Indian Customs Rules For Carrying Cash (2023 Guide)

The NRI Guides Team regularly reviews this article to ensure the content is up-to-date and accurate. The last editorial review and update were on 22 October 2023.

With the number of Indians travelling abroad at its highest level, many of us will have to decide how much cash to carry on our international flights. Even though it is safer to carry money as a credit or debit card, there are some situations where we have to keep some currency notes for our day-to-day expenses.

Indian Customs Cash Limit 2023

There are specific guidelines by the Reserve Bank of India (RBI) on the maximum limit of cash that can be carried through Indian airports by travellers including residents, NRIs and foreign tourists.

This article explains the Indian Customs rules for carrying cash as well as the cash limit allowed at Indian airports (Indian Rupees and Foreign Currency) while travelling to and from India.

Table of Contents

Cash limit on indian currency at indian airports.

According to the Central Board of Direct Taxes and Customs (CBDTC) guidelines, a resident of India who is returning from a visit abroad is allowed to bring in or take out Indian currency up to Rs 25,000 .

NOTE: A person coming to India from Nepal or Bhutan may bring Indian currency notes only in denominations not exceeding Rs 100 (which means currency notes of Rs 200, Rs 500 and Rs 2,000 are not allowed).

* If the traveller is a citizen of Pakistan and Bangladesh or coming from and going to either of the countries, carrying Indian currency is not allowed.

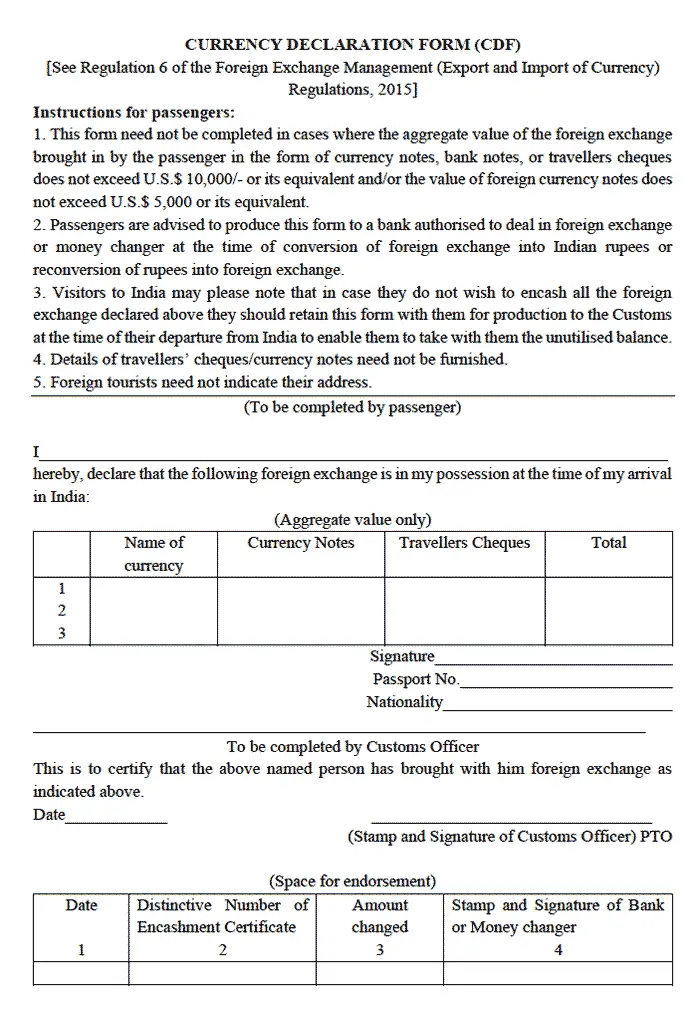

Condition 1: Passengers carrying foreign currency have to fill up a Currency Declaration Form (CDF) before Custom officers in the following cases:

- Where the value of foreign currency notes exceeds US$ 5,000 or equivalent.

- Where the aggregate value of foreign exchange including currency exceeds US$ 10,000 or equivalent.

Condition 2: Foreign currency taken out of India has to be purchased/issued by an RBI-approved/authorized foreign exchange dealer as per norms.

Exceptions Allowed With RBI Permission

According to Foreign Exchange Management (Export and Import of Currency) (Amendment) Regulations, 2020, “the Reserve Bank may, on an application made to it and on being satisfied that it is necessary to do so, allow any person to take or send out of India to any country or bring into India from any country currency notes of Government of India and /or of Reserve Bank of India subject to such terms and conditions as the Reserve Bank may stipulate.” ( source )

Cash Limit on Foreign Currency At Indian Airports

According to CBDTC, any person (Resident, NRI or Tourist) can bring into India , from a place outside India, foreign currencies without any limit (subject to declaration limit).

Passengers can also use the ATITHI app to file a declaration of dutiable items as well as currency with Indian Customs even before boarding the flight to India.

Currency Limit When Going Abroad From India

Indian residents travelling abroad can take Indian currency notes (Indian rupees) not exceeding Rs. 25,000 . Indian residents who went outside can also bring back Indian currency notes not exceeding Rs. 25,000.

Non-residents, tourists including foreign citizens (except citizens of Pakistan or Bangladesh),

- may take outside India currency notes up to an amount not exceeding Rs. 25,000 per person *

- may bring into India currency notes up to an amount not exceeding Rs. 25,000 per person *

*or such other amount and subject to such conditions as notified by the Reserve Bank of India from time to time.

How much money we can carry on international flights from India?

Indian residents travelling abroad can take foreign currency without any limit. This is as long as the same has been purchased or issued by an RBI-approved/authorized foreign exchange dealer as per the norms.

Tourists or NRIs while leaving India are allowed to take with them foreign currency not exceeding an amount brought in by them i.e. unspent foreign exchange left over from the amount declared in the Currency Declaration Form at the time of their arrival in India.

Important Tips On Currency Declaration Form

In case a visitor to India does not wish to encash all the foreign exchange declared on arrival they should retain the Currency Declaration Form with them for production to Indian Customs at the time of their departure from India to enable them to take with them the unutilised balance.

No declaration is required for bringing in foreign exchange/currency not exceeding US$ 5,000 in currency notes or its equivalent. This is also applicable to foreign exchange in the form of currency notes, bank notes or traveller’s cheques not greater than US$ 10,000 or its equivalent.

Generally, tourists can take out of India with them at the time of their departure foreign exchange/ currency not exceeding the above amount.

How much cash can I carry on a domestic flight in India?

There is no specific limit on the amount of cash that can be carried on a domestic flight in India. However, you are responsible for providing a valid reason and source (with proof) for carrying cash of more than INR 200,000 (Rupees 2 lakhs).

Please note that income tax laws in India prohibit any cash transaction exceeding INR 200,000 . Recently, there have been incidents of domestic travellers being caught with cash exceeding this limit.

Foreign Currency Limit For NRI

An NRI coming into India from abroad can bring foreign exchange without any limit .

In case, the total value of foreign currency notes, traveller’s cheques, etc. exceeds US$ 10,000 or its equivalent and/ or the value of foreign currency exceeds US$ 5,000 in currency notes or its equivalent, it should be declared to the Customs Authorities at the Airport in the Currency Declaration Form, on arrival in India.

Foreign Currency Limit for Medical Treatment Abroad

To meet medical treatment expenses outside India, you can purchase foreign currency self-certification for up to US$ 50,000 . Banks may also release exchanges for amounts above US$ 50,000 if they receive estimates from doctors or hospitals in India or overseas.

Also, foreign exchange of up to US$ 25,000 is available for the patient and accompanying attendant on self-certification in order to meet boarding/lodging/travel costs.

Foreign Currency Limit for Studying Abroad

The maximum amount of foreign exchange you can buy per academic year is US$ 30,000 or the estimate from the institution abroad, whichever is higher. There must be documentary evidence indicating the requirement.

Important Tips on How To Avoid Currency Issues at Airport

- If you are bringing foreign currency (in big amounts) from abroad, fill up the Currency Declaration form, get it stamped by Customs and keep it with you while returning.

- If you are buying foreign currency from India, buy from an authorised dealer or bank and keep the transaction receipts with you.

- On any travel, keep less than Rs 25,000 in Indian Rupees . Know the additional restrictions if you are travelling to and from Nepal or Bhutan.

Frequently Asked Questions

How much foreign currency can i carry to india.

There is no limit on the foreign currency that you can carry to India. However, you need to file a declaration if the currency value exceeds USD 5,000 or the total foreign exchange exceeds USD 10,000.

How much Indian currency can I carry outside India?

When going abroad, Indian residents, NRIs or Foreigners (except citizens of Pakistan and Bangladesh) are allowed to carry Indian currency notes of up to Rs 25,000.

Do I have to pay any tax on the foreign currency being imported to India?

There is no tax on the foreign currency you are importing to India. You just need to file a declaration if the currency value is above USD 5,000 or foreign exchange is above USD 10,000.

You May Also Like:

- Duty Free Allowance At Indian Airports

- Indian Customs Rules For Gold

- Indian Airport Customs Duty On LCD/LED TV

- Indian Customs Declaration Form

- How NRI Can Change Rs 2000 Currency Notes

Copyright © NRIGuides.com – Unauthorized reproduction of this article in any language is prohibited. The information provided on this website is intended for general guidance and informational purposes only. It should not be considered a substitute for professional advice, and travellers are encouraged to verify visa requirements and travel advisories through official government sources before making any travel arrangements.

Reference: CBEC Customs Guide for Travellers , Reserve Bank of India Circular No. 45/2015 , RBI Notification No. FEMA 6 (R)/2015-RB

Aneesh, the Founder & Editor of DG Pixels, holds a Master’s Degree in Communication & Journalism, and has two decades of experience living in the Middle East. Since 2014, he and his team have been sharing helpful content on travel, visa rules, and expatriate affairs.

114 thoughts on “Indian Customs Rules For Carrying Cash (2023 Guide)”

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

can we carry currency to India from London should we pay if its 50000 pounds

Hello sir, One of my friend from UK came to India who was carrying a demand draft of worth 50000 dollars. The flight landed on 07-09-2023. The customs people Firstly contacted me to inform the arrival. At the same time the demand from me Rupees 49900/- to allow her to enter to India. After that the customs lady again call me telling that she is carring DD of worth foreign currency of 50000/- the value of which is approx Rupees 47,00,000/-. Again customs lady demand from 99000/- assured me that they will allow to the UK visitor to India. At the same time she assured me that after said amount is paid, they will allow the UK visitor to enter to India. As a courtesy I paid RS. 49900.00+99000.00+ 15000.00 (one day lounge charges at Mumbai international Airport) = total Rupees 163900.00 . The interesting thing is that the account details on which they asked payment from me, belong to a lady Sabita Das’s personal account number :- ((Account name: Sabita Das Account number: 0259104000260466 Ifsc code: IBKL0000259 pan: HZDPD0528M address: barddhaman Idbi bank.)) Now custom lady Pooja call me and told me that the visitor has not produced Income Tax clearance certificate, for which if you Rupees 1,75,000/- , we release the visitor. Since I had transferred the huge ammount, I refused to customs lady that I am not able to make the payment as you are charging with us. I ask the customs lady to send the visitor back to UK. It is a talk of 08-09-2023. Now I donot know whether they had returned the visitor back to UK, as vistor has Neither access to Mumbai international Airport to talk or chat on WhatsApp Nor Customs lady picking my phone call. I humbly request you to explain me please what is happening? Is it fair with the foreign visitors who are our welcomed guests. What the customs rule says?? Please guide me regarding this situation. Can I get back my Amount paid to Mumbai international Airport customs people PERSONAL ACCOUNT? 2ND WHAT WILL HAPPEN WITH VISITOR? KINDLY GUIDE ME Thanks & regards

Hi I am travelling to India by next week from UK, I have saved as cash some INR2000 denominations, I have more than 2 lakhs with me, None of the FOREX is accepting the denominations due to recent announcements of withdrawal of Rs 2000. Will it is ok to carry to India to deposit in India bank accounts? Other question to you is ,I understand only Rs25000 is allowed to carry according to Customs Rule to India by NRI’s. In this case, I shall declare Indian rupees and take as much I can? I appreciate your response. Thanks Gobinath S

Officially , you are allowed to bring in only Rs.25000 per person. But many travellers have told me that because of withdrawal of Rs.2000 note & that RBI has made no arrangement for people who have these notes & are living overseas, the customs at Indian airports are generally relaxed about this issue. But if you declare them, you may have a problem.

I shall be travelling to Nepal. Credit/Debit cards issued to us in India are not permissible for use in Nepal and Bhutan as specifically mentioned on cards. I understand I can carry a maximum of Rs.25000/- in Indian currency. How then am I supposed to meet my expenses in Nepal if they exceed Rs.25000/- ??

My question is filing declaration above $5K and total 10K monitory policy is for per person , or per adult person or per family? If an NRI coming to India with Family Say husband & wife, 3 kids (5 year, 9 year & 13 year) Can we carry maximum of 5K * 5 =25K or 5K * 2 =10k or 5K

If foreigner comes india with DD more then 20k us doller so any charge will taken for FRRO certificate like 1.2 lakh approx and then for police verification they are asking 75 thousand and all this money they want in indian rupees so please someone reply that is this a rule in india ? And how will the person from other country will arrange it in indian currency

If foreigner comes india with DD chq and it is more than 10k us$ so is there taken charge for FRO certificate as amount 1.2 lakh and then for police verification approx 1 lakh rupees and all money they want in indian rupees . Pls someone answer it ,is it a rule here in india ? And if yes so how will the foreign person will arrange it the changes money in indian rupee pls some one reply its urgent

I am first time in foreign. Now I’m in Gabon. How much can I carry US$ while returning to India.

Pls i need answer.. If a person from London bringing 300000 ponds bringing through demand draft.. what is the proper procedure in Indian any airport??

I also want the ans for same question only difference in currency about 40k dollar ,if some one give answer you then please send answer me also because my 2 lakh cash was invested in this and then after they are not releasing that person and they want more 75 thousand rupees for police verification so please give me answer if someone vive you answer

how much indian currency can be taken to Bhutan?

I couldnt see any link to fill and upload , is there any online link to fill and submit . plz advise

Can a foreigner (Not a NRI) can bring Indian Rupees to India? Although the article says that foreigners could bring 25000 Indian rupees, the travellers guide in Indian Custom Department says it is prohibitted to do so. Please advice.

Start typing and press enter to search

- Destinations

How Much Money Can You Bring when traveling from USA to India

If you’ve never thought about visiting India, you should reconsider. From the food to stunning religious monuments, India has a lot to see and do. However, regardless of your reason for travelling from USA to India , the reality is that there are limits on the amount of cash you can bring into or out of India.

Table of Contents

What, after all, is cash? Any coin or banknote in any world currency is considered cash. Also, as cash equivalents, traveler’s cheques count toward your cash total. Continue reading to learn everything you need to know about bringing cash through Indian customs.

What are the implications of bringing too much cash into India?

In India, breaking customs rules can result in having your cash confiscated, being fined, or even being arrested and prosecuted.

Indian Customs Declaration Forms (CDF) are available from customs officers at international airports and seaports. They may be distributed on planes before you arrive in India, but if not, they can be obtained at the airport as you go through customs. You can also download the form and fill it out ahead of time.

Also Read: Fly Happily By Saving Money On Cheap Flight Rates

Do all passengers traveling to India need to fill out A CDF?

Also, all the passengers who are travelling to India from US need not have to fill out a CDF. Only passengers carrying dutiable or prohibited goods must fill out this form or use the ATITHI application to complete the customs declaration. It is always critical to be aware of any restrictions a country may impose on the amount of cash you carry in various currencies.

If you want to avoid the hassle of transporting large sums of cash in USD to India, you can instead choose to send money internationally via the internet. You will have many options.

Countries from which no declaration is required if traveling to India

If you are travelling from USA to India or visiting India from another country, you may be required to declare cash or cash equivalents at the border. The requirement is the same in all countries and is based on the amount you have with you. You must declare the amount if it is US$5,000 or more in coins and notes, or US$10,000 or more in coins, notes, and traveller’s cheques.

Also Read: How to Save Money by Booking Cheap Flights

Countries from which a declaration is required if traveling to India

Travelers from all countries must declare cash when entering India if the amount is US$5,000 or more in coins and notes, or US$10,000 or more in coins, notes, and traveller’s cheques.

How much money can you bring out of India?

If you intend to export cash from India, expect the same rules that apply to importing currency. Non-Indian residents are strictly prohibited from exporting Indian rupees. Indian citizens can travel abroad with a maximum of Rs. 25,000.

There is no limit to the amount of foreign currency that can be taken out of India. However, if it is worth more than US$5,000 in banknotes and coins, or US$10,000 in coins, notes, and traveler’s cheques, it must be declared.

It’s also necessary to keep in mind that if you plan to travel to India from USA or if any other country, you’re visiting may have restrictions on how much money you can bring with you. Make sure to do your research depending on the country you’re visiting.

Cash currency exchange is expensive

Exchanging foreign currency for Indian rupees in cash is probably not the cheapest way to get money for your trip. Using an exchange service, even if it advertises no fees, often means paying more due to an inflated exchange rate.

In most countries, including India, using your debit card to withdraw cash in the local currency from a local ATM is the cheapest option. You may be charged an ATM fee, but you will not be charged for a poor exchange rate.

Remember that whether you’re bringing cash from your home country or withdrawing it once you arrive, carrying large amounts of cash with you while visiting a foreign country is never a good idea.

Book best deals with Indian Eagle

If you are t ravelling from USA to India, we can help you find the cheapest USA to India flights . We have worked tirelessly to serve our customers and assist them in saving as much money as possible on their international travel.

It is one of the primary reasons why millions of our valued customers choose us frequently to book their international flight tickets . So, what are you holding out for? Book your flights at the best price with us today!

With these tips in hand, your international travel to India from USA should go off without a hitch. Have a safe and happy journey!

RELATED ARTICLES MORE FROM AUTHOR

Now Travelers Can Buy Alaska Airlines SAF Credits for Eco-Friendly Flight Experience

Places to Visit in Lakshadweep for an Amazing Island Experience

A 2-Week North India Itinerary: Exploring the Treasures of the Subcontinent

10 Useful Tips for Group Travelling for a Memorable Experience

Delta Air Lines is the Best Airline for Customer Service in Premium Categories

The Rise of Solo Travel in India

Leave a reply cancel reply.

Save my name, email, and website in this browser for the next time I comment.

EVEN MORE NEWS

Now Travelers Can Buy Alaska Airlines SAF Credits for Eco-Friendly Flight...

Telangana Cuisine beyond Hyderabadi Dishes: 7 Famous Food Items of Telangana

POPULAR CATEGORY

- United States 287

- Airlines 137

- Destinations 110

- Business News

- India Business News

Are you travelling overseas? This is how much cash you can legally carry

Visual Stories

PPF Calculator

This financial tool allows one to resolve their queries related to Public Provident Fund account.

FD Calculator

When investing in a fixed deposit, the amount you deposit earns interest as per the prevailing...

NPS Calculator

The National Pension System or NPS is a measure to introduce a degree of financial stability...

Mutual Fund Calculator

Mutual Funds are one of the most incredible investment strategies that offer better returns...

Other Times Group News Sites

Popular categories, hot on the web, trending topics, living and entertainment, latest news.

The Economic Times daily newspaper is available online now.

Travelling abroad this is how much cash you can legally carry.

Under the Reserve Bank of India's Liberalized Remittance Scheme (LRS), Indians are allowed to freely remit up to $250,000 (around Rs 1.80 crore) per financial year for any permissible transactions.

- Travellers proceeding to Iraq and Libya who can draw foreign exchange in the form of foreign currency notes and coins not exceeding $5000 or its equivalent per visit

- Travellers proceeding to the Islamic Republic of Iran, Russian Federation and other Republics of Commonwealth of Independent States who can draw entire foreign exchange (up-to $250,000) in the form of foreign currency notes or coins.

Do you qualify as an NRI, RNOR or an ordinary Indian resident?

Planning a European holiday? Know what is visa shopping, and why it's a bad idea

Need multiple-entry visa to Europe? This Schengen country is your best option

Read More News on

The 96% of Indians that need an economic push

Vedanta is up 50% this fiscal. What explains its sheen?

Should you worry about Covishield’s clotting side-effects?

Fake invoices, ghost entries: Once a ‘manpasand’ stock, how a juice maker lands in Sebi net

Warren Buffett is selling Apple shares to hold on to cash. What does he see that others don’t?

How India can easily build a sovereign fund double the size of Temasek

Find this comment offensive?

Choose your reason below and click on the Report button. This will alert our moderators to take action

Reason for reporting:

Your Reason has been Reported to the admin.

To post this comment you must

Log In/Connect with:

Fill in your details:

Will be displayed

Will not be displayed

Share this Comment:

Uh-oh this is an exclusive story available for selected readers only..

Worry not. You’re just a step away.

Prime Account Detected!

It seems like you're already an ETPrime member with

Login using your ET Prime credentials to enjoy all member benefits

Log out of your current logged-in account and log in again using your ET Prime credentials to enjoy all member benefits.

To read full story, subscribe to ET Prime

₹34 per week

Billed annually at ₹2499 ₹1749

Super Saver Sale - Flat 30% Off

On ET Prime Membership

Unlock this story and enjoy all members-only benefits.

Offer Exclusively For You

Save up to Rs. 700/-

ON ET PRIME MEMBERSHIP

Get 1 Year Free

With 1 and 2-Year ET prime membership

Get Flat 40% Off

Then ₹ 1749 for 1 year

ET Prime at ₹ 49 for 1 month

Stay Ahead in the New Financial Year

Get flat 20% off on ETPrime

90 Days Prime access worth Rs999 unlocked for you

Exclusive Economic Times Stories, Editorials & Expert opinion across 20+ sectors

Stock analysis. Market Research. Industry Trends on 4000+ Stocks

Get 1 Year Complimentary Subscription of TOI+ worth Rs.799/-

Stories you might be interested in

Update May 10, 2024

Information for u.s. citizens in the middle east.

- Travel Advisories |

- Contact Us |

- MyTravelGov |

Find U.S. Embassies & Consulates

Travel.state.gov, congressional liaison, special issuance agency, u.s. passports, international travel, intercountry adoption, international parental child abduction, records and authentications, popular links, travel advisories, mytravelgov, stay connected, legal resources, legal information, info for u.s. law enforcement, replace or certify documents.

Before You Go

Learn About Your Destination

While Abroad

Emergencies

Share this page:

Travel Advisory June 23, 2023

India - level 2: exercise increased caution.

Reissued with updates to health information.

Exercise increased caution in India due to crime and terrorism.

Do not travel to:

- The union territory of Jammu and Kashmir (except the eastern Ladakh region and its capital, Leh) due to terrorism and civil unrest .

- Within 10 km of the India-Pakistan border due to the potential for armed conflict .

Country Summary : Indian authorities report rape is one of the fastest growing crimes in India. Violent crime, such as sexual assault, has occurred at tourist sites and in other locations.

Terrorists may attack with little or no warning, targeting tourist locations, transportation hubs, markets/shopping malls, and government facilities.

The U.S. government has limited ability to provide emergency services to U.S. citizens in rural areas from eastern Maharashtra and northern Telangana through western West Bengal as U.S. government employees must obtain special authorization to travel to these areas.

Read the country information page for additional information on travel to India.

The Centers for Disease Control and Prevention (CDC) has determined India has a moderate level of COVID-19. Visit the CDC page for the latest Travel Health Information related to your travel.

If you decide to travel to India:

- Do not travel alone, particularly if you are a woman. Visit our website for Women Travelers .

- Review your personal security plans and remain alert to your surroundings.

- Enroll in the Smart Traveler Enrollment Program ( STEP ) to receive Alerts and make it easier to locate you in an emergency.

- Follow the Department of State on Facebook and Twitter .

- Review the Country Security Report for India.

- Prepare a contingency plan for emergency situations. Review the Traveler’s Checklist .

Union Territory of Jammu and Kashmir – Level 4: Do Not Travel

Terrorist attacks and violent civil unrest are possible in the union territory of Jammu and Kashmir. Avoid all travel to this state (with the exception of visits to the eastern Ladakh region and its capital, Leh). Sporadic violence occurs particularly along the Line of Control (LOC) separating India and Pakistan, and in tourist destinations in the Kashmir Valley: Srinagar, Gulmarg, and Pahalgam. The Indian government prohibits foreign tourists from visiting certain areas along the LOC.

Visit our website for Travel to High-Risk Areas .

India-Pakistan Border – Level 4: Do Not Travel

India and Pakistan maintain a strong military presence on both sides of the border. The only official India-Pakistan border crossing point for persons who are not citizens of India or Pakistan is in the state of Punjab between Attari, India, and Wagah, Pakistan. The border crossing is usually open but confirm the current status of the border crossing prior to commencing travel. A Pakistani visa is required to enter Pakistan. Only U.S. citizens residing in India may apply for a Pakistani visa in India. Otherwise apply for a Pakistani visa in your country of residence before traveling to India.

Northeastern States – Level 4: Do Not Travel

Incidents of violence by ethnic insurgent groups, including bombings of buses, trains, rail lines, and markets, occur occasionally in the northeast.

U.S. government employees at the U.S. Embassy and Consulates in India are prohibited from traveling to the states of Assam, Arunachal Pradesh, Mizoram, Nagaland, Meghalaya, Tripura, and Manipur without special authorization from the U.S. Consulate General in Kolkata.

Central and East India – Level 4: Do Not Travel

Maoist extremist groups, or “Naxalites,” are active in a large swath of India from eastern Maharashtra and northern Telangana through western West Bengal, particularly in rural parts of Chhattisgarh and Jharkhand and on the borders of Telangana, Andhra Pradesh, Maharashtra, Madhya Pradesh, Uttar Pradesh, Bihar, West Bengal, and Odisha. The Naxalites have conducted frequent terrorist attacks on local police, paramilitary forces, and government officials.

Due to the fluid nature of the threat, all U.S. government travelers to states with Naxalite activity must receive special authorization from the U.S. consulate responsible for the area to be visited. U.S. officials traveling only to the capital cities in these states do not need prior authorization.

Visit our website for Travel to High-Risk Areas .

Embassy Messages

View Alerts and Messages Archive

Quick Facts

Must be valid for six months beyond date of visa application to obtain a visa.

Two pages required.

Yes. Travelers must enter in either on a paper visa, valid for 10 years for U.S. citizens, or an e-tourist visa.

Required for yellow fever if the traveler is arriving from an infected area; others are suggested.

The possession of satellite phones is prohibited in India; Currency in excess of USD $5,000 must be declared. Please check with the Indian Embassy in Washington if you are planning to carry a large amount of currency into India.

Check local law for reporting requirements for exiting with large quantities of foreign currency and Indian rupees.

Embassies and Consulates

U.s. embassy new delhi.

Shantipath, Chanakyapuri New Delhi - 110021 India Telephone: +(91) (11) 2419-8000 Emergency After-Hours Telephone: +(91) (11) 2419-8000 Fax: +(91) (11) 2419-0017 [email protected]

The U.S. Embassy, New Delhi serves American citizens in the Indian states of Haryana, Himachal Pradesh, Punjab, Rajasthan, Uttarakhand, and Uttar Pradesh, the union territories of Chandigarh, Delhi, Jammu and Kashmir, and Ladakh, and the country of Bhutan.

U.S. Consulate General Mumbai (Bombay) C-49, G-Block, Bandra Kurla Complex Bandra East, Mumbai 400051 India Telephone: +(91) (22) 2672-4000 Emergency After-Hours Telephone: +(91) (22) 2672-4000 If you are calling from within India, but outside Mumbai, first dial 022. Fax: 91-(0)22-2672-4786 [email protected]

The Consulate General in Mumbai provides consular services for the states of Goa, Gujarat, Chhatisgarh, Madhya Pradesh, and Maharashtra, and the union territory of Diu and Daman, and Dadra and Nagar Haveli.

U.S. Consulate General Kolkata (Calcutta) 5/1 Ho Chi Minh Sarani Kolkata - 700 071, West Bengal, India Telephone: +(91) (33) 3984-2400 Emergency After-Hours Telephone: +(91) 99030 42956 or +(91) (33) 3984-2400 then dial "0" Fax: +(91) (33) 2282-2335

The United States Consulate General in Kolkata provides consular services for the states of Bihar, West Bengal, Jharkhand, Nagaland, Mizoram, Manipur, Meghalaya, Arunachal Pradesh, Sikkim, Tripura and Assam. [email protected]

U.S. Consulate General Chennai (Madras) 220 Anna Salai at Gemini Circle Chennai, India 600006 Telephone: +(91) (44) 2857-4000 Emergency After-Hours Telephone: (0) 44-2857-4000. Ask for American Citizen Services.(Within India, but outside Chennai, first dial 044. From the United States, first dial 011-(91) (44) ) Fax: +(91) (044) 2811-2020

The Consulate General in Chennai provides consular services for the states of Tamil Nadu, Karnataka, Kerala, and the Union Territories of Andaman and Nicobar Islands, Pondicherry and Lakshwadeep Islands. [email protected]

U.S. Consulate General Hyderabad Survey No. 115/1, Financial District, Nanakramguda Hyderabad, Telangana, 500032 Phone: 040 6932 8000

The Consulate General in Hyderabad provides services to the U.S. citizens in the Indian states of Andhra Pradesh, Telangana, and Odisha. [email protected]

Destination Description

Learn about the U.S. relationship to countries around the world.

Entry, Exit and Visa Requirements

All U.S. citizens need a valid passport as well as a valid Indian visa or an Overseas Citizen of India (OCI) card, to enter and exit India for any purpose. Travelers without valid documents or the correct type of visa may be denied entry into India. Indian visa regulations and instructions change frequently, often with little advance notice. Travelers are urged to check the website of the Indian Embassy in Washington, D.C. before any travel to India to review the most current information. The U.S. Embassy and Consulates General in India cannot assist you if you arrive without proper documentation.

U.S. citizens seeking to enter India solely for tourist purposes for stays of less than 60 days may apply for an eVisa at least four days prior to their arrival. Please visit the Indian government's website for electronic travel authorization for additional information and to submit an application.

U.S. citizens seeking to enter India as a tourist for longer than 60 days or for any other purpose must apply for a visa from an Indian embassy or consulate. The Government of India has appointed VFS Global to assist with visa services to individuals in the United States. Applicants may apply for Indian visas through the application link https://visa.vfsglobal.com/usa/en/ind/apply-visa .

Diplomatic and Official visa applications are accepted directly at the Indian Embassy and Consulates. All U.S. government employees traveling on official orders, including military personnel, must obtain country clearance for travel to India. Once you have received your visa, check it carefully to ensure that the type of visa and number of entries is appropriate for your travel plans.

Keep copies of your U.S. passport data page, as well as the pages containing the Indian visa and Indian immigration stamps with you at all times. Consider downloading these documents to your mobile phone in case of emergency. If your passport is lost or stolen, copies will help you apply for a replacement passport and an exit visa from the Indian government. Replacing a lost visa, which is required in order to exit the country, may take four or five business days.

U.S. citizens of Pakistani origin or descent are subject to administrative processing and should expect additional delays when applying for Indian visas.

Foreign citizens who visit India to study, do research, work, or act as missionaries, as well as all travelers and residents planning to stay more than 180 days, are required to register their visit or residency within 14 days of arrival with the Foreigners Regional Registration Office (FRRO) closest to where they will be staying in addition to having the appropriate visa when they enter India. The FRRO maintains offices in New Delhi, Mumbai, Chennai, Hyderabad, Kolkata, Bengaluru (Bangalore), Lucknow, Calicut, Goa, Cochin, Trivandrum, and Amritsar. District Superintendents of Police serve as Foreigners Registration Officers (FROs) in all other places. We recommend all U.S. citizens review the entry requirements described on the Frequently Asked Question (FAQ) section on the Indian Bureau of Immigration website.

If you overstay your Indian visa, or otherwise violate Indian visa regulations, you may require clearance from the Ministry of Home Affairs to leave the country. Generally, you will be fined and, in some cases, may be jailed for months. Visa violators seeking an exit permit must visit the Foreigners Regional Registration Office portal to submit the application and pay any levied fines. Processing of an exit permit under these circumstances can take up to 90 days and decisions will be made on a case-by-case basis.

For the most current information on entry and exit requirements, please contact the Embassy of India at 2536 Massachusetts Avenue NW, Washington, DC 20008, telephone (202) 939-9806 or the Indian Consulates in Atlanta , Chicago , Houston , New York , or San Francisco . Outside the United States, inquiries should be made at the nearest Indian embassy or consulate.

General information regarding Indian visa and immigration rules, including the addresses and telephone numbers for the FRRO offices, can be found at the Indian Ministry of Home Affairs Bureau of Immigration website.

HIV/AIDS RESTRICTIONS: There are no disclosure requirements or restrictions for HIV/AIDS patients who enter India on a tourist visa. Disclosure regarding HIV/AIDS is required of anyone seeking a resident permit in India. Foreign residents found to be suffering from HIV/AIDS will be deported. Please verify this information with the Embassy of India before you travel.

Find information on dual nationality , prevention of international child abduction and customs regulations on our websites.

Safety and Security

U.S. citizens should always practice good personal security and situational awareness. Be aware of your surroundings (including local customs and etiquette) and keep a low profile. Monitor local news reports, vary your routes and times in carrying out daily activities, and consider the level of security present when you visit public places, including religious sites, and when choosing hotels, restaurants, and entertainment and recreation venues.

India continues to experience terrorist and insurgent activities which may affect U.S. citizens directly or indirectly. Anti-Western terrorist groups, some on the U.S. government's list of foreign terrorist organizations, are active in India, including Islamist extremist groups such as Harkat-ul-Jihad-i-Islami, Harakat ul-Mujahidin, Indian Mujahideen, Jaish-e-Mohammed, and Lashkar-e Tayyiba. The U.S. government occasionally receives information regarding possible terrorist attacks that could take place in India, monitors such information to determine credibility, and advises U.S. citizens accordingly. Enroll in the Smart Traveler Enrollment Program (STEP) to receive messages from the Embassy automatically.

Past attacks have targeted public places, including some frequented by Westerners, such as luxury and other hotels, trains, train stations, markets, cinemas, mosques, and restaurants in large urban areas. Attacks have taken place during the busy evening hours in markets and other crowded places, but could occur at any time. Alerts are usually more frequent around major holidays. The Maoists (also known as “Naxalites”) are the most active insurgent group in India. The Naxalites typically attack Indian government officials, but have also derailed trains, targeted other government buildings such as police stations, and conducted other criminal activity. In eastern India’s Bihar state, 10 security personnel were killed and five injured in a Naxalite-triggered Improvised Explosive Device blast on July 18, 2016. In the eastern state of Jharkhand, seven policemen were killed and eight others injured in a landmine blast by Naxalites on January 27, 2016.

Beyond the threat from terrorism and insurgencies, demonstrations and general strikes, or “bandh,” often cause major inconvenience and unrest. These strikes can result in the stoppage of all transportation and tourist-related services, at times for 24 hours or more. U.S. citizens caught in such a strike may find they are unable to make flight and rail connections, as local transportation can be severely limited. Local media generally give an idea of the length and geographical location of the strike. Large religious gatherings that attract hundreds of thousands of people can result in dangerous and often life-threatening stampedes. Local demonstrations can begin spontaneously and escalate with little warning, disrupting transportation systems and city services and posing risks to travelers. In response to such events, Indian authorities occasionally impose curfews and/or restrict travel. You are urged to obey such curfews and travel restrictions and to avoid demonstrations and rallies as they have the potential for violence, especially immediately preceding and following political rallies, elections, and religious festivals (particularly when Hindu and Muslim festivals coincide). Tensions between castes and religious groups can also result in disruptions and violence. In some cases, demonstrators specifically block roads near popular tourist sites and disrupt train operations in order to gain the attention of Indian authorities; occasionally vehicles transporting tourists are attacked in these incidents. India generally goes on “High Alert” status prior to major holidays or events. You should monitor local television, print media, Mission India’s American Citizens Services Facebook page, and enroll with the Smart Traveler Enrollment Program for further information about the current situation in areas where you will travel.

The U.S. Embassy and U.S. Consulates General in Chennai, Hyderabad, Kolkata, and Mumbai will post information about routine demonstrations on the U.S. Embassy and U.S. Consulates General websites, under the heading “Demonstration Notices.” Please monitor our websites regularly for information about protest activities in the country. Please note that the Embassy and Consulates General will issue emergency/security messages for other purposes, as necessary.

Religious violence occasionally occurs in India, especially when tensions between different religious communities are purposefully exacerbated by groups pushing religiously chauvinistic agendas. There are active "anti-conversion" laws in some Indian states, and acts of conversion sometimes elicit violent reactions from Hindu extremists. Foreigners suspected of proselytizing Hindus have been attacked and killed in conservative, rural areas in India in the past.

Swimming in India: You should exercise caution if you intend to swim in open waters along the Indian coastline, particularly during the monsoon season. Every year, several people in Goa, Mumbai, Puri (Odisha), off the Eastern Coast in the Bay of Bengal, and other areas drown due to strong undertows. It is important to heed warnings posted at beaches and to avoid swimming in the ocean during the monsoon season. Trained lifeguards are very rare along beaches.

If you visit the Andaman Islands, be aware that there have been reports of crocodile attacks in salt water resulting in fatalities. Ask local residents about dangerous sea life before swimming and keep a safe distance from animals at all times.

Wildlife safaris: India offers opportunities for observation of wildlife in its natural habitat and many tour operators and lodges advertise structured, safe excursions into parks and other wildlife viewing areas for close observation of flora and fauna. However, safety standards and training vary, and it is a good idea to ascertain whether operators are trained and licensed. Even animals marketed as “tame” should be respected as wild and extremely dangerous. Keep a safe distance from animals at all times, remaining in vehicles or other protected enclosures when venturing into game parks.

Trekking in India: Trekking expeditions should be limited to routes identified for this purpose by local authorities. Use only registered trekking agencies, porters, and guides, suspend trekking after dark, camp at designated camping places, and travel in groups rather than individually or with one or two companions. Altitudes in popular trekking spots can be as high as 25,170 feet (7,672 m); please make sure that you have had a recent medical checkup to ensure that you are fit to trek at these altitudes and carry sufficient medical insurance that includes medical evacuation coverage.

Train Travel: India has the third largest rail network in the world, and train travel in India generally is safe. Nevertheless, accidents and on-board fires are sometimes caused by aging infrastructure, poorly maintained equipment, overcrowding, and operator errors. Train accidents and fires have resulted in the death and serious injury of passengers.

Areas of Instability: Jammu & Kashmir: The Department of State strongly recommends that you avoid travel to the union territory of Jammu & Kashmir because of the potential for terrorist incidents as well as violent public unrest. A number of terrorist groups operate in the territory targeting security forces, particularly along the Line of Control (LOC) separating Indian and Pakistani-controlled Kashmir, and those stationed in primary tourist destinations in the Kashmir Valley: Srinagar, Gulmarg, and Pahalgam. Since 1989, as many as 70,000 people (terrorists, security forces, and civilians) have been killed in the Kashmir conflict. Foreigners are particularly visible, vulnerable, and at risk. In the past, serious communal violence left the territory mostly paralyzed due to massive strikes and business shutdowns, and U.S. citizens have had to be evacuated by local police. The Indian government prohibits foreign tourists from visiting certain areas along the LOC (see the section on Restricted Areas, below).

India-Pakistan Border: The Department of State recommends that you avoid travel to areas within ten kilometers of the border between India and Pakistan. Both India and Pakistan maintain a strong military presence on both sides of the border. The only official India-Pakistan border crossing point for persons who are not citizens of India or Pakistan is in the state of Punjab between Atari, India, and Wagah, Pakistan. The border crossing is usually open, but you are advised to confirm the current status of the border crossing prior to commencing travel. A Pakistani visa is required to enter Pakistan. Only U.S. citizens residing in India may apply for a Pakistani visa in India. Otherwise you should apply for a Pakistani visa in your country of residence before traveling to India.

Both India and Pakistan claim an area of the Karakoram mountain range that includes the Siachen glacier. Travel or mountain climbing in this area is highly dangerous. The disputed area includes the following peaks: Rimo Peak; Apsarasas I, II, and III; Tegam Kangri I, II and III; Suingri Kangri; Ghiant I and II; Indira Col; and Sia Kangri. Check with the U.S. Embassy in New Delhi for information on current conditions.

Northeastern states: Incidents of violence by ethnic insurgent groups, including bombings of buses, trains, rail lines, and markets, occur occasionally in the northeast. While U.S. citizens have not been specifically targeted, it is possible that you could be affected as a bystander. If you travel to the northeast, you should avoid travel by train at night, travel outside major cities at night, and crowds. U.S. government employees at the U.S. Embassy and Consulates in India are prohibited from traveling to the states of Assam, Arunachal Pradesh, Mizoram, Nagaland, Meghalaya, Tripura, and Manipur without permission from the U.S. Consulate General in Kolkata. Restricted Area Permits are required for foreigners to visit certain Northeastern states (see the section on Restricted Areas, below.) Contact the U.S. Consulate General in Kolkata for information on current conditions.

East Central and Southern India: Maoist extremist groups, or “Naxalites,” are active in East Central India primarily in rural areas. The Naxalites have a long history of conflict with state and national authorities, including frequent terrorist attacks on local police, paramilitary forces, and government officials, and are responsible for more attacks in the country than any other organization through an ongoing campaign of violence and intimidation Naxalites have not specifically targeted U.S. citizens but have attacked symbolic targets that have included Western companies and rail lines. While Naxalite violence does not normally occur in places frequented by foreigners, there is a risk that visitors could become victims of violence.

Naxalites are active in a large swath of India from eastern Maharashtra and northern Telangana through western West Bengal, particularly in rural parts of Chhattisgarh and Jharkhand and on the borders of Telangana, Andhra Pradesh, Maharashtra, Madhya Pradesh, Uttar Pradesh, Bihar, West Bengal, and Odisha. Due to the fluid nature of the threat, all U.S. government travelers to states with Naxalite activity must receive authorization from the U.S. Consulate responsible for the area to be visited. U.S. officials traveling only to the capital cities in these states do not need prior authorization.

Restricted/Protected areas: While the Indian Government has designated that travelers to “portions” of certain areas need special advance permission, actual practice has been to require a permit to enter any portion of certain states or territories. Areas requiring a permit include:

- The state of Arunachal Pradesh

- Portions of the state of Sikkim

- Portions of the state of Himachal Pradesh near the Chinese border

- Portions of the state of Uttarakhand (Uttaranchal) near the Chinese border

- Portions of the state of Rajasthan near the Pakistani border

- Portions of the union territory of Jammu & Kashmir near the Line of Control with Pakistan and certain portions of the union territory of Ladakh

- The union territory of Andaman & Nicobar Islands

- The union territory of the Laccadives Islands (Lakshadweep)

- Portions of the state of Manipur

- Portions of the state of Mizoram

- Portions of the state of Nagaland

More information about travel to/in restricted/protected areas can be found from India’s Bureau of Immigration .

“Restricted Area Permits" are available outside India at Indian embassies and consulates abroad, or in India from the Ministry of Home Affairs (Foreigners Division) at Jaisalmer House, 26 Man Singh Road, New Delhi. The states of Arunachal Pradesh and Sikkim maintain official guesthouses in New Delhi, which can also issue Restricted Area Permits for their respective states for certain travelers. While visiting Mamallapuram (Mahabalipuram) in Tamil Nadu, be aware the Indira Gandhi Atomic Research Center, Kalpakkam, is located just south of the site and is not clearly marked as a restricted and dangerous area.

For the latest security information, travelers should enroll in STEP to receive updated security information and regularly monitor travel information available from the U.S. Embassy in New Delhi as well as the U.S. Consulates General in Mumbai (Bombay), Chennai (Madras), Hyderabad , and Kolkata (Calcutta).

CRIME: Petty crime, especially theft of personal property (including U.S. passports), is common, particularly on trains or buses, at airports, and in major tourist areas. Pickpockets can be very adept and women have reported having their bags snatched, purse-straps cut, or the bottom of their purses slit without their knowledge. If you are traveling by train, lock your sleeping compartments and take your valuables with you when leaving your berth. If you travel by air, be careful with your bags in the arrival and departure areas outside airports. Violent crime, especially directed against foreigners, has traditionally been uncommon, although in recent years there has been a modest increase. Be cautious about displaying cash or expensive items to reduce the chance of being a target for robbery or other crime, and be aware of your surroundings when you use ATMs. ATM card scams have been used to clone credit card details to withdraw money.

Sexual Assault: Travelers should be aware that there have been reported cases of sexual assault, including rape, of U.S. citizens traveling throughout India. U.S. citizens, particularly women, are cautioned not to travel alone in India. Women traveling in India are advised to respect local dress and customs. Customary everyday dress for Indian women throughout the country is conservative, and even more so in non-urban areas, with women wearing clothing that covers their legs and shoulders. Exceptions are vacation resorts catering to foreign clientele and some neighborhoods of the major cities of New Delhi and Mumbai. Western women, especially those of African descent, continue to report incidents of verbal and physical harassment by individuals and groups of men. Known locally as “Eve-teasing,” these incidents of sexual harassment can be quite frightening and can quickly cross the line from verbal to physical. Sexual harassment can occur anytime or anywhere, but most frequently has happened in crowded areas such as in market places, train stations, buses, and public streets. The harassment can range from sexually suggestive or lewd comments to catcalls to outright groping. The Government of India has focused greater attention on addressing issues of gender violence. One outcome has been greater reporting of incidences of sexual assault country-wide, and Indian authorities report rape is one of the fastest growing crimes in India. Among large cities, Delhi experienced the highest number of reported crimes against women. Although most victims have been local residents, recent sexual attacks against female visitors in tourist areas across India underline the fact that foreign women are at risk and should exercise vigilance.

Women should observe stringent security precautions, including avoiding use of public transport after dark without the company of known and trustworthy companions, restricting evening entertainment to well-known venues, and avoiding isolated areas when alone at any time of day. Keep your hotel room number confidential and make sure hotel room doors have chains, deadlocks, and peep holes. Travel with groups of friends rather than alone. In addition, only hire reliable cars and drivers and avoid traveling alone in hired taxis, especially at night. Use taxis from hotels and pre-paid taxis at airports rather than hailing them on the street. If you encounter threatening situations, call “100” for police assistance (“112” from mobile phones).

Scams: Major airports, train stations, popular restaurants, and tourist sites are often used by scam artists looking to prey on visitors, often by creating a distraction. Beware of taxi drivers and others, including train porters, who solicit travelers with "come-on" offers of cheap transportation and/or hotels. Travelers accepting such offers have frequently found themselves the victims of scams, including offers to assist with "necessary" transfers to the domestic airport, disproportionately expensive hotel rooms, unwanted "tours," unwelcome "purchases," extended cab rides, and even threats when the tourists decline to pay. There have been reports of tourists being lured, held hostage and extorted for money in the face of threats of violence against the traveler and his/her family members.

You should exercise care when hiring transportation and/or guides and use only well-known travel agents to book trips. Some scam artists have lured travelers by displaying their name on a sign when they leave the airport. Another popular scam is to drop money or to squirt something on the clothing of an unsuspecting traveler and use the distraction to rob them of their valuables. Tourists have also been given drugged drinks or tainted food to make them more vulnerable to theft, particularly at train stations. Even food or drink prepared in front of the traveler from a canteen or vendor could be tainted.

Some vendors sell carpets, jewelry, gemstones, or other expensive items that may not be of the quality promised. Deal only with reputable businesses and do not hand over your credit cards or money unless you are certain that goods being shipped are the goods you purchased. If a deal sounds too good to be true, it is best avoided. Most Indian states have official tourism bureaus set up to handle complaints.

There have been a number of other scams perpetrated against foreign travelers, particularly in Goa, Jaipur, and Agra that target younger travelers and involve suggestions that money can be made by privately transporting gems or gold (both of which can result in arrest) or by taking delivery abroad of expensive carpets, supposedly while avoiding customs duties. The scam artists describe profits that can be made upon delivery of the goods, and require the traveler to pay a "deposit" as part of the transaction.

India-based criminals use the internet to extort money from victims abroad. In a common scam, the victim develops a close romantic relationship with an alleged U.S. citizen they meet online. When the “friend” travels to India, a series of accidents occur and the victim begins to receive requests for financial assistance, sometimes through an intermediary. In fact, the U.S. citizen “friend” does not exist; they are only online personas used by criminal networks. Victims have been defrauded of thousands of dollars in these schemes. Do not send money to anyone you have not met in person and carefully read the Department of State’s advice on international financial scams .

U.S. citizens have had problems with business partners, usually involving property investments. You may wish to seek professional legal advice in reviewing any contracts for business or services offered in India. The U.S. Embassy and/or consulates are unable to provide legal advice or intervene on behalf of United States citizens with Indian courts on civil or criminal matters. A list of local attorneys is available on the Embassy and Consulates General websites .

In another common scam, family members in the United States, particularly older people, are approached for funds to help callers claiming to be grandchildren or relatives who have been arrested or are without money to return home. Do not send money without contacting the U.S. Embassy or Consulate General to confirm the other party’s situation. You can also call our Office of Overseas Citizens Services at 888-407-4747 (from overseas: 202-501-4444). Review our information on Emergency Assistance to Americans Abroad .

See the Department of State and the FBI pages for more information on scams.

Don’t buy counterfeit and pirated goods, even if they are widely available. Not only are the bootlegs illegal in the United States, if you purchase them you may also be breaking local law.

Victims of Crime: U.S. citizen victims of sexual assault should first contact the local police, then inform the U.S. Embassy or local Consulate.

Report crimes to the local police by calling “100” or “112” from a mobile phone.

Remember that local authorities are responsible for investigating and prosecuting the crime.

See our webpage on help for U.S. victims of crime overseas .

- help you find appropriate medical care

- assist you in reporting a crime to the police

- contact relatives or friends with your written consent

- explain the local criminal justice process in general terms

- provide a list of local attorneys

- provide our information on victim’s compensation programs in the U.S.

- provide an emergency loan for repatriation to the United States and/or limited medical support in cases of destitution

- help you find accommodation and arrange flights home

- replace a stolen or lost passport

Please note that you should ask for a copy of the police report, known as a “First Information Report” (FIR), from local police when you report an incident. Local authorities generally are unable to take any meaningful action without the filing of a police report.

If your passport is stolen, you should immediately report the theft or loss to the police in the location where your passport was stolen. A FIR is required by the Indian government in order for you to obtain an exit visa to leave India if the lost passport contained your Indian visa. Although the Embassy or Consulate General is able to replace a stolen or lost passport, the Ministry of Home Affairs and the Foreigners Regional Registration Office (FRRO) are responsible for approving an exit permit. This process usually takes three to four working days, but can take longer.

In cases of sexual assault or rape, the Embassy or Consulates General can provide a list of local doctors and hospitals, if needed, to determine if you have been injured and to discuss treatment and prevention options for diseases and pregnancy. You should be aware that in order for evidence of an assault to be submitted in a court case, Indian authorities require that the medical exam be completed at a government hospital. Therefore, if a victim goes to a private hospital for treatment, the hospital will refer them to a government hospital for this aspect of the medical process.

There are a number of resources in India for victims of rape and sexual assault. The specific toll-free Women’s Helpline Service number in Delhi is 1091; in Mumbai it is 103; in Kolkata, 1090; in Chennai, 1091 or 2345-2365; and in Hyderabad one can dial 1-800-425-2908 or 1098 for crimes in general.

The local equivalent to the “911” emergency line in India is “100.” An additional emergency number, “112,” can be accessed from mobile phones.

Please see our information for victims of crime , including possible victim compensation programs in the United States.

Domestic Violence: U.S. citizen victims of domestic violence may contact the Embassy for assistance.

Tourism: The tourism industry is unevenly regulated, and safety inspections for equipment and facilities do not commonly occur. Hazardous areas/activities are not always identified with appropriate signage, and staff may not be trained or certified either by the host government or by recognized authorities in the field. In the event of an injury, appropriate medical treatment is typically available only in/near major cities. First responders are generally unable to access areas outside of major cities and to provide urgent medical treatment. U.S. citizens are encouraged to purchase medical evacuation insurance. See our webpage for more information on insurance providers for overseas coverage.

Local Laws & Special Circumstances

Criminal Penalties: You are subject to local laws. If you violate local laws, even unknowingly, you may be expelled, arrested, or imprisoned.

Furthermore, some activities are crimes under U.S. law and can be prosecuted in the U.S. regardless of whether they are allowed under local law. For examples, see our website on crimes against minors abroad and the Department of Justice website.

Arrest Notification: If you are arrested or detained, ask police or prison officials to notify the U.S. Embassy immediately. See our webpage for further information.

Alcohol: Each of India’s states has independent regulations concerning alcohol purchase and consumption. Legal drinking ages range from 18 to 25 and can vary by beverage type. Some states permit alcohol use for medicinal purposes only, others require you to hold a permit to buy, transport, or consume alcohol. Penalties for violation can be harsh.

Drugs: Several U.S. citizens have been arrested at Indian airports for attempting to smuggle illegal drugs from India. All claimed that they did not realize they were carrying narcotics. Never transport or mail packages that do not belong to you and maintain direct control of your luggage at all times.

Beef and Cow Hide: Several states in India impose various types of prohibition on beef. In some rural areas, cow protection vigilantes have attacked people they suspected of selling or consuming beef, or possessing items made with cow hide.

SPECIAL CIRCUMSTANCES:

Dual nationality: India does not permit its citizens to hold dual nationality. In 2006, India launched the "Overseas Citizens of India" (OCI) program, which does not grant Indian citizenship but is similar to a U.S. "green card" in that you can travel to and from India indefinitely, work in India, study in India, and own property in India (except for certain agricultural and plantation properties). If you are a U.S. citizen and obtain an OCI card you will not become a citizen of India; you will remain a citizen of the United States. An OCI card holder does not receive an Indian passport, cannot vote in Indian elections, and is not eligible for Indian government employment. The OCI program is similar to the Persons of Indian Origin (PIO) card except that PIO holders must still register with Indian immigration authorities, and PIO cards are not issued for an indefinite period. U.S. citizens of Indian descent can apply for PIO or OCI cards at the Indian Embassy in Washington, or at the Indian Consulates in Chicago, New York, San Francisco, Atlanta, and Houston. Inside India, U.S. citizens can apply at the nearest FRRO office (please see “Entry/Exit Requirements” section above for more information on the FRRO). U.S. citizens are required to travel on a U.S. passport when traveling in and out of the United States.

Religious activities and faith-based travelers: See the Department of State’s International Religious Freedom Report . If you plan to engage in religious proselytizing you are required by Indian law to have a "missionary" visa. Immigration authorities have determined that certain activities, including speaking at religious meetings to which the general public is invited, may violate immigration law if the traveler does not hold a missionary visa. Foreigners with tourist visas who engage in missionary activity are subject to deportation and possible criminal prosecution. The states of Odisha, Chhattisgarh, Gujarat, Himachal Pradesh, Madhya Pradesh, and Arunachal Pradesh have legislation that regulates or places restrictions on conversion from one religious faith to another. If you intend to engage in missionary activity, you may wish to seek legal advice to determine whether the activities you intend to pursue are permitted under Indian law.

Tourists should also be mindful of restrictions and observances when planning to visit any religious establishment, whether Hindu temples, mosques, churches, or other locations considered sacred by the local population. Many individual temples and mosques do not permit non-members to enter all or parts of the facilities, and may require the removal of shoes, the covering of the head, or have other specific requirements for appropriate attire.

Customs restrictions: Before traveling to or from India, you are urged to inspect all bags and clothing thoroughly to ensure they do not inadvertently contain prohibited items. Several U.S. citizens have been arrested or detained when airport security officials discovered loose ammunition (even spent individual bullets and casings) or weapons in their luggage. If you are found to have loose ammunition or bullets (including empty bullet shells used in souvenirs) on your person or in your bags, you could be charged with violation of the Indian Arms Act, incarcerated, and/or deported from India.

In addition, U.S. citizens have been arrested for possession of satellite phones. Satellite phones, personal locator beacons, and hand-held GPS devices are illegal in India.

Indian customs authorities enforce strict regulations concerning temporary importation into or export from India of such items as, antiquities, electronic equipment, currency, ivory, gold objects, and other prohibited materials. Permission from the Government of India is required to bring in restricted items, even if you are only transiting through India. If you do not comply with these regulations, you risk arrest or fine or both and confiscation of these items. If you are charged with any legal violations by Indian law enforcement, have an attorney review any document before you sign it. The Government of India requires the registration of antique items with the local police along with a photograph of the item. It is advisable to contact the Embassy of India in Washington or one of India's consulates in the United States for specific information regarding customs requirements. More information is available from the Indian Central Board of Excise and Customs .

Indian customs authorities encourage the use of an ATA (Admission Temporaire/Temporary Admission) Carnet for the temporary admission of professional equipment, commercial samples, and/or goods for exhibitions and fair purposes. ATA Carnet Headquarters, located at the U.S. Council for International Business , 1212 Avenue of the Americas, New York, NY 10036, issues and guarantees the ATA Carnet in the United States. For additional information call (212) 354-4480, or email USCIB for details. Please see our section on Customs Information for more information.

Natural disaster threats: Parts of northern India are highly susceptible to earthquakes. Regions of highest risk, ranked 5 on a scale of 1 to 5, include areas around Srinagar, Himachal Pradesh, Rishikesh and Dehra Dun, the northern parts of Punjab, northwest Gujarat, northern Bihar, and the entire northeast. Ranked 4 (high damage risk) is an area that sweeps along the north through Jammu and Kashmir, Eastern Punjab, Haryana, Northern Uttar Pradesh, central Bihar and the northern parts of West Bengal. New Delhi is located in zone 4. Severe flooding is common in hilly and mountainous areas throughout India. Flooding in 2013 in Uttarakhand, Himachal Pradesh, Tamil Nadu and other areas left thousands of people presumed dead and temporarily stranded dozens of U.S. citizens.

Typhoons/cyclones and subsequent flooding are common along the Indian coasts, in particular the Eastern coastal states of Tamil Nadu, Andhra Pradesh, Odisha and West Bengal, and have at times resulted in massive loss of life. Tourists and residents in areas prone to these events should remain vigilant during severe weather, monitor local media for latest developments, and heed all municipal warnings. Residents in these areas should have contingency plans for loss of power and inavailability of goods and services, including supplies for multiple days after a severe weather event.

Accessibility: While in India, individuals with disabilities may find accessibility and accommodation very different than what you find in the United States. Despite legislation that all public buildings and transport be accessible for disabled people, accessibility remains limited. One notable exception is the Delhi metro system, designed to be accessible to those with physical disabilities.

Women Travelers: Please review our travel tips for Women Travelers .

Students: See our Students Abroad page and FBI travel tips .

LGBTQI+ Travelers: Section 377 of India’s penal code makes same-sex sexual acts illegal in India. On September 6, 2018, the Supreme Court of India declared unconstitutional the application of Section 377, barring discrimination on the basis of sexual orientation, effectively legalizing homosexuality in India. Reports of widespread discrimination and violence against LGBTQI+ persons, particularly in rural areas, persist. See our LGBTQI+ Travel Information page and section 6 of our Human Rights report for further details.

Zika is present in India. See the Centers for Disease Control’s website for more information.

The quality of medical care in India varies considerably. Medical care in the major population centers approaches and occasionally meets Western standards, but adequate medical care is usually very limited or unavailable in rural areas.

We do not pay medical bills. Be aware that U.S. Medicare does not apply overseas.

Medical Insurance: Make sure your health insurance plan provides coverage overseas. Most care providers overseas only accept cash payments. See our webpage for more information on insurance providers for overseas coverage .

We strongly recommend supplemental insurance (our webpage) to cover medical evacuation.

If traveling with prescription medication, check with the government of India to ensure the medication is legal in India. Always, carry your prescription medication in original packaging with your doctor’s prescription.

Vaccinations: Be up-to-date on all vaccinations recommended by the U.S. Centers for Disease Control and Prevention.

If you are arriving in India from Sub-Saharan Africa or other yellow-fever areas, Indian health regulations require that you present evidence of vaccination against yellow fever. If you do not have such proof, you could be subjected to immediate deportation or a six-day detention in the yellow-fever quarantine center. If you transit through any part of sub-Saharan Africa, even for one day, you are advised to carry proof of yellow fever immunization.

Dogs and bats create a high risk of rabies transmission in most of India. Vaccination is recommended for all prolonged stays, especially for young children and travelers in rural areas. It is also recommended for shorter stays that involve occupational exposure, locations more than 24 hours from a reliable source of human rabies immune globulin and rabies vaccine for post-exposure treatment, adventure travelers, hikers, cave explorers, and backpackers. Monkeys also can transmit rabies and herpes B, among other diseases, to human victims. Avoid feeding monkeys. If bitten, you should immediately soak and scrub the bite for at least 15 minutes and seek urgent medical attention.

Influenza is transmitted from November to April in areas north of the Tropic of Cancer (north India), and from June through November (the rainy season) in areas south of the Tropic of Cancer (south India), with a smaller peak from February through April; off-season transmission can also occur. All travelers are at risk. Influenza vaccine is recommended for all travelers during the flu season.

Outbreaks of avian influenza (H5N1 virus) occur intermittently in eastern India, including West Bengal, Manipur, Sikkim, Andhra Pradesh, Telangana, and Assam. For further information on pandemic influenza, please refer to the Department of State's 2009-H1N1, Pandemic Influenza, and H5N1 Fact Sheet .

Malaria prophylaxis depends on time of year and area the traveler is visiting. Please consult the CDC website for more information. Dengue fever presents significant risk in urban and rural areas. The highest number of cases is reported from July to December, with cases peaking from September to October. Daytime insect precautions such as wearing long-sleeved shirts and mosquito repellent are recommended by the CDC.

Tuberculosis is an increasingly serious health concern in India. For further information, please consult the CDC’s Travel Notice on TB .

Further health information:

- World Health Organization

- U.S. Centers for Disease Control and Prevention (CDC)

Air pollution is a significant problem in several major cities in India, and you should consult your doctor prior to travel and consider the impact seasonal smog and heavy particulate pollution may have on you. The air quality in India varies considerably and fluctuates with the seasons. It is typically at its worst in the winter. Anyone who travels where pollution levels are high is at risk. People at the greatest risk from particle pollution exposure include:

- Infants, children, and teens

- People over 65 years of age

- People with lung disease such as asthma and chronic obstructive pulmonary disease (COPD), which includes chronic bronchitis and emphysema;

- People with heart disease or diabetes

- People who work or are active outdoors

Current air quality data can be found on the Embassy’s Air Quality page . The data on this site are updated hourly.

Rh-negative blood may be difficult to obtain as it is not common in Asia.

For emergency services, dial 112 from a cell phone; from a land line, dial 100 for police, 102 for ambulance (108 in parts of South India), and 101 for fire. Ambulances are not equipped with state-of-the-art medical equipment, and traffic does not yield to emergency vehicles. Injured or seriously ill travelers may prefer to take a taxi or private vehicle to the nearest major hospital rather than wait for an ambulance. Most hospitals require advance payment or confirmation of insurance prior to treatment. Payment practices vary and credit cards are not routinely accepted for medical care.

Medical Tourism: Medical tourism is a rapidly growing industry. Companies offering vacation packages bundled with medical consultations and financing options provide direct-to-consumer advertising over the internet. Such medical packages often claim to provide high quality care, but the quality of health care in India is highly variable. People seeking health care in India should understand that medical systems operate differently from those in the United States and are not subject to the same rules and regulations. Anyone interested in traveling for medical purposes should consult with their local physician before traveling and refer to the information from the CDC . Persons traveling to India for medical purposes require the proper “medical” visa. Please check with the nearest Indian embassy or consulate for more information.

Despite reports of antibiotic-resistant bacteria in hospitals, in general travelers should not delay or avoid treatment for urgent or emergent medical situations. However, health tourists and other travelers who may be contemplating elective procedures in this country should carefully research individual hospital infection control practices.

Surrogacy: Commercial surrogacy is illegal for foreigners in India, subject to complex local regulation. For additional information, visit the Government of India’s official information on foreigner surrogacy .

The U.S. Embassy and Consulates General in India maintain lists of local doctors and hospitals, all of which are published on their respective websites under "U.S. Citizen Services." We cannot endorse or recommend any specific medical provider or clinic.

Travel and Transportation

Road Conditions and Safety: Travel by road in India is dangerous. India leads the world in traffic-related deaths and a number of U.S. citizens have suffered fatal traffic accidents in recent years. You should exercise extreme caution when crossing streets, even in marked pedestrian areas, and try to use only cars that have seatbelts. Seatbelts are not common in three-wheel taxis (autos) and in taxis’ back seats. Helmets should always be worn on motorcycles and bicycles.Travel at night is particularly hazardous.