- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Tin Leg Travel Insurance Review: Is it Worth the Cost?

Alisha is a freelance writer and photographer. She is the creator of travel and adventure site Terradrift.com and has written about travel and rewards for many publications, including American Way and Johnny Jet.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Tin Leg Travel Insurance plans and costs

Which tin leg travel insurance plan is best for me, can you buy a tin leg plan online, what isn’t covered by tin leg travel insurance, is tin leg travel insurance worth it.

- In addition Cancel For Any Reason, some plans offer cancel for work reason coverage.

- Adventure sports-specific coverage is available.

- Plans have overlap that can be hard to distinguish.

- Claim approval can be lengthy.

- Only one plan includes Rental Car Damage coverage available as an add-on.

Whether you’re traveling domestically or internationally, by car, plane, train or anything in between, Tin Leg travel insurance can protect your trip. The company offers coverage for trip cancellations, medical emergencies, lost luggage and more.

If you’re considering insurance options, here’s our Tin Leg travel insurance review of what types of plans and coverage are available, what’s not included and which plan to choose for your next trip.

Tin Leg offers nine different travel insurance coverage policies. Prices vary for each depending on your itinerary and trip costs, but as an example, we searched for plans using a sample itinerary for a $2,000, 1-week trip to Australia for a single, 35-year-old traveler from Arkansas.

The Basic plan ($61) is exactly what it sounds like: a policy for low-risk trips. It includes coverage for trip cancellation , delay and interruption , plus missed connections, emergency medical and evacuation, and lost and delayed luggage coverage.

The Economy plan ($80) is similar to the Basic plan, but it offers less emergency medical and evacuation coverage and no coverage for missed connections. It includes coverage for certain concierge services.

The Standard Plan ($96) offers a slight upgrade to Basic and Economy plans by offering coverage for domestic and international terrorism, plus it will cover trip costs if you have to cancel plans due to a layoff. Compared with the Basic plan, there’s less emergency medical coverage but the same amount of evacuation coverage .

The Luxury Plan ($105) , unlike the other cheaper policies, offers primary, not secondary, medical coverage, plus you can be covered if unforeseen work situations require you to cancel a trip.

The Adventure Plan ($129) also features primary medical coverage and work-related cancellations, plus more lost luggage insurance than the Luxury plan, coverage for accidental death and dismemberment during the trip (excluding flights) and extra coverage for delayed sports equipment. It’s also the only plan that offers medical coverage for adventure activities like mountain biking.

The Silver Plan ($98) looks a lot like the Standard plan but with over eight times more emergency medical coverage (more than the Luxury and Adventure plans, too) and five times more medical evacuation coverage. It also has larger payouts for travel delays and lost luggage.

The Gold Plan ($113) offers more emergency medical coverage than the Silver plan, but less medical evacuation, travel delay, and baggage delay and loss coverage. It also offers accidental death and dismemberment benefits (excluding flights).

The Platinum Plan ($79) is similar to Gold, but with less emergency medical coverage than both Silver and Gold. It offers an allowance for work-related trip cancellations and flight-related accidental death and dismemberment.

The USA Only Plan , as the name implies, is for travel within the U.S. It offers fewer specialty coverage than other plans. For example, there’s no coverage for terrorism, fewer reasons you can cancel a trip and less emergency medical coverage.

When comparing Tin Leg travel insurance plans, there doesn’t seem to be much rhyme or reason as to which plans offer the most benefits or the largest payouts. For example, just because a plan is more expensive or has a seemingly better name doesn’t mean it automatically offers you more protections across the board.

Instead, the only way to figure out the plan that’s right for you is to compare them all, look at the plan details, and decide which features and coverages suit you and your travel style best.

In general, you might consider more comprehensive plans for longer, more complex trips with higher likelihood of interruptions or cancellations. And you'll want to consider plans with better medical coverage — especially emergency health services — if you're planning anything adventurous.

Finally, if you have a premium credit card such as the Chase Sapphire Reserve® , you may not need a plan that offers similar coverage as the card already in your wallet.

» Learn more: Airline travel insurance versus independent travel insurance

To choose a Tin Leg plan, go to tinleg.com , select “Get quotes,” enter your trip information, select “Search now” and compare the various plans available. Just make sure to read the policy details before you buy.

You can filter plans by coverage options, too, including weather coverage, travel delay insurance limits and primary medical coverage.

As for what isn’t covered, that depends largely on the plan. But you can assume that, unless you opt for the Cancel For Any Reason upgrade, you won’t be able to just change your plans because you feel like it. Likewise, for most policies, injuries that result from participation in extreme sports, like rock climbing, aren’t covered, nor are incidents that occur when you’re under the influence of alcohol or narcotics.

Routine or elective medical services, like eye exams or cosmetic surgeries, aren’t typically covered either. Treatment for pre-existing conditions is only covered in a few plans, so check the details of your policy if that’s something you require.

» Learn more: The best credit cards with built-in travel insurance

Tin Leg travel insurance offers many plans suited for most types of travelers. But since most of the plans cover a collection of different things with varying coverage limits and payouts, you’ll likely have to compare all of the details to choose one that fits your needs.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

85,000 Earn 85,000 bonus points after spending $3,000 on purchases in the first 3 months from account opening.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Tin Leg Travel Insurance Coverage Review – Is It Worth It?

Christine Krzyszton

Senior Finance Contributor

313 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Keri Stooksbury

Editor-in-Chief

36 Published Articles 3291 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Table of Contents

Why purchase travel insurance, why purchase travel insurance from tin leg, travel insurance and covid-19, types of policies offered, how to get a quote, the value of travel insurance comparison websites, how tin leg compares, how to file a claim, everything else you need to know, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

You may not recognize the name, but this relatively new travel insurance company is becoming a respected player in the travel insurance marketplace.

Created in 2014 by travel insurance comparison website Squaremouth , Tin Leg has the daunting task of competing with significantly more established travel insurance companies.

And, while it’s certainly unusual for a travel insurance comparison website to start a travel insurance company, one of Tin Leg’s advantages might be that a travel comparison website would understand the needs of travelers and be able to create a competitive product with favorable pricing.

With this foundation in mind, let’s set off to compare and discuss this “young” travel insurance company, Tin Leg. We’ll take a look at why you might want to consider the company, the type of policies it offers, how to get a quote, what to do if you have a claim, and more.

If you’re looking for travel insurance, you’ll want to compare the best travel insurance companies and policies. Let’s look at just 1 of the possible options.

The compelling reasons for purchasing travel insurance are many, but it is particularly important to secure coverage if your trip includes a lot of non-refundable travel expenses. Additionally, if your trip is lengthy, has a complex itinerary, or you will not have medical coverage during your travels, you should also consider a comprehensive travel insurance policy.

Situations where travel insurance could save the day:

- You have a gallbladder attack while on a cruise and need immediate surgery (an actual Tin Leg claim that was covered).

- You injure your ankle while hiking and need to have x-rays to determine if it is broken.

- You or your travel companion become ill and must cancel your trip.

- You are on a safari and due to an injury, you need to be evacuated by helicopter to the nearest hospital.

There are endless situations where travel insurance could save you from significant unplanned expenses or reimburse you for any lost prepaid trip expenses.

Bottom Line: If your trip is expensive, complex, includes a lot of non-refundable prepaid expenses, or you will not have medical coverage during your travels, you should consider purchasing a travel insurance policy.

While Tin Leg is a newer company, this shouldn’t affect your decision to purchase its travel insurance. Policies issued by Tin Leg are underwritten (meaning coverage is provided by) several highly-rated, established insurance companies, including Berkshire Hathaway.

Forbes also speaks highly of Tin Leg as it gave the company a “superior” 5-star rating for its Gold plan that offers COVID-19 cancellation coverage and comes with high medical limits.

With over 103,000 of its Gold policies sold since its inception in 2014, it has outsold most established travel insurance companies .

Does Tin Leg get complaints? Every insurance company gets complaints. It’s human nature to want to pay as little as possible for a policy and yet expect as much coverage as possible when we have a claim. While complaints of expectations not being met can be important, complaints about the actual handling of the claim are equally, if not more, so.

Out of over 2,800 reviews, only 0.1% were negative (the average is 0.2%) and 2,191 of those reviews gave the company a 4- or 5-star rating.

Bottom Line: Tin Leg is backed by established highly-rated insurance companies, its Gold policy received a 5-star rating from Forbes, the company sells a large number of policies compared to more established companies, and it averages fewer negative complaints compared to other insurance companies.

Travel insurance does not cover canceling a trip due to any fear of getting COVID-19 or for related border shutdowns that may cause you to cancel your trip. In order to have any coverage for these trip cancellations, you would need to purchase Cancel for Any Reason insurance (CFAR) as an add-on to your policy.

CFAR insurance can be expensive and usually covers just 50% to 75% of the cost of your trip.

Many insurers include getting ill from COVID-19 as a covered reason for cancellation, but there are companies and specific policies that do not. Some companies even exclude medical coverage for COVID-19. Be sure to check any policy prior to purchasing.

Fortunately, Tin Leg offers policies that have the option for CFAR insurance. The company also includes coverage (at various levels) for COVID-19 illness, included for trip cancellation, delay, medical coverage , and more.

Bottom Line: Travel insurance does not cover voluntary trip cancellations. In order to have coverage, you must add Cancel for Any Reason insurance to your travel insurance policy. Tin Leg offers this coverage option on select policies it offers.

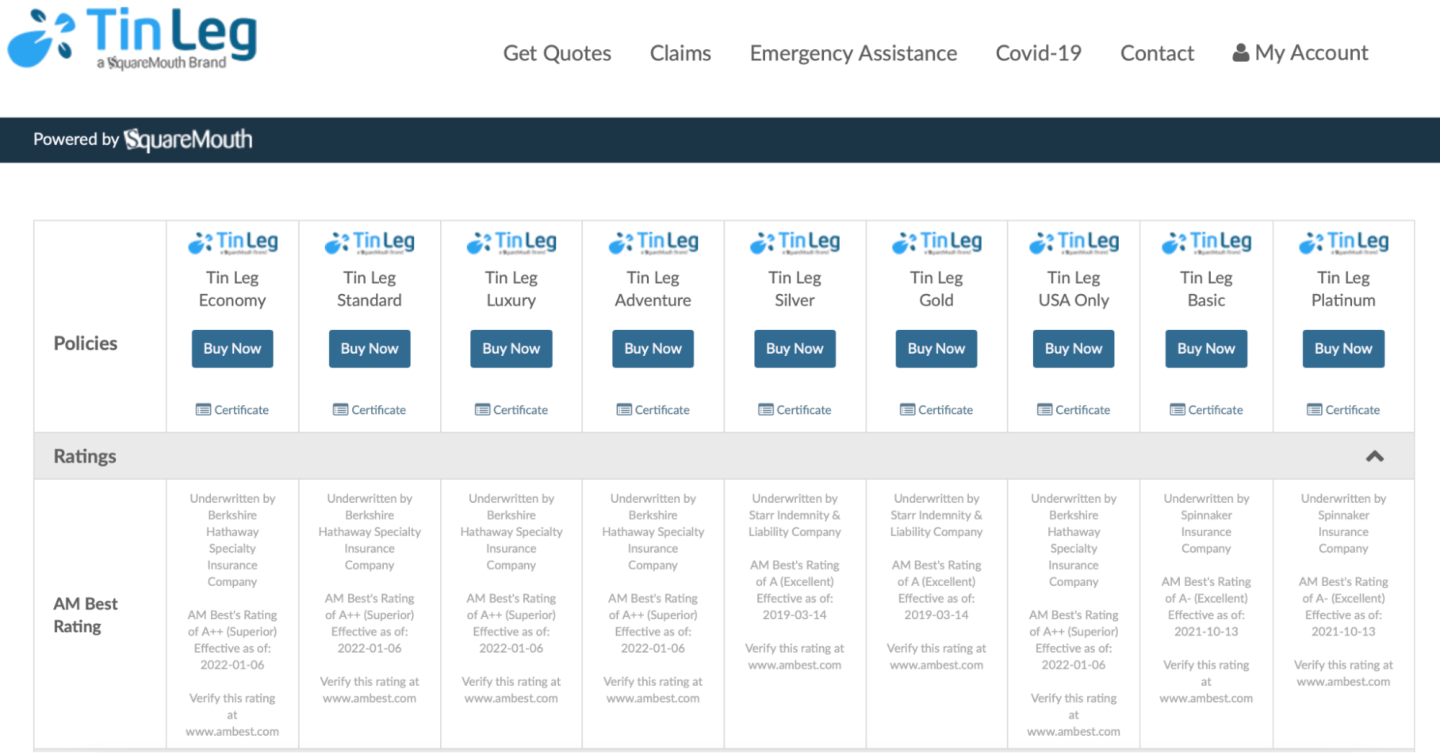

Tin Leg offers several types of travel insurance policies, each with different levels of coverage. You’ll find 9 policy options, including these plans: Economy, Standard, Luxury, Adventure, Silver, Gold, Basic, USA Only, and Platinum.

Here is a sampling of the types of coverages you can expect on 3 of Tin Leg’s most popular plans.

This is just a sampling of the core coverages on 3 plans offered by Tin Leg for a specific journey. Coverage will vary depending on which of the 9 policies you select, the coverages you prefer, where you reside, and the details of your trip.

There are also additional terms and conditions for each coverage; this is just an overview for comparison purposes only.

Bottom Line: Tin Leg offers 9 travel insurance plans, all with coverage options that can be tailored to a plan that fits your specific trip requirements and your personal priorities.

Obtaining a quote for Tin Leg travel insurance is simple. Visit the Tin Leg website and provide the number of travelers, ages, dates/cost of your trip, where you live, and your destination.

You’ll receive an instant quote for the applicable policies Tin Leg offers, as well as a collection of similar policies offered by competitors. You’ll also be able to select any add-on coverage you prefer.

Once you’ve selected a policy you want to buy, you can make a purchase immediately and the policy will be issued with coverage effective on the date you selected.

If you’re looking for travel insurance, the benefit of utilizing a travel insurance comparison website is undeniable. Comparing policies and companies can result in finding the best coverage for your situation at a price you’re willing to pay. You can also accomplish this with little effort.

In addition to policy comparisons, these sites also offer educational content, company rating information, and customer reviews.

Some of the best travel insurance comparison websites include the following:

- InsureMyTrip — Whether you’re looking for coverage for a single trip, for multiple trips in 1 plan, or for just medical insurance during your travels, this site has it all.

- TravelInsurance.com — While the site does not offer policy comparisons for medical-only plans, the site does a good job comparing comprehensive travel insurance policies.

- Squaremouth — You’ll find single-trip, multi-trip, group, adventure/sports coverage, and medical plans on this comparison site.

- AARDY — AARDY compares dozens of companies, but you will need to provide your email address to obtain a quote.

Bottom Line: A travel insurance comparison website takes the guesswork out of purchasing a travel insurance policy. You’ll be able to compare prices, coverage, and companies, all in just minutes.

While Tin Leg offers plenty of travel insurance options, let’s see how the company’s offerings compare to credit card travel insurance, other travel insurance companies, and to the coverage you might be offered at the point-of-sale when purchasing a flight or travel package.

To Credit Card Travel Insurance

The best credit cards for travel insurance are not meant to replace a comprehensive travel insurance policy. If your trip is simply a domestic round trip flight and a hotel room, however, the coverage you receive with your credit card may be more than adequate.

For a more complex trip that is expensive, has several non-refundable expenses, or if you need medical/evacuation coverage, even the basic plans offered by Tin Leg will serve you better than just the coverage offered on your credit card.

Also, credit card travel insurance can be secondary to any other coverage you have, while Tin Leg offers primary coverage.

Bottom Line: Credit card travel insurance can be adequate for a simple trip but a comprehensive travel insurance plan is needed to provide coverage for a complex, expensive trip, or if you need medical coverage.

To Other Travel Insurance Companies

We looked at a specific trip example of a traveler, 40 years of age, traveling to Mexico for 1 week. The total trip cost was $2,000 and the traveler needed medical coverage.

Tin Leg held its own when compared to similar policies with competitor companies. All the companies offered the same trip interruption/cancellation benefits but Tin Leg has limits on trip delay coverage that are not as strong as the competitors. Where Tin Leg shines is in providing medical coverage ($500,000).

When we add Cancel for Any Reason insurance to the plans, Tin Leg continues to offer competitive pricing. Seven Corners and Tin Leg also both offered $500,000 in medical coverage while Travel Insured International offered $100,000 and Travelex just $50,000.

Bottom Line: Tin Leg can offer competitive pricing with strong medical coverage on its plans when compared to competitors. You may be able to add CFAR insurance to its Gold plan and still receive competitive pricing.

To Point of Sale Coverage

Point of sale travel insurance is normally offered during checkout when you’re purchasing a flight, vacation package, or other travel. You’ll find the price rather compelling and you may be tempted to make the purchase thinking your trip would be covered if you needed to cancel.

These point-of-sale policies do not cover voluntary cancellations and do not replace a comprehensive travel insurance plan. Only specific reasons for cancellation, delay, or other disruption are covered, so be sure to review the specifics prior to making any point-of-sale travel insurance purchase.

You’ll also want to check out competitor policies and rates. Bottom Line: Always compare pricing prior to purchasing travel insurance at the point of sale.

Filing a claim with Tin Leg can be done online or by calling Tin Leg at 844-240-1233 on weekdays between 8 a.m. and 4 p.m. EST.

If you report your claim via phone, a claim form will be sent to you to complete. You can also complete the claim form online at any time.

The documentation you may be asked to provide may include:

- Completed claim form

- Proof of loss

- Proof of payment for travel arrangements

- Copy of airline tickets or other transportation

- A copy of the travel provider’s cancellation/refund policy

- The amount of any compensation received for the loss from providers and other sources

- Invoices and receipts that document incurred expenses

Prior to submitting any claim, you should first contact your travel provider as the provider may provide partial or full reimbursement. Based on that outcome, you can then submit a claim for any remaining out-of-pocket expenses.

Bottom Line: Report your claim as soon as possible, contact travel providers to determine if a refund or reimbursement is possible, and submit all documentation within the required time period.

Tin Leg offers high medical limits on many of its plans. The medical coverage is also primary, meaning you do not need to file a claim with other insurance first before coverage is valid.

We were able to find several options for travelers, even over age 100, so if you’re a senior looking for travel insurance , Tin Leg is a viable source for coverage. The levels of coverage available may vary by age, however.

When you purchase a policy from Tin Leg, you will have 14 days to review the plan. If you are not satisfied, you can then cancel and receive a full refund.

You can reach Tin Leg customer service from 8 a.m. to 10 p.m. Emergency assistance is available 24/7. Tin Leg also provides assistance services including helping you find return transportation should your trip being interrupted for a covered reason, assistance with lost/delayed baggage, medical and dental referrals, and more.

Don’t let the relative newness of Tin Leg keep you from considering the company for travel insurance. The company is backed by highly-rated, established companies.

Its policies are also competitively priced and you can select a plan that closely fits your situation without having to pay for coverage you don’t need or coverage you don’t consider a priority.

If you’re looking for a policy with strong medical coverage and the ability to add CFAR insurance, Tin Leg can be a good choice.

The ease of being able to compare Tin Leg on the Squaremouth website is also a plus. You will be able to view all of the Tin Leg policies available, plus compare these to the competitors, all in 1 visit to the site.

If you would like to learn more about the basics of purchasing travel insurance , the best travel insurance companies , and how travel insurance works with COVID-19, our articles can provide a lot of related information.

Frequently Asked Questions

Is tin leg a good travel insurance company.

Yes. Tin Leg is backed by highly rated travel insurance companies, gets few overall complaints, and offers a wide range of policies from which to select.

It also offers competitive pricing and has strong medical coverage compared to many of its competitors.

What insurance plans does Tin Leg offer?

Tin Leg offers 9 different travel insurance plans that offer various levels of coverage so that you can choose a policy that matches your needs and priorities.

Select from the Economy, Standard, Luxury, Adventure, Silver, Gold, Basic, USA Only, or Platinum plans.

Does Tin Leg cover COVID-19?

Yes. There is coverage for COVID-19 illness found under medical coverage, trip cancellation, and trip interruption.

Terms and conditions apply, but you can find coverage in various degrees for COVID-19 with Tin Leg.

Does Tin Leg offer Cancel for Any Reason Insurance?

Yes. Tin Leg offers CFAR insurance which covers trip cancellation for any reason. It is not available on every plan the company offers but it is available on select plans, including the Gold plan that is rated a 5-star product by Forbes.

Does Tin Leg have a rating with the Better Business Bureau?

Tin Leg has not yet been accredited or assigned a rating by the BBB.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

Discover the exact steps we use to get into 1,400+ airport lounges worldwide, for free (even if you’re flying economy!).

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

We research all brands listed and may earn a fee from our partners. Research and financial considerations may influence how brands are displayed. Not all brands are included. Learn more .

- Travel Insurance

https://money.com/tinleg-travel-insurance-review/

Tin Leg Travel Insurance Review

- Gerber Life Insurance Review

- What Is Schengen Travel Insurance?

- Australia Travel Guide

- Liberty Mutual Life Insurance Review

- AXA Travel Insurance Review

- Domestic Travel Insurance: What Does It Cover?

- 6 Best Life Insurance for Seniors of 2021

- 5 Best Small Business Loans of 2024

- Why Choosing a Higher Pet Insurance Deductible Can Pay Off

- Best Places to Travel in the Summer

When traveling, you want to make sure your investment is protected and you're covered in the event of an emergency. If you've spent a good deal of money on prepaid, non-refundable travel expenses or want the peace of mind that comes from having emergency medical coverage during your trip, consider getting travel insurance from one of the best travel insurance providers.

While not among our top picks, Tin Leg has made a name for itself in the travel insurance industry as a reliable and reputable company. In this Tin Leg travel insurance review, we’ll break down its plans and pricing and examine customer feedback to help you decide whether it's the right travel insurance option for you.

Tin Leg travel insurance pros and cons

Extensive coverage options, emergency assistance available 24/7, offers coverage for sports activities and equipment, limited baggage loss coverage, limited rental car coverage, pros explained.

Tin Leg offers a wide range of coverage options to suit different types of travelers. Customers can choose from nine plan tiers covering everything from basic travel mishaps to sports activities, concierge services and even identity theft protection.

All of Tin Leg’s travel insurance plans include emergency assistance services available 24/7 anywhere in the world. You can get support for a variety of medical and travel emergencies, whether you experience an injury or illness, need to be evacuated for medical reasons, your luggage is lost or delayed, or you need to return home early due to an emergency.

Tin Leg agents can coordinate the return of your rental vehicle, help you communicate with doctors and family members back home, arrange transportation and medical companion services, provide translation support and help you replace lost prescriptions.

Seven of Tin Leg's plans include limited coverage for sports activities, provided you're not participating in a professional sporting event, flying an aircraft or mountain climbing with specialized equipment such as pick-axes, anchors and carabiners. Sports equipment loss is also included in all plans, with the exception of the Tin Leg Basic.

Cons explained

The company’s maximum baggage loss coverage is $2,500 on the Silver plan and $1,000 on the Adventure plan. All Tin Leg’s other plans only cover up to $500 (either per person or per policy), which is well below the maximum other competitors offer for lost baggage and personal effects.

If you need rental car coverage on your upcoming trip, you'll have very few options with Tin Leg. This optional coverage, which can reimburse you for expenses related to the theft or damage of a rental vehicle, is available for purchase only with the high-tier Luxury plan.

Tin Leg travel insurance plans

Tin Leg boasts an extensive selection of policies catering to various travel needs. However, comparing the nine different plans can be a little confusing, especially for those buying travel insurance for the first time. Before comparing plans and getting quotes, it can help to first understand what travel insurance covers .

Regardless of the plan you select, Tin Leg provides comprehensive protection that includes coverage for the following:

- Trip cancellation

- Trip interruption

- Delays due to weather

- Emergency medical treatment, evacuation and repatriation

- Travel delays

- Baggage loss or delay

- 24/7 travel assistance

The key differences between the various plans are covered trip cancellation reasons and emergency medical and evacuation coverage, so you'll want to focus on these as you decide which plan is best for you.

Tin Leg Economy

The Tin Leg Economy plan is perfect for travelers seeking affordable essential coverage for their trips. This plan includes everything above with a maximum benefit of $20,000 for emergency medical coverage (but preexisting conditions aren’t covered) and $100,000 for medical evacuation and repatriation.

You also get concierge services coverage (e.g. restaurant referrals and reservations and ground-transportation arrangements) at this budget-friendly level.

Tin Leg Standard

The Tin Leg Standard plan provides more extensive protection. It covers trip cancellation due to acts of terrorism or being laid off from work, and provides assistance with costs related to identity theft.

Coverage maximums on this plan go up to $30,000 for emergency medical coverage and $200,000 for medical evacuation and repatriation. This tier is a good choice for travelers seeking comprehensive coverage and concierge services without breaking the bank.

Tin Leg Luxury

With this high-tier plan, you can indulge in luxury accommodations and exclusive services knowing that you have comprehensive coverage for various travel-related incidents. The Luxury plan offers the option to add Cancel For Any Reason (CFAR) coverage to your policy.

At this level, emergency medical is covered up to $100,000, and the medical evacuation and repatriation coverage goes up to $250,000. Tin Leg’s Luxury plan is the only one that offers optional rental car coverage.

Tin Leg Adventure

Designed for adventurers, this plan covers various activities often excluded from standard policies, including hiking, rock climbing and water sports. You can get up to $100,000 for medical emergencies and $1 million for medical evacuation and repatriation.

The Adventure plan provides $1,000 in baggage loss and equipment coverage as well as $500 for sports equipment delay. It also includes up to $25,000 in accidental death or dismemberment (AD&D) coverage.

Tin Leg Silver

Tin Leg Silver is a mid-tier plan best suited for travelers worried about baggage delays or loss. It offers the company’s highest baggage and personal effects coverage at $2,500 and the highest baggage delay benefit at $500.

As for medical coverage, Silver covers up to $250,000 in emergency medical benefits and up to $1 million in medical evacuation and repatriation. This plan is suitable for most travel needs, with balanced coverage and competitive pricing.

Tin Leg Gold

Gold offers the highest level of medical emergency coverage out of all Tin Leg’s plans: $500,000. It also includes up to $10,000 in AD&D benefits — the only other plan besides Adventure that includes this coverage.

Gold is one of four Tin Leg plans that offer optional CFAR coverage, along with Silver, Adventure and Luxury.

Tin Leg Basic

As the name suggests, the Tin Leg Basic plan offers straightforward travel protection at an affordable price. Basic is similar to Economy, but with higher medical coverage limits ($50,000), missed connection coverage and up to $25,000 in flight-only AD&D. It also offers coverage for preexisting conditions, but no concierge services.

Tin Leg Platinum

The Platinum plan is similar to the Luxury plan but doesn’t include concierge services or identity theft coverage, nor does it offer the option to add CFAR or rental car coverage. With Platinum, medical evacuation and repatriation coverage also increases to $500,000.

Tin Leg travel insurance pricing

As with other travel insurance companies, Tin Leg’s policies are priced based on factors such as your age, the duration of your trip, the number of travelers in your group and the travel insurance plan you select.

The names of Tin Leg's travel insurance plans don't necessarily reflect their actual cost. If you’re interested in travel insurance from Tin Leg, use the quote tool on its website to get accurate quotes for your specific travel needs.

To give you an idea of what you could expect from Tin Leg's plans in terms of pricing, we gathered sample quotes for three different trips. For more information, read our article on the average cost of travel insurance .

Tin Leg travel insurance financial stability

To make travel insurance worth it , the company you work with should be financially stable enough to pay out claims now and in the immediate future.

Tin Leg Travel Insurance was founded by the insurance comparison website Squaremouth in 2014. While it's a relatively new company, its plans are underwritten by well-established insurers such as Berkshire Hathaway Specialty Insurance Company, Starr Indemnity & Liability Company, and Spinnaker Insurance Company.

All of these underwriters have A ratings or higher with credit rating agency AM Best, evidencing their strong claims-paying ability.

Tin Leg travel insurance accessibility

Tin Leg is a Squaremouth brand available to U.S. residents traveling domestically and internationally. Plans can be purchased online through the marketplace.

Availability

Tin Leg’s sells coverage to U.S. residents exclusively. Coverage details may vary by state.

Contact information

Tin Leg’s customer service team is available daily from 8 a.m. to 10 p.m. ET.

- Tin Leg customer service phone number : 844-240-1233

- Tin Leg email address : [email protected]

The Tin Leg claims department can be reached on weekdays from 8 a.m. to 4 p.m. ET at the phone number above or by email at [email protected] . Claims can also be submitted on the website anytime.

Tin Leg's emergency assistance services are available 24 hours a day, seven days a week to insurance plan holders.

- Emergency assistance for domestic callers : 844-927-9265

- Emergency assistance for international callers : +1-727-264-5657

User experience

When you're ready to buy travel insurance, Tin Leg’s quote tool makes it easy to find the right plan. With nine Tin Leg plans to consider, you can view plans side by side to compare their coverage options.

Tin Leg Travel Insurance Customer Satisfaction

Tin Leg has earned high marks for customer satisfaction on Squaremouth’s website, where it has earned 4.61 out of 5 stars based on almost 3,300 reviews. Positive reviews praise Tin Leg’s easy claims process, helpful customer service and straightforward trip cancellation policies. Keep in mind, however, that Tin Leg is a Squaremouth brand.

On the Better Business Bureau's website, Squaremouth has an A- rating. There are few reviews on the site, and they’re almost entirely negative. While not all reviews mention Tin Leg, Squaremouth’s customers do complain about denied claims and poor communication.

Tin Leg Travel Insurance FAQ

Is tin leg legit, who handles claims for tin leg, how do i contact tin leg travel insurance, how we evaluated tin leg travel insurance.

In our evaluation of Tin Leg travel insurance, we considered these factors:

- Coverage options : We compared Tin Leg’s range of travel insurance plans.

- Pricing : We pulled sample quotes and compared Tin Leg’s rates with those of other travel insurance providers.

- Accessibility : We considered Tin Leg’s accessibility and availability to provide services to travelers.

- Customer satisfaction : We assessed customer reviews on the company's website as well as third-party review sites.

- Financial stability : We examined Tin Leg’s financial stability and industry reputation.

Summary of Tin Leg Travel Insurance Review

Tin Leg offers an impressive range of plans to accommodate various needs. While its nine plans offer various coverage amounts and covered cancellation reasons, customization by way of add-ons is limited.

Third-party customer reviews for Tin Leg and its parent company, Squaremouth, cite claim processing delays. With that in mind, do your research before you commit to a policy.

- Travel insurance plans

Tin Leg Travel Insurance Cost

Compare tin leg travel insurance.

- Why You Should Trust Us

Tin Leg Travel Insurance: An In-Depth Review

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

Before finalizing your travel plans, look into various insurance policies to safeguard yourself against potential risks. Travel insurance is an invaluable resource that can protect you from many unforeseen issues, but not all companies provide the same level of coverage. And some companies' policies may cost more than others.

That's where Tin Leg Travel Insurance comes in. Created by travel agency Squaremouth, Tin Leg offers eight different plans with varying coverage levels and benefits, with the option to add Cancel for Any Reason (CFAR) coverage to select plans. Keep reading to see if Tin Leg is the right travel insurance for you.

Trip cancellation coverage for up to 100% of the trip cost and trip interruption coverage for up to 150% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Policy coverage includes most pre-existing health conditions

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous medical and evacuation amounts for peace of mind

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. COVID coverage included by default on all insurance plans

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers a wide range of plans for various budgets and travel needs

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Some plans offer CFAR, “cancel for work reasons,” financial default, and unemployment coverage

- con icon Two crossed lines that form an 'X'. Limited add-on coverage options

- con icon Two crossed lines that form an 'X'. Baggage loss and delay coverage is low compared to competitors

Tin Leg travel insurance offers eight travel insurance plans to meet the unique needs of travelers.

- Tin Leg was founded in 2014 by the travel insurance industry experts at Squaremouth. Designed to meet the most common needs of travelers, these policies offer comprehensive Trip Cancellation and Trip Interruption benefits, and a range of Emergency Medical and Medical Evacuation limits.

Overview of Tin Leg Travel Insurance

Tin Leg is a travel insurance provider founded in 2014 by travel insurance aggregator SquareMouth. With eight different plans, Tin Leg is one of the providers listed in our guide on the best travel insurance companies , specifically for travelers with pre-existing conditions. We chose Tin Leg because seven of its eight plans offer pre-existing condition waivers, with a 15-day purchase window and no extra cost.

That said, Tin Leg has other coverages that are noteworthy. Its coverage limits for emergency evacuation go up to $1 million, which is great particularly if you have nautical travel plans, as water-to-land rescues can be costly.

Additionally, sports equipment loss is included with seven of Tin Leg's eight plans. However, you will need to call for more information on adventure sports, as Tin Leg doesn't guarantee coverage.

Tin Leg's Travel Insurance Plans

Tin Leg travel insurance offers eight travel insurance plans: Economy, Basic, Standard, Luxury, Adventure, Silver, Platinum, and Gold. Each plan offers varying levels of protection that correspond to the premium costs.

Here's a look at what you'll get with each plan. We've split the eight plans into two tables to make things easier to follow.

Here's how the Adventure, Silver, Platinum, and Gold plans compare:

Additional Coverage Options

Tin Leg travel insurance offers additional coverage options, but they're only available on specific plans.

You can add rental car damage coverage to the Luxury plan for an additional fee. And both the Gold and Silver plans allow you to add on CFAR (cancel for any reason) coverage . With CFAR coverage travel insurance, you can cancel for any reason not listed in the base policy and be reimbursed — in the case of Tin Leg, for 75% of your trip costs.

How to Purchase and Manage Your Tin Leg Policy

Travel insurance coverage varies greatly, and the amount you pay reflects the range of protection. However, since travel insurance protects your financial investment, it's typically worth spending a few extra dollars for higher coverage maximums, especially for medical insurance and evacuation expenses.

Getting a quote from Tin Leg travel insurance is an easy process. You can do so from their website or an insurance aggregator like SquareMouth. You should be prepared to provide the following information:

- Number of travelers

- Age of traveler(s)

- Duration of trip

- Whether you want trip cancellation coverage

- Date of booking

- If you have any trip payments left to make

- One country you're traveling to

- Country of residence/citizenship

After inputting some personal information, such as your age and state of residence, along with your trip details, like travel dates, destination, and trip costs, you'll get an instant quote for the plans available for your trip. And from there, it's easy to compare each option based on your coverage needs and budget.

Now let's look at a few examples to estimate Tin Leg's coverage costs.

As of April 2024, a 23-year-old from Illinois taking a week-long, $3,000 budget trip to Italy would have the following Tin Leg travel insurance quotes:

Premiums for Tin Leg plans are between 1.8% and 3.9% of the trip's cost, well below the average cost of travel insurance . It's also relatively cheap compared to many of its competitors

Tin Leg provides the following quotes for a 30-year-old traveler from California heading to Japan for two weeks on a $4,000 trip:

Once again, premiums for Tin Leg plans are between 3.4% and 5.2%, below the average cost for travel insurance.

A 65-year-old couple looking to escape New Jersey for Mexico for two weeks with a trip cost of $6,000 would have the following Tin Leg quotes:

Premiums for Tin Leg plans are between 6.9% and 9.4%, which is roughly in line with the average cost for travel insurance. This is to be expected, as travel insurance is often more expensive for older travelers.

How to File a Claim with Tin Leg Travel Insurance

One exceptionally nice aspect of Tin Leg is that you can report a claim online or over the phone. You can contact Tin Leg's claims department at 844-240-1233 or by email at [email protected]. It's available on weekdays between 8 a.m. and 4 p.m. ET.

You'll be asked to fill out a claims form that asks about your trip details and the issue you faced. Tin Leg will then ask you to file supporting documents related to your claim. If you're filing a claim because you canceled a flight due to an illness, they'll likely require medical documentation that supports this claim.

Tin Leg Customer Service and Support Experience

Tin Leg is well-reviewed, receiving an average of 4.6 stars out of five on SquareMouth across nearly 3,800 reviews. Reviews on its Better Business Bureau are consistent with its SquareMouth score, also averaging 4.6 stars across over 110 reviews, admittedly a limited sample size. Additionally, Tin Leg is not certified with the BBB.

While most customers reported a smooth and speedy claims service, some noted that communication from Tin Leg during the process can be spotty. Additionally, customers complained about their claims being denied due to requirements they were unaware of when purchasing coverage. One customer wrote about how they had to cancel a trip because of work but hadn't been working at their company long enough to qualify for trip cancellation coverage.

See how Tin Leg travel insurance stacks up against the competition.

Tin Leg Travel Insurance vs. AIG Travel Guard

To compare Tin Leg travel insurance to Travel Guard , we'll consider the coverage limits from its highest-rated Gold and Travel Guard Deluxe plans, respectively.

With AIG Travel Guard's Deluxe plan, you'll get:

- Trip cancellation coverage up to $150,000

- Trip interruption coverage up to $225,000

- Emergency medical coverage of $100,000

- Coverage for baggage loss, theft, or damage up to $2,500

- Travel delay coverage of up to $1,000

Comparing those coverages with Tin Leg's Gold plan, you'll see that AIG's coverages are better than Tin Leg's in all areas except one – emergency medical. While AIG offers emergency medical coverage of $100,000, Tin Leg's coverage limit is $500,000 (in primary coverage).

If the medical coverage piece is what's most important to you, Tin Leg would be the right choice in this scenario. That said, having $100,000 in emergency medical coverage is nothing to scoff at, so it may come down to comparing premium costs.

Remember that the premium costs will depend on the traveler's age, trip destination, and trip cost. So you'll need to compare these two insurers using your trip-specific information to get a solid idea of the costs associated with each plan.

Read our AIG Travel Guard insurance review here.

Tin Leg Travel Insurance vs. Allianz Travel Insurance

Both Allianz Travel Insurance and Tin Leg travel insurance offer a variety of travel insurance plans designed for different types of travelers with varying types and degrees of coverage.

In this comparison, we'll look at Allianz Travel Insurance's most popular single-trip plan, the OneTrip Prime plan, compared to Tin Leg's Basic plan.

With Allianz Travel Insurance's most popular single-trip OneTrip Prime plan, you'll get:

- Up to $100,000 in trip cancellation coverage

- Up to $150,000 in trip interruption coverage

- $50,000 in emergency medical coverage

- Up to $1,000 in coverage for baggage loss, theft, or damage

- Up to $800 in travel delay coverage

In looking at Tin Leg's basic plan, you'll find that these two policies offer the same $50,000 coverage limit for emergency medical. Still, Allianz Travel Insurance's plan exceeds Tin Leg's in the other coverage limits. That said, you'll have to quote both of these policies using your personal trip information to make an informed decision, especially if cost is the most important factor to you.

Read our Allianz travel insurance review here.

Tin Leg Travel Insurance vs. Credit Card Travel Insurance

Do you have a travel credit card? If so, consider the type of insurance coverage it may (or may not) offer. Some basic coverages, like primary rental car insurance, are provided through your credit card's travel protection . And if you don't need medical coverage or don't have a lot of non-refundable trip expenses, the coverage offered by your credit card could suffice.

That said, don't forget that credit card coverage is sometimes considered secondary coverage. That means you'll have to file a claim with any other applicable insurer before filing a claim with your credit card company.

Read our guide on the best credit cards with travel insurance here.

Tin Leg Travel Insurance FAQs

All policies except Economy cover pre-existing medical conditions as long as you purchase your policy within 15 days of trip deposit.

You have 14 days after you purchase your policy to refund your Tin Leg policy, as long as you haven't left for your trip.

All Tin Leg travel insurance policies include 24/7 emergency assistance services.

Tin Leg claims can be submitted online or over the phone at 844-240-1233 during business hours. You'll need to provide details about your trip and the problem that arose during your trip. The claims process is quick, according to customer reviews, but be sure to review your policy for guideline related to claims.

Yes, all tiers of Tin Leg travel insurance offer cancellation coverage if you or a non-traveling loved one contracts COVID-19, though you will need to provide a positive test to receive reimbursement.

Why You Should Trust Us: How We Reviewed Tin Leg

To review Tin Leg travel insurance, we looked at several different factors. These included premium costs, coverage categories, and claim limits. In addition, we compared the policies and premiums available through Tin Leg to those from the best travel insurance providers to see how they stack up — and also considered any additional add-on coverages available and the ease of getting a quote and filing a claim.

In the end, the best policy for you will be the one that provides the coverage you need and limits you're comfortable with while also staying within budget.

Read more about how Business Insider rates insurance products here.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

Currently traveling and need immediate help? Contact our 24/7 Emergency Assistance.

About tin leg.

Tin Leg was founded in 2014 by the travel insurance industry experts at Squaremouth. Designed to meet the most common needs of travelers, these policies offer comprehensive Trip Cancellation and Trip Interruption benefits, and a range of Emergency Medical and Medical Evacuation limits.

In 2018, Tin Leg’s Luxury policy was rated the best travel insurance for seniors by Forbes, and following the coronavirus pandemic in 2020, several Tin Leg policies were listed by Forbes as offering the best coverage for pandemics.

Tin Leg’s award-winning customer service department, dedicated 24-hour emergency support, and revolutionary claims process have established the company as a trusted leader in the travel insurance industry. Tin Leg’s products are underwritten by Berkshire Hathaway Specialty Insurance Company, Starr Indemnity & Liability Company, and Spinnaker Insurance Company.

Tin Leg Plans and Reviews

Quote and compare policies.

- Customer Reviews

- Contact Information

Why Choose Tin Leg for Travel Insurance

- Top rated and top selling provider on Squaremouth

- Plans underwritten by Berkshire Hathaway, Starr Insurance, and Spinnaker Insurance Co

- Named ‘Best Value Travel Insurance’ Provider by USA Today

Tin Leg has earned national recognition for their innovative policies, award-winning customer service, and generous coverage limits. They were recently named the ‘Best Value Travel Insurance Provider’ by USA Today, and Tin Leg’s policies were highlighted for their pricing and coverage limits. With nine different policies available, there are options to choose from for most budgets and trip itineraries.

All Tin Leg policies are comprehensive, and offer well-rounded benefits that offer coverage for most travel disruptions. Many of their plans offer more than $100,000 in Emergency Medical coverage, as well as strong protection against cancellations, delays, and baggage loss. Tin Leg also offers policies created for specific trip types, such as Adventure, which offers strong Medical Evacuation coverage and coverage for a wide range of sports and activities.

Tin Leg is known for keeping a strong pulse on the travel industry, and continues to enhance their policies to best meet the needs of today’s customers. Aside from being one of the highest selling providers on Squaremouth, Tin Leg has also earned a customer rating of 4.6 out of 5 stars, making it one of the highest rated providers on the platform, too.

This provider summary was written internally by a Squaremouth policy expert.

About Tin Leg

Tin Leg was founded in 2014 by the travel insurance industry experts at Squaremouth. Designed to meet the most common needs of travelers, these policies offer comprehensive Trip Cancellation and Trip Interruption benefits, and a range of Emergency Medical and Medical Evacuation limits.

Tin Leg’s policies have been highlighted by Forbes, Business Insider, and other global publications for their coverage, benefits, and pricing. Most recently, Tin Leg was listed as the Best Value Travel Insurance Provider of 2023 by USA Today, receiving recognition for affordability and traveler protection.

Tin Leg’s award-winning customer service department, dedicated 24-hour emergency support, and revolutionary claims process have established the company as a trusted leader in the travel insurance industry. Tin Leg’s products are underwritten by Berkshire Hathaway Specialty Insurance Company, Starr Indemnity & Liability Company, and Spinnaker Insurance Company.

- 5 stars 2893

- 4 stars 691

- 3 stars 214

- 1 star 48

222,742 policies sold

0.1% negative reviews

0.1% (128) negative reviews to sales Average on Squaremouth is 0.2%

Tin Leg ranked as USA Today’s best value travel insurance provider of 2023.

USA Today credited Tin Leg’s Gold and Adventure policies as the best priced policies for the level of coverage included.

Policies Offered by Tin Leg

Policy Description:

Tin Leg’s Economy policy provides cost-effective protection that covers the most common concerns of travelers.

Tin Leg Economy includes basic cancellation coverage, including 100% reimbursement for cancellations or interruptions caused by medical complications or inclement weather. It also comes with medical coverage in case of an emergency during the trip.

Additional benefits that come standard with this policy include Travel Delay, Baggage Delay, and Baggage Loss.

Underwritten By: Berkshire Hathaway Specialty Insurance Company

Underwritten Location: 1314 Douglas Street, Suite 1400 Omaha, NE 68102-1944

AM Best #: 00864

AM Best Rating: A++ (Superior)

Policy Detail

Tin Leg’s Standard policy is designed for travelers looking for extensive cancellation coverage and high medical benefits.

Tin Leg Standard includes cancellation coverage for the most common concerns, including medical reasons, terrorism, and severe weather. It also covers up to 150% of a traveler’s trip costs under Trip Interruption.

Tin Leg Standard’s medical coverage includes Emergency Medical and Medical Evacuation coverage, as well as Pre-Existing Condition coverage if purchased within 15 days of booking the trip.

Additional benefits, such as Travel Delay, Baggage Delay, and Baggage Loss, are included with this policy.

Tin Leg’s Luxury product is ideal for travelers who want the most comprehensive Trip Cancellation benefits, as well as high Primary Emergency Medical and Travel Delay benefits.

Tin Leg Luxury includes cancellation coverage for the most common traveler concerns, including cancellation for medical reasons and terrorism. It also boasts impressive cancellation coverage for inclement weather, with no minimum weather delay before cancellation can be claimed.

Tin Leg Luxury includes high Primary Medical and Medical Evacuation benefits, with optional upgrades available, as well as coverage for Pre-Existing conditions if purchased within 15 days of booking the trip.

Additional benefits, including Travel Delay, Baggage Delay, Baggage Loss and Missed Connection, come standard with this policy.

Tin Leg’s Adventure policy was built with active travelers in mind, offering high medical coverage and comprehensive sports and activities benefits.

Tin Leg Adventure offers $100,000 in Emergency Medical coverage, and $1 million in Medical Evacuation coverage. The medical benefits within this policy can extend to travelers who are injured during sports and activities that are excluded by many other travel insurance policies, such as contact sports, mountain climbing, jet skiing, and snowboarding, among others.

Tin Leg Adventure also offers Trip Cancellation coverage for the most common traveler concerns, including cancellations for medical reasons, weather, and terrorism. In addition to covering unused trip expenses, such as airfare, hotel accommodations, and tours, this policy can also refund unused sports equipment and fees, including lift tickets, green fees, and equipment rentals.

Other benefits, including Travel Delay, Missed Connection, Baggage Delay, and Baggage Loss, are also offered within this policy.

Tin Leg’s Gold policy is built for travelers who are looking for high medical benefits and comprehensive cancellation coverage.

Tin Leg Gold includes $500,000 in Primary Emergency Medical coverage, in addition to $500,000 in Medical Evacuation coverage. Travelers who purchase this policy within 14 days of booking their trip and insure their full trip cost will also be covered for Pre-Existing Conditions.

Tin Leg Gold also offers cancellation coverage for the most common traveler concerns, including cancellation for medical reasons, inclement weather, and terrorism. Cancel For Any Reason is also available as an optional upgrade within this policy.

Additional benefits that are included within this policy are Travel Delay, Missed Connection, Baggage Delay, Baggage & Personal Items Loss, and Accidental Death & Dismemberment.

Underwritten By: Starr Indemnity & Liability Company

Underwritten Location: 399 Park Avenue, New York, NY 10022

AM Best #: 013853

AM Best Rating: A (Excellent)

Tin Leg Basic is designed to provide travelers with all major travel insurance benefits at a competitive price.

This plan’s conservative benefit limits are adequate for most travelers and keep the premium affordable, offering up to $10,000 in Trip Cancellation coverage and $25,000 in Emergency Medical coverage. Additional coverage is available for Pre-Existing Conditions, as well as Baggage Loss, Travel Delays and Accidental Death.

Underwritten By: Spinnaker Insurance Company

Underwritten Location: One Pluckemin Way Suite 102, Bedminster, NJ 07921

AM Best #: 022321

AM Best Rating: A- (Excellent)

Tin Leg Platinum is a mid-level plan that can be ideal for larger families, or individual travelers taking longer trips.

Available for travel up to 90 days, this plan covers up to $20,000 in Trip Cancellation coverage and includes high Emergency Medical and Medical Evacuation benefits of $100,000 and $500,000, respectively. This plan is also suitable for those traveling with valuable belongings, boasting a Baggage benefit limit of $500.

Tin Leg Silver is built for travelers who are looking for comprehensive cancellation coverage and high medical benefits, with extensive Trip Delay coverage.

Tin Leg Silver includes cancellation benefits for the most prevalent traveler concerns, including cancellation for medical reasons and inclement weather. Travelers also have the option to purchase the Cancel For Any Reason upgrade.

In addition to comprehensive cancellation benefits, Tin Leg Silver includes $250,000 in Emergency Medical coverage and $1,000,000 in Medical Evacuation coverage. Travelers who buy this coverage within 15 days of their initial trip deposit date have the option to upgrade to Primary medical coverage.

Tin Leg Silver was created with extensive Trip Delay coverage in the event of a quarantine. This plan offers $2,000 per person in Trip Delay coverage after a 6 hour delay.

Additional benefits, such as Baggage Delay, Baggage Loss, and Missed Connection, also come standard with this policy.

Verified Customer Reviews

- 3,926 Reviews Since 2014

Your reps are the best! So easy to make changes, cancel policies.

Tin Leg was a good plan. Currently in the process of collecting some medical receipts to submit. Hopefully the claim process will go as smoothly as the pre-trip and interaction we had with Tin Leg during our travel.

The customer service representative was very professional and courteous. Was able to answer all questions.

All reviews are from Tin Leg customers

Contact Information for Tin Leg

For Use With These Policies: Adventure, Luxury, Standard, Economy, Basic, Platinum

8:00am - 10:00pm ET, 7 days a week

Monday through Friday from 8:00am to 4:00pm ET

For Use With These Policies: Gold, Silver

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Discover It® Cash Back Discover It® Student Chrome Discover It® Student Cash Back Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Cards Best Discover Cards Best American Express Cards Best Visa Credit Cards Best Bank of America Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Climate Change

- Corrections Policy

- Sports Betting

- Coach Salaries

- College Basketball (M)

- College Basketball (W)

- College Football

- Concacaf Champions Cup

- For The Win

- High School Sports

- H.S. Sports Awards

- Scores + Odds

- Sports Pulse

- Sports Seriously

- Women's Sports

- Youth Sports

- Celebrities

- Entertainment This!

- Celebrity Deaths

- Policing the USA

- Women of the Century

- Problem Solved

- Personal Finance

- Consumer Recalls

- Video Games

- Product Reviews

- Home Internet

- Destinations

- Airline News

- Experience America

- Great American Vacation

- Ingrid Jacques

- Nicole Russell

- Meet the Opinion team

- How to Submit

- Obituaries Obituaries

- Contributor Content Contributor Content

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel insurance

Tin Leg travel insurance review 2024

Jennifer Simonson

Kara McGinley

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 3:41 a.m. UTC April 18, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

Top-scoring plans

Covers covid, medical & evacuation limits per person, what you should know.

Tin Leg’s Gold plan is competitively priced for a travel insurance plan with emergency medical and emergency evacuation benefits of $500,000 per person. Other coverage though, such as for severe weather and baggage insurance, has lower limits than many top-rated travel insurance companies .

Pros and cons

- $500,000 per person emergency medical is primary coverage.

- “Cancel for any reason” upgrade available.

- Hurricane and weather coverage kicks in only after a 48-hour delay.

- Baggage delay is only covered after a 24-hour delay with a $100 daily limit.

- Baggage loss coverage, which includes theft, is only $500 per person.

Why trust our travel insurance experts

Our team of experts evaluates hundreds of insurance products and analyzes thousands of data points to help you find the best product for your situation. We use a data-driven methodology to determine each rating. Advertisers do not influence our editorial content. You can read more about our methodology below.

- 1,855 coverage details evaluated.

- 567 rates reviewed.

- 5 levels of fact-checking.

Tin Leg travel insurance offers nine travel insurance plans to cover the needs of almost every type of traveler.

In this Tin Leg travel insurance review we will outline what is covered in each plan to help you best determine which plan is right for you.

About Tin Leg travel insurance

The travel insurance comparison company Squaremouth founded Tin Leg in 2014.

Tin Leg travel insurance plans

Tin Leg travel insurance offers these travel insurance plans:

Tin Leg Basic

Tin Leg Basic is a good travel insurance plan for low-risk trips. The plan covers trip cancellation, delay and interruption as well as missed connections after a 12-hour delay.

The Basic plan includes $50,000 per person in secondary emergency medical coverage, $200,000 per person in medical evacuation as well as coverage for pre-existing conditions if the plan is purchased within 15 days of your first trip deposit and you insure the total cost of your trip.

Lost and delayed luggage coverage is also covered, up to policy limits.

You can not add “cancel for any reason” (CFAR) coverage to this basic plan.

Tin Leg Economy

This plan covers 100% of prepaid and nonrefundable trip costs for trip cancellation and interruption if you experience unforeseen problems such as bad weather and medical issues.

The Economy plan includes up to $20,000 for secondary emergency medical coverage and $100,000 for medical evacuation.

Pre-existing conditions present 180 days before your trip or sooner won’t be covered in most cases.

After 24 hours, the plan covers $200 per person for baggage delay. The plan covers $100 per item for baggage loss, up to $500 per person.

The economy plan does not include coverage for missed connections and CFAR coverage is not available.

Tin Leg Standard

The plan covers trip cancellation, delay and interruption, but does not cover missed connections.

The Standard plan includes up to $30,000 for secondary emergency medical coverage and $200,000 for medical evacuation. It also offers a pre-existing conditions waiver as long as you purchase the plan within 15 days of making your first trip deposit.

Unlike the Basic and Economy plans, the Standard plan includes coverage for terrorism. It also covers the financial default of your travel supplier after a 14-day wait if purchased within 15 days of your first trip deposit. The plan covers employment layoff if you were employed for at least one continuous year.

Tin Leg Luxury

Like the cheaper travel insurance plans, the Luxury plan covers trip cancellation, delay and interruption, but the Luxury plan provides primary — not secondary — medical coverage. The plan includes $100,000 in primary emergency medical coverage as well as $250,000 in emergency evacuation coverage.

It also covers trip cancellation because of an unforeseen work reason as long as the plan was purchased within 15 days of your first trip deposit. The luxury plan offers the ability to purchase a “cancel for any reason” (CFAR) coverage upgrade.

What truly sets this plan apart from the others is that it is the only plan that allows policyholders to purchase additional rental car damage coverage.

Tin Leg Adventure

The Adventure plan was designed for active and adventurous travelers. It includes comprehensive coverage for adventurous activities, $100,000 in primary emergency medical coverage, medical evacuation coverage of up to $1,000,000 and extra coverage for delayed sports equipment.

It is also one of only two plans that offer accidental death and dismemberment coverage. CFAR coverage is available as an upgrade to this plan.

Tin Leg Silver

Tin Leg Silver provides comprehensive cancellation coverage, increases the secondary medical coverage to $250,000 and includes higher reimbursement limits for travel delays, baggage delays and baggage loss. It includes financial default of supplier coverage after a 14-day waiting period, as long as the plan was purchased within 14 days of your first trip deposit.

It also includes $1,000,000 million per person in medical evacuation coverage. There’s no coverage available for employment layoff, but the plan does offer a CFAR upgrade.

Tin Leg Gold

This plan kicks up your primary medical coverage to $500,000. It also includes financial default of supplier coverage, with a 14-day waiting period, as long as you bought the plan within 14 days of your initial trip deposit.

The Gold plan includes employment layoff coverage if you were employed for three continuous years.

Unlike the Silver plan, Tin Leg Gold includes coverage for a missed connection, but decreases the coverage limits in medical evacuation, baggage loss and travel delay.

As with the Adventure plan, this plan offers coverage for accidental death and dismemberment insurance. You can also pay extra to add “cancel-for-any-reason” coverage.

Tin Leg Platinum

The Platinum plan is similar to the Gold plan with a few exceptions. It has the same trip interruption, trip cancellation, medical evacuation, travel delay and baggage loss coverage.

However, the Platinum plan offers less medical coverage and a smaller payout for a missed connection than the Gold plan.

While it does offer coverage for death or dismemberment during a flight, Tin Leg Platinum does not offer the ability to purchase additional CFAR coverage.

Additional travel insurance coverage available

Some Tin Leg travel insurance plans give you the option to add on coverage.

“Cancel for any reason”

“Cancel for any reason” (CFAR) coverage allows you to cancel your trip for any reason up to 48 hours before your scheduled departure.

Opting to add CFAR coverage typically increases the cost of your travel insurance by about 50%.

If you decide to cancel your trip with CFAR, you’ll be able to get up to 50% of your prepaid, forfeited, nonrefundable trip expenses reimbursed.

CFAR coverage is available with the Tin Leg Luxury, Adventure, Silver, and Gold policies, as long as you buy it within 14 to 15 days of your first trip deposit, depending on which plan you go with.

Car rental damage