Your Travel Insurance Claim

Please tell us about yourself

Please tell us about you and your policy. If you have a single trip or annual travel insurance policy, please enter the name, date of birth and postcode of someone insured on the policy.

We have detected your browser is out of date. For more information, please see our Supported Browsers page.

How to notify HSBC that you’re traveling

Great news! Due to enhancements in our security measures:

- You no longer need to schedule a notification for your HSBC debit or credit card when traveling

- We may still send you a fraud alert if we see unusual activity on your account

For more information on how we protect your account, see Credit Cards Fraud Alert & Detection

I still need help

Fastest way

- Chat with us for assistance.

Other ways to get help

By telephone

- Contact Customer Service .

- Manage HSBC Credit Card

Connect with us

HSBC VIP Travel and Expense Card

HSBC VIP Travel and Expense Card: Introducing the perfect travel companion – your new HSBC VIP Travel & Expense Mastercard© credit card.

Designed to make your business travel as convenient and seamless as possible, your new card includes exclusive benefits, such as airport lounge access, trip delay and cancellation insurance, complementary Boingo Wi-Fi in all major airports, premier customer service access and more.

Travel boldly with the card that offers benefits beyond the ordinary with the HSBC name that is instantly recognized and respected around the globe.

Introducing the perfect travel companion – your new HSBC VIP Travel & Expense Mastercard© credit card.

Mastercard© Coverage Brochure (PDF, 1.29MB)

Mastercard© Guide to Benefits (PDF, 389KB)

Mastercard© Guide to Benefits – Trip Cancellation & Trip Interruption (PDF, 1.43MB)

To file a claim visit: www.mycardbenefits.com or call 1-800-Mastercard

Mastercard Concierge

Priority Pass Registration

Priority Pass Member Support (FAQs, Priority Pass App, Contact)

Flight Delay Pass Registration

Flight Delay Pass Terms of Use (PDF, 438KB)

Boingo Wi-Fi for Mastercard Cardholders

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

How Do Travel Insurance Claims Work?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

How travel insurance claims work

How to submit your travel insurance claim and get reimbursed, time limits for filing a claim, how long do claim submissions take, how to choose a travel insurance plan, if you need to file a claim from your travel insurer ....

Whether your flight has been canceled, your luggage is lost or you get sick or injured during your trip, travel insurance can protect you. But to get your benefits, you need to submit one or more travelers insurance claims, depending on your situation.

Here's how travel insurance claims work and what to watch out for when submitting your claim.

Travel insurance claims are the system through which a traveler submits documentation to their insurance provider for reimbursement of a covered expense. This reimbursement is not guaranteed; instead, it hinges on the approval of the claim from the insurance underwriter.

In general, the provider will need to verify the situation before remitting any reimbursements to travelers, and the level of coverage varies significantly. Insurance providers typically have very explicit, extensive requirements in order for claims to be confirmed and refunded.

Travel insurance 101 means knowing how travel insurance claims work. Hopefully, you’ll never need to file a claim, but it pays to know the following facts if the worst should happen.

» Learn more: What to know before buying travel insurance

You must qualify for a covered reason

Insurance companies are very explicit about the situations they will cover, and coverage details vary by company and the type of policy that you've purchased.

In general, the more expensive your policy, the more benefits the policy will offer. While some policies cover only medical emergencies, others cover trip cancellation and interruption , lost or stolen bags, and other losses.

Even though policies can be dense or boring to read, be sure you look at the details of yours so you know what types of situations you're covered for .

The details of your claim matter

The details about your reason for canceling are important, and the specifics will determine your eligibility. For example, you may not be feeling well, but are you sick enough that a doctor would suggest that you cancel your trip? There's a big difference between having a small cough and having pneumonia.

You may have to go through extra steps, like seeing a doctor, to prove your eligibility.

» Learn more: The best travel insurance companies

Reservations must be nonrefundable to qualify for cancellation benefits

When you’re traveling on miles and points, you can receive medical, trip delay and lost luggage benefits from a travel insurance policy you purchase. But if you want reimbursement for a canceled flight, travel insurance only covers nonrefundable expenses.

This prevents travelers from trying to "double-dip" and get a refund from both the airline and the travel insurance company.

Keep cancellation policies in mind before purchasing travel insurance. If you’re flying Southwest Airlines, which offers easy changes and refunds, and if your hotel has a 24-hour cancellation policy and you don’t have many activities booked in advance, you may not need travel insurance. The more flexible your plans, the less need you will have for travel insurance.

Claims should be submitted as soon as possible

Being proactive and timely with your claim ensures you won’t miss any deadlines that the travel insurance company may have. You don't want to go through the entire claims process only to find out that you missed the deadline by a few days. Instead, start your claim as soon as you can.

Organization is your friend

The travel insurance company will require documentation to support your claim, so you'll want to be organized as you collect the necessary records.

To stay organized with your documents, set up a folder in your email account for relevant messages, keep all paper receipts in an envelope and write down details of every conversation.

Many travelers digitize everything to make it easier to submit documents via email or an online portal. Your documentation should show that you have a valid claim that meets the insurance company requirements.

Time limits for filing a travelers insurance claim vary from company to company, so it is wise to refer to your specific policy to ensure you have a clear idea of the timeframe. Overall, most companies require claim submissions within 3 months of the incident.

For instance, according to insurance provider Seven Corners , "You must file your claim within 90 days of the incident, also known as the timely filing limit."

After you've submitted your claim — and assuming you have provided all of the required documentation and other elements — it can take up to two weeks for your reimbursement to be remitted.

Generally speaking, you should expect communication regarding your claim within that same timeframe. This could be to alert you of your claim's approval or to ask for additional evidence.

The more complex your travel insurance claim, the longer your approval and reimbursement process may take.

If your claim is approved, expect to receive a check or direct deposit of the amount owed.

Shop around if you’re looking to purchase a travel insurance plan. There are many online providers of travel insurance and the coverage amounts, limits, exclusions and other offerings can vary widely from provider to provider, not to mention policy to policy — even within the same company.

A comparison tool, like SquareMouth , can help you filter results based on what is important to you. You can filter your search to find policies that cover trip cancellation, trip interruption, baggage, medical treatment or other needs. You can then compare the cost of one policy against others based on your preferences and budget.

Travel insurance offers valuable protection in case something goes wrong with your travel plans. Your policy benefits will vary based on the level of coverage purchased and which company is offering the protection. When evaluating travel insurance providers, learn about their claims process should the worst-case scenario come true.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Footer navigation

- What are IBANs and SWIFT codes?

- I know what the debit card payment is, but there’s a problem

- Find the address, opening hours or phone number of a branch

- How do I find my sort code and account number?

- What is the cheque clearing cycle and how long does it take?

- Find Barclays

How do I claim on my travel insurance?

If it’s not an emergency, you can make a claim in your Barclays app 1 . Once you’re logged in:

1. Go to ‘Products’, ‘Insurance’, ‘Travel and Breakdown Insurance’ and view your pack

2. Select ‘Make a claim’.

You can also do this online.

If you need to call, lines are open 24 hours a day, 365 days a year 2 .

Travel Pack

For emergencies, call 0800 158 2684 or (+44) 1603 604 976 from abroad.

For non-urgent travel claims, call 0800 404 6856 or (+44) 1603 604 964 from abroad.

Travel Plus Pack

For emergencies, call 0800 404 6853 or (+44) 1603 604 961 from abroad.

- Where can I find my Travel Pack policy documents online?

- What’s the emergency number for travel insurance?

- How do I change my travel insurance details?

Still have a question? Take a look at your contact options.

Check the directory

View now contact us options

Find more help here

- Text Alerts

- Your details

- Lost or stolen card

- Security and fraud

- Barclays Track It

- Travel abroad

- Your credit rating

- Barclays Cloud It

Bank accounts

- All current accounts help

- Opening an account

- Statements and balances

- All business accounts help

- Starting a business

- Premier accounts

- Students and graduates

- International accounts

- All cards help

- Debit cards

- Personalised debit cards

- Barclaycard

- Contactless (incl TfL)

- All savings and investments help

- Investments

- Interest rates

- All borrowing help

- All mortgages help

- Application

- Repayments and rates

- Mortgage reserve

- Fixed-rate mortgages

- Tracker mortgages

- Offset mortgages

- First-time buyer

- All insurance help

- Travel insurance

- Mobile insurance

- Life insurance

- Business insurance

- PPI complaints

- Smart Investor

Ways to bank

- All Online Banking help

- Using Online Banking

- Registration

- All mobile banking help

- Using mobile banking

- Mobile PINsentry

- Telephone Banking

- All payments help

- Direct Debit

- Standing order

- One-off payments

- International

- Third party access

Important information

You need to be 18 or over to access this product or service in our app. T&Cs apply . Return to reference

Calls may be monitored or recorded. Call charges . Return to reference

New safety measure for Android device

Beware of apps from sources other than your phone’s official app stores which may contain malware. From 26 Feb 2024, new safety measure in the Android version of the HSBC HK App will be launched to protect you from malware. Learn more .

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details please read our Cookie Policy .

- HSBC Online Banking

- Register for Personal Internet Banking

- Stock Trading

- Business Internet Banking

Making a claim and getting assistance

Submit a claim for.

Life insurance

General insurance

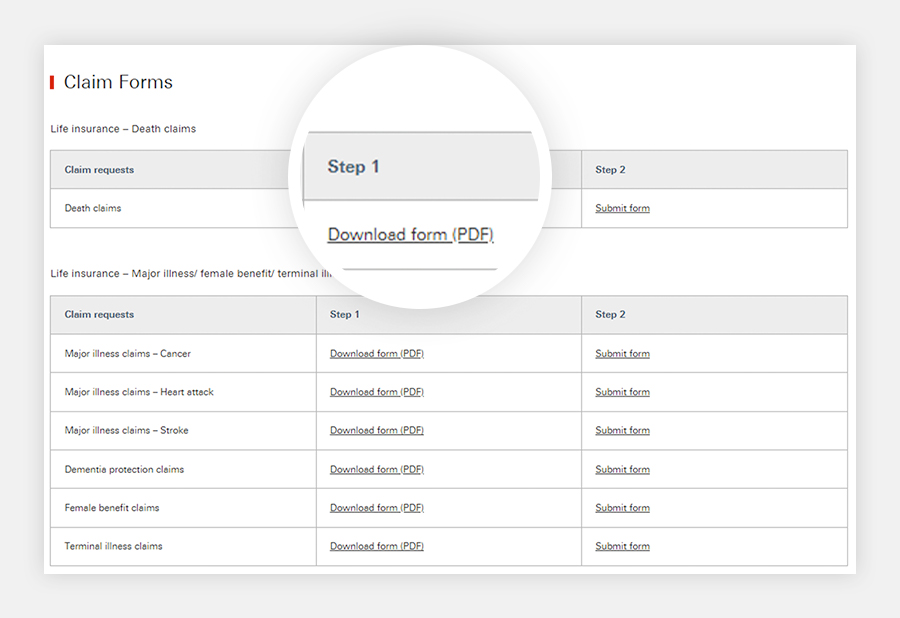

Submit a claim for your life insurance plan in 3 simple steps, step 1: prepare claim materials.

First, download and complete the relevant forms below and prepare supporting documents (if any)

- Death claims

- Major illness / Female benefit / Terminal illness claims

- VHIS Pre-authorisation and claims

- Disability claims

- Hospital cash / Unemployment claims

- HSBC One cancer coverage claims

- HSBC Premier Elite / HSBC Global Private Banking life coverage claims

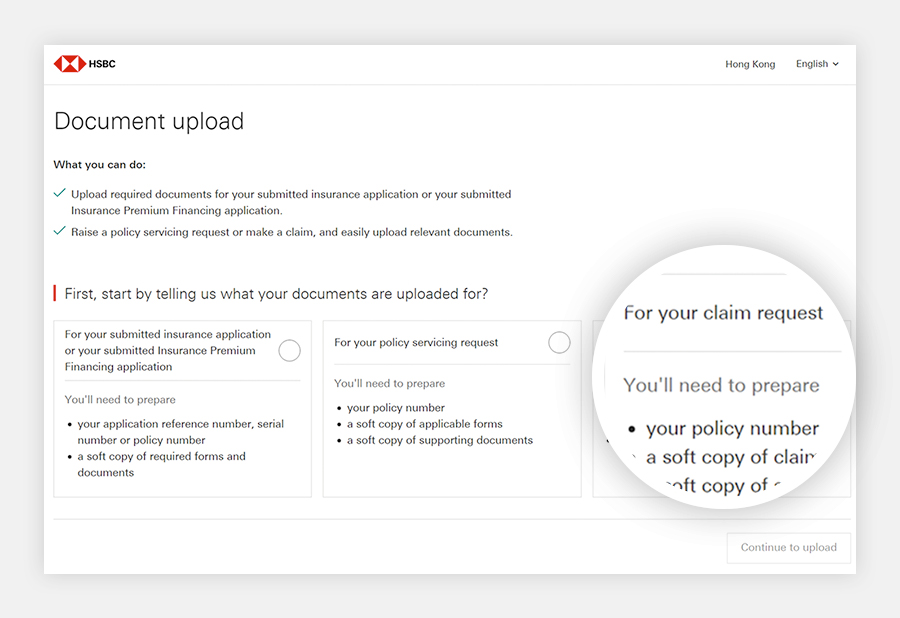

Step 2: Submit claim request

You can submit the completed forms and supporting documents in any of the following ways:

- Submit documents online

- Drop them off at one of our branches

- Send all the forms and documents by mail to: 18/F, Tower 1, HSBC Centre, 1 Sham Mong Road, Kowloon, Hong Kong

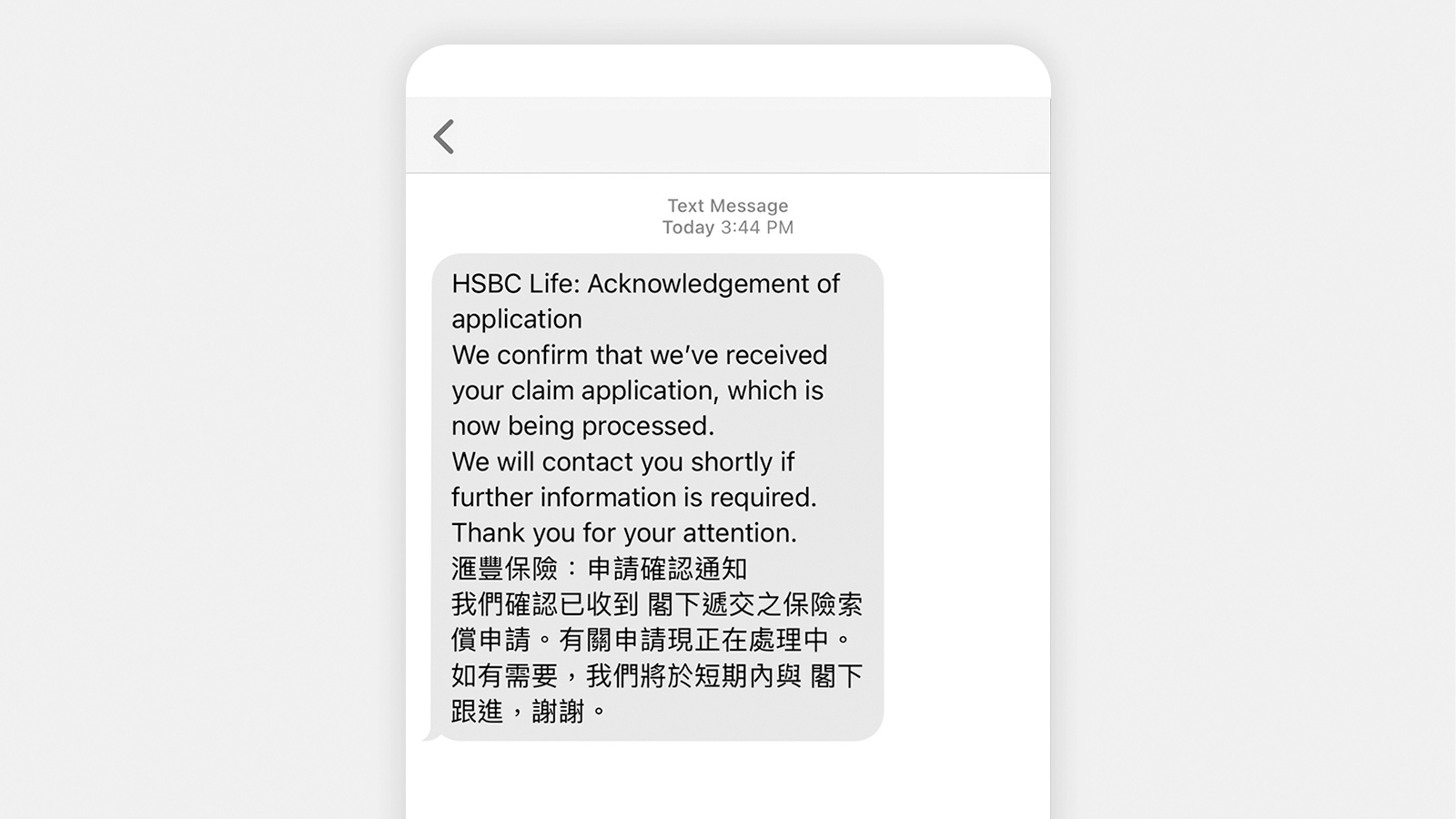

Step 3: Stay updated on claim or payment status

We'll send you an SMS once we've received your claim request. While we assess your claim, our Claims Servicing Specialists will keep you posted on the status.

Once approved, we'll issue the payment via payment method of your choice within an average of 2 business days[@insurance-time-taken-payment].

Need assistance for your life insurance claim?

Call us and get personalised assistance from our Claims Servicing Specialists and VHIS Medical Concierge Consultants for:

- making medical appointments

- help with claim related documentation and progress status update

- following up with doctors on required supporting documents (if applicable)

HSBC Life Claims Hotline:

(852) 3128 0122

Lines are open 9:00am to 6:00pm, Monday to Friday, except Saturday, Sunday and public holidays

Worldwide Emergency Assistance Service for VHIS 24/7 Hotline:

(852) 2193 5863

Find out more

What documents do i need to submit to make a claim , death benefit claims.

- Death Claim Form with Part I fully completed and signed by Beneficiary(ies)/Claimant(s)

- Death Claim Form with Part II fully completed and signed by the Attending Physician with chop, if needed

- Certified True Copy Death Certificate of Insured Person Certified by Bank Staff

- Copy of ID Card/Passport/Birth Certificate of Insured Person

- Copy of ID Card/Passport/Birth Certificate copy of Beneficiary(ies)/Claimant(s)

- Copy of Relationship Proof Between Insured Person and Beneficiary(ies)/Claimant(s)

- Original Policy Document

- Copy of Bank Account Proof of Beneficiary (applicable for sole or joint name bank account)

Major Illness/ Female Benefit/ Terminal Illness Claims

- Major Illness/ Female Benefit/ Terminal Illness Claim Form with Part I fully completed and signed by the Policyholder/Claimant/Insured Person and/or Dementia Protection Benefit Recipient

- Major Illness/ Female Benefit/ Terminal Illness Claim Form with Part II fully completed and signed by the Attending Physician with chop

- Major Illness/ Female Benefit/ Terminal Illness Claim Form with Part III fully completed and signed by the Policyholder/Claimant/Insured Person and/or Dementia Protection Benefit Recipient (if applicable)

- Copy of Histopathology, Laboratory Test Report, Endoscopy, Ultrasonogram, X-Ray, CT Scan, MRI, Diagnostic Written Report(s) and Operating theatre summary (if applicable)

- Copy of Policyholder and Insured Person's Identity Card

- Copy of Bank Account Proof (applicable for Policyholder's sole or joint name bank account other than Policyholder's premium deduction account)

VHIS Medical Claims

- VHIS Medical Claim Form with Part I fully completed and signed by the Policyholder/Insured Person

- VHIS Medical Claim Form with Part II fully completed and signed by the Attending Physician/ Surgeon with chop (to be obtained by Insured Person/ Claimant)

- Original receipt(s) of the medical expenses (including but not limited to deposit receipt)

- Copy of settlement advice from other insurer (if applicable)

- Copy of Bank Account Proof (applicable for Policyholder's sole or joint-name bank account other than Policyholder's premium deduction account)

Disability Claims

- Disability Claim Form with Part I fully completed and signed by the Policyholder/Insured Person

- Disability Claim Form with Part II fully completed and signed by the Attending Physician with chop (this report required to be applied by the claimant at his/her own cost)

- Copy of Sick Leave Certificate with diagnosis and/ or Consultation Proof

- Copy of Physiotherapy/ Occupational Therapy Report(s) (if applicable)

- Copy of Police Report (if applicable)

- Copy of Policyholder & Insured's Identity Card

Hospital Cash Benefit Claims

- Hospital Cash Benefit Claim Form with Part I fully completed and signed by the Policyholder/Insured Person

- Hospital Cash Benefit Claim Form with Part II fully completed and signed by the Attending Physician with chop (this report required to be applied by the claimant at his/her own cost)

- Copy of Discharge Summary/Discharge Slip if admitted into a hospital(s) under the Hospital Authority

- Copy of full set Hospital Receipt

- Copy of Laboratory, Ultrasonogram, X-Ray, CT Scan, MRI and Diagnostic Written Report(s) (if applicable)

- Copy of Policyholder & Insured Person's Identity Card

Unemployment Claims

- Unemployment Claim Form fully completed and signed by the Policyholder

- Copy of the letter of redundancy of employment and last payroll with breakdown on Severance Payment.

HSBC One Cancer Coverage Claims

HSBC One Cancer Claims

- Cancer Claim Form Part 1 completed and signed by Insured Person and Part 2 completed and signed by the Attending Physician with chop

- Copy of Diagnosis Proof (e.g. medical reports)

- Copy of Insured Person's ID

HSBC One Death Claims

- Death Claims Form Part 1 completed and signed by Payee

- Copy of Insured Person's Death Certificate

- Copy of Insured Person's Identity Card

- Copy of Letters of Administration (of Insured Person's Estate)

- Copy of Payee's Identity Card

For easier reference, you can check the "Claims Document Checklist" on the claim form. If you have any questions on claim submission, please call us at (852) 3128 0122 .

How can I follow up on the claim if I am currently unable to collect the above death documents?

Who will receive the payout of a death claim .

- If a designated beneficiary has been appointed, the death benefit will be paid to the beneficiary

- If a designated minor beneficiary has been appointed, the death benefit will be paid to the designated trustee or the legal guardian (if no designated trustee is assigned)

- If a designated beneficiary has been appointed but deceased before the insured person, the death benefit will be paid to the policyowner

- If no beneficiary has been appointed and the policyowner is alive, the death benefit will be paid to the policyowner

- If no beneficiary has been appointed and the policyowner is not alive, the proceeds are payable to the estate of the policyowner

- If the policy has been assigned, the assigned amount of proceeds are first payable to the assignee according to Assignment Deeds and the balance amount of proceeds will be payable according to above rules

How do I check the status of my claims?

Once we've received your claim request, we'll notify you via SMS. While we assess your claim, our professional Claims Servicing Specialist will get in touch with you to update about the status of your claim.

If you want to seek help or an immediate update of your claim, please call us at (852) 3128 0122 .

For VHIS claims, can I request to obtain Certified True Copy(ies) of original invoice(s) and receipt(s) after claim processing?

Yes, you can make your request on the claim form. We'll send you the Certified True Copy(ies) of original invoice(s) and receipt(s) after claim processing.

However, Certified True Copy will not be issued if the claims are fully reimbursed. If you have any special request about the invoice(s) and receipt(s), please call us at (852) 3128 0122 .

General insurance

Submit a claim online.

Use our online claims notification facility[@insurance-axa-online-claim] to notify AXA of your claim immediately, even during busy periods (such as after adverse weather).

You can also download forms and documents and submit to AXA by post.

Need assistance?

Personal General and Medical Insurance (AXA)

(852) 2867 8678

Monday to Friday: 9am to 6pm

Saturday: 9am to 1pm

The hotline is operated by AXA or its authorised representatives.

24/7 General Insurance hotlines

Disclaimer .

Life insurance policies are underwritten by HSBC Life (International) Limited ("HSBC Life") which is authorised and regulated by the Insurance Authority ("IA") to carry on long-term insurance business in the Hong Kong SAR. HSBC Life is incorporated in Bermuda with limited liability, and is one of the HSBC Group's insurance underwriting subsidiaries. Policyholders are subject to the credit risk of HSBC Life and early surrender loss.

General insurance products are underwritten by AXA General Insurance Hong Kong Limited ("AXA"), which is authorised and regulated by the Insurance Authority of the Hong Kong SAR.

The Hongkong and Shanghai Banking Corporation Limited ('HSBC') is registered in accordance with the Insurance Ordinance (Cap. 41 of the Laws of Hong Kong) as an agency of HSBC Life for the distribution of life insurance products and AXA for distribution of general insurance products in the Hong Kong Special Administrative Region. These products are products of HSBC Life and AXA but not HSBC and they are intended only for sale in the Hong Kong SAR.

In respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between HSBC and you out of the selling process or processing of the related transaction, HSBC is required to enter into a Financial Dispute Resolution Scheme process with you; however, any dispute over the contractual terms of the above insurance product should be resolved between HSBC Life or AXA and you directly.

COMMENTS

Your Travel Insurance Claim. Please tell us about yourself. Please tell us about you and your policy. If you have a single trip or annual travel insurance policy, please enter the name, date of birth and postcode of someone insured on the policy. First Name *.

Learn how to make a travel insurance claim online or by phone with Aviva, the provider of HSBC Travel Insurance. Find out what you need to provide, how long it will take and what's covered under your policy.

Learn how to make a claim for your HSBC insurance policy, whether it's for travel, home, car or other types of cover. Find out what to do in an emergency, what documents you need and how to contact your insurer.

Due to enhancements in our security measures: You no longer need to schedule a notification for your HSBC debit or credit card when traveling. We may still send you a fraud alert if we see unusual activity on your account. For more information on how we protect your account, see Credit Cards Fraud Alert & Detection.

Discover HSBC Travel, Powered by Priceline. Plan an adventure Plan an adventure Explore Pay with Rewards® Your Points can pay for purchases made with your HSBC card. ...

Mobile phone insurance claims. You can register your mobile phones and make a mobile phone insurance claim online or by calling Likewize on: 0800 001 4278. +44 1603 606 372 (if calling from outside the UK) Lines are open Monday to Friday: 08:00 to 20:00. Saturday, Sunday and public holidays: 08:00 to 18:00.

Cancelling your Select and Cover policy. You can cancel your policy at any time with no exit fee. Log on to online banking to cancel or call us on 0345 051 1351. Opening hours are 8:00 to 18:00, Monday to Friday, excluding public holidays. We may monitor or record calls.

Make a claim and manage your policy. Select the type of insurance cover you have with us to find out how to manage your policy and make a claim. If the worst happens, we'll do everything we can to help and to make the claims process easy for you. Make a claim or manage your policy here.

HSBC - Channel Islands & Isle of Man. Contact and support. Coronavirus guidance. Travel Insurance FAQs. Learn more about your rights if your travel plans have been disrupted by the coronavirus (COVID-19) outbreak. As new guidance is announced, the information on this page may change. Please check back regularly for the most up-to-date ...

Travel Claim Documentation The following is a guide on what documentation is required in the event of a claim. The relevant documentation to the type of claim that you have must be presented along with: • confirmation (payment documentation or statement) of HSBC Premier card payments related to the Trip;

formats please contact HSBC. Phone 03457 404 404 Textphone 03457 125 563 All lines open: 24 hours, 365 days a year Travel Claims Use this number to report any travel claims, which are not as a result of a medical emergency. Within the UK 08000 517 452 Outside the UK +44 1603 604 960 Lines open: 24 hours, 365 days a year. Legal Expenses Claims ...

HSBC VIP Travel and Expense Card: Introducing the perfect travel companion - your new HSBC VIP Travel & Expense Mastercard© credit card. Designed to make your business travel as convenient and seamless as possible, your new card includes exclusive benefits, such as airport lounge access, trip delay and cancellation insurance, complementary Boingo Wi-Fi in all major airports, premier ...

HSBC. 03457 70 70 70 Textphone 03457 125 563 Lines open: 24 hours, 365 days a year. Travel Claims Use this number to report any travel claims, which are not as a result of a medical emergency. Within the UK 0800 051 7459 Outside the UK +44 1603 604 910 Lines open: 24 hours, 365 days a year. Legal Expenses Claims and Advice

Make a claim online. If it's not an emergency, the easiest way to start your claim is online. Make sure you have these ready before you start: Policy number - you can find this in MyAviva. Your personal details, plus details of anyone else claiming on this policy. Details about your trip, for example, date of travel, airline (if it's relevant)

How to cancel. You have a statutory right to cancel your policy within 14 days of becoming an HSBC Credit Card account holder. This policy has been provided with your HSBC Platinum Credit Card and can only be cancelled when the card is cancelled. To cancel, please contact HSBC Card Services on 03457 404 404.

HSBC Insurance Aspects: Travel Insurance Policy Wording. Policy Number: 060605/011012 Effective from 20 April 2019 Please take time to read this policy booklet as it contains important information about your Worldwide Travel Insurance. To be covered you and any insured persons need to be:

Travel insurance 101 means knowing how travel insurance claims work. Hopefully, you'll never need to file a claim, but it pays to know the following facts if the worst should happen.

been purchased using the policy holder Premier Cards, HSBC & AIG Travel Guard wish you a very safe trip! We invite your attention to the following table, which will help you in the event of any loss, accident or sickness.. Zone Assistance Co. Claims Administrator USA & Canada Travel Guard Travel Guard Claims Services +1-877-897-1934

If it's not an emergency, you can make a claim in your Barclays app 1. Once you're logged in: 1. Go to 'Products', 'Insurance', 'Travel and Breakdown Insurance' and view your pack. 2. Select 'Make a claim'. You can also do this online. Make a claim. If you need to call, lines are open 24 hours a day, 365 days a year 2.

Limited time offer. Apply for TravelSurance between 18 Mar 2024 and 17 May 2024 (both days inclusive) to get: 30% off your first year's premium and HKD100 Wellcome supermarket cash vouchers for annual MultiTrip TravelSurance. 15% off for Single Trip TravelSurance. T&Cs apply.

Report your claim to us online through our travel claims hub. You can do this 24/7 and from anywhere in the world. Or call us ( 0330 6786 225) to report your claim to one of our dedicated claims team members. We'll give you a claim reference number, which you'll need to quote each time you call us. We'll check that you're covered by your ...

Step 1: Prepare claim materials. First, download and complete the relevant forms below and prepare supporting documents (if any) Death claims. Major illness / Female benefit / Terminal illness claims. VHIS Pre-authorisation and claims. Disability claims. Hospital cash / Unemployment claims. HSBC One cancer coverage claims.

For our joint protection, telephone calls may be recorded and/or monitored and will be saved for a minimum of 5 years. Calls to 0800 numbers from UK landlines and mobiles are free.