- Understand the competitive landscape and who the major players are

- View M&A activity and major deals

- Gain an understanding of the regulatory environment for the sector in Malaysia

- Build a clear picture of trends and issues for tourism infrastructure and accommodation.

See below for a complete table of report contents:

Email us at: [email protected]

SEE BELOW FOR A COMPLETE TABLE OF REPORT CONTENTS:

UN Tourism | Bringing the world closer

The first global dashboard for tourism insights.

- UN Tourism Tourism Dashboard

- Language Services

- Publications

share this content

- Share this article on facebook

- Share this article on twitter

- Share this article on linkedin

UN Tourism Data Dashboard

The UN Tourism Data Dashboard – provides statistics and insights on key indicators for inbound and outbound tourism at the global, regional and national levels. Data covers tourist arrivals, tourism share of exports and contribution to GDP, source markets, seasonality and accommodation (data on number of rooms, guest and nights)

Two special modules present data on the impact of COVID 19 on tourism as well as a Policy Tracker on Measures to Support Tourism

The UN Tourism/IATA Destination Tracker

Un tourism tracker.

- International tourist arrivals and receipts and export revenues

- International tourism expenditure and departures

- Seasonality

- Tourism Flows

- Accommodation

- Tourism GDP and Employment

- Domestic Tourism

International Tourism and COVID-19

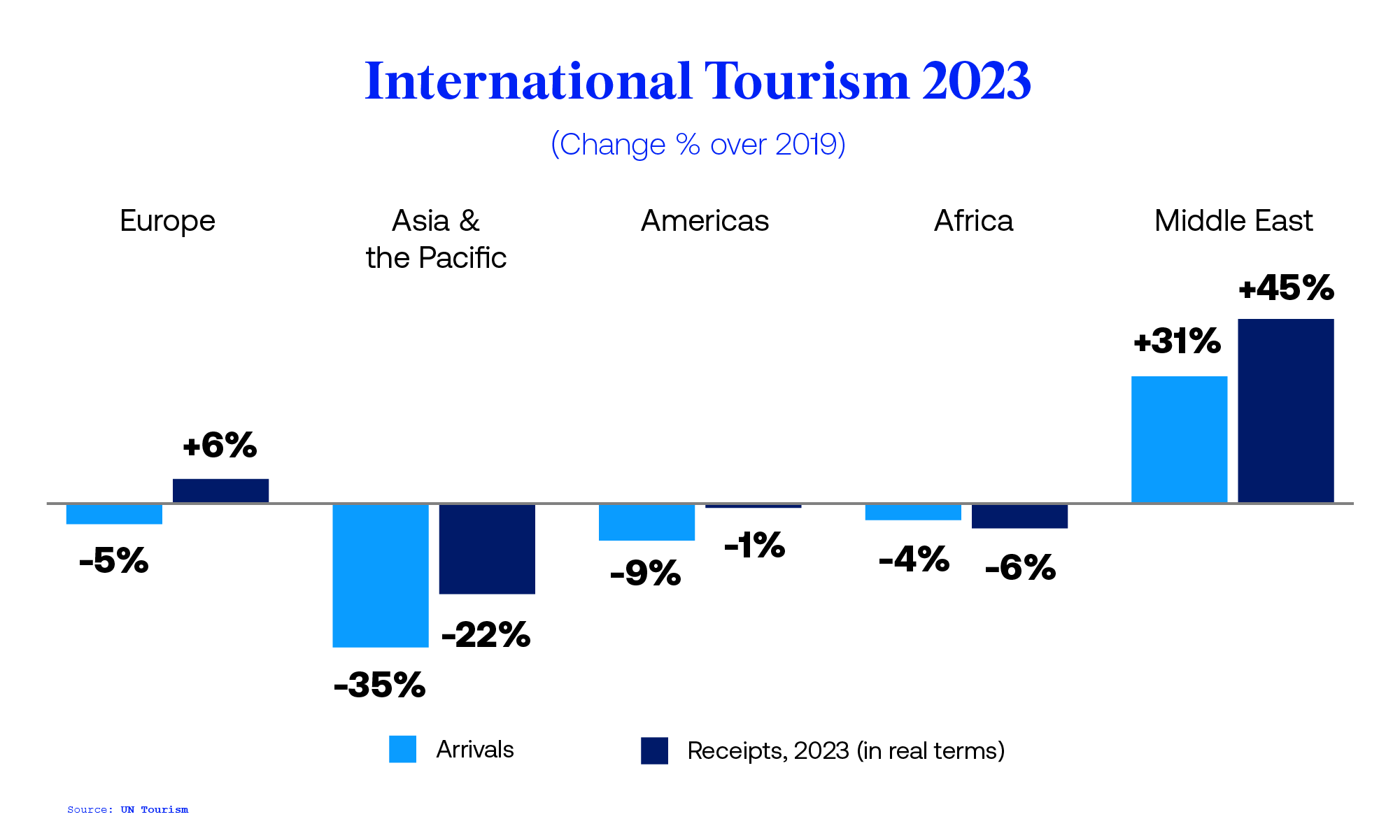

- The pandemic generated a loss of 2.7 billion international arrivals in 2020, 2021 and 2022 combined.

- Export revenues from international tourism (including receipts and passenger transport) dropped 62% in 2020 and 59% in 2021, versus 2019 (real terms) and then rebounded in 2022, remaining 23% below pre-pandemic levels.

- The total loss in export revenues from tourism amounts to USD 2.5 trillion for that three-year period.

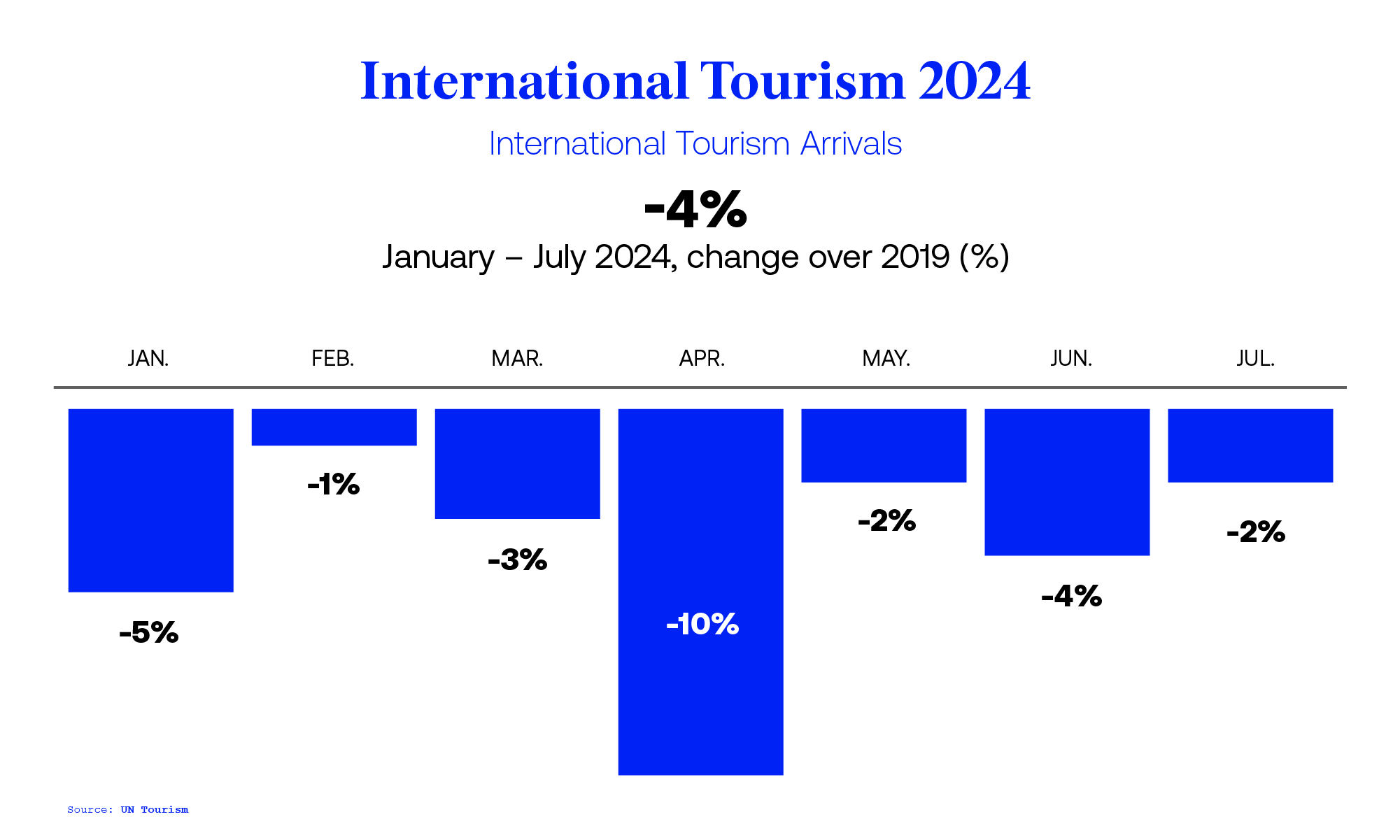

- International tourist arrivals reached 89% of pre-pandemic levels in 2023 and 96% in January-July 2024.

- Revised data for 2023 shows export revenues from international tourism reaching USD 1.8 trillion virtually the same as before the pandemic (-1% in real terms compared to 2019). Tourism direct GDP also recovered pre-pandemic levels in 2023, reaching an estimated USD 3.4 trillion, equivalent to 3% of global GDP.

COVID-19: Measures to Support Travel and Tourism

No spam. We promise.

Malaysia Travel & Tourism Economic Impact Research

Discover the direct and total economic contribution that the Travel & Tourism sector brings to Malaysia in this comprehensive report.

Create an account for free or login to download

This report is FREE for you as a WTTC member

Over the next few weeks we will be releasing the newest Economic Impact Research reports for a wide range of economies and regions. If the report you're interested in is not yet available, sign up to be notified via the form on this page .

Report details

This latest report reveals the importance of Travel & Tourism to Malaysia in granular detail across many metrics. The report’s features include:

- Absolute and relative contributions of Travel & Tourism to GDP and employment, international and domestic spending

- Data on leisure and business spending, capital investment, government spending and outbound spending

- Tables ranking Malaysia against other competing destinations and benchmarked against the world and regional average across various metrics

- Charts comparing data across every year from 2014 to 2024

- Detailed data tables for the years 2018-2023 plus forecasts for 2024 and the decade to 2034

Sponsored by

Research support partners.

Non-Members

Other reports you may like.

Armenia Travel & Tourism Economic Impact Research

Discover the direct and total economic contribution that the Travel & Tourism sector brings to Armenia in this comprehensive report.

Seychelles Travel & Tourism Economic Impact Research

Discover the direct and total economic contribution that the Travel & Tourism sector brings to Seychelles in this comprehensive report.

Paraguay Travel & Tourism Economic Impact Research

Discover the direct and total economic contribution that the Travel & Tourism sector brings to Paraguay in this comprehensive report.

MyMuslimTrip.com

ITC Corporate Website

MyMuslimTrip

ITC Annual Report 2020

Ready to tap into the Muslim tourist market and elevate your business?

IMAGES

COMMENTS

Annual Reports. Download Download Download Download Download Download ... MALAYSIA TOURISM PROMOTION BOARD (MTPB) HEAD OFFICE 9th Floor, No. 2, Tower 1, Jalan P5/6, Presint 5, 62200, Putrajaya, Malaysia. Phone: +603-8891 8000 Email: [email protected]. TOURISM INFO LINE

Tourism Malaysia

Tourism Malaysia receives and collates tourism related data from multiple sources. These have been formulated, configured and analysed to provide concise and useful information such as facts and figures on the performance of Malaysia tourism sector. Interactive arrivals dashboard. Statistics dashboard for international tourist arrivals sourced ...

Source : Bank Negera Malaysia Annual Report 2022, Strategic Planning Division, Tourism Malaysia MALAYSIA IN BRIEF 2022 Capital Kuala Lumpur Population 32.7 million Currency Ringgit Malaysia (RM) Employment 15.8 million Per Capita Income RM52,819 MAJOR FOREIGN EXCHANGE EARNINGS 2022 Manufactured Goods LNG Tourist Receipt RM1,306.65 billion RM67 ...

Tourism in Malaysia - statistics & facts. Choose a region: Malaysia. Touting the slogan "Malaysia, truly Asia", Malaysia offers a travel destination rich in cultural diversity and traditions ...

6 Annual Report 2018 Annual Report 2018 7 The Malaysia Tourism Promotion Board or Tourism Malaysia is an agency under the Ministry of Tourism, Arts and Culture Malaysia. It focuses on the specific task of promoting tourism in Malaysia and overseas. Since its inception in 1972, Tourism Malaysia has grown by leaps and bounds and has played a

For 2024, Tourism Malaysia is aiming to achieve 27.3 million tourist arrivals with a total expenditure of RM102.7bil. ... According to the fifth annual report by Mastercard Economics Institute ...

Ministry of Tourism, Arts and Culture Official Portal, MOTAC, Tourism, Arts, Culture ... Malaysia Tourism Quality Assurance (MyTQA) Watchlist of Entities Violating the Tourism Industry Act 1992; Home; Archives; 2020 Archive; Laporan Tahunan 2020; Laporan Tahunan 2020 . Last updated : 27 January 2022.

National Tourism Policy 2020-2030 In response, the Government launched the National Tourism Policy (NTP) 2020-2030 on 23 December 2020 to ensure the continuity of the country's tourism industry, while targeting to make Malaysia a global top 10 tourism destination in both arrivals and receipts.

Download. Tourism Revenues in Malaysia increased to 71308.50 MYR Million in 2023 from 28228.30 MYR Million in 2022. Tourism Revenues in Malaysia averaged 45589.97 MYR Million from 1998 until 2023, reaching an all time high of 86143.50 MYR Million in 2019 and a record low of 238.70 MYR Million in 2021. source: Tourism Malaysia. Feedback.

The Tourism Malaysia 2019 annual report takes readers on a pictorial journey to some of Malaysia's stunning beaches, idyllic islands, and scenic lakes. The flow and fluidity of water are symbolic of Tourism Malaysia's continuous stream of efforts in promoting tourism domestically. While 2019 presented challenges in advancing tourism promotions ...

Tourism in Malaysia is a major industry and contributor to the Malaysian economy. Malaysia was once ranked 9th in the world for tourist arrivals. [ 1 ] In 2017, the Travel and Tourism Competitiveness Report ranked Malaysia 26 out of 141 countries using its Travel & Tourism Competitiveness Index (TTCI) which measures the various components and ...

Malaysia Tourism Quality Assurance (MyTQA) Senarai Amaran Entiti Yang Melanggar Akta Industri Pelancongan 1992; Utama; Arkib; Arkib Tahun 2020; Laporan Tahunan 2020; Laporan Tahunan 2020 . Kemaskini Terakhir : 27 Januari 2022.

24 Jun 2024, 10:36 pm. KUALA LUMPUR (June 24): Malaysia welcomed over 7.56 million foreign tourists in the first four months of the year, marking a growth of 27.5% compared to the same period last year. Tourism, Arts and Culture Minister Datuk Seri Tiong King Sing noted that this achievement places Malaysia as the second-highest recipient of ...

Malaysia Tourism and Leisure Sector Report 2019/2020. Tourism and leisure contributed MYR 84.1bn (5.9% of GDP) directly to Malaysia's economy in 2018, making it a priority sector for the government which has allocated a single ministry - the Ministry of Tourism and Culture ("MOTAC") - to coordinate policy for this sector.

International Tourism and COVID-19. The pandemic generated a loss of 2.7 billion international arrivals in 2020, 2021 and 2022 combined. Export revenues from international tourism (including receipts and passenger transport) dropped 62% in 2020 and 59% in 2021, versus 2019 (real terms) and then rebounded in 2022, remaining 23% below pre-pandemic levels.

Malaysia tourism statistics for 2020 was 3,386,000,000.00, a 84.75% decline from 2019. Malaysia tourism statistics for 2019 was 22,200,000,000.00, a 1.95% increase from 2018. International tourism receipts are expenditures by international inbound visitors, including payments to national carriers for international transport.

This latest report reveals the importance of Travel & Tourism to Malaysia in granular detail across many metrics. The report's features include: Absolute and relative contributions of Travel & Tourism to GDP and employment, international and domestic spending. Data on leisure and business spending, capital investment, government spending and ...

ITC Annual Report 2020. Challenged by the pandemic in 2020, Alhamdulillah, ITC rises above the hardships by working together with its partners and relying on each other's combined resources, knowledge, courage, and spirit, to ensure a more resilient and sustainable tourism future for all. Download This Report.

Tourism Programmes. Volunteer Tourism (Voluntourism) Agrotourism; Homestay & Kampungstay. Guideline; Program Pengalaman Homestay Malaysia; New Student Travel Program Club Guidelines (K3P) Standards. ASEAN Tourism Standards; ASEAN Tourism Awards (List of the Awardees) Courses. Mesra Malaysia; Eco-Host Malaysia; Tourist Guide Level 2; Tourist ...

The Travel in Malaysia report includes: Analysis of key supply-side and demand trends. Detailed segmentation of international and local products. Historic volume and value sizes, company and brand market shares. Five year forecasts of market trends and market growth. Robust and transparent research methodology, conducted in-country.

Laporan Tahunan 2019. Laporan tahunan Tourism Malaysia 2019 membawa pembaca menelusuri perjalanan bergambar ke beberapa buah pantai yang mempesonakan, pulau-pulau yang memikat dan tasik-tasik yang indah di Malaysia. Aliran dan kelancaran air merupakan lambang kepada usaha berterusan Tourism Malaysia dalam mempromosikan pelancongan di peringkat ...

Malaysia's tourism industry is expected to exceed its targeted 18 million international tourist arrivals by the end of the year. In the first nine months of 2023, the number stood at 14 million, generating RM49 billion in tourist receipts. ... Furthermore, the latest Global Travel Trends 2023 report by ForwardKeys, a global air travel ...