Our Recommendations

- Best Small Business Loans for 2024

- Businessloans.com Review

- Biz2Credit Review

- SBG Funding Review

- Rapid Finance Review

- 26 Great Business Ideas for Entrepreneurs

- Startup Costs: How Much Cash Will You Need?

- How to Get a Bank Loan for Your Small Business

- Articles of Incorporation: What New Business Owners Should Know

- How to Choose the Best Legal Structure for Your Business

Small Business Resources

- Business Ideas

- Business Plans

- Startup Basics

- Startup Funding

- Franchising

- Success Stories

- Entrepreneurs

- The Best Credit Card Processors of 2024

- Clover Credit Card Processing Review

- Merchant One Review

- Stax Review

- How to Conduct a Market Analysis for Your Business

- Local Marketing Strategies for Success

- Tips for Hiring a Marketing Company

- Benefits of CRM Systems

- 10 Employee Recruitment Strategies for Success

- Sales & Marketing

- Social Media

- Best Business Phone Systems of 2024

- The Best PEOs of 2024

- RingCentral Review

- Nextiva Review

- Ooma Review

- Guide to Developing a Training Program for New Employees

- How Does 401(k) Matching Work for Employers?

- Why You Need to Create a Fantastic Workplace Culture

- 16 Cool Job Perks That Keep Employees Happy

- 7 Project Management Styles

- Women in Business

- Personal Growth

- Best Accounting Software and Invoice Generators of 2024

- Best Payroll Services for 2024

- Best POS Systems for 2024

- Best CRM Software of 2024

- Best Call Centers and Answering Services for Busineses for 2024

- Salesforce vs. HubSpot: Which CRM Is Right for Your Business?

- Rippling vs Gusto: An In-Depth Comparison

- RingCentral vs. Ooma Comparison

- Choosing a Business Phone System: A Buyer’s Guide

- Equipment Leasing: A Guide for Business Owners

- HR Solutions

- Financial Solutions

- Marketing Solutions

- Security Solutions

- Retail Solutions

- SMB Solutions

Mileage Reimbursement: What You Need to Know

Learn about the laws surrounding mileage reimbursement so you can create a company policy that meets state and federal regulations.

Table of Contents

If you don’t have a fleet of company vehicles and employees are driving their own vehicles on your business’s behalf – making deliveries, inspecting workplaces and gathering supplies – what are your obligations regarding fuel costs, maintenance and vehicle depreciation?

There are both legal requirements and business considerations to keep in mind when determining whether you need a mileage reimbursement policy and what it should look like. This guide explains the basics of mileage reimbursement and how to devise a policy that reimburses your employees fairly and efficiently.

What is mileage reimbursement?

Mileage reimbursement is when employers offer employees reimbursement for expenses associated with driving on behalf of the business. These expenses can include fuel costs, maintenance and vehicle depreciation.

Mileage reimbursement is typically set at a per-mile rate – usually below $1 per mile. Some companies prefer to set a monthly flat rate for reimbursement when employees are regularly using their own vehicles for company purposes. However, this approach can result in overpaying employees for mileage, which could incur additional taxes.

Managing a mileage reimbursement policy means understanding the minimum obligations under both federal and state laws, as well as how to establish an efficient rate that fairly reimburses employees without increasing their compensation and incurring payroll and income taxes for both the employer and employee.

How does mileage reimbursement law work?

There are two legal considerations to keep in mind when developing a mileage reimbursement policy: employment law and tax law.

Employment law related to mileage reimbursement

On the federal level, there is no requirement for employers to reimburse employees for mileage when workers are using personal vehicles for company purposes. However, all employers are federally required to reimburse employees for any work-related expense to a point. When failure to reimburse employees – including for mileage and vehicle costs – causes an employee’s net pay to fall below the federal minimum, employers could be open to lawsuits and the legal penalties associated with failure to pay the minimum wage.

“On the employment law side, you are required to reimburse employees for expenses,” said Danielle Lackey, chief legal officer at Motus. “You want to make sure you’re reimbursing them enough to cover their expenses.”

Certain states – including California, Illinois and Massachusetts – do mandate that employers reimburse employees for mileage and vehicle expenses related to work.

Tax law related to mileage reimbursement

Mileage reimbursement is tax-deductible for employers and independent contractors. Additionally, it is not considered income to an employee and therefore is nontaxable. [Read related article: Tax Deductions You Should Take – and Some Crazy Ones to Avoid ]

However, if an employer reimburses an employee beyond the true expense of driving for work-related purposes, a portion of the reimbursement could be considered compensation and would be subject to taxation.

“On the tax side, if you’re reimbursing, it is considered tax-free both to employer and employee,” Lackey said. “If you pay more than the cost of reimbursement, it is considered compensation and is taxable.”

Some employers choose to offer flat rates for mileage reimbursement to ensure they are in compliance with any applicable employment law. However, this approach can backfire if flat rates are too high, translating into taxable income for the employee and incurring payroll taxes for the employer.

Guidance on mileage reimbursement rates

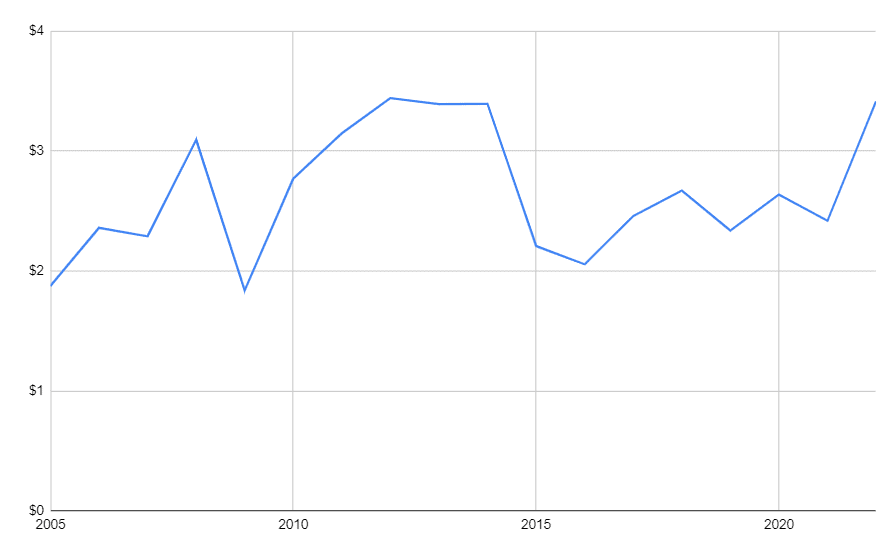

Each year, the IRS sets a mileage reimbursement rate. As of July 2022, the standard mileage rate is $0.625 per mile. For trips in 2022 that occurred from January to July, the rate was $0.585 per mile. Many employers reimburse employees at this rate, but the IRS amount is a national average based on the previous year’s data. It is more useful for tax deduction purposes than for setting a true reimbursement rate for your employees.

When establishing a mileage reimbursement policy, it’s important to consider that fuel costs vary significantly by geography.

“Computing geographic costs to each driver is important,” Lackey said. “Your own particular class of vehicle, the cost of driving that car where you live based on fuel costs and cost of depreciation … gets you closer to something that is accurate.”

“The IRS rate is the rate you can use to deduct [mileage as an independent contractor ],” she added. “Some people use it as reimbursement rate, and there is a safe harbor concept around it, but it’s not efficient for most businesses and not geographically sensitive.”

Lackey recommended using a fixed and variable rate (FAVR) program to determine a suitable mileage reimbursement rate for your business. The FAVR method accounts for fixed costs such as insurance premiums, license and registration fees, taxes, and depreciation. It also includes any variable expense, such as fuel, oil, maintenance and tire wear. Each of these costs is estimated based on geographical data.

Do employers have to pay mileage reimbursement to employees?

There is no federal requirement under the Fair Labor Standards Act (FLSA) for employers to reimburse employees for mileage accrued while driving for work-related purposes. However, there may be state requirements for mileage reimbursements, so business owners should check state law and confer with legal counsel to determine whether they have an obligation to reimburse their employees.

Again, though, employers must reimburse employees for mileage if failure to do so would reduce their net wages below minimum wage. This rule applies to businesses of any size. Depending on state law, under-reimbursing employees could be illegal, regardless of their wages or salaries, and it is always illegal to pay employees less than minimum wage .

In the context of mileage reimbursement, Lackey added, “Minimum wage is calculated as net employee take-home pay after costs they may incur for necessary business.”

There are limits on what employers are required to reimburse, however. The standard under the law is “reasonably necessary expenses” to perform job duties, Lackey said. For example, if an employee chooses to drive a Ferrari to deliver pizzas, the employer is not on the hook for the immense fuel, maintenance and depreciation costs for that kind of vehicle. Mileage reimbursement rates could instead be based on a more commonly used car for the job description, like a four-door sedan.

“The business isn’t required to reimburse you for the cost of that specific car,” Lackey said, “but the reasonably necessary costs.”

What are the 2022 mileage reimbursement rates?

The current IRS mileage deduction rate as of July 2022 is $0.625 per mile. This means employers and independent contractors are legally allowed to deduct that amount from their taxes when reimbursing employees for mileage accrued while driving for company purposes.

This rate is up 6.5 cents from 2021, when the deduction rate was $0.56 cents per mile. The IRS uses a national average of data to determine its annual rates. For a more accurate depiction of local driving costs, consider using a FAVR program and working with a third party to develop a rate that reflects the true costs your drivers incur.

How do you manage a mileage reimbursement policy?

Establishing and managing a mileage reimbursement policy can be tricky, but there are a few steps you can take to make the process easier.

1. Collect relevant data based on geography.

Geographic data is king. Understanding the typical driving costs for your region can help you determine a fair rate that will cover employee expenses as required by law without overcompensating staff and incurring additional taxes.

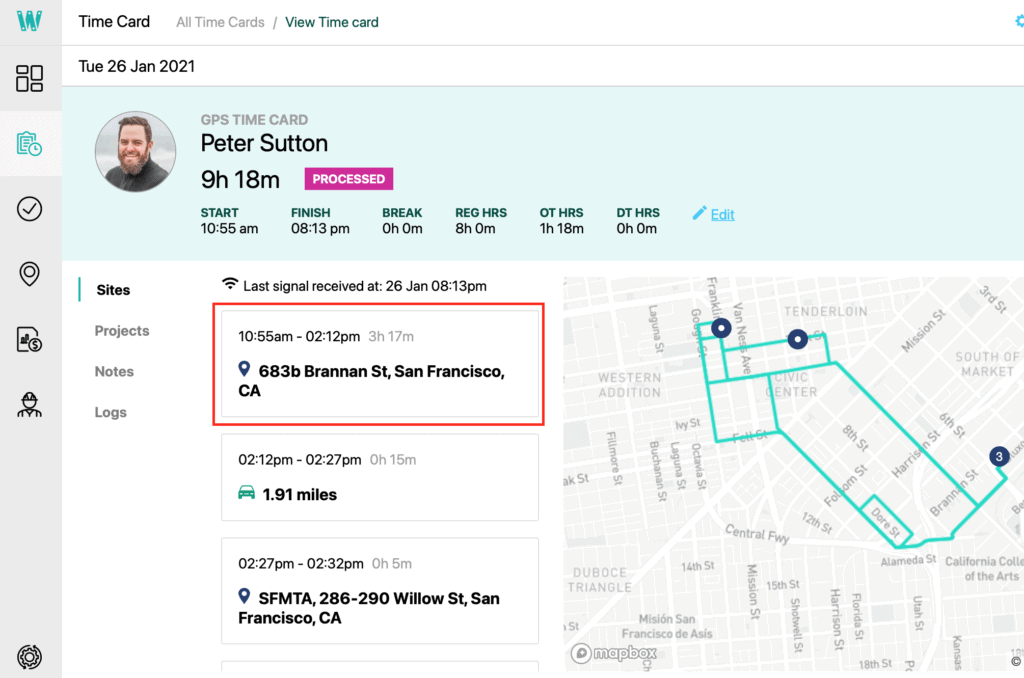

2. Track mileage and vehicle costs by driver.

Tracking mileage and vehicle costs on a driver-by-driver basis gives you a more accurate picture of individual expenses. Reimbursing based on individual drivers, rather than extending a flat rate on a monthly basis, can help you manage reimbursement costs and avoid additional taxes.

3. Use automated solutions to track mileage.

Some software, like Motus’ mileage reimbursement application, can eliminate over-reporting of mileage by drivers and make documenting mileage reimbursement easy.

“Employers often ask employees to manually track miles … we found the number of miles tracked by auto-capture versus manual capture is 20% lower,” Lackey said. She added that “people are not necessarily lying or trying to cheat the system,” but often just rounding up to the nearest mile.

Using a GPS fleet management system is a great way to efficiently manage all aspects of your driving team, including tracking and reimbursing mileage. These tools provide real-time data on employees’ fuel usage, idle time and distance traveled to help you look for opportunities to reduce fuel costs and improve the overall efficiency of your fleet. Learn more in our overview of the best GPS fleet management software and systems .

4. Communicate your policy clearly.

Employees should clearly understand your reimbursement rate and policy, including when expenses will be reimbursed and to whom they should send expense reports . Software can automate some of the process, automatically sending mileage reports to supervisors for approval. Clearly state the payment method of reimbursement as well – for example, will it be added to an employee’s paycheck each cycle? Or will it be a separate deposit?

Mileage reimbursement and labor laws

By using data to determine the optimal rate and leveraging software to track your drivers’ activities, you can establish an efficient and appropriate mileage reimbursement policy. This will keep you in compliance with legal requirements without hurting your company’s bottom line. Find out more labor laws you need to know for your business.

Jocelyn Pollock contributed to the writing and reporting in this article. Source interviews were conducted for a previous version of this article.

Building Better Businesses

Insights on business strategy and culture, right to your inbox. Part of the business.com network.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Missed Tax Day? File as soon as possible to limit penalties. Try our fast, hassle-free tax filing. It's just $50.

Missed Tax Day? Try our fast, hassle-free tax filing. It's just $50.

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

IRS Standard Mileage Rates 2024: What They Are, How They Work

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

IRS mileage rates 2024

Irs standard mileage rate for business, calculating standard mileage vs. actual expenses for business, other irs mileage rate types, how to claim tax deductions using irs mileage rates, tracking your mileage.

Certain taxpayers can deduct mileage from vehicle use related to business, charity, medical or moving purposes

To take the deduction, taxpayers must meet use requirements and may have to itemize on their returns if claiming certain types of mileage.

For 2024, the IRS' standard mileage rates are $0.67 per mile for business, $0.21 per mile for medical or moving, and $0.14 per mile for charity.

If you drive for your business or plan to rack up some miles while volunteering this year, you might be eligible to deduct some of that mileage on your tax return.

To qualify for this deduction, the miles must have been driven for qualifying business, medical, moving or charity purposes, and you may have to itemize on your return to claim the tax break. Rates are valid for electric, PHEV, gas, and diesel-fueled cars.

For the 2024 tax year (taxes filed in 2025), the IRS standard mileage rates are:

67 cents per mile for business.

14 cents per mile for charity.

21 cents per mile for medical/moving.

If you’re self-employed or work as a contractor, you might be able to deduct the cost of using your car for business purposes. Your tax deduction depends on how you use your vehicle. Commuting to work is generally not deductible mileage, but you may be able to deduct mileage for business-related trips, such as those made to clients, meetings or temporary workplaces [0] Internal Revenue Service . Publication 463: Travel, Gift, and Car Expenses . Accessed May 3, 2024. View all sources .

You can also choose whether to deduct standard mileage using the rates above versus actual expense (e.g., repairs, depreciation, gas, and so forth), but you can't deduct both. Expenses for tolls or parking fees related to business use, however, are separately deductible regardless of which method you use [0] Internal Revenue Service . Topic no. 510, Business Use of Car . Accessed Jan 17, 2024. View all sources .

There are two options for calculating the business deduction for the use of your vehicle.

1. Standard mileage deduction

This is the most straightforward way of calculating your driving expense: simply multiply the number of business miles by the IRS mileage rate. However, you’ll need to keep a record of your business-related mileage.

To use the standard IRS mileage deduction method, you must own or lease the car. But the rules for business mileage deductions can be complex, especially if you use lots of vehicles for business. The IRS website has more details [0] Internal Revenue Service . Topic No. 510, Business Use of Car . Accessed May 3, 2024. View all sources .

2. Actual expenses

If you don’t want to track your mileage, you could track and deduct the actual expenses you incur while using your vehicle for business purposes. These expenses may include:

Depreciation.

Lease payments.

Registration fees.

Gas and oil.

» MORE: See what other tax breaks you can take if you’re self-employed

IRS standard mileage rate for volunteering and charitable activities

If you use your car to help a charity or to go somewhere to volunteer, the mileage can be deductible. You can deduct parking fees and tolls as well.

If you don’t want to deduct your mileage, you can deduct your unreimbursed out-of-pocket expenses, such as gas and oil. However, the expenses have to relate directly to using your car to give services to a charitable organization. Also, you can't deduct repair and maintenance costs, depreciation, registration fees, tires, or insurance [0] Internal Revenue Service . About Publication 526, Charitable Contributions . Accessed May 3, 2024. View all sources .

» MORE: See what else counts as a charitable deduction

IRS standard mileage rate for moving

Only active-duty military members can deduct mileage related to moving. The move must be related to a permanent change of station [0] Internal Revenue Service . Instructions for Form 3903 . Accessed May 3, 2024. View all sources .

IRS standard mileage rate for medical

If you used your car for medical reasons, you may be able to deduct the mileage. "Medical reasons" include:

Driving to the doctor, hospital or other medical facility.

Driving a child or other person who needs medical care to receive medical care.

Driving to see a mentally ill dependent if the visits are recommended as part of treatment.

You can deduct parking fees and tolls as well.

If you don’t want to deduct your mileage, you can deduct your unreimbursed out-of-pocket expenses, such as gas and oil. However, the expenses have to relate directly to the use of your car for medical purposes. Also, you can't deduct repair and maintenance costs, depreciation or insurance.

Mileage isn’t the only transportation cost you might be able to deduct as a medical expense. IRS Publication 502 has the details. Here’s a big caveat: In general, you can deduct qualified, unreimbursed medical expenses that are more than 7.5% of your adjusted gross income .

» MORE: See what else you might be able to deduct as a medical expense

If you're deducting mileage for moving, medical or charity purposes, you'll need to itemize on your tax return in order to claim the tax deduction. Itemizing means you’ll need to set aside extra time when preparing your returns to fill tax forms Form 1040 and Schedule A , as well as supporting schedules that feed into those forms.

If you're self-employed, you’ll claim your mileage deduction as a business expense on Schedule C . If you file your taxes online, the software will ask about your mileage during the interview process and calculate the deduction.

» Ready to file? Check out NW's top tax software picks

This is important because if you’re audited, you may need to show a log of the miles you drove to substantiate your deduction.

There are many ways to track your mileage. Something as simple as keeping a pen and paper in the glove compartment can suffice, but a quick trip to Google or your phone's app store will reveal a variety of tools that can streamline things.

On a similar note...

Tax Resources for Accountants and Small Businesses (U.S.)

- Expense Reimbursements / IRS / Meals and Incidental Expenses / Mileage / Payroll / Per Diem Rates / Small business

- Complete Guide to Reimbursing Employees for Travel Expenses

Published September 2, 2020 · Updated April 21, 2021

When an employee travels away from the office and incurs expenses, the company should reimburse them. Whether travelling across the world or just driving their car to a client’s location, getting the reimbursement right isn’t hard.

Keep reading to learn how to make proper employee reimbursements.

Accountable Plans

You’ll first need to decide if you will implement an accountable or nonaccountable plan. This is just as it sounds; either you’ll have employees be accountable for business expense reimbursements or not.

All businesses should have an expense reimbursement plan in writing. This includes corporations, sole proprietors, the self-employed, and non-profits. Non-profits should be extremely careful when reimbursing disqualified persons because nonaccountable plan reimbursements not properly approved or recorded can cause significant tax exposure to the charitable organization.

An accountable plan must follow the IRS guidelines for expense reimbursement. To qualify, the following rules must be met:

- Expenses must be for business purposes.

- Expenses must be adequately reported to the company in reasonable time.

- Any excess reimbursement or allowance must be returned in a reasonable amount of time.

Any expense that doesn’t meet these three criteria is considered a reimbursement under a nonaccountable plan.

This distinction between these two types of plans is important because accountable plan reimbursements are not taxable to the employee, whereas nonaccountable plans are taxable.

Business Purpose

Expenses incurred as an employee while completing work for an employer have a business purpose. Examples include things like registration fees for a conference, taxi rides to the airport for a business trip, or meals while away on a business trip.

If however, an employer reimburses an employee for dinner when the employee works late, this does not qualify as a business purpose. This reimbursement would be taxable to the employee because it was made under a nonaccountable plan.

Reporting in a Reasonable Time

While what is considered a reasonable amount of time is subjective, the general rule is that all reimbursable expenses must be submitted within 60 days of when they were incurred.

Adequate reporting involves providing a record, like an expense report, of all expenses incurred and providing evidence, like receipts, to support the expenses.

Excess Reimbursement

If an employee receives a travel advance to cover travel expenses but spends less than the advance, the difference is an excess reimbursement and must be returned to the employer to not be taxable. If the excess isn’t returned in a reasonable amount of time, it’s taxable.

A reasonable period of time in this instance is generally deemed to be within 120 days of when the expense was incurred.

With a travel advance, employees should submit an expense report and receipts to substantiate all expenses.

Mileage and Business Use of Personal Vehicle

When an employee uses their personal vehicle for company business, you’ll need to reimburse them. You have three options.

- Standard mileage rate

- Actual costs

- Monthly allowance

Standard Mileage Rate

If you use the standard mileage rate, it is 57.5 cents per mile for 2020.

You can pay more, but the IRS’ safe-harbor threshold of 57.5 cents per mile will allow you a tax deduction without having to substantiate the rate.

Note that the IRS typically updates rates in December. So, you can expect to see the 2021 rate announced in December 2020. IRS 2021 Mileage Rates are here.

IRS Standard Mileage Rates 2020

Actual Costs

Instead of using the standard rate, you can reimburse employees for actual expenses.

The employee will sum up all the costs of owning the vehicle including everything from fuel, maintenance, tolls, registration, and insurance. And based upon the percentage of business miles driven, that portion of the total actual costs is reimbursed.

Monthly Allowance

Using the monthly allowance method is relatively easy. Each month you provide a set dollar amount to the employee.

If you require the employee to provide a mileage log at the end of the month, this will determine if any part of the allowance is taxable. If no mileage log is required, the entire allowance is taxable under an unaccountable plan.

If a mileage log is provided and the employee drove less than expected, they should return the excess allowance within 30 days. If they don’t, the excess becomes taxable to them.

An employee’s commute from their home to their normal place of business is not a reimbursable expense. Any business miles driven in excess of the commute miles is reimbursable.

For example, an employee’s normal round-trip commute is 20 miles. On Fridays, the employee works on-site at a client’s office that is 30 miles away from the employee’s home. So, the employee drives 60 miles round-trip on Fridays. Since this is longer than he would drive if he commuted to the office, you’ll want to reimburse the employee for 40 miles (60 miles – 20 miles).

Mileage Logs

Employees should keep mileage logs when using a personal vehicle for business use. The log should include:

- Employee’s name

- Description of vehicle

- Date of business use

- Purpose of business use

- Starting mileage on odometer

- Ending mileage on odometer

- Approval authorization

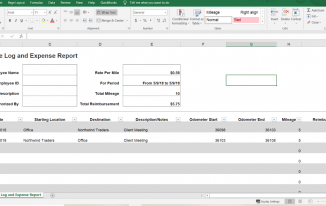

Here’s an example of a mileage log using Microsoft Excel.

Mileage log and expense report – employee reimbursement

Note that in this example, the employee drove from the office to a client and then back to the office. Therefore, there is no need to deduct commuting mileage.

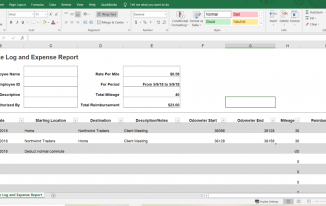

But suppose, like in our example from above, that on Fridays the employee drives from home to the client’s location and back home. His mileage log would look like this:

Mileage log and expense report example – employee reimbursement

But what if in this example, the drive to the client’s office from the employee’s home was shorter than his regular commute? In this case there is nothing to reimburse and the employee enjoys the benefit of less driving.

What would happen if this same employee didn’t normally work on Fridays or he always worked from home on Fridays? Then the entire drive to the client’s office would be reimbursable since the employee’s normal work schedule didn’t require him to commute on Fridays.

Many employees will forget to deduct their normal commute from mileage reimbursement requests. You’ll want to remind them.

Direct Expense Reimbursement of Travel Expenses

For employees who travel frequently, providing them with a company credit card is ideal. But for those times when an employee must use their own money for business expenses, you’ll want to reimburse employees quickly.

For easy recordkeeping, have employees complete expense reports when seeking reimbursements. Like the mileage log, it will detail who incurred the expense and when, what it was for, and the amount.

You can reimburse your employees with cash; however best practices would be to pay with check or some other trackable means, like ACH.

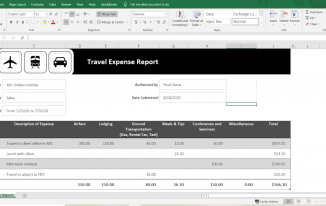

Here’s an example of an easy expense report in Excel.

Travel expense report example – employee reimbursement

For each expense, the employee should include receipts to support the amounts requested.

Receipts for purchases should contain the amount, date, place, and a brief description of the expense.

For example, hotel receipts should include:

- The name and location of the hotel.

- The dates stayed.

- Separate amounts for charges (i.e. lodging, meals, or food).

Restaurant and meal receipts should include:

- The name and location of the restaurant.

- The names of people in attendance.

- The date and amount of the meal.

You may choose to reimburse employees for meal tips. Be sure to have a clear policy of what will be reimbursed and what will not. For example, you’ll reimburse up to 20% for tips. Anything above that will not be reimbursed.

You’ll also need to consider your policy for lost receipts. You can still reimburse but have the employee fill out a missing receipt form to document the expense.

In lieu of direct expense reimbursement, consider using a per diem.

A per diem provides the employee with a specified dollar amount per day to use on meals, snacks, lodging, or other miscellaneous purchases. Larger expenses like airfare would be paid using the direct expense reimbursement method or paid for directly by the company.

Per diems should be prorated for partial days of travel. Acceptable methods include the ¾’s method or any other method you choose that is reasonable. The ¾’s method adds ¾ of a daily per diem rate on departure days and another ¾’s on return days.

The IRS sets per diem rates for cities and metropolitan areas. More expensive locales have higher daily rates than cheaper cities. For example, the daily rate for high cost cities like San Francisco, Vail, Colorado, and Nashville, Tennessee is $297. And many cities are designated high cost for only portions of the year. Miami and Park City, Utah are considered high cost only from December 1 – March 31.

And if you’re not in a high cost city, the daily rate is $200. These per diem rates are often updated each year. So you’ll always want to check for the current rates.

For example, Dave is travelling to Seattle for business. Seattle is a high cost locale. He’s leaving on Monday and returning on Thursday. Seattle’s maximum per diem rate is $297 per day. Dave will receive $222.75 ($297 x ¾) for Monday and Thursday and the full $297 for Tuesday and Wednesday.

Per diems are not taxable income to your employee if you use the IRS rates and your employee provides an expense report with receipts. However, using higher rates will create taxable income for the amount above the federal rate. And not submitting an expense report and receipts will make the entire per diem taxable because you’ll have an unaccountable plan and your company will not have the required receipts to support the tax deduction.

If your business operates in the transportation sector (i.e. shipping, trucking, or rail, etc…), it’s important to note that there are different per diem limits and rules you must follow.

Entertainment Expenses

With the 2017 Tax Cuts and Jobs Act, entertainment expenses are no longer tax deductible for companies.

As an employer, you may still reimburse your employees for entertainment expenses; however, these reimbursements will need to be segregated so that they are not included on your tax return. Examples of entertainment expenses include tickets to entertain clients at sporting events or country club fees for golf memberships.

What documentation you require for entertainment reimbursements is up to you but best practices suggest following the same requirements for travel or mileage reimbursements.

Commingling

If travel or meals involve both a business and personal aspect, only the portion of the expense that is business related is reimbursable. Expense reports and receipts should indicate whether there are any personal expenses.

For example, an employee makes a business trip to California from Georgia and elects to stay two days after business is finished for a mini-vacation. Best practices would have the employee check out of his hotel room and check back in using his personal credit card to pay the hotel bill for his extended stay. This way he has two different receipts; one for business and one for pleasure. However, if he doesn’t do that and the entire hotel stay is charged on the same receipt, you’ll need to back out the charges related to his personal stay.

None of this information should be taken as legal or financial advice, nor should it deter you from seeking the assistance of a licensed attorney, accountant, or financial services professional. But if you want to make sure your company’s policies for employee reimbursements are consistent with best practices, implementing these policies is a great place to start!

Tags: Business Use of Personal Vehicle Commingling Direct Expense Reimbursement employee Commuting reimbursement Employee Expense Reimbursement employee Monthly Allowance employees reimbursements entertainment expenses Excess Reimbursement Expense Reimbursement IRS Accountable Plans IRS Expense Reimbursement Mileage log and expense report Mileage Logs mileage on odometer Per Diem reimbursed expenses Reimbursing Employees Standard Mileage Rate travel expenses

- Next story 11 Facts about Employee Reimbursements Taxation

- Previous story Late Payment Calculator

- 2020 Mileage rates

- 2021 Mileage Rates

- Employee Reimbursements Taxation

- Gross from Net Calculator

- Reverse Sales Tax Calculator

- Taxation of Fringe Benefits

- IRS Mileage

Useful links

- Chamber of Commerce

Bistvo.com – Daily Inspiration

- 2020 Tax Calculator

- Accounting books

- Accounting education

- Accounting Jobs

- Accounting links

- Accounting Software

- Accounting software

- Accounting tutorials

- Additional Medicare Tax

- Annual Reports

- Calculators

- Chart of accounts

- Coronavirus

- Court decisions

- Depreciation

- EU Electronic Services

- European VAT on digital services

- Expense Reimbursements

- Federal income tax

- Federal Tax

- Financial statements

- FLSA – Fair Labor Standards Act

- Fringe Benefits

- Invoicing software

- Local Taxes

- Massachusetts

- Meals and Incidental Expenses

- Minimal Wage

- Minimum Wage

- Mississippi

- Net investment tax

- Nonprofits & Activism

- North Carolina

- OVDI Offshore Voluntary Disclosure Initiative

- Overtime pay

- Partnerships

- Payroll outsourcing

- Payroll software

- Penality and Interest

- Pennsylvania

- Per Diem Rates

- Principal business codes

- Professional tax software

- Retirement planning

- Self-Employed

- Small business

- Social Security and Medicare

- Sole Proprietorship

- State Licenses and Permits

- State Sales Tax

- Tax and Accounting Dictionary

- Tax calculators

- Tax court cases

- Tax Preparation Software

- Tax websites

- Title 26 – Internal Revenue Code

- U.S. Department of Labor (DOL)

- Underpayment Interest Rates

- Washinghton

- West Virginia

- West Viriginia

Ultimate Guide to Mileage Reimbursement in 2024: IRS Rates, Rules, and Best Practices

In this Article

Mileage reimbursements today become rarer by the day with the adoption of remote work and the fading out of the concept of company vehicles. However, in a fast-paced business environment, these instances must be addressed if the need arises. The problem is, understanding the IRS rules for mileage reimbursement can be confusing due to their many details and complexities.

So, here’s your go-to guide on mileage reimbursements in the US. We will go over everything from what mileage reimbursement is to how the laws around it work, the latest IRS information, and the best way to manage it. Let’s start with the basics—what is mileage reimbursement?

What is mileage reimbursement?

Mileage reimbursement is when employers compensate employees for using their vehicles for business purposes. It is calculated based on the miles run and includes any vehicle-related expenses they incur while carrying out a business operation.

For example, if an employee is asked to drive to a client’s office from the main office or another location for a business meeting, they qualify for mileage reimbursement.

What is considered as business mileage?

Simply put, business mileage refers to the total distance traveled for business-related purposes, for which you can be reimbursed. Let’s examine a few instances to understand what counts and doesn’t count as business mileage.

Here’s what DOES count:

- Traveling from your normal office location to a secondary office.

- Traveling for client meetings or business conferences.

- Traveling from your home to a temporary office.

Here’s what DOESN’T count:

- Daily commute from your home to your normal office.

Please note, if you are a self-employed or independent contractor, and your home is where you work out of, your home qualifies as an office, and you can deduct mileage between your home and another work location as long as it’s for the same business.

Mileage is not the only business expense you should keep track of. Check out all the other business expense categories here .

Is mileage reimbursement taxable?

In general, mileage reimbursements are not taxable if they follow IRS rules (which we will get to in a bit). But, if the employer reimburses based on a flat rate higher than the IRS rate, you might owe tax on the extra amount.

Self-employed or independent contractors can deduct business mileage expenses from their taxes, while companies can account for them as business expenses.

What is the 2024 federal mileage reimbursement rate?

According to the IRS , the mileage rate is set yearly “based on an annual study of the fixed and variable costs of operating an automobile.”

Here are the mileage rates for the year 2024:

- 67 cents per mile driven for business use, an increase of 1.5 cents from 2023.

- 21 cents per mile driven for medical or moving purposes for qualified active-duty members of the Armed Forces, a decrease of 1 cent from 2023.

- 14 cents per mile driven in service of charitable organizations; the rate is set by statute and remains unchanged from 2023.

You can find the official IRS Notice containing the optional 2024 standard mileage rates here.

What are the IRS mileage reimbursement rules?

Let's divide the IRS mileage reimbursement rules among employers, employees, and self-employed individuals.

Understanding the IRS mileage reimbursement rules is crucial for employers, especially in states like California, Massachusetts, and Illinois, where reimbursement is mandated. While federal laws don't enforce mileage reimbursement, it's a practice that can foster a positive employer-employee relationship. However, failing to reimburse work-related mileage expenses could lead to legal consequences if it causes the employees' net income to fall below the federal limit.

As an employer, you have the flexibility to choose the reimbursement method that best suits your company's policies and your employees' needs. You can opt for the IRS standard mileage rate of 67 cents (the rate for 2024) or set your own flat rate, which can be higher or lower than the standard IRS rate.

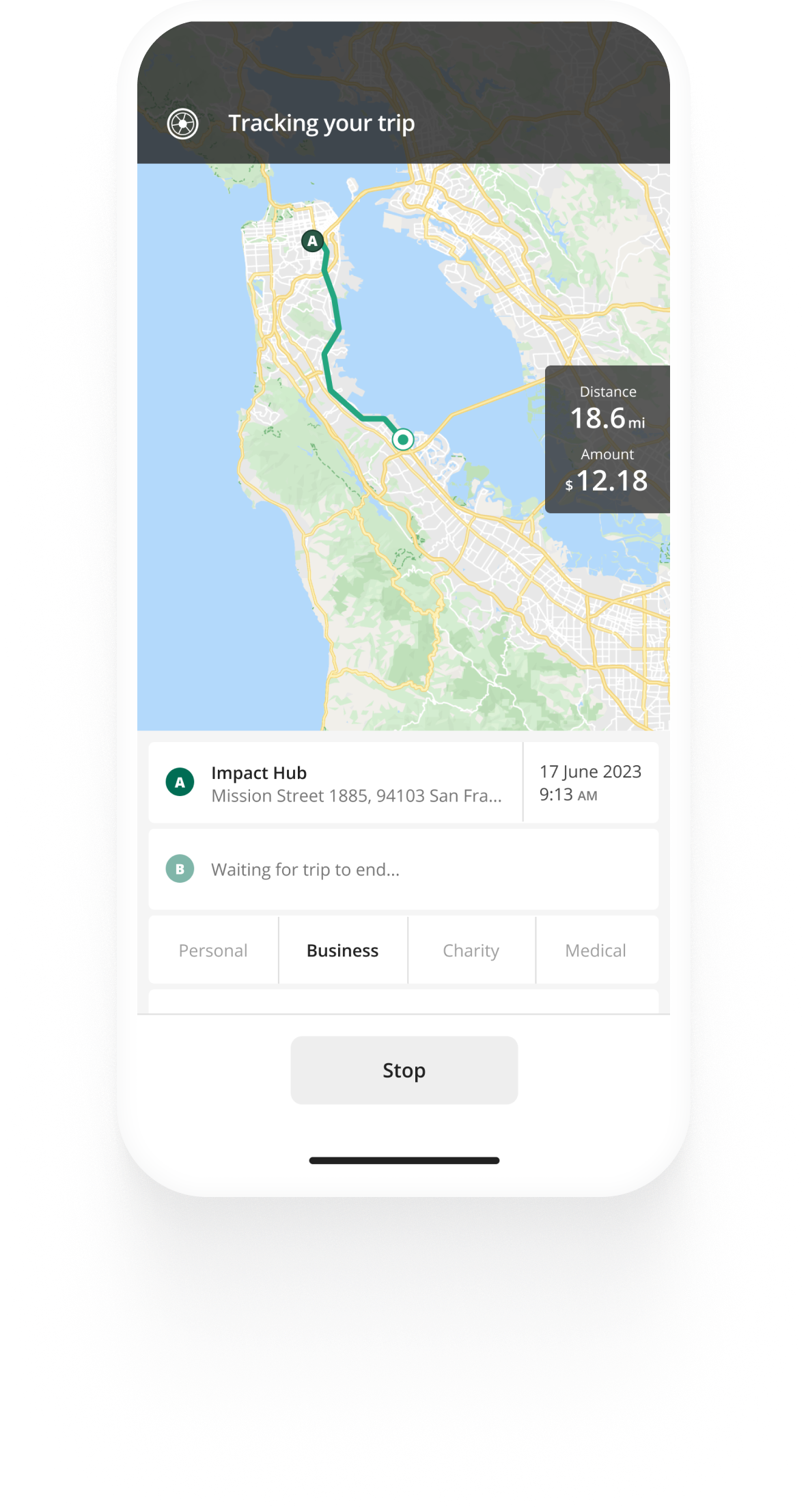

Your employees simply need to provide proof of the mileage driven for business purposes, either through a mileage log or a mileage tracking app . The advantage of reimbursing your employees is that these reimbursements are tax-deductible.

There are also other methods of reimbursement for mileage to your employees—you can provide mileage allowances or reimburse them based on Fixed And Variable Rates (FAVR).

What is the monthly mileage allowance method?

Mileage allowances are paid to the employee in advance so they can use them for the month's business mileage expenses.

What is the Fixed and Variable Rates Method?

With the FAVR method, you pay your employees a fixed cost (insurance, depreciation, and more) and a variable cost (fuel, oil, and more), generally a cents-per-mile rate.

If you're an employee, you are eligible for mileage reimbursement from your employer if you use your vehicle for business requirements. But, as mentioned earlier, no federal laws force employers to reimburse your mileage expenses (unless state laws require them).

Your employer can also choose which method they want to reimburse you. There are two things you as an employee need to keep in mind:

- Keep a detailed log of all your business mileage expenses - the date, miles traveled, locations, and the purpose of travel. Do check with your employer if they require more information.

- Ensure the mileage reimbursement you receive for each mile shouldn't exceed the IRS mileage rate regardless of how you're reimbursed. The reimbursement will be seen as added income and taxed accordingly if it does.

Self-employed

Things are different if you are self-employed. If you use the vehicle purely for business purposes, you can deduct all expenses associated with it. But if it's a mixed-purpose vehicle, you can only deduct the expenses you accrue during business use.

There are two methods of calculating mileage for tax deductions - the standard mileage rate method and the actual expense method (explained in more detail below).

In short, with the standard mileage method, you calculate the mileage based on the standard rate provided by the IRS to determine your deduction.

With the actual expenses method , you deduct the actual costs of using your vehicle for business purposes. These include gas, maintenance, repairs, depreciation, and other related expenses. The latter is more complex and needs thorough record-keeping.

What records do you need for mileage reimbursement?

According to the IRS, here’s everything you need to record to ensure you get reimbursed accurately:

- Destination

- Purpose of travel

- Odometer readings (start, stop, and miles traveled)

- Type of expenses incurred

- Expense amount paid

Your employer might require more information depending on their reimbursement policy, so please check with them in advance. Here’s an example of a daily business mileage and expense log according to the IRS:

How do you calculate your mileage reimbursement?

Standard mileage method.

Calculating your mileage reimbursement is very simple when following the IRS standard reimbursement rules.

It’s best explained through an example: If you’ve traveled 350 miles in a month, and 150 of them are business miles, you can calculate your mileage by simply multiplying the business miles traveled by the standard IRS rate for the year (67 cents/mile for 2024).

67 cents x 150 business miles = $100.5

Following the standard mileage method, you can deduct $100.5 as your mileage tax deduction for the month.

Actual expenses method

The actual expenses method is a little more complicated and requires you to keep a record of fuel, maintenance, repairs, insurance, depreciation, and other related expenses.

If you’re following the actual expenses method, here’s how you can calculate with another example:

Assume you spend around $600 monthly on fuel, maintenance, insurance, depreciation, etc.

- Calculate the total business miles driven = 150 miles.

- Determine the business use percentage. Since you drove 350 miles, the business use percentage = (150/350)*100 = 42.8%.

- Calculate the deduction by multiplying the total actual expenses incurred (gas, maintenance, oil) by the business use percentage.

$600 * 42.8% = $256.8

Following the actual expenses method, you can deduct $256.8 as your mileage tax deduction for the month.

Read more about the standard and actual expenses methods here.

How to manage a mileage reimbursement policy?

Now that you understand mileage reimbursement and how it should be calculated, it’s time to look at it from an organizational standpoint. As an employer, you should create a clear mileage reimbursement policy that your employees can follow.

It should include everything from mileage rates and what expenses can be reimbursed to what records are required from the employees and how they can keep track of them.

Here are a few tips on how you can create and manage mileage reimbursements in your business:

- Communicate your organization’s mileage reimbursement policy effectively - how to track it, what rules they have to follow, whom to contact in case of any issues, and how the reimbursement will be paid out.

- Request your employees to record all the trips they take for business purposes. The records should include the date, total miles driven, odometer reading before and after the trip, the purpose of the trip, and any other expenses incurred.

- Automate the tracking and reimbursement process with an easy-to-use mileage tracker software that can automatically track distance traveled, record the purpose of visits, deduct commuting miles, enforce policies, and help employees easily stay on top of their mileage reimbursements.

Check out our list of some of the best business mileage tracking tools in 2024 here.

Why use Fyle to track and manage mileage reimbursements

Tracking and managing employee mileage reimbursements can be cumbersome, but you don’t have to do it manually. Fyle is a complete mileage tracking and expense management tool built to simplify the process from accurately tracking mileage to reimbursing them on time. Here’s how Fyle helps:

Track mileage with ease

Fyle’s mileage tracking features are powered by Google Maps, which can help you get the most accurate readings. Just add the starting address, stops (if there are any), and destination, and Fyle will calculate the distance and the mileage rate automatically. It doesn’t get any easier than this!

You can also set up recurring mileage expenses, add purpose of travel, add bulk mileage, and more with Fyle.

Deduct commute miles for more accurate tracking

Since travel from home to office is not included when calculating mileage reimbursement, employees can add their home and work locations. Fyle will automatically calculate one-way and two-way distances and exclude them from the tracked mileage, simplifying the commute deduction process.

Pre-submission policy checks

Employers can easily create and enforce policies with Fyle. For example, if you restrict mileage reimbursements to only weekdays, any weekend mileage requests will be flagged even before submission. This ensures compliance and reduces fraud.

Reimbursements via ACH

With Fyle, you can simplify employee reimbursements and ensure they receive timely payments using the ACH payment system. You can even pay out multiple employees with a single click.

Fyle also integrates with major accounting software like NetSuite, Sage, QuickBooks, and Xero to eliminate manual data exports and streamline the entire process.

FAQs around mileage reimbursement

Does mileage reimbursement include gas .

Yes, gas is included if your company reimburses mileage using the IRS standard rate method. It’s not required to expense gas separately.

How do we determine reimbursement rates in a business?

There are two ways: use the standard mileage rate set by the IRS (67 cents/mile for 2024) or customize a flat rate depending on the location, gas prices, and other expenses.

What are the records required for mileage reimbursement?

According to the IRS, employees are required to keep a record of the trip’s date, the total miles traveled for each trip, the destination, and the purpose of the trip in order to qualify for mileage reimbursement.

Which is the best way to reimburse employees for mileage?

You can reimburse them based on their mileage (which is simpler to administer and manage) or the gas and other expenses incurred (proof provided).

How much should I be paid per mile?

According to the IRS, in 2024, the standard mileage rate for businesses is $0.67 per mile, $0.21 per mile for medical, and $0.14 per mile for charities.

Anand Sasikumar

Anand is our Content Marketer. Besides work, he likes a good run or work out. He is also known never to have ever resisted an ice cream. Be sure to drop him a note at [email protected], if you're looking for any guest blogging opportunities.

Stay updated with Fyle by signing up for our newsletter

What Are Real-Time Feeds, and Why Do They Matter

Activity-based costing (abc): a guide for a growing business.

Job Costing: The Definitive Guide for Your Business

Business Travel Expenses: A Guide to Management, Calculation, Tax Deductions & More

Close books faster with Fyle. Schedule a demo now.

Key Features

- GPS Time Clock Accurate time tracking made easy for workers

- Scheduling Ensure your crew always knows where to be and what to do

- Job Tracking Effortlessly monitor and oversee job progress

- Job Costing Accurately capture exact labor costs for each job

- Reporting Get key insights on how to optimize your workforce

- Labor Compliance Protect your business from costly labor disputes

- Integrations Integrate your key systems & workflows in minutes

- (650) 332-8623

- Help Center Find simple answers to any question about Workyard

- Developer API Connect & build integrations with our easy-to-use API

- About Us How Workyard came to be, our beliefs & who we are

- Blog Explore the latest on productivity, HR & more

Tools + Guides

- Employee Time Tracking Guide

- Free Construction Templates

- Construction Management Guide

- Field Service Management Guide

- Contractor Business Software Reviews

- Contact Sales

- Contact sales

Home Employee Time Tracking Employee Mileage Reimbursement

Employee Mileage Reimbursement In 2023: Rules, Rates & Tools

In this guide, we’ll cover the key facts about employee mileage reimbursement, including the rules, IRS rates, taxation, and effective tools.

What Is Employee Mileage Reimbursement?

Employee mileage reimbursement is when employers pay employees for expenses associated with driving their personal vehicles on behalf of the business. These payments aim to cover the cost of fuel and vehicle costs such as maintenance and depreciation.

To make these calculations practical, employee mileage reimbursement is calculated at a per-mile rate. The IRS provides guidance on what the mileage reimbursement rate should be and is continually updating its rate to reflect the rising costs of gas and other inflationary pressures on vehicle costs.

Having an effective employee mileage reimbursement policy requires both complying with both the minimum state and federal level rules, as well as making sure you have a competitive policy that fairly compensates employees for their expenses that is operationally practical to implement. In other words, you need to be careful you can effectively manage the employee mileage reimbursement policy so that you don’t end up overpaying employees for mileage because it has been poorly tracked and managed.

Are You Required To Have An Employee Mileage Reimbursement Policy?

When employees travel for work purposes, they need to be paid for their travel time . But do they need to get paid for mileage?

If employees are using a company vehicle, they will still need to get paid for their travel time. They won’t necessarily be reimbursed for mileage because they aren’t using their own car or gas, but you may still want to track mileage for financial reasons.

If your employees are using their personal vehicles, it becomes slightly more complicated.

Federal labor laws do not explicitly require employers to reimburse employees for mileage when using their personal vehicles. The exception is if the costs of using their personal vehicle would bring the employee under minimum wage—then the employee should be reimbursed to be brought up to minimum wage.

It’s important to note that there are three states that do explicitly require companies to reimburse their employees for mileage: California, Massachusetts, and Illinois.

What States Require Mileage Reimbursement?

If your business employs people in any of the following three states:

- Massachusetts

You are required to reimburse your employees for many expenses that they incur on behalf of your company while working, this includes the costs associated with using your personal vehicle for work-related purposes of which mileage is included. It’s important to note that these costs are not limited to mileage, they also include:

- vehicle depreciation,

- repair and maintenance expenses,

- lease payments

- parking fees,

- vehicle registration, and

- vehicle insurance.

The IRS publishes a standard mileage reimbursement rate that is designed to cover all these costs. Most companies choose to use the standard IRS mileage rate because most courts typically recognize it as the correct amount to be applied, though there are other methods as well.

IRS Mileage Reimbursement Rates In 2023

The IRS is continually updating its standard mileage reimbursement rate to reflect the inflationary pressures on the cost of gas and maintaining a vehicle. As of the 1st of January 2023, the IRS standard mileage reimbursement rate for businesses is 65.5 cents per mile . The current mileage reimbursement rates will be in effect until the end of the year. The rates do rise every year, so you can expect to see a regular increase in the IRS’s posted mileage amounts.

Not all employers use the IRS standard mileage rates when setting their mileage reimbursement policy. The IRS standard mileage rate is a national average based on the previous year’s data. It is more useful for tax deduction purposes than for setting a true reimbursement rate as it doesn’t factor in local factors. For example, the cost of gas can vary significantly across the United States. Although rare, some employers have a company mileage reimbursement policy that aims to reflect a more accurate cost than the IRS rate by setting their own cost per mile for each of their employees.

Tax Deductions Relating To Mileage Reimbursement

There are some definite tax breaks available to you when it comes to mileage reimbursements. The most significant is that you can deduct employee travel expenses (including mileage) from your taxes. But to do so, you need to keep careful track of all your travel—including where your employees went and why.

In addition, mileage reimbursements are not considered income to an employee and therefore nontaxable and treated separately from an employee’s net pay. When executing your payroll, be sure to enter mileage reimbursements as an expense reimbursement so they are not-taxed.

How to Calculate Mileage Reimbursement

So once you have determined that your company is going to pay mileage reimbursement as a policy and you have decided on the mileage reimbursement rate you are going to use, calculating mileage reimbursement is simple .

Here’s the formula for how to calculate mileage reimbursement:

Mileage Reimbursement = Miles driven x Mileage Rate

For example, if an employee traveled 200 miles for work in a week and you are using the standard IRS mileage rate of 62.5 cents per mile, the mileage reimbursement calculation would be as follows:

Mileage Reimbursement = 200 miles x 62.5 cents = $125

As you can see calculating mileage reimbursement is very simple, the hard part is accurately tracking mileage for each of your employees . The following questions arise:

- How do you make their mileage reimbursement claim doesn’t include mileage outside of work?

- How do you know they are being honest if they are self-reporting mileage reimbursement?

- How do you collect all of the mileage reimbursement claims across your whole team in an efficient way in time for payroll every week?

The good news is that there are tools you can use to solve these problems and make your employee mileage reimbursement program accurate and efficient, more on this in the next section.

Options For Tracking Employee Mileage Reimbursements

There are typically three ways of tracking and capturing mileage reimbursements: Self-reported manual logs, GPS tracking apps or devices , and GPS time clock apps . While they all have pros and cons, time clock apps with in-built mileage tracking give you the most reliable, efficient, and accurate solution.

Self-Reporting With Manual Logs

Some employers often just use paper logs to track employee hours . Employees would fill out their mileage reimbursement on paper whenever they travel for work including miles driven, and even sometimes including photos of odometer readings as evidence, however, these logs can be quite cumbersome, especially if an employee is visiting multiple sites each day.

Manual mileage logs have the same problems as paper timesheets . They are often inaccurate and easily forgotten about. While this system is fast and easy to set up, it will hinder efficiency and accuracy day to day.

If you are using manual mileage reports, you’re probably overpaying for mileage reimbursement across your whole team. It’s likely to be costing you thousands of dollars not to mention the admin time your whole crew is spending collecting the mileage reports, sharing them, and then performing the calculations.

GPS Tracking Devices

One of the most accurate ways to track employee mileage is via GPS trackers for company vehicles . These devices can be placed in company vehicles or given to employees to carry with them. When employees travel, the device tracks not only routes and mileage but also safe driving habits.

GPS tracking devices are accurate, but they’re expensive and the most fundamental problem is that they are not directly tied to the employee’s timesheet for the day. Many employers, especially smaller contractors, don’t want to spend money outfitting all their employees with GPS tracking devices , especially when they drive their own vehicles—it’s an unnecessary added expense. Additionally, any information gathered from separate GPS tracking devices will need to be reviewed and parsed out separately which makes the data collection and consolidation process more difficult and inefficient.

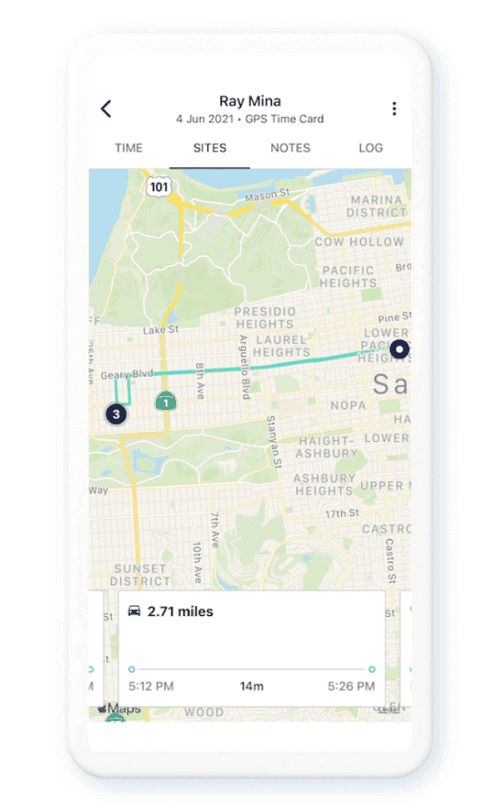

Recommended: GPS Time Clock Apps

Finally, there are GPS-powered time clock apps that make mileage tracking a breeze. A construction time clock will allow you to monitor what your employees are doing throughout the day and ensure that their mileage and drive times align with their time cards. These apps perform the same function as a GPS tracking device, but there’s no equipment cost; the app uses the GPS technology provided by the phone. Today, this GPS technology is highly accurate.

The best part is the employee’s mileage and travel throughout the day are directly tied to their timesheet where you can see their clock-in time, lunch break, and clock-out time.

Apps like Workyard will go one step further and automatically calculate the mileage traveled between each job site visit, and give you a simple report of each employee’s mileage by day and by week.

GPS-powered time clock apps also give you the added benefit of automatically calculating travel time pay for hourly employees for you in situations where you are paying workers different rates for travel time. This is also useful data that can help you identify if your employees are spending too much time traveling vs working on job sites.

The Advantages of Digital Mileage Tracking

Let’s look at some of the advantages of using apps to capture and track your mileage electronically.

100% Transparency = Peace of mind

With a GPS time clock app in place, you always where your employees are for every minute they have worked, including whether they were driving and exactly how many miles they racked up. This transparency across your team reduces disputes and also takes the stress off your employees having to worry about recording their miles accurately, they just clock out every day and the app takes care of the rest.

Another advantage of tracking employee mileage accurately with a digital solution is that you have a detailed log of evidence to support every employee mileage reimbursement you have made.

These records become invaluable in the event of a pay dispute with a certain employee because they provide concrete evidence that you reimbursed them accurately.

The IRS also requires businesses to keep detailed records of business expenses, including mileage. The IRS also roughly knows how much any business should be reporting as mileage. In the event of an IRS audit, having detailed support for all of your mileage claimed becomes invaluable.

Improved Client Reimbursements

If you bill your clients for travel expenses, accurate mileage tracking is essential. When you have GPS data or detailed mileage logs, you’re not just confident that you’re billing correctly—you have the paper trail to back it up. Improve relationships with clients and make it easier to get reimbursed.

Better Budgeting Insights

Tracking employee mileage can also give you better insights into your business budget. When you know how much your employees are traveling, you can make informed decisions about where to allocate your resources. You can also fine-tune your scheduling and your site management to reduce travel and improve efficiency.

Accurate Employee Mileage Tracking With Workyard

If you’re looking for an easier way to track employee mileage, look no further than Workyard. Our GPS time clock app makes it simple and easy to track employee travel and mileage —so you can get the most accurate picture of your company’s mileage costs.

Key features Workyard offers that make mileage tracking easy:

- Accurate mileage is automatically captured with every time card , including a breakdown of every trip, driving route, and mileage for that trip. No manual data entry by workers or your office is required.

- Mileage can also be also automatically allocated to projects based on driving destination.

- Convenient mileage reporting gives you a summary of driving time and mileage by employee and project.

Sign up for a free trial of Workyard today !

Workyard provides leading workforce management solutions to construction, service, and property maintenance companies of all sizes.

High Contrast

- Asia Pacific

- Latin America

- North America

- Afghanistan

- Bosnia and Herzegovina

- Cayman Islands

- Channel Islands

- Czech Republic

- Dominican Republic

- El Salvador

- Equatorial Guinea

- Hong Kong SAR, China

- Ireland (Republic of)

- Ivory Coast

- Macedonia (Republic of North)

- Netherlands

- New Zealand

- Philippines

- Puerto Rico

- Sao Tome & Principe

- Saudi Arabia

- South Africa

- Switzerland

- United Kingdom

- News releases

- RSM in the news

- AI, analytics and cloud services

- Audit and assurance

- Business operations and strategy

- Business tax

- Consulting services

- Family office services

- Financial management

- Global business services

- Managed services

- Mergers and acquisitions

- Private client

- Professional Services+

- Risk, fraud and cybersecurity

- See all services and capabilities

Strategic technology alliances

- Sage Intacct

- CorporateSight

- FamilySight

- PartnerSight

Featured topics

- 2024 economy and business opportunity

- Generative AI

- Middle market economics

- Environmental, social and governance

- Supply chain

Real Economy publications

- The Real Economy

- The Real Economy Industry Outlooks

- RSM US Middle Market Business Index

- The Real Economy Blog

- Construction

- Consumer goods

- Financial services

- Food and beverage

- Health care

- Life sciences

- Manufacturing

- Nonprofit and education

- Private equity

- Professional services

- Real estate

- Technology companies

- See all industry insights

- Business strategy and operations

- Family office

- Private client services

- Financial reporting resources

- Tax regulatory resources

Platform user insights and resources

- RSM Technology Blog

- Diversity and inclusion

- Middle market focus

- Our global approach

- Our strategy

- RSM alumni connection

- RSM Impact report

- RSM Classic experience

Experience RSM

- Your career at RSM

- Student opportunities

- Experienced professionals

- Executive careers

- Life at RSM

- Rewards and benefits

Spotlight on culture

Work with us.

- Careers in assurance

- Careers in consulting

- Careers in operations

- Careers in tax

- Our team in India

- Our team in El Salvador

- Apply for open roles

Popular Searches

Asset Management

Health Care

Partnersite

Your Recently Viewed Pages

Lorem ipsum

Dolor sit amet

Consectetur adipising

Tax issues arise when employers pay employee business travel expenses

Employers must determine proper tax treatment for employees.

Most employers pay or reimburse their employees’ expenses when traveling for business. Generally, expenses for transportation, meals, lodging and incidental expenses can be paid or reimbursed by the employer tax-free if the employee is on a short-term trip. However, the tax rules become more complex when the travel is of a longer duration. Sometimes the travel expenses paid or reimbursed by the employer must be treated as taxable compensation to the employee subject to Form W-2 reporting and payroll taxes.

The purpose of this article is to address some of the more common travel arrangements which can result in taxable income to employees for federal tax purposes. Although business travel can also raise state tax issues, those issues are beyond the scope of this article. This article is intended to be only a general overview as the tax consequences to an employee for a given travel arrangement depend on the facts and circumstances of that arrangement.

In the discussion below, it is assumed that all travel expenses are ordinary and necessary and incurred by an employee (or a partner in a partnership) while traveling away from home overnight for the employer’s business. In addition, it is assumed that the expenses are properly substantiated so that the employer knows (1) who incurred the expense; (2) where, when, why and for whom the expense was incurred, and (3) the dollar amount. Employers need to collect this information within a reasonable period of time after an expense is incurred, typically within 60 days.

Certain meal and lodging expenses can fall within a simplified substantiation process called the “per diem” rules (although even these expenses must still meet some of the substantiation requirements). The per diem rules are outside the scope of this article.

One of the key building blocks for the treatment of employee travel expenses is the location of the employee’s “tax home.” Under IRS and court holdings, an employee’s tax home is the employee’s regular place of work, not the employee’s personal residence or family home. Usually the tax home includes the entire city or area in which the regular workplace is located. Generally, only expenses paid or reimbursed by an employer for an employee’s travel away from an employee’s tax home are eligible for favorable tax treatment as business travel expenses.

Travel to a regular workplace

Usually expenses incurred for travel between the employee’s residence and the employee’s regular workplace (tax home) are personal commuting expenses, not business travel. If these expenses are paid or reimbursed by the employer, they are taxable compensation to the employee. This is the case even when an employee is traveling a long distance between the employee’s residence and workplace, such as when an employee takes a new job in a different city. According to the IRS, if it is the employee’s choice to live away from his or her regular workplace (tax home), then the travel expenses between the two locations which are paid or reimbursed by the employer are taxable income to the employee.

Example: Bob’s personal residence is in Chicago, but his regular workplace is in Atlanta. Bob’s employer reimburses him for an apartment in Atlanta plus his transportation expenses between the two cities. Since Atlanta is Bob’s tax home, these travel expenses are personal commuting expenses and the employer’s reimbursement of the expenses is taxable compensation to Bob.

Travel to two regular workplaces

Sometimes an employer requires an employee to consistently work in two business locations because of the needs of the employer’s business. Factors such as where the employee spends the most time, has the most business activity, and earns the highest income determine which is the primary location with the other being the secondary location. The employee’s residence may be in either the primary or the secondary location. In general, the IRS holds that transportation costs between the two locations can be paid or reimbursed by the employer tax-free. In addition, lodging and meals at the location which is away from the employee’s residence can generally be paid or reimbursed tax-free.

Example: Caroline lives in Location A and works at her company headquarters there. Her employer opens a new store in Location B and asks her to handle the day-to-day operations for two years while the store is getting up to speed. But Caroline is also needed at the headquarters so her employer asks her to spend two days a week at the headquarters in Location A and three days a week at the store in Location B. Because the work at each location is driven by a business need of Caroline’s employer, she is treated as having primary and secondary work locations and is not treated as commuting between the two locations. Caroline’s travel between the two locations and her meals and lodging at Location B can be reimbursed tax-free by her employer.

As a practical matter, the employer must carefully consider and be able to support the business need for the employee to routinely go back and forth between two business locations. In cases involving two business locations, the courts have looked at time spent, business conducted and income generated in each location. Merely having an employee “sign in” or “touch down” at a business location near his or her residence is unlikely to satisfy the requirements for having two regular workplaces. Instead, the IRS would likely consider the employee as having only one regular workplace with employer-paid travel between the employee’s residence and the regular workplace being taxable commuting expenses.

Travel when a residence is a regular workplace

In some cases an employer hires an employee to work generally, or only, from the employee’s home, as he or she is not physically needed at an employer location. If the employer requires the employee to work just from his or her residence on a regular basis, does not require or expect the employee to travel to another office on a regular basis, and does not provide office space for the employee elsewhere, then the residence can be the tax home since it is the regular workplace for the employee. When the employee does need to travel away from his or her residence (tax home), the temporary travel expenses can be paid or reimbursed by the employer on a tax-free basis.

Example: Jason is a computer programmer and works out of his home in Indianapolis for an employer in Seattle. He periodically travels to Seattle for meetings with his team. Since Jason has no assigned office space in Seattle and is expected by his employer to work from his home, Jason’s travel expenses to Seattle can be reimbursed by his employer on a tax-free basis.

Travel to a temporary workplace

Sometimes an employer temporarily assigns an employee to work in a location that is far from the employee’s regular workplace, with the expectation that the employee will return to his or her regular workplace at the end of the assignment. In this event, the key question is whether the employee’s tax home moves to the temporary workplace. If the tax home moves to the temporary workplace, the travel expenses between the employee’s residence and the temporary workplace that are paid or reimbursed by the employer are taxable compensation to the employee because they are personal commuting expenses rather than business travel expenses. Whether or not the employee’s tax home moves to the temporary workplace depends on the duration of the assignment and the expecations of the parties.

- One year or less . If the assignment is expected to last (and actually does last) one year or less, the employee’s tax home generally does not move to the temporary workplace. Therefore, travel expenses between the employee’s residence and temporary workplace that are paid or reimbursed by the employer are typically tax-free to the employee as business travel.

Example: Janet lives and works in Denver but is assigned by her employer to work in San Francisco for 10 months. She returns to Denver after the 10-month assignment. Janet’s travel expenses associated with her assignment in San Francisco that are reimbursed by her employer are not taxable income to her as they are considered temporary business travel and not personal commuting expenses.

- More than one year or indefinite . If the assignment is expected to last more than one year or is for an indefinite period of time, the employee’s tax home generally moves to the temporary workplace. This is the case even if the assignment ends early and actually lasts one year or less. Consequently, travel expenses between the employee’s residence and the temporary workplace that are paid or reimbursed by the employer are taxable compensation to the employee as personal commuting expenses.

Example: Chris lives and works in Dallas but is assigned by his employer to work in Oklahoma City for 15 months before returning to Dallas. Chris’s travel expenses associated with his assignment to Oklahoma City that are reimbursed by his employer are taxable income to him as personal commuting expenses.

- One year or less then extended to more than one year . Sometimes an assignment is intended to be for one year or less, but then is extended to more than one year. According to the IRS, the tax home moves from the regular workplace to the temporary workplace at the time of the extension. Therefore, travel expenses incurred between the employee’s residence and the temporary workplace that are paid or reimbursed by the employer are non-taxable business travel expenses until the time of the extension, but are taxable compensation as personal commuting expenses after the extension.

Example: Beth’s employer assigns her to a temporary workplace in January with a realistic expectation that she will return to her regular workplace in September. However, in August, it is clear that the project will take more time so Beth’s assignment is extended to the following March. Once Beth’s employer knows, or has a realistic expectation, that Beth’s work at the temporary location will be for more than one year, changes are needed to the tax treatment of Beth’s travel expenses. Only the travel expenses incurred prior to the extension in August can be reimbursed tax-free; travel expenses incurred and reimbursed after the extension are taxable compensation.

When an employee’s residence and regular workplace are in the same geographic location and the employee is away on a temporary assignment, the employee will often return to the residence for weekends, holidays, etc. Expenses associated with travel while enroute to and from the residence can be paid or reimbursed by an employer tax-free, but only up to the amount that the employee would have incurred if the employee had remained at the temporary workplace instead of traveling home.

Travel to a temporary workplace – Special situations

In order for an employer to treat its payment or reimbursement of travel expenses as tax-free rather than as taxable compensation, the employee’s ties to the regular workplace must be maintained. The employee must expect to return to the regular workplace after the assignment, and actually work in the regular workplace long enough or regularly enough that it remains the employee’s tax home. Special situations arise when an employee’s assignment includes recurring travel to a temporary workplace, continuous temporary workplaces, and breaks in assignments to temporary workplaces.

- Recurring travel to a temporary workplace . Although the IRS has not published formal guidance which can be relied on, it has addressed situations where an employee has a regular workplace and a temporary workplace to which the employee expects to travel over more than one year, but only on a sporadic and infrequent basis. Under the IRS guidance, if an employee’s travel to a temporary workplace is (1) sporadic and infrequent, and (2) does not exceed 35 business days for the year, the travel is temporary even though it occurs in more than one year. Consequently, the expenses can be paid or reimbursed by an employer on a tax-free basis as temporary business travel.