Call: 0860 766 942

Does Your Medical Aid Cover You Overseas? Tips for if You're Travelling

For many South Africans, travelling to exotic international destinations is the highlight of a lifetime. However, an accident or illness could ruin the experience. If you're not covered for medical emergencies overseas, your trip could also prove disastrously expensive.

We consider whether and how South African medical aids cover international medical expenses, and how you can mitigate the financial risks when travelling outside South Africa's borders.

International travel benefits

Most open medical aid schemes in South Africa do offer limited cover to members travelling outside the country. Schemes generally outsource the international component to travel partners, such as ER24 and Europ Assistance.

Principal members and beneficiaries are covered for up to 90 days from the date of departure. Benefits apply to medical emergencies, and are limited to between R5 million and R10 million per trip. Cover can extend to an emergency medical evacuation or repatriation.

It's important to note that international travel cover is often excluded from low cost entry level plans. Members of the Discovery Health KeyCare Series and the BonCap option by Bonitas, for instance, are not covered, and will have to make alternative arrangements.

Tip #1: Before you set off, find out if your medical aid plan has international travel benefits.

What's excluded from cover?

There are certain instances when medical aids will not pay for emergency treatment overseas. Common exclusions are:

- healthcare services excluded by waiting periods

- pre-existing conditions

- general exclusions quoted in the medical aid schemes' T&Cs

- high-risk adventure sports.

Tip #2: If you're an adrenalin junkie, consider topping up your international travel benefits with a policy that specifically includes cover for hazardous sports, such as Sanlam's Go Cover app .

The medical emergencies claims process

If a medical emergency requires surgery, expensive procedures and/or an extended stay in hospital, you'll need to obtain authorisation and a payment guarantee from your medical aid's travel partner. Payment is then made directly to the healthcare service providers.

In less expensive scenarios, you'll usually be expected to pay the costs from your own pocket, and claim the money back from your medical aid on your return to South Africa. A nominal co-payment may apply for treatment conducted out of hospital.

Tip #3: You can expedite the claims process by submitting the original account detailing the expenses, along with proof of payment, and a copy of the entry and exit stamps in your passport.

How top medical aids cover international medical emergencies

Let's compare international travel benefits offered by top medical aid schemes in South Africa.

Momentum Health

In partnership with Europ Assistance, Momentum Health offers international travel benefits on all its plans. Cover is limited to R5 million per beneficiary, and benefits include emergency transportation, evacuation and repatriation.

A co-payment of R1 300 applies to all emergency claims, and members and dependents are covered for 90 days. Authorisation is required for expenses of more than R5 000.

Bonitas uses ER24 as its international travel partner. All members, with the exception of BonCap subscribers, are eligible for medical emergency cover in and out of hospital.

Cover extends for 90 days, and is limited to R5 million and R10 million per beneficiary and per family per trip, respectively. There's an emergency optical and dental benefit and cover for mandatory travel vaccinations, travel assist services, and emergency transportation and evacuation.

Discovery Health

Discovery Health 's international travel benefit covers emergency medical costs, up to R10 million per person per journey, for up to 90 days. Benefits do not apply to members of the KeyCare Series.

The largest medical scheme in South Africa uses ER24 as its international travel partner. In addition to the international travel benefit, Discovery Health offers emergency medical evacuations from specified sub-Saharan countries via the Africa benefit.

Tip #4: Are you a frequent traveller? Consider switching to a medical aid scheme with favourable international travel benefits.

Travel insurance

Whether your medical aid option offers international travel benefits or not, it's a good idea to optimise your cover. In some cases – like when you pay for your air ticket with your credit card – you'll automatically get free travel insurance.

If you'll be travelling for more than 90 days, or are planning to scuba dive, paraglide, ski, summit a mountain peak or visit potentially dangerous areas, it's best to purchase comprehensive travel insurance as a separate product. This also means you'll enjoy benefits that aren't available from your medical aid, such as cover for lost baggage, stolen goods and cancelled flights.

Tip #5: If you're planning an extended trip abroad, maximise your cover with international travel insurance.

At IFC, we offer informed, objective advice about South African medical aid schemes , and can assist you in joining the scheme that best suits your needs and budget . Contact us for more information or to discuss your needs.

Related posts

Is It Time to Change Your Medical Aid Scheme or Plan?

Medical Aid Schemes that Cover Coronary Artery Disease

Best Medical Aids for 2021

- Currently Trending

- 10 Best Medical Aid Schemes in South Africa

- 5 Best Medical Aids Cover Pre-Existing Pregnancies

- 5 Best Medical Aids in South Africa Cover Braces

- 5 Best Medical Aids in South Africa Cover IVF

- 5 Best Medical Aids under R3000 in South Africa

- 5 Best Medical Aids under R2000 in South Africa

- 5 Best Medical Aids under R1500 in South Africa

- 5 Best Medical Aids for Students in South Africa

- 5 Best Medical Aid with Immediate Cover (No Waiting Period)

- 5 Best Medical Aids with no Late Joiner Fees

The Best Medical Aids

- Compare Plans

- Best Gap Covers

- 10 Best Gap Covers in South Africa

- 5 Best Dental Gap Cover in South Africa

- 5 Best Gap Cover Options for under R500

- 5 Best Gap Cover Options for under R300

- 5 Best Gap Cover Options for under R200

- 5 Best Gap Cover Options for under R1000

- 5 Best Hospital Plans for Kids

- 5 Best Hospital Plans for Babies

- 10 Best Hospital Plans in South Africa

- 5 Best Hospital Plans for Foreigners

The Best Hospital Plans

- 5 Best Medical Insurance Plans in South Africa

- 5 Best Medical Insurance for kids in South Africa

- 5 Best Travel Medical Insurance in South Africa

- 5 Best Medical Insurance for International Travel

- Top Pet Insurance Plans

- Best Pet Insurance in South Africa

- 5 Best Pet Insurance with no Waiting Period

Medical Aid Momentum Review – Analysis of Medical Aids’ Main Features

- ✅ Momentum Medical Scheme at a Glance

- ✅ Momentum Medical Scheme Regulation

- ✅ Momentum Medical Scheme Plan Overview

- ✅ Momentum Medical Scheme – Advantages over Competitors

- ✅ Momentum Medical Scheme Medical Savings Account

- ✅ How to apply for Medical Aid with Momentum Medical Scheme

- ✅ How to apply for Gap Cover with Momentum Medical Scheme

- ✅ How to Submit a Claim with Momentum Medical Scheme

- ✅ How to Submit a Compliment or Complaint with Momentum Medical Scheme

- ✅ How to Switch my Medical Aid to Momentum Medical Scheme

- ✅ Momentum Medical Scheme Customer Support

- ✅ Momentum vs Discovery Health vs Sizwe Hosmed – A Comparison

- ✅ Momentum Medical Scheme Member Reviews

- ✅ Our Verdict on Momentum Medical Scheme

- ✅ Momentum Medical Scheme Pros and Cons

- ✅ Momentum Medical Scheme Frequently Asked Questions

Momentum Medical Scheme at a Glance

Momentum Medical Scheme Regulation

The Council for Medical Schemes regulates Momentum Medical Scheme . The Council governs South Africa’s medical plan business for Medical Schemes (CMS), a regulating body set up under the Medical Schemes Act, No. 131 of 1998 (the Act). The CMS is responsible for a range of tasks related to the oversight of medical insurance plans, such as:

- Responsible for registering medical insurance plans and ensuring they comply with the law and other laws.

- Making sure healthcare plans have the money to pay claims.

- Examining and authorizing proposed price hikes for medical plans.

- Accepting and examining member complaints and initiating disciplinary action against medical plans that violate the Act or other applicable rules.

- Helping medical insurance plans follow the law and other laws.

Furthermore, if a medical scheme is found to violate the law, the CMS has the authority to issue administrative fines and penalties.

Momentum Medical Scheme Plan Overview

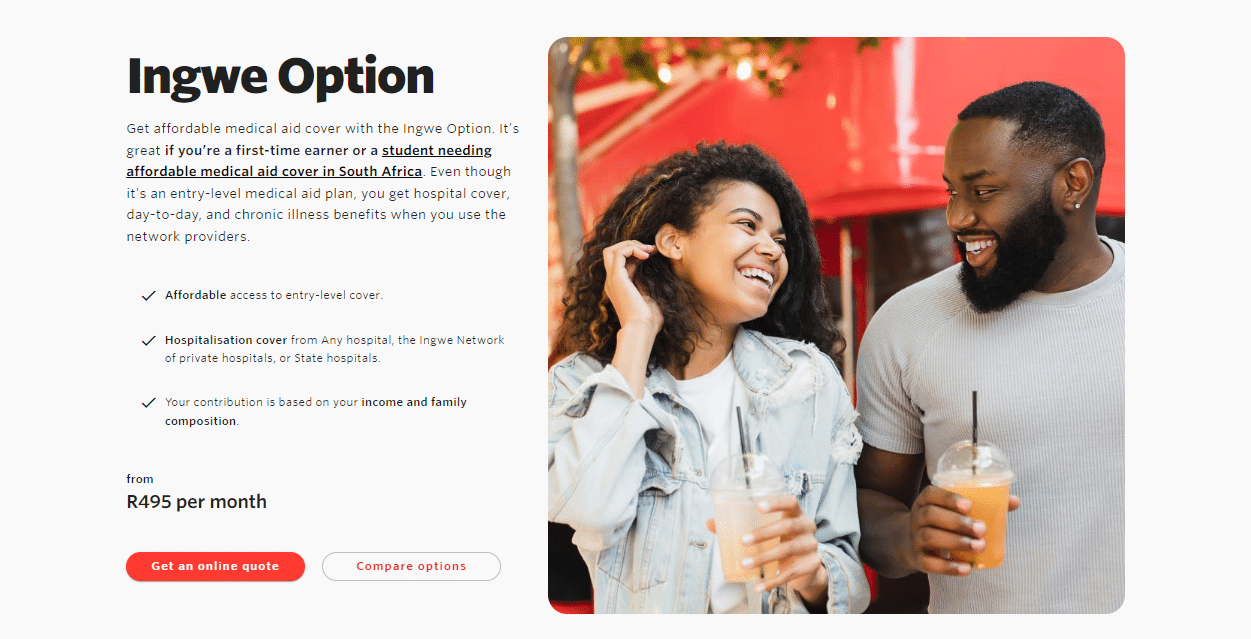

Momentum Ingwe Plan

The Ingwe Choice is an inexpensive option for entry-level protection. Members can use any hospital, the Ingwe Network of private hospitals, or State hospitals for an even lower monthly payment for hospitalization coverage. Depending on their provider choice, members must consult physicians within the Ingwe Primary Care Network or Ingwe Active Network for chronic treatment and day-to-day benefits such as GP visits and prescribed medication. Members who select any hospital may only utilize Ingwe Active Network GPs for chronic and routine care. In addition, members are covered for three virtual GP consultations per year through the Virtual GP Consultation Network, which includes Hello Doctor, enabling virtual consultations with a qualified doctor from the comfort of their own home or wherever they may be.

The Health Platform Benefit provides reimbursement for preventative care services offered by an Ingwe Primary Care Network or Ingwe Active Network provider. Certain Health Platform Benefits, such as the maternity program, are accessible from providers outside of the selected network provider. In addition, Momentum HealthSaver+ is available for members who require additional day-to-day advantages.

Momentum HealthSaver+ is a supplemental product offered by Momentum that enables users to save for uninsured medical bills.

Momentum Evolve Plan

Private hospital stays inside the Evolve Network are fully covered, with no annual caps, by selecting the Evolve Option. All Major Medical Benefits require a normal co-payment except for hospitalization due to pregnancy or childbirth or care received during an accident. Members are expected to use State facilities for chronic care and are provided with coverage for two virtual GP consultations through the GP Virtual Consultation Network, which includes Hello Doctor. The Health Platform Benefit also covers daily advantages like preventative screenings and check-ups. In addition, members can use the Momentum HealthSaver+ to pay for incidental, day-to-day costs like extra doctor’s appointments and medicines.

To help members prepare for future medical costs that are not covered by their current plan, Momentum offers a supplementary product called HealthSaver+.

Momentum Custom Plan

Private hospitalization costs are covered under the Customized Choice. Hospital stays are not capped at a certain number per year. You can use any hospital you like, or you can choose to utilize one of a chosen group of private hospitals in exchange for a lower contribution. Your choice of doctor and pharmacy for your long-term care needs is entirely up to you. You can also get a reduction in your regular payment by using a list of Associated physicians and a Medipost courier pharmacy for your long-term care needs. Alternatively, you can use State facilities for your chronic prescriptions, medications, and treatments and qualify for the maximum contribution discount.

The Health Platform Benefit protects you from routine medical expenses, including check-ups, immunizations, and other preventative services. The Momentum HealthSaver+ is there for you if you also need protection for regular healthcare costs like doctor’s appointments and medication. In addition, you can save money for medical costs not covered by your insurance plan of choice with the help of Momentum’s HealthSaver+. Except in the cases of automobile accidents, maternity confinement, and emergency care, the co-payment for Major Medical Benefits under the Custom Option is a flat dollar amount.

Momentum Incentive Plan

The Incentive Option provides coverage for hospitalization expenses at private facilities, with no cap on the number of hospital stays per year. Members can utilize any hospital of their choice or select from a pre-determined group of private hospitals known as Associated Hospitals to reduce their monthly premium. For long-term care needs, members can choose their doctor and pharmacy. However, members can reduce their monthly payments by utilizing a list of Associated doctors and the Medipost courier pharmacy. Additionally, by using state-run facilities for long-term prescriptions and medications, members have the opportunity to save the most on their monthly contributions. The Health Platform Benefit covers various medical services, including routine check-ups and cancer screenings. Ten percent of the monthly payment goes into a special Health Care Spending Account (Savings) to meet emergency and routine medical costs.

If extra coverage for everyday expenses is required, members can use the Momentum HealthSaver+. This complementary product offered by Momentum allows members to save for medical expenses not covered under their insurance plan.

Momentum Extender Plan

The Extender Option covers hospitalization in a private facility. There is no yearly cap on hospital stays. You can use any hospital you like, or you can choose to use only those on a select list of private hospitals (called Associated hospitals) to reduce your monthly premium. Regarding long-term care, you can visit any doctor you like for your chronic prescriptions and any pharmacy you like for your long-term medication. You can reduce your monthly payment using a list of Associated doctors and the Medipost courier pharmacy for your long-term care needs. If you prefer, you can use State facilities for your chronic prescriptions and medications and save the most on your contributions this way instead. Preventative screenings, specific check-ups, and more are all paid for by the Health Platform Benefit. In addition, the Personal Medical Savings (Savings) account will make 25% of your contribution available for use regularly.

If your annual day-to-day expenses exceed your Savings, you can turn to the Extended Cover benefit, which kicks in once your day-to-day claims reach the Threshold (a set amount calculated based on the number of people in your family). As soon as you reach the Threshold, the Scheme will begin paying your claims from the Extended Coverage pool. However, before activating your Extended Cover, you can use the Momentum HealthSaver+ to cover additional day-to-day expenses and out-of-pocket costs.

You can set aside money from your paycheck with Momentum HealthSaver+, a supplementary product offered by Momentum that helps you pay for medical costs not covered by your option.

Momentum Summit Plan

The Summit Option protects hospital stays at any private hospital without any annual limits. It also includes benefits for day-to-day and chronic care from any provider. Suppose you require additional coverage for everyday expenses. In that case, you can opt for the Momentum HealthSaver+, an additional product offered by Momentum to help save for medical expenses not covered by your chosen option. Additionally, the Health Platform Benefit offers coverage for preventative screening tests, specific check-ups, and more.

Momentum Medical Scheme – Advantages over Competitors

- A vast network of medical providers and facilities may offer members seeking medical care more options and convenience.

- Benefit options that allow members to tailor their coverage to their specific needs and budgetary constraints.

- A focus on preventative care and wellness can assist members in maintaining their health and reduce their future need for costly medical treatment.

- Strong dedication to customer service and support, which may aid members in navigating the complex healthcare system and maximizing their coverage.

- Access to online tools and resources for monitoring, understanding, and maintaining one’s health.

- A customizable insurance solution that meets the client’s and their family’s needs.

It is important to note that these are only some potential benefits of the Momentum Medical Scheme ; actual benefits and coverage may vary depending on the member’s specific plan and options.

You might also consider reading Easy Ways to Get Cheaper Medical Aid

Momentum Medical Scheme Medical Savings Account

Momentum Medical Scheme’s Medical Savings Account is known as the HealthSaver+. The Momentum HealthSaver+ is a product offered by Momentum that allows you to save for various medical expenses, such as vitamins, cosmetic surgery, and more. You can earn an interest rate of up to 10% on your positive balance, which is determined by a combination of your Healthy Heart Score and Active Dayz™. The annual fee for this account is only R40, and it offers a convenient way to pay for treatments and procedures that your insurance may not cover. You can use your funds to pay for medical scheme contributions, fund your child’s education, buy vouchers for people in need, boost your retirement, and pay for non-medical expenses at pharmacies and veterinarians.

Additionally, if you contribute monthly, you can access a digital assistant, Hey Jude, which will help you find or organize anything you need. You can also use your funds to purchase fitness devices, and if you qualify, you can get credit from as low as 0% interest. Furthermore, you can access your funds with the Multiply Money Card to pay for various healthcare-related expenses such as medication, treatments, and consultations.

How to apply for Medical Aid with Momentum Medical Scheme

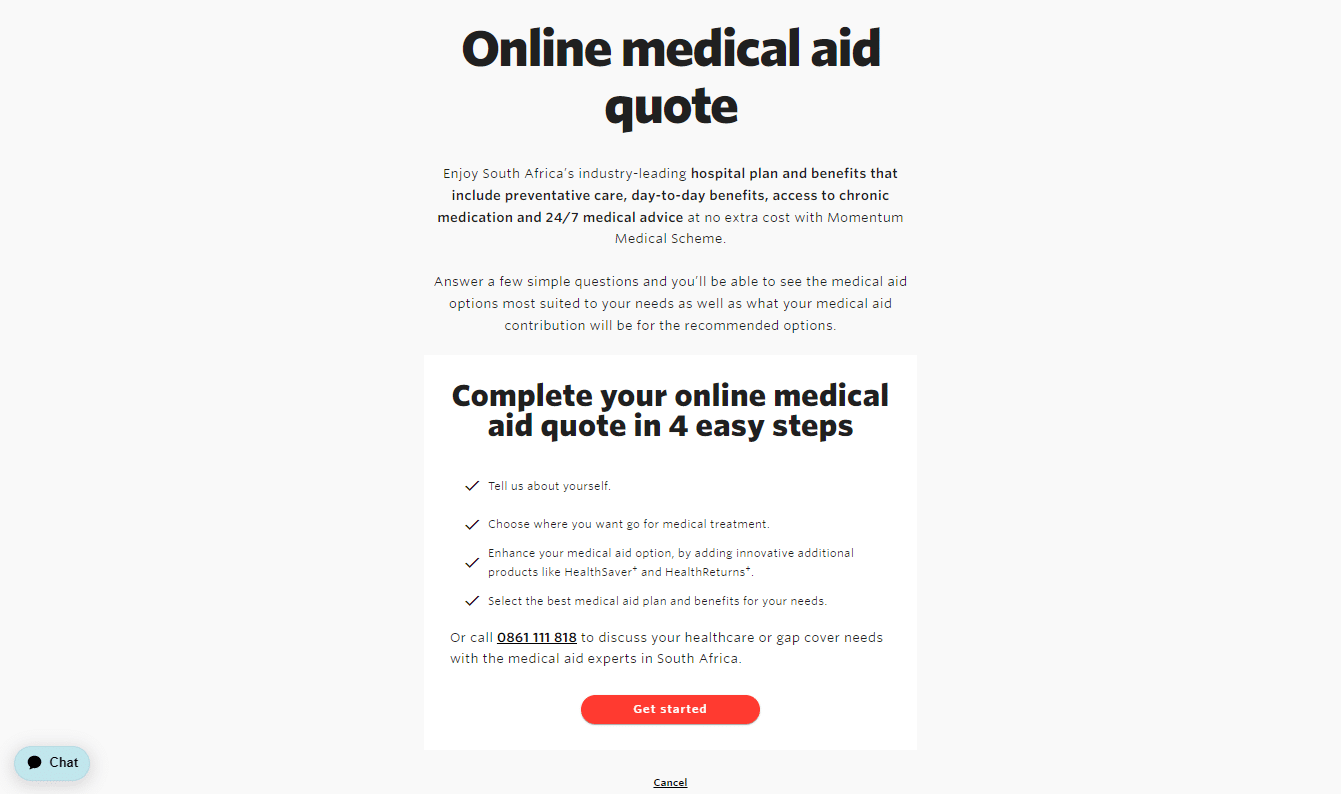

Medical aid quote momentum medical scheme process explained.

To apply for Medical Aid through Momentum Medical Scheme, you must visit the official Momentum website, click the menu in the top left corner of the page, and select “Medical Aid” from the listed options. You can view all the medical aid options from here or get an online quote. You can select your option and apply online or request a callback to complete the application.

New Members 35 years or older may be subject to late-joiner penalties on Momentum Medical Aid Plans.

Get a Momentum Medical Aid quote from our Dedicated Medical Aid Specialists Broker

How to apply for Gap Cover with Momentum Medical Scheme

Visit the Momentum website and select “Medical Aid” from the menu on the left-hand side of the home page (click the three lines in the left corner). Click “GapCover+” under the “Convenient, innovative features, unique to Momentum.” From here, you can view the GapCover+ brochure or click on “Get GapCover.” The Individual Application form for GapCover will open in a new tab, and you must print the document to complete it.

You may also like:

5 Best Gap Cover Options for Under R1500

5 Best Gap Cover Options for Under R300

How to Submit a Claim with Momentum Medical Scheme

To submit a claim to Momentum Medical Scheme, you can follow these steps. Go to the “Medical Aid” section on the Momentum homepage. Scroll down and click on “Submit a Claim” under “Claims and Authorizations.”

- ✅ Via the App: Download the Momentum app, log into your profile, scan or upload your claim, and submit it to Momentum.

- ✅ Via the website: Use the Web Chat facility on the website.

- ✅ Via WhatsApp: Click on the “WhatsApp Message” link and follow the instructions to submit your claim.

- ✅ Telephonically: Call the toll-free number from within South Africa or use the landline number provided if you are calling from abroad.

- ✅ Email: Email your claim to the Momentum Health claims department.

- ✅ Via Post: You can send your claim via the postal service in South Africa to Momentum Health’s postal address in Durban, KwaZulu-Natal.

How to Submit a Compliment or Complaint with Momentum Medical Scheme

To submit a compliment or a complaint to Momentum Medical Scheme, follow these steps:

- ☑️ Go to the Momentum Website and click “Contact Us” from the righthand side of the home screen.

- ☑️ Scroll down to “Compliments and Complaints” and click “Share Your Experience.”

- ☑️ Select “Compliments” or “Complaints.”

If a complaint has not been managed to your satisfaction, you can explore the following avenues, depending on your complaint:

- ☑️ Council for Medical Schemes

- ☑️ Financial Advisory and Intermediary Services (FAIS) Advice-Related Complaints

- ☑️ Ombudsman for Long-Term Insurance

- ☑️ Ombudsman for Short-Term Insurance

- ☑️ Pension Funds Adjudicator

- ☑️ The National Consumer Commission (Consumer Protection Act)

- ☑️ Protection of Privacy

Read more: How to Report a Medical Aid Scheme for Wrongdoing

How to Switch my Medical Aid to Momentum Medical Scheme

It would help if you notified your current medical aid of your intent to terminate coverage before switching to the Momentum Medical Scheme. After giving your current medical aid provider notice that you will cancel your coverage, you can apply for Momentum Medical Scheme online or over the phone.

Momentum Medical Scheme Customer Support

Momentum Medical Scheme provides multiple channels of communication with its customer service team.

- Call +27 (0)11 350 0000 to reach the Momentum Medical Scheme help desk.

- Momentum Medical Scheme’s email address for contacting customer service is [email protected] .

- You can reach the customer service team of the Momentum Medical Scheme via their website’s online contact form.

- Contacting Momentum Medical Scheme is also possible via various social media channels.

- Stop by a branch: Momentum Medical Scheme has locations across the country where you can get help.

- Momentum medical aid contact details Call or WhatsApp 0860 11 78 59

Remember that the customer service hours and availability may change based on the method of contact and the nature of the issue at hand.

Momentum vs Discovery Health vs Sizwe Hosmed – A Comparison

Read more comparisons between Momentum Medical Scheme and other Medical aid schemes:

- Momentum Medical Scheme vs. Discovery Health

- Momentum Medical Scheme vs. KeyHealth

- Momentum Medical Scheme vs. BestMed Medical Scheme

- Sizwe Hosmed Medical Fund vs Momentum Medical Scheme

- Bonitas vs. Momentum Medical Scheme

- Fedhealth vs. Momentum Medical Scheme

- Medihelp vs. Momentum Medical Scheme

- Medimed vs Momentum Medical Scheme

Momentum Medical Scheme Member Reviews

I would like to take a moment to say that Momentum consistently has excellent customer service. Professionally, the consultants never fail to assist us and provide us with their undivided attention. Momentum, I appreciate I. – Mustafa Shields

Trusted Support.

Momentum Health has been excellent to work with since my husband had a medical emergency; they have been prompt in authorizing and approving PMBs. Their customer service representatives are always helpful and polite. Wow, that was effective! – Samuel Shepard

High-Quality Service.

Positive feelings about Momentum. Financial security includes a pension, life insurance, and medical assistance. Invariably helpful and high-quality service. – Zahraa Graves

Our Verdict on Momentum Medical Scheme

Overall, Momentum Medical Scheme is a well-established and trustworthy medical aid provider that offers an array of comprehensive health insurance plans focusing on preventative care and additional benefits for its clients. Momentum Medical Scheme has a range of customer support options, including a website and branches for those who want to learn more about the scheme and the overall company. Additionally, Momentum has diversified its product portfolio to include healthcare, car and home insurance, life cover, savings, and investments.

With six medical aid plan options available, it is easy for both low- and high-income earners to find a suitable plan within the scheme. Furthermore, Momentum and Momentum Health strongly emphasize preventative measures, making it an ideal choice for individuals who want to stay on top of their health status. Therefore, Momentum Health is one of the most trusted schemes in South Africa .

Poll 1: 5 Best Medical Aids in South Africa for Young Adults

Poll 2: 5 Best Medical Aids under R500

Momentum Medical Scheme Pros and Cons

You might also like the Momentum Summit

You might also like the Momentum Ingwe

You might also like the Momentum Incentive

You might also like the Momentum Extender

You might also like the Momentum Evolve

You might also like the Momentum Custom

You might also like the Multiply Rewards

Momentum Medical Scheme Frequently Asked Questions

Is momentum a good medical aid.

Momentum is the third-largest medical aid in South Africa, with a high trust rating of 4.3, making it a popular and reputable option for South Africans regardless of their health needs.

Is Momentum an affordable medical aid?

Momentum’s entry-level medical aid plans provide South Africans extensive cover in terms of day-to-day care, hospital cover, and chronic conditions from 541 ZAR , making it a good and affordable option. Furthermore, the Ingwe option allows members to choose a plan according to their monthly income, ensuring they can choose a suitable option comfortably.

Where can I find the Momentum Medical Aid plans and prices for 2023?

You can find this information under the “Medical Aid” section of the official Momentum website.

Is the Momentum Hospital Plan a good option?

According to existing members, the Momentum Hospital plan offers comprehensive coverage and flexible contribution options that suit every budget.

How can I access my Momentum Medical Aid Login from Web or Mobile?

You can access the official Momentum page and the “Medical Aid” option from the main menu. In addition, you can click on “log in” from the top right side of the page to enter your credentials and access your client portal.

How do I Downgrade my Plan with Momentum Medical Scheme?

Momentum Medical Scheme does not currently indicate whether members can downgrade their plan.

How do I add a Beneficiary to Momentum Medical Scheme?

If you want to add a child or adult dependent, you can log into your Momentum Medical Scheme profile.

Are there different levels of coverage available with Momentum Health?

Yes, there are different levels of cover available with the Momentum Evolve Plan, ranging from the comprehensive Premier Option to the more affordable Ingwe Option.

How long does Momentum take to pay out a claim?

Momentum takes several days up to weeks, depending on the overall process and the documents and information received.

Does Momentum have cashback?

Yes, Momentum has a cashback program. However, this cashback is on its insurance and not medical aid. The Momentum optional benefit reimburses 15% of your paid premiums if you go four consecutive years without filing a claim. Once a claim has been resolved, a new Momentum Rewarder cycle will commence immediately after the incident date.

Does Momentum cover gym membership?

Momentum offers discounts on gym memberships. Momentum Health’s optional rewards program offers a 25% gym membership discount. In addition, Virgin Active and Planet Fitness studios nationwide offer discounted rates without a minimum number of visits per month or year.

Does Momentum cover Surgery?

This Major Medical Benefit covers hospitalization, specialized procedures, and scans. In addition, option-specific benefits cover hospitalization and surgery.

How can you apply for chronic Momentum medication?

To apply for Momentum’s chronic medication and activate your chronic benefit, you must request that your treating doctor contact Momentum to receive the application. Once approved, you can receive your medication from a pharmacy.

Does Momentum cover over-the-counter medication?

Depending on your plan and available benefits, Momentum pays for prescribed and over-the-counter medication, often on plans with savings for medical aid or day-to-day benefits for OTC medicine.

Does Momentum cover depression?

Mental health illnesses like depression, drug and alcohol rehabilitation, and post-traumatic stress are included in the list of 270 conditions that must be treated to qualify for the Prescribed Minimum Benefit. However, the treatment of these illnesses with medication is not covered.

Does Momentum have a waiting period?

Momentum, like all other medical aids in South Africa, has waiting periods that the Council determines for Medical Schemes (CMS), which can range from 3 to 12 months depending on specific and pre-existing conditions, previous cover, and more.

Does Momentum cover childbirth?

Momentum provides both a daily benefit for hospitalization and a lump sum maternity benefit in the event of childbirth.

Ladies can make use of our free Ovulation Calculator

What is the Momentum Medical Aid Contact Number?

Momentum can be contacted on 0860 11 78 59 telephonically or on WhatsApp for customer care, chronic medication, emergency GP and Casualty Benefits, and other options. For emergencies, Momentum Medical Aid can be contacted at 082 911.

You might also like

Table of Contents

Free medical aid quote, our trusted partners.

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved | Copyright 2024

Top 5 Medical Aids

- Discovery Health

- Momentum Health

Top 5 Gap Cover Plans

- Totalriskcover

- Stratum Benefits

- Liberty Gap Cover

Top 5 Hospital Plans

- Discovery Health Hospital Plan

- Bestmed Beat 1 Hospital Plan

- Bonitas Hospital Standard Medical Plan

- Medihelp MedMove! Medical Aid Plan

- KeyHealth Essence Medical Aid Plan

- Momentum Custom Medical Aid Plan

Top 5 Pet Insurance

Your compare list

- Bahasa Indonesia

- Slovenščina

- Science & Tech

- Russian Kitchen

Moscow and St. Petersburg present a new tourist pass

Russia has introduced a new tourist pass called PassCity , which will be of use not only to foreign travelers who have come to Russia for a few days, but also to students from overseas and expatriates whose stay extends to a few months and more. PassCity has apps available for Android and iOS with free audio guides in English and Chinese.

PassCity has become Russia's first pass which is valid in two cities at once and covers all the major museums of Moscow and St. Petersburg. The price for a tourist pass for 3/5/7/10 days varies from $80 (1 person, 3 days - 5190 rubles ) to $230 (2 people, 10 days - 14,390 rubles ). A 90/180/360-day pass costs from $ 64 (1 person, 90 days - 3990 rubles ) to $160 (2 people, 360 days - 9990 rubles ). The package for several days was designed for tourists and includes an unlimited number of museum visits per day, as well as public transit. The 3/6/12-month card is meant for temporary residents of the cities and covers one museum visit a day, without access to public transit.

Apart from admission to museums, the pass gets you free coffee in the DoubleB chain of coffee shops , several trips on the airport express in Moscow, and subway rides in St. Petersburg or by taxi ordered through the Yandex.Taxi service.

For the practical and the cautious

The Voxxter team spent more than two years developing the pass; while working on it, they established partnerships with Mastercard, Yandex.Money , Yandex.Taxi (a Russian taxi service similar to Uber ), and DoubleB , a popular chain of coffee shops in St. Petersburg and Moscow.

PassCity is as easy to use as a regular credit card: It uses the Mastercard payment system, and the chosen package of services is activated upon purchase. You can deposit money on the card and use it to pay for other goods and services: Using an extra credit card instead of your primary card when traveling is a sensible security measure.

Cards are delivered through a system that has recently gained popularity among Internet banks. "You can order the pass online or through the app, and our courier will deliver it where and when you decide, for instance, your hotel, or the railway station where the airport express arrives. Our customers have confirmed that this is a lot more convenient than having to look for a sales office in an unknown city," explains Maksim Ivlev, Voxxter CEO.

Voxxter believes the pass could be useful for tourists who come to Russia to watch upcoming sporting events, including the 2018 FIFA World Cup.

If using any of Russia Beyond's content, partly or in full, always provide an active hyperlink to the original material.

to our newsletter!

Get the week's best stories straight to your inbox

- 5 cheapest ways to travel through the world’s largest country

- See Russia visa-free: Kaliningrad, St. Petersburg and Vladivostok

This website uses cookies. Click here to find out more.

IMAGES

COMMENTS

International travel cover. check. R15 500 emergency optometry. check. R15 500 emergency dentistry. check. R765 000 terrorism cover. *A R2 070 co-payment applies per out-patient claim paid by the Scheme. Benefit information.

Book a health or fitness assessment. Download your health tax and travel certificates. + You may choose to make use of additional products available from Momentum Metropolitan Holdings Limited (Momentum), to seamlessly enhance your medical aid. Momentum is not a medical scheme and is a separate entity to Momentum Medical Scheme.

Momentum Medical Scheme's Ingwe Option is a popular student healthcare cover solution. For just R541 per month, you can get all the benefits you need to stay healthy and protected, including: check Unlimited access to any private hospital in South Africa. check Unlimited doctor visits. check Emergency benefits. check Dentistry. check Eye care.

risk in the country you will be visiting. If you do travel, Momentum Medical Scheme will provide cover outside of South Africa for coronavirus, provided you pre-notify us before leaving South Africa. Remember to obtain pre-authorisation from ISOS on +27(0)11 541 1263 if treatment is needed. Your

Let's compare international travel benefits offered by top medical aid schemes in South Africa. Momentum Health. In partnership with Europ Assistance, Momentum Health offers international travel benefits on all its plans. Cover is limited to R5 million per beneficiary, and benefits include emergency transportation, evacuation and repatriation.

COVID-19 SA resource centre. Get the latest news, statistics and media releases on COVID-19 on the official South African government's Online Resource and News Portal. Momentum is a leading FSP offering financial advice, medical aid, insurance, Wills, Trust and investment products to individuals and businesses in SA.

Medical aid plans. With Momentum Medical Scheme open_in_new, you can access a wide range of medical aid plans and industry-leading benefits. Whether you're a student looking for the most affordable medical aid open_in_new, a young professional, or a breadwinner who needs extensive cover for your whole family in South Africa, you can compare the cover and benefits of 2 or more medical aid ...

Gap cover helps you avoid unexpected shortfalls for in-hospital expenses, that are not covered by your medical aid option. from R236 per month. Learn more. + You may choose to make use of additional products available from Momentum Metropolitan Holdings Limited (Momentum), to seamlessly enhance your medical aid.

Momentum offers a range of medical aid options to suit your individual or family needs, with industry-leading benefits and affordable rates. Whether you need hospital cover, day-to-day benefits, or comprehensive cover, you can compare and choose the best plan for you online. Join Momentum and get access to quality healthcare and financial advice.

Medical aid quotes. Once you've narrowed down your choice to the most affordable medical aid cover for your needs, you can get an online medical aid quote in 4 easy steps, or call 0861 111 818 to discuss your medical aid and gap cover needs. + You may choose to make use of additional products available from Momentum Metropolitan Holdings Limited (Momentum), to seamlessly enhance your medical ...

If you're on Momentum Medical Scheme's Evolve, Custom, Incentive, Extender or Summit Option, you qualify for Multiply Inspire and Multiply Inspire Plus where you'll qualify for HealthReturns. For more information, visit multiply.co.za or speak to your financial adviser. + You may choose to make use of additional products available from Momentum ...

Momentum Health Insurance: Health4Me Call or WhatsApp. 0860 102 903. Business hours ... Multiply Travel. 0861 100 155. mailto: [email protected] Business hours. ... Personal accident and health cover. 0861 426 837 [email protected] Business hours. Mon-Fri: 08:15 to 16:30.

Momentum Health provides cover for approximately 298 000 lives and is one of the 5 largest open South African medical schemes. There are 23 options to choose from, with premiums for a single member ranging from R455 to R10 642. ... Benefits offered include discounted gym membership, travel & movie tickets as well as discounts and cash-back from ...

Momentum is part of Momentum Metropolitan Life Limited, an authorised financial services and registered credit provider. ©2021 Momentum Metropolitan Life Limited

The Best Travel Medical Insurance for Visitors to the U.S. Atlas America - Best Overall. Patriot America Lite - Best for Cost. Patriot America Plus - Great for Trip Interruption Insurance ...

Momentum Gap Cover. View all the up-to-date benefits, features, and coverage. ... 🟨 Travel Cover Extender: None: None: None: 🟩 Average Price: R219: R203: R242 - R788: 🟦 Exclusions: Yes: ... Momentum GapCover+ is a health insurance plan offered by Momentum Health Insurance that covers the gap between what your medical scheme covers ...

Save on travel with a wide variety of partners. Multiply makes travelling easy. With up to 40% off flights and 40% off car hire, you can afford to stay for an extra day or two. Take a break and see the world, you deserve it.

Momentum Medical Aid Scheme. Overall, Momentum Medical Scheme offers 6 medical aid plans (Ingwe, Evolve, Incentive, etc.) starting from R541 per month. Additionally, Momentum Medical Scheme offers 24/7 emergency support and offers a comprehensive gap cover on every policy. Medical Aid. Momentum. Registration Number.

The HealthSaver is a Momentum product that lets you save for medical expenses such as vitamins, cosmetic surgery, over the counter medication and more. Not only can you choose the amount to contribute - according to your own needs and pocket - but seamless integration with your medical aid means it is the most convenient way to pay for ...

KM Travel is in Chesterfield, KM Travel may offer holiday tours, sightseeing tours, and general city tours in Chesterfield. ... Page List. (Click on the page required to be linked with that page in the brochure) Page 1 - Front cover. Page 2 - Introduction. Page 3 - Contact information. Customer information. Page 4 - How to make a booking ...

from General Colin Powell regarding the sensitivity of the document as well as the cover page and the proposed schedule. When looking at the proposed schedule, students should consider how much time President Reagan spent one-on-one with General Secretary Gorbachev and how much time was spent with other outside groups/people.

PassCity has become Russia's first pass which is valid in two cities at once and covers all the major museums of Moscow and St. Petersburg. The price for a tourist pass for 3/5/7/10 days varies ...

The city covers an area of 2511 km2, while the urban area covers 5891 km2, and the metropolitan area covers over 26000 km2. Moscow is among the world's largest cities, being the most populous city entirely in Europe, the largest urban and metropolitan area in Europe, and the largest city by land area on the European continent. - Wikipedia