High-value datasets – tourism in the EU

Discover statistics to analyse tourism flows

This is part of a series of articles showcasing examples of high-value datasets from their different thematic categories. High-value datasets are defined by EU law based on their potential to provide essential benefits to society, the environment and the economy. This series aims to help readers find reliable and accurate information from official sources relating to the availability of various high-value datasets, and to present this information through data visualisation. You can check out the article providing an overview of high-value datasets .

Only datasets specifically defined by law can be considered high-value datasets and, as such, the data presented in this series of articles does not necessarily fall under that definition. Instead, the data has been chosen to be thematically adjacent to high-value datasets and to showcase what can be done with information made available by official EU bodies and EU Member States. The official list of high-value datasets adopted on 12 December 2022 can be found in the legal documents that define these datasets and their characteristics.

Using high-value datasets to analyse tourism

Representing nearly 10 % of the EU’s GDP and accounting for 23 million jobs in 2019 , tourism is an essential part of the EU’s economy. The EU’s tourism ecosystem involves various sectors such as food and beverage services, online information and services, travel agents and tour operators, accommodation suppliers and transportation.

Furthermore, the EU’s industrial strategy aims to accelerate the green and digital transitions and increase tourism resilience. In February 2022, the European Commission proposed a transition pathway for the tourism industry, including 27 areas of measures for the green and digital transitions and improving tourism resilience. Based on the Commission’s transition pathway, the Council of the European Union has adopted the European agenda for tourism 2030 , which includes a multiannual work plan with actions for Member States, the Commission and tourism stakeholders.

In this context, data on tourism can provide essential insights and as such, tourism statistics have been included in the list of high-value datasets. The ‘Statistics’ category of high-value datasets includes several datasets about tourism flows in Europe, as laid out by section 2 of Annex I to Regulation (EU) No 692/2011 of the European Parliament and of the Council.

Tourism-related high-value datasets contain information about yearly tourism flows and include indicators such as the number of nights spent at tourist establishments, including specifically by EU residents, participation in tourism for personal purposes, tourism trips and expenditures. The indicators may also offer several breakdowns, including the countries of origin and destination, duration of the trip, means of transport and accommodation. In some cases, geographical information is also accessible, with data available up to the NUTS 2 (region), NUTS 3 (province) or coastal/non-coastal area levels.

Tourism data from Eurostat

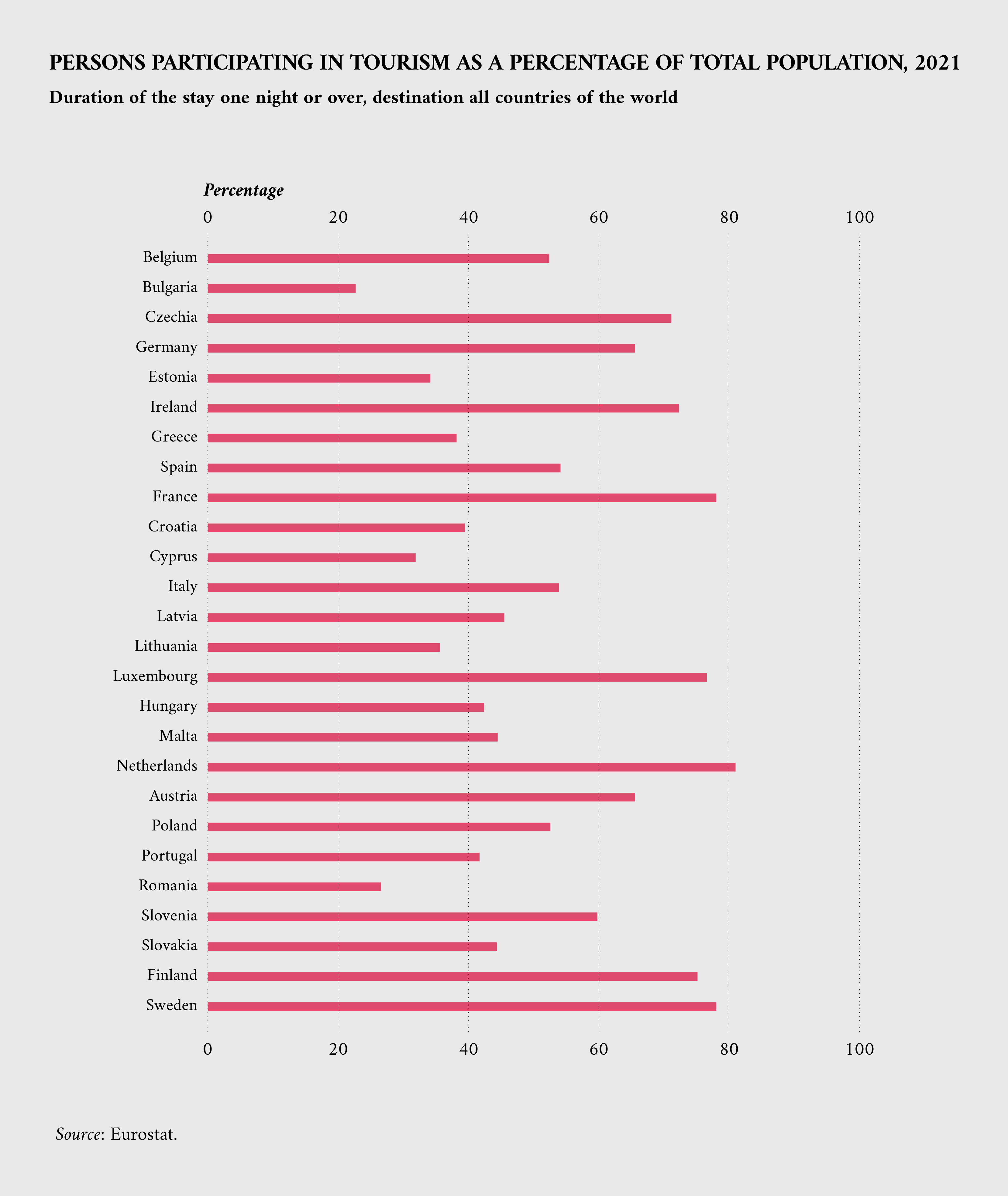

The EU’s official statistical office, Eurostat , offers a large number of datasets to study tourism, along with a detailed page in the ‘Statistics Explained’ section that shows major trends. One way to look at tourism is to analyse where people tend to come from and where they go. Eurostat data can be used to determine the countries in which people travel the most and others where tourism is less frequent.

The following visualisation shows the share of people out of the total population participating in tourism, from Member States to other world destinations. This data shows that the countries with the highest values are the Netherlands, France, Luxembourg, Finland and Sweden.

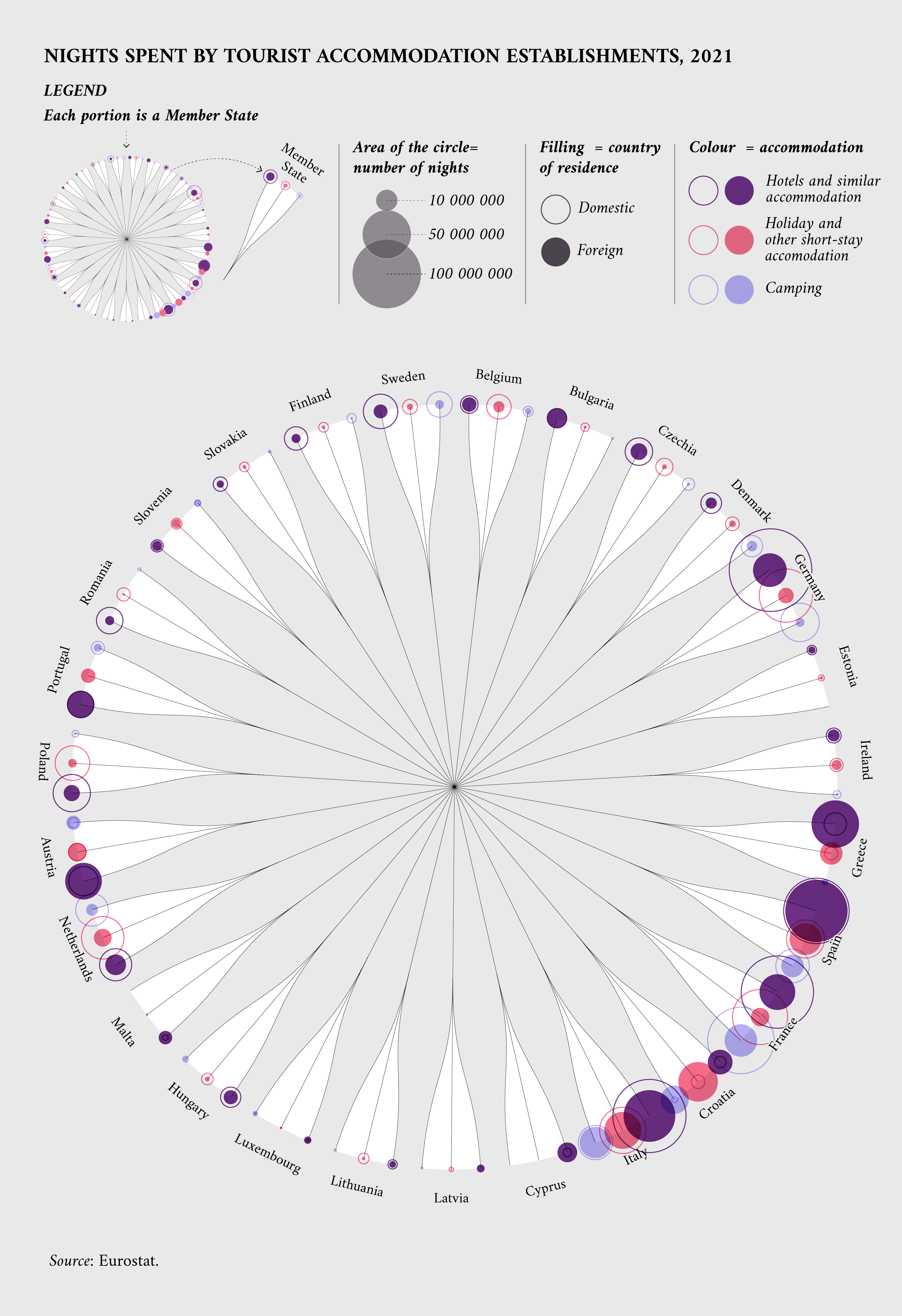

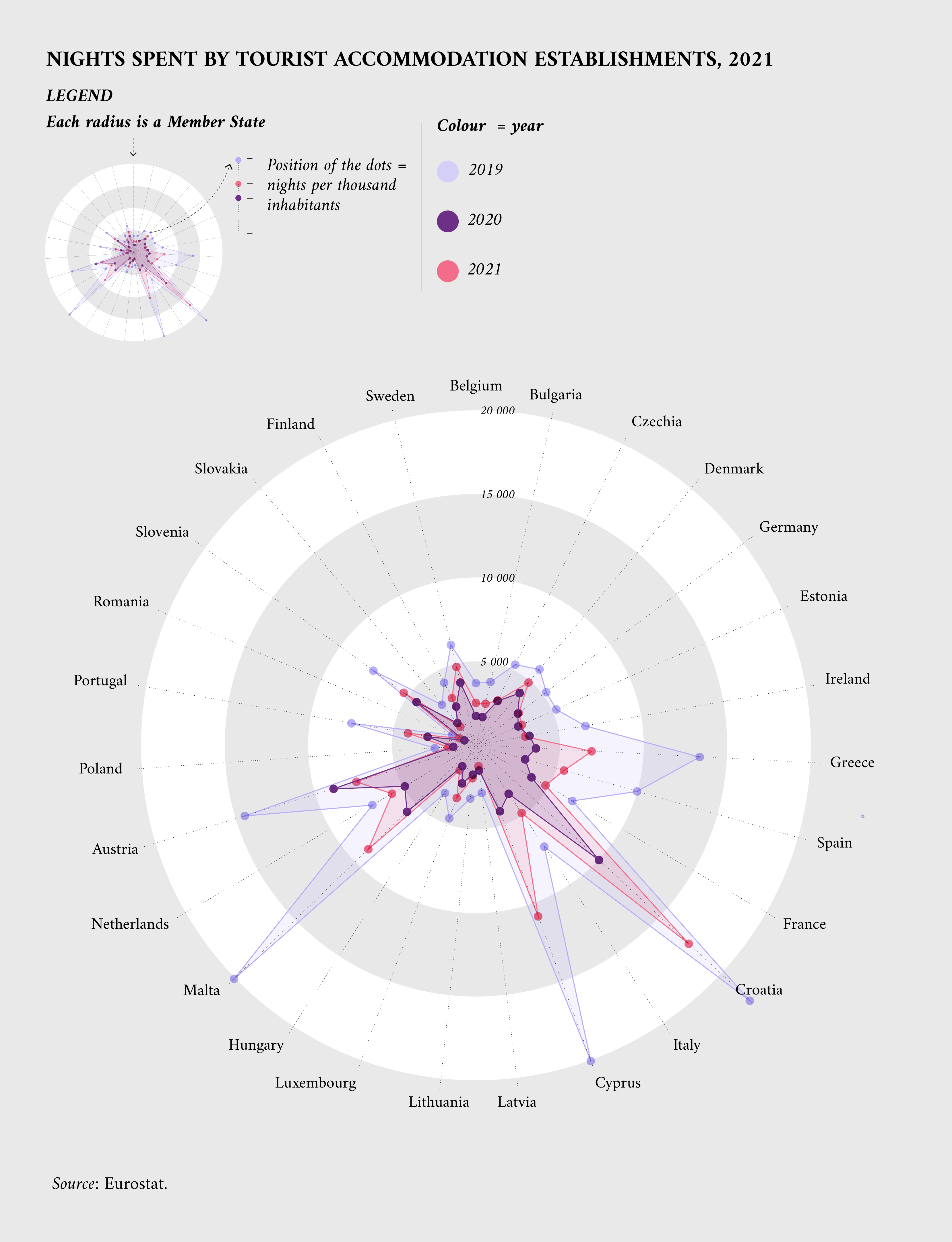

Eurostat also offers datasets that show the preferred destinations for tourists from inside and outside the EU. A good indicator to measure this phenomenon is the total number of nights spent in tourist accommodation establishments, which is available for all guests or only for international guests .

To better understand tourists’ preferences, data can be disaggregated to show the type of accommodation they chose – a hotel, a camping site or other short-term accommodation – and whether the tourists were domestic or came from abroad.

By adjusting for population, the indicator called ‘Tourism intensity’ represents the number of nights spent by domestic or international guests in tourist accommodation. Looking at this indicator, smaller countries like Croatia, Malta, Cyprus, Austria and Greece stand out as major tourism destinations.

Tourism data on data.europa.eu

As previously mentioned, high-value datasets include several indicators through which it is possible to analyse tourism from different perspectives. Information of similar scope has been provided by Member States on the data.europa.eu portal, where it can be freely reused by everyone.

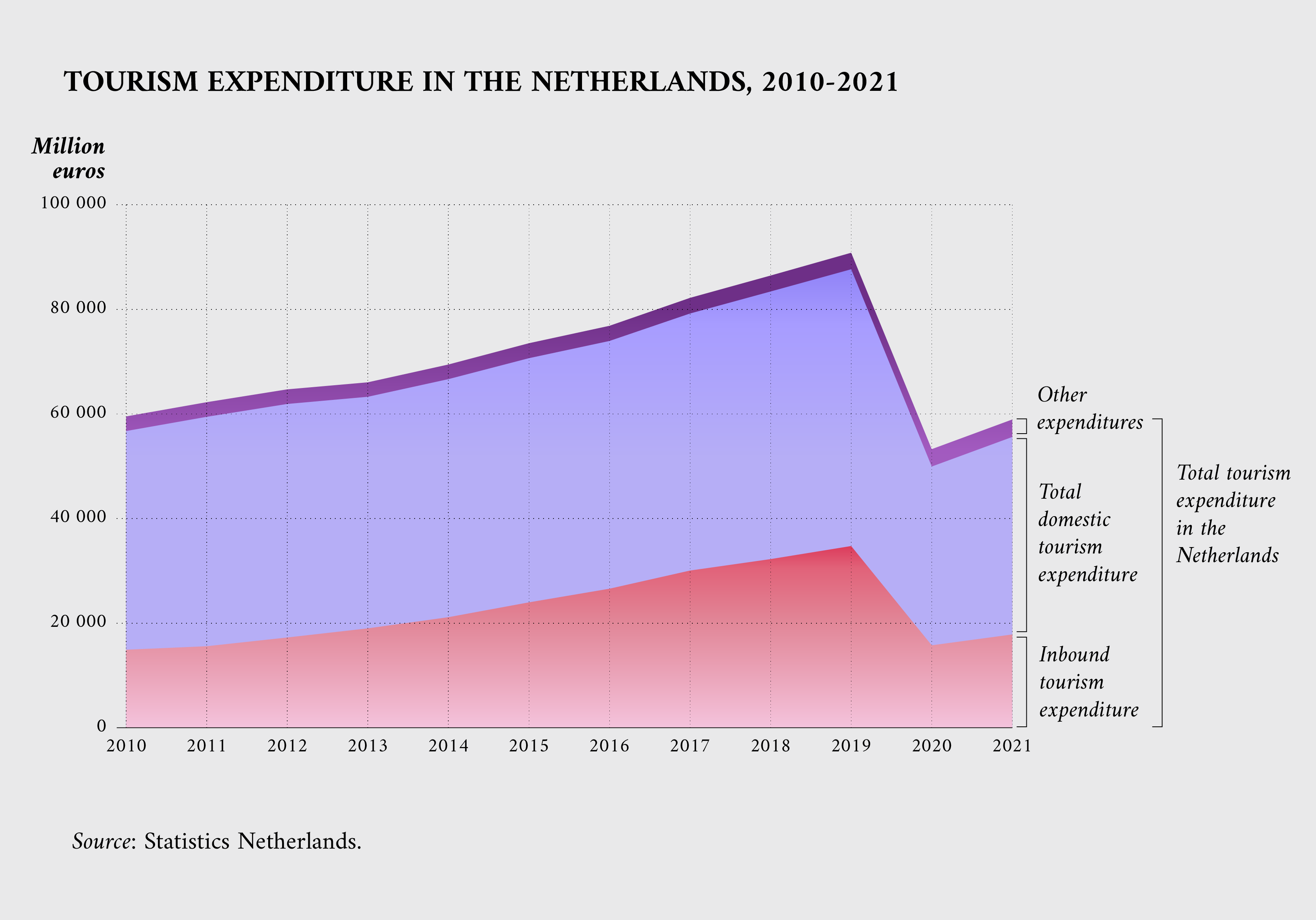

One of these indicators is tourism expenditure, for which the portal provides several datasets . Examples include a study from the EU’s Joint Research Centre that estimated the average economic value generated for each night spent or a dataset showing expenditures and earnings by and from travellers to and from Ireland.

Another interesting dataset was uploaded by the data portal of the Dutch government. The Eurostat data revealed that Dutch people are among the most active in tourist activities and this dataset offers many insights about their travel habits over time.

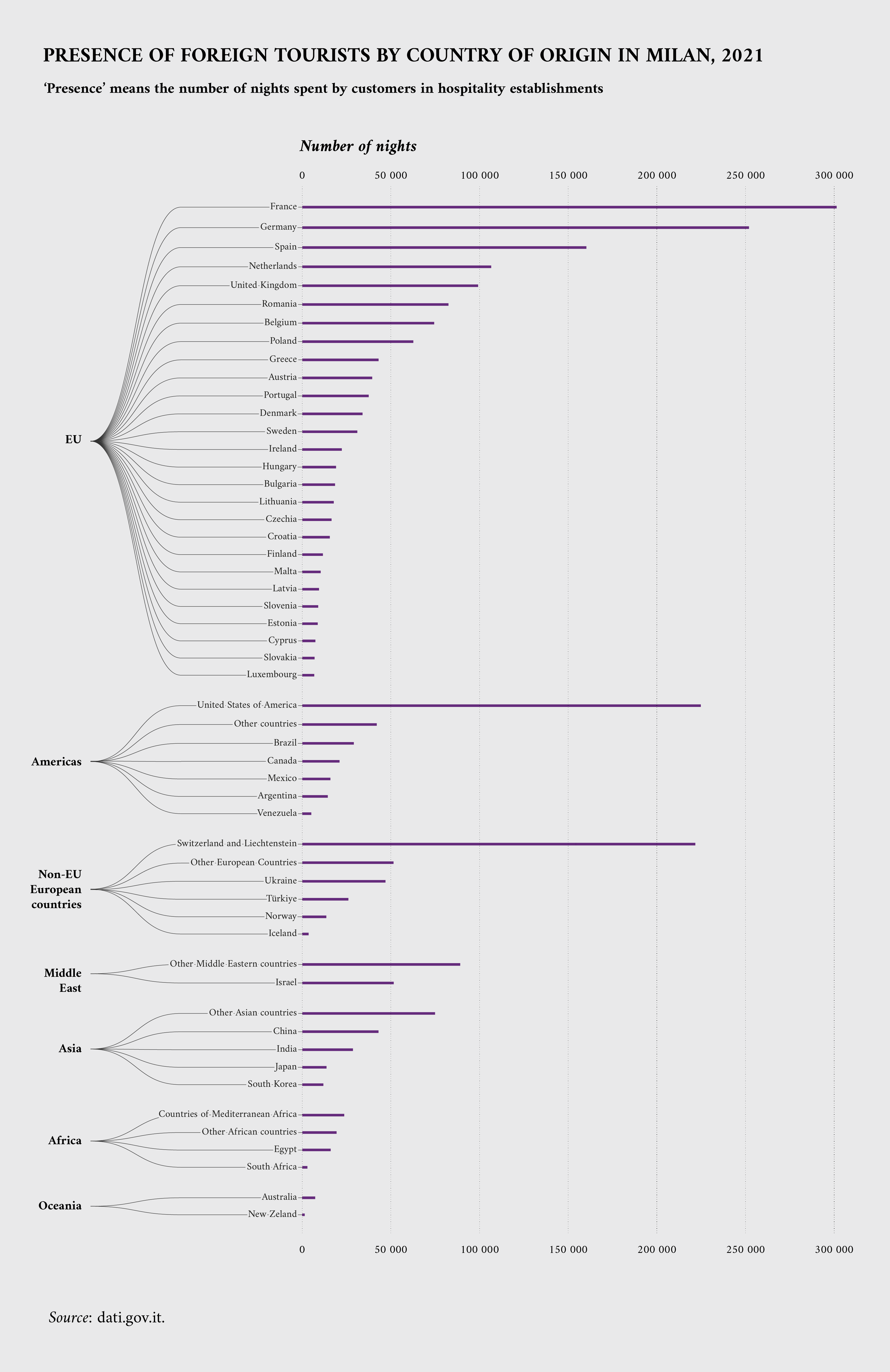

Datasets on data.europa.eu also cover other aspects related to tourism, such as means of transport , accommodation and booking modalities . Examples include a Joint Research Centre study that estimated the percentage of travel by train and the number of foreign tourists staying in Milan by area of origin and type of accommodation.

Data for tourism in Milan accounts for the number of nights spent in the city and shows a significant presence of tourists from other Member States – especially France and Germany. The third-largest influx of tourists come from the United States, while other important groups of people travelled to Milan from Switzerland, Liechtenstein and from several Middle Eastern countries.

Other than Eurostat and the Member States, data about tourism is also produced by the European Environmental Agency , which focuses on the environmental impact of tourism. Sociological data is made available by Eurobarometer , with public opinion surveys on a range of EU-related topics across its Member States regularly conducted by the Commission and other EU institutions since 1973. Some of those surveys asked European residents about their attitude towards tourism and the results can be downloaded from the data.europa.eu portal.

Download the data visualisations presented in this story and the data behind them.

Article by Davide Mancino

Data visualisations by Federica Fragapane

EU tourist stays neared pre-pandemic levels in 2022 - Eurostat

- Medium Text

Sign up here.

Reporting by Diana Mandiá and Dina Kartit. Editing by Sharon Singleton

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Thomson Reuters

Reports on the French and Benelux markets from Gdansk. Previously worked at El Pais, as a freelance journalist based in Marseille for several Spanish-language news outlets and at the European Parliament in Brussels.

Markets Chevron

Stocks dip as investors digest inflation data; dollar dips

Global stock indexes edged lower on Friday, reversing early gains, while Treasury yields rose and the U.S. dollar declined as investors absorbed data that showed U.S. monthly inflation was unchanged in May.

How quickly is tourism recovering from COVID-19?

The pandemic helped fuel a decline in tourism globally. Image: Unsplash/Markus Spiske

.chakra .wef-1c7l3mo{-webkit-transition:all 0.15s ease-out;transition:all 0.15s ease-out;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;outline:none;color:inherit;}.chakra .wef-1c7l3mo:hover,.chakra .wef-1c7l3mo[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.chakra .wef-1c7l3mo:focus,.chakra .wef-1c7l3mo[data-focus]{box-shadow:0 0 0 3px rgba(168,203,251,0.5);} Victoria Masterson

.chakra .wef-9dduvl{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-9dduvl{font-size:1.125rem;}} Explore and monitor how .chakra .wef-15eoq1r{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;color:#F7DB5E;}@media screen and (min-width:56.5rem){.chakra .wef-15eoq1r{font-size:1.125rem;}} Travel and Tourism is affecting economies, industries and global issues

.chakra .wef-1nk5u5d{margin-top:16px;margin-bottom:16px;line-height:1.388;color:#2846F8;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-1nk5u5d{font-size:1.125rem;}} Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:, travel and tourism.

- Tourists spent an extra 1.8 billion nights in the European Union in 2021 compared with the year before.

- But this is still almost 40% lower than pre-pandemic levels, according to EU statistics.

- Tourism is an important sector for the world economy, and is expected to continue recovering gradually in 2022.

- However, there are still risks – including Russia's invasion of Ukraine and COVID-19 variants.

Tourism was hit particularly hard by the pandemic, as lockdowns restricted people to travelling around their homes and neighbourhoods rather than around the world. But there are now signs that tourist numbers are starting to recover as limitations on movement are eased.

There was a 27% rise in nights spent at EU tourist accommodation in 2021 , according to Eurostat, the statistical office of the EU. This took the total to 1.8 billion, although this was still 37% less than in 2019, before COVID-19.

The first global pandemic in more than 100 years, COVID-19 has spread throughout the world at an unprecedented speed. At the time of writing, 4.5 million cases have been confirmed and more than 300,000 people have died due to the virus.

As countries seek to recover, some of the more long-term economic, business, environmental, societal and technological challenges and opportunities are just beginning to become visible.

To help all stakeholders – communities, governments, businesses and individuals understand the emerging risks and follow-on effects generated by the impact of the coronavirus pandemic, the World Economic Forum, in collaboration with Marsh and McLennan and Zurich Insurance Group, has launched its COVID-19 Risks Outlook: A Preliminary Mapping and its Implications - a companion for decision-makers, building on the Forum’s annual Global Risks Report.

Companies are invited to join the Forum’s work to help manage the identified emerging risks of COVID-19 across industries to shape a better future. Read the full COVID-19 Risks Outlook: A Preliminary Mapping and its Implications report here , and our impact story with further information.

Where tourists went

Greece, Spain and Croatia saw the biggest rises in visitors last year, with the number of nights spent at tourist accommodation jumping by more than 70%. Trips to Austria, Latvia and Slovakia fell, but by less than 18%.

“This shows signs of recovery in the tourism sector,” Eurostat says.

However, when 2021 tourist night numbers are compared with 2019, it shows some countries lost more than half their bookings. Latvia, Slovakia, Malta and Hungary were the worst hit.

Denmark and the Netherlands, on the other hand, were the least affected countries. They saw drops of less than 20% in nights spent in tourist accommodation.

Eurostat says the figures are “far less dramatic” than the contrast between 2019 and 2020, when tourism in the EU halved .

Tourism supports jobs

More than 2 million businesses – mostly small and medium-sized companies – make up the EU’s tourism industry , according to the European Parliament.

These firms employ an estimated 12.3 million people, but worker numbers increase to 27.3 million when related sectors are taken into account.

Across the EU in 2018, travel and tourism made up about 4% of GDP – the total value of products and services produced in a country – or 10% if closely related sectors are taken into account.

Three-quarters of these tourism businesses operated in either accommodation or serving food and drink. Italy, France, Spain and Germany were home to 55% of the EU’s tourism firms in 2018.

Have you read?

This is how the covid-19 crisis has affected international tourism, we urgently need to kickstart tourism’s recovery but crisis offers an opportunity to rethink it, a new era of sustainable travel prepares for take-off, global growth and risks.

Tourism is the world’s third-biggest export sector , according to the World Tourism Organization (UNWTO), a special United Nations agency.

Because of COVID-19, tourism lost out on around $1 trillion of export revenues in 2021, UNWTO estimates. It predicts that the tourism industry will recover gradually in 2022 .

International tourist arrivals globally grew 130% in January 2022, UNWTO says. And this was despite the Omicron variant of COVID-19 slowing down the speed of the recovery.

The war in Ukraine also poses a new risk to the global tourism industry – by potentially disrupting the return of confidence to travel, UNWTO says.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The agenda .chakra .wef-n7bacu{margin-top:16px;margin-bottom:16px;line-height:1.388;font-weight:400;} weekly.

A weekly update of the most important issues driving the global agenda

.chakra .wef-1dtnjt5{display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;-webkit-flex-wrap:wrap;-ms-flex-wrap:wrap;flex-wrap:wrap;} More on Industries in Depth .chakra .wef-17xejub{-webkit-flex:1;-ms-flex:1;flex:1;justify-self:stretch;-webkit-align-self:stretch;-ms-flex-item-align:stretch;align-self:stretch;} .chakra .wef-nr1rr4{display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;white-space:normal;vertical-align:middle;text-transform:uppercase;font-size:0.75rem;border-radius:0.25rem;font-weight:700;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;line-height:1.2;-webkit-letter-spacing:1.25px;-moz-letter-spacing:1.25px;-ms-letter-spacing:1.25px;letter-spacing:1.25px;background:none;padding:0px;color:#B3B3B3;-webkit-box-decoration-break:clone;box-decoration-break:clone;-webkit-box-decoration-break:clone;}@media screen and (min-width:37.5rem){.chakra .wef-nr1rr4{font-size:0.875rem;}}@media screen and (min-width:56.5rem){.chakra .wef-nr1rr4{font-size:1rem;}} See all

How these 5 steel producers are taking action to decarbonize steel production

Mandy Chan and Daniel Boero Vargas

June 25, 2024

How we can best empower the future of business in APAC with GenAI

John Lombard

June 24, 2024

AMNC24: What you need to know about industry transformation

Pooja Chhabria

June 23, 2024

The energy transition could shift the global power centre. This expert explains why

Liam Coleman

June 4, 2024

Top 5 countries leading the sustainable tourism sector

Robot rock stars, pocket forests, and the battle for chips - Forum podcasts you should hear this month

Robin Pomeroy and Linda Lacina

April 29, 2024

- Even more »

Account Options

The Sofia Globe

Bulgaria’s independent English-language news and features website.

Eurostat: EU tourism industry eclipsed pre-pandemic levels in 2023

In 2023, European Union tourism continued to show signs of rebounding from the Covid-19 pandemic, EU statistics agency Eurostat said on January 16.

The estimated number of nights spent at tourist accommodation establishments in 2023 reached 2.92 billion, exceeding the pre-pandemic level for 2019 (2.87 billion) by 1.6 per cent and setting a record year for the EU accommodation sector.

In 2023, 171 million more nights were spent compared with 2022 (+6.3 per cent), mainly driven by an increase in nights spent by international guests (+146 million) and to a lesser extent by an increase in nights spent by domestic guests (+25 million).

Tourism levels (in terms of nights spent) were 25 per cent higher than 10 years earlier (2013: 2.33 billion nights spent).

This information comes from early estimates on tourism published by Eurostat on January 16 (based on monthly January-October or November 2023 data, depending on each respective country).

Compared with 2022, nearly all EU members recorded an increase in 2023, only Luxembourg recorded a small decrease (-0.1 per cent).

In Malta and Cyprus, the growth exceeded 20 per cent and in 8 other EU members, it exceeded 10 per cent (Slovakia, Latvia, Bulgaria, Austria, Czechia, Portugal, Romania and Greece).

In absolute numbers, the biggest increase in nights spent was observed in Germany (+32.8 million nights) and Spain (+32.3 million nights).

Following three years with a significantly lower share of international tourists (respectively 29 per cent, 32 per cent, and 44 per cent of all nights spent in 2020, 2021, and 2022), foreigners accounted for 46 per cent of the 2.87 billion nights spent in 2023.

This shows a near-return to the pre-pandemic contribution of international tourists (47 per cent), Eurostat said.

However, in terms of volume, international tourism was still catching up (-0,4 per cent compared with 2019).

In terms of accommodation, hotels and similar accommodation were the dominant segment with 1.8 billion nights spent (63 per cent of the total), followed by holiday and other short-stay accommodation (24 per cent). Campsites accounted for 13 per cent of the total, the statistics agency said.

( Photo: Lance Nelson of Bansko App )

Please support The Sofia Globe’s independent journalism by becoming a subscriber to our page on Patreon :

Share this:

- ← Voting rights of millions of Britons living abroad restored

- Defence Chief: Bulgaria on track to receive eight F-16 fighter jets in 2025 →

The Sofia Globe staff

The Sofia Globe - the Sofia-based fully independent English-language news and features website, covering Bulgaria, the Balkans and the EU. Sign up to subscribe to sofiaglobe.com's daily bulletin through the form on our homepage. https://www.patreon.com/user?u=32709292

You May Also Like

Bulgaria’s investment promotion law spurs renewed debate in Parliament

Bulgarian national charged by SEC for stock market fraud in US

Coastal tourism

Coastal and maritime tourism is the largest sector of the EU Blue Economy in terms of GVA and employment, with EU coastal areas being highly sought-after destinations for both European and international travellers. Over half of the EU bed capacity is located in regions with a sea border 1 .

Tourism plays a significant role in the economies of many non-landlocked EU Member States, particularly in Southern Europe, where it contributes a substantial portion of their total national revenue 2 .

At the same time, coastal regions are those with the highest seasonality, i.e., with tourism demand concentrated in a limited number of months, usually July and August 3 .

The Coastal tourism sector comprises recreational activities in the proximity of the sea (e.g. beach-based tourism, coastal walks, wildlife watching) as well as those in the maritime area, including nautical sports (e.g. sailing, scuba diving, cruising, etc.). The socio-economic statistics presented in this section originate from three typologies of activities typically undertaken by tourists as reported by EU Member States, attributed to coastal areas on the basis of a specific computation methodology:

- Accommodation , i.e. nights spent at tourist accommodation establishments in coastal areas;

- Transport , reflecting the maritime proportion of sea-borne, road, rail and air passenger travel;

- Other expenditures , covering specific tourist expenditures in coastal areas (e.g., food & beverage services, cultural and recreational goods, purchase of water-sport equipment and clothing, etc.).

The sector was hit hard by the COVID-19 pandemic in 2020. In 2021, the coastal tourism sector recovered, but still did not reach the pre-crisis level. The GVA generated by the sector amounted to €49.9 billion, up from €28.6 billion registered in 2020, i.e., a year-on-year 74% increase, but still a 38%-contraction compared to 2019. Gross profits, at €16.1 billion, increased 4.2 times compared to 2020. Nonetheless, the sector’s turnover resulting from the aggregation of the abovementioned sub-sectors amounted to €140.0 billion (Figure 2.14).

In 2021, Spain led the Coastal tourism sector in terms of employment contributing 22% of jobs, followed by Greece with 19%, France with 13% and Italy with 9%. The sub-sector Accommodation employed almost 848 000 persons, accounting for about 44% of the jobs, while about 812 000 persons (42%) were employed in Other services (e.g. restaurants), and about 263 000 persons (14%) were employed in Transport.

In terms of GVA, Spain led with 23%, France with 20%, and Italy with 11% in 2021. The sub-sector Accommodation generated €24 billion in GVA, about 48% of the sector’s GVA, while other services generated €16.7 million (34%) and Transport €9.1 million (18%).

Coastal tourism was hit hard by the Covid-19 pandemic and is taking longer than other blue economy sectors to recover. The overall tourism sector was hit hard by the pandemic in 2020, even if coastal tourism was the least affected typology. Controlling for restrictions, the loss in guest nights in 2020 compared to 2019 was relatively higher in urban and rural destinations, indicating higher preferences from tourists for coastal destinations 4 .

The first priority area of the “Coastal and Maritime Strategy” of 2014 highlights “opportunities for cruise tourism” in a sustainable manner.

According to industry representatives, the cruise sector represented 1.2 million jobs and contributed $150 billion to the global economy before the Covid-19 pandemic. With around sixty ports suitable for cruise ships, Europe ranks second behind the American continent.

It has a notable effect on regions and countries with cruise ports, contributing to job creation, port infrastructure development, and the stimulation of local economies. However, cruise tourism also encounters substantial criticism for its significant impacts, particularly concerning pollution, carbon footprint, etc. 5

Measuring the exact economic impact of this type of tourism on the local economy can be challenging due to the lack of overnight stays, which sets it apart from other forms of tourism. Tourists typically visit for the day, participating in activities such as shopping and dining. To accommodate the arrival of hundreds or even thousands of tourists, host cities need to have robust infrastructure, logistics, transportation, and services in place.

Number of passengers by country

The Eurostat dataset 6 includes data on cruise passengers, including both those making stopovers and those starting or ending their cruise. However, this study does not consider expenses in the embarkation port such as hotel accommodations, restaurants (however it might be considered in standard coastal tourism economic impact assessment based on overnight stays). The graph below illustrates the volume of tourists (in thousands) disembarking during their cruises in European countries.

Throughout the 2010s, the cruise tourism industry experienced rapid growth from 12 to 17 million passengers disembarking in EU ports, offering an expanding array of itineraries, varying lengths of stay, and diverse ports of call. Italy and Spain emerged as the top two European countries hosting the highest number of cruise passengers. Together they represented half of all European cruise passengers in 2019, i.e., over 8 million people.

However, the onset of the COVID-19 pandemic halted cruise operations for over 4 months, with a slow recovery due to strict restrictions. There has therefore been an exceptional 16-fold reduction in stopover passengers between 2019 and 2020.

During this period, the sector utilised the pause to rebuild and construct ships with greater environmental sustainability and increased capacity. Since then, the industry has largely resumed its operations, returning progressively to pre-pandemic levels.

Number of passengers by port

Eurostat also provides a breakdown of cruise passengers by port, allowing them to group them by seaboards. Certain countries, like Italy and Spain, have ports hosting cruise ships on two seaboards. In 2022, the most important seaboard in the EU-27 in terms of number of cruise passengers was Western Mediterranean (almost half of the EU total with Barcelona, Palma de Mallorca and Civitavecchia as main ports), followed by Northern Europe (with Antwerp-Bruges and Hamburg being the main ports) and Scandinavia/Baltic (Kiel being the main port).

*Fig. 3: This method leads to a sum of visitors per country slightly lower than the figures obtained in the database by country but the breakdowns by seaboards are comparable.

Measuring the economic impacts of cruise tourism

Hosting countries can receive economic benefits from cruise tourism:

- Revenue from passengers’ expenditure : Cruise tourists typically spend money on various goods and services such as shopping, dining, tours, and transportation, directly benefiting local businesses and contributing to the economy.

- Port Fees and Taxes : Cruise lines pay fees to dock their ships at ports, and passengers may incur local taxes or tariffs, contributing to the revenue of port authorities and local governments.

- Job Creation : Cruise tourism creates employment opportunities in sectors like hospitality, retail, transportation, and entertainment, providing jobs for local residents.

- Infrastructure Development : Ports may invest in infrastructure improvements to accommodate cruise ships, leading to long-term economic benefits by enhancing port capacity and attracting additional tourism-related businesses.

- Multiplier Effect : Cruise tourism generates indirect effects through supply chain linkages and multiplier effects, stimulating economic activity and job creation beyond direct passenger spending.

Overall, cruise tourism can be a significant driver of economic growth and development for host countries, particularly those with attractive port destinations and supportive infrastructure.

Despite the economic benefits that cruise tourism offers, it is also subject to criticism and various challenges. Some of the main criticisms and challenges associated with the cruise industry include: air and water pollutions, waste management, overcrowding in port cities, regulatory challenges due to the specific status of the cruise industry, etc.

Spending patterns of cruise passengers

The average expenditure of cruise passengers in ports varies significantly based on factors such as destination, cruise line, duration of the cruise, demographics, and individual spending habits. Research from Cruise Lines International Association (CLIA) indicates that, in Europe, expenditure varies with a range of €50 to €150 per day per passenger. These figures are approximate and can differ based on the port, itinerary, and passenger preferences.

Cruise lines and port authorities often analyse spending patterns to tailor offerings and improve the overall passenger experience in each region. Based on a literature review, the amount of money spent by cruise passengers during their stopovers varies between €30 and €70 on average in Europe. Among these sources, no significant differences are observed across EU seaboards as variations of expenses depend on other drivers.

Then, by multiplying this individual expenditure with Eurostat data by seaboards, we estimated the contribution of cruise tourists' spending to the EU local economies. We based our estimates on 3 scenarios of average expenditure:

- “high”: €70

- “medium”: €50

In 2022, the sum of cruise passengers’ expenditure in Europe ranges between €276 and €644 million according to the calculations. Before COVID-19 it was between €465 million and €1 billion. For EU-27 only, the total amounted to €274 and €644 million in 2022. These estimates are much lower than the estimates of the Cruise Lines International Association that consider a €44 billion economic contribution and 315 000 jobs provided by the industry in Europe in 2021 7 . This highlights that cruise passengers onshore expenditures may only represent a limited share of the economic contribution of the sector.

Towards sustainability

While recovering from the Covid-19 pandemic, the Coastal tourism sector has engaged in the sustainability transition with the aim to green its operations, reduce its negative impacts on the marine environment, and strengthen its resilience to exogenous shocks such as commodity and fuel price inflation.

For this purpose, the European Commission has published the Tourism Transition Pathway involving all tourism stakeholders. The updated Industrial Strategy (2021) calls for the acceleration of green and digital transformation to increase the European economy's resilience.

The strategy also identifies 27 initiative areas for the green and digital transition to improve tourism in the EU. These include:

• Regulation and public governance , which includes; improving statistics and indicators for tourism and comprehensive tourism strategies.

• Green and digital transition , which includes; research and innovation projects on circular and climate-friendly tourism and support for digitalisation of tourism SMEs and destinations.

• Resilience , which includes; seamless cross-border travelling, fostering skills in tourism, promoting fairness and equality in tourism jobs, and accessibility.

As part of the EU Sustainable Blue Economy , the coastal and maritime tourism sector has been identified as an area with potential to foster a smart, sustainable and inclusive Europe. The EU's tourism policy aims to keep Europe's position as a leading tourist destination while also maximising the industry's contribution to economic growth and jobs.

Interaction with other sectors

While European destinations are welcoming tourists at pre-pandemic levels, the rise in tourist numbers and their concentration in attractive touristic destinations may generate issues of over tourism, particularly in coastal areas and small island. Increasing tourism intensity requires long-term solutions .

At the same time, Covid-19 will likely have long-term impacts on EU citizens’ travelling behavior. A recent Eurobarometer survey showed that 82% of EU citizens are ready to change their travel and tourism habits to be more sustainable, for example, by consuming local products (55%), choosing ecological means of transport (36%) or by paying more to protect the natural environment (35%) or to benefit the local community (33%). The survey also found out that 38% of European respondents are expecting more domestic travelling in the future .

One example of a sustainable approach to coastal and maritime tourism is the ECO-CRUISING FU_TOUR .

For many experts in the business, this is a game-changing opportunity that will lead to greater and faster adoption of more sustainable environmental solutions and greater respect for coastal natural and cultural qualities of coastal areas. The European Green Deal and the new EU Sustainable Blue Economy can help in such green transitions, thanks to policy reforms, specific financial mechanism, as well as innovation, digitalisation, education and training.

1 European Commission. Coastal and maritime tourism. https://ec.europa.eu/growth/sectors/tourism/offer/maritime-coastal_en .

2 Eurostat. 2023. Tourism Satellite Accounts in Europe – 2023 edition: Available at: https://ec.europa.eu/eurostat/web/products-statistical-reports/w/ks-ft-22-011 .

European Commission. Tourism Dashboard. Available at: https://tourism-dashboard.ec.europa.eu/map-view?lng=en&ctx=tourism&is=TOURISM&ts=TOURISM&pil=indicator-level&tl=0&i=344&clc=socio-economic-vulnerability&db=1289&it=ranking-chart&cwt=bar-chart .

3 Eurostat (2022). Tourism statistics - seasonality at regional level. https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Tourism_statistics_-_seasonality_at_regional_level#The_regions_with_the_highest_seasonality_are_coastal_regions .

Batista e Silva, F., Barranco, R., Proietti, P., Pigaiani, C., & Lavalle, C. (2021). A new European regional tourism typology based on hotel location patterns and geographical criteria. Annals of Tourism research, 89, 103077. https://doi.org/10.1016/j.annals.2020.103077 .

4 Curtale, R., Batista e Silva, F., Proietti, P., & Barranco, R. (2023). Impact of COVID-19 on tourism demand in European regions-An analysis of the factors affecting loss in number of guest nights. Annals of Tourism Research Empirical Insights, 4(2), 100112. https://doi.org/10.1016/j.annale.2023.100112 .

5 The return of the cruise – How luxury cruises are polluting Europe’s cities. TE- Transport Environment.

6 Data source: Eurostat Passengers embarked and disembarked in all ports by direction - annual data [mar_pa_aa] .

7 State of the Cruise Industry 2023 – Cruise lines international association.

Share this page

Travel, Tourism & Hospitality

- Travel and tourism: share of GDP in the EU-27 and the UK 2019-2022, by country

Share of travel and tourism's total contribution to GDP in European Union member countries (EU-27) and the United Kingdom (UK) in 2019 and 2022

Additional Information

Show sources information Show publisher information Use Ask Statista Research Service

2019 and 2022

figures are in constant 2022 prices and exchange rates as of March 2023

Data can be found in the source's weblink by clicking on each country report.

Other statistics on the topic Travel and tourism in Europe

- European countries with the highest number of inbound tourist arrivals 2019-2023

- Number of international tourist arrivals worldwide 2005-2023, by region

Leisure Travel

- Market cap of leading online travel companies worldwide 2023

- Leading airlines in Europe based on passenger numbers 2022

- Immediate access to statistics, forecasts & reports

- Usage and publication rights

- Download in various formats

* For commercial use only

Basic Account

- Free Statistics

Starter Account

- Premium Statistics

Professional Account

- Free + Premium Statistics

- Market Insights

1 All prices do not include sales tax. The account requires an annual contract and will renew after one year to the regular list price.

Statistics on " Travel and tourism in Europe "

- International tourist arrivals worldwide 2019-2022, by subregion

- Travel and tourism's total contribution to GDP in Europe 2019-2034

- Distribution of travel and tourism expenditure in Europe 2019-2023, by type

- Distribution of travel and tourism expenditure in Europe 2019-2023, by tourist type

- Travel and tourism's total contribution to employment in Europe 2019-2034

- Leading European countries in the Travel & Tourism Development Index 2023

- International tourist arrivals in Europe 2006-2023

- International tourist arrivals in Europe 2010-2022, by region

- Monthly number of inbound tourist arrivals in Europe 2019-2024

- Change in monthly tourist arrivals in Europe 2020-2023, by region

- Inbound tourism visitor growth in Europe 2020-2025, by region

- International tourist arrival growth in European countries 2019-2023

- International tourism spending in Europe 2019-2034

- Number of domestic tourist trips in EU-27 countries and the UK 2018-2021

- Number of domestic arrivals in tourist accommodation in the EU 2011-2022

- Domestic tourism spending in Europe 2019-2034

- Domestic tourism spending in EU-27 countries and the UK 2019-2022

- Share of Europeans planning to take a domestic summer trip 2024, by country

- Outbound tourism visitor growth worldwide 2020-2025, by region

- Outbound visitor growth in Europe 2020-2025, by region

- Number of outbound trips from EU-27 countries and the UK 2018-2021

- European countries with the highest outbound tourism expenditure 2019-2022

- Travel intentions of Europeans in the next six months 2024, by destination

- Share of Europeans planning to travel domestically or in Europe 2023-2024

- Europeans planning domestic or European trips in the next six months 2024, by age

- Europeans planning leisure domestic or European trips 2024, by trip type

- European travelers' favorite destinations for their next European trip 2024

- Number of tourist accommodation establishments in the EU 2012-2022

- Number of overnight stays in tourist accommodation establishments in the EU 2011-2022

- Hotel market revenue in Europe 2017-2028

- Hotel market revenue in Europe 2017-2028, by region

- Share of hotel market sales in Europe 2017-2028, by channel

- Estimated EV/EBITDA ratio in the online travel market 2024, by segment

- Market capitalization of leading travel and leisure companies in Europe 2024

- Travel and tourism revenue in Europe 2018-2028, by segment

- Number of users of package holidays in Europe 2019-2028

- Number of users of hotels in Europe 2019-2028

- Number of users of vacation rentals in Europe 2019-2028

- Revenue of travel and tourism market in selected countries worldwide 2023

Other statistics that may interest you Travel and tourism in Europe

- Basic Statistic Number of international tourist arrivals worldwide 2005-2023, by region

- Premium Statistic International tourist arrivals worldwide 2019-2022, by subregion

- Basic Statistic Travel and tourism's total contribution to GDP in Europe 2019-2034

- Basic Statistic Distribution of travel and tourism expenditure in Europe 2019-2023, by type

- Basic Statistic Distribution of travel and tourism expenditure in Europe 2019-2023, by tourist type

- Basic Statistic Travel and tourism: share of GDP in the EU-27 and the UK 2019-2022, by country

- Basic Statistic Travel and tourism's total contribution to employment in Europe 2019-2034

- Premium Statistic Leading European countries in the Travel & Tourism Development Index 2023

Inbound tourism

- Premium Statistic International tourist arrivals in Europe 2006-2023

- Premium Statistic International tourist arrivals in Europe 2010-2022, by region

- Premium Statistic European countries with the highest number of inbound tourist arrivals 2019-2023

- Basic Statistic Monthly number of inbound tourist arrivals in Europe 2019-2024

- Basic Statistic Change in monthly tourist arrivals in Europe 2020-2023, by region

- Premium Statistic Inbound tourism visitor growth in Europe 2020-2025, by region

- Premium Statistic International tourist arrival growth in European countries 2019-2023

- Basic Statistic International tourism spending in Europe 2019-2034

Domestic tourism

- Premium Statistic Number of domestic tourist trips in EU-27 countries and the UK 2018-2021

- Basic Statistic Number of domestic arrivals in tourist accommodation in the EU 2011-2022

- Basic Statistic Domestic tourism spending in Europe 2019-2034

- Basic Statistic Domestic tourism spending in EU-27 countries and the UK 2019-2022

- Premium Statistic Share of Europeans planning to take a domestic summer trip 2024, by country

Outbound tourism

- Premium Statistic Outbound tourism visitor growth worldwide 2020-2025, by region

- Premium Statistic Outbound visitor growth in Europe 2020-2025, by region

- Premium Statistic Number of outbound trips from EU-27 countries and the UK 2018-2021

- Premium Statistic European countries with the highest outbound tourism expenditure 2019-2022

European travelers

- Premium Statistic Travel intentions of Europeans in the next six months 2024, by destination

- Premium Statistic Share of Europeans planning to travel domestically or in Europe 2023-2024

- Premium Statistic Europeans planning domestic or European trips in the next six months 2024, by age

- Premium Statistic Europeans planning leisure domestic or European trips 2024, by trip type

- Premium Statistic European travelers' favorite destinations for their next European trip 2024

Accommodation

- Basic Statistic Number of tourist accommodation establishments in the EU 2012-2022

- Basic Statistic Number of overnight stays in tourist accommodation establishments in the EU 2011-2022

- Premium Statistic Hotel market revenue in Europe 2017-2028

- Premium Statistic Hotel market revenue in Europe 2017-2028, by region

- Premium Statistic Share of hotel market sales in Europe 2017-2028, by channel

Travel companies

- Basic Statistic Market cap of leading online travel companies worldwide 2023

- Premium Statistic Estimated EV/EBITDA ratio in the online travel market 2024, by segment

- Premium Statistic Market capitalization of leading travel and leisure companies in Europe 2024

- Premium Statistic Leading airlines in Europe based on passenger numbers 2022

- Premium Statistic Travel and tourism revenue in Europe 2018-2028, by segment

- Premium Statistic Number of users of package holidays in Europe 2019-2028

- Premium Statistic Number of users of hotels in Europe 2019-2028

- Premium Statistic Number of users of vacation rentals in Europe 2019-2028

- Premium Statistic Revenue of travel and tourism market in selected countries worldwide 2023

Further related statistics

- Basic Statistic Global travel and tourism expenditure 2019-2022, by type

- Basic Statistic Forecast: economic contribution of travel and tourism to GDP worldwide 2020-2029

- Premium Statistic Inbound tourism of visitors from Denmark to the Netherlands 2013-2019

- Premium Statistic Leisure, travel and tourism apprenticeships in England 2011-2019

- Basic Statistic Impact of coronavirus on the summer holiday plans in the Netherlands 2020

- Premium Statistic Leading countries in the MEA in the Travel & Tourism Competitiveness Index 2018

- Premium Statistic Sub-Saharan African countries in the Travel & Tourism Competitiveness Index 2019

- Premium Statistic Countries with the most restrictive visa requirements worldwide 2014

- Premium Statistic Preferred city break entertainment in Poland 2020

- Premium Statistic Planned city break expenses in Poland 2020

- Premium Statistic Inbound tourism of visitors from Russia to the Netherlands 2013-2018

- Premium Statistic Opinion on a short-term holiday plans in Poland 2020

- Premium Statistic Perception of city break trips in Poland 2020

Further Content: You might find this interesting as well

- Global travel and tourism expenditure 2019-2022, by type

- Forecast: economic contribution of travel and tourism to GDP worldwide 2020-2029

- Inbound tourism of visitors from Denmark to the Netherlands 2013-2019

- Leisure, travel and tourism apprenticeships in England 2011-2019

- Impact of coronavirus on the summer holiday plans in the Netherlands 2020

- Leading countries in the MEA in the Travel & Tourism Competitiveness Index 2018

- Sub-Saharan African countries in the Travel & Tourism Competitiveness Index 2019

- Countries with the most restrictive visa requirements worldwide 2014

- Preferred city break entertainment in Poland 2020

- Planned city break expenses in Poland 2020

- Inbound tourism of visitors from Russia to the Netherlands 2013-2018

- Opinion on a short-term holiday plans in Poland 2020

- Perception of city break trips in Poland 2020

What are you looking for?

68+ europe travel & tourism statistics (latest 2024 data).

It’s no secret that Europe is home to some of the most popular places to visit in the world . With fascinating history, diverse cultures, and gorgeous natural sceneries, there is something to suit every type of tourist.

According to the UN, there are 44 countries in Europe with 27 of them listed as part of the European Union .

That’s a lot of places to explore and get lost in!

France was the most visited destination in Europe as it saw over 79.4 million global tourist arrivals in 2022.

Meanwhile, Paris welcomed 16.8 million international tourists in 2018 . It’s second in Europe only to London.

Today, we’re here to present some of the most interesting and crucial statistics about travel and tourism in Europe. From how much revenue this industry generates each year to the impact that recent pandemic had.

Here they are!

Sources : I’ve referenced individual sources after each stat. Please go to the bottom of the post for a full list of all the articles and sources I’ve used here.

Travellerspoint

Most asked questions about Europe travel & tourism

How many tourists visit europe each year.

In 2019, Europe recorded 745 million international tourist arrivals.

The pandemic caused international tourism to plummet in Europe, but the number has recovered to 595 million arrivals in 2022.

Roughly 4 in 10 baby boomers state that Europe is their first choice for international travel.

How much of Europe's economy is tourism?

In 2022, travel and tourism contributed $1,939 billion to the overall GDP in Europe.

This is an increase from the $1,450 billion contribution in 2021, but not yet recovered to its pre-pandemic levels.

Which country in Europe has the most tourism?

With 89.4 million international tourist arrivals in 2019 and 79.4 million in 2022, France is the most popular place to visit in Europe .

Both before and after the pandemic, France remains the most visited country in Europe.

What percentage of Europeans travel?

In 2021, 56% of Europeans participated in tourism in 2021, compared with 65% in 2019.

What's the least visited country in Europe?

According to Eurostat, Luxembourg was the least visited country in Europe by EU residents in 2019.

Europe Travel & Tourism Key Statistics

- Europe at large (both EU and non-EU) remains the most visited region in the world, accounting for 50% of the world’s tourist arrivals

- In 2022, travel and tourism contributed $1,939 billion to the overall GDP in Europe

- 61% of all international arrivals to the EU in 61% were for recreational purposes

- In 2020, the tourism industry generated, directly and indirectly, 34.76 million jobs

- In 2017, there were more female (59%) than male employees in the tourism industry

- In 2019, there were 717 thousand travel accommodation establishments in EU countries, which is a 69% increase from 2006

- In 2019, EU residents made 1.1 billion trips that included overnight stays

- Due to the Coronavirus pandemic, international arrivals in Europe plummeted from over 746 million in 2019 to just about 236 million in 2020

Inbound tourism in Europe

How many tourists visit Europe annually?

1. In 2019, Europe recorded 745 million international tourist arrivals.

[Statista]

Europe receives the highest number of international arrivals compared to other regions, including Americas, Asia Pacific, Middle East, and Africa.

2. The pandemic caused international tourism to plummet in Europe, but the number has recovered to 595 million arrivals in 2022.

In comparison, the Americas received 150 million international tourist arrivals in 2022, only 25% of Europe.

3. In July 2023, there were 89.8 million monthly international arrivals in Europe, roughly 7% lower than in July 2019.

This has exceeded the monthly levels of July 2020, 2021, and 2022, but yet to recover to pre-pandemic levels.

4. 6 of the top 10 most visited destinations by international tourist arrivals worldwide are located in Europe.

[Wikipedia]

This includes France, Spain, Italy, Turkey, Germany, and the United Kingdom in that order.

5. There were 36.4 million outbound trips from the US to Europe in 2019.

In 2019, there were 36.4 million trips from the US to Europe .

6. About 33% of these trips from the US were made to destinations in Western Europe.

11.9 million, or 33%, of these trips were to Western Europe. Central or Eastern Europe received the least number of outbound trips from the US at 4.3 million arrivals in 2019.

7. Europe at large (both EU and non-EU) remains the most visited region in the world, accounting for 50% of the world’s tourist arrivals.

Domestic tourism in europe.

How popular is Europe among domestic tourists?

8. In 2019, there were 682 million domestic arrivals in EU countries.

Domestic tourism continues to be more popular as this number steadily grows from only 491 million in 2008 to 682 million in 2019.

9. There were 187 million overnight trips in Europe made by French residents in 2019 alone.

Out of all EU countries, French residents have been the most active in domestic tourism in Europe.

10. Germany is close behind as its residents made roughly 161 million domestic trips in 2019.

Domestic trips include both personal and professional purposes.

11. An April 2023 survey showed that French respondents were the most likely to take a domestic summer holiday trip.

12. As of September 2023, the preferred destination among European travelers for their next European trip is France, with 7% of respondents planning to visit France on their next trip within Europe.

After France, Italy and Spain followed in the ranking.

13. A survey in September 2023 revealed that 68% of respondents intended to likely or very likely take an overnight trip domestically or in Europe in the following six months.

This percentage was a slight decrease from a similar study in March 2023, when 72% reported the same.

14. In 2022, the expenditure of domestic tourists in Europe was 1.13 trillion U.S. dollars just 0.5% lower than that in 2019.

15. in terms of domestic tourism expenditure of the eu-27 countries and the uk, germany had the highest figure in 2019 (320.9 billion u.s. dollars) and 2022 (317 billion u.s. dollars)., europe tourism and the economy.

How much revenue does Europe’s tourism generate?

16. In 2021, travel and tourism contributed $1,450 billion to the overall GDP in Europe.

From 2012 to 2019, the travel industry has steadily contributed an increasing amount of GDP in Europe, peaking at $2,191 billion in 2019.

17. Domestic tourism expenditure reached a record high of $1,222 billion in 2019.

Domestic travellers are important in Europe’s tourism industry as they spent $1,222 billion in 2019 alone, which is the highest number in recent recorded history.

18. In 2019, Spain was the second top tourism earner after the US, recording $79.7 billion in international tourism receipts.

Spain is the second country in the world that makes the most money from tourism. It recorded $79.7 billion in international tourism receipts in 2019.

19. France follows closely behind making $63.8 in international tourism receipts.

Why people travel to europe.

What motivates people to visit Europe?

20. 61% of all international arrivals to the EU in are for recreational purposes.

Holiday, recreation, and other leisure-related purposes are the most common reason for visiting Europe.

21. In the meantime, 15% visited EU countries for business reasons and 24% came to visit friends and relatives or other purposes.

Business travel makes up 15% of all visits to the EU .

22 Most international visitors arrive in Europe by air travel (57%), compared to 40% for land transport and only 4% by water.

Over half of all global visitors to Europe come through flights, while 2 out of 5 visitors arrive by land transport. Only 4% travel by water to Europe.

23. 62% of all residents in the EU went on a minimum of one personal trip in 2017.

In terms of domestic tourism in Europe, 3 out of every 5 EU residents took at least one personal trip back in 2017.

24. 11% of domestic trips to Europe in 2015 were for professional purposes, including business trips.

11% of all domestic trips in Europe in 2015 were made for professional reasons, such as business trips.

25. The European hotel market generated a revenue of 98.09 billion U.S. dollars in 2022, a significant improvement from 2020 and 2021.

26. the european region with the highest revenue in the hotel market in 2022 was central & western europe was, generating more than 61 billion u.s. dollars. .

The region with the second-highest revenue in the hotel market in 2022 was Southern Europe.

Tourism employment in Europe

How large is Europe’s tourism workforce?

27. In 2020, the tourism industry generated, directly and indirectly, 34.76 million jobs.

In 2022, there’s still a 8.5% decrease in tourism jobs in Europe compared to 2019 due to the Covid-19 pandemic .

28. Travel and tourism provided 37.98 million jobs in Europe in 2019.

29. in 2017, there were more female (59%) than male employees in the tourism industry..

The tourism industry has long been a major employer for women , especially considering that only 36% of employees in non-financial business economies in Europe were female.

30. The tourism labour force also tends to attract younger workers aged 15 to 24 (13%) and part-time positions (24%).

These statistics are much higher than those in the non-financial business economies and services sectors as a whole.

Popular tourist destinations in Europe

What are the most popular tourist destinations in Europe?

31. With 89.4 million international tourist arrivals in 2019 and 79.4 million in 2022, France is the most popular place to visit in Europe.

France, Spain (83.5 million), and Italy (64.5 million) recorded the most international tourist arrivals in 2019. The ranking changed slightly in 2020, with Italy receiving more international tourists than Spain.

Moreover, European travellers comprise 39.3% of the total tourist arrivals in Venice .

32. The capital city, Paris, welcomed more than 16.8 million international visitors in 2018, making it the second most visited European city after London.

Paris received over 16.8 million international visitors in 2018 and was the second most visited city in Europe.

It is second only to London, which receives the highest number of tourists that year .

33. In terms of bed nights, Spain is the most popular among international tourists, with 299 million nights spent in tourist accommodations in 2019 alone.

This number accounts to 22% of the total nights spent in tourist accommodations in Europe.

34. After Spain, Italy is the second most popular tourist destination for overnight stays in Europe. There were 221 million nights spent here in 2019.

When it comes to cities in Europe with the most overnight stays in 2019, Italy sits on the second place.

35. This is followed by France (136 million nights) and Greece (120 million nights).

36. all together, spain, italy, france, and greece dominate 57% of the total nights spent by international tourists in european tourist accommodations..

Spain, Italy, France, and Greece are the four most popular tourist destinations in Europe in terms of night spent in a tourist accommodation.

In fact, travellers from Europe make up the majority of overseas tourist arrivals in Rome (2.78 million) .

37. Meanwhile, the least popular EU destinations for tourists in 2019 were Luxembourg, Latvia, Lithuania and Estonia.

38. in terms of region, international arrivals in southern/mediterranean europe has surpassed pre-pandemic levels in july 2023, while central/eastern europe experienced a 30% drop., accommodation in europe’s travel industry.

Where do tourists usually stay when visiting Europe?

39. In 2022, there were 621 thousand travel accommodation establishments in EU countries, a slight increase from the 617 thousand recorded in 2019.

The 621 thousand travel accommodations include RV campgrounds , hotels, short-stay accommodation, and trailer parks.

40. As of 2019, a majority of these (more than 479 thousand) were holiday and other short-stay accommodations, while 209 thousand were hotels and similar accommodation types.

The most common type of tourist accommodation in Europe is holiday/ short-stay vacation rentals .

41. In 2019, it was estimated that residents and international visitors spent a total of 2.87 billion nights in EU travel accommodation.

In 2019 alone, tourists in EU countries spent a total of 3.42 billion nights in accommodation establishments.

For budget travel, Kyiv is the cheapest city destination for backpacking, with daily costs amounting to an average of $37.69 .

42. In 2022, the number still has yet to reach its pre-pandemic figure, at just 2.74 billion nights spent in EU travel accommodations.

43. In 2019, Italy recorded just shy of 1.1 million bedrooms in hotels and similar accommodation. This is the highest in any country in Europe.

At 1.1 million individual hotel and similar rooms , Italy is the country in Europe with the highest number of bedrooms.

44. Germany and Spain are close behind with 993 and 934 million bedrooms respectively.

45. in terms of occupancy rate of bed places in hotels and other similar accommodation in eu countries, cyprus leads the chart with 71.8% of net occupancy rate..

Hotels and similar accommodation types in Cyprus recorded an astounding 71.8% net occupancy rate, the highest in any one country in EU countries.

46. Interestingly, despite having the second most hotel bedrooms in Europe, Germany had a pretty low occupancy rate of 45.7% in 2019.

47. in 2021, europe became the region with the highest glamping market worldwide, with 35.11% of market share..

[Grand Review Research]

Glamping is an up-and-coming industry and Europe seems to be the leading world region in terms of market share (35.11%) .

48. In 2022, most hotel market sales in Europe were made online (77%), which represents a steady growth since 2017 and is expected to continue until 2027.

Online booking has an increasingly large role in hotel market sales in Europe, with 77% of sales in 2022 made online .

49. There are 1.4 million Airbnb Hosts in the EU, the highest number in any region in the world.

Out of the 1.4 million Airbnb Hosts in the EU , more than 1.1 million have just one listing.

50. The average EU Host on Airbnb earned just below €4,000 in 2022, which is equivalent to over two months additional pay for the median EU household.

Outbound tourism by europeans.

How many European tourists go on a trip each year?

51. Almost two out of every three Europeans went on a tourism trip in 2019, but the percentage decreased to 56% in 2021.

52. in 2021 compared with 2019, 14 % or 35 million fewer europeans made tourism trips., 53. around 70% of these trips were made within their own country..

In 2021, nearly 7 out of 10 European tourists made only domestic trips.

54. In terms of night spent, Spain and Italy were the most popular destinations for European tourists.

The most popular destinations for tourists from Europe are Spain and Italy, where they spent the highest number of nights in 2019.

55. For non-EU destinations, the United Kingdom, Turkey and the USA had been the top choices.

56. eu residents spent an average of €421 per trip in 2019..

The average EU resident would spend €421 per trip.

57. In 2019, EU residents made 1.1 billion trips that included overnight stays.

EU residents went on a total of 1.1 billion trips which included overnight stays to both domestic and international locations in 2019 alone.

58. The contribution of travel and tourism to Europe’s GDP fell significantly in 2020, from $2,191 billion, to roughly 50% of the number in 2019.

The average European solo traveler spends €285 for their flight and hotel .

59. The EU country that travels the most is Switzerland, with 82.2% of the population travelling in 2021.

Sweden is on fifth place, with 78% of its population participating in tourism in 2021.

Meanwhile, Ireland takes 8th place with 72.3% of the population travelling in 2021 .

60. On the other end of the spectrum, the country that participated the least in tourism in 2021 is Bulgaria (22.7% of population).

61. residents aged 65 or over represented 25% of the eu population aged 15 years or older, they accounted for only 17% of eu tourists..

Still, this 17% equals to a significant number of 36 million tourists.

Covid-19 and Europe’s tourism

How has the pandemic affected travel & tourism in Europe?

62. The contribution of travel and tourism to Europe’s GDP fell significantly in 2020, from $2,191 billion, to roughly 50% of the number in 2019.

Due to the recent pandemic, the total contribution from the travel and tourism industry to GDP in Europe decreased dramatically in 2020 from 2019.

63. Domestic tourism also fell from $1,167 billion in 2019 to $668 billion in 2020.

Domestic tourism expenditure in Europe decreased by roughly 43 percent in 2020 over the previous year, due to the impact of the coronavirus (COVID-19) pandemic.

64. International arrivals in Europe plummeted from over 746 million in 2019 to just about 236 million in 2020.

65. the number of international tourist arrivals dropped by 97% in april 2020 compared to april 2019. .

Travel to and from countries was restricted as the virus spread, resulting in a sharp drop in arrivals across the region.

66. In May 2021, international tourist arrivals have more than quadrupled since the same month in 2020.

However, this figure of 12.1 million arrivals is still much below the 64.2 million from May 2019.

Travel companies in Europe statistics

67. the 'package holidays' segment of the travel and tourism market in europe is expected to achieve a +1.66% growth in number of users between 2023 and 2027, reaching a record-high of 134.52 million users., 68. as of june 2023, oriental land co. ltd is the travel and leisure company with the largest market cap in europe, valued at 54.83 billion u.s. dollars..

Flutter Entertainment PLC and Evolution AB followed, each with a market capitalisation of roughly 27.76 billion U.S. dollars.

69. In Europe, Lufthansa became the airline which carried the highest number of travelers in 2022, with 101.8 million passengers in total.

Turkish Airlines was in second place, with a total of 71.8 million passengers in 2022.

As home to some of the world’s most popular tourist destinations, it will not be a surprise if tourism in this region only grows from now on.

While the recent Coronavirus pandemic has caused some major setbacks in terms of GDP and tourist arrivals in these countries, it does seem that things are looking brighter.

Once the world has recovered even more from this trying time, we believe that people looking for a getaway will look to visit various European destinations. As such, the number of domestic and international visitors will surely rise again soon.

We hope this post is thorough enough for you to learn more about tourism in Europe.

Can you think of other questions or aspects of Europe’s travel and tourism that we haven’t covered? Feel free to comment below!

Don't miss out these other statistic guides!

- Norway Travel & Tourism Statistics

- Canada Travel & Tourism Statistics

- Peru Travel & Tourism Statistics

- Grand Review Research

Leave a comment

Let us know what you think.

5 million people can't be wrong

IMAGES

COMMENTS

Eurostat also publishes a separate series on short-stay accommodation offered via online collaborative economy platforms; data on tourism trips made by EU residents, including information on destination, duration, accommodation, transport, expenditure, etc. and data on participation in tourism. Additionally, other business or social statistics ...

In 2021, almost one in ten enterprises in the EU non-financial business economy belonged to the tourism industries (see Table 1, Table 2). These 2.4 million enterprises employed 11.3 million persons, accounting for 8.6 % of the persons employed in the non-financial business economy and 20.5 % of persons employed in the services sector.

Tourism trips: Residents of Luxembourg, Belgium, Malta, Slovenia and the Netherlands made more foreign than domestic trips. 75 % of all trips made by EU residents were inside their own country. EU residents (aged 15 and above) made nearly 1.1 billion tourism trips in 2022, for personal or business purposes. The number of trips increased by 51 % ...

The EU tourism dashboard is an online knowledge tool aimed at monitoring the green and digital transitions of the tourism ecosystem to make tourism more resilient and sustainable. The dashboard visualises tourism-relevant data and indicators collected from available, trusted sources covering the tourism ecosystem. It offers snapshot views of ...

In 2019 (the year before the COVID-19 pandemic, which strongly hit the tourism sector), guests spent more than 554 million nights in an accommodation booked via Airbnb, Booking, Expedia Group or Tripadvisor in the EU. This means that, on an average day, around 1.5 million guests slept in a bed booked through one of these four platforms.

Following recovery from the subprime crisis, tourism in the EU grew sustainability between 2009 and 2019 before it became one of the most affected sectors hit by COVID in 2020.

Figure 2: European overview of percentage of population employed in tourism-related sectors, source: Eurostat Tourism decrease caused by COVID-19. Travel bans make tourism one of the industries that is hit the hardest by the COVID-19 crisis. In Europe, several countries already show that the number of nights spent in tourist accommodation was halved in March 2020 compared to previous years.

The official list of high-value datasets adopted on 12 December 2022 can be found in the legal documents that define these datasets and their characteristics. Using high-value datasets to analyse tourism. Representing nearly 10 % of the EU's GDP and accounting for 23 million jobs in 2019, tourism is an essential part of the EU's economy.

The growth rate of inbound tourism in the region accelerated in the 2010s, with Europe reporting a peak of more than 740 million inbound visitors in 2019. While this figure declined sharply with ...

The 27-nation bloc recorded 2.72 billion nights spent in tourist accommodation last year, down by only 5.6% from 2019 levels, before COVID-19 inflicted heavy losses on the tourism industry due to ...

Source: Eurostat (tour_occ_ninat) With almost 2.8 billion nights spent in 2022 (see Table 1), EU tourism reached 96 % of pre-pandemic 2019 levels. Spain, France, Italy and Germany each recorded more than 400 million nights spent in 2022. Jointly, these four countries accounted for more than six out of ten nights spent in the EU in 2022.

Tourism is an important sector for the world economy, and is expected to continue recovering gradually in 2022. ... "This shows signs of recovery in the tourism sector," Eurostat says. However, when 2021 tourist night numbers are compared with 2019, it shows some countries lost more than half their bookings. Latvia, Slovakia, Malta and ...

Source: Eurostat/Tourism Economics ... "Ensuring a sustainable path for tourism is crucial for the prosperity of the industry. All tourism stakeholders should actively shape this future, including destinations, businesses, residents and travellers. Understanding travel patterns and traveller behaviour is one of many important steps, which

Eurostat, Tourism (Occupancy of tourist accommodation establishments: arrivals and nights spent by residents and non-residents. Capacity of tourist accommodation establishments: number of ...

In 2023, European Union tourism continued to show signs of rebounding from the Covid-19 pandemic, EU statistics agency Eurostat said on January 16. The estimated number of nights spent at tourist accommodation establishments in 2023 reached 2.92 billion, exceeding the pre-pandemic level for 2019 (2.87 billion) by 1.6 per cent and setting a ...

Tourism is a major economic activity in the European Union with wide-ranging impact on economic growth, employment, and social development. It can be a powerful tool in fighting economic decline and unemployment. Nevertheless, the tourism sector faces a series of challenges.

3 April 2024. EU tourism nights mark 6.1% yearly increase in 2023. 8 March 2024. Seniors travel closer to home and outside peak season. 19 February 2024. Tourism industry eclipses pre-pandemic levels in 2023. 16 January 2024. 1. 2.

15:25 - 16 January 2024. Economy Reporter. Tourism in Cyprus increased by more than 20% in 2023 compared to 2022, the second largest growth in the EU, as tourism rebounds across Europe after the COVID-19 pandemic, according to early estimates published by Eurostat based on the data that is so far available for 2023.

The overall tourism sector was hit hard by the pandemic in 2020, even if coastal tourism was the least affected typology. Controlling for restrictions, the loss in guest nights in 2020 compared to 2019 was relatively higher in urban and rural destinations, ... 3 Eurostat (2022). Tourism statistics - seasonality at regional level. ...

This article presents statistics on employment in the tourism industries in the European Union (EU). Tourism statistics focus on either the accommodation sector (data collected from hotels, campsites, etc.) or on tourism demand (data collected from households), and relate mainly to physical flows (arrivals or nights spent in tourist accommodation or trips made by a country's residents).

Greece and Portugal followed in the ranking in 2022, with travel and tourism representing 18.5 percent and 15.8 percent of GDP, respectively. Read more. Share of travel and tourism's total ...

In 2021, tourism was among the sectors that started to recover from the COVID-19 pandemic, following the easing of certain restrictions related to it, such as travel restrictions as well as other precautionary measures taken in response. In 2021, the number of nights spent at EU tourist accommodation establishments totalled 1.8 billion, up by 27% compared with 2020, but down by 37% compared ...

28. Travel and tourism provided 37.98 million jobs in Europe in 2019. [Statista] 29. In 2017, there were more female (59%) than male employees in the tourism industry. [Eurostat] The tourism industry has long been a major employer for women, especially considering that only 36% of employees in non-financial business economies in Europe were ...