AgentMax Online

AgentMax™, our unique, award-winning web-based application, has been helping travel agents increase their sales and income for more than a decade. Now, with AgentMax Online, we've made offer travel insurance easier than ever with an array of upgraded and mobile-optimized features— giving travel agents greater flexibility, efficiency, and an all-around better experience.

Built with you in mind

An easier way to sell, a smarter selling tool, a greater experience, why agentmax online, how do i get started.

AgentMax has been helping travel agents like you increase their sales and income for more than a decade. Now, we’ve made our award-winning sales tool even easier to use. AgentMax Online gives you greater flexibility, efficiency, and an all-around better selling experience.

Reach your financial goals by booking more travel insurance policies.

- Create quotes faster and track sales with ease to earn more commissions—some of the highest in the industry

- Send automated 2nd Chance by MaxMail offers to customers who decline insurance so you’ll never miss a sale

- Put your logo and contact information in front of travelers with easy access to our brochure ordering tool and personalized marketing materials

Work more efficiently while you’re in or out of the office.

- Work seamlessly with interconnected capabilities on your desktop, smartphone, and tablet—so AgentMax is on when you are

- Access customer information, saved quotes, and product details in seconds—you’re in, you’re out, and on to your next customer

- Enjoy an intuitive digital experience, a fast quote—creation process, and automated updates for hassle-free sales

Spend more time helping customers and keep them coming back.

- Focus more on your customers and less on the sales software—AgentMax is designed to maximize your time with travelers

- Help your customers find the value in having travel insurance with expert selling tips

- Keep your customer loyal and happy with your recommendation, to the tune of a 95% satisfaction rating

- The online version of AgentMax was specifically designed to work on any device.

- We’ve streamlined the process to make it faster and easier to create a quote.

- Passwords are required to accommodate increased security.

- You can quote, buy, modify/cancel travel insurance plans, order brochures, access the waiver, see News & Resources, and set up 2nd Chance by MaxMail.

- Access to on-going reporting

To get started, log in to AgentMax Online today, or for more information on how to navigate the site, download the AgentMax Online training guide .

More from #Tools

New single trip travel insurance selling tool

For customers who would benefit more from individual trip protection, this new selling tool will help you show them why.

Destination Requirements

Have more questions.

We’re here for you! Drop us a line and let us know what questions you have. Your dedicated team is always happy to help.

Sign up for notifications so you never miss a beat!

Advisor Tools

- Training Tools

- Travel Restrictions Map

Articles & Posts

- In The News

- Advisor Stories

Partnership

- Partner Sign-Up

- Partnership Advantages

Sign in to start your session

- Our history

- Allianz Advantage

- Global footprint

- Social responsibility

- Travel protection

- Tuition protection

- Event ticket protection

- Bankcard services

- Assistance services

- Technology solutions

- Allianz Fusion

- Allianz TravelSmart

- Stories & insights

- In the news

- Press releases

- Vacation confidence index

- Internships

Allianz Upgrades AgentMax Online Travel Insurance Booking Platform

New notifications feature helps travel agents keep track of new sales and expiring benefits.

RICHMOND, VA, September 23, 2020 —Travel insurance and assistance company Allianz Partner has launched a new notification feature on its award-winning platform for travel advisors, AgentMax Online , which will help agents keep up to date on their clients’ travel insurance needs. Using AgentMax’s QuoteMax rapid quoting tool and its MaxMail email marketing function, travel advisors will now have faster access to the changing travel insurance requirements of their clients.

Designed to simplify travel advisors’ lives and boost their efficiency, a new notifications tab helps keep track of both new sales and expiring benefits, by providing alerts and offering a single location to access these updates. Now, whenever agents are logged into AgentMax Online, they’ll notice a blue Notifications tab at the top of any page they may be on. A red dot with a notification counter will appear inside the tab when a client purchases a travel insurance product using MaxMail or QuoteMax, or when a client’s deadline to purchase a product in order to receive coverage for pre-existing medical conditions is nearing.

From the Notifications page, agents will notice three tabs:

MaxMail: Advisors can access notification details as soon as a customer purchases travel protection from a quote that was sent through any of the MaxMail automated email tools in AgentMax Online .

QuoteMax: Advisors are able to view updates when their customer purchases travel protection from a quote generated through their email or web version of QuoteMax.

Benefit Alerts: For outstanding quotes with soon-to-expire pre-existing medical condition benefit eligibility, agents will receive a reminder—along with their customer’s contact info and the option to email them their original quote with a quick message.

“AgentMax allows travel advisors to spend more time creating memorable trips for their clients and less time tracking and managing travel insurance offers,” said Daniel Durazo, Director of Marketing and Communications Allianz Partners. “With the arrival of AgentMax Notifications, agents can stay on top of their clients travel insurance needs in order to provide the valuable protection that travelers deserve.”

For additional information, please visit https://partner.allianztravelinsurance.com/amo/

About Allianz Partners

Allianz Partners (AGA Service Company) is a leading consumer specialty insurance and assistance company with operation centers in 35 countries. In the United States, the company offers Allianz Travel-branded travel protection plans and serves over 45 million customers annually. In addition to travel insurance, the company offers tuition insurance, event ticket protection, registration protection for endurance events and unique travel assistance services such as international medical assistance and concierge services. The company also serves as an outsource provider for in-bound call center services and claims administration for property and casualty insurers and credit card companies.

* Terms, conditions, and exclusions apply to all plans. Plans are available only to U.S. residents. Not all plans are available in all jurisdictions. Benefits and limits vary by plan. For a complete description of the coverage and benefit limits offered under your specific plan, carefully review your plan’s Letter of Confirmation/Declarations and Certificate of Insurance/Policy. Insurance coverage is underwritten by BCS Insurance Company (OH, Administrative Office: Oakbrook Terrace, IL), rated "A‐" (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: Richmond, VA), rated "A+" (Superior) by A.M. Best Co., under Jefferson Form No. 101‐C series or 101‐P series, depending on state of residence. AGA Service Company d/b/a Allianz Global Assistance is the licensed producer and administrator of Allianz Travel-branded travel protection plans in the U.S. and an affiliate of Jefferson Insurance Company. Allianz Global Assistance, TravelSmart, and AgentSmart are marks of AGA Service Company or its affiliates. The insured shall not receive any special benefit or advantage due to the affiliation between Allianz Global Assistance and Jefferson Insurance Company. Plans include insurance and assistance services. Noninsurance benefits/products are provided and serviced by Allianz Global Assistance. SmartBenefits proactive payments and “no receipts” payments available only on certain plans. For plans that include proactive payments: when you opt in and provide flight information, Allianz Global Assistance will monitor flights and send flight status and benefit alerts, including alerts about flight delays that qualify for automated travel delay payments. Standard message/data rates apply to SMS alerts. Automated claims and payment system availability is not guaranteed and is subject to our sole discretion. All claims subject to policy terms, conditions, and exclusions.

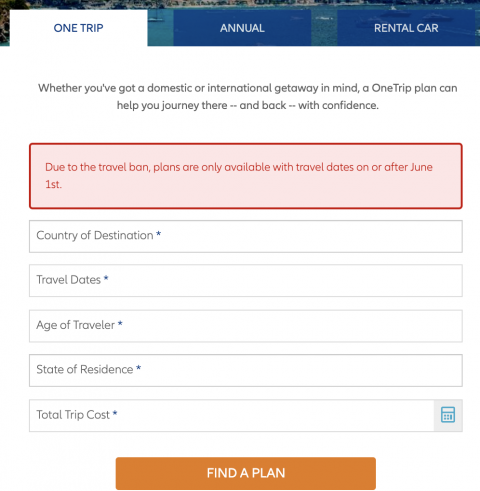

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova; North Korea; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Manage Your Policy

To find your policy, please provide either your email address or your policy number. Your policy number can be found on your policy documents or in your confirmation email. You can also view your policies by signing in to your account.

My Policies

- ? Type of Plan {{policyPlanTypeName()}} Select the type of plan that works best with your type of travel. Not sure? Just call us toll-free: 1-866-884-3556.

- Email Address or Policy Number {{policyIdTypeName()}}

- {{dateText}} or Purchase Date {{policyDateTypeValue.Name}}

Search Results

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

- Worldwide Presence

- Our History

- Corporate Social Responsibility

- TripWise Mobile App

- Seeking medical treatment

- How to file a claim

- Access Claims Portal

- Complaint resolution process

- Coverage Alerts

- Archived news

- Work With Us

Travel has changed, and we’re changing with it

Dedicated to helping and protecting.

With over 30 years of experience helping Canadian travellers in their time of greatest need, we place the customer at the heart of everything we do.

This commitment to caring and customer-first approach is a common thread throughout the full range of unique travel insurance and emergency assistance solutions we provide to our partners and their customers.

Travelling or returning to Canada?

Waiting at customs can take its toll after a long trip. To avoid delays, be sure to follow the new mandatory travel requirements and submit your information digitally using ArriveCAN .

Learn more at Canada.ca/ArriveCAN

Allianz among Interbrand's Best Global Brands 2022

You’re already giving your customer greater flexibility by giving them the freedom to cancel for any reason. Now, protect them while they travel by adding a Travel Impressions Cancel for Any Reason (CFAR) Waiver and a Travel Protection Insurance* (TPI) plan from Allianz Global Assistance to every Travel Impressions vacation you book.

Partner with Allianz Global Assistance today to start offering the new CFAR/TPI package.

- Our history

- Allianz Advantage

- Global footprint

- Social responsibility

Travel protection

- Tuition protection

- Event ticket protection

- Bankcard services

- Assistance services

- Technology solutions

- Allianz Fusion

- Allianz TravelSmart

- Stories & insights

- In the news

- Press releases

- Vacation confidence index

- Internships

When the world calls, help your customers answer with confidence.

Looking for a travel insurance plan, get a quote at allianztravelinsurance.com ..

Benefits to help travelers explore reassured.

Expert assistance means travelers are never alone.

Industry-leading technology for the future of travel.

Travel safe. Travel simple. Allianz TravelSmart.

Our free Allianz TravelSmart TM app puts your customers’ travel protection plan at their fingertips, making it easy to check their coverage benefits, connect to our 24/7 assistance, or file a claim on the go.

What makes Allianz TravelSmart even smarter? We’ve loaded it with safety features to help customers explore more securely, including timely alerts about events that may impact their travels, a locator for nearby emergency assistance, medical translations, and more.

“I cannot even begin to tell you how wonderful my experience was with Allianz!! I had a terrible ski accident in France and every single Allianz person was unbelievably helpful. I now recommend Allianz to everyone I know and I will NEVER travel overseas without it. I am so very grateful for all the support I received.”

- Lindsay T., MN, 2021

“So often when you buy warranty or insurance it’s hard to actually get it to do what it’s supposed to do, but Allianz worked as it should. The cost for travel insurance is so negligible that it’s a no brainer to add to your trip.”

- Kyle Y., GA, 2021

“When I filed my claim your company made the process very easy. And you did not try to avoid your contract responsibilities like many other insurance companies with whom I have had to work with. I have recommended you to all of my travel friends.”

– Scott H., IL, 2021

Have questions about our products or services?

contact us — we’re here to help. .

You are using an outdated browser. Please upgrade your browser to improve your experience.

At ConsumersAdvocate.org, we take transparency seriously.

To that end, you should know that many advertisers pay us a fee if you purchase products after clicking links or calling phone numbers on our website.

The following companies are our partners in Travel Insurance: Travel Guard Insurance , Allianz Global Assistance , Travelex , TravelInsurance.com , Seven Corners , Generali Global Assistance , Trawick International , Squaremouth , and Faye .

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on the page.

For example, when company ranking is subjective (meaning two companies are very close) our advertising partners may be ranked higher. If you have any specific questions while considering which product or service you may buy, feel free to reach out to us anytime.

If you choose to click on the links on our site, we may receive compensation. If you don't click the links on our site or use the phone numbers listed on our site we will not be compensated. Ultimately the choice is yours.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity.

Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process, click here.

Product name, logo, brands, and other trademarks featured or referred to within our site are the property of their respective trademark holders. Any reference in this website to third party trademarks is to identify the corresponding third party goods and/or services.

- Travel Insurance

- Allianz Global Assistance Review

Allianz Global Assistance Travel Insurance Review

The following companies are our partners in Travel Insurance: Travel Guard Insurance , Allianz Global Assistance , Travelex , TravelInsurance.com , Seven Corners , Generali Global Assistance , Trawick International , Squaremouth , and Faye .

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on a Top 10 list.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity. Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process, click here.

Allianz Global Assistance offers a variety of different standard and personalized plans at various benefit levels. Depending on which plan you choose, benefits may include:

- Trip Cancellation

- Trip Interruption

- Cancel anytime, up to 80%: Only available in conjunction with the OneTrip Prime or Premier.

- Emergency Medical Transportation

- Emergency Medical / Dental

- Lost / Stolen / Delayed Baggage

- Travel Delay

- Change Fee Benefit

- Loyalty Program Redeposit Fee Benefit

- Rental Car Damage Benefit

- 24-Hour Hotline Assistance

- Concierge Services

Single trip

Annual (multi-trip) plans

Allianz Global Assistance's opening price point plans include the most common types of coverage purchased by travelers. While it does not have the high coverage limits included with more expensive plans, it does provide pre-existing medical condition coverage. Plan benefits and limits may vary by state.

SINGLE TRIP PLANS

* Must be purchased within 14 days of the first trip deposit; additional conditions may apply.

Annual (Multi-Trip) Plans

Optional: Rental Car Damage ($11/ day)

Coverage for covered collision, loss and damage up to $50,000

Allianz Global Assistance has a wide array of standard and optional benefits so travelers can get the specific protection they need. Pre-existing conditions are covered under the company's medical provisions if the plan is purchased within 14 days of travel. Allianz Global Assistance also offers 24-hour emergency assistance and concierge services.

- Complete cessation of service

- Covered traveled delay – loss of 50%

- Death of Family Member

- Death of insured

- Death of travelling companion

- Employer termination – 3 years

- Felonious assault

- Foreign and domestic terrorism

- Home uninhabitable

- Illness of family member

- Illness of insured

- Illness of travelling companion

- Injury of family member

- Injury of insured

- Injury of travelling companion

- Involved in a traffic accident

- Jury/ subpoena

- Military obligations

- Unable to receive immunizations

Allianz Travel Insurance Summary

Allianz opening price point plans offer travelers the most commonly purchased coverage options. Trip cancellation and interruption services are offered even under its OneTrip Cancellation Plus, the company's entry level offering. Trips are insured up to their full purchase price. The company extends protection to children under 17 when accompanied by a paying adult with no additional cost on their OneTrip Prime and OneTrip Premier plans.

Allianz offers customers a full refund if coverage is cancelled within fifteen days of purchase.

Allianz’s satisfied customers describe how much they appreciate the company’s help with serious overseas medical situations. Negative comments generally come from people unhappy because the company’s contract didn’t apply to their claims. Those comments reinforce the importance of reading and understanding insurance contracts before purchasing them. This is particularly important in less-regulated insurance markets (such as travel insurance) where there is no “standard” policy.

Customer Comments

- ← Previous

- Next →

- Trip cancelations, delays, medical emergencies, lost baggage, unexpected crises, and more

Access to a worldwide network of prescreened hospitals

Quick claim payments for qualifying delays

24-7 emergency assistance services

Related to Travel Insurance

Top articles.

- Trip Cancellation Insurance – What is Covered?

- Do I Really Need Travel Insurance?

- Emergency Travel Insurance Coverage

- Common Parasites and Travel-Related Infectious Diseases

Suggested Comparisons

- Travel Guard Insurance vs. Travelex

- Allianz Global Assistance vs. Travel Guard Insurance

- Allianz Global Assistance vs. Berkshire Hathaway

- Allianz Global Assistance vs. Travelex

- Or via Email -

Already a member? Login

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Allianz Travel Insurance Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does Allianz Travel Insurance cover?

Allianz single trip plans, allianz annual/multi-trip plans, which allianz travel insurance plan is best for me, can you buy allianz travel insurance online, what isn't covered by allianz travel insurance, is allianz travel insurance worth it.

- Annual or single-trip policies are available.

- Multiple types of insurance available.

- All plans include access to a 24/7 assistance hotline.

- More expensive than average.

- CFAR upgrades are not available.

- Rental car protection is only available by adding the One Trip Rental Car protector to your plan or by purchasing a standalone rental car plan.

Allianz Travel Insurance is provided by Allianz Global Assistance, an insurer that operates in 35 countries and serves 40 million customers in the U.S. The company offers several types of travel insurance plans depending on your needs.

Travel insurance will help protect you if unexpected events affect your vacation. Whether you’re looking for a comprehensive plan or emergency medical coverage only to supplement the travel insurance you have from your credit cards , Allianz Global Assistance offers plenty of options.

Allianz trip insurance plans fall into two categories: single trip and annual/multi-trip plans. We evaluated several single trip and annual/multi-trip plans to help you figure out which policy makes sense for you.

Depending on what type of coverage you’re looking for, Allianz offers several different travel insurance options. Allianz’s plan choices fall under single trip or annual/multi-trip plans.

Single trip plans are designed for individuals who are leaving their home, visiting another destination (or destinations) and returning home. These travel insurance plans are the most comprehensive and provide benefits like trip cancellation, trip interruption and medical coverage.

Annual/multi-trip plans are designed for those who like to take a lot of little trips throughout the year as well as for business travelers. Because the coverage period is longer, these plans are more expensive.

Some of these plans include medical coverage only while others also provide more comprehensive travel insurance perks. There’s coverage for business equipment as these plans are geared toward work travelers.

Allianz offers five travel insurance plans for single trips, including a plan that's mainly focused on emergency medical coverage.

The OneTrip Cancellation Plus plan is geared toward domestic travelers who are looking for trip cancellation, interruption and delay coverage but don't need post-departure benefits like emergency medical or baggage loss. This plan is Allianz’s most affordable option.

OneTrip Basic, Prime and Premier are three comprehensive travel insurance plans.

OneTrip Basic is the most economical plan and offers trip cancellation, interruption and delay benefits along with emergency medical and baggage loss.

OneTrip Prime provides all the benefits of the Basic plan but with higher limits, a few extra coverage areas and complimentary coverage for children 17 and under when traveling with a parent or grandparent.

OneTrip Premier offers the most coverage, doubling almost every post-departure limit of the Prime plan with more covered cancellation reasons.

If you don't need pre-departure trip cancellation and interruption protections or you already have coverage through a premium travel credit card , the standalone OneTrip Emergency Medical plan may be a good choice. The plan mainly provides emergency medical protections along with some baggage loss/delay benefits.

» Learn more: Travel medical insurance: Emergency coverage while you travel internationally

Allianz single-trip plan cost

Here's a look at the cost of an Allianz travel insurance policy for a one-week, $1,500 vacation to Croatia in August 2020 taken by a 30-year-old from Texas.

The OneTrip Premier is the most expensive plan and provides the highest level of protection, especially for emergency medical events.

However, if you’re OK with lower limits on emergency medical, a OneTrip Prime or Basic plan could be a more appropriate choice. These costs represent a range of 3.4%-7.5% of the total cost of the trip, which is in line with typical costs of 4%-8%, according to the U.S. Travel Insurance Association.

» Learn more: How to find the best travel insurance

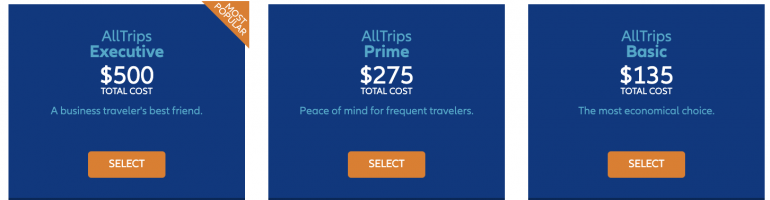

Allianz offers four different annual/multi-trip plans.

AllTrips Basic is suitable for those who would like emergency medical coverage while abroad but don't need trip cancellation and interruption benefits. The AllTrips Prime, Executive and Premier plans provide an entire year of comprehensive travel insurance benefits.

The Executive and Premier plans offer various levels of trip cancellation and interruption benefits. The Executive plan is specifically designed for business travelers since it offers protection for business equipment.

Allianz annual/multi-trip plans cost

Let's look at an example of an annual Allianz travel insurance plan that starts in July 2020 for a 50-year-old from Illinois.

Coverage under these plans is offered for trips up to 45 days in length.

The AllTrips Executive plan costs significantly more than the other plans; this is mainly due to higher trip cancellation coverage, emergency medical and business equipment protections. The Executive coverage amount for trip cancellation can be increased beyond what is quoted here, driving that plan's price up to as much as $785.

If you’re not concerned with pre-trip cancellation benefits and don’t need the increased level of medical coverage, the Basic plan is the most affordable option.

For trips longer than 45 days, the AllTrips Premier plan might be a better choice as it offers coverage for up to 90 days. Using the same search parameters but with 90 days of coverage per trip, the cost of the annual plan is $475.

Choosing the right plan for your trip involves understanding what type of coverage you will want while you’re abroad.

If you have a premium travel card (e.g., the Chase Sapphire Reserve® ): These cards often offer some trip cancellation and trip interruption coverage, so you may not need a plan that offers all the same coverage. In this case, getting the OneTrip Medical plan might be enough.

If you’re going on a trip and returning home: OneTrip Prime, Basic or Premier are good options to choose from while offering different levels of coverage.

If you’ll be going on multiple and longer trips: the AllTrips Premier plan might be best as it provides insurance benefits for trips up to 90 days in length. The remaining three annual AllTrips plans cover multiple trips, up to 45 days.

If the coverage provided by your card isn’t adequate, you don’t have credit card coverage or you didn’t pay for your trip with that credit card: In these instances, it's best to choose a comprehensive plan depending on how much coverage you need and for how long. Consider one of the single trip or multi-trip plans.

» Learn more: Your guide to Chase Sapphire Reserve travel insurance

Yes, head over to AllianzTravelInsurance.com and choose "Find a Plan" from the menu on the top.

You will be able to view all plans or see plans categorized by single trip, annual/multi-trip and a rental car add-on option. Once you’ve decided on the plan you want, choose the "Get a Quote" option.

You will be required to input the relevant trip details before you can see which plans are available to you in your state.

» Learn more: Is travel insurance worth it?

Travel insurance plans have a lot of exclusions that you need to pay attention to so you know exactly what type of coverage you’re getting. Here are some general exclusions you can expect:

High-risk activities: Skydiving, bungee jumping, heli-skiing, and other types of high-risk sporting activities that the insurer deems unsafe.

Intentional acts: Losses sustained from intoxication, drug use, self-harm and criminal activity.

Specifically designated events: Epidemics, natural disasters and war are specifically mentioned in the policy as exclusions.

It's important to note that exclusions may vary based on the policy and where you live, so it's always best to review the fine print to ensure you’re clear about what is and isn’t covered.

Allianz has been offering insurance for more than 25 years. The company is well established and offers numerous single and annual travel insurance policies to fit many different needs.

Allianz travel insurance plans offer a wide array of benefits including (but not limited to): coronavirus-related coverage, trip cancellation, interruption, emergency medical coverage and transportation, baggage loss/damage, baggage delay, travel delay, change fee coverage, loyalty program redeposit fees, 24-hour assistance and many more benefits. Each plan is different, so you’ll want to look at the specific plans you’re considering to know exactly which benefits you’ll receive.

No, Allianz doesn't offer the Cancel For Any Reason optional upgrade. Review the policy details of the Allianz plan you’re considering to ensure you’re comfortable with the list of covered reasons. For example, the loss of a job can be considered a covered reason, but wanting to cancel a trip because you’re afraid to travel isn't.

Most often, you will need to file a claim with the insurer after you’ve incurred costs. If the claim is approved, you will receive a reimbursement. In other instances (e.g., covered baggage delay), the insurer will pay you a fixed amount per day and you won’t need to submit receipts.

Allianz Global Assistance offers several good travel insurance plans to choose from. If you’re looking for a travel insurance plan for a vacation, a single-trip plan is your best bet.

If you’re a frequent traveler or take lots of business trips, a multi-trip plan could be the way to go. If you have a travel credit card, look at what travel insurance benefits you may already have so you don’t duplicate your coverage .

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Don't have an account? Register

Agents: need help?

Click here for answers to our Frequently Asked Questions

For further help and technical questions: Email Support

Shine the spotlight on your brand

Email Sales to find out how to get your content seen!

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

Generali Global Assistance

Learn about travel insurance plans offered through Generali Global Assistance and how they compare.

Generous coverage amounts for emergency medical expenses and evacuation

Customize your plan with select add-on coverages

Cancel for any reason (CFAR) coverage available with Premium plan

Preexisting conditions coverage available with Premium plan

Preferred pricing for families

CFAR coverage only reimburses at 60% and must be purchased within 24 hours of initial trip deposit

Baggage delay benefits require a minimum delay of 12 to 24 hours (depending on plan)

No annual plans

What Generali Global Assistance Is Known For

Generali Global Assistance keeps things simple by offering three main travel insurance plans for consumers: the basic Standard plan, the mid-tier Preferred plan and the Premium plan with superior coverage. These plans stand out in several areas, including their relatively high limits for emergency medical expenses and emergency medical evacuation, robust coverage amounts for travel delays, included concierge services, and 24-hour travel assistance.

The company's Premium plan offers the most coverage and highest policy limits by far, as well as access to several add-ons you can't purchase with other plans. For example, the Premium plan from Generali Global Assistance includes coverage for preexisting medical conditions, but only if travel insurance is purchased within 24 hours of making a final trip payment. This is unique from many other plans that cover preexisting conditions, which typically require you to purchase travel insurance within a few weeks of making an initial trip deposit instead.

This top-tier plan also includes rental car coverage automatically, and it's the only plan from Generali that lets consumers add on cancel for any reason (CFAR) travel insurance . With this type of insurance, individuals can cancel their trip for any reason and get part of their upfront costs back.

With CFAR coverage from Generali Global Assistance, however, travelers are only reimbursed up to 60% for prepaid travel expenses like airfare, hotels and tours. This is less than you'll get with many other travel insurance plans that let you buy CFAR coverage and reimburse at 70% to 80% of prepaid trip costs. Not only that, but you can only add CFAR coverage to a plan if you purchase travel insurance within 24 hours of making an initial deposit on your trip.

Generali Global Assistance Travel Insurance for Individual Trips

Generali Global Assistance offers three tiers of travel insurance protection to choose from. The basic Standard plan includes essential coverage with lower limits, and the Preferred and Premium plans offer more coverages with higher limits and more optional benefits.

The chart below highlights what you'll get with each of the travel insurance plans from Generali Global Assistance, plus the policy limits that apply.

As you compare travel insurance plans from Generali Global Assistance, you should know about some of the fine print terms that can apply. The most important details are highlighted below:

- Baggage delays: This coverage doesn't kick in until at least 24 hours with the Standard plan, 18 hours with Preferred coverage and 12 hours with the Premium plan.

- Baggage insurance: Items lost in baggage without a receipt are reimbursed at 75% of actual cash value (not replacement value).

- Sporting equipment: Sports equipment that's lost or stolen in baggage without a receipt will be reimbursed at 75% of actual cash value (not replacement value).

- Sporting equipment delays: This coverage requires an 18-hour delay with the Preferred plan and a 12-hour delay with the Premium plan.

- Travel delay coverage: This protection kicks in after a 10-hour delay with Standard plans, a delay of eight or more hours with the Preferred plan, and a six-hour delay with the Premium plan.

Generali Global Assistance Travel Insurance Costs

Costs for travel insurance from Generali Global Assistance vary based on the plan you select, the number of travelers in a plan, the total cost for a trip, the age of travelers and other factors. To help you get an idea of how much you'll pay for a plan, we applied for travel insurance quotes for several different trips that cost between $2,500 and $14,000.

Generali Global Assistance is accredited with the Better Business Bureau, where it also has an A+ rating. However, the company has a very low average star rating of just 1.11 out of 5 stars across 300-plus user reviews on the platform. The company has also closed more than 500 customer complaints with the BBB in the last three years, 258 of which were resolved in the last 12 months.

Generali has a 4.57 rating out of 14,000-plus reviews on InsureMyTrip and a 4.33 rating out of about 4,500 reviews on Squaremouth. On Trustpilot, the company has an average star rating of 3.4 out of 5 stars across more than 400 reviews from past customers. Below, we listed examples of positive and negative user reviews from several platforms that show some of the best and worst attributes of the company.

I've used Generali Travel Insurance in South America and Japan

I've used Generali Travel Insurance in the past. I like the website purchase as it is straightforward and displays 3 options with clear coverage. It only asked a few questions to filter the individual to the right product. – Richard S. via Trustpilot

Generali Global Assistance Standard

Generali was professional and courteous. I had to file a medical cancellation claim and it was easy to file and was resolved very quickly. Generali was great and I would use them again. – Edward K. via InsureMyTrip

Policy: Standard

My experience with Global was very good. The only issue was a computer glitch in their new claim system. It was a little confusing at times but my claim agent was very helpful and helped me get through the process. They settled my claim much faster than I anticipated. It was overall, a good experience. – Katherine via Squaremouth

If I could give this company 0 stars I would. My wife went into labor and they refused to refund us our vacation rental booking because they didn't consider a woman going into labor as an emergency. We even talked to them before canceling and they told us to cancel the whole booking to get our full refund. This is a HORRIBLE company that needs to be investigated thoroughly. Shame on VRBO for using them as a travel insurance company. – Tanner B. via Better Business Bureau

If I could give zero stars I would

If I could give zero stars I would. I think the people (or bots) giving higher stars have not had to make a claim. I was diagnosed with AML and will be hospitalized for a month to receive a stem cell transplant and needed to cancel my trip. I have uploaded all the documentation they requested. I have not been able to talk to an actual person. I have tried 4 different phone numbers and sent emails to the suggested address only to get an automated response. This company is a complete scam! – Denise via Trustpilot

Why Trust U.S. News Travel

Holly Johnson is a travel writer who covers topics like travel insurance, family travel, all-inclusive resorts and cruises. She has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world and has experience navigating the claims and reimbursement process. Johnson works alongside her husband, Greg, who sells travel insurance through their travel agency, Travel Blue Book .

Read more about Generali Global Assistance in:

- The Best Travel Insurance Companies

- The Cheapest Travel Insurance Companies

- The Best Travel Insurance for Europe

- The Best Travel Insurance for Mexico

- The Best Travel Insurance for Australia

IMAGES

VIDEO

COMMENTS

AgentMax Online is the online portal for travel agents who partner with Allianz Global Assistance. Log in to access policies, coverage alerts, and more.

AgentMax has been helping travel agents like you increase their sales and income for more than a decade. Now, we've made our award-winning sales tool even easier to use. ... Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products ...

Sign in to start your session. Remember me? Forgot your password?

We are currently experiencing technical difficulties while trying to retrieve your claims. For immediate assistance, please call 1-866-884-3556. Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Travel insurance can reimburse you for your prepaid, non-refundable trip costs — including vacation rentals, car rentals, hotels and flights — if you have to cancel for a covered reason. Travel delays leave you stranded. Travel insurance can reimburse you for eligible meals, accommodation and transportation expenses during a covered delay.

Learn how to sell and service Allianz Travel Insurance plans with our online solutions, software, brochures, and training. Complete the online participation agreement and access your account information the next business day.

Allianz Travel Insurance plans are underwritten by BCS Insurance Company or Jefferson Insurance. Company, depending on the insured's state of residence. AGA Service Company is the licensed producer and administrator of these plans. The Cancel for Any Reason Waiver is offered through Travel Impressions, which holds an agent or producer license ...

Now, when your customers book a Travel Impressions vacation, you can provide them with more flexibility and greater travel protection with a CFAR/TPI package. You'll also earn 30% commission on the travel insurance plan and 16% on the waiver when you book through AgentMax. Travel agents need to be partners with Allianz Global Assistance and ...

Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

AllTrips Premier. This plan provides an entire year of worldwide travel protection and concierge service. One plan can cover you and your household, whether you're traveling separately or together. Discover the affordable and comprehensive travel insurance plans offered by Allianz Global Assistant. Get a Quote and buy online instantly.

RICHMOND, VA, September 23, 2020 —Travel insurance and assistance company Allianz Partner has launched a new notification feature on its award-winning platform for travel advisors, AgentMax Online, which will help agents keep up to date on their clients' travel insurance needs.Using AgentMax's QuoteMax rapid quoting tool and its MaxMail email marketing function, travel advisors will now ...

Please avoid placing detailed personal data and credit card information in the email request. Please feel free to contact us with any questions or comments you may have: Phone: 1-866-884-3556. Mail: Allianz Global Assistance. P.O. Box 71533. Richmond, VA 23255-1533. Email us: We look forward to helping you with your inquiry.

Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Dedicated to helping and protecting. With over 30 years of experience helping Canadian travellers in their time of greatest need, we place the customer at the heart of everything we do. This commitment to caring and customer-first approach is a common thread throughout the full range of unique travel insurance and emergency assistance solutions ...

Allianz Travel Insurance plans are underwritten by BCS Insurance Company or Jefferson Insurance. Company, depending on the insured's state of residence. AGA Service Company is the licensed producer and administrator of these plans. The Cancel for Any Reason Waiver is offered through Travel Impressions, which holds an agent or producer license ...

Allianz Partners offers travel insurance plans for domestic and international trips, with 24/7 expert assistance and innovative technology. To access your account, log in at allianztravelinsurance.com or download the Allianz TravelSmart app.

Trip cancelations, delays, medical emergencies, lost baggage, unexpected crises, and more. Access to a worldwide network of prescreened hospitals. Quick claim payments for qualifying delays. 24-7 emergency assistance services. (855) 909-4004. GET QUOTES. Allianz Global Assistance gives travelers excellent standard coverage with its travel ...

Allianz single-trip plan cost. Here's a look at the cost of an Allianz travel insurance policy for a one-week, $1,500 vacation to Croatia in August 2020 taken by a 30-year-old from Texas. The ...

Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Agents: need help? Click here for answers to our Frequently Asked Questions . For further help and technical questions: Email Support

EN. E-mail *. Password *. Login. Forgot your password? We use cookies to personalize content and ads, to provide social media features and to analyze our traffic. We also share information about your use of our site with our social media, advertising and analytics partners. Click here to read our Cookie Policy. Accept.

Learn to Sell Allianz as an Expert. 3/7. The Allianz Partners Specialist Program includes information on all aspects of selling travel insurance: Ways you can provide better protection for your customers, as well as maximize your earning potential, by offering travel insurance from a dedicated, third-party provide.

The company has also closed more than 500 customer complaints with the BBB in the last three years, 258 of which were resolved in the last 12 months. Generali has a 4.57 rating out of 14,000-plus ...