Subscribe Now! Get features like

- Latest News

- Entertainment

- Real Estate

- Lok Sabha Speaker Election Live

- Arvind Kejriwal Hearing Live

- T20 World Cup 2024

- Crickit Predictor

- World Cup Schedule 2024

- World Cup Most Wickets

- World Cup Points Table

- Budget 2024

- The Interview

- Web Stories

- Virat Kohli

- Mumbai News

- Bengaluru News

- Daily Digest

- Election Schedule 2024

IRCTC approves 1:5 stock split: What it means and how it will benefit company

Apart from stock split, the IRCTC board also approved the unaudited financial results for the quarter which ended on June 30.

The board of Indian Railway Catering and Tourism Corporation (IRCTC) on Thursday announced splitting of the company's one equity share into five. This means that one share of ₹ 10 will be split into five equity shares with a face value of ₹ 2 each.

The move will be subjected to approval from the railways ministry and other shareholders, IRCTC said.

"Recommended the proposal for sub-division of Company's one (1) equity share of face value of ₹ 10/- each into five (5) equity shares of face value of ₹ 2- each, subject to the approval of Ministry of Railways, shareholders and other approvals as may be required," IRCTC said in a release.

What is stock split?

This is a move to issue more shares of stocks to a company's current shareholders without diluting the value of their stocks. A stock split increases the number of shares and lowers the individual value of each share.

The market capitalisation of the company, however, remains unaffected.

Why do companies opt for stock split?

The boards of many companies decide to split the stock, either to achieve a target or create more liquidity by making the price of the stock more attractive for a larger number of people, especially small investors.

The most common split ratios are 2-for-1 or 3-for-1, which means the stockholders will have two or three shares - as the split maybe - for every share held.

What about IRCTC's split?

In IRCTC's cases, every one share held by a shareholder will become five shares. According to Livemint, post-split the number of shares will increase to 125,00,00,000 from 25,00,00,000.

IRCTC expects the stock split process to be completed within three months after receiving approval from government of India, Livemint reported.

The board meeting of IRCTC commenced at 12:30pm and concluded at 2pm, the company said in the release.

Elevate your career with VIT’s MBA programme that has been designed by its acclaimed faculty & stands out as a beacon for working professionals. Explore now!

Get latest updates on Petrol Price along with Gold Rate , Today Weather and Budget 2024 at Hindustan Times.

Join Hindustan Times

Create free account and unlock exciting features like.

- Terms of use

- Privacy policy

- Weather Today

- HT Newsletters

- Subscription

- Print Ad Rates

- Code of Ethics

- Live Cricket Score

- India Squad

- T20 World Cup Schedule

- Cricket Teams

- Cricket Players

- ICC Rankings

- Cricket Schedule

- Points Table

- T20 World Cup Australia Squad

- Pakistan Squad

- T20 World Cup England Squad

- India T20 World Cup Squad Live

- T20 World Cup Most Wickets

- T20 World Cup New Zealand Squad

- Other Cities

- Income Tax Calculator

- Petrol Prices

- Diesel Prices

- Silver Rate

- Relationships

- Art and Culture

- Taylor Swift: A Primer

- Telugu Cinema

- Tamil Cinema

- Board Exams

- Exam Results

- Competitive Exams

- BBA Colleges

- Engineering Colleges

- Medical Colleges

- BCA Colleges

- Medical Exams

- Engineering Exams

- Horoscope 2024

- Festive Calendar 2024

- Compatibility Calculator

- The Economist Articles

- Lok Sabha States

- Lok Sabha Parties

- Lok Sabha Candidates

- Explainer Video

- On The Record

- Vikram Chandra Daily Wrap

- EPL 2023-24

- ISL 2023-24

- Asian Games 2023

- Public Health

- Economic Policy

- International Affairs

- Climate Change

- Gender Equality

- future tech

- Daily Sudoku

- Daily Crossword

- Daily Word Jumble

- HT Friday Finance

- Explore Hindustan Times

- Privacy Policy

- Terms of Use

- Subscription - Terms of Use

- Technical Signals

- Live Stream

- Stock Recos

- BigBull Portfolio

- Stock Reports Plus

- Market Mood

- Investment Ideas

- Sector: Tourism & Hospi...

- Industry: Travel Agen. / Touri...

IRCTC - Indian Railway Catering & Tourism Corporation Share Price

- 990.45 -4.65 ( -0.47 %)

- Volume: 31,36,020

- 990.90 -4.10 ( -0.41 %)

- Volume: 3,00,581

- Last Updated On: 26 Jun, 2024, 03:31 PM IST

IRCTC - Indian Railway ...

- Shareholdings

- Corp Actions

- English English हिन्दी ગુજરાતી मराठी বাংলা ಕನ್ನಡ தமிழ் తెలుగు Rank 435 - ET 500 2023 ranking

IRCTC share price insights

In the last 4 years, only 1.2 % trading sessions saw intraday declines higher than 5 % .

Company has spent less than 1% of its operating revenues towards interest expenses and 6.77% towards employee cost in the year ending 31 Mar, 2024. (Source: Consolidated Financials)

Stock gave a 3 year return of 140.22% as compared to Nifty 100 which gave a return of 52.57%. (as of last trading session)

Company has used Rs 215.35 cr for investing activities which is an YoY decrease of 31.67%. (Source: Standalone Financials)

Indian Railway Catering & Tourism Corporation Ltd. share price moved down by -0.47% from its previous close of Rs 995.10. Indian Railway Catering & Tourism Corporation Ltd. stock last traded price is 990.45

Insights IRCTC

Do you find these insights useful?

Key Metrics

- PE Ratio (x) 71.65

- EPS - TTM (₹) 13.89

- Dividend Yield (%) 0.65

- VWAP (₹) 991.45

- PB Ratio (x) 24.65

- MCap (₹ Cr.) 79,608.00

- Face Value (₹) 2.00

- BV/Share (₹) 40.37

- Sectoral MCap Rank 2

- 52W H/L (₹) 1,138.90 / 614.35

- MCap/Sales 17.42

- PE Ratio (x) 72.36

- VWAP (₹) 990.87

- MCap (₹ Cr.) 80,396.00

- 52W H/L (₹) 1,148.30 / 614.45

IRCTC Share Price Returns

Et stock screeners top score companies.

Check whether IRCTC belongs to analysts' top-rated companies list?

IRCTC News & Analysis

Announcement under Regulation 30 (LODR)-Earnings Call Transcript

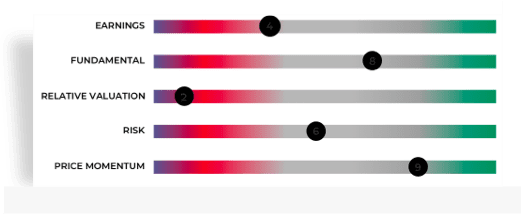

IRCTC Share Analysis

Unlock stock score, analyst' ratings & recommendations.

- View Stock Score on a 10-point scale

- See ratings on Earning, Fundamentals, Valuation, Risk & Price

- Check stock performance

IRCTC Share Recommendations

Recent recos.

Mean Recos by 5 Analysts

That's all for IRCTC recommendations. Check out other stock recos.

Analyst Trends

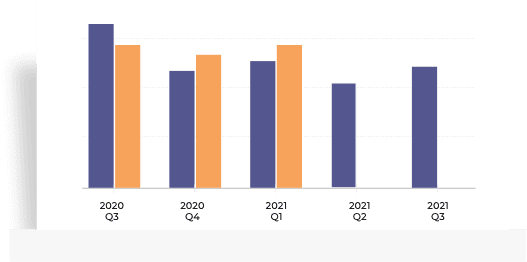

Irctc financials.

- Income (P&L)

Balance Sheet

Employee & Interest Expense

All figures in Rs Cr, unless mentioned otherwise

Cash from Operations vs PAT

Decrease in Cash from Investing

Financial Insights IRCTC

Operating cash flow of Rs 882.17 cr is 0.79 times compared to the reported net profit of Rs 1111.08 cr. (Source: Consolidated Financials)

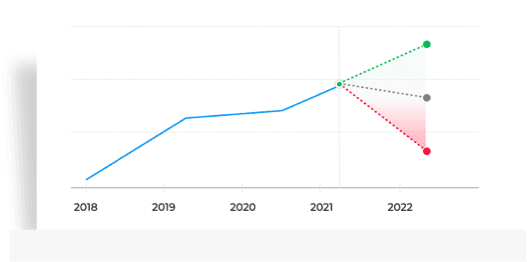

IRCTC Share Price Forecast

Get multiple analysts’ prediction on irctc.

- High, low, medium predictions for Price

- Upcoming predictions for Revenue

- Details about company earnings

IRCTC Peer Comparison

Irctc stock performance, ratio performance.

Stock Returns vs Nifty 100

Choose from Peers

Choose from Stocks

Peers Insights IRCTC

Irctc shareholding pattern, total shareholdings, mf ownership.

MF Ownership details are not available.

Top Searches:

Irctc f&o quote.

- Expiry 27-06-2024 (Current Month)

993.45 -16.50 (-1.63%)

Open Interest

3,15,875 3,500 (1.11%)

Open Interest as of 24 Apr 2024

Corporate Actions

Irctc board meeting/agm, irctc dividends, about irctc.

Indian Railway Catering & Tourism Corporation Ltd., incorporated in the year 1999, is a Mid Cap company (having a market cap of Rs 80,820.00 Crore) operating in Tourism & Hospitality sector. Indian Railway Catering & Tourism Corporation Ltd. key Products/Revenue Segments include Other Services (Tour Income), Packaged Drinking Water, Beverages & Food, Other Services, Scrap for the year ending 31-Mar-2023. For the quarter ended 31-03-2024, the company has reported a Consolidated Total Income of Rs 1,187.41 Crore, up 2.02 % from last quarter Total Income of Rs 1,163.86 Crore and up 18.23 % from last year same quarter Total Income of Rs 1,004.28 Crore. Company has reported net profit after tax of Rs 284.18 Crore in latest quarter. The company’s top management includes Mrs.Seema Kumar, Mr.Ajit Kumar, Mr.Manoj Kumar Gangeya, Mr.Neeraj Sharma, Mr.Devendra Pal Bharti, Mr.Namgyal Wangchuk, Mr.Vinay Kumar Sharma, Mr.Kamlesh Kumar Mishra, Dr.Lokiah Ravikumar, Mrs.Suman Kalra. Company has Serva Associates as its auditors. As on 31-03-2024, the company has a total of 80.00 Crore shares outstanding. Show More

Seema Kumar

Manoj Kumar Gangeya

Neeraj Sharma

Devendra Pal Bharti

Namgyal Wangchuk

Vinay Kumar Sharma

Kamlesh Kumar Mishra

Lokiah Ravikumar

Suman Kalra

- P R Mehra & Co. Serva Associates

Travel Agen. / Tourism Deve. / Amusement Park / Catering

Key Indices Listed on

Nifty Next 50, Nifty 100, Nifty 200, + 28 more

11th Floor, Statesman House,B-148, Barakhamba Road,New Delhi, Delhi - 110001

http://www.irctc.com

More Details

- IRCTC Chairman's Speech

- IRCTC Company History

- IRCTC Directors Report

- IRCTC Background information

- IRCTC Company Management

- IRCTC Listing Information

- IRCTC Finished Products

FAQs about IRCTC share

- 1 Week: IRCTC share price moved down by 2.39%

- 1 Month: IRCTC share price moved down by 10.69%

- 3 Month: IRCTC share price moved up by 6.64%

- 6 Month: IRCTC share price moved up by 13.87%

- 2. What are the IRCTC quarterly results? Total Revenue and Earning for IRCTC for the year ending 2024-03-31 was Rs 4434.66 Cr and Rs 1111.08 Cr on Consolidated basis. Last Quarter 2024-03-31, IRCTC reported an income of Rs 1187.41 Cr and profit of Rs 284.18 Cr.

- PE Ratio of IRCTC is 71.65

- Price/Sales ratio of IRCTC is 17.42

- Price to Book ratio of IRCTC is 24.65

- 4. What is 52 week high/low of IRCTC share price? In last 52 weeks IRCTC share had a high price of Rs 1,138.90 and low price of Rs 614.35

- Promoter holding has not changed in last 9 months and holds 62.4 stake as on 31 Mar 2024

- Domestic Institutional Investors holding has gone up from 9.91 (30 Jun 2023) to 12.72 (31 Mar 2024)

- Foreign Institutional Investors holding has gone up from 6.99 (30 Jun 2023) to 8.08 (31 Mar 2024)

- Other investor holding have gone down from 20.7 (30 Jun 2023) to 16.79 (31 Mar 2024)

- 6. What is the CAGR of IRCTC? The CAGR of IRCTC is 52.81.

- 8. Who is the chairman of IRCTC? Seema Kumar is the Chairman & Managing Director of IRCTC

- 9. Who are the peers for IRCTC in Tourism & Hospitality sector? Top 3 Peers for IRCTC are Thomas Cook (India) Ltd., Wonderla Holidays Ltd. and Dreamfolks Services Ltd.

- 10. What is the PE & PB ratio of IRCTC? The PE ratio of IRCTC stands at 71.65, while the PB ratio is 24.65.

- 11. What is the market cap of IRCTC? Market Capitalization of IRCTC stock is Rs 79,608.00 Cr.

- 12. What dividend is IRCTC giving? An equity Interim dividend of Rs 2.5 per share was declared by Indian Railway Catering & Tourism Corporation Ltd. on 26 Oct 2023. So, company has declared a dividend of 125% on face value of Rs 2 per share. The ex dividend date was 17 Nov 2023.

Trending in Markets

- Sensex Today

- Share Market Live

- Motor Insurance New Rules

- Ixigo IPO GMP

- Bajaj Finance Housing

- F&O Stocks to Buy Today

- TBI Corn Share Price

IRCTC Quick Links

Equity quick links, more from markets.

DATA SOURCES: TickerPlant (for live BSE/NSE quotes service) and Dion Global Solutions Ltd. (for corporate data, historical price & volume, F&O data). Sensex & BSE Quotes and Nifty & NSE Quotes are real-time and licensed from BSE and NSE respectively. All timestamps are reflected in IST (Indian Standard Time).

DISCLAIMER: Any and all content on this website including tools/analysis is provided to you only for convenience and on an “as-is, as- available” basis without representation and warranties of any kind. The content and any output of such tools/analysis is for informational purposes only and should not be relied upon or construed as an investment advice or guarantee for any specific performance/returns advice or considered as recommendation for the purchase or sale of any security or investment. You are advised to exercise caution, discretion and independent judgment with regards to the same and seek advice from professionals and certified experts before taking any decisions.

By using this site, you agree to the Terms of Service and Privacy Policy.

- International

- Today’s Paper

- T20 World Cup

- Express Shorts

- Mini Crossword

- Premium Stories

- Health & Wellness

IRCTC shares hit 52-week high on stock split announcement

Irctc share price: the irctc stock surged 6.08 per cent to hit a 52-week high of rs 2,727.95 on the bse while on the national stock exchange (nse), it rallied 6.09 per cent to rs 2,728.85 during the intraday trade as the company announced a stock split in the ratio 1:5..

Shares of Indian Railway Catering and Tourism Corporation (IRCTC) surged over 6 per cent and hit a 52-week high on the stock exchanges on Thursday after the company announced a stock split and reported a profit in the first quarter of financial year (FY21).

The scrip surged 6.08 per cent to hit a 52-week high of Rs 2,727.95 on the BSE while on the National Stock Exchange (NSE), it rallied 6.09 per cent to Rs 2,728.85 during the intraday trade. It eventually settled at Rs 2,694.95 on the NSE, up 4.77 per cent and at Rs 2689.85 on the BSE, up 4.60 per cent.

The e-ticketing and catering arm of the Indian Railways announced a split of one equity share of the face value of Rs 10 into five equity shares of the face value of Rs 2. The board approved this proposal in an earnings call.

The same has to be approved by the Ministry of Railways and shareholders, the company informed in a filing to the stock exchanges.

- 68 murdered in Maliana, all accused acquitted 36 years later, residents ask: So who killed our families?

- In appeal, Rahul says was mistreated, sentenced to attract disqualification

- Kalakshetra suspends 4 teachers, appoints independent committee to probe sexual harassment allegations

“Recommended the proposal for sub-division of Company’s one (1) equity share of face value of Rs 10/- each into five (5) equity shares of face value of Rs 2/- each, subject to the approval of Ministry of Railways, shareholders and other approvals as may be required,” IRCTC said in a BSE filing.

IRCTC said that the stock split is proposed for two reasons:

1. To comply with the Guidelines on Capital Restructuring of Central Public Sector Enterprises issued by the Department of lnvestment & Public Asset Management (DIPAM), Ministry of Finance;

2. To enhance the liquidity in the capital market, to widen the shareholder base and to make the shares affordable to small investors.

The process may take three months to complete after receiving the necessary approvals from the Ministry of Railways.

While there will be no change in the share capital, the number of shares will increase 5 times.

Additionally, the company also reported a profit of Rs 82.52 crore for the quarter ended June, compared to a loss of Rs 24.60 crore in the corresponding period year-ago.

- Indian Railway Catering and Tourism Corporation

- Indian Railways

The Opposition is demanding the post of Deputy Speaker in Lok Sabha, which has been vacant since the start of the 17th Lok Sabha. Rahul Gandhi of Congress has stated that the Opposition will support the NDA's candidate for Speaker if the Deputy Speaker's post is given to the Opposition. However, governments have often overlooked the constitutional mandate to appoint both positions promptly.

- AP Inter Supplementary Results 2024 Live Updates: BIEAP inter 1st year supply result at bie.ap.gov.in today 42 mins ago

- Delhi News Today Live Updates: CBI 'trying to carve out a case when none exists', says Kejriwal's counsel in court 46 mins ago

- Latest News Today Live Updates: Congress to chalk out strategy for Haryana Assembly polls 1 hour ago

- Israel Hamas War Live Updates: Gaza at the verge of famine, over 495,000 people face food insecurity 2 hours ago

Best of Express

Buzzing Now

Jun 26: Latest News

- 01 2 inmates charged with attempted murder after attack on Montana jail guards

- 02 Euro 2024: Austria shock Netherlands 3-2 to finish top of Group D; France held by Poland to end as 2nd

- 03 After Amritpal Singh, another NSA detainee Bajeke might contest Gidderbaha bypoll

- 04 ‘Find it hard to let my children win,’ says Lionel Messi on his fierce competitiveness

- 05 California governor defends progressive values, says they’re an ‘antidote’ to populism on the right

- Elections 2024

- Political Pulse

- Entertainment

- Movie Review

- Newsletters

- Web Stories

- Personal Finance

- Today's Paper

- T20 World Cup

- Partner Content

- Entertainment

- Social Viral

- Pro Kabaddi League

IRCTC sets 29 Oct as record date for stock split

Disclaimer: No Business Standard Journalist was involved in creation of this content

IRCTC gains as Ahmadabad Mumbai Tejas Express to resume services

Irctc hits record high on heavy volumes, irctc hits record high; rises 10% in seven days, irctc temporarily suspends operations of two tejas express, irctc hits record high; rises 5% in two sessions, blue dart express gains on raising average shipment prices, rajesh dahiya quits axis bank, cabinet approves listing ecgc on bourses, sterling and wilson solar rises for third day; adds nearly 60% this year, hdfc asset management company ltd leads losers in 'a' group.

Don't miss the most important news and views of the day. Get them on our Telegram channel

First Published: Sep 30 2021 | 9:17 AM IST

Explore News

- Suzlon Energy Share Price Adani Enterprises Share Price Adani Power Share Price IRFC Share Price Tata Motors Share Price Tata Steel Share Price Yes Bank Share Price Infosys Share Price SBI Share Price Tata Power Share Price

- Latest News Company News Market News India News Politics News Cricket News Personal Finance Technology News World News Industry News Education News Opinion Shows Economy News Lifestyle News Health News

- Today's Paper About Us T&C Privacy Policy Cookie Policy Disclaimer Investor Communication GST registration number List Compliance Contact Us Advertise with Us Sitemap Subscribe Careers BS Apps

- ICC T20 World Cup 2024 Budget 2024 Lok Sabha Election 2024 Bharatiya Janata Party (BJP)

- Option Chain

- Daily Reports

- Press Releases

26-Jun-2024 15:30

26-Jun-2024 | 83.5500

26-Jun-2024 12:29

Lac Crs 431.98 | Tn $ 5.17

25-Jun-2024

- A+ | Reset | A-

- High Contrast | Reset

- Mutual Fund

You will be redirected to another link to complete the login

Quote - Equity

- In Top 10 today

Special Pre Open Session

- Price mentioned in band is Indicative Equilibrium Price (IEP) as on

Series : | ( )

Announcements.

- Announcements XBRL

Annual Reports

Business responsibility and sustainability report, board meetings, corporate actions.

- Company Directory

Corporate Governance

Corporate information, daily buy back, event calendar, financial results, financial results comparision.

- Further Issues XBRL Fillings

Insider Trading

Investor complaints, promoter encumbrance details.

- Issue Offer Documents / Issue Summary Documents

Related Party Transactions

- SAST Regulations

Statement of Deviation/Variation

- System Driven Disclosures - PIT

- System Driven Disclosures - SAST

Secretarial Compliance

Share transfers, shareholder's meetings, shareholding patterns.

- Statement on Impact of Audit qualification

Unitholding Patterns

Voting results, intraday chart, security status, financial results (amount in cr.), shareholding patterns (in %).

Click here for Block Deals

To Read all the information, please Click here

Corporate Announcements

Announcement xbrl.

- All Values are in ₹ Lakhs.

Insider Trading (PIT) - Annual

No data found.

- Transfer Agent details

Statement on Impact of Audit qualification --> Statement on Impact of Audit qualification

- Price mentioned in band is Indicative Equilibrium Price (IEP). The equilibrium price shall be the price at which the maximum volume can be matched.

- ATO stands for “At the Open”, any “market order” placed to buy or sell a stock gets traded as ATO

- Click here for more on Pre-Open Market Call Auction

(Period to )

( period to ), data for 52 week period:, yearly data for period:, monthly data for period :, delivery position, value at risk (%), industry classification, announcement xbrl details, quick links, quick links, for investors, for corporates, for members, old website, quick links for investors.

Dashboard for end of day reports download, quick market snapshot and important announcements.

Market Snapshot

Volume (Lakhs)

Value (Lakhs)

FFM .Cap (Lakhs)

Quick Links for Corporates

Dashboard for tracking corporate filings

Latest Corporate Filings

Showing 0 of 5 selected companies, latest circulars, quick links for members, members message area.

Exchange has published Member Help Guide and new FAQs for Access to Markets. Visit the link: https://www.nseindia.com/trade/all-member-faqs

Contact for Support

- Trending Stocks

- DEE Development INE841L01016, DEEDEV, 544198

- Vodafone Idea INE669E01016, IDEA, 532822

- Amara Raja INE885A01032, ARE&M, 500008

- Suzlon Energy INE040H01021, SUZLON, 532667

- HDFC Bank INE040A01034, HDFCBANK, 500180

- Mutual Funds

- Commodities

- Futures & Options

- Cryptocurrency

- My Portfolio

- My Watchlist

- FREE Credit Score ₹100 Cash Reward

- My Messages

- Price Alerts

- Chat with Us

- Download App

Follow us on:

- Global Markets

- Indian Indices

- Economic Calendar

- Technical Trends

- Big Shark Portfolios

- Stock Scanner

- Auri ferous Aqua Farma , 519363

- Loans @ 12% Up to ₹ 15 Lakhs!

- Zero Ads Get Premium Content Daily Stock Calls Stock Insights Daily Newsletters Stock Forecasts Technical Indicators Go Pro @₹99

- Top Stories Technical Trends

- Financial Times Opinion

- Learn GuruSpeak

- Webinar Interview Series

- Business In The Week Ahead Research

- Technical Analysis Personal Finance

- My Subscription My Offers

- Budget 2024

- Loans

- Home FII & DII Activity

- Earnings Webinar

- Web Stories

- Tax Calculator

- Silver Rate

- Storyboard18

- Home Tech/Startups

- Auto Research

- Opinion Politics

- Home Loans

- Home Performance Tracker

- Top ranked funds My Portfolio

- Top performing Categories Forum

- MF Simplified

- Home Gold Rate

- Trade like Experts

- IFBA Season 3 Pharma Industry Conclave

- Unlocking opportunities in Metal and Mining REA

- Advanced Technical Charts

- International

- Go pro @₹99

- Budget 2 24

- T20 WC 2024

- Loan up to ₹15L

- Personal Finance

- Moneycontrol /

- Share/Stock Price /

- Miscellaneous

- Options CE PE View Option Chain »

Samco Stock Rating

IRCTC - Indian Railway Catering & Tourism Corp Ltd.

As on 26 Jun, 2024 | 03:31

* BSE Market Depth (26 Jun 2024)

As on 26 Jun, 2024 | 03:32

(OI , PRICE )

See Historical Trend

Market Depth (13 Jan 2021)

- Jul 30,2020

- Aug 30,2020

- Sep 30,2020

- June 26, 2020

- Open Interest 84739329239 4.43%

- Price 345.5 5.43%

- Open Interest 84739329239 -18.73%

- Price 345.5 -5.43%

- Top 5 Trending Stocks

- #KnowBeforeYouInvest

Forecast

Stock with good financial performance alongside good to expensive valuation

The Estimates data displayed by Moneycontrol is not a recommendation to buy or sell any securities. Estimates data is a third party aggregated data provided by S&P Global Market Intelligence LLC for informational purposes only. The Company advises the users to check with duly registered and qualified advisors before taking any investment decision. The Company does not guarantee the accuracy, adequacy or completeness of any information/data and is not responsible for any errors or omissions or for the results obtained from the use of such information/data. The Company or anyone involved with the Company will not accept any liability for loss or damage as a result of reliance on the Estimates data. The Company does not subscribe or endorse any of the services and/or content offered by such third party.

Hits/Misses

- MC Insights

- MC Technicals

- Price & Volume

- Corp Action

- Shareholding

Note: High PE if PE ≥ 80 percentile, Low PE if PE ≤ 30 percentile and Average PE if 30 < PE < 80 percentile (calculations based on 3 years data)

Note: High P/B if P/B ≥ 80 percentile, Low P/B if P/B ≤ 30 percentile and Average P/B if 30 < P/B < 80 percentile (calculations based on 5 years data)

- Advanced Chart

*Delayed by 20 seconds.

Share Price Forecast

Earnings forecast, consensus recommendations.

- Underperform

Get detailed analysis with Moneycontrol Stock Insights.

- 13.05% away from 52 week high

- Market Cap - Market Leader

- Promoters holding remains unchanged at 62.40% in Mar 2024 qtr

BIG SHARK INVESTORS

- President Of India 62.4%

- Management Interviews

- --> Investor Presentation

- Earnings Transcripts

- Credit Rating

- Resignation

Pivot levels

Note : Support and Resistance level for the day, calculated based on price range of the previous trading day.

Note : Support and Resistance level for the week, calculated based on price range of the previous trading week.

Note : Support and Resistance level for the month, calculated based on price range of the previous trading month.

- Very Bullish

- Very Bearish

Improving ROE

Companies that are improving efficiency in utilising shareholders funds, improving roce, companies increasing efficiency in utilisation of all sources of capital, rising profits, falling margins, companies that have grown their net profits but decreased net profit margins over the past 12 months.

- ROE>ROE 1 yr Back

- ROE>ROE 3 yr Avg

- Market Capitalization >250

- ROCE>ROCE 1 yr Back

- ROCE>ROCE 3 yr Avg

- NetProfit>NetProfit1YrBack AND

- NPM<NPM1YrBack AND

- NetProfit1YrBack>0 AND

- MarketCap>250

DII Buying FII Buying

List of companies in which diis and fiis have increased their holdings in last quarter, debt free companies, companies in which fiis have increased holding qoq.

- FIIHolding >FIIHolding1QtrBack AND

- DIIHolding >DIIHolding1QtrBack AND

- MarketCap >250

- Debt =0 AND

- Market Capitalization >500

- FIIHolding>FIIHolding1QtrBack AND

- MarketCap>500

5X Premium to Book Value

Companies trading at more than 5 times their book values, debt free, pledge free, list of companies with zero debt and pledge.

- Price to book value > 5 AND

- Book value >0 AND

- Market Capitalization >500 AND

- Pledged percentage<0.1 AND

- Debt<0.1

Institutions Favourites

List of companies in which fiis and diis have increased holding over last 3 years, rising book value, book value of these companies rising over last 3 years.

- VariationInDiiHoldingOver3Yrs>0 AND

- DIIHolding>DIIHolding1QtrBack AND

- VariationInFiiHoldingOver3Yrs>0 AND

- BookValue>BookValue1YrBack AND

- BookValue1YrBack>BookValue3YrsBack AND

Price to Book Value Above Industry

Companies with price to book value above industry, premium to peers, companies trading at premium pe valuation as compared to their industry peers.

- Price to book value >Industry PBV AND

- Price to Earning >Industry PE AND

Dividend Champions

Companies that have consistently given dividends over last 3 years, profit pioneers, companies that are consistently generating 25% or higher profit growth for last 3 years.

- DividendPayout>25 AND

- DividendPayout<100 AND

- NetProfit3yrCAGR>10 AND

- DividendPayout3yrAvg>25 AND

- NetProfit3yrCAGR>25 AND

- NetProfitGrowth>25 AND

Falling Quarterly Profits

Companies that have shown a fall in qoq profits as per their latest results, increasing institutional interest, companies in which diis and fiis have increased their holding in the latest quarter.

- QuarterlyNetProfit<NetProfit1QtrBack AND

Price and Volume

Irctc consolidated march 2024 net sales at rs 1,154.77 crore, up 19.66% y-o-y.

IRCTC Standalone March 2024 Net Sales at Rs 1,154.77 crore, up 19.66% Y-o-Y Jun 12 2024 12:04 PM

Reduce Indian Railway Catering and Tourism Corporation; target of Rs 811: Prabhudas Lilladher Jun 03 2024 05:14 PM

IRCTC Q4 FY24 u2013 Ticket expensive for a slow train May 30 2024 11:05 AM

Stock Radar: PNB Housing Finance, Hindalco, Grasim, Aster DM Healthcare, Tata Steel in focus on Wednesday May 29 2024 02:24 AM

Community Sentiments

What's your call on IRCTC today?

Read 4 investor views

Thank you for your vote

You are already voted!

worst stock in bull market....mark my word View more

Posted by : gomu108

Repost this message

worst stock in bull market....mark my word

Professor777

markets are at all time high but this trashy stock doesnt want to go up. 900 jayega kya yeh ghatiya share View more

Posted by : Professor777

markets are at all time high but this trashy stock doesnt want to go up. 900 jayega kya yeh ghatiya share

iska operator gaon Gaya hai , ek do saal main wapas aayaga tab 2-3 rs price badega, daily false volume no delivery based buying , pure din main false volume kar trap karta hai View more

Posted by : bulls_only

iska operator gaon Gaya hai , ek do saal main wapas aayaga tab 2-3 rs price badega, daily false volume no delivery based buying , pure din main false volume kar trap karta hai

- Broker Research

Prabhudas Lilladher

- Company analysis giving insights of fundamentals, earnings, relative valuations, risk, price momentum and inside trading.

- Thomson Reuters proprietary rating of stock on scale of 1 to 10

- Industry ranking and detailed sector analysis of recent happening in sector

- Analyst rating like Buy/Sell/Hold with Earnings estimates with 1 year price target

ISHARES CORE MSCI EMERGING MARKETS ETF

Ishares core emerging markets mauritius co.

*Transaction of a minimum quantity of 500,000 shares or a minimum value of Rs 5 crore.

GRAVITON RESEARCH CAPITAL LLP

Integrated core strategies (asia) pte. ltd., xtx markets llp, nk securities research private limited.

*A bulk deal is a trade where total quantity of shares bought or sold is more than 0.5% of the equity shares of a company listed on the exchange.

Insider Transaction Summary

The president of india, acting through and represented by the ministry of railways, goverment of india, the president of india acting through and represented by the ministry of railways government of india.

*Disclosures under SEBI Prohibition of Insider Trading Regulations, 2015

Life Insurance Corporation of India Acquisition

The president of india, acting through & represented by the ministry of railways, government of india disposal, the president of india, acting through & represented by ministry of railway disposal.

*Disclosures under SEBI SAST (Substantial Acquisition of Shares and Takeovers) Regulations, 2011

Corporate Action

- Announcements

- Board Meetings

IRCTC - Indian Railway Catering & Tourism Corp - Announcement under Regulation 30 (LODR)-Earnings Call Transcript

Irctc - indian railway catering & tourism corp - announcement under regulation 30 (lodr)-analyst / investor meet - outcome.

- Consolidated

- Income Statement

- Balance Sheet

- Debt to Equity

- Half Yearly

- Nine Months

Detailed Financials

- Profit & Loss

- Quarterly Results

- Half Yearly Results

- Nine Months Results

- Yearly Results

- Capital Structure

- Mutual Funds have increased holdings from 2.43% to 2.97% in Mar 2024 qtr.

- Number of MF schemes decreased from 27 to 26 in Mar 2024 qtr

- FII/FPI have increased holdings from 7.34% to 8.08% in Mar 2024 qtr.

About the Company

Company overview, registered office.

11th Floor, Statesman House, ,B-148, Barakhamba Road, ,Connaught Place,

011-23311263

011-23311259

http://www.irctc.com

4E/2, Jhandewalan Extension,,

New Delhi 110055

011-42541234, 23451234

011-41543474

http://www.alankit.com

Designation

Chairman & Managing Director

Director - Finance & CFO

Independent Director

Included In

INE335Y01020

Your feedback matters! Tell us what we got right and what we didn’t? Click here>

- Know Before You Invest

- Shareholding Pattern

- Deals & Insider

We at moneycontrol are continually attempting to improve our products and what’s more, carry the best to our users!

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry’s standard dummy text ever since the 1500

Which stock to buy and why? Make an informed investment decision with advanced AI-based features like SWOT analysis, investment checklist, technical ratings and know how fairly the company is valued.

An analysis of stocks based on price performance, financials, the Piotroski score and shareholding. Find out how a company stacks up against peers and within the sector.

Read research reports, investor presentations, listen to earnings call and get recommendations from the best minds to maximise your gains.

Is the company as good as it looks? Track FII, DII and MF trends. Keep a tab on promoter holdings along with pledge details. Get all the information on mutual fund schemes and the names of institutions which invested in a company.

Advanced charts with more than 100 technical indicators, tools and studies will give you the edge, making it easier to negotiate the market and its swings.

Who is raising the stake and who is exiting? Stay updated with the latest block and bulk deals to gauge big investor mood and also keep an eye on what Insiders are doing.

- Share Price & Valuation Forecast

- MC Essentials

- Sharpest Opinions & Actionable Insights

- Exclusive Webinars

- Research & Expert Technical Analysis

You got 30 Day’s Trial of

- Ad-Free Experience

- Actionable Insights

- MC Research

You are already a Moneycontrol Pro user.

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Premium News

- Biden Economy

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Investment Ideas

- Research Reports

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Analyst Rating

- Technical Events

- Smart Money

- Top Holdings

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Credit Card Offers

- Best Free Checking

- Student Loans

- Personal Loans

- Car Insurance

- Mortgage Refinancing

- Mortgage Calculator

- Morning Brief

- Market Domination

- Market Domination Overtime

- Asking for a Trend

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Indian railway catering & tourism corporation limited (irctc.ns), valuation measures, financial highlights, fiscal year, profitability, management effectiveness, income statement, balance sheet, cash flow statement, trading information, stock price history, share statistics, dividends & splits.

- 1 Data provided by Refinitiv.

- 2 Data provided by EDGAR Online.

- 3 Data derived from multiple sources or calculated by Yahoo Finance.

- 4 Data provided by Morningstar, Inc.

- 5 Shares outstanding is taken from the most recently filed quarterly or annual report and Market Cap is calculated using shares outstanding.

- 6 Implied Shares Outstanding of common equity, assuming the conversion of all convertible subsidiary equity into common.

- 7 EBITDA is calculated by S&P Global Market Intelligence using methodology that may differ from that used by a company in its reporting.

- 8 A company's float is a measure of the number of shares available for trading by the public. It's calculated by taking the number of issued and outstanding shares minus any restricted stock, which may not be publicly traded.

Abbreviation Guide

- mrq = Most Recent Quarter

- ttm = Trailing Twelve Months

- yoy = Year Over Year

- lfy = Last Fiscal Year

- fye = Fiscal Year Ending

Related Tickers

- +91- 9640901313 [email protected]

- Search for a Case

- Press Release

- Case Studies

Stock Split: A Case of IRCTC

Indian Railway Catering and Tourism Corporation Limited (IRCTC) was established in 1999 by the Government of India as a public limited company to meet the needs of travelers of the Indian Railways. IRCTC offered various services and products, including catering, online ticketing, and packed drinking water, among others. Over the period, the company established itself as a strong player with a sound financial position, thanks to a monopoly in online train ticketing for Indian Railways. In 2019, IRCTC went in for an IPO and was later listed at a premium of more than 101% over the offer price of Rs. 320. The growth story of IRCTC stock continued and the share price touched Rs. 2,331.30 by July 2021. The company’s management decided to go in for a stock split in October 2021. Before the stock split, IRCTC’s stock had reached a record high of Rs. 6,369 on October 14, 2019. The IRCTC stock was performing well and many analysts suggested holding the stock after the stock split. However, some experts cautioned investors against investing in any stock after the stock split.

- Understand the significance of the corporate actions of a company.

- Analyze the effect of a stock split on the market price of the company.

IRCTC; Investment Decisions; Stock Split; Stock Split in India; Impact of Stock Split on share price; Ex-date; Record Date; Share price momentum; Corporate Actions; Different Types of Stock Split; Reasons for Stock Split; Profit Distribution; Profit Sharing

Buy this case study (Please select any one of the payment options)

Copyright © 2020 - 2025 All Rights Reserved - icmrindia.org

Super Investors

- Account

- Share Holding

- Balance Sheet

- Corp. Action

IRCTC share price

NSE: IRCTC BSE: 542830 SECTOR: Travel Services 1612k 11k 2k

Price Summary

₹ 1002.75

₹ 988

₹ 1138.9

₹ 614.35

Ownership Stable

Valuation fair, efficiency excellent, financials very stable, company essentials.

₹ 79212 Cr.

₹ 77278.27 Cr.

₹ 40.37

₹ 1933.73 Cr.

₹ 0 Cr.

₹ 13.89

Add Your Ratio

Your Added Ratios

Index presence.

The company is present in 36 Indices.

NIFTY100WEIGHT

NIFTY200QLTY30

NY500MUL50:25:25

NIFTYLGEMID250

NIFTYTOTALMCAP

NIFTYINFRAST

NIFTYDIGITAL

NIFTY100ESG

NIFTY100ESGSECT

NIFTY100ENHESG

NIFTYMOBILITY

NIFTYNONCYCLIC

NIFTYTRANSLOG

BSE100LARGECAPTMC

S&P LARGEMIDCAP

S&P MIDSMLCAP

- Price Chart

- Volume Chart

Price Chart 1d 1w 1m 3m 6m 1Yr 3Yr 5Yr

Volume chart 1d 1w 1m 3m 6m 1yr 3yr 5yr, pe chart 1w 1m 3m 6m 1yr 3yr 5yr, pb chart 1w 1m 3m 6m 1yr 3yr 5yr, peer comparison, group companies.

Track the companies of Group.

Sales Growth

Profit growth, debt/equity, price to cash flow, interest cover ratio, cfo/pat (5 yr. avg.).

Share Holding Pattern

Promoter pledging %, strengths.

- The company has shown a good profit growth of 25.1543839721907 % for the Past 3 years.

- The company has shown a good revenue growth of 16.0776112053932 % for the Past 3 years.

- Company has been maintaining healthy ROE of 33.1418267707332 % over the past 3 years.

- Company has been maintaining healthy ROCE of 45.3693602974949 % over the past 3 years.

- Company is virtually debt free.

- Company has a healthy Interest coverage ratio of 85.034730799069 .

- The Company has been maintaining an effective average operating margins of 31.5982876456564 % in the last 5 years.

- The company has an efficient Cash Conversion Cycle of -1354.62091221166 days.

- The company has a high promoter holding of 62.4 %.

Limitations

- The company is trading at a high PE of 71.28 .

- The company is trading at a high EV/EBITDA of 47.4266 .

Quarterly Result (All Figures in Cr.)

Profit & loss (all figures in cr. adjusted eps in rs.), balance sheet (all figures are in crores.), cash flows (all figures are in crores.), corporate actions dividend bonus rights split.

President Of India

Holding Value: 49425.53241255 Cr.

As of March2024

Investors Details Promoter Investors

Annual reports.

- Annual Report 2023 10 Aug 2023

- Annual Report 2022 10 Aug 2023

- Annual Report 2021 18 Sep 2021

- Annual Report 2020 2 Oct 2020

- Annual Report 2019 9 Mar 2021

- Annual Report 2018 10 May 2021

- Annual Report 2017 10 May 2021

Ratings & Research Reports

- Credit Report By:ICRA 9 Oct 2023

- Credit Report By:CARE 9 Oct 2023

- Research Way2Wealth 6 Apr 2021

- Research Way2Wealth 3 Jan 2023

- Research Way2Wealth 28 Mar 2023

- Research way2wealth 25 Sep 2023

- Research Way2Wealth 24 Nov 2021

- Research Way2Wealth 22 Mar 2023

- Research Way2Wealth 21 Feb 2024

- Research IDBI Capital 6 Sep 2022

- Research IDBI Capital 23 Nov 2021

- Research IDBI Capital 22 Jun 2023

- Research IDBI Capital 2 Jul 2021

- Research IDBI Capital 19 Feb 2024

Company Presentations

- Concall Q4FY23 7 Jun 2023

- Concall Q3FY24 21 Feb 2024

- Concall Q3FY21 8 Feb 2021

- Concall Q1FY24 23 Aug 2023

- Concall Q1FY22 23 Aug 2021

- Presentation Q2FY21 20 Nov 2020

Company News

Irctc stock price analysis and quick research report. is irctc an attractive stock to invest in.

Stock investing requires careful analysis of financial data to determine a company's true net worth. This is generally done by examining the company's profit and loss account, balance sheet and cash flow statement, which can be time-consuming and cumbersome.

Examining a company's financial ratios is an easier way to determine its performance, which can help to make sense of the overwhelming amount of information in its financial statements.

IRCTC stock price today is Rs 1000 . Here are a few indispensable ratios that should be a part of every investor’s research process, or, in simpler words, how to analyse IRCTC .

PE ratio : Price to Earnings ratio, which indicates how much an investor is willing to pay for a share for every rupee of earnings. A general rule of thumb is that shares trading at a low P/E are undervalued (it depends on other factors too). IRCTC has a PE ratio of 71.9906124241399 which is high and comparatively overvalued .

Share Price : - The current share price of IRCTC is Rs 1000 . One can use valuation calculators of ticker to know if IRCTC share price is undervalued or overvalued.

Return on Assets (ROA) : - Return on Assets measures how effectively a company can earn a return on its investment in assets. In other words, ROA shows how efficiently a company can convert the money used to purchase assets into net income or profits. IRCTC has ROA of 22.9979567009546 % which is a good sign for future performance. (higher values are always desirable)

Current ratio : - The current ratio measures a company's ability to pay its short-term liabilities with its short-term assets. A higher current ratio is desirable so that the company could be stable to unexpected bumps in business and economy. IRCTC has a Current ratio of 1.82015199350129 .

Return on equity : - ROE measures the ability of a firm to generate profits from its shareholders' investments in the company. In other words, the return on equity ratio shows how much profit each rupee of common stockholders’ equity generates. IRCTC has a ROE of 46.2610438014866 % .(higher is better)

Debt to equity ratio : - It is a good metric to check out the capital structure along with its performance. IRCTC has a Debt to Equity ratio of 0 which means that the company has low proportion of debt in its capital.

Sales growth : - IRCTC has reported revenue growth of 88.5191717719565 % which is fair in relation to its growth and performance.

Operating Margin : - This will tell you about the operational efficiency of the company. The operating margin of IRCTC for the current financial year is 36.0364525166916 % .

Dividend Yield : - It tells us how much dividend we will receive in relation to the price of the stock. The current year dividend for IRCTC is Rs 5.5 and the yield is 0.6533 % .

Earnings Per Share : - It tells us how much profit is allocated to to each outstanding share of a common stock. The latest EPS of IRCTC is Rs 13.8907 . The higher the EPS, the better it is for investors.

One can find all the Financial Ratios of IRCTC in Ticker for free. Also, one can get the intrinsic value of IRCTC by using Valuation Calculators, which are available with a Finology ONE subscription.

Brief about IRCTC

Indian railway catering and tourism corporation ltd. financials: check share price, balance sheet, annual report and quarterly results for company analysis.

Indian Railway Catering and Tourism Corporation Ltd. (IRCTC) is a leading hospitality and travel company that operates in India. In this article, we will provide a comprehensive analysis of IRCTC's stock from a long-term investor's perspective. We will cover various topics such as share price, balance sheet, annual report, dividend, quarterly result, stock price, price chart, news, concall, transcripts, investor presentations, promoters, and shareholders.

Indian Railway Catering And Tourism Corporation Ltd. Share Price:

The share price of IRCTC is an essential indicator of investor sentiment towards the company. The share price is influenced by various factors such as the company's financial performance, global economic conditions, and market sentiment. Long-term investors can use our pre-built screening tools to analyze IRCTC's share price and identify any trends or patterns. The company's share price has shown a stable trend over the past few years, reflecting the company's strong brand value and reputation in the hospitality and travel industry.

Indian Railway Catering And Tourism Corporation Ltd. Balance Sheet:

IRCTC's balance sheet provides crucial information about its financial health. The company's assets include fixed assets, investments, and current assets, while liabilities include borrowings, trade payables, and other liabilities. Equity includes share capital, reserves, and surplus. Long-term investors can use our pre-built screening tools to analyze IRCTC's balance sheet and identify any red flags. The company's balance sheet has shown a stable trend over the past few years, reflecting the company's strong financial position.

Indian Railway Catering And Tourism Corporation Ltd. Annual Report:

IRCTC releases an annual report every year, which provides detailed information about the company's financial performance, strategic initiatives, and future plans. The annual report includes a letter from the Chairman, financial statements, and management discussion and analysis. Long-term investors can download IRCTC's annual report from our website and use it to make informed investment decisions. The annual report provides valuable insights into the company's operations and financial performance.

Indian Railway Catering And Tourism Corporation Ltd. Dividend:

IRCTC has a consistent dividend payout history. The company has been paying dividends regularly, reflecting the company's strong financial position. Long-term investors should consider this when evaluating IRCTC's stock. Our pre-built screening tools can be used to analyze the company's dividend history and identify any trends or patterns.

Indian Railway Catering And Tourism Corporation Ltd. Quarterly Results:

IRCTC releases its quarterly results every three months. The quarterly results provide information about the company's revenue, earnings, and expenses. Long-term investors can use our pre-built screening tools to analyze IRCTC's quarterly results and identify any trends or patterns. The quarterly results are an important indicator of the company's financial health and performance.

Indian Railway Catering And Tourism Corporation Ltd. Stock Price:

The stock price of IRCTC is affected by various factors such as the company's financial performance, global economic conditions, and market sentiment. Long-term investors can use our pre-built screening tools to track IRCTC's stock price and identify potential buying opportunities. The stock price of IRCTC has shown a stable trend over the past few years, reflecting the company's strong brand value and reputation in the hospitality and travel industry.

Indian Railway Catering And Tourism Corporation Ltd. Price Chart:

A price chart provides a visual representation of a company's stock price over a period of time. Long-term investors can use our pre-built screening tools to analyze IRCTC's price chart and identify any trends or patterns. The price chart shows that the stock price of IRCTC has shown a stable trend over the past few years, reflecting the company's strong brand value and reputation in the hospitality and travel industry.

Indian Railway Catering And Tourism Corporation Ltd. News:

Keeping up to date with the latest news about IRCTC is important for investors. Our website provides the latest news about IRCTC from various sources such as financial news websites and social media. Long-term investors can use this information to make informed investment decisions.

Indian Railway Catering And Tourism Corporation Ltd. Concall:

IRCTC holds conference calls with analysts and investors to discuss its financial performance and future plans. Long-term investors can listen to IRCTC's concall and use the information provided to make informed investment decisions. Our website provides information about upcoming concalls and links to listen to past concalls.

Indian Railway Catering And Tourism Corporation Ltd. Transcripts:

Transcripts of IRCTC's concalls are available on our website. Long-term investors can download the transcripts and use them to analyze the company's financial performance and future plans. The transcripts provide valuable insights into the company's operations and financial performance.

Indian Railway Catering And Tourism Corporation Ltd. Investor Presentations:

IRCTC provides investor presentations on its website. These presentations provide information about the company's financial performance, strategic initiatives, and future plans. Long-term investors can download IRCTC's investor presentations from our website and use them to make informed investment decisions. The investor presentations provide valuable insights into the company's operations and financial performance.

Indian Railway Catering And Tourism Corporation Ltd. Promoters:

Promoters are individuals or entities that have a significant stake in a company. IRCTC's promoters include the Government of India. Long-term investors can use our pre-built screening tools to analyze IRCTC's promoter holdings and identify any potential conflicts of interest. The promoter holdings of IRCTC are relatively stable, which is a positive sign for long-term investors.

Indian Railway Catering And Tourism Corporation Ltd. Shareholders:

IRCTC has a large number of shareholders, including institutional investors and individual investors. Long-term investors can use our pre-built screening tools to analyze IRCTC's shareholder base and identify any potential risks or opportunities. The shareholder base of IRCTC is diverse, which is a positive sign for long-term investors.

Indian Railway Catering And Tourism Corporation Ltd. Premium Features:

Our website provides premium features tools such as DCF Analysis, BVPS Analysis, Earnings multiple approach, and DuPont analysis. These tools can help long-term investors make better investment decisions by providing more detailed insights into the company's financial performance and valuation.

Indian Railway Catering And Tourism Corporation Limited ROCE

The Return on Capital Employed (ROCE) is an important financial metric for investors to assess the profitability and efficiency of Indian Railway Catering And Tourism Corporation Limited. It measures the company's ability to generate profits from the capital invested in its operations. By analyzing the ROCE, investors can gain insights into the company's ability to generate returns on its investments. The ROCE data for Indian Railway Catering And Tourism Corporation Limited can be found in the financials table or ratio section.

Indian Railway Catering And Tourism Corporation Limited EBITDA

EBITDA, which stands for Earnings Before Interest, Tax, Depreciation, and Amortization, is a key indicator of the operating performance of Indian Railway Catering And Tourism Corporation Limited. It represents the company's earnings before accounting for non-operating expenses and income. By examining the EBITDA, investors can evaluate the company's profitability and efficiency in generating operating income. The EBITDA data for Indian Railway Catering And Tourism Corporation Limited can be accessed in the financials table or ratio section.

Indian Railway Catering And Tourism Corporation Limited DPS

DPS refers to Dividends Per Share and it is an important metric to consider for investors looking at Indian Railway Catering And Tourism Corporation Limited. DPS represents the portion of the company's profits that is distributed to shareholders in the form of dividends. By examining the DPS, investors can assess the company's dividend payment history and its commitment towards shareholder returns. You can find the DPS data for Indian Railway Catering And Tourism Corporation Limited in the financials table or ratio section.

Indian Railway Catering And Tourism Corporation Limited EPS

EPS, or Earnings Per Share, is a critical measure for evaluating the profitability and financial performance of Indian Railway Catering And Tourism Corporation Limited. It indicates the company's net earnings attributable to each outstanding share. By analyzing the EPS, investors can gauge the company's ability to generate earnings for its shareholders. The EPS data for Indian Railway Catering And Tourism Corporation Limited can be found in the financials table or ratio section.

Please note that this website provides comprehensive information and analysis for Indian Railway Catering And Tourism Corporation Limited, including the above-mentioned financial ratios.

Ratio Delete Confirmation

Upcoming IPO, GMP, Allotment, Status, Subscription, Listing

IRCTC Stock Split Ratio 1:5 Approved, What’s Next For Investors

The Indian Railway Catering and Tourism Corporation (IRCTC) board on Thursday the proposal for an IRCTC Stock Split Ratio 1:5 Approved or sub-division of shares. It has been decided to split 1 share of the face value of ₹10 into 5 equity shares of the face value of ₹2 subjects to the approval of the Ministry of Railways, Shareholders, and other approvals.

Shares of IRCTC rose over 5% to hit a new high of Rs 2,727 on BSE today during the market trading day. IRCTC has given multi-bagger returns to investors by increasing more than 5 times since its IPO issue price of ₹320 per share. The company said the stock split will help increase liquidity in the capital market, widen the shareholder base and make the shares affordable for small investors.

Stock Split Notice: Click here Notice Link

Indian Railway Catering and Tourism Corporation (IRCTC) is a wholly-owned subsidiary of Indian Railways providing ticketing, catering, and tourism services to Indian Railways.

Service: Online ticketing, Catering and hospitality, Tourism.

Table of Contents

IRCTC Stock Split Ratio:

The ratio is : 1:5, ipobazar team recommendation:, highly recommendation to irctc stock buy after share split because this share is multibagger stock the long term..

Disclaimer: STOCK MARKET INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

Trade with LTP Calculator

Indian Railway Catering & Tourism Corporation Ltd

Incorporated in 1999, IRCTC is a Mini Ratna (Category 1, Central Public Sector Enterprises ) and the only company authorized by the Indian government to provide online railway tickets, catering services, and packaged drinking water at railway stations and trains in India [1]

Business Divisions: [1] [2] a) Catering and hospitality b) Internet ticketing c) Packaged drinking water d) State teertha e) Tourism Company manages catering and hospitality services at railway stations, on trains, and other important locations and promotes domestic travel and international tourism through the development of budget hotels, special tour packages, and e-ticketing services.

- Market Cap ₹ 79,272 Cr.

- Current Price ₹ 991

- High / Low ₹ 1,148 / 614

- Stock P/E 68.6

- Book Value ₹ 40.4

- Dividend Yield 0.56 %

- ROCE 53.8 %

- Face Value ₹ 2.00

- Sales & Margin

- EV / EBITDA

- Price to Book

- Market Cap / Sales

- Company has reduced debt.

- Company is almost debt free.

- Company has delivered good profit growth of 32.2% CAGR over last 5 years

- Company has a good return on equity (ROE) track record: 3 Years ROE 41.9%

- Stock is trading at 24.5 times its book value

- Promoter holding has decreased over last 3 years: -5.00%

* The pros and cons are machine generated. Pros / cons are based on a checklist to highlight important points. Please exercise caution and do your own analysis.

Peer comparison

Sector: Railways Industry: Travel Agencies

Quarterly Results

Standalone Figures in Rs. Crores / View Consolidated

Profit & Loss

Balance sheet, shareholding pattern.

Numbers in percentages

* The classifications might have changed from Sep'2022 onwards. The new XBRL format added more details from Sep'22 onwards. Classifications such as banks and foreign portfolio investors were not available earlier. The sudden changes in FII or DII can be because of these changes. Click on the line-items to see the names of individual entities.

Announcements

- Announcement under Regulation 30 (LODR)-Earnings Call Transcript 4 Jun - Transcript of Earning Conference Call for quarter and year ended 31.03.2024 held on 29.05.2024 is attached herewith.

- Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Outcome 30 May - In reference to our communication dated May 29, 2024, please find below the revised link of Audio Recording of Earning Conference Call on for the …

- Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Outcome 29 May - In compliance with the Regulation 30 of the SEBI (LODR) Regulations 2015, please find below the link of Audio Recording of Earning Conference Call on …

- Announcement under Regulation 30 (LODR)-Newspaper Publication 29 May - Newspaper publication of the Audited (Standalone & Consolidated) Financial Results of the Company for the quarter and year ended on 31st March, 2024.

- Corporate Action-Board approves Dividend 28 May

Annual reports

- Financial Year 2023 from bse

- Financial Year 2022 from bse

- Financial Year 2021 from bse

- Financial Year 2020 from bse

- Jun 2024 Transcript Notes PPT

- Feb 2024 Transcript Notes PPT

- Nov 2023 Transcript Notes PPT

- Sep 2023 Transcript Notes PPT

- Jun 2023 Transcript Notes PPT

- Feb 2023 Transcript Notes PPT

- Nov 2022 Transcript Notes PPT

- Aug 2022 Transcript Notes PPT

- Jun 2022 Transcript Notes PPT

- Feb 2022 Transcript Notes PPT

- Dec 2021 Transcript Notes PPT

- Nov 2021 Transcript Notes PPT

- Aug 2021 Transcript Notes PPT

- Jul 2021 Transcript Notes PPT

- Mar 2021 Transcript Notes PPT

- Feb 2021 Transcript Notes PPT

- Nov 2020 Transcript Notes PPT

- Jul 2020 Transcript Notes PPT

INDIAN RAIL TOUR CORP LTD

Irctc chart, upcoming earnings, about indian rail tour corp ltd.

See all ideas

Analyst rating

Stock brokers.

See all brokers

Frequently Asked Questions

- Technology News

- IRCTC wants you to remember these 3 important things while booking tickets; and believe no other 'viral news'

IRCTC wants you to remember these 3 important things while booking tickets; and believe no other 'viral news'

What the ‘false’ news claim

IRCTC Issues Clarification On Same Surname For Booking Rule; Says Its Fake News

T he world of the internet is filled with avenues of duplicitous pitfalls to bring about harm to individuals through misinformation and disinformation. In another instance of charlatans spreading fake news, a report that the Indian Railway Catering and Tourism Corporation or IRCTC has amended a new rule for booking tickets has been making the rounds on the internet.

Tickets On For Family?

The fake rule claimed that according to a fictitious section 143 of the railway rulebook, consumers were only allowed to book tickets online for their kin or people with the same surname as them.

This 'rule' also said that consumers could not book these online tickets for their friends or other individuals who are not related to them by blood. The fake piece of information also claimed that booking against these rules would invite a penalty of 3 years or a Rs 10,000 fine.

The IRCTC has now come out with a clarification rebutting these claims. The state-owned entity took to its X (formerly Twitter) account to clear the air.

In a statement, the IRCTC said, "The news in circulation on social media about restrictions on the booking of e-tickets due to different surnames is false and misleading. The concerned should be discouraged from spreading such false news.

You Can Book Tickets For Anyone

In order to allay fears, the IRCTC further clarified on booking and said, "One can book tickets on personal User ID for friends, family, and relatives"

The statement further added, "Tickets booked on personal User IDs are not meant for commercial sale and such an act is an offence under section 143 of Railways Act 1989."

The IRCTC share prices declined 0.53 per cent or Rs 5.30, in intraday trade on Wednesday, June 26, taking its cumulative value to Rs 989.80.

- SECTOR : DIVERSIFIED CONSUMER SERVICES

- INDUSTRY : TRAVEL SUPPORT SERVICES

- INDIAN RAILWAY CATERING & TOURISM CORPORATION LTD.

Indian Railway Catering & Tourism Corporation Ltd. NSE: IRCTC | BSE: 542830

Indian Railway Catering & Tourism Corporation Ltd. Live Share Price Today, Share Analysis and Chart

Expensive performer.

990.45 -4.65 ( -0.47 %)

61.22% Gain from 52W Low

3.4M NSE+BSE Volume

NSE 26 Jun, 2024 3:40 PM (IST)

- Share on Facebook

- Share on LinkedIn

- Share via Whatsapp

SWOT Analysis

Indian railway catering & tourism corporation ltd. live price chart, earnings conference calls, investor presentations and annual reports, earnings calls, annual reports, investor presentation, indian railway catering & tourism corporation ltd. faq, how is indian railway catering & tourism corporation ltd. today, indian railway catering & tourism corporation ltd. today is trading in the down by -0.47% at 990.45., how has indian railway catering & tourism corporation ltd. performed historically, indian railway catering & tourism corporation ltd. is currently trading down -0.47% on an intraday basis. in the past week the stock fell -4.06%. stock has been up 6.65% in the past quarter and rose 57.77% in the past year. you can view this in the overview section..

- LIVE DISCOURSE

- BLOG / OPINION

- SUBMIT PRESS RELEASE

- Advertisement

- Knowledge Partnership

- Media Partnership

Railway Safety and Passenger Amenities Revamped in Major Overhaul

Railway minister ashwini vaishnaw conducted a detailed meeting on safety and passenger amenities, resulting in key decisions about safety equipment, food quality, and cleaning protocols. the meeting included top railway officials and focused on comprehensive improvements to enhance passenger experience..

Railway Minister Ashwini Vaishnaw spearheaded a detailed review of railway safety and passenger amenities on Monday at Rail Bhawan. The high-profile meeting included Railway Board Chairperson and CEO Jaya Varma Sinha, Member Infrastructure Anil Kumar Khandelwal, the director general of the Research Design and Standards Organisation (RDSO), and general managers from all railway zones.

Officials disclosed that significant decisions were made to enhance safety protocols, specifically focusing on the maintenance and installation of safety equipment. These measures will be evaluated in workshops organized by the RDSO, involving all key manufacturers.

In a bid to improve the travel experience, the Indian Railway Catering and Tourism Corporation (IRCTC) will upgrade base kitchens across 1,000 locations. This task, targeted for completion within six months, aims to significantly improve food quality. Additionally, a stringent deep-cleaning schedule for pantry cars has been incorporated into the maintenance routine. Measures to enhance water availability and mid-journey train cleaning were also deliberated, ensuring comprehensive passenger comfort.

INSILLION Partners with RSGI and IRCTC to Revolutionize Travel Insurance

Irctc debunks e-ticket booking myths.

NX Group Joins Hands with Controlant for Enhanced Pharmaceutical Logistics

Max Life Insurance Earns 'Laureate' Honour by GPTW®

Top Financial Times Stories: Shein's IPO, Edinburgh's Halt, Sunak's Defense ...

Denmark Sets Precedent with First Livestock CO2 Tax

Latest news, philippine employers tackle workforce challenges amid technological shifts, un experts condemn criminalization of homelessness, urge repeal of cruel laws, italian pm giorgia meloni criticizes eu job distribution plan, prodapt solutions expands with new puerto rico facility.

OPINION / BLOG / INTERVIEW

Beyond the white coat: unveiling the true drivers of health worker performance, tackling the global alcohol crisis: who's bold new action plan, human-like conversations with perceptiveagent: enhancing ai empathy and interaction, revolutionizing urban transport: exploring human-autonomy interaction with digital twin technology, connect us on.

- ADVERTISEMENT

- KNOWLEDGE PARTNERSHIP

- MEDIA PARTNERSHIP

- Agro-Forestry

- Art & Culture

- Economy & Business

- Energy & Extractives

- Law & Governance

- Science & Environment

- Social & Gender

- Urban Development

- East and South East Asia

- Europe and Central Asia

- Central Africa

- East Africa

- Southern Africa

- West Africa

- Middle East and North Africa

- North America

- Latin America and Caribbean

OTHER LINKS

- Write for us

- Submit Press Release

- Opinion / Blog / Analysis

- Business News

- Entertainment News

- Technology News

- Law-order News

- Lifestyle News

- National News

- International News

OTHER PRODUCTS

Email: [email protected] Phone: +91-720-6444012, +91-7027739813, 14, 15

© Copyright 2024

IMAGES

VIDEO

COMMENTS

The board of Indian Railway Catering and Tourism Corporation (IRCTC) on Thursday announced splitting of the company's one equity share into five. This means that one share of ₹ 10 will be split ...

IRCTC Split Information. BSE: 542830 | NSE: IRCTCEQ | IND: Travel Agen. / Tourism Deve. / Amusement Park / Catering | ISIN code: INE335Y01020 | SECT: Tourism & Hospitality. You can view the Split history of Indian Railway Catering & Tourism Corporation Ltd. along its Announcement Dates, Ex-Split Dates, Old Face Value New Face Value. Splits History.

IRCTC Share Price Today (24 Jun, 2024): IRCTC Stock Price (₹ 1010.25) Live NSE/BSE updates on The Economic Times. Check out why IRCTC share price is down today. Get all details on Indian Railway Catering & Tourism Corporation shares news and analysis, Forecasts, Dividend, balance sheet, profit & loss, Quarterly results, annual report information, and more

IRCTC share price: The IRCTC stock surged 6.08 per cent to hit a 52-week high of Rs 2,727.95 on the BSE while on the National Stock Exchange (NSE), it rallied 6.09 per cent to Rs 2,728.85 during the intraday trade as the company announced a stock split in the ratio 1:5. Indian Railway Catering and Tourism Corporation (IRCTC).

On October 28, 2021, the shares of the Indian Railway Catering and Tourism Corporation Limited (IRCTC) were split into a 1:5 ratio based on a decision taken earlier in August 2021. After the stock split, the market price of IRCTC shares adjusted and it closed at Rs. 775.80 on November 29, 2021. After that, IRCTC's shares showed a growth of 4. ...

Capital Market. Last Updated : Sep 30 2021 | 9:31 AM IST. Indian Railway Catering and Tourism Corporation (IRCTC) fixed 29 October 2021 as the record date for the proposed 5-for-1 stock split. The company's board in August 2021 recommended the proposal for sub-division of one equity share of face value of Rs 10 each into five equity shares of ...

Indian Railway Catering And Tourism Corporation Limited Share Price Today, Live NSE Stock Price: Get the latest Indian Railway Catering And Tourism Corporation Limited news, company updates, quotes, offers, annual financial reports, graph, volumes, 52 week high low, buy sell tips, balance sheet, historical charts, market performance, capitalisation, dividends, volume, profit and loss account ...

The government of India owned 67.4 percent of the corporation as of June 30, 2021. In the case of IRCTC, each shareholder's one share will be multiplied by five. The number of shares would ...

Sep 27, 1999. Headquarters. New Delhi, Delhi. India. Website. irctc.com. Employees. 1,400. Get the latest Indian Railway Ctrng nd Trsm Corp Ltd (IRCTC) real-time quote, historical performance ...

Indian Railway Catering & Tourism Corporation Ltd. has split the face value 1 time since Oct. 28, 2021. Indian Railway Catering & Tourism Corporation Ltd. had last split the face value of its shares from ₹10 to ₹2 in 2021.The share has been quoting on an ex-split basis from Oct. 28, 2021. Ex-Date.

Discover historical prices for IRCTC.NS stock on Yahoo Finance. View daily, weekly or monthly format back to when Indian Railway Catering & Tourism Corporation Limited stock was issued.

IRCTC Share Price: Find the latest news on IRCTC Stock Price. ... Reduce Indian Railway Catering and Tourism Corporation; target of Rs 811: ... Life Insurance Corporation of India Acquisition ...

Indian Railway Catering and Tourism Corporation Limited (IRCTC) was established in 1999 +91- 9640901313 ... Price: Rs.300 Organization: Indian Railway Catering and Tourism Corporation Limited (IRCTC), Industry: Travel & Tourism Countries ... each stock of IRCTC at a face value of Rs. 10 was split into five equity shares with a face value of Rs ...

Indian Railway Catering & Tourism Corporation Splits: Discover the stock split history of Indian Railway Catering & Tourism Corporation and explore the details of past splits. Stay informed on ...

Find out all the key statistics for Indian Railway Catering & Tourism Corporation Limited (IRCTC.NS), including valuation measures, fiscal year financial statistics, trading record, share ...

Indian Railway Catering and Tourism Corporation (IRCTC) shares surged more than 7 per cent in a strong market on the news that the board will meet on August 12 to consider splitting shares of the company. The decision on the stock split will be subject to the approval of the Ministry of Railways and the shareholders.

The growth story of IRCTC stock continued and the share price touched Rs. 2,331.30 by July 2021. The company's management decided to go in for a stock split in October 2021. Before the stock split, IRCTC's stock had reached a record high of Rs. 6,369 on October 14, 2019. The IRCTC stock was performing well and many analysts suggested ...

Indian Railway Catering And Tourism Corporation Ltd. Share Price Today: CLOSE 1012.3, HIGH 1046, LOW: 1008.2. Get latest balance sheet, annual reports, quarterly results, and price chart. Indian Railway Catering And Tourism Corporation Ltd. Share Price Today: CLOSE 1012.3, HIGH 1046, LOW: 1008.2. ... Split; Super Investors. President Of India ...

The Indian Railway Catering and Tourism Corporation (IRCTC) board on Thursday the proposal for an IRCTC Stock Split Ratio 1:5 Approved or sub-division of shares. It has been decided to split 1 share of the face value of ₹10 into 5 equity shares of the face value of ₹2 subjects to the approval of the Ministry of Railways, Shareholders, and other approvals.

See companies where a person holds over 1% of the shares. Latest Announcements. Browse, filter and set alerts for announcements. Upgrade to premium; ... I R C T C Summary Chart Analysis Peers Quarters Profit & Loss Balance Sheet Cash Flow Ratios Investors Documents. Notebook. Indian Railway Catering & Tourism Corporation Ltd ₹ 1,010-0.21% 24 ...

Indian Railway Catering & Tourism Corporation. is trading-0.21% lower at Rs 1,013.45 as compared to its last closing price.. Indian Railway Catering & Tourism Corporation has been trading in the ...

INE335Y01020. FIGI. BBG00GM75WS8. Indian Railway Catering & Tourism Corp. Ltd. provides railway related services. It engages in Catering and Hospitality, Internet Ticketing, Travel and Tourism and Rail Neer Plants business. The firm operates through the following business segments: Catering, Packaged Drinking Water, Internet Ticketing, and ...

Indian Railway Catering and Tourism Corporation Ltd (IRCTC) stock price has flourished since 2023. In a year, the stock is up by 54% on BSE, while in 2024 so far, it has given double-digit returns ...

Indian Railway Catering and Tourism Corporation, or IRCTC, has debunked the 'news in circulation on social media' in which it is being claimed that iIf you book train tickets for your friends ...

The statement further added, "Tickets booked on personal User IDs are not meant for commercial sale and such an act is an offence under section 143 of Railways Act 1989." The IRCTC share prices ...

Indian Railway Catering & Tourism Corporation Ltd. live share price at 11 a.m. on Jun 25, 2024 is Rs 1000.90. Explore financials, technicals, Deals, Corporate actions and more ... Share Analysis and Chart. Expensive Performer. Download real time. 1000.90 -9.35 (-0.93 %) ... All Dividend Bonus Split Rights Board Meetings. Alerts ...