Quitting Nicotine

Declare your freedom.

Develop a personal strategy for quitting tobacco, vaping, or nicotine use, and explore the behavior changes that will help you overcome cravings and resist temptations.

Are E-Cigarettes or Vaping Devices A Safe Substitute For Cigarettes?

Research does not support using e-cigarettes and vaping devices as a safe alternative to smoking cigarettes. They are not currently regulated and have been connected to health problems and diseases. Kaiser Permanente recommends other means for quitting nicotine. Learn more about e-cigarettes .

Is Social Use Ok?

Any amount of nicotine can have an adverse effect on your health. Even non-nicotine devices are not safe. Social use is not safe — and you also put those around in you in jeopardy.

How Can I Help Myself?

There are many ways to help you cope with the process of quitting nicotine.

Use Cultivating Health(R) Freedom From Tobacco to develop a quit program that works for you.

Help yourself every step of the way:

- Planning your strategy

- Handling withdrawal symptoms

- Avoiding weight gain

View reasons why it’s worth it to quit tobacco .

Breaking The Habit

Quitting successfully depends on being ready to change, and on developing new skills and habits.

Watch the video.

Could A Health Coach Help Me?

Sometimes, we all need a little help as we’re working towards a goal. As you work to quit, a health coach can be a valuable resource in your journey. A health coach can help you determine your patterns and behaviors, set goals, and find new coping strategies.

Learn more about Kaiser Permanente’s health coaching sessions .

Online Resources To Help You Quit

- Stop Smoking

- Quit smoking and vaping tools

- Quit dip and chew

- How to Quit

- Kaiser Permanente online wellness programs that help you create positive changes in your life

Looking For More?

- Freedom from tobacco and vaping classes

- Telephone coaching

- Oregon and Washington QuitLine, 1-800-QUIT NOW (784-8669)

- Free quitSTART mobile app

- Become an EX personalized quit plan

- Guide to quitting smokeless (chewing) tobacco

- Tips on quitting vaping

Kaiser Permanente members who need help managing their emotions during quitting have access to digital mental health and wellness tools, at no charge. Check out this page for the Calm, Headspace Care, or myStrength apps. You also can call a health coach for additional subscriptions to SilverCloud, Thrive, and apps for teens and parents.

Are There Medications That Can Help?

Medications like Zyban and Chantix can be effective tools for quitting, particularly when combined with behavioral changes.

How do you know if medications are right for you?

- You have tried on your own to stop, but you were not able to stop.

- You smoke more than 10 cigarettes a day.

- You want to increase your chances of success.

Learn more about your medication options and if they’re right for you.

The independent source for health policy research, polling, and news.

2019 Employer Health Benefits Survey

Published: Sep 25, 2019

- Summary of Findings

- Survey Design and Methods

- Section 1: Cost of Health Insurance

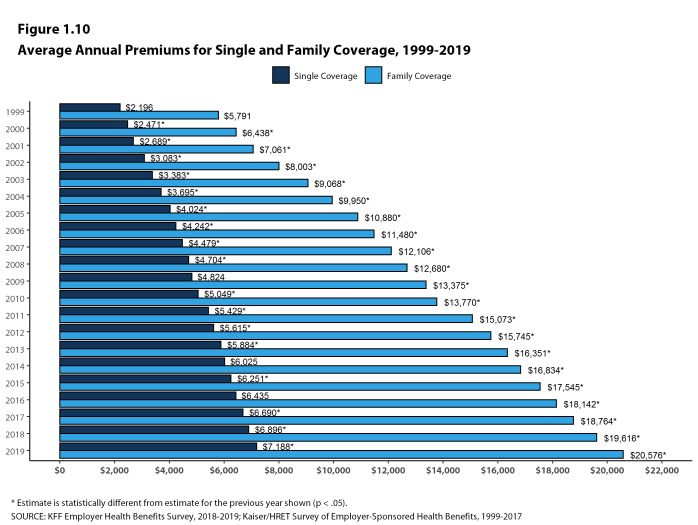

In 2019, the average annual premiums are $7,188 for single coverage and $20,576 for family coverage. The average premium for single coverage increased by 4% since 2018 and the average premium for family coverage increased by 5%. The average family premium has increased 54% since 2009 and 22% since 2014.

This graphing tool allows users to look at changes in premiums and worker contributions for covered workers at different types of firms over time: https://www.kff.org/interactive/premiums-and-worker-contributions/

PREMIUMS FOR SINGLE AND FAMILY COVERAGE

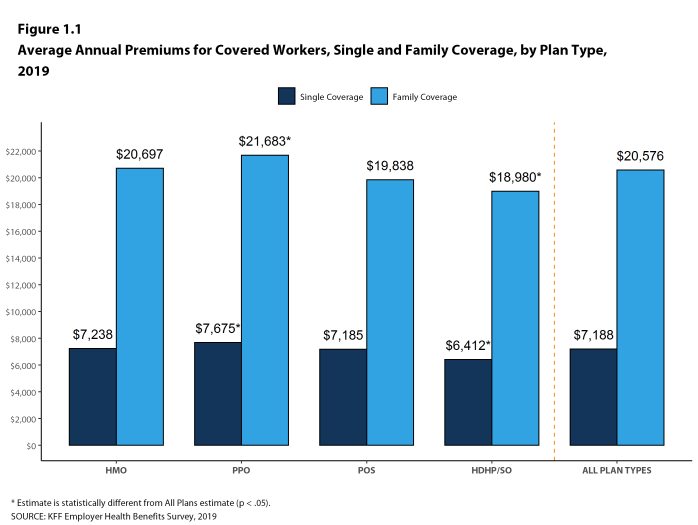

- The average premium for single coverage in 2019 is $7,188 per year. The average premium for family coverage is $20,576 per year [ Figure 1.1 ].

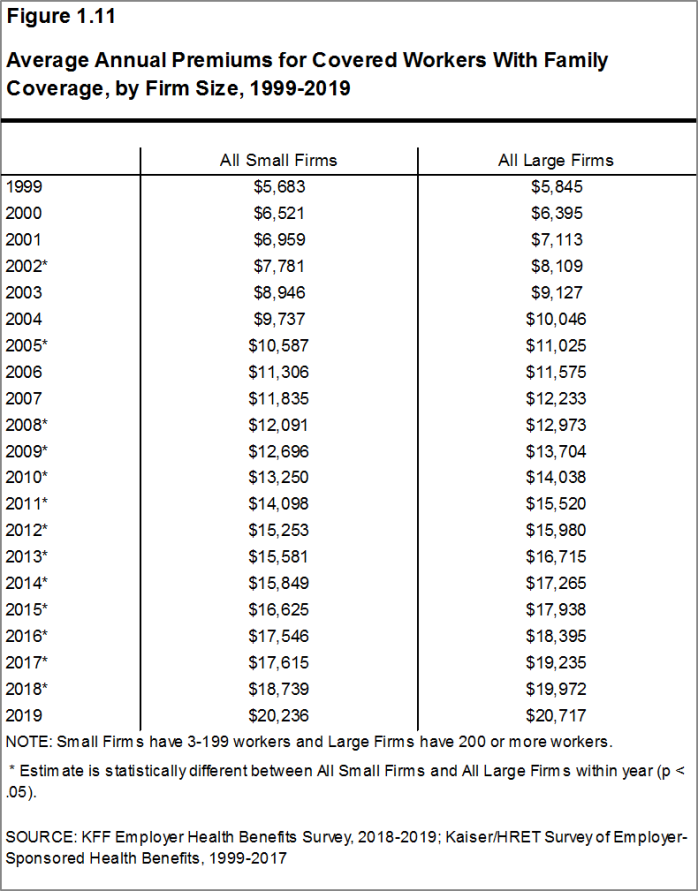

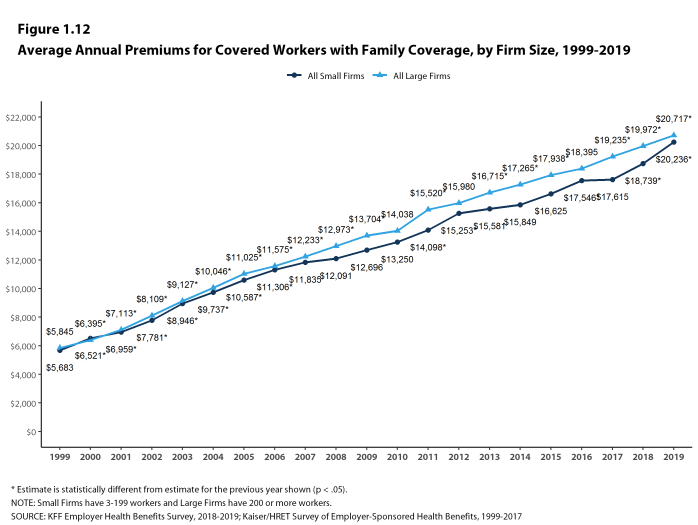

- The average annual premium for family coverage for covered workers in small firms ($20,236) is similar to the average premium for covered workers in large firms ($20,717). [ Figure 1.2 ].

- The average annual premiums for covered workers in HDHP/SOs are lower for single coverage ($6,412) and family coverage ($18,980) than overall average premiums. The average premiums for covered workers enrolled in PPOs are higher for single ($7,675) and family coverage ($21,683) than the overall plan average [ Figure 1.1 ].

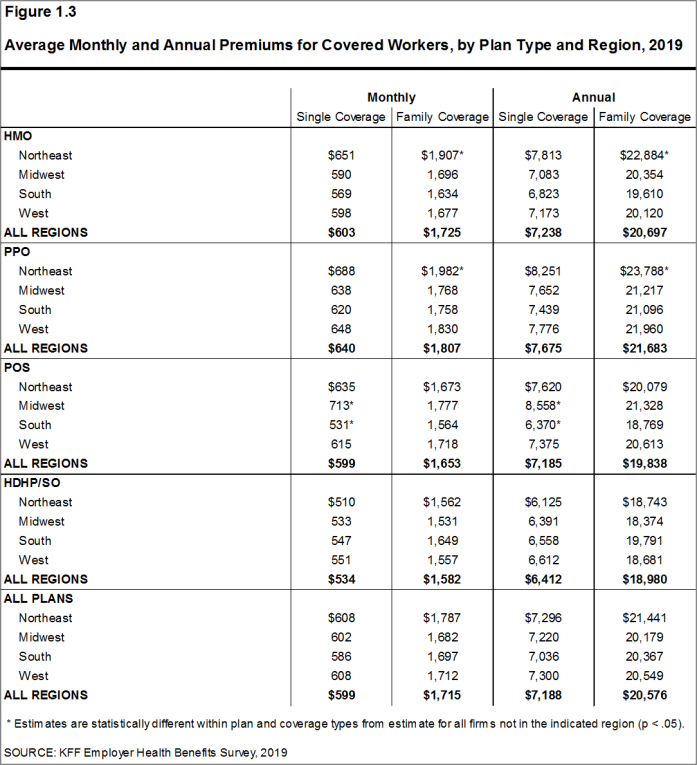

- The average premiums for covered workers with single coverage and for family coverage are similar across regions for all plan types [ Figure 1.3 ].

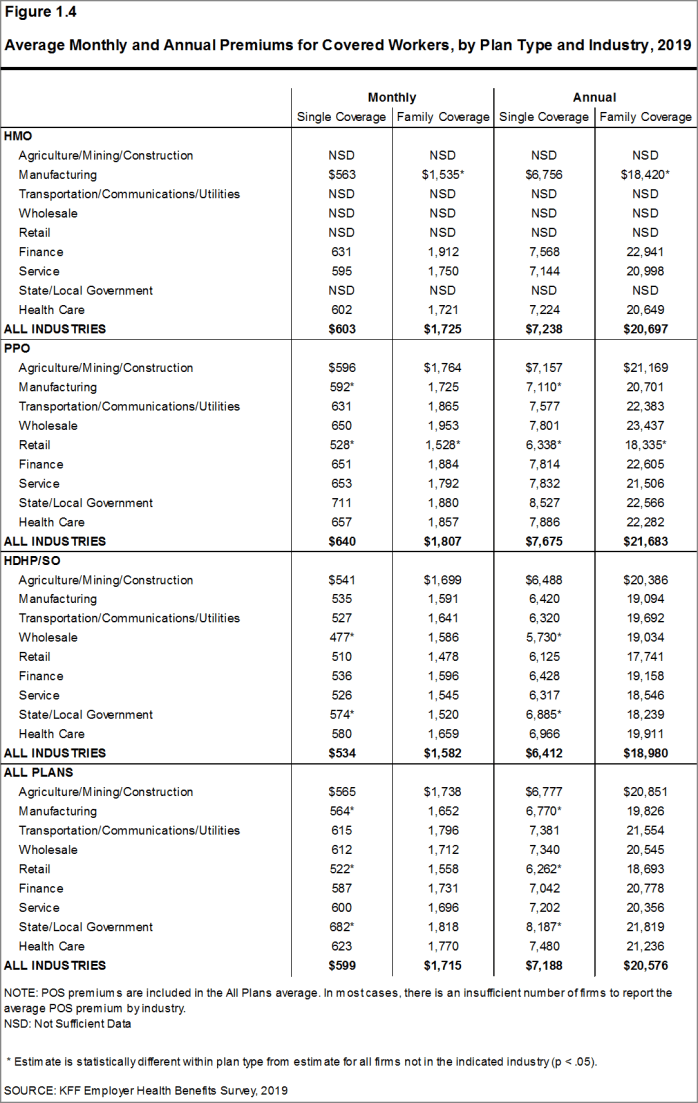

- The average premium for single coverage varies across industries. Compared to the average single premiums for covered workers in other industries, the average premiums for covered workers in the Manufacturing and Retail categories are relatively low and the average premium for State and Local Government workers are relatively high [ Figure 1.4 ].

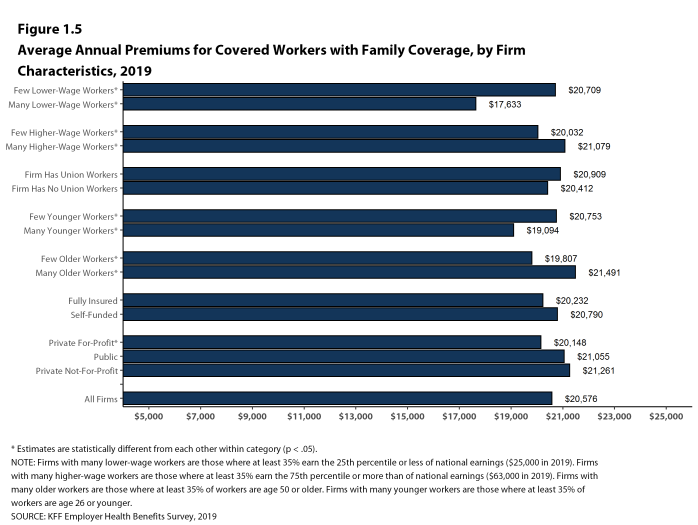

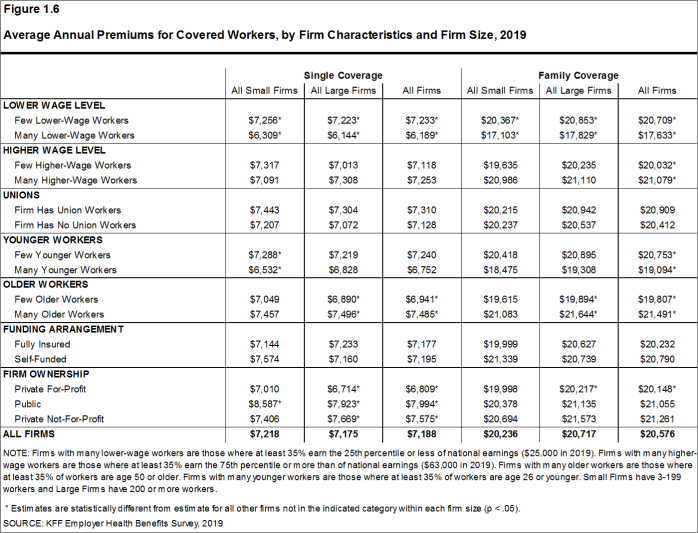

- The average premiums for covered workers in firms with a relatively large share of lower-wage workers (where at least 35% of the workers earn $25,000 annually or less) are lower than the average premiums for covered workers in firms with a smaller share of lower-wage workers ($6,189 vs. $7,233 for single coverage and $17,633 vs. $20,709 for family coverage) [ Figure 1.6 ].

- The average premiums for covered workers in firms with a relatively large share of older workers (where at least 35% of the workers are age 50 or older) are higher than the average premiums for covered workers in firms with a smaller share of older workers ($7,485 vs. $6,941 for single coverage and $21,491 vs. $19,807 for family coverage) [ Figure 1.6 ].

- The average premiums for family coverage for covered workers in firms with a relatively large share of younger workers (where at least 35% of the workers are age 26 or younger) are lower than the average premiums for covered workers in firms with a smaller share of younger workers ($19,094 vs. $20,753) [ Figure 1.6 ].

- Premiums also vary by type of firm ownership. Covered workers at private for-profit firms have lower average annual premiums than covered workers at public firms or private not-for-profit firms for both single and family coverage [ Figure 1.6 ].

Figure 1.1: Average Annual Premiums for Covered Workers, Single and Family Coverage, by Plan Type, 2019

Figure 1.2: Average Monthly and Annual Premiums for Covered Workers, by Plan Type and Firm Size, 2019

Figure 1.3: Average Monthly and Annual Premiums for Covered Workers, by Plan Type and Region, 2019

Figure 1.4: Average Monthly and Annual Premiums for Covered Workers, by Plan Type and Industry, 2019

Figure 1.5: Average Annual Premiums for Covered Workers With Family Coverage, by Firm Characteristics, 2019

Figure 1.6: Average Annual Premiums for Covered Workers, by Firm Characteristics and Firm Size, 2019

PREMIUM DISTRIBUTION

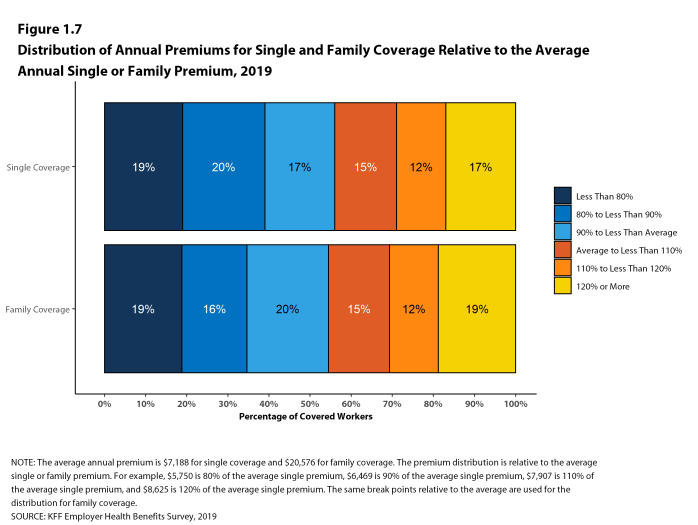

- Seventeen percent of covered workers are employed in a firm with a single premium at least 20% higher than the average single premium, while 19% of covered workers are in firms with a single premium less than 80% of the average single premium [ Figure 1.7 ].

- For family coverage, 19% of covered workers are employed in a firm with a family premium at least 20% higher than the average family premium, while 19% of covered workers are in firms with a family premium less than 80% of the average family premium [ Figure 1.7 ].

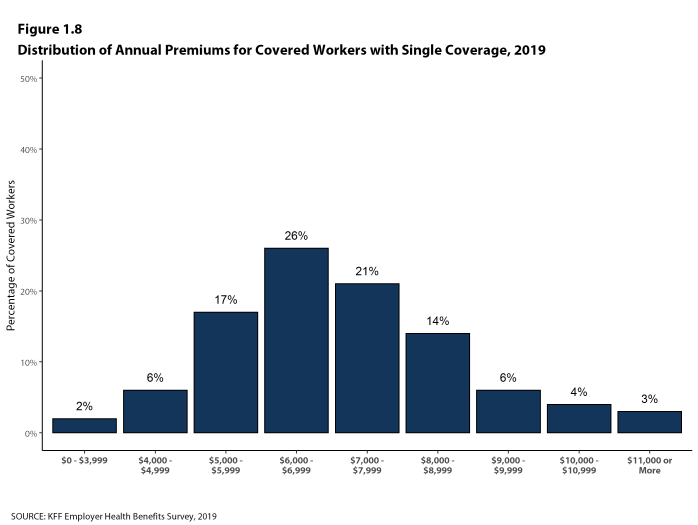

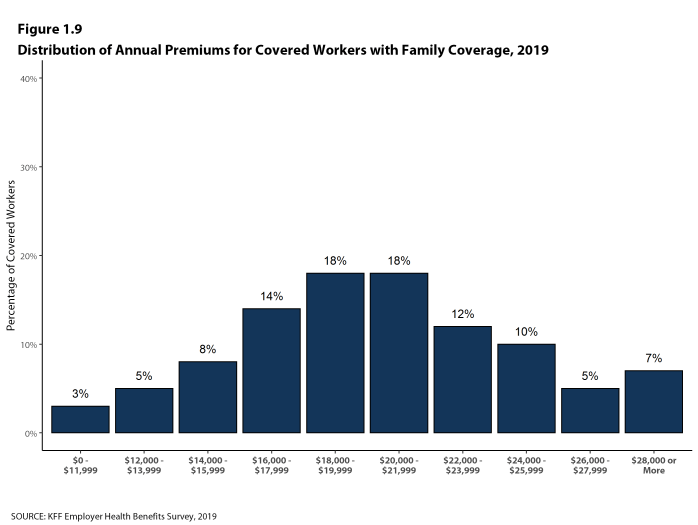

- Seven percent of covered workers are in a firm with an average annual premium of at least $10,000 for single coverage [ Figure 1.8 ]. Seven percent of covered workers are in a firm with an average annual premium of at least $28,000 for family coverage [ Figure 1.9 ].

Figure 1.7: Distribution of Annual Premiums for Single and Family Coverage Relative to the Average Annual Single or Family Premium, 2019

Figure 1.8: Distribution of Annual Premiums for Covered Workers With Single Coverage, 2019

Figure 1.9: Distribution of Annual Premiums for Covered Workers With Family Coverage, 2019

PREMIUM CHANGES OVER TIME

- The average premium for single coverage has grown 19% since 2014, similar to the growth in the average premium for family coverage (22%) over the same period [ Figure 1.10 ].

- The average family premiums for both small and large firms have increased at similar rates since 2014 (28% for small firms and 20% for large firms). For small firms, the average family premium rose from $15,849 in 2014 to $20,236 in 2019. For large firms, the average family premium rose from $17,265 in 2014 to $20,717 in 2019 [ Figures 1.11 and 1.12 ].

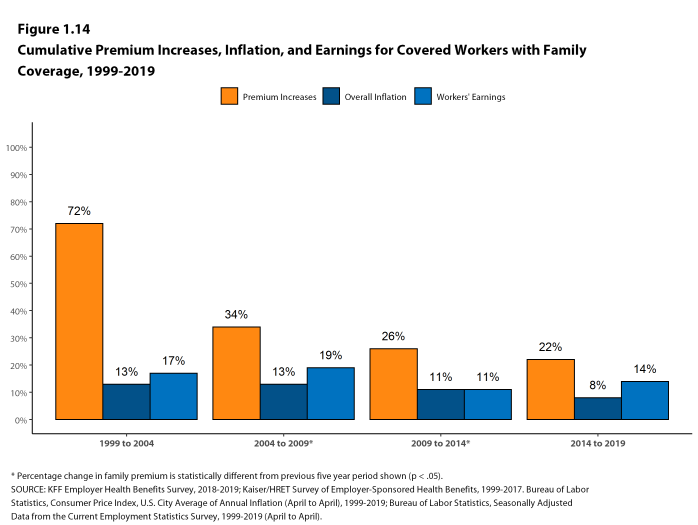

- The $20,576 average family premium in 2019 is 22% higher than the average family premium in 2014 and 54% higher than the average family premium in 2009. The 22% family premium growth in the past five years is similar to the 26% growth between 2009 and 2014 but slower than the 34% premium growth between 2004 and 2009 [ Figure 1.14 ].

- The average family premiums for both small and large firms have increased at similar rates since 2009 (59% for small firms and 51% for large firms). For small firms, the average family premium rose from $12,696 in 2009 to $20,236 in 2019. For large firms, the average family premium rose from $13,704 in 2009 to $20,717 in 2019 [ Figures 1.11 and 1.12 ].

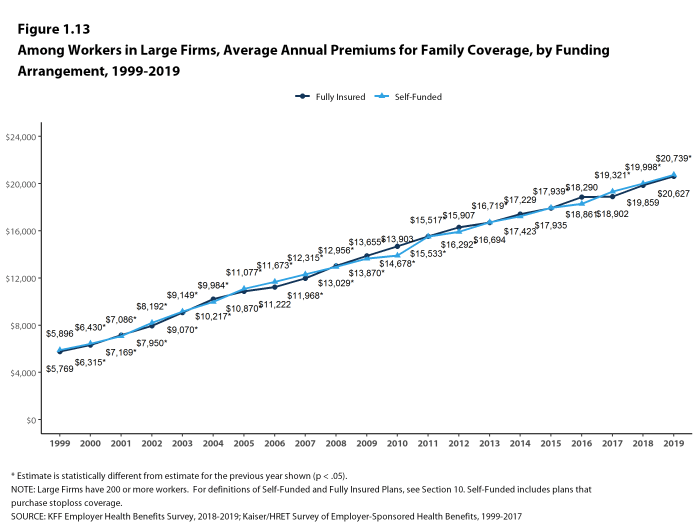

- For covered workers in large firms, over the past five years, the average family premium in firms that are fully insured has grown at a similar rate to the average family premium for covered workers in fully or partially self-funded firms (18% for fully insured plans and 20% for self-funded firms) [ Figure 1.13 ].

- Premium growth continues to outpace both inflation and increases in workers’ earnings [ Figure 1.14 ].

Figure 1.10: Average Annual Premiums for Single and Family Coverage, 1999-2019

Figure 1.11: Average Annual Premiums for Covered Workers With Family Coverage, by Firm Size, 1999-2019

Figure 1.12: Average Annual Premiums for Covered Workers With Family Coverage, by Firm Size, 1999-2019

Figure 1.13: Among Workers in Large Firms, Average Annual Premiums for Family Coverage, by Funding Arrangement, 1999-2019

Figure 1.14: Cumulative Premium Increases, Inflation, and Earnings for Covered Workers With Family Coverage, 1999-2019

- Health Costs

- Private Insurance

- Cost Sharing

- Prescription Drugs

- Employer Health

- High Deductible Plans

- Wellness Programs

- Section 2: Health Benefits Offer Rates

- Section 3: Employee Coverage, Eligibility, and Participation

- Section 4: Types of Plans Offered

- Section 5: Market Shares of Health Plans

- Section 6: Worker and Employer Contributions for Premiums

- Section 7: Employee Cost Sharing

- Section 8: High-Deductible Health Plans with Savings Option

- Section 9: Prescription Drug Benefits

- Section 10: Plan Funding

- Section 11: Retiree Health Benefits

- Section 12: Health and Wellness Programs

- Section 13: Grandfathered Health Plans

- Section 14: Employer Practices and Health Plan Networks

- SUMMARY OF FINDINGS

- TABLES - SECTION 1

Also of Interest

- What are the recent trends in employer-based health coverage?

- How Many Employers Could Be Affected by the High-Cost Plan Tax

- Kaiser Family Foundation/LA Times Survey Of Adults With Employer-Sponsored Insurance

Study record managers: refer to the Data Element Definitions if submitting registration or results information.

Search for terms

- Advanced Search

- See Studies by Topic

- See Studies on Map

- How to Search

- How to Use Search Results

- How to Find Results of Studies

- How to Read a Study Record

- Learn About Studies

- Other Sites About Studies

- Glossary of Common Site Terms

- Submit Studies to ClinicalTrials.gov PRS

- Why Should I Register and Submit Results?

- FDAAA 801 and the Final Rule

- How to Apply for a PRS Account

- How to Register Your Study

- How to Edit Your Study Record

- How to Submit Your Results

- Frequently Asked Questions

- Support Materials

- Training Materials

- Selected Publications

- Clinical Alerts and Advisories

- Trends, Charts, and Maps

- Downloading Content for Analysis

- ClinicalTrials.gov Background

- About the Results Database

- History, Policies, and Laws

- ClinicalTrials.gov Modernization

- Media/Press Resources

- Linking to This Site

- Terms and Conditions

- Search Results

- Study Record Detail

A Long-term Extension Study of PCI-32765 (Ibrutinib) (CAN3001)

- Study Details

- Tabular View

- No Results Posted

Inclusion Criteria:

- Participants must be currently participating in an ibrutinib clinical study considered complete and have received at least 6 months of treatment with ibrutinib. At study entry, participants must be actively receiving treatment with single-agent ibrutinib; or participants must have participated in an ibrutinib randomized clinical study in which they initially received comparator treatment and now cross-over to ibrutinib. Note: A minimum of 6 months requirement for prior ibrutinib treatment will not be mandatory in this case and participants with less than 6 months will be required to have more frequent initial safety assessments; or participants must be currently participating in study PCI-32765LYM1002. At study entry, participants must be actively receiving combination treatment with ibrutinib and nivolumab or single-agent ibrutinib

- Investigator's assessment that the benefit of continued ibrutinib therapy as a single agent or in combination with nivolumab will outweigh the risks

- Agrees to protocol-defined use of effective contraception

- Negative blood or urine pregnancy test at screening

Exclusion Criteria:

- Requires anticoagulation with warfarin or equivalent vitamin K antagonists

- Requires treatment with strong cytochrome P450 (CYP)3A4/5 inhibitors, unless previously approved by sponsor

- Any condition or situation which, in the opinion of the investigator, may put the participant at significant risk, may confound the study results, or may interfere significantly with volunteer's participation in the study

- For Patients and Families

- For Researchers

- For Study Record Managers

- Customer Support

- Accessibility

- Viewers and Players

- Freedom of Information Act

- HHS Vulnerability Disclosure

- U.S. National Library of Medicine

- U.S. National Institutes of Health

- U.S. Department of Health and Human Services

IMAGES

VIDEO

COMMENTS

The Medicare yearly wellness visit is your time to talk and plan with your doctor about your health. It's about preventing health problems and disability. And it's about making sure you get the medical care you need. Together, you and your doctor create a health care strategy that's right for you. These wellness visits are meant to support ...

Members enrolled in grandfathered plans can also contact our Member Services at 1-800-464-4000 (TTY 711), 24 hours a day, 7 days a week (closed holidays), for information about their plan's coverage of specific preventive care services.

Available 24/7 with no appointment, e-visits offer Kaiser Permanente members quick, convenient online care for many health concerns such as flu or COVID-19 symptoms. About Kaiser Permanente Home. ... Health and wellness. Our care. The fastest path to care. January 15, 2021.

Whether you want to stay healthy, lose weight, or find a fitness program that suits your needs, Kaiser Permanente Fitness and Exercise has something for you. Explore the benefits of being active, get discounts on fitness gear and online classes, and earn rewards for joining a qualifying fitness center. Visit Kaiser Permanente Fitness and Exercise today and start your wellness journey.

Your annual wellness visit is covered 100% by your Kaiser Permanente Medicare Advantage plan. You pay nothing for the appointment if it is performed by a Kaiser-approved doctor at a Kaiser Permanente medical facility. Any deductibles required by your plan do not apply to the Medicare annual wellness visit.

Call Member Services at 800-777-7902 (TTY 711), Monday through Friday, 7:30 a.m. to 9 p.m. (except holidays). This number is also found on your Kaiser Permanente ID card. Kaiser Foundation Health Plan of the Mid-Atlantic States, Inc. 2101 E. Jefferson St., Rockville, MD 20852. 2021MC1684 MAS 12/1/21-12/31/22.

Our care. Through our unique model, our focus on prevention, and our cutting-edge treatment, we provide members with high-quality, affordable care. See how we're different.

For information on KP Wellness Program appeals, please visit their website Kaiser Permanente Wellness Program. *Please visit the Sharecare section of our website for more information on the Wellness program and incentives for eligible members enrolled in the Anthem Blue Cross and Blue Shield (Anthem) and UnitedHealthcare Plan Options.

Kaiser Permanente members who need help managing their emotions during quitting have access to digital mental health and wellness tools, at no charge. Check out this page for the Calm, Headspace Care, or myStrength apps. You also can call a health coach for additional subscriptions to SilverCloud, Thrive, and apps for teens and parents.

Wellness Programs. In 2019, the average annual premiums are $7,188 for single coverage and $20,576 for family coverage. The average premium for single coverage increased by 4% since 2018 and the ...

Detailed Description: This is an open-label (identity of assigned study drug will be known) study designed to collect long-term safety and efficacy data and provide ibrutinib access to participants in completed ibrutinib studies. PCI-32765 (Ibrutinib) is a first-in-class, potent, orally-administered, covalently-binding small molecule inhibitor ...

The Medicare yearly wellness visit is your time to talk and plan with your doctor about your health. It's about preventing health problems and disability. And it's about making sure you get the medical care you need. Together, you and your doctor create a health care strategy... Region Choose your region.

Supplementary Appendix Supplement to: Slamon D, Lipatov O, Nowecki Z, et al. Ribociclib plus endocrine therapy in early breast cancer. N Engl J Med 2024;390:1080-91.

Great Communication with patients, colleagues and specialists. Applying evidence based… · Experience: Kaiser Permanente · Education: MUE University · Location: Orange County · 154 ...