Wells Fargo Mobile 4+

Mobile banking you can trust, wells fargo.

- #14 in Finance

- 4.9 • 9M Ratings

Screenshots

Description.

Account Management •Access your cash, credit, and investment accounts with Touch ID®¹ or Face ID®¹ •Review activity and balances •View your credit card transactions and manage your rewards •Easily activate or turn cards on or off², add cards to digital wallets³, view recurring payments, and manage account access with Card Settings Deposit Funds⁴ •Deposit checks using your iPhone® camera •Instantly view the processing deposit in your account Make Transfers and Payments •Transfer funds between your Wells Fargo accounts and to other financial institutions⁵ •Send and receive money with friends and family using a U.S. mobile phone number or email address with Zelle®⁶ •Pay your bills •Add your eligible cards to Apple Wallet™ to use Apple Pay® for fast and convenient payments³ Track Investments •Monitor balances, holdings, account activity, and open orders for your WellsTrade® accounts •Get real-time quotes, charts, and market data Stay Secure •Visit the Security Center to report fraud and maintain safe accounts •Manage alerts⁷ •Get notified of suspicious card activity with alerts •Access to your FICO® Credit Score Contact Us •Email [email protected] •Locate one of more than 12,700 ATMs or find one of our approximately 4,800 branches •Set up an appointment to meet with a Banker ____________________________ Screens are simulated. 1.Only certain devices are eligible to enable biometrics. 2.Turning your card off is not a replacement for reporting your card lost or stolen. 3.Not all smartphones are enabled to use a digital wallet. Your mobile carrier’s message and data rates may apply. 4.Some accounts are not eligible for mobile deposit. Deposit limits and other restrictions apply. 5.Terms and conditions apply. See Wells Fargo’s Online Access Agreement for more information. 6.Mobile numbers may need to be enrolled with Zelle before they can be used. Available to U.S.-based bank account holders only. 7.Sign-up may be required. 8.Some features may not be available on all mobile devices. Apple, the Apple logo, Apple Pay, Apple Watch, Face ID, iPad, iPad Pro, iPhone, iTunes, Mac, Safari, and Touch ID are trademarks of Apple Inc., registered in the U.S. and other countries. Apple Wallet is a trademark of Apple Inc. App Store is a service mark of Apple Inc. FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries. Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license. Investment and Insurance Products are: •Not Insured by the FDIC or Any Federal Government Agency •Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate •Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested DEPOSIT PRODUCTS OFFERED BY WELLS FARGO BANK, N.A. MEMBER FDIC. Investment products and services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC (WFCS) and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company. WellsTrade(R) and Intuitive Investor(R) accounts are available through WFCS. Use of stock symbols is for illustrative purposes only and not a recommendation. 9.$0 per trade is applicable to commissions for online and automated telephone trading of stocks and exchange-traded funds (ETFs). For stock and ETF trades placed with an agent over the telephone, a $25 agent-assisted trading fee is charged. Each trade order will be treated as a separate transaction subject to commission. An order that executes over multiple trading days may be subject to additional commission. One commission will be assessed for multiple trades, entered separately, that execute on the same day, on the same side of the market. Other fees and commissions apply to a WellsTrade account. Schedule subject to change at any time. PM-04202025-6041073.1.1

Version 24.06.00

We are continuing to roll out Wells Fargo Mobile® app updates each month. New this month: •CD accounts now have a streamlined view with easy access to important account information •Receive reminders and check-in for your appointment on the Wells Fargo Mobile® app and more coming throughout 2024!

Ratings and Reviews

Has options that are unusable.

Things like ‘report your card lost or stolen’ and ‘replace your card’ after nothing your app can actually do. They will give you an 800 number to call, where they then try to force you into using the sentence “my voice is my password please verify me”. Big mistake! Don’t do that I have in the past and it locks you out of your account plus anyone with a voice cab impersonate you easy enough to trick their kindergarten-level-security-system. Next, Good help you if it’s the weekend because they will make you talk to people for hope until they tell you claims department is closed on Saturdays and Sundays so ordering a new card, disputing a charge or unlocking you’re card won’t happen until Monday-Friday (regular business hours; probably closes at va 5pm, can’t recall). So don’t este your time, they are all good at pretending to help then after half an hour or more, tell. You thru can’t help. And they get all confused and offended if you breathe. I’m thinking about changing my bank but I’ve only had this account open for a week and I’m already having so many debit card issues. Last Thursday or Friday I disputed two .97 cent charges from Facebook and they said they’d have to shoot my entire card down which I had for several days, I see today a new charge went thru and I’m wondering why why the card supposedly was cancelled indefinitely last week! So these liars wasted my time in the phone and during this review!

Developer Response ,

We're sorry to hear that and would like to try and help. Please email us with details (phone number, link to this public comment and your reviewer name) at [email protected]. Do not share anything private when emailing us, such as account numbers. -Roger

Very Nice App, Minor Quirks

The Wells Fargo app is a very good one - you can nickname accounts (even ones from Greenhouse by Wells Fargo), send and request money via Zelle in-app, and add external accounts and initiate transfers from the app. The colors are nice and vibrant, and the iconic stage coach graphics are nice. There are some minor quirks, of course; certain options are given names instead of using the description (i.e. card lock/unlock is under “Control Tower”), so it can be a bit difficult to find certain options or features, at least when you haven’t used the app in a while. Some suggestions for the app - incorporating pictures of bank cards (debit and credit) within the app would be a neat visual; being able to rearrange your accounts within the app (like Chase and Capital One) would be awesome; and maybe some trivia in the app would be nice, including historical trivia about Wells Fargo bank, being one of the oldest banks around (US). When clicking/tapping on the last four digits of accounts numbers to see the whole thing, seeing the routing number would be awesome, so you know are what it is, and being able to copy it to the device’s “clipboard” would be awesome. And finally, being able to view product information would be really nice; ie. view information for checking/savings accounts, as well as credit cards & certificate accounts too. Hopefully some of these things could be implemented in the near future.

Overall meh, still lacking useful features.

I’ve been a customer for several years now and have used their mobile nearly since opening my accounts. Yet their app has really only been good for basic functions such as checking balances or making simple deposits, withdrawals, or payments. The app itself has always lacked an intuitive interface. It’s always been confusing finding several functions, or straight up lacking, like searching for old transactions. It took them years for you to simply view your bank statements other than logging in on a desktop or even viewing your own account numbers or routing numbers. The biggest glaring, missing feature is a useful budgeting/spending tool. Recently a monthly spending report has been added, albeit within layers of unclear tabs and options. This spending report is pretty useless. I’m guessing it categorizes transactions based on the institution classification that the charge went to, and then shows an overall amount spent on that category. It doesn’t show you the transactions in question so you don’t know what you spent on which could help in managing your spending in the future. Bank of America has a great budget/spending tool that clearly shows what you’ve spent on and not just dumping everything into general categories. As a long time customer I would like to see something like this added. Pretty soon the lackluster services provided by Wells Fargo will soon outweigh the hassle of transferring accounts to another bank.

We're sorry to hear that and would like to try and help. Please email us with details (phone number, link to this public comment and your reviewer name) at [email protected]. Do not share anything private when emailing us, such as account numbers. -Becky

NOW AVAILABLE

App privacy.

The developer, Wells Fargo , indicated that the app’s privacy practices may include handling of data as described below. For more information, see the developer’s privacy policy .

Data Linked to You

The following data may be collected and linked to your identity:

- Contact Info

- User Content

- Identifiers

Data Not Linked to You

The following data may be collected but it is not linked to your identity:

- Financial Info

- Diagnostics

Privacy practices may vary, for example, based on the features you use or your age. Learn More

Information

English, Spanish

- Developer Website

- App Support

- Privacy Policy

Get all of your passes, tickets, cards, and more in one place.

More by this developer.

Wells Fargo CEO Mobile

WellsOne Expense Manager

Wells Fargo Meetings & Events

E-Inspect By Wells Fargo

You Might Also Like

T-Mobile MONEY: Better Banking

Citi Mobile®

Aspiration Spend, Save, Invest

GO2bank: Mobile banking

Lili - Small Business Finances

PenFed Mobile

Wells Fargo Rewards program: How to earn, redeem and transfer points

Alongside the launch of the Wells Fargo Autograph Journey℠ Card (see rates and fees ), Wells Fargo revamped its travel rewards program, adding a total of six transfer partners — five airlines and one hotel — to its Wells Fargo Rewards program.

Previously, those holding the Wells Fargo Autograph℠ Card (see rates and fees ) could earn points and redeem them for 1 cent per dollar through the portal. However, Wells Fargo points are now more valuable with the addition of transfer partners, as cardholders can maximize their points by earning transferable rewards .

Keep reading to find out more about how to earn, redeem and transfer your Wells Fargo Rewards.

How to earn Wells Fargo Rewards

To earn Wells Fargo Rewards, you need to spend on your Wells Fargo credit card. If you sign up for the Autograph Journey Card, you will earn 60,000 bonus reward points after spending $4,000 in the first three months. If you opt to redeem your rewards via the Wells Fargo portal, your points will be valued at 1 cent each; therefore, this bonus would be worth $600. However, as mentioned, you can get more value out of your welcome bonus points if you transfer them to travel partners.

Aside from earning points via the welcome bonus, you will earn 5 points per dollar spent at hotels, 4 points per dollar spent on airline purchases, 3 points per dollar spent on other travel and restaurant purchases and 1 point per dollar spent on other purchases.

If you're searching for a no-annual-fee credit card, you may want to check out the Wells Fargo Autograph Card , which offers 20,000 bonus points after spending $1,000 in purchases within the first three months of card membership. Plus, you'll earn 3 points per dollar spent on restaurants (dining in, takeout, catering, delivery and more), travel-related purchases (airfare, hotels, car rentals, cruises and more), gas (gas stations and electric vehicle charging stations), transit (subways, ride-sharing services, parking, tolls and more), streaming services and phone plans. You'll also earn 1 point per dollar spent on other purchases.

Though no longer available to new applicants, the Wells Fargo Visa Signature® card will allow you to redeem 1.5 cents per point on travel redemptions through the online portal.

The information for the Wells Fargo Visa Signature card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Wells Fargo Rewards transfer partners

Wells Fargo Rewards joins the list of valuable transferable currencies you can earn alongside Chase Ultimate Rewards , Capital One miles, American Express Membership Rewards , Citi ThankYou Rewards and Bilt Rewards® .

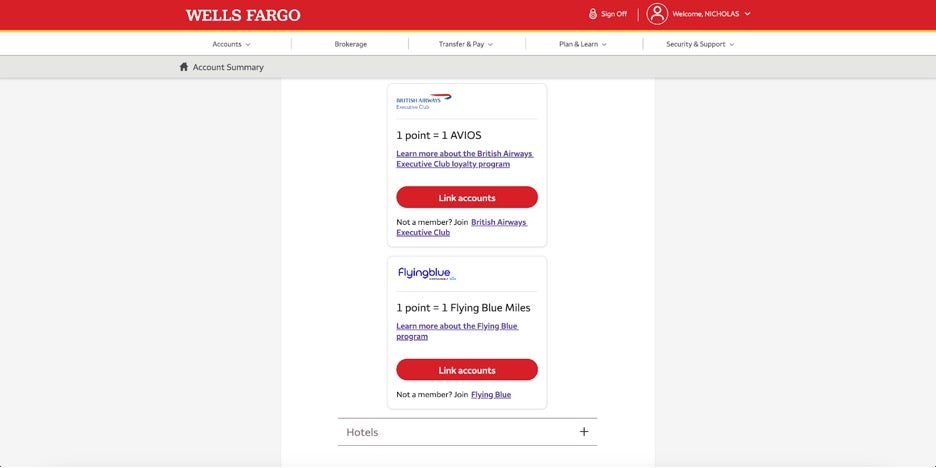

As of April 4, Wells Fargo Autograph and Journey cardholders can now transfer their points to the following programs at a 1:1 ratio:

- Aer Lingus AerClub

- Air France-KLM Flying Blue

- Avianca LifeMiles

- British Airways Executive Club

- Iberia Plus

- Choice Privileges (transfers at a 1:2 ratio)

Related: How (and why) you should earn transferable credit card points

How to redeem Wells Fargo Rewards

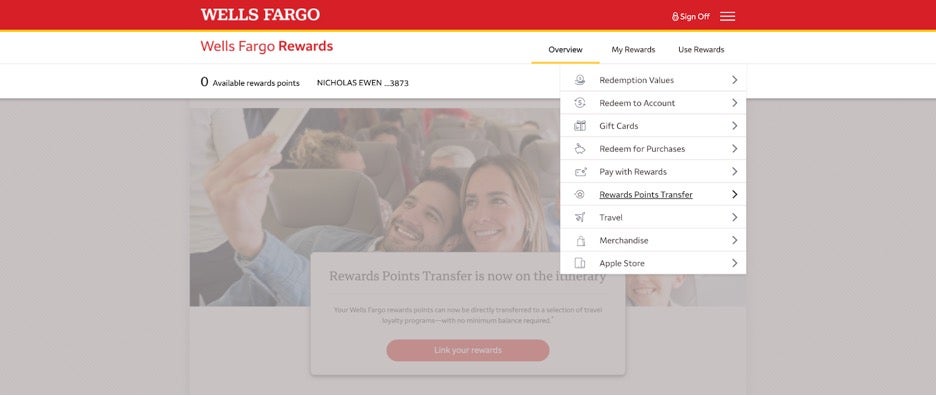

To redeem your points, sign into your credit card account or the mobile app and click on the Wells Fargo Rewards page. From there, you can hover over "Use Rewards" and select how you would like to redeem your rewards.

You can redeem your points for travel, such as airfare and hotels, make a charitable donation, buy products from retailers, pay for specific purchases using points, purchase gift cards or get a statement credit for items already purchased.

When used for travel purchases, Wells Fargo Rewards can be redeemed at 1 cent per point. However, other redemptions, such as when purchasing gift cards or items from retailers, may be redeemed at a lesser value.

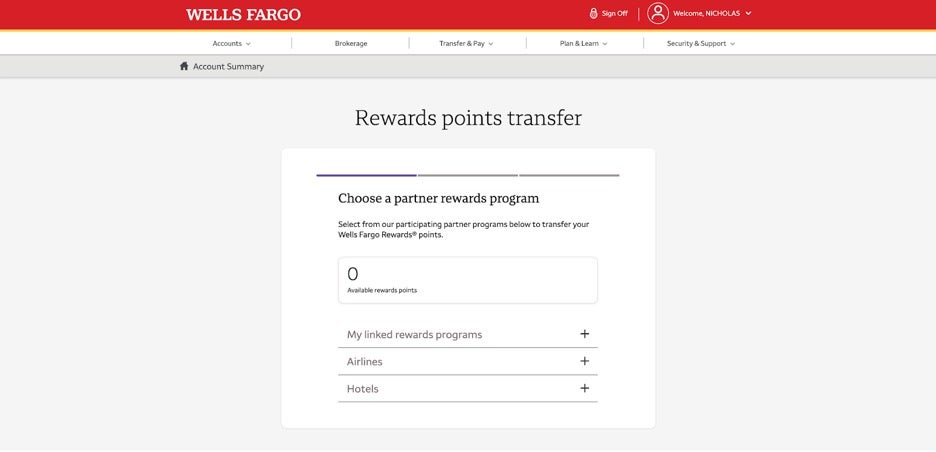

If you want to transfer your points, hover over "Use Rewards" and select "Rewards Points Transfer." You'll see a list of the airlines and hotel transfer partners.

From there, click on "Link accounts" for the partner you want to link and enter your partner account number before clicking "Continue."

You'll see a confirmation message to confirm that the accounts have been linked (it only takes a few seconds). From there, you can transfer points (if you have them), but if you click "Cancel," you'll come back to the main transfer page — which now has a new expandable menu labeled "My linked rewards programs."

Transfers can be made in multiples of 1,000 points, with a 1,000-point minimum. Remember, transfers are non-reversible, so be sure you check award availability on the partner's website if you're transferring points for a specific redemption. Also, transfers may not happen instantly, so keep that in mind when looking to book award travel.

Wells Fargo Rewards credit cards

Though Wells Fargo offers several types of credit cards, including cash rewards cards, you can currently only earn Wells Fargo Rewards points with the following cards:

- Wells Fargo Autograph Journey Card

- Wells Fargo Autograph Card

Both cards offer an attractive welcome bonus to help you earn points to redeem on your next travel or shopping purchase. With the introduction of transferable partners, we're excited to see Wells Fargo expanding its loyalty program. Plus, we wouldn't be surprised if the number of airline and hotel partners grows within the next two years to compete with other credit card reward companies.

We'll Be Right Back!

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Wells Fargo Credit Cards Mobile App Review

Chanelle Bessette is a personal finance writer at NerdWallet covering banking. She previously worked at Fortune, Forbes and the Reno Gazette-Journal. Her expertise has appeared in The New York Times, Vox and Apartment Therapy.

Kimberly Palmer is a personal finance expert at NerdWallet. She is also the author of three books about money: "Smart Mom, Rich Mom," "The Economy of You" and “Generation Earn.” Kimberly's work also appears at NerdWallet Canada .

Erin is a credit card and travel rewards expert at NerdWallet, based in Baltimore, Maryland. She has spent nearly two decades showing readers unique ways to maximize their investments and personal finances. Prior to joining NerdWallet, Erin worked on dozens of newsletters and magazines in the areas of investing, health, business and travel with Agora Publishing. Her love of travel led to a passion for credit card and loyalty rewards to subsidize trips, and she thrives on teaching others how to harness the power of credit card rewards. When she's not writing or editing, Erin is planning her next adventure for her family of four using points and miles. Erin recommends this card as the cornerstone for all travelers looking to build up their rewards portfolio - see it here.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

The Wells Fargo app gives customers a quick overview of their accounts and makes it easy to make payments, turn cards on or off and manage rewards. Just like on the bank’s website, you can toggle between different accounts and easily explore different rewards options.

The app’s navigation often isn’t intuitive, but if you use it for the same purpose each time, such as making a payment or reviewing transactions, it’s easy to find your way.

» MORE: See NerdWallet’s Best Wells Fargo credit cards

The Wells Fargo mobile app can help you perform basic functions, such as viewing your account balance and activating a new card. Some features that can simplify managing your credit card include:

Login and security

To log in to the app, you can manually enter your username and password or you can set up Face ID. The app logs you out after a period of inactivity.

Upon login, you land on an account summary page, which displays information from all your Wells Fargo accounts, highlighting your credit card balance and available rewards balance.

From there, you can navigate to different sections, including making a payment or viewing past statements.

Users can opt into 2-step verification for the app and desktop logins, which means that in addition to entering your username and password, you will also be prompted to enter a code sent to you by text, phone call, or email. That provides an additional layer of security.

Making payments

Once you click on your credit card account from within the app, you can pay your card from a connected bank account with a few taps. You can also review upcoming due dates, minimum payments due and available credit. From the app, you can add cards to your digital wallets, including Apple Pay and PayPal.

Monitoring transactions

It’s easy to scroll through your most recent purchases, including temporary authorizations, and you can also view older purchases through statements that are posted as PDFs on the app.

Protecting your money

From the main menu button on the bottom right, you can turn cards on or off, request a replacement card, activate credit cards, and more. You can notify Wells Fargo of upcoming travel plans, too, to prevent an erroneous fraud alert from being placed on your card.

Rewards and redemptions

If you have a rewards-earning card, you can click on your Wells Fargo Rewards , and from the app you can redeem them for a variety of options, including statement credits, travel, gift cards and merchandise. Clicking on some options prompts you to leave the app and go to a browser page.

Credit score monitoring

Tap the "Menu" icon at the bottom of the app’s screen and look for the "Financial Planning" tab. There you can view your FICO® credit score, powered by Experian. The app also gives a historical view of your score over the past 12 months in graph form.

The app lets you easily sign up for an array of different alerts: You can receive alerts for single purchases above a certain amount, online purchases, daily total spending limits and more.

Special offers

Under "My Wells Fargo Deals," you can explore offers (like coupons) that give you additional cash back on your purchases. Just tap to activate them, and they will be applied to your card on your next eligible purchase.

» MORE: Best credit cards this year

The app lacks a back button on all pages, which means navigation is done primarily by clicking the sections along the bottom of the screen. That can limit your options and force you to start over instead of backing up one step, which can make the app more time-consuming than it needs to be.

In online reviews, users also complain about the app’s slowness to load and difficulty in reaching customer service through the app. In fact, the “Help & Support” page only offers to help you make an appointment by leading you out of the app and onto a Wells Fargo website page.

Some users also point out that the lack of a search function can make it hard to find what you are looking for. But if you’re using the app primarily to track your transactions and make payments, it will give you what you’re looking for.

Desktop vs. mobile

As mentioned above, the app lacks the helpful back button that does exist when you check your Wells Fargo account from a desktop. Other than some slowness issues reported by app users, the Wells Fargo desktop and mobile experiences are very similar.

Ranked 6th out of 11 major credit card issuers — Wells Fargo ranked in the middle of its competitors in the J.D. Power 2020 U.S. Credit Card App Satisfaction Study.

4.8 / 5 — Apple's App Store (rating as of March 2021)

4.8 / 5 — Google Play Store (rating as of March 2021)

On a similar note...

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

Notifying Wells Fargo of Your Travel Plans on the App: A Hassle-Free Step-by-Step Guide

To notify Wells Fargo of your travel plans using the app, follow these steps:

- Log in to your Wells Fargo account on the app.

- Hover over the “Accounts” drop-down menu at the top of the screen.

- Click on “Manage Travel Plans,” which is under the “Manage Cards” section.

- Enter your travel dates and destination(s).

If you need to set up a travel notice through your online account, you can do so by logging in, hovering over the “Help & Support” menu tab, and clicking on “Set Travel Notice” in the drop-down menu.

Enter your destination(s), travel dates, contact number, and the card(s) you’re taking with you. Share any other travel details you think are relevant.

Table of Contents

How to Notify Wells Fargo of Travel on App

Wells fargo travel plans notice.

Wells Fargo has designed their app to simplify banking tasks, including the ability to notify them of your travel plans .

If you are a Wells Fargo customer and planning to travel, it is important to notify the bank about your travel plans.

By providing a travel notice to Wells Fargo, you can prevent any potential issues with your debit or credit cards while abroad. Keep your accounts safe and worry-free with this simple precaution.

Step-by-Step Guide

By following these step-by-step instructions, you’ll be able to skip the hassle and concentrate on enjoying your trip:

Step 1: Log in to Your Wells Fargo Account

- Open the website

- Enter your username and password on the login page. Then click “Sign On”

- If you haven’t created an account, tap on “Sign Up” and follow the instructions to register.

- Once logged in, you will see several options on the upper part of the screen.

Step 2: Access the Travel Notification Feature

- Click on the options that says “Accounts”.

- Once you click on “Accounts”, you’ll see several drop-down lists.

- Under “Manage Cards”, click “Manage Travel Plans”.

Step 3: Add Your Travel Details

- Click on “Add a New Travel Plan”.

- Enter the date and destination of your travel plan as well as any other required information. Then click on “Add”.

- You can also enter your US mobile number or any international contact number so the bank can reach you in case there are any unusual activities with your cards abroad.

- Double-check that all the information is accurate and tap on “Continue” at the bottom.

Step 4: Select the Cards

- Select the cards you would use, then click “Continue”.

- Verify the cards by following the steps.

- After verification, click on “Submit”.

Congratulations! You have successfully notified Wells Fargo of your travel plans using their app. Now, you can enjoy your vacation without any worries about your account.

How To Let Wells Fargo Know You’re Traveling

To inform Wells Fargo about your travel plans, follow these steps: 1. Log in to your Wells Fargo account. 2. Go to the “Manage Travel Plans” section. 3. Enter your destination, duration, and travel dates. 4. Confirm your contact details. 5. Submit the information to notify Wells Fargo about your travel arrangements.

Things You Should Know Before Notifying Wells Fargo

Here are a few important things to keep in mind while notifying Wells Fargo of your travel plans:

Make sure to notify Wells Fargo about your upcoming travel plans at least a few days before your departure. This will allow them enough time to update their records and ensure uninterrupted access to your accounts while you’re away.

2. Multiple Accounts

If you have multiple Wells Fargo accounts, remember to notify them for each individual account separately. This will help them accurately track and monitor your transactions while you’re abroad.

3. Validity Period

Keep in mind that your travel notification with Wells Fargo will usually remain valid for a specific period, typically ranging from 30 to 90 days. If your trip extends beyond this period, you may need to update or renew your notification to avoid any inconveniences.

Helpful Tips

While notifying Wells Fargo of your travel plans on the app, keep the following tips in mind for a smooth experience:

1. Double-Check Account Information

Prior to submitting your travel plans, verify that the account information displayed on the website is accurate. Mistakenly notifying the wrong account can result in potential issues or delays during your trip.

2. Keep a Record of Your Submission

Take a screenshot or note down the confirmation number provided by the app after submitting your travel plans. This record can be handy in case you need to reach out to Wells Fargo for any reason or if any issues arise during your journey.

3. Enable Notifications

Ensure that you have enabled notifications from the Wells Fargo app on your smartphone. This will help you stay informed about any account activity or updates while you’re away, giving you peace of mind.

4. Contact Customer Support if Needed

If you encounter any difficulties while notifying Wells Fargo through the app or have any specific concerns related to your travel plans, don’t hesitate to reach out to their customer support. They are available 24/7 and will be more than happy to assist you.

5. Use Secure Internet Connections

While accessing the Wells Fargo app to notify them of your travel, it is crucial to use secure internet connections, preferably Wi-Fi networks you trust. Public Wi-Fi networks can pose security risks, so it’s best to avoid them to safeguard your sensitive information.

It’s that simple! You can now keep your travel plans up-to-date with just a few taps on the Wells Fargo app.

Related Video

Can I notify Wells Fargo of my travel plans via phone or email?

While Wells Fargo provides various channels for its customers, notifying them of your travel plans through the app is the most convenient and efficient method. However, if you face any issues or prefer alternative methods, you can contact their customer support for assistance.

How long does it take for Wells Fargo to update my travel plans?

In most cases, Wells Fargo updates your travel plans almost instantly once you submit the details through the app. However, it is recommended to notify them a few days in advance to ensure your plans are processed without any delays.

Do I need to notify Wells Fargo if I am traveling domestically?

While domestic travel within the United States may not require explicit notification, it is still a good practice to inform Wells Fargo about your travel plans. This will help them distinguish between legitimate transactions and potential fraudulent activity, ensuring the security of your accounts.

Can I use the Wells Fargo app abroad without notifying them?

Although notifying Wells Fargo of your travel plans is not mandatory for using the app abroad, it is highly recommended. This allows them to recognize and authorize your international transactions, avoiding any inconvenience or disruption to your banking activities .

Is notifying Wells Fargo of my travel plans free of charge?

Yes, notifying Wells Fargo of your travel plans using their app is completely free of charge. However, standard data charges or internet fees may apply based on your cellular or internet service provider.

Related Topics

Here are a few related topics that might be of interest to you:

1. How to Safeguard Your Financial Information While Traveling

Discover effective strategies to protect your financial information and ensure a secure banking experience when traveling.

2. Maximizing the Benefits of Wells Fargo’s Travel Rewards Program

Unleash the full potential of Wells Fargo’s travel rewards program and make the most out of your travel-related expenses.

3. Tips for Choosing the Best International Credit Card

Learn about the key factors to consider and the top features to look for when selecting an international credit card for your travels .

Now that you are armed with all the information you need, informing Wells Fargo of your upcoming adventures will be a breeze. Enjoy your trip, and let the Wells Fargo app take care of your banking needs!

Related Posts:

- Salt And Pepper Squid: Food To Spice Up Your Meal Plans

- Plenty of Fish vs. Hinge: Which Dating App is Right for You?

- How To Check Travel Ban In Metrash (Step By Step)

- Overall Bank Rating

- Pros and Cons

About Wells Fargo

- Personal Credit Cards

- Personal Loans

How Wells Fargo Banking Compares

Wells fargo bank review 2024.

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate banking products to write unbiased product reviews.

The information for the following product(s) has been collected independently by Business Insider: Wells Fargo Attune℠ Card. The details for these products have not been reviewed or provided by the issuer.

Compare Today's Banking Offers

Wells Fargo Review: Overall Rating

Wells fargo: pros and cons.

Wells Fargo is a national brick-and-mortar bank with more than 4,000 branches and 12,000 ATMs. Branches are available in about 36 states and Washington, DC.

You can apply for bank accounts, credit cards, personal loans, home loans, and auto loans. The bank also has a robo-advisor platform called Intuitive Investor.

Wells Fargo bank account deposits are FDIC insured up to $250,000, or $500,000 for joint accounts. This means your money is safe even if Wells Fargo were to shut down.

Wells Fargo Online and Mobile Banking Experience

Wells Fargo offers standard online and mobile banking, similar to other national banks. You'll be able to make mobile check deposits, send money with Zelle, and set bank account alerts to maintain your account balance.

The bank's mobile app has received 4.8 out of 5 stars in the Apple Store based on 8.7 million ratings. In the Google Play store, it's also received 4.8 out of 5 stars based on over 2 million reviews.

Wells Fargo Customer Service and Support

Wells Fargo offers customer support at branches or by phone. You can schedule an appointment with a banker online or walk into a branch during traditional business hours.

For specific services, like personal loans or mortgage financing, the hours may vary.

Is Wells Fargo Trustworthy?

The Better Business Bureau currently gives Wells Fargo an F rating because it has received customer complaints on the BBB website and there has been government action taken against the bank. In the past few years, Wells Fargo has been involved in the following controversies:

- In December 2022, the Consumer Financial Protection Bureau required Wells Fargo to pay more than $3.7 billion in a settlement that accused the bank of wrongfully charging fees that led thousands of customers to lose vehicles and homes. The settlement also accuses the bank of wrongfully charging overdraft fees on checking and savings accounts.

- In 2021, Wells Fargo consented to a Cease and Desist order from the Office of the Comptroller of the Currency. The OCC stated that the bank's home lending loss mitigation program was unsuccessful, and it charged Wells Fargo a $250 million civil penalty.

Wells Fargo FAQs

Wells Fargo customer service availability is better than many other banks. Some banks only offer customer support during the weekdays or traditional banking hours, but Wells Fargo offers 24/7 customer support for general banking.

Wells Fargo stands out from other banks if you prioritize an extensive branch and ATM network. Wells Fargo also has a variety of bank accounts, credit cards, mortgages, and loan types, so it may be worthwhile if you want to do all your banking with one financial institution. You may prefer another bank if you want to open a high-yield savings account or investment options with lower minimum opening requirements.

Yes. The Consumer Financial Protection Bureau required Wells Fargo to pay over $2 billion in redress to customers who had their bank accounts frozen, vehicles repossessed, or homes lost due to bank fees.

Wells Fargo Banking Review

Wells fargo way2save® savings account.

$5 monthly service fee

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. $25 minimum opening deposit

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Automatic savings feature

- con icon Two crossed lines that form an 'X'. Low APY

- con icon Two crossed lines that form an 'X'. $5 monthly service fee

- Approximately 4,900 branches and 12,000 ATMs

- Waive $5 monthly service fee by maintaining a $300 daily balance, OR setting up automatic savings options, OR be under age 24 and the primary account owner OR transferring $25 or more from a linked Wells Fargo checking account, or have 1 automatic transfer each business day within the fee period of $1 or more from a linked Wells Fargo checking account

- Save As You Go® transfers $1 into your Way2Save Savings Account from checking each time you swipe your debit card

- Interest compounded daily, paid monthly

- FDIC insured

Wells Fargo savings rates are low, but it does come with plenty of other perks.

You also only need $25 to open an account, and there are several ways to waive the $5 monthly service fee. You can link the account to your Wells Fargo checking account so that every time you swipe your debit card, you automatically transfer $1 from checking into savings.

Read Business Insider's Wells Fargo Savings Rates Review .

Wells Fargo Everyday Checking Account

Earn a $300 bonus when you open a new account from the offer webpage with a $25 minimum opening deposit and receive a total of $1,000 or more in qualifying electronic deposits to your new checking account within 90 calendar days of account opening (offer ends September 25, 2024)

$10 monthly service fee

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Relatively easy to waive monthly fee

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Free overdraft protection available

- con icon Two crossed lines that form an 'X'. $10 monthly service fee

- con icon Two crossed lines that form an 'X'. $35 overdraft fee

- con icon Two crossed lines that form an 'X'. $2.50 out-of-network ATM fee

Wells Fargo is a solid choice if you're looking for a brick-and-mortar bank with a national presence. It also offers some of the best checking and savings account bonuses out there for opening new accounts. But to earn high savings rates, you'll want to look elsewhere.

- Approximately 4,700 branches and 12,000 ATMs

- Earn $300 bonus when you open a new account from the offer webpage with a $25 minimum opening deposit and receive a total of $1,000 or more in qualifying electronic deposits to your new checking account within 90 calendar days of account opening (offer ends September 25, 2024)

- Waive $10 monthly fee when you have $500 in direct deposits per month, OR maintain minimum balance of $500, OR link account to a Wells Fargo Campus ATM or Campus Debit Card OR are 17-24 years old

The most appealing feature of Wells Fargo Everyday Checking Account is the $325 sign-up bonus. You may qualify if you receive at least $1,000 in direct deposits within 90 days of opening the account. You also have multiple options for waiving the $10 monthly service fee.

Wells Fargo Standard Fixed Rate CD

1.50% to 4.51%

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Interest compounded daily

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Choose how often your interest is paid

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Standard early withdrawal penalties

- con icon Two crossed lines that form an 'X'. $2,500 minimum deposit

- con icon Two crossed lines that form an 'X'. Limited term options

- Choose from 3-month, 6-month, or 1-year CD term

- Earn the Relationship APY when linked to a Prime Checking, Premier Checking, or Private Bank Interest Checking account

- Early withdrawal penalty is 3 months interest for 3-month, 6-month, and 1-year CDs

- Interest compounded daily; choose how often to be paid

Wells Fargo requires $2,500 to open a CD, and it only offers terms up to one year — many banks have terms up to five or even 10 years. It pays decent rates for a brick-and-mortar bank. The Wells Fargo Special Fixed Rate CD pays an even higher rate of 4.25% to 5.01% (varies by location), but it only has a 7-month term, and you'll need $5,000 to open an account.

Read Business Insider's Wells Fargo CD Rates Review .

Wells Fargo Investing Review

Wells fargo intuitive investors.

0.25% to 0.35%

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Smart-beta automated portfolios

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Tax-loss harvesting

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Unlimited access to human advisors

- con icon Two crossed lines that form an 'X'. High account minimum

- con icon Two crossed lines that form an 'X'. Only offers exchange traded funds (ETFs)

- con icon Two crossed lines that form an 'X'. Doesn’t offer advanced charting tools or goal-tracking features

- Wells Fargo members with a checking account get up to a 0.10% management fee discount

- Offers Globally Diversified and Sustainability Focused portfolios

- Dividend reinvesting

Wells Fargo has an automated investing platform called Intuitive Investors. You'll need at least to open an account, which is steep compared to other robo-advisors.

Read Business Insider's Wells Fargo Intuitive Investor Review .

Wells Fargo Mortgages Review

Wells fargo mortgage.

Conforming, jumbo, VA, FHA, USDA, new construction, cash-out refinance, Dream. Plan. Home. Mortgage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers several types of home loans

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Dream. Plan. Home. Mortgage has more flexible credit requirements

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Down payment and closing cost assistance available

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Current customers could get a discount on a jumbo loan

- con icon Two crossed lines that form an 'X'. No home equity loan, HELOC, or reverse mortgage

- con icon Two crossed lines that form an 'X'. Ranks low in J.D. Power’s Mortgage Origination Satisfaction Study

- con icon Two crossed lines that form an 'X'. Ranks low in trustworthiness

Wells Fargo Mortgage offers a wide variety of mortgages, including the Dream. Plan. Home. Mortgage, which offers assistance and grants to people who make below 80% of the area median income. But it ranks extremely low in trustworthiness.

- Offers mortgages in all 50 US states and Washington, DC

- Dream. Plan. Home. Mortgage has more lax credit score requirements and is for people who earn less than 80% of the median area income

- Minimum credit score and down payment displayed are for conforming mortgages

Wells Fargo offers conforming loans, jumbo loans, VA loans, FHA loans, and new construction loans. The bank also has a Dream. Plan.Home. Mortgage. which is a fixed-rate mortgage specifically for customers who are below 80% of the area median income.

Read Business Insider's Wells Fargo Mortgage Review .

Wells Fargo Personal Credit Cards Review

Wells Fargo Autograph Journey℠ Card

- Earn unlimited 5X points on hotels, 4X points on airlines, 3X points on other travel and restaurants, and 1X points on other purchases.

21.24%, 26.24%, or 29.99% Variable

Earn 60,000 bonus points

Good or Excellent

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Trip cancellation and lost baggage protection

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Airline and hotel transfer partners available

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Welcome bonus

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous cellphone protection

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Low annual fee

- con icon Two crossed lines that form an 'X'. Transfer partner network not as diverse or robust as competitors

The Wells Fargo Autograph Journey℠ Card is a true travel credit card, with benefits that rival many of the best travel rewards credit cards currently on the market. This card has a low annual fee on par with that of popular competing credit cards and Wells Fargo's newly announced Points Transfer program allows cardholders to juice maximum value from every point they earn.

- Select “Apply Now” to take advantage of this specific offer and learn more about product features, terms and conditions.

- Earn 60,000 bonus points when you spend $4,000 in purchases in the first 3 months – that’s $600 toward your next trip.

- $95 Annual Fee.

- Book your travel with the Autograph Journey Card and enjoy Travel Accident Insurance, Lost Baggage Reimbursement, Trip Cancellation and Interruption Protection and Auto Rental Collision Damage Waiver.

- Earn a $50 annual statement credit with $50 minimum airline purchase.

- Up to $1,000 of cell phone protection against damage or theft. Subject to a $25 deductible.

- Find tickets to top sports and entertainment events, book travel, make dinner reservations and more with your complimentary 24/7 Visa Signature® Concierge.

Read Business Insider's Wells Fargo Autograph Journey Card Review .

Wells Fargo Autograph℠ Card

Earn unlimited 3x points on restaurants, travel, gas stations, transit, popular streaming services and phone plans. Earn 1x points on other purchases.

0% intro APR on purchases for 12 months from account opening

20.24%, 25.24%, or 29.99% variable

Earn 20,000 bonus points

Good to Excellent

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous welcome bonus for a no-annual-fee card

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Great earning rates in useful categories, including dining, travel, and gas stations

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Useful benefits including cell phone protection and Visa Signature concierge

- con icon Two crossed lines that form an 'X'. Minimum spending requirement to earn bonus is slightly higher than similar no-annual-fee cards

- con icon Two crossed lines that form an 'X'. No airline or hotel transfer partners

The Wells Fargo Autograph℠ Card is one of the best credit card options if you're looking for a no-annual-fee cash rewards card with a solid welcome bonus — especially if you spend a lot in its 3x bonus categories.

- Select "Apply Now" to take advantage of this specific offer and learn more about product features, terms and conditions.

- Earn 20,000 bonus points when you spend $1,000 in purchases in the first 3 months - that's a $200 cash redemption value.

- Earn unlimited 3X points on the things that really add up - like restaurants, travel, gas stations, transit, popular streaming services, and phone plans. Plus, earn 1X points on other purchases.

- $0 annual fee.

- 0% intro APR for 12 months from account opening on purchases. 20.24%, 25.24%, or 29.99% variable APR thereafter.

- Up to $600 of cell phone protection against damage or theft. Subject to a $25 deductible.

- Redeem your rewards points for travel, gift cards, or statement credits. Or shop at millions of online stores and redeem your rewards when you check out with PayPal.

Read Business Insider's Wells Fargo Autograph Credit Card Review .

Wells Fargo Attune℠ Card

Earn unlimited 4% cash rewards on select self-care, planet-friendly, and sports, recreation, and entertainment purchases. Earn 1% cash rewards on other purchases.

0% intro APR for 12 months from account opening on purchases

Earn a $100 cash rewards bonus

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. High cashback rate on common expenses including gyms, spas, pet care, concert tickets, and public transit

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. No annual fee

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Cellphone protection

- con icon Two crossed lines that form an 'X'. Limited reward redemption beyond cash back

Read Business Insider's Wells Fargo Attune Card Review .

Wells Fargo Reflect® Card

0% intro APR for 21 months from account opening on purchases and qualifying balance transfers made within 120 days, then 18.24%, 24.74%, or 29.99% variable APR

0% intro APR for 21 months from account opening on purchases and qualifying balance transfers made within 120 days

18.24%, 24.74%, or 29.99% variable

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Extra-long intro APR on purchases and qualifying balance transfers

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Cell phone protection

- con icon Two crossed lines that form an 'X'. No rewards

- con icon Two crossed lines that form an 'X'. Foreign transaction fees

If you're looking for the best Wells Fargo credit card for balance transfers, the Wells Fargo Reflect® Card is a great choice. And it offers an extra-long interest-free period on new purchases, too.

- 0% intro APR for 21 months from account opening on purchases and qualifying balance transfers. 18.24%, 24.74%, or 29.99% variable APR thereafter; balance transfers made within 120 days qualify for the intro rate, BT fee of 5%, min $5.

- $0 Annual Fee.

- Through My Wells Fargo Deals, you can get access to personalized deals from a variety of merchants. It's an easy way to earn cash back as an account credit when you shop, dine, or enjoy an experience simply by using an eligible Wells Fargo credit card.

Read Business Insider's Wells Fargo Reflect Credit Card Review .

Wells Fargo Active Cash® Card

- Earn unlimited 2% cash rewards on purchases.

0% intro APR on purchases and qualifying balance transfers for 15 months from account opening

Earn $200 cash rewards bonus

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Good welcome bonus for a $0 annual fee card

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Straightforward 2% cash rewards on purchases with no categories to track

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Strong benefits including cell phone protection, Visa Signature perks, and an intro APR on purchases and qualifying balance transfers

- con icon Two crossed lines that form an 'X'. If you've opened a Wells Fargo card in the past six months, you may not qualify for an additional Wells Fargo credit card

The Wells Fargo Active Cash® Card is definitely worth considering if you want to earn a strong rate of cash rewards on purchases without rotating categories or earning caps and with no annual fee. It's got a solid welcome bonus and intro APR offer, which puts it high on our list of the best zero-interest credit cards.

- Earn a $200 cash rewards bonus after spending $500 in purchases in the first 3 months.

- 0% intro APR for 15 months from account opening on purchases and qualifying balance transfers. 20.24%, 25.24%, or 29.99% Variable APR thereafter; balance transfers made within 120 days qualify for the intro rate and fee of 3% then a BT fee of up to 5%, min: $5.

- No categories to track or remember and cash rewards don't expire as long as your account remains open.

Read Business Insider's Wells Fargo Active Cash Card Review .

Bilt Mastercard®

Earn up to 1x points on rent payments without the transaction fee, up to 100,000 points each calendar year. Earn 2x points on travel. Earn 3x points on dining. Earn 1x points on other purchases. Earn points when you make 5 transactions that post each statement period.

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Only credit card to offer rent payments to any landlord

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Excellent range of airline and hotel transfer partners through the Bilt App

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. World Elite Mastercard benefits and no annual fee

- con icon Two crossed lines that form an 'X'. If you’re not a renter, other cards offer better welcome bonuses and rewards

- con icon Two crossed lines that form an 'X'. Must make 5 transactions per statement period to earn points

The Bilt Mastercard® is the first credit card to offer up to 100,000 points in a calendar year rewards for paying rent without the transaction fee — and you can redeem your points for travel, merchandise, and more. While it now offers bonus points on dining and select travel, if you're not a renter, you should consider other no-annual-fee rewards credit cards as well.

- Earn up to 1x points on rent payments without the transaction fee, up to 100,000 points each calendar year.

- 2x points on travel.

- 3x points on dining.

- 1x points on other purchases.

- Earn points when you make 5 transactions that post each statement period.

- When renting at a Bilt Alliance property, you can choose to have your rent payments automatically reported by Bilt to the three major credit bureaus each month; Experian™, TransUnion™, and Equifax™.

Read Business Insider's Bilt Mastercard Card Review .

Choice Privileges® Select Mastercard®

Earn 10X points on stays at participating Choice Hotels properties. Earn 5X points on purchases at gas stations, grocery stores, home improvement stores and phone plan services. Plus earn 1X points on other purchases.

20.99%, 25.24%, or 29.99% Variable

Earn 60,000 points

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous welcome bonus offer

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Automatic Platinum elite status

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Strong benefits including 30,000 points on each card anniversary, cell phone protection, Global Entry/TSA PreCheck application fee credit, and no foreign transaction fees

- con icon Two crossed lines that form an 'X'. Annual fee of $95

- con icon Two crossed lines that form an 'X'. No travel insurance or purchase protections

Wells Fargo has two Choice Hotels credit cards, and the Choice Privileges® Select Mastercard® is the most rewarding of the pair with automatic elite status, and points on your card anniversary.

- Earn 60,000 bonus points when you spend $3,000 in purchases in the first 3 months - enough to redeem for up to 7 rewards nights at select Choice Hotels® properties.

- Earn 10X points on stays at participating Choice Hotels properties.

- Earn 5X points on purchases at gas stations, grocery stores, home improvement stores and phone plan services. Plus earn 1X points on other purchases.

- $95 annual fee.

- Up to $800 of cell phone protection against damage or theft. Subject to a $25 deductible.

- Receive 20 Elite night credits qualifying for at least Platinum level status each calendar year.

- No Foreign Currency Conversion Fee.

Read Business Insider's Choice Privileges Select Mastercard Review .

Choice Privileges® Mastercard®

Earn 5X points on stays at participating Choice Hotels properties. Earn 3X points on purchases at gas stations, grocery stores, home improvement stores and phone plan services. Plus earn 1X points on other purchases.

Earn 40,000 points

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Welcome bonus worth up to five reward nights at Choice Hotels

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Good benefits including automatic Gold elite status and cell phone protection

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. No annual fee or foreign transaction fees

- con icon Two crossed lines that form an 'X'. No anniversary points or award night

While the the Choice Privileges® Mastercard® has no annual fee and modest benefits, it's a weaker option compared to many other no-annual-fee hotel credit cards on the market.

- Earn 40,000 bonus points when you spend $1,000 in purchases in the first 3 months - enough to redeem for up to 5 rewards nights at select Choice Hotels® properties.

- Earn 5X points on stays at participating Choice Hotels properties.

- Earn 3X points on purchases at gas stations, grocery stores, home improvement stores and phone plan services. Plus earn 1X points on other purchases.

- Receive 10 Elite night credits qualifying for at least Gold level status each calendar year.

Read Business Insider's Wells Fargo Choice Privileges Mastercard Review .

Wells Fargo has some of the best credit cards overall. The Bilt Mastercard® stands out as a strong option for renters because you can earn rewards for paying rent. Meanwhile, the Wells Fargo Active Cash® Card is a great option for cash-back rewards, and the Wells Fargo Reflect® Card has an impressive intro APR offer.

The bank also recently launched the Wells Fargo Autograph Journey℠ Card , which may be appealing if you're searching for a travel rewards credit card.

Read Business Insider's Best Wells Fargo Credit Cards .

Wells Fargo Personal Loans Review

Wells fargo personal loan.

Relationship discount of 0.25%

8.49% to 24.49% (with relationship discount)

$3,000 to $100,000

Undisclosed

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Large maximum loan amounts

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Discounts for current customers

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Established brick-and-mortar lender

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. No origination fee or prepayment penalty

- con icon Two crossed lines that form an 'X'. Significant late fees

- con icon Two crossed lines that form an 'X'. History of mismanaging customer information

- con icon Two crossed lines that form an 'X'. No online applications for non-customers

Wells Fargo Personal Loan are a good choice if you need a significant amount of cash, as you can borrow up to $100,000 with the lender. However, if you're not a current customer, you can't apply for a personal loan without visiting a branch.

- Loan amounts range from $3,000 to $100,000

- Term lengths range from 1 to 7 years

- Rate discounts to customers who have a checking account with the bank and who make their loan payments automatically through that account

- Non-customers must apply by visiting a branch and talking with a banker

- Loans made by Wells Fargo, member FDIC

Wells Fargo offers some of the best low-interest personal loans . Loans amount range from $3,000 to $100,000, and you can choose from term lengths between one to seven years.

Read Business Insider's Wells Fargo Personal Loans Review .

We've compared Wells Fargo bank acocunts to two other big, national banks: Bank of America and Chase.

Wells Fargo vs. Bank of America

Your decision may ultimately come down to which institution has the most nearby branch locations. If you're looking for a sign-up bonus, Wells Fargo is likely the better choice.

For checking accounts, Bank of America offers a $200 bonus for eligible new customers who open a Bank of America Advantage SafeBalance Banking® account with qualifying activities (offer expires May 31, 2024). This is lower than Wells Fargo's checking bonus. Wells Fargo also offers a substantial savings bonus if you can deposit at least $25,000, while Bank of America doesn't have a savings bonus at all.

If you take bonuses out of the equation, Bank of America might be the better choice for a savings account. With the Bank of America Advantage Savings Account , you won't have to worry about monthly service fees during the first six months of opening an account. If you get the Wells Fargo Way2Save® Savings Account you'll need to meet certain requirements every month to waive a $5 monthly service fee.

Bank of America Review

Wells Fargo vs. Chase

Chase and Wells Fargo are two of the largest national banks in the US. Your choice between the two might depend on where you live. Otherwise, your decision could rely on differences between bank account features and perks.

You might favor Wells Fargo over Chase if you're only looking to open a checking account. Wells Fargo makes it easier to waive the monthly service fee than Chase. You can earn a $300 bonus when you open an account and make direct deposits totaling $500 or more within 90 days of coupon enrollment (offer expires on 07/24/2024). While this bonus is easier to earn than Wells Fargo's checking bonus, it's still not quite as high. Chase also doesn't offer a savings bonus.

Chase Bank Review

Should You Bank with Wells Fargo?

Wells Fargo is a decent option if you want to bank with a brick-and-mortar financial institution. It has an extensive branch and ATM network, so you'll likely find a nearby branch in many states. Wells Fargo also has a variety of bank accounts, credit cards, mortgages, and loan types. Hence, it may also be worthwhile if you want to bank with one financial institution primarily.

If you're interested in competitive savings or CD rates, other financial institutions may be more suitable choices. Wells Fargo also has many common bank fees like monthly service fees and overdraft fees. There are ways to waive these fees at Wells Fargo. That said, keep in mind that some banks and credit unions do not charge these fees at all.

Why You Should Trust Us: How We Reviewed Wells Fargo

To review Wells Fargo, we rated accounts and services using our editorial standards .

At Business Insider, we rate products on a scale from zero to five stars. We review different features for distinct products.

In general, we look at ethics, customer support, and mobile apps when rating a bank account. Other factors we consider depend on which type of account we're reviewing. For example, we look at overdraft protection for checking accounts, and early withdrawal penalties for CDs.

We also used distinct methodologies for reviewing credit cards, personal loans, student loans, home loans, and investment accounts. For example, we examined annual fees and rewards rates with credit cards, and we looked at fees and term options with personal loans.

- Bank accounts

- Savings and CD rate trends

- How banks operate

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

For a guide to the benefits of the Bilt Mastercard, please click here.

For rewards and benefits of the Bilt Mastercard, please click here.

- Main content

How to Set Up A Travel Notification for 9 Major Credit Cards

- Updated May 18, 2023

- Posted in Travel Planning

- Tagged as Travel Hacks and Tips , Travel Planning

A travel notification can prevent credit cards from declining charges due to suspected fraudulent activity.

Being stranded in a foreign country without a credit card is a nightmare.

Do you agree?

Thankfully, this is avoidable.

We have compiled step-by-step instructions for how how set up travel notifications for major credit card carriers.

Due to evolving security features, some credit cards do not recommend or require travel notifications. I, however, still like to notify my credit card prior to a trip for peace of mind!

Setting Up A Travel Notification: A Step-by-Step Guide

American express.

American Express does not require or recommend you set a travel notification. They feel confident in their security measures because of the fraud detection practices implemented. Actually, there is not even an option online to create a travel notification.

American Express recommends that you keep your contact information updated in case they need to reach you during your travels.

Fun Fact : Amex credit cards are not as widely accepted globally. So if you are a frequent international traveler, it may be wise to look for a credit card with a Mastercard or Visa logo as they are more widely accepted among merchants across seas.

Bank Of America

Bank of America lets you set a travel notice online, through the mobile app, or by phone at (800) 432-1000 .

According to Bank of America, a travel notice can be set no more than 60 days prior to departure and last up to 90 days from the first day of your trip. You can only have one travel notice set at a time.

How To Set A BoA Travel Notification

Step 1: Log into your bankofamerica.com account.

Step 2: Hover over “Help & Support” tab.

Step 3: Click on “Set Travel Notice” in the drop-down menu.

Step 4: Complete the Travel Notification Form and submit!

As you complete the travel notification form, enter your destination(s), travel dates, contact number(s), and card(s) you’re taking with you.

Barclaycard

You can set a travel notice for Barclays credit cards online or by phone at 1-866-928-8598.

How To Set a Barclaycard Travel Notification

Step 1: log into your barclaycard account or on the mobile app, step 2: select the “tools” tab and click “my travel”, step 3: enter your travel dates and destinations.

If you choose to set a travel notification by phone, call the toll free number listed above. You will need to enter your card number and ask to speak with a representative regarding a travel notice.

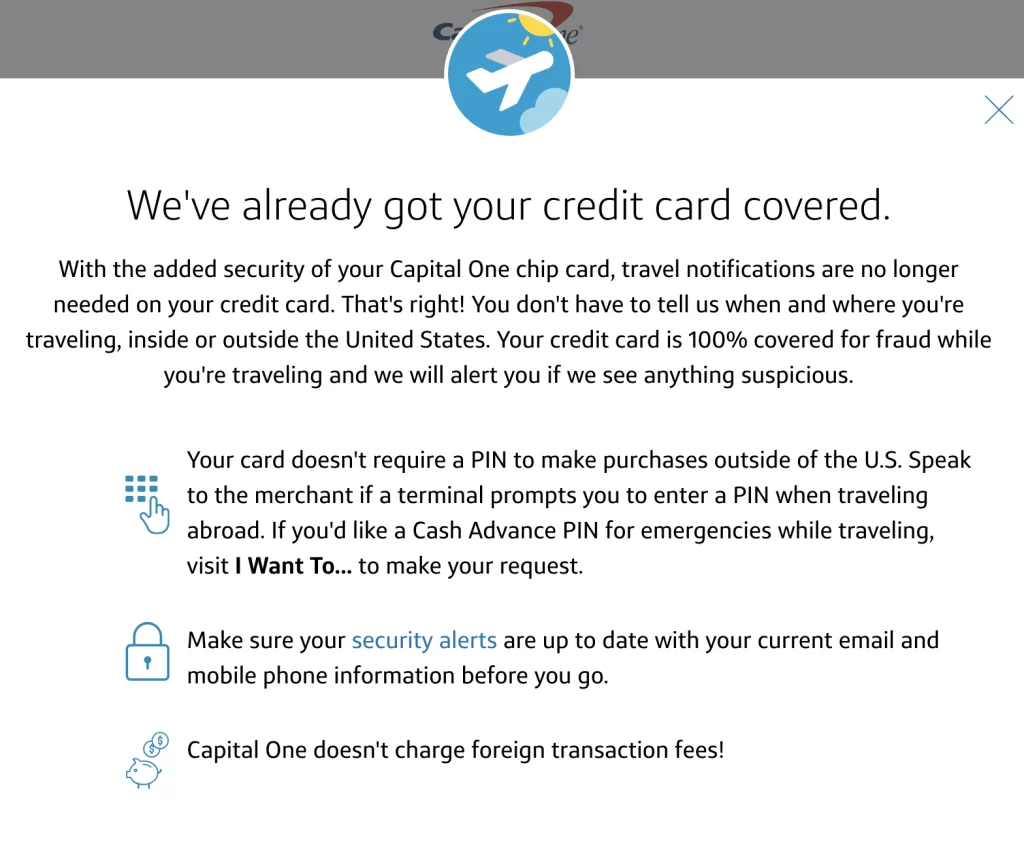

Capital One

Surprise! Like American Express, there is no need to set a travel notice for Capital One credit cards. You still, however, have the option to set a travel notice.

If you log into your capitalone.com account and click “Set Travel Notification,” you will get this window:

To notify Chase of travel plans, you can do this through your online account, by calling the number on the back of your card, or through their mobile app.

According to Chase, a travel notice can be set up to 1 year prior to departure and last up to 1 year from the first day of your trip.

If you will be gone for longer than this period of time, you will just need to let Chase know at some point to extend the travel notice.

How to set a Chase travel notification

Step 1: Log into your Chase.com account.

Step 2: Click on the menu icon in the left hand corner.

Step 3: Click on “Profile & Settings” in the drop-down menu.

Step 4: Click on “Travel” (located under “more settings”)

Step 5: Click “Update” on the right side of the screen (Located next to the credit card section).

Step 6: Finally, you will be able to enter your travel information. Here you should enter your destination(s) and travel date(s). Click Save!

Already out of the country? No problem! You can call Chase collect at 1-302-594-8200 to alert the issuer of your travel plans.

Citibank also lets you easily set up a travel notice online.

How to set a Citibank travel notification

Step 1: Sign into your Citi.com account.

Step 2: Click on “Services” and then “Travel Services.”

Step 3: Select “Add a Travel Notice.”

Step 4: Enter your destination(s) and travel date(s).

Step 5: Verify the phone number and email address that Citi has on file to ensure they are up to date.

To set a travel notice for Discover, you can do this by logging into your online account or by calling Discover customer service at 1-800-347-2683.

How to set a Discover travel notification

Online Instructions:

Step 1: Log into your discover.com account.

Step 2: select the card you will be taking with you on your trip., step 3: click on the “manage” tab at the top of your screen., step 4: click on “register travel” under the “manage cards” section., step 5: enter your destination(s) and travel date(s)..

F un Fact: Like Amex, Discover credit cards are not the best when traveling internationally because they are not as widely accepted.

Wells Fargo

If trying to notify Wells Fargo of your travel plans, you can do this online, through their mobile app, or by calling the number on the back of your card.

How to set a Wells Fargo travel notification

To do this online:

Step 1: Log into your wellsfargo.com bank account.

Step 2: hover over the “accounts” drop-down menu that is located at the top of the screen., step 3: click on “manage travel plans” (located under the “manage cards” section)., step 4: enter your destination(s) and travel date(s).

Unfortunately, U.S. Bank does not allow you to set up a travel notification through your online account. You will have to contact its customer service team directly.

Why is it Important to Set up a Travel Notification?

Avoid fraudulent activity.

When you travel, especially to a different country or region, your credit card transactions may appear suspicious to the card issuer. They might flag these transactions as potentially fraud and take measures to protect your account, such as freezing it temporarily. By setting up a travel notification, you inform your credit card company about your travel plans in advance, reducing the likelihood of your legitimate transactions being blocked.

Enhanced Security

Travel notifications act as an additional layer of security for your credit card. When you notify your credit card issuer about your travel plans, they can monitor your account more closely during that period. If they notice any unusual activity, they can reach out to you to verify its authenticity or take appropriate action to protect your account.

Convenience

Without a travel notification, your credit card company might see foreign transactions as suspicious and decline them. This can be inconvenient when you’re traveling and relying on your credit card for expenses. By notifying your credit card company in advance, you can ensure uninterrupted access to your funds and enjoy a hassle-free travel experience.

Preventing Account Lockouts

Some credit card issuers have strict security measures in place, and if they detect unusual activity, they may freeze your account for your protection. While this is done to prevent fraudulent charges, it can be frustrating and time-consuming to resolve the issue while you’re away. By setting up a travel notification, you reduce the chances of your account being locked due to your legitimate transactions.

Assistance in Emergencies

In case of an emergency, having a travel notification in place allows your credit card company to better assist you. If you encounter any issues with your card while traveling, such as loss, theft, or unauthorized transactions, notifying your credit card company beforehand ensures they can provide immediate support and guidance.

To enjoy a smooth and secure experience while using your credit cards during your travels, it’s highly recommended to set up travel notifications. The process is typically straightforward and can usually be done through your credit card company’s website, mobile app, or by calling their customer service.

We know the challenges with traveling and hope that this guide will answer any questions regarding travel notifications. Our goal is to make travel simple, easier, and more fun for you!

Until next time!

xxx Sara + Josh

Travel Notification FAQ’s

What are travel notifications, how do you tell your bank you're traveling chase, how do i notify bank of america that i am traveling, how do i set up a travel notice with citibank, need more travel tips.

10 Travel Hacks For Stress Free Adventure

How To Make Planning Your Next Trip Easier

And please do me a little favor and share this article with others, for there’s a good chance that it will help them with their travels!

Share my adventures Share this content

- Opens in a new window X

- Opens in a new window Facebook

- Opens in a new window Pinterest

Sara & Josh

You might also like.

Trip Planning 101: How To Plan Your Next Vacation

Changing The Name on Your Passport: A Step-by-Step Guide

Setting Sail: A Comprehensive Comparison of Major Cruise Lines Revealed

Leave a reply cancel reply.

Save my name, email, and website in this browser for the next time I comment.

This Post Has One Comment

Thanks for sharing this informative post! I didn’t know about the need to set up travel notifications on my credit cards. I’ll definitely be making this a habit from now on, especially when I’m traveling abroad. Your tips are super helpful and easy to follow, the section on credit card travel policies was particularly enlightening. I’ll be checking my cards again now to ensure I have the correct notifications set up.

The Enlightened Mindset

Exploring the World of Knowledge and Understanding

Welcome to the world's first fully AI generated website!

How to Notify Wells Fargo of Upcoming Travel Plans

By Happy Sharer

Introduction

When planning a trip, it is important to notify your bank of your upcoming travel plans. This is especially true if you are a customer of Wells Fargo. Wells Fargo has put in place certain measures to protect its customers from fraudulent activities while they are away from home. In this article, we will explore how to notify Wells Fargo of your upcoming travel plans so that you can enjoy a worry-free vacation.

Email Wells Fargo of Your Upcoming Travel Plans

The easiest way to notify Wells Fargo of your upcoming travel plans is to send them an email. Here are some tips for writing an effective email:

- Be sure to include your full name and Wells Fargo account number in the email.

- Provide Wells Fargo with the dates you will be traveling and the countries or regions you will be visiting.

- Include your contact information in case Wells Fargo needs to reach you while you are away.

- Keep your email brief and to the point.

Use the Wells Fargo Mobile App to Notify Them

If you have the Wells Fargo mobile app on your phone, you can use it to notify Wells Fargo of your upcoming travel plans. Here’s how:

- Download and install the Wells Fargo mobile app on your device.

- Open the app and log in to your account.

- Go to the “Travel” section and select “Notify Wells Fargo of Travel”.

- Enter your travel dates and destination.

- Confirm your travel notification by selecting “Submit”.

Using the mobile app is a quick and convenient way to notify Wells Fargo of your upcoming travel plans. It also allows you to access your account information and manage your finances while you are away.

Call Wells Fargo Customer Service for Notification

Another option for notifying Wells Fargo of your upcoming travel plans is to call their customer service number. Here are the steps to follow when calling Wells Fargo:

- Call the Wells Fargo customer service number.

- Verify your identity by providing your name, address, and account number.

- Provide the customer service representative with your travel dates and destination.

- Request that your account be flagged for international transactions.

- Ask the customer service representative to confirm your request.

Calling customer service is a good option if you need assistance setting up your travel notification. The customer service representative can provide you with helpful information and answer any questions you may have.

Login to Your Online Banking Account to Update Travel Information

You can also log in to your Wells Fargo online banking account to update your travel information. Here’s how:

- Navigate to the Wells Fargo website and log in to your account.

- Go to the “Settings” tab and select “Travel Notifications”.

Updating your travel information online is a convenient way to notify Wells Fargo of your upcoming travels. Plus, you can view your account balance and make payments while you are away.

Submit a Form Through Wells Fargo’s Website

You can also submit a form through Wells Fargo’s website to notify them of your upcoming travel plans. Here’s what you need to do:

- Navigate to the Wells Fargo website and locate the “Travel Notification Form”.

- Fill out the form with your name, address, and account number.

- Provide your travel dates and destination.

- Submit the form.

Submitting a form is a simple way to notify Wells Fargo of your upcoming travels. It only takes a few minutes and can be done from the comfort of your own home.

Send a Letter to Wells Fargo with Your Travel Details

You can also send a letter to Wells Fargo with your travel details. Here’s what you need to include in the letter:

- Your full name and Wells Fargo account number.

- Your travel dates and destination.