- Customer Service

- En Español

International Travel - Money Tips

Going abroad? TD Bank has you covered.

- Debit card: 1-888-751-900

- TD Connect Card: 1-888-568-7130

- Credit card: 1-888-561-8861

- TD Go card: 1-855-219-8050

Wherever your international travels take you, making purchases overseas is easy with a little bit of planning. Here are a few things to keep in mind before you leave the country.

Be sure to pack the right mix of cash and cards.

- Get foreign cash before you leave for bus or subway fares, taxis, tips, and for emergencies

- Plan ahead: Visit your nearest TD Bank and order currency for pick up within 2 days.

- When you get home, exchange your foreign cash for U.S. dollars at your local TD Bank

Find a TD Bank and see what foreign currencies are available.

- Pay no foreign transaction fees when you use your TD Bank debit card, TD Cash or TD First Class credit card, or prepaid cards*

- You're protected with chip technology and Visa Zero Liability 1

- Use your debit card to get cash at ATMs while traveling

- You may be covered for lost luggage reimbursement if you purchased your trip with your TD Visa Signature ® credit card .

Subject to credit approval. APRs for purchases and balance transfers will range between 13.24%, 18.24% and 23.24% based on creditworthiness. APR for cash advances is 23.49%. All APRs will vary with the market based on the Prime Rate. Balance Transfer fee – 4% of each balance transfer, minimum $10. Cash Advance fee – 5% of each cash advance, minimum $10. Minimum Interest Charge – $1.00.

Other helpful tips

- Save these international phone numbers in your phone in case you need to reach us in an emergency. Debit and prepaid cards: 1-215-569-0518 Credit cards: 1-706-644-3266

- Download the TD Bank mobile app to keep track of your transactions while you travel

- Don't keep all of your cash in one place

- Use a money belt for keeping cash and important documents away from pickpockets

- If you're budget conscious, a prepaid card is a great alternative to cash and will help you keep your budget under control. Just load up funds before you go and set up a balance alert to keep you on track.

- Check the State Department website 1 for alerts and additional travel resources.

*See the Important Credit Card Terms and Conditions for TD Cash and TD First Class for details.

1 By clicking on this link you are leaving our website and entering a third-party website over which we have no control.

Neither TD Bank US Holding Company, nor its subsidiaries or affiliates, is responsible for the content of third party sites hyper-linked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites.

Third party sites may have different Privacy and Security policies than TD Bank US Holding Company. You should review the Privacy and Security policies of any third party website before you provide personal or confidential information.

©2016 Visa U.S.A. Inc.

International Resource Center

Frequently Asked Questions

Collapse payments, how do i make a payment to a recipient overseas.

There are two main methods: sending an international wire transfer or purchasing a foreign draft. International wire transfers are typically sent out over an international communications system known as SWIFT, and settlement is arranged between individual banks. A foreign draft is like a cashiers check in local currency drawn on an account maintained by TD Bank.

What is SWIFT?

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) is an industry-owned co-operative providing secure, standardized messaging services and interface software to over 8,000 financial institutions in 200 countries and territories. The SWIFT community includes banks, broker-dealers and investment managers.

What is the fastest method for making an international payment?

A wire transfer is more efficient than a foreign draft as funds are made available sooner. To complete a wire transfer, you must know the banking information of your recipient.

Is sending U.S. dollars the best way to send a payment to an overseas beneficiary?

Generally, it may be beneficial to send your payment in the local currency of the beneficiary (e.g., Pounds Sterling for the United Kingdom). U.S. Dollars sent to an account in a foreign currency will take longer and incur higher bank charges than if you send the local currency.

What is an IBAN?

As Europe is moving to the Single Euro Payments Area (SEPA), the European Union (EU) – as well as Norway, Iceland, Liechtenstein and Switzerland – have made a series of regulatory changes designed to improve straight-through processing of payments and reduce costs.

A key element of this transition is the introduction of the International Bank Account Number, or IBAN – the new domestic account number standard for all retail and commercial banking accounts in the EU. IBANs are assigned by the European banks to their corporate customers and can be found on invoices and/or settlement instructions you receive from your counterparties.

The IBAN consists of up to 34 alphanumeric characters: two characters are used to identify the country in which the counterparty's account resides; two characters are used for check digit verification; and the rest identify the account holding bank and the counterparty's account number.

Why do I need to use the IBAN?

Your wire payments can still be made without an IBAN, but you should ask your European beneficiaries for it and supply it to us with the payment details. Your beneficiaries will be familiar with the request.

Failure to provide the IBAN reduces the opportunity to process the payment straight-through (STP), which may subject you to additional repair charges, and could result in return of the payment.

Who do I contact to arrange a wire transfer in a foreign currency or get a foreign draft?

Your local TD Bank store can assist you with arranging a wire transfer in a foreign currency or obtaining a foreign draft.

What information should I provide to the originator of a foreign (non-U.S. Dollar) wire payment in order to get the money into my account at TD Bank?

Incoming Foreign Currency Wire Payment Instructions

- Correspondent Bank SWIFT Code: TDOMCATTTOR

- Correspondent Bank Name: The Toronto-Dominion Bank, Toronto, Ontario, Canada

- For Further credit to: TD Bank, Store Address: Street, City, State, Country

- In Favor of Beneficiary Account Number: Your TD Bank account number as it appears on your statement

- In favor of Beneficiary Full Name and Full Address: Your name and address as it appears on your TD Bank account statement

Will TD Bank continue to offer international wires? I heard there was a new regulation and that some banks will no longer offer international wire transfer services.

TD Bank will continue to offer international wires.

About the Dodd-Frank Remittance Transfer Regulation The Consumer Financial Protection Bureau has issued new rules to protect consumers who send funds electronically to foreign countries. This rule, known as Dodd-Frank Remittance Transfer is effective as of October 28, 2013, and is intended to provide customers who send international wire transfers more complete information about fees and foreign exchange rates associated with the international wire transfer, as well as disclosure of the date when funds will be made available to the receiving party. The rule also addressed customers' rights in terms of investigation of international wire transfers who may have encountered an issue in the initiation or processing of the international wire transfer. TD Bank, NA, is prepared to comply with the requirements of this new regulation.

When I deposit a check drawn on a bank outside the U.S., how is it cleared?

TD Bank can clear overseas checks in a variety of foreign currencies and U.S. Dollars using TD Bank's network of correspondent banking relationships. Some checks are eligible for immediate provisional credit – until it is finally settled by the issuing bank – while some items must be sent out on "collection" for final payment. Collection items can take some time before payment is settled.

When I travel overseas, how would I make payments for purchases?

Before you leave the country, if you are a TD Bank Customer, you may order foreign currency from your local TD Bank store. While traveling, you can also use your credit card or your TD Bank Visa ® Debit Card to make purchases or to get cash at an ATM.

Expand Global Trade Finance

What are my payment options for doing business overseas.

There are four main options: payment in advance, letter of credit, documentary collection or open account.

Payment in advance is the least risky for a seller in that you receive payment prior to shipping goods and assume no financing costs. However, many buyers won't want to pay in advance.

A letter of credit is one of the safest ways to get paid by overseas customers in that your bank is assuring payment, but, as a buyer, it is the equivalent of a loan for which you must apply.

With documentary collection, payment becomes due when your customer accepts ownership of your goods. Your bank acts as an agent for buyers and sellers, in that the bank maintains control of the title documents, but it does not contain an assurance of payment by the bank.

Open account is the same as in domestic trade in that a seller agrees to grant a buyer "credit" and the buyer agrees to make payment once the conditions of the sale are met. It has the highest risk of non-payment for a seller.

Deciding on which option to use can be complex and involve many different factors. Please contact a TD Bank Global Trade Finance representative at 800-937-8226 to find out which option is best for you.

How do I obtain a letter of credit (import/standby) from TD Bank?

Import and standby letters of credit are an extension of credit, like a loan. The bank must make a decision to grant you credit, just as they would for any commercial loan. For small businesses, you need to begin the process by talking to the banking and business development officer at your local TD Bank store; larger corporations should speak with a commercial lending officer. The seller normally provides the specific details of the letter of credit, and you would use that information to complete our commercial letter of credit application or standby letter of credit application . The completed application is processed by the TD Bank Global Trade Finance department once the lending authority at the bank has approved the extension of credit to you.

Can the importer complete the import letter of credit application online?

Yes. Customers who regularly require letters of credit may utilize our online trade services system, TD Bank Trade. View our TD Bank Trade information online and/or call TD Bank Global Trade Finance at 800-937-8226 for more details.

Can the exporter receive the advice of the letter of credit online?

TD Bank Customers may receive the advice of a letter of credit online when they use our online trade services system, TD Bank Trade. Call TD Bank Global Trade Finance at 800-937-8226 for more details.

Can the importer request the letter of credit be issued in the seller's local currency?

Yes. While many countries, such as China, Taiwan and South Korea prefer U.S. currency, others prefer local currency. TD Bank can easily issue a letter of credit in either the local currency or U.S. Dollars.

Can the exporter's letter of credit be made out to be in the local currency of the buyer?

Yes. This is a good way for the seller to remain competitive and to maintain control of the export sale.

What is a standby letter of credit and how is it used?

A standby letter of credit is an obligation of the issuing bank to make payment to the designated beneficiary, contingent on whether the bank's customer fails to perform as called for under the terms of a contract.

The standby letter of credit is issued based on the creditworthiness of the borrower, with an evaluation of credit similar to that for a commercial loan. They are issued by banks for a variety of purposes, including standing behind monetary obligations, insuring the refund of advance payment, supporting performance and bid obligations and insuring the completion of a contract.

Expand Foreign Exchange

How can i get foreign currency for a trip i am taking abroad.

Visit TD Bank to exchange over 75 foreign currencies before you go abroad to avoid higher exchange rates and unexpected fees while traveling. Major currencies are available on the spot at select TD Bank locations and others can be ordered for pickup within two business days. You can also exchange any unspent foreign currency banknotes when you return from your trip. Visit your local TD Bank or call Customer Service at 1-888-751-9000 for more information on foreign currency exchange.

Can I order foreign currency online?

At this time, we do not have online ordering capability for foreign currency. However, if you are a TD Bank Customer, you may visit a local TD Bank store to place an order and then pick up within two business days.

Can I use my TD Bank Visa Debit Card at a bank overseas to obtain local currency?

Yes. Due to security risks, use of your ATM or Visa Debit Card may be restricted in certain countries.

Can I trade foreign currency online with TD Bank?

Yes. TD Bank offers TDFX, our online trading platform for corporations to buy and sell foreign currency spot, forward and for variable date forwards. Learn more about TDFX online , Email [email protected] for more details.

Does TD Bank offer deposit accounts in foreign currencies?

Yes. TD Bank offers foreign currency accounts in a number of currencies, primarily for commercial depositors. Please call representative at your commercial banker to learn more about this product. Don't have one? Call 1-888-388-0408 or schedule an appointment .

Are there techniques that I can use to protect myself from the risk of currency fluctuations when buying or selling products overseas?

TD Bank's Corporate Foreign Exchange team offers a full complement of foreign exchange products and services and risk management tools, including forwards, options, swaps and blended products. Call your commercial banker to find out how we can help you compete in the global marketplace. Don't have one? Call 1-888-388-0408 or schedule an appointment .

Learn more about these other topics:

Foreign Exchange Services | International Services | International Payments | Global Trade Finance Online Services | Resource Center -->

Call one of our representatives:

- Commercial Foreign Exchange: 1-888-388-0408

- Retail Foreign Exchange: 1-888-751-9000

- Global Trade Finance: 1-800-937-8226, option 2

© 2014 Visa U.S.A. Inc.

- ABM Locator

- Savings Account

- Tax-Free Savings Account

- Retirement Savings Account

- Retirement Income Fund Savings Account

- US$ Savings Account

- Children’s Savings Account

- View All Savings Accounts

- Looking for Guaranteed Investments (GICs)?

- No-Fee Daily Chequing Account

Credit Cards

- World Mastercard®

- Money-Back Credit Card

- Compare Credit Cards

- Guaranteed Investment (GICs)

- Mutual Fund Investments

- Tax-Free Savings Account (TFSA)

- Retirement Savings Plan (RSP)

- Retirement Income Fund (RIF)

- Non-Registered Investment

- Home Equity Line of Credit

- Line of Credit

- View All Borrowing Options

- Learning Centre | The Juice

- Money Management Tools

- Help Centre

- Business Savings Account

- US$ Business Savings Account

- Business Guaranteed Investment

- US$ Business Guaranteed Investment

- Learning Centre - The Juice

- Retirement Savings Account (RSP)

- Retirement Income Fund Savings Account (RIF)

- View All Borrowing Solutions

- Learning Centre

- Money-back Credit Card

- Guaranteed Investments (GIC)

- US$ Guaranteed Investments (GIC)

How to protect your money when you travel

August 11, 2023

Written by Barry Choi

Written by Barry Choi

Key takeaways

Be cautious of any calls or websites offering free or deeply discounted travel deals.

Keep the contents of your travel wallet to a minimum.

Never travel out of country without having a travel medical policy in place.

Article content

- Things to do before you take off

Get your cards ready for travel

Beware of your surroundings, the final word.

Yet when something goes wrong, it can also be a nerve-racking experience. When we travel it's easy to let our guards down, making tourists an easy target for thieves and pickpockets. There's no worse feeling than having your finances compromised when you're away from home.

Follow these tips, and your money will be better protected wherever you travel.

Things to do before you take off

Beware of deals: Some travel scams happen before you even depart. Be cautious of any calls or websites offering free or deeply discounted travel deals. It's recommended to only book with reputable sites or through a professional travel agent. Remember, if a deal looks too good to be true, it probably is.

Empty your wallet : When travelling, it's best to keep the contents of your wallet to a minimum. I suggest just one credit card, your debit card, a single piece of ID, and a little bit of cash. There's no need to carry non-essential cards, or items such as your Social Insurance Number or birth certificate.

Get travel insurance: The cost of medical attention outside Canada can be expensive, so never travel out of country without having a travel medical policy in place. Fortunately many employers and credit card providers offer a comprehensive package as a standard benefit , but you'll want to read the details of the policy. If you're not covered, you can purchase your own policy which is usually reasonably priced.

Make copies of your documents: You'll want to write down or take photos of all your important documents, including your passport, travel itinerary, insurance policies and the contact numbers for your debit and credit card providers. Email this information to someone you trust and yourself so you have everything available in case of an emergency.

Inform your debit and credit card providers: Thanks to increased security measures with debit and credit cards, the major banks no longer require you to alert them of your travel plans. However, if your credit card is issued by a different provider, it's still a good idea to let them know that you'll be away so your cards don't get blocked.

Bring an extra credit card: It's always a smart move to bring another credit card just in case your main one gets lost or stolen. Keep that secondary card somewhere secure, such as in your hotel safe. Never carry both of your credit cards in your wallet at the same time.

When to use it: While travelling, your credit card's built-in benefits, such as extended warranty and purchase protection, can offer additional peace of mind.

Watch out for suspicious ABMs: Check with your bank about any partner ABM networks that you can use while travelling. You can also check with VISA and Mastercard for their partner ABMs. You'll want to avoid individual machines, which may not be as secure or may charge you a higher exchange rate. Don't forget to always cover the keypad when entering your PIN.

Look up common scams: In many places around the world, there are some common scams you should look out for. Broken taxi meters, “free" religious items or bracelets, and spills on your clothing are just a few ways scammers try to get at your money. Always research local scams before you depart.

Keep an eye on your valuables: Pickpockets lurk in many major cities, so don't make yourself an easy target. Never leave your bag unattended, not even for a second. Whenever you're on public transportation or in a crowded space, keep your valuables close.

No matter how prepared you are, there's still a chance that you may become a victim. Just prepare as best you can and don't let thieves ruin your travels.

Travelling can be a thrilling experience — whether you're venturing abroad or into your own backyard, there's nothing more exciting than exploring someplace new.

Things to do before you take off

Make copies of your documents: You'll want to write down or take photos of all your important documents, including your passport, travel itinerary, insurance policies and the contact numbers for your debit and credit card providers. Email this information to someone you trust and yourself so you have everything available in case of an emergency.

When to use it: While travelling, your credit card's built-in benefits, such as extended warranty and purchase protection, can offer additional peace of mind.

Watch out for suspicious ABMs: Check with your bank about any partner ABM networks that you can use while travelling. You can also check with VISA and Mastercard for their partner ABMs. You'll want to avoid individual machines, which may not be as secure or may charge you a higher exchange rate. Don't forget to always cover the keypad when entering your PIN.

Look up common scams: In many places around the world, there are some common scams you should look out for. Broken taxi meters, “free" religious items or bracelets, and spills on your clothing are just a few ways scammers try to get at your money. Always research local scams before you depart.

Keep an eye on your valuables: Pickpockets lurk in many major cities, so don't make yourself an easy target. Never leave your bag unattended, not even for a second. Whenever you're on public transportation or in a crowded space, keep your valuables close.

If you liked it, why not share?

Legal stuff.

This article or video (the “Content”), as applicable, is provided by independent third parties that are not affiliated with Tangerine Bank or any of its affiliates. Tangerine Bank and its affiliates neither endorse or approve nor are liable for any third party Content, or investment or financial loss arising from any use of such Content.

The Content is provided for general information and educational purposes only, is not intended to be relied upon as, or provide, personal financial, tax or investment advice and does not take into account the specific objectives, personal, financial, legal or tax situation, or particular circumstances and needs of any specific person. No information contained in the Content constitutes, or should be construed as, a recommendation, offer or solicitation by Tangerine to buy, hold or sell any security, financial product or instrument discussed therein or to follow any particular investment or financial strategy. In making your financial and investment decisions, you will consult with and rely upon your own advisors and will seek your own professional advice regarding the appropriateness of implementing strategies before taking action. Any information, data, opinions, views, advice, recommendations or other content provided by any third party are solely those of such third party and not of Tangerine Bank or its affiliates, and Tangerine Bank and its affiliates accept no liability in respect thereof and do not guarantee the accuracy or reliability of any information in the third party Content. Any information contained in the Content, including information related to interest rates, market conditions, tax rules, and other investment factors, is subject to change without notice, and neither Tangerine Bank nor its affiliates are responsible for updating this information.

Tangerine Investment Funds are managed by 1832 Asset Management L.P. and are only available by opening an Investment Fund Account with Tangerine Investment Funds Limited. These firms are wholly owned subsidiaries of The Bank of Nova Scotia. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

This article or video (the “Content”), as applicable, is provided by independent third parties that are not affiliated with Tangerine Bank or any of its affiliates. Tangerine Bank and its affiliates neither endorse or approve nor are liable for any third party Content, or investment or financial loss arising from any use of such Content.

The Content is provided for general information and educational purposes only, is not intended to be relied upon as, or provide, personal financial, tax or investment advice and does not take into account the specific objectives, personal, financial, legal or tax situation, or particular circumstances and needs of any specific person. No information contained in the Content constitutes, or should be construed as, a recommendation, offer or solicitation by Tangerine to buy, hold or sell any security, financial product or instrument discussed therein or to follow any particular investment or financial strategy. In making your financial and investment decisions, you will consult with and rely upon your own advisors and will seek your own professional advice regarding the appropriateness of implementing strategies before taking action. Any information, data, opinions, views, advice, recommendations or other content provided by any third party are solely those of such third party and not of Tangerine Bank or its affiliates, and Tangerine Bank and its affiliates accept no liability in respect thereof and do not guarantee the accuracy or reliability of any information in the third party Content. Any information contained in the Content, including information related to interest rates, market conditions, tax rules, and other investment factors, is subject to change without notice, and neither Tangerine Bank nor its affiliates are responsible for updating this information.

Tangerine Investment Funds are managed by 1832 Asset Management L.P. and are only available by opening an Investment Fund Account with Tangerine Investment Funds Limited. These firms are wholly owned subsidiaries of The Bank of Nova Scotia. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

Please turn on JavaScript in your browser It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Do i need to notify a credit card company when traveling.

If you have planned travel coming up, alerting your credit card issuers about your vacation plans can help to ensure that your charges aren't declined when you arrive. Here's how you can prepare yourself and your credit card for your next trip.

What is a credit card travel notice?

A travel notice is an alert to your credit card issuer that you'll be going on a trip to a different location. By giving this notice in advance, you're letting your credit card company know that you may be making charges from a different state or country.

Why should you notify your credit card company of travel?

Credit card companies check cardholders' accounts for any unusual or suspicious activity when a transaction occurs. If your company sees a charge from a location away from home, your issuer may think this is suspicious activity and decline the charge. If you're visiting a country or location where fraudulent charges occur more often, the chances of your credit card getting declined are higher when you don't alert your credit card issuer about your travel.

Do you need to notify your credit card company?

You're not required to notify your credit card company when you're going away on vacation, but it is highly recommended. By letting your credit card company know where you're going and for how long, your company will know that any card transactions from that location were likely authorized by you. Check with your credit card issuer to see if they have travel notification capabilities.

Traveling outside your city

If you're traveling to an area not far from home, it's unlikely that any credit card charges will be declined, so setting a travel notification may not be a necessity.

Traveling outside your state

As you travel further from home, the chance of charges being declined is higher. If you're visiting another state, you can notify your credit card company that you're going away to avoid any hassles as you travel.

Traveling outside your country

You should definitely consider filing a travel notice for every trip outside your country. If you don't file a travel alert with your card issuer, your credit card may get declined and you might need to contact your credit card company to approve your transactions. If you're in a different country you may have trouble with making an international call, an inconvenience that can prevent you from authorizing your charge and enjoying your trip.

Which credit cards require a travel notice?

Not all credit card companies recommend that you set a travel notice before you go away, including those with EMV chips that may provide added security when you travel. If your credit card doesn't have an EMV chip, you should contact your bank before you leave to make sure your trip goes smoothly.

Multiple credit cards

If you own multiple credit cards, you should set travel notifications for each of the cards you plan to use on vacation. Even if you plan to use one of the cards only in case of emergency, set a travel alert for it just in case.

Risks of not filing a credit card travel notice

If you don't give your credit card issuer a travel notice, the company won't know that you'll be making purchases in a new location. If the company starts to see charges on your credit card from a different state or country, it may flag these transactions as fraud. The credit card issuer may then put your account on hold and prevent you from making any purchases until you can authorize the charges.

Once a credit card is declined, the cardholder has to call the issuer or provide an app verification in order to prove that the purchase made was authorized. You may have difficulties contacting your bank for various reasons, such as if your vacation spot has bad cell service or if you didn't set up international calling for your phone plan. Notifying your credit card company before you leave on vacation will help you avoid this hassle.

How to notify your credit card company of travel

You can notify your credit card issuer about your vacation over the phone, online, through a mobile app or in person. You can also contact your credit card issuer to get a better understanding of how to set a travel notice.

Setting your travel notice online or through a mobile app

Setting your travel notification online or through an app can be easier than speaking with customer service, depending on your preferences. Log into your account on your credit card company's website or app and search for “travel notice" options. If you're unable to find where to set your travel notice, get in contact with your credit card issuer.

Setting your travel notice over the phone or in-person

To set a travel alert for your credit card over the phone, call the number on the back of your card to get in touch with your bank. The customer service line will either let you speak to a representative on the phone or work with an automated system. If you have any questions or concerns about your travel notice, calling your credit card company is a good method to set the notification.

If you want to set your travel notice in person, go to your nearest branch to meet with a representative. Meeting face-to-face gives you the chance to ask any questions you might have.

Chase Sapphire is an official partner of the PGA Championship .

- card travel tips

- credit card benefits

What to read next

Rewards and benefits frequent flyer programs: a guide.

Frequent flyer programs offer a variety of perks. Learn more about what frequent flyer programs are and what to consider when choosing one.

rewards and benefits Are frequent flyer credit cards worth it?

Frequent flyer credit cards help frequent flyers earn and redeem points or miles towards the cost of their future travel plans. Learn more about their risks and rewards.

rewards and benefits Chase Sapphire Events at Miami Art Week

Learn about the exclusive events a Chase Sapphire Reserve cardmember can experience at Miami Art Week.

rewards and benefits How to choose a credit card to earn travel points

There are many things to consider when choosing a credit card with travel points - how travel points work, how to earn them, and so on. Learn more here.

- Security and Fraud Protection

Tell Us Your Travel Plans to Avoid Declined Transactions

: Avoid the hassle of denied transactions due to suspicious activity. Notify TDECU of your upcoming travel plans through Online/Mobile Banking.

Let TDECU know when you travel

Sometimes, these calculations can flag transactions that are legitimate. This occurs more often when you travel. However, there are steps you can take to avoid blocked transactions while keeping your accounts secure.

Most of us share our exciting travel plans on social media, so why not take a moment to share your travel plans with TDECU to avoid the hassle of a denied transaction! We need two pieces of information:

- Your travel destination

- The dates you will be there

TDECU will place notes on your debit or credit card so your transactions will not be interrupted during your trip. You can message us in Online/Mobile Banking or call the number on the back of your card to set up your travel notification for your TDECU credit card or debit card.

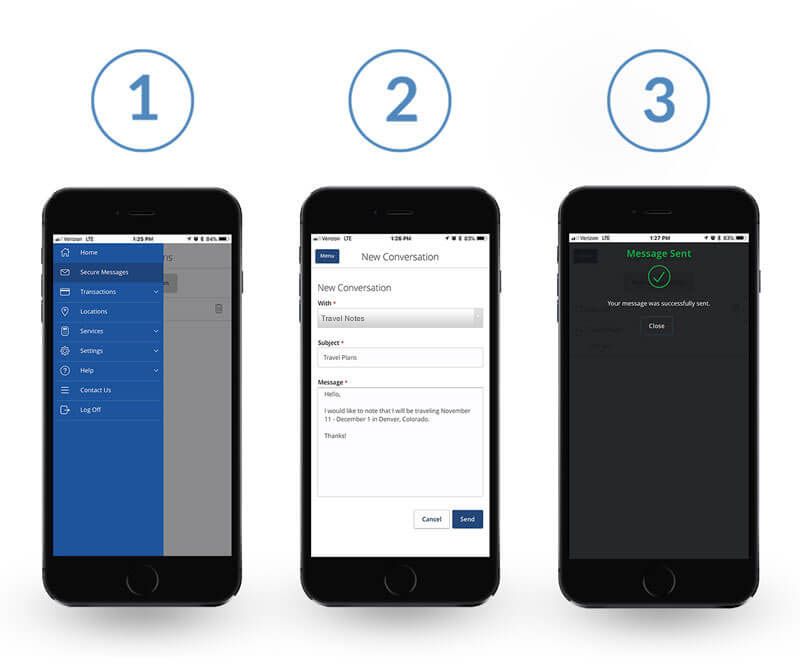

Message us in Online or Mobile Banking

- Log in to Online Banking or open the TDECU Mobile Banking app .

- Select Secure Messages from the menu.

- Select New Conversation .

- Select Travel Notes in the dropdown menu.

- Enter your subject line and message . Be sure to include your travel destination and the dates of your trip .

- Select send .

- You’re done! Member Care will confirm by messaging you back within one business day.

Alternatively, you can call the number on the back of your card to inform us of your travel.

Enjoy your trip

It’s that easy to add travel notes to your debit or credit card accounts! Now you can rest easy knowing you can use your cards as needed when you travel.

You are now leaving TDECU’s website.

We only link to sites that we feel will be valuable to our members, but we have no control over these external sites. TDECU does not provide, and is not responsible for, the product, service, overall website content, security, or privacy policies on any external third-party sites.

If you find that there is anything we should be aware of on the site you are visiting, please let us know.

Do you want to continue to ?

How to Set a Travel Notice for Your Credit Cards

Susan Shain

Susan is a freelance writer who specializes in turning complex financial topics into engaging and accessible articles. She's been writing about personal finance for six years, and was previously the senior writer at The Penny Hoarder and a staff writer at Student Loan Hero. Her personal finance writing has also appeared in publications like MarketWatch and Lifehacker.

When I worked at a ski rental shop in Breckenridge, Colorado, I witnessed many international (and some out-of-state) customers’ credit cards get declined.

Not because their credit limits were too low or because they were purchasing too much — but because they failed to set up travel notifications with their card issuers.

So now, any time I travel to a foreign country, I always set up a travel notice on my credit card beforehand.

Since I travel with the Chase Sapphire Reserve® (Review), I create a Chase travel notice, but you can take this step with most major credit or debit cards. Here’s how.

What Is a Credit Card Travel Notice?

As a way to prevent fraud , your credit card issuer monitors your spending activity. If it notices a suspicious purchase — in an unusually large amount, or from a new location — it may decline the transaction. This could be more likely in countries where fraud is a bigger problem.

Which is why the answer to the question “Should I notify my credit card company when traveling?” is usually yes.

Although you can often get away with shopping in another state without triggering a red flag, international travel is another story.

By notifying your credit card of your travel plans, you’ll reduce the chances of getting your transaction declined in the checkout line — which, trust me, is never fun — and having to call your card issuer to verify your purchases. It’s still possible to have your purchases declined after setting a travel notice, but it’s much less likely.

How to Set Up Travel Notices for 8 Major Credit Card Issuers

Ready to create your first travel alert? While you could call your card issuer, it’s easier to do it online.

Here’s how to set up travel notices with eight different credit card issuers.

When you visit MoneyTips, we want you to know that you can trust what’s in front of you. We are an authoritative source of accurate and relevant financial guidance. When MoneyTips content contains a link to partner or sponsor affiliated content, we’ll clearly indicate where that happens. Any opinions, analyses, reviews or recommendations expressed in our content are of the author alone, and have not been reviewed, approved or otherwise endorsed by the advertiser.

We make every effort to provide up-to-date information; however, we do not guarantee the accuracy of the information presented. Consumers should verify terms and conditions with the institution providing the products. Some articles may contain sponsored content, content about affiliated entities or content about clients in the network. While reasonable efforts are made to maintain accurate information, the information is presented without warranty.

Chase travel notice

Because of the company’s abundant travel perks and partnership with the Visa network — which is widely accepted worldwide — Chase cards are a favorite among globetrotters.

You can create Chase travel notifications up to a year in advance for credit cards, and up to 14 days for debit cards. Your travel dates can span an entire year — if you’re away for longer, you’ll simply have to adjust your dates once you’re on the road. Chase will have your request on file within 24 hours from the time you submit.

To set up Chase travel notifications, you’ll need to log in to your account and click on the credit card you plan to use. Under the “Things you can do” dropdown menu on the right, you’ll see the “Travel notification” option. That will take you to your “Profile & Settings” page, where you’ll be able to create a travel alert.

Insider tip

Depending on the type of Chase account you have, the process may be slightly different for you. In any case, just look for your “Profile & Settings” page, and then look for a button to set a travel notice.

Alternatively, if you’re already outside the country, you can call Chase collect at 1-302-594-8200 to alert the issuer of your travel plans.

Setting up a travel notice with the Chase bank app

After logging in to the Chase mobile app, tap the profile icon (this should appear as the outline of a person) and select “My settings.” Choose “Travel” within the settings menu and tap “Update” near any credit or debit card products you’ll be taking.

This will allow you to enter the details for your upcoming trip, which can be edited at a later time. Saving this information will successfully set up a travel notice.

Our favorite Chase travel card: While many Chase credit cards are adventure-ready, we’d recommend the Chase Sapphire Preferred® Card for new travelers. Not only does it earn 2X Chase Ultimate Rewards points per dollar on travel, but you’ll also get a great introductory bonus: 60,000 bonus points after spending $4,000 on purchases in the first 3 months. You’ll also earn 5X Ultimate Rewards points per dollar on Lyft rides and travel purchased through Chase Ultimate Rewards. You can transfer the points you earn to a variety of airline and hotel loyalty programs. The Sapphire Preferred has a $95 annual fee.

American Express travel notice

Surprise! You actually can’t create an Amex travel notice.

On its site, the issuer says it uses “industry-leading fraud detection capabilities” that help it recognize when you’re on the road, thereby eliminating the need to create an American Express travel notification.

The issuer does recommend you update your contact information, so it can reach you in case of any complications, and download the Amex app, so you can manage your account on the go.

Note that Amex credit cards aren’t as widely accepted across the globe. If you’re a frequent international traveler, we’d recommend looking for a card with a Visa or Mastercard logo instead because they’re accepted by most merchants.

Our favorite American Express travel card: For its $695 Rates & Fees annual fee, The Platinum Card® from American Express offers a slew of travel perks. They include extensive airport lounge access; 5X Membership Rewards points per dollar on eligible flights and hotels (starting 1/1/21, on up to $500,000 spent per calendar year); and up to $200 in Uber credits per year. Its introductory bonus is Earn 100,000 Membership Rewards® points after you spend $6,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card®, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu..

Capital One travel notice

As with Amex, there’s no need to set a travel notice for Capital One credit cards.

If you log in and click “Set Travel Notification,” you’ll be greeted by this window:

The issuer, long popular with international travelers for its lack of foreign transaction fees, says: “With the added security of your Capital One chip card, travel notifications are no longer needed on your credit card.”

It notes Capital One will cover you with its $0 fraud liability policy, and will also be on the lookout for any suspicious activity.

Our favorite Capital One travel card: The Capital One Venture Rewards Credit Card is a fantastic, easy-to-use travel rewards card, offering 2X Venture miles per dollar on everything. The introductory bonus is 60,000 bonus miles for spending $3,000 in the first 3 months. It comes with a $95 annual fee.

Bank of America travel notice

Ready to travel with your Bank of America card? Log in to your account, and in the menu at the top right, you’ll see “Help & Support.”

Hover over those words, and a drop-down menu will appear. Click on “Set Travel Notice” — and voila! You’ll be able to add your travel dates and destinations, as well as extra details about your trip, like any planned layovers.

Setting a travel notice with Bank of America.

Bank of America cards allow you to set travel notices up to 60 days in advance, and they can last for up to 90 days. If you’ll be traveling longer than that you’ll need to adjust your travel notice later on.

Our favorite Bank of America travel credit card: If you don’t want to pay an annual fee, the Bank of America® Travel Rewards Credit Card might work for you. You’ll earn 3X points per dollar at the Bank of America travel center and 1.5X points on everything else. After you make $1,000 in purchases in the first 90 days, you’ll earn 25,000 points — enough for a $250 statement credit toward travel purchases.

Citi travel notice

If you have a Citi credit card, the first step is to log in to your account.

Then you should hover over the “Services” button in the menu, and then select “Travel Services.” Next you can select “Manage Travel Notices,” before selecting the card for which you want to set a notice. Unlike some other issuers, you’ll need to set a separate notice for each card you plan to travel with.

Citi advises making sure your contact information is up to date before traveling, and also to download the Citi Mobile App to more easily monitor your account.

Here’s what setting a Citi travel notice looks like:

Setting a travel notice with Citi.

Then, once you fill out your destination and dates and verify your info, you’ll be good to go!

Our favorite Citi travel credit card: The offers a generous 3X ThankYou points per dollar on air travel and at gas stations, restaurants, supermarkets, and hotels. You can earn None. There’s a None annual fee to pay for this card.

Discover travel notice

Although Discover credit cards aren’t the best for traveling internationally, as they aren’t accepted as widely as Visa or Mastercard, you should still set up a travel notice if you bring your Discover card overseas.

You can do this from your online account by selecting “Manage” at the top of your screen, then clicking “Manage Cards” and then “Register Travel.”

Setting a travel notice with Discover.

Our favorite Discover travel card: For a card with no annual fee, the Discover it® Miles isn’t a bad choice. You’ll get 1.5X miles per dollar spent on everything, with double your miles at the end of your first cardholder year.

PNC travel notice

If you have a PNC credit or debit card, the bank recommends you set up a travel notice, explaining: “You typically use your card at local merchants and online, but suddenly you’re buying tapas in Madrid or sushi in Tokyo. This unexpected activity is what triggers the alert. Although less likely, this kind of predicament also can happen when traveling domestically.”

To notify PNC, you can either call the financial institution at 1-888-PNC-BANK or set up an alert online. After logging in to your account, you’ll select: “Customer Service” –> “Account Services” –> “Debit/ATM Card Services” –> “Edit/View Preferences.”

Then, in the bottom right corner of your screen, you’ll see an option to “Notify PNC of Foreign Travel.” After filling it out with your dates, destinations, and phone number, you’ll be ready to go.

Recommended PNC travel credit card: Like the BofA card, the PNC Premier Traveler® Visa Signature® isn’t the best option out there — but it’s fine for PNC loyalists. It offers a 30,000-mile introductory bonus when you spend $3,000 in the first three billing cycles, and 2X miles per dollar spent on everything. Its $85 annual fee is waived the first year.

Wells Fargo travel notice

If you’d like to tell Wells Fargo of your travel plans, you can either call the number on the back of your card, use the bank’s mobile app, or log in to your online account.

If you choose the latter method, you’ll hover over the “Accounts” dropdown menu, then click on “Manage Cards” –> “Manage Travel Plans.” As with the other issuers, you’ll enter your dates and destinations before submitting.

Recommended Wells Fargo travel credit card: There aren’t any Wells Fargo travel cards at the moment.

If you’d prefer a Visa card from Wells Fargo for traveling, consider the Wells Fargo Active Cash℠ Card . It offers 2% cash back on everything you buy, with a solid introductory bonus, but it also has a foreign transaction fee.

4 Things to Consider When Choosing a Travel Credit Card

If you’re looking for another piece of plastic to add to your wallet, here are four things to consider when choosing the best travel rewards credit card:

- Foreign transaction fees: Some credit cards charge a 3% fee for making purchases in a foreign currency. If you plan to travel abroad, make sure your chosen card has no foreign transaction fees.

- Annual fees: Many of the top-tier travel rewards credit cards have hefty annual fees. But before getting scared off, see if the card offers any credits or benifits that offset it. For example, while the Chase Sapphire Reserve® has a $550 annual fee, it also offers a $300 annual travel credit that applies toward flights, car rentals, and even Lyft rides.

- Rewards and perks: One of the most compelling reasons to get a travel credit card is the opportunity to earn points and miles that you can exchange for free travel. So take a look at your potential card’s introductory bonus and earning ability. You should also read the fine print to learn all about its travel perks, which might include airport lounge access or travel insurance.

- Loyalty programs: The majority of hotel chains and airlines have co-branded cards that earn additional rewards when you spend money with them. So if you are loyal to a particular brand, it’s wise to consider the co-branded options. For hotel cards, examples include the IHG® Rewards Club Premier Credit Card, Marriott Bonvoy Boundless™ Credit Card, and The World of Hyatt Credit Card. For airline cards, you can choose from options like the United℠ Explorer Card or Southwest Rapid Rewards® Plus Credit Card.

Whichever card you choose, be sure to set a travel notice before you board your next train or cruise or flight — and then enjoy your vacation free of worries!

You don’t have to stick to “travel credit cards” just because you want to, you know, travel with your credit card. As long as you set up a travel notification when you go, you can use any card you’d like. So, in case they’re a better fit, here are links to the best cash back, balance transfer, and 0% intro APR credit cards.

Share Article

On This Page Jump to Close

You should also check out….

- Find a Branch

- Schwab Brokerage 800-435-4000

- Schwab Password Reset 800-780-2755

- Schwab Bank 888-403-9000

- Schwab Intelligent Portfolios® 855-694-5208

- Schwab Trading Services 888-245-6864

- Workplace Retirement Plans 800-724-7526

... More ways to contact Schwab

Chat

- Schwab International

- Schwab Advisor Services™

- Schwab Intelligent Portfolios®

- Schwab Alliance

- Schwab Charitable™

- Retirement Plan Center

- Equity Awards Center®

- Learning Quest® 529

- Mortgage & HELOC

- Charles Schwab Investment Management (CSIM)

- Portfolio Management Services

- Open an Account

How to manage your Schwab Bank Visa® Platinum Debit Card

Transcript of the video:

Upbeat music plays throughout

Video Introduction Plays

Narrator: You can easily manage your Schwab debit card online.

Screen fades to Schwab Homepage.

Narrator: To begin, click Support and select Debit Cards & Checks.

Mouse clicks Support, then clicks on Debit Cards & Checks.

Narrator: From this page, you can choose from several options to manage your debit card. For Schwab Bank debit cards, features include setting debit card alerts, giving travel notices, replacing a card and more. Please note that some of these features and services may not be available on the Schwab One brokerage debit card. For this tutorial, we'll be focused on managing a Schwab Bank debit card. Let's begin by setting debit card alerts. Select Debit Card Alerts.

Mouse clicks on Debit Card Alerts.

Narrator: Scroll to the Banking and Debit Card section and click the drop-down arrow to expand the panel.

Mouse scrolls to the bottom of the page and clicks on the arrow in the Banking and Debit Card box.

Narrator: Here, you'll find several alert options to choose from. For each account and issued debit card, you can select how you would like to receive alerts as well as the type of activity you would like to be alerted for. If you're noticing that one or more alert delivery methods are disabled, this means that you haven't verified that delivery method. To fix this, scroll up and click Profile. Then select Alerts, click on Delivery Options, and follow the instructions shown on screen.

Mouse scrolls to the top and clicks on Profile. Mouse elects Alerts. Mouse selects Delivery Options.

Screen fades back to Manage Cards and Checks page.

Narrator: To give a travel notice, select Travel Notices from the bottom left corner of the debit card panel.

Mouse clicks on Travel Notices.

Narrator: From this drop down, select Add Travel Notice and fill out relevant details that appear on your screen. Once you're done, you can submit your travel notice by clicking Add Travel Notice.

Mouse clicks on Add Travel Notice and fills out the form, then clicks on Add Travel Notice.

Narrator: To replace the debit card, select Replace Debit Card from the right side of the debit card panel.

Mouse clicks on Replace Debit Card.

Narrator: From this page, select the card you wish to replace, the reason for replacing your card, choose your desired mailing address, and click request card. In a rush? You can expedite the delivery of your card by opting for expedited shipping. Mouse clicks on debit card, selects Card expiring and selects Expedited Shipping.

Narrator: Though this option may not be available depending on the reason you've chosen.

Mouse clicks on Replace Card.

Video outro plays.

Manage your Schwab Bank Debit Card online, set alerts, provide travel notices and more.

Manage Cards & Checks

Related Content

- How to automatically invest in mutual funds

- How to buy Treasuries

- How to add and manage an authorized user

Please enter a valid email address

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The subject line of the email you send will be "Fidelity.com: "

Your email has been sent.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Clicking a link will open a new window.

- Default text size A

- Larger text size A

- Largest text size A

Travel notifications

Travel notifications may prevent you from encountering issues while using your Fidelity ® Debit Card during your travels. Letting us know your travel plans, whether domestic or international, helps reduce the likelihood of authorized debit card transactions being declined when traveling. We monitor your activity 24/7 and decline transactions that do not appear to belong to you.

What we'll cover

Placing a travel notification Advanced notice Multiple travel destinations Edit/delete a travel notification

Placing a travel notification

You can place a travel notification in three different ways:

Select the Add travel notification button at the top of this page and follow the instructions.

Use the Fidelity mobile app to add a travel notification. Select your account, click the utility menu (three dots) and click the Manage debit card link.

Call the Fidelity Debit Card Services number on the back of your card.

A debit card security alert is sent to confirm the addition of a travel notification. If you did not add the travel notification, please contact Fidelity Debit Card Services.

Advanced notice

Notifications will immediately be noted to your account. You can notify us of any travel plans you have up to 90 days in advance.

Multiple travel destinations

Each destination should be added as a unique travel notification. If you'll be in two locations on the same day, your end date should be based on the destination in which you’ll spend the majority of that day.

Edit/delete a travel notification

Should your travel plans change, you can easily edit or delete your travel notification. You can access the travel notification page the same way you set up your notification and simply use the Edit or Delete link next to the notification you want to modify.

The Fidelity ® Debit Card is issued by PNC Bank, N.A. or Leader Bank, N.A., and the debit card program is administered by BNY Mellon Investment Servicing Trust Company. These entities are not affiliated with each other, and Fidelity is not affiliated with PNC Bank or BNY Mellon. The parent company of Fidelity has a minority percentage, noncontrolling interest in Leader Bank. Visa is a registered trademark of Visa International Service Association, and is used by PNC Bank and Leader Bank pursuant to a license from Visa U.S.A. Inc.

Fidelity Brokerage Services LLC, Member NYSE, SIPC , 900 Salem Street, Smithfield, RI 02917

- Mutual Funds

- Fixed Income

- Active Trader Pro

- Investor Centers

- Online Trading

- Life Insurance & Long Term Care

- Small Business Retirement Plans

- Retirement Products

- Retirement Planning

- Charitable Giving

- FidSafe , (Opens in a new window)

- FINRA's BrokerCheck , (Opens in a new window)

- Health Savings Account

Stay Connected

- News Releases

- About Fidelity

- International

- Terms of Use

- Accessibility

- Contact Us , (Opens in a new window)

- Disclosures , (Opens in a new window)

Important Information Virtual Assistant is Fidelity’s automated natural language search engine to help you find information on the Fidelity.com site. As with any search engine, we ask that you not input personal or account information. Information that you input is not stored or reviewed for any purpose other than to provide search results. Responses provided by the virtual assistant are to help you navigate Fidelity.com and, as with any Internet search engine, you should review the results carefully. Fidelity does not guarantee accuracy of results or suitability of information provided. Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917 796549.1.0

- PayPal Community

- Send and Request

You are viewing the PayPal Community Archives. This content may be old or outdated. Leave the Archive

- About Settings

HELPPPP -- I can't set travel notification

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Printer Friendly Page

- Mark as New

- Report Inappropriate Content

- All forum topics

- Previous Topic

Haven't Found your Answer?

It happens. Hit the "Login to Ask the community" button to create a question for the PayPal community.

- PayPal Debit Card Refused To Pay With Funds? in About Payments Feb-27-2018

- over 2 hrs per travel notification in About Payments Jan-26-2018

- I cannot add travel notifications to my account in About Settings Dec-20-2017

- Travel Notification in About Payments Oct-17-2017

- 50% Reserve on Funds for 180 Days in About Settings Sep-22-2017

Advertiser Disclosure

Bankrate.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which Bankrate.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval, also impact how and where products appear on this site. Bankrate.com does not include the entire universe of available financial or credit offers.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

The Best Prepaid and Debit Cards of 2024

- • Business credit cards

- • Credit card debt

India Davis is an editor specializing in credit cards and updates. She believes in putting the reader first and carrying out a brand’s voice to its fullest potential. She has lived and worked in three different countries and hopes to explore more of the world post-pandemic.

- • Credit scores

- • Building credit

Courtney Mihocik is an editor at Bankrate Credit Cards and CreditCards.com specializing in credit card news and personal finance advice. Previously, she led insurance content at Reviews.com and worked as the loans editor at The Simple Dollar.

- • Credit cards

- • Rewards credit cards

Jason Steele is a professional journalist and credit card expert who has been contributing to online publications since 2008. He was one of the original contributors to The Points Guy, and his work has been appearing there since 2011. He has also contributed to over 100 of the leading personal finance and travel outlets.

The listings that appear on the website are from credit card companies from which Bankrate receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). This site does not include all credit card companies or all available credit card offers. Here's an explanation for how we make money.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

If you need to limit spending or use an alternative to bank accounts, the best prepaid cards available can help you with your goals. You can load and reload prepaid cards with funds and then use them like a debit card, avoiding checking accounts and some bank-imposed fees in the process.

At Bankrate, our staff has reviewed and rated hundreds of today's top credit cards, with independence and transparency, so you'll have an easier time making an informed decision. When reviewing the best prepaid cards of 2024, we considered accessibility, affordability and extra benefits, among other factors, to help you decide which prepaid card is best for you.

View card list

Table of contents

Why choose bankrate.

We helped put over 115,000 cards in people's wallets in 2023

Match to cards with approval odds and apply with confidence

Over 47 years of experience helping people make smart financial decisions

The Bankrate Promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money and how we rate our cards .

Best prepaid and debit cards of 2024:

- Netspend® Visa® Prepaid Card

- Self Lender — Credit Builder Account

What is a prepaid card?

Tips on choosing the best prepaid card for you, expert advice on prepaid cards, how we assess the best prepaid cards.

- Frequently asked questions

Best for no activation fee

Netspend® Visa® Prepaid Card

Bankrate score

Our writers, editors and industry experts score credit cards based on a variety of factors including card features, bonus offers and independent research. Credit card issuers have no say or influence on how we rate cards.

Regular APR

What we love : If you want the convenience of a debit card without opening a traditional bank account, the Netspend Visa Prepaid Card may be worth a look. You can have your paycheck, tax refund or government benefits deposited directly to your Netspend Visa and can use the card anywhere Visa cards are accepted. Alternatives : If you’re a fan of this card’s savings account option, Brink’s Armored™ Account offers a similar benefit and the ability to earn some ongoing cash back rewards.

- There are no application fees and no minimum balance required for this card, so you can start an account with relatively little hassle.

- When you start your card account, you’ll get access to a high-yield savings account that offers 5 percent APY on the first $1,000 you save.

- The card's monthly fee is $9.95 (it lowers to $5 if you receive at least $500 in payroll checks in any one month).

- While it may not have an application fee, this card is associated with several other fees — an ATM withdrawal fee, an inactivity fee and a cash reload fee, just to name a few.

- With Direct Deposit, you can get paid faster than a paper check.

- No late fees or interest charges because this is not a credit card.

- Use the Netspend Mobile App to manage your Card Account on the go and enroll to get text messages or email alerts (Message & data rates may apply).

- Card use is subject to activation and ID verification. Terms and Costs apply.

- Card issued by Pathward N.A., Member FDIC. Card may be used everywhere Visa debit card is accepted.

- See additional NetSpend® Prepaid Visa® details.

Best for no credit check

What we love : This prepaid card could be a good fit for someone who wants a convenient way to spend without having to worry about a credit check. The Netspend Visa Prepaid card also comes with select cash back and personalized offers that can help you save on purchases. Alternatives: Since this prepaid card does not offer overdraft protection, you might consider the Walmart MoneyCenter debit card , which has an overdraft feature (fees may apply).

- There's no credit check required when opening the card, so your credit score won't be impacted.

- The card does offer some cash back rewards which are personalized based on your spending.

- This card doesn't report to any of the three credit bureaus, so it won't help improve your credit score.

- Like most prepaid cards, this card offers no overdraft protection.

Best for building credit

Self - Credit Builder Account with Secured Visa® Credit Card

What we love : The Self - Credit Builder Secured Visa® serves both as a traditional credit card and a savings account — payments made into this account are reported to the three major credit bureaus, helping you build savings and establish a positive credit history at the same time. The credit limit on this card is also equal to the amount you have saved in your Credit Builder Account. Learn more : Is the Self – Credit Builder Account with Secured Visa Credit Card worth it? Alternative : If you’re seeking access to a physical card immediately, the Netspend® Visa® Prepaid Card is a solid choice that offers potential rewards, albeit one that carries a series of fees.

- This card reports to all three credit bureaus, helping you to achieve any credit-building goals.

- Since no hard credit inquiry is required for application, your credit score won't be impacted.

- If you're looking for a card to use immediately, this isn’t a fit as it takes three months of on-time loan payments totaling at least $100 before you’re eligible for the secured card.

- You’ll pay an annual fee for this card, which is unusual for a secured card.

- Start with a Credit Builder Account* that reports to all 3 credit bureaus. Each on-time monthly payment builds credit history and savings. Choose the plan that works for you.

- Make at least 3 monthly payments on time, have $100 or more in savings progress in your Credit Builder Account, and be in good standing.** Then, you’ll be eligible for the Self Visa® Credit Card, without a hard credit check.

- Your savings progress from your Credit Builder Account acts as your security deposit for your secured Credit Card.

- Get the savings plan that helps build credit today.

- No credit score is needed to get started.

- Your money is secured and protected in a bank account.

- *Credit Builder Account Sample Product: $48 monthly payment, 24 month term with a $9 admin fee at a 15.72% Annual Percentage Rate. Please refer to https://www.self.inc/pricing for the most recent pricing options.

- **Secured Credit Card Disclaimers, Rates and Fees: https://www.self.inc/card-agreement

- Self Visa® Credit Card issued by Lead Bank or SouthState Bank, N.A., each Member FDIC. See self.inc for details.

- Active Credit Builder Account in good standing, 3 on time payments, $100 or more in saving progress. Requirements subject to change.

Compare Bankrate's top prepaid cards

On This Page

Prepaid debit cards are similar to debit cards, except prepaid cards aren’t connected to banking or checking accounts. Instead, funds are loaded onto the card — either online, in person at specific locations, by depositing checks or reloading with cash — then reloaded when those funds run out.

Think of them as a cross between gift cards and debit cards — they have a card number, CVV code and expiration date like debit and credit cards. They also don't usually impact your credit score, as prepaid card issuers typically don’t check your credit when you apply, and they won’t check your banking history (though this isn’t always the case).

However, you should keep in mind that most prepaid cards have fees associated with them, such as:

- Reload fees

- Monthly fees

- ATM withdrawal fees

- Inactivity fees

- Transaction fees

Pros and cons of prepaid cards

While one of the benefits of a prepaid card is its accessibility, make sure to read the fine print before you apply. Some cards have activation fees and monthly maintenance charges, which can eat into your spending.

No credit check needed: People with low or no credit can practice responsible credit habits without taking a hit to their credit scores.

Budgeting tool: Because you’re limited to spending your deposit amount, prepaid cards make it easier to stay within your budget and cut back on monthly spending.

More fees than debit cards: Debit cards typically charge overdraft, monthly and sometimes ATM fees. Unfortunately, prepaid cards charge those fees on top of transaction fees, reload fees, inactivity fees and more.

Can’t build credit: Prepaid card issuers don’t report to credit bureaus, meaning users won’t improve their credit scores over time with this card type. Secured credit cards are a better option for people with no credit or low credit to increase their scores.

Prepaid cards are an excellent option for anyone with difficulty accessing traditional banking services, but features vary among cards. Here are some things you should keep in mind while shopping for a prepaid card.

- Take a look at the fees. One of the reasons many people have a difficult time accessing traditional banking services is because of the costs. If your prepaid card charges a litany of fees, such as ATM fees, monthly service fees or reload fees, you should consider if the card is worth it.

- Know your loading options . How difficult or easy will it be to reload your prepaid card? Are fees attached? Some prepaid cards will allow you to reload your card with ACH transfers, but you’ll often reload manually at an ATM. It’s important that you have access to several ATMs in your area.

- Make sure the card offers mobile access. Mobile banking is becoming increasingly popular, and for good reason. It’s convenient, safe and can give you peace of mind. The best prepaid cards will offer you the option to use the cards online and have access to a mobile app.

- Consider if you’re banked or underbanked . While prepaid cards function similarly, there are significant differences between prepaid cards and debit cards , specifically where funds are stored, which can be a significant factor for those who are unbanked or underbanked. Prepaid cards provide several benefits to people who don’t have access to traditional bank accounts (unbanked people) or whose access to banking services is inconvenient or too expensive ( underbanked people). If you’ve struggled to gain access to traditional banking services because of upfront costs (such as deposit minimums or initiation fees), a prepaid card might be the answer.

You can use Bankrate's Compare Credit Cards tool to help shop for the best prepaid card with as few fees as possible.

Rates of unbanked people are particularly high for those in low-income households. While the U.S. average for being unbanked is around 4.5 percent , those who have an income of under $25,000 and are underbanked are 17 percent . The main reasons cited are lack of proper funds and lack of trust . Prepaid cards can be a great alternative for people facing these hurdles.

To make the most of your prepaid card and ensure a seamless financial experience, follow these expert tips.

How to choose a prepaid card

Decide on a payment network.

Payment networks like PayPal, Visa, Mastercard and Netspend all have prepaid debit cards available. Some networks are accepted at more merchants than others so make sure to pick one that’s accepted at stores you regularly shop at.

Check fees and limitations

Prepaid cards come with a multitude of fees. If you don’t factor these into your spending, you might have less than you originally thought.

Review spending habits

Prepaid cards only have what you load onto them, so make sure to load a proper amount to avoid the reload fee that could possibly be attached to the card.

Pick up & load the card

You can receive your prepaid card from many places, both in-person and online, and may even be able to get it the same day. Once you activate and load your card, you should be able to start using it immediately.

How to maximize a prepaid card

When it comes to managing your spending and avoiding debt, a prepaid card can be valuable. With the right features and responsible usage, you can maximize the benefits of a prepaid card while staying in control of your finances.

Prepaid debit cards let you use plastic when shopping online or in stores without a traditional checking account . It’s great for scenarios like a parent or guardian giving a teenager a card to make purchases with a monthly budget or if you need to cut back on spending and want to set hard limits. Understand what you’re using a prepaid card for and how it can ultimately help you reach your financial goals.

Research and compare cards

Each prepaid card may come with its own set of features, fees and limitations. You can find a card that aligns with your specific needs by conducting thorough research. Look for cards with low or no activation fees, reasonable transaction fees and useful benefits tailored to your requirements.

Set a budget

One of the key advantages of using a prepaid card is that it allows you to set a budget and stick to it. By loading only the amount you plan to spend onto the card, you can avoid overspending and accumulating debt, so it's essential to do so with a strategic approach.

Strategize your reloads

Consider your spending patterns and avoid reloading large sums unnecessarily, as it might tie up your funds or expose you to additional fees. Plan your reloads effectively. Strike a balance between having enough funds and not maintaining an excessive balance on the card.

Be aware of drawbacks

Prepaid cards may not offer the same consumer protections as credit or debit cards in case of fraud or unauthorized transactions. It's crucial to review the terms and conditions the card issuer provides regarding liability protection and dispute resolution processes. As a precaution, make sure to set some money aside for an emergency or rainy day fund .

Have more questions for our credit cards editors? Feel free to send us an email , find us on Facebook , or Tweet us @Bankrate .

When evaluating the best prepaid cards, we take into account several factors, including how cards score in our proprietary card rating system and whether they offer features that fit the priorities of a diverse group of cardholders, from low fees to wide acceptance to earning rewards.

We analyzed the most popular prepaid card options and scored each card based on its fee structure, rewards rate and earnings, perks and more to determine whether it belonged in this month’s roundup.

Here are some of the key factors that we considered:

Reasonable fees

To start, all cards on this list charge either a variable monthly fee, fixed monthly fee or a one-time account fee. As many prepaid cards have monthly fees, we identified those with limited additional costs and hidden fees.