Home » Blog » Understanding the Presumptive Tax Regime u/s 44AD for eligible Businesses

Understanding the Presumptive Tax Regime u/s 44AD for eligible Businesses

- Blog | Income Tax |

- 10 Min Read

- Last Updated on 13 April, 2023

Recent Posts

Blog, Advisory, Company Law

[Analysis] SEBI’s New Insider Trading Regulations | Key Changes and Implications

Blog, GST & Customs

Overview of Foreign Trade Policy 2023 – Background | Interpretation | Classification

Latest from taxmann.

Table of Contents

- Presumptive taxation regime of Section 44AD of the Act?

- Which assessees are eligible to opt for the scheme under section 44AD?

- Which assessees are barred from availing section 44AD scheme?

- Disqualification incurred by opting out of section 44AD before availing it for 6 consecutive previous years

1. Presumptive taxation regime of Section 44AD of the Act

The objective of section 44AD of the Act is to provide a presumptive income scheme for small taxpayers to lower compliance costs for them and to reduce the administrative burden on the tax machinery.

The following features of section 44AD may be noted:

- In the case of an “eligible assessee” engaged in an “eligible business”, the profits and gains from such business shall be deemed to be 8% of the total turnover or gross receipts (6% in case of turnover or gross receipts realised digitally/through banking channels on or before the due date for filing ITR u/s 139(1) on account of such eligible business.

- It must be noted that ‘eligible assessee’ needs to opt for section 44AD for the entire turnover of his ‘eligible business’ if he opts for section 44AD. He cannot, for instance, opt for section 44AD for only digital turnover portion of his turnover.

- The rate of 8 per cent (6% in case of digital turnover) is comprehensive. All deductions under sections 30 to 38 of the Act including depreciation, will be deemed to have been already allowed and no further deduction will be allowed under these sections. The written down value will be calculated, where necessary, as if depreciation as applicable has been allowed.

[For amendments by Finance Act, 2023 to section 44AD w.e.f. A.Y. 2024-25]

In Oopal Diamond v. ACIT [ 2022] 144 taxmann.com 184 (Mumbai – Trib.), it was held that in view of Task Force Report [See Report of the Task Group for Diamond Sector to make India an “International Trading Hub For Rough Diamonds”, February 2013, published by the Union the Ministry of Commerce and Industry], Net Profit addition for purchases from tainted party is not to exceed 1.5% to 4.5% range in case of diamond manufacturers. The Tribunal held as under:

- Where the assessee was a manufacturer and trader of diamonds and had made purchases from certain parties who were treated as tainted dealers as per information gathered from the search carried out in the entities of Shri Bhawarlal Jain and Group but the sales made out of these purchases were not doubted by the AO, CIT(A) was justified in reducing the 5% net profit addition made by AO in respect of these purchases to 3% as the 3% addition is in line with Benign Assessment Procedure recommended in the report of Task Force for Diamond Sector which recommended Net Profit presumptive margin of 1.5% to 4.5% for diamond manufacturers and 1.5% to 3% for diamond traders.

- We find that the Tribunal has been consistently taking the stand by estimating the profit element on the basis of reliance placed on the aforesaid report of the Task Force. In the instant case, the assessee is engaged in the business of both trading as well as manufacturing of diamonds. Considering the same, the ld. CIT(A) was duly justified in estimating the profit percentage at 3%. In other words, the estimation of profit percentage at 3% by the ld. CIT(A) is just and fair and does not require any interference. Accordingly, ground No. 2 raised by the assessee is dismissed.

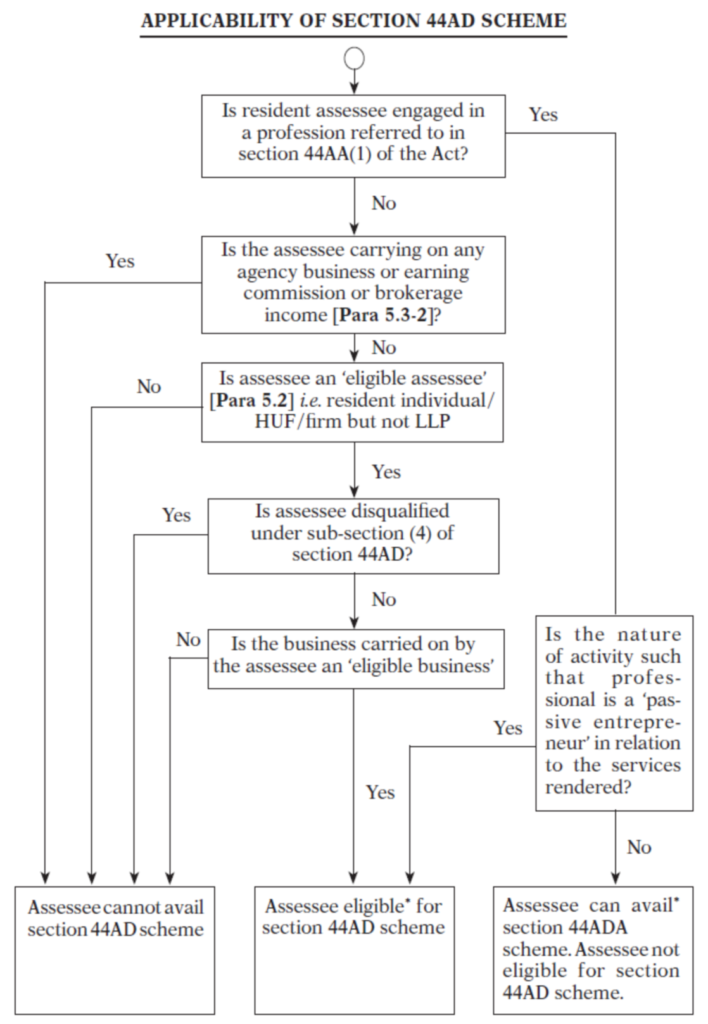

The following flowchart explains who can opt for the presumptive taxation scheme under section 44AD.

2. Which assessees are eligible to opt for the scheme under section 44AD?

Assessee should be an “eligible assessee” within the meaning of clause (a) of the Explanation to section 44AD. According to the said clause (a), “eligible assessee” means:

- An individual, HUF or firm

- Who is resident and

- Who has not claimed deduction under sections 10A, 10AA, 10B, 10BA of the Act or deduction under any provisions of Chapter VIA of the Act under the heading “C-Deductions in respect of certain incomes”.

Also, assessee should not be barred from availing the section 44AD Scheme

Where assessee was not carrying on any business independently but was only a partner in a firm, interest and salary received by assessee could not be construed as business income under section 28(v) and accordingly, assessee’s claim of estimating income on presumptive basis under section 44AD with respect to interest and remuneration earned from partnership firm had rightly been denied. [ Anandkumar v. ACIT [2020] 122 taxmann.com 252 (Madras)]

2.1 Section 44AD can be availed only by individuals, HUFs and firms

The benefit of section 44AD can be availed only by resident individuals, Hindu Undivided Families and firms. Section 2(23) of the Act defines “firm” to include Limited Liability Partnerships (LLPs) registered under the Limited Liability Partnership Act, 2008 (LLP Act, 2008). However, clause (a) of the Explanation to section 44AD bars LLPs from availing the benefit of section 44AD. Clause (a) uses the words “but not a “limited liability partnership firm” as defined under clause (n) of sub-section (1) of the Limited Liability Partnership Act, 2008 (6 of 2009)”.

Thus, only general partnership firms within the meaning of Indian Partnership Act, 1932 can avail the benefit of section 44AD. LLPs cannot avail the benefit of section 44AD.

2.2 Non-residents are not eligible assessees and cannot avail benefit of section 44AD

Section 44AD benefit is available only to residents. Non-residents cannot avail section 44AD.

2.3 Not claimed any deduction under Part C of Chapter VIA-A of the Act or under section 10A, 10AA, 10B or 10BA

No deduction is admissible under section 10BA with effect from Assessment Year 2010-11. Likewise, no deduction is admissible under section 10A or 10B with effect from Assessment Year 2012-13. Section 10AA contains “Special provisions in respect of newly established Units in Special Economic Zones”. Part C of Chapter VI-A under the heading “C-Deductions in respect of certain incomes” comprises sections 80HH to 80RRB (both inclusive). Most of these sections in Chapter VIA-C either legally or practically do not apply to small businesses. Many of these sections are past their “sunset clause” date and hence deductions under them are not legally admissible. SUGAM ITR-4 form is prescribed for filing ITRs of assessees who opt for section 44AD. In ITR-4, there is no column for claiming any deduction under Chapter VIA-C.

3. Which assessees are barred from availing section 44AD scheme?

Section 44AD(6) of the Act provides that the provisions of section 44AD shall not apply to:

(i) a person carrying on profession as referred to in sub-section (1) of section 44AA of the Act

(ii) a person earning income in the nature of commission or brokerage

(iii) a person carrying on agency business.

Sub-section (4) of section 44AD provides restrictions against opting in and opting out at will. Sub-section (4) provides that where an eligible assessee declares profit of 8% or more (6% or more in case of digital turnover) in accordance with section 44AD for Assessment Year 2017-18 or any subsequent assessment year, he should declare 8% or more (6% or more in case of digital turnover) for next 5 consecutive assessment years also before opting out of section 44AD by declaring lower than 8% (lower than 6% for digital turnover) for any year. Where assessee opts out in violation of sub-section (4) i.e. before declaring profit of 8% or more (6% or more in case of digital turnover) for 6 consecutive years, he shall be barred from availing section 44AD scheme for next 5 consecutive assessment years.

3.1 Which are the professions referred to in section 44AA(1) [Section 44AD(6)(i)]

A person carrying on a profession referred to in section 44AA(1) of the Act cannot avail section 44AD in respect of either the profession or for that matter in respect of any “eligible business” carried on by him . Under section 44AA(1) of the Act, the following professions have been notified so far:

- Accountancy

- Architectural

- Authorised Representative

- Company Secretary

- Engineering

- Film artists – Art Director (including Assistant Director), Cameraman, Dance Director (including Assistant Dance Director), Dialogue writer, Director (including Assistant Director), Dress Designer, Editor, Lyricist, Music Director (including Assistant Music Director), Screenplay writer, Singer, Story writer

- Interior Decoration

- Information Technology

- Technical Consultancy

The following implications of clause (i) of section 44AD(6) may be noted:

- The exclusion applies not merely to the profession referred to in section 44AA(1) but to the person carrying on such profession.

- This means, for example, if a doctor [a profession referred to in section 44AA(1)] has a business of pharmacy shop as well, it goes without saying that he would not be able to claim section 44AD for his medical practice 1 .

- What is further important is that he would also not be able to opt for presumptive taxation under section 44AD for his pharmacy shop business.

- On the other hand, if his pharmacy shop business is carried on by a partnership firm (not being an LLP), the firm can avail section 44AD in respect of that business as the doctor and firm are distinct ‘persons’ with separate PAN numbers as far as the Income-tax Act, 1961 is concerned.

- The person barred is the person carrying on profession referred to in section 44AA(1) – i.e., the doctor. The firm carrying on pharmacy business is a distinct and separate person and the bar does not apply to the firm.

- Likewise a partnership firm selling law books having a lawyer as a partner is not barred from availing section 44AD since the bar in section 44AD(6) applies to the lawyer and not to the firm which is a separate entity for income-tax purposes.

- If profession carried on is one that is not covered by section 44AA(1) of the Act (e.g. teaching, authorship), the person carrying on the same can avail the presumptive income scheme under section 44AD in respect of that profession and also in respect of any other eligible business.

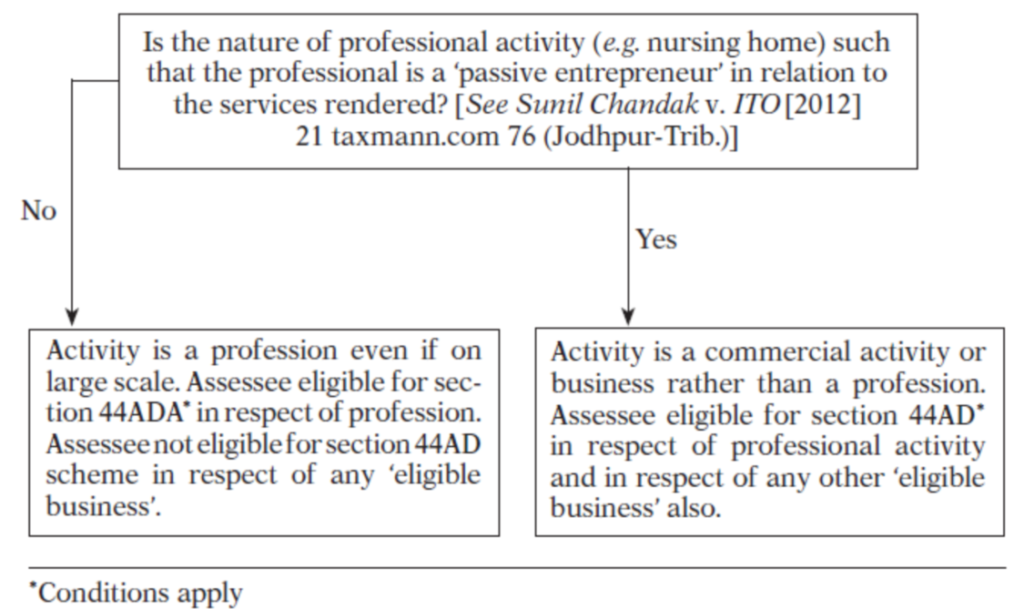

It must be noted that the activity of a professional doctor/lawyer/architect etc. would still be a profession and not be a business even if it is carried out on a large scale by hiring other doctors/lawyers etc. unless the doctor/lawyer becomes a passive entrepreneur in relation to the services.

In Sunil Chandak v. ITO [2012] 21 taxmann.com 76/136 ITD 324 (Jodh. - Trib.), the Tribunal dealt with this issue in great detail. The ITAT laid down the following propositions:

- Even if a doctor carries out his activities on a large scale by hiring other doctors in his nursing home, his activity will be ‘profession’ and not ‘business’ unless he becomes a passive entrepreneur in relation to services.

- The fact that physicians/doctors have been hired is not relevant.

- What is relevant and crucial is the nature of the services rendered by them (hired doctors), whether facilitative or substantially so, or on independent, standalone basis, or substantially so. It is only in the latter case that the nursing home acquires the character of a business enterprise.

- A lawyer or an architect, say, may keep juniors or even experienced lawyers or architects, to assist him, or to be able to increase the capacity or manage efficiently the volume or range of services, i.e., impact positively the quality and quantum of work/professional output. The same would be essentially a question of size, i.e., make it a law firm or a solicitor firm as against an individual lawyer or solicitor, and not impinge on the character of the services. The question is not even of capital, which again plays a dormant role.

- Where, however, the lawyers employed or hired are specialists in their respective areas of practice, engaged with a view to broaden the horizons of the professional services being offered, the firm, though only a law firm as far as the clients are concerned, its proprietor could be said to be carrying out trade or commerce, inasmuch as his function in relation to those services is only passive, of an entrepreneur, managing the affairs, much in the same manner as a non-professional would.

- A business is characterized by a much higher level of risk in comparison to profession.

- By undertaking to invest capital, entailing financial risk as where it is borrowed at a cost, and arranging for a gamut of services, the promoter assumes a level of business risk not warranted by the exercise of profession, in as much as he is trading or leveraging on the professional ability of those employed or hired to successfully run a particular segment of the business, if not the whole of it, and not merely to act as assistants or facilitators working under a stable, supervised and, thus, controlled, conditions.

If the doctor conducts activities of his nursing home on large scale by hiring other doctors to the extent he becomes a passive entrepreneur, he could no longer be said to be “carrying on a profession” within the meaning of section 44AD(6)(i) or “engaged in a profession” to use the words of section 44ADA. In such a case, the doctor would not be eligible for presumptive scheme under section 44ADA but would be eligible for the presumptive scheme under section 44AD.

Applicability of Presumptive Income Scheme Under Sections 44AD/44ADA to Resident Assessee Engaged in Profession Referred to in Section 44AA(1)

3.2 Whether a person earning commission or brokerage income [Section 44AD(6)(ii)] can avail section 44AD scheme for his other business activities?

A person earning income in the nature of commission or brokerage cannot opt for presumptive taxation under section 44AD not only in respect of his activities giving rise to commission or brokerage income but also in respect of other ‘eligible business’. If an individual is carrying on his commission or brokerage activities in individual proprietary name but is a partner in a firm carrying on ‘eligible business’, the firm is not barred from availing section 44AD as it is a separate entity with separate PAN for tax purposes. It is also important to note that mere earning of commission or brokerage income disqualifies a person from opting for section 44AD even if he has ceased carrying on the activities giving rise to the income and these are results of his past efforts.

4. Disqualification incurred by opting out of section 44AD before availing it for 6 consecutive previous years

Sub-section (4) of section 44AD provides as under:

- Where an eligible assessee declares profit for any previous year in accordance with the provisions of this section.

- Then in any of the next 5 assessment years relevant to the previous year succeeding such previous year, he opts out of section 44AD by declaring profit not in accordance with section 44AD – i.e. he declares profit less than 8% (less than 6% in case of digital turnover) or he declares a loss.

*Conditions apply.

- With effect from assessment year 2017-18, the doctor can opt for presumptive income scheme for his medical practice under section 44ADA.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

8 thoughts on “Understanding the Presumptive Tax Regime u/s 44AD for eligible Businesses”

What if actual profit is more than 8% in case the return is filed under 44AD ?. Should we declare actual profit or 8% as per the law ?.

Ethically yes, actual profit should be declared but practically things may vary on the ground of non-maintenance of books.

As per section 44AD, the assessee should mention 8%/6% of turnover as minimum profit. However, if the actual profit is more than the prescribed % then the assessee can declare actual profit in his income tax return.

Can business of teaching and income from it will be eligible for presumptive taxation u/s 44AD? Thanks for this great article.

If the profession carried on by the assessee is one that is not covered by section 44AA(1) of the Act, the person carrying on the same can avail the presumptive income scheme under section 44AD in respect of that profession and also in respect of any other eligible business.

Can a pilot show their income under section 44AD, since he is not covered under section 44AA and further where it has been written that the actual profit must be shown, can we just simply pay6/8% of the gross receipts?

What is the threshold limit u/S 44AD for Service providers e.g. Manpower Supply, Renting of Machinery etc.?

Any business carried out by the eligible assessees is eligible for Section 44AD if turnover or gross receipts from such business in the financial year does not exceed Rs. 2 crores. However, the limit of Rs. 2 crores shall be increased to Rs. 3 crores if the amount or aggregate of the amount of cash received during the previous year does not exceed 5% of the total turnover or gross receipts of such year.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

PREVIOUS POST

To subscribe to our weekly newsletter please log in/register on Taxmann.com

Latest books.

Income Tax Rules

Finance Act 2023 Essentials Combo

Finance Act 2023 Commentary Combo

Everything on Tax and Corporate Laws of India

Author: Taxmann

- Font and size that's easy to read and remain consistent across all imprint and digital publications are applied

Everything you need on Tax & Corporate Laws. Authentic Databases, Books, Journals, Practice Modules, Exam Platforms, and More.

- Express Delivery | Secured Payment

- Free Shipping in India on order(s) above ₹500

- Missed call number +91 8688939939

- Virtual Books & Journals

- About Company

- Media Coverage

- Budget 2022-23

- Business & Support

- Sell with Taxmann

- Locate Dealers

- Locate Representatives

- CD Key Activation

- Privacy Policy

- Return Policy

- Payment Terms

Kanakkupillai Learn – India's Top Business Consulting Company

- +91 7305345345

- [email protected]

- Over 35,146 Startups and MSMEs Assisted

- Rated 4.8 out of 5 on Google Reviews

- 99.9% Satisfaction Guarantee

Unlocking the Secrets of Presumptive Tax: Exploring Section 44AD

- Post author: Kanakkupillai

- Post published: September 14, 2023

- Post category: Taxation

Last Updated on September 14, 2023 by Kanakkupillai

Presumptive Tax

Navigating taxation is no small feat, especially for small businesses and self-employed individuals striving to balance operations and financial management. In this intricate landscape, the concept of Presumptive Tax under Section 44AD emerges as a guiding light, offering simplicity and relief to those engaged in modest commercial ventures.

Presumptive Tax under Section 44AD

Imagine a tax approach to ease the burden on small businesses and self-employed professionals, allowing them to focus on growth instead of complex calculations. This is precisely what Presumptive Tax under Section 44AD aims to achieve. Section 44AD of the Income Tax Act provides an alternative method for calculating taxable income, simplifying the tax structure for those whose turnovers do not exceed a specified threshold.

Relevance for Small Businesses and Self-Employed Individuals:

Presumptive Tax under Section 44AD is particularly relevant and beneficial for small businesses and self-employed individuals for several reasons:

- Simplicity in Calculation: Keeping meticulous records and calculating intricate tax components can be daunting for many small businesses. With the Presumptive Tax method, they can determine their tax liability based on a predetermined percentage of their turnover, simplifying the entire process.

- Reduced Compliance Burden: Traditional tax calculations involve extensive documentation and complex accounting practices. Presumptive Tax drastically reduces this compliance burden, allowing entrepreneurs to allocate their time and resources more effectively.

- Focus on Business Growth: Small businesses often face resource constraints. By eliminating the need for exhaustive accounting, Presumptive Tax frees up valuable time and energy, enabling business owners to concentrate on enhancing their services and expanding their customer base.

- Financial Predictability: Businesses can estimate their tax liability more predictably with a fixed percentage applied to turnover. This assists in better financial planning and allocation of funds for tax payments.

- Reduced Risk of Scrutiny: Since Presumptive Tax offers a simplified method of computation, businesses are less likely to attract the scrutiny that can come with complex tax arrangements.

Understanding Section 44AD

What is section 44ad.

In the symphony of the Income Tax Act, Section 44AD stands as a harmonious alternative for small businesses and self-employed individuals, offering a simplified approach to tax calculation. This provision provides a method of taxation that eases the burdensome complexities of the conventional tax regime. Designed as a beneficial provision, Section 44AD offers eligible taxpayers a reprieve from intricate calculations, allowing them to focus on their core activities while ensuring fair taxation.

Purpose of the Income Tax Act

The primary purpose of Section 44AD is to alleviate the tax compliance burden on certain taxpayers. It acknowledges the challenges faced by small businesses, self-employed professionals, and those with modest turnovers. By providing a presumptive taxation framework, this section aims to promote ease of doing business, stimulate entrepreneurship, and streamline the tax process. It is a testament to the government’s commitment to fostering a more inclusive and simplified tax environment.

Who Can opt for Presumptive Tax under Section 44AD?

Section 44AD extends its accommodating embrace to a specific set of taxpayers. These include:

- Resident Individuals: Individuals who are residents of India can avail themselves of the benefits of this section.

- Hindu Undivided Families (HUFs): HUFs, a unique entity in Indian tax law, are also eligible to opt for the presumptive taxation scheme.

- Partnerships (Excluding LLPs): Partnership firms , except Limited Liability Partnerships (LLPs), can leverage the provisions of Section 44AD.

Types of Businesses Eligible

This provision welcomes a spectrum of businesses within its fold, aiming to accommodate diverse economic activities. Eligible businesses include:

- Professionals: Individuals in professions such as doctors, engineers, architects, interior designers, and legal practitioners can opt for the presumptive tax scheme .

- Traders: Small traders dealing in goods and commodities are eligible beneficiaries.

- Manufacturers: Individuals engaged in manufacturing activities are also welcomed under this provision.

- Service Providers: The scope extends to service providers whose turnover does not exceed the specified threshold.

The significance of Section 44AD lies in its inclusive approach, aiming to encompass a wide array of small businesses and self-employed professionals, easing their tax calculations and fostering a conducive environment for economic growth.

As we journey further into how this provision operates, let us explore the benefits it bestows upon eligible taxpayers and unravel the mechanism of Presumptive Taxation under Section 44AD.

Benefits of Opting for Presumptive Tax

Simplified taxation:.

Explaining Simplified Tax Calculation through Presumptive Tax:

Imagine tax calculations stripped of complexities—a simplified approach where your tax liability is based on a flat percentage of your turnover. This is precisely what Presumptive Tax offers. Rather than diving into intricate accounting and exhaustive record-keeping, you can apply a predefined rate on your turnover to determine your taxable income. This method takes the guesswork out of complex tax computations, allowing you to allocate more time and resources towards your business growth.

Lower Compliance Burden:

Unlocking the Benefit of Reduced Documentation and Accounting:

Conventional tax calculations often demand meticulous record-keeping, voluminous documentation, and comprehensive accounting practices. This burden can overwhelm small businesses and self-employed individuals with limited resources. Opting for Presumptive Tax lightens this load significantly. By embracing this method, you are granted relief from maintaining exhaustive records, intricate accounting practices, and a mountain of documentation. This newfound simplicity in compliance frees up your time and energy, which can be channelled towards enhancing your business operations.

Presumed Income Rate:

Understanding the Role of Fixed Percentage in Tax Calculation:

One of the most distinct features of Presumptive Tax is the application of a fixed percentage of presumptive income on your turnover. For instance, if you are engaged in non-digital transactions, the presumptive income rate is typically 8% of your total turnover. This fixed percentage is deemed your taxable income, eliminating the need for elaborate calculations. This approach simplifies the process and provides predictability, allowing you to estimate your tax liability more accurately.

Presumed income rates are designed to reflect a fair approximation of actual profits. While the actual profits might be higher or lower, this uniform rate ensures simplicity and consistency in tax assessment.

As we explore the practical implications of calculating tax liability through Presumptive Tax under Section 44AD, let’s unravel the steps involved in determining your taxable income, factoring in deductions and exemptions available under this provision.

Calculation of Tax Liability

Clarifying total turnover calculation for presumptive tax:.

Calculating your total turnover is the first step in determining your tax liability under Presumptive Tax. Your turnover includes the gross receipts from your business activities during the financial year. It encompasses the total amount received or receivable from the sale of goods or services, excluding taxes.

It is important to note that turnover for Presumptive Tax purposes includes all receipts related to your business, whether in cash, cheque, draft, or any other form. This comprehensive approach ensures that your tax assessment is accurate and aligned with your business activities.

Illustrating the Calculation Process with Presumptive Income Rate:

Once your total turnover is determined, the next step involves calculating your presumptive income using the applicable rate. For instance, if you are a non-digital transaction business, the presumptive income rate is typically 8% of your total turnover.

Here is how the calculation unfolds:

Presumptive income = 8% of Total Turnover

This calculated presumptive income becomes your taxable income under Presumptive Taxation . It is important to remember that this percentage may vary based on the nature of your business. For digital transactions, the presumptive income rate could differ.

Considering Deductions and Exemptions Available:

While Presumptive Taxation offers a simplified approach to tax calculation, it is full of provisions for deductions and exemptions. Despite the presumptive nature of this taxation method, you are entitled to claim deductions under various sections of the Income Tax Act . Some standard deductions include those related to interest paid on loans, depreciation on assets, and certain business-related expenses.

Exemptions available under other sections of the Income Tax Act can also be claimed. However, navigating these deductions and exemptions under the tax laws and guidelines is essential. Engaging with a tax professional can be particularly helpful in ensuring that you leverage these provisions effectively to optimize your tax liability.

As you calculate your tax liability under Presumptive Tax, remember that while the approach is simplified, precision and adherence to legal requirements are paramount.

Filing Tax Returns:

Explaining reporting of presumptive income:.

Filing your income tax return under the Presumptive Taxation scheme is relatively straightforward. To report your presumptive income, follow these steps:

- Income Details: In your income tax return form, navigate to the section where you report your business income.

- Presumptive Income: Enter your presumptive income calculated per the applicable rate (e.g., 8% of turnover for non-digital transactions).

- Gross Receipts: Provide details of your total gross receipts or turnover. This helps validate the calculation of your presumptive income.

- Other Income: If you have any other sources of income not covered under the Presumptive Taxation scheme, report them separately in the appropriate sections of the return form.

Understanding Income Tax Return Form ITR-4:

Income Tax Return Form ITR-4 , also known as “Sugam,” is the specific form designed to accommodate the needs of businesses opting for the Presumptive Taxation scheme under Section 44AD. This form streamlines the process of reporting your business income, making it compatible with the scheme’s simplicity.

Form ITR-4 gathers essential information about your business’s turnover, expenses, and presumptive income. It also provides space for you to detail any other income sources you might have. This form ensures that your tax return accurately reflects your Presumptive Tax calculations and ensures compliance with the applicable tax laws.

When filling out Form ITR-4, consider the sections relevant to your business and ensure that you provide accurate and complete information. The form’s layout is designed to guide you through the process smoothly, making it easier to report your income and deductions accurately.

As you prepare to file your tax return using Form ITR-4 , remember that while Presumptive Tax under Section 44AD simplifies tax calculations, precision and adherence to reporting requirements remain vital. Consulting a tax professional can provide valuable guidance if you still need to determine any aspect of the process.

Hence, Presumptive Taxation under Section 44AD presents an accessible avenue for simplifying tax calculations for small businesses and self-employed individuals. By understanding its nuances, calculating your tax liability, and accurately reporting your income, you can leverage this scheme to its fullest potential, contributing to a more streamlined and manageable tax journey.

Section 44AD’s Presumptive Tax is a beacon of simplicity tailored to empower small businesses and self-employed individuals in the intricate taxation landscape. With a flat rate applied to turnover, complex calculations dissipate, and reduced compliance burdens grant more space for productive pursuits. The fixed presumptive income rate adds a layer of predictability, aiding financial planning .

However, the significance of meticulous record-keeping remains steadfast, while transitioning beyond income limits necessitates careful consideration. The choice between Presumptive Tax and conventional methods depends on various factors, underscoring the importance of personalized decision-making.

Form ITR-4 becomes the canvas to report presumptive income, and adherence to legal stipulations ensures smooth sailing. This streamlined approach to taxation harmonizes with aspirations of growth and efficiency, offering a win-win scenario for taxpayers and the tax ecosystem.

Please Share This Share this content

- Opens in a new window

Kanakkupillai

You Might Also Like

New India redefines its Angel Tax Theory on Start-ups!

Is It Time To Pay Advance Tax?

Tax Implications of Leaving a Company in India

- Consultants

- Be a Member

- SIGN IN Become a Member

FAQs on Section 44AD under Presumptive Taxation

Faqs on section 44ad under presumptive taxation.

To provide the relief to the small taxpayers, the government has issued the presumptive scheme. Because the maintaining the books of accounts is very tedious work for the small taxpayers. It consumes extra money to be efficient. So, section 44AD of the Income Tax Act provides the Presumptive taxation scheme for the Business. Let us know about the Section 44AD for presumptive Taxation through the FAQs on Section 44AD. Following are the FAQs on Section 44AD under Presumptive Taxation:

For whom the presumptive taxation scheme of section 44AD is designed?

The presumptive taxation scheme of section 44AD is designed to give relief to small taxpayers engaged in any business (except the business of plying, hiring or leasing of goods carriages referred to in section 44AE).

The presumptive taxation scheme of section 44AD can be adopted by the following persons :

- Individual (Resident)

- Hindu Undivided Family (Resident)

- Resident Partnership Firm (not Limited Liability Partnership Firm)

In other words, the scheme cannot be adopted by a non-resident and by any person other than an individual, a HUF or a partnership firm (not Limited Liability Partnership Firm).

This scheme cannot be adopted by a person who has made any claim towards deductions under section 10A/10AA/10B/10BA or under sections 80HH to 80RRB in the relevant year.

Businesses not covered under the presumptive taxation scheme of section 44AD

The scheme of section 44AD is designed to give relief to small taxpayers engaged in any business, except for the following businesses:

- The business of plying, hiring or leasing of goods carriages referred to in section 44AE.

- A person who is carrying on any agency business.

- A person who is earning income in the nature of commission or brokerage

Apart from above discussed businesses, a person carrying on profession as referred to in section 44AA(1)is not eligible for presumptive taxation scheme.

An insurance agent cannot adopt the presumptive taxation scheme of section 44AD

A person who is earning income in the nature of commission or brokerage cannot adopt the presumptive taxation scheme of section 44AD. Insurance agents earn income by way of commission and, hence, they cannot adopt the presumptive taxation scheme of section 44AD.

A person engaged in a profession as prescribed under section 44AA(1) cannot adopt the presumptive taxation scheme of section 44AD

A person who is engaged in any profession as prescribed under section 44aa(1) cannot adopt the presumptive taxation scheme of section 44ad., a person whose total turnover or gross receipts for the year exceed rs. 2,00,00,000 cannot adopt the presumptive taxation scheme of section 44ad.

The presumptive taxation scheme of section 44AD can be opted by the eligible persons if the total turnover or gross receipts from the business do not exceed Rs. 2,00,00,000. In other words, if the total turnover or gross receipt of the business exceeds Rs. 2,00,00,000 then the scheme of section 44AD cannot be adopted.

The manner of computation of taxable business income under the normal provisions of the Income-tax Act, i.e., in case of a person not adopting the presumptive taxation scheme of section 44AD

Generally, as per the Income-tax Act, the taxable business income of every person is computed as follows:

For the purpose of computing taxable business income in the above manner, the taxpayers have to maintain books of account of the business. Income will be computed on the basis of the information revealed in the books of account.

The manner of computation of taxable business income in case of a person adopting the presumptive taxation scheme of section 44ad.

In case of a person adopting the provisions of section 44AD, income is computed on presumptive basis at the rate of 8% of the turnover or gross receipts of the eligible business for the year.

In order to promote digital transactions and to encourage small unorganized business to accept digital payments, section 44AD is amended with effect from the assessment year 2017-18 to provide that income shall be computed at the rate of 6% instead of 8% if turnover/gross receipt is received by an account payee cheque or an account payee bank draft or use of electronic clearing the system through a bank account during the previous year or before the due date of filing of return under section 139(1).

Hence, in case of a person adopting the provisions of section 44AD, income will not be computed in the normal manner as discussed earlier (i.e., Turnover -(less) Expenses) but will be computed @ 6% or 8%, as the case may be, of the turnover or gross receipt.

However, a person may voluntarily disclose his business income at more than 8% or 6%, as the case may be, of turnover or gross receipt.

The presumptive income computed as per the prescribed rate is the final income and no further expenses will be allowed or disallowed.

after allowing deduction in respect of expenses which are deductible as per the Income-tax Act and after disallowing expenses which are not deductible as per the Income-tax Act.

In case of a person who is opting for the presumptive taxation scheme of section 44AD, the provisions of allowance/disallowances as provided for under the Income-tax Act will not apply and income computed at the presumptive rate of 6% or 8% will be the final taxable income of the business covered under the presumptive taxation scheme. In other words, the income computed as per the prescribed rate will be the final taxable income of the business covered under the presumptive taxation scheme and no further expenses will be allowed or disallowed.

While computing income as per the provisions of section 44AD, separate deduction on account of depreciation is not available. However, the written down value of any asset used in such business shall be calculated as if depreciation as per section 32 is claimed and has been actually allowed.

No need to maintain books of account as prescribed under section 44AA

Section 44AA deals with provisions relating to maintenance of books of account by a person engaged in business/profession. Thus, a person engaged in business/profession has to maintain books of account of his business/profession according to the provisions of section 44AA.

In case of a person engaged in a business and opting for the presumptive taxation scheme of section 44AD, the provisions of section 44AA relating to maintenance of books of account will not apply. In other words, if a person adopts the provisions of section 44AD and declares income @ 6% or 8% (as the case may be) of the turnover. Then he is not required to maintain the books of account as provided for under section 44AA in respect of business covered under the presumptive taxation scheme of section 44AD.

Payment of advance tax in respect of income from business covered under section 44AD

Any person opting for the presumptive taxation scheme under section 44AD is liable to pay the whole amount of advance tax. On or before the 15th March of the previous year. If he fails to pay the advance tax by 15th March of the previous year, he shall be liable to pay interest as per section 234C.

Note : Any amount paid by way of advance tax on or before the 31st day of March shall also be treated as advance tax paid during the financial year ending on that day.

Provisions to be applied if a person does not opt for the presumptive taxation scheme of section 44AD and declares income at a lower rate, i.e., at less than 8%

A person can declare income at the lower rate (i.e., at less than 6% or 8%). However, if he does so, and his income exceeds the maximum amount which is not chargeable to tax. Then he is required to maintain the books of account as per the provisions of section 44AA. Also, has to get his accounts audited as per section 44AB.

Consequences if a person opts out from the presumptive taxation scheme of section 44AD

If a person opts for the presumptive taxation scheme then he is also required to follow the same scheme for the next 5 years. If he failed to do so, then presumptive taxation scheme will not be available for him for the next 5 years. [For example, an assessee claims to be taxed on the presumptive basis under Section 44AD for AY 2017-18. For AY 2018-19 and 2019-20 and he offers income on basis of presumptive taxation scheme. However, for AY 2020-21, he did not opt for presumptive taxation Scheme. In this case, he will not be eligible to claim the benefit of presumptive taxation scheme for the next five AYs. (i.e. from AY 2021-22 to 2025-26.)]

Further, he is required to keep and maintain books of account. He is also liable for tax audit as per section 44AB from the AY in which he opts out from the presumptive taxation scheme. [If his total income exceeds maximum amount not chargeable to tax]

Faridabad , India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.

Presented by

Related Posts

Finance bill 2021- paradigm shift in the provisions relating to income tax search and seizure assessments and income tax settlement commission.

Feb 02, 2021

by CA Mohit Gupta

in Income Tax Consultancy

Join our free webinar on 5th June (5 PM- 6 PM) on Basic Concepts of Transfer Pricing with Case Studies by Ashutosh Mohan Rastogi

Jun 03, 2020

by ConsultEase Administrator

Join our free webinar on 29th & 30th May (11 AM- 1 PM) on Impact DTAA on International Taxation-I & II by CA Nitin Kanwar

May 28, 2020

Join our free webinar on 20th May (5 PM Onwards) on Taxation of Charitable Institutions by Madhav Bhatt

May 19, 2020

Join our free webinar on 8th May (5 PM onwards) on CIT(Appeals) Procedure under Income Tax including Drafting and Filing Area by CA Rohit Kapoor

May 05, 2020

Join our free webinar on 2nd April 2020 ( 5 PM- 6 PM) on Deciphering the Vivad Se Vishwas Scheme by CA Mehul Shah

Mar 31, 2020

विवाद से विश्वास अपील वाले करदाताओं के लिए

Mar 18, 2020

by CA Raghuveer Poonia

जरूरी काम, इनकम टैक्स के, जो 31 मार्च 2020 से पहले करने जरूरी हैं

Join our free webinar today(4 pm-5 pm) on handling of notices u/s 143(1)(a)/139(9) of income tax act, 1961 by ca suresh wadhwa.

Mar 11, 2020

Join our free webinar on Today (6 PM-7 PM) on Vivad Se Vishwas Scheme, 2020 by Deepak Bholusaria

Mar 05, 2020

New Income Tax Regime - Structural Shift in Taxation under Income Tax Act

Mar 03, 2020

by Parth Shah

in Income Tax Compliance

Get recordings of all our webinars: Join CEUU

Feb 24, 2020

in GST Compliances

विवाद से विश्वास: इनकम टैक्स में लिटिगेशन सेटल करने का सुनहरा अवसर

Feb 14, 2020

Guidelines for scrutiny of invalid returns: CBDT Circular

Nov 30, 2019

सीए पर तामील कराए गए नोटिस की वैधता

Nov 07, 2019

एलिफेंट बॉन्ड क्या है?

कमिश्नर अपील्स की एनहांसमेंट की पावर.

Oct 30, 2019

Nifty big shot over stimulus package by FM

Sep 20, 2019

Exception to monetary limits for filing appeals: Circular No. 23 of 2019 (CBDT)

Sep 07, 2019

CBDT guidelines for manual selection of returns for detailed scrutiny

Sep 06, 2019

FAQs on RBI notification on Foreign Liabilities & Assets Reporting

Jul 09, 2019

by Parv Bansal

मृत व्यक्ति को धारा 148 का नोटिस

Apr 08, 2019

धारा 148 के नोटिस

Apr 05, 2019

पुरानी सालों की इनकम टैक्स की डिमांड

Mar 05, 2019

धारा 133(6) के नोटिस का जवाब देने की डेडलाइन

एडवांस टैक्स, tax slabs and deductions.

Feb 25, 2019

by Jyoti Jain

6th Residential Conference by FTAP

Jan 25, 2019

in Companies Act Consultancy

धारा 54EC के अनुसार

कृषि भूमि के बेचान पर टैक्स, धारा 54 की छूट.

Jan 22, 2019

लॉन्ग टर्म कैपिटल गेन में से छूट व कर की गणना

Jan 21, 2019

लॉन्ग टर्म व शॉर्ट टर्म कैपिटल एसेट

Jan 19, 2019

कैपिटल एसेट क्या है

Jan 17, 2019

in GST Consultancy

लॉन्ग टर्म कैपिटल गेन की गणना

Jan 15, 2019

No sec. 263 revision for further disallowance

Oct 15, 2018

Suggested GST Resources

Inspiring consultants.

Latest Resources

Analysis of 16 cbic circulars providing the biggest relief to the taxpayer.

Jun 27, 2024

by CA Shafaly Girdharwal

in Uncategorized

Discussing Some of the Recent High-Stakes Legal Settlements and Their Effects

Jun 21, 2024

in Business

Harnessing the Power of Marketing Agencies to Grow Your Business

Jun 12, 2024

in Marketing

Beyond Numbers: The Psychology Behind Stress-Free Income Tax Filing

Jun 05, 2024

in Income Tax

The Importance of Protecting Your Brand on Amazon

May 16, 2024

Stay informed...

Recieve the most important tips and updates

Absolutely Free! Unsubscribe anytime.

We adhere 100% to the no-spam policy.

whether the manufacturer opted composition scheme liable to pay GST on nil rated supply?

Get updates in your mailbox

Need a consultation? Start your search...

Are you a consultant join the evergrowing family of consultants.

Comprehensive

Season #2 / 24 hours, by shaifaly girdharwal.

Get your GST Queries answered by Shaifaly Girdharwal via one on one phone or email consulting.

Starting 3,000

Section 44AD: Presumptive Taxation for Business

Sakshi Shah

To provide relief to small taxpayers from the tedious task of maintaining books of accounts and getting books of accounts audited, the CBDT introduced the Presumptive Taxation Scheme. Section 44AD of the Income Tax Act provides the provision of the presumptive taxation scheme for businesses. A business with a turnover of up to INR 3 Crore can take the benefit of presumptive taxation under Section 44AD.

Section 44AD: Eligibility

Calculation of presumptive income under section 44ad, income tax on presumptive income under section 44ad, tax audit and books of accounts for presumptive income under section 44ad, section 44ad of income tax: 5 year rule.

The following taxpayers engaged in any business can opt for the Presumptive Taxation Scheme under Section 44AD.

- Resident Individual

- Resident HUF

- A resident partnership firm (not LLP)

The following taxpayers cannot opt for the Presumptive Taxation Scheme under Section 44AD:

- Non-Resident Taxpayer

- LLP i.e. Limited Liability Partnership

- A taxpayer other than an individual, HUF, partnership firm

- Taxpayer claiming deductions under Section 10A/ 10AA/ 10B/ 10BA or Section 80H to 80RRB

- Business of plying, hiring or leasing of goods carriages under Section 44AE

- A taxpayer with agency business

- Taxpayer earning brokerage or commission income. Eg: Insurance Agent

To opt for Presumptive Taxation Scheme under Section 44AD, the following two conditions should be satisfied:

- The gross sales or turnover of the business should be less than or equal to INR 3 Crore.

- The taxpayer should report 6%/8% or more of the gross sales or turnover as income in the ITR.

Note: The prescribed rate of 8% is for non-digital transactions in the business and the rate of 6% is for digital transactions in the business.

File Your Tax Return

On Time , Online on Quicko.com

Open Your Account Today

Akshay runs a trading business. The gross sales for FY 2023-24 are INR 1.8 Crore. Sales include cash payments of INR 80 lacs and non-cash payments of INR 1 Crore. Total Purchases are INR 50 lacs. The total expenses are INR 20 lacs which includes a salary, rent, electricity, maintenance, travelling, etc. Can he opt for the Presumptive Taxation Scheme under Section 44AD?

Since the gross sales are less than INR 3 Crore, Akshay can opt for Presumptive Taxation Scheme under Section 44AD.

- Pay tax on INR 12,40,000 lacs as per the slab rate.

- Do not maintain books of accounts as per Sec 44AA.

- Do not go for Tax Audit since the income reported is at least 6% of gross receipts for digital transactions and at least 8% of gross receipts for non-digital transactions.

- Income Head and Tax Rate – Income under the presumptive taxation scheme is a business income classified under the head PGBP . Such income is taxable at slab rates as per the Income Tax Act.

- Claiming Expenses – Since the taxpayer reports a fixed percentage of gross receipts as income, they cannot claim expenses. However, they can claim deductions under Chapter VI-A . Partner’s remuneration and interest on capital can be claimed as an expense in case of a partnership firm opting for presumptive taxation.

- Payment of Advance Tax – Taxpayers opting for a presumptive taxation scheme under Sec 44AD should pay the entire amount of advance tax on or before 15th March of the financial year. If the advance tax payment is not done before the due date, interest under Section 234C is levied. The interest would be levied only if the tax liability exceeds INR 10,000.

- ITR Form – Taxpayers opting for presumptive taxation under Section 44AD should report such income as PGBP Income and file Form ITR 4 on the Income Tax Website . They must mention the specified Business and Profession Codes based on the nature of the profession. If the taxpayer has income from capital gains along with presumptive income, they should file Form ITR 3 .

- Books of Accounts under Sec 44AA – If a taxpayer opts for a presumptive taxation scheme u/s 44AD and reports income at 6%/8% or more of the gross receipts, They is not required to maintain books of accounts as per Sec 44AA .

- Applicability of Tax Audit – If a taxpayer declares income less than 6%/8% of gross receipts and the total income exceeds INR 2,50,000 (basic exemption limit), they should maintain books of accounts and get the books of accounts audited under Section 44AB(e)

As per this rule, if a taxpayer opts for the presumptive taxation scheme in a financial year, they should opt for it for the next 5 financial years continuously. However, if the taxpayer fails to do so, they would not be able to take the benefit of presumptive taxation scheme for the next 5 financial years. For eg: A professional opts for Sec 44AD for AY 2018-19 and AY 2019-20. However, for AY 2020-21, he does not opt for the presumptive taxation scheme. In this case, he will not be eligible to claim the benefit of the presumptive taxation scheme for the next five AYs, i.e. from AY 2021-22 to AY 2025-26.

Yes. If the total tax liability for a financial year exceeds INR 10,000, you must pay advance tax. If you have opted for presumptive taxation scheme u/s 44AD or 44ADA, you are required to pay advance tax on or before 15th March instead of 4 instalments in other cases. However, if you fail to pay advance tax by 15th March of the financial year, interest is Sec 234B and Sec 234C is required to be paid.

A person engaged in a business having gross sales or turnover up to INR 2 Cr has the option to opt for the Presumptive Taxation Scheme under Sec 44AD. They can report 6%/8% or more of gross receipts as income and pay tax on it. If they opt for Presumptive Taxation, they are not required to maintain books of accounts as per Section 44AA. They are also not liable for Tax Audit as per Section 44AB.

Got Questions? Ask Away!

I am a practicing doctor, majority of my receipts are in cash but my gross receipts are less than Rs. 50 lakhs. Can I opt this presumptive taxation scheme?

Hi @Swapnil_Agarwal ,

The condition of cash receipts not exceeding 5% of the gross receipts is applicable only on the enhanced limits of ₹75 Lakhs, so you can opt for presumptive taxation scheme even if your cash receipts exceeds 5% of the gross receipts with total receipts not exceeding ₹50 lakhs.

Hope this helps!!

Hello Niyati, I am working as freelancer for a foreign client. My income would be 60L approximately. Since the income exceeds the limit of 50L but less than 75L can I still opt for sec 44ADA? I have no other source of income.

Hi @Ishwar ,

Yes, you can opt for Sec 44ADA as your income is less than ₹75 Lakhs. The enhanced limits are applicable for the FY 2023-24. Also you will have to check that your cash receipts don’t exceed 5% of the gross income from Freelancing.

Thanks for your reply. I don’t earn any money in form of cash.

Since you won’t be earning any money in form of cash you can opt for Sec 44ADA

Hi @CA_Niyati_Mistry . Thank you so much for your time.

I successfully filed my taxes under 44ADA for AY 22-23. I want to file my tax for AY23-24 now. I have two major questions.

- For AY23-25, do I have to pay advance tax (100% of my total tax) by 15th March 2023 or 2024 ? Which year?

- If I have to pay it by 15th March 2023, I should go to the income tax website and pay advance tax for AY23-24. But I distinctly remember that for AY22-23, I could file my tax from the normal File Income Tax section where I could select section ADA and fill my information and the website would calculate my tax for me. But when opting for advance tax this year I do not see any such options.

Cleartax has this to say.

Further, anyone opting for this scheme is not bound by the mandate of maintaining books of accounts too. While he is also liable to file his return by 31 July of the assessment year, he must file his return in ITR 4.

They say I have to file it by 31st July 2024. What am I missing? Again thank you for your time!

@CA_Niyati_Mistry I have a thread about this topic here now.

On further research I realised I misunderstood quite a few things.

Please correct me if I’m wrong!

Income tax filing and Advance payment are completely different things. You pay advance tax before 15th March of the financial year and then file your income tax returns in the Assessment year.

Okay it makes sense now. I will make the following assumptions for my timeline. Please let me know if I am correct.

For my FY22-23 income, I should go to the income tax website and pay my estimated advanced tax for the income I earned between 1st April 2022 and 31st March 2023 under AY23-24 . Because I’m eligible for 44ADA, I have the benefit of paying it all in one go before March 15th 2023 instead of paying it in instalments.

Then before 31st July 2023 , I will have to file my income tax return. Neutral case - I won’t have to pay anything when filing my ITR because my estimated advanced tax payment was correct. Worst case - I have to file any difference and pay some more. Best case, my advance tax payment was more and I get a refund.

Are the dates mentioned correct? Are my assumptions right? Thanks again for your time.

Hi @Vivek_Negi ,

Yes, the dates mentioned and the assumptions are correct. Income Tax Return filing and Advance Tax payment are two different concepts. While you file ITR after the PY 2022-23 ends till 31st July, Advance tax is the tax liability that you pay before the year ends. In case of 44ADA only one installment of Advance tax is applicable i.e 15th March where you pay the entire estimated tax liability in one go.

At the time of return filing the income will be calculated again and thus tax liability might differ from what you had determined earlier at the time of Advance tax payment. In case you have paid excess Advance Tax you will receive refund and in case of deficiency you will have to pay tax along with interest.

Hope this clarifies!

so . whether i opt for presumptive or non-presumptive ; advance tax has to be paid as pet the % slabs and as per the dates ! am i right ?

Continue the conversation on TaxQ&A

111 more replies

Participants

Last Updated on 7 months by Shreya Sharma

- Submit Post

- Union Budget 2024

Provisions of Section 44AD – As Amended by Finance Act 2012

CA Sanjay Patel

i. Section 44AD is a part of the Presumptive Scheme of Taxation which reads as “Special Provisions for computing profits and gains of business on presumptive basis” .

ii. Such presumptive taxation u/s 44AD and 44AE was introduced by Finance Act 1994 w.e.f. A.Y. 1994-95.

Under that regime, section 44AD was applicable to assessees engaged in the business of civil construction or supply of labour for civil construction.

Whereas Section 44AE is applicable to assessee’s engaged in the business of plying, hiring or leasing of goods carriages where the assessee does not own more than 10 goods carriages at any time during the previous year.

iii. Yet another section 44AF was introduced by Finance Act 1997 w.e.f. A.Y. 1998-99 which was applicable to assessee’s engaged in retail trade of goods and merchandise.

Now, by virtue of Finance Act (No. 2) of 2009, and w.e.f. A.Y. 2011-12, both Section 44AD and Section 44AF have been substituted by New Section 44AD, which is considered as a paradigm shift in the entire scheme of presumptive taxation , and I would be discussing the same at length.

Further, the monetary limits have been amended by Finance Act 2010 and 2012. Also, a subsection no. 6 has been inserted by Finance Act 2012, w.r.e.f. A.Y. 2011-12 to exclude specified categories of assessees.

I have taken the Issues for Consideration in the paper book based on various subsections of section 44AD as well as Miscellaneous Issues for consideration.

Well a bare look at section 44AD of the Act, gives an impression that it is a step of Finance Ministry towards simplification of Tax Structure and Compliance applicable to Small Businessmen. Also the Section appears to be lucid in interpretation and application, but believe me it is not so as it appears to be.

With this background and without much ado, I start with the various provision of Section 44AD of the Act.

Notwithstanding anything to the contrary contained in sections 28 to 43C , in the case of an eligible assessee engaged in an eligible business , a sum equal to eight per cent of the total turnover or gross receipts of the assessee in the previous year on account of such business or , as the case may be, a sum higher than the aforesaid sum claimed to have been earned by the eligible assessee , shall be deemed to be the profits and gains of such business chargeable to tax under the head “Profits and gains of business or profession”.

Ø On perusing the provisions of section 44AD one thing is crystal clear that the moment an eligible assessee is engaged in eligible business, Section 44AD is automatically applicable to such business, unless the case is covered by section 44AD(5). So only under a situation where the actual income is less than 8% of Gross Receipts or Turnover, the assessee can escape applicability of section 44AD of the Act, by maintaining Books of Accounts as per section 44AA clause (iv) and getting the same audited as per section 44AB clause (d).

In all other cases, the assessee is governed by the provisions of section 44AD only, whether the assessee declares income at the 8% or higher income or lower income in cases covered by 44AD(5) where the Total Income does not exceed the maximum amount not chargeable to tax.

Ø Who is eligible assessee?

According to Explanation (a) to Section 44AD, Eligible Assessee means:

i. A Resident Individual,

A Resident HUF,

A Resident Partnership Firm

(But does not include a Limited Liability Partnership as defined u/s 2(1)(n) of the LLP Act, 2008.)

AND

ii. Who, out of the above categories of assessees, has not claimed Deduction during the relevant year;

u/s 10A, 10AA, 10B and 10BA

Deduction under any provision of Chapter VI-A under the Heading “Deduction in respect of certain incomes”.

Ø Thus, it is clear that the definition is exhaustive and it includes only what it expressly means. Hence, all other persons such as –

– Non Resident; Individual, HUF and Partnership Firm

– Company

– Limited Liability Partnership

– AOP / BOI

– Artificial Juridical Person

Are impliedly not covered by the provisions of this section.

Ø What is eligible business?

According to Explanation (b) to Section 44AD, Eligible Business means:

(i) any business except the business of plying, hiring or leasing goods carriages referred to in section 44AE;

(ii) whose total turnover or gross receipts in the previous year does not exceed an amount of Rs. 1 Crore. (Rs. 60 Lakhs for A.Y. 2012-13)

◊ Here as regards the business of plying, hiring or leasing of goods carriages is concerned, it is important to note that:

i. If more than 10 goods carriages are owned by assessee, then he will be outside the purview of Section 44AE and hence he will get covered under 44AD if the Turnover from such business does not exceed Rs. 1 Crore.

ii. If assessee is carrying out business of plying, hiring or leasing goods carriages which have not been owned by the assessee but have been hired by it, and the turnover therefrom does not exceed Rs. 1 Crore, then also 44AD shall apply instead of section 44AE.

◊ Also, the definition of Business has been enlarged to cover each and every business, except as discussed, be it manufacturing, trading, construction, speculative, job work and so on and so forth.

◊ Here the only thing that has to be borne in mind is the distinction between business and profession, because Section 44AD is applicable to Business and not Profession and Business is different from Profession.

Some activities have been held to be business:-

(i) Advertising agent

(ii) Clearing, forwarding and shipping agents – CIT v/s. Jeevanlal Lallubhai & Co. [1994] 206 ITR 548 (Bom).

(iii) Couriers

(iv) Insurance agent

(v) Nursing home

(vi) Stock and share broking and dealing in shares and securities – CIT v/s. Lallubhai Nagardas & Sons [1993] 204 ITR 93 (Bom).

(vii) Travel agent.

Ø What is Total Turnover or Gross Receipts?

Total Turnover means the amount received/receivable from clients in respect of business transaction of the assessee for the relevant Previous Year.

Gross Receipts are the amount received from clients for the services provided or to be provided and does not include the value of material supplied by the client.

The Turnover or Gross Receipts should be inclusive of –

– Sales Tax, Excise duty, Service Tax and other such Levies and Duties,

– Sales of unusable empties and Packages,

– Service Charges charged for delivery, etc.

◊ Now the next question arises as to the calculation of Total Turnover or Gross Receipts.

In this regard the applicability of Section 145 of the Act cannot be ruled out. Section 145 prescribes the Method of Accounting applicable to assessees for computing income from Business or Profession. Section 44AD does not override this section. Hence, as per this section the assessees have an option to choose either Mercantile or cash method and determine the Total Turnover or Gross Receipts Accordingly.

(If the method adopted is Mercantile, the Turnover can be calculated on the basis of Sales Bills / Purchase Bills and other ancillary records like Debit Note/ Credit Note, etc.

Whereas, if cash system is followed, the Receipts as per Bank Statement and Cash Records could be Grossed up, if there is any deduction like TDS, etc., to determine Turnover or Gross Receipts.)

Ø Consider the following: –

– Net Profit as per Books of Accounts – Rs. 10 Lakhs

– Income @ 8% of Turnover – Rs. 8 Lakhs. (i.e. Turnover is Rs. 1 Crore.)

– Income as per Normal Provisions of Act – Rs. 7.5 Lakhs.

For the purpose of comparison of Actual Income with income @ 8% of Turnover, which amount should be considered, Net Profit as per Books or Income from Business and Profession as per Normal Provisions of Act?

◊ In this situation, it has to be borne in mind that the provisions section 44AD override sections 28 to 43 C of the IT Act.

Hence, the question of computation of income as per normal provisions does not arise.

Thus, income as per the records maintained by the assessee needs to be compared with presumptive income at the rate of 8% to find out whether the same is higher or lower than 8% of Turnover. If it is lower 44AD (5) comes into picture and if the same is higher, the assessee is at the option to disclose the same in the return of income.

Ø Consider and comment on the following: –

– The assessee filed return of income u/s 44AD of the Income Tax Act, and the assessing officer wants to disallow the following:-

i. Rs. 1 Lakh u/s 40(a)(ia) ii. Rs. 1 Lakh u/s 43B iii. Rs. 1 Lakh u/s 40A(2)

◊ As per section 44AD (1), this section overrides section 28 to 43C of the Act, and hence all those section could not be applied once the assessee is assessable u/s 44AD of the Act.

In this regard reliance can be placed on the decision of Ahmedabad Tribunal in case of Gopal Raj Purohit 94 TTJ 865.

(Here, though no disallowance is called for u/s 40(a)(ia), but if the assessee (assuming an Individual or HUF) is covered by clause (a) or (b) of section 44AB in the immediately preceding year, then he will be deemed to be an “ assessee in default” u/s 201 of the Act, unless he satisfies the conditions stipulated therein for not being treated so.

Further, if the assessee satisfies the conditions for not being treated as “ assessee in default” , he cannot escape the liability of Interest u/s 201(1A). However, as he is not an “ assessee in default” the Penalty u/s 271C can be avoided.)

Ø Can assessee file Return u/s 44AD declaring Income @ 8% of Turnover (assuming Turnover is not exceeding Rs. 1 Crore) even though he has earned more than 8%?

Can the Assessing Officer add the Difference between actual income and disclosed income in the assessment proceedings?

{Let us assume that the Turnover of the assessee is Rs. 50 Lakhs and all the receipts are by cheque and the same is deposited in the only Bank account maintained by the assessee. There are no outstanding receipts at year end.

All the payments for expenses on revenue account are through cheques debited to the same account and there are no outstanding expenses at year end. The total expenses are Rs. 25 Lakhs.

Thus the balance of Rs. 25 Lakhs as per his bank account is the income as per the records of assessee.

He filed Return u/s 44AD declaring of Rs. 4 Lakhs @ 8% of Turnover.

Can the AO add the difference of Rs. 21 Lakhs to the income of assessee?}

◊ First of all the assessee, being covered by section 44AD, is under no obligation to maintain books of accounts u/s 44AA.

Secondly, the turnover being less than Rs. 1 Crore and declared income not being less than 8% of Turnover, Section 44AB is not applicable to the assessee.

◊ Further the assessee is given the option u/s 44AD (1) to declare higher income. The word used is 8% OR higher income.

Thus, the option is with the assessee to disclose higher income OR to file Return disclosing the income @ of 8% of Turnover.

Here the assessee is free to exercise any option at his will. He may morally show actual income and pay tax on it as an Honest citizen of the country, but such Honesty is not digressed even if he files return @ 8% as he is legally correct. (Here the decision of Honourable Supreme Court in case of Dr. Qureshi can be recalled where the apex court, condemning the High Court, held that “cases have to be decided on merits and legality instead of morality”.)

Legally he is given the option by the statute and such an option cannot be equated with obligation cast upon the assessee. There is a definite difference between OPTION and OBLIGATION and an Option granted to the assessee cannot be construed to be his obligation when his actual income is more than 8% of Turnover.

◊ Also, the AO cannot make any addition on this count as there is no provision under the Act permitting to make such addition.

◊ Further, the words used are “higher income claimed to have been earned by the assessee”.

Here if the assessee has not made a claim in the Return of Income regarding any higher income, it implies there is no claim for Higher Income made by assessee. AO cannot claim that the assessee has earned higher income, because under the statue, he is not entitled to do so.

Any deduction allowable under the provisions of sections 30 to 38 shall , for the purposes of sub-section (1), be deemed to have been already given full effect to and no further deduction under those sections shall be allowed :

Provided that where the eligible assessee is a firm, the salary and interest paid to its partners shall be deducted from the income computed under sub-section (1) subject to the conditions and limits specified in clause (b) of section 40.

◊ It implies the following: –

i. No deduction 35AD for any capital expenditure incurred by the assessee for specified business,

ii No carry-forward of depreciation u/s 32 or business loss, (except in cases covered by 44AD(5))

iii. No weighted deduction for contribution to research institutes, etc.

(Here, one thing that requires consideration is deduction of capital expenditure is available to assessees in case of specified business u/s 35AD. It is a newly inserted section by Finance Act (no. 2) of 2009 w.e.f. A.Y. 2010-11. Remember this was the same Finance Act which introduced New Section 44AD.

In my humble view, the provisions of section 44AD needs to be amended to exclude such businesses covered by section 35AD from its scope otherwise it implies that assessees covered by section 44AD cannot take benefit of section 35AD which promotes investments.

Such a situation will lead to unfair practices and will motivate assessees to bring down the profitability of business by manipulating books of account and to go for audit and get the benefit of such sections. { One can show less income as per books and get the same audited and compute income as per normal provisions of Act, because u/s 44AD income can be 8% of Turnover or higher, but it cannot be lower.)

(In my personal view, a consequential amendment should follow soon.)

Ø In case of partnership firms where 44AD is applicable, how to compute Salary and Interest payable to partners u/s 40b?

As per the provisions of section 44AD(2), the deduction u/s 40b in respect of remuneration and interest to partners is allowable.

The interest to partners can be credited by preparing a Memorandum Capital Account of Partners where no books are maintained. Whereas where books are maintained the same can be credited as per the balance in capital account as per the books so maintained.

As regard remuneration, the deemed income @ 8% of Turnover or higher income, as reduced by Interest paid to partners shall be deemed to be the BOOK PROFIT for the purpose of 40b and Salary can be calculated accordingly. (Because such income @ 8% or higher income, is nothing but deemed income form business as per this section and the same is before allowances under section 40b.)

– Turnover of assessee – Rs. 50 Lakhs

– Income @ 8% – Rs. 4 Lakhs & Actual Income as per records of assessee is Rs. 4.5 Lakhs (after deducting current depreciation as per books of Rs. 5 Lakhs). Assessee declares Income of Rs. 4.5 Lakhs as per books as income u/s 44AD of the Act.

– Unabsorbed Depreciation brought forward – Rs. 10 Lakhs

– Unabsorbed Business Loss brought forward – Rs. 10 Lakhs.

Comment on the set off of brought forward loss and depreciation and it carry forward to subsequent years.

◊ First of all it is worth considering that set off of brought forward unabsorbed business loss is governed by section 72 of the Act.

Whereas set off of brought forward depreciation is governed by section 32 (2) of the Act and as per section 32 (2) of the act, brought forward depreciation gets merged with and forms part of current depreciation.

◊ As regards the set of brought forward business loss is concerned the same is available to the assessee as a reduction in Income in Order to arrive at the Gross Total Income of the assessee. (Reliance can be placed on Universal Cargo v/s CIT (Cal.) 165 ITR 209.)

◊ Whereas, unabsorbed depreciation is not akin to business loss. Hence set off of the same is not permissible. (Reliance can be placed on Universal Cargo v/s CIT (Cal.) 165 ITR 209.)

Here, in the given example) total depreciation as per section 32 including brought forward depreciation as per section 32(2) comes to Rs. 15 Lakhs.

However, as per section 44AD(2), all deductions u/s 30 to 38 shall be deemed to have been given full effect to and no further deduction under those section shall be allowed.

So technically and legally speaking, the assessee cannot take set off of unabsorbed depreciation against income as per section 44AD of the Act.

(Here no set off or deduction for depreciation in the current year is not an issue that requires due consideration.

What is annoying indeed is the words “ full effect” and “ no further deduction under those sections shall be allowed” .

Does this mean that, the unabsorbed Depreciation of Rs. 10 Lakhs is reduced to “ NIL” in the current year under consideration and hence the same cannot even be carried forward?

The answer is YES, because legally the language of section is very clear and unambiguous. But logically, this sounds unjust. But, it has been rightly said that what may be Logical may not necessary be Legal always and vice versa.

Look at the anomalous nature of the provision. On one hand assessee is paying tax on deemed income u/s 44AD, whereas on the other hand, the assessee is losing the benefit of brought forward depreciation of earlier years. This leads to double jeopardy. The provision seems to be arbitrary to this extent.

(This is the area which will give rise to maximum litigation. )

The written down value of any asset of an eligible business shall be deemed to have been calculated as if the eligible assessee had claimed and had been actually allowed the deduction in respect of the depreciation for each of the relevant assessment years.

◊ Here, it is significant to note that WDV has to be calculated as per section 32 of the Act for the purpose of arriving at closing WDV at year end and for the purpose of applicability of section 50 of the Act relating to Short Term Capital Gain / Loss in case of Depreciable assets.

FOR EXAMPLE: –

Mr. A, a Resident individual having a machinery of RS.1,00,000/- as on 31-03-2011 eligible for depreciation under section 32 @ 15%. In A.Y 2011-12, he is covered by Section 44AD. In the Assessment Year 2012-13, his turnover is Rs. 1.5 Crores, so he calculated his profit as per normal provisions of the Act. In A.Y 2013-14, he is again covered by Section 44AD, In this Assessment year he sold the Assets for Rs.80,000/-. What are the implications of the asset so sold under the Income Tax Act?

Calculation of WDV:

Calculation of Capital Gains

The provisions of Chapter XVII-C shall not apply to an eligible assessee in so far as they relate to the eligible business .

◊ Chapter XVII-C deals with provisions relating to Advance Payment of Tax.

On plain reading of this subsection, we conclude that eligible assessees are exempt from payment of Advance Tax.

But the second part of Provision “in so far as they relate to eligible business” has created a blunder so far as practical computation of advance tax in concerned and has taken away the sheen out of the first part.

Ø Consider and comment on the following: –

Income under section 44AD Rs 4 lakhs

(Say Turnover is RS.50 lakhs)

Interest Income Rs.5 Lakhs

Total Income Rs.9 lakhs

◊ Now the question is How to calculate Advance tax when the assessee has income u/s 44AD as well as some other income?

From the understanding of Law, it is clear that the assessee has to pay advance tax on interest income of Rs.5 Lakhs. But how this tax calculation is to be made is nowhere provided in the statute?

(However one may consider the following option: –