An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

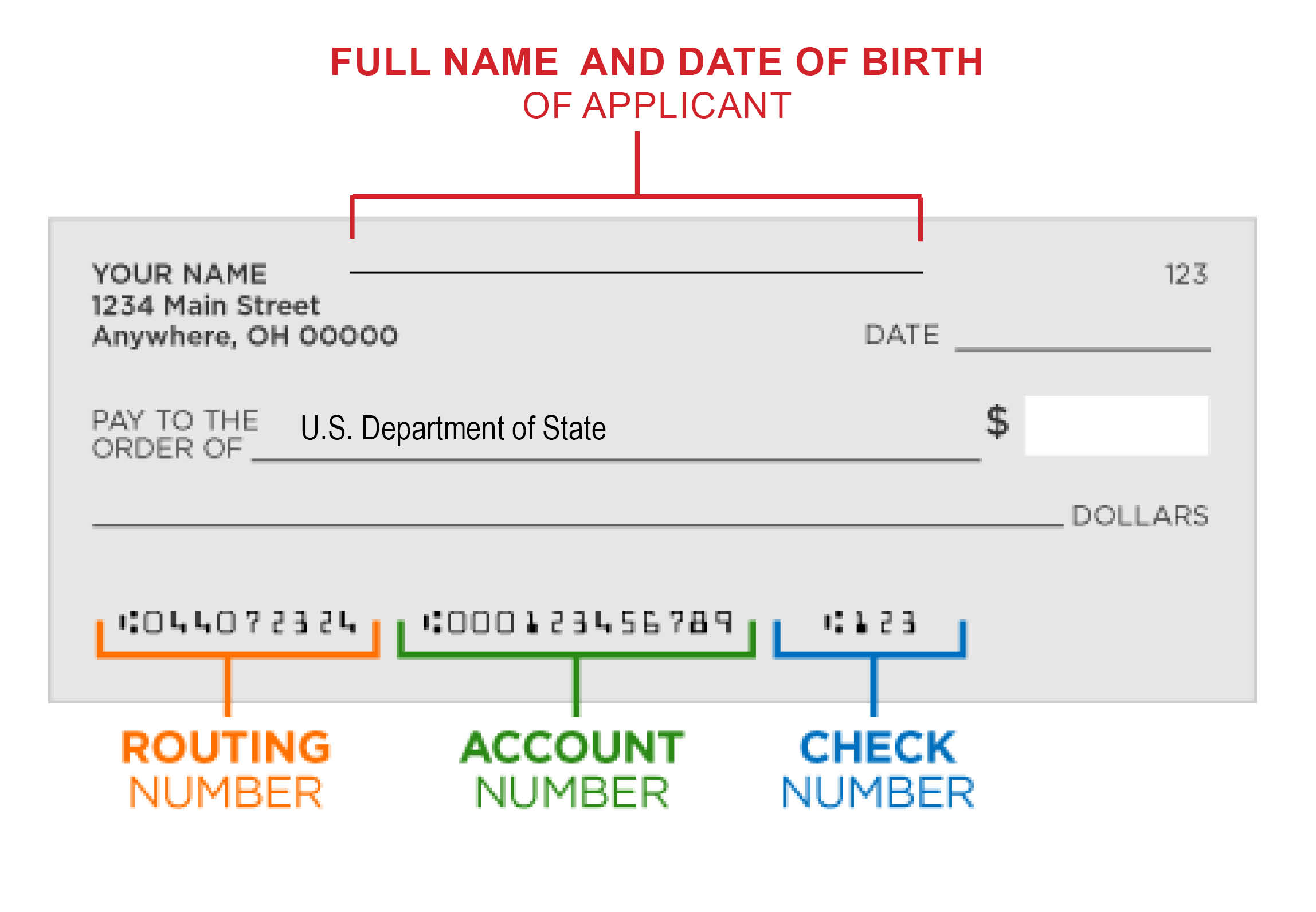

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

Topic no. 511, Business travel expenses

More in help.

- Interactive Tax Assistant

- Report Phishing

- Fraud/Scams

- Notices and Letters

- Frequently Asked Questions

- Accessibility

- Contact Your Local IRS Office

- Contact an International IRS Office

- Other Languages

Travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job. You can't deduct expenses that are lavish or extravagant, or that are for personal purposes.

You're traveling away from home if your duties require you to be away from the general area of your tax home for a period substantially longer than an ordinary day's work, and you need to get sleep or rest to meet the demands of your work while away.

Generally, your tax home is the entire city or general area where your main place of business or work is located, regardless of where you maintain your family home. For example, you live with your family in Chicago but work in Milwaukee where you stay in a hotel and eat in restaurants. You return to Chicago every weekend. You may not deduct any of your travel, meals or lodging in Milwaukee because that's your tax home. Your travel on weekends to your family home in Chicago isn't for your work, so these expenses are also not deductible. If you regularly work in more than one place, your tax home is the general area where your main place of business or work is located.

In determining your main place of business, take into account the length of time you normally need to spend at each location for business purposes, the degree of business activity in each area, and the relative significance of the financial return from each area. However, the most important consideration is the length of time you spend at each location.

You can deduct travel expenses paid or incurred in connection with a temporary work assignment away from home. However, you can't deduct travel expenses paid in connection with an indefinite work assignment. Any work assignment in excess of one year is considered indefinite. Also, you may not deduct travel expenses at a work location if you realistically expect that you'll work there for more than one year, whether or not you actually work there that long. If you realistically expect to work at a temporary location for one year or less, and the expectation changes so that at some point you realistically expect to work there for more than one year, travel expenses become nondeductible when your expectation changes.

Travel expenses for conventions are deductible if you can show that your attendance benefits your trade or business. Special rules apply to conventions held outside the North American area.

Deductible travel expenses while away from home include, but aren't limited to, the costs of:

- Travel by airplane, train, bus or car between your home and your business destination. (If you're provided with a ticket or you're riding free as a result of a frequent traveler or similar program, your cost is zero.)

- The airport or train station and your hotel,

- The hotel and the work location of your customers or clients, your business meeting place, or your temporary work location.

- Shipping of baggage, and sample or display material between your regular and temporary work locations.

- Using your car while at your business destination. You can deduct actual expenses or the standard mileage rate, as well as business-related tolls and parking fees. If you rent a car, you can deduct only the business-use portion for the expenses.

- Lodging and non-entertainment-related meals.

- Dry cleaning and laundry.

- Business calls while on your business trip. (This includes business communications by fax machine or other communication devices.)

- Tips you pay for services related to any of these expenses.

- Other similar ordinary and necessary expenses related to your business travel. (These expenses might include transportation to and from a business meal, public stenographer's fees, computer rental fees, and operating and maintaining a house trailer.)

Instead of keeping records of your meal expenses and deducting the actual cost, you can generally use a standard meal allowance, which varies depending on where you travel. The deduction for business meals is generally limited to 50% of the unreimbursed cost.

If you're self-employed, you can deduct travel expenses on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship) , or if you're a farmer, on Schedule F (Form 1040), Profit or Loss From Farming .

If you're a member of the National Guard or military reserve, you may be able to claim a deduction for unreimbursed travel expenses paid in connection with the performance of services as a reservist that reduces your adjusted gross income. This travel must be overnight and more than 100 miles from your home. Expenses must be ordinary and necessary. This deduction is limited to the regular federal per diem rate (for lodging, meals, and incidental expenses) and the standard mileage rate (for car expenses) plus any parking fees, ferry fees, and tolls. Claim these expenses on Form 2106, Employee Business Expenses and report them on Form 1040 , Form 1040-SR , or Form 1040-NR as an adjustment to income.

Good records are essential. Refer to Topic no. 305 for information on recordkeeping. For more information on these and other travel expenses, refer to Publication 463, Travel, Entertainment, Gift, and Car Expenses .

ACCOUNTING for Everyone

The Longest Running Online Certified Bookkeeping Course

When to Reclaim Subsistence Expenses: A Guide for Employees

When it comes to business travel, subsistence expenses can quickly add up. These expenses can include meals, lodging, and other incidental costs incurred while on the road. Fortunately, in many cases, these expenses can be reclaimed by the traveler or their employer. However, it’s important to understand the rules and regulations surrounding subsistence expenses to ensure that you’re eligible for reimbursement.

To start, it’s important to understand what subsistence expenses are. These expenses are defined as the cost of food and lodging while traveling for business purposes. In some cases, incidental expenses such as transportation costs may also be included. However, it’s important to note that not all expenses incurred while on the road are considered subsistence expenses and therefore may not be eligible for reimbursement.

Eligibility for reclaiming subsistence expenses can vary depending on a number of factors. These factors can include the purpose of the travel, the length of the trip, and the location of the travel. It’s important to understand these factors and how they impact your eligibility for reimbursement before submitting any expenses for reimbursement.

Understanding Subsistence Expenses

Subsistence expenses are a type of business expense that an employee or self-employed individual may claim to cover the cost of food, drink, and accommodation while on a business trip or working away from their usual place of work. These expenses are typically incurred when an employee or self-employed individual is required to travel for work purposes, such as attending a conference or meeting with a client.

In general, subsistence expenses are tax-deductible, meaning that they can be claimed as a business expense and reduce the amount of tax owed by the employee or self-employed individual. However, it is important to note that subsistence expenses must be reasonable and necessary for the business purpose, and any personal expenses must be excluded.

Employers may also reimburse their employees for subsistence expenses incurred while on a business trip. In this case, the reimbursement is not subject to tax and National Insurance contributions, as long as it meets certain conditions. For example, the expenses must be incurred wholly, exclusively, and necessarily in the performance of the employee’s duties.

Self-employed individuals and company directors can also claim subsistence expenses, provided that they are incurred wholly and exclusively for the purposes of their trade or profession. Partners in a partnership can claim subsistence expenses in the same way as self-employed individuals.

It is important to keep accurate records of all subsistence expenses, including receipts and invoices, as HM Revenue and Customs (HMRC) may request evidence to support any claims. Failure to provide evidence may result in the claim being disallowed, and potentially lead to penalties and interest charges.

Subsistence expenses can be a valuable way for employees, self-employed individuals, and company directors to reduce their tax liability and offset the costs of business travel. However, it is important to ensure that all claims are reasonable and necessary, and that accurate records are kept to support any claims made.

Eligibility for Reclaiming Subsistence Expenses

Employees are eligible to reclaim subsistence expenses if they meet certain criteria. The following entities are relevant when determining eligibility:

- Reclaim: The employee must have paid for the expenses out of their own pocket and not have been reimbursed by their employer.

- HMRC: The expenses must be allowable by HM Revenue and Customs (HMRC) for tax purposes.

- Reasonable: The expenses must be reasonable and necessary for the employee to carry out their job duties.

- Normal Place of Work: The employee must have a normal place of work, which is defined as a place where they spend a significant amount of time carrying out their job duties.

- Temporary Place of Work: The employee must be required to work at a temporary place of work for a limited period of time.

- Extended Period of Time: The employee must be required to work at a temporary place of work for an extended period of time, which is typically more than 24 months.

- Main Depot: The temporary place of work must be different from the employee’s main depot.

- Normal Working Day: The employee must be required to work at the temporary place of work for a normal working day, which is typically 10 hours or more.

Employees who meet these criteria may be eligible to reclaim subsistence expenses, such as meals, accommodation, and travel expenses. It is important for employees to keep accurate records of their expenses and to submit them to their employer in a timely manner. Employers should have clear policies and procedures in place for processing and reimbursing employee expenses.

Types of Subsistence Expenses

Subsistence expenses refer to expenses incurred by an employee while on a business trip or performing work-related duties away from the usual place of work. These expenses are usually reimbursed by the employer. The following are the types of subsistence expenses:

Food and Drink

Food and drink expenses refer to the cost of meals and non-alcoholic beverages that an employee incurs while on a business trip. The cost of alcoholic beverages is not usually reimbursed unless it is part of a meal or entertainment expense.

Accommodation

Accommodation expenses refer to the cost of hotel accommodation incurred by an employee while on a business trip. The cost of accommodation is usually reimbursed by the employer, provided it is reasonable and necessary.

Meals expenses refer to the cost of meals that an employee incurs while performing work-related duties away from the usual place of work. The cost of meals is usually reimbursed by the employer, provided it is reasonable and necessary.

Entertainment

Entertainment expenses refer to the cost of entertaining clients or customers while on a business trip. The cost of entertainment is usually reimbursed by the employer, provided it is reasonable and necessary.

Travel expenses refer to the cost of travel incurred by an employee while on a business trip. This includes public transport costs, taxis, parking, and tolls. The cost of travel is usually reimbursed by the employer, provided it is reasonable and necessary.

Staff Entertainment

Staff entertainment expenses refer to the cost of entertaining employees while on a business trip. The cost of staff entertainment is usually reimbursed by the employer, provided it is reasonable and necessary.

Process of Reclaiming Subsistence Expenses

When an employee incurs expenses while on a business trip, the employer can reimburse them for the cost of subsistence expenses. The process of reclaiming subsistence expenses involves submitting receipts and ensuring that the expenses are eligible for reimbursement.

To claim subsistence expenses, the employee must provide receipts for all expenses incurred. These receipts should include the date, location, and amount of the expense. The employer may also require the employee to provide additional documentation, such as a description of the business purpose of the trip.

VAT on subsistence expenses can be reclaimed by the employer if the employee provides a valid VAT receipt. The employer can then claim back the VAT on their next VAT return. However, if the employer is not VAT registered, they cannot claim back the VAT on subsistence expenses.

Tax relief may also be available for subsistence expenses. If the employee is required to work away from their normal place of work for a period of time, they may be entitled to tax relief on their subsistence expenses. The employee can claim this relief by completing a P87 form and submitting it to HMRC.

When reimbursing subsistence expenses, the employer should ensure that the expenses are incurred for business purposes. If the expenses are not incurred for business purposes, they may not be eligible for reimbursement.

The process of reclaiming subsistence expenses involves submitting receipts, ensuring that the expenses are eligible for reimbursement, and claiming back any VAT or tax relief that may be available. The employer should also ensure that the expenses are incurred for business purposes before reimbursing the employee.

Special Cases and Exceptions

While the rules for reclaiming subsistence expenses are generally straightforward, there are some special cases and exceptions to be aware of.

Overnight Stays

If an employee has to stay overnight on a business trip, they can claim for reasonable subsistence expenses such as meals and accommodation. The expenses must be necessary and reasonable for the trip, and not excessive.

Temporary Workplace

If an employee has to work at a temporary workplace, they can claim for subsistence expenses such as meals and drinks if they are working away from their usual place of work for a limited period. However, if the temporary workplace becomes the employee’s main place of work, they can no longer claim for subsistence expenses.

Scale Rates and Benchmark Rates

The Road Haulage Association and other organizations provide scale rates and benchmark rates for subsistence expenses. These rates are designed to simplify the process of claiming expenses by providing a fixed amount for each day of the trip. If an employee uses these rates, they do not need to provide receipts for their expenses.

Bespoke Amounts

If an employer provides bespoke amounts for subsistence expenses, they must ensure that the amounts are reasonable and reflect the actual costs incurred by the employee. The employer should also keep records of the expenses and the reasons for the amounts paid.

Rail Strike

If an employee is unable to use public transport due to a rail strike or other disruption, they can claim for reasonable subsistence expenses such as meals and accommodation. The expenses must be necessary and reasonable for the trip, and not excessive.

Favourite Sandwich Bar

If an employee chooses to eat at their favourite sandwich bar instead of a cheaper alternative, they cannot claim for the additional cost. The expenses must be reasonable and necessary for the trip.

Tax Invoices

If an employee incurs subsistence expenses of more than £25, they must obtain a tax invoice to support their claim. The invoice must show the date, the amount, and the name and address of the supplier.

Overall, it is important for employees to understand the rules and exceptions for reclaiming subsistence expenses to ensure that they do not incur any unnecessary costs.

Record Keeping and Compliance

In order to reclaim subsistence expenses, it is important to maintain accurate records. Failure to do so could result in non-compliance with HMRC regulations and potential fines.

Businesses must keep records of all expenses incurred, including subsistence expenses, for a minimum of six years. These records must be kept in a format that can be easily accessed and understood by HMRC.

It is important to note that subsistence expenses must be incurred wholly, exclusively and necessarily for the purposes of the business. Any personal expenses incurred cannot be claimed as subsistence expenses.

In addition to maintaining records, businesses must also ensure they are complying with corporation tax regulations. Subsistence expenses can be claimed as a deduction against corporation tax, but only if they meet the necessary criteria.

It is also worth noting that subsistence expenses incurred for marketing purposes, such as entertaining clients, are subject to stricter rules and may not be fully deductible.

Businesses must also be aware of the regulations surrounding the use of cookies on their website. If cookies are used to track user behaviour for marketing purposes, this may impact the deductibility of subsistence expenses.

Finally, engineers and partners must also be aware of any specific regulations that may apply to their industry or profession. It is important to seek professional advice if unsure about any regulations or compliance requirements.

Overall, maintaining accurate records and complying with HMRC regulations is essential when reclaiming subsistence expenses.

Frequently Asked Questions

How do i claim subsistence expenses.

To claim subsistence expenses, you need to keep a record of all the expenses you incur while on a business trip. This includes expenses such as meals, accommodation, and travel costs. You can then submit these expenses to your employer for reimbursement. It is important to keep receipts for all expenses incurred to support your claim.

What is the process for claiming VAT on travel expenses?

If you are a VAT-registered business, you can claim back VAT on travel expenses that you incur while on a business trip. To do this, you need to keep a record of all the expenses you incur and the VAT paid on those expenses. You can then claim back the VAT on your VAT return.

Can I claim VAT back on reimbursed expenses?

If your employer reimburses you for expenses that include VAT, you cannot claim back the VAT on those expenses. This is because your employer has already claimed back the VAT on the expenses.

What are the rules around claiming allowances for subsistence?

The rules around claiming allowances for subsistence vary depending on your employer’s policy and the tax laws in your country. In general, you can claim a subsistence allowance if you are away from your normal place of work on business. The allowance is designed to cover the cost of meals and other expenses you incur while away from home.

When is it appropriate to claim subsistence expenses?

It is appropriate to claim subsistence expenses when you are away from your normal place of work on business and you incur expenses such as meals, accommodation, and travel costs. You should only claim expenses that are reasonable and necessary for the business trip.

How are subsistence expenses taxed?

Subsistence expenses are generally tax-free as long as they are reasonable and necessary for the business trip. However, if the expenses are excessive or not necessary for the business trip, they may be subject to tax. It is important to keep accurate records of all expenses incurred to support your claim and avoid any potential tax issues.

Get More From Accounting for Everyone With Weekly Updates

Check your inbox or spam folder to confirm your subscription.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

This site uses Akismet to reduce spam. Learn how your comment data is processed .

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Explore sell to government

- Ways you can sell to government

- How to access contract opportunities

- Conduct market research

- Register your business

- Certify as a small business

- Become a schedule holder

- Market your business

- Research active solicitations

- Respond to a solicitation

- What to expect during the award process

- Comply with contractual requirements

- Handle contract modifications

- Monitor past performance evaluations

- Explore real estate

- 3D-4D building information modeling

- Art in architecture | Fine arts

- Computer-aided design standards

- Commissioning

- Design excellence

- Engineering

- Project management information system

- Spatial data management

- Facilities operations

- Smart buildings

- Tenant services

- Utility services

- Water quality management

- Explore historic buildings

- Heritage tourism

- Historic preservation policy, tools and resources

- Historic building stewardship

- Videos, pictures, posters and more

- NEPA implementation

- Courthouse program

- Land ports of entry

- Prospectus library

- Regional buildings

- Renting property

- Visiting public buildings

- Real property disposal

- Reimbursable services (RWA)

- Rental policy and procedures

- Site selection and relocation

- For businesses seeking opportunities

- For federal customers

- For workers in federal buildings

- Explore policy and regulations

- Acquisition management policy

- Aviation management policy

- Information technology policy

- Real property management policy

- Relocation management policy

- Travel management policy

- Vehicle management policy

- Federal acquisition regulations

- Federal management regulations

- Federal travel regulations

- GSA acquisition manual

- Managing the federal rulemaking process

- Explore small business

- Explore business models

- Research the federal market

- Forecast of contracting opportunities

- Events and contacts

- Explore travel

Per diem rates

- Transportation (airfare rates, POV rates, etc.)

- State tax exemption

- Travel charge card

- Conferences and meetings

- E-gov travel service (ETS)

- Travel category schedule

- Federal travel regulation

- Travel policy

- Explore technology

- Cloud computing services

- Cybersecurity products and services

- Data center services

- Hardware products and services

- Professional IT services

- Software products and services

- Telecommunications and network services

- Work with small businesses

- Governmentwide acquisition contracts

- MAS information technology

- Software purchase agreements

- Cybersecurity

- Digital strategy

- Emerging citizen technology

- Federal identity, credentials, and access management

- Mobile government

- Technology modernization fund

- Explore about us

- Annual reports

- Mission and strategic goals

- Role in presidential transitions

- Get an internship

- Launch your career

- Elevate your professional career

- Discover special hiring paths

- Climate Action

- Events and training

- Agency blog

- Congressional testimony

- GSA does that podcast

- News releases

- Leadership directory

- Staff directory

- Office of the administrator

- Federal Acquisition Service

- Public Buildings Service

- Staff offices

- Board of Contract Appeals

- Office of Inspector General

- Region 1 | New England

- Region 2 | Northeast and Caribbean

- Region 3 | Mid-Atlantic

- Region 4 | Southeast Sunbelt

- Region 5 | Great Lakes

- Region 6 | Heartland

- Region 7 | Greater Southwest

- Region 8 | Rocky Mountain

- Region 9 | Pacific Rim

- Region 10 | Northwest/Arctic

- Region 11 | National Capital Region

- Per Diem Lookup

FY 2024 Per Diem Rates Now Available

Please note! The FY 2024 rates are NOT the default rates until October 1, 2023.

You must follow these instructions to view the FY 2024 rates. Select FY 2024 from the drop-down box above the “Search By City, State, or ZIP Code” or “Search by State" map. Otherwise, the search box only returns current FY 2023 rates.

GSA establishes the rates that federal agencies use to reimburse their employees for lodging and meals and incidental expenses incurred while on official travel within the continental United States (CONUS). A standard rate applies to most of CONUS. Individual rates apply to about 300 non-standard areas (NSAs). Most NSAs are a key city/primary destination and the surrounding county. Rates for the coming federal government fiscal year are typically announced in mid-August. Search the rates below or refer to the flat files , API , or trip calculator .

Search by city, state, or ZIP code

Required fields are marked with an asterisk ( * ).

Search by state

Need a state tax exemption form.

Per OMB Circular A-123, federal travelers "...must provide a tax exemption certificate to lodging vendors, when applicable, to exclude state and local taxes from their hotel bills." GSA's SmartPay team maintains the most current state tax information , including any applicable forms.

PER DIEM LOOK-UP

1 choose a location.

Error, The Per Diem API is not responding. Please try again later.

No results could be found for the location you've entered.

Rates for Alaska, Hawaii, U.S. Territories and Possessions are set by the Department of Defense .

Rates for foreign countries are set by the State Department .

2 Choose a date

Rates are available between 10/1/2021 and 09/30/2024.

The End Date of your trip can not occur before the Start Date.

Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained.

Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries."

Per diem localities with county definitions shall include "all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately)."

When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality.

- Accounts Content Our Accounting services View Services Annual Accounts Bookkeeping Business Plan Financial Forecasting Online Accounting Business Valuations Buying a Business Selling a Business Business Rescue Management Accounts Accounting Articles Content View articles

- Legal Content Our Legal Services View Services Business Purchase Business Sale Commercial Leases Employment Contracts Funding Agreements Due Diligence Service and Supplier Agreements Company Formation Company Secretarial Services Share Option Schemes Share Structure Trademarks and Intellectual Property Writing Terms and Conditions Shareholders Agreements Legal Articles Content View articles

- Tax Content Our Tax Services View Services Capital Gains Tax Corporation Tax EIS Exit Planning Inheritance Tax Research and Development Self Assessment VAT Returns Tax Articles Content View articles

- Payroll Content Our Payroll Services View All PAYE Registration Salary Payments Payrolling Benefits Payroll Portal Pensions

- HR Content Our HR Services View all HR Training Employee Wellbeing HR Consultancy Employment Contracts Employee Handbook HR Helpline HR Policies Content View articles

Need to talk Tax?

Help with accounts, expert legal advice.

- About Content Who we are Find out All About Us How We Help Jobs Who We Help Entrepreneur’s Club Our Experts Content Our News

How to Prepare Your Business for Sale

What are the financing options for buying a...

The Complete Guide to Buying a Business

Can an overseas investor or non-UK resident own...

Dividend tax rates 2024/25: A UK guide

How much is VAT in the UK

Human Resources Mega Guide

Attracting Talent: Our Top Five Tips

How to Deal with Difficult Staff

Payroll Jargon Glossary by Accounts and Legal

Payroll in the UK: A Complete Guide

Meet Hannah

#IWD2024 at Accounts and Legal

Meet the Team: Neil Ormesher

Subsistence expenses: A guide to the rules

The government website sets out the essential requirements for complying with HMRC’s rules on subsistence expenses.

As an employer paying your employees’ travel costs, you have certain tax , National Insurance and reporting obligations . This includes costs for:

providing travel

reimbursing travel

accommodation, if your employee needs to stay away overnight

meals and other ‘subsistence expenses’ while travelling

Subsistence include meals and any other necessary costs of travelling, for example, parking charges, tolls, congestion charges or business phone calls.

Business travel

You must report your employees’ travel expenses to HMRC, unless they are exempt. You may have to deduct or pay tax and National Insurance on it.

Some business travel expenses are covered by exemptions. This means you will not have to include them in your end-of-year reports. If you do not have an exemption, you must report the cost on form P11D. You do not have to deduct or pay any tax or National Insurance.

If you reimburse your employee with more than the necessary costs of their business travel, the extra amount counts as earnings, so you must:

add it to your employee’s other earnings

deduct and pay PAYE tax and Class 1 National Insurance through payroll

If you’ve agreed with HMRC that this will be a scale rate payment, you will not need to report it.

Related: VAT on business entertainment explained

Private travel

All non-business travel is counted as private. This includes the journey between an employee’s home and permanent workplace.

If, you arrange the transport and pay for it, you must:

report the cost on form P11D

pay Class 1A National Insurance on the value of the benefit

If your employee arranges transport and you pay the supplier directly, you must:

add the cost of the transport to the employee’s other earnings and deduct and pay Class 1 National Insurance (but not PAYE tax) through payroll

If your employee arranges and pays for the transport, and you reimburse them, the money you pay them counts as earnings, so you must:

You’ll be exempt from reporting or paying anything if the cost is for:

a works bus service

an employee with a disability (but only in certain circumstances)

a taxi home after occasional and irregular late-night working

a taxi home if a car-sharing system is temporarily unavailable

bicycles or cycle safety equipment

travelling to work because public transport has been disrupted by industrial action.

Those are HMRC’s rules and guidelines as set out on the website. However, there are many circumstances that may affect your ability to claim an allowance or mean that you have to pay tax or National Insurance on the expenses.

In this guide, we set out our understanding of the rules and their interpretation. However, this is an area that can be complex and it may be important to take professional advice to ensure you comply with HMRC’s rules.

Qualifying business travel

To qualify for tax relief, expenses for business travel must be incurred wholly, exclusively and necessarily for your business. Two scenarios meet that definition:

Your employee travels from their regular place of work, generally your office, to another location to take part in a meeting or carry out essential duties.

Your employee travels from home to a temporary workplace for a limited period.

However, travel to the temporary workplace must involve a longer journey than the employee’s ‘regular commute’ from home to your office. Where the distance is 10 miles to either the main office or the temporary workplace, for example, no claim is possible.

Related: How to calculate R&D tax relief for SMEs

Employees working from home

The situation has become more complicated because of the dramatic rise in working from home following the pandemic. In many cases, employees may treat their home as the permanent place of work. In that case:

A journey to the office for a meeting may not count as essential business travel.

A journey to a temporary location for a specific business purpose would qualify as business travel.

Employees travelling as part of the job

Some jobs may involve regular travel from the office to other locations and claims need to be carefully considered.

A sales representative or service engineer, for example, will probably travel to other locations to carry out their work on a daily basis. They may be based at your office or work from home. HMRC describe this as ‘travelling on work’ rather than ‘travelling to work’ and allow claims because business travel is an integral part of the job.

The situation is different for someone who travels regularly to other locations, but not on a daily basis as an integral part of their job. An area manager, for example, may visit other branches of your business several days a week as well as spending time at the main office. The journey from home to the main office would not qualify as business travel, but any journey from home or the main office to another branch would qualify.

Employees working on multiple sites

An employee who has no permanent workplace, but works on a number of different sites, is classed by HMRC as a ‘site-based employee’. Examples include consultants, inspectors , construction workers or caretakers responsible for a number of different sites. You can reimburse employees and claim tax relief for business travel, provided the time spent at each site is less than two years.

Read More: New VAT Reverse Charge For Construction Sector

Employees on longer-term postings to other sites

If an employee has to work on another site for an extended period, the other site is regarded as a temporary workplace and travel to that site qualifies as business travel. Generally, qualifying travel covers a period up to 24 months at the temporary workplace. If the situation goes beyond 24 months, the employee must spend at least 40 percent of their time at the site to qualify.

Making a qualifying subsistence expenses payment

When you are satisfied that any business travel related expenditure incurred by an employee meets HMRC’s qualifying criteria, you can reimburse the employee and claim tax relief on the expenditure.

To simplify the process, HMRC publishes a set of ‘scale rate payments’ :

Breakfast rate (£5)

The rate may be paid when an employee leaves home earlier than usual and before 6am and incurs a cost on breakfast taken away from home after the qualifying journey has started. If an employee usually leaves before 6am the breakfast rate does not apply.

Late evening meal rate (£15)

The rate may be paid where the employee has to work later than usual, finishes work after 8pm having worked their normal day and has to buy a meal before the qualifying journey ends which they would usually have at home.

One meal (5-hour) rate £5)

The rate may be paid where the employee has been undertaking qualifying travel for a period of at least 5 hours and has incurred the cost of a meal.

Two meal (10-hour) rate (£10)

The rate may be paid where the employee has been undertaking qualifying travel for a period of at least 10 hours and has incurred the cost of a meal or meals.

Scale rate payments

To make scale rate payments, you must have an agreed arrangement with HMRC. The published rates are the maximum amount you can pay without tax implications. If you pay a higher rate, the whole of the payment may be subject to tax and National Insurance.

Your employees must actually incur the costs and should keep receipts to validate their claims.

Travel costs for journeys in an employee’s private vehicle can be reimbursed on a cost per mile basis. HMRC publishes Approved Mileage Allowance Payments which means there are no tax or National Insurance implications. The current rates for private cars are:

45 pence per mile for the first 10,000 qualifying miles

25 pence per mile for subsequent qualifying miles.

You can also reimburse employees for associated costs such as parking, hotel accommodation and telephone charges, as well as travel costs on public transport.

Support from Accounts and Legal

This is a brief outline of the rules on paying subsistence expenses. If you would like professional advice on any aspect of subsistence expenses, or would like confirmation that you are complying with HMRC’s rules, our team of experienced tax accountants will be glad to help.

To find out more, please contact us on 0207 043 4000 or [email protected] .

You can also get an instant online accountancy quote through clicking the link.

Speak to an expert

Neil Ormesher

Speak to neil ormesher.

Meet Neil Ormesher, CEO of Accounts and Legal.

Neil has been in the industry for over 25 years, and as a fully qualified accountant who has worked his way up the ranks – he knows a thing or two about helping businesses.

In his previous role, Neil was instrumental in helping the Danbro Business Brand grow from zero to 1500 clients. During which he helped develop a bullet-proof team and service offering centered around helping business owners achieve their dreams.

Not only that, but he’s an advocate for everything we hold dearly at Accounts and Legal.

Oops! We could not locate your form.

Know what you need ? Get a quote.

Related insights.

Boris Johnson’s tax “bonanza”: Would it work?

HMRC struggling to bear the double-brunt of Making...

Almost half of all UK accountants do not...

Related services.

Corporation Tax

VAT Returns

Self Assessment

Capital Gains Tax

Exit planning.

Research and Development

Inheritance tax.

Tax Advisor London

Tax, tax, tax. Every business owner’s favourite worst enemy… But...

Tax Advisor Manchester

Travel and Subsistence Expenses HMRC – All you Need to Know About It

What are travel and subsistence expenses.

Travel and subsistence expenses are incurred when an employee travels for business purposes from one place to another. It includes the cost of travelling, meals, accommodation, laundry, and other related expenditures .

Since subsistence is considered a cost associated with business-related travel, it falls under the same category.

As an employee, when you are travelling to another location as a part of your job, you are qualified for a certain amount for your travel and subsistence expenses depending on your working rank or designation.

However, before the actual travel begins, employees have to provide a list of expenses that can be possibly incurred during travel. These particular expenses are qualified for reimbursement if you are working for an organisation or a company.

However, If an employee spends over limits on travel and subsistence expenses, they have to pay that cost from their own pockets.

Being an employer, you are obliged to pay certain taxes and National Insurance NI contribution to HMRC on the travelling costs of the employees. That cost includes:

- Travelling costs such as train tickets or flight tickets.

- Reimbursement of travelling expenses.

- Accommodation costs such as Hotel if the employer needs to stay overnight.

- Food costs and other subsistence expenses such as parking charges, tolls, congestion charges and business phone calls

A Change in Subsistence Expenses

As of April 2019, HMRC no longer requires businesses to provide receipts for every cost incurred as part of a business journey. the employee will just need to prove that they’re on a business trip when the expenses were incurred. So, if an employee on a business trip eats three meals, they actually only need to provide proof (a receipt) for one of those meals.

However, things to keep in mind:

- This doesn’t apply if you use specially-agreed custom allowance rates

- It also doesn’t apply if you follow industry-agreed rates

Unclaimable Travel and Subsistence Expenses

There are certain costs and expenses that are not under the category of travel and subsistence expenses and therefore, you cannot claim those expenses for reimbursement from your organisation.

Unclaimable expenses include

Daily Travelling Expense – the amount you spent on commuting from your home to the permanent workplace regardless of time and distance. However, If an employee has to travel some extra distance for the purpose of work, the cost spent on the distance can be claimable.

Personal Vehicles — if the employee has purchased a personal vehicle on loan or through capital allowance , both amount respectively doesn’t come under the travel and subsistence allowance and hence, is unclaimable.

As per HMRC, employees are entitled to tax-free reimbursements for their business travelling. The employee has both options; get paid by the employer tax-free or the employee themself can opt for tax relieves on any shortfall via their tax return.

Claimable Travel Expenses

Mileage Allowance

HMRC has allowed the usage of personal vehicles for work-related travelling on fixed amounts. These fixed amounts should be approved by the organisation first, and then can proceed with the claim. However, if the employee incurred over the fixed amount, they should pay the exceeding amount on their own. However, if the employer doesn’t pay the Approved and fixed allowance, the employee can claim the full amount spent on the travel.

VAT on Mileage Allowance: If your organisation is VAT registered and does not use flat rate VAT accounting, it can claim back the VAT on the fuel element of the mileage allowance.#

Workplaces

Temporary workplace.

the employee can claim the incurred cost spend at the temporary workplace. A temporary workplace is where the employee spends less than 40% of work time or has spent less than 2 years.

Permanent Workplaces

An employee cannot claim the daily expense of travelling from home to the permanent workplace. But there are some exceptions such as:

- If you frequently travel from one place to another for work-related purposes such as meeting clients, you can claim the expenses spent on your travel. The important thing to keep in mind is that only those expenses would be qualified for a claim if your travel journey is different from usual travel to the workplace.

- If you have to travel on an urgent basis; if there is an emergency call-out service, the employee can claim the expenses incurred for that emergency travel.

Extensive Travelling

Frequent travelling could be a part of the job. In such cases, the employee extensively travelling from one place to another have the right to claim the expenses incurred during his travel. However, the employer should make sure that the place where the employee is travelling, should not fall under the permanent workplace category.

Hotel and Subsistence Expenses

Any expenses incurred by the employee on accommodation, meals and drinks, sundry charges such as laundry etc are obliged for the tax to HMRC. The employee is accountable to HMRC in case there are any inaccurate expenses in the bills. Companies may choose to allow employees to go over the limits, but they’ll have to pay tax every time they do.

Scale Rates for Subsistence Expenses

HMRC has set the standard rates for subsistence payments known as “scale rates for subsistence expenses”. The employees, If claim their expenses as per these scale rates, their payments will be free from tax and National Insurance contributions.

Breakfast Rate

you can claim a tax-free breakfast price of up to £5. However, this tax-free rate is claimable only if you had breakfast before 6 am and leave your current accommodation place before the usual time.

Meal Rates:

- you can be paid the price of one meal up to £5 if you are away from your place of stay and workplace for more than 5 hours.

- Similarly, you can be paid the price of two meals up to £10 if you are away from your place of stay and workplace for more than 10 hours.

- You can be paid the price of the evening meal up to £25 if you leave your workplace after 8 pm or later than the usual working hours.

Above mentioned Benchmark scale rates are only qualified for the following conditions:

- the travel must be part of the employee’s job or to a temporary place of work.

- the employee should be absent from their normal place of work or home for more than 5 hours or 10 hours.

- the employee should have incurred a cost on a meal (food and drink) after starting the journey.

Travel and Subsistence Cost as an Employer:

An employer is obliged to pay certain taxes and National Insurance on the reimbursements they made to employees for their Travel and subsistence costs. It includes costs of Travel, reimbursing travel, accommodation, and cost of utilising Public transport. Also, subsistence costs such as meals, drinks and laundry charges. The employer should take care of all these costs and should accurately report to HMRC.

In case, your employees are using public transport, its costs include the following:

Seasonal Tickets

If directly provided to the employees:

As an employer If you provided your employee with a seasonal travelling ticket, you should report the cost of a ticket to HMRC via filing up the cost on the form P11D. ticket cost should also be included in the earnings of the employees and Class 1 National Insurance should be deducted via the employee’s payroll.

If reimbursement is paid for seasonal tickets:

If your employees purchase seasonal tickets on their own, as an employer, you have more than one option for reimbursement such as

- you can cover the ticket costs by providing an additional allowance to the employee

- You can increase the salary of the employee,

However, the cost of the seasonal ticket is counted as earnings, so the employee is responsible to pay taxes and class 1 national insurance through their payroll.

Loan for seasonal tickets

If an employee is provided with a loan by the employer for a season ticket, it should be considered as any other common loan and therefore, the employer has to pay national insurance and certain taxes on it. However, there are some interest-free loans such as beneficial loans etc.

Contribution to Providing Facilities to Employees

As an employer, if you are paying a certain amount for facilitating your employees, you are not obliged to report these amounts to HMRC and neither have to pay any tax or National Insurance contribution on it. For example, if you are contributing to financing a bus route to reduce the travel distance for your employees, you are under no obligation to pay any type of tax.

The complicated reimbursement process has made it difficult for employers and employees alike. Those who are employed through an intermediary body like an agency or umbrella company might spend quite some time on their business travel expenses while trying to figure out how much is eligible in subsistence costs (and what’s not).

Consequently, it’s important for small business owners and entrepreneurs to establish processes with specialised accountants so that they can file claims quickly when necessary. However, If you are in search of a Specialised Accountant, Clear House Accountants have a team of expert and professional chartered accountants with years of experience. The team at Clear House Accountants take care of all type of tax obligations, and National Insurance contribution.

Jibran Qureshi

Managing Director

+44 (0)207 117 2639

chacc.co.uk

Jibran Qureshi FCCA is the Managing Director of Clear House Accountants and has over 13 years of experience in practice across multiple industries. Jibran’s educational background includes a Master’s in Financial Strategy from Oxford University and an Executive MBA from Hult International Business Schoo l. His experience in Financial Strategy, Tax Planning, Operational Consultancy and Performance Reporting guide his cognizant approach to leading Clear House and its clients to the future. This dexterity led him to be Enterprise Nation’s Top 50 Advisors. Jibran recognised the need to manage the innovative disruptions sustainably early on and shaped Clear House Accountants not just to be compliance specialists but advisors who help build complex ecosystems around cloud accounting software, provide advice on funding support, help manage innovative tax schemes, set up and implement complex strategic plans, and much more. So, his clients can thrive, not just survive .

You Might Also Want To Read

Leave a Comment Cancel reply

Privacy overview.

- 01952 462693

- [email protected]

- FREE WEBINARS TO BOLSTER YOUR BUSINESS

Guide to business travel and subsistence expenses

- Carrie Stokes

- Disclaimer: This post was last updated on February 28, 2024 so is based on rates, allowances legislation in effect on this date.

When your employees travel away for business purposes, it can be costly, especially when accommodation and food are involved. If you choose to cover the cost of your employees’ business travel, then you will have specific tax and National Insurance obligations to adhere to. But did you know that as a business owner or self-employed individual, you can claim tax relief when covering these costs?

Travel and subsistence expenses are the costs associated with business-related journeys, such as transportation, meals, accommodation and other miscellaneous expenses. Effective management of business travel expenses is crucial to the overall financial success of your business.

Read our in-depth guide below to find out all you need to know about business travel expenses for you and your employees and what can be claimed as legitimate business expenses.

At Spotlight Accounting, we are helping you manage your own and your employees’ travel costs so you can stay as tax-efficient as possible. We’ll guide you through the business costs of work-related travel and how you can make tax deductions on these costs.

If you are looking for professional business and accounting support , then please get in touch with our experts today!

What is classified as a business travel expense?

Business travel expenses cover a range of costs incurred while you or your employees are away for business-related purposes. This means travelling from the regular place of work, such as the office, to another location, either a temporary workplace, to meet with clients or participate in business events.

These costs can include :

- Certain travel expenses, such as train or plane tickets

- Accommodation costs when an employee stays overnight

- Food and drink

- Other necessary costs directly related to business travel

Unfortunately, you cannot claim expenses for employees’ everyday trips to and from their permanent workplace, parking fines, or any non-business-related travel costs.

So, if your employees have recently taken a business trip or are due to take one soon, then remember that many of the costs involved can be deducted. Make sure you keep track of the receipts so that you and your accountant can easily claim expenses when filing your returns.

Does an employer have to pay employees’ travel expenses?

When it comes to business journeys and work-related travel, it is typically the responsibility of the employer to cover any relevant costs incurred. This can vary depending on the work arrangement and employee’s contract.

However, it is usually good practice for employers to arrange transport and accommodation or reimburse employees for business-related travel, as it ensures employees are paid for expenses that benefit the company.

Plus, if you do cover these costs, you are eligible for certain tax deductions, which, in turn, can reduce your taxable profits, and help you attract and retain talent.

In situations where an employer doesn’t cover an employee’s travel expenses, the employee may be able to claim tax relief instead, as long as they meet the specific criteria set by HMRC.

HMRC business travel expenses guidelines

If you are covering the cost of your employees’ business travel, you can claim tax relief on some of these expenses. However, you will need to keep a few things in mind when it comes to HMRC compliance.

Firstly, the travel and subsistence costs must be “wholly and exclusively” for business purposes to qualify. This means they need to contribute to running or developing the business.

Secondly, there are various ways in which you can choose to cover these costs. You can reimburse them for the entire cost of their travel and subsistence, so long as they provide receipts, or you can set a fixed amount they can spend during the business trip.

What if the business trip requires employees to stay away?

When employees are required to stay away for a night or more, they will require overnight accommodation, which is classed as a subsistence cost. As an employer, you can cover these costs and reclaim any tax and VAT on them when filing your returns.

What are subsistence expenses for employees travelling?

When travelling for business-related matters, as a business owner, self-employed individual or employee, you’ll often need to pay for things like food and accommodation to keep you comfortable on your trip. These daily living expenses are known as subsistence.

As an employer, you can cover these expenses for your employees. However, if you choose not to cover subsistence costs, tax-paying employees can claim tax relief instead.

HMRC has set out a handy benchmark for subsistence rates, detailing a fixed amount you can cover that is National Insurance and tax-free.

The UK travel expenses benchmark rates are as follows:

These rates are only in relation to subsistence payments and do not cover overnight accommodation, as HMRC have not yet set a benchmark rate for accommodation expenses.

If you choose to reimburse employees at a higher rate than that set out by HMRC, you may be required to pay PAYE tax and National Insurance on the additional cost.

How much can an employee claim for subsistence expenses?

While there is no limit to how much employees can spend on subsistence, as an employer with a growing business, it may be wise to set an upper limit on the amount they can claim.

It is also vital for employees to keep receipts of their travel costs to show proof that their claim is accurate.

How do you manage travel expenses

Managing travel expenses doesn’t have to be a daunting task. There are many things you can do to ensure you can cover any travel and subsistence costs an employee arranges while reducing the tax and National Insurance impact.

Here are some of our top tips for staying on top of your travel expenses:

- Clearly outline your company’s travel policies

- Use digital tools and accounting software to maintain records

- Utilise corporate discounts when travelling

- Ensure expense reports are accurate and on time

- Stay informed on tax regulations

Get tax advice from Spotlight Accounting

At Spotlight Accounting, we are here to help you understand your company’s finances, guiding you to your full potential. We are a friendly team of chartered accountants dedicated to making our client’s businesses more profitable.

As a team of enthusiastic number-crunchers, strategic minds and tax experts , we’ll help you understand the intricacies of business travel expenses.

To find out more about how we can help you, please get in touch today !

Frequently asked questions about business travel and subsistence expenses

For more information about claiming expenses on business trips, take a look at some of our FAQs below.

What happens if I lose receipts for my business travel expenses?

As a business owner, you should be well aware of the importance of keeping receipts. Losing a receipt for business expenses when travelling can be frustrating, but you may still be able to claim back some of the costs if your employees can’t provide proof of their expenses.

Ask the employee to gather any supporting documents, such as bank statements and confirmation emails or contact the vendor to see if they can provide a copy of the receipt.

If you cover employees’ travel expenses at the benchmark subsistence rates set out by HMRC, then you may not need to provide a receipt to make a claim.

Is there VAT on travel expenses?

Most travel-related expenses do not include VAT, although some do. If your business is VAT registered, you can reclaim VAT on certain travel expenses, such as plane tickets and hotel accommodation.

What is a per diem expense UK?

Per diem rates or allowances are a fixed amount of money you can pay your employees to cover their subsistence expenses while on business-related trips. It can cover daily costs such as food and other necessary purchases.

As an employer, you can choose the per diem rates you give to employees that fit their travel demands. HMRC also provides benchmark scale rates which cover these costs. If you happen to exceed the benchmark set out by HMRC, then you may be required to pay tax and National Insurance contributions.

Carrie Stokes Chartered Accountant

I work with directors of limited companies in Shropshire , Staffordshire and the West Midlands giving them a clear and up to date financial picture of their business that they understand. Looking at the numbers, what they mean and how they can be improved to grow their business.

" * " indicates required fields

Popular Posts

Stealth Taxes – The hidden cost of inflation and why It’s time to rethink how value is extracted out of your business

Every business needs three fundamental elements to thrive

How Timely Information Drives Business Growth

Why Have I Got No Cash?

Get the latest news and tax saving ideas.

By entering your email address, you agree to receive occasional marketing offers as well as advice in accordance with our Privacy Policy . You can easily unsubscribe at any time.

- © 2024 Spotlight Accounting

- Cookie Policy

- Privacy Policy

- Source Material

- Reimbursement of Travel and Subsistence

TaxSource Total

Here you can access relevant source documents which support the summaries of key tax developments in Ireland, the UK and internationally

Source documents include:

- Chartered Accountants Ireland’s representations and submissions

- published documents by the Irish Revenue, UK HMRC, EU Commission and OECD

- other government documents

The source documents are displayed per year, per month, by jurisdiction and by title

Tax Briefing Issue 03 Reimbursement of Travel and Subsistence Expenses by Intermediaries

1.background.

Revenue has examined a number of cases involving the provision of the services of an individual to an end-user through an intermediary. Typically, the intermediary used in such circumstances is a company. In some cases the company may be controlled by the individual and/or persons connected with him/her. In other cases it may not.

The intermediary enters into a contract, either directly with the end-user or via an agency, under which it agrees to supply the services of the individual. There is no written contract between the individual and the end-user. An assumption underlying the type of arrangements referred to above is that the individual is not an employee of the end-user. While this may be true in the generality of cases, it cannot be automatically assumed. The facts of each case will determine whether there is an implied contract of employment between the individual and the end-user.

One recurring issue in the cases examined to date has been the tax treatment of various expenses of travel and subsistence. The purpose of this article is to clarify the circumstances in which expenses of travel and subsistence may be reimbursed free of tax.

2. Travel and Subsistence Expenses - existing guidance

A payment in respect of expenses which is not otherwise chargeable to income tax as income is treated as a perquisite of the office or employment by virtue of the provisions of Section 117 Taxes Consolidation Act 1997. Any such payment by an employer to a director or employee is within the scope of the PAYE/USC systems of deduction at source. Notwithstanding this, Revenue accepts that expenses of travel and subsistence may be reimbursed free of tax in certain circumstances. Revenue's practice in relation to tax–free reimbursement of expenses of travel and subsistence is set out in detail in Statement of Practice SP IT/02/2007 and Revenue Leaflets IT 51 and IT 54 .

The key paragraphs of Statement of Practice SP IT/02/2007 that must be considered where the services of an individual are provided via an intermediary are paragraphs 2.3 and 2.6 which are reproduced below.

Paragraph 2.3

“It is a long established principle of tax case law that the expenses of travelling from home to work and work to home are expenses of travelling which are NOT necessarily incurred by an office holder or employee in the performance of the duties of his/her office or employment.

If an office holder or employee receives expense payments in respect of travelling to and from work, such expense payments are taxable and subject to PAYE deductions.”

Paragraph 2.6

“Where an office holder or employee, in the performance of the duties of his/her office or employment, begins a business journey directly from home or returns directly to home, then the expenses of travel and subsistence that may be reimbursed without deduction of tax are the lesser of those incurred on the journey between -

- home and the temporary work location; or

- the normal place of work and the temporary work location.”

Revenue's practice as set out above is supported by case law, which clearly indicates that the necessity to incur travel expenses must be imposed

- by the duties of the office or employment itself rather than by the personal circumstances of the office holder or employee, and

- on every person holding that office or employment regardless of the holder's personal circumstances or where he or she lives.

The examples set out in part 4 of this article are intended to illustrate the circumstances in which Revenue is prepared to accept that expenses of travel and subsistence may be reimbursed free of tax using the Civil Service schedule of rates. However, nothing in this article should be taken as limiting an individual's right to make a claim, under the provisions of Section 114 Taxes Consolidation Act 1997, for a deduction for the actual allowable expenses incurred. Where the employee decides to make such claims, any reimbursement of expenses by the employer, including any flat rate allowances, is regarded as pay and taxed accordingly.

3. Applying the guidance in the case of intermediaries.

3.1 In most cases, the normal place of work of an employee/director of an intermediary will be the premises of the intermediary's client. In many cases, the contract may specify fixed working hours at that premises or the nature of the work requires attendance at the premises, regardless of whether this is specified in the contract. Revenue does not accept that the location at which the administration of the intermediary is carried out and its books kept (whether this is at the registered office of the intermediary or at the director's home) constitutes a normal place of work of the director/employee.

Travel expenses incurred by a director/employee on the journey from his/her home to his/her normal place of work (and vice versa) do not qualify for a statutory deduction under Schedule E and may not be reimbursed free of tax. The rationale for this is that the necessity to incur the expense of travelling to or from home is imposed by the individual's personal circumstances and not by the duties of the office or employment and would not be imposed on every individual holding that office or employment.

3.2 The fact that an intermediary may undertake a series of short term contracts does not alter the position set out in paragraph 3.1 viz. the director/employee's home or the intermediary's registered office does not become a normal place of work of the director/employee of the intermediary. It follows that the cost of travel from home to the premises of the intermediary's client may not be reimbursed free of tax.

3.3 An intermediary may undertake a number of contracts contemporaneously. In such situations, the deductibility of travel expenses depends on the purpose of each journey. In all cases, the cost of travel from home to the first client premises and the cost of travel back to home from any of the clients’ premises may not be reimbursed free of tax. However, the cost of travel between client premises may be reimbursed free of tax.

3.4 The contract between the intermediary and the client may require the employee/director of the intermediary to attend the client premises but also to travel daily to multiple client locations for a temporary purpose or to travel to other locations, for example, to carry out inspections or deal with customers of the client.

In such cases, Revenue will accept, in line with paragraph 3.1 that the client's premises is the individual's normal place of work. The guidance in paragraph 4.2 of Statement of Practice IT/2/07 may be applied accordingly.

3.5 Sections 886 and 886A of the Taxes Consolidation Act 1997 impose statutory obligations in relation to the keeping of records. Paragraph 1.4 of Statement of Practice SP IT/02/2007 and Revenue Leaflets IT 51 and IT 54 specify obligations in the context of the reimbursement by employers of expenses of travel and subsistence free of tax to employees or directors. In the absence of adequate records and relevant supporting documentation, expenses of travel and subsistence may not be reimbursed free of tax to employees or directors.

4. Examples

Emma is a director of a company with a contract to provide computer programming services to A Ltd which runs a payroll service for its clients. Her normal place of work is located at A Ltd's headquarters. From time to time she brings work home with her rather than staying late at A Ltd's premises. The expenses of travel and subsistence incurred on the return journey between Emma's normal place of work and home may not be reimbursed free of tax even on the occasions when she brings work home with her.

From time to time Emma is required to travel from her normal place of work to customers of A Ltd to assist them in implementing revised payroll packages. The expenses of travel and subsistence incurred on the return journey between her normal place of work and the customer's premises may be reimbursed free of tax.

From time to time when Emma is required to visit customers of A Ltd, she travels to them directly from home. The expenses which may be reimbursed free of tax are the lesser of those incurred on the journey between her home and the customer's premises and those incurred on the journey between her normal place of work and the customer's premises.

Dermot is a director of a company with a contract to provide electrical services to BE Ltd. The contract involves multiple daily appointments with various customers of BE Ltd.

In this scenario, Dermot holds a “travelling appointment” as described in paragraph 4.2 of Statement of Practice SP IT/02/2007 and the premises of BE Ltd will be treated as his normal place of work.

The expenses of travel and subsistence incurred by Dermot in travelling from his home to the premises of BE Ltd may not be reimbursed free of tax. However, expenses of travel and subsistence incurred by Dermot travelling from the premises of BE Ltd to the customers of BE Ltd may be reimbursed free of tax.

Where a business journey commences from Dermot's home or Dermot returns directly to home from the premises of a customer, then the expenses that may be reimbursed without deduction of tax are the lesser of those incurred on the journey between:-

- home and the customer's premises and

- the employer's base (normal place of work) and the customer's premises.

Deirdre is a director of a company with a contract to provide advertising services to GH Ltd. Up to December 2012, she worked at the premises of GH Ltd but GH Ltd now allows her to work from home and she attends the premises of GH Ltd every Friday to provide work updates and discuss projects. The expenses of travel and subsistence incurred on the return journey each Friday between Deirdre's home and the premises of GH Ltd may not be reimbursed free of tax.

Kevin is a director of a company with a number of contracts to provide weekly health and safety advice to A Ltd, B Ltd and C Ltd to ensure that these companies comply with the appropriate Health and Safety legislation. Under these contracts, Kevin is required to work Mondays and Tuesdays with A Ltd, Wednesdays and Thursdays with B Ltd and Fridays with C Ltd.

The expenses of travel and subsistence incurred by Kevin on the return journey from his home to A Ltd, B Ltd and C Ltd may not be reimbursed free of tax. On each day Kevin is merely travelling from his home to his normal place of work and vice versa.

Kevin's work pattern changes. He is now required to spend Monday and Tuesday mornings with A Ltd before travelling to B Ltd where he works on Tuesday afternoon and Wednesday. He spends Thursday and Friday with C Ltd. The expenses of travel and subsistence incurred on the journey between A Ltd and B Ltd only may be reimbursed free of tax.

Alison is a director of a company with three engineering contracts. On most days she works from home by choice. Once a month she takes a day out to attend the premises of the three clients to discuss issues arising on the engineering contracts.

The travel and subsistence expenses incurred by Alison on the journey from her home to the first call and from the last call to her home may not be reimbursed free of tax. They are not expenses which are necessarily incurred “in the performance of the duties” of the office or employment. However, the travel and subsistence expenses necessarily incurred by Alison in travelling between clients’ premises may be reimbursed free of tax.

Adam is a director of a company. Throughout the tax year 2012 the company won three contracts with three different clients to install heavy duty electrical equipment at three different premises. Adam spent 2 months, 6 months and 4 months respectively in the year 2012 at the 3 different premises installing the equipment.

The expenses of travel incurred by Adam on the return journey from his home to the various premises and any expenses of living away from home may not be reimbursed free of tax.

Source: Revenue Commissioners . www.revenue.ie . Copyright Acknowledged

Cookies on GOV.UK

We use some essential cookies to make this website work.

We’d like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services.

We also use cookies set by other sites to help us deliver content from their services.

You have accepted additional cookies. You can change your cookie settings at any time.

You have rejected additional cookies. You can change your cookie settings at any time.

Bring photo ID to vote Check what photo ID you'll need to vote in person in the General Election on 4 July.

- Business tax

Tax rules on other types of travel and related expenses (490: Chapter 8)

Find out about the tax treatment of other types of travel and related expenses such as training courses, removal expenses, car parking and overnight expenses.

Tax rules on other types of travel and related expenses

This chapter explains the tax treatment of some other types of travel and related expenses. The National Insurance contributions treatment will in most cases follow that for tax.

You can find more information in the CWG2: further guide to PAYE and National Insurance contributions .

Incidental overnight expenses

An employee making a business trip may spend money on items such as private phone calls, laundry and newspapers. These are not ‘travel expenses’ – they’re personal expenses incurred while travelling.

An employee is not entitled to tax relief for personal expenses of this kind under the normal travel rules. But there is a separate rule which gives tax relief for these expenses in certain circumstances.

Employees who stay away overnight while travelling on business, or attending work-related training of the kind described in paragraphs 8.7 and 8.8 , are entitled to tax relief for personal expenses they incur where these are paid for or reimbursed by, or on behalf of, their employer.

Employees are not entitled to tax relief for expenses they pay out of their own money which their employer does not reimburse.

Employees are entitled to tax relief for these expenses if the employer pays or reimburses no more than:

- £5 for every night spent away on business in the UK

- £10 for every night spent away on business outside the UK

Sally stays in a hotel in Peterborough for 3 nights as part of a business trip. During that time she spends £3.50 on personal telephone calls and £1.50 on newspapers. Her employer reimburses these expenses.

Sally is not entitled to tax relief for these expenses under the normal travel rules but she is entitled to tax relief under the separate rule for incidental overnight expenses.

Mary stays in a hotel in Cambridge for 4 nights as part of a business trip. Her employer pays her £5 for each night to cover her incidental expenses even though Mary does not spend the full amount.

Mary is not entitled to tax relief for these payments under the normal travel rules but she is entitled to tax relief under the separate rule for incidental overnight expenses up to the amount of expense she incurred.

The additional amounts over and above her actual expenses are chargeable to tax and National Insurance contributions as earnings from her employment.

Where the employer pays more than the amounts shown in 8.4, unless there is an established policy which needs employees to repay any excess over these amounts (and repayment is made within a reasonable time), the employee is taxed on the full amount paid by the employer and is not entitled to any tax relief to set against that amount.

Philip stays in a hotel in Sheffield for one night as part of a business trip. His employer gives him an allowance of £6 to spend on personal expenses. Philip is taxable on the whole of the £6.