An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

TSA PreCheck®

Enjoy the same great tsa precheck benefits you know and love, now with new enrollment options..

Enjoy a smoother security screening process with no need to remove shoes, laptops, 3-1-1 liquids, belts or light jackets.

*TSA uses unpredictable security measures, both seen and unseen, throughout the airport. All travelers will be screened, and no individual is guaranteed expedited screening.

TSA PreCheck Benefits

Wait 10 Minutes or Less

About 99% of TSA PreCheck® passengers wait less than 10 minutes.

Families Welcome

Children 17 and under can join an adult with TSA PreCheck® when TSA PreCheck appears on the child’s boarding pass. Learn more .

Nationwide Access

More than 200 airports and 90+ airlines provide TSA PreCheck®

How it works

To enroll in TSA PreCheck just follow these three steps or walk into any enrollment location. Be sure the enrollment provider selected has enrollment locations near you. To renew simply click here and complete your renewal online in as little as 5 minutes.

1. Apply Online

Select an enrollment provider with enrollment locations near you. Submit your TSA PreCheck application online in as little as 5 minutes.

2. Visit an Enrollment Location

Complete enrollment in 10 minutes at your chosen provider which includes fingerprinting, document and photo capture, and payment.

3. Get Your TSA PreCheck Number

Once approved, get your Known Traveler Number (KTN), add it to your airline reservations and start saving time in screening.

New TSA PreCheck Enrollment Options

TSA has selected the following partners to help enroll travelers in TSA PreCheck. Applicants can pick any enrollment provider based on cost, locations , and additional benefits. Get started below.

Costs for enrollment vary by provider which results in pricing variation.

tsaprecheckbytelos.tsa.dhs.gov

Enroll in TSA PreCheck® with Telos and look for upcoming travel deals.

38 Active Locations

Renew through Telos for a convenient renewal experience

- Renew online for $70

- Renew in-person for $70

tsaprecheckbyclear.tsa.dhs.gov

Enroll in minutes when it's convenient for you - no appointment necessary.

13 Active Locations

Renew through CLEAR and you may qualify for discounts on other CLEAR travel products.

- Renew online for $68.95

- Renew in-person for $77.95

tsaenrollmentbyidemia.tsa.dhs.gov

Convenient access to 620+ enrollment centers and local enrollment events daily.

620+ Active Locations

IDEMIA provides fast and easy online renewal

- Renew in-person for $78

Additional TSA Resources

Tsa precheck customer service.

Learn who to contact based on your question or concern, plus ways to contact us.

Find your TSA PreCheck Number

Need your Known Traveler Number (KTN) to complete a renewal or update an existing airline reservation? TSA PreCheck members only, excludes Global Entry.

Search Here

TSA PreCheck Enrollment Locations

Find open enrollment locations for CLEAR, IDEMIA or Telos. Check back for updates.

Get TSA PreCheck for free!

- Twitter / X

- Readers' Choice

- Food & Drink

- Arts & Culture

- Travel Guides

USA TODAY 10Best

Where to buy E-ZPass and how to use it

December 24, 2022 // By Sharon Nolan

By Sharon Nolan Travel Expert December 24, 2022

Approaching toll booths and paying the ticketed amount can mean added travel time, inconvenience and the necessity of traveling with small amounts of cash at all times. The introduction of E-ZPass across many states offers anyone traveling the roads a better way to pay and keep their travel time to a minimum with less interruptions for toll payment.

Understanding and implementing the process is quick and easy, and it may be just the thing to simplify your road trips, whether they be short or long, frequent or not that often. Is E-ZPass the option that works best for you? Here’s what you need to know to see if this electronic option will make your trips easier.

Understanding E-ZPass

E-ZPass is a method of paying road, bridge and tunnel tolls faster, easier and more efficiently. This multi-state electronic toll pass system eliminates the need to stop to pay fees while traveling toll roads. Instead of toll booths, the system works via overhead readers that pick up account information and charge your fee via a transponder mounted on your windshield.

Advertisement Advertisement

It offers an easy, speedy, touchless way to handle tolls, and eliminates the need to get and keep track of a ticket, the time to stop to pay the amount due, as well as the hassle of finding the correct amount of money due. The system translates the steps to an electronic transaction and streamlines the entire travel toll process.

As an additional bonus, the transponders also work to provide traffic data. Readers provide information on the speed and flow of traffic so that traffic reports can be accurate. They do not work to track individual speeders but help to inform traffic reporters of congestion on roads, travel time, slowdowns and the like.

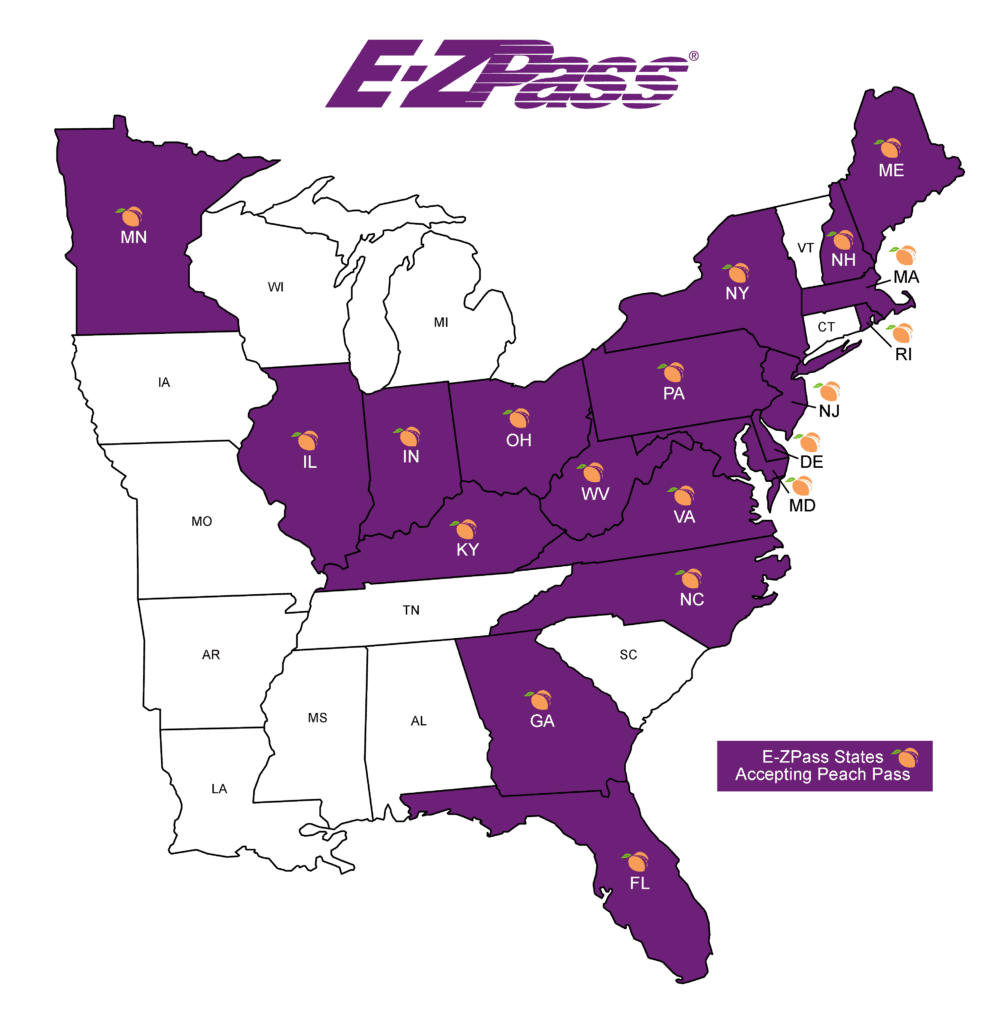

The concept of E-ZPass was introduced in 1987, and its goal was to unite several states’ toll collection systems into one. The current setup now includes 19 states and is the largest, most successful interoperable toll collection program anywhere in the world.

Where E-ZPass can be used

E-ZPass works in states from Florida up to Maine and west to Illinois. It’s good on toll roads, bridges and tunnels. More than 49 million E-ZPass devices are currently in circulation. Once you’ve received a transponder, simply adhere it to the windshield of your vehicle and, when passing through an E-ZPass-labeled toll center, observe as the reader detects and processes your toll due and sends you on your way.

Signs in states and gateways that participate will indicate appropriate lanes to be in to use the system, and then simply following the directions once you’re there will allow you to pass through quickly and easily. The toll amount will be deducted from your E-ZPass account (usually secured with a credit card or paid on a toll-by-toll basis). Should you want to see your charges at any times, you may log into your account and view them, update your payment information or a variety of other options.

How to get E-ZPass

Each participating state operates its own E-ZPass service center. You’ll want to decide if a personal or commercial account is best for your situation. E-ZPasses may be obtained by visiting the correct state’s E-ZPass website and applying via their online form. You may also print out the forms and apply by mail or fax. You may include up to four tags under each account.

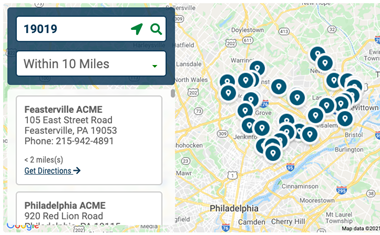

Users receive their transponders typically within a few days to a week and can begin travel at that point. Additionally, E-ZPass Go Paks can be purchased locally for a small convenience fee, so you’re up and running faster. Merchants like Walmart, AAA and area supermarkets often carry them, making the process one that’s easily added to your daily to-do list and gets you out on the road in no time.

About Sharon Nolan

Sharon is a native to the Philadelphia area, but loves to wander from its familiar borders. She has traveled to more than 30 countries, trekked five continents, ventured out with family, friends and on solo trips and tackled numerous adventures that were both in and well out of her comfort zone. When she's not traveling, you may find her out on her bicycle on the local roads and trails dreaming up her next adventure. Her other works can be found at AAA The Extra Mile, Trekaroo.com, FWT Magazine, NJ Family and a variety of other online publications.

Read more about Sharon Nolan here.

Connect with Sharon via: Facebook | Instagram | Twitter | Pinterest

- Bestellhotline

Beratung & Bestellung

Du hast noch Fragen?

Dann stell sie uns einfach. Wir helfen Dir gerne.

Vodafone EasyTravel

Mit EasyTravel nimmst Du Deinen Handy-Tarif mit auf Reisen – z.B. in die Türkei, die USA, die Schweiz oder nach Kanada.

Schweiz, Türkei, USA, Kanada, Monaco, Andorra, Färöer-Inseln, Isle of Man, Jersey, Guernsey. Um ein EasyTravel-Paket buchen zu können, brauchst Du einen Handy-Tarif von uns.

Alle EasyTravel-Pakete im Überblick

EasyTravel Tag

Dein Tagespaket: Zahl nur, wenn Du Deinen Tarif nutzt

Nutz Deinen Handy-Tarif auf Reisen wie zuhause. Und das nur an den Tagen, an denen Du es willst. EasyTravel Tag wird automatisch aktiviert, wenn Du mit Deinem Handy in den EasyTravel-Ländern telefonierst, simst oder surfst. Mit der MeinVodafone-App behältst Du Deinen Verbrauch immer im Blick. Du zahlst nur an Tagen, an denen Du Deinen Tarif im Ausland nutzt. Dabei gilt die deutsche Ortszeit. EasyTravel Tag läuft zum Ende eines Tages oder bei Deiner Einreise nach Deutschland aus. Du musst die Option nicht selbst stornieren oder deaktivieren.

7,99 € pro Tag

EasyTravel Woche

7 Tage online mit der EasyTravel Woche

Mit der EasyTravel Woche musst Du Dich eine Woche lang um nichts kümmern. Buch Dein Wochenpaket schon einen Tag vor Deiner Abreise. Und nutz Deinen Handy-Tarif sofort bei der Ankunft am Reiseziel wie zuhause. Schick einfach eine kostenlose SMS mit Easy7 an die 70127 .

21,99 € pro Woche

EasyTravel Flat Flex

Hol Dir die Flex-Option für 6 Monate

Du planst eine längere Reise? Hol Dir die EasyTravel Flat Flex für 6 Monate. 1 Du kannst die Option mit einer Frist von einem Monat zum Ende der Vertragslaufzeit kündigen. Kündigst Du nicht rechtzeitig, verlängern wir die Option auf unbestimmte Zeit. Du kannst dann mit einer Frist von einem Monat kündigen.

9,99 € pro Monat

In allen EasyTravel-Paketen inklusive

500 Minuten pro Tag nach Deutschland oder innerhalb des Reiselands telefonieren

500 SMS pro Tag nach Deutschland oder innerhalb des Reiselands verschicken

Datenvolumen zum Surfen wie im Inland nutzen – je nach Tarif

Buch EasyTravel Woche oder EasyTravel Flat Flex in MeinVodafone oder der MeinVodafone-App

So buchst Du Dein EasyTravel-Paket

Logg Dich bei MeinVodafone oder in der MeinVodafone-App ein. Unter Mein Vertrag findest Du Optionen . Klick drauf und wähl dann den Reiter Ausland . Hier findest Du die EasyTravel Flat Flex und die EasyTravel Woche . Such Dir eine aus. Und bestätige mit Akzeptieren & zahlungspflichtig kaufen .

Dann ist das ReisePaket Plus die richtige Option für Reisen in die USA, die Türkei, Schweiz oder nach Kanada. Für 5,99 € pro Tag sicherst Du Dir 50 Minuten zum Telefonieren, 50 SMS und 100 MB Datenvolumen . Für das ReisePaket Plus gilt die deutsche Ortszeit. Hast Du Deine Freiminuten, SMS oder Dein Datenvolumen verbraucht, zahlst Du 20 Cent pro Minute, SMS oder MB. Wir informieren Dich per SMS über Deinen Verbrauch. Buch das ReisePaket Plus in der MeinVodafone-App . Oder schick eine kostenlose SMS mit dem Stichwort Plus an die 70127 .

Mit unseren ReisePaketen bleibst Du auf Fernreisen günstig vernetzt.

Rechtliche Hinweise zu EasyTravel

- InfoDok 4607: EasyTravel Tag und Woche

- InfoDok 4608: EasyTravel Flat Flex

- Widerrufsbelehrung

1 Hinweise zur EasyTravel Flat Flex : Du kannst die EasyTravel Flat Flex zu diesen Tarifen buchen:

- alle GigaMobil-Tarife

- alle GigaMobil Young-Tarife

- alle Red-Tarife

- alle FamilyCard-Tarife

- alle Young-Tarife

- alle Smart 2022 Tarife, bis Smart 2017 in den Tarifstufen Smart L, L+, XL

- alle Vodafone Easy-Tarife

Nach den Richtlinien der fairen Nutzung hast Du in den Ländern Schweiz, Türkei, USA und Kanada folgendes Datenvolumen pro Monat:

- 87 GB im Tarif Red XL

- 87 GB im Tarif GigaMobil XL

- 76 GB in den Tarifen Young XL (Young 2020) und Young XXL (Young 2017)

- 76 GB im Tarif GigaMobil Young XL

Nach Verbrauch dieses Datenvolumens zahlst Du 0,18 Cent pro MB. Nach Beendigung der EasyTravel Flat Flex gelten automatisch die Konditionen von EasyTravel Tag. So bleibt Dein Tarif weiterhin zur Nutzung in den EasyTravel-Ländern aktiviert. In den Ländern Schweiz, Türkei, USA und Kanada zahlst Du 7,99 Euro pro Kalendertag, an dem Du telefonierst, simst oder Dein Datenvolumen nutzt. Dabei gilt die deutsche Ortszeit. Mehr Infos über EasyTravel Tag findest Du im InfoDok 4607. Abweichend von der Nutzung im Inland gilt in den Ländern Schweiz, Türkei, USA und Kanada eine Begrenzung bei Telefonie und SMS im Ausland: Bei Verbrauch von über 500 Minuten oder 500 SMS pro Tag zahlst Du nach den Richtlinien der fairen Nutzung zusätzlich 20 Cent pro Minute oder pro SMS. Nach Verbrauch Deiner Highspeed-MB gilt SpeedGo aus Deinem jeweiligen Tarif.

- How To Install Your E-ZPass

- E-ZPass Read Zones

- E-ZPass Retail Locations

- Fare Calculator

E-ZPass FAQ

- Forms & Policies

- Pay Unpaid Toll

If there's a question we haven't answered, just contact our Customer Service Center (CSC) at (440) 971-2222 to get the information you need

Q: What is E-ZPass ® and how does it work?

Q: What are the benefits of having an E-ZPass ® transponder?

Q: Is Ohio's E-ZPass ® program compatible with other states offering E-ZPass ® ?

Q: Will I receive the discounted Ohio E-ZPass ® toll rate when using an out-of-state transponder?

Q: Are there administrative fees charged for using an out-of-state transponder on the Ohio Turnpike?

Q: Where can I obtain a transponder?

Q: What is the cost to obtain an E-ZPass ® transponder?

Q: How long will it take to receive and activate my Ohio Turnpike E-ZPass ® transponder?

Q: Where should the E-ZPass ® transponder be installed in my vehicle?

Q: Can I hold the transponder up, instead of mounting it to my windshield?

Q: Can vehicles share an E-ZPass ® transponder?

Q: Can I use my E-ZPass in a rental vehicle?

Q: Can I use my E-ZPass while pulling a trailer or camper?

Q: Are there dedicated E-ZPass ® lanes?

Q: How often will I receive statements showing my E-ZPass ® usage?

Q: How do I update my billing information?

Q: I haven't traveled recently, why has my credit card been charged?

Q: What if my transponder is not working?

Q: What is the lifespan of my transponder?

Q: What if I have a mischarge on my account?

Q: How can I close my Ohio Turnpike E-ZPass ® account?

Q: Where can I return the transponder?

Q: What are the electronic tolling rules?

Q: How do I sign up or open a new E-ZPass ® account?

Q: I left my transponder at home and went through an E-ZPass lane. Now what?

Q: How do I pay my Unpaid Toll Invoice?

Q: I received an Unpaid Toll Ticket in the lanes with a toll collector. How do I pay?

Q: I'd like to dispute my toll. How can I request a hearing?

Q: Why am I paying a higher toll rate on my E-ZPass with a license plate transaction?

Q: What is E-ZPass ® and how does it work? A: E-ZPass ® is an electronic toll collection system that allows you to enter and exit the Turnpike without stopping to get a ticket or having to stop to pay the toll. The E-ZPass ® system uses a transponder to electronically record your fares. As you enter or exit the Turnpike, an overhead antenna reads the information stored in the transponder. Fares are automatically deducted from your account and the toll booth gate rises automatically.

Q: What are the benefits of having an E-ZPass ® transponder? A: Travelers can save 33% on average with E-ZPass ® on their Ohio Turnpike tolls. If you travel on the Ohio Turnpike or on other toll roads that accept E-ZPass ® , your savings can add up fast. Using E-ZPass ® also reduces travel time and helps reduce fuel consumption by eliminating the need to fully stop when entering or exiting the Turnpike. And, because E-ZPass ® records each toll transaction, it's a fast way to keep track of your travel expenses for business or tax purposes.

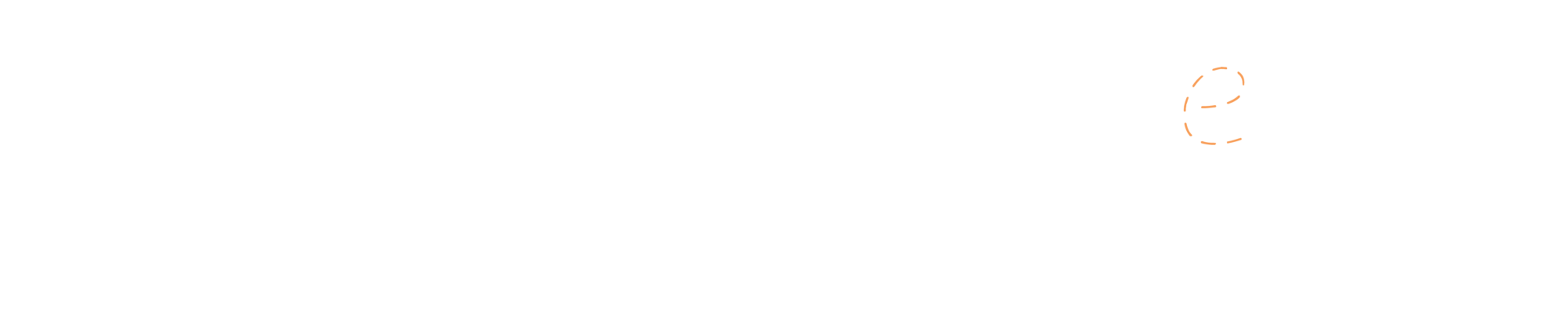

Q: Is Ohio's E-ZPass ® program compatible with other states offering E-ZPass ® ? A: Yes, customers with an account from any of the agencies listed below can use their transponder on the Ohio Turnpike. Likewise, the Ohio Turnpike E-ZPass ® transponder will work on any of the systems listed below:

Buffalo and Fort Erie Public Bridge Authority Burlington County Bridge Commission Chicago Skyway Delaware Department of Transportation Delaware River and Bay Authority Delaware River Joint Toll Bridge Commission Delaware River Port Authority Illinois State Toll Highway Authority Indiana Toll Road Maine Turnpike Authority Maryland Transportation Authority MTA Bridges and Tunnels Massachusetts Department of Transportation New Hampshire DOT Bureau of Turnpikes New Jersey Turnpike Authority New York State Bridge Authority New York State Thruway Authority North Carolina Turnpike Authority Pennsylvania Turnpike Commission Port Authority of New York/New Jersey Rhode Island Turnpike and Bridge Authority South Jersey Transportation Authority Virginia Department of Transportation West Virginia Parkways Authority Niagara Falls Bridge Commission Kentucky Public Transportation Infrastructure Authority Thousand Islands Bridge Authority Central Florida Expressway Authority Florida Turnpike (Sun Pass)

Q: Will I receive the discounted Ohio E-ZPass ® toll rate when using an out-of-state transponder? A: Customers using a transponder from any of the agencies listed above will receive the discounted toll rate when traveling on the Ohio Turnpike.

Q: Are there administrative fees charged for using an out-of-state transponder on the Ohio Turnpike? A: If a customer has already established an E-ZPass ® account with another toll agency, there is no "administrative", or "service" fee paid to the Ohio Turnpike.

Q: Where can I obtain a transponder? A: You can open a new E-ZPass ® account and obtain a transponder several ways: 1.) ONLINE: Just click HERE . 2.) CALL: (440) 971-2222 3.) IN-PERSON: At any Ohio Turnpike Service Plaza or retail location found HERE .

Q: What is the cost to obtain an E-ZPass ® transponder? A: Transponder pricing varies by toll agency. For Prepaid Accounts, an initial minimum deposit of $25.00 per transponder is required to establish your account, and a credit card is required to maintain the account. Toll fares will be deducted from your account when the transponder is read at an interchange. When the balance on the E-ZPass ® account reaches or falls below $10.00 per transponder, the customer's credit card on file will be charged to replenish the E-ZPass ® balance for future use. A one-time $3.00 charge is deducted when the customer's transponder is activated. *International shipping rates will apply.

For Commercial Accounts, an initial minimum deposit of $50.00 per transponder is required to establish your account, and a credit card is required to maintain the account. Toll fares will be deducted from your account when the transponder is read at an interchange. When the balance on the E-ZPass ® account reaches or falls below $20.00 per transponder, the customer's credit card on file will be charged to replenish the E-ZPass ® balance for future use. A one-time $3.00 charge is deducted when the customer's transponder is shipped. *International shipping rates will apply. Transponder pricing varies by toll agency. While some charge an upfront fee, the Ohio Turnpike leases transponders to Ohio E-ZPass ® customers for $0.75 per month. NOTE: The $0.75 per month maintenance fee will be waived for all Ohio Turnpike E-ZPass transponders that are used for 30 single or 15 round trips in Ohio in the previous month.

Q: How long will it take to receive and activate my Ohio Turnpike E-ZPass ® transponder? A: Once you have ordered your transponder online, via phone, or US Mail, allow 7-10 days to receive your transponder. It will already be active when you receive it. If you obtained a transponder at an Ohio Turnpike Retail Location, it will need to be activated by calling (440) 971-2222 or by clicking the E-ZPass ® button on the website. Your transponder will be active and ready to use the following day for travel on the Ohio Turnpike. Note: Please allow 24-48 hours for activation and use of the transponder in other states.

Q: Where should the E-ZPass ® transponder be installed in my vehicle? A: The transponder should be installed near the rear-view mirror on the inside of the front windshield, below any tinting. Velcro mounting strips are included with your transponder.

*Certain vehicles require special mounting. Some newer vehicles may have devices that can interfere with the signal of the E-ZPass ® . Make sure the E-ZPass ® is not mounted near these devices (remote start, GPS, satellite radio, rain sensors or anything else that is metal or mechanical). The best location is typically in a lower corner close to the dashboard and still on the windshield.

Q: Can I hold the transponder up, instead of mounting it to my windshield? A: No. The E-ZPass ® antenna is located overhead, well in advance of the toll booth. If you do not have the transponder properly mounted as you pass the "read zone" then it may not work properly. Transponders must be in place prior to approaching the toll lanes.

Q: Can vehicles share an E-ZPass ® transponder? A: Transponders are not linked to one vehicle and can be moved. We ask that you add all vehicles to your account while in use to avoid any violations, and the device must be in the vehicle at the time of use. This can be updated online at www.ezpassoh.com or by calling (440) 971-2222.

Q: Can I use my E-ZPass ® in a rental vehicle? A: Transponders can be used in rental vehicles. All vehicles should be added to your account while in use to avoid any violations, be sure to remove rental vehicles when you turn them back in. Be advised you are responsible for tolls until the rental is removed from your account. This can be added and removed online at www.ezpassoh.com or by calling (440) 971-2222.

Q: Can I use my E-ZPass ® while pulling a trailer or camper? A: You can use your transponder while pulling a trailer or camper. When you enter the lanes in Ohio, it will count the number of axles associated with the E-ZPass ® transponder and charge you accordingly. We ask that you register all vehicles, including trailers and campers, to your account to avoid violations. This can be done online at www.ezpassoh.com or by calling (440) 971-2222.

Q: Are there dedicated E-ZPass ® lanes? A: The majority of toll plazas have dedicated lanes available exclusively for E-ZPass ® customers. Smaller toll plazas with fewer lanes and lower traffic volume may not have dedicated E-ZPass ® lanes, but all open lanes are E-ZPass ® compatible.

Q: How often will I receive statements showing my E-ZPass ® usage? A: Customers are able to access their E-ZPass ® account information online 24/7. Transactions are generally recorded within 1-3 days of a trip. Statements are generated every month on the account anniversary date. However, transactions can be viewed and exported to PDF or CSV for any time period within the My Transactions module in the online account. Note: If a customer requests to receive a paper statement via U.S. mail, a processing fee will apply.

Q: How do I update my billing information? A: Visit www.ezpassoh.com to access your account and update your billing information under Billing & Payments. Self-Service is also available 24 hours a day by calling (440) 971-2222.

Q: I haven't traveled recently, why has my credit card been charged? A: There is a $0.75 monthly fee per transponder regardless of use; this is deducted on the monthly anniversary of the account open date. The monthly fee may have taken your account balance below the low balance threshold.

Q: What if my transponder is not working? A: All Ohio Turnpike issued E-ZPass ® transponders have been tested and should be in good working order. Customers who experience problems with a transponder can contact the Ohio Turnpike E-ZPass ® Customer Service Center at (440) 971-2222. Note: Windshields containing metallic tinting and/or heating features may prevent the E-ZPass ® signal from being read properly. A CSC representative can advise these customers of another location to place the transponder in certain vehicles.

Q: What is the lifespan of my transponder? A: The transponder does have a battery with a current life of 8-15 years. If you are traveling in Ohio and the battery stops working the gate will not go up. If you are traveling out of state, you may receive a red-light warning in the lanes. If the transponder fails to read in Ohio, and the account is valid, the toll collector can manually enter the serial number on the E-ZPass ® to ensure that you receive the E-ZPass ® rate. After your travels, you can return the device and request a replacement.

Q: What if I have a mischarge on my account? A: If you have an Ohio account, please contact the Customer Service Center at (440) 971-2222 to dispute this charge. If you have a device issued from another agency, you will need to contact them directly and advise of the mischarge. At this time, we are not able to adjust out of state accounts and you will have to contact your home agency.

Q: How can I close my Ohio Turnpike E-ZPass ® account? A: Customers may close their E-ZPass ® account at any time by returning the transponder to:

Ohio Turnpike and Infrastructure Commission P.O. Box 460 Berea, OH 44017

If a customer's E-ZPass ® account is terminated, the customer must return all transponders. Be sure to put the transponder in the Mylar bag it came with, or wrap it in aluminum foil, to prevent it from reading in transit. Upon termination, any positive balance on the account will be refunded by crediting the customer's credit card on file. This refund is given approximately 60 days from the account closure. All transponders remain the property of the Ohio Turnpike and Infrastructure Commission and the customer agrees to surrender possession of all transponders immediately upon request by the Commission. A $10.00 fee will be assessed on each unreturned transponder.

Q: Where can I return the transponder? A: Transponders may be mailed to:

Q: What are the electronic tolling rules? A: Click HERE to view a PDF of the electronic toll rules.

Q: How do I sign up or open a new E-ZPass ® account? A: Click HERE to sign up for an E-ZPass ® account.

Q: I left my transponder at home and went through an E-ZPass lane. Now what? A: If your license plate is registered to an active E-ZPass account, the tolls will be posted to the account at the V-Toll rate. If the license plate is not listed to an active E-ZPass account, an Unpaid Toll Invoice will be mailed to the address associated with the license plate registration.

Q: How do I pay my Unpaid Toll Invoice? A: You can pay online at www.ezpassoh.com with a credit or debit card. For payments made with check or money order send the invoice to:

Ohio Turnpike and Infrastructure Commission P.O. Box 94672 Cleveland, OH 44101

Q: I received an Unpaid Toll Ticket in the lanes with a toll collector. How do I pay? A: You can pay online at www.ezpassoh.com with a credit or debit card. For payments made with check or money order send the notice to:

Q: I'd like to dispute my toll. How can I request a hearing? A: To dispute any transaction on an invoice, please visit www.ezpassoh.com . You can file a hearing request by selecting Pay Your Unpaid Toll or under the Contact Us page.

Q: Why am I paying a higher toll rate on my E-ZPass with a license plate transaction? A: The Schedule of Tolls describes how tolls are determined. Customers paying their tolls electronically with E-ZPass ® transponders pay a reduced toll rate.

Is E-ZPass one company?

The E-ZPass Group is an association of toll entities in 19 states which provides the public with a seamless, accurate method for paying tolls at E‑ZPass facilities.

Do I have to sign up for E‑ZPass in each state that I want to travel in? Which one do I need?

No, you only have to sign up with one agency in order to experience the convenience of using E‑ZPass anywhere E‑ZPass is accepted.

Certain toll agencies offer discount programs to their frequent customers. It is suggested that you inquire about any discount programs offered by the agency whose facilities you will most frequently use and, if applicable, establish your account with that agency's E-ZPass service provider.

I need to update my credit card, address or other account information.

Please visit the website for the agency that issued your transponder and go to the account management section or the contact us section of their website.

My E‑ZPass did not work. Can I change the battery?

The E‑ZPass must be mounted to the vehicle as prescribed by the agency who issued the transponder. In most cases the transponder must be mounted to the top of the windshield oriented with the label so that you can read it normally and not upside down.

The Standard E‑ZPass battery has about a 10 year life under normal usage conditions.

There are no user replaceable components in your E‑ZPass.

If you have a properly mounted device and are having problems please contact your E‑ZPass service center for assistance.

I have an E‑ZPass and got a violation notice or bill from another state.

This usually means one of two things.

Your transponder was not read and a photo of your license plate was taken and the license plate is not listed on your account as required.

Your account may have had insufficient funds when the transaction was attempted.

You will need to contact your Customer Service Center to assist you in identifying the problem.

How can I speak with a real person?

Please visit the website of the agency that issued your transponder for their contact information.

Most agencies have staffed service centers that you may physically visit if needed. Please see their website for more information on locations of their service centers.

How do I know which agency issued my E‑ZPass?

If you look at your transponder it will have the agency who issued your transponder along with their phone number and address as well as a serial number of the transponder.

I tried logging in to my E‑ZPass account and my password does not work.

If you are trying to login on this website www.e‑zpassiag.com you are in the wrong place. You will need to visit the website of the agency that issued your account and try to login there. Their site should have password recovery tools to assist you with access to your account.

Can I use my E-ZPass in Florida?

A s of May 28th 2021 E-ZPass can be used througout Florida.

Peach Pass & E-ZPass: Your Passport to Travel

Last updated: 1/16/24 Click to enlarge

Join the Peach Pass CommuteNity and share your commuting experience with us!

- Please select to opt-in and receive communications about the Peach Pass CommuteNity.

Share Your Comments About Peach Pass

- Please select to grant the State Road & Tollway Authority/Peach Pass permission to use your quote/comments below in our marketing & promotions.

- First and Last name (Ex: John Doe)

- First Name Only (Ex: John)

- First name/Last Name Initial (Ex: JD)

Working Together to Enhance Your Ride

Participating state toll agencies.

Still Have Questions?

Statements will be sent by the toll agency that issued the customer’s transponder. Peach Pass statements will include toll charges for travel throughout Georgia and participating states. Customers can check their statements for free online, as sent via email or, for a fee, mailed via USPS.

Toll invoices will only be sent to Peach Pass customers if your transponder is not mounted properly, or you have a negative account balance. An invoice will be sent from the agency operating the toll road where you traveled.

If you are a Peach Pass customer: You can dispute a toll charge through one of the following methods: Mypeachpass.com Website, Mail/Fax, SRTA Walk-In Center or Peach Pass GO! 2.0 Mobile App. You may also call the Peach Pass Customer Service Center at 1-888-PCH-PASS (724-7277). To submit a dispute online as a Peach Pass account holder, log in to your Peach Pass account, select “Online Support” and follow the steps to submit your dispute.

If you are not a Peach Pass customer but received a Peach Pass Toll Invoice: Select “Contact Us” on the bottom of the Peachpass.com home page and select “Email Peach Pass.” Then, follow the steps to submit your dispute.

If you are a customer of an out-of-state toll agency: Contact your toll agency for information on how to file a dispute.

Having more than one transponder in your vehicle could allow you to be double charged. We recommend only having one toll account for each vehicle.

Only Peach Pass account holders are eligible to travel without paying the toll on I-85 through toll-exempt or non-toll mode accounts. Peach Pass customers are not able to take advantage of occupancy discounts in other states. We recommend keeping the account from the state where you travel the most frequently.

Navigate at sbb.ch

- To contents

Service links

- Search Open Search term Search

English is currently selected as the language.

Swiss Travel Pass.

Discover Switzerland with just a single ticket: the Swiss Travel Pass lets you travel by public transport to Switzerland’s most scenic regions.

The Swiss Travel Pass gives you unlimited travel by train, bus and boat, as well as many other advantages.

The advantages for you.

- Unlimited travel by train, bus and boat

- Unlimited travel on premium panorama trains (seat reservation fees and/or surcharges apply)

- Unlimited use of public transport in more than 90 towns & cities

- Free admission to more than 500 museums Link opens in new window.

- Mountain excursions included: Rigi, Stanserhorn and Stoos

- Discount of up to 50% on other mountain excursions

- Discount of up to 50% on leisure travel offers

Please note.

- The Swiss Travel Pass has been developed for guests from abroad. It is available to persons permanently resident outside Switzerland and the Principality of Liechtenstein.

- For online purchasing, purchase as a “guest”. You do not need a login.

- To receive the Swiss Family Card directly, add the child as a passenger under ‘Add passengers’ when you buy your Swiss Travel Pass.

- The Swiss Travel Pass / Swiss Half Fare Card / and the Family Card cannot be loaded onto a SwissPass card. You will not receive a customer number or an additional card.

Offers for adults aged 25 or over.

Choose 3, 4, 6, 8 or 15 consecutive days of travel.

Prices effective until 31.12.2024. Prices and product specifications subject to change.

Swiss Travel Pass Flex.

Valid on 3, 4, 6, 8 or 15 freely selectable days within one month.

Offers for young persons under 25.

The Swiss Travel Pass Youth gives young persons under 25 a 30% discount on the Swiss Travel Pass. It offers the same validity.

Swiss Travel Pass Youth.

Swiss travel pass flex youth., children aged between 6 and 16..

Children from their 6th up to their 16th birthday accompanied by at least one parent (holding a Swiss Travel System ticket) travel free of charge on train, bus, boat and mountain railway with the complimentary Swiss Family Card.

Children under 6.

Children under 6 years of age travel free of charge.

Further content

Swiss travel pass, more on the topic..

- Children travel for free with the Swiss Family Card Link opens in new window.

- FAQ Link opens in new window.

- Miscellaneous provisions Link opens in new window.

- Map of validity Link opens in new window.

- Area of validity Swiss Travel Pass (PDF, 2,0 MB) Link opens in new window. This document is not barrier-free.

Replacements for Internet Explorer 11.

Microsoft is gradually discontinuing its support for Internet Explorer 11 ( more info on microsoft.com Link opens in new window. ). If you continue to use Internet Explorer to access SBB.ch, you may experience functional limitations and display problems in the future. For this reason, we recommend using a more modern browser (e.g. Mozilla Firefox Link opens in new window. , Google Chrome Link opens in new window. , Microsoft Edge Link opens in new window. ).

We are aware that switching to a new browser may take some getting used to and cause some uncertainties. A more modern browser will allow you to benefit from faster and more secure internet access in future. We are committed to continuing our work with the utmost enthusiasm in the future to guarantee you accessible and inclusive access to SBB.ch.

Help & Contact

Do you have questions, need help or want to get in contact with us? We’re here to help you.

Rail traffic information

Find the latest information on the current service situation, information, disruptions as well as planned construction work on the Swiss rail network and on strikes and on important disruptions and strikes abroad.

Newsletter & Social Media

Our newsletter regularly informs you of attractive offers from SBB via e-mail.

- Display the SBB Facebook page. Link opens in new window.

- Display the SBB X account. Link opens in new window.

- Display the SBB Youtube channel. Link opens in new window.

- Display the SBB Instagram account. Link opens in new window.

- SBB Social Media

- Jobs & careers Link opens in new window.

- Business customers Link opens in new window.

- Company Link opens in new window.

- SBB News Link opens in new window.

- SBB Community Link opens in new window.

Timeless SBB design.

Would you also like to get your hands on an official Swiss station clock by Mondaine? Whether you’d like it as a watch, wall clock, pocket watch or alarm clock, order the model you want online now. Link opens in new window. Take a look and order Link opens in new window.

- Cookie settings

- Legal information

- Data protection

- Accessibility

In collaboration with

The Indiana Toll Road does NOT send out text messages asking for sensitive information. If you receive a message, please contact Customer Service (574) 675-4010 or visit https://www.indianatollroad.org/contact/.

About E-ZPass

- Purchase an E-ZPass

Activate your E-ZPass

- Toll Calculator

- Pay Unpaid Toll

- Dispute a Toll Amount

- Travel Advisories

- Road Projects

- Lane Closure Report

- Travel Plazas & Commuter Parking

- Military Convoys

- Emergency Info

- File a Claim

- Travel Information

- Dimensions & Weight Limits

- Lane Widths

- Special Hauling Permits

E-ZPass is the fastest, easiest way to pay your tolls on the Indiana Toll Road. There’s no need to waste travel time searching for coins, credit cards or tickets which can add unnecessary time and stress to your day. All you need is a transponder in your vehicle and you can simply drive through E-ZPass designated toll lanes. Your toll is debited from a prepaid account.

E-ZPass is accepted in these states

- Chicago Skyway

- Illinois State Toll Highway Authority

- Louisville-Southern Indiana Ohio River Bridges

- Massachusetts

- New Hampshire

- North Carolina

- Ohio Turnpike

- Pennsylvania Turnpike

- Rhode Island

- West Virginia Parkways

- Please note, Indiana Toll Road E-ZPass is not accepted in Georgia

Want to learn more about E-ZPass?

More e-zpass resources.

Get your E-ZPass

It’s quick and easy to sign up and purchase your E-ZPass.

Once you have your E-ZPass, you need to activate it.

E-ZPass Login

Already have your E-ZPass? Access your account here.

PUBLIC NOTICE: New toll rates effective 07/01/2024. You can find the rates here .

You must be logged in to download this Bid Pack

Username or Email

Don’t have an account yet? Sign up here.

Password recovery

E-ZPass Personal Account

E-ZPass is the most convenient, least expensive way to travel the PA Turnpike. E‑ZPass customers save nearly 60% on tolls.

Manage Your Personal E‑ZPass Account Online

Manage your account.

- Update your Contact, Vehicle and Billing Information

- Access Transactions and Statements

- Make a Payment

Open an E-ZPass Account

- Apply for an E‑ZPass online

- Activate your Go Pak

Find an E-ZPass Go Pak Retailer

Learn about e‑zpass.

- How E-ZPass Works

- Payment Options

- Report a Lost or Stolen Transponder

Visit the E-ZPass Website

Become a Road Pro with E‑ZPass

Using E-ZPass is the most convenient and least expensive way to travel the PA Turnpike. Make sure your transponder is mounted in your windshield, drive through a Toll Point and your toll will be deducted from your pre-paid account balance. You save nearly 60% on your tolls and don’t have to be on the lookout for an invoice in the mail.

Grabbing an E-ZPass Go Pak at one of 600-plus retailers is your shortcut to E-ZPass convenience.

Shop E-ZPass

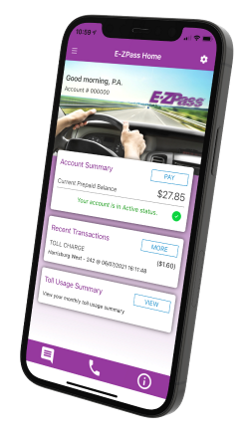

Manage Your Account with the PA Toll Pay App

Download the PA Toll Pay app to manage your account. Customers can add or remove vehicles including rentals with the snap of a photo, update payment information, activate your transponder and review account activity.

Frequently Asked Questions

Where can i use e-zpass.

View a list of E-ZPass locations here .

What is E-ZPass Plus?

E-ZPass Plus is a benefit for E-ZPass customers that allows them to use their transponders to pay for charges at participating facilities displaying the E-ZPass Plus logo. There is no additional charge for the E‑ZPass Plus program. You only pay the charges when they occur. Charges less than $20 are deducted from your prepaid E-ZPass account. Charges of $20 or more are charged directly to the credit card used to replenish your E-ZPass account. All E-ZPass Plus transactions are recorded on your statement.

All accounts with a prepaid balance and a valid credit card for primary replenishment are automatically enrolled in E-ZPass Plus. If you decide not to participate in the E-ZPass Plus program, you can make that change by either accessing your account online, through our mobile app, PA Toll Pay, or by contacting the PA Turnpike E-ZPass Customer Service Center at 1-877-736-6727 and when prompted, say "Customer Service" then select 1.

The E-ZPass Plus program is not available for E-ZPass customers who replenish via ACH or Manual. Auto replenishment using a credit card is required to participate. If you have chosen ACH or Manual as your primary form of replenishment and you would like to participate in E-ZPass Plus, please contact the PA Turnpike E-ZPass Customer Service Center at 1-877-736-6727. When prompted, say "Customer Service" then select 1.

By participating in the E-ZPass Plus program, you consent to the release of your name and address to E‑ZPass Plus facility operators.

Where is E-ZPass Plus available?

E-ZPass Plus is currently available at the following sites:

- Albany International Airport, New York, NY

- JFK International Airport, New York, NY

- LaGuardia International Airport, New York, NY

- Newark Liberty International Airport, Newark, NJ

- New York Avenue Garage, Atlantic City, NJ

- Atlantic City International Airport, Atlantic City, NJ

- Great New York State Fair, Syracuse, NY (Seasonal)

Click here for a complete list of participating facilities.

Can I purchase E-ZPass as a gift?

Yes. The PA Turnpike Commission offers E-ZPass gift certificates as a convenient way of gift giving. E‑ZPass gift certificates may be used to open a new E-ZPass account or to add funds to the prepaid balance of an existing PA Turnpike E-ZPass account. Gift certificates must be redeemed with the PA Turnpike E‑ZPass Customer Service Center.

E-ZPass gift certificates can be purchased in amounts starting at $38 (the minimum required to open a new account) to a maximum of $100. Visit the PA Turnpike E-ZPass Customer Service Center at 300 East Park Drive in Harrisburg, PA 17111 or call 1-877-736-6727 and when prompted, say "Customer Service" then select 1 to purchase gift certificates.

What happens if I’m in a rental vehicle? How will I be invoiced?

E-ZPass customers can add their rental vehicle information to their existing PA Turnpike E-ZPass account. To add a rental vehicle, access your account online or via our mobile app, PA Toll Pay . When adding the vehicle to your account, indicate the vehicle is a rental. Enter the start and end dates when prompted. You can also call the PA Turnpike E-ZPass Customer Service Center at 1-877-736-6727 and when prompted, say "Customer Service".

The PA Turnpike is required by statute to send TBP invoices to the vehicle’s registered owner. Customers with rental vehicles should check with the rental company regarding their toll policy and payment options before traveling on the PA Turnpike. Each rental company has a different policy for the payment of tolls.

Customers who do not have an E-ZPass account but want to pay the toll for a rental vehicle when traveling on the PA Turnpike, can do so by opening a Toll By Plate account online or via our mobile app, PA Toll Pay .

Customers are responsible for any tolls incurred while the vehicle registration is listed on their account.

See the Rental Vehicles page on our website for more details.

View more E-ZPass questions on the FAQs page .

E-ZPass Resources

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

Skip the Lines with Global Entry

Apply Now!

Are You Eligible for Global Entry?

Find Out Now!

Are You Ready to Schedule an Interview?

Find a Local Enrollment Center

- Trusted Traveler Programs

Global Entry

-->trusted traveler program enrollment -->.

Global Entry is a U.S. Customs and Border Protection (CBP) program that allows expedited clearance for pre-approved, low-risk travelers upon arrival in the United States. Members enter the United States by accessing the Global Entry processing technology at selected airports .

At airports, program members proceed to the Global Entry lanes where processing technology will be used to expedite the members by capturing a photo to verify their membership. Once the photo has been captured, the member will receive on-screen instructions and proceed to a CBP officer who will confirm that you have successfully completed the process.

Travelers must be pre-approved for the Global Entry program. All applicants undergo a rigorous background check and in-person interview before enrollment. If a traveler was unable to schedule an interview at an Enrollment Center prior to their international travel, they have an option to complete their interview via Enrollment on Arrival upon their arrival to the United States.

Another upcoming processing technology option for travelers will be the Global Entry Mobile App. This app will enable members to validate their arrival to the U.S. on their iOS or Android device prior to entering the Federal Inspection Services area.

While Global Entry’s goal is to speed travelers through the process, members may still be selected for further examination when entering the United States. Any violation of the program’s terms and conditions will result in the appropriate enforcement action and termination of the traveler’s membership privileges.

Global Entry Benefits

- No processing lines

- No paperwork

- Access to expedited entry

- Available at major U.S. airports

- Reduced wait times

Welcome to NC Quick Pass

Open account

Plan ahead and see your savings!

Use the toll calculator to plan your next trip with NC Quick Pass.

Roads & rates

Explore the toll facilities in North Carolina

Transponder options

See what transponder fits your travel needs

Learn about free travel in the I-77 Express Lanes

- Shop all deals

- Free phones

- Smartphones

- Fios Home Internet

- Bring your own device

- Accessories

- Refer a Friend

- Verizon Visa® Card

- Certified pre-owned phones

- Apple iPhone 15 Pro

- Apple iPhone 15

- Samsung Galaxy S24 Ultra

- Google Pixel 8 Pro

- Other phones

- Trade in your device

- Tablets & laptops

- Certified pre-owned watches

- Jetpacks & hotspots

- Shop all accessories

- Phone cases

- Screen protectors

- Tablet accessories

- Chargers & cables

- Phone attachments

- MagSafe compatible

- Verizon accessories

- Shop all watch accessories

- Smart watches

- Shop all plans

- International services

- Connected devices

- Discounts overview

- Mobile + Home

- First responders

- Verizon Forward

- Connected car plans

- Shop all home solutions

- 5G Home Internet

- LTE Home Internet

- Accessories overview

- Cables & connectors

- Networking & Wi-Fi

- TV accessories

- Phone equipment

- 5G Home accessories

- Prepaid overview

- Phone plans

- Smartwatch plans

- Tablet & hotspot plans

- International plans

- Smartwatches

- Hotspots & routers

- Basic phones

- Why Verizon Prepaid

- Disney+, Hulu, ESPN+

- Apple Arcade

- Google Play Pass

- Apple Music

- Xbox All Access

- Services & perks overview

- Entertainment

- Protection & security

- Digital family

- Financial services

- Back to Menu

- Sign in to My Account

- Prepaid instant pay

- Business Log in

Choose your cart:

- Mobile solutions

- Home solutions

Layer_4 Created with Sketch.

TravelPass® FAQs

TravelPass lets you take your talk, text and data with you to 210+ countries and destinations for a set daily fee. For more information about using your device internationally, visit our Trip Planner .

TravelPass days on us

What is travelpass.

TravelPass lets you use your domestic talk, text and data* in 210+ countries and destinations outside the US for a set daily fee. Calling within the country you're visiting and back to the US are both included with this plan. *High speed data applies for the first 2 GB/day with 3G speeds thereafter. If more than 50% of your talk, text or data usage in a 60-day period is in Canada or Mexico, use of those services in those countries may be removed or limited.

How will I be charged for TravelPass?

You're only charged on days you use your device in a TravelPass country :

- $5/day in Mexico and Canada. Remember, calling, texting and data use in Mexico and Canada are included at no extra cost in our Unlimited mobile plans.

- $10/day in other TravelPass countries.

- If you travel to 2 countries within a single 24-hour session or have a layover in a different country on your way to your final destination, you're still only charged for the first session.

- There's no charge when you're in the US.

What will I be charged if I call another country other than the one I'm visiting or the US?

You will be charged as per your International Long Distance plan. If you do not have one, you will be charged international long distance pay per minute rates.

How does TravelPass work?

After you add TravelPass to your line:

- A 24-hour TravelPass session starts automatically when you use your device in a TravelPass country (e.g., make or answer a phone call, send a text or use data).

- You must turn on cellular data or data roaming when you go to the TravelPass country to use Travel Pass.

- App content refreshing (e.g., Weather apps, Fitness Tracker, etc.)

- Syncing (e.g., with email)

- Device or app software updates

- 2 hours after the session starts we send you a text letting you know when your 24-hour TravelPass session ends. Using your device after that time will start a new session.

Which countries can I call with TravelPass?

With TravelPass, you can call within the country you're visiting and you can call back to the US. If you want to call a different country, add an International Long Distance Plan to your line in My Verizon website or the My Verizon app. If you don't add an international long distance plan you'll be charged international long distance pay per minute rates for these calls.

Can I use Wi-Fi calling with TravelPass?

Wi-Fi calling isn't included with TravelPass. Wi-Fi calling to a country other than the US is charged international long distance rates regardless of whether or not you have an international travel plan.

Can I use my device while traveling outside the US?

Most smartphones and some tablets can be used when you travel abroad. Use our Trip Planner to find out if your device will work for your trip.

How do I get my device ready to use outside the US?

Before you use your device while traveling, make sure your device's roaming is turned on. Roaming must be on so your device can connect to cellular networks in your destination country. For instructions to turn roaming on and off:

- Visit Let's Troubleshoot Your Devices to learn how to adjust your roaming settings.

- Enter your device in the search field under Filter (e.g., "Samsung" or "S23", etc.) and choose your device.

- Select Troubleshoot under the device's name on the device tile.

- In the Search Another Issue field, type "Turn data roaming on or off." Follow the instructions for your device.

How do I add TravelPass to my line?

You can add TravelPass to your line by:

- Visiting the Trip Planner in My Verizon.

- Texting the word Travel to 4004.

- For TravelPass to work, you must turn on cellular data or data roaming when you go to the TravelPass country.

Do I have to opt in every day to use TravelPass?

No, you don't need to opt in every day. Add TravelPass once and it stays on your line so you're all set for your next trip. You're only charged for the days that you use your device in a TravelPass country . There's no charge when you're in the US.

How do I get more high speed data once I've reached my limit?

TravelPass gives you high-speed data for the first 2 GB/day. After that, you'll have unlimited data at 3G speeds for the remainder of your TravelPass session. To get more high speed data after you use the daily 2 GB:

- This additional data costs $5 in Mexico and Canada, $10 in all other TravelPass countries.

- Reply speed to get the added high speed data.

You can buy additional 2 GB of high speed data multiple times during a single 24-hour session. Note: Additional high speed data sessions are not available in Andorra, Burundi, Bahrain, Ethiopia, Kiribati, Kosovo, Mauritius, Namibia, Nepal, Pakistan, Sudan, South Sudan, Zimbabwe.

How do I get TravelPass days on us?

You get TravelPass days on us when you have:

- 5G Get More*, 5G Do More* – Get a TravelPass day each month.

- Verizon Visa Card – You get 2 TravelPass days per calendar year if you apply and are approved for the Verizon Visa Card.

*No longer available to add to your account.

Can I see how many TravelPass days I have?

All of your TravelPass days are stored in your TravelPass bank. To view your TravelPass bank:

- In the My Verizon app, tap the Menu icon in the top left corner of the screen.

- Tap Verizon Up .

- Scroll down to Manage your TravelPass days.

You’ll see the number of TravelPass days you have. You can tap Manage to see the expiration dates of each of your TravelPass days and/or transfer* them to another eligible line on your account. *TravelPass days earned with 5G Get More or 5G Do More phone plans can't be transferred to other lines.

How do I use my TravelPass days?

The TravelPass days assigned to your line are automatically used when you have TravelPass active on your line and travel outside the US to a TravelPass country. When you arrive at your international destination, you receive a text message telling you how many TravelPass days you have. Once all your TravelPass days are used, the normal TravelPass daily fee will be applied. Note: TravelPass days aren't eligible for use on cruise ships .

Can I transfer my TravelPass days to another line on my account?

TravelPass days you get through the Verizon Visa Card can be transferred to another eligible line on the account. The Account Owner or Account Manager can make the transfer through the My Verizon app:

- Go to your TravelPass bank in the My Verizon app.

- Tap Manage .

- Tap Reassign next to the TravelPass day you want to transfer to another line.

- Select the eligible line you want to reassign the TravelPass day to.

The TravelPass day is now assigned to that line. Note:

- TravelPass days you receive from your Verizon Visa Card won't automatically be assigned. You can view them and assign them on the Use Rewards tab of the Verizon Up screen in the My Verizon app.

- TravelPass days earned with 5G Get More* or 5G Do More* phone plans can't be transferred to other lines.

Do my TravelPass days expire?

Here's when your TravelPass days expire:

- Verizon Visa Card: TravelPass days expire at the end of the calendar year.

- 5G Get More* and 5G Do More* TravelPass days expire 12 months after you receive them.

Tips on using TravelPass

Length: 1:00

Video Transcript

Verizon TravelPass Hi there! If you're planning on traveling abroad, we have a few simple tips to help you get the most out of your Verizon phone and your TravelPass. Make sure you enable roaming before you go, so that you can use data and voice services internationally. Go to settings, select cellular, then roaming, and make sure data and voice roaming are turned on. Remember, it may take up to three minutes for your phone to connect to local networks. If you experience service issues, be sure to turn your device off, then back on. This is a simple, yet effective way to reconnect your device to the international network while traveling. Making calls while outside the US will always need the international access code followed by a country code, and then the number you're calling. So on your iPhone, hold down the zero until you see the plus sign appear, enter the country code, then dial the number you want to call. And if you call a contact stored on your phone, double check that you've included the "+" and the country code. For more travel tips from Verizon, follow the link below: www.go.vzw.com/traveltips That's all for now! Enjoy your trip!

Additional support

International travel faqs, prepaid travelpass faqs.

- Home Internet & TV

- Mobile + Home discount

- Support overview

- Return policy

- Community Forums

- Business support

- Download My Verizon App

- Accessibility

- Check network status

- Responsibility

- Verizon Innovative Learning

- Consumer info

- 5G overview

- Innovation Labs

- Apple iPhone 15 Pro Max

- Apple iPhone 15 Plus

- Apple AirPods Max

- Apple Watch Series 9

- Elizabeth James

- Terms & Conditions

- Device Payment Terms & Conditions

- Report a security vulnerability

- Mobile customer agreement

- Announcements

- Radio frequency emissions

- Taxes & surcharges

- Legal notices

- facebook-official

- Privacy Policy

- California Privacy Notice

- Health Privacy Notice

- Open Internet

- Terms & Conditions

- About Our Ads

- Credit Cards

- Best Travel Credit Cards

19 Best Travel Credit Cards Of June 2024

Expert Reviewed

Updated: May 30, 2024, 2:57pm

For anyone who travels enough to have a separate savings account, like I do, credit cards are a valuable resource toward booking and paying for your trip. The rewards can offset a huge portion of your out-of-pocket expenses, and the best travel cards often pay for themselves in money saved and headaches avoided.

Why you can trust Forbes Advisor

Our editors are committed to bringing you unbiased ratings and information. Our editorial content is not influenced by advertisers. We use data-driven methodologies to evaluate financial products and companies, so all are measured equally. You can read more about our editorial guidelines and the credit card methodology for the ratings below.

- 113 countries visited

- 5,500 hotel nights spent

- 93,000,000 miles and points redeemed

- 29 loyalty programs covered

Best Travel Rewards Credit Cards

- Chase Sapphire Preferred® Card : Best Travel Credit Card for Beginners

- Capital One Venture X Rewards Credit Card : Best Premium Travel Rewards Card

- Chase Sapphire Reserve® : Best Travel Credit Card for International Travel

- The Platinum Card® from American Express : Best Travel Rewards Credit Card for Lounge Access

- American Express® Gold Card : Best Travel Rewards Earning for Foodies

- Capital One Venture Rewards Credit Card : Best Flat-Rate Rewards Credit Card for Travel

- Bilt World Elite Mastercard® : Best Travel Rewards Credit Card With No Annual Fee

- Credit One Bank Wander® Card : Best Travel Credit Card for Fair Credit

- Aeroplan® Credit Card : Best Airline Rewards Program for International Travel

- United Quest℠ Card : Best United Credit Card

- United Club℠ Infinite Card : Best Premium Airline Card

- British Airways Visa Signature® Card : Best for British Airways Passengers

- Southwest Rapid Rewards® Priority Credit Card : Best for Southwest Passengers

- IHG One Rewards Premier Credit Card : Best Midrange Hotel Card

- The World of Hyatt Credit Card : Best Travel Credit Card for Hyatt Loyalists

- Marriott Bonvoy Boundless® Credit Card * : Best for Marriott Customers

- Hilton Honors Aspire Card from American Express * : Best Premium Hotel Card

- Wyndham Rewards Earner® Card * : Best No Annual Fee Hotel Card

- Best Credit Cards Of 2024

- Credit Cards With Travel Insurance

- Best Hotel Credit Cards

- Best Credit Card For Lounge Access

- Best No-Annual-Fee Cards For Travel

- Best Airline Credit Cards

Best General Purpose Travel Credit Cards

Best travel credit card for beginners, chase sapphire preferred® card.

Up to 5x Reward Rate

Earn 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all Read More

Welcome Bonus

75,000 bonus points

Regular APR

21.49%-28.49% Variable

Credit Score

Excellent, Good (700 - 749)

I jumped at the chance to get the Chase Sapphire Preferred® Card when it was first launched. More than a decade later, I’m still a loyal cardholder.

Why We Like It

For a modest annual fee (which is partially justified with an annual hotel credit) you get a rare mix of high rewards rates and redemption flexibility.

What We Don’t Like

The highest earning rate requires making reservations through Chase Travel℠ and doesn’t include direct bookings or online travel agencies.

Who It’s Best For

Travelers who want to earn transferable points without a steep annual fee.

It’s the granddaddy of travel credit cards, but it still earns its reputation as one of the best around with solid bonus categories, strong travel protections, a great set of domestic and international transfer partners and a reasonable annual fee to boot. You can’t go wrong with it as your first travel credit card.

- Earn high rewards on several areas of spending

- Transfer points to travel partners at 1:1 rate

- Many travel and shopping protections

- No intro APR offer

- Best travel earning rates are only for bookings through Chase

- Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s over $900 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 75,000 points are worth $937.50 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

Best Premium Travel Rewards Card

Capital one venture x rewards credit card.

Up to 10X Reward Rate

Earn 2 miles per dollar on all eligible purchases, 5 miles per dollar on flights and 10 miles per dollar Read More

Earn 75,000 bonus miles

19.99% - 29.99% (Variable)

Excellent (750 - 850)

The Capital One Venture X Rewards Credit Card ( rates & fees ) is packed with extras that put it firmly in competition with other upscale credit cards. Just as important, the easy earnings structure is ideal for anyone who doesn’t want to stress over details.

Its annual fee is easily recouped through an annual travel credit and bonus miles, which makes the perks feel almost free.

The flat-rate earnings mean that if you have high spending in a single category, you might be better off with a different card.

Travelers who want premium benefits and are willing to book through Capital One travel at least once a year.

If you’re looking for lofty perks without a lofty annual fee, the Venture X fits the bill. While other cards with elite benefits can run close to $700 a year, the Venture X is nearly half that. And you’ll still get Capital One and Priority Pass airport lounge access for you and your eligible guests, an annual travel credit and solid earnings on everyday purchases.

- Annual fee lower than others in its category

- Annual travel credit through Capital One Travel and anniversary miles alone could justify the annual fee

- Miles are easy to earn and easy to use

- Lack of domestic airline and upscale hotel travel partners

- Capital One lounge network in its infancy

- Lack of hotel status benefits

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you’ll get Capital One’s best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- Use your Venture X miles to easily cover travel expenses, including flights, hotels, rental cars and more—you can even transfer your miles to your choice of 15+ travel loyalty programs

- Elevate every hotel stay from the Premier or Lifestyle Collections with a suite of cardholder benefits, like an experience credit, room upgrades, and more

- Receive up to a $100 credit for Global Entry or TSA PreCheck®

Best Travel Credit Card for International Travel

Chase sapphire reserve®.

Up to 10x Reward Rate

Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Read More

22.49%-29.49% Variable

Earn superior points rates if you spend frequently on travel and dining out with the Chase Sapphire Reserve® . Its greatest selling point, though, is the awesome list of 1:1 transfer partners.

The $300 travel credit compensates for much of the annual fee, and the travel protection benefits have personally reimbursed me more than $1,000.

There’s an extra fee to add an authorized user to your account.

Anyone looking to take advantage of built-in travel insurance protections.

The Chase Sapphire Reserve card is one of the most valuable flexible rewards credit cards thanks to its lucrative bonus categories and easy-to-use travel credit. Cardholders can offset the annual fee and get great value when redeeming Chase Ultimate Rewards points earned on the card, thanks to partnerships with numerous airlines and hotels and its convenient travel booking portal, Chase Travel.

- $300 annual travel credit is incredibly flexible

- Generous welcome bonus

- Get 50% more value when you redeem points for travel through Chase

- Points transfer to valuable airline and hotel partners

- High annual fee

- High variable APR on purchases

- Excellent credit recommended

- Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $1,125 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 75,000 points are worth $1125 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

Best Travel Rewards Credit Card for Lounge Access

The platinum card® from american express.

5X Reward Rate

Earn 5 Membership Rewards Points per dollar on prepaid hotels booked with American Express Travel and on flights booked directly Read More

Earn 80,000 points

See Pay Over Time APR

Good,Excellent (700 - 749)

The Platinum Card® from American Express (terms apply, see rates & fees ) is destined for frequent travelers who intend to fully leverage the rich set of travel benefits. Trust me when I say the perks can make you feel like a VIP. The staggering annual fee for this classic status card won’t be worth it for everyone, but in the right hands the expense can be well justified.

Lounge access with this card extends beyond the Priority Pass membership you see on other premium cards.

Many of the statement credits and other offers have limitations for how you can use them.

Cardholders who will track and maximize the long list of member benefits.

Being an Amex Platinum cardholder grants access to the International Airline Program, which can save you money on first and business-class seats on more than 20 airlines, as well as premium economy tickets for you and up to seven traveling companions. Start your search on the Amex Travel website to find international flights departing or arriving in the U.S. for any of those premium cabins.

- High reward potential on flights and hotels booked through American Express Travel

- Multiple credits can help justify the fee

- Comprehensive airport lounge access

- Luxury travel benefits and elite status with Hilton and Marriott with enrollment

- Very high annual fee

- Maximizing the statement credits takes some work and could be impractical for many

- Reward rate outside of travel is sub-par for a premium card

- Earn 80,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card®. The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- The American Express Global Lounge Collection® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market. As of 03/2023.

- $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card® to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card®.

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $189 CLEAR® Plus Credit: CLEAR® Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. CLEARLanes are available at 100+ airports, stadiums, and entertainment venues.

- Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 year period for TSA PreCheck® application fee for a 5-year plan only (through a TSA PreCheck® official enrollment provider), when charged to your Platinum Card®. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card®. That’s up to $50 in statement credits semi-annually. Enrollment required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

- $695 annual fee.

- Terms Apply.

Runner-Up Travel Cards

Best travel rewards earning for foodies, american express® gold card.

Up to 4X Reward Rate

Earn 4X Membership Rewards® points at restaurants, plus takeout and delivery in the U.S.; Earn 4X Membership Rewards® points at Read More

Earn 60,000 points

Excellent/Good (700 - 749)

Foodies and travelers can leverage the American Express® Gold Card (terms apply, see rates & fees ) to the hilt, earning up to 4 points per dollar. The annual fee may seem intimidating—I get that. But my household comes out ahead by taking advantage of the card’s dining credits and rotating Amex Offers.

The grocery earnings on this card are impressive and rare for a travel card. Earn on everyday spending and redeem toward vacation: perfect.

The dining credits and Uber Cash are provided monthly rather than in an annual lump sum.

Cardholders with high spending on food expenses.

This card makes it easy to earn Membership Rewards points while doing regular grocery shopping since the card earns bonus points at supermarkets. And for the nights that cardholders don’t want to cook, they can make use of the monthly dining and Uber credits (which can be used on Uber Eats orders).

- High rewards earnings possibilities

- Points transfer option to many partners

- Add up to 5 authorized users for no additional annual fee

- Can choose from regular or rose gold versions

- No lounge benefits

- Limited options to carry a balance

- High APR for pay over time feature

- High pay over time penalty APR

- Earn 60,000 Membership Rewards® points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership.

- Earn 4X Membership Rewards® Points at Restaurants, plus takeout and delivery in the U.S., and earn 4X Membership Rewards® points at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X).

- Earn 3X Membership Rewards® points on flights booked directly with airlines or on amextravel.com.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and each month automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S., totaling up to $120 per year.