Trending Search is available and can be access through arrow keys

- Bank Your Way

New to Scotia OnLine? Activate Now

- Advice+ features

How to open a chequing account online in Canada as a non-resident

New to Canada

Figuring out how to open a chequing account in Canada as a non-resident isn't as complicated as you might think.

Whether you plan to move to Canada temporarily for school or permanently for a new job or other opportunities, getting your finances in order before you move will save you a lot of trouble. One of the top smart money moves you can make is to open a Canadian bank account. While this is not required by most schools or places of employment, it will make it much easier to receive your paycheque and pay taxes, as well as build up your credit history and use your debit card locally.

Figuring out how to open a chequing account in Canada as a non-resident isn't as complicated as you might think. As long as you have the proper documentation, you should be able to open up an account today.

1. Check your options for opening an account in Canada

There are a few different routes you can take to open a chequing account online or in-person. The method you choose might depend on how much paperwork you have available. For example, if you are still waiting for your employment ID card, setting up your Canadian bank account through a correspondent bank could be faster.

Here are the different options to consider:

- Use a correspondent bank: Correspondent banks are authorized to provide financial services on behalf of another bank. A correspondent bank will process payments and complete wire transfers to your existing bank from your origin country. This option is best for individuals who are staying in Canada temporarily or university students who just need funds wired occasionally.

- Open an international account: Some banks operate all over the world. Other banks have regional branches in Canada, making it easier to conduct your banking business in your home country and Canada. It will be easier to set up your bank account before you move. An international bank account can make it easier to obtain a Canadian bank account.

- Talk to a Canadian bank: The top Canadian banks have different services and help available for non-residents. Talk with your desired bank to find out what their process is for non-residential accounts. Scotiabank’s newcomer program can help you get your bank account started before your move date.

- Open an account when you are present in Canada: While each bank will have its own requirements, typically you will need to present your passport, immigration papers, and temporary resident, work, or student permit. While it is possible to obtain a bank account this way, it is best to try to set up an online bank account before you move.

New to Canada? We’re here to help you to be financially ready for the future.

2. consider how you will use this account .

Canada is home to many banking options. While asking, “What do I need to open a chequing account in Canada?" also consider what you need this account for. Knowing how you will use your account will help you chose the right one for you. Other factors to consider:

- Location: Is the bank easy to access on your daily journey to work, school, or errands? If you have to drive 30 minutes to the closest branch, it is going to be a pain to manage your money and any issues you might run into with paycheques or bills. If you want an open chequing account online that is easy to use virtually anywhere, make sure to test out the bank's online and mobile options.

- Accessibility: Think about what you need your bank account for and how you want to use it. If you want a combined chequing and savings account , look for banks that specialize in those accounts. If you just want a bank account that can hold your paycheque and give you a debit card so you can shop locally with ease, look for a bank that offers low account fees.

- Fees: Canadian bank accounts typically have fees for holding an account and for different tasks performed, such as money transactions. You want to choose the bank and account that will give you the most mileage for your money. Don't opt for a low-fee chequing account that limits your debit transactions if you do more than 20 per month. Similarly, look for accounts that line up with how you save and spend.

3. Learn about different bank account types

Whether this is a permanent relocation or a temporary stay for a few years, you will probably want your money to do more than just sit in an account. Different types of banking accounts will help you with your financial goals. Here is a brief overview of the different chequing accounts and savings accounts you can access in Canada.

Types of Chequing Accounts

- Standard chequing: This type of chequing is the most common and allows you to spend your money through a debit card, paper cheques, and online bill pay.

- Interest-earning chequing: Select chequing accounts will earn a small amount of interest on account balances. Expect to need a Canadian Social Insurance Number (SIN) for tax purposes on interest earned.

- Student/teen account: Using a student chequing account while you are enrolled in university is ideal and available for non-residents. This chequing account typically offers little to no monthly account fees and reduced overdraft and transaction fees.

- Senior package: Senior chequing accounts can also have lower fees but also limited free transactions.

Types of Savings Accounts

- High interest-earning savings account: You will need to provide a SIN for tax purposes on interest earned.

- Tax-free savings accounts (TFSA): Non-residents who have a SIN through employment are eligible to open a TFSA. However, non-residents will be subject to a 1% tax for each month the contribution stays in the account. This account is not taxed in Canada if you withdraw from it, though your home country might have other tax laws in place if you plan to withdraw and use the money later. Also, your savings will not grow if you leave Canada. 1

- Foreign currency savings accounts: This allows you to easily do transactions in U.S. dollars or Euros without large exchange rate fees.

Different accounts will come with its own unique fees. Some accounts waive certain fees while other accounts are better suited for one type of consumer. It is important to know these fees upfront so that your bank account doesn't cost you more than you expect. Some common banking account fees include the following:

- Monthly chequing account fees: These may be waived on some accounts if your account minimum stays above $3,000 to $4,500 CAD.

- ATM fees: Pulling out money from your bank's ABMs will not result in a fee, but accessing your account through a different ABM often will.

- Interac e-Transfer fees: Many accounts allow a few free Interac e-Transfer ƚ transactions per month and then charge a minimal fee for transfer requests over the limit.

- Foreign transaction fees: If you use your debit card outside of Canada, you may incur a foreign transaction fee in addition to the foreign currency exchange rate.

- Cheque book fees: A flat cost to order cheques.

- Debit transaction fees: If your account comes with a monthly debit transaction limit, then you will pay a minimal fee for all transactions over the limit.

- Non-Sufficient Funds (NSF) fees and overdraft fees: If your account total cannot cover debit transactions or scheduled payments, you will receive a fee for every transaction that is covered.

Look for special banking offers for non-residents to avoid fees for the first year in the country. Scotiabank offers an account to newcomers that waives the chequing monthly account fee for one year as well as unlimited no-fee foreign money transfers. 2 Offers like these help you to establish your chequing account without being bombarded with fees.

4. Check the list of documents required

In order to open a bank account in Canada, you will be asked to provide proper identification. You don't need to wait until you are in the country to start either—you can open a chequing account online.

What do I need to open a chequing account in Canada?

- Gather the necessary documents. Each bank can vary on what documents they require, but typically you will need to provide a Canadian SIN (if you want to open an interest-bearing account), valid work, student or residential permit, your passport, and immigration papers. If you currently have a Canadian debit or credit card from a different bank, these are also useful to present when signing up for your new account.

- If you are under 18 years age, identify your custodian.

- Complete an application. Save yourself time by completing your banking application online. Have all of your important documents, employee ID and bank account numbers nearby to help you fill out your application.

- Fund your account. Even if you are opening up your chequing account to receive paycheques from your new job seamlessly, it is a good idea to put down a deposit. This can help with your account approval. If you set up your chequing account online, you will be able to wire transfer the money from your non-Canadian bank.

New to Canada? Speak to a Scotia advisor to get your finances on track in your new country

† Interac and Interac Flash are trademarks of Interac Corp. Used under license.

1 https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/tax-free-savings-account/who-open-a-tfsa.html.

2 Foreign currency exchange rates apply. For Ultimate Package customers and customers onboarded as a part of the Scotiabank StartRight® Program, we do not charge a service fee for the transfer, however, foreign currency exchange rates apply. Subject to daily limits and additional terms and conditions as set out in the Scotiabank International Money Transfer Agreement found at www.scotiabank.com/international-money-transfer.

Legal Disclaimer: This article is provided for information purposes only. It is not to be relied upon as financial, tax or investment advice or guarantees about the future, nor should it be considered a recommendation to buy or sell. Information contained in this article, including information relating to interest rates, market conditions, tax rules, and other investment factors are subject to change without notice and The Bank of Nova Scotia is not responsible to update this information. All third party sources are believed to be accurate and reliable as of the date of publication and The Bank of Nova Scotia does not guarantee its accuracy or reliability. Readers should consult their own professional advisor for specific financial, investment and/or tax advice tailored to their needs to ensure that individual circumstances are considered properly and action is taken based on the latest available information.

Related articles

How to save and invest when you're new to canada.

We’ll walk you through everything you need to know about saving and investing in Canada.

Here’s everything you need to know about filing your Canadian taxes on time

How to file taxes as a Canadian immigrant, international student, and temporary foreign worker.

Everything you need to know about credit

Now that you’re in Canada, you may have started hearing a lot about credit.

START TODAY

How to Open a Bank Account for Foreigners in Canada

February 2, 2024

Sinethemba Phongolo

With its reputation for stability, diversity, and opportunity, Canada is an attractive destination for individuals seeking to establish financial roots in a new country. Newcomers to Canada might find it hard to understand how banks work here.

To ease your financial integration in Canada, we will explore the essential steps and considerations involved in opening a bank account as a foreigner in Canada, empowering you to navigate this important milestone confidently.

Discover the streamlined process and essential steps for foreigners to open a bank account in Canada successfully!

Things to Consider Before Opening a Bank Account as a Foreigner in Canada

Several essential factors must be considered before taking the plunge and opening a bank account in Canada as a foreigner. These factors include:

- Which purpose will you be using the account, e.g., saving or making payments,

- Number of charges or fees due on the account,

- Earnings potential from the interest accumulated from the money in your account, and

- Having a clear understanding of the terms and conditions of your account,

- Receipt of your account agreement, and

- If you have deposit insurance to protect your deposits.

The Right to Open a Bank Account in Canada

In Canada, the right to open a bank account is fundamental and protected by law via the Financial Consumer Agency of Canada , ensuring all residents' access to essential financial services, regardless of their citizenship or immigration status. Therefore, you can open a bank account ( deposit or personal account) or other savings accounts at a bank.

This includes federal credit unions, authorized foreign banks, provincially regulated financial institutions, or other federally regulated financial institutions offering bank account services. You can open a bank account even if you are unemployed or bankrupt and can’t immediately deposit cash into your account.

As part of your rights, after you have opened your account, your bank should provide you with information about your account, including:

- A Copy of the account agreement,

- A List of all charges due on the account,

- Interest rate information (if applicable),

- maximum cheque hold periods information,

- Policies for when maximum cheque hold periods don’t apply, and

- Electronic alert circumstances.

How To Open a Bank Account in Canada

Here are the streamlined, step-by-step processes to open an account in Canada as a foreigner at the bank and online.

At the Bank

To open an account at the bank, you must:

Step 1: Choose a Canadian Bank Account That Caters to Foreigners

The first step in opening a bank account at a physical branch in Canada is to research and select a bank that offers accounts specifically designed for foreigners. Major Canadian banks that offer bank account services to foreigners in Canada include:

- Royal Bank of Canada (RBC),

- Toronto-Dominion Bank (TD),

- Bank of Montreal (BMO),

- Canadian Imperial Bank of Commerce (CIBC), and

- Scotiabank .

These accounts often come with features such as multilingual customer support, waived fees for newcomers, and assistance with the documentation process.

Step 2: Visit Your Chosen Bank's Local Branch With the Required Identification Documents

Once you've chosen a bank, the next step is to visit a local branch in person. Be sure to bring the required identification documents, which typically include:

- Document indicating your name and address,

- Document indicating your date of birth,

- identification issued by the Canadian government or provincial or territorial government,

- Tax assessment notices issued by the provincial, territorial, or federal Canadian government,

- Benefits statements from the provincial, territorial, or federal Canadian government,

- Canadian public utility bill,

- Credit card statements, and

- Foreign passports.

It's essential to verify the specific requirements of your chosen bank to ensure you have all the necessary paperwork.

Step 3: Speak With a Bank Representative About Opening An Account as a Foreigner

Upon arriving at the bank branch, inform a bank representative that you are interested in opening an account as a foreigner. The representative will guide you through the process and assist you in choosing the right type of account based on your needs and eligibility.

They may also provide information about any special offers or promotions available to newcomers, such as waived monthly fees or bonus incentives for opening a new account.

Step 4: Complete and Submit The Required Application Forms And Documents

Once you've selected the type of account you wish to open, the bank representative will provide you with the necessary application forms to fill out. These forms will require you to provide personal information such as your name, address, contact details, and employment status.

Step 5: After Your Application is Approved, Deposit the Minimum Required Fee

After submitting your application forms and documents, the bank will review your information and assess your eligibility for opening an account. Once your application is approved, the bank will notify you, and you can deposit the minimum required fee to activate your account.

You can open a bank account online by following these steps::

Step 1: Choose an Online Bank or Financial Institution

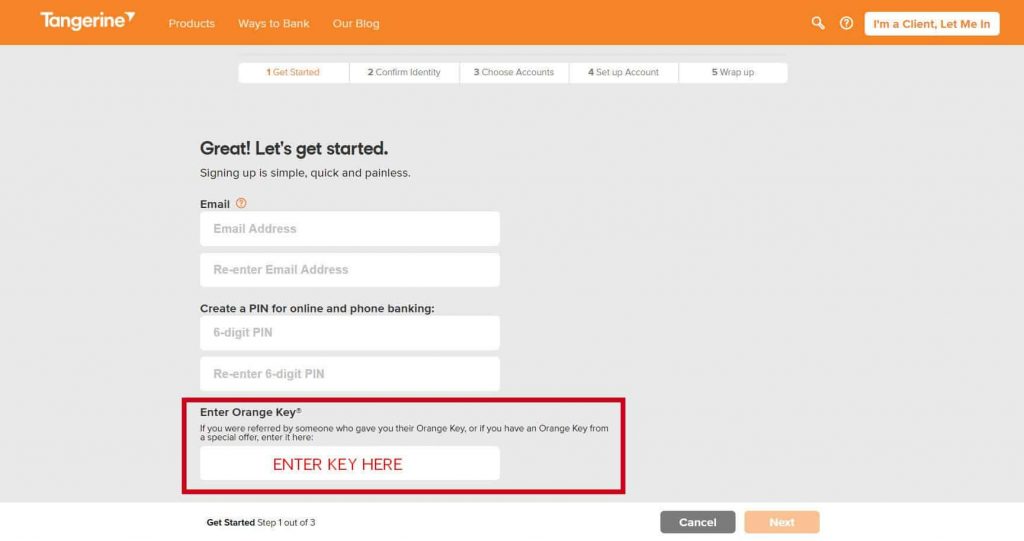

The first step in opening a bank account online in Canada is to choose an online bank or financial institution that meets your needs and preferences. Several reputable online banks in Canada, such as Tangerine , EQ Bank , and Simplii Financial , offer various banking services tailored to different customer needs.

Step 2: Visit Your Chosen Online Bank’s Website and go to Its Account-Opening Service

Once you've selected an online bank, visit its official website and navigate to the section dedicated to account opening or new customer enrollment. This section may be labeled "Open an Account," "Get Started," or something similar.

From there, you'll typically find information about the types of accounts available and instructions on how to proceed with the application process. Follow the prompts to begin the account-opening process.

Step 3: Complete the Online Application Form With The Necessary Information

The next step is to complete the online application form with the required information. This form will typically ask for personal details such as your:

- Passport,Contact information,

- Date of birth,

- Social insurance number (SIN) or individual tax identification number (ITIN).

You may also need to provide information about your employment status, income, and citizenship or residency status.

Step 4: Upload The Required Digital Documentation

In addition to completing the online application form, you must upload digital copies of the required documentation to verify your identity and address. This documentation may include a valid passport or government-issued identification, proof of address (such as a utility bill or rental agreement), and, in some cases, additional documents related to your immigration status or financial history.

Step 5: Wait For the Approval of Your Application

Once you've submitted your online application and uploaded the required documentation, all that's left to do is wait for the approval of your application. The processing time may vary depending on the bank and the application volume, but you can expect to receive a decision within a few business days.

Can a Bank Refuse to Open an Account For You?

A bank may refuse to open an account for you as a foreign due to the following circumstances:

- If they reasonably believe your account will be used for fraudulent or illegal purposes,

- Find out you have a history of fraudulent or illegal activity with financial service providers(in the last seven years),

- If you made false statements in the information you provided,

- If they think you may cause physical harm to, harass, or abuse its employees or customers,

- The bank only offers accounts linked to an existing account with another bank, which you don’t already have,

- You are not allowed to verify the identification information you presented is valid, and

- If you don’t agree to become a financial institution member, it is a federal credit union.

Benefits of Opening a Bank Account in Canada as a Foreigner

In today's interconnected world, the benefits of establishing a bank account in Canada as a foreigner extend far beyond mere convenience. Here are some of the more prominent benefits:

Can Conduct Seamless International Transactions

Opening a bank account in Canada empowers you to conduct international transactions effortlessly. Whether sending money to loved ones abroad, investing in global markets, or receiving payments from overseas clients, having a local Canadian bank account streamlines the process and minimizes associated fees.

Access to Canada’s Diverse Banking Services

Canadian banks offer a wide array of financial services tailored to meet the diverse needs of their clients. From basic savings and checking accounts to specialized products like investment accounts, mortgages, and credit cards, you can access comprehensive banking solutions to help you achieve your financial goals.

Learn more with Canada’s Job Bank .

Enhances Your Credibility and Trustworthiness in Canada

Having a local bank account in Canada enhances your credibility and trustworthiness, especially when conducting business or applying for rental accommodations. It demonstrates your commitment to integrating into the Canadian financial system, which can bolster your reputation and open doors to various opportunities.

Builds a Strong Credit History in Canada

Establishing a bank account in Canada lays the foundation for building a strong credit history, which is crucial for accessing credit cards, loans, and other financial products with favorable terms and conditions. A positive credit history facilitates your current financial endeavors and paves the way for future opportunities, such as purchasing a home or starting a business.

Seamless Integration into Canadian Society

Beyond finances, opening a bank account in Canada facilitates your integration into Canadian society. It provides you with a tangible connection to the local community. It fosters a sense of belonging, enabling you to participate more actively in daily life, from shopping and dining to philanthropic endeavors.

Find the 5 things you need to know about moving to Canada .

Opportunity for Long-Term Residency in Canada

A local bank account is often a prerequisite for those considering long-term residency or eventual citizenship in Canada. It demonstrates your commitment to establishing roots in the country and showcases your ability to adapt to its financial landscape, which can positively influence immigration and citizenship applications.

Learn about the 7 benefits of long-term residency in Canada .

What Should I Do if I Encounter Difficulties or Have Questions During The Account Opening Process?

If you encounter difficulties or have questions while opening a bank account in Canada, don't hesitate to contact the bank's customer service team for assistance. They can provide guidance and support to help you navigate the process smoothly.

Can I Transfer Money to My Canadian Bank Account From Abroad?

Yes, most Canadian banks offer international wire transfer services, allowing you to transfer funds from your foreign bank account to your Canadian bank account. However, be aware of any associated fees and currency exchange rates.

Do I Need a Social Insurance Number (SIN) or Individual Tax Identification Number (ITIN) to Open a Bank Account in Canada?

A SIN or ITIN can facilitate the account opening process, but it is not always required. Many banks offer options for foreigners to open accounts using alternative forms of identification.

- Live In Canada

- Work in Canada

- Immigration

- Small Business

- English Selected

Just arrived in Canada

Welcome to Canada! Read on below to learn how to start banking in Canada or browse our products and services for newcomers .

We speak your language

How to start banking with us, understanding your finances.

Life in Canada

As a newcomer, we understand you have a lot on your mind. Opening a bank account is an important first step when you arrive in Canada. With convenient hours, accessible locations and same-day appointments, it’s simple to walk into your nearest TD branch and get started.

Banking basics

Here are some of the accounts and services that can help you get settled in:

Explore chequing accounts for convenient everyday banking.

Start saving towards your financial goals

It’s important to start building your Canadian credit history.

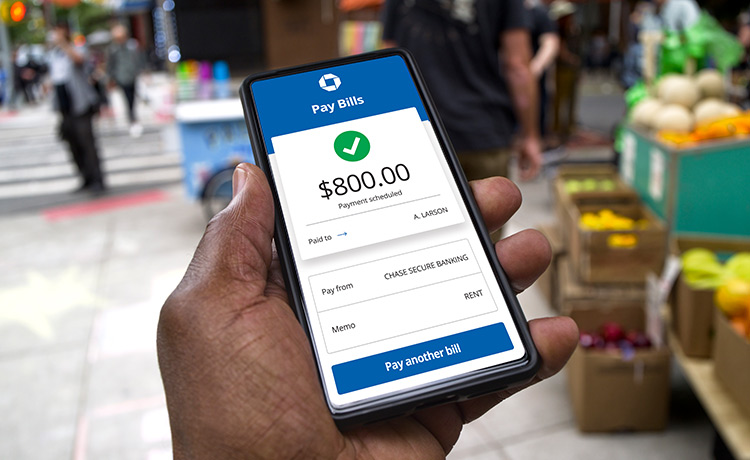

With TD, it’s easy to pay bills and send money online.

What to bring to TD

Ready to open an account or speak to a banking specialist?

Bring 1 of these documents:

Permanent Resident card

Confirmation of permanent residence (e.g., IMM Form 5292)

Temporary Permit (e.g., IMM Form 1442, 1208, 1102)

And bring 2 of these documents:

Valid passport

Canadian driver’s licence

Government of Canada ID card

Note: Other ID documents may be acceptable or required. Please visit a TD branch for details.

TD wants to help you understand your finances. Visit us at a branch, and we’ll answer your banking questions and walk you through your options.

Together, we can explore convenient features like TD MySpend, the TD app, TD Mobile Deposit, Direct Deposit, Apple Pay , Google Pay & Samsung Pay We help make it easy for you to pay bills, send money and manage your accounts on the go. See how .

Building credit in Canada

A good credit score is important if you want to borrow money to buy a house or a car, or to make any other big purchases. It can also help you qualify for phone and internet services, and rental unit.

Establish good credit by paying your bills on time and avoid exceeding your credit limit. It can help you get lower interest rates in the future.

Manage your finances

Whatever your financial goals are, we can help you come up with a plan you can feel confident about.

Start investing

Learn about the basics of investing in Canada and start putting your money to work.

Protect your finances

Learn how to prepare for the unexpected by protecting your finances today.

We want to help you bank confidently

Digital confidence can help you connect with your community

See how TD employees use technology to build connected communities. As former newcomers, they now help others settle in.

From newcomer to mentor

See how we’re celebrating the impact volunteers like Rizwan Kalim can have in our communities.

How to spot the Canada Revenue Agency (CRA) scam

Protect your finances. Be aware of this common phone scam that often targets new Canadians.

How one program helps Canadians handle a mid-career job switch

The Spanning the Gaps program welcomes 70 part-time students to learn about writing and math each year.

Helping close the underemployment gap for skilled new Canadians

The Ready Commitment and the TD Ready Challenge are working to help bridge the underemployment gap.

What the red envelope taught me about spending

Attitudes towards money are often shaped by our family and culture. Here’s what you can learn from this Chinese tradition.

Lines of credit in Canada

Learn about the different types of lines of credit and how to choose one that could be right for you.

Learn about secured lines of credit

A TD Investment Secured Line of Credit uses your investments as security so you may be able to borrow at a lower rate.

More resources for newcomers

Banking products for newcomers.

Explore chequing accounts, savings accounts, credit cards and mortgages.

Move your money

We make it easy to send money to over 200 countries and territories with Western Union ® Money Transfer SM .

Ways to bank with TD

Bank online, in person or by phone. Plus, use the TD app for convenient banking on the go.

Get in touch

Book an appointment.

Speak with a banking specialist in person at the branch closest to you.

Locate a Branch

Find TD branches wherever you go in Canada.

Speak with a banking specialist anytime, anywhere.

Have a question? Find answers here

Popular questions, helpful related questions, did you find what you were looking for.

Sorry this didn't help. Would you leave us a comment about your search?

See you in a bit

You are now leaving our website and entering a third-party website over which we have no control.

TD Bank Group is not responsible for the content of the third-party sites hyperlinked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites.

Third-party sites may have different Privacy and Security policies than TD Bank Group. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information.

TD Personal Banking

- Personal Home

- My Accounts

- Today's Rates

- Accounts (Personal)

- Chequing Accounts

- Savings Accounts

- Youth Account

- Student Account

- Credit Cards

- Aeroplan points

- Travel Rewards

- No Annual Fee

- U.S. Dollar

- Personal Investing

- GIC & Term Deposits

- Mutual Funds

- TFSA - Tax-Free Savings Account

- RSP - Retirement Savings Plan

- RIF - Retirement Income Options

- RESP - Education Savings Plan

- RDSP - Disability Savings Plan

- Precious Metals

- Travel Medical Insurance

- All Products

- New To Canada

- Banking Advice for Seniors (60+)

- Cross Border Banking

- Foreign Exchange Services

- Ways to Pay

- Ways to Bank

- Green Banking

TD Small Business Banking

- Small Business Home

- Accounts (Business)

- Chequing Account

- Savings Account

- U.S. Dollar Account

- AgriInvest Account

- Cheque Services

- Overdraft Protection

- Line of Credit

- Business Credit Cards

- Business Mortgage

- Canada Small Business Financial Loan

- Agriculture Credit Solutions

- TD Auto Finance Small Business Vehicle Lending

- Invest for your Business

- Advice for your Profession or Industry

- TD Merchant Solutions

- Foreign Currency Services

- Employer Services

TD Investing

- Investing Home

- Direct Investing

- Commissions and Fees

- Trading Platforms

- Investment Types

- Investor Education

- Financial Planning

- Private Wealth Management

- Markets and Research

TD Corporate

- Investor Relations

- Environment

- Supplier Information

- TD Newsroom

Other TD Businesses

- TD Commercial Banking

- TD Asset Management

- TD Securities

- TD Auto Finance

U.S. Banking

- TD Bank Personal Banking

- TD Bank Small Business Banking

- TD Bank Commercial Banking

- TD Wealth Private Client Group

- TD Bank Personal Financial Services

- How to Choose the Right Credit Card

- How to Apply for a Credit Card

- How to Cancel a Credit Card

- Ways To Pay Off Credit Card Debt

- Why Your Credit Card Was Declined

- How to Get Out of Credit Card Debt

- What to Know About Credit Card Minimum Payments

- What Is a Credit Card and Should You Get One?

- How Do Credit Cards Work in Canada?

- What Are the Different Types of Credit Cards?

- How an International Credit Card Works

- Common Credit Card Terms and Conditions

- Credit Card Fees and Charges

- Credit Card Interest Calculator

- First-Time Home Buyer Incentive

- Tax-Free First Home Savings Account

- Home Equity Loan

- How a Reverse Mortgage Works

- Home Equity Line of Credit

- Mortgage Renewal

- Getting a Second Mortgage

- How to Refinance a Mortgage

- How Does Mortgage Interest Work?

- Realtors vs Real Estate Agents vs Brokers

- Is Canada’s Housing Market Crashing?

- Types of Houses in Canada

- First-Time Home Buyer Grants and Assistance Programs

- Types of Mortgages in Canada: Which Is Right for You?

- How Does a Mortgage Work in Canada?

- What Is an Interest Rate?

- Guaranteed Investment Certificate (GIC)

- Savings Account Guide

- Common Canadian Bank Fees and Charges

- Types of Bank Accounts in Canada

- EQ Bank Review

- Simplii Financial Review

- Tangerine Bank Review

- National Bank of Canada Review

- CIBC Review

- Scotiabank Review

- TD Bank Review

- What Is Canadian Investor Protection Fund (CIPF) Coverage?

- How Capital Gains Tax Works

- Investing for Canadian Beginners

- Understanding Asset Classes in Investing

- Understanding Fixed-Income Investments

- How to Invest in Stocks

- What Are T-Bills

- What is a Bond

- What is Registered Disability Savings Plan (RDSP)

- What Are Mutual Funds

- What is an ETF (Exchange Traded Fund)

- What Is Forex Trading

- What Is Cryptocurrency and How Does It Work

- What Is a Stock

- What is Old Age Security and How Does It Work

- What is Registered Retirement Income Funds (RRIFs)

- How a Life Income Fund (LIF) Works for Retirement

- What Is An In-Trust Account

- What Is a Locked-in Retirement Account (LIRA)

- How Much Money You’ll Need To Retire

- Defined Benefit vs. Defined Contribution Pension Plans

- Can Annuities Fund Your Retirement?

- What Is a Personal Loan?

- Personal Loan Insurance: Do You Need It?

- What Is a Secured Personal Loan?

- What Is a Payday Loan?

- What Is a Pawn Loan?

- What Is a Car Title Loan?

- Small Business Loan vs Personal Loan

- Personal Loan vs. Line of Credit

- Personal Line of Credit vs Home Equity Loan:

- Personal Line of Credit vs Car Loan

- HELOC vs Personal Loan

- Debt Consolidation vs Personal Loan

- Cash Advance vs Personal Loan

- Business Loan vs Personal Loan

- Price Matching Tips to Help You Save Big

- How to save for Wedding

- How to Save Money on Groceries

- Ways to Save on Your Next Family Vacation

- Tips to Help You Save On Gas

- How to Save Money in 8 Easy Steps

- Passive Income: What It Is and How to Make It

- Budgeting 101: How to Budget Your Money

- Ways to Make Money Online and Offline in Canada

- How Do Credit Inquiries Work?

- What is the Ideal Credit Utilization Ratio?

- What Credit Score is Needed for a Credit Card?

- How to Get a Better Credit Score

- What is a Good Credit Score in Canada?

How to Open a Bank Account

Almost anyone can open a bank account at a bank or credit union across the country .

Even for non-residents living, working or going to school in Canada, banks offer a variety of bank accounts that can be opened in person or online, in a few steps.

How to open a bank account in person

The traditional way of opening a bank account is to go to the financial institution in person. Although, banks may ask you to book an appointment before you visit a branch.

You don’t need to have a job or the money to deposit right away, but you’ll need to keep the required ID and documents with you. After you’ve answered some necessary questions regarding your name, date of birth, address, etc. the bank representative will help you open an account in just a few minutes.

Once your account is open, you will receive a debit card which you can start using right away.

How to open a bank account online

Like most online banks , many traditional banks now allow you to open a bank account online . The process is very similar to what you would do in person. You will need to answer personal questions, upload the required documents, and verify your identity either online or in person as per the bank’s policy.

Once you’ve completed the process and your account is active, the bank will mail you your debit card.

What do I need to open a bank account?

To open your bank account in Canada, you will need to provide two forms of identification as verification. The most commonly accepted types of identity documents to prove your name, address, age and nationality include:

- Valid Canadian driver’s license.

- Valid Canadian passport.

- Canadian birth certificate.

- Old age security card.

- Certificate of Indian status.

- Provincial or territorial health card.

- Certificate of Canadian Citizenship or Certification of Naturalization.

- Permanent Resident card or an Immigration, Refugees and Citizen Canada form IMM 1000, IMM 1442, or IMM 5292. Some banks may also accept form IMM 5688.

- A document card with your photo and picture issued by select provincial and territorial authorities (find the list here ).

If you only have a single piece of ID from the primary list, you can use one of the following as your secondary document:

- Record of employment in Canada

- Canadian debit or bank card with your name and signature

- Canadian credit card statement

- Client card from the Canadian National Institute for the Blind with your photo and signature

- Current foreign passport

Note that you must show the original documents to open a bank account. Photocopies will not be accepted.

If you’re opening an account where you’ll earn interest, such as a high-interest savings account (HISA) or registered retirement savings plan (RRSP), you are required to provide your Social Insurance Number (SIN) . Because the interest you earn on these accounts is taxable, the financial institution needs your SIN to report that income to the Canada Revenue Agency.

Best High Interests Savings Accounts in Canada

Compare all different saving accounts side-by-side and find out the highest rate that make your save more

What to consider when opening a bank account

When opening your first bank account, think about how you would use it. If you want an account to handle day-to-day transactions, choose a chequing account . If you’re planning to save up for a special expense, a savings account may be ideal.

You’ll see that most banks offer these standard account options. However, the bank and account fees, interest rates, withdrawal limits and perks may vary. So, take your time to do some research and find the right account type and financial institution to best suit your specific needs.

What’s the minimum age to open a bank account in Canada?

Different banks have different age limits for children, youth and student accounts . For example, suppose you’re under the age of majority in your province or territory. In that case, you might not be able to open an account online. For some accounts, like the CIBC Youth account , you need to open the account with a parent or legal guardian.

In most cases, anyone with a valid government-issued ID and supporting documents can open a bank account in Canada. However, each bank has its own age restrictions and qualification rules for these accounts, so it’s a good idea to look at a few options before choosing an account.

About the Authors

Siddhi Bagwe is a content management specialist at NerdWallet Canada. Treating content marketing as an educational medium for readers, Siddhi believes in empowering them with the knowledge of personal finance…

Hannah Logan is a freelance writer and blogger who specializes in personal finance and travel. You can follow her personal travel blog EatSleepBreatheTravel.com or find her on Instagram @hannahlogan21.

DIVE EVEN DEEPER

How Direct Deposit Works and How to Set It Up in Canada

Direct deposit is a fast, convenient alternative to waiting for a paper cheque to arrive in the mail, and it requires no work on your end after the initial setup.

How Does CDIC Deposit Insurance Protect Your Money?

The Canada Deposit Insurance Corporation (CDIC) may protect your money in the unlikely event that your financial institution fails. The CDIC will cover up to $100,000 per eligible account, per member bank.

How to Switch to a New Bank or Credit Union in Canada

Unhappy with your bank? Switching to a new bank doesn’t have to be hard — using a checklist can make for a smooth transition to your new institution.

What Is an Overdraft and How Does Overdraft Protection Work?

An overdraft drops your bank account balance below zero, and can result in fees and interest. Overdraft protection prevents a non-sufficient funds fee.

- Argentina

- Australia

- Brasil

- Česko

- Canada

- Deutschland

- España

- France

- India

- Italia

- Magyarország

- Malaysia

- Nederland

- New Zealand

- Österreich

- Polska

- Portugal

- România

- Schweiz

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

- 简体中文 (中国)

How to Open a Canadian Bank Account From USA without Leaving Home

If you’re a US resident who wants to work and study north of the border, it’s worth knowing how to open a Canadian bank account before you relocate to Canada. You can get your finances in order, transfer money over and have everything ready to go when you want to make the move.

Although US and Canadian banks have close ties, most Canadian banks do require you to visit in person to open a full feature account. That’s not always the case though, you can explore online options like Wise and Revolut – so read on for all you need to know about how to open a Canadian bank account while you’re in the US.

Learn more about Wise Learn more about Revolut

Quick Summary: Canadian bank account for US Citizens

- Yes, it’s possible to open an account to hold, send, spend and receive CAD from the USA

- Banks usually require proof of address in Canada, but non-bank providers like Wise and Revolut allow you to open an account with a proof of address from the USA

- Some banks let you start the account opening process online before you move to Canada, but this service isn’t always available to US citizens

- For a flexible option you can open a Canadian dollar account with Wise online and get CAD account details

Can a US citizen open a bank account in Canada?

Americans can open a bank account in Canada , but if you don’t open an account in person at a Canadian bank branch, things do get more complicated. You have a few different options:

- Several US banks have Canadian branches or a partnership with banks in Canada. You can contact your US bank to ask them about the possibility of opening a Canadian bank account. In many cases, having an existing account with a US bank will be necessary before they will consider opening a Canadian bank account for you.

- If you’re going to be a Canadian resident , you can visit a Canadian bank when you’re there and provide documents proving your intent to immigrate, together with your identity and proof of address. There are several documents you will need to have before you’re allowed to open a Canadian bank account in person. Learn more about how to open an international bank account .

- Open an online multi-currency account with a specialist provider like Wise or Revolut , to access CAD bank account details and low cost currency exchange, before you move to Canada. We’ll cover this option in more detail later – and you can also get a full Wise review here.

Learn more about Wise Learn more about Revolut

What documents do you need to open a bank account in Canada?

The Financial Consumer Agency lists the documents that a bank will typically ask for. The documents usually requested include several options which US citizens are unlikely to have – like a Canadian passport or birth certificate.

Instead, to open a CAD bank account with a Canadian bank as a US citizen, you’ll probably need to provide a couple of pieces of ID taken from a list which includes:

- A current US passport

- An employee ID card with your picture on it

- A debit card, bank card or Canadian credit card

- Temporary Residence Permit

- Work or study permit

- Confirmation of Permanent Residence

In some cases, if you can’t provide the specific documents requested you may be able to have someone in good standing with the bank or in the local community confirm your identity.

If you’re opening an account that will earn interest and be liable to tax, you must also provide a Social Insurance Number (SIN). You can obtain an SIN from the Canadian government.

Identification and account opening requirements do vary from bank to bank, so it’s always worth contacting a bank where you want to open an account to see what their specific needs are.

Save the paperwork with alternative solutions like Wise or Revolut

Canadian banks usually require customers to provide a proof of residence document showing a local Canadian address. That can make it tricky if you’re not a resident yet – or even if you’ve just moved to the country and don’t yet have bills and household paperwork in your name.

Want an easier option? Specialist services like Wise or Revolut can help. These online alternatives have been built with international customers in mind, and can accept a proof of address from the US or a range of other countries. Verification is done by uploading images of your paperwork online or in the provider app. Just use your proof of address from your country of residence, to open a Wise or Revolut account online, and open up a CAD balance.

Go to Wise Go to Revolut

Once you’re all set up you can receive, hold, and spend CAD easily before you even arrive in Canada – a great solution for expats, non-residents and digital nomads who want to hit the ground running.

How to open a bank account in Canada as a non-resident

If you’re already in Canada, or you’re about to move there for the long term, you may decide to open a bank account with a bank there. Typically most Canadian banks will require you to either be a resident or have immigration papers that show you are going to be a resident before you open an account.

If you’ve chosen a bank which allows you to start the process of applying for an account online before you relocate, you’ll normally need proof of ID, and your Canadian Visa/Landing Document Number. You may then need to visit a branch to finalize your application and get full account features.

If you’re not intending to move to Canada, you may still find that some banks will let you open your non-resident account online – or at least get started on your application online – but it’s pretty common to need to visit a branch to show your paperwork and get your account up and running.

Can I open a bank account in Canada before arrival?

If you’re planning to move to Canada in the near future you can go some way towards setting up a local account with a global provider like HSBC . However what you’ll actually have to do is set up an international account which has limited functionality initially, and then convert it to the account package you prefer once you can attend a branch in person. That can be a hassle.

Alternatively, or if you’re not actually moving to Canada at the moment, you can choose a specialist service like Wise or Revolut instead.

Go to Wise Go to Revolut

1. Cross-border account opening between the US and Canada

Several US banks have Canadian branches or close partnerships with Canadian banks. In these cases, you may be able to open a Canadian bank account without leaving the US. You should contact your US bank and ask them about the possibility of opening an account in Canada.

Many of these banks will have a cross-border account opening process. Find the contact details for your bank, get in touch and ask them if they have provisions for opening an account in Canada from the US. In every case, you’ll need your immigration details as you can’t open an account without them.

2. Visit a Canadian bank with the right documentation to open an account

The easiest way to open a Canadian bank account is to visit a Canadian bank. While you can’t do that from home or remotely, in some cases it may be your easiest option. Before you visit a Canadian branch, contact the bank and ask them about the account opening process as a US citizen. They will talk you through all of the rules, requirements and documentation you will need to open a bank account in Canada.

3. Open a bank account online in Canada

If you can’t open a Canadian bank account using the options above, you have another choice—an online account from a specialist. These are digital accounts that you can access from anywhere and that give you a bank account in a variety of countries.

Online specialist services offer the option to open a multi-currency account which can hold both USD and CAD, and may even provide local bank details so you can get paid in CAD as easily as you can in US dollars. The providers we’ve picked out below offer accounts with no ongoing fees, which can hold, send, spend and exchange multiple currencies – for more flexibility with transparent, low fees.

Wise multi-currency account : Hold and exchange 40+ currencies and get local bank details to be paid in USD, CAD and up to 8+ other major currencies. You can also get a linked debit card to spend in 150+ countries, and send low cost payments with the mid-market exchange rate to 160+ countries.

Revolut multi-currency account : Hold and exchange 25+ currencies, with a linked international debit card and some no-fee currency exchange which uses the mid-market exchange rate. You can choose a plan with no monthly fee – or upgrade to an account with monthly charges for full feature access.

Next, we’ll look at some of the best account options in general, then we’ll look at Wise and Revolut more in detail, so you can compare and see which approach might suit you.

Which account is best in Canada for foreigners?

To help decide which account might work for you, let’s look at 2 online providers – Wise and Revolut – alongside a couple of newcomer account packages from traditional Canadian banks.

As you can see, if you’re opening an account before you move to Canada – or if you love to travel and need ways to hold CAD alongside USD or other currencies – online specialist accounts may offer a more flexible option compared to Canadian banks. Here’s the topline on the providers we picked and what’s great about them:

Wise – 40+ currencies, and ways to get paid conveniently in foreign currencies, including USD and CAD. All currency exchange uses the mid-market exchange rate

Revolut – 25+ currencies, including USD and CAD, with some no-fee currency exchange depending on the account plan you select

TD Bank – large, established bank in Canada, which offers some USD products alongside its standard CAD accounts. Good if you need a branch network for face to face service

Scotiabank – reliable and familiar banking services, where you can get all your financial needs met under one roof

We’ll take a look at Wise and Revolut in more detail, next – and there’s more on TD Bank Canada and Scotiabank a little later, too.

Wise account

Open a multi-currency Wise Account online or in the Wise app for free , to hold and exchange 40+ currencies with the mid-market exchange rate and low fees from 0.43%.

You’ll be able to order your linked international debit card for a low one time fee, to spend in 150+ countries. Wise accounts can be topped up in around 20 currencies, and also come with local bank details for up to 9 currencies so you can get paid by others conveniently.

Key points about Wise account:

- The Wise Account is a multiple currency account that lets you hold money in more than 40 currencies, including US dollars and Canadian dollars.

- You can get local bank account details for 9+ currencies including USD, CAD, AUD and GBP.

- You can use your Wise account to send payments to 160+ countries, and exchange currencies using the mid-market exchange rate with low, transparent fees.

- You also get a linked Wise debit card , so you can spend money from the account. The debit card is free to use if you’re spending money in the local currency.

- Spend from your CAD balance using your Wise card – and if you don’t hold enough in CAD, the card will auto convert from another currency balance using the lowest available fee.

- There’s a Wise mobile app where you can easily check your spending, balances and limits.

- Wise is safe , fully licensed and regulated for all its activities in the US around the world.

Go to Wise

Account types: Wise accounts can be opened by people resident in many countries around the world, including both the US and Canada. Open on arrival, or before you head out, to hold, exchange, send and spend in 40+ currencies

Eligibility: Use your home proof of address to get your account open and access a CAD balance. The exact account services available may vary based on location, so check the Wise website for more information.

Is it safe? Wise is registered and regulated in the US – and also covered by FINTRAC in Canada, and a range of other global bodies in the other countries it trades in.

If you want to learn more, check our detailed review: Wise account review

Wise CAD account details

Once you’ve opened your Wise account you can open a CAD currency balance and get local CAD account details so other people can pay you conveniently.

Just log into Wise on the app, and tap on the CAD currency balance to see your bank details, which you can then give to anyone needing to send you a payment in Canadian dollars.

Here’s what you’ll get:

Fees for the Wise account

There are no minimum account amounts, no monthly fees and no maintenance fees on the Wise account .

The key Wise fees you’ll pay are:

- Fees from 0.43% for switching between currencies and sending international payments

- 9 USD one off charge to get a Wise debit card

- 1.5 USD + 2% for ATM withdrawals over 100 USD/month

- Receiving USD wire payments – 4.14 USD – getting paid by ACH is free

- Receiving CAD SWIFT payments – 10 CAD – no fee to get paid by local payment methods

Revolut account

Revolut accounts have multi-currency functionality for 25+ fiat currencies including both USD and CAD, a linked debit card for spending and withdrawals, and extra perks like budgeting and saving tools. Revolut customers can provide a proof of address from the US or any of the other regions they operate in. It’s worth noting, though, that Revolut can’t be opened using a Canadian proof of address – so this is one to set up before you travel.

Standard Revolut plans come with no monthly fees and an array of features including some no-fee currency exchange. Or you can upgrade to a different account tier, where you’ll pay a monthly fee to get higher levels of no-fee transactions and extra benefits.

Account types: Personal and business accounts available. Standard plans don’t have monthly fees for both personal and business customers. Or you can upgrade to a paid plan for up to $16.99/month as a personal customer.

Eligibility: Available to customers with addresses in regions including the UK, EEA, Australia, Singapore, Switzerland, Japan, and the US.

Is it safe? Yes. Revolut is fully authorized and licensed for all the services it offers.

Go to Revolut

Fees for the Revolut Account

The fees you pay for a Revolut account will depend a lot on the account tier you pick. Here’s a rundown of some key costs:

- Monthly fee – no monthly fee for standard accounts; Premium account plans cost 9.99 USD/month and Metal account plans cost 16.99 USD/month

- 2% fee once you’ve exhausted your plan limit for no-fee ATM withdrawals

- 1% fee for currency exchange out of hours

- 0.5% fee when exchanging currency above your plan’s no-fee limit

More information: Best Canadian Dollar accounts in the US

Canadian Banks for US Citizens

Canadian banks in the usa.

There are quite a few Canadian banks which have branches in the USA, or global banking brands which have branches in both Canada and the US. Here are a few you may consider:

- BNP Paribas

If you already have a bank account with one of these banks, that may be a good starting point. However, these accounts may have high minimum one-off or ongoing deposit requirements and there can be significant ongoing fees for holding these accounts.

US banks with Canadian branches

Canada has US branch and office locations of several major US banks, some of which may be able to help you as an immigrant. Bear in mind though that some US banks only offer specific services in Canada, such as wealth management or business banking. You’ll need to shop around a bit to see whether any suit your specific needs. Here are a few to consider:

- Bank of America

- Wells Fargo

Here’s a bit more detail about the 2 banks we picked out in the comparison table earlier – TD Bank and Scotiabank. We’ve also looked at another popular Canadian bank – RBC.

TD Bank is one of the largest banks in Canada, and a familiar name to many US citizens, too. There’s a specific newcomers service which allows residents from certain countries to start account opening before traveling, and complete on arrival. If you’re coming from certain regions you can also call on free local numbers to get advice and support in arranging your account. At the time of writing this service is not promoted to US residents looking for a standard account, so you’ll need to call the bank to check if it’s on offer at the time you want to apply.

TD Bank has a wide range of account products, but suggests the Unlimited Chequing account as a good option for new arrivals. In this account you’ll pay a 16.95 CAD monthly fee, which can be waived if you meet a minimum balance requirement, for unlimited free transactions and TD Bank ATM withdrawals. Fees apply to send and receive international payments.

Account types: There are a few different accounts on offer to newcomers – you’ll be able to pick from checking and saving accounts, as well as student accounts aimed at international students.

Eligibility: You’ll need to provide ID including your passport and proof of legal residence in Canada

Is it safe? Yes. TD Bank is one of the largest banks in Canada, with a significant presence internationally, too. It’s a fully regulated provider, trusted by millions.

Scotiabank lets customers from selected countries open international accounts online. At the time of writing this is not available to US residents, so you may need to wait until you arrive to get your account arranged. Scotiabank offers a range of account options, with the most popular – the Preferred account – being eligible for the newcomer international application process.

The Preferred Package costs 16.95 CAD a month but comes with unlimited free transactions, interest on your balance, and overdraft protection. If you hold a 4,000 CAD or more minimum balance for the month your monthly fee may be waived.

Account types: Scotiabank has a good range of chequing and savings accounts, including a couple which can be opened online in advance or arrival by people from selected countries

Is it safe? Yes. Scotiabank is FINTRAC registered and fully licensed to trade in Canada

Royal Bank of Canada

Royal Bank of Canada – often shortened to just RBC – has a newcomer package which is aimed at new residents and international students. You can get some fees waived when you first arrive, and there are also easier ways to get a credit card which don’t rely entirely on having a local credit history. Once your fee free period is over you’ll pay 11.95 CAD a month for a standard package, or more if you have the VIP service.

Account types: RBC is a large bank with a full suite of checking and savings accounts, credit cards, loans and more

Is it safe? Yes. RBC is large, trusted and fully licensed to trade in Canada

What do I need to know before opening a bank account in Canada?

As a foreigner in Canada you’ll usually need to provide a suite of documents to support your application if you want to open an account with a bank. Generally, full service accounts are only available to full Canadian residents, so if you’re not living in Canada yet you’ll probably only be able to access a more limited account type with banks.

Can I open a bank account in Canada with only my passport?

You can not usually open a bank account in Canada with only a passport. You’ll normally need 2 pieces of ID which confirm your name and address. In some cases you may be able to present only one piece of ID, but this is usually only an option if you can also have someone locally – who is in good standing in the community, or holds an account with your preferred bank already – visit the bank with you to vouch for you.

What is a bank account in Canada needed for?

If you’re moving to Canada you’ll need a CAD account to pay for rent, utilities, everyday essentials and services, as well as to allow others to pay you. If you’re not a resident all year round you may still like a CAD account if you spend time in Canada often or if you’re a frequent visitor there.

Benefits of opening a bank account in Canada

Opening a CAD account can bring a few benefits if you need to transact in CAD often:

- Make payments in Canadian dollars without incurring currency exchange costs

- Hold a balance in CAD, and access preferential exchange rates

- Get paid a salary, benefits or other payments in CAD without needing to convert back to USD

- Get a Canadian credit card and build your credit history

How much does it cost to open a bank account in Canada?

It’s usually free to open a bank account in Canada. However accounts from traditional banks will often have monthly fees, which can only be waived if you maintain a set minimum balance all month. There are also transaction costs to consider, which can quickly mount up.

Is it possible to open a fee free account in Canada?

It’s not usually possible to get a completely fee free account in Canada. However, many banks offer accounts which waive certain costs if you hold a high enough balance or if you’re a new customer. It’s worth comparing a few options to see which may suit your needs. Don’t forget to also look at non-bank alternatives like Wise and Revolut which have low cost accounts which are flexible and easy to open.

What are the additional costs?

Transaction costs are the most common extra fees you’ll pay. Some banking packages come with a fixed number of free transactions a month, some have unlimited transactions for free, and some come with charges for every transaction you make within your account – make sure you read all the details carefully before you sign up.

Here’s what to look out for:

- Account maintenance costs

- ATM withdrawal fees

- Overdraft or credit card interest charges

- Inactivity or closing fee

- International transfer fees

- Foreign transaction fees

Tips for transferring money

One of the most common transactions you’ll need to make as an expat is probably moving money across currencies with international transfers – this can also be a costly thing with traditional banks. Here are a few things to watch out for:

- Check the exchange rate you’re offered against the rate you find on Google to see if a markup – and extra fee – has been applied

- International transfer fees may vary depending on the value of the payment, and whether you arrange it online or in a branch

- Third party fees may be deducted as the payment is processed, and can mean your recipient gets less than you expect

Using a specialist service like Wise to send your international payments can mean you get less complicated fees – with no hidden costs added to the exchange rate.

Related: Best travel cards for Canada

How to open a business account in Canada?

If you’re interested in opening a business bank account in Canada you may need to follow a slightly different process. While some banks offer online opening options for personal accounts, it’s far more common to open a business account in person by visiting a branch. That means it’s trickier to open a business bank account with a traditional Canadian bank as a non-resident. If you’re not planning on moving to Canada you might find that choosing a multi-currency account with a specialist online provider is a simpler option.

No matter how you decide to set up your Canadian business bank account you’ll need to provide your personal ID documents plus a suite of business documentation, based on entity type – business licenses, registration numbers, partnership agreements or articles of incorporation for example.

To learn more, check our detailed guide on How to Open a Business Bank Account in Canada .

Conclusion: Can you open a bank account in Canada from the US?

Yes. You can open a bank account in Canada as a US citizen. However exactly how you get started will depend on whether you’re planning to move to Canada or need an account as a non-resident.

Usually it’s far easier to open a bank account with a traditional Canadian bank if you’re a resident there. If you’re not planning on making the move to Canada, you can still get a CAD account with Canadian banking details from a specialist provider like Wise or Revolut. Wise offers both personal and business account options for US citizens, with CAD bank details, a linked debit card and no ongoing charges. Revolut accounts can be opened from the US, to hold and exchange CAD and USD, and access some no-fee currency exchange, depending on the account type you pick.

FAQs on opening a Canadian bank account

1. Can I open a bank account online in Canada from the USA?

Some Canadian banks do offer online account opening services, but it’s pretty common to need to visit a branch in person to get your account fully up and running. If opening your account online is essential you might be better off choosing a specialist provider like Wise, which offers a fully digital account opening service.

2. Can a foreigner open a bank account in Canada online?

Some Canadian banks do offer online account opening, but you may find it tricky to provide the required identification and residence documents. As a US citizen the easiest way to open your Canadian account is probably to choose a specialist online account provider which can accept your US identification documents.

3. Which US banks have branches in Canada?

Key options for banks which have branches in both the US and Canada include:

4. Can I open a Canadian Bank Account from the US?

You’ll be able to open a Canadian bank account from the US with a specialist provider, or in some cases, with a traditional bank in Canada. Use this guide as a starting point to research which banks and account providers might suit you.

5. Can you open a bank account in Canada as a non-resident?

As a Canadian non-resident you might be able to open an account with a traditional bank, but many regular accounts aren’t available to non-resident customers. Learn more about how to open a Canadian bank account as a non-resident – or take a look at specialist international account providers which tend to be more flexible with non-resident customers.

Open a Bank Account Before Arriving in Canada

by Corinna Frattini | Aug 26, 2020 | Banking & Financial First Steps in Canada

Opening a bank account before you arrive in Canada offers many benefits including transferring funds before you travel to Canada. Also, when you land in Canada, immigration officials may ask you to show proof of funds. When you open a bank account before you arrive, you can easily prove that you have available funds.

Canadian banks are among the most solid, secure financial institutions in the world. The Canada Deposit Insurance Corporation (CDIC) provides insurance to protect eligible deposits made to CDIC-member banks. And for Canadians, knowing their money is CDIC-protected is reassuring!

How to Choose a Bank in Canada

It’s necessary to open a bank account in Canada. Most Canadians rely on their bank to:

- Receive paycheques

- Save money and earn interest.

To select a bank, you can visit the bank’s website to compare services and fees. While many banks have national branches and automatic banking machines (ABM) networks, it’s best to select a bank that has branches in the community where you will live.

Advertisement:

Also, when you open a bank account you will receive a statement with your new mailing address. You can use your statement as identification when you apply for:

- G overnment services

- A provincial health card, or

- A driver’s license.

Open a Bank Account with the Right Features

Banks offer a wide range of accounts to choose from, and that can be overwhelming. But keep in mind that most newcomers will require a chequing account to deposit funds, write cheques, and pay bills. You will also need a debit card to deposit and withdraw funds from an ABM or branch. You may also want a higher-interest savings account and credit card.

Related Posts:

Building Credit History in Canada as a Newcomer

How Much Money Will I Need to Move to Canada?

Move to Canada | Transferring Cash & Valuables

Types of Bank Accounts to Save for Your Future

Banking and Finance in Canada: Your First Steps

Banks offer banking service packages at low-cost monthly fees. For example, The Scotiabank StartRight ™ Program for Newcomers*¹ offers a number of low-cost options to meet your banking needs. To help you make your important banking decisions, Scotiabank can explain your options in the language that you prefer and provide personal support at the bank branch.

Feel free to ask for an explanation if there is anything you don’t understand. The role of the bank employee is to provide quality customer service and any questions you may have. So you don’t need to worry about asking questions or taking up too much of their time.

Most importantly, get answers to your questions and only sign a contract when you’re confident you understand the terms.

Documents You Need to Open a Bank Account

To open a bank account in Canada, you will require the following documents:

- Permanent Resident Card or Confirmation of Permanent Residence

- One piece of government identification such as your passport or driver’s license

If you’re an international student, you will require a letter of acceptance from a Canadian educational institution and a study permit.

If you are a foreign worker, you will require a current valid passport and work permit.

To open a bank account, you need to go to a local branch in person and have two original pieces of identification. You will have an interview with a bank employee who will:

- Discuss different banking options

- Suggest the right bank account based on your needs

- Explain your rights and responsibilities, and

- Help you complete the paperwork.

*¹ – The Scotiabank StartRight Program, created for Canadian Permanent residents from 0-3 years in Canada, International Students, and Foreign Workers.

- Learn the basics of banking in Canada

Corinna Frattini is the content marketing strategist at Prepare for Canada and contributes articles related to working in Canada. With a background in human resources and leadership development, her articles focus on what Canadian employers seek and how newcomers can continue their careers in Canada.

RECENT POSTS

- Fredericton, New Brunswick, Immigrants and Housing

- Summer Jobs in Canada: Tips for Newcomer High School Students

- 5 Mistakes Newcomers Make With Credit Cards

SEARCH ARTICLES

Sign up for email updates.

Unsubscribe anytime

Can a Foreigner Open a Bank Account in Canada?

- BY GlobalBanks Team

- Updated Nov 16, 2023

In this article, we’re going to answer the question “can a foreigner open a bank account in Canada?”.

So, if you’re looking to start an account as a foreigner in Canada, you’re not alone. A bank account in Canada has proven to be a safe and secure international bank account over the last few decades.

And with a recession looming, it’s not surprising that foreigners and non-residents are interested in opening bank accounts here.

In fact, it’s a common question we get asked by entrepreneurs, especially those who own an online business.

KEY TAKEAWAYS

- Opening a bank account in Canada as a foreigner is difficult

- Most banks will require you to show up in person to open

- Banks in Canada offer CAD and USD accounts

- Banks strongly prefer opening bank accounts for Canadian residents

- Business accounts may be easier to start (in-person opening)

- Int’l money transfers may be better served outside of Canada (send money abroad)

Feel free to use the table of contents to jump ahead to the sections most relevant to you.

Table of Contents

What Are the Benefits Offered By a Canadian Bank?

What do i need to open a canadian bank account as a foreigner, what are the challenges of opening a canadian bank account as a foreigner.

- How Do I Know Which Canadian Banks Best Suits My Needs?

Frequently Asked Canadian Banking Questions

Do you want help opening bank accounts.

To open an account in Canada as a foreigner you will need to provide proper documentation, meet the bank’s standard due diligence requirements, and be able to clearly communicate your reason for requiring a Canadian bank account. In most cases, you will be required to show up in person.

Of course, opening a non-resident bank account in Canada can be frustrating and time-consuming without the right information. This is especially true if you are trying to open an account from your home country or online.

That’s why our team of banking experts has analyzed all of the Canadian banks that allow foreigners to open bank accounts. And, we’re happy to report that it’s very much possible to do so. In some special cases, you might even be able to start an account without visiting Canada.

In this article, we provide you with the information you need to know when applying. So, if you’re a foreigner and opening an account in Canada is something you’re interested in, keep reading!

Do You Want to Explore All Your Offshore Banking Options?

After the 2008 global financial crisis, Canadian banks were (at the time) hailed as some of the safest and best-managed in the world. Today, Canada is still seen as a stable banking jurisdiction when compared to other countries like the United States and Mexico .

But, with so many other options to choose from, why do foreigners and non-residents want to open a Canadian bank account?

Firstly, opening an account here as a foreigner has many perks. These include both personal and business perks. For instance, banking in Canada can form an important part of your international banking and tax strategy as this country offers an efficient structure, known as the Canadian LP, which offers efficiency and privacy.

Additionally, when opening payment processing relationships in Canada, businesses are able to access both CAD and USD. Meaning, if your business is primarily selling to customers in the US, you will be able to save on foreign currency fees while still using low-cost payment processing outside of the US. That said, with foreign currency fees fluctuating, it’s important to consider which currency your business wants to prioritize.

Here are eight benefits foreigners can expect when opening bank accounts in Canada.

- Access to CAD and USD payment processing

- Saving on foreign currency transactions

- Accounts are easily accessible

- Reduced foreign exchange rates and fees

- Stable banks

- Strong online banking platforms

- English-speaking bankers

- ATM availability

Now, we don’t recommend opening a bank account with just any Canadian financial institution. This is especially true because issues can arise when choosing the wrong bank.

Additionally, if you already have an account in here, you shouldn’t automatically choose your personal bank for your business bank or vice versa. Not only could you be limiting yourself to a bank that doesn’t fit your business needs, but you could also end up paying unnecessary fees.

Unfortunately, there can be a lot of confusion over how to open a bank account in Canada as a foreigner.

Canadian banks require specific documentation and have multiple identity requirements when it comes to opening a bank account, especially for non-residents and foreigners.

That said, even if you’re not a Canadian citizen, you still have the option to start a bank account as long as you have the proper documentation and can overcome the bank’s onboarding procedures. Of course, some banks here do require you to show up in person when opening a bank account. However, this isn’t required in all cases.

Whether you’re looking to open a personal bank account or a business bank account, you’re required to provide proof of specific documents. These documents can vary from bank to bank.

What documents do you need to open a Canadian personal account?

Banks may request the following five documents when you apply for a personal bank account.

- Your valid, current/unexpired passport

- A copy of your driver’s license

- Other identifying documents issued by a governmental agency

- Verification of your residence or physical address (having a Canadian address makes this process run smoothly, but it’s not always a requirement)

- Financial reference documents or bank statements

What documents do you need to open a business account in Canada?