What are your financial priorities?

Answer a few simple questions, and we’ll direct you to the right resources for every stage of life.

Welcome back. Your personalized solutions are waiting.

Welcome back. Here's where you left off.

You might also be interested in:

- Introduction

Make sure you have the right credit card

Have your digital wallet ready, carry some foreign cash, related content.

View infographic , 2 minutes

Read more , 4 minutes

Read more , 3 minutes

Traveling abroad? Understanding payment methods and how to avoid transaction fees

Understanding the different ways of paying can save you money and help your trip run more smoothly

Read, 4 minutes

Hidden costs and fees on your various cards can add up quickly in a foreign country, whether you’re withdrawing money from an ATM, buying souvenirs or settling your hotel bill. Many credit cards charge a foreign transaction fee—typically 2% to 3%—on every international purchase. And every trip to the ATM may also incur a fee. You can minimize or avoid fees by following these tips and resources—before you depart and while you’re traveling.

Article continues below

Credit cards are a widely accepted form of payment. They are easy to use, provide purchase-protection benefits and have favorable exchange rates. But some cards are better than others for international travel.

Find out if your card charges for foreign transactions either by calling the number on the card or checking your agreement. If it does, you may want to investigate applying for a new card that doesn’t. Also consider a credit card that will earn you rewards for travel, dining or other purchases. Don’t wait to do this—the process of getting a new card can take six to eight weeks. And before applying, review any potential impact on your credit score .

You should also make sure your card has an EMV (Europay, MasterCard, and Visa) chip. These cards, standard in more than 130 countries, are considered more secure than credit cards with magnetic stripes. If your card only has a magnetic stripe or signature, it may not work in the country you’re visiting.

While you’re there

It’s a good idea to have a cash-vs.-card strategy. One solid rule of thumb is to pay for frequent small purchases, such as coffee and snacks, with cash. Save your credit card for more expensive purchases, such as pricey gifts, restaurant tabs and hotel bills.

Many establishments frequented by tourists will give you a choice of paying in local currency or U.S. dollars. You’re almost always better off going with the local currency. And remember that your credit card usually has a more favorable exchange rate and lower fees than local merchants can offer.

Searching for the right card? Research Bank of America credit card options.

Before you travel, set up alerts for unusual activity on your credit card. That way, you will be notified immediately by email, text message or through your mobile app if your bank sees anything questionable. For more travel tips, see our checklist .

In many countries, merchants are moving to contactless payment. In fact, you may find that some stores and restaurants not only won’t take cash but may not even have a credit card reader.

Contactless payments are done through near-field communication (NFC) technology or quick response (QR) codes. NFC terminals at checkout counters use radio waves to read a physical credit card or one stored on a smartphone or smartwatch. QR codes can originate with the merchant or be stored on your phone. You might scan a merchant’s QR code with your phone’s camera and then tap on a link to complete the payment process. Or you might use an app to generate a QR code with your credit card information, and then the merchant scans it for payment.

A Digital Wallet can help you navigate contactless payments. You will be able to pay in-store, online and in-app, receive payments and get cash from ATMs using only your smartphone.

Set up a Digital Wallet by adding credit or debit card information to your smartphone. You can do this through your mobile banking app or another pay app on your phone. If you are traveling to a country such as China, where QR code payments are common, make sure your app can generate QR codes.

See how to add your Bank of America credit or debit card to a Digital Wallet.

The benefits of using a Digital Wallet go beyond the convenience of contactless payments and include:

Most experienced travelers will recommend arriving at your destination with enough local currency to last at least the first 24 hours of your trip. This will make it easier to pay for services such as luggage carts, taxis and tips.

To get an advantageous currency exchange rate, purchase currency through your bank before you leave. Generally, larger banks offer more favorable rates and lower fees than other conversion services, such as airport exchange desks or kiosks at the destination. Some banks let you order currency online or through their mobile app. Allow three to five days before you travel to receive the currency.

Learn how to order foreign currency from Bank of America before you travel.

Did you know?

Currency exchange rates constantly change depending on markets as well as economic and geopolitical factors. Individual rates among banks, hotels, kiosks and other currency exchange businesses also vary due to profit, fees and other markups.

Even though it’s good to have cash on hand, try to limit ATM withdrawals. Using an international ATM can trigger unexpected fees, and some banks cap how much you can withdraw each day. You can minimize fees by using the ATMs in your home bank’s network or at a bank that partners with it. And remember that if you use your credit card to withdraw cash from ATMs, you may be charged cash advance fees and interest.

Find Bank of America’s international ATM partners.

Some international ATMs support only four-digit PINs and do not have letters on their keypads. Be sure your PIN doesn’t start with a zero and know it by its numbers.

If you have excess foreign cash at the end of your trip, you may be able to apply it toward your hotel bill or final meal. If you’d rather give the money to charity, look for donation bins at the airport. Or think about giving it to friends who plan to travel. You can also exchange foreign cash back into U.S. dollars, though the exchange rate will be different, you may pay a fee and banks typically won’t buy back coins.

The material provided on this website is for informational use only and is not intended for financial or investment advice. Bank of America Corporation and/or its affiliates assume no liability for any loss or damage resulting from one’s reliance on the material provided. Please also note that such material is not updated regularly and that some of the information may not therefore be current. Consult with your own financial professional when making decisions regarding your financial or investment management. ©2024 Bank of America Corporation.

What to read next

More from bank of america, foreign currency exchange, compare our credit cards.

We're here to help. Reach out by visiting our Contact page or schedule an appointment today.

You're continuing to another website

You're continuing to another website that Bank of America doesn't own or operate. Its owner is solely responsible for the website's content, offerings and level of security, so please refer to the website's posted privacy policy and terms of use. It's possible that the information provided in the website is available only in English.

Va a ir a una página que podría estar en inglés

Es posible que el contenido, las solicitudes y los documentos asociados con los productos y servicios específicos en esa página estén disponibles solo en inglés. Antes de escoger un producto o servicio, asegúrese de haber leído y entendido todos los términos y condiciones provistos.

Advertising Practices

We strive to provide you with information about products and services you might find interesting and useful. Relationship-based ads and online behavioral advertising help us do that.

Bank of America participates in the Digital Advertising Alliance ("DAA") self-regulatory Principles for Online Behavioral Advertising and uses the Advertising Options Icon on our behavioral ads on non-affiliated third-party sites (excluding ads appearing on platforms that do not accept the icon). Ads served on our behalf by these companies do not contain unencrypted personal information and we limit the use of personal information by companies that serve our ads. To learn more about ad choices, or to opt out of interest-based advertising with non-affiliated third-party sites, visit YourAdChoices powered by the DAA or through the Network Advertising Initiative's Opt-Out Tool . You may also visit the individual sites for additional information on their data and privacy practices and opt-out options.

To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review the Bank of America Online Privacy Notice and our Online Privacy FAQs .

Connect with us

Your Privacy Choices

Some materials and online content may be available in English only.

Bank of America, N.A. Member FDIC. Equal Housing Lender

© 2024 Bank of America Corporation. All rights reserved.

Investment products:

Bank of America and its affiliates do not provide legal, tax or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Avoid International ATM Fees: 7 Easy Ways

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Table of Contents

Types of foreign ATM fees

1. use a travel credit card instead, 2. choose a bank that doesn’t charge foreign atm fees, 3. use a bank that reimburses atm fees, 4. use your bank network's atms or partner atms, 5. pay in local currency, 6. reduce atm usage, 7. use your debit card to get cash back at a store, final thoughts on avoiding international atm fees.

When you’re traveling out of the country and go to withdraw cash in the local currency, fees can hit you from every direction: from your bank, the ATM, even currency commissions.

With a bit of planning and understanding, though, you can save some cash on pesky hidden charges. Here are all the types of foreign ATM fees you could encounter along with six way to these fees when you travel.

Here are the types of fees you should be aware of when using a debit card and ATM abroad.

Foreign transaction fees

Foreign transaction fees are charged by your bank for currency conversion.

If your bank charges foreign transaction fees — and many do — you’ll pay a percentage of the total withdrawal amount, usually 1% to 3%, for using your card at a foreign ATM (or anywhere else abroad).

Out-of-network ATM fees

This is the fee your bank charges for using a non-network ATM outside your home country. Often, it’s a flat fee that you’ll pay per withdrawal and is likely $2 to $5.

ATM surcharge

The ATM or its affiliated bank also charges a fee, which is likely several dollars, in exchange for its use.

Currency conversion fees

When you withdraw money from a foreign ATM, the machine will sometimes offer the choice to convert transactions into your home currency, but this can involve hidden currency conversion fees, sometimes as high as 7%.

» Learn more: What banks charge for debit foreign transaction fees

Instead of looking for ATM machines and withdrawing cash to pay for your purchases, consider using a travel credit card that waives foreign transaction fees.

That way, you can skip ATM fees and not need to worry about carrying a lot of cash around with you.

Here's a selection of popular travel cards that also waive foreign transaction fees.

on American Express' website

on Chase's website

on Citibank's application

Earn 80,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Terms Apply.

Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

Get up to $1,050 in Chase Travel℠ value. Earn 60,000 bonus points after $4,000 in purchases in your first 3 months from account opening. That’s worth $750 when redeemed through Chase Travel. Plus, get up to $300 in statement credits on Chase Travel purchases within your first year.

Earn 70,000 bonus ThankYou® Points after spending $4,000 in the first 3 months of account opening, redeemable for $700 in gift cards or travel rewards at thankyou.com

If you're not necessarily looking for a travel card and just need a card that waives foreign transaction fees and also has no annual fee , those are available as well.

» Learn more: The best travel credit cards right now

If you have accounts with more than one bank or are considering setting up an account at a new bank and you travel often, consider banks that don’t charge foreign transaction fees or foreign ATM fees.

For example:

A Capital One 360 checking account won’t charge you fees for using an out-of-network ATM.

HSBC doesn’t charge foreign transaction fees or foreign ATM fees, plus it has international ATMs.

USAA international ATM fees don’t exist, either (though a 1% foreign transaction fee still applies).

Chase international ATM fees vary depending on what type of checking account you have. The Chase Sapphire Checking account charges no fees for foreign ATM use.

Bank of America international ATM fees cost a flat $5.

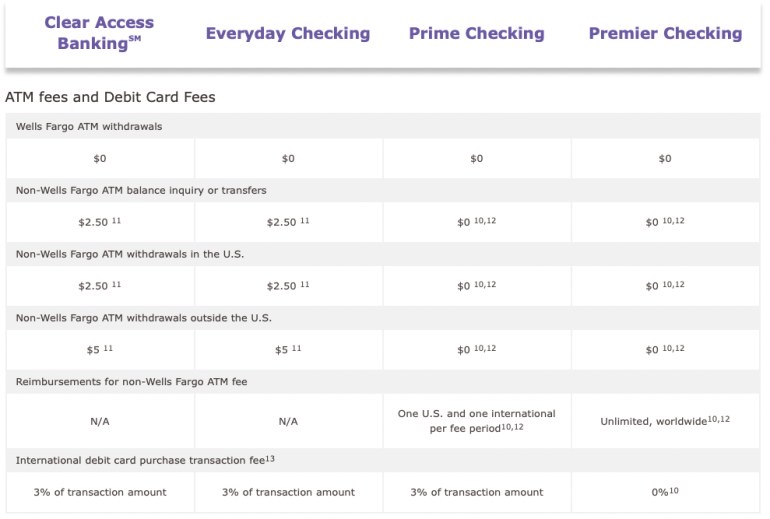

Wells Fargo international ATM fees cost $5 for two of their checking accounts — Clear Access and Everyday checking — while Wells Fargo Prime and Premier account holders pay $0.

Alternatively, check whether your bank refunds out-of-network ATM fees. USAA will reimburse up to $10 in ATM surcharges, while Wells Fargo will reimburse one foreign ATM fee per month if you have a Prime account, and for its Premier checking accounts, reimbursement is unlimited.

A Chase Sapphire Checking account offers a fee refund if you are charged by non-Chase ATMs.

Check your account details or contact your bank to see whether your account features that benefit.

If your bank operates ATMs around the world, like HSBC , find out where those ATMs are and whether there are any where you’re headed; if so, use those if at all possible.

If your bank doesn’t operate outside the U.S., check whether it’s part of any fee-free ATM networks that do.

If a foreign ATM offers the option to pay or withdraw in your home currency or the local currency, always choose to pay in the local currency because your bank may offer a better conversion rate.

» Learn more: How to order foreign currency before you travel

While it’s not always ideal to waltz around a foreign city with loads of cash in your wallet, reducing the frequency that you withdraw money from a foreign ATM can save you more than a few dollars.

Withdraw as much cash at one time as you feel comfortable with and keep it in a safe place. This will reduce how often you have to make another withdrawal and pay another fee.

Additionally, any time you can pay with a credit card, do so. You’ll avoid additional fees as long as you use a card with no foreign transaction fees.

» Learn more: Excellent no foreign transaction fee credit cards

Not every establishment allows you to request cash back when you make a purchase, but it’s worth asking about during checkout.

If a business permits it, requesting cash back when you swipe your card may help you avoid an ATM foreign transaction fee. Just make sure you use a debit card with no foreign transaction fee to avoid an additional charge.

» Learn more: How to avoid foreign transaction fees

It’s possible to avoid international ATM fees when you travel. You just need to understand how foreign fees work, look into your bank’s fee structure and plan withdrawals wisely.

An easier way to do so is to get a travel credit card that waives foreign transaction fees so that you don't need to goto the ATM often or carry large amounts of cash with you.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

[Limited Time] New Cardholders Can Get up to $1,050 in Chase Travel℠ Value

Chase Sapphire Preferred® Card

✈️ Our Nerds say it's "nearly a must-have for travelers " because of its big sign-up bonus, high-value points and money-saving perks like hotel credit and rental car insurance.

🤑 Better yet, it's offering one of the best bonuses ever right now, only for a limited time...

- Sign in

Debit Card FAQs

Select your state.

Please tell us where you bank so we can give you accurate rate and fee information for your location.

Bank of America offers several convenient ways to order a debit card:

On our website

Log in to Online Banking to order a new or replacement card

Not an Online Banking customer? Enroll in Online Banking today

On your mobile device

If you're on a mobile device, Log in to the mobile app to order a new or replacement card.

Get the app

Schedule an appointment at a financial center or call 800.432.1000 (Mon-Fri 8 a.m.-11 p.m. or Sat-Sun 8 a.m.-8 p.m., all times ET). Outside the U.S. call 1.315.724.4022 (international collect; cell phone roaming charges may apply). You will receive your debit card in 4-6 business days.

Bank of America offers several convenient ways to replace your debit card:

Log in to Online Banking to replace your debit card

If you're on a mobile device, Log in to the mobile app to replace your debit card

Show me how to replace my debit card on the mobile app

Schedule an appointment at a financial center or call 800.432.1000 (Mon-Fri 8 a.m.-11 p.m. or Sat-Sun 8 a.m.-8 p.m., all times ET). Outside the U.S. call 1.315.724.4022 (international collect; cell phone roaming charges may apply).

Bank of America offers several convenient ways to activate a debit card:

Log in to Online Banking to activate your card

If you're on a mobile device, Log in to the mobile app to activate your card

Use your card

Using your new debit card with your current PIN to make a purchase or at any Bank of America ATM will automatically activate your card.

Misplaced your ATM/debit card? It's quick and easy to lock or unlock it using Online Banking or the mobile app. Log in to do it now. You can type your question in the search bar or follow a few simple steps.

Want us to walk you through it? Show me how to lock a card in Online Banking Show me how to lock a card on the mobile app

Not enrolled in Online Banking? Enroll in Online Banking Get the app

New or replacement debit cards can take 4-6 business days to arrive by mail. If you need yours sooner, download our mobile app to request a digital version of the card to use while you're waiting. You can add the temporary version of your card to a digital wallet and use it at Bank of America cardless ATMs, stores and more. Not all customers or accounts are eligible for a digital version.

From the mobile app, simply go to Manage Debit Card and follow the menu instructions to replace your card and/or request a digital equivalent.

Bank of America offers you a wide variety of alert options that deliver important information such as your available balance, when a direct deposit is posted, when a debit card payment over a certain dollar amount occurs and much more. There are 2 easy ways you can set up alerts:

Log in to Online Banking to manage alerts

- Log in to the Mobile Banking app

- Tap Alerts then Settings

- Select your account and choose your alerts

Show me how to set up alerts on the mobile app

Simply log in to Online Banking to set ATM limits for your debit card

There is no fee to replace a debit card. However, fee's may apply when you request a Rush delivery of Debit or ATM Card. Please refer to the Personal Schedule of Fees for complete details.

There are no fees for Bank of America customers using one of thousands of Bank of America ATMs in the United States to transfer funds, make deposits, inquire about a balance and withdraw cash. Find a Bank of America ATM

Fees may be assessed when Bank of America customers make withdrawals and transfers from non-Bank of America ATMs. A fee may also be charged by the ATM operator, or any network used for the transactions.

Other account fees may apply to the transaction. Please refer to the Personal Schedule of Fees and the disclosure information that accompanied your card for complete details.

Bank of America doesn't charge transaction fees when you use your debit card to make purchases, but some merchants may impose a transaction fee or surcharge.

An international transaction fee may be charged for debit card purchases and ATM cash withdrawals. Please refer to the Personal Schedule of Fees and the disclosure information that accompanied your card for complete details.

There is no additional cost to have or to use your new card with smart chip technology.

Yes, there may be a fee associated with the transaction. Please refer to the Personal Schedule of Fees for complete details.

Although not required, a quick call to the merchant can often answer your questions and easily resolve your dispute. The merchant's phone number may be located with an internet search, on your receipt or monthly statement, or within the transaction description in your Online Banking account. To dispute a transaction:

Log in to Online Banking to dispute an ATM or debit transaction

You may also dispute a transaction by calling us at 877.366.1121.

If your card is lost or stolen, contact us immediately by calling 800.432.1000 (Mon-Fri 8 a.m.-11 p.m. or Sat-Sun 8 a.m.-8 p.m., all times ET). Outside the U.S. call 1.315.724.4022 (international collect; cell phone roaming charges may apply).

You can also report a lost or stolen card on our website or from your mobile device.

Log in to Online Banking to notify us that your card has been lost or stolen

Log in to the mobile app to notify us that your card has been lost or stolen

Misplaced your ATM/debit card? It's quick and easy to lock or unlock it using Online Banking or the mobile app. Log in to do it now. You can type your question in the search bar, or follow a few simple steps.

To change your PIN: Visit a Bank of America ATM and select More Options then Change PIN . You can also change your PIN by scheduling an appointment or visiting a financial center.

If you don't know your PIN: You will need to request a new PIN by scheduling an appointment or calling 800.432.1000 (Mon-Fri 8 a.m.-11 p.m. or Sat-Sun 8 a.m.-8 p.m., excluding holidays; all times ET) and we will mail you a reminder.

Find an ATM or financial center

If your PIN isn't working and you're certain you're using the correct PIN and entering it properly, contact us immediately by calling 800.432.1000 (Mon-Fri 8 a.m. -11 p.m. or Sat-Sun 8 a.m.-8 p.m., excluding holidays; all times ET). Outside the U.S. call 1.315.724.4022 (international collect; cell phone roaming charges may apply).

No. Whether you sign or use your PIN, there is no difference in how much you are charged.

If you select debit, you will use your PIN and enter it in on the merchant keypad. If you select credit, you may be required to sign a receipt to authorize your purchase. A signature may not be required for certain transactions such as internet, mail order and pay-at-the-pump gas purchases. Your options may differ depending on the merchant.

A digital card for debit (aka Virtual card) is a digital version of your physical debit/credit card you can use right away. It provides greater flexibility to manage your plastic and digital card together or independently. It also provides industry leading fraud protection with dynamic security code that changes every time it's viewed (except reoccurring transactions). Digital cards can be found in our Mobile banking application.

You can request/Opt into receive a Digital Card for Debit in our Mobile Banking app, under Manage Card settings. Note: You must already have a physical debit card to get a digital card.

No, the PIN for your physical Card is also the same PIN for your Virtual Cards, including the Digital Card for Debit.

Yes. The expiration date for your digital card will be displayed when you view you it and may be a different date than your physical card expiration date. However, since it’s digital it automatically renews when it expires, there’s nothing you need to do.

Yes, you can add either your physical debit card or your digital card to your digital wallet. Once a card is added to your wallet, you’re able to start shopping immediately.

You may lock, unlock, or delete your Digital card independently from your physical card at any time in the mobile app, under “Digital Wallets and Virtual Cards” page by selecting your Digital card.

To help protect your account against Fraud, each time you view your digital card, you will see a different, dynamically generated security code. The digital card security code will change each time it’s viewed and only is valid for a single purchase. It will also expire if not used in a timely manner (24 to 72 hours). Don’t share it with anyone other than merchant with whom you are transacting.

Yes, but it must be loaded to your digital wallet first, then you can use it at the ATM.

A digital wallet allows you to store debit/credit card information on your smartphone or smartwatch in order to complete transactions online, contactless (tap-to-pay) or for in person transactions (e.g., Apple Pay, Google Pay, Samsung Pay). The card(s) stored in the Digital wallet are called virtual/digital cards that are unique and different from the physical card. " aria-label="Footnote 1"> Footnote [1]

Show me how to add my card to a digital wallet

Learn more about Apple Pay ® »

Learn more about Google Pay ™ »

Learn more about Samsung Pay »

Virtual Card means a digital substitution for your Card that includes a unique virtual card number.

A digital card for debit is a virtual card accessible on your mobile device in mobile banking that includes a unique virtual card number, expiration and dynamic cvv. It’s separate from your physical debit card and can be managed independently.

When you use your debit card to make a purchase, the merchant will request an authorization (or approval) for the transaction. An authorization confirms that your account is open and active and that there are enough funds available to cover the purchase amount at the time of the request.

The purchase amount sent by the merchant for authorization varies by merchant type. Many merchants request an authorization for the exact purchase amount, but some merchants may send an authorization request for a nominal amount such as $1 or an estimate that is more or less than the actual purchase amount. The authorization hold amount reduces your available balance and will remain on the account up to 3 business days when your debit card is swiped or inserted in person, or up to 5 business days when used for an internet, phone or mail order transaction.

When the transaction is presented to the bank, the actual purchase amount is deducted from your account. Some internet, phone and mail order merchants send items in multiple shipments. When this happens, a single authorization is placed on the account and the authorization hold amount is reduced as each item ships. The hold will remain on the account up to 5 business days or until the authorization amount is reduced to $0, whichever occurs first.

When you do not have enough available funds in your account to cover everyday non-recurring debit card purchases or ATM withdrawals, we will decline the transaction and you will not be subject to overdraft fees for those declined transactions. If you have enough available funds in your account to cover part of an everyday non-recurring debit card purchase, but not the full amount, some merchants will accept those available funds as partial payment and then allow you to pay the balance of your purchase from another source, or will allow you to reduce your purchase to fall within your available balance, such as by reducing the number of items in your cart.

A pending transaction or an authorization amount may vary from the final or actual purchase amount in situations where there is an estimated authorization amount or a tip is involved. Here are 2 examples that show how a pending transaction or authorization amount might be different from the final amount:

- At a restaurant, an authorization is requested prior to a tip being added. The final purchase amount will include a tip you add. Some restaurants may add an estimated tip to the transaction total when requesting an authorization. Because of this practice, your final purchase amount may vary from the authorized amount.

- A hotel is allowed to request an authorization for an amount based on the length of your stay and applicable taxes. An estimated amount for incidentals may also be made. Cruise lines and car rental companies may also follow this practice.

It may take several business days for the final purchase amount to replace the pending transaction amount on your account. The pending transaction reduces your available balance. When the transaction is presented to the bank, the final or actual purchase amount is deducted from your account, usually within 3 to 5 business days (3 business days when a card is swiped or inserted in person or 5 business days when used via the internet, phone or mail order transaction).

Schedule an appointment at a financial center to review and discuss the error, or call us at 800.432.1000 (Mon-Fri 8 a.m. –11 p.m. or Sat-Sun 8 a.m. –8 p.m., all times ET). Outside the U.S. call 1.315.724.4022 (international collect; cell phone roaming charges may apply).

You can get these services at any Bank of America ATM across the country and at many ATM networks worldwide. Some services may not be available at non-Bank of America ATMs. Fees may apply for the available services at non-Bank of America ATMs. Please refer to the Personal Schedule of Fees and the disclosure information that accompanied your card for other fees that may apply.

Find a Bank of America ATM

You can use a debit card just like a credit card wherever Visa or MasterCard cards are accepted. However, when you use a debit card, the purchase amount is deducted from your Bank of America checking account.

You may link up to 15 eligible accounts to your debit card by scheduling an appointment in a financial center or calling us at 800.432.1000 (Mon-Fri 8 a.m.–11 p.m. or Sat-Sun 8 a.m. –8 p.m., all times ET). Outside the U.S. call 1.315.724.4022 (international collect; cell phone roaming charges may apply). Find a financial center near you

Affinity debit cards have all the same benefits as a standard Bank of America debit card while highlighting on the card one of many charitable causes, special interests, organizations, sports, colleges or universities. Affinity debit cards are available with eligible checking accounts.

To request an affinity debit card, simply schedule an appointment at a financial center or call 800.432.1000 (Mon-Fri 8 a.m.–11 p.m. or Sat-Sun 8 a.m.–8 p.m., all times ET). Outside the U.S. call 1.315.724.4022 (international collect; cell phone roaming charges may apply).

A chip card is a standard-size plastic debit card that contains an embedded microchip as well as the traditional magnetic stripe.

Want to simplify your life with a Bank of America debit card?

All you need is a Bank of America checking account to get started.

Please select your county

- Schedule an appointment

- Phone number: 844.375.7028

Enter your zip code

Please enter the zip code for your home address so we can give you accurate rate and fee information for your location.

IMAGES

VIDEO

COMMENTS

Set up a Digital Wallet by adding credit or debit card information to your smartphone. You can do this through your mobile banking app or another pay app on your phone. If you are traveling to a country such as China, where QR code payments are common, make sure your app can generate QR codes.

Be ready to use your debit or credit card for purchases. The chip in your debit or credit card provides additional security only when used at chip-enabled terminals, which are common in over 130 countries. Plus, you’ll be covered by our $0 Liability Guarantee, so you won’t be responsible for any unauthorized charges. 7 Before you go, be sure to:

For debit card issues: 1.315.724.4022. Mon–Fri 7 a.m.-10 p.m. or Sat–Sun 8 a.m.-5 p.m. All times ET. Tips for worry-free travel outside the U.S. A travel checklist can help you plan ahead, avoid problems and reduce stress. Here are a few travel tips to get you started on creating your own checklist:

Where can I find information about travel warnings and restrictions for foreign countries? Travel warnings, restrictions and public announcements issued by the United States government to its citizens can be found on the U.S. State Department website: Foreign Travel Information from Bank of America.

1. Use a travel credit card instead. 2. Choose a bank that doesn’t charge foreign ATM fees. 3. Use a bank that reimburses ATM fees. 4. Use your bank network's ATMs or partner ATMs. 5. Pay in local...

Explore the best debit cards for international travel. Our guide presents cards with low fees, wide acceptance, and security features. Start your journey now!

Contact us. Find answers to frequently asked questions about Bank of America debit cards, including how to order, activate, or temporarily lock your misplaced debit card.

Bank of America’s foreign transaction fee is usually 3% for international transactions¹. But this can also depend on the card product itself, as there are a few exceptions to this: we found 8 credit cards on their website with no foreign transaction fees.

These are the best fee-free debit cards for international travel. While most debit cards will work for withdrawing cash abroad, only a select few will reimburse you for any third-party ATM fees and waive the foreign conversion fee on top of it.

Traveling Internationally? Use your Bank of America ATM or debit card at one of our International partner ATMs and avoid the non-Bank of America ATM $5 usage fee for each withdrawal, transfer or balance inquiry 1 as well as the ATM operator access fee.