Capital One Main Navigation

- Learn & Grow

- Life Events

- Money Management

- More Than Money

- Privacy & Security

- Business Resources

How does travel insurance through Capital One cards work?

December 14, 2023 | 6 min read

Ever found yourself scrambling for lost luggage when you’re traveling? Or trying to book alternate flights due to bad weather? These kinds of events can be stressful—and costly. When the unexpected happens, travel insurance through your card could help protect you from travel expenses beyond your control.

Many cardholders have travel insurance as part of their card benefits. Coverage varies by card, issuer and the network that provides the benefits. To prepare for your next trip, you might want to check out whether your card offers travel insurance and what benefits come with it.

Key takeaways

- Travel insurance through your card could help protect you from paying for unexpected expenses if something goes wrong when you travel.

- Card travel insurance may offer coverage for both domestic and international travel.

- Your coverage depends on your card. Check your card’s benefits guide for details.

- Travel insurance is offered to Capital One cardholders through the Visa® and Mastercard® networks.

Earn 75,000 bonus miles

Redeem your miles for flights, vacation rentals and more. Terms apply.

What is credit card travel insurance?

Card travel insurance can help protect you financially when you incur unexpected expenses during travel. Whether you’re visiting family, flying abroad or driving across the country, card travel insurance can be a kind of safety net.

By booking and paying for a trip with a card that offers travel insurance benefits, you could get compensation up to a set limit for your unexpected expenses. For example, some Capital One rewards credit cards offer benefits like travel accident insurance and lost luggage reimbursement.*

What types of coverage does card travel insurance provide?

Imagine traveling with peace of mind, knowing that a potential accident or expensive mishap could be reimbursed. With travel insurance through your card, you could be covered in a number of scenarios.

Every card is different, so be sure to check your card’s terms and conditions to see what types of travel insurance you might receive. Here are a few of the most common types of coverage you may have access to:

Trip cancellation and interruption insurance

Canceling a trip at the last minute or cutting it short can be disappointing. But getting your money back for flights and reservations you didn’t end up using might help relieve your stress.

If you booked and paid for your trip with a card that offers trip cancellation and interruption insurance, you may qualify for reimbursement in certain situations, like these:

- Severe weather at the beginning of a trip

- Unexpected health issues or accidental injuries

- Death of someone in your travel party or an immediate family member

You may want to make sure you’re aware of situations that aren’t typically covered by this type of insurance. For example, exclusions can include preexisting medical conditions or when a travel agency, hotel or airline goes out of business. Check the terms of your card to learn more about trip cancellation insurance.

Maximum reimbursement depends on your card and can vary significantly. Some cards might offer up to $2,000 per trip. (For others, it could be less.)

Trip delay insurance

Travel schedules don’t always go as planned. Flights may get delayed or severe weather may affect your travels. Or you may need to pay for a meal or last-minute hotel room while you wait. If you paid for your trip with a card that has trip delay insurance, certain reasonable costs you incur during the delay might be covered.

Cards may vary in how long the delay must be before coverage kicks in. But having travel delay insurance could help take care of your most urgent needs.

Rental car insurance

If you pay for a rental car with your card, you might be able to skip the added cost of buying insurance through the rental company. Credit card rental car insurance could cover collisions, theft and towing if your car breaks down while you’re traveling.

This type of insurance usually goes into effect after your regular auto insurance policy does. Whether you’re renting a car in the U.S. or abroad may affect whether you’ll need additional coverage and how much. Remember, rental car insurance usually only covers the vehicle. You may need to buy liability coverage when traveling internationally if your personal auto policy is limited to the U.S.

Lost or delayed baggage insurance

Imagine that you’re waiting in the baggage claim area after a flight, confident that you packed everything you need for your trip. But your luggage never rolls by on the carousel.

Lost, delayed or even stolen baggage can interrupt your trip. If you need to buy replacement items, you could be reimbursed.

Travel accident insurance

While travel often goes smoothly, sometimes it doesn’t. Accidents happen. Travel accident insurance could provide an added layer of support. In cases of severe injury or death, you or your family members could receive benefits if you booked and paid for your trip with a card that offers travel accident insurance.

Where will Venture X take you?

Earn 75,000 bonus miles and other exclusive perks with the Venture X card.

How do you file a travel insurance claim?

If you need to file a travel insurance claim, you can start by reading your card’s benefits guide to get the specifics on your travel insurance. That way, you can know which travel events are covered and for how much.

It can be a good idea to save your purchase receipts while you’re traveling. Then you’ll have a paper trail if you want to be reimbursed for things like replacement articles of clothing, a last-minute hotel booking or a trip to the emergency room.

Finally, you can file a claim by contacting the administrator listed in your card’s benefits guide. Check if there’s a time limit on how long you have to file a claim after the travel incident. You may have to answer a few questions, complete a form and submit your receipts to complete the claim. If your claim is accepted, you may be compensated for the covered expenses you paid for with your personal funds.

Capital One card travel insurance FAQ

Here are a few frequently asked questions about travel insurance in general and travel insurance through a Capital One card in particular:

Do cards automatically have travel insurance?

Not necessarily. Some cards, like the Capital One Venture card , offer travel insurance. But some may not. If you’re not sure about your card, check its benefits guide for more information.

Do I have to pay extra for travel insurance?

That may depend on your card. Some cards may include travel insurance at no charge. Others may allow you to purchase additional travel protection benefits for a fee. And some might charge an annual fee that may be balanced out by premium travel benefits and enhanced travel insurance protection.

Is my family covered under my Capital One card’s travel insurance?

Coverage for family members generally depends on your card issuer and network. For example, if you’re a Mastercard or Visa cardholder, your spouse is typically covered. Depending on their ages, your kids may be covered as well. Capital One cardholders can learn about their travel insurance benefits by reading their benefits guide.

Does travel insurance through my Capital One card cover flight cancellation?

Some Capital One cards may offer flight cancellation insurance as part of their travel insurance coverage. Check your benefits guide to see whether your card provides this type of protection. Your guide will also detail the process of filing a claim if your flight gets canceled unexpectedly. If you want the freedom to cancel your flight for any reason, consider booking your flight through Capital One Travel .

Capital One card travel insurance in a nutshell

Capital One’s card travel insurance can help protect you when things go wrong while you’re traveling, whether you’re in the U.S. or abroad. If you’re interested in learning whether your card comes with travel insurance, be sure to check its benefits guide to learn more.

If you’re ready to take advantage of this travel protection, apply for a Capital One travel and miles rewards card today. If you’re approved for either Venture or Venture X , you’ll have the opportunity to earn 75,000 bonus miles that you can redeem for flights, hotels, vacation rentals and more.

Other ways to maximize your travel benefits

Who wouldn’t want to get the most out of their credit card? Here are some things to know about Capital One travel rewards credit cards:

Get a one-time 75,000-mile bonus with the Capital One Venture X card and receive an additional 10,000 bonus miles every year, starting on your first anniversary. ( View important rates and disclosures .)

Earn unlimited 2X miles per dollar on every purchase, every day and get 75,000 bonus miles upon signup with the Capital One Venture card . ( View important rates and disclosures .)

Earn unlimited 1.25X miles with no annual fee with the Venture One card from Capital One . ( View important rates and disclosures .)

Explore travel rewards card options by comparing Capital One Venture cards .

Learn how Venture X cardholders can get access to a worldwide network of airport lounges thanks to a complimentary Priority Pass membership .

Related Content

Capital one rewards credit card benefits.

article | April 30, 2024 | 8 min read

How does rental car insurance through credit cards work?

article | April 23, 2024 | 6 min read

16 travel packing tips for your next adventure

article | June 1, 2023 | 9 min read

Introduction to the Capital One Travel Portal

Utilizing rewards for bookings, how to use capital one travel, what is the capital one premier collection.

- Cards that are eligible for the travel portal

Capital One Miles Value in the Capital One Travel portal

Capital one travel portal: your guide to booking and rewards.

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

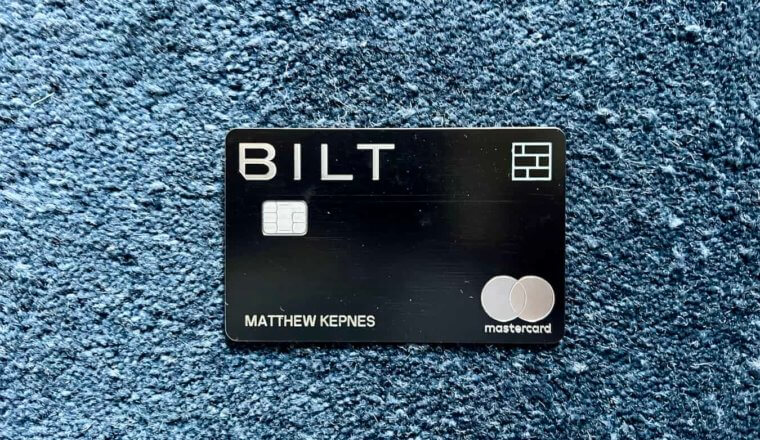

The information for the following product(s) has been collected independently by Business Insider: Capital One Venture X Business Card†, Capital One Savor Cash Rewards Credit Card†, Capital One Spark Miles for Business†, Capital One Spark Miles Select for Business†, Capital One Spark Cash Plus†, Capital One Spark Cash Select for Excellent Credit†, Capital One Spark 1% Classic†, Capital One Walmart Rewards® Mastercard®†, Journey Student Rewards from Capital One†. The details for these products have not been reviewed or provided by the issuer.

The Capital One Travel portal is an online travel platform that allows customers to book flights, hotels, and rental cars. The site provides exclusive travel deals, discounts, and tools to help you save on your next vacation. Select Capital One credit card customers can earn elevated rewards for every purchase made through the portal or redeem them for bookings. It's a great tool that lets you make all your travel reservations in one place and takes the guesswork out of redeeming miles.

However, Capital One Travel also has several downsides. You're giving up loyalty rewards with those programs by booking hotels and rental cars through Capital One. The Price Freeze function also doesn't work as promised and redeeming Capital One miles for travel bookings may not be the best way to maximize your rewards.

Overview of the Portal

The Capital One Travel Portal offers excellent value for money and flexibility, with various travel options to suit any budget. It also provides a range of rewards, discounts, and tools to help you save on your travels.

With the added convenience of booking flights, hotels, and car rentals all in one place, it is the perfect choice for anyone looking to book their next trip. While some of its features are more gimmicky than others, the fact remains that this portal provides ease and convenience for travelers who don't want to deal with multiple booking platforms and loyalty programs.

The Capital One Travel portal is a travel booking platform powered by Hopper, an app that helps travelers pick the best times to book and travel at the lowest prices. Capital One Travel offers competitive prices, exclusive discounts, and access to a wide selection of flight, hotel, and rental car options for Capital One cardholders. Customers can use the portal to earn and redeem rewards on travel bookings.

Additionally, the portal provides helpful tools such as a price calendar to find the cheapest airfares and price drop protection that will refund the fare difference if it drops post-booking. The portal also has a price freeze feature, which allows users to "freeze" a specific airfare for up to $25 or 2,500 miles.

Benefits of Booking Through the Portal

One of the key benefits of using the Capital One Travel portal is that certain types of bookings will earn you higher rewards when you pay with an eligible Capital One credit card. For example, the Capital One Venture X Rewards Credit Card earns 10 miles per dollar on hotels and rental cars and 5 miles per dollar on flights booked through Capital One travel. And with the Capital One Venture Rewards Credit Card , you'll earn 5 miles per dollar on hotels and rental cars booked through the portal.

This works out well for Capital One Venture X Rewards Credit Card cardholders' flight bookings since Capital One lets you enter your frequent flyer number on the booking page. You'll not only earn elevated Capital One miles, but you'll also earn airline miles and elite-qualifying miles through your chosen frequent flyer program. You won't get the same benefits on hotel or rental car bookings, so that's worth weighing into your booking decision.

Above all else, the Capital One Travel portal provides convenient and easy travel booking. You can use it to compare airfare from multiple airlines at once, helping you find the best deal on your next trip. Additionally, you can use your Capital One miles to pay for travel bookings at a rate of 1 cent per mile, or get discounted rates on certain flights or hotel stays. Finally, customers have access to customer service representatives who can answer questions and assist with bookings.

How to Use Capital One Miles

The Capital One Travel portal can be a great way to earn elevated rewards and enjoy extra perks. Booking flights through this portal can make sense since you can double-dip, earning rewards with your credit card and frequent flyer miles from airlines. However, you won't earn hotel points or elite night credits on Capital One bookings, which means you'll miss out on possible elite benefits with major hotel loyalty programs. Depending on how often you travel, this could be a significant downside.

Transferring Capital One miles to one of the 18 airline or hotel partners can be a much better value proposition. If you redeem your miles for business and first-class travel, you'll usually get more than the 1 cent per mile your rewards are worth through the Capital One Travel portal. For example, a sample of fun, valuable ways to use the Capital One VentureOne welcome bonus of 20,000 miles after spending $500 on purchases within three months from account opening.

However, not all card members want to learn the ins and outs of various loyalty programs to get the most value. Some people want simplicity and the Capital One Travel portal offers just that. If you prefer convenience over value, booking with the Capital One Travel portal is a smart move. But if you're willing to put in the legwork for a high-value redemption, transferring Capital One miles to an airline or hotel program is the best option.

Using the Capital One Travel Portal is straightforward. Simply head to travel.capitalone.com and log into your account. From here, you can select between a flight, hotel, or rental car tab. Enter your destination and travel dates, then browse through the available options.

You can filter results by price, airline, hotel type, and more to find the best deal. Once you've made your selection, you can book directly with Capital One and either pay with your eligible Capital One card or use miles to pay for all or part of your trip.

Before booking anything, check out the travel offers section underneath the tabs mentioned above. Here, you'll find travel credits in select target markets. If you make a qualifying booking, you'll get a travel credit that's applicable toward future bookings.

How to Book Flights Through the Capital One Travel Portal

You can book flights with both domestic and international airlines through the Capital One travel portal. On the Capital One Travel homepage, select the "Flights" tab and enter the number of travelers, departure city, destination, and travel dates. You can book both one-way and round-trip flights.

When you select your travel dates, a color-coded calendar will show the cheapest and most expensive travel dates. This is great when your travel dates are flexible and you just want to find the lowest fare.

Choose your outbound and return dates on the calendar and select "done." Next, select the blue "search flights" button to generate your search results. On the results page, you can sort by price, departure time, arrival time, number of stops, and duration. You can also filter results by fare class, stops, airline, time, and price.

Capital One offers a price predictor tool at the top of the page, recommending whether it's a good time to book a particular price. You'll also get the option to freeze a specific price and book it later, though this feature isn't reliable in my experience. If you're not ready to book, you can select "watch this trip" to receive alerts when fares drop.

You'll also get the option to purchase cancel for any reason insurance (CFAR travel insurance) during the flight booking process. And, if Capital One Travel recommends you buy a specific flight now, it will apply free price drop protection to that flight for 10 days. If the price drops within that time period, Capital One will credit you the difference in fare, up to a maximum of $50.

How to Book Hotels Through the Capital One Travel Portal

Booking hotels through Capital One Travel is similar to booking flights. On the top of the Capital One Travel page, select the "Hotels" tab. Enter your destination, travel dates, number of travelers, and rooms, then select "Search Hotels."

Unlike the flight search tool, there is no calendar function displaying the lowest rates. However, the hotel search tool does have a city map to help you narrow down your options and find the cheapest rates. Hotel search results can also be filtered by star rating, amenities, price, and amenities. You can also sort results by price and star rating.

Once you select your room and rate, you'll be directed to the checkout page to see your total amount due in miles or cash. You can choose to pay either the cash rate or redeem miles. Note that some hotels charge additional service fees at check-in. These will be displayed on the checkout page, but you won't pay them until you get to the hotel.

How to Book Rental Cars Through the Capital One Travel Portal

To book a rental car, select the "Rental Cars" tab on the Capital One Travel portal and enter your pick-up and drop-off location, rental dates, pick-up and drop-off time, and driver age. Drivers under the age of 25 may be subject to additional fees. Click "Search Cars" to be redirected to the results page.

You can filter results by vehicle type, price per day, rental car company, cancellation policy, and other factors. As with flights and hotel bookings, Capital One displays both the total cash rate and mileage redemption rate (including taxes and fees). Once you've selected your vehicle, you'll get to a booking page displaying your total. During booking, you'll pay the rental cost minus taxes. The taxes will be collected at pick-up.

The Capital One Premier Collection is a curated list of luxury hotels and resorts worldwide that eligible cardholders can access via the Capital One Travel portal. Each property offers special benefits and includes bonus points and money-saving extras, including daily breakfast for two, experience credits, and room upgrades when available.

In addition to earning bonus points, eligible cardholders can also redeem Capital One miles toward their Premier Collection bookings. That's a huge plus, considering some of the properties in the collection are quite pricey. For example, Montage Hotels often have room rates of $1,000 per night or higher. Being able to redeem miles for these stays is a great way to save on upscale hotel bookings.

Capital One Premier Collection Hotels

Some Premier Collection hotels are operated by major hotel chains, while others are independent. Regardless of the hotel's affiliation, booking through the Premier Collection can help you secure added benefits typically reserved for elite members or those willing to pay extra for them.

There are currently seven major hotel chains represented in the collection. They include upscale brands like 1 Hotels, Design Hotels, Leading Hotels of the World, Montage, Preferred Hotels & Resorts, Small Luxury Hotels of the World, and Viceroy Hotels.

Some of these names may be more familiar than others. They include high-end hotels like the Montage Laguna Beach, Viceroy Los Cabos, Hotel Cafe Royal London, and the Wittmore in Barcelona.

Who Can Book the Capital One Premier Collection?

The only Capital One credit cards that have access to the Premier Collection are the Capital One Venture X Rewards Credit Card and Capital One Venture X Business Card† . Both of these are premium cards with high annual fees; for example, the Capital One Venture X Rewards Credit Card costs $395 per year ( rates and fees ) but comes with an annual $300 travel credit you can apply toward Premier Collection bookings. In addition to all the hotel-specific benefits, cardholders who book a Premier Collection stay will earn 10 miles per dollar spent — the highest travel booking payout of any transferable points card.

The Capital One Venture X Business Card was previously known as the Capital One Spark Travel Elite, and it's very similar to the Venture X. It has the same $395 annual fee, $300 travel credit, and 10,000 annual bonus miles.

Both cards are great for travel enthusiasts and those looking to earn generous rewards on their daily spending. While the Premier Collection access is not enough reason to get a Venture X card (the list of participating hotels is limited), it is an excellent addition to the various other benefits these cards offer.

Capital One Premier Collection Benefits

Booking through Premier Collection provides travelers with various perks, including special amenities and bonus miles. The following benefits are available at Premier Collection properties worldwide:

- 10 miles per dollar on hotel bookings

- $100 experience credit per stay

- Daily breakfast for two

- Space-available room upgrade

- Early check-in and late check-out

- Complimentary Wi-Fi

The experience credit will vary by property, but you'll need to charge the qualifying expense to your room to receive it. The hotel will then apply the credit to your folio upon checkout.

The daily breakfast can be especially valuable in high-priced destinations like the Maldives, where the remote setting often translates to breakfast charges of $50 or more per person. Having breakfast included in the cost of your stay, along with $100 toward some of the most expensive spa treatments in the world, is an excellent value in exchange for booking a stay through Capital One's Premier Collection.

Capital One Credit Cards That Are Eligible for the Travel Portal

You don't necessarily need a high-priced travel credit card to use the Capital One Travel portal. The platform is open to many Capital One cardholders, including those who carry a student credit card or small-business credit card issued by Capital One.

Over a dozen options are available, ranging from no-annual-fee credit cards like the Capital One Quicksilver Cash Rewards Credit Card to the Capital One Venture X Rewards Credit Card, a premium credit card :

- Capital One Venture Rewards Credit Card

- Capital One Venture X Rewards Credit Card

- Capital One VentureOne Rewards Credit Card

- Capital One Quicksilver Cash Rewards Credit Card

- Capital One QuicksilverOne Cash Rewards Credit Card

- Capital One Quicksilver Student Cash Rewards Credit Card

- Capital One Quicksilver Secured Cash Rewards Credit Card

- Capital One Savor Cash Rewards Credit Card†

- Capital One SavorOne Cash Rewards Credit Card

- Capital One SavorOne Student Cash Rewards Credit Card

- Capital One Spark Miles for Business†

- Capital One Spark Miles Select for Business†

- Capital One Spark Cash Plus†

- Capital One Spark Cash Select for Excellent Credit†

- Capital One Spark 1% Classic†

- Capital One Walmart Rewards® Mastercard®†

- Journey Student Rewards from Capital One† (no longer available to new applicants)

At 10 miles per dollar spent on hotels and rental cars and 5x on flights booked through the portal, Capital One Venture X Rewards Credit Card cardholders will earn the most rewards on Capital One Travel bookings. The Capital One Venture X Rewards Credit Card includes $300 per year in credits toward Capital One Travel bookings, which helps offset much of the card's $395 annual fee.

Capital One miles are worth 1 cent each in the Capital One Travel Portal. This is pretty generous, considering miles are earned at a rate of 2 to 5 per dollar spent with the Capital One Venture Rewards Credit Card and 2 to 10 miles per dollar on the Capital One Venture X Rewards Credit Card.

However, it's possible to get more value from your miles by skipping the portal and instead transferring rewards to Capital One's transfer partners . You can transfer miles to 18 airline and hotel loyalty programs to book award travel.

Business Insider's points and miles valuations peg the value of Capital One miles at 1.7 cents each, because it's possible to get outsized value from transferring miles to partners and booking award flights or stays. Be sure to read Insider's guide on how to earn and redeem Capital One miles to find out more about maximizing your rewards.

Yes, the Capital One Travel Portal allows you to book a wide range of airlines and hotels, offering the flexibility to use your miles without blackout dates or restrictions.

Yes, you can earn Capital One miles on bookings made through the portal, further increasing your rewards.

The portal provides tools to predict price trends for flights and flexible booking options that allow you to filter searches based on free cancellation policies, offering you peace of mind and potential savings.

Yes, Capital One offers the flexibility to pay with a combination of cash and miles, giving you more options to utilize your rewards.

For changes or cancellations, you can either manage your booking directly through the portal or contact Capital One's customer support for assistance.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

***Terms, conditions, and exclusions apply. Refer to your Guide to Benefits for more details. Travel Accident Insurance is not guaranteed, it depends on the level of benefits you get at application.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

- Main content

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit cards

A complete guide to the Capital One travel portal

Carissa Rawson

Allie Johnson

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Robin Saks Frankel

Published 5:50 a.m. UTC Jan. 16, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

hocus-focus, Getty Images

You may know Capital One as a company that offers credit cards, car loans and bank accounts, but they also have a travel portal that allows you to book flights, hotels, rental cars and luxury vacations. For eligible Capital One cardholders, booking through the Capital One travel portal can be an excellent way to earn and redeem Capital One miles. Let’s take a look at the Capital One travel portal, how it works and who has access to its perks.

- The Capital One travel portal is accessible to cardholders of more than 15 different Capital One cards.

- Eligible cards will earn extra rewards on their Capital One travel bookings.

- Features of the Capital One travel portal include price drop protection and price matching.

- Capital One miles can be earned and redeemed through the Capital One travel portal.

How to book travel through the Capital One travel portal

Booking travel through the Capital One travel portal is simple. To do so, simply navigate to the Capital One travel portal website . Then log in to your Capital One account.

Once logged in, you’ll be directed to the site’s home page.

From there, you can search for flights, hotels and rental cars for any travel you have planned. Just enter your search parameters, such as travel dates and destination, to get a list of booking options.

Your search results will vary depending on what type of travel you want to book. For example, if you’re searching for a hotel, Capital One will bring up a dynamic map and a list of properties that match your filters.

Once you’ve perused available options, you can make a selection that suits your needs. You’ll then go through the checkout process, which includes filling in your personal details and payment information. Note that you’ll need to use your eligible Capital One card to pay.

Who can use the portal?

The Capital One travel portal is accessible to those with an eligible Capital One credit card. These include:

- Capital One Venture Rewards Credit Card * The information for the Capital One Venture Rewards Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- Capital One Venture X Rewards Credit Card * The information for the Capital One Venture X Rewards Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- Capital One QuicksilverOne Cash Rewards Credit Card * The information for the Capital One QuicksilverOne Cash Rewards Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- Capital One Savor Cash Rewards Credit Card * The information for the Capital One Savor Cash Rewards Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- Capital One SavorOne Student Cash Rewards Credit Card * The information for the Capital One SavorOne Student Cash Rewards Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- Capital One Spark 2X Miles * The information for the Capital One Spark 2X Miles has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

- Capital One Venture X Business Card * The information for the Capital One Venture X Business Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

You’ll want to be aware that not all Capital One cards provide access to the travel portal. For example, the Capital One Platinum Credit Card * The information for the Capital One Platinum Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. , which is designed to help build credit, does not offer this feature.

Is the portal worth using?

There are a few factors to consider when deciding whether or not to use the Capital One travel portal for a booking.

First, depending on which Capital One card you hold, you may be able to earn big rewards by booking your travel through the portal. For example, the Capital One Venture X earns 2 miles per $1 on purchases, 5 miles per $1 on flights booked through Capital One Travel and on purchases through Capital One Entertainment and 10 miles per $1 on hotels and rental cars booked via Capital One Travel.

Capital One miles can be redeemed in a variety of ways, but are worth one cent each toward travel, which means you’re effectively getting 10% back on eligible bookings.

That being said, many hotel and rental car companies limit the benefits you’ll receive if you choose to book through a third party (such as the travel portal). This can mean you lose out on perks such as bonus points and the benefits of any elite status that you’ve earned. However, this varies by hotel, so you might want to check before you book.

How to maximize your Capital One travel benefits through the portal

Capital One has built a robust portal that provides value to its customers. This is especially true when it comes to booking flights. The flight search function includes a handy calendar of prices to show you at a glance when fares are high.

Capital One has also partnered with the travel app Hopper to give customers free price prediction tools. When searching, the portal will let you know whether you should book or wait for a better price.

Even better, if you book a flight when recommended by Capital One, you’re automatically enrolled in price drop protection for 10 days. If the price goes down during that time frame, you’ll get a refund of up to $50.

You can also choose to set an alert for your flight, which will notify you when the price changes. Finally, if you’re not ready to book but are worried that the price will increase, you can pay a small fee to freeze the cost of your fare so you can return later to book.

Other benefits associated with the Capital One travel portal include access to the Lifestyle Collection and the Premier Collection. If you have an eligible Capital One card, you’ll be able to book specialty hotels with exclusive benefits such as room upgrades, late checkout and experience credits.

Quick guide to Capital One rewards

Different Capital One cards earn different types of rewards. Some cards earn cash back while others earn miles.

Capital One miles can be redeemed in a variety of ways, including transfers to Capital One hotel and airline partners. This is generally the most valuable method of redeeming miles, but you can also redeem them for statement credits against travel purchases that you’ve made. While this isn’t typically the best way to redeem Capital One rewards, it can be useful if there are no reward options available for the dates you want to travel.

Finally, Capital One miles can also be used for bookings within the Capital One travel portal. You’ll be able to redeem them at a rate of one cent each — but you’d be better off using your card to pay, then redeeming miles against your purchase. This allows you to earn rewards on your booking before wiping away the charges.

Other ways to redeem miles include gift cards, entertainment and cash, but you’ll want to be wary of doing so as you won’t get as much value from your rewards this way as you would with travel redemptions.

Frequently asked questions (FAQs)

The Capital One travel portal works with many different airlines, including Delta Air Lines, United Airlines, American Airlines, Alaska Airlines, Frontier Airlines, Spirit Airlines and JetBlue.

However, you won’t see flights from Southwest Airlines on the Capital One travel portal. Instead, you’ll want to search directly with the airline to find these tickets.

Capital One miles don’t expire as long as you have an eligible Capital One credit card open. If you plan to close a Capital One credit card account, make sure to use or transfer any accumulated miles first.

Unlike hotels and rental cars, airlines generally don’t penalize those who book through a third party. This means you’ll be able to enter your loyalty program number and earn rewards on flights booked through the Capital One travel portal.

Many of the best credit cards on the market offer a statement credit (up to $100) that will reimburse you for the cost of TSA PreCheck or Global Entry, two popular trusted traveler programs that can help you speed through the airport. This includes Capital One cards such as the Capital One Venture X rewards credit card and the Capital One Venture Rewards credit card.

Making a booking through the Capital One travel portal doesn’t automatically entitle you to entry into airport lounges. However, certain Capital One credit cards offer this as a benefit. For example, those who have the Capital One Venture X rewards credit card or the Capital One Venture X Rewards Business card receive a complimentary Priority Pass Select membership (enrollment required) and unlimited access to Capital One lounges for themselves and two guests.

*The information for the Capital One Platinum Credit Card, Capital One QuicksilverOne Cash Rewards Credit Card, Capital One Savor Cash Rewards Credit Card, Capital One SavorOne Student Cash Rewards Credit Card, Capital One Spark 2X Miles, Capital One Venture Rewards Credit Card, Capital One Venture X Business Card and Capital One Venture X Rewards Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Carissa Rawson is a credit cards and award travel expert with nearly a decade of experience. You can find her work in a variety of publications, including Forbes Advisor, Business Insider, The Points Guy, Investopedia, and more. When she's not writing or editing, you can find her in your nearest airport lounge sipping a coffee before her next flight.

Allie is a journalist with a passion for money tips and advice. She's been writing about personal finance since the Great Recession for online publications such as Bankrate, CreditCards.com, MyWalletJoy and ValuePenguin. She's also written personal finance content for Discover, First Horizon Bank, The Hartford, Travelers and Synovus.

Robin Saks Frankel is a credit cards lead editor at USA TODAY Blueprint. Previously, she was a credit cards and personal finance deputy editor for Forbes Advisor. She has also covered credit cards and related content for other national web publications including NerdWallet, Bankrate and HerMoney. She's been featured as a personal finance expert in outlets including CNBC, Business Insider, CBS Marketplace, NASDAQ's Trade Talks and has appeared on or contributed to The New York Times, Fox News, CBS Radio, ABC Radio, NPR, International Business Times and NBC, ABC and CBS TV affiliates nationwide. She holds an M.S. in Business and Economics Journalism from Boston University. Follow her on Twitter at @robinsaks.

Best Hyatt credit cards of June 2024

Credit cards Harrison Pierce

Why I’m switching back to the Chase Sapphire Preferred

Credit cards Eric Rosenberg

Why I always push my parents to use their Bank of America Travel Rewards card

Credit cards Carissa Rawson

Why I keep my Chase Ink Business Preferred card year after year

Credit cards Natasha Etzel

New 85K Chase Southwest credit cards’ welcome offer: It’s a scorcher

Why the Ink Business Unlimited is essential for small business owners

Credit cards Jason Steele

How much of my credit limit should I use?

Credit cards Louis DeNicola

American Express Platinum rental car benefits guide 2024

Credit cards Lee Huffman

What are the benefits of a business credit card?

Credit cards Sarah Brady

Secured vs. unsecured credit cards: What’s the difference?

Credit cards Michelle Lambright Black

Southwest credit card benefits guide 2024

Credit cards Julie Sherrier

Amex Green Card benefits guide 2024

Credit cards Tamara Aydinyan

Here’s how to avoid my embarrassing rookie Chase Sapphire Preferred travel redemption mistake

Ramp credit card review 2024: A corporate charge card that streamlines accounting

Americans’ travel habits and behavior in 2024

Credit cards Dawn Papandrea

Why Capital One Travel should be your only stop for booking (and enjoying) your next trip

No matter how often you travel or how savvy you are, planning and booking any trip can be an overwhelming task. Throw in two kids under 5 years old (like I have), and it's almost inevitable that you'll overlook something. So I'm always looking for the most efficient way to arrange my travel, including which card and program will offer me the most value.

That's where Capital One Travel comes in. It is more than just a booking platform; it has all the tools I need to help me travel smarter — which is why it's the first place I go when it's time to plan a trip.

See how Capital One Travel can transform your booking and travel experience.

In fact, Capital One Travel delivers value at all stages of travel — from the initial planning phase to the booking process to the travel experience and even back home, where all of the rewards you've earned can jumpstart your next trip. Sure, you can purchase flights, reserve rental cars and book your accommodations through Capital One Travel. But it also tells you if you're getting a good price on your flight, and if not, you can set up alerts for when it's time to book.

If you have a Capital One Venture X Rewards Credit Card , you get unlimited access to Capital One Lounges. Plus, there's a new culinary-focused airport concept — Capital One Landing — coming to Ronald Reagan Washington National Airport (DCA) and New York City's LaGuardia Airport (LGA) in partnership with legendary Chef José Andrés. And the recently-announced Premier Collection will offer luxurious accommodations and value-added benefits for Venture X cardholders.

In short, Capital One Travel makes it easy to be a smarter traveler while earning valuable rewards.

Keep reading to see everything you can enjoy with Capital One Travel .

Experience a better way to book travel

Does Capital One Travel finally answer the question, "When's the best time to book airfare?" Each situation is unique, but one thing's for sure: Capital One Travel makes sure you have all the information you need to feel confident both before and after booking your flight.

With its proprietary price prediction technology, Capital One Travel shows you a color-coded calendar as soon as you search for a flight, allowing you to see which dates have the lowest prices to fly to your desired destination. If prices are still high, there's no need to constantly monitor them yourself — you can create price alerts that'll notify you when it's time to book.

And it gets even better thanks to Capital One Travel's price drop protection , another tool automatically available to cardholders at no extra cost.

The premise is simple yet so valuable. If Capital One Travel recommends that you book a flight (or a price alert tells you to book), it will keep watching your itinerary for 10 days after booking. If the price drops during that time, Capital One Travel will automatically issue a credit for the price difference — up to $50 per ticket.

These features — price alerts and price drop protection — aren't found with any other card issuer's travel portal.

When it comes to hotels, you can trust that you're getting the best price as well. Capital One Travel utilizes proactive price matching with online travel agencies like Expedia. However, if you still somehow find a better price at the same hotel within 24 hours of booking, Capital One Travel will match the better price. This even extends to flights and car rentals.

But giving cardholders these unique, innovative insights and tools is just part of what makes Capital One Travel so valuable.

Earn extra rewards on travel

Cardholders can look forward to earning up to 10 miles per dollar when booking travel with Capital One Travel (depending on which card they hold). Capital One Venture X cardholders earn 10 miles per dollar on hotels and rental cars and 5 miles per dollar on flights. All other Capital One rewards cardholders — including the Venture, Savor, Quicksilver, Spark Business and Student product suites — earn 5 miles (or 5% cash back) per dollar on hotels and rental cars.

Once you've earned those valuable rewards, you can redeem them directly through Capital One Travel for future trips, or you can transfer them to one of over a dozen airline and hotel partners . Alternatively, Venture X and Venture cardholders can choose to cover recent travel purchases by redeeming their miles at a rate of 1 cent per mile. Even when I pay for my trip with Venture X, I could use the miles that I earned through Capital One Travel to then offset all (or part) of my travel purchases.

And then, during your trip, you can look forward to starting your vacation early — by kicking back and relaxing at a Capital One Lounge.

Start your vacation off right with special lounge access

There's no need to wait until you land at your destination for your vacation to begin. Venture X cardholders get unlimited complimentary access (plus two guests) to over 1,300 airport lounges worldwide, including Capital One Lounges and the Partner Lounge Network. Meanwhile, Venture cardholders receive two complimentary visits per year to Capital One Lounges or 100+ Plaza Premium lounge locations .

A Capital One Lounge is now open at Dallas Fort Worth International Airport (DFW), and two more locations are coming soon to Denver International Airport (DEN) and Washington, D.C.'s Dulles International Airport (IAD).

And these aren't just your run-of-the-mill airport lounges.

Boasting a contemporary, light and airy layout, a Capital One Lounge features a premium dining experience, including health-conscious food options that are plated small bites served via dining stations rather than buffet-style. All food is freshly prepared with a focus on locally sourced ingredients — including vegetarian, vegan and gluten-free options.

For travelers in a hurry, there's a whole section of grab-and-go items — including artisanal nut mixes, fresh fruits, juice shots and rotating warm selections like breakfast sandwiches in the mornings or fresh-from-the-oven cookies in the afternoons. These sustainably-packaged selections are perfect for those without long layovers who still want some terrific food while traveling.

If you can spend some time in the lounge, you'll enjoy a fully stocked bar with craft cocktails on tap, local beers and hand-selected wines. A full-service coffee and espresso bar featuring La Colombe cold brew on tap appeals to even the most discerning coffee aficionados, while a custom, six-tap system of artisanal sodas and flavored waters keeps all members of the family happy.

Beyond these extensive food and beverage offerings, travelers can also take advantage of relaxation rooms, Peloton bikes, nursing rooms and showers where they can freshen up before (or after) a long flight.

Related: 5 distinctive amenities in the Capital One Lounge that impressed me the most

But that's not all.

Last month, Capital One announced a new offering as it continues to rethink the airport experience. Capital One Landings , a new chef-driven concept, will focus on bringing an elevated dining experience to the heart of the terminal. In partnership with the award-winning José Andrés Group, Capital One Landings will offer top-notch food for travelers on their way to the gate. The first locations will debut in Terminal B at LGA and at DCA in the near future.

And while you may never want to leave the comfort of the Capital One Lounge (or Landing), the luxury travel benefits continue upon arrival at your destination.

Elevate your hotel stay with the Premier Collection

In addition to Capital One Landings, the issuer continues to raise the bar for what travelers can expect with its Premier Collection of hotels and resorts, offering cardholders premium benefits with every stay. Capital One hand-picked these properties for their unparalleled service, immersive culture and authentic character — all to deliver exceptional experiences to travelers.

The Premier Collection will be available to Venture X cardholders later this year and will include hotels from all over the world — from city stays to villas and private island retreats. Cardholders will enjoy benefits like a $100 experience credit, daily breakfast for two, complimentary Wi-Fi and more. Venture X cardholders will also earn 10 miles per dollar spent on Premier Collection properties booked through Capital One Travel .

Bottom line

The Capital One Travel ecosystem continues to grow. With top-notch credit cards, an outstanding booking experience, luxurious lounges, new airport dining options and premium hotel perks, Capital One deserves a place at the top of every traveler's mind.

You can book your flights with confidence thanks to price alerts and the color-coded calendar. And you'll get a price match guarantee on all bookings — all while earning Capital One rewards to use on future travel.

The Capital One Lounge iat DFW will be joined by two more locations in 2023 (IAD and DEN), and as a complement, the issuer will debut its culinary-focused airport experience — Capital One Landing — at LGA and DCA to provide fresh, unique and inventive food and drinks for travelers in the heart of the terminal.

Plus Venture X cardholders have even more to look forward to with the Premier Collection, Capital One's curated set of luxury hotels and resorts.

So what are you waiting for? Join the many Americans (and TPG staffers ) who are using Capital One Travel to elevate their trips — and unlock incredible value along the way.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Capital One Travel: Your Guide To Booking Flights, Hotels & Car Rentals

Carissa Rawson

Senior Content Contributor

269 Published Articles

Countries Visited: 51 U.S. States Visited: 36

Keri Stooksbury

Editor-in-Chief

35 Published Articles 3260 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Director of Operations & Compliance

6 Published Articles 1179 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

Table of Contents

Why book travel through capital one travel, what are capital one miles worth, how to access capital one travel, how to book a flight through capital one travel, how to book a hotel through capital one travel, how to book a rental car through capital one travel, how do the prices compare to other sites, other ways to use capital one miles, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Trying to figure out how to use your rewards? Whether you’re a longtime fan of Capital One Miles or you’ve just jumped on the Capital One Venture X Rewards Credit Card train, there’s a lot to love about this flexible point currency.

Although it’s possible to transfer your Capital One miles out to a variety of partners, you can also use Capital One Travel to earn and redeem rewards for your stays. Let’s take a look at Capital One Travel, how it works, and when you should use it.

Capital One is heavily pushing its customers toward its travel portal — and for good reason. There’s a lot to love about Capital One Travel, and if you’re the kind of person who values simplicity and high rewards over elite status, it could be a good match for you.

Earn Miles or Points by Paying With a Credit Card

There are 2 ways in which you’ll earn miles or points when booking through Capital One Travel.

As a Capital One cardholder, you’ll earn a varying amount of miles depending on which card you use to pay:

Capital One Venture X Rewards Credit Card

The Capital One Venture X card is an excellent option for travelers looking for an all-in-one premium credit card.

The Capital One Venture X Rewards Credit Card is the premium Capital One travel rewards card on the block.

Points and miles fans will be surprised to see that the Capital One Venture X card packs quite the punch when it comes to bookings made through Capital One, all while offering the lowest annual fee among premium credit cards.

Depending on your travel goals and preferences, the Capital One Venture X card could very well end up being your go-to card in your wallet.

- 10x miles per $1 on hotels and rental cars purchased through Capital One Travel

- 5x miles per $1 on flights purchased through Capital One Travel

- 2x miles per $1 on all other purchases

- $395 annual fee ( rates & fees )

- Does not offer bonus categories for flights or hotel purchases made directly with the airline or hotel group, the preferred booking method for those looking to earn elite status

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- Use your Venture X miles to easily cover travel expenses, including flights, hotels, rental cars and more—you can even transfer your miles to your choice of 15+ travel loyalty programs

- Elevate every hotel stay from the Premier or Lifestyle Collections with a suite of cardholder benefits, like an experience credit, room upgrades, and more

- Receive up to a $100 credit for Global Entry or TSA PreCheck ®

- APR: 19.99% - 29.99% (Variable)

- Foreign Transaction Fees: None

Capital One Miles

The Capital One Venture X card earns 10 miles per $1 spent on hotels and rental cars booked through Capital One Travel, 5 miles per $1 spent on flights booked through Capital One Travel, and 2 miles per $1 spent everywhere else.

Capital One Venture Rewards Credit Card

Get 2x miles plus some of the most flexible redemptions offered by a travel credit card!

The Capital One Venture Rewards Credit Card is one of the most popular rewards cards on the market. It’s perfect for anyone in search of a great welcome offer, high rewards rates, and flexible redemption options.

Frequent travelers with excellent credit may benefit from this credit card that offers a lot of bells and whistles. And it offers easy-to-understand rewards earning and redemption.

- 5x miles per $1 on hotels and rental cars booked through Capital One Travel

- Global Entry or TSA PreCheck application fee credit

- $95 annual fee ( rates & fees )

- Limited elite benefits

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enrich every hotel stay from the Lifestyle Collection with a suite of cardholder benefits, like a $50 experience credit, room upgrades, and more

- Transfer your miles to your choice of 15+ travel loyalty programs

The Capital One Venture card earns 5 miles per $1 spent on hotels and rental cars booked through Capital One Travel and 2 miles per $1 spent on everything else.

Capital One Spark Miles for Business

The Capital One Spark Miles card is a low-annual-fee business card that earns 2x transferable miles on every $1 you spend. (Information collected independently. Not reviewed by Capital One.)

The Capital One Spark Miles for Business is a great option for business owners looking for an uncomplicated rewards card that earns double miles on every purchase they make and offers access to transfer partners, all for a low annual fee.

- Unlimited 2x miles per $1 spent on all purchases

- 5x miles per $1 spent on hotel and rental cars purchased through Capital One Travel

- 2 complimentary visits to a Capital One Lounge per year

- Annual fee: $0 intro for the first year, $95 after that

- Earn a one-time bonus of 50,000 miles – equal to $500 in travel – once you spend $4,500 on purchases within the first 3 months from account opening

- Earn unlimited 2X miles per dollar on every purchase, everywhere, no limits or category restrictions, and miles won’t expire for the life of the account

- Unlimited 5X miles on hotels and rental cars booked through Capital One Travel

- Transfer your miles to 15+ travel loyalty programs

- Redeem your miles instantly for any travel-related purchases, from flights and hotels to ride-sharing services

- Skip the lines with up to a $100 statement credit on TSA PreCheck ® or Global Entry

- $0 intro annual fee for the first year; $95 after that

- Free employee cards which also earn unlimited 2X miles from their purchases

- APR: 26.24% (Variable)

The Capital One Spark Miles card earns 5 miles per $1 spent on hotels and rental cars booked through Capital One Travel and 2 miles per $1 spent on everything else.

Capital One Venture X Business Card*

The Capital One Venture X Business card offers at least 2x miles on all purchases, and comes packed with premium perks.

The information regarding the Capital One Venture X Business card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

The Capital One Venture X Business card is a great all-around premium rewards card that helps you rack up miles on all of your business expenses.

From 2x miles on all purchases, airport lounge access, an annual travel credit, complimentary employee cards, and more, there is plenty to love about the Capital One Venture X Business card.

- $395 annual fee ( rates and fees )

- 10x and 5x bonus categories are limited to Capital One Travel bookings

- Earn unlimited 2X miles on every purchase, everywhere—with no limits or category restrictions

- This card has no preset spending limit, so you get purchasing power that adapts to your spending needs. The annual fee on this card is $395

- Earn 150,000 bonus miles once you spend $30,000 in the first 3 months from account opening

- Redeem your miles on flights, hotels and more. Plus, transfer your miles to any of the 15+ travel loyalty programs

- Earn unlimited 10X miles on hotels and rental cars and 5X miles on flights booked through Capital One Travel, where you’ll get the best prices on thousands of options

- Every year, you’ll get 10,000 bonus miles after your account anniversary date. Plus, receive an annual $300 credit for bookings through Capital One Travel

- Empower your teams to make business purchases while earning rewards on their transactions, with free employee and virtual cards. Plus, automatically sync your transaction data with your accounting software and pay your vendors with ease

- Skip the lines with up to a $100 statement credit on TSA PreCheck ® or Global Entry. Then enjoy unlimited complimentary access to Capital One Lounges and a network of 1,300+ lounges worldwide, including Priority Pass™ and Plaza Premium Group lounges

- This is a pay-in-full card, so your balance is due in full every month

- Elevate your stay at luxury hotels and resorts from the Premier Collection with a $100 experience credit and other premium benefits on every booking

- APR: All charges made on this account are due and payable in full when you receive your periodic statement. The minimum payment due is the New Balance as indicated on your statement.

The Capital One Venture X Business card earns 10 miles per $1 spent on hotels and rental cars booked through Capital One Travel, 5 miles per $1 spent on flights booked through Capital One Travel, and 2 miles per $1 spent everywhere else. *(Information collected independently. Not reviewed by Capital One.)

You’ll still earn points even when paying with a different credit card; cards including the Chase Sapphire Reserve ® will earn you 3 Chase Ultimate Rewards points per $1 on all travel, even when using Capital One Travel to book.

Earn Points With Your Loyalty Program

Flights booked through Capital One Travel are counted as paid tickets . This is true whether you use your Capital One miles for a redemption or use cash. Because of this, you’ll be able to earn frequent flyer miles on any flights that you book. Signing up is free and easy — there’s no reason for you to miss out on these miles!

The same can’t be said of hotel programs. Nearly all hotel chains will skip out on benefits if you don’t book your stay directly with the hotel . Not only will you miss out on your perks, but you’ll also lose the ability to earn elite night credits for your stays, which can be a real blow if you’re trying to earn elite status. Keep this in mind when you’re using Capital One Travel for hotel bookings.

Ease of Use

If you’re not a huge points and miles geek, it can make sense for you to book with Capital One Travel. This is because it’s simple; you simply log in, look for the flights/hotels/rental cars that you need, and then book. You won’t have to sift through endless programs trying to find the best rates, and it’s especially easy when you’re looking to redeem your Capital One miles. They’ll always be worth 1 cent each when used for travel via Capital One Travel , which is a solid redemption. It’s not the best, however, as you’ll see later on.

Price Match Guarantee

In a bid for your business, Capital One offers a price match guarantee on all of its hotel bookings . If you find a publicly available price within 24 hours that is better than the one you’ve booked, Capital One will match it.

Capital One also offers price-drop protection for its flights . If the Capital One price prediction tool recommends you purchase a flight and you do, the same tool will automatically keep monitoring the cost of the flight. If prices drop again, you’ll get a refund on some or all of the price difference.

Bottom Line: There are a lot of reasons to book with Capital One Travel, though you’ll want to be wary of limitations that arise from booking with a third party.

We value points and miles according to a variety of factors, including how easy they are to use and redeem. Although you can use your Capital One miles for travel on Capital One Travel, there are plenty of other ways they can be redeemed.

The most valuable use of your miles occurs when you transfer them to any one of Capital One’s hotel and airline partners. In these cases, you can get outsized value for every mile. This is why we consider Capital One miles to be worth 1.8 cents each — nearly double the amount you’ll get when redeeming them within Capital One Travel.

You need to be a Capital One cardholder in to access Capital One Travel . Once on the page, you’ll log in to your account. After logging in, you’ll be brought to the portal’s home page:

From here, you can choose to book flights, hotels, or rental cars.

Booking a flight through Capital One Travel is fairly intuitive. After you log in and reach the landing page, you’ll want to select Flights in the toolbar up top:

This will bring you to the search page for flights. You’ll want to input all your information, including departure airport, destination, and dates of travel:

Like Google Flights , Capital One Travel will give you an estimation of price within a calendar feature:

Unlike Google Flights, however, Capital One has partnered with the booking site Hopper to tell you when you should book. You’ll be presented with detailed information regarding price predictions :

As you can see in the screenshot above, you have the option to freeze your price or set a price watch alert. If you’re looking to book immediately, you’ll want to scroll down, where Capital One will give you a list of results:

When selecting a flight, Capital One Travel will also give you a breakdown of information and the ability to book economy or first class tickets:

Once you’ve selected your outbound flight, you’ll pick the return. If booking a one-way, you’ll be taken to the checkout page.

Hot Tip: Capital One’s price drop protection automatically monitors the cost of flights you purchase and refunds you if prices fall.

As is normal with checkout pages, you’ll need to fill in your passenger information and credit card information. You can also select seats and choose whether or not you’d like to redeem miles. Capital One will give you 1 cent per point of value when using your miles through Capital One Travel . While this isn’t terrible, there are much better uses of those miles — such as transferring to a partner and booking a reward seat.

Once you’ve input all your info, you’ll hit Confirm and Book . That’s it!

Bottom Line: Booking flights through Capital One Travel is both intuitive and easy. Plus, you’ll be able to earn frequent flyer points on your booking.

If you’re looking to book a hotel through Capital One Travel, the process is simple. As before, you’ll start by logging into your account. Once you’ve hit Capital One Travel’s landing page, you’ll select Hotels in the top toolbar:

You’ll be taken to Capital One’s hotel search bar, where you can put in your travel destination and dates:

Once you select Search Hotels , you’ll be taken to a results page featuring an interactive map:

Along with filtering by rating and price, Capital One offers a variety of ways to narrow down your search:

As we mentioned above, Capital One Travel offers a hotel price match guarantee , which means you won’t find cheaper prices elsewhere. If you do happen to stumble across one on a publicly available site within 24 hours of booking, you can submit a price match request and, if approved, Capital One Travel will drop the cost down to the rate you’ve found.

Selecting a hotel from the search results will open a new tab where you can alter your information:

Scrolling down, you’ll be able to select the room type you prefer:

Once you’ve picked your room, you’ll be taken to the checkout page where you’ll fill out your traveler and payment information. You can also choose to use your Capital One miles for a value of 1 cent per point towards your booking:

Hot Tip: Be aware that booking hotels through Capital One Travel counts as a third-party booking — which means you won’t receive any elite status benefits or credit towards earning elite status when booking this way.

Once everything is filled in, you simply need to select Confirm and Book .

Just as with flights and hotels, you’ll log in to your account. From the landing page, you’ll select Car Rentals from the top toolbar:

You’ll be taken to the rental car search page where you can enter your information, including dates of travel and location:

Once you’ve hit Search Cars , you’ll be taken to the results page:

You can choose from a variety of filters, including the rental car company you’ll be booking, what type of car you prefer, and the cancellation policy of your booking. After picking the car you’d like to reserve, you’ll have the chance to review your booking:

If everything is correct, you’ll hit Reserve , which will take you to the checkout page where you can enter driver information and your method of payment:

As with hotels and flights, you can apply your Capital One miles to your rental car booking at a rate of 1 cent each. Again, there are better ways to use your miles, which we’ll discuss below.