- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

The Pros and Cons of Booking Through Online Travel Agencies

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

You’re likely already familiar with online travel agencies, even if you don’t travel often. These companies — such as Priceline , Expedia and Orbitz — act as intermediaries between you and a travel provider.

Booking your travel through an OTA can be a good idea in some circumstances, but you’ll want to be wary of its pitfalls. Let’s take a look at the pros and cons of online travel agencies, so you’ll know what to use to book your next vacation.

Pros of booking through online travel agencies

There are certainly advantages booking through online travel agencies, though you’ll find different experiences whether you’re using public OTAs — such as Kayak — or private ones like those offered by your card issuer, such as the Chase's travel portal .

✅ It may be cheaper

When searching for flights online, you may see different prices for the same routes that vary across websites. Although it may be a result of fare type — for example, some search results may not clarify that a fare is basic economy rather than main cabin or economy — other times, the difference comes down to competition for your business.

Online travel services will often offer slightly lower prices on flights in an effort to entice you as a customer. This is true for both hotels and airlines.

» Learn more: Best credit cards for online travel-booking websites

✅ It can earn you more rewards

Have you ever heard of shopping portals ? By logging into a shopping portal, you can earn rewards for purchases made with many online merchants. Some hotel chains, such as Hilton , Marriott and IHG , can be accessed through shopping portals while still booking directly on the hotel website. In this way, you can earn rewards with the hotel directly as well as with the shopping portal.

The same isn’t true for shopping portals and most airline sites. However, many public online travel agencies are accessible through shopping portals, which can then earn you rewards for airfare bookings. By opting to book in this way, you’ll be able to earn points or cash-back rewards through the shopping portal that you’d otherwise miss.

Some card issuers will also reward you heavily when using their online travel services. Clear examples of this can be seen with Capital One and Chase. With the Capital One Venture X Rewards Credit Card , for example, you’ll get 10 miles per dollar spent on hotels and rental cars booked through Capital One Travel .

The Chase Sapphire Reserve® is similar. With this card, you can get 10 Ultimate Rewards® points per dollar spent on hotels and rental cars booked through Chase's portal.

While these numbers are high, it’s important to remember that there are trade-offs when booking through an OTA rather than directly with a hotel or airline. We’ll get into that a little later.

Online travel agencies offered by your card issuer may not feature the same prices as booking directly; you’ll want to compare these before committing to a purchase.

Some card issuers will go so far as to give your points more value when redeeming through their online travel agencies.

This is true with the Chase Sapphire Preferred® Card . When redeeming points on Chase's travel portal, you’ll get 1.25 cents in value per point rather than 1 cent elsewhere.

» Learn more: How much are your airline miles and hotel points worth this year?

Cons of booking through online travel agencies

There are several downsides when it comes to using online travel services for booking travel. It mainly comes down to the fact that travel providers prefer that you book directly with them — and offer more perks to woo your business.

❌ It can be harder to change a booking

Ever needed to change a flight after it's booked? No matter the reason, attempting to alter or otherwise cancel a flight can be a hassle — especially if you’ve booked through a third party.

Generally speaking, rather than offering you direct assistance, both hotels and airlines will recommend you contact the online travel agency you’ve booked with in order to make any changes.

While you may be able to make changes or get refunds with the travel agency, airlines and hotels can — and will — offer much more flexibility when you’ve booked with them directly. You may also be subject to additional fees charged by the online travel agency, which can erase any savings you’ve received.

❌ You may not receive elite benefits

This is the real kicker for anyone wanting elite status. Although airlines will almost always recognize your elite status and allow you to earn miles even for bookings made through an online travel agency, hotels and rental car companies will not.

This is especially important for hotel chains. Earning elite status with hotels generally relies on elite night credits. Although these can be earned in a variety of ways — including having complimentary status by holding certain credit cards — the main method of acquiring elite night credits is by spending nights in hotels. Rooms booked through an online travel agency do not count toward elite status as elite night credits.

Additionally, you will not receive any of the benefits of your existing elite status if your booking is through a third party. This can mean the loss of perks such as room upgrades, complimentary breakfast and even free Wi-Fi.

» Learn more: The best airline and hotel rewards loyalty programs this year

❌ It may be more expensive

Did you know that many hotel chains have best price guarantees? Hyatt, Hilton, Marriott and IHG all have a guarantee that’ll give you either points or a discount if you find a better rate elsewhere.

These guarantees are generous; Hilton, for example, will match the rate and then discount it by a further 25%.

Although you’ll need to file claims for these guarantees and they face limitations — such as a 24-hour window from when you made the booking — you can save a lot of money on your stay if your request is approved.

Online travel agencies can be hit or miss

There are two sides to every coin and this is no different, as there are several benefits and limitations of online travel services. Depending on your needs and loyalty program status, you’ll want to choose whether to book directly with a travel provider or rely on OTAs to do the job for you.

Booking travel through credit card portals from issuers like Chase and Capital One can earn you big rewards. But if you anticipate altering your travel plans or aim to earn elite status instead, booking directly is the way to go.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1.5%-5% Enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

Up to $300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options.

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

Advantages and Disadvantages of Online Travel Agencies (OTAs)

Table of Contents

For many travelers, Online Travel Agencies (OTAs) are the preferred way to search for and book package deals, accommodation, flights, tours, and other travel. Online travel agents like Expedia, Hotels.com and Booking.com are among some of the most popular websites in the world.

For business-savvy tour operators who recognize that organic search engine traffic alone may not generate enough revenue, OTAs are an important component of a successful distribution channel strategy. They can help you reach many more travelers and generate more bookings. However, the advantages of OTAs need to be balanced with the disadvantages, like having to pay a commission on every booking.

To help you figure out the best plan of action, here’s a rundown of the pros and cons of online travel agents, and how you can use them to benefit your business.

What is an Online Travel Agency (OTA)?

An OTA is a one-stop online travel marketplace where travelers can search for, compare, and book everything from flights and hotels, to tours and car rentals.

Think of an OTA as an Amazon.com for travel. OTAs like GetYourGuide and Expedia attract millions of visitors every day because of their convenience, price and product comparison capabilities, and their huge range of hotels, tours, and other travel.

From an OTA’s perspective, the typical business model involves making money by taking a commission from each booking. Many also offer display advertising or charge companies a “pay-per-click” fee to ensure their listing appears at the top of relevant search results.

Advantages of Online Travel Agencies (OTAs)

Expand your reach.

The main advantage of OTAs is their huge popularity, which enables tour operators to reach more travelers. It’s no secret why OTAs attract so many people:

- Breadth of choice: Just as consumers use Amazon for buyer research and price comparison purposes, OTAs offer a huge range of experiences and price points for travelers who are shopping for something specific or looking for ideas.

- Price comparison and deals: OTAs are also popular among price-conscious travelers and bargain hunters. They let people search for travel within a set budget, and weigh their options in one place—comparing different options side by side.

- Convenience and ease of use: Like other online retailers, OTAs are simply an easy and convenient way to shop compared to the offline equivalent. The ability to use filters to narrow down their selection according to their preferences makes OTAs an invaluable time-saving tool when researching travel.

Create marketing efficiencies

OTAs spend enormous amounts of money promoting their websites. If you have a limited marketing budget, it’s a cost-effective way to reach a much larger audience. Listing your tours on an OTA could also increase sales through your own website—a phenomenon known as the “billboard effect” .

Many savvy buyers use OTAs as a type of meta search engine (a search engine within a website that surfaces results from lots of different search engines). For example, a traveler searches for “things to do Waikiki” on Expedia. To explore their options and narrow down their preferences, they’ll skim through activities, read reviews, and compare pricing before switching over to Google. Now they have a better idea of what’s out there and what they’re interested in, so their search keywords will be very specific. For example, “Atlantis Submarines Waikiki.”

So how do you benefit from this buyer behavior and make sure your business takes advantage of the billboard effect on OTA websites?

- Have a strong direct pricing strategy. Consider all of your costs, including digital marketing, resellers commission, etc. to come up with a price that works for your audience, market, and business.

- Build a strong SEO and paid-search strategy so you show up prominently in search results.

- Protect your brand name with selective organic and paid keyword combinations.

- Thoroughly read through an OTA’s terms before signing on. Make sure you own your brand name in paid search.

Generate more low season bookings

If you experience a downturn in sales during the low season , listing your tours on an OTA lets you piggyback their marketing efforts—at a time when you may need to reduce your costs—to sell tours more quickly, easily, and cost-effectively (even factoring in commissions) than you might be able to do yourself.

Gain invaluable insights

When you list your tours on an OTA, you may receive access to the analytics and data insights generated by the platform. Carefully consider how to measure your customers’ buying patterns. You can test different pricing strategies and use the platform’s analytics to spot potential new trends and opportunities, or use these insights to make better-informed business decisions.

Done correctly, all of these things allow business-savvy tour operators to use OTAs as a valuable tool for direct business.

Disadvantages of Online Travel Agencies (OTAs)

Having to pay a commission.

While listing on an OTA is free, OTAs make their money by charging a commission on every booking. This can be as much as 20% of the cost of the sale or even higher. Of course, this cost may be offset by selling more tours, faster.

Customer service issues and cancellation rules

One reason some travelers don’t like using OTAs is the customer service, or lack thereof. Post-sale, OTAs typically become the main contact for cancellation, booking changes, or issue resolution. If something goes wrong, such as a cancellation due to an unforeseen event, travelers can be left dealing with a large company and the impersonal and unsatisfying customer service that often goes along with that. This may also affect their impression of your business.

Risk of overbooking

Overbookings can be a common problem even if you don’t currently list on an OTA. You might already be taking bookings over the phone, at your office, on your website, and through resellers. Adding multiple online travel agents to the mix can create more work to manage overbooking your tours and activities. Doing it manually or using a number of different systems and processes can be unproductive, reducing the many benefits of selling through OTAs. The best solution for overbooking is a centralized booking system with a channel manager that lets you keep track of all your bookings.

Potential loss of business

It is actually possible to hurt revenues by using an OTA due to common OTA marketing strategies. For example, an OTA might favor some tour companies over others due to them receiving a higher commission. That means your business finds it more difficult to appear in searches, while a competitor appears prominently.

Loss of complete control

The moment you start using an OTA, you face limitations around how you can market your business on their site. This includes restrictions on how tour descriptions are presented, a limited ability to edit and update listings, and so on. The good news is that you can offset this potential disadvantage by connecting to an OTA via a centralized booking system that allows you full control over your content.

Examples of Online Travel Agencies (OTAs)

Ready to get started with OTAs? Here’s an online travel agency list to check out—from huge global brands selling everything from flights to vacation rentals and experiences, to smaller, more niche OTAs.

A leading booking site for the Asian market in particular, offering all types of travel bookings, especially accommodation.

Part of the Expedia Group, which owns multiple OTAs, also including Orbitz and Travelocity.

One of the largest OTAs for tours and activities in the world.

GetYourGuide

A growing OTA specializing in unique experiences, especially for millennial travelers.

A growing OTA focused on selling tickets to museums and other attractions, but that does list other local experiences.

All of these websites have a section explaining how they work with tour companies, what their commission is, and how to get started.

Already selling through OTAs? Integrate Rezgo with Expedia, Viator, and GetYourGuide to manage your availability and revenues in one place and ensure a smooth customer experience.

Editor’s Note – July 2022: Updated to reflect the current percentages charged by OTAs.

Written By | Rob Mathison

Rob Mathison is a Vancouver-based freelance writer focusing on tech, travel, digital marketing, and education. He is a co-author of The Complete Resident’s Guide to Vancouver.

Previous Article How To Promote Your Tour Business and Activity Packages on Social Media

Next Article Your Marketing Mix: the 7 Ps of Travel and Tourism Marketing

Related Posts

Articles , Increase Online Bookings , Tourism Trends

17 innovative tourism business ideas and trends for 2024.

Articles , Increase Online Bookings , Marketing Strategies

Your marketing mix: the 7 ps of travel and tourism marketing.

Articles , Increase Online Bookings , Tourism Best Practices

Search the blog.

- All Categories

- Increase Online Bookings

- Tourism Best Practices

Most Popular Articles

- 17 Innovative Tourism Business Ideas and Trends for 2024 130 views

- Your Marketing Mix: the 7 Ps of Travel and Tourism Marketing 46 views

- How to Create a Business Plan for Your Tour or Travel Company 24 views

- Advantages and Disadvantages of Online Travel Agencies (OTAs) 23 views

- How to Create and Promote Amazing Tour Packages 14 views

I have read and agree to the Rezgo Privacy Policy

GET STARTED

Sign-up for a free demo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmo tempor incididunt ut labore et dolore magna aliqua.

Schedule A Demo

- Property Management System

- Channel Manager

- Booking Engine

- Marketplace

- Revenue Management

- Cloudbeds Payments

- Cloudbeds Amplify

- Whistle for Cloudbeds

- B&Bs and Inns

- Hotel Groups

- Vacation Rentals

- Channel Connections

- Ambassador Partner Program

- Cloudbeds Horizon

- Become a Partner

- Customer Stories

- Resource Center

- Guides & Reports

- Calculators

- What to Expect

- Customer Success

- Knowledge Base

- Compass What's new in Q2

- Cloudbeds University

- Government Compliance

- Company News

- Meet the Team

- Careers We're Hiring!

- Become an Ambassador

- Event Schedule

5 benefits of using online travel agencies

Online travel agencies (OTAs) can be one of the greatest allies that lodging operators have. They help open up new markets and secure a stream of steady bookings when used in parallel with a strong direct booking strategy. Travelers gravitate towards OTAs due to their strong presence, which results in trust and credibility.

Here, we look at some of the benefits OTAs bring to travelers.

1. Convenience

With so much information online today, travelers use OTAs to easily browse and book their accommodations using a trustworthy website. OTAs provide the convenience of price, location, and property-type comparisons. The ability to filter down thousands of properties to one that fits their trip goals is an invaluable tool that saves hours of time.

2. Loyalty programs

Larger OTAs have loyalty programs that reward travelers for booking multiple trips through their site, including rooms (or beds), car rentals, plane tickets, and activities. For example, the new One Key reward program gives travelers the flexibility to earn and use rewards across Expedia Group using OneKeyCash.

3. Price-driven decisions.

Online travel agencies are often considered the cheapest place to book and the best place to find package deals. Though many hotel brands have tried to change this perception by pushing direct booking campaigns and strategies, OTAs still benefit from being thought of as low-cost leaders.

For example, Agoda has a ‘ Coupons & Deals ’ section of its website offering daily deals and spontaneous savings. Every day, these offers change and include incentives such as percentage off coupons and special rates on select hotels. Offers like this are hard for consumers to pass up and help increase the likelihood of generating a booking.

4. Extensive advertising & marketing budgets

Discount and deal-centric advertising campaigns help shape consumer notions that OTAs are the best place to book. In Q1 2024 alone, Airbnb, Expedia Group, Booking Holdings, and Trip.com Group spent a combined $4.08 billion USD on sales and marketing, up 10.6% from Q1 2023.

How are they spending these enormous budgets? Skift reports the going rate for a 30-second Superbowl slot during the 2024 game was $7 million USD, with Booking.com making an appearance with its Booking.yeah ad.

Airbnb, on the other hand, partnered with Mattel to deliver the “Malibu Barbie DreamHouse” listing on Airbnb. Airbnb CEO Brian Chesky said this campaign “became a phenomenon on social media and got more press, more articles than our IPO.”

Online travel agencies have one job: to get their inventory, including yours, in front of the right person at the right time. They’re constantly creating new and innovative ways to get rooms and rates in front of travelers. Of course, the cost of this innovation is how they justify their fees and commissions to the properties that list on their platforms.

5. Secure global payments & traveler protection

OTAs give travelers the ability to complete safe and secure payment transactions in their preferred currency. They support multiple payment methods depending on location, providing travelers the flexibility that independent properties are often unable to accommodate unless they use secure, integrated payment processing (which the Cloudbeds Hospitality Platform offers) that’s equipped to send hospitality-enriched data to banks and also supports multiple payment methods and currencies.

In addition, OTAs often offer traveler protection to provide peace of mind while booking. Last year, Airbnb introduced Aircover, a free protection for travelers included for every guest. Its purpose is to help provide refunds or new accommodations if you experience an issue such as a host cancellation, trouble checking in, or a key missing amenity.

The Big Book of OTAs

- First name *

- Last name *

- Property Name *

- Property Type * Property type* Hotel Bed and Breakfast Hostel Apartment Groups Vacation Homes Alternative Accommodations

- How many listings do you have?

- How many Addresses does your business have?

- Language for your demo * English

- Increase revenue

- Delight guests

- Streamline operations

- Property Name

- Property Type Property type* Hotel Bed and Breakfast Hostel Apartment Groups Vacation Homes Alternative Accommodations

- Postal Code

- Language for your demo English Spanish Portuguese Franch Vietnamese Japanese Thai Italian

- Cloudbeds Hospitality Platform

- Cloudbeds Websites

- Ambassador Program

- Product Updates

- Cloudbeds Login

- Terms of Service

- Privacy Policy

- Data Security

- Cookie Policy

- Accessibility

Exploring the Pros and Cons of Online Travel Agency Bookings: A Comprehensive Guide

When planning a trip, there are numerous options available for booking accommodations, flights, and activities. One popular avenue is booking through online travel agencies (OTAs). These platforms provide a convenient way to compare prices, read reviews, and book all aspects of your trip in one place. However, like any other option, booking through OTAs has its pros and cons.

The Pros of Booking Through Online Travel Agencies

1. Convenience and Time-Saving: One of the biggest advantages of using OTAs is the convenience they offer. With just a few clicks, you can compare prices, check availability, and make reservations. This saves valuable time and effort that would otherwise be spent researching multiple websites or contacting providers individually.

2. Extensive Options: OTAs typically have a wide range of accommodations, airlines, and activities listed on their platforms. This gives travelers the opportunity to explore different options and choose the one that best suits their preferences and budget. Whether you’re looking for a luxury hotel or a budget-friendly hostel, OTAs have got you covered.

3. Deals and Discounts: OTAs often offer exclusive deals and discounts that may not be available elsewhere. These promotions can help you save money on accommodations, flights, car rentals, and more. By taking advantage of these offers, you can stretch your travel budget further and potentially enjoy additional perks like complimentary breakfast or room upgrades.

4. User Reviews and Ratings: One of the key features of OTAs is the ability to read user reviews and ratings. This allows you to get a sense of the quality and reputation of a particular provider before making a booking. By relying on the experiences shared by other travelers, you can make more informed decisions and avoid potential disappointments.

The Cons of Booking Through Online Travel Agencies

1. Lack of Personalized Service: While OTAs offer convenience, they often lack the personalized service that you might receive when booking directly with hotels or airlines. If you have specific requests or preferences, it can be more challenging to communicate them through an intermediary platform.

2. Hidden Fees and Charges: Some OTAs have been known to add hidden fees and charges during the booking process. These additional costs may not be apparent until you reach the final stages of making a reservation. It’s important to carefully review the terms and conditions to avoid any unexpected expenses.

3. Limited Flexibility: When booking through an OTA, you may encounter restrictions or limitations in terms of changes or cancellations. These policies can vary depending on the provider and the type of reservation. It’s crucial to understand the terms and conditions before committing to a booking.

4. Potential Information Gaps: Although OTAs strive to provide comprehensive information, there may be times when important details are missing or incomplete. This can include updates on renovations, construction nearby, or other factors that could impact your stay or travel experience. It’s essential to conduct additional research and reach out directly to the provider if necessary.

In conclusion, booking through online travel agencies offers convenience, extensive options, deals, and access to user reviews. However, it’s important to consider the potential drawbacks such as limited personalization, hidden fees, inflexibility, and potential information gaps. By weighing the pros and cons, travelers can make an informed decision about whether to use OTAs or explore alternative booking methods for their next adventure.

Exploring the Ups and Downs of Booking through Online Travel Agencies: A Comprehensive Analysis

Related questions, what are the advantages and disadvantages of using online travel agencies for booking travel arrangements.

Advantages: 1. Convenience: Online travel agencies (OTAs) offer a convenient platform for travelers to search, compare, and book various travel arrangements from the comfort of their own homes. 2. Wide range of options: OTAs provide access to a vast selection of airlines, hotels, car rental services, and other travel products, allowing users to choose from a wide range of options at different price points. 3. Competitive prices: Due to their large network and bargaining power, OTAs often offer competitive prices and exclusive deals that may not be available through other channels. 4. User reviews and ratings: Most OTAs include customer reviews and ratings for hotels, airlines, and other services, providing valuable insights and helping users make informed decisions. 5. Ease of customization: Many OTAs allow users to customize their travel itineraries by selecting specific flights, accommodations, and additional services to meet their particular needs.

Disadvantages: 1. Additional fees: Some OTAs may charge extra fees for services such as booking changes, cancellations, or seat selections, which can increase the overall cost of the trip. 2. Lack of personalized assistance: Unlike traditional travel agents, OTAs do not typically provide personalized customer service or assistance in case of travel disruptions or emergencies. 3. Limited flexibility: Certain travel arrangements, such as complex itineraries or multi-city trips, may be challenging to book through OTAs, as their systems may not accommodate all specific requirements. 4. Potential misinformation: Occasionally, OTAs may display incorrect information regarding flight schedules, availabilities, or hotel amenities, leading to misunderstandings or inconveniences for travelers. 5. Less negotiation power: While OTAs offer competitive prices, they may have limited flexibility for negotiating terms or additional perks compared to direct bookings with airlines or hotels.

Overall, using online travel agencies can be a convenient and cost-effective option for many travelers. However, it is essential to weigh the advantages and disadvantages carefully and consider individual travel preferences and needs before making a booking decision.

How do online travel agencies impact the financial aspects of planning a trip, such as savings and costs?

Online travel agencies (OTAs) have a significant impact on the financial aspects of planning a trip. They offer several benefits that can help travelers save money and manage costs more effectively.

Savings: OTAs play a crucial role in providing competitive prices for flights, accommodations, and other travel services. They often negotiate exclusive deals and discounts with airlines, hotels, and car rental companies, allowing travelers to access lower prices than those available through traditional booking methods. This competition among different OTAs can result in considerable savings for travelers who shop around and compare prices.

Costs: OTAs also provide transparency and convenience in comparing prices and services across multiple vendors. By using an OTA, travelers can easily compare various options and select the most cost-effective one. Additionally, some OTAs offer package deals that include flights, accommodations, and other services at a bundled price, which can often be cheaper than booking each component separately.

Expert Insights for Financial Planning: Many OTAs also provide helpful financial planning tools and insights. These resources can assist travelers in managing their budgets, tracking expenses, and optimizing their spending during the trip. Moreover, some OTAs offer loyalty programs or reward systems, allowing users to earn points or discounts for future travels, essentially providing a long-term financial benefit.

Travel Insurance: OTAs often offer optional travel insurance packages that provide coverage for unexpected events such as trip cancellation, medical emergencies, or lost luggage. While these add-ons may increase the overall cost of the trip, they offer financial protection and peace of mind in case of unforeseen circumstances.

However, it’s important for travelers to exercise caution when using OTAs. Some OTAs may charge additional fees or have less flexible cancellation policies. It’s crucial to carefully read the terms and conditions, compare prices across different platforms, and consider the reputation and reliability of the OTA before making a booking.

In summary, online travel agencies can have a positive impact on the financial aspects of trip planning. They offer competitive prices, convenient comparison tools, and often provide financial insights and protection options. However, travelers should remain vigilant and make informed decisions to ensure they are getting the best value for their money.

Are there any specific risks or considerations to be aware of when using online travel agencies for booking travel, particularly in relation to credit card payments and protection against fraud?

When using online travel agencies (OTAs) for booking travel, there are certain risks and considerations to keep in mind, especially related to credit card payments and protection against fraud.

1. Security of Payment Information : It is essential to ensure that the OTA’s website has secure socket layer (SSL) encryption, indicated by a padlock symbol in the website address. This encryption protects your credit card information from being intercepted by hackers.

2. Use Credit Cards for Payments : When making online bookings, it is generally recommended to use a credit card rather than a debit card or bank transfer. Credit cards offer better fraud protection and dispute resolution options compared to other payment methods.

3. Read Reviews and Do Research : Before choosing an OTA, read reviews and do thorough research. Look for customer experiences related to any credit card fraud issues or instances of identity theft. Stick to well-established and reputable OTAs.

4. Check the OTA’s Terms and Conditions : Carefully review the OTA’s terms and conditions regarding cancellation policies, refunds, and chargebacks . Ensure they have a fair process in place to protect your rights in case of fraud or unauthorized charges.

5. Monitor Your Credit Card Statements : Regularly monitor your credit card statements for any suspicious activity or unauthorized charges. If you notice anything unusual, contact your credit card provider immediately to report fraud and take necessary actions.

6. Consider Travel Insurance : Travel insurance can provide additional protection against trip cancellations, interruptions, or other unforeseen circumstances. Some policies also cover fraud-related losses, providing an extra layer of security.

Remember, while most OTAs maintain high-security standards, no system is entirely foolproof. By taking these precautions and staying vigilant, you can reduce the risk of credit card fraud and ensure a safer online booking experience with online travel agencies.

Disclaimer: The information provided here is for general informational purposes only and should not be considered as professional financial advice. Always seek the advice of a qualified expert or conduct thorough research with official sources before making any financial decisions.

Table of contents

Discover financial empowerment on CJDFintech.com, your guide through the world of credit, loans, insurance, and investment with straightforward, expert advice.

Recent articles

Frontier miles: the complete guide to maximizing your travel rewards, exploring the surprising truth: a hotel kitchen may not save you money after all, unlocking the benefits: a comprehensive guide to carecredit card for smart financial management.

All You Need to Know About Mortgage Loan Modifications: A Comprehensive Guide

Unlocking Opportunities: Everything You Need to Know About Commercial Bridge Loans

5 Ways Merchants Can Protect Themselves from Credit Card Fraud: Tips for Avoiding Becoming a Victim

447 Broadway 2nd floor

New York, NY 10013

Copyright © 2015-2023 CJD Fintech

ColorWhistle

Digital Web Design Agency India

Explore our Market-Fit Services

We ensure to establish websites with the latest trends as we believe that, products whose value satisfies the needs of the market and its potential customers can be efficiently successful.

Quick Links

- About Us – ColorWhistle

- Engagement Models

- Testimonials

- Case Studies

- Agency Services

- Web Development

- Web App Development

- Digital Marketing

- Travel Website Development Services Company

- Real Estate Website Development Services Company

- Education Website Development Services Company

- Healthcare Website Development Services Company

- Hotel and Restaurant Website Development Services

Category: Travel

Date: May 31, 2024

Online Travel Agencies – A Brief Introduction

The role of an online travel agency (OTA) is becoming increasingly important in the accommodation industry as they provide a convenient way for travelers to arrange their stay. From the comfort of their home, travelers can compare hotel prices and book them over the internet.

In this blog, we are going to discuss what an OTA is, the best OTA platforms, travel website development and how to do it right, and more.

Ready? Let’s go.

What Are Online Travel Agencies?

An online travel agency (OTA) arranges and sells accommodations, tours, transportation and trips on an online platform for travelers. They are third parties who sell services on behalf of other companies.

Usually, these OTAs offer many benefits with added convenience with more of a self-service approach. They also include a built-in booking system which allows instant bookings.

How Do Online Travel Agencies Work?

OTAs generally work on two models. They are,

1. Merchant Model

In this model, hotels sell rooms to OTAs at a discounted or wholesale price. Then, the OTA sells them to the customer at a markup price

2. Agency Model

This is a commission-based model where OTAs acts as a distribution partner. OTAs receive full commission after the stay has taken place. The hotel directly receives the payment from the end customer and does not wait for the payment transfer from third-party distributors.

What Are the Benefits of Partnering with Online Travel Agencies?

In one word – exposure! Online travel agents get thousands of website visitors from all over the world. Plus, they have positioned themselves as an authority on everything related to travel. So, people trust the recommendation they receive from OTAs.

By listing in OTAs, accommodation businesses like hotels not only reach a vast set of audience but will also find their service among many other reputable sources of information.

In addition, hotels that are listed on OTAs can also benefit from what is referred to as the ‘billboard effect’. This means that OTAs provide a form of advertising for service providers such as hotels on their platforms. Once the user gains this awareness, they may even go to the website of that particular hotel to make a direct booking.

What Are the Advantages and Disadvantages of Selling Through Online Travel Agents?

Accommodation businesses like hotels and B&Bs have pros and cons of getting listed in OTAs. Let’s take a look at them.

Advantages Of Online Travel Agents

- Low-cost method of selling accommodation services

- Reduced online marketing spend as OTAs invest in advertising to attract potential customers

- Impartial reviews give customers the confidence to book

- Users can easily compare various accommodation costs at one place

Disadvantages Of Online Travel Agents

- Commission rates are charged on every sale. It can range between 10-15% of the gross cost

- Restrictive cancellation terms

- Even if accommodation businesses use OTAs, the need for their own website and booking engine does not go away

- Investment in a balanced multi-channel strategy may be needed to boost sales

Even though OTAs can help to fill your rooms, accommodation businesses must try to maximize revenue through their own website. Consistent work on search engine optimization tactics and other digital marketing techniques is a must. Accommodation businesses must focus on customer retention techniques and directly target their existing customers through emails and direct marketing.

How To Start An Online Travel Agency?

Travel agencies no longer inform customers about the availability of flights and rooms. They issue rooms and get a commission from the respective accommodation businesses. That is why most of the new travel businesses follow the OTA model.

If you plan to enter the OTA arena, you can specialize in pilgrimages, leisure travel, business travel or any niche. But, focusing on how effectively you offer things is the key to success.

Here Are Some Points You Have To Consider When Starting An Online Travel Agency.

- Register the name of your agency and if applicable, take a license as per your local laws

- Try to get a membership in IATA or any other reputed travel organization

- Gain more knowledge about the travel industry and particularly the nice you want to concentrate

- Get your travel website designed by a professional company like ColorWhistle

- Offer deals that focus on a specific geography. Focusing on a particular niche will also bring more success

- Publicize your business in the online space

- Utilize the power of blogging

- Create a good social media presence

Why Do People Use Online Travel Agencies?

here are some of the main reasons they prefer ota’s..

- Few OTAs offer reward programs which can be used for future travel needs

- Special rates which cannot be found elsewhere

- Some OTAs may have generous cancellation policies. For example, Priceline does not offer any penalty if the user cancels the ticket until the end of the next business day

- Most users may not have an idea on where to book other than an OTA

- OTAs make it easy to compare different rates

Which Are the Best OTA Platforms?

1. booking.com.

Booking.com is one of the largest accommodations websites which has now expanded to smaller markets such as family-operated bed and breakfast, vacation rentals and self-catering apartments.

Interesting statistics

- Every day, 1,550,000 nights are booked

- 68% of nights booked came from families and couples

- 42% of nights booked came from unique places such as homes and apartments

- 38% of reviews are given by guests which are useful for other travelers

- 75% of nights booked come from guests who booked more than 5 times

2. Expedia’s Hotels.com

Expedia’s Hotels.com is a popular brand which has a global audience and attracts diverse travelers. The company gained more power in the industry by acquiring Travelocity.

- Gets over 675 million monthly site visits

- Operates in 70+ countries and 40+ languages

- Attracts 75 million monthly flight shoppers

Airbnb revolutionized the travel accommodation industry by introducing home-sharing. The website has diverse listings and travelers get a sense of safety as they can know their guest’s identity.

- 2.9 million hosts are present on Airbnb

- Average of 800k stays each night

- 14k new hosts join every month

Apart from these major OTAs, there are many small ones such as OneTravel, Vayama, Tripsta, TravelMerry, ExploreTrip, Kiss&Fly, Webjet, GoToGate, Travelgenio, Bookairfare, Fareboom, Skybooker, Travel2be, OneTwoTrip!, and eBookers.

Drive Conversions and Boost your Business with Expert Travel Website Development.

What the future holds for online travel agencies.

It is clear that, in the near future, accommodation businesses are not about to back down from OTAs. They are enjoying the billboard effect and trying their best to retain website visitors and convert them into direct booking.

Sure, there is a cost involved. The upside of this is that accommodation businesses are working hard to create a loyal customer base that will continue to seek direct bookings.

The chances of OTAs suffering in the long run are pretty slim. Smaller accommodation businesses have a lot to gain from the exposure they receive through OTAs. Plus, a large portion of the younger generation prefers OTAs. So their market will continue to grow.

If you need any help to design, develop or market an OTA website, contact our travel web design and development experts at ColorWhistle .

We can create an amazing website with beautiful designs combined with dynamic content such as live rates and special offers. Contact us today for your free business analysis and consultation.

In quest of the Perfect Travel Tech Solutions Buddy?

Be unrestricted to click the other trendy writes under this title that suits your needs the best!

- Travel Meta Search Engine

- GDS Travel Agency Guide

- GDS OTA Travel Meta Searchengines

- Travel Aggregator Website

- Best Travel Websites Inspiration

- Travel Website Features

- Top WordPress Travel Website Themes

Related Posts

Enhancing Travel Marketing with AI-driven Customer Insights

How Predictive Maintenance Can Help the Travel Industry

Exploring the World Through AI and VR in the Travel Industry

About the Author - Anjana

Anjana is a full-time Copywriter at ColorWhistle managing content-related projects. She writes about website technologies, digital marketing, and industries such as travel. Plus, she has an unhealthy addiction towards online marketing, watching crime shows, and chocolates.

View Our Services

Have an idea? Request a quote

Share This Blog

its a good website i love it

i think it is a great website i love it so much but i need more information about what am looking for. thanks

It is a good website and I need more information for learning

I learned a lot through this web.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Ready to get started?

Let’s craft your next digital story

Sure thing, leave us your details and one of our representatives will be happy to call you back!

Eg: John Doe

Eg: United States

Eg: [email protected]

More the details, speeder the process :)

Discussion Schedule: Ready for a GMeet Call Discussion Today / Tomorrow Available on a Phone Call Discussion Today / Tomorrow Send me a Calendar to Book The Meeting

Pros and cons of an online Travel agency vs. offline travel agency

What is the difference between an online travel agency and an offline travel agency? We will look at the pros and cons of online travel agencies vs. offline travel agencies

By Jessica Freedman

February 9, 2024

As travel managers constantly look for ways to optimize their corporate travel programs, part of doing so is understanding the differences between going digital or taking your travel management needs offline. In this explanatory guide, we will look at the pros and cons of online travel agencies vs. offline travel agencies so that you are prepared to understand the differences in order to choose the travel booking tool and management system that is most suitable for your company.

Here’s what we’ll cover:

- What is a TMC?

What is an OTA?

Pros and cons of online travel agencies, offline travel agencies, pros and cons of offline travel agencies, how to choose the best corporate travel platform.

Let’s start with a short introduction to some simple terminology to give you a guiding hand.

Types of online booking tools

For starters, to recognize the difference between online travel agencies and offline, it’s important to understand that there is a wide range of online booking tools available for travel. Let’s take a look at the different types:

Travel aggregators

Corporate online booking tools, direct bookings, travel agencies.

Travel aggregators are websites that essentially consolidate the travel offers and prices from multiple sources all in one place. This allows users to book at the lowest prices based on the results listed in the search results. This helps users find the best prices out of all the results the aggregator has found. This way it is easy for consumers to know that they are booking at the lowest price possible.

TMCs like BCD (which we will discuss more in detail below) can function as a travel aggregator. For instance, for hotel bookings, TMCs combine GDS content with content from Expedia, Booking.com, HRS, and others offering this all together in a mobile app or website. In the case of AMEX, they have a proprietary online booking tool, called KDS, which also serves as a travel aggregation tool.

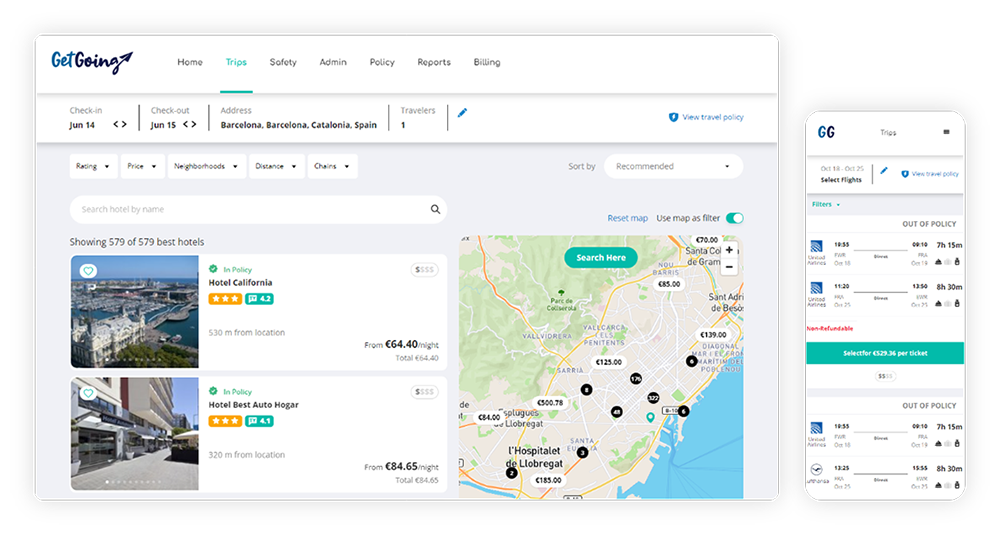

When it comes to business travel, corporate online booking tools are frequently used by businesses to keep a hand on their business travelers. Corporate online booking tools are ideal for keeping track of trips, travel spend, and ultimately streamlining business travel. GetGoing and Booking.com for business are examples of corporate online booking tools, as well as EHI Direct .

Direct bookings are carried out by going directly to the airline, hotel, train or rental car company’s respective sites and booking directly instead of through a third party.

We will look more at online travel agencies, or OTAs below, but the idea is that you can get access to travel inventory all in one place. Online travel agencies are the most common way of booking online travel.

What is a TMC?

A TMC, or a Travel Management Company uses a Global Distribution System (GDS) as a travel booking tool. TMCs started before the boom of online travel. Travel was booked in a traditional way via telephone or email and then arrangements were made by travel agents.

Nonetheless, TMCS have evolved since their beginnings, investing in making business travel more digital even though they still have a way to come in terms of technology. TMCs offer the value of industry experience while offering more personal service through their agents. TMCs integrate custom-built booking preferences to give business travelers the best choices within their travel policy , allowing them to compare options. As a travel manager you can work with your TMC to decide how you want to set up your business travel program.

A TMC like BCD Travel, AMEX, and CWT can help companies make the most of their travel in general beyond just booking travel. They can give a helping hand with cost analysis, reporting, duty of care, etc., but that isn’t to say that an online travel agency won’t provide you with data reports of your travel spend.

Full-service business and corporate travel management companies can help optimize, manage and improve your business travel, ensuring you adhere to your travel policy, and providing seamless booking experiences, while offering a hand with travel data, allowing you to optimize your travel spend and costs to make the most out of your business travel program.

OTAs, or online travel agencies offer customers the possibility to book their travel online. OTAs started in 1996 with Travelocity being the first online travel agency. Most of them started off with a strong digital product and platform and added agent support/service as an added benefit.

They are third party agents who sell services on behalf of airlines, hotels, car rental companies, tour operators and others. They arrange and sell accommodations, tours, transportation and trips on an online platform for travelers. Some well-known travel platforms such as Booking or Expedia act both as travel agencies and tour operators allowing customers to read reviews to decide where to stay, and also book package holidays.

Several online travel agencies are only customer-facing, like the above examples, whereas other OTAs can service both B2B and B2C like Booking.com, which offers services for business clients as well as regular customers. On the other hand, OTAs like GetGoing and Travel Perk are designed exclusively with Business travelers in mind .

What is an online travel agent?

An online travel agent is an OTA that is part of web-based platform that allows users to book travel services over the internet. Online travel agents are intermediaries between travelers and service providers like airlines, hotels, car rental companies and tour operators. They provide a central platform to book, compare and search for travel arrangements, whether it be for business or leisure.

OTAs have a big market share

The global business travel market is a $695.9 billion industry as of 2020 , and is expected to reach $2,001.1 billion by 2028. Whereas the online travel market is a $433.2 billion dollar industry, with the revenue share of online sales in the global travel and tourism market at 66% (according to a study by Statista.com ).

As can be noted by the 66% market share of online travel sales, the great majority of reservations are being made via online travel agencies, and for this reason, OTAs have become an important distribution channel for tourism businesses. While OTAs are often used to book holidays and leisure trips, there are also online travel agencies, known as Travel Management Companies, or TMCs that have the same functionality as OTAs but are primarily used by companies or businesses.

Advantages and disadvantages of online travel agency

An online travel agency is convenient, has a wide range of options, allows you to easily compare prices, can be a great way to see reviews and ratings from other users, gives special deals and discounts and is available 24/7. Some disadvantages of an online travel agency is that there may be hidden fees, you have less leeway for personalization, customer service is harder to track down, and there is less flexibility.

Now that you have a better idea of some of the basic terminology, and some of the advantages and disadvantages of an online travel agency, let’s look at some of the pros and cons of an online travel agency.

online travel agency

1. an online travel agency is self-service .

Online travel agencies are a way to self-manage your travel needs. They have an integrated online booking tool that allows you to make travel arrangements, make cancellations, manage bookings and do everything that a brick and mortar travel agency would let you do with the convenience and benefits of a self-service approach.

2. Keep track and manage travel expenses

In addition to being self-service, as a travel manager, with an online travel agency or TMC you can keep track of your travel spend and optimize your expenses while at the same time automating your travel policy so that travelers will be notified when their travel expenses are out of policy, and ensuring that you stay on budget.

3. Increased productivity

Working with an online travel agency leads to more productivity because you spend less time managing your trips. All your trip information is conveniently stored in your profile so that you can manage, edit and cancel hotel bookings, car rentals, train bookings as necessary. This means that in the case of travel managers, you can work with the OTA to automate your travel policy, which takes the automated work out of the hands of you and your travelers.

4. Help keep travelers safe

In the case of an online travel platform like GetGoing, you can have added assistance in keeping your traveler’s safe thanks to built-in AI technology that prefers the safe travel options, like not passing through high-risk countries, helping to fulfill your duty of care. You can also have access to traveler tracking and emergency support in the case of need.

1. Less personal

While online provides great convenience, one of the cons is that it is less personal, lacking the personal touch of an in-person offline travel agency. Of course there is always the possibility to call, chat or speak to a representative, it’s not the same as a face-to-face encounter, especially for managing business.

2. Less hand-holding

For those inexperienced travelers, online travel agencies can be more “do-it-yourself” meaning that there is less hand-holding if you need it . This can take away from productivity because travelers must evaluate the options themselves, rather than having a TMC that can give you a helping hand. A TMC would be able to discover the most effective (and safest options), meaning less layovers in potentially risky countries.

3. Hard to get around the rules

When you are working with an offline agency it’s easier to bend the rules or get around travel provider’s policies. TMCs can oftentimes make changes to bookings without charges that travelers or travel managers on their own wouldn’t be able to do thanks to their business relationships with the providers.

Now that we’ve looked in depth at online travel agencies, let’s take a look at offline travel agencies, including their pros and cons.

What is an offline travel agency?

Offline Travel Agencies are travel agencies, including corporate travel departments, who operate from “brick and mortar” offices. This means that they have physical offices rather than operating as an OTA with only a website. Customers typically call or go to their offices to get travel-related services, which they provide using a GDS like Galileo. An offline travel agency usually has a team of travel agents who can help clients book flights, hotels, car rentals and other travel services.

While it’s true online travel agencies have gained popularity for their convenience, there are still many who prefer the personalized service provided by a face-to-face interactions at offline travel agencies. Offline travel agencies may cater to a specific market or specialize in certain kind of travel, i.e., business travel, group trips, leisure travel, etc. and this kind of assistance and hand-holding may give clients a sense of reassurance.

Advantages and disadvantages of offline travel agency

An offline travel agency has its advantages like the ability to get expert advice, personalized service, the face-to-face component, the ease of problem resolution, and the convenience of being hand-held along the process of booking travel. However, there are also some disadvantages like limited accessibility, potentially higher costs, limited choices, time-consuming, constraints on availability of store hours, and perhaps less transparency.

Now that you have a better idea of what an offline travel agency does, as well as the advantages and disadvantages, let’s take a look at some of the pros and cons.

offline travel agency

1. it’s more personal.

As much as we move more and more towards a digital-first approach, there is still an element of face-to-face contact that can’t be replaced. This is one of the main pros of an offline agency, being able to meet in person to book travel and even design your corporate travel program. Also for the travel agency, it’s easier to cater to the traveler’s needs, and really understand what they are looking for.

2. Enhanced service

Since online agencies tend to be more self-service, it can be argued that offline agencies offer enhanced services. Trip planning, including more complex routings or integrated travel booking, which include multiple forms of transport, accommodation and leisure activities can be more easily managed with an offline travel agency, setting them apart from their offline counterparts.

3. It’s more inclusive

While for the purposes of this article, we are more focused towards business travel, it goes without saying that offline travel agencies are more inclusive. According to a study by the UN’s ICT agency, an estimated 37% of the world’s population (2.9 billion people) have never used the Internet. For that reason, in underdeveloped countries, an offline travel agency is still crucial in order to service this part of the population.

1. Not as flexible

With an offline travel agency, you must adhere to business hours in order to make your business travel plans. If it’s late at night and you are working after hours to plan your business trip, this means you’ll have to wait until the next business day to book your trip.

2. Less technology-forward

Of course, offline travel agencies use technology like GDS to book your travel, it goes without saying that a traditional offline travel agency is less technologically advanced. Unlike online agencies, they don’t have to rely on technology or even have a fast website to help make travel plans. Since they are dealing with external systems for the most part, there is no precedent for having a technologically-forward website.

3. Less efficient

While it can be efficient to work with an offline agency when you are booking complex trips with multiple providers, it can be less efficient for everyday use. With OTAs, all the information is readily available making it quick and efficient to book a trip. In the case of going offline, you have to rely on the help of an agent to take care of your everyday travel needs, which can be less efficient than handling travel plans on your own.

Now that you’ve fully understood the pros and cons of an online travel agency vs. an offline travel agency, here are some tips to choose a corporate travel platform that’s right for you.

- Look for balance between online technology with offline support

- Ease of creating your travel policy

- Safety first

- Simple approach to data

- Allows you to save money

1. Look for balance between online technology with offline support

This means that you have a tool that has all the functionalities of an online travel platform, but with expert service and assistance when you need it most. Sometimes business travel doesn’t go as planned; there might be delays, lost luggage, long wait times, cancellations, overbookings or a wide range of other issues. This is why you need to have a support system in place that is ready to help when the going gets tough. At GetGoing you have the ease of digital but with the guarantee of 24/7 service when you need it. This way you can travel worry-free knowing that an expert is there to lend you a hand if any of these unexpected circumstances arise.

2. Ease of creating your travel policy

When it comes to creating your travel policy, you want to find a travel management company that will support you in creating a policy that allows you to save money, protect your travelers and optimize your business travel. This is why you should look for a TMC that allows you to automate your travel policy . Automation is at the core of productivity and by optimizing your travel policy, you can also save money.

3. Safety first

Whether you decide to go with an online travel agency or an offline travel agency, ensure that your traveler’s safety is first and foremost. This means that you should be able to offer certain security measures to your travelers so that as business travel slowly recovers, they feel safe to get going.

4. Simple approach to data

Not everyone on your team is data-savvy, so you want to find a corporate travel management system that makes understanding data easy. Whether you’re a Finance manager , an HR or Office Manager , you need to have a system that allows you to visualize your data, including travel spend, seeing how much travel is booked within your travel policy, and using detailed reports to optimize routes, supplier relations and keep your travelers happy. Having data at your fingertips is the best way to optimize your business travel program.

5. Allows you to save money

While optimizing your travel program, and understanding your data, you will without a doubt save money. However, another very important part of business travel is having access to corporate travel deals . Not only does having access to deals save you money, but your staff will also be more productive because they don’t have to look in a million different places for the best deals.

Get a helping hand in business travel

GetGoing is your helping hand in business travel so that you can book, manage and optimize your business travel. We provide the ease of a digital platform but with the peace of mind of a travel agency.

- Empower your team

- Save time and money

- Gain more visibility

- Ensure safe and comfortable travel

Go share the news:

Sign up now to receive exciting news & updates.

- Digital Advertising

- Social Media Marketing

- Digital Marketing Services

- Ontario SEO

- Digital Marketing Resources

Home / Digital Marketing Blog / The Advantages and Disadvantages of Online Travel Agencies

The Advantages and Disadvantages of Online Travel Agencies

If you’re a business in the travel and tourism sector you’ve probably considered partnering with online travel agencies in an effort to boost your revenue. In this blog, we’ll explore the advantages and disadvantages of working with online travel agencies so you can make an informed decision about whether it’s the right choice for your business.

What is an Online Travel Agency?

An Online Travel Agency (OTA) is a digital platform that facilitates the booking and purchase of travel-related services such as flights, hotels, car rentals, vacation packages, tours, and more. Put simply, they are an intermediary between customers and travel suppliers, offering a centralized platform for travellers to search, compare, and book travel services online.

5 Advantages of Working with Online Travel Agencies

Working with OTAs can provide several advantages for businesses in the travel and tourism industry. Here are the top five advantages:

1. Increased Brand Awareness

Partnering with OTAs allows businesses to tap into their vast user base and reach a wider audience. Listing your business on popular OTAs such as Expedia or Booking.com may significantly increase your brand visibility and awareness among potential customers who may not have discovered your business otherwise.

2. Lower Cost of Operations

OTAs can handle various aspects of the reservation process, including managing bookings, handling returns or exchanges, and customer support. By offloading these operational tasks, businesses can reduce their internal workload and operational costs, allowing them to focus on other core areas of their operations.

3. Access to a Wider Customer Base

OTAs often cater to a diverse range of travelers, attracting customers of various demographics, regions, and preferences. By partnering with OTAs, businesses gain access to this extensive customer base, exposing their offerings to a broader audience and increasing the chances of attracting new customers who align with their target market.

4. Ability to Leverage Their Marketing Budgets

OTAs often have substantial marketing budgets to promote their platform and offerings listed on their site. By partnering with OTAs, businesses can benefit from this marketing power and leverage their advertising campaigns, reaching a larger audience and gaining exposure that may be challenging to achieve independently.

5. Simplified Bookings Process

OTAs typically provide user-friendly platforms that allow customers to browse, compare, and book various travel services seamlessly. By integrating your offerings into an OTA’s booking system, you can provide a hassle-free experience for customers, leading to increased bookings and customer satisfaction.

5 Disadvantages of Working with Online Travel Agencies

While there are several advantages to working with OTAs, there are also some drawbacks that travel and tourism businesses need to consider:

1. Lack of Direct Client Relationship

Since the OTA acts as an intermediary between the business and the customer, it can be challenging to establish a direct line of communication and build a personalized connection with clients, potentially limiting opportunities for upselling or personalized service.

2. Brand Dilution and Loss of Customer Ownership

By listing offerings on OTAs, businesses risk diluting their brand identity and losing ownership of the customer experience. Customers may perceive the services as being solely associated with the OTA rather than recognizing the business behind it. This can weaken the business’s unique selling proposition and diminish the opportunity to foster long-term customer loyalty.

3. Commission Fees

Working with OTAs typically involves paying commission fees for each booking or transaction facilitated through their platform. These fees can eat into the business’s profit margins and impact overall revenue. Therefore, the costs associated with commissions should be carefully considered and factored into your business’s financial calculations.

4. Limited Customization and Branding

Online travel agencies often have standardized templates and formats for presenting travel offerings, limiting the level of customization and branding that businesses can apply. This can restrict the business’s ability to showcase its unique features, highlight its value proposition, or differentiate itself from competitors on the OTA platform.

5. Dependency on Third-Party Platforms

Relying heavily on online travel agencies for bookings and customer acquisition can create a dependency on third-party platforms. While OTAs provide valuable exposure, businesses risk losing control over their distribution channels as any changes or disruptions in the policies, algorithms, or availability of the OTA platform could directly impact the business’s visibility and revenue.

Should You Work with Online Travel Agencies?

Deciding whether or not to work with OTAs is a strategic decision that requires careful consideration. While working with OTAs can expand your reach and boost your bookings, that doesn’t mean you should neglect your marketing efforts of generating direct bookings.

At Ontario SEO, we specialize in driving direct bookings for our clients in the travel and tourism industry. Our marketing campaigns can complement your OTA program or replace them. Contact us today to discover how our comprehensive digital marketing services can support your business goals and ensure a successful online presence.

Share this blog post on social media:

Recent Posts

Why You Need to Save Your Universal Analytics Data Now

Google Announces Major Changes to Comply With the DMA

Why Your B2B Business Needs Social Media Marketing

Google is Replacing Perspectives Filter with Forums Filter

Google Tests SGE AI Overviews in the U.S

How to Choose a Category for your Google Business Profile

- English (UK)

- English (CA)

- Deutsch (DE)

- Deutsch (CH)

The 10 best online travel agencies in 2024

The top 10 online travel agencies.

- Booking.com

- Lastminute.com

Best online travel agencies for business travel

1. travelperk.

Main offerings and features:

- Industry-leading travel inventory

- Flexible booking with FlexiPerk

- Safety alerts with TravelCare

- Integrated travel policy & approval flows

- Centralized invoicing

- Easy & real-time expense reports

- Carbon offsetting with GreenPerk

- 24/7 fast customer support in target 15s

- VAT reclaim

- Integration with 3rd party tools , such as expense management or HR software like Expensify and BambooHR

Save time and money on your business travel with TravelPerk

2. sap concur.

?)

- Works with some of the biggest brands

- Easy tracking and reporting of expenses for expense reports

- Many connected apps, such as Uber and Airbnb for cars and hotels

- One solution for a variety of business travel spending

Click below to compare both platforms’ features and benefits

?)

- Ample integrations

- Award-winning mobile app

- Employee-centric travel management

Click below for a more detailed comparison between both platforms:

Best online travel agencies for leisure travel, 1. booking.com.

?)

- Intuitive booking tool and website

- Flight + Hotel booking for easily planning trips with no cross-referencing travel websites

- Simple car rental options and taxi hire

- Available in over 40 different languages and offers over half a million properties across 207 countries

- You can book experiences in your destination city to entertain you on your travels

- Genius rewards program

?)

- Simple interface and booking tool

- Deals when making more than one booking

- 38 different languages and offers a 24-hour, multilingual customer support service

- Free cancellation within 24 hours of booking

- Millions of reviews to help make your decision

3. Lastminute.com

?)

- Filter hotels according to budgets, star ratings, guest ratings, board types, and more

- ATOL protection on flight + hotel bundles

- Flash sales for last-minute deals

- Payment plans to spread out the cost of travel

- Extra entertainment booking for your trips, like theatrical productions and day trips

- Gift cards for gifting travel

?)

- Expedia rewards for hotels, cars, and more

- Experienced support

- Compare cruise lines

- Big savings when booking flights, hotels, and car rentals

- Operates in nearly 70 countries and in over 35 different languages

- Luxury travel options

?)

- Book hotels, flights, cars, and bundles

- 24/7 support

- Lower prices on the app

- Great last-minute deals for spontaneous travel

6. Bookmundi

?)

Best online travel agencies for flights

1. skyscanner.

?)

- Super flexible booking filters

- Cheaper flights and hotels than other OTAs

- Price alerts for travel routes of interest

- Easy-to-use booking tool and UI

- Hundreds of location and currency options

- One-way, return, and multi-city travel options

2. Kiwi.com

?)

- Simple flight booking tool

- Partnerships with Booking.com and Rentalcars.com

- Discover deals anywhere with the option to open up your search

- Easy-to-use app

How do online travel agencies work?

What are the advantages of booking through an online travel agency.

- Access to comparison tools

- Peer reviews to help you with your decisions

- Flexible cancellation policies

- All your travel in one place

- Local flights and deals

Rewards programs

Comparison tools, peer reviews, flexible cancellation.

?)

Flexiperk: Cancel anytime, anywhere. Get a minimum of 80% of your money back.

One account for all of your travel needs, a local approach to global travel, wrapping up.

?)

Make business travel simpler. Forever.

- See our platform in action . Trusted by thousands of companies worldwide, TravelPerk makes business travel simpler to manage with more flexibility, full control of spending with easy reporting, and options to offset your carbon footprint.

- Find hundreds of resources on all things business travel, from tips on traveling more sustainably, to advice on setting up a business travel policy, and managing your expenses. Our latest e-books and blog posts have you covered.

- Never miss another update. Stay in touch with us on social for the latest product releases, upcoming events, and articles fresh off the press.

Speak to a travel expert

?)

10 Most impactful travel technology companies in 2024

?)

5 best corporate travel management apps

?)

The 8 best business travel management companies in Europe

- Business Travel Management

- Offset Carbon Footprint

- Flexible travel

- Travelperk Sustainability Policy

- Corporate Travel Resources

- Corporate Travel Glossary

- For Travel Managers

- For Finance Teams

- For Travelers

- Thoughts from TravelPerk

- Careers Hiring

- User Reviews

- Integrations

- Privacy Center

- Help Center

- Privacy Policy

- Cookies Policy

- Modern Slavery Act | Statement

- Supplier Code of Conduct

The benefits of online travel agencies

With the current brouhaha swirling around the scuffle between American Airlines and online travel agencies Orbitz and Expedia (in case you haven't heard, American has pulled its fares from Orbitz and Expedia has pulled American's fares from Expedia.com and Hotwire.com), I've seen a lot of blog post comments basically saying, "Who needs online travel agencies? What good are they? I always book directly with the airline's website anyway. Good riddance!"

But before we dance a jig around the grave of these third-party web sites, let's all take a deep breath and remember what travel agents — whether online or "bricks and mortar" — are good for.

Online travel agencies do at least six things well that airline sites don't (meta search sites such as Kayak offer some, but not all, of these advantages):