市場別情報・統計データ

訪日インバウンドに関する世界の主要市場についての基礎情報、外国旅行および訪日旅行の動向、毎月発表の訪日外客統計データを公開しています。

- Corporate customers

- Individual customers

- Business partners

- Our Business

- Sustainability

- Corporate information

- The JTB Way

- The Value Creation Process at JTB

- Brand Movie

- 110 years of JTB history

- Tourism business

- Area solution business

- Business solution

- Global Business (incl. Japan Inbound business)

- Top Commitment

- Sustainable Business Management

- Feature Story

- Materiality-Guided Sustainability Priorities

- Data Highlights

- The JTB Brighter Earth Project

- Report / Materials

- Sustainable business management

- Mental and Physical Wellbeing

- Personal Growth and Development

- Helping communities and businesses

- Empowering Our People to Shine

- Human Rights & Diversity

- Creating Regional Allur

- Caring for the Earth

- Stakeholder Connections

- JTB Sustainability Priorities and the SDGs

- Corporate Governance

- Sustainability Report

- Top message

- Company profile

- Company Brochure (ESSENCE BOOK)

- JTB group organization

- Our history

- Overseas Group Companies

Print to PDF

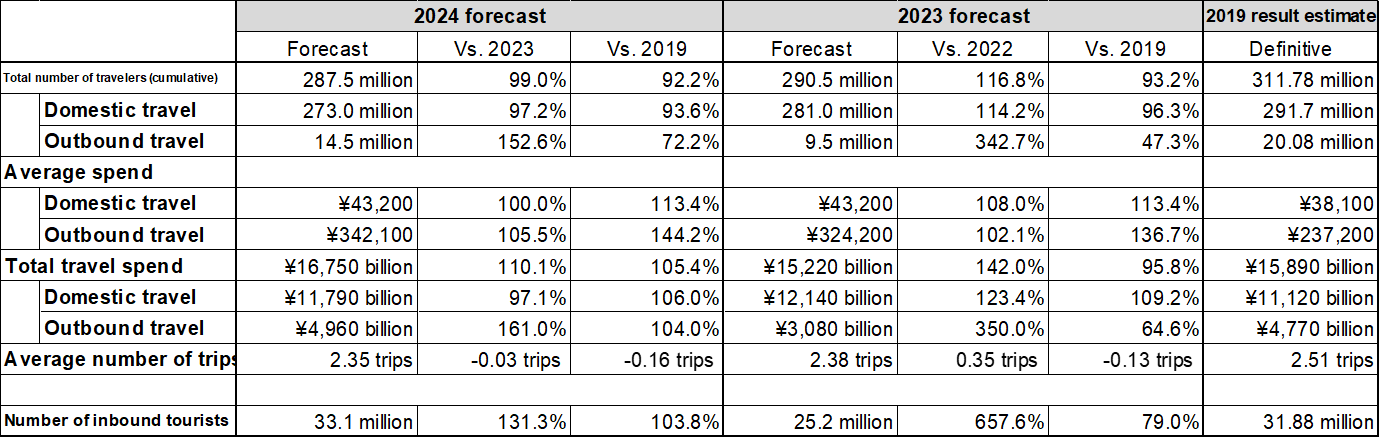

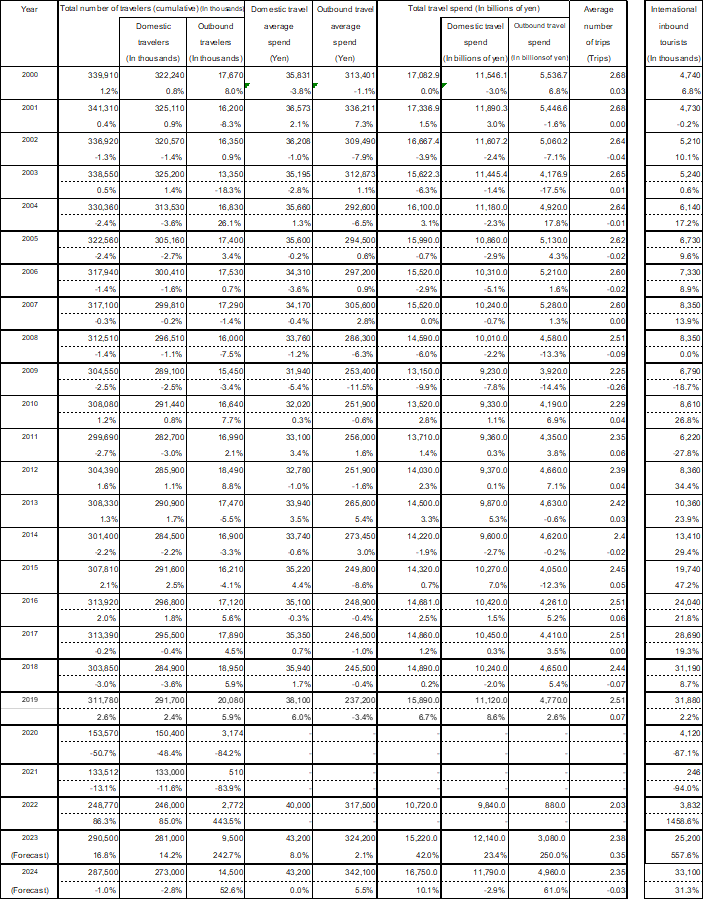

The number of inbound tourists is likely to hit record high at 33.1M. ●The number of Japanese domestic travelers is estimated at 273 million (97.2% of 2023 and 93.6% of 2019). ●The number of outbound travelers is estimated at 14.5 million (152.6% of 2023 and 72.2% of 2019). ●The number of international inbound tourists is estimated at 33.1 million (131.3% of 2023 and 103.8% of 2019).

JTB has compiled a report on a 2024 travel trend outlook. For 2021 and 2022 when COVID-19 had a significant impact, JTB released estimates for domestic trips only. JTB resumed releasing estimates for Japanese resident outbound trips and international inbound trips in 2023. The survey provides estimates on overnight or longer trips of Japanese residents travelling in Japan (including business trips and visits to hometowns) and of international visitors travelling to Japan. The estimates are made based on data such as economic indicators, consumer behavior surveys, transport/tourism related data, and surveys conducted by the JTB Group. The survey has been conducted continuously since 1981. The estimated size of the travel market in 2024 is as follows.

*Domestic travel spend means total expenditures incurred after leaving home and until returning home. It includes spending at travel destinations such as shopping and meals and does not include spending before and after a trip (e.g., the cost of purchasing clothing or other travel goods).

*Outbound travel spend includes travel expenditures (including fuel surcharges) and spending at travel destinations such as shopping and meals. It does not include spending before and after a trip (e.g., the cost of purchasing clothing or other travel goods).

*For inbound trips, only the number of inbound tourists is estimated. Travel spend is not calculated.

*Figures at or below the second decimal point are rounded for comparisons with previous years and with 2019.

*The number of domestic travelers is the number of travelers going on an overnight or longer trip.

*The numbers of domestic travelers and outbound travelers both include those on business trips and visiting their hometown.

*Because the survey results are rounded, there could be discrepancies in the sub-totals or differences with previous years' figures.

<Social and Economic Trends and Environment Surrounding Traveling>

1.Situation of COVID-19 and travel trends before the end of 2023

The World Health Organization (WHO) announced in May 2023 the end of a global health emergency brought about by COVID-19 after more than three years had elapsed since they had declared COVID-19 as a worldwide pandemic in March 2020. While economic activities have mostly returned to their pre-COVID conditions worldwide, ongoing inflations and high interest rates caused by factors such as the rapid recovery in demand are having various impacts on people's lives. With respect to travelling, except for some countries and regions, international arrival and departure restrictions have generally been removed, enabling international travel in the same manner as in the pre-COVID period. According to the World Tourism Barometer released by the United Nations World Tourism Organization (UNWTO) in November 2023, the number of international tourists worldwide during the January-September 2023 period recovered to 87% of its pre-COVID level. Unstable international situations and the resulting rises in energy and other prices, however, are causing concerns. Furthermore, there are regional differences in recovery: the Asia Pacific region including Japan is recovering slower than Europe and the United States.

The Japanese government ended its border control measures in April 2023 and re-classified COVID-19 into Class-5, the same category as seasonal influenza, under the country's infectious disease laws in May 2023. These brought people's lives mostly back to pre-pandemic conditions. Regulatory restrictions on travelling have also been removed, and some regions are implementing a government-funded travel discount program as well as travel support measures of local governments. Partly due to these measures, tourism activities are returning nationwide, combined with a recovery in inbound tourism. Meanwhile, some tourist spots and areas are experiencing a service staff shortage and rising accommodation charges due to changes in the environment caused by the COVID-19 pandemic. In addition, there are concerns about overtourism.

2.Economic environment surrounding traveling and living conditions

The Nikkei Stock Average has remained over ¥30,000 since May 2023, demonstrating robust market activities in Japan. Meanwhile, the country's economic outlook remains uncertain due to the impact of global conditions and monetary policies of European countries and the United States. The World Economic Outlook released by the International Monetary Fund (IMF) in October 2023 forecasted Japan's growth rate in 2023 at 2.0%, which was above the actual growth rate of 1.0% recorded in 2022. The IMF, however, makes a grimmer forecast for 2024, expecting the 2024 growth rate to decline to 1.0%.

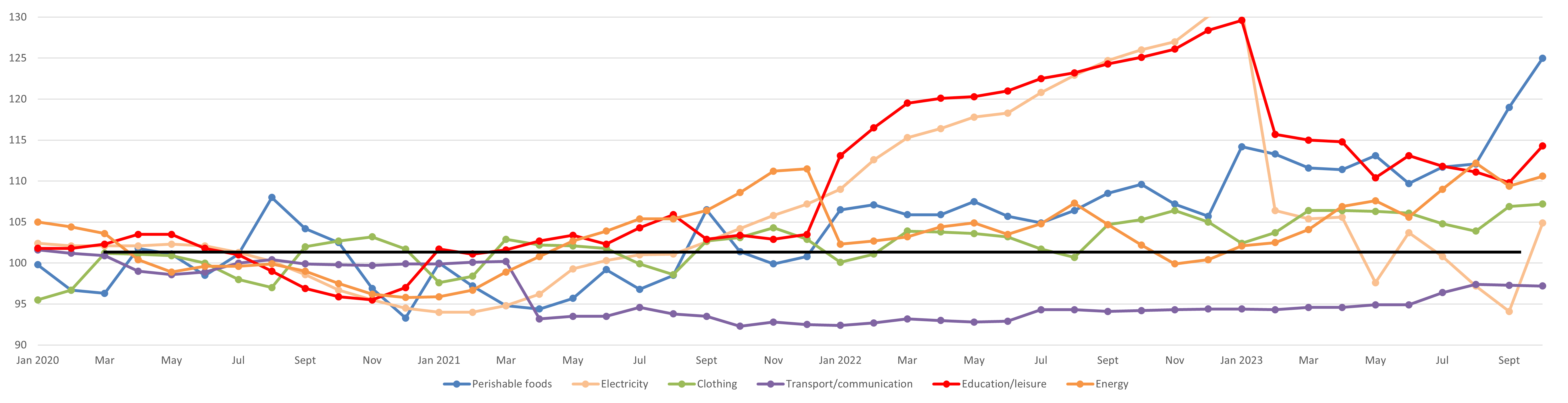

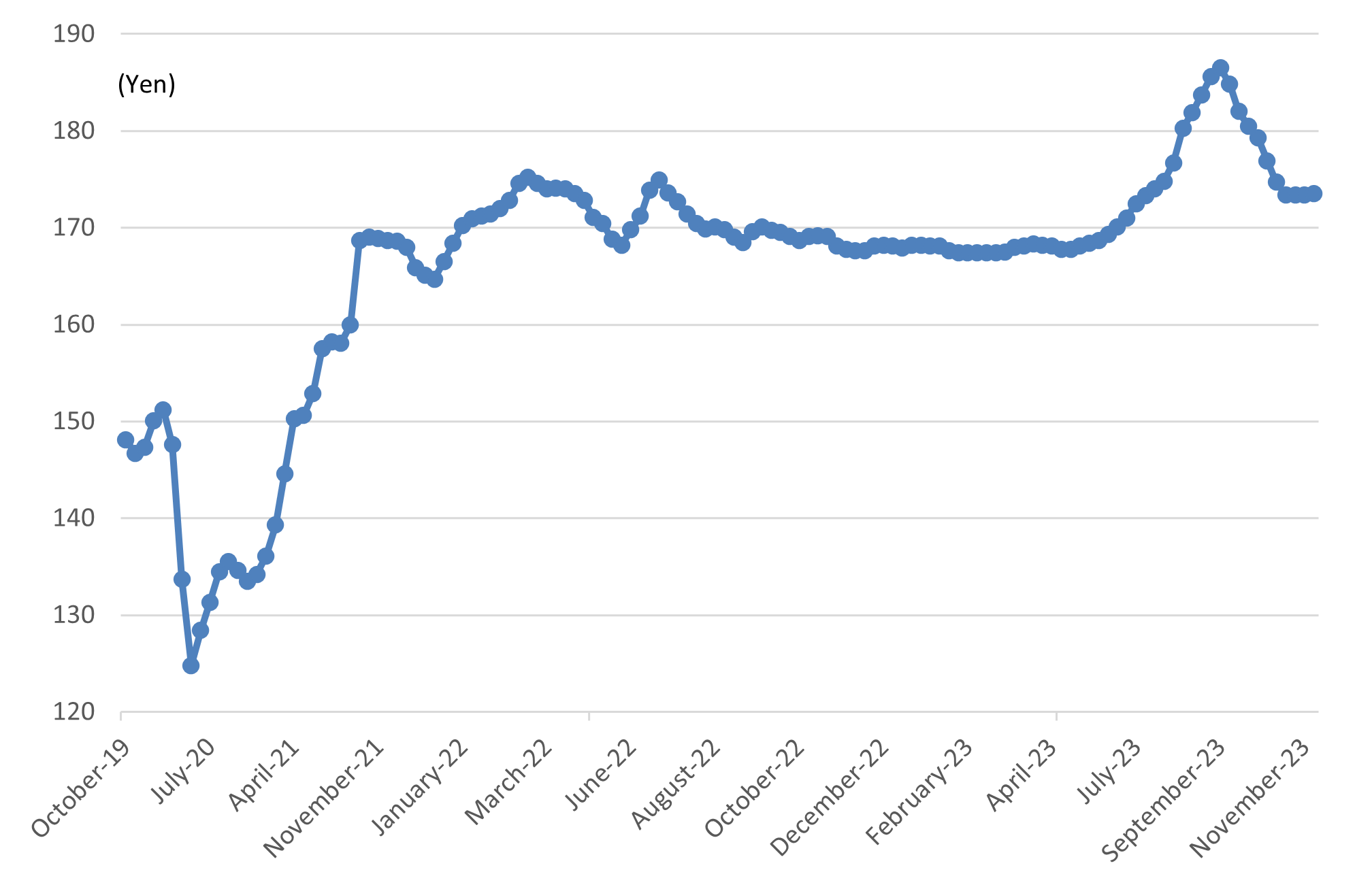

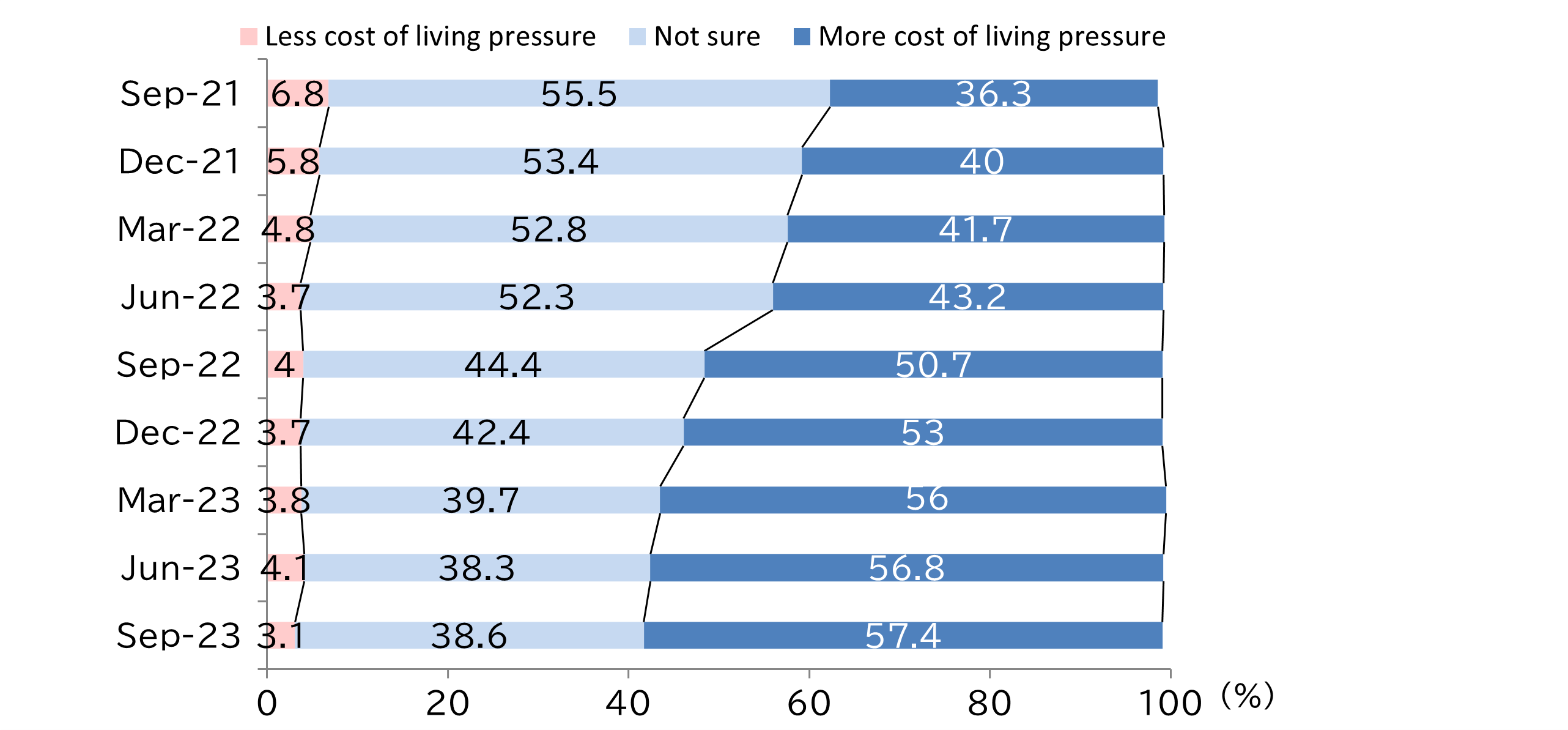

Looking at the current economic conditions, the trend of the rising US dollar against the Japanese yen accelerated in 2023 with a US dollar temporarily nearing the ¥152 mark on the FOREX market in November 2023. This has led to the ongoing rises in import prices, which are having a material impact on households (Figure 2). Looking at the consumer price index of major items, while electricity cost has relatively been stable thanks to the subsidies continuously provided by the Japanese government, prices of perishable foods, clothing, among others are rising and transport and communication costs are also steadily increasing (Figure 3). The prices of gasoline have also been kept down by the government subsidies, but they have constantly remained at around ¥170/liter (Figure 4). In this environment, looking at consumer sentiments, according to the current living conditions illustrated in a Bank of Japan survey on consumer sentiment, the ratio of respondents who are feeling a greater cost of living pressure has been consistently on the rise since September 2021, reaching 57.4% of all the respondents in September 2023, which is 21.1 percentage points (pp) higher compared with September 2021 (Figure 5). This shows that economic conditions remain difficult.

(Figure 2) 2023 FOREX Rates of Major Currencies Against Yen

Source: Telegraphic Transfer Middle Rate (TTM) in the Tokyo FOREX market (FOREX data provided by Mitsubishi UFJ Research & Consulting Co., Ltd.)

(Figure 3) Consumer Price Index of Major Items

Source: Prepared by JTB Tourism Research & Consulting Co. based on consumer price index data (2020=100) provided by the Ministry of Internal Affairs and Communications, Japan

(Figure 4) Regular Gasoline Price

Source: Prepared by JTB Tourism Research & Consulting Co. based on a survey of petroleum product prices by the Agency for Natural Resources and Energy, Japan

(Figure 5) Current Living Conditions

Source: Prepared by JTB Tourism Research & Consulting Co. based on data from the consumer sentiment surveys conducted by the Bank of Japan

3.Status of travelers

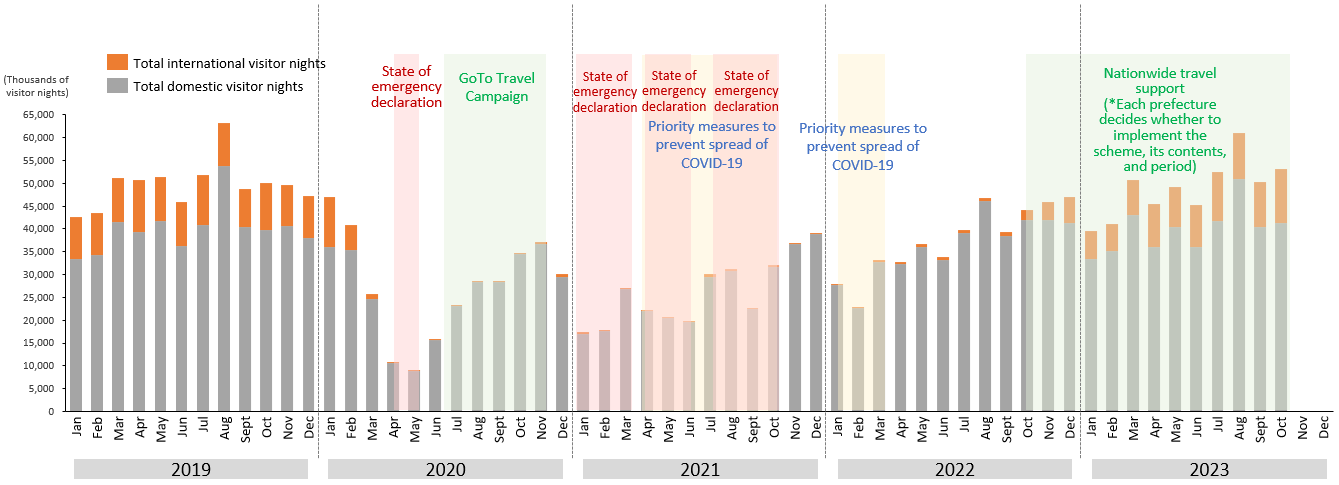

With respect to domestic travel, the number of visitor nights recovered to nearly its pre-COVID level in 2023 mainly because no COVID-related restrictions were placed on people's movements, the classification of COVID-19 was changed to Class-5 on May 8, and the Japanese government offered nationwide travel support subsidies. The total visitor nights in October 2023 were 41,333,000, representing 98.5% of the same figure in October 2022 (41,969,000) and 103.9% of the same month in 2019 (39,791,000). The cumulative total visitor nights from January to October 2023 stood at 398,765,000, representing 113.7% of the same period in 2022 (350,730,000) and 99.3% of the same period in 2019 (401,723,000) *1 (Figure 6).

*1: Source: Visitor nights statistic surveys by the Japan Tourism Agency; the first preliminary figure for October 2023, the second preliminary figure for January-September 2023, and definitive figures for 2019 and 2022.

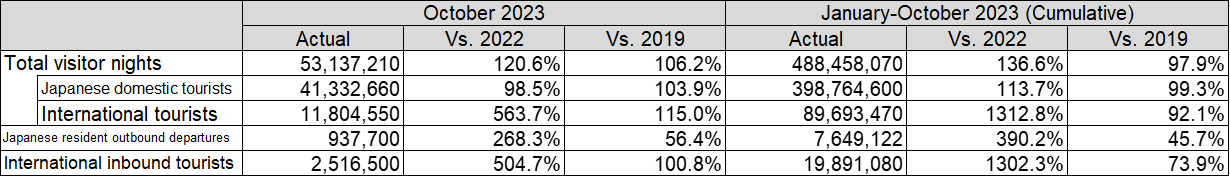

After the Japanese government ended its border control measures on April 29, 2023, international travel has become easier in terms of national regulations. Recovery in outbound travelers, however, has been slow due to factors including inflations, the cheaper yen, and ongoing uncertainty in situations of certain areas. In October 2023, Japanese resident outbound departures stood at 938,000, representing 268.3% of the same figure in October 2022 (350,000 departures). The October 2023 figure, however, only represents 56.4% of the same figure in October 2019 (1,663,000 departures). The cumulative total for the January-October period was 7,649,000 departures, representing 390.2% of the same figure in the same period in 2022 (1,960,000 departures) and 45.7% of the same period in 2019 (16,726,000 departures) *2 (Figure 7).

*2: Numbers of inbound travelers to Japan and Japanese resident outbound departures provided by the Japan National Tourism Organization (JNTO); an estimate for October 2023, a provisional figure for January-September 2023, and definitive figures for October 2019 and October 2022.

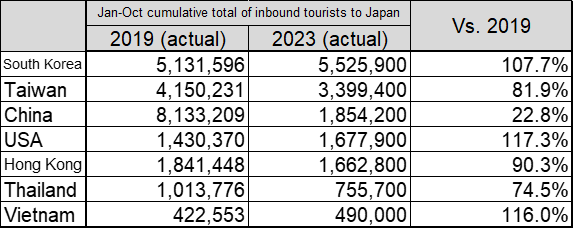

Recovery in inbound tourism accelerated in 2023 due to factors such as the end of Japan's border control measures and the termination or relaxation of measures to combat COVID-19 worldwide. The number of inbound tourists to Japan in October 2023 was 2,517,000, representing 504.7% of the same figure in October 2022 (499,000) and 100.8% of the same figure in October 2019 (2,497,000), exceeding its pre-COVID level for the first time on a single-month basis. The cumulative total for the January-October period was 19,891,000, representing 1,302.3% of the same period in 2022 (1,527,000) and 73.9% of the same period in 2019 (26,914,000) *3 (Figure 7). By country and region, the largest number of inbound tourists to Japan during the January-October 2023 period came from South Korea (5,526,000; 107.7% of the same period in 2019), followed by Taiwan (3,399,000; 81.9% of the same period in 2019), and China (1,854,000; 22.8% of the same period in 2019) (Figure 8).

*3: Numbers of inbound travelers to Japan and Japanese resident outbound departures provided by the Japan National Tourism Organization (JNTO); estimates for September and October 2023, a provisional figure for January-August 2023, and definitive figures for 2019 and 2022.

(Figure 6) Cumulative Total Visitor Nights

Source: Prepared by JTB Research & Consulting Co. based on visitor nights statistic surveys conducted by the Japan Tourism Agency; definitive figures for 2019 to 2022, the second preliminary figure for January-September 2023, and the first preliminary figure for October 2023).

(Figure 7) Total Visitor Nights, Japanese Resident Outbound Departures and International Inbound Tourists in October 2023 and January-October 2023 Period (Cumulative)

Source: Prepared by JTB Research & Consulting Co. based on visitor nights statistic surveys conducted by the Japan Tourism Agency and the numbers of inbound travelers to Japan and Japanese resident outbound departures provided by the Japan National Tourism Organization (JNTO).

(Figure 8) 2023 International Inbound Tourists by Country and Comparison with 2019 (Top 7 Countries)

Source: Prepared by JTB Research & Consulting Co. based on the numbers of inbound travelers to Japan and Japanese resident outbound departures provided by the Japan National Tourism Organization (JNTO).

<2024 Travel Market>

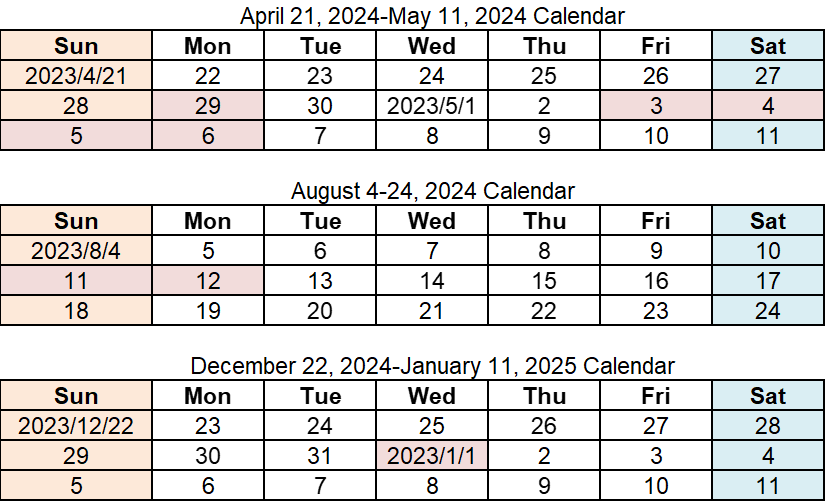

4.2024 calendar and major events

There are 11 long weekends in 2024. It is a significant increase from 2023 which had seven long weekends. While the Golden Week holidays are split into the first long weekend (Saturday, April 27 to Monday, April 29) and the second long weekend (Friday, May 3 to Monday, May 6), it can become 10 consecutive holidays from Saturday, April 27 to Monday, May 6, if one takes time off work from Tuesday, April 30 to Thursday, May 2. In summer, if one takes time off work during the Obon festival period (Tuesday, August 13 to Friday, August 16), there will be nine consecutive holidays from Saturday, August 10 to Sunday, August 18. The 2024/25 year-end/new year period can be turned into nine consecutive holidays from Saturday, December 28 to Sunday, January 5, if one takes time off work on Monday, December 30 and Tuesday, December 31.

*The red letters indicate national holidays.

[1]The 33rd Olympics Games (Paris 2024 Summer Olympics) and Paris 2024 Paralympics Games

One of the notable events in 2024 is the 33rd Olympics Games (Paris 2024 Summer Olympics) and Paris 2024 Paralympics Games that will take place in France. The 33rd Olympics Games (Paris 2024 Summer Olympics) will start on Friday, July 26 and end on Sunday, August 11, while the Paris 2024 Paralympics Games is scheduled to start on Wednesday, August 28 and to end on Sunday, September 8. Both events will take place in multiple cities including Paris, while the surfing Olympics event will be held in Tahiti, a French territory.

[2]Extension of Hokuriku Shinkansen and opening of Kurobe-Unazuki Canyon Route in Japan

In Japan, the Kanazawa-Tsuruga section of Hokuriku Shinkansen is scheduled to start operating on Saturday, March 16. This reduces the travel time between Tokyo Station and Fukui Station to as short as two hours 51 minutes. In addition, in the Kurobe Canyon in Toyama Prefecture, the Kurobe-Unazuki Canyon Route that connects the Kurobe Dam and the Kurobe Gorge Railway Keyakidaira Station will be opened to the public on Sunday, June 30.

In addition, there are art events scheduled in 2024 such as the 8th Yokohama Triennale (Yokohama City, Kanagawa; Friday, March 15 to Sunday, June 9) and Echigo-Tsumari Art Triennale 2024 (Tokamachi City, Niigata; Saturday, July 13 to Sunday, November 10).

[3]Successive openings of new areas in popular theme parks and large commercial facilities

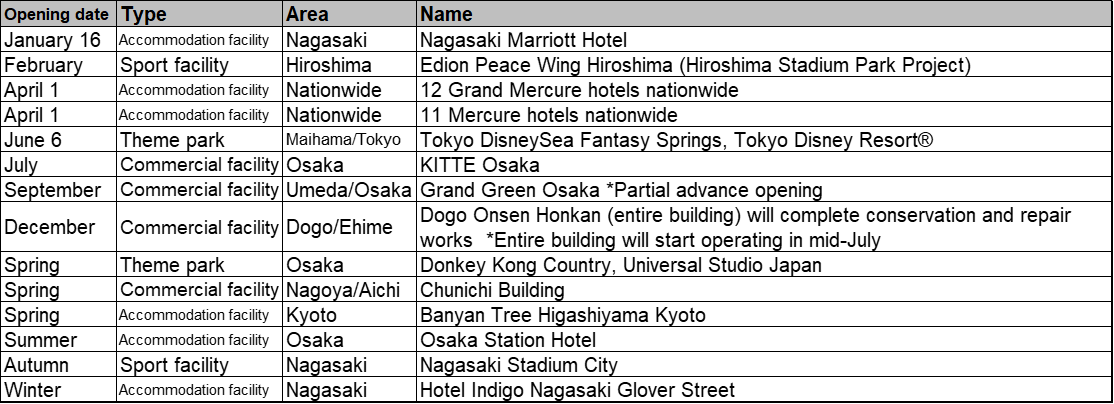

There are many scheduled openings of commercial facilities and launches of new contents in popular theme parks in 2024.

Universal Studio Japan plans to expand the Super Nintendo World™ area to 1.7 times the current size to open the Donkey Kong Country area featuring globally popular Donkey Kong. Meanwhile, Tokyo Disney Resort® plans to open a new theme port, Fantasy Springs, the eighth theme port in Tokyo DisneySea, on Thursday, June 6. The new port will consist of three areas themed after Frozen, Rapunzel, and Peter Pan and a new Disney Hotel, Tokyo DisneySea Fantasy Springs Hotel.

Regarding commercial facilities, as part of the redevelopment project around Osaka Station in Osaka City (Osaka), the Umekita 2nd Project "Grand Green Osaka," some facilities including a park, hotel, and commercial facilities will start operating in September ahead of others. In Nagoya City (Aichi), the Chunichi Building, which closed in 2019 due to ageing, has been rebuilt and is scheduled to open in spring. In Matsuyama City (Ehime), Dogo Onsen Honkan, which has been operating partially for conservation and repair works since 2019, will begin operating in full in mid-July for the first time in five years (conservation and repair works are scheduled to be fully completed in December).

[4]Lively activities for accommodation facilities; many new openings including openings of all the Mercure Hotels in Japan

New accommodation facilities are also scheduled to open successively. Daiwa Resort Co., Ltd. has rebranded 23 existing Daiwa Royal Hotels into 12 Grand Mercure hotels, the first group of Mercure hotels in Japan, and 11 Mercure hotels. All the hotels will start operating on April 1.

In the Kansai area, Banyan Tree Higashiyama Kyoto, the flagship brand of Banyan Tree Hotels & Resorts headquartered in Singapore, is scheduled to open in Kyoto City (Kyoto) in spring, while the Osaka Station Hotel is scheduled to open in Osaka City (Osaka) inside KITTE Osaka. which is scheduled to open in July (Figure 9).

(Figure 9) Main Facilities Scheduled to Open in 2024

5. Domestic travel trends *Domestic trips of residents of Japan excluding international inbound tourists

The number of domestic travelers in 2024 is projected at 273 million (97.2% of 2023 and 93.6% of 2019).

The average spend is estimated at ¥43,200 (100.0% of 2023 and 113.4% of 2019).

Total domestic travel spend is forecast at ¥11,790 billion (97.1% of 2023 and 106.0%of 2019).

In 2024, the number of domestic travelers is estimated at 273 million (97.2% of the same figure in 2023 and 93.6% of 2019), average spend at ¥43,200 (100.0% of the same figure in 2023 and 113.4% of 2019) due to the expected continuation of high prices, and total domestic travel spend at ¥11,790 billion (97.1% of the same figure in 2023 and 106.0% of 2019). Although the classification of COVID-19 was changed to Class-5 in May 2023 and its impacts were mostly eliminated, the number of travelers is likely to plateau due to factors such as high travel expenditures and the easing of travel appetite (as spending in reaction to the reduced activities during the COVID-19 pandemic will run its course). In 2024, the living environment is anticipated to remain difficult due to the ongoing inflation, while there are expectations for the Japanese government's economic policy.

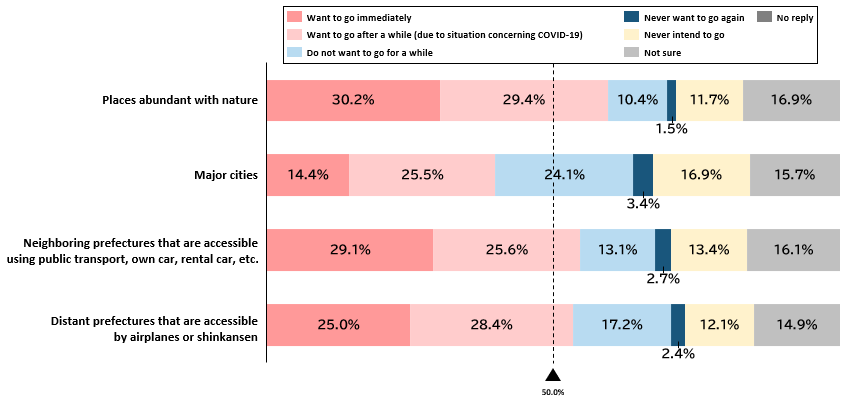

In the 2023/24 year-end/new year travel trend survey (December 23, 2023-January 3, 2024) conducted by JTB, on a question about future domestic travel plans by destination, "Places abundant with nature" ranked first as a place that the respondents "Want to go immediately" with 30.2% of the respondents choosing this option, followed by "Neighboring prefectures that are accessible using public transport, own car, rental car, etc." at 29.1%. This shows a trend of choosing places with nature and nearby places as travel destinations (Figure 10).

Due to COVID-19, climate change, uncertain international situations, and so on, lifestyles and values have changed worldwide, which is affecting Japanese residents' domestic travel preferences and tourist spots in Japan.

Promotion of travel/hospitality operators' and local communities' initiatives with awareness of SDGs

Travel companies are promoting various initiatives aiming to contribute to Sustainable Development Goals (SDGs) and sustainability. For instance, these include tours and events designed to reduce CO 2 emissions, the protection, development, and exchange of traditional local cultures and arts, and the use of natural resources for tourism. Airline carriers are also working on reducing their CO 2 emissions through efforts such as the introduction of sustainable aviation fuel (SAF).

Meanwhile, tourism destinations have begun initiatives to build sustainable tourism spots. For instance, 10 places in Japan were selected in the 2023 Top 100 Stories chosen by Green Destinations, a certification organization for international indices for sustainable tourism developed by the Global Sustainable Tourism Council (GSTC). The Japan Tourism Agency has been promoting the sustainable management of tourism places since the establishment of the Japan Sustainable Tourism Standard for Destinations (JSTS-D) in June 2020.

Nationwide promotion of measures to prevent overtourism

Since the end of the COVID-19 pandemic, some tourist places are facing an issue of overtourism brought about by a recovery in travel demand. In response, the Japanese government prepared a policy package for measures against overtourism and is scheduled to select approximately 20 places for its pilot projects. The government's support may include the dissemination of real-time crowd information of tourist spots to disperse visitors from overcrowded destinations and the introduction of a shared-taxi ride service.

Meanwhile, some tourist places have already started implementing measures to tackle overtourism. For instance, in Kyoto, visiting hours of temples and other tourist attractions have been extended to the early morning and nighttime to spread visitors and efforts are made to reduce congestion by displaying crowd situations on apps or transmitting real-time images of tourist destinations using installed cameras.

(Figure 10) Future Domestic Travel Intensions by Destination Type

Source: Prepared using the unpublished data of JTB's 2023/24 year-end/new year travel trend survey (December 3, 2023-January 3, 2024).

6.International travel trends

The number of outbound travelers in 2024 is estimated at 14.5 million (152.6% of 2023 and 72.2% of 2019).

The average spend is projected at ¥342,100 (105.5%t of 2023 and 144.2% of 2019).

Total outbound travel spend is estimated at ¥4,960 billion (161.0% of 2023 and 104.0% of 2019).

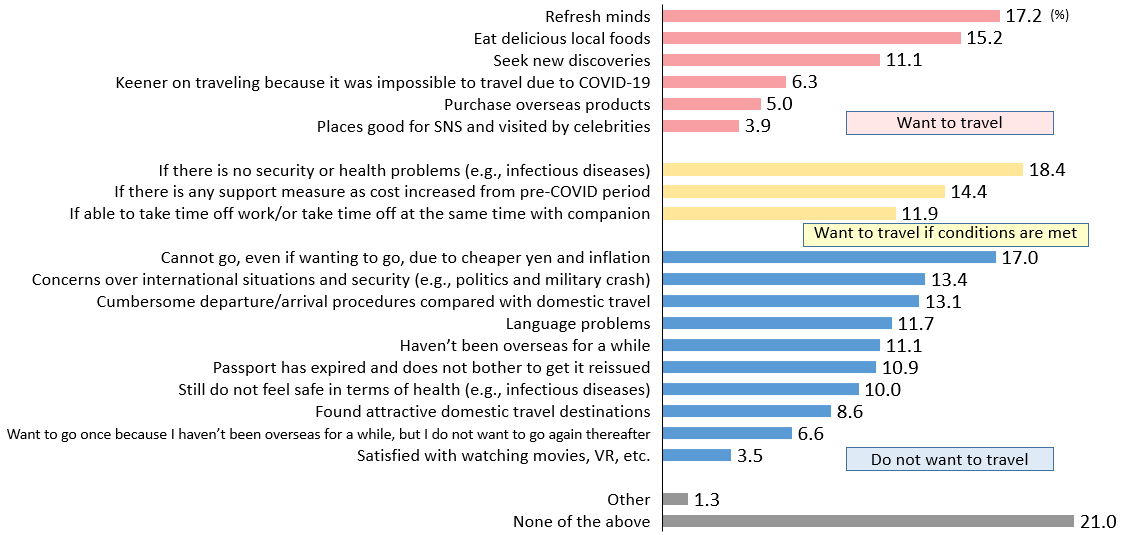

In 2024, the number of outbound travelers is estimated at 14.5 million (152.6% of the same figure in 2023 and 72.2% of 2019), average spend at ¥342,100 (105.5% of the same figure in 2023 and 144.2% of 2019) due to the continuing impact of the cheaper yen and overseas inflations, and total outbound travel spend at ¥4,960 billion (161.0% of the same figure in 2023 and 104.0% of 2019). While international travel has become easier in terms of national regulations after the termination of Japan's border control measures in April 2023, the number of outbound travelers in 2024 is expected to recover slowly due to factors such as uncertain international situations, in addition to economic factors. As a result, the number is not expected to recover to its pre-COVID level at least until 2025. The average spend per person is projected to exceed the previous year and reach the highest since 2000.

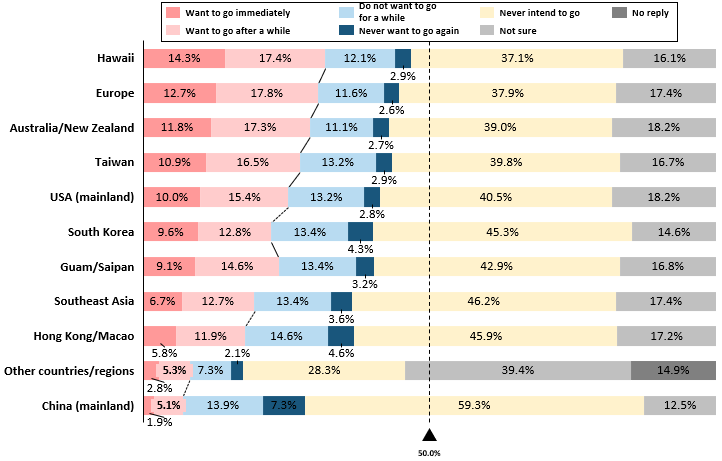

In the 2023/24 year-end/new year travel trend survey (December 23, 2023-January 3, 2024) conducted by JTB, Hawaii ranked highest at 14.3% among the destinations the respondents wanted to go immediately, in response to a question on future outbound travel plans. This was followed by "Europe (12.7%)," "Australia/New Zealand (11.8%)," "Taiwan (10.9%)," "USA (mainland) (10.0%)," "South Korea (9.6%)," and "Guam/Saipan (9.1%)." Relatively distant countries/regions ranked higher, followed by relatively closer countries/regions, showing a clear trend of division between close and distant destinations (Figure 11). With respect to the respondents' current international travel intentions, although they are positive about travelling overseas, economic and other factors are posing obstacles (Figure 12).

(Figure 11) Future International Travel Intensions by Destination

(Figure 12) Current International Travel Intensions

Source: 2023/24 Year-end/new year travel trend survey (December 23, 2023-January 3, 2024) by JTB

7 . Number of inbound travelers to Japan

The estimated number of inbound travelers to Japan in 2024 is 33.1 million (131.3% of 2023 and 103.8% of 2019).

The number of inbound travelers to Japan in 2024 is estimated at 33.1 million (131.3% of the same figure in 2023 and 103.8% of 2019). The number of inbound tourists is rapidly recovering due to the increased ease to travel to Japan from overseas following the end of Japan's border control measures in April 2023 and a sense of better value for money spent due to the cheaper Japanese yen and relatively low prices compared with Europe, the United States, and other areas. By country and region, the numbers of visitors from South Korea, Taiwan, the United States, and Hong Kong have already exceeded or recovered close to their pre-COVID levels. Inbound visitors from these places are expected to further increase in 2024 and to reach a record high exceeding the 2019 level. Although recovery in the number of visitors from China has been significantly slower than other countries/regions, the number is steadily increasing, albeit slowly, and is expected to further recover in 2024, especially those travelling as individuals.

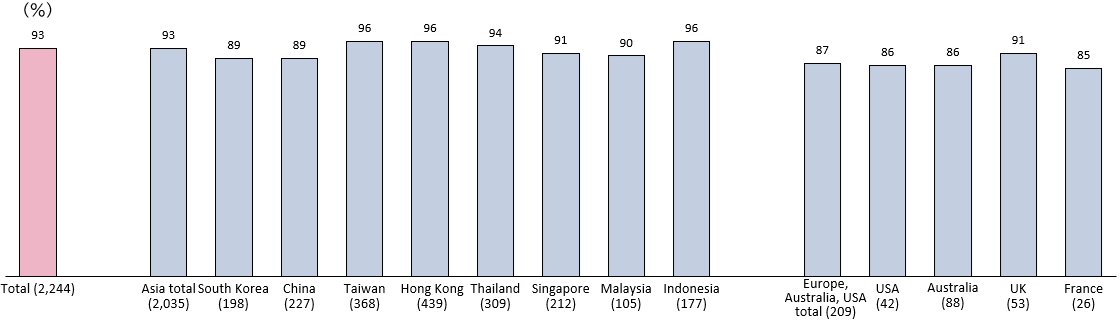

According to the Development Bank of Japan (DBJ) and Japan Travel Bureau Foundation (JTBF) 2023 survey of inbound visitors to Japan from Asia, Europe, the United States, and Australia, released by DBJ and JTBF in October 2023 *4 , Japan ranked first, as in the previous year, as the country/region the respondents wanted to travel next, showing strong popularity of Japan as a travel destination (Figure 13). In addition, there is a strong interest in visiting regional areas in Japan (among those wishing to visit Japan and those who have visited Japan), raising expectations for the spread of inbound visitors to regional communities as promoted by the Japanese government (Figure 14).

*4: A survey of male/female respondents aged 20-79 who have travelled overseas and live in 12 countries/regions including Asia, Europe, USA, and Australia (South Korea, China, Taiwan, Hong Kong, Thailand, Singapore, Malaysia, Indonesia, USA, Australia, UK, France).

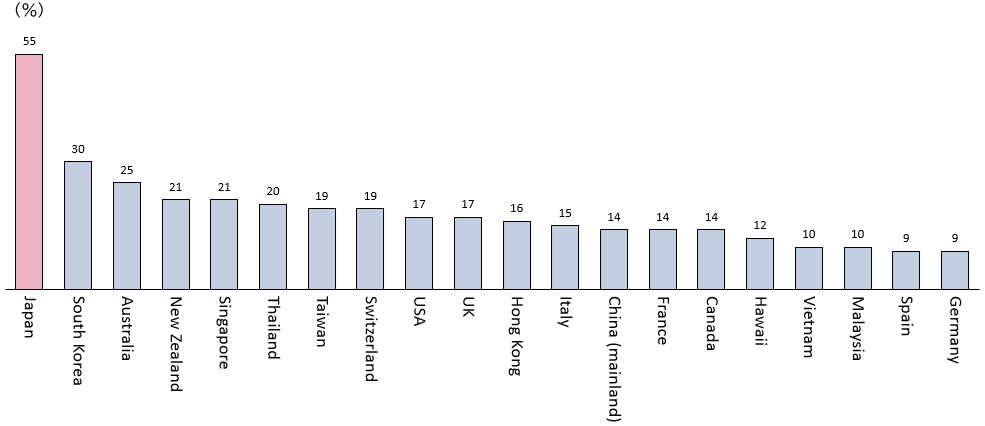

(Figure 13) Countries/Regions Respondents Want to Visit Next (n = 7,414; allowed to choose up to 5 destinations; top 20 countries/regions)

Source: Prepared by JTB Research & Consulting Co. based on the DBJ/JTBF 2023 survey of inbound visitors to Japan from Asia, Europe, the United States, and Australia conducted by the Development Bank of Japan (DBJ) and Japan Travel Bureau Foundation (JTBF).

*The countries/regions where the respondents are from and their neighboring countries/regions (China/Hong Kong/Macao, Malaysia/Singapore, Thailand/Malaysia, USA/Canada/Mexico, Hawaii/Guam, Australia/New Zealand, UK/France/other European countries) were removed from the options for the countries/regions to visit next. When calculating percentages, if the "country/region respondents want to visit" and "the respondents' country/region" and "the respondents' neighboring countries/regions" are same, those respondents are removed from the number of samples (denominator).

(Figure 14) Interest in Regional Communities Among People Wishing to Travel to Japan and People Who Have Traveled to Japan (n = 2,244; single answer)

(The percentages of people who have responded that they are "Very keen to travel in the future" or "Keen to travel in the future if there is an opportunity")

(Figure 15) 2000-2022 Estimates and 2023-2024 Forecasts (The figures in the lower row show year-on-year percentage changes)

Back to Index

- Subscribe Digital Print

- overtourism

- Tokyo governor race

- Latest News

- Deep Dive Podcast

Today's print edition

Home Delivery

- Crime & Legal

- Science & Health

- More sports

- CLIMATE CHANGE

- SUSTAINABILITY

- EARTH SCIENCE

- Food & Drink

- Style & Design

- TV & Streaming

- Entertainment news

Japan sees record 2.79 million visitors in February due to Lunar New Year boost

Japan welcomed 2.79 million visitors in February, a record for the month and the most for any month since the COVID-19 pandemic began, boosted by travel during Lunar New Year holidays.

Arrivals in February were 7.1% higher than in 2019, when the Lunar New Year also fell in the second month of the year rather than the first. For all of 2019, Japan welcomed a record 31.9 million visitors before the pandemic struck.

Tourism to Japan all but stopped for more than two years during the pandemic. Since then, the industry has received a major boost from a weak yen that has made Japan a bargain destination for foreign travelers.

Current account data in January showed a record gain attributable to inbound tourism, illustrating the sector's widening role in the economy. Visitors spent more than ¥5 trillion ($33.3 billion) in the country last year for the first time, exceeding the government's goal.

Travelers from 19 of 23 countries and territories, including South Korea and the United States, set records for February, the JNTO said.

According to Agoda Chief Executive Omri Morgenshtern, Japan is the top destination for travelers from 12 countries on the company's online booking platform.

"Demand for Japan is very strong," Morgenshtern said. "I assume, overall, you will see 2024 in the 2019 levels or slightly above."

In a time of both misinformation and too much information, quality journalism is more crucial than ever. By subscribing, you can help us get the story right.

Tourism Statistics

Provide the latest and most up-to-date tourism statistics / Japanese economic trend

Tourism Statistics Highlight 01 May 2024

- Inbound According to Japan National Tourism Organization (JNTO), the estimated number of international travelers to Japan in March 2024 was 3,081,600 (+11.7% compared to 2019), exceeding 3 million for the first time in a single month.

- Japanese tourists According to preliminary figures from the Immigration Service Agency of Japan, the number of Japanese overseas travelers in March 2024 accounted for 1,219,789, +75.7% compared to March 2023, and -36.8% compared to 2019.

March 2024 (Estimated figures)

3,081,600 Visits

YOY +69.5%

View more statistical bulletins

1,219,789 Visits

YOY +75.7%

Statistics of Visitors to Japan from Overseas

- Overseas Residents’ Visits to Japan by month

- Overseas Residents’ Visits to Japan by year

- Overseas Residents’ Visits to Japan by Country and Region

- Overseas Residents’ Visits to Japan by country

- Overseas Residents’ Visits to Japan by Region

View more time series

Statistics of Japanese Tourists Travelling Abroad

- Japan Residents’/Japanese Visits Abroad by Month

- Japan Residents’/Japanese Visits Abroad by Year

- Japan Residents’/Japanese Visits Abroad by Country and Region

- Japanese Visits Abroad by Airport and Seaport, Monthly

- Japanese Visits Abroad by Airport and Seaport in the Last Decade

Japanese Economic Trend

- GDP Growth Rate

- Unemployment Rate

- Exchange Rate

- Consumption Expenditure per Household

- Consumption expenditures on Travel & Communication

- Sales of Department Stores

- Wholesale Price of Unleaded Gasoline

View more time series related to Japan Economic Trend

Travel & Tourism Development Index 2024

The Travel & Tourism Development Index (TTDI) 2024 is the second edition of an index that evolved from the Travel & Tourism Competitiveness Index (TTCI) series, a flagship index of the World Economic Forum that has been in production since 2007. The TTDI is part of the Forum’s broader work with industry and government stakeholders to build a more sustainable, inclusive, and resilient future for economies and local communities.

Six trends shaping new business models in tourism and hospitality

As destinations and source markets have changed, tourism and hospitality companies have evolved too. Six key trends have shaped business models in this sector over the past decade.

About the authors

This article is a collaborative effort by Caroline Tufft , Margaux Constantin , Matteo Pacca , and Ryan Mann , with Ivan Gladstone and Jasperina de Vries, representing views from McKinsey’s Travel, Logistics & Infrastructure practice.

In accommodation, asset-light models like franchising and management have proliferated, though luxury and small-scale brands are opting out. Consolidation has driven economies of scale. Hotels are looking to reclaim their relationship with guests, and almost two decades in, home sharing is charting its own course.

In the experiences space, reinvention is the name of the game. Cruises and theme parks have both focused on attracting new demographics while fine-tuning their revenue management strategies. Experiences remains a highly fragmented, legacy sector, creating massive opportunity for those able to crack the code on aggregation.

By considering the six trends, tourism and hospitality companies can gain insights on business practices for today—and on areas of future opportunity.

Accommodation: New models and value propositions

Large hotel brands have increasingly turned away from hotel ownership, scaling their business through franchising and management instead. The move is paying off. We find there is a 0.84 correlation between a hotel company’s share of franchised properties and its net profit margin.

Not all of hospitality is embracing asset-light model, however. Luxury hotel chains have resisted the trend, largely retaining in-house ownership to control standards. And smaller brands may find that they cannot reach the economies of scale that make the math of a franchise business work—focusing instead on creating distinctive experiences on a smaller scale.

Consolidation set the stage for the past decade. Several hotel brands quickly grew their foothold in key geographies and customer segments through strategic acquisitions, achieving economies of scale along the way.

As major hotels take a breather from a series of substantial acquisitions, further mergers between large hotel brands seem unlikely. However, tuck in acquisitions to target key growth demographics, like the luxury and youth categories, are likely to continue.

Another trend on the horizon is direct booking. Long reliant on online travel agencies, hotels are looking to reclaim their relationships with customers—both to cut down on intermediary booking fees and to learn more about their guests. Hotels are encouraging direct bookings through a variety of levers, ranging from best-rate guarantees to higher reward-earnings rates and improved mobile applications. 1 For example, Hyatt offers a best-rate guarantee for booking on hyatt.com and Marriott International is growing direct bookings. For more, see “Marriott sees record direct bookings at its hotels,” Skift, May 4, 2022.

Home sharing is here to stay. The segment has grown from 10 to 14 percent of booking value between 2017 and 2023, experiencing ups and downs in profitability along the way.

Recently, home sharing has positioned itself as more than a stand-in for traditional hotels. Airbnb’s recent advertising campaign “Get an Airbnb” leaned into the differences of home sharing from other hospitality offerings, emphasizing the space and privacy that renting a house can offer. 1 Samantha Shankman, “‘Get an Airbnb’ campaign challenges hotels,” Skift, August 30, 2023.

Home-sharing companies have also become a key distribution channel for smaller hotels, as they can offer more control over inventory and lower fees than other channels. In 2019, Airbnb reported a 152 percent increase in the number of rooms available for booking through its platform in boutique hotels, bed and breakfasts, and resorts. 2 “More hotels are using Airbnb,” Airbnb news release, January 16, 2019.

Experience providers: New segments and revenue streams

Cruises may only account for 2 percent of the overall travel and tourism market, but they have achieved 6 percent yearly revenue growth in the past decade. 1 McKinsey analysis of publicly listed tourism and hospitality companies’ Form 10-Ks. Attracting new travelers and providing new experiences have been key growth strategies.

Luxury hotels are capturing the new-to-cruising segment with the launch of yacht brands, purposefully positioned as a distinct experience from traditional cruises. Meanwhile, millennials are challenging stereotypes about cruising: of all cruise passengers, they are the demographic most likely to say they plan to cruise again (88 percent). 2 State of the cruise industry 2023: September 2023 update, CLIA, September 2023.

In parallel, cruises have fine-tuned their profitability through economies of scale and new revenue streams. Megaships have become the new normal, as ships with over 3,000 berths have grown from 27 to 47 percent of the global cruise fleet since 2015. Ancillary purchases such as onshore excursions and onboard casinos have also become a major source of growth, now accounting for 30 percent of revenue on average. 3 Calculated using the weighted average based on 2023 Form 10-Ks statements of publicly listed cruise companies.

Theme park attendance has grown 3 percent a year over the past decade, as theme park providers capitalize on new demographics and refine their revenue management strategies. 1 Global attraction attendance report , joint report from AECOM and Themed Entertainment Association, 2019.

Two new groups of visitors in particular are powering growth. First, the Asia–Pacific region accounted for much of the growth in theme park attendance in the past decade: of the total number of new visitors between 2013 and 2018, 57 percent were from Asia. Second, millennials are heading to parks in greater numbers, and not just for their children. A similar proportion of millennial parents (78%) and millennial nonparents (75%) say they are interested in going to a theme park. 2 Morning Consult survey, 2,201 participants, June 14–19, 2018.

To increase value from growing attendance, theme parks have become increasingly sophisticated in the field of revenue management. Demand-based pricing, tiered annual passes, and skip-the-line fees are all poised to go from pioneering to widespread practices.

Experiences are increasingly important to travelers, but the segment remains a highly fragmented space. Operators of activities ranging from walking tours to snorkeling outings tend to be small businesses with a limited digital presence.

This has created an opportunity for tech-forward companies to help travelers discover and book experiences. Destination marketing organizations have long played a role in this. For instance, VisitScotland helps visitors discover interesting activities like attending Harry Potter filming locations and whiskey tastings.

Several private companies that offer online discovery and booking platforms for travel activities, like Viator, GetYourGuide, and Klook, have achieved considerable growth in the US, European, and Asian markets. 1 Yeoh Siew Hoon, “GetYourGuide gets into pole position to win in $250b experiences market,” WIT, September 20, 2023. GetYourGuide grew its revenue fourfold between 2022 and 2023, Viator revenue was up 49 percent for the same time period, and Klook reported twice as many new customers in 2023 as in 2019. 2 “Klook completes US$210 million funding, embarks on a new era of profitable growth,” Klook news release, December 6, 2023; Mitra Sorrells, “With speculation of a sale in the air, Tripadvisor reports record revenue driven—again—by Viator,“ Phocus Wire, February 14, 2024.

Looking forward: Strategies to stay ahead of the curve

Where does this leave tourism and hospitality companies? Companies in any given sector tend to follow a power law curve : a small share of companies account for an outsize portion of both profits and losses. The tourism and hospitality sector is no different.

Over the past decade, publicly listed accommodation and experience providers grew revenue at 3 percent and 4 percent, respectively, roughly in line with global GDP growth. Accommodation providers increased their profits by five percentage points, while experience providers remained at an 18 percent average profit margin.

As stakeholders gear up for the next decade, there are things that businesses across the sector can do to sustain their hard-won growth—and profits. Moving forward, three strategies in particular can help tourism and hospitality companies stay on the leading edge of innovation.

Unbundle offerings

Hotel and experience providers can take a page from the airline playbook by unbundling rates and letting consumers pay for the exact experience they want. For example, at the time of booking, hotels can present guests with an individually priced bundle for a room on a higher floor, including breakfast and free parking—features that the guest’s past behavior suggests they would particularly value. Ensuring that guests can find their ideal room can lead both to increased revenue and increased satisfaction. A major hotel brand reported that guests chose to spend an additional $22 per night, on average, to customize their hotel room to their liking. 1 “IHG Hotels & Resorts revolutionizes booking experience through next-gen cloud solutions,” InterContinental Hotels news release, September 12, 2023.

Cross-sell exclusive experiences

For accommodation and transportation companies, partnering with experience providers to cross-sell a full journey provides an opportunity to tap into a growing area of traveler spending—and a chance to deepen the relationship with customers as a vacation creator. For example, airlines can partner with museums to offer discounted rates if booked at the time of the flight, or hotels can partner with a historical site nearby to offer early-hours admission. For uptake rates to become significant, the partnership needs to add value beyond mere cross-selling. Offering features like insurance or an option to buy now and pay later is one way to add value; creating a distinctive experience like a combined train and historic hotel journey is another.

Embrace a data-powered strategy

Tourism and hospitality entities individually hold a treasure trove of untapped data. Take Paris: hotels may see a surge in bookings for the “shoulder season.” Experience aggregator platforms might see that street food tours have attracted rising interest. Social media might reveal that a particular neighborhood is exploding in popularity. What special guest experiences could be created by combining these insights? Stakeholders can unlock new revenue streams by thinking through what data they hold that can be of value to others. More broadly speaking, combining multiple sources of data can help guide a strategy of unbundling and cross-selling to create more gratifying and pertinent experiences for travelers around the world. Embracing data isn’t just smart—it’s the future of travel.

Caroline Tufft is a senior partner in McKinsey’s London office, Margaux Constantin is a partner in the Dubai office, Matteo Pacca is a senior partner in the Paris office, Ryan Mann is a partner in the Chicago office, Ivan Gladstone is an associate partner in the Riyadh office, and Jasperina de Vries is an associate partner in the Amsterdam office.

The authors wish to thank Abdulhadi Alghamdi, Alessandra Powell, Alex Dichter, Cedric Tsai, Diane Vu, Elisa Wallwitz, Lily Miller, Maggie Coffey, Nadya Snezhkova, Nick Meronyk, Paulina Baum, Peimin Suo, Rebecca Stone, Sarah Fellay, Sarah Sahel, Sophia Wang, Steffen Fuchs, Steffen Köpke, Steve Saxon, and Urs Binggeli for their contributions to this article. The authors also wish to thank Mabrian for providing data.

Explore a career with us

Related articles.

How the world’s best hotels deliver exceptional customer experience

What AI means for travel—now and in the future

UN Tourism | Bringing the world closer

Share this content.

- Share this article on facebook

- Share this article on twitter

- Share this article on linkedin

International tourism reached 97% of pre-pandemic levels in the first quarter of 2024

- All Regions

- 21 May 2024

International tourist arrivals reached 97% of pre-pandemic levels in the first quarter of 2024. According to UN Tourism, more than 285 million tourists travelled internationally in January-March, about 20% more than the first quarter of 2023, underscoring the sector’s near-complete recovery from the impacts of the pandemic.

In 2023 international tourist arrivals recovered 89% of 2019 levels and export revenues from tourism 96%, while direct tourism GDP reached the same levels as in 2019.

UN Tourism’s projection for 2024 points to a full recovery of international tourism with arrivals growing 2% above 2019 levels. In line with this, the newest data released by the UN specialized agency for tourism show that:

Yet it also recalls the need to ensure adequate tourism policies and destination management, aiming to advance sustainability and inclusion, while addressing the externalities and impact of the sector on resources and communities

- The Middle East saw the strongest relative growth, with international arrivals exceeding by 36% pre-pandemic levels in Q1 2024, or 4% above Q1 2023. This follows an extraordinary performance in 2023, when the Middle East became the first world region to recover pre-pandemic numbers (+22%).

- Europe , the world's largest destination region, exceeded pre-pandemic levels in a quarter for the first time (+1% from Q1 2019). The region recorded 120 million international tourists in the first three months of the year, backed by robust intra-regional demand.

- Africa welcomed 5% more arrivals in the first quarter of 2024 than in Q1 2019, and 13% more than in Q1 2023.

- The Americas practically recovered pre-pandemic numbers this first quarter, with arrivals reaching 99% of 2019 levels.

- International tourism is experiencing a rapid recovery in Asia and the Pacific where arrivals reached 82% of pre-pandemic levels in Q1 2024, after recovering 65% in the year 2023.

UN Tourism Secretary-General Zurab Pololikashvili said: "The recovery of the sector is very welcome news for our economies and the livelihoods of millions. Yet it also recalls the need to ensure adequate tourism policies and destination management, aiming to advance sustainability and inclusion, while addressing the externalities and impact of the sector on resources and communities".

By subregions, North Africa saw the strongest performance in Q1 2024 with 23% more international arrivals than before the pandemic, followed by Central America (+15%), the Caribbean and Western Europe (both +7%). Southern Mediterranean Europe exceeded pre-pandemic levels by 1%, while South America virtually reached 2019 levels. Northern Europe recovered 98% of pre-pandemic levels, while Subsaharan Africa and North America both recovered 95%.

According to available data, many destinations across the world continued to achieve strong results in Q1 2024, including Qatar (+177% versus Q1 2019), Albania (+121%), Saudi Arabia (+98%), El Salvador (+90%), Tanzania (+53%), Curaçao (+45%), Serbia (+43%), Turks and Caicos (+42%), Guatemala (+41%) and Bulgaria (+38%).

The robust performance of international tourism can also be seen in the UN Tourism Confidence Index which reached 130 points (on a scale of 0 to 200) for the period January-April, above the expectations (122) expressed for this period in mid-January.

International tourism receipts reached USD 1.5 trillion in 2023, meaning a complete recovery of pre-pandemic levels in nominal terms, but 97% in real terms, adjusting for inflation.

By regions, Europe generated the highest receipts in 2023, with destinations earning USD 660 billion, exceeding pre-pandemic levels by 7% in real terms. Receipts in the Middle East climbed 33% above 2019 levels. The Americas recovered 96% of its pre-pandemic earnings in 2023 and Africa 95%. Asia and the Pacific earned 78% of its pre-crisis receipts, a remarkable result when compared to its 65% recovery in arrivals last year.

Total export revenues from international tourism, including both receipts and passenger transport, reached USD 1.7 trillion in 2023, about 96% of pre-pandemic levels in real terms. Tourism direct GDP recovered pre-pandemic levels, reaching an estimated USD 3.3 trillion in 2023, equivalent to 3% of global GDP.

Several destinations achieved remarkable results in terms of receipts in the first quarter of 2024 as compared to 2019 levels based on available data, including Serbia (+127%), Türkiye (+82%), Pakistan (+72%), Tanzania (+62%), Portugal (+61%), Romania (+57%), Japan (+53%), Mongolia (+50%), Mauritius (+46%) and Morocco (+44%).

Looking ahead to a full recovery globally in 2024

International tourism is expected to recover completely in 2024 backed by strong demand, enhanced air connectivity and the continued recovery of China and other major Asian markets.

The latest UN Tourism Confidence Index shows positive prospects for the upcoming summer season, with a score of 130 for the period May-August 2024 (on a scale of 0 to 200), reflecting more upbeat sentiment than earlier this year. Some 62% of tourism experts participating in the Confidence survey expressed better (53%) or much better (9%) expectations for this 4-month period, covering the Northern Hemisphere summer season, while 31% foresee similar performance as in 2023.

Challenges remain

According to the UN Tourism Panel of Experts, economic and geopolitical headwinds continue to pose significant challenges to international tourism and confidence levels.

IMF's latest World Economic Outlook (April 2024) points to a steady but slow economic recovery, though mixed by region. At the same time, persisting inflation, high interest rates, volatile oil prices and disruptions to trade continue to translate into high transport and accommodations costs.

Tourists are expected to continue to seek value for money and travel closer to home in response to elevated prices and the overall economic challenges, while extreme temperatures and other weather events could impact the destination choice of many travellers. This is increasingly mentioned by the UN Tourism Panel of Experts as a concern for the sector.

Uncertainty derived from the Russian aggression against Ukraine, the Hamas-Israel conflict and other mounting geopolitical tensions, are also important downside risks for international tourism.

As international tourism continues to recover and expand, fuelling economic growth and employment around the world, governments will need to continue adapting and enhancing their management of tourism at the national and local level to ensure communities and residents are at the center of this development.

Related links

- Download News Release on PDF

- Excerpt | World Tourism Barometer - Volume 22 • Issue 2 • May 2024

Category tags

Related content, international tourism to reach pre-pandemic levels in 2024, international tourism to end 2023 close to 90% of pre-p..., tourism’s importance for growth highlighted in world ec..., international tourism swiftly overcoming pandemic downturn.

- Meetings & Events

- Newsletter Sign-up

- Coronavirus (COVID-19) Advisory Information

- Select Language 简体中文 繁體中文(香港) 繁體中文(臺灣) India (English) Bahasa Indonesia 한국어 ภาษาไทย Tiếng Việt Singapore (English) Philippines (English) Malaysia (English) Australia/New Zealand (English) Français Deutsch Italiano Español United Kingdom (English) Nordic countries(English) Canada (English) Canada (Français) United States (English) Mexico (español) Português العربية Japan(日本語) Global (English)

- India (English)

- Bahasa Indonesia

- Singapore (English)

- Philippines (English)

- Malaysia (English)

- Australia/New Zealand (English)

- United Kingdom (English)

- Nordic countries(English)

- Canada (English)

- Canada (Français)

- United States (English)

- Mexico (español)

- Global (English)

- Fujiyoshida

- Shimonoseki

- Ishigaki Island

- Miyako Island

- Kerama Island

- Tokyo Island

- Koka & Shigaraki

- Hida Takayama

- Ginza, Nihonbashi

- Beppu & Yufuin (Onsen)

- Ginzan Onsen

- Nagasaki Islands

- Kumano Kodo

- Shikoku Karst

- Amami Oshima

- Hachimantai

- Omihachiman

- Aizuwakamatsu

- Diving in Japan

- Skiing in Japan

- Seasonal Flowers in Japan

- Sustainable Outdoors

- Off the Beaten Track in Japan

- Scenic Spots

- World Heritage

- Home Stays & Farm Stays

- Japanese Gardens

- Japanese Crafts

- Temple Stays

- Heritage Stays

- Festivals and Events

- Theater in Japan

- Japanese Tea Ceremony

- Cultural Experiences in Japan

- Culture in Japan

- Local Cuisine Eastern Japan

- Local Cuisine Western Japan

- Local Street Food

- Japan's Local Ekiben

- Japanese Whisky

- Vegetarian and Vegan Guide

- Sushi in Japan Guide

- Japanese Sake Breweries

- Art Museums

- Architecture

- Performing Arts

- Art Festivals

- Japanese Anime and Comics

- Japanese Ceramics

- Local Crafts

- Scenic Night Views

- Natural Wonders

- Theme Parks

- Samurai & Ninja

- Iconic Architecture

- Wellness Travel in Japan

- Japanese Ryokan Guide

- A Guide to Stargazing in Japan

- Relaxation in Japan

- Forest Bathing (Shinrin-yoku)

- Experiences in Japan

- Enjoy my Japan

- National Parks

- Japan's Local Treasures

- Japan Heritage

- Snow Like No Other

- Wonder Around Japan

Visa Information

- Getting to Japan

Airport Access

- COVID-19: Practical Information for Traveling to Japan

- Anime Tourism

- Countryside Stays

- Accessible Tourism

- Hokkaido Great Outdoors

- Scenic World Heritage in Tohoku

- Shikoku’s Nature and Traditions

- Southern Kyushu by Rail

- Traveling by Rail

- How to Travel by Train and Bus

- JR Rail Passes

- Scenic Railways

- Renting a Car

- Sustainable Travel in Japan

- Travel Brochures

- Useful Apps

- Online Reservation Sites

- Eco-friendly Accommodation

- Luxury Accommodations

- Traveling With a Disability

- Hands-free Travel

- How to Book a Certified Tour Guide

- Volunteer Guides

- Tourist Information Center

- Japanese Manners

- Spring in Japan

- Summer in Japan

- Autumn in Japan

- Winter in Japan

- Cherry Blossom Forecast

- Autumn Leaves Forecast

- Japan Visitor Hotline

- Travel Insurance in Japan

- Japan Safe Travel Information

- Accessibility in Japan

- Vegetarian Guide

- Muslim Travelers

- Safety Tips

- News from JNTO

US Partner News

- Interesting Articles

- Press Release

- Newsletter Archives

- Trade Newsletter

- Tender Notice

My Favorites

${v.desc | trunc(25)}

Planning a Trip to Japan?

Share your travel photos with us by hashtagging your images with #visitjapanjp

Travel Japan - The Official Japan Guide

U.S.-JAPAN TOURISM YEAR 2024

Go Beyond Japan’s Major Cities: Hokuriku Shinkansen Extension in 2024

Sakura and Beyond: Famous Japanese Flowers to Check Out in 2024

"Open the Treasure of Japan" in 2023 and Beyond

The Japan You Never Knew | VICE Guide to Ehime

Ehime is shaping up to be an emerging tourist destination in Japan.

Sustainable Stays: Enhance Your Japan Experience and Have a Positive Impact with Incredible Accommodations

Inspiration Awaits You at Every Turn: Discover the Indelible Art of Japan

Let Japan’s Spirituality Heal Both Your Body and Soul

Highlighted Features

Adventure in Japan’s Great Outdoors and Explore Japanese Culture with 5 Unforgettable Summer Activities

Experience the rich nature, traditional culture and contemporary art of uncharted Japan

Experience Japanese Culture Online

From Zen to Geisha

Important Notice

Travel Highlights

Popular places.

Explore by Interest

News from JNTO & Our Partners

Visitor Photos

Share your travel photos with us by hashtagging your images with #visitjapanUS

For First-Time Visitors

- Wi-Fi & Connectivity

- Weather & Geography

- IC Travel Cards

Where to Stay

- Luxury Stay

- Haneda Airport

- Narita Airport

- Osaka (KIX)

- Fukuoka Airport

Getting Around

- Shinkansen (Bullet Train)

- Luggage & Storage

Suggested Walks & Tours

- Tokyo 48 Hours

- Golden Route

- 2 Weeks in Japan

- Tour & Activities

Brochure Download

- Tours and Activities

Japanese Government Information

Aug 28, 2019

Aug 26, 2019

Aug 09, 2019

Please Choose Your Language

Browse the JNTO site in one of multiple languages

Mobile Menu Overlay

The White House 1600 Pennsylvania Ave NW Washington, DC 20500

FACT SHEET: Kenya State Visit to the United States

Today, President Biden welcomes President Ruto of Kenya for a State Visit and Dinner to celebrate and deepen ties between our two nations. This visit marks 60 years of official U.S.-Kenya partnership. This partnership is founded on shared values, deep cooperation, and a common vision for the future. The two leaders’ agenda showcases how our ties deliver tangible benefits to the people of our nations in areas including Democracy, Human Rights, and Governance; Health Partnerships; People-to-People Ties; Shared Climate Solutions; Trade and Investment; Debt, Development, and Sustainable Finance; Digital, Critical, and Emerging Technology Cooperation; and Peace and Security Cooperation.

Democracy, Governance, and Human Rights

Our countries are bonded by our shared democratic values and mutual commitment to advancing human rights and strengthening political institutions. This historic State Visit is about the Kenyan and American people and their hopes for an inclusive, sustainable, and prosperous future for all. Our countries endeavor to guard against the erosion of political checks and balances, counter misinformation and disinformation, mitigate hate-fueled violence targeting members of vulnerable communities, and tackle corruption by building transparent and accountable governance systems. The State Visit highlights new areas of cooperation to safeguard rights and freedoms in the face of rising authoritarianism, expand avenues for dialogue, and elevate our shared global commitment to protecting democracy.

- Delivering Democracy: The United States has programed nearly $40 million for democracy, human rights, and governance programming in Kenya, including through Presidential Initiative for Democratic Renewal programs that defend democratic elections and political processes, increase women’s political participation and leadership, counter Gender Based Violence, and advance digital democracy. Additional support for activities in Kenya under the Presidential Initiative for Democratic Renewal build on Kenya’s important work as a member of the 14-country Global Partnership for Action on Gender-Based Online Harassment and Abuse, which is advancing global policies to address online safety for women and girls, including targeted violence against women political and public figures.

- Supporting Independent Civil Society: President Ruto executed on May 9 the legal instruments required to operationalize the 2013 Public Benefits Organization Act, which institutionalizes groundbreaking, global best practices for civil society protections. The United States announced $700,000 in new assistance to support this effort in addition to the $2.7 million the United States is providing to improve civil society engagement in and oversight of governance processes. The U.S. Agency for International Development (USAID) also announced an additional $1.3 million youth empowerment program aimed at strengthening political engagement at the subnational level and $600,000 to advance disability inclusion.

- Bringing Transparency to Government: The United States and Kenya commit to strengthening the Open Government Partnership (OGP), which Kenya co-leads and the United States co-founded, including through robustly fulfilling our open government commitments at home. USAID Administrator Power plans to represent the United States at the OGP event on the margins of the UN General Assembly High Level Week in September. This event gathers world leaders for an opportunity to showcase the powerful global coalition on open government and democracy and to consider opportunities for further collaboration.

- Promoting Human Rights: The United States and Kenya affirm their commitment to upholding the human rights of all. Together they stand with people around the world defending their rights against the forces of autocracy. Kenya and the United States commit to bilateral dialogues that reinforce commitments to human rights, as well as a series of security and human rights technical engagements with counterparts in the Kenyan military, police, and Ministry of Foreign Affairs aimed at strengthening collaboration on security sector governance, atrocity prevention, and Women, Peace and Security in Kenya and regionally.

- Combatting Corruption: The Administration intends to provide $500,000 for a new Fiscal Integrity Program to make county budget processes more transparent and inclusive and increase citizen engagement, and $500,000 to broaden the reach and effectiveness of anti-corruption advocacy by empowering civil society actors to create and disseminate multimedia content that engages citizens and mobilizes action against corruption. To support the Government of Kenya to combat corruption, the Administration is providing $250,000 through the Global Accountability Program, and $300,000 to support Kenya’s proposed Whistleblower Protection law to strengthen Kenya’s anti-corruption legal architecture. In addition, USAID has provided $2.7 million to support the improved enforcement of policy and laws that deal with fraud, waste, and abuse in the delivery of public services to Kenyan citizens.

- Gathering Anti-Corruption Professionals: With support from the U.S. Department of State’s Bureau of International Narcotics and Law Enforcement Affairs, the UN Office on Drugs and Crime and the East African Association of Anti-Corruption Authorities convened a regional conference from May 20-23, 2024, in Nairobi, Kenya, gathering anti-corruption practitioners and policymakers from countries participating in the East Africa Anti-Corruption Platform.

- Strengthening Police Reform Efforts: Building on a longstanding partnership to further police capacity building and reform efforts, the United States and Kenya announced a new $7 million partnership to advance and strengthen the modernization and professionalization of Kenya’s National Police Service, with a focus on staff and training development.

- Reducing Prison Overcrowding and Improving Detention Conditions: The United States and Kenya are committed to further advancing Kenyan-led efforts to improve the oversight of and conditions within Kenya’s prison service. The United States announced a new $2.2 million initiative to provide training, mentoring, and technical assistance to implement priority reforms.

- Combatting Transnational Organized Crime and Supporting Criminal Justice Sector Reform: Recognizing the regional role Kenya plays in combating transnational organized crime, the United States intends to provide $4.9 million in new funding for Kenya and other East African countries to improve cooperation and coordination in combating criminal networks and holding criminals accountable. Funding also supports capacity building and reform efforts within the Kenyan police and justice sectors.

- Supporting Investigative Journalism: The United States seeks to amplify Kenya’s leadership in building Africa’s digital resilience by supporting linkages between well-known international investigative organizations and select Kenyan NGOs, media outlets, and citizen journalists to build up Nairobi as a regional hub for exposing issues in the public interest. This support also helps journalists in their pursuit of public information. Pursuing these efforts in Kenya – a regional media and technology leader – positively impacts East Africa and the broader continent, particularly as Kenyan recipients connect with counterparts in the region.

- Strengthening Kenya’s Frameworks for Free and Fair Elections: Working with Congress, the Administration intends to provide $1.5 million in new technical assistance to support Kenya’s electoral legal framework reform process aimed at strengthening the election commission, political parties, and campaign finance. This funding aims to improve public awareness raising and advocacy around the reforms, laying the groundwork for a more inclusive, transparent and peaceful 2027 election. This support complements Kenya’s amendment to the Independent Electoral and Boundaries Commission Act, which passed the National Assembly on May 3 and is now with the Senate.

Health Partnership: Securing Our Collective Health

Decades of collaboration between the United States and Kenya in the health sector have resulted in tremendous improvements in health not only for millions of our citizens, but also for the broader global community. This cooperation is vital to developing medical innovations, preventing the emergence of future global pandemics, and ensuring that effective treatments are widely available. Our governments are working in lockstep with the private sector, which is developing new manufacturing capacity in Kenya that can serve Africa and the world. The efforts showcased during the State Visit build upon these successes to ensure a healthier, more prosperous future for all.

- Continuing the Fight against HIV/AIDS: The United States and Kenya are developing a “Sustainability Roadmap” to integrate HIV service delivery into primary health care, ensuring quality and impact are retained. With more than $7 billion in support from the President’s Emergency Plan for AIDS Relief (PEPFAR) spanning two decades, Kenya has successfully responded to the HIV epidemic and strives to end HIV as a public health threat in Kenya by 2027. These efforts improve holistic health services for the 1.3 million Kenyans currently receiving antiretroviral therapy and millions more benefiting from HIV prevention programs, while allowing for greater domestic resources to be put toward the HIV response, allowing PEFPAR support to decrease over time.

- Partnering for Global Health Security: Kenya and the United States announced a formal proclamation between the U.S. Center for Disease Control and Prevention (CDC) and Government of Kenya for sharing information, identifying best practices, and defining steps toward the development and full launch of the Kenyan National Public Health Institute. As a gateway to East Africa through Port Mombasa, Kenya’s capacity to prevent, detect, and respond to infectious disease threats is critical. To support our health partnership, Kenya and the United States plan to develop and launch a customized Public Health Emergency Management training program to enhance health security across all 47 counties in Kenya.

- Reducing the Impacts of Malaria: Through the President’s Malaria Initiative (PMI), the United States contributed $33.5 million in 2023 to fight malaria in Kenya, providing vital financial and technical assistance to the Government of Kenya. The United States supports resilient health systems to deliver care by training health workers, strengthening supply chains, improving data monitoring, and reinforcing national health policies and guidelines. These investments have contributed to a 50% reduction in malaria prevalence over the last decade. In support the Government of Kenya’s localization goals, PMI is expanding its procurement of pharmaceutical supplies from Kenyan manufacturers and intends to procure up to an additional 5 million malaria treatments and 475,000 preventive treatment doses from Kenyan producers in 2024.

- Growing Health Manufacturing: Kenya committed to working with lawmakers to advance the Kenyan Pharmacy and Poisons Board (PPB) Act, a necessary step to boost local manufacturing of medical products and expand private American investment in the sector. Securing and diversifying global supply chains by promoting local and regional manufacturing of health products is a priority of the United States. The implementation of the PPB Act has the potential to increase manufacturing capacity in Kenya and Africa to ensure the availability of life-saving medicines, diagnostic tests, and devices. This should also mitigate the impact of global supply chain shocks, which were so evident during the COVID-19 pandemic. To further these goals, USAID provided $2.3 million in support to Revital Healthcare to develop rapid diagnostic tests for HIV, malaria, hepatitis B and C, dengue, and pregnancy, and to build a manufacturing plant capable of producing 240 million tests per year. Additionally, USAID and the Kenyan Ministry of Health are partnering to equip all neonatal clinics with Revital-made continuous positive airway pressure machines for babies requiring respiratory support.

- Partnering with the Private Sector in Healthcare: The U.S. International Development Finance Corporation (DFC) is investing in Kenya’s vibrant private sector by making a $10 million direct loan to Kenyan company Hewa Tele, which provides an affordable and regular supply of medical oxygen to healthcare facilities in Africa, and two rounds of equity investment totaling $4 million to Kasha Global, a Kenya-based e-commerce company that provides personal care, health care, and beauty products to low-income women in Kenya and Rwanda.

- Expanding Joint Research: Kenya and the United States recommitted to our long-standing partnership through a Memorandum of Understanding (MoU) between the CDC and the Kenyan Medical Research Institute (KEMRI) to support Kenya’s Applied Science Hub, building on 45 years of research partnership on malaria, HIV, tuberculosis, vaccine-preventable diseases, maternal and child health, emerging infectious diseases, and COVID-19. The research in the Applied Sciences Hub aims to expand surveillance, answer critical public health questions, and introduce novel diagnostic methods, including advanced molecular and serology-based methods, and training in public health laboratory core competencies. This year, the United States provided an estimated $12.9 million to support research efforts by KEMRI through CDC, the National Institutes of Health (NIH), and the Department of Defense. In FY 2023 NIH supported over 250 grants to U.S. organizations that collaborated with Kenyan organizations, covering a wide range of relevant biomedical research topics, and approximately 90 of these collaborations include researchers at KEMRI.

- Meeting Kenya’s Digital Health Goals: The United States announced over $31 million to advance Kenya’s efforts to set up a digital superhighway to enable a holistic view of health care delivery. The United States has worked closely with the Kenyan Ministry of Health to build and deploy digital health solutions to support disease programs and improve the ability to prevent, detect, and respond to public health threats. This includes $4 million through USAID Power Africa’s Health Electrification and Telecommunications Alliance to support solar power solutions for health facilities and activities to strengthen community and facility information systems to improve patient care and expand access to emergency medical services for mothers and newborns. Additionally, the NIH Harnessing Data Science for Health Discovery and Innovation in Africa (DS-I Africa) program focuses on facilitating the use of data science to impact health outcomes in Africa and supports a data hub and training and educational development programs in Kenya.

People-to-People Ties: Improving and Enriching Lives

The American and Kenyan people have deep ties that go far beyond the 60 years of official cooperation between our governments. These relationships – rooted in family, friendship, and community – improve and enrich our lives. They drive our cooperation, underpin our shared values, and elevate our aspirations. The benefits of these ties are particularly evident in our cooperation in educating the next generation of leaders, entrepreneurs, and visionaries. The State Visit builds on this fundamental strength, catalyzing stronger partnerships through a series of groundbreaking education and exchange programs.

- Strengthening Connections Between U.S. and Kenyan Educational Institutions:

- Kennedy-Mboya Partnerships: As the United States and Kenya celebrate 60 years of bilateral relations, and recalling the positive and enduring impact of the Kennedy-era student airlift, the newly announced Kennedy-Mboya Partnerships support a new scholarship program that promotes intellectual, academic, and innovative exchange. The Administration intends to provide $3.3 million for a U.S. Department of State program for sixty Kenyan undergraduate students to study for a semester in the United States, with a focus on STEM. This program supports the development and success of the next generation of Kenyan scientists, researchers, and engineers.

- Partnership 2024 : The Administration intends to provide $500,000 for Partnership 2024 to support the development of Kenyan students, scientists, researchers, and engineers by encouraging U.S. universities to increase investment in relationships with Kenyan universities and research institutions. Faculty and research collaboration are planned to bolster the program, supported by Fulbright Specialists to provide additional expertise.

- EDTECH Africa: The Governments of Kenya and the United States, in collaboration with Microsoft, Mastercard’s Center for Inclusive Growth, Howard University, Spelman College, Clark Atlanta University, and Morehouse College announced the establishment of EDTECH Africa. This initiative serves as an emerging technology bridge between Historically Black Colleges and Universities (HBCUs) and African scholars, aimed at cultivating educational exchanges in the ever-evolving landscape of emerging technology. This initiative expands Mastercard’s existing investment of $6.5 million for the Atlanta University Center Consortium Data Science Initiative and $5 million for Howard University’s Center for Applied Data Science and Analytics, actively involving African scholars with HBCU students and faculty in the journey toward greater proficiency as data scientists. Microsoft will invest an additional $500,000 to support HBCU and Kenyan students engaged in research at the Microsoft Africa Research Institute (MARI) in Nairobi, Kenya, complementing its recent contribution of $350,000 for the Atlanta University Center Consortium Data Science Initiative to establish a network of data science faculty across HBCUs. USAID intends to invest $850,000 to facilitate this partnership between HBCUs and Kenyan universities.

- National Science Foundation (NSF) International Activities : NSF has committed to offering workshops, planning grants, or supplements to U.S. universities to strengthen connections between U.S. and Kenyan universities, jointly identify research foci, and facilitate collaboration in research, education, and workforce development.

- Employment Pathways for Youth : USAID announced $6.5 million to support a partnership between Edison State Community College in Piqua, Ohio, and Kenya’s United States International University of Africa to strengthen up to 40 Kenyan technical vocational education and training institutions in the high-growth sectors of information and communications technology (ICT) and manufacturing of pharmaceuticals and textiles.

- Framework for Cooperation: The United States and Kenya signed a Framework for Cooperation to support higher education partnerships for STEM education. The Framework describes U.S. and Kenyan priorities and is accompanied by a commitment from Microsoft, Micron, Mastercard, and several U.S. and Kenyan universities expressing their support for STEM education. The Framework fosters higher education partnerships and commitments to partner private sector stakeholders, Kenyan institutions, and U.S. institutions to build mutual capacity in information and computer technology, microchip manufacturing, and other STEM-related education and career opportunities.

- Collaboration with the National Museums of Kenya: The Smithsonian Institution announced a $150,000 project funded by the U.S. Department of State to assess opportunities, challenges, and possible enhancements to support the National Museums of Kenya continued evolution as a leader in cultural and natural heritage preservation. Smithsonian officials plan to work collaboratively to identify possible areas for enhancement and growth, including facilities, collections care and conservation, curation, digital infrastructure, exhibitions, and research programs.

- Supporting Primary Education: USAID intends to provide $24.5 million for the Kenya Primary Literacy Program (KPLP), a new nationwide early grade literacy activity implemented in close partnership with Kenya’s Ministry of Education. KPLP programs are delivered in English and Kiswahili to all public primary schools and select private schools. KPLP expands new innovations to address literacy needs of grade 1-3 learners while building more inclusive, accountable, and resilient education institutions and systems.