- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Discover It® Cash Back Discover It® Student Chrome Discover It® Student Cash Back Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Cards Best Discover Cards Best American Express Cards Best Visa Credit Cards Best Bank of America Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Climate Change

- Corrections Policy

- Sports Betting

- Coach Salaries

- College Basketball (M)

- College Basketball (W)

- College Football

- Concacaf Champions Cup

- For The Win

- High School Sports

- H.S. Sports Awards

- Scores + Odds

- Sports Pulse

- Sports Seriously

- Women's Sports

- Youth Sports

- Celebrities

- Entertainment This!

- Celebrity Deaths

- Policing the USA

- Women of the Century

- Problem Solved

- Personal Finance

- Consumer Recalls

- Video Games

- Product Reviews

- Home Internet

- Destinations

- Airline News

- Experience America

- Great American Vacation

- Ingrid Jacques

- Nicole Russell

- Meet the Opinion team

- How to Submit

- Obituaries Obituaries

- Contributor Content Contributor Content

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel insurance

HTH Worldwide travel insurance review 2024

Jennifer Simonson

Mandy Sleight

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Kara McGinley

Updated 5:55 a.m. UTC March 19, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

HTH Worldwide

Top-scoring plan

Covers covid, medical & evacuation limits per person, what you should know.

Along with a couple of other policies, HTH’s TripProtector Classic offers generous layoff coverage. You’re eligible if you’ve been continuously employed for at least a year, with no waiting period.

- Preexisting conditions can be covered if you buy a TripProtector Classic plan within 14 days of your first trip deposit.

- Best-in-class financial default coverage after only a 10-day wait.

- Top-notch $1 million per person in medical evacuation coverage.

- TripProtector Classic doesn’t offer a “cancel for any reason” upgrade, but the pricier Preferred plan does.

- No “interruption for any reason” upgrade available.

- No non-medical evacuation coverage.

Why trust our travel insurance experts

Our team of experts evaluates hundreds of insurance products and analyzes thousands of data points to help you find the best product for your situation. We use a data-driven methodology to determine each rating. Advertisers do not influence our editorial content. You can read more about our methodology below.

- 2,332 coverage details evaluated.

- 385 rates reviewed.

- 5 levels of fact checking.

HTH Worldwide overview

Created under the Worldwide Insurance Services umbrella, HTH Worldwide provides travel insurance for both business and leisure travel. Nationwide Mutual Insurance Company underwrites HTH Worldwide’s single-trip insurance plans.

HTH Worldwide travel insurance plans

HTH Worldwide offers TripProtector plans that cover single domestic or international trips. In addition to travel protection and medical benefits, each plan includes non-insurance travel assistance such as a 24-hour emergency hotline service, destination health and security information and an online doctor search.

HTH provides a 10-day “free look” period to give you the chance to look over your policy and cancel for a full refund if it doesn’t suit your needs. If you are not satisfied, return your policy within 10 days of receipt along with a letter indicating your reason for cancellation for a full refund (not available in NY or WA).

Economy

HTH’s starter travel insurance plan offers basic coverages, including:

- Emergency medical evacuation: $500,000.

- Emergency medical: $75,000.

- Trip cancellation: 100% reimbursement of eligible trip costs up to $5,000.

- Trip delay: $500 maximum (after an eight-hour delay and with a $100 per day limit).

- Trip interruption: 125% reimbursement of eligible trip costs.

While the Economy plan also covers baggage loss, baggage delay and missed connections, it does not include rental car damage coverage or a preexisting conditions waiver. It includes accidental death and dismemberment coverage for air only.

TripProtector Classic

The TripProtecor Classic plan includes everything in the Economy plan and increases the travel protection and travel medical benefits. This plan gets 3 stars in our rating of the best travel insurance companies .

- Emergency evacuation: $1 million.

- Emergency medical: $250,000.

- Trip cancellation: 100% reimbursement for eligible trip costs up to $25,000.

- Trip delay: $1,000 ($200 per day after a six-hour delay).

- Trip interruption: 150% reimbursement of eligible trip costs.

The plan also includes a preexisting condition waiver if the insurance is purchased within 14 days of your first trip deposit, as well as accidental death and dismemberment coverage of up to $25,000 per person. Like the Economy plan, lost and delayed baggage and missed connections coverage is also included.

TripProtector Preferred

The TripProtector Preferred plan offers enhanced coverage but is more expensive than the Classic and Economy plans.

- Emergency medical: $500,000.

- Trip cancellation: 100% reimbursement of eligible trip costs up to $50,000.

- Trip delay: $2,000 ($200 per day after a six-hour delay).

- Trip interruption: 200% reimbursement of eligible trip costs.

- Optional “cancel for any reason” (CFAR): 75% reimbursement for eligible trip costs.

- Pet medical expense: $250.

- Rental car damage: $35,000.

- Accidental death and dismemberment: $50,000.

Unlike the other two plans, the Preferred Benefits plan offers pet medical expense coverage, rental car damage coverage and optional cancel for any reason travel insurance coverage. You can get a preexisting conditions waiver if the travel insurance plan is purchased within 21 days of your first trip deposit.

This plan also includes coverage for lost and delayed baggage and missed connections.

What HTH travel insurance covers

HTH Worldwide’s three TripProtector plans include the following coverage:

- Travel medical insurance reimburses you for medical expenses like care, hospitalization, lab work and more if you get sick while on your trip.

- Emergency medical evacuation covers the cost of emergency medical transportation to the nearest adequate treatment center if you become seriously injured or ill while traveling and require immediate care.

- Trip cancellation insurance reimburses prepaid, forfeited, nonrefundable trip costs if you need to cancel your trip for a covered reason.

- Trip delay coverage reimburses reasonable extra expenses, such as meals, lodging and transportation, if your travels are delayed due to reasons like a flight being canceled due to severe weather.

- Trip interruption coverage reimburses you for unused, prepaid, nonrefundable trip expenses such as hotel nights and missed excursions if you need to end your trip early because of a reason listed in your policy, such as a child back home getting sick.

- Baggage loss reimburses you for luggage and personal items that are lost, stolen or damaged during transit.

- Baggage delay reimburses for expenses paid for items like toiletries and a change of clothes needed because of delayed baggage.

Each plan has coverage limits and time frames for when coverage kicks in (like six hours for baggage delay coverage). Be sure to read your policy to understand the limits and exclusions.

What HTH travel insurance doesn’t cover

All travel insurance plans have exclusions, or things the policy does not cover.

Some examples of the emergency medical coverage exclusions in HTH Worldwide’s TripProtector Classic plan are:

- Accidental injury or sickness when traveling against the advice of a physician.

- Being under the influence of drugs or intoxicants (except when prescribed by a physician).

- Cosmetic surgery (except as a result of an accident).

- Dental treatment (except as the result of injury).

- Suicide, attempted suicide or any intentionally self-inflicted injury.

- Participation as an athlete in professional sports.

- Participation in adventure sports such as canoeing, kayaking, zip-lining, water skiing, camping, hiking, backpacking and sailing.

- Pregnancy and childbirth (except for complications of pregnancy).

Additional policy add-ons

HTH Worldwide’s TripProtector Preferred plan offers optional upgrades including “cancel for any reason” (CFAR) coverage , pet medical coverage and rental car damage coverage (not available in every state).

“Cancel for any reason” (CFAR) coverage

TripProtector Preferred policyholders have the option to purchase “cancel for any reason” (CFAR) coverage. This coverage reimburses up to 75% of your prepaid, nonrefundable trip payments or deposits if you cancel your trip for any reason at least 48 hours before your scheduled departure.

To get CFAR coverage, you need to buy it within 21 days of your first trip deposit. This benefit is not available in New York or Washington.

HTH Worldwide travel medical insurance

HTH Worldwide offers two plans for travelers who want travel medical insurance for international trips. Both plans are available to United States residents who are 95 years old or younger.

Single-trip option for travelers with primary health insurance

This short-term international medical plan was created for travelers who have primary health insurance but want extra coverage for traveling abroad. The maximum benefit amounts range from $50,000 to $1 million, and deductibles range from $0 to $500. There is no preexisting condition exclusion.

The plan covers 100% of the following:

- Ambulatory surgical center.

- Anesthesia.

- Dental injury expenses ($500 maximum).

- Diagnostic X-rays and lab work.

- In-hospital doctor visits.

- In-patient medical emergency.

- Office doctor visits.

- Outpatient prescription drugs.

The plan covers mental health emergencies as it would any other condition. The single-trip plan also includes common travel insurance coverages like medical evacuation, accidental death and dismemberment, trip interruption, trip delay and lost and delayed baggage.

Single-trip option for travelers without primary health insurance

This plan is for those traveling abroad who do not have primary health insurance. Like the plan for travelers with primary health insurance, the benefits range from $50,000 to $1 million and deductibles range from $0 to $500.

This plan covers 100% of the following:

- Dental injury expenses ($300 maximum).

- Diagnostic X-rays and lab work.

- In-patient medical emergency.

Like the other, this plan also covers mental health emergencies as it would any other condition. However, this plan has a 180-day preexisting condition exclusion and only covers 50% of prescription drugs.

Expat health insurance plans

HTH Worldwide also offers two international expatriate health insurance plans for people who live or work outside their home country:

- Xplorer Premier: Administered through GeoBlue Insurance, this plan provides complete health insurance coverage that can be used anywhere in the world by individuals or families who intend to be outside their home country for at least three months a year.

- Navigator: Also through GeoBlue, this is a health insurance plan specifically designed for crew, missionary or student travelers who plan to be outside their home country at least three months a year.

More travel insurance companies to compare

Here’s how insurers in our rating of the best travel insurance companies compare.

Via Compare Coverage’s website

Methodology

Our insurance experts reviewed 1,855 coverage details and 567 rates to determine the best travel insurance. For companies with more than one travel insurance plan, we shared information about the highest-scoring plan.

Insurers could score up to 100 points based on the following factors:

- Cost: 40 points. We scored the average cost of each travel insurance policy for a variety of trips and traveler profiles.

- Medical expenses: 10 points. We scored travel medical insurance by the coverage amount available. Travel insurance policies with emergency medical expense benefits of $250,000 or more per person were given the highest score of 10 points.

- Medical evacuation: 10 points. We scored each plan’s emergency medical evacuation coverage by coverage amount. Travel insurance policies with medical evacuation expense benefits of $500,000 or more per person were given the highest score of 10 points.

- Preexisting medical condition exclusion waiver: 10 points. We gave full points to travel insurance policies that cover preexisting medical conditions if certain conditions are met.

- Missed connection: 10 points. Travel insurance plans with missed connection benefits of $1,000 per person or more received full points.

- “Cancel for any reason” upgrade: 5 points. We gave points to travel insurance plans with optional “cancel for any reason” coverage that reimburses up to 75%.

- Travel delay required waiting time: 5 points. We gave 5 points to travel insurance policies with travel delay benefits that kick in after a delay of 6 hours or less.

- Cancel for work reasons: 5 points. If a travel insurance plan allows you to cancel your trip for work reasons, such as your boss requiring you to stay and work, we gave it 5 points.

- Hurricane and severe weather: 5 points. Travel insurance plans that have a required waiting period for hurricane and weather coverage of 12 hours or less received 5 points.

Some travel insurance companies may offer plans with additional benefits or lower prices than the plans that scored the highest, so make sure to compare travel insurance quotes to see your full range of options.

HTH Worldwide travel insurance review FAQs

Yes, HTH Worldwide’s three TripProtector plans cover both domestic and international travel.

The cost of a HTH Worldwide travel insurance plan varies depending on several factors such as the traveler’s age, trip cost, trip destination and type of coverage. For example, the cost of HTH Worldwide TripProtector Classic plan for a $3,000 trip for two 30-year-old travelers heading to Mexico for eight days would be about $116.

Yes, HTH Worldwide travel insurance plans include coverage for COVID-19 in its emergency medical coverage.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Jennifer Simonson covers everything from business to the wine industry to international travel. Outdoor adventure, water parks and all things Texas are by far her favorite beats. Her work has appeared in Forbes, Travel + Leisure, Texas Monthly, Smithsonian Magazine, Fodor's, Lonely Planet, Slate and more. You can follow her on Instagram at @storiestoldwell.

Mandy is an insurance writer who has been creating online content since 2018. Before becoming a full-time freelance writer, Mandy spent 15 years working as an insurance agent. Her work has been published in Bankrate, MoneyGeek, The Insurance Bulletin, U.S. News and more.

Kara McGinley is deputy editor of insurance at USA TODAY Blueprint and a licensed home insurance expert. Previously, she was a senior editor at Policygenius, where she specialized in homeowners and renters insurance. Her work and insights have been featured in MSN, Lifehacker, Kiplinger, PropertyCasualty360 and more.

10 worst US airports for flight cancellations this week

Travel insurance Heidi Gollub

10 worst US airports for flight cancellations last week

Survey: 20% of Americans have had a life-changing experience while traveling

Travel insurance Timothy Moore

Our travel insurance ratings methodology

AXA Assistance USA travel insurance review 2024

Travel insurance Jennifer Simonson

Cheapest travel insurance of June 2024

Travel insurance Mandy Sleight

Average flight costs: Travel, airfare and flight statistics 2024

John Hancock travel insurance review 2024

Airfare at major airports is up 29% since 2021

USI Affinity travel insurance review 2024

Trawick International travel insurance review 2024

Travel insurance for Canada

Travelex travel insurance review 2024

Best travel insurance companies of June 2024

Travel insurance Amy Fontinelle

Best travel insurance for a Disney World vacation in 2024

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

HTH Travel Insurance Review: Is It Worth the Cost?

After spending seven years in the U.S. Air Force as an Arabic linguist, Carissa is now a freelance writer using points and miles to fund a four-year (and counting!) adventure. She previously worked as a reporter for The Points Guy. Her writing has since been featured in numerous publications, including Forbes, Business Insider, and The Balance. When she's not flying, you'll usually find her in a Priority Pass lounge somewhere, sipping tea and cursing slow Wi-Fi.

Megan Lee joined the travel rewards team at NerdWallet with over 12 years of SEO, writing and content development experience, primarily in international education and nonprofit work. She has been published in U.S. News & World Report, USA Today and elsewhere, and has spoken at conferences like that of NAFSA: Association of International Educators. Megan has built and directed remote content teams and editorial strategies for websites like GoAbroad and Go Overseas. When not traveling, Megan adventures around her Midwest home base where she likes to attend theme parties, ride her bike and cook Asian food.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is HTH travel insurance?

What does hth cover, hth policy overview, what’s not covered by an hth plan, how hth compares to its competitors, how much is hth travel insurance, how to buy an hth policy, which hth travel insurance plan is best for me, does hth offer 24/7 travel assistance, how to file a claim with hth travel insurance, is hth travel insurance worth it, hth travel insurance recapped, star rating methodology.

HTH Travel Insurance

- Covers travelers up to 95 years old.

- Includes direct pay option so members can avoid having to pay up front for services.

- A 24-hour delay is required for baggage delay coverage on the TripProtector Economy plan.

- No waivers for pre-existing conditions on the lower-level plan.

HTH travel insurance provides plans for all types of travelers, including those going on a single trip, those looking for an annual policy, ship crew members, missionaries and students.

Combined with the ability to have your health care providers paid directly by your policy, this makes HTH travel insurance a good choice for many.

Why trust NerdWallet?

Our Nerdy editorial team aims to be a starting point in your travel insurance research. We default towards transparency and follow a comprehensive methodology for rating and reviewing travel insurance companies. Advertisers and advertising relationships do not influence our ratings. Learn more about our strict editorial guidelines .

Founded in 1997, HTH travel insurance provides coverage to more than 700,000 customers a year. HTH has policies offering wide range of coverage to many types of travelers, so odds are you’ll find a plan that suits your needs.

HTH’s travel insurance policies are underwritten by a few companies, including BCS Insurance Company, 4 Ever Life International Limited and Nationwide Mutual Insurance Company.

Among these, Nationwide Mutual Insurance Company is the most highly rated, scoring a Financial Strength Rating (FSR) of A (excellent) from credit rating firm AM Best. HTH’s remaining underwriters have an FSR score of A-, which is still considered excellent.

Many specialized HTH travel insurance medical coverage plans exist, though HTH travel’s insurance coverage still provides limited trip protections.

Generally speaking, here’s what you can expect when you purchase an HTH travel insurance plan:

HTH health insurance coverage : Covers doctor visits, inpatient visits, surgery and more, whether routine or an emergency.

Medical evacuation : Reimburses costs for when your medical care requires evacuation to another location.

Trip interruption : Covers costs for nonrefundable expenses as a result of your trip being interrupted.

Trip delay : Pays for costs incurred as a result of your travel being delayed.

Lost luggage : Reimburses you for loss, theft or damage to personal effects during a covered trip.

HTH’s policies have a broad array of inclusions. It offers five single-trip plans that fall into two main categories, medical and travel.

It also offers two annual travel insurance plans for specific kinds of travelers.

Some plans focus on medical care, whether or not you have a primary health insurance plan in the U.S. These provide high limits for medical care but limited and fixed benefits for trip protections.

Single Trip Option for Travelers with Primary Health Insurance.

Single Trip Option for Travelers Without Primary Health Insurance.

TripProtector plans, meanwhile, have a lower maximum on health costs and they cover only accidents or illnesses while you’re traveling, not routine care. At the same time, they provide more trip protections, which can be better for those on expensive vacations.

TripProtector Economy.

TripProtector Classic.

TripProtector Preferred.

Here's an overview of HTH's single-trip plan options and what is included.

Long-term travel insurance

HTH also offers long-term travel medical options for those who travel often or who are away for longer than six months.

HTH offers two types of annual plans:

Plans for standard or corporate travelers, called the Xplorer plan.

Plans for maritime crew members, missionaries and students, called the Navigator plan.

Both plans provide only medical coverage and don’t offer other trip protection benefits.

» Learn more: How does annual travel insurance work?

Add-on options

HTH doesn’t provide many options when it comes to add-ons. However, it's most expensive TripProtector Preferred plan allows you to purchase Cancel For Any Reason (CFAR) insurance, which will reimburse you for up to 75% of expenses if you cancel your trip.

Don’t want to shell out for travel insurance? A variety of travel credit cards offer complimentary trip insurance assuming you pay for the trip with your card.

» Learn more: The best travel credit cards right now

The coverage you’ll receive with an HTH plan will depend on which plan you’re purchasing. For example, TripProtector Preferred comes with rental car insurance , though none of the other available options do.

HTH’s medical-focused plans are also missing trip cancellation insurance , which is included on each of the TripProtector policies.

Whether you have pre-existing conditions included on your HTH plan is also going to depend on which plan you choose. TripProtector Economy and a Single Trip plan for those without health insurance do not have this option.

Beyond this, most travel insurance plans have specific exclusions to their coverage, including:

Activities when you’re under the influence of drugs or alcohol.

Extreme sports.

Named storms.

Participation in athletic events.

» Learn more: How to find the best travel insurance

On a 5-star scale, NerdWallet rated HTH 4.5 stars. Jump to see our methodology.

A sample trip for a 36-year-old traveler from Indiana to Canada for five days found that the cheapest HTH plan cost $146. If you were to spring for the premium plan, which increases your coverage limits, expect to pay $233.

When looking across multiple providers, the basic plan for the same sample trip ranges in cost from $10-$202. Note that price isn't the only differentiating factor. Coverage is not identical across plans; each company offers various levels of scope, limits and exclusions.

How much does HTH travel insurance cost? To find out the cost of various HTH travel insurance policies, we generated a sample quote for a 28-year-old from Nevada on a three-week vacation to Ireland, with a total trip cost of $4,700.

As you can see, HTH travel insurance costs much more when you add in greater trip protection benefits.

Purchasing an HTH travel insurance policy can be done online. To do so, you’ll first want to generate a quote on HTH’s website .

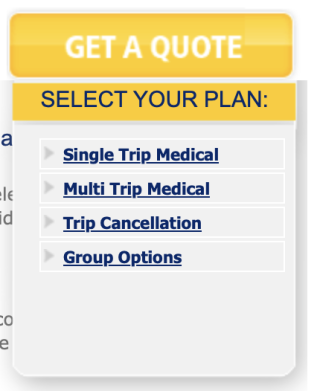

Before getting a quote, you’ll want to decide if you want more medical benefits or trip protections. Based on this, you can select Single Trip Medical or Trip Cancellation from the drop-down menu on the homepage.

Once you’ve put in all your travel information, HTH will generate quotes for each plan level. You can then select the one that suits your needs and check out with your new policy.

Consider comparison shopping

If you're not 100% sold on purchasing a plan from HTH, you can use a travel insurance aggregator to compare policies across multiple companies at once.

The HTH plan that best suits you will vary based on your needs. For example, if you anticipate having health needs while traveling abroad, you may want to opt for medical-focused plans.

But if you’re planning a more extended trip with many moving parts and want to be reimbursed for things like delayed luggage or missed connections, a TripProtector plan may be more appropriate.

Not everyone has the same needs when traveling, so not everyone should choose the same insurance policy. Here are some things to consider before purchasing a plan.

Look at coverage details

Scour your plan benefits to see what’s covered. If you won't need trip interruption insurance, don’t buy it. Similarly, depending on your health status, you may feel comfortable purchasing a less expensive plan with fewer medical benefits.

Think long term

How often do you travel? If you’re frequently out of the country, you’ll want to weigh the cost of purchasing multiple single-trip plans versus one annual plan. Do the math and see where you’d come out ahead.

Use existing coverage

Many travel credit cards offer travel insurance, though coverage levels will vary. To qualify for this complimentary insurance, you’ll need to pay for your trip using your eligible card. Common card benefits include trip interruption insurance, baggage delay reimbursement and emergency medical insurance.

HTH offers 24/7 travel assistance on its TripProtector plans. The issues with which HTH can help you range from prescription replacements and passport replacements to lost luggage retrieval.

You can contact HTH at 877-865-5979, 610-254-8771 or via email at [email protected] .

One of the best features of HTH travel insurance is its Direct Pay option. This allows your HTH policy to pay your medical costs directly to the provider, eliminating the need for a refund.

If you can't use a provider within HTH’s network and the one you choose won’t accept Direct Pay, it’s possible to submit a claim.

To do so, you’ll need to log in to your HTH account.

From there, you can fill out and submit the paperwork for your claim. This is also true of any trip protection claims you have, such as lost luggage or a trip delay.

Is HTH travel insurance good? You'll rarely find health care plans for travel abroad unless they’re just covering accidents and illnesses.

That’s what makes HTH’s medical policies stand out. The fact that HTH provides long-term policies for expats is another bonus, as many countries require that you provide independent medical coverage.

But its TripProtector plans are somewhat limited in scope compared with those from other insurance companies, plus they lack customization opportunities.

Overall, HTH may be a good option for you if you need to seek health care while traveling and don’t mind missing out on many trip protection benefits. Otherwise, you may want to look elsewhere .

HTH’s trip interruption and trip delay benefits can help reimburse the costs incurred by a flight cancellation.

If you use Direct Pay, you won’t need to file a claim since HTH will pay for your health care visit automatically. Otherwise, the time it takes to receive a refund can depend on a variety of factors, including what you’re claiming and the documentation you submit.

HTH travel insurance is secondary, which means it will pay out after other available insurance benefits.

Yes, HTH plans will cover COVID-19 costs.

HTH offers a few travel insurance plans depending on your needs, including options for single- and multi-trip policies. Before you buy a plan, be sure you’ve understood its coverage and costs, especially compared with other policies.

Travel insurance

NerdWallet's ratings for travel insurance companies take into account the following details about each insurer:

Scope of coverage.

Customizability.

Consumer experience and complaints.

The best travel insurers excel in all of these categories. They provide the information people need to make a purchase without any surprises along the way. They offer insurance at a fair price and allow customers to customize plans to meet their coverage preferences. They're also able to keep their customers happy throughout the relationship.

Data collection and review process

NerdWallet collects over a dozen data points for each insurer we analyze from their public-facing websites and third-party analyses. These data points are then compared against one another and against NerdWallet's standards for good travel insurance companies to determine a star rating.

Data is collected on a regular basis and reviewed by our editorial team for consistency and accuracy. Final star ratings are presented on a scale of one to five stars, where a one-star score represents "poor" and a five-star score represents "excellent."

The reviews team

The writers and editors behind NerdWallet's travel insurance reviews are insurance specialists who have had their work featured by or appear in The Associated Press, The Washington Post, The New York Times, the Chicago-Sun Times, U.S. News & World Report and the Society for Advancing Business Editing and Writing. Each writer and editor follows NerdWallet’s strict guidelines for editorial independence .

In addition to travel insurance, the team covers travel rewards programs, airlines and hotels.

Rating specifics

Our star ratings are weighted based on our editorial and professional opinions. We use the following weightings when rating travel insurers:

Scope of coverage (25%).

Customizability (25%).

Consumer experience and complaints (25%).

Cost (25%).

Scope of coverage ratings are based on assessments of a company’s standard protections, including:

Travel medical insurance.

Trip cancellation.

Trip interruption.

Trip delay.

Baggage and personal belongings, lost luggage.

Emergency medical assistance.

Emergency medical evacuation.

Emergency medical repatriation.

Accidental death and dismemberment insurance.

Rental car coverage.

Customizability ratings factor in coverage limit range (a fixed price or a percent of trip cost?), whether or not a policy has customizations available, and the number of bonus features. We consider the following services as above and beyond a standard policy:

24-hour assistance.

Pre-existing medical conditions coverage.

Extreme sport coverage.

CFAR add on availability.

Travel health insurance.

Interruption for Any Reason.

Travel Inconvenience.

Cancel for Work Reasons.

Electronics coverage.

Consumer experience ratings are based on provider reviews on Squaremouth.com. If the company is not in the Squaremouth database, we default to Google reviews.

Affordability ratings are based on the percentage of total trip cost a plan costs a policyholder. Less than 4% is considered excellent, whereas over 9% is considered poor.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Best Travel Insurance 2024

- Cheapest Travel Insurance

- Trip Cancellation Insurance

- Cancel for Any Reason Insurance

- Seniors' Travel Insurance

- Annual Travel Insurance

- Cruise Insurance

- COVID-19 Travel Insurance

- Travel Medical Insurance

- Medical Evacuation Insurance

- Pregnancy Travel Insurance

- Pre-existing Conditions Insurance

- Mexico Travel Insurance

- Italy Travel Insurance

- France Travel Insurance

- Spain Travel Insurance

- Canada Travel Insurance

- UK Travel Insurance

- Germany Travel Insurance

- Bahamas Travel Insurance

- Costa Rica Travel Insurance

- Disney Travel Insurance

- Schengen Travel Insurance

- Is travel insurance worth it?

- Average cost of travel insurance

- Is airline flight insurance worth it?

- Places to travel without a passport

- All travel insurance guides

- Best Pet Insurance 2024

- Cheap Pet Insurance

- Cat Insurance

- Pet Dental Insurance

- Pet Insurance That Pays Vets Directly

- Pet Insurance For Pre-Existing Conditions

- Pet Insurance with No Waiting Period

- Paw Protect Review

- Spot Pet Insurance Review

- Embrace Pet Insurance Review

- Healthy Paws Pet Insurance Review

- Pets Best Insurance Review

- Lemonade Pet Insurance Review

- Pumpkin Pet Insurance Review

- Fetch Pet Insurance Review

- Figo Pet Insurance Review

- CarePlus by Chewy Review

- MetLife Pet Insurance Review

- Average cost of pet insurance

- What does pet insurance cover?

- Is pet insurance worth it?

- How much do cat vaccinations cost?

- How much do dog vaccinations cost?

- All pet insurance guides

- Best Business Insurance 2024

- Business Owner Policy (BOP)

- General Liability Insurance

- E&O Professional Liability Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Cyber Liability Insurance

- Inland Marine Insurance

- Commercial Auto Insurance

- Product Liability Insurance

- Commercial Umbrella Insurance

- Fidelity Bond Insurance

- Business Personal Property Insurance

- Medical Malpractice insurance

- California Workers' Compensation Insurance

- Contractor's Insurance

- Home-Based Business Insurance

- Sole Proprietor's Insurance

- Handyman's Insurance

- Photographer's Insurance

- Esthetician's Insurance

- Salon Insurance

- Personal Trainer's Insurance

- Electrician's Insurance

- E-commerce Business Insurance

- Landscaper's Insurance

- Best Credit Cards of 2024

- Best Credit Card Sign-Up Bonuses

- Best Instant Approval Credit Cards

- Best Cash Back Credit Cards

- Best Rewards Credit Cards

- Best Credit Cards for Bad Credit

- Best Balance Transfer Credit Cards

- Best College Student Credit Cards

- Best 0% APR Credit Cards

- Best First Credit Cards

- Best No Annual Fee Cards

- Best Travel Credit Cards

- Best Hotel Credit Cards

- Best American Express Cards

- Best Amex Delta SkyMiles Cards

- Best American Express Business Cards

- Best Capital One Cards

- Best Capital One Business Cards

- Best Chase Cards

- Best Chase Business Cards

- Best Citi Credit Cards

- Best U.S. Bank Cards

- Best Discover Cards

- Amex Platinum Card Review

- Amex Gold Card Review

- Amex Blue Cash Preferred Review

- Amex Blue Cash Everyday Review

- Capital One Venture Card Review

- Capital One Venture X Card Review

- Capital One SavorOne Card Review

- Capital One Quicksilver Card Review

- Chase Sapphire Reserve Review

- Chase Sapphire Preferred Review

- United Explorer Review

- United Club Infinite Review

- Amex Gold vs. Platinum

- Amex Platinum vs. Chase Sapphire Reserve

- Capital One Venture vs. Venture X

- Capital One Venture X vs. Chase Sapphire Reserve

- Capital One SavorOne vs. Quicksilver

- Chase Sapphire Preferred vs. Capital One Venture

- Chase Sapphire Preferred vs. Amex Gold

- Delta Reserve vs. Amex Platinum

- Chase Sapphire Preferred vs. Reserve

- How to Get Amex Pre-Approval

- Amex Travel Insurance Explained

- Chase Sapphire Travel Insurance Guide

- Chase Pay Yourself Back

- CLEAR vs. TSA PreCheck

- Global Entry vs. TSA Precheck

- Costco Payment Methods

- All Credit Card Guides

- Raisin (SaveBetter) Interest Rates

- Citibank Savings Account Interest Rate

- Capital One Savings Account Interest Rate

- American Express Savings Account Interest Rate

- Western Alliance Savings Account Interest Rate

- Barclays Savings Account Interest Rate

- Discover Savings Account Interest Rate

- Chase Savings Account Interest Rate

- U.S. Bank Savings Account Interest Rate

- Marcus Savings Account Interest Rate

- Synchrony Bank Savings Account Interest Rate

- Ally Savings Account Interest Rate

- Bank of America Savings Account Interest Rate

- Wells Fargo Savings Account Interest Rates

- SoFi Savings Account Interest Rate

- UFB Direct Savings Account Interest Rate

- Best Savings Accounts & Interest Rates

- Best High Yield Savings Accounts

- Best 7% Interest Savings Accounts

- Best 5% Interest Savings Accounts

- Savings Interest Calculator

- Emergency Fund Calculator

- Pros and Cons of High-Yield Savings Accounts

- Types of Savings Accounts

- Is Savings Account Interest Taxable?

- Checking vs Savings Accounts

- Average Savings by Age

- How Much Should I Have in Savings?

- How to Save Money

- Compare Best Checking Accounts

- Compare Online Checking Accounts

- Best Business Checking Accounts

- Compare Best Teen Checking Accounts

- Best Student Checking Accounts

- Best Joint Checking Accounts

- Best Second Chance Checking Accounts

- Chase Checking Account Review

- Bluevine Business Checking Review

- Amex Rewards Checking Account Review

- Best Money Market Accounts

- U.S. Bank Money Market Account

- Money Market vs. Savings Account

- Best CD Rates

- Best 1-Year CD Rates

- Best 6-Month CD Rates

- Best 3-Month CD Rates

- 6% CD Rates

- Synchrony Bank CD Rates

- Capital One CD Rates

- Barclays CD Rates

- Travel Insurance

- HTH WorldWide Travel Insurance Review

On This Page

- Key takeaways

Is HTH Worldwide legit?

- Bottom Line Main highlights of HTH Worldwide travel insurance

HTH Worldwide travel insurance plans & coverage

Things not covered by hth worldwide travel insurance, cost of hth worldwide travel insurance plans, hth worldwide travel insurance reviews from customers, is hth worldwide travel insurance worth it, faqs: hth worldwide travel insurance, related topics.

HTH WorldWide Travel Insurance Review 2024: Is It Worth It?

- HTH Worldwide is a well-established travel insurance provider with 27 years of experience .

- The provider offers three comprehensive travel insurance policies : TripProtector Economy, TripProtector Classic and TripProtector Preferred. These plans cover trip cancellation, trip interruption, medical emergencies and more.

- Some plans include coverage for natural disasters and situations that involve acts of terrorism . Most travel insurance providers do not offer this type of coverage.

- Optional add-ons are available with the Preferred plan. These add-ons include cancel for any reason (CFAR) coverage, a collision damage waiver and a pre-existing medical condition waiver.

- It offers two additional policies designed specifically for medical and medical evacuation coverage .

- To compare multiple travel insurance policies and find the best one to suit your travel needs, try using our online comparison tool .

If you’re exploring travel insurance options, HTH Worldwide stands out as a trustworthy provider .

The company offers comprehensive plans catering to various travel needs , including unique features like coverage for natural disasters and substantial medical care limits.

In this HTH Worldwide review, we’ll break down all the plan details, optional add-ons, customer reviews and overall suitability so that you can make an informed decision about what to purchase for your upcoming journey.

- Good coverage for interruptions (up to 200%)

- Offers comprehensive trip protection and travel medical insurance

- Access to health services worldwide via the mPassport app

- Offers coverage for expatriates

- Medical plans may have a high deductible

- Baggage delay coverage requires 12 hour delay (long)

HTH Worldwide Travel Insurance, which is also known as HTH Travel Insurance and Worldwide Insurance Services, is a legitimate insurance provider.

The company was founded in 1997 under the name Highway to Health; today, it operates under the HTH Worldwide brand. With 27 years of trading, the company is firmly established in the travel insurance market. HTH Travel Insurance offers a variety of comprehensive plans for travelers of all kinds.

Are you considering HTH Worldwide travel insurance for your next trip? To help you decide if this is the best travel insurance for your journey, here’s an in-depth look at the primary features, benefits and highlights of the company’s plans.

Bottom Line: Main highlights of HTH Worldwide travel insurance

When you buy travel insurance from HTH Worldwide, you gain access to a variety of comprehensive benefits.

Depending on the plan you choose, you can get trip coverage for situations that are typically excluded from most travel insurance policies, including natural disasters.

HTH Worldwide’s highest-level plans come with luxury benefits that are hard to find elsewhere — the TripProtector Preferred plan will reimburse you for up to 200% of your costs in case of a trip interruption. If you’re traveling as a group, HTH Worldwide offers a 10% discount.

If you’re concerned about medical coverage on your trip, HTH Worldwide offers high-limit options up to $500,000 for medical care and $1 million for medical transportation . Plus, with the company’s mPassport app, it’s easier to locate the closest health providers anywhere in the world. If you need to be hospitalized, the Direct Pay system can work with the facility to settle the bill.

Most HTH Worldwide travel insurance plans are designed for people who are taking a single trip.

HTH Travel Insurance

Options include:

TripProtector Economy:

This base-level TripProtector plan offers more trip coverage than HTH Worldwide’s single-trip plans; it’s best for shorter trips to low-risk, politically stable destinations. You’ll get a maximum of $5,000 for trip cancellation, 125% of the cost of trip cancellation, $75,000 of medical coverage and $500,000 for medical evacuation.

TripProtector Classic:

If you need a mid-range option with high medical coverage limits and comprehensive trip protection, this is your best bet. It covers trip cancellation up to $25,000 and trip interruption of up to 150% of the cost of the trip. Plus, you’ll get coverage for natural disasters and situations that involve terrorist activities.

TripProtector Preferred:

This is HTH Worldwide’s premier travel insurance plan; it comes with all the benefits of the Classic and Economy plans, plus trip interruption coverage up to 200% of the trip cost and up to $50,000 for trip cancellation. You’ll also get $500,000 in medical coverage and up to $1 million in medical transportation. This plan is a good option if you’re taking an expensive trip or traveling to a remote destination with high-cost medical evacuation options . For example, African safari vacations are often costly and involve outdoor excursions where the terrain can make access to emergency assistance a challenge, so this plan would be ideal for coverage on your trip to Botswana .

TravelGap Excursion excl US:

This plan is best if you already have U.S. health insurance and you want extra medical insurance for your trip. You can choose a maximum benefit ranging from $50,000 to $1 million and a deductible between $0 and $500. This plan covers professional services, inpatient hospital services, medical evacuation and a companion’s transportation to join you if you’re injured during your trip. It also comes with modest trip coverage.

TravelGap Voyager excl US:

This plan is best for people who need flexible travel medical coverage and don’t have primary health insurance in the United States. It comes with medical insurance during your trip, medical evacuation, companion travel and basic trip coverage. You can choose coverage limits between $50,000 and $1 million and a deductible between $0 and $500.

Here’s a brief look at how these plans compare:

Optional add-ons

HTH Travel Insurance offers a few optional add-ons, but only if you purchase the TripProtector Preferred plan.

These benefits provide extra coverage and come at an extra cost.

Cancel for any reason coverage (CFAR)

This add-on allows you to cancel a trip for reasons not covered in the main policy. When you use it, you’ll be reimbursed for just 75% of the trip costs. To be eligible for CFAR coverage , you must cancel at least two days before you’re scheduled to depart.

Collision damage waiver

The collision damage waiver, which maxes out at $35,0000, covers any damages that result from theft, vandalism, collisions or certain weather conditions. You must be listed on the car rental agreement. The collision damage waiver isn’t available in New York or Texas.

Pre-existing medical condition waiver

The TripProtector Preferred plan can cover pre-existing medical conditions — but only if you buy the policy within 21 days of the date you make the first deposit for the trip. In addition, you must be medically cleared to travel on the day you buy the policy. This waiver covers diseases, illnesses and medical conditions for 60 days before your departure date.

Like most providers, HTH Worldwide travel plans come with a list of exclusions — things the policies do not cover.

If you have the TripProtector Preferred plan, for example, typical exclusions include:

- Self-inflicted injuries

- Participation in war activities

- Flying a plane

- Mental and emotional disorders (unless you’re hospitalized)

- Athletic participation in professional sports

- Nonemergency surgeries and exams

- Pregnancy (unless it’s a complication of pregnancy)

- Dental treatment (unless it’s necessary after an injury)

- Suicide or suicide attempts

- Extreme sports

- High-risk or criminal activity

- Travel that goes against the advice of a doctor

- Travel to seek medical care

It’s also important to note that HTH Worldwide’s baggage benefits don’t apply to a wide range of items, including boats, professional equipment, musical instruments, hearing aids and orthodontic devices.

Bear in mind that each policy may have different exclusions — read the fine print carefully to determine what your plan does not cover.

Based on our sales data, customers who purchased HTH Worldwide travel insurance via our platform spent an average of $203 for a 30-day trip. Therefore, we can assume that HTH Worldwide travel insurance costs around $7 per day.

To help you better understand how much HTH Worldwide travel insurance costs, we got quotes to five different countries for the three comprehensive HTH Worldwide plans: TripProtector Economy, TripProtector Classic and TripProtector Preferred. We then took the average of each quote.

Average Cost of HTH Worldwide Travel Insurance Plans

Keep in mind that the price of a travel insurance policy varies depending on several factors, such as your age and the cost of your trip. Therefore, your final cost will be different than those displayed above. To find out how much you’ll pay, get a quote using our online comparison tool .

Methodology for reaching these averages

We used the following details for each quote:

- Total trip cost : $2,000

- Trip duration : Seven days

- Time of trip : September 2024

- State of residence : California

- Destinations : Dominican Republic , Italy , Japan , Mexico and Spain

HTH Worldwide travel insurance plans have 481 customer reviews with an overall rating of 4.23 out of five on Squaremouth .

Here’s what reviewers had to say about HTH Worldwide.

What customers like

Positive reviews highlight these points:

- Easy purchase process

- Availability of direct insurance billing

- Kind and helpful customer service team

These are some reviews from pleased customers:

“I, unfortunately, had to utilize medical facilities on my most recent trip, and had a good experience with HTH…I was connected to someone who instantly created that email for me, and sent it to me and to the hospital. The whole thing took less than 30 minutes. With that letter in tow, I was able to be seen, treated and released without payment on my part. This made the entire episode easier on me. So, I had a very positive experience with HTH and would absolutely use them again.” - Philip

“I spoke with the customer service representatives several times both before and after purchasing my travel policy. Everyone I spoke with was very courteous and very professional. They explained everything very clearly.” - Patrick

What customers don’t like

Reviews that reflect unpleasant experiences mention these issues:

- Can be challenging to connect to support

- Filing claims can be confusing

- Claim processing can take more than one month

Below are some comments from unhappy reviewers.

Bear in mind that customers are often more likely to leave a review when they are upset, rather than when they are satisfied.

“Very difficult to reach them and when I did they would only say I had to file my small claim through the internet.” - Donna

“Had to call a couple different numbers to get a few simple questions answered so it made me concerned if I did have an issue or to file a claim.” - Justin

HTH Travel Insurance may be worth it if emergency medical coverage is your primary concern while traveling.

With the company’s emergency assistance line and mPassport app, you can find healthcare providers that contract directly with HTH Worldwide to handle direct payments and reduce your out-of-pocket costs. Many plans offer high limits for both medical and trip coverage , which is convenient for high-ticket trips to far-flung destinations.

If you need customizable medical coverage, your best bet is one of the company’s TravelGap plans. They allow you to choose your coverage and deductible limits , and they’re available to people with and without primary health insurance.

When you want high coverage limits for both medical care and trip protection, HTH Worldwide’s TripProtector plans are a better option. The Economy, Classic and Preferred plans offer tiered benefits with trip cancellation coverage up to $50,000, medical care up to $500,000, and medical evacuation up to $1 million. The Classic and Preferred plans also offer coverage for natural disasters and terrorism, which is useful when you’re traveling to high-risk countries.

If you want travel insurance that covers multiple trips or long-term travel, you might want to choose another provider .

Do HTH Worldwide travel insurance plans cover COVID?

Certain HTH Worldwide travel insurance plans cover COVID . For example, if you purchase the TripProtector Preferred plan and fulfill the requirements for the preexisting condition waiver, you can use the policy benefits if COVID affects your plans.

Do HTH Worldwide travel insurance plans cover preexisting medical conditions?

Many travel insurance plans from HTH Worldwide, including both single-trip policies, cover preexisting medical conditions. If you’re buying a TripProtector plan, keep in mind that the Economy and Classic plans do not cover preexisting conditions; the Preferred plan does, but only if you purchase it within 21 days of your first trip deposit.

Who owns HTH travel insurance?

HTH Travel Insurance falls under the umbrella of HTH Worldwide.

About the Author

Hayley Harrison is an active personal finance contributor for LA Times Compare. She is passionate about helping consumers make informed financial decisions and achieve their financial goals by simplifying complex topics relating to insurance and personal finance.

Hayley brings first-hand knowledge of the finance industry thanks to her previous experience as a branch manager for a mid-sized regional bank and as a licensed accident and health insurance agent.

Explore related articles by topic

- All Travel Insurance Articles

- Learn the Basics

- Health & Medical

- Insurance Provider Reviews

- Insurance by Destination

- Trip Planning & Ideas

Best Travel Insurance Companies & Plans in 2024

Best Medical Evacuation Insurance Plans 2024

Best Travel Insurance for Seniors

Best Cruise Insurance Plans for 2024

Best COVID-19 Travel Insurance Plans for 2024

Best Cheap Travel Insurance Companies - Top Plans 2024

Best Cancel for Any Reason (CFAR) Travel Insurance

Best Annual Travel Insurance: Multi-Trip Coverage

Best Travel Medical Insurance - Top Plans & Providers 2024

- Is Travel Insurance Worth It?

Is Flight Insurance Worth It? | Airlines' Limited Coverage Explained

Guide to Traveling While Pregnant: Pregnancy Travel Insurance

10 Romantic Anniversary Getaway Ideas for 2023

Best Travel Insurance for Pre-Existing Medical Conditions June 2024

22 Places to Travel Without a Passport in 2024

Costa Rica Travel Insurance: Requirements, Tips & Safety Info

Best Spain Travel Insurance: Top Plans & Cost

Best Italy Travel Insurance: Plans, Cost, & Tips

Best Travel Insurance for your Vacation to Disney World

Guide to Chase Sapphire Travel Insurance Benefits 2024

2024 Complete Guide to American Express Travel Insurance

Schengen Travel Insurance: Coverage for your Schengen Visa Application

Mexico Travel Insurance: Top Plans in 2024

Best Places to Spend Christmas in Mexico this December

Travel Insurance to Canada: Plans for US Visitors

Best Travel Insurance for France Vacations in 2024

Travel Insurance for Germany: Top Plans 2024

Best UK Travel Insurance: Coverage Tips & Plans June 2024

Best Travel Insurance for Trips to the Bahamas

Europe Travel Insurance: Your Essential Coverage Guide

Best Trip Cancellation Insurance Plans for 2024

What Countries Require Travel Insurance for Entry?

Philippines Travel Insurance: Coverage Requirements & Costs

Travel Insurance for the Dominican Republic: Requirements & Tips

Travel Insurance for Trips Cuba: Tips & Safety Info

AXA Travel Insurance Review June 2024

Best Travel Insurance for Thailand in 2024

Travel Insurance for a Trip to Ireland: Compare Plans & Prices

Travel Insurance for a Japan Vacation: Tips & Safety Info

Faye Travel Insurance Review June 2024

Travel Insurance for Brazil: Visitor Tips & Safety Info

Travel Insurance for Bali: US Visitor Requirements & Quotes

Travel Insurance for Turkey: U.S. Visitor Quotes & Requirements

Travel Insurance for India: U.S. Visitor Requirements & Quotes

Australia Travel Insurance: Trip Info & Quotes for U.S. Visitors

Generali Travel Insurance Review June 2024

Travelex Travel Insurance Review for 2024

Tin Leg Insurance Review for June 2024

Travel Insured International Review for 2024

Seven Corners Travel Insurance Review June 2024

Medjet Travel Insurance Review 2024: What You Need To Know

Antarctica Travel Insurance: Tips & Requirements for US Visitors

Travel Insurance for Kenya: Recommendations & Requirements

Travel Insurance for Botswana: Compare Your Coverage Options

Travel Insurance for Tanzania: Compare Your Coverage Options

Travel Insurance for an African Safari: Coverage Options & Costs

Nationwide Cruise Insurance Review 2024: Is It Worth It?

Travel Insurance for Hurricane Season: All You Need To Know

- Travel Insurance for Seniors

- Cheap Travel Insurance

- Cancel for Any Reason Travel Insurance

- Travel Health Insurance

- How Much is Travel Insurance?

- Is Flight Insurance Worth It?

- Anniversary Trip Ideas

- Travel Insurance for Pre-Existing Conditions

- Places to Travel Without a Passport

- Christmas In Mexico

- Europe Travel Insurance

- Compulsory Insurance Destinations

- Philippines Travel Insurance

- Dominican Republic Travel Insurance

- Cuba Travel Insurance

- AXA Travel Insurance Review

- Travel Insurance for Thailand

- Ireland Travel Insurance

- Japan Travel Insurance

- Faye Travel Insurance Review

- Brazil Travel Insurance

- Travel Insurance Bali

- Travel Insurance Turkey

- India Travel Insurance

- Australia Travel Insurance

- Generali Travel Insurance Review

- Travelex Travel Insurance Review

- Tin Leg Travel Insurance Review

- Travel Insured International Travel Insurance Review

- Seven Corners Travel Insurance Review

- Medjet Travel Insurance Review

- Antarctica Travel Insurance

- Kenya Travel Insurance

- Botswana Travel Insurance

- Tanzania Travel Insurance

- Safari Travel Insurance

- Nationwide Cruise Insurance Review

- Hurricane Travel Insurance

Policy Details

LA Times Compare is committed to helping you compare products and services in a safe and helpful manner. It’s our goal to help you make sound financial decisions and choose financial products with confidence. Although we don’t feature all of the products and services available on the market, we are confident in our ability to sound advice and guidance.

We work to ensure that the information and advice we offer on our website is objective, unbiased, verifiable, easy to understand for all audiences, and free of charge to our users.

We are able to offer this and our services thanks to partners that compensate us. This may affect which products we write about as well as where and how product offers appear on our website – such as the order in which they appear. This does not affect our ability to offer unbiased reviews and information about these products and all partner offers are clearly marked. Given our collaboration with top providers, it’s important to note that our partners are not involved in deciding the order in which brands and products appear. We leave this to our expert freelance writers who review and rate each product independently.

At LA Times Compare, our mission is to help our readers reach their financial goals by making smarter choices. As such, we follow stringent editorial guidelines to ensure we offer accurate, fact-checked and unbiased information that aligns with the needs of the Los Angeles Times audience. Learn how we are compensated by our partners.

Suggested companies

Travel insured international, generali travel - usa.

HTH Travel Insurance Reviews

Visit this website

Company activity See all

Write a review

Reviews 3.1.

Most relevant

Worst Insurance Plan

My wife was travelling to visit me in the states. I didn't have her on my primary insurance plan back then. I purchased a single-trip insurance from the HTH travel insurance and their partner GeoBlue. Everything went smooth and I was able to get her insurance card via email. On her fourth day of travel, she dislocated her collar bone to which we went to doctor and sought medical attention. After having her checked up, surprisingly the nurse showed saying the insurance does not cover it. I said there should be a mistake, but to no avail she was right. I contacted GeoBlue, someone picked up and as I could not understand him I asked to talk to a supervisor. He put me on hold and minutes later he handed to phone to some colleague. I gave her all the details of insurance card and she said the company does not offer insurance in the states. I said why do not you fix your website then as it allows people to buy, she was rude enough to cancel the insurance immediately with no reasoning at all. The bill was huge and I paid out of pocket. I am urging people, if there was a zero star rating, I would have spared the 1 star rating. Think twice buying this company's insurance. It is a waste of your time, money and can get you in trouble.

Date of experience : April 30, 2024

Highly recommend (from someone who’s submitted several claims)

I’ve used HTH a number of times over the years, and they have always been easy to work with. I’ve wound up in the hospital/clinic several times, and HTH has reimbursed me each time with no hassle. They’re pretty affordable and I’ve never had trouble getting in touch with customer service to ask questions about the plans. I would highly recommend them. I don’t even second guess it at this point, I just buy insurance from them whenever I go on a trip. Obviously you should do your research and make sure the plan works for your activities and risk tolerance, but it’s great for me and I’m a fairly adventurous traveler.

Date of experience : February 24, 2023

Is this your company?

Claim your profile to access Trustpilot’s free business tools and connect with customers.

HTH Travel Insurance Review

HTH Travel Insurance

Choose your limits and deductibles

Multi-trip insurance plan, special plans for international travel, group rates for five or more.

- John Hancock

- Allianz Global Assistance

How We Reviewed HTH Travel Insurance

8 hours of research

5 plans evaluated

2 competitors compared

HTH Travel Insurance offers a variety of policies and the option to choose your limits and deductibles. From single-trip insurance plans to policies covering international travel and long-term visits, HTH has a plan for almost anyone. This also extends to those traveling in groups of five or more with 10% off standard rates. About the only problem we saw was that anyone opting for a single-trip plan without U.S. primary health insurance will have to opt for a weaker alternative. Other policies offered such as multi-trip and international don’t even have an alternative, requiring you to have a health plan.

That being said, the flexibility of the policies on offer and your ability to choose the limits and deductibles still make for compelling policies worth considering. Especially if you are traveling in a group.

From the homepage: “We offer a wide selection of travel health insurance plans that include coverage for hospital care, surgery, office visits, prescription drugs and medical evacuation.”

Is it true?

Yes — as long as you have U.S. primary health insurance.

As stated on the homepage, the company “offers a variety of travel medical insurance across the U.S. under leading brands.” This means that HTH Travel Insurance is a secondary provider and almost all of the plans and policies offered required you to have primary health insurance.

So, while it is true that these plans can include coverage for hospital care, surgery, office visits, prescription drugs and medical evacuation, you might not get to experience these without primary health insurance. There is a version of the single-trip policy designed for those without a policy but it offers less coverage and some notable coverages are absent.

Product Overview

Those with primary health insurance traveling in a group

Those without health insurance

When you purchase a Single Trip travel insurance policy from HTH Travel Insurance, you can select how much emergency medical coverage you want — up to $1 million. You also get a say in how much you want your deductible to be. Few travel insurance providers give you these options and determine the coverage limits and deductibles for you. That makes HTH’s flexibility a rare find in the industry and something you definitely want to keep in mind as you select the right travel insurance policy for you.

HTH Travel Insurance’s multi-trip plan covers emergency medical expenses for an unlimited amount of trips within a 12-month period. If you’re a frequent traveler, particularly if you spend a lot of time out of the country, this plan is invaluable. It covers pre-existing conditions as well as hospital care, prescription medications, and medical evacuations. Annual travel insurance plans are difficult to come by so, if you travel often, HTH Travel Insurance’s multi-trip plan is something you should check out.

HTH Travel Insurance offers two different travel insurance plans specifically designed for people traveling outside the U.S. Their Premier Expat plan covers emergency medical and dental care both inside and outside the country and you can keep this coverage for up to nine months after your trip. There’s also the Essential plan which just covers any emergency treatment you receive while you’re out of the country. In addition, there are also two plans just for students studying abroad. The short-term plan offers up to $1 million in coverage and the long-term plan has no medical maximum at all, so you can be sure that you’re covered for the entire duration of your trip no matter what happens.

The TravelGap Group plans cover trips as long as six months and offer rates 10% lower than standard single-trip rates. The group plans do not cover trip cancellation or interruption for lost or stolen luggage. However, they do provide solid emergency medical and dental coverage for all members of the group. Most travel insurance companies do not offer group rates unless there are 10 or more people traveling, so HTH Travel Insurance’s plan is pretty unique in the industry. If you’re traveling as part of a student organization or a missionary group, this is something you should look into.

Possible Drawbacks

Some policies require a health plan.

Because HTH Travel Insurance is a secondary provider, several of their policies only insure individuals who already have some sort of primary health insurance. This means that your primary insurance provider must handle your claims first. Any costs not covered by your primary health insurer are then be covered by HTH Travel Insurance. There are several other travel insurance companies out there that offer primary coverage for emergency medical treatment, and these are going to be better options for you if you don’t meet the criteria for HTH’s travel insurance policies.

The Competition

Hth travel insurance vs. john hancock travel insurance.

John Hancock has fewer options than HTH Travel Insurance and no where near the flexibility when it comes to coverage and deductibles. However, we appreciated the fact that what fewer plans John Hancock had were all solid. John Hancock also had a slightly higher financial strength rating but HTH’s A- is still considered excellent and reliable should you ever need a claims payout.

HTH Travel Insurance vs. Allianz TraveL Insurance

Allianz and HTH Travel Insurance offer a wide variety of plans and coverages to choose from. However, when put side-to-side, Allianz squeaked out ahead by not only having a couple more plans but also offering free coverage for children under 18. Allianz also has a higher financial strength rating of A+ but, again, an A- is nothing to sneeze at. One thing that was missing from Allianz that we found in both HTH and John Hancock was the option for any annual plans. If you’re a student or doing mission work, you’re going to need a long-term plan and Allianz might not be your best bet.

HTH Travel Insurance FAQ

Do i need a primary health plan to be eligible for hth travel insurance policies.