You are about to leave geico.com

When you click "Continue" you will be taken to a site owned by , not GEICO. GEICO has no control over their privacy practices and assumes no responsibility in connection with your use of their website. Any information that you provide directly to them is subject to the privacy policy posted on their website.

Travel Insurance

Get a travel insurance quote and protect your next trip

For flight insurance protection:

AirCare Flight Quote

For all-in-one trip insurance protection:

ExactCare Travel Quote

Manage Your Travel And Flight Insurance

Manage your policy online

Need a travel insurance quote?

Existing policyholder?

Why Travel Insurance Matters

Travel insurance provides peace of mind by offering protection against a wide range of travel-related risks. From covering non-refundable trip costs in case of cancellations to providing financial assistance for medical emergencies abroad, a comprehensive travel insurance plan ensures you are prepared for the unexpected.

AirCare Flight Insurance

If you only need to protect your travel costs for a flight, AirCare may be what you need. With affordable coverage for both domestic and international flights, AirCare flight insurance helps you plan with peace of mind.

ExactCare Travel Insurance

If you want to cover your flight and other trip arrangement's ExtraCare can help. An ExactCare Travel Insurance policy can help with the unexpected, such as:

- Trip Cancellations/Interruptions/Delays

- Lost/Stolen travel documents

- Unexpected medical expenses

What's the difference between flight insurance and travel insurance?

Flight insurance is a type of travel insurance that offers specific financial protection for air travel issues. Whereas travel insurance provides coverage for the entire travel experience from trip cancellations to medical emergencies and beyond.

What Flight Insurance Covers

AirCare Flight Insurance has a variety of benefits including emergency travel assistance, 24/7/365. Some common flight coverages are:

- Airfare incase flights are cancelled or you miss a connection

- Personal items like lost or delayed luggage

- Flight delays in your departure (at the gate or on the tarmac)

AirCare Quote

What Travel Insurance Covers

ExactCare Travel Insurance offers comprehensive protection tailored to residents of specific states or regions, with benefits that may vary depending on your location. This all-in-one travel protection comes with family friendly pricing and worldwide emergency travel assistance 24/7/365. Common things covered by travel insurance are:

- Trip cancellation or interruption

- Personal items like passports and luggage

- Medical costs like hospital and doctor expenses, medical evacuations, and more

ExactCare quote

Travel Insurance Additional Coverage

Travel insurance optional coverage upgrades vary by plan. They are tailored to meet your specific needs and offer an extra layer of security for unforeseen circumstances. Some popular travel insurance coverage options from GEICO include:

Cancel for Any Reason (CFAR) Coverage: This type of coverage allows travelers to cancel their trip for any reason not covered by standard trip cancellation policies. It typically reimburses a percentage of the prepaid, non-refundable trip costs.

Rental Car Collision Coverage: This optional coverage provides protection against damage to rental vehicles due to collision, theft, or vandalism while traveling.

Baggage Delay or Loss Coverage: This coverage reimburses travelers for essential items, such as clothing and toiletries, lost due to baggage delay or loss.

Pre-existing Medical Condition Coverage: Some travel insurance policies offer coverage for pre-existing medical conditions, which may otherwise be excluded from standard policies. Please note that this coverage can't be purchased as upgrades or add-ons. Please contact our specialist to learn more about this coverage as other restrictions may also apply.

Natural Disaster Coverage: Provides coverage for trip cancellations, interruptions, or delays due to natural disasters such as hurricanes, earthquakes, or floods. Please note that this coverage can't be purchased as upgrades or add-ons. Please contact our specialist to learn more about this coverage as other restrictions may also apply.

Pet Coverage: This optional coverage reimburses travelers for expenses related to pet care if they need to extend their trip due to unforeseen circumstances. It does not provide the same coverage as dedicated pet insurance policies, so be sure to check with your provider for specifics.

Extended Personal Liability Coverage: Offers protection against third-party claims for bodily injury or property damage caused by the traveler while on their trip.

What Travel Insurance Does Not Cover

Your travel insurance is based on the plan you choose. However, travel insurance does not usually cover the following:

- Action and team sports, for example auto racing, pro sports travel, or other extreme sport activities

- Travel to get medical care

- Trip Cancellation because you changed your mind

For more information, please check your policy.

Is travel or trip insurance worth the cost?

Travel insurance can help protect your vacation or trips from unexpected things happening. You can travel without trip insurance but doing so brings greater risk if something goes wrong or you encounter unexpected delays. Flight insurance or trip insurance coverage can include things like flight cancellation, lost luggage, trip cancellation, emergency medical transportation, and more. Learn more about travel insurance and why you should get a travel insurance quote today!

How Much is Travel Insurance?

Travel insurance typically costs 5 to 10 percent of your total trip cost, though that can be influenced by several things.

- The cost of the trip

- The length of your trip and destination

- The amount of coverage selected

- The number of travelers covered under the policy

Travel Insurance Worldwide Service and Claims Information.

It's easy to manage your travel insurance..

Berkshire Hathaway Travel Protection (BHTP) has made it easy to manage your travel insurance. You can:

- Visit Berkshire Hathaway Travel Protection's website

- Email [email protected]

Is travel insurance worth it?

Yes. Things happen that are out of your control. Whether it's your flight being cancelled or delayed to a family emergency. Life happens and that's how travel insurance can help. Plan for the unexpected with a travel insurance policy so you can rest easy knowing you're covered.

Travel Insurance FAQs

- What travel insurance plans are available? BHTB offers AirCare (flight only) and 3 main plans: ExactCare Value, ExactCare, and ExactCare Extra. ExactCare Value provides great traveling insurance coverage for budget minded travelers. You can rest easy knowing you're covered for things like trip cancellation, trip interruption, and medical expenses. The main difference is the maximum amount that will be covered. ExactCare and ExactCare Extra's insurance cover the same things as ExactCare Value and add coverage for missed connections and accidental death & dismemberment. The overall amount covered is also increased for each plan respectively.

- Is there travel insurance that can cover my vehicle while traveling to Mexico? Your US auto insurance policy won't cover your vehicle when you drive into Mexico. We're here to help you find the Mexico car insurance you need to insure your car.

- How can I save money on my next trip? No one wants to overpay things. We're here to help. Check out our 5 ways to save your money on your next family vacation.

- Where you're going

- Number of days you're traveling

- Cost of your overall trip

- Coverage you pick

- Number of people covered under your policy and more

- How Can I Get Travel Insurance? To get GEICO travel insurance, visit the GEICO website and navigate to our travel insurance section. There, you can review the different plans available, which include coverage for trip cancellations, medical emergencies, lost luggage, and more. You can get a quote by entering your travel details and personal information.

- When Is It Too Late to Buy Travel Insurance? It's generally too late to buy travel insurance once your trip has started, or a loss has occurred. Most policies must be purchased before departure, with some providers allowing purchases until the day before.

- How Much Travel Insurance Do I Need? The amount of travel insurance you need depends on your trip cost, destination, duration, and personal risk factors, such as your age and health. In general, you should aim for coverage that includes medical expenses, trip cancellations, lost luggage, and emergency evacuation. You may want to consider higher limits for expensive or high-risk destinations.

- How Can I Add Travel Insurance After Booking a Flight? To add travel insurance through GEICO after booking a flight and before travel begins, visit the GEICO website, navigate to our travel insurance section, and apply for coverage. You can also call our dedicated customer service team for assistance.

If you choose to get a rate quote or service your policy online, you will be taken to the Berkshire Hathaway Travel Protection website which is owned by Berkshire Hathaway Specialty Insurance Company, not GEICO. Travel Insurance is underwritten by Berkshire Hathaway Specialty Insurance Company; NAIC #22276. Any information that you provide directly to Berkshire Hathaway Specialty Insurance Company on its website is subject to the privacy policy posted on their website, which you should read before proceeding. GEICO assumes no responsibility for their privacy practices or your use of their website.

ExactCare is provided through Berkshire Hathaway Global Insurance Services, LLC. ExactCare and AirCare are underwritten by Berkshire Hathaway Specialty Insurance Company. Both coverages are secured through the GEICO Insurance Agency, LLC.

Benefits may vary by jurisdiction. Please contact a representative to confirm availability.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

How Does Flight Insurance Work, and Is It Worth It?

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is flight insurance?

What does flight insurance cover, what does flight insurance not cover, how do i get flight insurance, should i get flight insurance, flight insurance on award tickets, is flight insurance worth it.

Flight insurance covers flight expenses only — lodging, rental cars, etc. are not covered.

You can purchase standalone flight insurance from a third party or from the airline itself.

Your qualifying expenses are only reimbursed if a covered reason affects your flight.

You might already have sufficient flight insurance through your credit card.

Whether you’re booking a flight with cash or miles, flight insurance can help you get your money or miles back if your trip is unexpectedly canceled or delayed. Here’s what you need to know to decide if flight insurance is worth it for your trip.

Travel insurance terminology can get confusing. To keep things simple, when we refer to flight insurance, we mean insurance that will protect your nonrefundable flight that was paid for in cash or with miles.

Generally, flight insurance is offered when you:

Purchase a comprehensive travel insurance policy through a travel insurance provider (i.e. TravelSafe , Berkshire Hathaway , etc.)

When you use a premium travel card (that offers complimentary travel insurance) to book your flight.

Are buying a flight and get an option to purchase the airline’s trip insurance during the checkout process.

Since flight insurance specifically covers your flight, it can be a good option if you need to insure only a flight but no other aspects of your trip. For example, you buy a nonrefundable flight to visit family — you'll be staying with them, and you don’t need to book a hotel, car rental or excursions. Flight insurance might be sufficient for this type of trip, and buying a comprehensive travel insurance plan might be overkill.

» Learn more: Is travel insurance worth it in 2024?

Whether you’re getting flight insurance through a comprehensive travel insurance plan, your premium credit card or as an add-on from the airline, there are a few common types of coverage that may be included. Naturally, coverage amounts and limits will vary by policy and/or credit card.

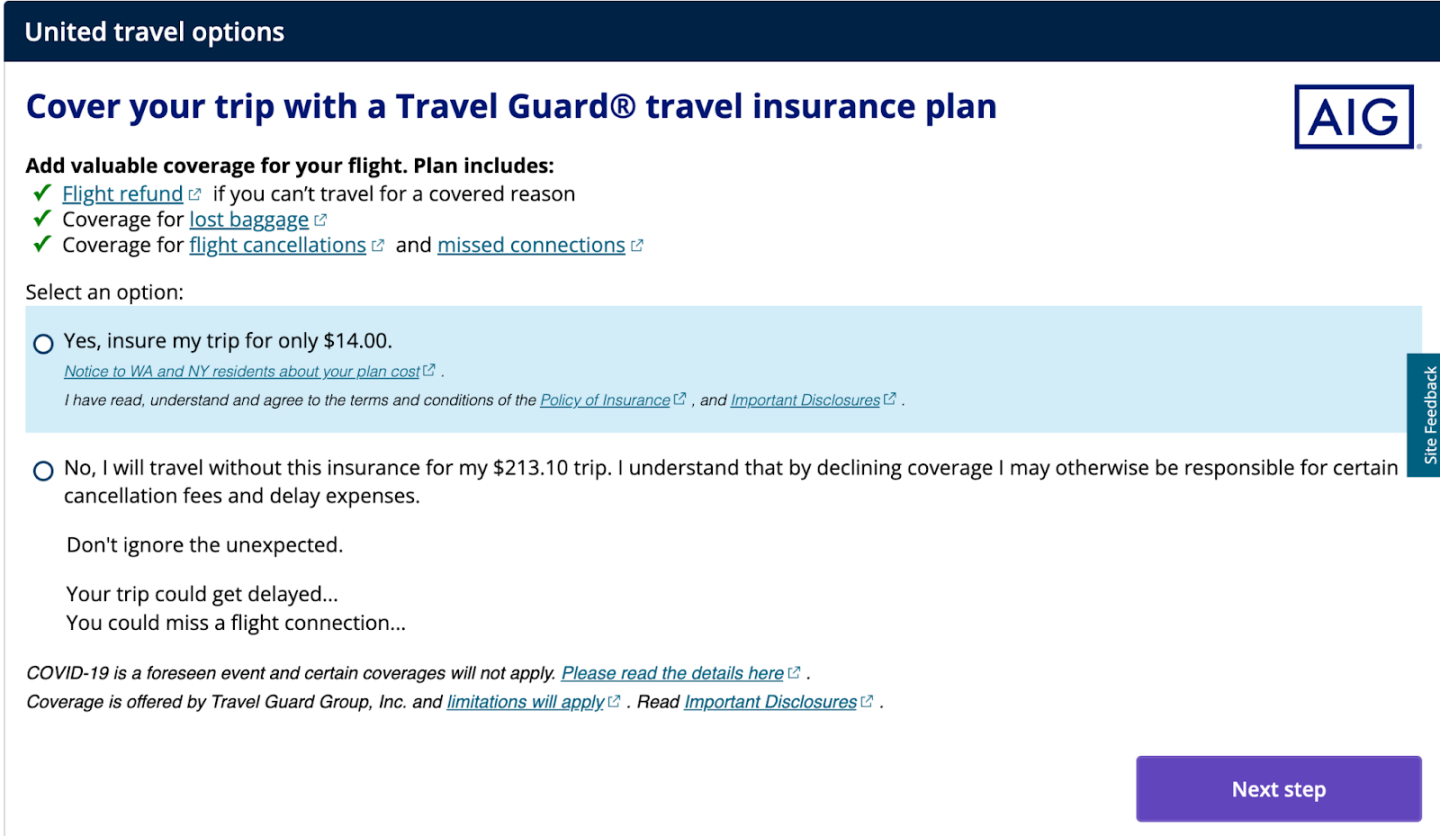

Here’s an example of what coverage is included on a flight insurance plan offered by United Airlines when purchasing a flight.

The flight insurance add-on is provided by Travel Guard and costs $14 to insure a $213 flight. The plan includes: a flight refund (i.e., trip cancellation insurance) if you cannot travel for a covered reason, lost baggage coverage, as well as coverage for flight cancellations and missed connections.

There's a notice posted for residents of Washington and New York, so if you live in one of those states, the coverage may differ.

» Learn more: What to know before buying travel insurance

Trip cancellation insurance

Trip cancellation insurance will reimburse you for prepaid, nonrefundable expenses if your flight is canceled for a covered reason. In the event you use your premium travel card from American Express or Chase to book your trip with points or miles, the trip cancellation insurance that comes with these cards will reimburse you in cash for the value of the points you used.

Notably, trips booked with an American Express card are only covered when booked as roundtrips. If you have a travel card with American Express, you’ll want to check the benefits guide for your card because that's where this caveat is located, and it's easy to overlook.

If you purchase a comprehensive travel insurance policy or an airline add-on policy, you typically will be reimbursed for the full cost of your flight, up to the policy maximums.

» Learn more: The best travel insurance companies

Trip delay insurance

This coverage kicks in if you’re delayed during a trip and you incur expenses as a result. Each policy details the reimbursement amount that is allowed, along with how long the delay must be in order for the trip to qualify.

For example, say you’re going on vacation and you have a connecting flight with a layover. An approaching snowstorm in the connecting city delays your flight, and after hours of waiting in the airport, you find out your upcoming flight is delayed until the next morning . Now you need a hotel room, toiletries, dinner and breakfast the next morning.

If you have trip delay coverage, you will be reimbursed for all of these expenses, as long as the delay exceeds a certain number of hours and you remain within the allowed daily monetary limit. For the United policy shown above, you will be covered up to $500 if you miss your connecting flight due to inclement weather or a delay of your original flight.

According to Squaremouth, a travel insurance comparison site, not all travel insurance policies offer coverage for missed connections, so if you’re booking a flight that has connections, you’ll want to pay attention to this benefit.

» Learn more: Chase trip delay insurance: What to know

Lost-luggage insurance

If you have lost-luggage insurance, you'll be eligible for reimbursement for your luggage contents if your luggage is lost, damaged or stolen during a trip. In the event of damage, the reimbursement would be for the cost to repair or replace, whichever is lower.

Lost-luggage coverage will likely include an overall limit as well as a per-item limit, and a separate limit for expensive items. We examined a flight insurance add-on offered by American Airlines and found that the baggage loss coverage had a limit of $300. If your luggage or its contents cost more than $300, that limit may not be sufficient for you.

» Learn more: Baggage insurance: How it works, what to know

Although flight insurance offers many protections, it's important to be aware of what may not be covered. Some examples of things that aren’t covered include:

Change of mind: If you cancel a flight because you change your mind about going, that won't be covered. The cancellation must be for a covered reason (i.e., too sick to travel and you have a doctor's note, job loss, inclement weather, etc.).

Expensive luggage: As detailed above with the American Airlines policy, the lost-luggage coverage is capped at $300. If you’re traveling with high-end luggage or your the contents of your luggage exceed that amount, anything above $300 won't be insured if the luggage is lost or damaged.

Medical evacuation: This type of coverage generally kicks in when you have a medical emergency during your trip and you need to be transported to the nearest medical facility. This type of coverage goes beyond a flight and is a benefit more likely to be included in a comprehensive insurance policy.

A comprehensive travel insurance policy will typically include medical evacuation and higher limits for luggage coverage.

If you’re looking for coverage that goes beyond your flight, you’ll want to look into a standalone travel insurance policy, a credit card that offers travel insurance or the Cancel For Any Reason (CFAR) travel insurance add-on to a comprehensive policy. This optional additional coverage will allow you to cancel your trip for any reason and get the majority (up to 75%) of your nonrefundable trip costs reimbursed.

» Learn more: The guide to Cancel For Any Reason (CFAR) travel insurance

If you’re planning a trip and decide to insure your flight, you’ll first need to determine what type of policy will provide the coverage you need. There are a few ways to protect your flight:

Purchase a standalone travel insurance policy

A comprehensive travel insurance policy will include the most benefits, including trip cancellation, trip delay, baggage loss , emergency medical , repatriation and more. Providers that offer comprehensive travel insurance plans include Seven Corners , World Nomads and Allianz .

Use the complimentary travel insurance provided by your credit card

Many travel cards offer complimentary travel insurance protections that are similar to those offered on standalone travel insurance policies.

However, the limits are usually lower, medical costs may not be included, and the entire trip must be charged on the same card to receive coverage.

Here are a few examples of cards with travel insurance benefits:

on Chase's website

on American Express' website

• Trip delay: Up to $500 per ticket for delays more than 12 hours.

• Trip cancellation: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Trip interruption: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Baggage delay: Up to $100 per day for five days.

• Lost luggage: Up to $3,000 per passenger.

• Trip delay: Up to $500 per ticket for delays more than 6 hours.

• Trip delay: Up to $500 per trip for delays more than 6 hours.

• Trip cancellation: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

• Trip interruption: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

Terms apply.

• Trip cancellation: Up to $1,500 per person and $6,000 per trip.

• Trip interruption: Up to $1,500 per person and $6,000 per trip.

• Baggage delay: Up to $100 per day for three days.

Purchase the airline’s travel insurance add-on when buying a flight

When you buy your flight from an airline (in cash or miles), you may see an option to purchase trip insurance during the checkout process. As examples, United offers a flight insurance option provided by Travel Guard, while American Airlines’ flight insurance provider is Allianz. Trip protections may include trip cancellation, trip interruption and trip delay, as well as coverage for lost bags.

Since coverage will differ between airlines, you’ll want to be aware of any restrictions. One common theme among the policies is that the protections are only valid if your trip is canceled or delayed for a covered reason, such as a natural disaster, illness, death or other extraordinary event.

NerdWallet recently reviewed travel insurance policies to help you choose the plan that provides the best travel insurance for your trip .

» Learn more: Comparing travel insurance options: airline or credit card?

If you have a credit card that provides some form of travel insurance, the coverage limits may be enough to protect your flight. If you don’t have one of these cards and your trip only includes a nonrefundable flight, purchasing the travel insurance add-on from the airline when booking your flight may provide sufficient coverage.

However, if your trip also includes a hotel and other nonrefundable bookings, you’d be better off with a standalone travel insurance policy or relying on your credit card coverage (if the limits are sufficient and your entire trip was booked with the card).

» Learn more: Airline travel insurance vs. independent travel insurance: Which is right for you?

If you use airline miles to book an award ticket, the flight insurance offered during the checkout process typically covers a redeposit of your miles back to your frequent flyer account if the trip is canceled.

Comprehensive trip insurance policies and credit card travel insurance will reimburse you for the taxes and fees paid on award tickets but may not cover the miles.

Make sure to check your policy if booking with points; some comprehensive and credit card plans will reimburse you for "redeposit fees" that the airline will charge you to get your miles back (if you didn’t purchase their add-on protection). That redeposit fee reimbursement allows you to get your miles back.

» Learn more: Does travel insurance cover award flights?

If you’re interested in insuring only your flight, you have many options to choose from.

For tickets purchased with cash, comprehensive insurance plans, premium travel credit cards and airline trip insurance will cover your nonrefundable flight costs. Award flights that are booked with miles could benefit from any of the three options if redeposit fees are part of the coverage.

If you want to be able to cancel your flight for any reason whatsoever, CFAR will protect most of your nonrefundable trip deposit, but it is also more expensive and only available as an add-on to a comprehensive travel insurance plan.

Insurance Benefit: Trip Delay Insurance

Up to $500 per Covered Trip that is delayed for more than 6 hours; and 2 claims per Eligible Card per 12 consecutive month period.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

Insurance Benefit: Trip Cancellation and Interruption Insurance

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period.

Insurance Benefit: Baggage Insurance Plan

Baggage Insurance Plan coverage can be in effect for Covered Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier Vehicle (e.g., plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an Eligible Card. Coverage can be provided for up to $2,000 for checked Baggage and up to a combined maximum of $3,000 for checked and carry-on Baggage, in excess of coverage provided by the Common Carrier. The coverage is also subject to a $3,000 aggregate limit per Covered Trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each Covered Person with a $10,000 aggregate maximum for all Covered Persons per Covered Trip.

Underwritten by AMEX Assurance Company.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Wells Fargo Autograph℠ Card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Points + $300 Travel Credit Get up to $1,050 in Chase Travel℠ value. Earn 60,000 bonus points after $4,000 in purchases in your first 3 months from account opening. That’s worth $750 when redeemed through Chase Travel. Plus, get up to $300 in statement credits on Chase Travel purchases within your first year.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

IMAGES