Capital One Main Navigation

- Learn & Grow

- Life Events

- Money Management

- More Than Money

- Privacy & Security

- Business Resources

How does travel insurance through Capital One cards work?

December 14, 2023 | 6 min read

Ever found yourself scrambling for lost luggage when you’re traveling? Or trying to book alternate flights due to bad weather? These kinds of events can be stressful—and costly. When the unexpected happens, travel insurance through your card could help protect you from travel expenses beyond your control.

Many cardholders have travel insurance as part of their card benefits. Coverage varies by card, issuer and the network that provides the benefits. To prepare for your next trip, you might want to check out whether your card offers travel insurance and what benefits come with it.

Key takeaways

- Travel insurance through your card could help protect you from paying for unexpected expenses if something goes wrong when you travel.

- Card travel insurance may offer coverage for both domestic and international travel.

- Your coverage depends on your card. Check your card’s benefits guide for details.

- Travel insurance is offered to Capital One cardholders through the Visa® and Mastercard® networks.

Earn 75,000 bonus miles

Redeem your miles for flights, vacation rentals and more. Terms apply.

What is credit card travel insurance?

Card travel insurance can help protect you financially when you incur unexpected expenses during travel. Whether you’re visiting family, flying abroad or driving across the country, card travel insurance can be a kind of safety net.

By booking and paying for a trip with a card that offers travel insurance benefits, you could get compensation up to a set limit for your unexpected expenses. For example, some Capital One rewards credit cards offer benefits like travel accident insurance and lost luggage reimbursement.*

What types of coverage does card travel insurance provide?

Imagine traveling with peace of mind, knowing that a potential accident or expensive mishap could be reimbursed. With travel insurance through your card, you could be covered in a number of scenarios.

Every card is different, so be sure to check your card’s terms and conditions to see what types of travel insurance you might receive. Here are a few of the most common types of coverage you may have access to:

Trip cancellation and interruption insurance

Canceling a trip at the last minute or cutting it short can be disappointing. But getting your money back for flights and reservations you didn’t end up using might help relieve your stress.

If you booked and paid for your trip with a card that offers trip cancellation and interruption insurance, you may qualify for reimbursement in certain situations, like these:

- Severe weather at the beginning of a trip

- Unexpected health issues or accidental injuries

- Death of someone in your travel party or an immediate family member

You may want to make sure you’re aware of situations that aren’t typically covered by this type of insurance. For example, exclusions can include preexisting medical conditions or when a travel agency, hotel or airline goes out of business. Check the terms of your card to learn more about trip cancellation insurance.

Maximum reimbursement depends on your card and can vary significantly. Some cards might offer up to $2,000 per trip. (For others, it could be less.)

Trip delay insurance

Travel schedules don’t always go as planned. Flights may get delayed or severe weather may affect your travels. Or you may need to pay for a meal or last-minute hotel room while you wait. If you paid for your trip with a card that has trip delay insurance, certain reasonable costs you incur during the delay might be covered.

Cards may vary in how long the delay must be before coverage kicks in. But having travel delay insurance could help take care of your most urgent needs.

Rental car insurance

If you pay for a rental car with your card, you might be able to skip the added cost of buying insurance through the rental company. Credit card rental car insurance could cover collisions, theft and towing if your car breaks down while you’re traveling.

This type of insurance usually goes into effect after your regular auto insurance policy does. Whether you’re renting a car in the U.S. or abroad may affect whether you’ll need additional coverage and how much. Remember, rental car insurance usually only covers the vehicle. You may need to buy liability coverage when traveling internationally if your personal auto policy is limited to the U.S.

Lost or delayed baggage insurance

Imagine that you’re waiting in the baggage claim area after a flight, confident that you packed everything you need for your trip. But your luggage never rolls by on the carousel.

Lost, delayed or even stolen baggage can interrupt your trip. If you need to buy replacement items, you could be reimbursed.

Travel accident insurance

While travel often goes smoothly, sometimes it doesn’t. Accidents happen. Travel accident insurance could provide an added layer of support. In cases of severe injury or death, you or your family members could receive benefits if you booked and paid for your trip with a card that offers travel accident insurance.

Where will Venture X take you?

Earn 75,000 bonus miles and other exclusive perks with the Venture X card.

How do you file a travel insurance claim?

If you need to file a travel insurance claim, you can start by reading your card’s benefits guide to get the specifics on your travel insurance. That way, you can know which travel events are covered and for how much.

It can be a good idea to save your purchase receipts while you’re traveling. Then you’ll have a paper trail if you want to be reimbursed for things like replacement articles of clothing, a last-minute hotel booking or a trip to the emergency room.

Finally, you can file a claim by contacting the administrator listed in your card’s benefits guide. Check if there’s a time limit on how long you have to file a claim after the travel incident. You may have to answer a few questions, complete a form and submit your receipts to complete the claim. If your claim is accepted, you may be compensated for the covered expenses you paid for with your personal funds.

Capital One card travel insurance FAQ

Here are a few frequently asked questions about travel insurance in general and travel insurance through a Capital One card in particular:

Do cards automatically have travel insurance?

Not necessarily. Some cards, like the Capital One Venture card , offer travel insurance. But some may not. If you’re not sure about your card, check its benefits guide for more information.

Do I have to pay extra for travel insurance?

That may depend on your card. Some cards may include travel insurance at no charge. Others may allow you to purchase additional travel protection benefits for a fee. And some might charge an annual fee that may be balanced out by premium travel benefits and enhanced travel insurance protection.

Is my family covered under my Capital One card’s travel insurance?

Coverage for family members generally depends on your card issuer and network. For example, if you’re a Mastercard or Visa cardholder, your spouse is typically covered. Depending on their ages, your kids may be covered as well. Capital One cardholders can learn about their travel insurance benefits by reading their benefits guide.

Does travel insurance through my Capital One card cover flight cancellation?

Some Capital One cards may offer flight cancellation insurance as part of their travel insurance coverage. Check your benefits guide to see whether your card provides this type of protection. Your guide will also detail the process of filing a claim if your flight gets canceled unexpectedly. If you want the freedom to cancel your flight for any reason, consider booking your flight through Capital One Travel .

Capital One card travel insurance in a nutshell

Capital One’s card travel insurance can help protect you when things go wrong while you’re traveling, whether you’re in the U.S. or abroad. If you’re interested in learning whether your card comes with travel insurance, be sure to check its benefits guide to learn more.

If you’re ready to take advantage of this travel protection, apply for a Capital One travel and miles rewards card today. If you’re approved for either Venture or Venture X , you’ll have the opportunity to earn 75,000 bonus miles that you can redeem for flights, hotels, vacation rentals and more.

Other ways to maximize your travel benefits

Who wouldn’t want to get the most out of their credit card? Here are some things to know about Capital One travel rewards credit cards:

Get a one-time 75,000-mile bonus with the Capital One Venture X card and receive an additional 10,000 bonus miles every year, starting on your first anniversary. ( View important rates and disclosures .)

Earn unlimited 2X miles per dollar on every purchase, every day and get 75,000 bonus miles upon signup with the Capital One Venture card . ( View important rates and disclosures .)

Earn unlimited 1.25X miles with no annual fee with the Venture One card from Capital One . ( View important rates and disclosures .)

Explore travel rewards card options by comparing Capital One Venture cards .

Learn how Venture X cardholders can get access to a worldwide network of airport lounges thanks to a complimentary Priority Pass membership .

Related Content

Capital one rewards credit card benefits.

article | April 30, 2024 | 8 min read

How does rental car insurance through credit cards work?

article | April 23, 2024 | 6 min read

16 travel packing tips for your next adventure

article | June 1, 2023 | 9 min read

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards

The 8+ Best Credit Cards for Travel Accident Insurance [2024]

Christine Krzyszton

Senior Finance Contributor

312 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Keri Stooksbury

Editor-in-Chief

35 Published Articles 3262 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Director of Operations & Compliance

6 Published Articles 1179 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

![visa travel accident insurance The 8+ Best Credit Cards for Travel Accident Insurance [2024]](https://upgradedpoints.com/wp-content/uploads/2018/11/Airport-Boarding-Line.jpg?auto=webp&disable=upscale&width=1200)

Table of Contents

What is travel accident insurance, the best credit cards for travel accident insurance, additional credit cards with travel accident insurance, how to file a claim, other useful travel protections and benefits, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Upgraded Points: Expertise You Can Trust

Our seasoned and experienced team brings years of expertise in the credit card and travel sectors. Committed to integrity, we offer data-driven guides to help you find the card(s) that best fit your requirements. See details on our intensive editorial policies and card rating methodologies .

- Content by Leading Industry Experts

- Routine Updates and Fact-Checks

- First-Hand Credit Card Experience

- Shared Across 200+ Top Outlets

The U.P. Rating System

- 1039+ Expert Credit Card Guides

You don’t embark on a journey thinking something bad will happen because chances are that the worst won’t happen. It’s good to know, however, that if something did happen and you were severely injured or even worse, there is coverage available — and it comes complimentary on your credit card.

Travel Accident Insurance is widely available but seldom used. In fact, news and media provider Reuters reports that there were zero accidental deaths on scheduled commercial U.S. air carriers in 2017, which is the most recent data available.

And while you don’t normally base your credit cards on this coverage, it’s helpful to know which cards come with this coverage. Travel protections and benefits can save you money when you travel and provide peace of mind knowing you have coverage should something drastic happen during your trip.

Travel Accident Insurance, specifically, is one of those peace-of-mind coverages that can be a welcome resource should you need it.

Here’s a look into travel accident insurance with the objective of defining the coverage and letting you know which popular cards carry the protection as part of a broader package of travel protections and benefits.

Travel Accident Insurance is a complimentary travel protection that is offered on certain travel rewards credit cards. The coverage pays out a specified benefit should you or your immediate family become severely injured, including dismemberment, loss of sight, hearing, or speech, or death due to a covered accident on a common carrier during your travels.

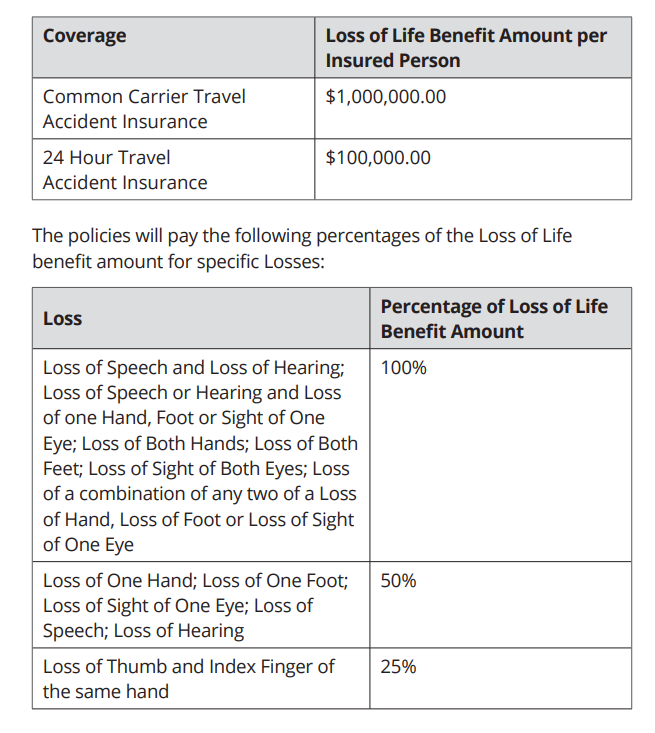

The coverage works similar to life insurance in the case of accidental death. Dismemberment and severe injury is handled differently in that a percentage of the total death benefit is paid out depending on the severity of the injury. The limits of the benefit payouts are depicted in a table published within the Guide to Benefits for each specific credit card.

Travel Accident Insurance is different than trip cancellation, trip interruption , and trip delay insurance in that it only pays a benefit in the case of accidental death or specified severe injuries when traveling on a common carrier.

Also, unlike most travel insurance policies that come with your credit card, travel accident insurance is not secondary coverage . This means it will pay benefits in addition to other life, disability, or medical coverage you hold.

Primary and additional cardholders can generally designate a beneficiary for the accident life insurance portion of the coverage.

Bottom Line: Travel Accident Insurance comes complimentary on many travel rewards credit cards. It works similar to an accidental life insurance policy in the case of death and pays out a percentage of that benefit in the case of severe injury.

The best credit cards for travel accident insurance coverage have travel protections and benefits beyond that of just travel accident insurance. The following travel rewards credit cards offer some of the best travel insurance packages available and all of the coverages come complimentary with the card .

Card Summary

Chase travel accident insurance.

Chase actually has 2 types of travel accident insurance:

- Common Carrier Travel Accident Benefit — this protection covers you while you are a passenger on any common carrier or at the airport/terminal/station immediately before or after your trip.

- 24-Hour Travel Accident Benefit — you will be covered as soon as you begin your trip, during your qualifying trip, and until you return for accidental death, dismemberment, and loss of speech, sight, or hearing.

Chase Cards that Provide Travel Accident Insurance

Chase sapphire preferred ® card (top pick).

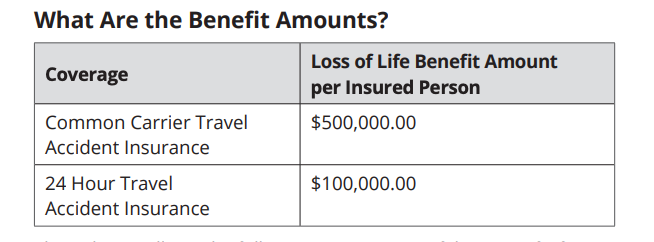

The Chase Sapphire Preferred provides up to $500,000 for the Common Carrier Benefit, or $100,000 for the 24 Hour Benefit. In addition to travel Accident insurance, the Chase Sapphire Preferred card offers additional travel insurance .

A fantastic travel card with a huge welcome offer, good benefits, and perks for a moderate annual fee.

The Chase Sapphire Preferred ® card is one of the best travel rewards cards on the market. Its bonus categories include travel, dining, online grocery purchases, and streaming services, which gives you the opportunity to earn lots of bonus points on these purchases.

Additionally, it offers flexible point redemption options, no foreign transaction fees, and excellent travel insurance coverage including primary car rental insurance . With benefits like these, it’s easy to see why this card is an excellent choice for any traveler.

- 5x points on all travel booked via the Chase Travel portal

- 5x points on select Peloton purchases over $150 (through March 31, 2025)

- 5x points on Lyft purchases (through March 31, 2025)

- $95 annual fee

- No elite benefits like airport lounge access or hotel elite status

- Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 75,000 points are worth $937.50 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

- APR: 21.49%-28.49% Variable

- Foreign Transaction Fees: None

Chase Ultimate Rewards

Ink Business Preferred ® Credit Card

The Ink Business Preferred card provides up to $500,000 for the Common Carrier Benefit, or $100,000 for the 24 Hour Benefit.

The Ink Business Preferred card is hard to beat, with a huge welcome bonus offer and 3x points per $1 on the first $150,000 in so many business categories.

The Ink Business Preferred ® Credit Card is a powerhouse for earning lots of points from your business purchases , especially for business owners that spend regularly on ads.

Plus the card offers flexible redemption options, including access to Chase airline and hotel transfer partners where you can achieve outsized value.

Business owners will also love the protections the card provides like excellent cell phone insurance , rental car insurance, purchase protection, and more.

- 3x Ultimate Rewards points per $1 on up to $150,000 in combined purchases on internet, cable and phone services, shipping expenses, travel, and ads purchased with search engines or social media sites

- Cell phone protection

- Purchase protection

- No elite travel benefits like airport lounge access

- Earn 100k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $1,000 cash back or $1,250 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

- Purchase Protection covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per account.

- APR: 21.24%-26.24% Variable

Chase Sapphire Reserve ®

In addition to Travel Accident Insurance of up to $1,000,000 , the Chase Sapphire Reserve card offers complimentary emergency evacuation insurance up to $100,000 and $2,500 in emergency medical/dental expenses.

A top player in the high-end premium travel credit card space that earns 3x points on travel and dining while offering top luxury perks.

If you’re looking for an all-around excellent travel rewards card, the Chase Sapphire Reserve ® is one of the best options out there.

The card combines elite travel benefits and perks like airport lounge access , with excellent point earning and redemption options. Plus it offers top-notch travel insurance protections to keep you covered whether you’re at home or on the road.

Don’t forget the $300 annual travel credit which really helps to reduce the annual fee!

- 10x total points on hotels and car rentals when you purchase travel through Chase TravelSM immediately after the first $300 is spent on travel purchases annually

- 10x points on Lyft purchases March 31, 2025

- 10x points on Peloton equipment and accessory purchases over $250 through March 31, 2025

- $550 annual fee

- Does not offer any sort of hotel elite status

- Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 75,000 points are worth $1125 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck ®

- APR: 22.49%-29.49% Variable

Marriott Bonvoy ® Bold Credit Card

The Marriott Bonvoy Bold card offers up to $500,000 in travel accident insurance benefits when you purchase your common carrier ticket with your card.

A great option for Marriott hotel fans who want a no annual fee card and automatic Marriott Bonvoy elite status.

Casual travelers who like to frequent properties that are part of the Marriott Bonvoy collection of brands may want to consider the Marriott Bonvoy Bold ® Credit Card.

The Marriott Bold card rewards cardholders for Marriott stays and gives them a boost towards Marriott Bonvoy elite status.

- Up to 14x points per $1 on Marriott purchases

- 2x points per $1 on travel purchases

- 15 Elite Night Credits each year (automatically gives you Silver Elite status)

- Lower point earn rate than other Marriott Bonvoy cards

- Marriott Bonvoy Silver Elite status is the lowest status tier

- Earn 30,000 Bonus Points after you spend $1,000 on purchases in the first 3 months from account opening.

- Pay no annual fee with the Marriott Bonvoy Bold ® Credit Card from Chase ® !

- Earn up to 14X total points per $1 spent at thousands of hotels participating in Marriott Bonvoy ® with the Marriott Bonvoy Bold ® Card.

- 1X point for every $1 spent on all other purchases.

- Your points don't expire as long as you make purchases on your card every 24 months.

- No Foreign Transaction Fees.

- APR: 21.49%–28.49% Variable

Marriott Bonvoy

The World of Hyatt Credit Card

Pay for your transportation ticket with your World of Hyatt card and receive up to $500,000 in travel accident insurance due to a covered loss.

The World of Hyatt card offers a fast track to Hyatt elite status, an annual free night, and up to 9x points per $1 on Hyatt stays.

The World of Hyatt Credit Card makes your Hyatt stays more rewarding and helps you get coveted World of Hyatt elite status faster. This card is a must-have for any traveler who regularly stays at Hyatt hotels, or even for anyone who’s able to take advantage of the card’s annual free night certificate.

When you factor in all the benefits the World of Hyatt card offers, it’s easy to see why it is one of the best co-branded hotel credit cards on the market.

- Up to 9 points total for Hyatt stays: 4 Bonus Points per $1 spent at Hyatt hotels and 5 Base Points per $1 from Hyatt as a World of Hyatt member

- 2x points per $1 at restaurants, on airline tickets purchased directly from the airline, local transit, rideshares, and fitness clubs/gym memberships

- 1x point per $1 on all other purchases

- Earn 30,000 Bonus Points after you spend $3,000 on purchases in your first 3 months from account opening. Plus, up to 30,000 More Bonus Points by earning 2 Bonus Points total per $1 spent in the first 6 months from account opening on purchases that normally earn 1 Bonus Point, on up to $15,000 spent.

- Enjoy complimentary World of Hyatt Discoverist status for as long as your account is open.

- Get 1 free night each year after your Cardmember anniversary at any Category 1-4 Hyatt hotel or resort

- Receive 5 tier qualifying night credits towards status after account opening, and each year after that for as long as your account is open

- Earn an extra free night at any Category 1-4 Hyatt hotel if you spend $15,000 in a calendar year

- Earn 2 qualifying night credits towards tier status every time you spend $5,000 on your card

- Earn up to 9 points total for Hyatt stays - 4 Bonus Points per $1 spent at Hyatt hotels & 5 Base Points per $1 from Hyatt as a World of Hyatt member

- Earn 2 Bonus Points per $1 spent at restaurants, on airline tickets purchased directly from the airlines, on local transit and commuting and on fitness club and gym memberships

- APR: 21.49% - 28.49% Variable

World of Hyatt

United-branded Credit Cards

With priority boarding privileges, no foreign transaction fees and more, MileagePlus members will definitely enjoy their partnered card.

You travel United all the time, but you have heard that there could be ways to make your travel experiences even better, including priority boarding, free bags, and more miles.

You should consider the United℠ Explorer Card , because this card does all that and more!

- 2x miles per $1 on United purchases, dining purchases (including delivery services), and hotel stays

- 1x mile per $1 on all other purchases

- First checked bag free for you and up to 1 traveling companion

- $0 intro annual fee for the first year, then $95 annual fee

- Does not earn transferable rewards

- Earn 50,000 bonus miles after you spend $3,000 on purchases in the first 3 months your account is open.

- $0 introductory annual fee for the first year, then $95.

- Earn 2 miles per $1 spent on dining, hotel stays, and United ® purchases

- Up to $100 Global Entry, TSA PreCheck ® or NEXUS fee credit

- 25% back as a statement credit on purchases of food, beverages and Wi-Fi on board United-operated flights and on Club premium drinks when you pay with your Explorer Card

- Free first checked bag - a savings of up to $140 per roundtrip. Terms Apply.

- Enjoy priority boarding privileges and visit the United Club℠ with 2 one-time passes each year for your anniversary

- APR: 21.99% - 28.99% Variable

United MileagePlus Frequent Flyer Program

Perfect for frequent United flyers who want premium perks like United Club access and free baggage benefits.

The United Club℠ Infinite Card is a premium card designed for the most dedicated of United frequent flyers who are looking for a card that provides the opportunity to earn extra United MileagePlus miles and receive lounge access via a yearly United Club membership.

United frequent flyers will find that the United Club Infinite card provides an enhanced experience on their United flights thanks to the money saved on each flight and the conveniences it provides.

- 4x miles per $1 on United purchases

- 2x miles per $1 on travel and dining purchases

- Complimentary United Club membership

- $525 annual fee

- Earn 80,000 bonus miles after qualifying purchases

- Earn 4 miles per $1 spent on United ® purchases

- Earn 2 miles per $1 spent on all other travel and dining

- Earn 1 mile per $1 spent on all other purchases

- Free first and second checked bags - a savings of up to $320 per roundtrip (terms apply) - and Premier Access ® travel services

- 10% United Economy Saver Award discount within the continental U.S. and Canada

- Earn up to 10,000 Premier qualifying points (25 PQP for every $500 you spend on purchases)

The United Quest card is a fantastic option for United flyers looking to earn more miles and enhance their flights.

The newest addition to United’s lineup of cards is the United Quest℠ Card . With it, you can bolster your United MileagePlus miles, thanks to the bonus categories, while enjoying the card’s many perks designed to help save you money on each United flight.

With an annual fee that falls between the United℠ Explorer Card and United Club℠ Infinite Card , the United Quest card makes for a fantastic card option for United frequent flyers.

- 3x miles per $1 on United purchases

- 2x miles per $1 spent on travel, dining, and select streaming services

- $125 annual United credit

- Does not offer airport lounge access

- Earn 60,000 bonus miles and 500 PQP after qualifying purchases

- Earn 3 miles per $1 spent on United ® purchases

- Earn 2 miles per $1 spent on all other travel, dining and select streaming services

- Free first and second checked bags - a savings of up to $320 per roundtrip (terms apply) - and priority boarding

- Up to a $125 United ® purchase credit and up to 10,000 miles in award flight credits each year (terms apply)

- Earn up to 6,000 Premier qualifying points (25 PQP for every $500 you spend on purchases)

The United Gateway card is a great option for those looking to earn more United miles without paying an annual fee.

The United Gateway℠ Card is a great option for those looking to earn more United miles without wanting to pay a credit card annual fee. Plus, the card offers other solid benefits like a 25% back on United inflight purchases, purchase protection, and rental car insurance.

- 2x miles per $1 on United purchases

- 2x miles per $1 at gas stations and on local transit and commuting, including rideshare services, taxicabs, train tickets, tolls, and mass transit

- If you are a frequent United flyer, other cards offer more perks

- It does not earn transferable rewards

- Earn 20,000 bonus miles

- No annual fee

- Earn 2 miles per $1 spent on United ® purchases, at gas stations and on local transit and commuting

- Earn 2 miles per $1 spent on United ® purchases

- Earn 2 miles per $1 spent at gas stations, on local transit and commuting

- 25% back as a statement credit on purchases of food, beverages and Wi-Fi on board United-operated flights and on Club premium drinks when you pay with your Gateway Card

- APR: 0% Intro APR on Purchases for 12 months; after that, 21.99% - 28.99% Variable

The United Club Business card is a great option for frequent United flyers looking for United Club access.

The United Club℠ Business Card is a premium card option for dedicated United loyalists seeking a card that offers complimentary United Club access, helps them earn and retain status, and doesn’t skip on the benefits.

From free checked bags to upgrades on award tickets and the ability to earn Premier qualifying points, there is plenty to the United Club Business card that United flyers are sure to love.

- 2x miles per $1 spent on United purchases

- 1.5x miles per $1 spent on all other purchases

- $450 annual fee

- Earning rate for United purchases is poor compared to other United cards

- Earn 50,000 bonus miles + 1,000 Premier qualifying points (PQP) after $5,000 on purchases in the first 3 months your account is open

- Earn 2x miles on United purchases

- Earn 1.5x miles on all other purchases

- Employee cards at no additional cost

- United Club membership — up to a $650 value per year. Relax in comfort while waiting for your flight with complimentary beverages, snacks, high-speed Wi-Fi, and more

- Free first and second checked bags for you and a companion, save up to $320 per round-trip

- 25% back on United inflight purchases

- No foreign transaction fees

- APR: 21.99%–28.99% Variable

- Foreign Transaction Fees: $0

These United-branded credit cards come with complimentary travel accident insurance of up to $500,000 .

Chase Coverage Details and Conditions

Who is covered on chase-issued credit cards.

The primary cardholder, additional card holder, and immediate family members are covered for Chase Travel Accident Insurance.

Immediate family is defined as you (the cardholder), your spouse or domestic partner, you or your domestic partner’s children, including adopted children or step-children. Additionally, legal guardians or wards, siblings or siblings-in-law, parents or parents-in-law, grandparents, grandchildren, aunts/uncles, and nieces/nephews are covered.

Conditions for Coverage on Chase Cards

- Pay for the common carrier fare in full or in part with your eligible Chase card

- The accident occurs while riding as a passenger, boarding, exiting, or being struck by a common carrier on a covered trip

- The accident occurs at the airport, terminal, or station at the beginning or end of the common carrier-covered trip

Bottom Line: Many Chase credit cards come with travel accident insurance and since the definition of covered persons is so broad, benefits are provided for even extended family members.

There are several other travel rewards cards that offer Travel Accident Insurance to varying degrees.

Capital One-Issued Rewards Cards — All of Capital One’s Visa Signature and Mastercard Rewards cards come with Travel Accident Insurance coverage. Charge your entire travel fare to your card and receive up to $250,000 in benefits. You can read about our recommended Capital One Cards here.

Visa Infinite Credit Cards — Cardholders and dependents are covered when the common carrier ticket is purchased with the eligible card. Coverage is provided up to $500,000 for accidental death or dismemberment.

Wells Fargo Visa Signature Cards — Pays up to $1,000,000 when your common carrier ticket is paid for in full with your card.

Filing a claim for accidental death or severe injury is straightforward regardless of the issuing credit card institution. The first step is to contact the benefits administrator as soon as possible after the accident, generally no later than 30 days, by calling the number on the back of your card.

You could be asked to submit any of the following for documentation:

- Completed and signed claim form

- Proof of payment method for common carrier ticket

- Explanation of loss

- Death certificate, if applicable

- Medical records, if applicable

Bottom Line: Regardless of the credit card issuer, you’ll want to submit your claim on a timely basis and confirm that all the required documentation has been received by the benefits administrator to avoid any chance your claim being delayed or denied due to lack of information.

Travel Accident Insurance is just one travel protection offered complimentary on travel rewards credit cards. Look for these additional travel benefits when selecting a travel rewards card.

- Car rental collision damage waiver insurance — one of the most valuable travel benefits you can have is primary rental car insurance. Learn which cards are best for car rental insurance .

- Trip cancellation and trip interruption coverage — When your trip is canceled or delayed, it’s bound to result in unplanned expenses. Trip cancellation and interruption coverage will reimburse you for covered events that cause you to cancel your trip or cause disruption while your trip is in progress.

- Trip delay reimbursement — If your flight is delayed a specified number of hours, usually 12 hours or more, a benefit is paid to reimburse you for expenses such as lodging, transportation, meals, and necessary personal items

- Lost, damaged, or delayed luggage insurance — Chances are you’ll get paid by the airline if your baggage is lost, damaged, or delayed. This coverage will pay for eligible incidents where your out-of-pocket costs are more than the common carrier will cover.

- Travel and emergency assistance services — Help is just a phone call away, day or night, if something goes wrong during your travels. Get help finding an English speaking medical provider, legal services, or assistance replacing a lost passport.

- Emergency evacuation insurance — A few premium travel rewards cards such as the Amex Platinum Card and the Chase Sapphire Reserve provide emergency evacuation transportation services.

- Emergency medical coverage — The Amex Platinum Card, Chase Sapphire Preferred, and Chase Sapphire Reserve all offer limited reimbursement coverage for medical emergency expenses.

- Roadside dispatch – Premium travel rewards cards such as the Amex Platinum Card come with free roadside assistance. Other cards charge a flat discounted fee per service call. Roadside dispatch is a handy coverage to have on your card, in either case, if you should break down on the side of the road.

Bottom Line: Finding a card that has a package of complimentary travel protections and benefits you can use brings extra value that can save you money or provide peace of mind during your travels.

No one likes to think about having a severe accident happening during their travels. Chances are, you’ll never have to worry about using the travel accident insurance that comes with your card. However, just knowing it exists is enough.

It is not a key travel insurance coverage that causes you to weigh one travel rewards card over another. Selecting a card that offers a broader collection of travel protections and benefits you can use is a more prudent approach.

Always compare the coverage that comes on your card with a comprehensive travel insurance policy to determine if the complimentary coverage is adequate for your trip. If not, you can supplement the complimentary coverage easily and inexpensively.

All information and content provided by Upgraded Points is intended as general information and for educational purposes only, and should not be interpreted as medical advice or legal advice. For more information, see our Medical & Legal Disclaimers .

The information regarding the Marriott Bonvoy Bold ® Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding The World of Hyatt Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the United Club℠ Business Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Frequently Asked Questions

How does travel accident insurance work.

Travel accident insurance is an ancillary coverage that comes complimentary with many credit cards. It functions like a life insurance policy in the case of accidental death and pays a benefit in case of severe accidental injury (dismemberment or the loss of sight or hearing).

Coverage can range from $100,000 to $1,000,000 depending on the credit card for accidental death or severe injury when traveling on a common carrier such as a plane, train, or cruise ship.

The definition of who is covered also differs by credit card. Some cards cover only the cardholder, spouse, and dependent children under a certain age.

Other cards extend coverage to immediate family including in-laws, and step-children.

Travel accident insurance is not a secondary excess coverage. This means that even if you have other insurance coverage it will still pay the full appropriate benefit.

Some cards require that you pay for your entire common carrier ticket with your eligible card, others require that only a portion of your ticket be paid for with your card.

How do I know if my card has travel accident insurance?

The easiest way to find out if you have travel accident insurance is to call the number on the back of your card.

You can also access your printed Guide to Benefits that came with your card or go to your online credit card account and access the information there.

Additionally, you can request a copy of the Guide to Benefits be sent to you.

Does travel accident insurance cover rental cars?

Travel accident insurance does not cover accidents that happen with rental cars. However, chances are you have coverage for damage to the rental car either on your own auto insurance policy, car rental coverage that comes with your credit card, or coverage you purchased from the rental car company.

Travel accident insurance also does not cover accidental death or severe injury from an accident involving a rental car. Coverage is limited to accidents involving common carriers such as planes, trains, and cruises.

Is travel accident insurance important?

Chances are you will never have to use travel accident insurance. However, having it can give you peace of mind that if something drastic should happen during your travels, the coverage is there.

Travel accident insurance is just one benefit among many travel insurance benefits you should look for when selecting a travel rewards card.

It often comes included with other important travel benefits such as car rental insurance, trip interruption, trip cancellation, trip delay reimbursement, emergency travel assistance, and roadside assistance, plus others.

Selecting a card that has a full package of travel benefits you can use will bring the most value.

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Search Search Please fill out this field.

- Credit Cards

- Credit Card Basics

How Does Credit Card Travel Accident Insurance Work?

Know the key coverages before you leave

:max_bytes(150000):strip_icc():format(webp)/KhadijaKhartit-4f144e2b63ee4dd4af60ac8a02233c50.jpg)

What Is Travel Accident Insurance?

- What Does Credit Card Travel Accident Insurance Cover?

What Does Credit Card Travel Accident Insurance Not Cover?

How to file a travel accident claim, do i need travel accident insurance on my credit card.

Ippei Noei / Getty Images

We already know that travel is stressful. From planning to budgeting to packing, going on a trip involves a great deal of effort. Although it’s worth it in the end, juggling all the details can leave you feeling overwhelmed—especially when things go awry.

Fortunately, certain credit cards can offer aid in these circumstances. Depending on your card issuer, you may be eligible for credit card travel accident insurance. This insurance will cover you and your immediate family members in case of severe injury or death while you travel.

Credit card travel accident insurance is a benefit offered by a variety of card issuers. This insurance offers a payout in cases of severe injury or death for you and your family members while traveling. The maximum benefit varies based on the card you have, how you sustain your injuries, how severe those injuries are, and if you sustained them in transit or during a non-travel period of your trip.

Issuers That Offer Cards With Travel Accident Insurance

Chase offers travel accident insurance on many of its travel cards. The Chase Sapphire Reserve offers a maximum payout of up to $1 million depending on when and where the accident happens. Other Chase cards provide coverage up to $500,000:

- Chase Sapphire Preferred

- World of Hyatt

- Marriott Bonvoy Bold

- United Quest

Capital One’s Visa Signature cards offer up to $250,000 in coverage, while its World and World Elite Mastercard options provide up to $1 million.

Barclays credit cards provide travel accident insurance, but the coverage amounts and benefits vary based on which network (Visa or Mastercard) the card is part of, a Barclays representative told The Balance by email.

Most credit card policies offer “common carrier” travel accident insurance, which covers you while you’re entering, exiting, or riding as a passenger on a common carrier (plane, bus, taxi, courtesy shuttle, etc.). Chase Sapphire cards, however, offer 24-hour travel accident insurance. This insurance continues to cover you during the first 30 days of your trip. For trips longer than 30 days, check your guide to benefits for coverage limits.

Not every credit card has travel accident insurance. To find out if yours offers this service, check the guide to benefits that comes with your credit card. Within it, you’ll find all the perks your card offers, including travel accident insurance—if it’s available.

Fortunately for cardholders, it’s simple to qualify for your credit card’s travel accident insurance: Pay for the trip with your card. Some cards may specify that you’ll need to pay for the trip in full with your card, so splitting payments with other travelers may disqualify you. This doesn’t necessarily apply to using points or vouchers, so you can combine those with your card payment and still be eligible for travel accident insurance.

If you are involved in an accident while traveling or preparing for transit to and from your destination, you’ll need to file a claim with the credit card issuer’s benefits administrator. If the benefits administrator approves your claim, you or your beneficiaries will receive a cash benefit within the limits of the benefit.

What Does Credit Card Travel Accident Insurance Cover?

Warning: The following section contains information some readers may find disturbing.

In general, credit-card travel accident insurance covers accidental loss of life, limb, sight, speech, or hearing. Credit card issuers tend to have very specific rules for the maximum benefit you can receive based on when injury or death occurs.

For example, Chase travel accident insurance covers:

- Loss of at least four fingers above your middle knuckle, even if the fingers are reattached.

- Loss of at least three fingers and your thumb above their middle knuckles, even if the fingers are reattached.

- Permanent loss of vision in one or both eyes, where remaining eyes have 20/200 vision or worse.

- Loss of feet severed at or above the ankle joint.

- A death that occurs during travel, or that occurs because of the accident within 365 days of the incident.

- Injury caused by accidental consumption of a substance contaminated by bacteria.

Coverage amounts for each injury depend on the severity of the injury. Travel insurance available on Capital One Visa Signature cards pays out the full $250,000 for accidental loss of life, two or more body parts, and sight in both eyes, but only pays $125,000 for the loss of one body part, sight in one eye, and speech or hearing.

Your card’s guide to benefits has all the specific details about what is covered and coverage amounts. If you have any questions, call the benefits administrator listed in the benefits guide.

In most cases, your travel accident insurance won’t cover injuries or death that happen during certain types of activities.

Capital One Visa Signature cards don’t cover death or injury resulting from war, acts of terrorism, travel between your residence and work, and flights on planes owned by Capital One Financial.

The Chase Sapphire Reserve doesn’t cover death or injury resulting from the commission of an illegal act, parachute jumping and vehicular races, sporting events in which there is a cash prize, and trips taken on aircraft that don’t have government registration or certification.

Neither Capital One nor Chase cover the cost of emotional trauma, mental illness, disease, pregnancy, childbirth, or miscarriage.

If you find yourself in an accident resulting in an injury severe enough to warrant using your travel accident insurance, then you’ll need to file a claim. The process for filing a claim varies by card. Chase and Capital one, for example, both require you to file a written claim within 20 days after your accident.

Credit-card issuers typically use a third-party insurance company to handle travel accident claims. The company's contact information should be available in your card’s benefits guide.

The benefits administrator or insurance company will send you forms within a defined period. You’ll need to return them soon thereafter to receive your payout, although you may get leeway if you aren’t able to respond quickly because of your injuries. Documents you may have to provide include:

- Completed and signed claim form

- Travel itinerary

- Police report confirming the claimed accident

- The credit card account statement showing the charge for the common carrier or scheduled airline fare

- Copy of the death certificate

Be sure to check with your card issuer for specific details about filing a travel accident claim.

Finally, be aware that filing a claim for your travel accident insurance isn’t affected by any other health or travel insurance that you possess. You’ll receive your payout regardless of other coverages you have.

Since credit card travel accident insurance covers instances of severe injury or death, it may make sense for you if you’re a frequent traveler and would like a supplement to a life insurance policy.

If that doesn’t sound like something that applies to you, you may want to look for a credit card that provides a different type of travel insurance. Cards like the Platinum Card from American Express offer benefits such as a global assistance hotline through which you can arrange for emergency medical evacuation at no cost to you. Additional types of insurance include trip delay or trip cancellation insurance , which can reimburse in the case of lost luggage , missed flight connections, or delayed flight departures.

Chase. " Sapphire Reserve Travel Benefits ."

Chase. " Marriott Bonvoy Bold Benefits ."

United Quest Card. " Travel Protection ."

World of Hyatt Credit Card. " Travel Protection ."

Chase Sapphire Preferred. " Travel Accident Insurance ."

Capital One. " Your Guide to Benefits: Visa Signature Card ," Page 8.

Capital One. " Capital One World Mastercard Guide to Benefits ," Page 12.

Capital One. " Capital One World Elite Mastercard Guide to Benefits ," Page 12.

What’s covered by credit card travel accident and emergency evacuation insurance?

Editor's Note

Many perks available from your credit cards are well-known and well-utilized. However, benefits such as trip cancellation insurance , delayed baggage insurance , lost baggage insurance , and trip delay protection can quite literally save the day and justify paying an annual fee.

Today, we'll explain a couple of lesser-known benefits that you hopefully won't have to use but, if needed, can protect you from extreme financial hardship and ensure your family and loved ones are provided for if something happens to you.

You can easily find the coverage and terms of any protection your travel credit card offers by doing a quick web search for the card's updated benefits guide. These benefits are not exclusive to travel credit cards , and many standard credit cards come with travel protection and insurance.

Travel accident insurance

Often called common carrier insurance , this policy pays in case of death, loss of eyesight or loss of limb(s) while on a plane, train, ship or bus licensed to carry passengers and available to the public. A few cards also have travel accident insurance that offers protection for the entire duration of a trip (up to 31 days long) but pays out less than the common carrier insurance policies. To be eligible, you must typically pay for the entire fare with the credit card.

Different credit cards have different payment tables for how much your beneficiary would receive in case of death, losing one limb, losing two limbs, losing sight in one eye or becoming legally blind. Coverage is also typically extended to authorized users on the account, spouses, domestic partners, and dependent children of the cardholder on trips paid for with the card.

By default, the beneficiaries in order of precedence are spouse, then children, then estate. You can submit a letter to the card issuer to establish another beneficiary.

Emergency evacuation insurance

In the past, when traveling to remote destinations like the Maldives and Fiji, I bought third-party emergency medical evacuation insurance , not realizing the cards I already had would have covered me. There are a few crucial aspects of emergency evacuation insurance offered by credit cards that you need to understand and follow so you don't compound your medical situation with the stress of financial hardship:

- Everything must be approved and coordinated through a benefits administrator. This is who you or your companions should call when things first start to look like you'll need assistance. You will not be reimbursed for anything that you decide to pay for on your own.

- Evacuation does not mean repatriation. If you're far overseas, you won't be evacuated back to the U.S. Most policies state you'll be moved to the nearest medical facility capable of proper care.

- Preexisting conditions may lead to your request for evacuation at the credit card provider's expense being denied. Read your credit card's full terms and benefits guide to see which exclude these conditions and the credit card's definition of a preexisting condition.

- The coverage is only for the cost of evacuation and medical care during transportation. Once you're back on the ground, you still need medical insurance to pay the doctors and staff who provide care.

- Some cards have country exclusions, so don't expect to head into Syria or Afghanistan and rely on your credit card benefits administrator to get you to a hospital.

To get all the relevant information, download and read the entire section of the benefits guide pertaining to these coverages. Here are a few cards offering travel accident and/or emergency evacuation insurance.

The Platinum Card® from American Express

The Amex Platinum card removed travel accident insurance in 2020. However, it still offers the most generous emergency evacuation insurance of any card.

There's no cost cap , and benefits are extended to immediate family and children under 23 (or under 26 if enrolled full-time in school). Best of all, you don't even have to use the card to pay for the trip.

You must be on a trip less than 90 days in length and at least 100 miles away from your residence. A Premium Global Assist (PGA) administrator must coordinate everything to not incur any cost. The benefit will also pay economy airfare for a minor under 16 to be returned home if left unattended, pay for an escort to accompany that minor if required to get them home and get a family member to the place of treatment if hospitalization of more than 10 consecutive days is expected.*

Other American Express cards offer access to the Premium Global Assist Hotline. However, anything they coordinate will be at your expense. Make sure you read your Amex card's benefits guide carefully.

For more details, see our full review of the Amex Platinum .

Related: Your complete guide to Amex travel protections

*Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, cardmembers are responsible for the costs charged by third-party service providers.

Apply here: Amex Platinum

Chase Sapphire Reserve® and Chase Sapphire Preferred® Cards

The Chase Sapphire Reserve ® offers two travel accident insurance benefits : common carrier travel accident insurance and 24-hour travel accident insurance. The former applies while riding as a passenger in, entering or exiting any common carrier. The latter applies any time during your trip — but you cannot be paid out on both the common carrier and 24-hour policies.

If you use your Chase Ultimate Rewards points to book your trip, you are covered under the card's benefits.

People eligible for coverage include "you, your spouse, your spouse's or domestic partner's children, including adopted children or stepchildren; legal guardians or wards; siblings or siblings-in-law; parents or parents-in-law; grandparents or grandchildren; aunts or uncles; nieces or nephews." Chase pays up to $1,000,000 for a common carrier loss and up to $100,000 for a 24-hour policy loss based on the following table:

Some interesting exclusions with Chase that would prevent a payout include the insured person participating in a motorized vehicular race or speed contest, the insured person participating in any professional sporting activity for which they received a salary or prize money or if the insured person traveling or flying on any aircraft engaged in flight on a rocket-propelled or rocket-launched aircraft.

The Chase Sapphire Reserve® also offers emergency evacuation insurance. If you or an immediate family member paid for at least a portion of your trip with the card, you're eligible for up to $100,000 in emergency medical evacuation.

Your covered trip must last between five and 60 days and be at least 100 miles from your residence. If you are hospitalized for more than eight days, the benefits administrator can arrange for a relative or friend to fly round-trip in economy class to your location. If your original ticket cannot be used, you can also be reimbursed for the cost of an economy ticket home. In a worst-case situation, the benefit also pays up to $1,000 to repatriate your remains.

The Chase Sapphire Preferred Card offers the same travel accident insurance as the Reserve, except with lower payouts on the common carrier policy. The benefits pay up to $500,000 for a common carrier loss and up to $100,000 for a 24-hour policy loss based on the following table:

For more details, see our full reviews of the Chase Sapphire Reserve and Chase Sapphire Preferred .

Related: Your guide to Chase's trip insurance coverage

Apply here: Chase Sapphire Reserve and Chase Sapphire Preferred

United Club℠ Infinite Card

The top-tier United Club℠ Infinite Card offers travel accident and emergency evacuation insurance. The travel accident insurance benefits pay up to $500,000 for a common carrier loss.

The card also carries the same benefit as the Chase Sapphire Reserve for emergency evacuation coverage, with up to $100,000 of coverage provided for evacuation.

For more details, see our full review of the United Club Infinite Card .

Apply here: United Club Infinite

Bottom line

We hope none of us perfectly ever have to worry about either of these policies, but it's nice to have peace of mind if you or your family need emergency assistance. This reassurance is one more reason to ensure one of these cards is always in your wallet when traveling.

The benefit guides of all cards are updated regularly, so make sure you don't toss them in the trash when updates show up in the mail and read the online guides for the latest terms and conditions.

Related: The best credit cards with travel insurance

franckreporter/Getty Images

Advertiser Disclosure

Guide to travel insurance with credit cards

As you plan your next trip, check your credit cards for their travel insurance benefits

Published: July 13, 2022

Author: Susan Ladika

Editor: Grace Pilling

Reviewer: Kaitlyn Tang

How we Choose

This guide features what’s included in travel insurance and how to assess what coverage you need based on your trip type, destination and length.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. Please review our list of best credit cards , or use our CardMatch™ tool to find cards matched to your needs.

Travel insurance has your back when the unexpected happens on a trip. In fact, many countries—from Anguilla to the United Arab Emirates—require visitors to have travel insurance upon arrival.

One way to protect your investment in a grand getaway or storybook honeymoon is through travel insurance. A number of credit cards offer travel insurance , covering everything from canceled or interrupted travel to lost luggage and damage to a rental car. That said, the type of coverage varies.

According to Carol Mueller, vice president of Berkshire Hathaway Travel Protection, about 25 percent to 30 percent of leisure travelers in the United States purchase travel insurance.

But before you purchase a travel insurance policy for your next vacation or hop on a flight assuming your credit card’s got you covered, here’s what you should know about travel insurance and how to pick the right coverage for you.

- What is travel insurance?

Travel insurance (sometimes called trip insurance) will reimburse your prepaid travel expenses if things go awry or compensate you in the event of an emergency.

Depending on the type of coverage you have — either offered via a credit card or with a travel insurance policy you paid for — you may get your money back if you have to cancel the trip before you depart or if you cut your trip short for an unforeseen reason.

Credit cards may include types of coverage that you won’t find with a travel insurance policy you purchase, such as coverage for rental cars. And the travel insurance you purchase may offer coverage that your card doesn’t include, such as medical evacuation insurance.

- Who needs travel insurance?

In some cases, the insurance benefits provided by your credit card may be enough. In other cases, you might want to boost your benefits by purchasing travel insurance. The difference may depend on where you’re headed and how much the trip costs.

If you spend $200 on an airline ticket to visit your parents one state over, you might not need additional travel insurance. But if you’re going on a cruise that costs thousands of dollars and need to make payments months in advance, you might want the extra protection that travel insurance offers.

To determine what kind of travel insurance you need, including how much coverage you need in terms of dollars, consider the following questions:

- Will you be traveling domestically or internationally?

- How long will you be traveling? Is it a short trip (seven days or less) or a long trip?

- Are you traveling for business, pleasure or an emergency?

For example, if you’re going on a quick business trip, you will likely not need the same level of travel insurance coverage as if you’re heading out on a weeklong vacation outside the U.S.

How much does travel insurance cost?

If you have a credit card that offers travel insurance, then there’s no extra cost. You generally need to just use that card to pay for the trip in order to be eligible for coverage.

If your cards don’t meet your travel insurance needs — or you just want to be covered for any contingency — you may want to supplement your coverage by purchasing a travel insurance policy.

A travel insurance policy usually costs about 5 percent to 7 percent of the cost of the trip, Mueller says.

The main factors in the price of a travel insurance policy are the type of trip, including cost, length and destination, and the traveler’s age and any existing medical conditions.

What are the types of travel insurance?

There can be big differences between credit card coverage and a travel insurance policy you pay for out of pocket. The types of coverage offered can also vary greatly from one credit card to another.

Trip cancellation and trip interruption insurance

Trip cancellation insurance can reimburse your nonrefundable travel costs if you need to cancel your trip for a covered reason, such as illness or injury, before you depart.

Trip interruption insurance can reimburse your costs when you’re already on the road and your trip is interrupted for a covered reason, such as an illness or a natural disaster.

Many credit cards provide either trip cancellation, trip interruption insurance or both. There can be wide variations in coverage limits for trip cancellation/interruption insurance, and premium cards usually offer more generous policies.

For example, the Chase Sapphire Reserve , which has a hefty $550 annual fee, offers both trip interruption and cancellation insurance that provides coverage of up to $10,000 per person (up to $20,000 per trip) for prepaid, nonrefundable travel expenses. Meanwhile, the no-annual-fee Wells Fargo Visa Signature credit card * provides up to $2,000 per person in trip cancellation or interruption insurance.

Travel accident insurance

Travel accident insurance (often called flight accident insurance or accidental death and dismemberment insurance) is included with several credit cards. This insurance can provide a payout if you are killed or lose a limb or one of your senses — such as sight or hearing — while traveling on a common carrier.

The Capital One Venture Rewards Credit Card , for example, provides up to $250,000 of such insurance.

Emergency medical and evacuation insurance

This type of insurance covers emergency evacuation if you or your spouse, domestic partner or dependent children become seriously injured or ill while you’re traveling. Both the Citi Prestige® Card * and Chase Sapphire Reserve cards cover emergency services and transportation up to $100,000.

Once you are evacuated to a hospital, though, you may have to foot your own medical bills.

According to Steven Benna, spokesperson for the travel insurance site Squaremouth.com, Medicare generally does not pay if you have a medical emergency outside of the United States, and many private health insurance plans may not cover you if you’re traveling abroad.

Travel insurance policies you purchase on your own can include both emergency evacuation insurance and emergency medical insurance.

‘Cancel for any reason’ insurance

Cancel for any reason (CFAR) insurance will allow you to earn refunds on hotels and flights even if you cancel these reservations for reasons not included by traditional travel insurance policies.

These policies can be expensive, with most carriers who provide them offering them as an upgrade to a traditional travel insurance policy. Not all CFAR policies reimburse all your travel costs. Some policies, for instance, only reimburse you for 75 percent of your costs.

Trip delay insurance

Both comprehensive travel insurance policies and many credit cards, including some airline credit cards , will cover your expenses if your trip is delayed for a certain amount of time. The United Explorer Card , for example, will cover expenses such as meals or lodging if your trip is delayed more than 12 hours or if an overnight stay is required.

Lost or delayed baggage

Comprehensive travel insurance will typically cover the purchase of clothing and other essentials if your baggage is delayed. Some credit cards will also cover lost or delayed luggage. The Capital One Venture Rewards Card, for example, reimburses you for up to $3,000 if your luggage is lost.

Auto insurance

Credit cards may also offer travel protections that extend beyond flights, hotels and cruises. A number of credit cards, including the American Express® Gold Card , will cover you if you decline the collision damage waiver when renting a car and your rental vehicle is damaged or stolen.

Comprehensive insurance

Comprehensive insurance is by far the most popular type of coverage sold by travel insurance companies, Mueller says.

It bundles different coverages for one flat fee and can include trip interruption and cancellation insurance, accidental death and dismemberment insurance, travel delay insurance, emergency medical, dental and evacuation insurance and baggage delay insurance.

Who is covered by travel insurance?

Benefits provided by your credit card may cover you, your spouse or domestic partner and your dependent children. If you purchase travel insurance, you can buy a policy just for yourself or for your whole family if you are traveling together.

Be sure to check your benefit details or clearly communicate with an insurance provider when purchasing a policy to ensure your travel insurance offers sufficient coverage for all travelers in your party who need it.

- How to find travel insurance

If you’ve got a trip coming up, first check your credit cards to see which types of coverage they provide. Travel insurance benefits on Chase cards , for example, tend to be impressive, especially on cards with a higher annual fee. You can also find solid travel insurance benefits with American Express and other issuers.

If you’re in the market for a new card and you’ve got a big trip on the horizon, you might want to check the travel benefits offered before applying for the card. You might even land a sweet sign-up bonus that will help cover some of your travel costs.

If you want to supplement your card benefits with other coverage, reach out to your current provider for home or auto insurance or check out travel insurance aggregators such as InsureMyTrip or SquareMouth .

Mueller recommends buying travel insurance within 15 days of making a deposit or paying for your trip.

Considering many policies have exclusions for preexisting conditions, you don’t want to be diagnosed with a disease and then be unable to buy travel insurance. Another reason to buy insurance well ahead of your trip includes the potential for unforeseen circumstances, such as a natural disaster or terrorist attack near or at your trip’s destination.

What to look out for with travel insurance

Changes to your credit card benefits.

Even if one of your credit cards offered travel insurance when you initially signed up, card issuers can change or remove benefits, so be sure to check your coverage before you depart. By the same token, perhaps you’re unaware of coverage offered by a card or, less commonly, one of your existing cards may also start offering travel insurance, so it’s wise to check the offerings on all your cards before a trip.

Exclusions and fine print

Both travel insurance that comes with your credit card and coverage you purchase will have exclusions, so read the fine print . For example, travel insurance typically won’t cover you for preexisting medical conditions or if you’re traveling against the advice of a physician.

Accidents arising from certain activities may also be excluded from coverage — if you’re participating in a competitive sport, for example, or a high-risk activity like sky diving. If your itinerary includes such activities, you might be able to purchase a special policy, often tagged as an “adventurer” package.

Bottom line

Whatever you do and wherever you go on your next trip, you’ll want to be prepared. To be safe, be sure your next trip’s planning involves checking your credit card travel insurance benefits and purchasing additional travel insurance if you feel it’s needed.

*All information about Wells Fargo Visa Signature and Citi Prestige has been collected independently by CreditCards.com. The issuer did not provide the content, nor is it responsible for its accuracy.

Editorial Disclaimer

The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. It has not been provided or commissioned by the credit card issuers. However, we may receive compensation when you click on links to products from our partners.

Susan Ladika spent more than three decades working as a journalist, reporting everywhere from Bali to Bosnia to Tampa Bay. Susan began writing about the fascinating field of personal finance for CreditCards.com and Bankrate during the heart of the Great Recession, when everyone wanted to learn how to save money and spend what they had more wisely. Over the years she’s written about a wide range of personal finance topics, including credit cards and debit cards, financial scams and frauds, savings and checking accounts, real estate and insurance.

On this page

- Cost of travel insurance

- Types of travel insurance

- Who is covered?

- What to look out for

Essential reads, delivered straight to your inbox

Stay up-to-date on the latest credit card news 一 from product reviews to credit advice 一 with our newsletter in your inbox twice a week.

By providing my email address, I agree to CreditCards.com’s Privacy Policy

Your credit cards journey is officially underway.

Keep an eye on your inbox—we’ll be sending over your first message soon.

Learn more about Education

Best credit cards for international travel

The best credit cards for international travel can make traversing the globe a more comfortable and rewarding experience. Compare our top picks to see how they work for your travel style and goals.

Best no-annual-fee travel credit cards of 2023

Looking for the best travel rewards with no annual fee doesn’t have to be hard. There are plenty of great credit cards you can explore to help you earn and redeem rewards for travel.

Best credit cards for trip cancellation

What to know about prepaid travel credit cards

10 credit and money tips for travel abroad

TSA PreCheck vs. Global Entry vs. Clear: Which is best for you?

Explore more categories

- Card advice

- Credit management

- To Her Credit

Questions or comments?

Editorial corrections policies

CreditCards.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which CreditCards.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval also impact how and where products appear on this site. CreditCards.com does not include the entire universe of available financial or credit offers. CCDC has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Since 2004, CreditCards.com has worked to break down the barriers that stand between you and your perfect credit card. Our team is made up of diverse individuals with a wide range of expertise and complementary backgrounds. From industry experts to data analysts and, of course, credit card users, we’re well-positioned to give you the best advice and up-to-date information about the credit card universe.

Let’s face it — there’s a lot of jargon and high-level talk in the credit card industry. Our experts have learned the ins and outs of credit card applications and policies so you don’t have to. With tools like CardMatch™ and in-depth advice from our editors, we present you with digestible information so you can make informed financial decisions.

Our top goal is simple: We want to help you narrow down your search so you don’t have to stress about finding your next credit card. Every day, we strive to bring you peace-of-mind as you work toward your financial goals.

A dedicated team of CreditCards.com editors oversees the automated content production process — from ideation to publication. These editors thoroughly edit and fact-check the content, ensuring that the information is accurate, authoritative and helpful to our audience.

Editorial integrity is central to every article we publish. Accuracy, independence and authority remain as key principles of our editorial guidelines. For further information about automated content on CreditCards.com , email Lance Davis, VP of Content, at [email protected] .

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.