Key Statistics

Current financial information.

*Starting in Q1 2023 we have disclosed and reconciled Gross Margin Yields and Net Yields, as defined in our Quarterly Report on Form 10-Q for the three months eneded March 31, 2023. We utililze these financial metrics to measure relevant rate comparisons to the corresponding periods in 2019, which is the last year of normalized operations, given our 2022 and 2021 reduction in capacity and revenues, due to the impact of the COVID-19 pandemic on our operations.

Historical Financial Information

Capital structure*, capital structure* (see 10-k), fleet expansion projects.

Cautionary Statement Concerning Forward-Looking Statements

Certain statements in this release relating to, among other things, our future performance estimates, forecasts and projections constitute forward-looking statements under the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to: statements regarding revenues, costs and financial results for 2020 and beyond. Words such as “anticipate,” “believe,” “could,” “driving,” “estimate,” “expect,” “goal,” “intend,” “may,” “plan,” “project,” “seek,” “should,” “will,” “would,” “considering”, and similar expressions are intended to help identify forward-looking statements. Forward-looking statements reflect management’s current expectations, are based on judgments, are inherently uncertain and are subject to risks, uncertainties and other factors, which could cause our actual results, performance or achievements to differ materially from the future results, performance or achievements expressed or implied in those forward-looking statements. Examples of these risks, uncertainties and other factors include, but are not limited to the following: the impact of the global incidence and spread of COVID-19, which has led to the temporary suspension of our operations and has had and will continue to have a material adverse impact on our business and results of operations, or other contagious illnesses on economic conditions and the travel industry in general and the financial position and operating results of our Company in particular, such as: the current and potential additional governmental and self-imposed travel restrictions, the current and potential extension of the suspension of cruises and new additional suspensions, guest cancellations; our ability to obtain sufficient financing, capital or revenues to satisfy liquidity needs, capital expenditures, debt repayments and other financing needs; the effectiveness of the actions we have taken to improve and address our liquidity needs; the impact of the economic and geopolitical environment on key aspects of our business, such as the demand for cruises, passenger spending, and operating costs; incidents or adverse publicity concerning our ships, port facilities, land destinations and/or passengers or the cruise vacation industry in general; concerns over safety, health and security of guests and crew; further impairments of our goodwill, long-lived assets, equity investments and notes receivable; an inability to source our crew or our provisions and supplies from certain places; the incurrence of COVID-19 and other contagious diseases on our ships and an increase in concern about the risk of illness on our ships or when traveling to or from our ships, all of which reduces demand; unavailability of ports of call; growing anti-tourism sentiments and environmental concerns; changes in US foreign travel policy; the uncertainties of conducting business internationally and expanding into new markets and new ventures; our ability to recruit, develop and retain high quality personnel; changes in operating and financing costs; our indebtedness, any additional indebtedness we may incur and restrictions in the agreements governing our indebtedness that limit our flexibility in operating our business, including the significant portion of assets that are collateral under these agreements; the impact of foreign currency exchange rates, interest rate and fuel price fluctuations; the settlement of conversions of our convertible notes, if any, in shares of our common stock or a combination of cash and shares of our common stock, which may result in substantial dilution for our existing shareholders; our expectation that we will not declare or pay dividends on our common stock for the near future; vacation industry competition and changes in industry capacity and overcapacity; the risks and costs associated with protecting our systems and maintaining integrity and security of our business information, as well as personal data of our guests, employees and others; the impact of new or changing legislation and regulations or governmental orders on our business; pending or threatened litigation, investigations and enforcement actions; the effects of weather, natural disasters and seasonality on our business; emergency ship repairs, including the related lost revenue; the impact of issues at shipyards, including ship delivery delays, ship cancellations or ship construction cost increases; shipyard unavailability; and the unavailability or cost of air service.

In addition, many of these risks and uncertainties are currently heightened by and will continue to be heightened by, or in the future may be heightened by, the COVID-19 pandemic. It is not possible to predict or identify all such risks.

More information about factors that could affect our operating results is included under the caption “Risk Factors” in our most recent quarterly report on Form 10-Q, as well as our other filings with the SEC, and the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our most recent annual report on Form 10-K, copies of which may be obtained by visiting our Investor Relations website at www.rclinvestor.com or the SEC’s website at www.sec.gov . Undue reliance should not be placed on the forward-looking statements in this release, which are based on information available to us on the date hereof. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Press Releases

Royal caribbean group reports first quarter 2022 results and provides a business update.

MIAMI – May 5, 2022 – Royal Caribbean Group (NYSE: RCL) today reported first quarter 2022 net loss of $(1.2) billion and loss per share of $(4.58). The Group continues to make strides in its healthy return to operations in a strong demand environment. Load factors continue to improve sequentially with total revenue per Passenger Cruise Day up versus record 2019 levels. Operating cash flow significantly improved throughout the first quarter and approached breakeven in March.

“It is gratifying to see our ships and crew returning to our mission of delivering the best vacation experiences in a safe and responsible way,” said Jason Liberty, president and chief executive officer of the Royal Caribbean Group. “Despite the impact of Omicron earlier in the year and the horrific conflict in Ukraine, we are encouraged by the strong demand for cruising and the steady acceleration in booking volumes,” Liberty added. “Since the beginning of March, booking volumes have exceeded the record levels achieved in 2019 and we are optimistic that 2022 will be a strong transitional year as we return to full operations and profitability in the second half of the year.”

Business Highlights

- By the end of the first quarter of 2022, the Group had returned 54 out of 62 ships to operations across its five brands, representing close to 90% of worldwide fleet capacity.

- During the first quarter, the Group carried approximately 800,000 guests and achieved record guest satisfaction scores and record total revenue per Passenger Cruise Day.

- The Group continues to make progress towards profitability with operating cash flow only slightly negative in March and turning positive in April.

- The Group expects to return the full fleet to operations before the summer season of 2022.

- Across all markets, bookings in the first quarter of 2022 were higher than in the fourth quarter of 2021, and throughout the first quarter, bookings improved each week.

- In March and April, booking volumes have been significantly higher than the same period in 2019.

- The second half of the year is booked slightly below historical ranges but at higher prices than 2019, with and without future cruise credits (FCCs). Based on the strong and close-in nature of bookings, the company expects load factors will continue to improve each quarter and expects fleetwide load factors to exceed 100% by year end.

- For 2023, all quarters are currently booked within historical ranges at record pricing.

- The Group is managing through inflationary and supply chain challenges, mainly related to fuel and food costs, as well as transitory costs related to health and safety protocols, which are expected to weigh on 2022 earnings.

- The Group expects a return to net profit for the second half of 2022.

First Quarter 2022

The Company reported Net Loss for the first quarter of 2022 of $(1.2) billion or $(4.58) per share compared to Net Loss of $(1.1) billion or $(4.66) per share in the prior year. The Company also reported Adjusted Net Loss of $(1.2) billion or $(4.57) per share for the first quarter of 2022 compared to Adjusted Net Loss of $(1.1) billion or $(4.44) per share in the prior year. The Net Loss and Adjusted Net Loss for the quarter are primarily the result of the continued impact of the COVID-19 pandemic on the business.

The Group made significant progress in its recovery trajectory in the first quarter mainly due to continued strong demand for cruising and nimble execution in a challenging operating environment. During the first quarter, four additional ships resumed operations. The company continues to thoughtfully ramp up the fleet and load factors while emphasizing industry-leading health and safety standards, world-class guest experiences and financial prudence.

Ships that operated the Group's core itineraries in the first quarter achieved a load factor of 59%. Core itineraries exclude sailings during the early ramp-up period of up to four weeks. First quarter load factor was 57% with month-over-month sequential improvements. March load factors were 68%. Total revenue per Passenger Cruise Day in the first quarter was up 4% versus record 2019 levels driven by continued strong onboard revenue performance. Cash flow from ships in operation was positive in the first quarter. The Groups’ cruise operating expenses per Available Passenger Cruise Days (APCD) improved in the first quarter 2022 from the fourth quarter 2021 despite inflationary pressures and elevated health protocol costs.

Continued Fleet Ramp-Up

The Group’s fleet size expanded to 63 with the delivery of Wonder of the Seas and Celebrity Beyond in the first quarter and early second quarter, respectively. These ships, along with six other new ships which have joined the fleet over the last 20 months and represent over 10% of total capacity, are significantly contributing to yield growth and profitability. The Group expects its entire fleet of 63 ships will be operational by the beginning of the 2022 summer season.

The Group is now offering cruises in almost all of its destinations. Australia, one of the last remaining countries to re-open, announced the resumption of cruising effective April 2022. The Group expects to return to Australia for the local summer season in the fourth quarter of 2022. China remains closed to cruising due to the ongoing lockdowns. While the Group remains optimistic to capture long-term growth opportunities in that market, ships planned for China have been temporarily redeployed to other markets.

The Group expects to operate approximately 10.3 million Available Passenger Cruise Days (APCD) for the second quarter with load factors of 75% to 80%. The Group also expects cash flow from ships in operation to be positive in the second quarter. Operating cash flow significantly improved throughout the first quarter and is turning positive in April.

Update on Bookings

Booking volumes in the first quarter improved consistently week-over-week and reached typical Wave levels at the end of the quarter. Bookings have now been surpassing comparable 2019 levels for the last two months with particularly strong trends for North America based itineraries. In addition, the elevated cancellations experienced earlier in the year returned to pre-Omicron levels as cases subsided in February. While load factors for sailings in the second half of 2022 are currently slightly below historical levels, consumers are booking their cruises closer to sailing and the Group is capitalizing on that healthy close-in demand to improve load factors. For the full year and the second half of 2022, pricing remains higher than in 2019 both including and excluding FCCs.

Bookings for Europe sailings improved throughout the first quarter but softened due to the war in Ukraine with a bigger impact on Baltic itineraries. While bookings for Europe are now exceeding 2019 levels for the same period, the situation in Ukraine is expected to weigh on load factors in Europe this summer.

"The performance of our core business continues to strengthen, fueled by strong demand and excellent operational execution,” said Naftali Holtz, chief financial officer at Royal Caribbean Group. “Our near-term focus is to return to full operations and profitability as we execute on our recovery and build for long term success.”

As of March 31, 2022, the company's customer deposit balance was $3.6 billion. This represents an improvement of about $400 million over the previous quarter despite the significant quarter-over-quarter increase in revenue recognition and near-term cancellations due to the Omicron variant, both of which reduced the customer deposit balance. The customer deposit balance at the end of the first quarter of 2022 was similar to the March 31, 2019 balance for the three brands. Approximately 27% of the customer deposit balance is related to FCCs compared to 32% in the prior quarter, a positive trend indicating new demand. To date, approximately 56% of FCCs have been redeemed.

Liquidity and Financing Arrangements

As of March 31, 2022, the company’s liquidity position was $3.8 billion, which includes cash and cash equivalents, undrawn revolving credit facility capacity, and a $700 million commitment for a 364-day term loan facility.

In January, the company completed an issuance of $1 billion of 5.375% senior unsecured notes. These notes are due in 2027 with proceeds to be used to repay principal payments on debt maturing in 2022. In February, the company entered into a $3.15 billion backstop facility, which provides flexibility in refinancing debt maturities due in June 2023.

Net interest expense for the second quarter of 2022 is expected to be in the range of $300-$310 million.

Fuel Expense

Bunker pricing, net of hedging, for the first quarter was $588 per metric ton and consumption was 321,000 metric tons.

Consumption is 55% hedged via swaps for the remainder of 2022 and 25% hedged for 2023. For the remainder of 2022 and all 2023, the annual average cost per metric ton of the fuel swap portfolio is approximately $483 and $585, respectively.

Based on current fuel prices, the company expects approximately $271 million of fuel expense in its second quarter 2022 at an average pricing of $695 per metric ton net of hedging.

Capital Expenditures

The expected capital expenditures for 2022 are $3.0 billion. These expenditures are mainly driven by new shipbuilding projects that have committed financing.

Depreciation and amortization expenses for the second quarter of 2022 are expected to be in the range of $350-$355 million.

CONFERENCE CALL SCHEDULED

The Company has scheduled a conference call at 10:00 a.m. Eastern Time today. This call can be heard, either live or on a delayed basis, on the Company's Investor Relations website at www.rclinvestor.com .

About Royal Caribbean Group

Royal Caribbean Group (NYSE: RCL) is one of the leading cruise companies in the world with a global fleet of 63 ships traveling to approximately 1,000 destinations around the world. Royal Caribbean Group is the owner and operator of three award winning cruise brands: Royal Caribbean International, Celebrity Cruises, and Silversea Cruises and it is also a 50% owner of a joint venture that operates TUI Cruises and Hapag-Lloyd Cruises. Together, the brands have an additional 11 ships on order as of March 31, 2022. Learn more at www.royalcaribbeangroup.com or www.rclinvestor.com .

Cautionary Statement Concerning Forward-Looking Statements

Certain statements in this press release relating to, among other things, our future performance estimates, forecasts and projections constitute forward-looking statements under the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to: statements regarding revenues, costs and financial results for 2021 and beyond. Words such as “anticipate,” “believe,” “could,” “driving,” “estimate,” “expect,” “goal,” “intend,” “may,” “plan,” “project,” “seek,” “should,” “will,” “would,” “considering”, and similar expressions are intended to help identify forward-looking statements. Forward-looking statements reflect management’s current expectations, are based on judgments, are inherently uncertain and are subject to risks, uncertainties and other factors, which could cause our actual results, performance or achievements to differ materially from the future results, performance or achievements expressed or implied in those forward-looking statements. Examples of these risks, uncertainties and other factors include, but are not limited to the following: the impact of the global incidence and spread of COVID-19, which has led to the temporary suspension of our operations and has had and will continue to have a material adverse impact on our business, liquidity and results of operations, or other contagious illnesses on economic conditions and the travel industry in general and the financial position and operating results of our Company in particular, such as: the current and potential additional governmental and self-imposed travel restrictions, the current and potential extension of the suspension of cruises and new additional suspensions, guest cancellations; our ability to obtain sufficient financing, capital or revenues to satisfy liquidity needs, capital expenditures, debt repayments and other financing needs; the effectiveness of the actions we have taken to improve and address our liquidity needs; the impact of the economic and geopolitical environment on key aspects of our business including the conflict between Ukraine and Russia, such as the demand for cruises, passenger spending, and operating costs; incidents or adverse publicity concerning our ships, port facilities, land destinations and/or passengers or the cruise vacation industry in general; our ability to accurately estimate our monthly cash burn rate during the suspension of our operations; concerns over safety, health and security of guests and crew; any protocols we adopt across our fleet relating to COVID-19, such as those recommended by the Healthy Sail Panel, may be costly and less effective than we expect in reducing the risk of infection and spread of COVID-19 on our cruise ships; further impairments of our goodwill, long-lived assets, equity investments and notes receivable; an inability to source our crew or our provisions and supplies from certain places; the incurrence of COVID-19 and other contagious diseases on our ships and an increase in concern about the risk of illness on our ships or when traveling to or from our ships, all of which reduces demand; unavailability of ports of call; growing anti-tourism sentiments and environmental concerns; changes in US foreign travel policy; the uncertainties of conducting business internationally and expanding into new markets and new ventures; our ability to recruit, develop and retain high quality personnel; changes in operating and financing costs; our indebtedness, any additional indebtedness we may incur and restrictions in the agreements governing our indebtedness that limit our flexibility in operating our business, including the significant portion of assets that are collateral under these agreements; the impact of foreign currency exchange rates, interest rate and fuel price fluctuations; the settlement of conversions of our convertible notes, if any, in shares of our common stock or a combination of cash and shares of our common stock, which may result in substantial dilution for our existing shareholders; our expectation that we will not declare or pay dividends on our common stock for the near future; vacation industry competition and changes in industry capacity and overcapacity; the risks and costs related to cyber security attacks, data breaches, protecting our systems and maintaining integrity and security of our business information, as well as personal data of our guests, employees and others; the impact of new or changing legislation and regulations or governmental orders on our business; pending or threatened litigation, investigations and enforcement actions; the effects of weather, natural disasters and seasonality on our business; emergency ship repairs, including the related lost revenue; the impact of issues at shipyards, including ship delivery delays, ship cancellations or ship construction cost increases; shipyard unavailability; the unavailability or cost of air service; and uncertainties of a foreign legal system as we are not incorporated in the United States.

In addition, many of these risks and uncertainties are currently heightened by and will continue to be heightened by, or in the future may be heightened by, the COVID-19 pandemic. It is not possible to predict or identify all such risks.

More information about factors that could affect our operating results is included under the caption “Risk Factors” in our most recent annual report on Form 10-K, as well as our other filings with the SEC, and the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our most recent annual report on Form 10-K, copies of which may be obtained by visiting our Investor Relations website at www.rclinvestor.com or the SEC’s website at www.sec.gov. Undue reliance should not be placed on the forward-looking statements in this release, which are based on information available to us on the date hereof. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Definitions

Selected Operational and Financial Metrics

Adjusted Loss per Share (“Adjusted EPS”)

Represents Adjusted Net Loss divided by weighted average shares outstanding or by diluted weighted average shares outstanding, as applicable. We believe that this non-GAAP measure is meaningful when assessing our performance on a comparative basis.

Adjusted Net Loss

Adjusted Net Loss represents net loss excluding certain items that we believe adjusting for is meaningful when assessing our performance on a comparative basis. For the periods presented, these items included (i) impairment and credit losses (recoveries); (ii) restructuring charges and other initiative expenses; (iii) the amortization of the Silversea Cruises intangible assets resulting from the Silversea Cruises acquisition in 2018; (iv) the amortization of non-cash debt discount on our convertible notes; (v) the estimated cash refunds expected to be paid to Pullmantur guests as part of the Pullmantur S.A. reorganization in 2020; (vi) loss on the extinguishment of debt; (vii) equity investment asset impairments; (viii) net insurance recoveries related to the collapse of the drydock structure at the Grand Bahama Shipyard involving Oasis of the Seas ; and (ix) the net gain recognized in the first quarter of 2021 in relation to the sale of the Azamara brand.

Available Passenger Cruise Days ("APCD")

Available Passenger Cruise Days is our measurement of capacity and represents double occupancy per cabin multiplied by the number of cruise days for the period, which excludes canceled cruise days and cabins not available for sale. We use this measure to perform capacity and rate analysis to identify our main non-capacity drivers that cause our cruise revenue and expenses to vary.

Occupancy, in accordance with cruise vacation industry practice, is calculated by dividing Passenger Cruise Days by APCD. A percentage in excess of 100% indicates that three or more passengers occupied some cabins.

Passenger Cruise Days

Passenger Cruise Days represent the number of passengers carried for the period multiplied by the number of days of their respective cruises.

For additional information see “Adjusted Measures of Financial Performance” below.

Adjusted Measures of Financial Performance

This press release includes certain adjusted financial measures defined as non-GAAP financial measures under Securities and Exchange Commission rules, which we believe provide useful information to investors as a supplement to our consolidated financial statements, which are prepared and presented in accordance with generally accepted accounting principles, or US GAAP.

The presentation of adjusted financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with US GAAP. These measures may be different from adjusted measures used by other companies. In addition, these adjusted measures are not based on any comprehensive set of accounting rules or principles. Adjusted measures have limitations in that they do not reflect all of the amounts associated with our results of operations as do the corresponding US GAAP measures.

A reconciliation to the most comparable US GAAP measure of all adjusted financial measures included in this press release can be found in the tables included at the end of this press release.

(1) Represents the amortization of non-cash debt discount on our convertible notes.

(2) Represents estimated cash refunds expected to be paid to Pullmantur guests as part of the Pullmantur S.A. reorganization.

(3) Represents equity investment asset impairments primarily for TUI Cruises GmbH in 2021 as a result of the impact of COVID-19.

(4) Represents net insurance recoveries related to the collapse of the drydock structure at the Grand Bahama Shipyard involving Oasis of the Seas.

Related Images

We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here . By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service .

New to Zacks? Get started here.

Member Sign In

Don't Know Your Password?

- Zacks #1 Rank

- Zacks Industry Rank

- Zacks Sector Rank

- Equity Research

- Mutual Funds

- Mutual Fund Screener

- ETF Screener

- Earnings Calendar

- Earnings Releases

- Earnings ESP

- Earnings ESP Filter

- Stock Screener

- Premium Screens

- Basic Screens

- Research Wizard

- Personal Finance

- Money Management

- Retirement Planning

- Tax Information

- My Portfolio

- Create Portfolio

- Style Scores

- Testimonials

- Zacks.com Tutorial

Services Overview

- Zacks Ultimate

- Zacks Investor Collection

- Zacks Premium

Investor Services

- ETF Investor

- Home Run Investor

- Income Investor

- Stocks Under $10

- Value Investor

- Top 10 Stocks

Other Services

- Method for Trading

- Zacks Confidential

Trading Services

- Black Box Trader

- Counterstrike

- Headline Trader

- Insider Trader

- Large-Cap Trader

- Options Trader

- Short Sell List

- Surprise Trader

- Alternative Energy

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK . If you do not, click Cancel.

Image: Bigstock

Investors Heavily Search Royal Caribbean Cruises Ltd. (RCL): Here is What You Need to Know

Royal Caribbean ( RCL Quick Quote RCL - Free Report ) is one of the stocks most watched by Zacks.com visitors lately. So, it might be a good idea to review some of the factors that might affect the near-term performance of the stock.

Shares of this cruise operator have returned +7.6% over the past month versus the Zacks S&P 500 composite's +3.2% change. The Zacks Leisure and Recreation Services industry, to which Royal Caribbean belongs, has gained 0.3% over this period. Now the key question is: Where could the stock be headed in the near term?

While media releases or rumors about a substantial change in a company's business prospects usually make its stock 'trending' and lead to an immediate price change, there are always some fundamental facts that eventually dominate the buy-and-hold decision-making.

Earnings Estimate Revisions

Rather than focusing on anything else, we at Zacks prioritize evaluating the change in a company's earnings projection. This is because we believe the fair value for its stock is determined by the present value of its future stream of earnings.

Our analysis is essentially based on how sell-side analysts covering the stock are revising their earnings estimates to take the latest business trends into account. When earnings estimates for a company go up, the fair value for its stock goes up as well. And when a stock's fair value is higher than its current market price, investors tend to buy the stock, resulting in its price moving upward. Because of this, empirical studies indicate a strong correlation between trends in earnings estimate revisions and short-term stock price movements.

Royal Caribbean is expected to post earnings of $2.69 per share for the current quarter, representing a year-over-year change of +47.8%. Over the last 30 days, the Zacks Consensus Estimate has changed +0.6%.

For the current fiscal year, the consensus earnings estimate of $10.96 points to a change of +61.9% from the prior year. Over the last 30 days, this estimate has changed +0.5%.

For the next fiscal year, the consensus earnings estimate of $12.59 indicates a change of +14.9% from what Royal Caribbean is expected to report a year ago. Over the past month, the estimate has changed +3.1%.

With an impressive externally audited track record , our proprietary stock rating tool -- the Zacks Rank -- is a more conclusive indicator of a stock's near-term price performance, as it effectively harnesses the power of earnings estimate revisions. The size of the recent change in the consensus estimate, along with three other factors related to earnings estimates , has resulted in a Zacks Rank #1 (Strong Buy) for Royal Caribbean.

The chart below shows the evolution of the company's forward 12-month consensus EPS estimate:

12 Month EPS

Due to inactivity, you will be signed out in approximately:

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Biden Economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Student Loans

- Personal Loans

- Car Insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Asking for a Trend

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Royal caribbean cruises' (nyse:rcl) investors will be pleased with their notable 71% return over the last year.

Passive investing in index funds can generate returns that roughly match the overall market. But if you pick the right individual stocks, you could make more than that. To wit, the Royal Caribbean Cruises Ltd. ( NYSE:RCL ) share price is 71% higher than it was a year ago, much better than the market return of around 22% (not including dividends) in the same period. So that should have shareholders smiling. And shareholders have also done well over the long term, with an increase of 57% in the last three years.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

See our latest analysis for Royal Caribbean Cruises

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year Royal Caribbean Cruises grew its earnings per share, moving from a loss to a profit.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

However the year on year revenue growth of 38% would help. We do see some companies suppress earnings in order to accelerate revenue growth.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

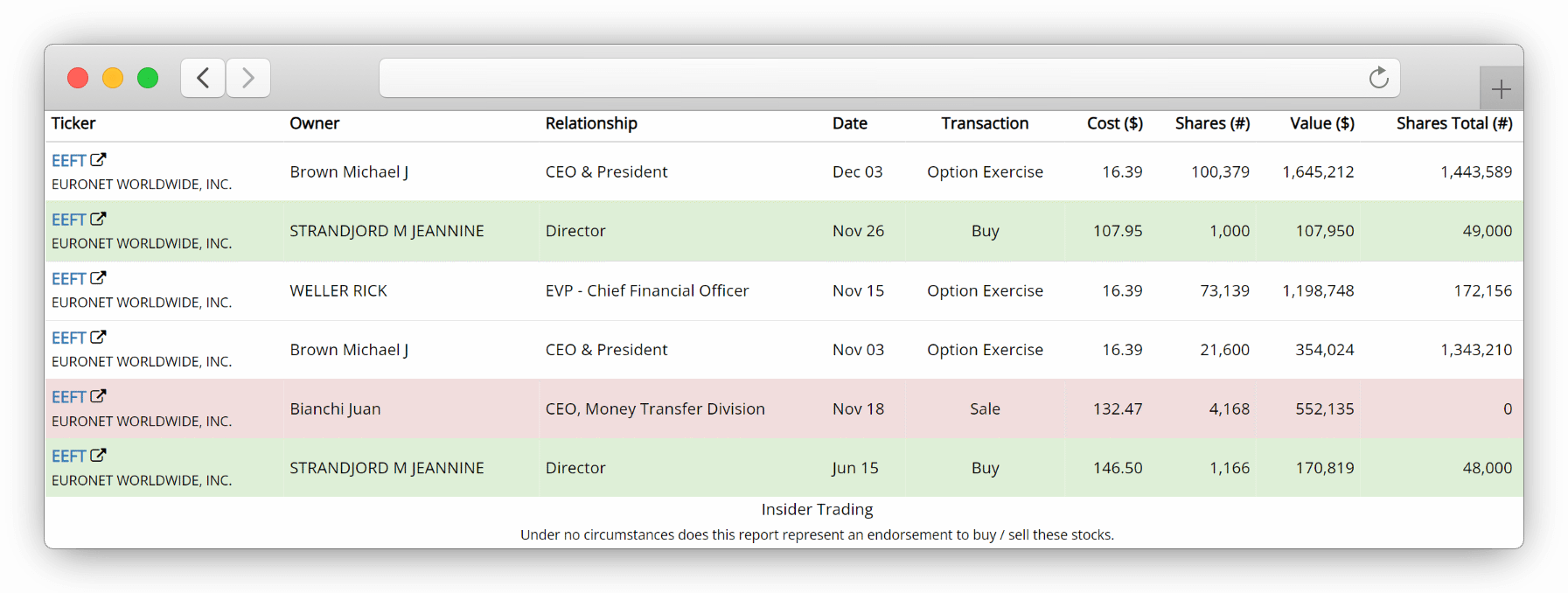

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free report showing analyst forecasts should help you form a view on Royal Caribbean Cruises

A Different Perspective

It's nice to see that Royal Caribbean Cruises shareholders have received a total shareholder return of 71% over the last year. That gain is better than the annual TSR over five years, which is 5%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for Royal Caribbean Cruises (1 doesn't sit too well with us) that you should be aware of.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Royal Caribbean Cruises Ltd (RCL) SEC Filing 10-K Annual report for the fiscal year ending Tuesday, December 31, 2019

Sec filings, rcl valuations.

- Select PDF Feature:

- Include Exhibits

- Highlight YoY Changes

- Highlight Sentiment

February 2024

December 2023

October 2023

Last10K.com | 10-K Annual Report Tue Feb 25 2020

Royal caribbean cruises ltd.

Please wait while we load the requested 10-K report or click the link below:

https://last10k.com/sec-filings/report/884887/000088488720000009/rcl-20191231.htm

View differences made from one year to another to evaluate Royal Caribbean Cruises Ltd's financial trajectory

Compare this 10-K Annual Report to its predecessor by reading our highlights to see what text and tables were removed , added and changed by Royal Caribbean Cruises Ltd.

Assess how Royal Caribbean Cruises Ltd's management team is paid from their Annual Proxy

- Voting Procedures

- Board Members

- Executive Team

- Salaries, Bonuses, Perks

- Peers / Competitors

SEC Filing Tools

Read 10-K Annual Reports Better Last10K.com and Stocksnips.net computationally analyzes management discussions inside annual and quarterly reports to determine if they are bullish , bearish or neutral on the company's finances and operations. View Rating for FREE "> Rating Learn More

We provide 5 of these remarks for FREE. To see all the remarks without having to find them in the 10-K Annual Report, become a member of Last10K.com

Adjusted Earnings per Share ("Adjusted EPS") represents Adjusted Net Income attributable to Royal Caribbean Cruises Ltd. divided by weighted average shares outstanding or by diluted weighted average shares outstanding, as applicable.

. The increase was primarily due to transaction costs incurred by us related to the Silversea Cruises acquisition, marketing, selling and administrative expenses due to the addition of Silversea Cruises, the impairment and other costs related to the exit of our tour operations business, which occurred in 2018, and an increase in payroll and benefits expense primarily driven by an increase in headcount, partially offset by lower stock prices year over year related to our performance share awards, as well as higher spending on advertisemen

Gross Yields and Net Yields were calculated as follows (in thousands, except APCD and Yields: Gross Cruise Costs, Net Cruise Costs and Net Cruise Costs Excluding Fuel were calculated as follows (in thousands, except APCD and costs per APCD): ___________________________________________________________________ (1) For the year ended December 31, 2019, the amount does not include integration costs related to the Silversea Cruises acquisition of $0.9 million, transaction costs related to the Silversea Cruises acquisition of $1.2 million and restructuring and other initiative costs of $13.7 million.

Consistent with our earnings growth, we also announced a 11% increase to our common stock dividend, our seventh consecutive year with a dividend increase.

. The increase was primarily attributable to an increase in capital expenditures of $3.1 billion primarily due to the delivery of Symphony of the Seas and Celebrity Edge and to a lesser extent the purchase of Azamara Pursuit in 2018 compared to no ship deliveries or purchases in 2017 and $916.1 million of cash paid for the acquisition of Silversea Cruises, net of cash acquired, in 2018 as well as $230.0 million of proceeds received from the sale of property and equipment in 2017, which did not recur in 201

. The increase in Passenger... Read more

Improvement costs that we believe... Read more

. The increase was primarily... Read more

Onboard revenue and Net onboard... Read more

The estimated negative impact resulting... Read more

. The increase in cash... Read more

We have not provided a... Read more

Excluding the impact of the... Read more

If the fair value of... Read more

. RankingQ1Q2Q3Q4YTD 20201AUDGBPGBPAUDGBP2CADCADCNHGBPAUD3GBPAUDEURCADCAD4BRLCNHCADEURCNH5MXNEURAUDCNHEUR Ranking Q1... Read more

Total cruise operating expenses, excluding... Read more

We believe Net Yields, Net... Read more

. Depreciation and Amortization Expenses... Read more

. Net cash provided by... Read more

. Net cash used in... Read more

We utilize Net Revenues and... Read more

A reconciliation of historical Gross... Read more

The program includes five goals... Read more

. Additionally, dividends received from... Read more

Effective June 5th, 2019, we... Read more

. These contingencies generally relate... Read more

The addition of new vessels... Read more

In addition to the items... Read more

. Our cost of fuel... Read more

Adjusted EPS for 2019, on... Read more

Adjusted Net Income represents net... Read more

These non-GAAP financial measures are... Read more

Effective fourth quarter of 2019,... Read more

We believe our most critical... Read more

Changes in guest sourcing and... Read more

These goals have been put... Read more

. Cruise Operating Expenses Total... Read more

Total revenues increased $1.5 billion... Read more

However, should certain factors or... Read more

The effect of changes in... Read more

. The increase in expense... Read more

We have implemented several measures... Read more

We were able to achieve... Read more

. The increase was partially... Read more

To that base, we add... Read more

Cruise operating expenses increased $801.0... Read more

. The increase in Onboard... Read more

Goodwill is recognized as the... Read more

Other intangible assets assigned finite... Read more

. Additionally, 2017 includes the... Read more

. The decrease was primarily... Read more

Onboard and other revenues also... Read more

. Debt denominated in other... Read more

. (6) Debt denominated in... Read more

. Passenger ticket revenues increased... Read more

. As of December 31,... Read more

While it is typically very... Read more

. The remaining 28.3% of... Read more

. The remaining 28.5% of... Read more

. Based on our highest... Read more

. The change was primarily... Read more

. Gross and Net Cruise... Read more

Liability-classified contingent consideration is remeasured... Read more

. Revenues Total revenues for... Read more

In measuring our ability to... Read more

. Equity investment income increased... Read more

. The change of $875.7... Read more

. The change of $16.4... Read more

The Company remains focused on... Read more

In addition, we recently announced... Read more

Due to significant uncertainty, we... Read more

The impairment review for indefinite-life... Read more

Quoted market prices are often... Read more

As of December 31, 2019... Read more

. Gross and Net Yields... Read more

If we had reduced our... Read more

. The cash received as... Read more

. The specific covenants and... Read more

Financial Statements, Disclosures and Schedules Inside this 10-K Annual Report

Material Contracts, Statements, Certifications & more Royal Caribbean Cruises Ltd provided additional information to their SEC Filing as exhibits

Ticker: RCL CIK: 884887 Form Type: 10-K Annual Report Accession Number: 0000884887-20-000009 Submitted to the SEC: Tue Feb 25 2020 5:13:38 PM EST Accepted by the SEC: Tue Feb 25 2020 Period: Tuesday, December 31, 2019 Industry: Water Transportation

Intrinsic Value Calculator

Our Intrinsic Value calculator estimates what an entire company is worth using up to 10 years of financial ratios to determine if a stock is overvalued or not

Never Miss A New SEC Filing Again

Receive an e-mail as soon as a company files an Annual Report, Quarterly Report or has new 8-K corporate news

We Highlighted This SEC Filing For You

Read positive and negative remarks made by management in their entirety without having to find them in a 10-K/Q

Widen Your SEC Filing Reading Experience

Remove data columns and navigations in order to see much more filing content and tables in one view

Uncover Actionable Information Inside SEC Filings

Read both hidden opportunities and early signs of potential problems without having to find them in a 10-K/Q

Adobe PDF, Microsoft Word, Excel and CSV Downloads

Export Annual and Quarterly Reports to Adobe Acrobat (PDF), Microsoft Word (DOCX), Excel (XLSX) and Comma-Delimited (CSV) files for offline viewing, annotations and analysis

Financial Stability Report

Our Financial Stability reports uses up to 10 years of financial ratios to determine the health of a company's EPS, Dividends, Book Value, Return on Equity, Current Ratio and Debt-to-Equity

Get a Better Picture of a Company's Performance

See how over 70 Growth, Profitability and Financial Ratios perform over 10 Years

See when company executives buy or sell their own stock

Use our calculated cost dollar values to discover when and how much registered owners BUY , SELL or excercise their company stock OPTIONS aggregated from Form 4 Insider Transactions SEC Filings

See how institutional managers trade a stock

View which hedge funds, pension / retirement funds, endowments, banks and insurance companies have increased or decreased their positions in a particular stock. Includes Ownership Percent, Buy versus Sell comparison, Put-Call ratio and more

FREE Financial Statements

Get one-click access to balance sheets, income, operations and cash flow statements without having to find them in Annual and Quarterly Reports

SEC Filing Exhibit

Loading SEC Filing Exhibit...

SEC Filing Financial Summary

Loading SEC Filing Financial Summary...

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

You Can Now Status Match Between Royal Caribbean, Celebrity Cruises, and Silversea

Carissa Rawson

Senior Content Contributor

268 Published Articles

Countries Visited: 51 U.S. States Visited: 36

Stella Shon

News Managing Editor

95 Published Articles 679 Edited Articles

Countries Visited: 25 U.S. States Visited: 22

Table of Contents

Royal caribbean group status match for cruisers, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

The Royal Caribbean Group has announced a new status-matching opportunity between its 3 cruise lines. This is a great way for existing elite status members to get extra benefits thanks to the equivalent tier status they’ll receive.

Let’s take a look at how this new status match program works for loyalty members.

The Royal Caribbean group owns 3 cruise lines: Royal Caribbean , Celebrity, and Silversea.

And while it has previously allowed those with elite status to match between Royal Caribbean and Celebrity, the same wasn’t true for Silversea . That has changed as the Royal Caribbean group has announced that all three cruise lines will begin matching interchangeably for sailings departing on (or after) Wednesday, June 5.

These matches take place automatically, so you’ll need to be enrolled in each program for it to take effect.

Silversea is the luxury arm of the Royal Caribbean Group, while Royal Caribbean tends to focus on budget-minded travelers and Celebrity caters to the crowd between the 2.

This is great news for sailors on any of these lines, but most especially for those with Royal Caribbean Crown & Anchor Society Diamond status , which is earned after just 80 nights with Royal Caribbean , while Elite with Celebrity’s Captain’s Club can take as many as 150 nights.

This new status match opportunity means that Royal Caribbean sailors with Diamond status will be able to receive Silversea’s coveted 250 VS Days status without needing to pay for Silversea’s much more expensive cruises. The benefits of 250 VS Days status in the Venetian Society are many:

- VS events on reunion voyage

- 5% off Venetian Society sailings

- 10% off all future sailings

- Pre-sale access to new itineraries

- Complimentary party onboard

- Complimentary laundry and pressing

- Upgraded bottle of champagne in suite

Not all of these are significant, though anyone who’s cruised before will likely argue that laundry service is a must. That said, getting 10% off all sailings can save you a lot of money, especially since Silversea cruises tend to run on the more expensive side.

Silversea members can also match right back to Royal Caribbean and Celebrity, which entitles them to benefits such as complimentary drink packages, free Wi-Fi, and concierge lounge access .

Want to take a cruise without spending a ton of cash? Check out our guide on the best websites to book cruises at the cheapest prices .

This new status match program is great news for elites with status on any of the lines, especially for Royal Caribbean. If you have upcoming sailings with Royal Caribbean, Celebrity, or Silversea, check to see when your elite status is matched.

Was this page helpful?

About Carissa Rawson

Carissa served in the U.S. Air Force where she developed her love for travel and new cultures. She started her own blog and eventually joined The Points Guy. Since then, she’s contributed to Business Insider, Forbes, and more.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

COMMENTS

Welcome to the Preview Royal Caribbean Cruises Ltd. Investors website. Here you can review stock info, meet our leadership team, download reports, and more. Royal Caribbean Cruises Ltd. About Us. ... and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our most recent annual report on Form 10-K, ...

Based in Miami, Florida. Royal Caribbean Group (NYSE: RCL) is a cruise vacation company comprised of three award-winning global brands: Royal Caribbean International, Celebrity Cruises, and Silversea Cruises. Royal Caribbean Group is also a 50% owner of a joint venture that includes TUI Cruises and Hapag-Lloyd Cruises.

Royal Caribbean Group Annual Report 2023 Form 10-K (NYSE:RCL) Published: February 23rd, 2023 PDF generated by stocklight.com . UNITED STATES ... Royal Caribbean Cruises Ltd., was incorporated on July 23, 1985 in the Republic of Liberia under the Business Corporation Act of Liberia. As a result of the global pandemic impact of COVID-19, we ...

Royal Caribbean Cruises Ltd. About Us. About Us; Stock Info. Stock Quote; Stock Chart; Stock Lookup; Stock Calculator; ... as defined in our Quarterly Report on Form 10-Q for the three months eneded March 31, 2023. ... and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our most recent annual ...

MIAMI - February 1, 2024 - Royal Caribbean Group (NYSE: RCL) today reported 2023 Earnings per Share ("EPS") of $6.31 and Adjusted EPS of $6.77. These results were better than the company's guidance due to stronger close-in demand. The strength is continuing into 2024 with Adjusted EPS expected to be in the range of $9.50 to $9.70 per share.

Royal Caribbean was founded in 1968 as a partnership. Its corporate structure has evolved over the years and, the current parent corporation, Royal Caribbean Cruises Ltd., was incorporated on July 23, 1985 in the Republic of Liberia under the Business Corporation Act of Liberia. COVID-19 Return to Healthy Sailing

As used in this Annual Report on Form 10-K, the terms "Royal Caribbean," "Royal Caribbean Group," the "Company," "we," "our" and "us" refer to Royal Caribbean Cruises Ltd. and, depending on the context, Royal Caribbean Cruises Ltd.'s consolidated subsidiaries and/or affiliates. The terms "Royal Caribbean International," "Celebrity Cruises," "Azamara" and ...

Results of Operations In addition to the items discussed above under "Executive Overview," significant items for 2021 include: Our Net Loss attributable to Royal Caribbean Cruises Ltd. and Adjusted Net Loss attributable to Royal Caribbean Cruises Ltd. for the year ended December 31, 2021 was $(5.3) billion and $(4.8) billion, or $(20.89) and ...

Royal Caribbean Cruises Ltd (RCL) SEC Filing 10-K Annual Report for the fiscal year ending Saturday, December 31, 2022. Home. SEC Filings. Royal Caribbean Cruises Ltd (RCL) 10-K Annual Report Thu Feb 23 2023.

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 F or the fi s c al ye ar e nde d De c e mbe r 31, 2019 or ... ROYAL CARIBBEAN CRUISES LTD. (E xa c t na m e of re gi s t ra nt a s s pe c i fi e d i n i t s c ha rt e r)

The terms "Royal Caribbean International," "Celebrity Cruises," and "Silversea Cruises" refer to our wholly owned global cruise brands. Throughout this Annual Report on Form 10-K, we also refer to our partner brands in which we hold an ownership interest, including "TUI Cruises," and "Hapag-Lloyd Cruises."

Royal Caribbean Group reports on 2020 results and provides business update. ... Inside Royal Caribbean Cruises Ltd's 10-K Annual Report: Financial - Cash Flow Highlight. Long-lived Assets Events surrounding the COVID-19 pandemic negatively impacted the expected undiscounted cash flows of certain of our long-lived assets.

Royal Caribbean was founded in 1968 as a partnership. Its corporate structure has evolved over the years and, the current parent corporation, Royal Caribbean Cruises Ltd., was incorporated on July 23, 1985 in the Republic of Liberia under the Business Corporation Act of Liberia. Our Global Brands

Spain and Latin America. Acquired by Royal Caribbean Cruises Ltd. in 2006, Pullmantur is the only cruise line that enables guests to truly experi-ence and discover the Latin culture and way of life. Pullmantur offers joyful, emotional and memorable experiences with the warmest service, which has Royal Caribbean Cruises Ltd.

The terms "Royal Caribbean International," "Celebrity Cruises," "Azamara Club Cruises" and "Silversea Cruises" refer to our wholly- or majority-owned global cruise brands. Throughout this Annual Report on Form 10-K, we also refer to regional brands in which we hold an ownership interest, including "TUI Cruises ...

View Annual Reports. Ten years of annual and quarterly financial statements and annual report data for Royal Caribbean Cruises (RCL). Income statements, balance sheets, cash flow statements and key ratios.

ROYAL CARIBBEAN CRUISES LTD. CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) Year Ended. December 31, 2021. 2020 (unaudited) Operating Activities. Net Loss

Royal Caribbean Group is the owner and operator of three award winning cruise brands: Royal Caribbean International, Celebrity Cruises, and Silversea Cruises and it is also a 50% owner of a joint venture that operates TUI Cruises and Hapag-Lloyd Cruises. Together, the brands have an additional 10 ships on order as of December 31, 2022.

MIAMI - February 1, 2024 - Royal Caribbean Group (NYSE: RCL) today reported 2023 Earnings per Share ("EPS") of $6.31 and Adjusted EPS of $6.77. These results were better than the company's guidance due to stronger close-in demand. The strength is continuing into 2024 with Adjusted EPS expected to be in the range of $9.50 to $9.70 per share.

Royal Caribbean Group is the owner and operator of three award winning cruise brands: Royal Caribbean International, Celebrity Cruises, and Silversea Cruises and it is also a 50% owner of a joint venture that operates TUI Cruises and Hapag-Lloyd Cruises. Together, the brands have an additional 11 ships on order as of March 31, 2022.

Investors can select to view data from four periods of either annual or quarterly information, allowing them to track the NYSE:RCL financials over time via breakdowns of their annual reports. Royal Caribbean Cruises Ltd. reported earnings results for the first quarter ended March 31, 2024.

Royal Caribbean is expected to post earnings of $2.69 per share for the current quarter, representing a year-over-year change of +47.8%. Over the last 30 days, the Zacks Consensus Estimate has ...

As used in this Annual Report on Form 20-F, the terms "Royal Caribbean," "Company," "we," "our" and "us" refer to Royal Caribbean Cruises Ltd., the term "Celebrity" refers to Celebrity Cruise Lines Inc. and the terms "Royal Caribbean International" and "Celebrity Cruises" refer to our two cruise brands.

It's nice to see that Royal Caribbean Cruises shareholders have received a total shareholder return of 71% over the last year. That gain is better than the annual TSR over five years, which is 5%.

MIAMI - February 4, 2020 - Royal Caribbean Cruises Ltd. (NYSE: RCL) today reported 2019 US GAAP earnings of $8.95 per share and adjusted earnings of $9.54 per share and announced that 2020 adjusted earnings are expected to be in the range of $10.40 to $10.70 per share. Given the fluidity of the circumstances related to the Wuhan Coronavirus and the actions being taken to contain its spread ...

Royal Caribbean Cruises ( NYSE:RCL - Get Free Report) last released its earnings results on Thursday, April 25th. The company reported $1.77 earnings per share for the quarter, beating the consensus estimate of $1.33 by $0.44. The firm had revenue of $3.73 billion during the quarter, compared to analyst estimates of $3.69 billion.

This new status match opportunity means that Royal Caribbean sailors with Diamond status will be able to receive Silversea's coveted 250 VS Days status without needing to pay for Silversea's much more expensive cruises. The benefits of 250 VS Days status in the Venetian Society are many: VS events on reunion voyage.

Carnival Corp. returned over 40% in 2023, while the largest cruise operator of them all, in terms of market cap, Royal Caribbean Cruises , delivered at least twice the returns as compared to ...