Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

- S&P Dow Jones Indices

- S&P Global Market Intelligence

- S&P Global Mobility

- S&P Global Commodity Insights

- S&P Global Ratings

- S&P Global Sustainable1

- Investor Relations Overview

- Investor Presentations

- Investor Fact Book

- News Releases

- Quarterly Earnings

- SEC Filings & Reports

- Executive Committee

- Corporate Governance

- Merger Information

- Stock & Dividends

- Shareholder Services

- Contact Investor Relations

- Email Subscription Center

- Media Center

Thailand’s tourism sector drives economic recovery

Executive Director and Asia-Pacific Chief Economist, S&P Global Market Intelligence

Thailand has shown a gradual economic recovery from the COVID-19 pandemic during 2022, helped by rising international tourism arrivals. Real GDP growth rose from 1.5% in 2021 to 2.6% in 2022, with growth momentum expected to improve further in 2023.

The latest S&P Global Thailand Manufacturing PMI survey results for February 2023 continued to signal expansionary conditions for manufacturing output and new orders. Due to the importance of international tourism for the Thai economy, the recovery of the tourism inflows is expected to be a key factor that will help to support improving economic growth momentum during 2023.

Thailand: Economic recovery from pandemic

Thailand recorded real GDP growth of 2.6% in 2022, representing a relatively modest pace of economic recovery from the recessionary conditions caused by the COVID-19 pandemic. Thailand's growth rate in 2022 was quite moderate in comparison with other large ASEAN economies such as Malaysia, Vietnam and Philippines, which posted very high growth rates as they rebounded from the pandemic.

A key driver for improving economic growth in 2022 was the recovery of private consumption, which grew by 6.3% compared with just 0.6% y/y growth in 2021. Private investment growth also improved from a pace of 3% in 2021 to 5.1% in 2022. However public investment contracted by 4.9% in 2022, while government consumption was flat.

Strong growth in private consumption and investment as well as rising energy import prices helped to boost import growth, which rose by 15.3% in 2022, while exports rose by just 5.5%, measured in USD terms. Consequently, the trade balance narrowed from USD 32.4 billion in 2021 to USD 10.8 billion in 2022.

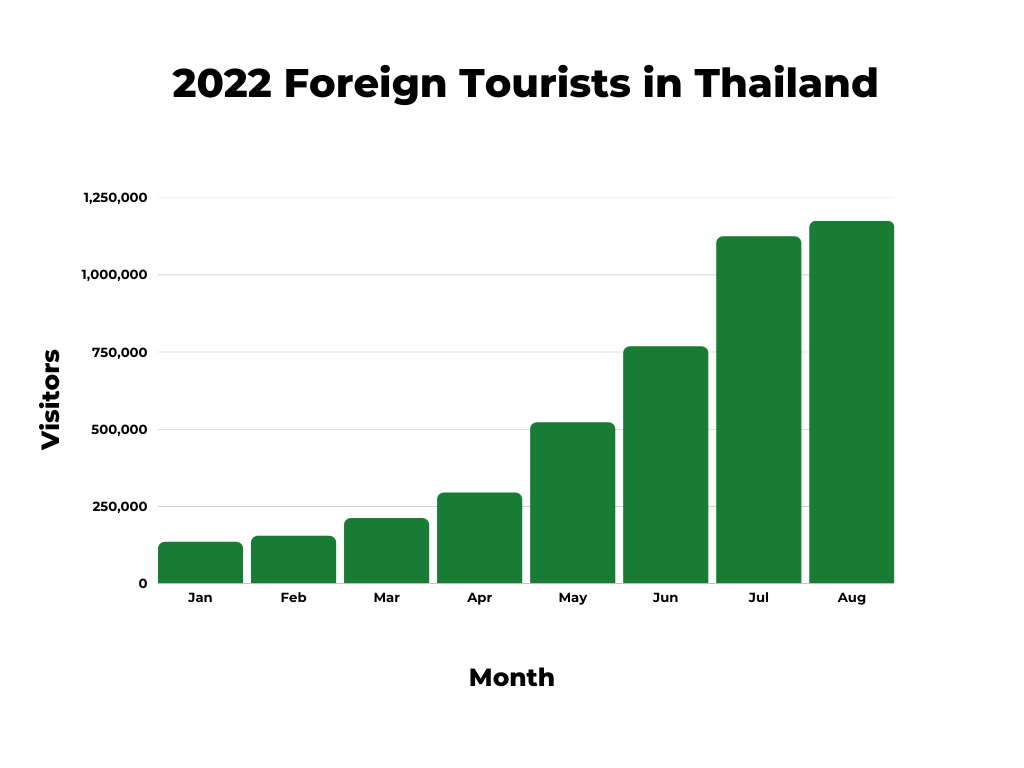

Due to the important contribution of international tourism to Thailand's GDP, a key factor that constrained the rate of recovery of the Thai economy in 2022 was the slow pace of reopening of international tourism, although this gathered momentum in the second half of 2022.

Thailand's manufacturing sector has also shown some improvement in momentum, with the S&P Global Thailand Manufacturing PMI for February 2023 having shown strong expansion. The latest PMI data signalled further growth in output and new orders. The PMI rose for the third month running to 54.8 in February, from 54.5 in January indicating improving business conditions for the 14th consecutive month.

New orders for Thai manufactured goods expanded at the quickest pace in five months. The easing of COVID-19 disruptions supported the latest expansion. Foreign demand for Thai manufactured goods continued to shrink, however, amid challenging external conditions.

Meanwhile supply constraints persisted within the Thai manufacturing sector. Vendor performance deteriorated for the tenth straight month on the back of higher demand and transportation delays. Concurrently, input cost inflation rose in February, reflecting higher raw material costs and heightened shipping cost pressures.

Thailand's headline CPI inflation rate has eased to 5.0% y/y in January 2023, compared with 7.9% y/y in August 2022. The Monetary Policy Committee (MPC) of the Bank of Thailand decided to raise the policy rate by 0.25% from 1.25% to 1.50% at their Monetary Policy meeting on 25 January 2023. This follows three 25bp rate hikes by the MPC in 2022, In 2022, the Monetary Policy Committee (MPC) decided to increase the policy rate three times by 25 basis points each in August, September and November. As a result, the policy rate stood at 1.25 percent compared to 0.50 percent at the end of 2021The MPC assessed that headline inflation will decline, while medium-term inflation expectations remain anchored within the target range.

Recovery of international tourism sector

International tourism was a key part of Thailand's GDP prior to the COVID-19 pandemic, contributing an estimated 11.5% of GDP in 2019. However, foreign tourism visits collapsed after April 2020 as many international borders worldwide were closed, including Thailand's own restrictions on foreign visitors.

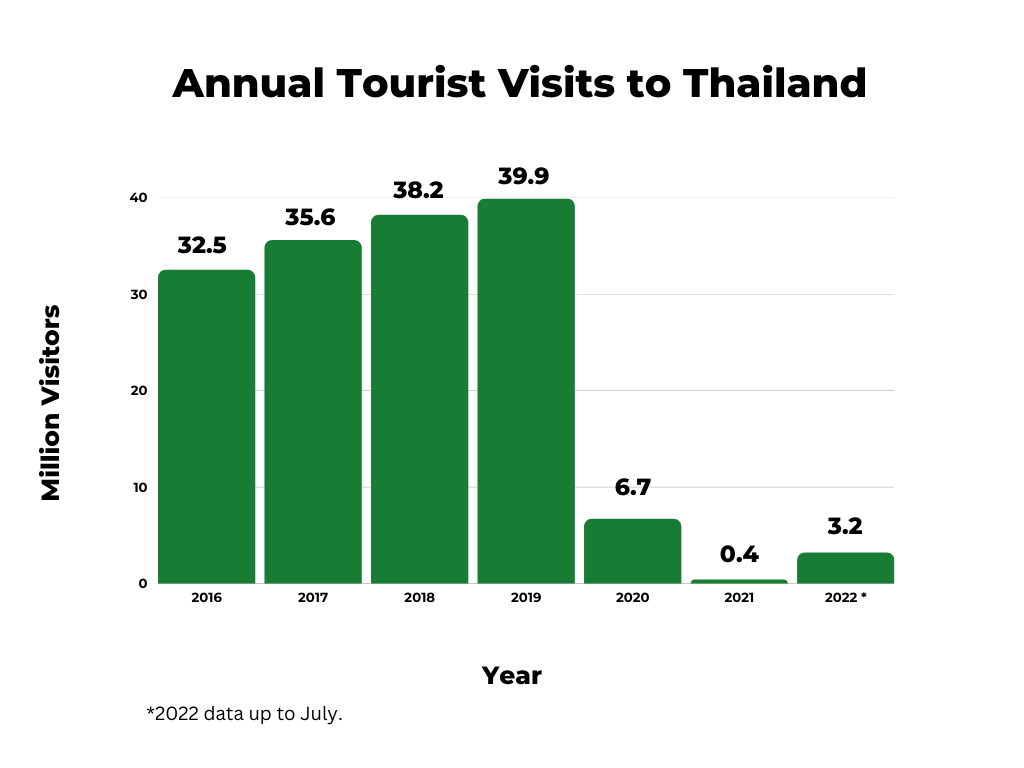

As COVID-19 border restrictions were gradually relaxed in Thailand and also in many of Thailand's largest tourism source countries during 2022, international tourism showed a significant improvement during the second half of the year. The number of international tourist arrivals reached 11.15 million in 2022, compared with just 430,000 in 2021. However, the total number of visits was still far below the 2019 peak of 39.8 million, indicating considerable scope for further rapid growth in the tourism sector during 2023.

Thailand economic outlook

Despite the upturn in private consumption and international tourism arrivals in 2022, the overall pace of economic expansion was relatively moderate, at just 2.6%. Easing of pandemic-related travel restrictions during 2022 has also allowed a gradual reopening of domestic and international tourism travel, which gathered momentum in the second half of 2022.

With more normal conditions expected for international tourism travel in 2023, this should provide a significant boost to the economy. Due to the importance of tourism inflows from mainland China prior to the pandemic, the reopening of mainland China's international borders will be an important factor contributing to the further recovery of Thailand's tourism market.

Helped by the continued recovery of the international tourism sector, some upturn in GDP growth to a pace of around 3.5% is expected in 2023.

Over the next decade Thailand's economy is forecast to continue to grow at a steady pace, with total GDP increasing from USD 500 billion in 2022 to USD 860 billion in 2032. A key driver will be rapid growth in private consumption spending, buoyed by rapidly rising urban household incomes.

The international tourism sector will continue to be a dynamic part of Thailand economy, buoyed by rapidly rising tourism arrivals the populous Asian emerging markets, notably mainland China, India and Indonesia.

By 2036, Thailand is forecast to become one of the Asia-Pacific region's one trillion-dollar economies, joining mainland China, Japan, India, South Korea, Australia, Taiwan, Philippines and Indonesia in this grouping of the largest economies in APAC. The substantial expansion in the size of Thailand's economy is also expected to drive rapidly rising per capita GDP, from USD 6,900 in 2022 to USD 11,900 by 2032. This will help to underpin the growth of Thailand's domestic consumer market, supporting the expansion of the manufacturing and service sector industries.

However, rising per capita GDP levels will also put pressures on Thailand's competitiveness in certain segments of its manufacturing export industry. Therefore, an important policy priority for nation will be to continue to transform manufacturing export industries towards higher value-added processing in advanced manufacturing industries.

One of the key economic and social challenges facing Thailand is its rapidly ageing population, which will result in a rising burden of health care and social welfare costs over the next two decades. This will be a drag on Thailand's long-term potential growth rate, making investment in technology and innovation increasingly important to mitigate the economic impact of demographic ageing.

Rajiv Biswas, Asia Pacific Chief Economist, S&P Global Market Intelligence

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn more about PMI data

Request a demo

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Week Ahead Economic Preview: Week of 20 May 2024

Monthly PMI Bulletin: May 2024

Week Ahead Economic Preview: Week of 13 May 2024

Thailand economy grows at fastest pace in year on tourism rebound

The southeast Asian nation’s economy grows 2.5 percent in the June quarter following the easing of pandemic curbs.

Thailand’s economy expanded at the fastest pace in a year in the second quarter as eased COVID-19 restrictions boosted activity and tourism, but multiyear high inflation and China’s slowdown remain a drag on the nascent recovery.

The government slightly revised its 2022 economic growth forecast to 2.7-3.2 percent from an earlier 2.5-3.5 percent growth range, citing a rebound in the crucial tourism sector, increased consumption and exports. Last year’s growth of 1.5 percent was among the slowest in Southeast Asia.

Keep reading

Putin says russia and n korea will expand bilateral relations, japan’s economy rebounds from covid, growing 2.2 percent in q2, malaysia ex-pm begins final bid to quash corruption conviction, china’s economy slows as ‘zero covid’ drags down sales, industry.

The economy grew an annual 2.5 percent in the June quarter, the fastest since the second quarter of 2021, data from the National Economic and Social Development Council showed on Monday.

That compared with a forecast 3.1 percent rise in a Reuters poll and upwardly revised 2.3 percent growth in the March quarter.

Southeast Asia’s second-largest economy is making a steady recovery after the lifting of pandemic curbs but the absence of Chinese visitors and China’s slowdown have continued to pressure growth at a time when Thailand has started to raise rates to tackle inflation.

“Thailand’s economy kept rebounding in the second quarter of the year on the back of a reopening boost. Although higher commodity prices will drag on prospects, with the tourism sector enjoying a decent rebound, we expect the recovery to continue over the coming months,” Capital Economics said in a note.

However, it expects inflation to weigh on consumer spending and investment, while exports will be restrained by a slowdown in the global economy.

On a quarterly basis, gross domestic product (GDP) grew a seasonally adjusted 0.7 percent in April-June, missing a forecast 0.9 percent increase, and against an upwardly revised 1.2 percent in the first quarter.

“This reflected the adversities of the Russian-Ukraine war which bumped up import bills and imported inflation,” said Kobsidthi Silpachai, head of capital markets research of Kasikornbank.

“This is likely to persuade monetary policymakers to proceed carefully. We view that the Bank of Thailand will move rates by another 25 bps at the November meeting rather than at the September meeting to better assess the response of the last move as well as the stance of the US Federal Reserve,” he added.

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

- Account details

- Lost password

- Real Estate

- Media OutReach Newswire

- PR Newswire

- Submit a Press Release

- Press Releases

Thailand expects 9.3 million tourists in 2022

Thailand is expected to see over 7 million tourists visit the kingdom in the second half of this year, generating total revenue of around 1.27 trillion baht for the Thai economy.

According to Government Spokesperson Thanakorn Wangboonkongchana, the Ministry of Tourism and Sports has reported a total of over 1,978,000 foreign visitors entering Thailand between January 1 to June 28, generating total revenue of around 114 billion baht.

India, Singapore, Malaysia, Vietnam and the United States among top visitors

The majority of air travelers came from India, Singapore, Malaysia, Vietnam and the United States. Tourists arriving by land mostly came from Malaysia, Laos, Cambodia, Vietnam and China.

According to the ministry’s forecast, roughly 2.7 million tourists will visit Thailand between July and September, with another 4.5 million visiting between October and December.

Revenue of around 1.27 trillion baht

Total arrivals should number around 9.32 million, generating revenue of around 1.27 trillion baht.

Related Posts

Tat and webbeds launch a series of innovative destination videos showcasing bangkok, thailand has welcomed 12 million tourists in four months, overtourism and challenges for the thai tourism industry, tat and unionpay international sign letter of intent.

The government spokesperson added that the fourth phase of the We Travel Together campaign has received positive feedback from the public, with more registrations for the program preceding upcoming holidays this month. He also said businesses and hotels participating in the program have indicated their readiness to accommodate tourists.

The government is urging operators to provide fair accommodations and services to help revitalize the tourism sector and the national economy.

Information and Source

- Reporter : Natthaphon Sangpolsit

- Rewriter : Paul Rujopakarn

- National News Bureau : http://thainews.prd.go.th

About the author

National News Bureau of Thailand. Public Relation Department of Thailand

Headline Editor

Thailand Business News covers the latest economic, market, investment, real-estate and financial news from Thailand and Asean. It also features topics such as tourism, stocks, banking, aviation, property, and more.

- Thailand inks $2 billion rice export deal with a Chinese company

- Thailand and China to implement visa-free travel starting in March

- Consumer Confidence rebounds in August following new government nomination

- Thailand Ranked 9th Among Most Business-Friendly Countries in 2023

Sustainability-linked bonds: a financing solution for emerging markets?

How long can the bank of thailand stay dovish.

TAT’s CF-Hotels Initiative: A Step Towards Sustainable Tourism

Thailand has greeted more than 10 million international visitors this year.

Latest News

Thai property market down 13%, with transferred units at lowest level since 2018

Thai Cabinet approves new 10-year EEC visa

Thailand aims to broaden its tax base and promote incentives for long-term savings

Thailand cuts internet and phone connections with Myanmar’s online fraud center

What other people are reading.

Subscribe notifications via Email

Enter your email address to subscribe and receive notifications of new posts by email.

Email Address

- Advertising

- Community Standards

- Cookie Policy

- Cryptocurrencies and Digital Asset Laws in Thailand

- Internships

- Investment in Thailand

- Privacy Policy

- Terms of Use

- Thailand Business Visa

© 2023 Thailand Business News

Welcome Back!

Login to your account below

Remember Me

Create New Account!

Fill the forms below to register

Retrieve your password

Please enter your username or email address to reset your password.

Discover more from Thailand Business News

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

Are you sure want to unlock this post?

Are you sure want to cancel subscription.

We use cookies to ensure best experience for you

We use cookies and other tracking technologies to improve your browsing experience on our site, show personalize content and targeted ads, analyze site traffic, and understand where our audience is coming from. You can also read our privacy policy , We use cookies to ensure the best experience for you on our website.

By choosing I accept, or by continuing being on the website, you consent to our use of Cookies and Terms & Conditions .

- Leaders Speak

- Brand Solutions

- Thailand hits 10 million visitors in 2022 as tourism recovers

- Published On Dec 11, 2022 at 04:00 PM IST

- Updated On Dec 11, 2022 at 04:00 PM IST

All Comments

By commenting, you agree to the Prohibited Content Policy

Find this Comment Offensive?

- Foul Language

- Inciting hatred against a certain community

- Out of Context / Spam

Join the community of 2M+ industry professionals

Subscribe to our newsletter to get latest insights & analysis., download ethospitalityworld app.

- Get Realtime updates

- Save your favourite articles

- thai hotels association

- marisa sukosol

- Thailand recovery

- hospitality news

Tourism industry in Thailand

Statistics report about tourism industry in Thailand

This report presents graphs and tables about the tourism industry in Thailand. It provides an overview of the tourism industry, as well as an economic impact, tourist flows, and the tourist perspectives in Thailand.

Download your Report

Table of contents.

- Premium Statistic Value of tourism GDP Thailand 2017-2021

- Basic Statistic Number of quarterly foreign visitors Thailand Q1 2021-Q4 2022

- Premium Statistic Number of local tourists Thailand 2023

- Premium Statistic Size of employment in tourism sector Thailand 2017-2021

Economic impact

- Premium Statistic Direct contribution of tourism to gross domestic product Thailand 2017-2021

- Premium Statistic Indirect contribution of tourism to gross domestic product Thailand 2017-2021

- Premium Statistic Value of tourism tax Thailand 2017-2021

- Premium Statistic International tourist arrivals revenue Thailand 2023

- Premium Statistic Local tourists revenue Thailand 2023

- Premium Statistic Number of international visitors Thailand 2023, by region of origin

- Premium Statistic Number of foreign visitors Thailand 2023, by region

- Premium Statistic Revenue generated from foreign visitors Thailand 2023, by region

- Premium Statistic Number of traveling locals Thailand 2023, by region

- Premium Statistic Revenue generated from traveling locals Thailand 2023, by region

Accommodation

- Premium Statistic Share of foreign visitors to total guests of accommodations Thailand 2015-2023

- Premium Statistic Share of foreign visitors to total guests of accommodations Thailand 2023, by region

- Premium Statistic Advance reservation rate of accommodations Thailand 2015-2023

- Premium Statistic ADR of accommodations Thailand 2015-2023

- Premium Statistic Popular accommodations for Thais when travelling Thailand Q2 2021

Tourist perspectives

- Premium Statistic Ideal travel destinations in Asia among Thais 2023

- Premium Statistic Online travel agency usage Thailand 2023

- Premium Statistic Most used online travel agencies Thailand 2023

- Premium Statistic Most common duration before a trip to purchase travel tickets on OTAs Thailand 2023

- Premium Statistic Reasons for using online travel agencies for purchasing tickets Thailand 2023

- Premium Statistic Reasons for not using online travel agencies for purchasing tickets Thailand 2023

If this report contains a copyright violation , please let us know. Note that you will leave this page when you click the link.

Recommended and recent reports

Recommended statistics.

- Premium Statistic Market size of the tourism sector worldwide 2011-2024

- Premium Statistic Total number of people employed in the tourism sector New Zealand 2014-2023

- Premium Statistic Tourism industry direct contribution as share of GDP Malaysia 2013-2022

- Premium Statistic Tourism industry employee count in the U.S. 2012-2022

- Premium Statistic Number of employees in tourism industry Malaysia 2013-2022

Statista report shop

We provide information on industries, companies, consumers, trends, countries, and politics, covering the latest and most important issues in a condensed format.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

- Immediate access to all reports

- Access to all Premium statistics

- Usage and publication rights

TAT showcases digital transformation of Thai tourism at Global Tourism Forum 2022

Showcasing thailand’s innovation approach on digital tourism that aims to benefit both tourism businesses and tourists..

Dubai, 27 March, 2022 – The Tourism Authority of Thailand (TAT) presented Thailand’s innovation approach on digital tourism in line with key strategies under the ‘Visit Thailand Year 2022: Amazing New Chapters’ tourism campaign at the Global Tourism Forum (GTF) 2022: Dubai Blockchain for Travel, which was held yesterday (26 March).

Mr. Nithee Seeprae, TAT Deputy Governor for Digitalisation, Research, and Development, highlighted Thailand’s readiness on digital tourism during the GTF 2022’s session 5 on Blockchain Technology a Bridge to Smart Tourism. Also sharing knowledge at the session were Ms. Sumaira Isaacs, CEO of the World Tourism Forum Institute, and Ms. Angela Gerekou, President, Greek National Tourism Organisation, with Ms. Neslihan Gündeş, Director of Partnerships and Board Affairs, World Tourism Forum Institute, as the session’s moderator.

Mr. Nithee said as the world exited the COVID-19 pandemic, TAT launched the ‘Visit Thailand Year 2022: Amazing New Chapters’ tourism campaign with the aim to revitalise and transform Thai tourism towards stronger and sustainable, more responsible, more digital, and more inclusive tourism growth in response to the growing trend under the new normal.

“There is opportunity in every crisis. The Coronavirus pandemic hit Thai tourism particularly hard, but it has also brought unprecedented digital transformation that now plays a pivotal role in accelerating the country’s tourism ecosystem to quality and sustainability. As such, TAT is adopting ‘smart tourism’ in our strategy aimed at elevating Thai tourism’s competitiveness, while promoting Thailand as a remote workers friendly destination among tech savvy travellers and digital nomads,” Mr. Nithee said.

TAT’s innovation approach on digital tourism is based on 3 key factors.

Firstly, TAT is placing emphasis on domestic Thai tourists by sharing knowledge and building trust on the readiness of Thailand’s digital tourism. A ‘Durian Farm Virtual Tour’ platform was recently launched to allow tourists to visit a farm in the virtual world and purchase real fruit to be delivered to them. Similar projects are underway to create personalised experiences in the Metaverse virtual world and pave the way for the utilisation of cryptocurrency. In addition, TAT is looking at utilising a Non-fungible Token (NFT) to promote Thai tourism through digital art starting with local wisdom products; such as, paintings, graphics, videos, and music.

Secondly, still focusing on creating greater awareness on Thailand’s digital tourism among domestic Thai tourists, TAT has initiated a “Thailand Holideals” project on holideals.tourismthailand.org , offering special tourism packages, privileges, and tour promotions from tourism businesses up and down the country that can be purchased using a digital token, thus making it the first time in Thailand that a digital token can be used for tourism products and services.

Thirdly, TAT is promoting Thailand as a remote workers friendly destination by placing emphasis on a new generation of international travellers, including the digital native, Gen Z, and digital nomads. This is in response to a growing trend in light of the Coronavirus pandemic whereby people work remotely and enjoy a vacation. This group of travellers are moving to cryptocurrency payments, and among several projects underway, a TAT NFT will be introduced to enhance the international awareness of local Thai arts and crafts.

About GTF 2022

The Global Tourism Forum (GTF), the World Tourism Forum Institute (WTFI)’s premier flagship, is an international collaboration platform focused on addressing the challenges for the travel industry. Through this event, the WTFI aims to be at the forefront of this revolution by presenting new options to a new generation of travellers with an alternative way to purchase travel and all opportunities with blockchain revolution. Several high-profile speakers and influencers will be attending the event from both the ecosystems, including Mr. François Hollande, former President of France, Mr. Taleb Rifai, Secretary-General of the World Tourism Forum Institute and former Secretary-General of the UNWTO, and Mr. Michael Gebert, Chairman of the European Blockchain Association. For more information, visit: https://www.globaltourismforum.org/dubai-blockchain-for-travel/ .

TAT Newsroom

Surfing in phuket, tat showcases phuket and phang-nga tourism delights to mongolian travel agents and media, related articles.

New Netflix Film ‘Mother of the Bride’ Spotlights Phuket as a Hub for Global Film Production

TAT outlines plan for greater promotion of lower central region

Thailand Tourism Stats for 2022

Home / Equip & Educate / Educate / Thailand Tourism Stats for 2022

Thailand is one of the world’s most popular tourist destinations and, like many global tourism hotspots, was severely affected by the Covid-19 pandemic. This comprehensive list of statistics about tourism in Thailand provides insight into this key driver of the Thai economy. How has the tourism industry in Thailand recovered as global travel restrictions have been curtailed? What are the key historical tourism stats in Thailand? On this page you’ll find all the key stats you need to know about tourism in Thailand.

Here’s a breakdown of the statistics you’ll find here:

- Thailand Tourism Statistics (top stats)

How many tourists visit Thailand each year?

How many tourists visit thailand now how many are expected to visit in 2022, what nationality visits thailand the most.

- Which region of the world do most visitors to Thailand come from?

- Which European nationalities visit Thailand the most?

How many US citizens visit Thailand?

- How much does the average tourist spend per capita in Thailand?

- Which foreign visitors spend the most per capita in Thailand?

- Which foreign visitors spend the least per capita?

- How much time do people spend in Thailand (average trip length)

- What is the average occupancy rate of accommodation?

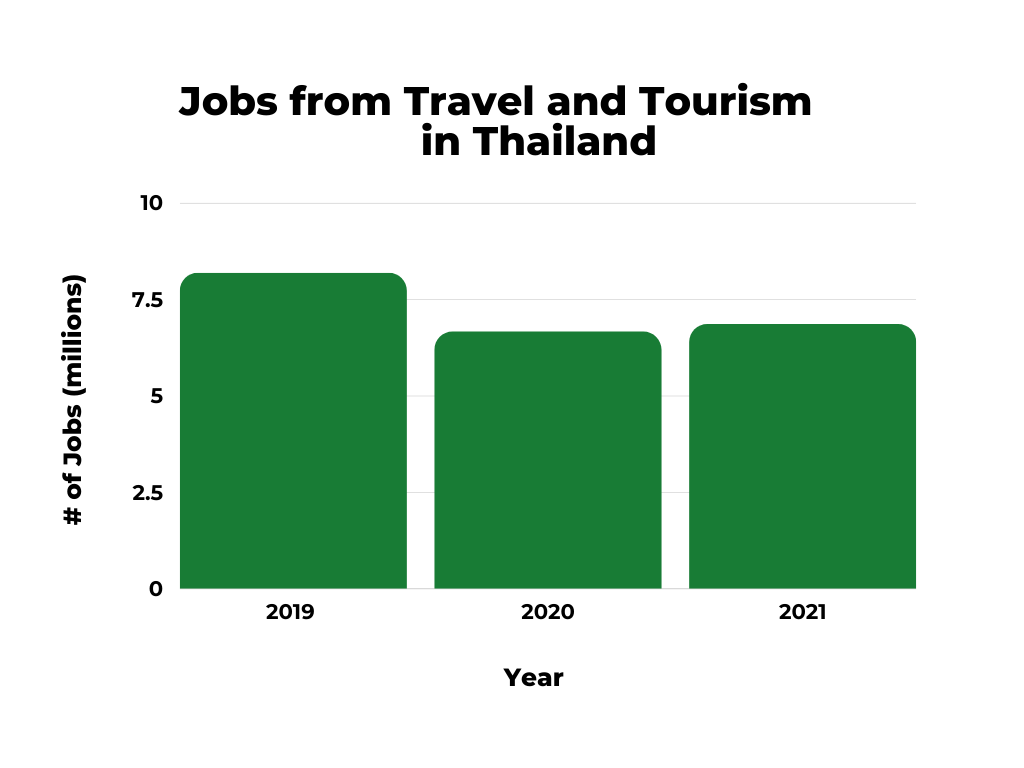

- How many jobs do travel and tourism contribute to the Thai economy?

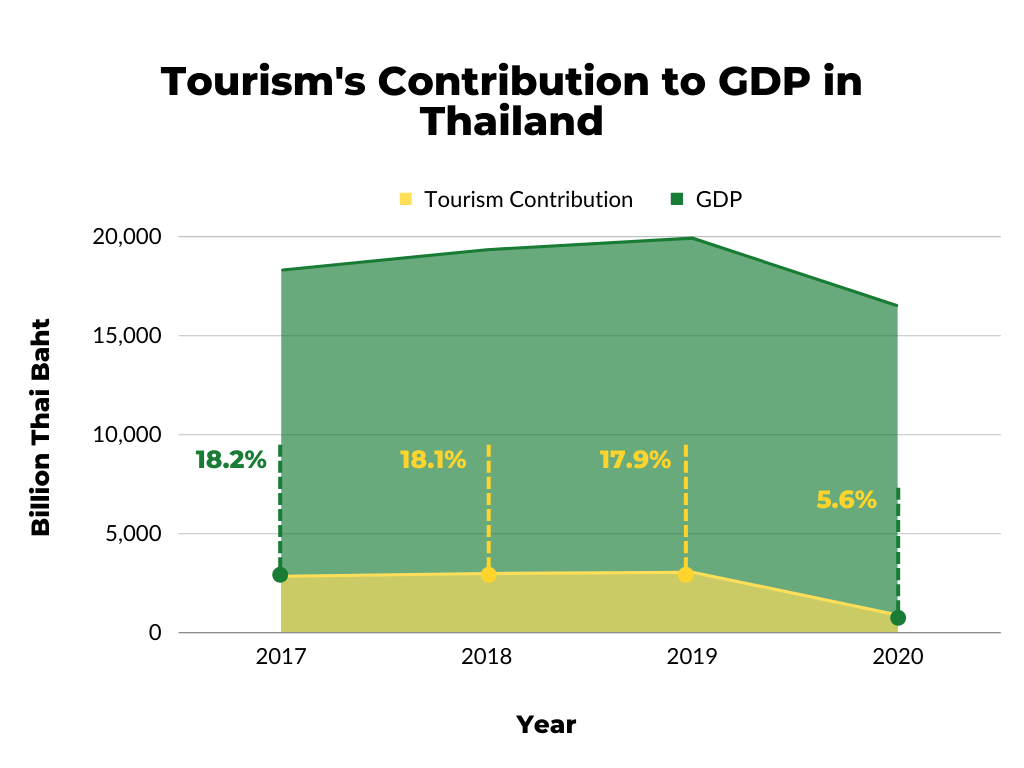

- How much does Tourism contribute to the GDP of Thailand?

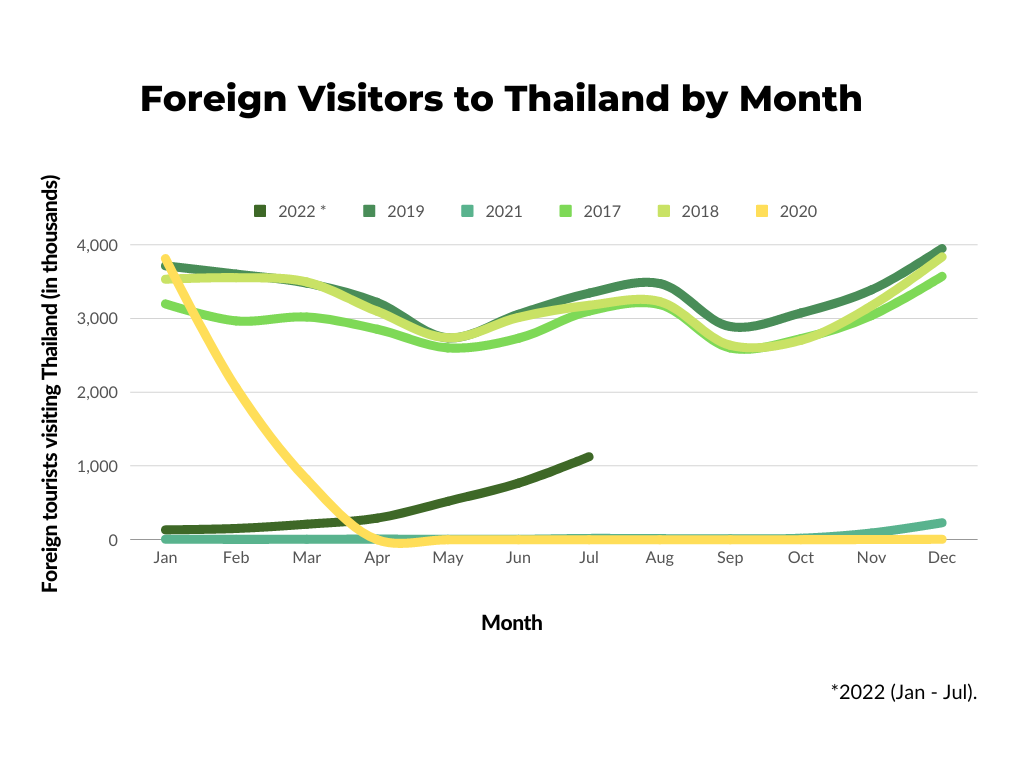

What is the busiest month for Tourism in Thailand?

Thailand tourism statistics (top stats).

- Prior to the Covid 19 pandemic Thailand received a record number of visitors, 39,916,250 in 2019 . In 2021 , that number fell to 427,869 .

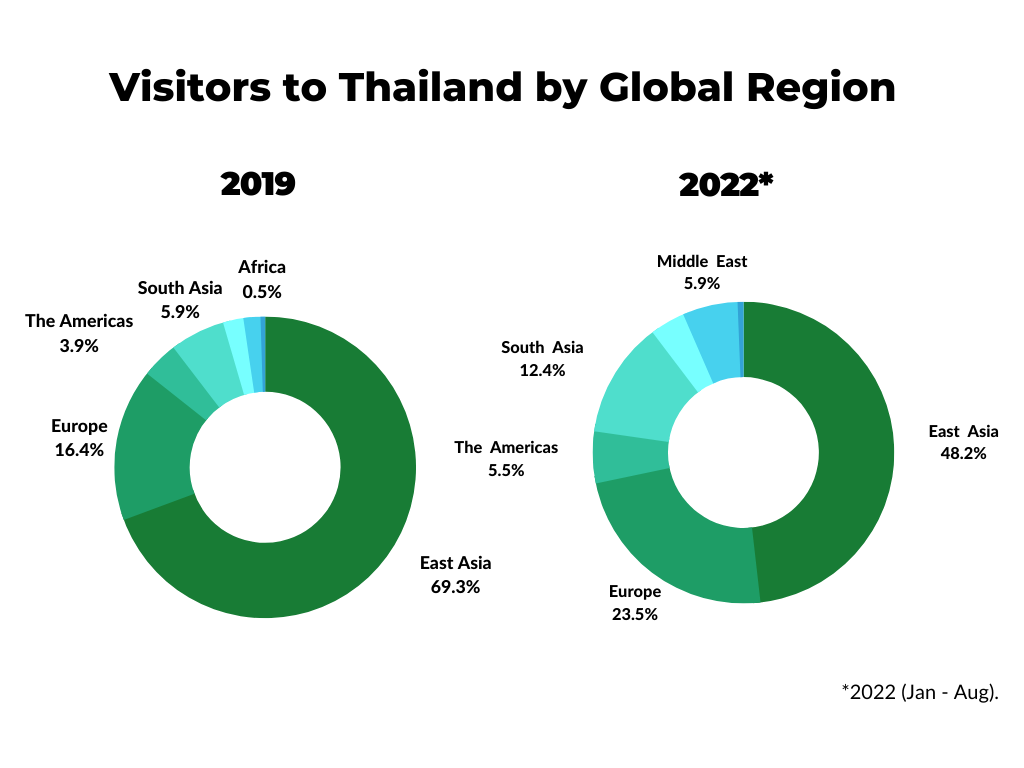

- In 2019 , Thailand received 11,138,658 visitors from China . In the first 8 months of 2022, only 114,596 Chinese tourists visited Thailand.

- Thailand expects to receive a total of 10 million foreign tourists in 2022 and has already received 4,378,920 for the period of January through August of 2022.

- In 2022, citizens of the United Kingdom made up 19.8% of European visitors representing the largest cohort of visitors from Europe.

- In 2019, 1.48 million Russian tourists visited Thailand which represented the largest portion of European visitors at 22.7% percent. In 2022 only 87,485 Russian visitors arrived in Thailand representing 8.5% of the total visitors from Europe.

- The average per capita visitor spend per day is 5,172 Baht or $167 USD per day as of 2019.

- The average tourist visits Thailand for just over 9 days .

- December is historically the busiest month for foreign tourism in Thailand. In December of 2019, Thailand received over 3.947 million visitors.

- In 2020, the tourism industry contributed around 883 billion Thai baht to Thailand’s GDP or approximately 5.67% of GDP

In 2019 , prior to the Covid-19 pandemic 39.9 million foreign tourists visited Thailand. This was a record number of tourists for one year.

Tourism numbers have increased through 2022 as travel restrictions have been curtailed with Thailand receiving a total 4,378,920 foreign visitors through the end of August, 2022 . This number already drastically exceeds the 427,869 foreign visitors that arrived through all of 2021 . The Thai government expects 1.5 million arrivals each month in the last quarter of 2022 and 10 million visitors for the complete 2022 calendar year.

As of 2022 visitors from Malaysia, India and Singapore make up the top 3 nationalities visiting Thailand. Prior to the pandemic the top 3 positions were occupied by China, Malaysia, and India. The biggest change was China falling from a 27.9% share of visitors to Thailand in 2019 to 2.6% in 2022 as the number of visitors from China traveling to Thailand fell drastically from its’ pre-pandemic peak of 11,138,657.

What region of the world do most visitors to Thailand come from?

In 2022 , the majority of international visitors to Thailand came from Eastern Asia, 2,110,234, followed by Europe , 1,030,003. The overall percentage of visitors from Eastern Asia fell significantly, with the decline in Chinese tourists.

Here is a detailed breakdown of visitors to Thailand by global region or origin:

Which European nationalities visit Thailand the most?

For the year-to-date 2022 , visitors from the United Kingdom represented the largest portion of European visitors to Thailand with 204,231. Historically, Russian visitors were the largest cohort of European travelers to Thailand, representing 23% of 2019 foreign European visitors.

In 2022 (Jan- August), 187,205 US citizens visited Thailand . In 2019, 1,136,21 US citizens visited.

How much do tourists spend in Thailand per Capita?

In 2019 , the per capita spend per foreign visitor to Thailand was 5,172 Baht or $167 USD per day.

Which foreign tourists spend the most per Capita in Thailand?

In 2019 , visitors from Kuwait spent the most spending a per capita amount of $224.16 USD per day.

Which foreign tourists spend the least per capita in Thailand?

In 2019 , visitors from France spent the least per capita amount of $112.02 USD per day.

Here’s the complete breakdown of per capita spends by tourists visiting Thailand:

How long does the average traveler spend in Thailand?

The average visitor spends just over 9 days in Thailand.

Which nationality spends the longest amount of time in Thailand?

Tourists from Sweden typically spend the longest amount of time in Thailand with an average stay in 2019 of 19 days.

Which nationality spends the shortest amount of time in Thailand?

Tourists from Malaysia typically spend the shortest amount of time in Thailand with an average stay of just under 5 days.

Here’s a complete breakdown of the average trip duration to Thailand:

What is the average occupancy rate of tourist accommodation in Thailand?

Tourist accommodation occupancy in Thailand has increased to 47% as of July 2022 up from a Covid era low of 2.2% set in April of 2020 , but well off the 2019 annual average of 71.3%.

How many jobs do travel and tourism contribute to the economy in Thailand?

In 2021, the travel and tourism industry contributed an estimated 6.86 million jobs to the economy in Thailand. This was a sharp reduction from the 8.19 million jobs the sector contributed in 2019.

How much does Tourism contribute to Thailand's GDP?

In 2020, the tourism industry contributed around 883 billion Thai baht which was 5.65% of the country’s GDP. This was a sharp drop from 2019 , when Tourism contributed 3,029 billion Thai baht and 17.9% of GDP.

Historically, December is the busiest month for tourism in Thailand with the largest number of foreign tourists visiting. In December of 2019 , Thailand received over 3.947 million visitors . During the post-pandemic years 2020 and 2021, just over 6.500 and 230,000 foreign tourists came to Thailand in December.

Here’s a closer look at the pre and post pandemic foreign tourist numbers by month:

There you have it, a breakdown of the major travel and tourism statistics for Thailand. Thailand’s tourism industry appears to be rebounding from the nadir of the early stages of the Covid-19 pandemic, but it remains to be seen when numbers will meet or exceed the records recorded in 2019.

Data sources : Thailand Ministry of Tourism & Sports , The World Bank , Bank of Thailand

Planning a trip to Thailand? Don't forget this.

Emergency medical situations can and do happen. Don’t forget your travel insurance! I went years without making a claim on travel insurance until a suffered a broken collarbone and racked up medical bills in excess of $15, 000. Fortunately, I had travel insurance!

World Nomads is the best choice for traveling in Thailand with comprehensive coverage for medical, luggage & gear and trip cancellation. Hopefully you never need to make a claim, but if you do you’ll be beyond happy you were prepared!

Disclaimer: Some of the links in this post may be affiliate links. If you click one of the links and make a purchase we’ll earn a small commission at no cost to you. Just like the travel backpacks we build, we’re very particular . So any products or services we suggest, we test and use ourselves before making any recommendations or endorsements.

Share this post

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

More Tales from the Banana Trail

Kananaskis Backcountry Camping | Best Spots for Backpacking

Kananaskis Country is a sublime section of Rocky Mountain wIlderness that provides some incredible opportunities for backcountry camping and overnight hiking. Situated just south of

Balian Beach | Ultimate Guide to Bali’s Hidden Paradise

Balian Beach feels like a mirage. Didn’t this Bali die long ago under a crush of Instagram swings and co-working hubs?

Best Backpack for Peru | How to Pick a Backpack for Peru

What is the best backpack for Peru? Should you take a hiking backpack or will a travel backpack work better? Read this post before you decide.

Adventure with us on Instagram @ BananaTrail

Download the Explorer's guide.

Shop Banana Backpacks Gear

- Kiri Customizable Everyday Collection

- Khmer Explorer Travel Set

Explore the Tales

- Plan Your Adventure

- The Explorer Series

- Learn, Pack, & Get Equipped

Thailand Sustainable Tourism Market Summary, Competitive Analysis and Forecast to 2028

All the vital news, analysis, and commentary curated by our industry experts.

Published: March 22, 2024 Report Code: GD0121-2948IP-ST

- Share on Twitter

- Share on LinkedIn

- Share on Facebook

- Share on Threads

- Share via Email

- Report Overview

- Key Players

Table of Contents

Sustainable Tourism in Thailand industry profile provides top-line qualitative and quantitative summary information including: market size (value and volume 2019-23, and forecast to 2028). The profile also contains descriptions of the leading players including key financial metrics and analysis of competitive pressures within the market.

Key Highlights

– Sustainable tourism minimizes the negative impacts and maximizes the positive impacts of tourism as an activity while conserving resources or using them wisely to maintain their long-term viability. It takes full account of socioeconomic, cultural, and environmental impacts and addresses the needs of visitors, industry, and host communities. The market scope includes hotels & motels, travel intermediaries (travel agents, direct), food service (commercial food services), and transportation (airlines, passenger rail, road). – The Thai sustainable tourism market had total revenues of $3.7 billion in 2023, representing a negative compound annual growth rate (CAGR) of 22.2% between 2018 and 2023. – The domestic segment accounted for the market's largest proportion in 2023, with total revenues of $2.9 billion, equivalent to 77.9% of the market's overall value. – Thailand accounted for 6.2% of the Asia-Pacific sustainable tourism market in 2023.

– Add weight to presentations and pitches by understanding the future growth prospects of the Thailand sustainable tourism market with five year forecasts by both value and volume

Reasons to Buy

– What are the main segments that make up Thailand's sustainable tourism market?

About GlobalData

Table 18: Thailand exchange rate, 2019–23

Figure 10: Drivers of degree of rivalry in the sustainable tourism market in Thailand, 2023

Frequently asked questions

- Currency Conversion is for Indicative purpose only. All orders are processed in US Dollars only.

- USD - US Dollar

- AUD — Australian Dollar

- BRL — Brazilian Real

- CNY — Yuan Renminbi

- GBP — Pound Sterling

- INR — Indian Rupee

- JPY — Japanese Yen

- ZAR — South African Rand

- USD — US Dollar

- RUB — Russian Ruble

Can be used by individual purchaser only

Can be shared by unlimited users within one corporate location e.g. a regional office

Can be shared globally by unlimited users within the purchasing corporation e.g. all employees of a single company

Undecided about purchasing this report?

Get in touch to find out about multi-purchase discounts.

[email protected] Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

“The GlobalData platform is our go-to tool for intelligence services. GlobalData provides an easy way to access comprehensive intelligence data around multiple sectors, which essentially makes it a one-for-all intelligence platform, for tendering and approaching customers.

GlobalData is very customer orientated, with a high degree of personalised services, which benefits everyday use. The highly detailed project intelligence and forecast reports can be utilised across multiple departments and workflow scopes, from operational to strategic level, and often support strategic decisions. GlobalData Analytics and visualisation solutions has contributed positively when preparing management presentations and strategic papers.”

“COVID-19 has caused significant interference to our business and the COVID-19 intelligence from GlobalData has helped us reach better decisions around strategy. These two highlights have helped enormously to understand the projections into the future concerning our business units, we also utilise the project database to source new projects for Liebherr-Werk to use as an additional source to pitch for new business.”

Your daily news has saved me a lot of time and keeps me up-to-date with what is happening in the market, I like that you almost always have a link to the source origin. We also use your market data in our Strategic Business Process to support our business decisions. By having everything in one place on the Intelligence Center it has saved me a lot of time versus looking on different sources, the alert function also helps with this.

Having used several other market research companies, I find that GlobalData manages to provide that ‘difficult-to-get’ market data that others can’t, as well as very diverse and complete consumer surveys.

Our experience with GlobalData has been very good, from the platform itself to the people. I find that the analysts and the account team have a high level of customer focus and responsiveness and therefore I can always rely on. The platform is more holistic than other providers. It is convenient and almost like a one stop shop. The pricing suite is highly competitive and value for our organisation.

I like reports that inform new segments such as the analysis on generation Z, millennials, the impact of COVID 19 to our banking customers and their new channel habits. Secondly the specialist insight on affluent sector significantly increases our understanding about this group of customers. The combination of those give us depth and breadth of the evolving market.

I’m in the business of answering and helping people make decisions so with the intelligence center I can do that, effectively and efficiently. I can share quickly key insights that answer and satisfy our country stakeholders by giving them many quality studies and primary research about competitive landscape beyond the outlook of our bank. It helps me be seen as an advisory partner and that makes a big difference. A big benefit of our subscription is that no one holds the whole data and because it allows so many people, so many different parts of our organisation have access, it enables all teams to have the same level of knowledge and decision support.

“I know that I can always rely on Globaldata’s work when I’m searching for the right consumer and market insights. I use Globaldata insights to understand the changing market & consumer landscape and help create better taste & wellbeing solutions for our customers in food, beverage and healthcare industries.

Globaldata has the right data and the reports are of very high quality compared to your competitors. Globaldata not only has overall market sizes & consumer insights on food & beverages but also provides insights at the ingredient & flavour level. That is key for B2B companies like Givaudan. This way we understand our customers’ business and also gain insight to our unique industry”

GlobalData provides a great range of information and reports on various sectors that is highly relevant, timely, easy to access and utilise. The reports and data dashboards help engagement with clients; they provide valuable industry and market insights that can enrich client conversations and can help in the shaping of value propositions. Moreover, using GlobalData products has helped increase my knowledge of the finance sector, the players within it, and the general threats and opportunities.

I find the consumer surveys that are carried out to be extremely beneficial and not something I have seen anywhere else. They provided an insightful view of why and which consumers take (or don’t) particular financial products. This can help shape conversations with clients to ensure they make the right strategic decisions for their business.

One of the challenges I have found is that data in the payments space is often piecemeal. With GD all of the data I need is in one place, but it also comes with additional market reports that provide useful extra context and information. Having the ability to set-up alerts on relevant movements in the industry, be it competitors or customers, and have them emailed directly to me, ensures I get early sight of industry activity and don’t have to search for news.

Related reports

Every Company Report we produce is powered by the GlobalData Intelligence Center.

Subscribing to our intelligence platform means you can monitor developments at Thailand Sustainable Tourism Market Summary, Competitive Analysis and Forecast to 2028 in real time.

- Access a live Thailand Sustainable Tourism Market Summary, Competitive Analysis and Forecast to 2028 dashboard for 12 months, with up-to-the-minute insights.

- Fuel your decision making with real-time deal coverage and media activity.

- Turn insights on financials, deals, products and pipelines into powerful agents of commercial advantage.

Making destructive tourism sustainable

From Thailand to Mallorca, local ecosystems have suffered under the weight of mass tourism. Can visitor number limits and sustainable practices help restore the balance?

Tourism accounts for around 8% of global greehouse gas emissions, with around half coming from flying to and from destinations.

As airlines and hotels out-compete each other on price, post-pandemic tourist numbers are breaking records , with one million people arriving in Greece per week in the summer of 2022 — despite high inflation and an energy crises driven by the war on Ukraine, and intense wildfires linked to climate change .

The ecological and climate impact of this overtourism is forcing the industry to act, and to follow in the footsteps of some sustainable tourism pioneers.

'The Beach': Thailand's Maya Bay closes for restoration

Maya Bay , an an idyllic beach on an uninhabited island in Thailand's Phi Phi archipelago, become globally famous when it was the location for "The Beach," the 2000 film starring Leonardo DiCaprio.

Flanked by vast limestone cliffs, the secluded cove with its white sand and turquoise water became jammed with flotillas of boats and cruisers as thousands of tourists flocked to the beach daily for nearly two decades.

Tourist traffic led to pollution from discarded trash and damaged coastal vegetation, but the main problem was the boats dropping their anchors onto the coral below.

When "The Beach" was sealed off to the public in 2018, there was only 8% of the coral coverage in the bay, compared to up to 70% some 30 years before.

A restoration team set about replanting the destroyed coral to rehabilitate the reef in five to 10 years. Boats have to dock at a new pier rather than come ashore on the beach, swimming is forbidden, and new boardwalks keep visitors from trampling the delicate coastal ecostyem.

When Maya Bay finally reopened in early 2022, visitor numbers were cut from the previous height of around 7000 to around 400 per day, noted Thon Thamrongnawasawat, head of the restoration team, in an interview with China's State news agency, Xinhua.

"It is one of the most successful marine actions in many years not only for Thailand but for the whole world," he said.

Bhutan adapts to climate change via tourism fee

The tiny Himalayan kingdom of Bhutan, known for its philosophy of promoting " gross national happiness ," introduced a Sustainable Development Fee (SDF) of $65 (€61) around three decades ago to limit mass tourism in the mountainous nation.

Under the mantra of "high-value, low-volume" tourism, the tax revenue has been invested into conservation and sustainability through planting trees, clean and maintain trails and to electrify transport. The fee has helped Bhutan become South Asia's only carbon-negative country as its protected forests continue to store more carbon than the country emits.

The money also addresses high vulnerability to climate change , with impacts ranging from severe drought to melting glaciers.

In 2022, the Bhutan government raised the daily fee to $200 dollars per person when it reopened following the pandemic, saying the cash would be used to offset tourism emissions.

But the fee hike hit tourist numbers and resulted in losses across the sector. In August, Bhutan halved the amount to US$100 to stimulate tourism as it strikes a balance between climate protection and the local economy.

Costa Rica fights deforestation with ecotourism

In 1997, Costa Rica implemented a Certification for Sustainable Tourism that became a pioneering blueprint for a climate- and environment-friendly travel industry.

The reform was in line with an attempt to reverse decades of deforestation, with around half the forest that once covered 75% of Costa Rica lost between the 1940s and 1980s.

Small ecotourism entrepreneurs soon created low impact resorts and ecolodges aimed at more affluent travellers wanting to explore the country's rich biodiversity and natural beauty.

Sustainable tourism is integral to the fact that over half the nation is again covered in forest. Meanwhile, more than 98% of the Latin American nation's energy comes from renewable sources.

As part of its strict ecotourism certification, Costa Rica has continued to prove the fact that some visitors will pay more for a genuine sustainable travel experience.

Mallorca: Can sustainability tax offset overtourism?

During peak tourist season, an airplane lands or takes off in the Balaeric Sea island of Mallorca every 90 seconds.

"There are few places in the world that contribute as much to global warming as Mallorca," Jaume Adrover, a spokesperson for the Mallorca-based environmental group Terraferida, told DW in 2022 of the tourist mecca. "And this is due to only one activity: tourism."

During its 2019 peak, 12 million visitors descended on an island whose population is a little over 900,000 people. The sheer weight of numbers has forced the government to limit the ecological and climate impact of the industry.

A new 2022 tourism law addresses issues of energy efficiency and CO2 reduction in the hotels sector. Hotels need to eliminate fuel oil or diesel boilers to reduce CO2 emissions, and also install water-saving devices while banning single-use plastics. A moratorium on any new tourist accommodation until 2026 aims to reduce the explosion in tourism numbers.

This follows the introduction in 2016 of a daily eco tourism tax, currently as high as €4 euros per day, that is being reinvested in sustainability, including the restoration of Posidonia seagrass meadows.

Dubbed the "lungs of the Mediterranean," the seagrass produces oxygen, absorbs carbon, provide habitat and shelter for a variety of species, yet has receded around Mallorca due to pollution, and like in Maya Bay, boat anchors.

But without significantly reducing the number of tourists, and therefore flights, local ecologists like Jaume Adrover still fear that not enough is being done to transform the tourist hotspot into a model of sustainability.

Edited by: Tamsin Walker

Author: Stuart Braun

Thailand’s Cannabis Re-Criminalization Risks Street Protests and Industry Lawsuits

T hailand’s move to reclassify cannabis as a narcotic threatens to trigger street protests and class-action suits by owners of thousands of dispensaries which sprung across the country in the wake of decriminalization two years ago.

A complete re-criminalization ordered by Prime Minister Srettha Thavisin on Wednesday will also push the cannabis trade underground, said Rattapon Sanrak, owner of Bangkok-based dispensary Highland Cafe. Writing Thailand’s Cannabis Future, an advocacy group, said it will hold a protest against the move in Bangkok on May 16.

Cannabis currently enjoys the status of a “controlled herb” in Thailand and there is no outright ban on its recreational use, allowing nearly 8,000 dispensaries to open since it was decriminalized in 2022. Srettha’s directive to re-label cannabis as a “category five” narcotic will make it a crime to “produce, sell, import, export, or possess” the plant and use it, according to Thai drug laws. Cannabis for medical and health purposes will still be allowed, according to the premier.

“We’re all doing everything by the book but then suddenly the book is going to change,” Rattapon said. “We’re gearing up to protest and preparing to file lawsuits in the event it happens.”

The policy volte-face is another blow to Thailand’s nascent cannabis industry after decriminalization was pitched as a way to boost agricultural income and wellness tourism. Liberal use of cannabis became a hot-button political issue ahead of the Thailand’s national election last year. With efforts to establish regulations around the marijuana industry failing, concerns grew about the social impact of addiction from easy availability of the drug.

Watch: Inside Thailand’s Complicated Legalization of Weed

The policy reversal is part of ruling Pheu Thai Party’s hard-line anti-drug campaign. Earlier this week, Srettha gave a 90-day deadline for law enforcement and local authorities to crack down on drugs in 25 provinces considered as “red zones.”

Bhumjaithai Party, which spearheaded the decriminalization policy under the previous administration but is now part of Srettha’s government, said a bill to regulate recreational use would be more effective than outlawing the plant entirely. But the premier defended the move on Thursday saying “whatever we decide to do, we do it for the people.”

Thailand’s nascent cannabis industry has battled legal uncertainties since inception as lawmakers couldn’t agree on how to regulate it. The first attempt to pass a bill to control cannabis use last year was blocked in parliament as part of political jockeying ahead of the election. The most recent attempt under the Srettha government to outlaw recreational use and tighten licensing rules on planting, sales, exports and imports of cannabis was stalled by bureaucratic process.

More than 1 million households have registered with Thai authorities to plant cannabis in addition to commercial cultivation by companies seeking to benefit from the booming demand.

Once the health ministry wraps up the process of classifying cannabis as a category five drug, its possession could land one a jail sentence of up to 15 years and a maximum fine of 1.5 million baht ($40,600).

Cannabis advocates are urging health authorities to weigh the pros and cons of cannabis in comparison to alcohol and cigarettes and use science and facts to determine what should be drugs.

The constant policy flip-flop will not only risk damaging foreign investor confidence but also create “wide ripple effects” across the industry, causing legitimate cannabis businesses to shut down, workers to lose jobs and growers to lose income from the cash crop, Rattapon of Highland Cafe said.

“Instead of regulating the industry properly, you’re choosing to close it up and make it worse by pushing it underground,” Rattapon said.

More Must-Reads from TIME

- The New Face of Doctor Who

- Putin’s Enemies Are Struggling to Unite

- Women Say They Were Pressured Into Long-Term Birth Control

- Scientists Are Finding Out Just How Toxic Your Stuff Is

- Boredom Makes Us Human

- John Mulaney Has What Late Night Needs

- The 100 Most Influential People of 2024

- Want Weekly Recs on What to Watch, Read, and More? Sign Up for Worth Your Time

Contact us at [email protected]

The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

News & Analysis

- Professional Exclusives

- The News in Brief

- Sustainability

- Direct-to-Consumer

- Global Markets

- Fashion Week

- Workplace & Talent

- Entrepreneurship

- Financial Markets

- Newsletters

- Case Studies

- Masterclasses

- Special Editions

- The State of Fashion

- Read Careers Advice

- BoF Professional

- BoF Careers

- BoF Insights

- Our Journalism

- Work With Us

- Read daily fashion news

- Download special reports

- Sign up for essential email briefings

- Follow topics of interest

- Receive event invitations

- Create job alerts

Inside Thailand’s Booming Beauty Sector

Key insights

- Following the global successes of J-beauty and K-beauty products, Thai beauty companies are working to make T-beauty an international fixture.

- The growing popularity of Thai celebrities, films and dramas across the region is helping T-beauty brands cast a wider net in markets like Japan and China.

- In the $6.6 billion Thai beauty market, experts say foreign players should emphasise their origins, fine tune their positioning and cater more to local preferences.

For years, global shoppers have bought into the sheet masks, snail mucin and rice water cleansers that made J-beauty and K-beauty products famous. And while the Japanese and South Korean brands behind those export waves are in a different league, some of their Chinese peers have also started gaining overseas fans with intricately packaged yet affordable C-beauty products. Now, brands from Thailand believe it’s T-beauty’s time to shine.

Two companies leading the charge in the T-beauty industry are SSUP Holdings-owned Oriental Princess, which focuses on natural ingredients, and Better Way-owned Mistine, one of the country’s first direct-to-consumer beauty brands.

Mistine has already made its mark outside the region, according to Euromonitor research analyst Rachel Kok. Having gained ground before and during the pandemic, the brand is now “growing at breakneck speed in its main export market China,” where it has found favour through its sunscreens among China’s price-conscious Gen-Z consumers, who trust products capable of withstanding Thailand’s high temperatures.

Mindd Nuchata Sukkang, a Bangkok-based makeup artist whose clients include actors Atthaphan Phunsawat and Louis Vuitton favourite Urassaya Sperbund, stocks her kit with a mishmash of Western, Korean, Chinese and Thai products. Mistine and Cathy Doll are among her favourite T-beauty brands alongside 4U2, a label known for its wide assortment of cheap and cheerful products.

ADVERTISEMENT

While Thai shoppers are “open to try new things,” they are also budget-conscious due to the country’s sluggish economy, explains Virithipa Pakdeeprasong, a local model and TV personality who founded the beauty brand Sewa in 2017.

The entrepreneur, who manufactures products in South Korea but localised her line to suit the Thai market and climate, notes that most local brands play into this consumer mindset by selling products in smaller sample-sized packaging — at a fraction of the cost of equivalent foreign products — to encourage brand switching. “Sewa sells millions of these [sample-size products] every year,” Pakdeeprasong said.

Cathy Doll, owned by 27-year-old, 15-brand strong Thai beauty conglomerate Karmart, is another brand known for its smaller, affordable items, and has its eyes set on overseas markets including mainland China, Taiwan and the Middle East after expanding into Japan.

But T-beauty’s potential for global growth is down to more than just low prices and weather-resistant products. It also has cultural capital thanks to an association with Thailand’s entertainment industry, which produces content and stars that are increasingly popular across Asia.

Brands with cultural capital

Thailand’s relatively progressive stance on social issues like LGBT rights and gender, including expressions of masculinity, adds to its popularity as an international tourist destination. It also helps to make the country’s creative industries, which often feature such storylines, increasingly popular abroad.

The country’s queer romance dramas, a genre known as Boys’ Love (BL), have become a hot cultural export attracting legions of male and female fans, and inspiring global fashion and luxury brands to partner with their lead actors. Following Christian Dior’s appointment last year of “Mile” Phakphum Romsaithong and “Apo” Nattawin Wattanagitiphat as brand ambassadors, Vachirawit Chivaaree and Metawin Opas-Iamkajorn have inked deals with Calvin Klein and Prada, respectively.

Male heartthrobs aren’t the only ones serving as a conduit for local beauty businesses and trends. One example is actress and Gucci Beauty face Davikah Hoorne’s recent photoshoot , where she wears quintessential T-beauty makeup styles and a floral take on a traditional Thai headdress and accessories.

Sukkang, for one, has helped shape the ‘T-beauty look.’ For women, she cherry-picks elements from Western beauty alongside features from K-, J- and C-beauty, before melding the softness, youthful base and detailed eye looks of the East with shading and bold colours from the West.

“When Thai celebrities are in front of the camera, people focus on their makeup. People notice that we have a Thai style,” said Sukkang. “I get messages from a lot of fans, international ones too. When I post their pictures, people are always asking me what I use.”

Ratchatawipasanan cites the ‘ swai meiku’ T-beauty makeup trend (“swai” meaning beautiful in Thai, and “meiku” meaning makeup in Japanese), which has already gained traction in Japan, where bloggers replicate actors’ looks and recommend brands like Cathy Doll to their viewers.

T-beauty trends have even greater influence closer to home in Southeast Asian markets like Vietnam, Cambodia, Laos and Myanmar, thanks in part to the availability and influence of Thai media in the region.

The growing popularity of T-beauty brands across Asia has made their home market an increasingly important one for global players to invest in and monitor for trends. As Thai brands start gearing up for global expansion, the qualities that give them an edge back home often serve as lessons for foreign brands looking to enter or expand in Thai market.

Ample room for growth

Thailand’s relative maturity as a luxury market and its popularity as a global tourism hub render it a vibrant space for both local and foreign beauty players. Market scale and growth rates are also important considerations.

According to Euromonitor, the Thai beauty and personal care market was worth $6.6 billion in 2022, marking a 9.2 percent uptick from 2021, and a full recovery following a pandemic-induced contraction the previous year.

The growth trajectory doesn’t just reflect the performance of big multinationals, according to Euromonitor’s Kok. “This includes local brands that have found their competitive edge at comparatively lower price points in a market dominated by foreign and imported brands,” she said.

Though Thailand lags mature beauty markets like South Korea ($12.9 billion) and Japan ($30.1 billion), regional giant China ($80 billion in the mainland and $3.2 in Hong Kong) and India ($16 billion), it’s ahead of all Southeast Asian countries except Indonesia ($7.6 billion). Further afield, Australia ($7.9 billion) is only marginally larger.

While Thailand boasts a skincare market that is almost the same size as Indonesia (despite the latter having four times the population as the former), Thailand’s spending per capita is almost four times higher, says Chayapat Ratchatawipasanan, senior beauty and personal care analyst at Mintel.

When it comes to colour cosmetics, Thailand’s market was half Indonesia’s size, but the former’s spending per capita was almost double the spending in the latter. “This shows that the beauty market in Thailand still has more room to grow, especially in premium and luxury cosmetics categories,” explained Ratchatawipasanan.

Chayapa Rattanadej, the country general manager of Sephora Thailand, echoes that sentiment, revealing that Thailand was one of the fastest-growing markets for the French retailer in 2023.

“Due to our climate, one of the categories that do very well in Sephora Thailand is sun-care, anti-pollution and acne care for sensitive skin,” said Rattanadej. “We see Thai beauty brands potentially levelling up in Asia given these beauty essentials are nearly universal in our region.”

Though it’s better known for bringing global names like Fenty Beauty and Rare Beauty to Thailand, Sephora is also tapping into interest in T-beauty by stocking the likes of skincare brands FYNE, Delphini and Skinsyrip. The retailer has observed growing demand for Thai products from international tourists who specifically ask for brands exclusive to its local outposts, Rattanadej said.

Beyond Western multi-brand retailers like Sephora, which has nearly a dozen branches in malls across Greater Bangkok and an outlet in Phuket, Thai brands can also be found nationwide at both local boutiques and drugstore chains like Watsons and Matsumoto Kiyoshi that hail from other Asian countries.

Domestic e-commerce upstarts like Konvy, which carries a diverse range of local and global beauty brands and in January announced a $11 million fundraising round from New Day Ventures, Alibaba International Digital Commerce Group, and Insignia Ventures Partners, are also making their mark. Konvy’s CEO Qinggui Huang said in a statement that the capital would power its expansion across the region, starting with the Philippines.

Thinking global and local

One characteristic of Thailand’s beauty market that is especially true from the perspective of foreign brands is that it is fragmented.

Despite the growth of and increasing consumer trust in domestic players, global conglomerates like L’Oréal Group, Unilever, Procter & Gamble and Estée Lauder Companies are still dominant in the crowded market, which in recent years has also witnessed the rise of rivals from South Korea and Japan.

While Thai shoppers steer toward local brands for the lower price tags, they still have a strong preference for overseas names, which are “perceived as [boasting] superior quality,” according to Ratchatawipasanan, who notes the country of origin as a “crucial factor” in selling products to Thais. “This inclination is evident in various marketing campaigns,” she said, citing Thai brands that strategically adopt foreign-sounding identities to tap into that goodwill.

Contrary to some of the localisation strategies that work elsewhere, in Thailand “emphasising the country of origin or explicitly highlighting [the brand’s] foreign identity could prove more advantageous than transitioning to a local image,” she said.

Ratchatawipasanan acknowledges the need for most foreign brands to maintain premium price tags even if more competitive pricing strategies might help them to grow sales. But there are other ways foreign brands can cater to local needs without compromising their positioning.

For one, a sharper focus on products geared toward an older demographic could be advantageous. Thailand is one of the world’s fastest aging societies, according to the World Health Organization, with Kasikorn Bank estimating that over 20 percent of its population will be older than 65 by 2029. With that in mind, categories that global brands could explore more include anti-aging skincare, makeup for mature skin, and equivalent offerings across hair care and body care.

Sukkang also raises the popularity of personal colour analysis, which most T-beauty brands mastered early on. “Around 70 or 80 percent of Thai people have yellow, warm undertones [and] they’re very [aware of] this [when choosing suitable products],” said Sukkang. “Baby pink [lipstick] was popular ten years ago, for example, but it won’t sell now because people know they need the right palette for their skin tone.”

“If you’re a global brand, you need to focus on things like that.”

Why Thai Celebrities Are Fashion’s New Power Players

Global luxury brands are signing celebrity ambassadors from Thailand to tap into rising local demand and leverage the stars’ growing appeal across the wider Asia region.

How TikTok Brought Back K-Beauty

While the K-beauty craze of the 2010s has waned in recent years, brands and retailers are seeing renewed interest in South Korean beauty.

Why Japanese Beauty Giants Are Buying Up Global Brands

M&A is gathering pace in Japan’s beauty industry as local conglomerates look to diversify their portfolios beyond Asia and target high-growth categories overseas.

© 2024 The Business of Fashion. All rights reserved. For more information read our Terms & Conditions

Worldview: Australian Fashion Week Taps Textile Innovators

This week’s round-up of global markets fashion business news also features Burberry’s trademark dispute in China, pan-African e-tailer Jumia and South Korea’s investigation into Coupang.

When Will India’s Streetwear Scene Become Big Business?

Local streetwear brands, festivals and stores selling major global labels remain relatively small but the country’s community of hypebeasts and sneakerheads is growing fast.

Worldview: China’s May Holiday Sees Domestic Travel Spending Recover

This week’s round-up of global markets fashion business news also features Senegalese investors, an Indian menswear giant and workers’ rights in Myanmar.

Brazil Succumbs to the Retail Apocalypse It Staved Off for Years

Though e-commerce reshaped retailing in the US and Europe even before the pandemic, a confluence of economic, financial and logistical circumstances kept the South American nation insulated from the trend until later.

Subscribe to the BoF Daily Digest

The essential daily round-up of fashion news, analysis, and breaking news alerts.

Our newsletters may include 3rd-party advertising, by subscribing you agree to the Terms and Conditions & Privacy Policy .

Our Products

- BoF Insights Opens in new window

Thai business group cuts 2024 GDP growth forecast to 2.2%-2.7%

- Medium Text

Sign up here.

Reporting by Orathai Sriring and Kitiphong Thaichareon; Editing by John Mair

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Three foreign tourists and one Afghan citizen were killed by gunmen in Afghanistan's central Bamyan province on Friday, the Taliban interior ministry said.

World Chevron

Portuguese speaker defends lawmaker's race remarks as free speech

A comment made by a far-right lawmaker in Portugal's parliament on Friday that opponents have criticised as racist has sparked a storm over whether or not such remarks should be considered as protected free speech.

Israeli strikes on southern and eastern Lebanon killed at least five people on Friday including two children, security sources and UNICEF said.

COMMENTS

Recently, the tourism receipts from foreign visitors in Thailand had shown gradual increase, amounting to over 26 billion Thai baht in June 2022. Tourism has also brought opportunities in ...

Thailand has shown a gradual economic recovery from the COVID-19 pandemic during 2022, helped by rising international tourism arrivals. Real GDP growth rose from 1.5% in 2021 to 2.6% in 2022, with growth momentum expected to improve further in 2023. The latest S&P Global Thailand Manufacturing PMI survey results for February 2023 continued to ...

Revenue from tourism, which used to account for 11% of GDP in 2019, when it reached US$59.8bn, dropped to a dismal US$5bn or 1% of GDP in 2021. In the first half of 2022 travel receipts were roughly on a par with the level seen in the full year of 2021. As arrivals picked up further in the third quarter of 2022, the recovery of travel receipts ...

Thailand received 11.15 million foreign visitors in 2022, a surge from just about 428,000 the previous year when broad pandemic-related travel curbs were in place, tourism ministry data showed on ...

Thailand is struggling to restore its crucial tourism industry to pre-pandemic levels [Courtesy of Vijitra Duangdee] By Vijitra Duangdee Published On 16 May 2022 16 May 2022

Q2 GDP seen at 0.9% q/q sa vs +1.1% in Q1. Q2 GDP data due on Monday, Aug 15. BENGALURU, Aug 12 (Reuters) - Thailand's economy likely grew at its fastest pace in a year last quarter, thanks to ...

The government slightly revised its 2022 economic growth forecast to 2.7-3.2 percent from an earlier 2.5-3.5 percent growth range, citing a rebound in the crucial tourism sector, increased ...

Q4 GDP data due on Monday, Feb. 21 at 0130 GMT. BENGALURU, Feb 18 (Reuters) - Thailand's economy likely returned to growth in the fourth quarter thanks to robust exports and easing of COVID-19 ...

Updated on. August 29, 2022 at 10:05 PM PDT. Listen. 2:29. This article is for subscribers only. Thailand expects to net about 400 billion baht ($11 billion) from a surge in foreign tourist ...

Bangkok, 11 February, 2022 - The Tourism Authority of Thailand (TAT) is moving forward with its goal to revitalise and transform Thai tourism, with the 'Visit Thailand Year 2022: Amazing New Chapters' campaign, and formulating a 'DASH' model to help revive the tourism sector and the Thai economy overall.. The 'Visit Thailand Year 2022: Amazing New Chapters' campaign was initially ...

Tourism Jump to Power Thai GDP Growth to Five-Year High in 2023. Thailand set for 4.2% economic growth in 2023, Prayuth says. About 19 million visitors forecast next year, triple 2022 pace. By ...

Bangkok, 28 October, 2022 - Thailand welcomed over 7 million tourists between 1 January and 26 October, 2022, with the full year target for 2022 being between seven and 10 million visitor arrivals.. Mr. Yuthasak Supasorn, Governor of the Tourism Authority of Thailand (TAT), said "With the difficult times of recent now behind us, Thailand is seeing its efforts across the board - from ...

The Thailand Tourism Outlook data showed details on the number of foreign tourists arriving in Thailand, and it was found that the number of tourists arriving in Thailand in the first 10 months of 2022 (January-October) reached 7,163,465; compared with the previous year, the percentage of the increase was a stunning 6,65,0.53%, a total increase ...

The Tourism Authority of Thailand (TAT), in cooperation with the Phuket Tourist Association and the Digital Economy Promotion Agency (DEPA), has announced that the 'Thailand Travelution 2022' event - which will focus on the importance of using technology and the insight of Big Data to help drive the Thai tourism industry's digital transformation - will be held on 18-19 November, 2022, at ...

The recovery pace of Thai hotels under our coverage is faster - their RevPAR recovered to 48-84% of the pre-Covid level in 2Q22 (vs industry average of 33%) - as most of the hotels are in the upscale segment and capture high-spending tourists. Momentum should continue in 2H22 with RevPAR almost reaching pre-Covid by 4Q22, driven by ADR.

Thailand expects 9.3 million tourists in 2022. Thailand is expected to see over 7 million tourists visit the kingdom in the second half of this year, generating total revenue of around 1.27 trillion baht for the Thai economy. According to Government Spokesperson Thanakorn Wangboonkongchana, the Ministry of Tourism and Sports has reported a ...

Thailand: Tourism industry. The number of overseas visitors to Thailand is the top in ASEAN and the 8th largest in the world (data from the World Tourism Organization in 2019). The number of foreign visitors, which is increasing year by year, marked a record high of about 40 million in 2019. The country's rich natural environment, beach resorts ...

Published On Dec 11, 2022 at 04:00 PM IST. Thailand celebrated the arrival of its 10 millionth international visitor of 2022 on Saturday, according to the tourism authority, as the kingdom consolidated the recovery of its Covid-battered travel sector. Thailand welcomed some 40 million people in 2019, but then the pandemic hit and travel was ...

BANGKOK, Oct 10 (Reuters) - Thailand's economic recovery will not be affected by a global slowdown due to a rebound in tourism, Finance Minister Arkhom Termpittayapaisith told reporters on Monday.

Value of tourism GDP Thailand 2017-2021. Basic Statistic. Number of quarterly foreign visitors Thailand Q1 2021-Q4 2022. Premium Statistic. Number of local tourists Thailand 2023. Premium ...

Dubai, 27 March, 2022 - The Tourism Authority of Thailand (TAT) presented Thailand's innovation approach on digital tourism in line with key strategies under the 'Visit Thailand Year 2022: Amazing New Chapters' tourism campaign at the Global Tourism Forum (GTF) 2022: Dubai Blockchain for Travel, which was held yesterday (26 March).. Mr. Nithee Seeprae, TAT Deputy Governor for ...

Tourism numbers have increased through 2022 as travel restrictions have been curtailed with Thailand receiving a total 4,378,920 foreign visitors through the end of August, 2022.This number already drastically exceeds the 427,869 foreign visitors that arrived through all of 2021.. The Thai government expects 1.5 million arrivals each month in the last quarter of 2022 and 10 million visitors ...

Sustainable Tourism in Thailand industry profile provides top-line qualitative and quantitative summary information including: market size (value and volume 2019-23, and forecast to 2028). The profile also contains descriptions of the leading players including key financial metrics and analysis of competitive pressures within the market. Key Highlights - Sustainable tourism minimizes the ...

A new 2022 tourism law addresses issues of energy efficiency and CO2 reduction in the hotels sector. Hotels need to eliminate fuel oil or diesel boilers to reduce CO2 emissions, and also install ...

BANGKOK, Sept 19 (Reuters) - Thailand expects to earn 2.38 trillion baht ($64.50 billion) in tourism revenue in 2023, a government official said on Monday. The government wants tourism next year ...

The policy volte-face is another blow to Thailand's nascent cannabis industry after decriminalization was pitched as a way to boost agricultural income and wellness tourism.