Exciting news for TD Rewards members

Members can earn and redeem points on vacation packages, flights, hotels, car rentals and more. Who doesn't like to save?

Sign-in using your existing TD online banking credentials.

The expedia for td program.

It's easier than ever for TD Travel or Rewards credit card holders to find and book their dream vacation on Expedia For TD.

The best part? Not only do you have the flexibility to use your TD Rewards Points to pay for all or part of your trip, but eligible TD credit cards can also earn up to 9 points for every $1 spent on travel purchases 1.

TD First Class Travel Visa Infinite *

- 8 TD Rewards Points per $1 Spent on Travel Purchases at Expedia For TD (Online/ Phone) 1

- Annual $100 TD Travel Credit on your first Eligible Travel Credit purchase of $500 that is made with Expedia For TD 2

- Birthday Bonus - earn up to 10K bonus TD Rewards Points a year (up to $50 value on Expedia For TD) 3,4

- Comprehensive Travel insurance coverage 4

TD Platinum Travel Visa *

- 6 TD Rewards Points per $1 spent on Travel Purchases at Expedia For TD (Online/Phone) 1

- Car Rental Discounts 5,6,7

TD Rewards Visa *

- 4 TD Rewards Points per $1 Spent on Travel Purchases at Expedia For TD (Online/Phone) 1

- Car rental discounts 5,6,7

TD Business Travel Visa *

- 9 TD Rewards Points per $1 when you book travel online, or 6 Points per $1 Spent on travel made by phone through Expedia For TD 1

Not only does Expedia For TD provide you with exclusive deals on travel , but y ou r TD points are worth more when redeeming them and you can earn TD points faster when purchasing travel with your TD credit card. 1,9

Explore with Options

A flight to Las Vegas? How about an all-inclusive stay at a Cancun resort? A house in Banff for a ski trip? All of these are available on Expedia For TD.

No restrictions on adventure

We don't have black-out dates or seat restrictions on flights, 8 which means you're free to book anytime you want.

Redeem and earn points on:

- Flights and packages

- Hotels, vacation rentals, car rental

- Activities and cruises

And you’ll have access to Expedia benefits

Expedia’s Price Guarantee

Find a cheaper Flight + Hotel package within 24 hours of booking or a cheaper hotel rate up to 48 hours before check-in and Expedia will refund the difference. Sign in to find out more.

Save on hotels

Exclusive offers and deals, including up to 20% off hotel stays

Fulltime support

A dedicated customer service team available 24/7 at 1-877-222-6492

How it works

Paying with TD points .

It’s easy to shop for travel: Find your ideal trip and pay with your TD Travel or Rewards Credit Card at checkout. On the billing page, select the amount of TD points you wish to redeem.

200 TD Rewards Points = $1 . .

Every 200 points are worth $1 off travel purchases on Expedia For TD. Redemptions are made in 200-point increments, and travelers need a minimum of 200 points to make a redemption.

Use points for all or part of your trip

For example, if your trip costs $1000, use 120,000 Rewards Points (worth $600). Pay the remainder with your TD credit card and earn up to additional 8 points for every $1 spent 1,9 . That is up to 32k additional points!

Automatic credit for points redeemed

When you purchase travel using TD Rewards Points your TD credit card will be charged the full amount. The dollar value of points redeemed will be credited to your account in 3-5 business days.

Already an eligible TD cardholder?

Use your existing TD online banking credentials to sign in to Expedia For TD and find your perfect trip Sign In

Earn TD Rewards Points on bookings made with your TD Travel Rewards Credit Card and pay with points by redeeming TD Rewards Points towards all or part of your trip. Sign In

Pay for travel and everyday items with your TD Travel Credit Card to earn TD Reward Points. When you're ready, you can redeem TD points to pay for all or part of your trip.

Looking to become a TD travel cardholder?

Learn more about TD’s travel credit cards and choose the one that best matches your spending habits and travel style.

1 TD First Class Travel Cardholders earn eight TD Rewards Points for every dollar spent on travel Purchases made online or by phone through Expedia For TD. TD Platinum Cardholders earn six TD Rewards Points for every dollar spent on travel purchases made online or by phone through Expedia For TD. TD Rewards Cardholders earn four TD Rewards Points for every dollar spent on travel purchases made online or by phone through Expedia For TD. TD Business Travel Cardholders earn 9 TD Rewards Points for every dollar spent on travel purchases made online through Expedia For TD and 6 TD Rewards Points for every dollar spent on travel purchases made by phone through Expedia For TD. Any returned items, refunds, rebates or other similar credits will reduce or cancel the TD Rewards Points earned on the original Travel Purchase. Fees, Cash Advances (including Balance Transfers, Cash-Like Transactions and TD Visa Cheques), interest charges, optional service, refunds, rebates or other similar credits do not earn TD Rewards Points. Other Conditions: Offer may be changed, withdrawn or extended at any time and cannot be combined with any other offer.

2 In order to receive the TD Travel Credit, the Account must be open, active and in Good Standing. An Eligible Travel Credit Purchase means: • A Hotel, Motel, Lodging, or Vacation Rental Purchase of $500.00 CAD or more made with Expedia For TD; • A Vacation Package Purchase of $500.00 CAD or more made with Expedia For TD, that includes a Hotel, Motel, Lodging or Vacation Rental booking packaged with a transportation booking. See your TD Rewards Program Terms and Conditions for more details.

3 Each year, receive a TD Rewards Birthday Bonus (“Birthday Bonus”) equal to 10% of the TD Rewards Points earned while using the TD First Class Travel® Visa Infinite* over the 12 months preceding the Primary Cardholder’s birthday, to a maximum Birthday Bonus of 10,000 TD Rewards Points. For the first year, we will only award the TD Rewards Birthday Bonus based on the TD Rewards Points earned from October 30, 2022, to your next birthday. Previously earned points on other Rewards Cards, Acquisition Bonus Points, or other Promotional Rewards Points earned do not count towards the Birthday Bonus.

4 Insurance coverages are subject to conditions, limitations and exclusions. For more information, (including information on the insurer and/or administrator) please refer to the Certificate of Insurance included with your TD Credit Cardholder Agreement.

5 Rate displayed by Expedia For TD reflects the discounted offer. No discount code needs to be applied.

6 Provided by Avis Rent A Car System ULC. Minimum discount offer subject to discount code and to terms and conditions which may change without notice. Blackout dates may apply. Base rate refers to time and kilometer/mile charges only. Taxes, fees and surcharges are extra. The Toronto-Dominion Bank is not responsible for any vehicles, services, discounts or other offers made available by Avis Rent A Car System ULC.

7 Provided by Budget Rent A Car System, Inc. Minimum discount offer subject to discount code and to terms and conditions which may change without notice. Blackout dates may apply. Base rate refers to time and kilometer/mile charges only. Taxes, fees and surcharges are extra. The Toronto-Dominion Bank is not responsible for any vehicles, services, discounts or other offers made available by Budget Rent A Car System, Inc.

8 Subject to carrier/space availability. 9 Every 200 TD Points redeemed are worth $1 in travel savings off the cost of Travel Purchases made through Expedia For TD. Redemptions can only be made in 200 TD Points increments. * Trademark of Visa International Service Association; Used under license.

TD Business Travel Visa* Card review

- Rates & Fees

- Eligibility

9 Earn 9 TD Rewards Points for every $1 you spend using ExpediaForTD.com

6 Earn 6 TD Rewards points for every $1 in foreign currency purchases and at restaurants and on recurring bills

2 Earn 2 TD Rewards Points for every $1 spent on all other purchases.

50% Earn 50% more TD Rewards Points at Starbucks when you link your card with your Starbucks account.

19.99% Purchase APR

22.99% Cash Advance APR

$149 Annual Fee Waived in the first year. Additional cards: $49

2.50% Foreign Transaction Fee Earn 6 TD Rewards Points for every $1 on Foreign Currency purchases

Very Good Recommended Credit Score

By Tyler Wade & Cory Santos

Updated: May 07, 2024

Play article

( mins)

( )

Quick Overview of the TD Business Travel Visa* Card

The TD Business Travel Visa* Card is a powerhouse for Canadian businesses, especially if you love to (or have to) travel. With a slew of benefits, from high rewards rates on Expedia bookings to comprehensive insurance coverage, it's a card that demands attention.

Who's the TD Business Travel Visa* Card for?

The TD Business Travel Visa* Card is ideal for Canadian businesses that frequently travel. Whether you're a small business owner or a corporate executive, the card offers a range of benefits that can enhance your travel experience. From the high rewards rates on Expedia bookings to the comprehensive insurance coverage, the TD Business Travel Visa* Card is designed to meet business travel needs and provide cardholders with peace of mind while on the go.

Pros and cons

High rewards rate : Earn up to 9 TD Rewards Points per $1 on travel bookings through ExpediaForTD.com.

Flexible redemption : No blackout dates or seat restrictions.

Comprehensive insurance : From travel medical to car rental coverage.

Special offers : Lucrative welcome bonuses and limited-time offers.

Annual fee : A $149 annual fee, though it's rebated in the first year.

TD Business Travel Visa* Card welcome bonus

Before June 3, 2024, new cardholders can earn a whopping 175,000 TD Rewards Points, equivalent to a travel value of up to $875 when booked through ExpediaForTD.com.

- Welcome Bonus of 30,000 TD Rewards Points upon the first purchase.

- Earn up to 120,000 TD Rewards Points when spending $2,500 each month for the first 12 months.

- Earn up to 25,000 TD Rewards Points by setting up new regularly recurring bill payments (maximum two).

- You can earn 30,000 more rewards by becoming a TD Small Business Banking customer when you open an Every Day Business Plan (A, B, C, or TD Unlimited Business Plan between now and October 31, 2023.

- And another 30,000 TD Rewards points if you’re approved for the TD Business Travel Visa* Card within 120 days of opening a new Business Chequing Account and process at least one transaction within the first 90 days.

- Full Annual Fee rebate for the Primary Cardholder and first two additional cardholders for the first year (a value of up to $247). Total value of $1,240.

- Plus, TD is throwing in a 12-month Uber One membership ($120 value).

How to earn TD Rewards points with the TD Business Travel Visa* credit card

Despite the $149 annual fee, the TD Business Travel Visa* Card is a lucrative travel rewards powerhouse that provides companies with impressive rewards in a wide variety of critical business travel categories. This card shines with its earn rates:

- 9 TD Rewards Points for every dollar spent on ExpediaForTD.com bookings.

- 6 TD Rewards Points for every $1 spent on foreign currency purchases, restaurant expenses and recurring bill payments.

- 2 TD Rewards Points for every $1 spent on all other eligible business purchases.

The easiest way to redeem TD Rewards is through eligible travel bookings through Expedia for TD. Business Travel Visa account managers can use TD Rewards points towards "Book Any Way" travel bookings through Expedia for TD or opt to use points for statement credits and education credits or to purchase gift cards or merchandise.

TD Business Travel Visa* Card key benefits

The TD Business Travel Visa* Card offers a range of key benefits that make it an excellent choice for frequent travelers. With this card, you can enjoy the convenience of no travel blackouts or seat restrictions, giving you the freedom to book your travel through any agency. Additionally, you have the flexibility to use your points to cover taxes and fees on your travel bookings, making it even more cost-effective. This card truly understands the needs of business travelers and aims to provide them with a seamless and hassle-free experience.

TD Business Travel Visa* Card Insurance coverage

The TD Business Travel Visa* Card offers a robust insurance package:

- Travel medical insurance : Up to $2 million coverage for the first 15 days of your trip.

- Travel accident insurance : Up to $500,000 for covered losses.

- Trip cancellation/interruption : Up to $1,500 per person for cancellations and maximum of $5,000.

- Flight/trip delay insurance : Up to $500 towards hotel and restaurant expenses.

- Lost or stolen baggage : Coverage up to $1,000 per trip.

- Car rental coverage : 48 consecutive days of coverage for auto rental collision/loss damage up to $65,000 MSRP.

- Purchase security : On most items for 90 days from purchase date against loss or damage.

- Extended warranty protection : Automatically extends manufacturer’s warranty.

Extra benefits of the Business Travel Visa* credit card from TD The card also provides a suite of benefits designed to support businesses on business trips, at the office or even when planning a company get-together. Additional features of the TD Business Travel Visa* Card include:

- The Visa SavingsEdge program offers sweet deals to grow your business on brands like Amazon Business, Budget Rent-a-car, Google Ads, Constant Contact, UPS, Zendesk and more.

- Get a free 12-month Uber One membership, valued at $120.

- Get your Starbuck ® fix - earn more at Starbucks ® by linking the card to earn 50% more TD Rewards Points and Stars.

- Save a minimum of 10% on the lowest available base rates in North America with Avis and Budget.

- Redeem your TD Rewards Points towards business purchases at Amazon.ca.

- Access TD Card Management Tool to redistribute available credit among cardholders, set restrictions on spend type, temporarily turn a Card on or off, track employees spending with up to 18 months of business transaction data and more.

How the TD Business Travel Visa* Card compares

The TD Business Travel Visa* Card falls into the travel and foreign transaction category. When considering such cards, it's crucial to compare features, fees and benefits to ensure you're getting the best value.

TD Business Travel Visa* Card Vs TD First Class Travel ® Visa Infinite* Card

These two cards are similar, so what sets them apart? Business perks vs. a focus on travel. The First Class card charges $139 for its annual fee, or $10 less than the Business Travel Visa*. The welcome bonus with Visa Infinite isn’t as enticing at 115,000 TD Rewards points and they charge 20.99% APR vs. 19.99% with the business travel card. On top of that, you earn eight TD Rewards Points, instead of nine, for every $1 in travel purchases. For some good news, both cards’ travel insurance packages are identical.

The TD First Class Travel ® Visa Infinite* also gives you an annual credit of $100 when you book at Expedia for TD. And, because you’re part of the Visa Infinite Benefits program, you’ll get access to 24/7 concierge services, luxury hotel and dining experiences and more. Ultimately, pick the card that best suits your needs.

TD Business Travel Visa* Card vs. TD ® Aeroplan ® Visa* Business Card

The TD ® Aeroplan ® Visa* Business Card’s biggest difference is Aeroplan vs. TD Rewards Points. If you love flying with Air Canada and its partner airlines, want a free first checked bag and access to the Maple Leaf Lounges in North America (though you earn one pass for every $10,000 spent), then this may be a good card for you. It charges a $149 annual fee that you can get waived in the first year. It features the same great insurance benefits, the Visa SavingsEdge program and the TD Card Management Tool. One last difference, the TD® Aeroplan® Visa* Business Card only charges 14.99% interest.

So really, which points program would you rather have?

TD Business Travel Visa* Card Vs.CIBC Aventura ® Visa* Card for Business Plus

Another business card, a different rewards program. CIBC will waive the $120 annual fee in the first year, charge 19.99% APR and has a Visa Spend Clarity for Business to track your spending, customize payment controls and use powerful reporting tools.

Much like the Expedia for TD program, you can book on any airline, every flight, every seat with points that don’t expire with the CIBC Rewards Centre. CIBC’s welcome bonus of 60,000 Aventura points doesn’t seem as strong as TD’s welcome bonus, but the dollar value is about the same (~$1,200).

A significant differentiator is the lack of emergency medical insurance with CIBC.

Is the TD Business Travel Visa worth it?

The TD Business Travel Visa* Card is a strong contender in the best business credit card category. With its massive welcome bonus (that serves as a draw to their banking products), high earn rate, great insurance coverage and business tools (TD Card Management Tool), this card stands up against some of the best. If you like the security of a big bank, a credit card you can confidently give to your employees, and want to unlock some bonuses while travelling, this card is a winner.

TD Business Travel Rewards Visa* eligibility requirements

TD has specific requirements when applying for a business credit card. For starters, the company must be a registered and operating business in Canada. Additionally, the applicant must be a Canadian resident and of the age of majority in their province/territory of residence. While these requirements seem restrictive, it still leaves the door open to freelancers and other small or part-time proprietors to open a business credit card account.

How to switch from TD Business Travel Visa* to regular

Switching your TD business card without losing points is easy. Simply call 1-800-983-8472 and speak with customer service. If you’re switching to Aeroplan though, be sure to use up as many points as possible, even if it’s to help pay off your balance.

Is the annual fee worth it?

Given the card's travel, insurance and business benefits, the $149 annual fee is justified, especially with the first-year rebate. However, it's essential to compare its pros and cons for what your business needs.

Can I use my TD Rewards Points for non-travel expenses?

Yes, you can redeem your TD Rewards Points for purchases at Amazon.ca, retail business merchandise, gift card and even to pay down the account balance.

Tyler Wade has worked in personal finance for over 5 years writing for brands like Ratehub, Forbes, KOHO, and now Money.ca.

Cory Santos is a finance writer, editor and credit card expert with over seven years of experience in personal finance. Cory joined Wise Publishing from BestCards, with bylines in numerous print and digital publications across North America, including the Miami Herald, St. Louis Post-Dispatch, AOL, MSN and Medium as well as financial podcasts like KOFE Talk.

Latest Articles

Canadians want action on reducing landfill waste, converting empty offices into apartments in canada, 4 reasons why you should use credit over cash, new canadians face unique financial challenges, eq bank launches new notice savings account, employment a real struggle for younger canadians.

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter.

TD Business Travel Visa* Card

Reward calculator, enter your total monthly expenses or by category.

Restaurants

Bills & Utilities

Net annual rewards the 1st year

Net annual rewards in subsequent years

Requirements

Purchase protection

Purchase security for lost or stolen items within 90 days of purchase.

Medical emergency

Travel medical insurance coverage up to $2,000,000 for the first 15 days of your trip (or 4 days if you're over 65).

Trip cancellation

For trip cancellation, receive coverage up to $1,500 per person.

Trip interruption

Up to $5,000 coverage for trip interruption.

Travel accident

Common carrier travel accident insurance of up to $500,000 also applies.

Lost or stolen baggage `insurance

Any delayed or lost baggage is covered up to $1,000.

Flight delay

Flight/trip delay insurance will cover up to $500 for over 4 hours of delay.

Auto rental coverage

For rental cars, receive 48 consecutive days of coverage for auto rental collision/loss damage.

Extended warranty

Extended warranty on all purchased items.

More rewards with additional card

Add supplementary cardholders to earn more rewards, faster.

Exclusive discounts with my favorite brands

Cardholders also receive discounts of up to 25% off purchases made as part of the Visa SavingsEdge program. Save on car rentals with discounts at Avis and Budget Rent a Car, and get 50% more TD Rewards Points and Stars at Starbucks.

Similar Cards

Review ( 0 )

Related articles.

A welcome offer is a bonus offered for new credit card sign-ups, with the goal of attracting new customers. Welcome offers are often offered in a variety of forms, such as cash back, bonus points or waiving the annual fee for the first year. But the best credit card is not the same for everyone, since […]

Today, prepaid cards mean you don’t have to worry about your credit score, because anyone can apply and be approved for a prepaid card in Canada. The best prepaid cards – those that offer rewards and no fees – are almost always Mastercards. All the cards presented here are designed to make shopping safe and […]

Balance transfer credit cards are a great way to catch your breath when you’re drowning in high-interest debt. By paying off one credit card with another at a much lower rate, you can significantly reduce your monthly interest charges and get back on track financially. The Pros of Balance Transfer Credit Cards The main advantage […]

KOHO, the fintech known for offering one of the best prepaid cards and an app full of tools to improve your finances, no longer offers a free plan. As a reminder, to order your prepaid card, you must open a KOHO account and choose a plan. The cheapest plan is now the Essential at $4 […]

Thanks for this great article – I featured it in my weekly round up in “the best of the rest”

Thanks Ross, I really appreciate the support!

Join 3,500 Canadian Subscribers!

Sign up today to learn all about the best cash back and travel rewards credit cards, plus how to maximize your rewards and loyalty programs.

Your browser is out of date.

We highly encourage you to update your browser to the latest version of Internet Explorer, or use another browser such as Google Chrome or Mozilla Firefox.

TD Business Travel Visa* Card

Limited Time Offer:

Earn a value of up to $1, 122 ^ in TD Rewards Points (that's up to 175,000 TD Rewards Points) ^ with no Annual Fee in the first year ^ . Conditions Apply. Account must be opened by June 3, 2024.

Earn up to 175,000 TD Rewards Points ^ for the first year from Account opening (a travel value of up to $875 when you book travel Purchases through ExpediaForTD.com ^ ) and get full Annual Fee rebates for the first year for the Primary Cardholder and first two Additional Cardholders ^ (a value of up to $247 ^ ). That’s a total value of $1,122 ^ . Conditions Apply. Account must be opened by June 3, 2024.

- Earn a Welcome Bonus of 30,000 TD Rewards Points when you make your first Purchase ^ with your new Card

- Earn up to 120,000 TD Rewards points when you spend $2,500 in Purchases each month for the first 12 months of Account opening ^ .

- Plus, earn up to 25,000 TD Rewards points when you spend $250 on eligible mobile wallet Purchases within 90 days of Account opening ^ .

- Get an Annual Fee rebate for the first year for the Primary Cardholder and two Additional Cardholders ^ . Additional Cardholders must be added by June 4, 2024.

- Earn an additional 60,000 TD Rewards Points when you spend $5,000 in the first 3 months of account opening ^

- Plus, earn up to 40,000 TD Rewards points by setting up new regularly recurring bill payments (maximum two)

- Earn 9 TD Rewards Points ^ when you book travel online through ExpediaForTD.com ^ using your Card

- Earn 6 TD Rewards Points ^ for every $1 you spend on Foreign Currency Purchases using your Card when making foreign exchange Purchases.

- Earn 6 TD Rewards Points ^ for every $1 you spend on regularly recurring bill payments and Restaurant Purchases made on your card

- Earn 2 TD Rewards Points ^ for every $1 you spend on business purchases made using your Card

How to Redeem:

- Travel Accident Insurance

- Trip Interruption/ Cancellation Insurance

- Travel Medical Insurance

- Rental Collision/ Loss Damage Insurance

- Flight Delay Insurance

- Baggage Insurance

- Extended Warranty

- $49.00 for the first Additional Cardholder. $0 for subsequent Additional Cardholders.

- There is a 21-day interest grace period on all new purchases

^ Terms and Conditions apply.

All trade-marks are the property of their respective owners.

* Trademark of Visa International Service Association and used under license.

® The TD logo and other trade-marks are the property of The Toronto-Dominion Bank.

Last updated 03/25/2024. Check with the credit card issuer for the most up-to-date information before applying.

Find errors in the information for this credit card? Report this listing.

Other cards you may be interested in

Report Credit Card Listing

- Describe the issue:

Report this listing

WealthRocket is reader-supported. When you buy through links on the website, we may earn an affiliate commission.

Best TD Business Credit Cards

Steven brennan.

Why you can trust us

The team at WealthRocket only recommends products and services that we would use ourselves and that we believe will provide value to our readers. However, we advocate for you to continue to do your own research and make educated decisions.

The right credit card can help Canadian business owners take charge of their finances. From managing cash flow to building credit history, a business credit card can be a real asset. And importantly, it can also help keep personal and business expenses separate.

If you’re in the market for a TD business credit card, you’ve got several options. Knowing which card best fits your needs can be a challenge, especially if your business is growing fast.

Read on to discover which of these TD credit cards are best for your business.

TD Business Cash Back Visa Card

- Welcome bonus None

- Annual fee $0

- Interest Rates Purchases: 19.99%, Cash Advances: 22.99%

- Recommended Credit Score 660 - 724

TD Aeroplan Visa Business Card

- Welcome bonus 10,000 Aeroplan points when you make your first purchase

- Annual fee $149 (first year waived)

- Interest Rates Purchases: 19.99%, Cash advances: 14.99%

- Recommended Credit Score 725 - 759

TD Business Travel Visa* Card

- Welcome bonus 30,000 TD Rewards Points when you make your first purchase

- Interest Rates Purchases: 19.99%, Cash advances: 22.99%

- Recommended Credit Score 760 - 900

In This Article

Best td business credit cards, what is a business credit card, how to get a business credit card, when should i use a business credit card.

- Earn 60,000 TD Rewards points after spending $5,000 within the first three months of account opening, and another 60,000 points when you spend $2,500 a month for the first 12 months. Must apply by May 28, 2023.

- Earn TD rewards points from everyday business purchases, including retail business merchandise via TDRewards.com . Redeem on travel expenses, Amazon.ca, or put toward your balance

- Earn 9 TD Rewards Points when booking travel through ExpediaForTD.com ; 6 points for every $1 spent in a foreign currency, at a restaurant, and on recurring bill payments; and 2 points for every $1 spent on all other eligible business purchases

- $49 for additional cards

- No travel blackout dates

Most Ideal For

Those who travel often or have high net purchases on travel.

Less Ideal For

Those who won’t spend enough on credit to earn rewards points.

- Earn an extra 20,000 Aeroplan points when you spend $5,000 within the first three months and an extra 30,000 when you spend $2,500 a month for the first 12 months

- Earn Aeroplan points on eligible business purchases, travel with Air Canada and more. Redeem on travel, hotels, office supplies, and everyday business expenses

- Earn 2 Aeroplan points on every dollar spent directly with Air Canada, on eligible purchases

- Earn 1.5 Aeroplan points on every dollar spent on eligible travel, dining and business categories, such as qualifying car rentals and internet bill payments

- Annual fee rebate up to $247 for the first year, with up to two additional cardholders

Those who travel often with Air Canada.

Those who don’t rack up a lot of travel miles.

- Earn 2% in Cash Back Dollars on eligible office supply and gas purchases

- Earn 2% in Cash Back Dollars on recurring bill payments

- Earn 0.5% in Cash Back Dollars on all other purchases. Cash Back Dollars will be annually credited to your account for spending.

- No expiration on Cash Back Dollars as long as your account is open and in good standing

- Access online reporting and take advantage of TD business banking tools for budgeting

Those looking to generate cash back on business expenses.

Businesses with high expenditure that could benefit from a comprehensive rewards program.

TD Business Select Rate Visa Card

- Annual fee $49 (optional)

- Interest Rates No annual fee: 11.99% on purchases and cash advances, Annual fee: 8.99% on purchases and cash advances

- Fixed low interest rate allows businesses to shop with confidence

- Access lower rates for paying annual fee

- 21-day grace period on all new purchases when your balance is fully paid prior to your monthly billing period

- Enjoy car rental collision and loss damage insurance for up to 48 consecutive days when you pay using your card

- Access to the TD Card Management Tool for online banking

Those strictly interested in the lowest interest rate available.

Those seeking a card with extensive benefits and rewards programs.

A business credit card is a credit card intended for business owners. These cards can help owners improve the organization of their businesses’ finances, especially when it comes to taxes and bookkeeping.

Business credit cards can also help fund everyday business expenses without the owner having to dip into their personal finances or use a personal credit card . For businesses with high upfront costs, or those struggling with expense management, they can be extremely helpful.

Applying for a business credit card isn’t difficult, but you will need to provide more documentation compared to a personal card application. You can usually apply online, and in addition to proving your financial suitability, you’ll also have to document essential details about your small business.

For example, during the application process for any TD business credit card, you’ll be asked to provide your Master Business Licence. You may also need to show a history of your businesses’ financial statements.

One of the biggest advantages of using a business credit card is it allows owners to easily separate personal spending from business purchases. They are also intended to help cover costs when cash is low, or when unexpected business expenses crop up.

Steven is a finance content writer based in Vancouver, B.C. He enjoys writing about many aspects of personal finance, including credit, loans, banking, and investments.

Frequently asked questions

Depending on which TD business credit card you apply for, you will need a good to excellent credit score (660 – 724, according to Equifax).

TD does not currently offer a secured business credit card. However, there is a TD secured credit card for personal spending, which might be a viable alternative.

Most business accounts can qualify for credit cards if the business owner has a good credit score.

Depending on which TD business credit card you apply for, you will need a good to excellent credit score (660 - 724, according to Equifax).

Related Articles

Best BMO Credit Cards in Canada

Gabriel Sigler June 4, 2024

Best Capital One Credit Cards in Canada

Best cibc credit cards in canada.

Steven Brennan June 4, 2024

Best TD Credit Cards in Canada

The best american express credit cards in canada.

Gabriel Sigler May 23, 2023

Best No Foreign Transaction Fee Credit Cards in Canada

Hannah Logan June 4, 2024

- How to Choose the Right Credit Card

- How to Apply for a Credit Card

- How to Cancel a Credit Card

- Ways To Pay Off Credit Card Debt

- Why Your Credit Card Was Declined

- How to Get Out of Credit Card Debt

- What to Know About Credit Card Minimum Payments

- What Is a Credit Card and Should You Get One?

- How Do Credit Cards Work in Canada?

- What Are the Different Types of Credit Cards?

- How an International Credit Card Works

- Common Credit Card Terms and Conditions

- Credit Card Fees and Charges

Credit Card Interest Calculator

- First-Time Home Buyer Incentive

- Tax-Free First Home Savings Account

- Home Equity Loan

- How a Reverse Mortgage Works

- Home Equity Line of Credit

- Mortgage Renewal

- Getting a Second Mortgage

- How to Refinance a Mortgage

- How Does Mortgage Interest Work?

- Realtors vs Real Estate Agents vs Brokers

- Is Canada’s Housing Market Crashing?

- Types of Houses in Canada

- First-Time Home Buyer Grants and Assistance Programs

- Types of Mortgages in Canada: Which Is Right for You?

- How Does a Mortgage Work in Canada?

- What Is an Interest Rate?

- Guaranteed Investment Certificate (GIC)

- Savings Account Guide

- Common Canadian Bank Fees and Charges

- Types of Bank Accounts in Canada

- EQ Bank Review

- Simplii Financial Review

- Tangerine Bank Review

- National Bank of Canada Review

- CIBC Review

- Scotiabank Review

- TD Bank Review

- What Is Canadian Investor Protection Fund (CIPF) Coverage?

- How Capital Gains Tax Works

- Investing for Canadian Beginners

- Understanding Asset Classes in Investing

- Understanding Fixed-Income Investments

- How to Invest in Stocks

- What Are T-Bills

- What is a Bond

- What is Registered Disability Savings Plan (RDSP)

- What Are Mutual Funds

- What is an ETF (Exchange Traded Fund)

- What Is Forex Trading

- What Is Cryptocurrency and How Does It Work

- What Is a Stock

- What is Old Age Security and How Does It Work

- What is Registered Retirement Income Funds (RRIFs)

- How a Life Income Fund (LIF) Works for Retirement

- What Is An In-Trust Account

- What Is a Locked-in Retirement Account (LIRA)

- How Much Money You’ll Need To Retire

- Defined Benefit vs. Defined Contribution Pension Plans

- Can Annuities Fund Your Retirement?

- What Is a Personal Loan?

- Personal Loan Insurance: Do You Need It?

- What Is a Secured Personal Loan?

- What Is a Payday Loan?

- What Is a Pawn Loan?

- What Is a Car Title Loan?

- Small Business Loan vs Personal Loan

- Personal Loan vs. Line of Credit

- Personal Line of Credit vs Home Equity Loan:

- Personal Line of Credit vs Car Loan

- HELOC vs Personal Loan

- Debt Consolidation vs Personal Loan

- Cash Advance vs Personal Loan

- Business Loan vs Personal Loan

- Price Matching Tips to Help You Save Big

- How to save for Wedding

- How to Save Money on Groceries

- Ways to Save on Your Next Family Vacation

- Tips to Help You Save On Gas

- How to Save Money in 8 Easy Steps

- Passive Income: What It Is and How to Make It

- Budgeting 101: How to Budget Your Money

- Ways to Make Money Online and Offline in Canada

- How Do Credit Inquiries Work?

- What is the Ideal Credit Utilization Ratio?

- What Credit Score is Needed for a Credit Card?

- How to Get a Better Credit Score

- What is a Good Credit Score in Canada?

- Credit Cards

Expedia for TD Review: What You Need to Know

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own.

Put TD Rewards points to work through the Expedia for TD platform, an Expedia portal exclusively for TD credit cardholders that offers the highest redemption value possible for hard-earned TD points.

How does Expedia for TD work?

Is it worth getting expedia for td.

- How to earn TD rewards

How much are TD Rewards points worth?

How to redeem your points on expedia for td, does expedia for td price match, how to log in to expedia for td, pros and cons of expedia for td.

Expedia for TD is an Expedia platform for TD Bank credit cardholders.

TD cardmembers log into the Expedia for TD platform to browse travel deals and redemption options, which include vacation packages, accommodations, exclusive deals and more. TD points are worth more when redeemed through the Expedia for TD platform. Purchasing travel through the platform with a TD credit card earns accelerated TD points.

Expedia.ca vs. Expedia for TD

Expedia.ca is an online travel agency that can be used to book airfare, cruises, hotel accommodations, car rentals and more.

Expedia for TD is an Expedia platform exclusively for customers with credit cards that earn TD Rewards. TD cardholders who earn cash back or Aeroplan points with their cards can’t access the platform.

Other notable differences between Expedia for TD and Expedia.ca? The former offers accelerated TD Rewards points for money spent on travel purchases through Expedia for TD and a dedicated support team for TD customers, while the latter does not.

Outside this, Expedia for TD is not unlike its parent platform, Expedia.ca. Cardholders can browse and book flights, hotel stays, car rentals, cruise tickets and more.

TD Rewards points are most valuable when redeemed through Expedia for TD. The platform, accessed at expediafortd.com, also offers an accelerated earn rate of up to 9 TD Rewards points per $1 spent on travel bookings.

Additional Expedia for TD perks include its price-matching policy on hotels and travel packages and dedicated 24-hour customer support. There are a couple of drawbacks, though. The platform is only for TD credit cardholders who earn TD Rewards points. Plus, there are limitations to Expedia for TD’s price matching — time restrictions apply, and refunds are only issued on flight and hotel packages.

How to earn TD rewards

Some TD credit cards earn TD Rewards points. Earn rates vary.

TD credit cards that earn TD rewards

The following TD credit cards earn TD Rewards points:

- TD Rewards Visa Card.

- TD Platinum Travel Visa Card.

- TD First Class Travel Visa Infinite Card.

- TD Business Travel Visa Card.

For those interested in earning the most TD Rewards Points per dollar, the TD First Class Travel Visa Infinite Card and the TD Business Travel Visa Card carry the highest earn rates. This makes them the best cards for individuals and businesses, respectively.

TD credit cardholders will get the most bang for their buck by redeeming their TD Rewards points through Expedia for TD.

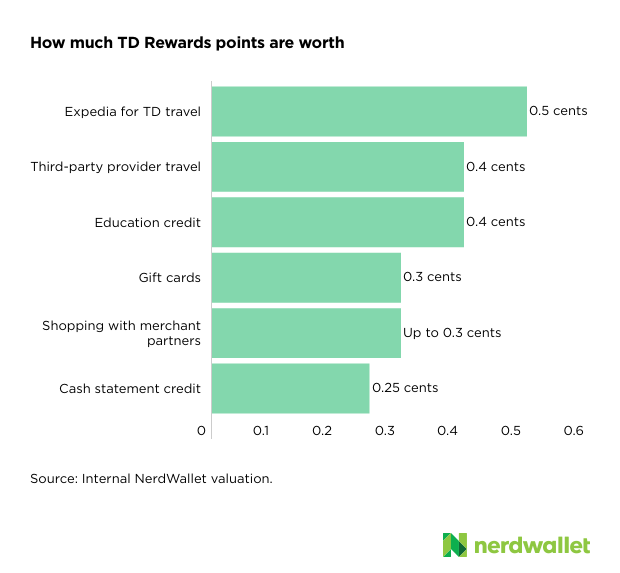

Expect to get around 0.25 to 0.5 cents per TD Rewards point, according to NerdWallet analysis.

The value of TD Rewards points varies depending on the redemption method, but TD Rewards points are at their most valuable when used to redeem travel offers through the Expedia for TD portal. Cardholders can expect to get 0.5 cents per TD Rewards point for travel purchases made through Expedia for TD.

Cardholders must have at least 200 TD Rewards Points — worth $1 — to make a redemption through the Expedia for TD portal.

To redeem your TD points on the Expedia for TD platform:

- Register your TD Rewards account on TD’s website.

- Log into Expedia for TD with your username and password.

- Find the travel offer you’d like to purchase.

- Book your offer through the online Expedia for TD portal or by phone.

- Redeem your TD Rewards Points when you book.

Expedia for TD redemption options

The Expedia for TD booking portal offers numerous redemption options:

- Car rentals.

- All-inclusive vacations.

- Train travel.

How to maximize TD Rewards points

Even if your TD points don’t entirely cover the cost of your booking through the Expedia for TD portal, paying the difference with your TD credit card earns you accelerated points — which gets you closer to another free or discounted travel experience.

Let’s say you book a $500 Air Canada round-trip flight to the Dominican Republic through the Expedia for TD portal. You use 50,000 TD Rewards points towards the booking. This reduces the cost of your trip by $250. You put the outstanding $250 balance on your TD credit card.

Since you can earn up to 9 TD Rewards points for $1 spent through the Expedia for TD portal, the $250 you put on your TD credit card earns you 2,250 TD Rewards Points — which is a value of $11.25 back in your pocket.

Looking for a travel rewards credit card?

We compared the best options in Canada.

Yes. Customers can take advantage of price matching through the Expedia for TD portal — also called Expedia’s Price Guarantee.

How does price matching work?

Expedia will refund the difference if you find cheaper travel packages or accommodations after booking through the Expedia for TD portal. But there are two important caveats. Expedia will only issue a refund if you find:

- A less expensive flight and hotel package within 24 hours of booking.

- A cheaper hotel rate up to 48 hours before check-in.

Pros and cons of Expedia for TD price matching

- Get refunded the difference between your booking and a cheaper travel deal.

- Limited to hotel stays and flight and hotel packages.

- Time restrictions apply.

Once you’ve registered your TD Rewards account on TD’s website, you can log in to Expedia for TD from:

- tdrewards.com.

- expediafortd.com.

Expedia for TD customer service

Expedia for TD has a dedicated support team for TD credit cardholders. The team can be reached by phone at 1-877-222-6492 24 hours a day.

3 tips for using Expedia for TD

Make the most of your TD Rewards points and the Expedia for TD platform with the following tips:

1. Book through Expedia for TD instead of TD’s “Book Any Way.”

Your TD Rewards points are worth 0.5 cents per point when redeemed for travel purchases booked through Expedia for TD. You can also book travel experiences through third-party travel websites and agencies — what TD calls its “Book Any Way” redemption option — but your points won’t go as far. Expect to receive 0.4 cents per point for the first $1,200 of any Book Any Way travel redemption request, and 0.5 cents per point for any amount over $1,200 for the same Book Any Way travel redemption.

2. Use your TD credit card to cover outstanding expenses from Expedia for TD bookings.

You’ll earn TD Rewards points at an accelerated rate when you use your TD credit card to cover outstanding expenses on the Expedia for TD platform. Different cards earn points at different rates:

- TD Rewards Visa earns 4 TD points for every $1 spent on travel purchases through the platform.

- TD Platinum Travel Visa earns 6 TD points for every $1 spent on travel purchases through the platform.

- TD First Class Travel Visa Infinite earns 8 TD points for every $1 spent on travel purchases through the platform.

- TD Business Travel Visa earns 9 TD points for every $1 spent on travel purchases booked online and 6 TD points for every $1 spent on travel purchases booked by phone through the platform.

3. Don’t wait to shop around.

Expedia for TD will only honour its price-matching policy under specific circumstances. If you’ve booked a flight and hotel package, you have just 24 hours to submit a refund request to Expedia for TD if you find a cheaper package. Hotel bookings have a more generous timeframe: Expedia for TD will issue a price-matching refund up to 48 hours before check-in.

- Redeem TD Rewards points for flights, hotel stays, car rentals, cruise tickets and more.

- Earn up to 9 TD Rewards points for every $1 spent on travel purchases through Expedia for TD.

- Receive an annual $100 travel credit when booking through Expedia For TD. (Limited to TD First Class Travel Visa Infinite Cardholders).

- Take advantage of Expedia’s price-matching policy to secure the lowest rates for hotels and hotel/flight packages.

- Dedicated Expedia For TD support team available 24 hours a day.

- Limited to TD credit cardholders who earn TD Rewards.

- Price matching limitations apply.

Frequently asked questions about Expedia for TD

TD points never expire so long as you remain a TD cardholder with an account in good standing. If you don’t earn or redeem any TD Rewards points for at least one year, your account will be deemed inactive. At this time, TD may close your account and offer you the opportunity to redeem your TD Rewards points by a specified date.

There’s no cost associated with accessing the Expedia for TD platform. The travel package options on Expedia for TD are no different than those offered on Expedia.ca, but only certain TD credit cardholders can gain access to it.

About the Author

Shannon Terrell is a lead writer and spokesperson for NerdWallet, where she writes about credit cards and personal finance. Previously, she was a writer, editor and video host for financial…

DIVE EVEN DEEPER

22 Best Credit Cards in Canada for June 2024

NerdWallet Canada’s picks for the best credit cards include top contenders across numerous card categories. Compare these options to find the ideal card for you.

Interest charges don’t need to be a mystery. Use our credit card interest calculator to see how much interest you’d owe if you carry a credit card balance.

18 Best Travel Credit Cards in Canada for June 2024

Explore the best travel credit cards in Canada for daily spending, flexible travel rewards, big welcome bonuses and more.

How to Choose a Travel Credit Card

With so many cards, rewards programs and benefits available, choosing the right travel credit card can be overwhelming. However, once you’ve got one in your wallet, you can reap the rewards on your next trip.

- Credit Cards

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources.

First , we provide paid placements to advertisers to present their offers. The payments we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market.

Second , we also include links to advertisers’ offers in some of our articles. These “affiliate links” may generate income for our site when you click on them. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor.

While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof.

TD First Class Travel Vs. TD Aeroplan: Which Is Better?

Published: Jun 20, 2024, 3:26pm

Table of Contents

What is td first class travel, earning rewards, what is td aeroplan, td first class travel vs td aeroplan: which to choose, td first class travel and td aeroplan cards comparison, td first class travel vs. td aeroplan.

One bank, two rewards programs. If you’re looking for a travel rewards card with TD Bank, you’ll have the choice between one of the many TD Aeroplan cards they offer and a TD First Class Travel Visa Infinite. But how do you know which one will benefit you the most? We break down the differences between these two types of travel cards.

Featured Partner Offer

TD® Aeroplan® Visa Infinite Privilege* Card

On TD’s Website

Welcome Bonus

Up to $2,700 in value† including up to 75,000 Aeroplan points†

Regular APR (Purchases) / Regular APR (Cash Advances)

20.99% / 22.99%

American Express® Aeroplan®* Card

On American Express’s Secure Website

Up to 50,000 Aeroplan points

Regular APR

30% (charge card)

- TD® Aeroplan® Visa Infinite* Card

Up to $1,000 in value† including up to 40,000 Aeroplan points†

Credit Score Description

Good/Excellent

TD First Class Travel isn’t really the name of a rewards program with TD. Rather, it refers to a specific credit card TD issues: the TD First Class Travel Visa Infinite . This card and several others from TD earn TD Reward points.

TD Reward points are exclusive to TD and are specifically linked to TD credit cards , meaning you won’t find them anywhere else. TD Reward points use a fixed-value points system, ensuring they can be redeemed consistently across various redemption options. This feature makes them good for covering incidental travel expenses like boutique hotel bookings, vacation rentals and other travel-related expenses.

How Many TD First Class Travel cards does TD offer?

TD only offers one TD First Class Travel card: the TD First Class Travel Visa Infinite Card.

It does offer a few other credit cards that earn TD Rewards points, including:

- TD Platinum Travel Visa

- TD Travel Rewards Visa

- TD Business Travel Visa

TD First Class Travel Rewards

Pros of td first class travel.

- Earn up to 8 points per dollar on select spending

- Points can be redeemed through multiple travel booking sites, including Expedia for TD

- Includes travel insurance

Cons of TD First Class Travel

- TD Rewards points are exclusive to TD Bank

- Must earn either $60,000 in annual personal income or $100,000 in annual household income to be eligible for this card

Redemption Options for TD First Class Travel

TD Rewards points can be redeemed for Amazon.ca purchases, Starbucks Rewards Stars and gift cards. You can also redeem TD Rewards points for travel bookings, like flights , hotels and car rentals, on any site through the TD Book Any Way option on any travel booking website or on Expedia For TD. You can also use your TD Reward points for a statement credit or for continuing education credits.

TD Aeroplan refers to credit cards issued by TD Bank that earn Aeroplan points. Aeroplan was originally designed as a loyalty program for Air Canada customers but changed hands several times over the years. 2018 Air Canada repurchased the program and reintroduced it in 2020.

Following its relaunch, Aeroplan focused on flexible rewards and expanded, adding a wide range of airline and retail partners to its network and removing fuel surcharges. Aeroplan credit cards are issued by TD Bank but are also issued by CIBC and American Express .

How Many TD Aeroplan cards does TD offer?

TD currently offers four Aeroplan credit cards:

- TD Aeroplan Visa Infinite

- TD Aeroplan Visa Platinum

- TD Aeroplan Visa Infinite Privilege

- TD Aeroplan Visa Business

TD Aeroplan Rewards

Pros of td aeroplan.

- Generous welcome bonus

- Points can be used for various items, including travel, merchandise, gift cards, and statement credit.

- Many partner retailers earn more points

- Business card option

- Cards include other travel perks, like travel insurance

Cons of TD Aeroplan

- The most benefits for redemption are with Air Canada

- All TD Aeroplan cards have an annual fee

- Lower earn rates than the TD First Class Travel card.

- Some Aeroplan cards have income eligibility requirements.

- You must fly Air Canada when redeeming Aeroplan Points.

Redemption Options for TD Aeroplan Credit Cards

Aeroplan points can be used for everything from booking flights and vacations with Air Canada to flights on partner airlines, hotel rooms, and car rentals. You can also redeem your Aeroplan points for merchandise, gift cards, and statement credit.

In order to take a closer look and help us choose between choose a TD First Class Travel Visa and a TD Aeroplan card, let’s review some of the facts.

Best for frequent flyers

Td first class travel® visa infinite* card.

Up to $700 in value†, including up to 75,000 TD Rewards Points†

$139 (fee rebated in the first year)

Think of the TD First Class Travel Visa Infinite Card as a cheaper step down from its higher-flying cousins on this list. Packed with travel benefits, but lacking a heavyweight rewards program, this card is really aimed at frequent fliers rather than high spenders who also like to travel.

- High earn rate for rewards with Expedia.

- Exclusive travel benefits.

- Expensive annual fee.

- Low annual net rewards earnings for average spenders.

- Earn up to $700 in value†, including up to 75,000 TD Rewards Points, no Annual Fee for the first year† and additional travel benefits. Conditions Apply. Account must be approved by September 3, 2024.

- Earn a welcome Bonus of 20,000 TD Rewards Points when you make your first Purchase with your Card†.

- Earn 55,000 TD Rewards Points when you spend $5,000 within 180 days of Account opening†.

- Earn a Birthday Bonus of 10% of the TD Rewards Points you have earned over the past year, up to a maximum of 10,000 TD Rewards points†.

- Get an annual TD Travel Credit † of $100 when you book at Expedia ® For TD.

- Get an Annual Fee Rebate for the first year†.

- To receive the first-year annual fee rebate for the Primary Cardholder, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening. To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by September 4, 2024.

- This offer is not available for residents of Quebec.

- † Terms and conditions apply.

Best for earn rates

Thanks to the TD Aeroplan Visa Infinite Card ’s robust Aeroplan rewards program, cardholders can earn roughly twice what they’d net through any of the other cards on this list, although its travel insurance coverage leaves something to be desired.

- Great rewards program earnings

- Plenty of perks, including comprehensive travel insurance and a NEXUS rebate

- High annual fee

- Earn up to $1,000 in value†, including up to 40,000 Aeroplan points† and additional travel benefits. Account must be approved by September 3, 2024.

- Earn a welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card†.

- Earn 15,000 Aeroplan points when you spend $7,500 within 180 days of Account opening†.

- Plus, earn a one-time anniversary bonus of 15,000 Aeroplan points when you spend $12,000 within 12 months of Account opening†.

- Enroll for NEXUS and once every 48 months get an application fee rebate†.

- Plus, share free first checked bags with up to 8 travel companions†.

- This offer is not available to residents of Quebec.

Best For Aeroplan Points with Low Annual Fee

Td® aeroplan® visa platinum* card.

Up to $500 in value†

$89 (first year of annual fee rebated)

The TD Aeroplan Visa Platinum Card shares many lots of the same features seen in premium cards that cost five times the annual fee. However, it does lack a bit in the insurance department.

- Decent travel and consumer protection benefits

- Allows cardholders to earn Aeroplan Points twice

- Low annual fee that’s rebated the first year

- Lower insurance coverage than other Aeroplan cards

- Earn up to $500 in value† including up to 20,000 Aeroplan points† and no annual fee for the first year. Conditions Apply. Account must be approved by September 3, 2024.

- Earn an additional 10,000 Aeroplan points when you spend $1,000 within 90 days of Account opening†.

- Get an annual fee rebate for the first year†.

- To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening and you must add your Additional Cardholders by September 4, 2024.

Best For Exclusivity

True to its name, the TD Aeroplan Visa Infinite Privilege Card is exclusive and expensive, but brings to bear a broad array of perks and benefits, along with a surprisingly accessible credit score threshold.

- Extensive travel perks, insurance and consumer protections

- Low credit score threshold for such a powerful card

- The most expensive annual fee on the list

- Requires minimum personal income of $150,000 a year or $200,000 in annual household income

- Earn up to $2,700 in value† including up to 75,000 Aeroplan points (enough for a round trip to Honolulu†) and additional travel benefits. Conditions Apply. Account must be approved by September 3, 2024.

- Earn a welcome bonus of 20,000 Aeroplan points when you make your first purchase with your new card†

- Earn an additional 25,000 Aeroplan points when you spend $12,000 within 180 days of Account opening†

- Plus, earn a one-time anniversary bonus of 30,000 Aeroplan points when you spend $24,000 within 12 months of Account opening†

- Share first free checked bags with up to 8 travel companions† and get unlimited access to Maple Leaf Lounges†, including complementary access for one guest.

- Plus, primary card holders get 6 complimentary worldwide select airport lounge visits annually through the Visa Airport Companion Program†.

- †Terms and conditions apply.

Best Aeroplan Card for Business Owners

Td® aeroplan® visa* business card.

Up to 65,000 Aeroplan points

This card is a must for business owners , especially those who travel. With exclusive perks and benefits starting at the airport, insuring you at take-off and at your destination with a robust travel insurance package and even providing discounts when you rent a car, you’ll feel like someone’s rolling out the red carpet for you on every business trip.

- High earn rate, especially on essential categories for business

- Travel perks like travel insurance and priority check-in and boarding

- $149 annual fee

- Limited travel benefits compared to other premium cards

- Limited acceptance outside of Aeroplan and Air Canada partners

- Earn up to $1,850 in value† including up to 65,000 Aeroplan points, no annual fee for the first year, and additional travel benefits†. Accounts must be opened by January 3, 2024.

- Get an annual fee rebate for the first year for the primary cardholder and two additional cardholders†.

- Share free first checked bags and get access to Maple Leaf Lounges†.

- Earn 2 points for every dollar spent on eligible purchases made directly with Air Canada® including Air Canada Vacations®.

- Earn 1.5 points for every dollar you spend on eligible purchases for travel, dining and select business categories such as shipping, internet, cable and phone services made on your Card.

- Earn 1 point for every dollar you spend on all other eligible purchases on your Card.

- Earn 50% more points at Starbucks when you link your TD card with your Starbucks® Rewards account.

With this in mind, the decision comes down to how you want to book travel, what you’re using the card for, what the decision comes down to is how you want to book travel, what you’re using the card for and how you like to redeem your points.

If you prefer to book travel through Expedia or other platforms, you’re better off choosing the TD First Class Travel card. If you prefer to book through Air Canada, you’ll likely get more value from an Aeroplan card.

The TD First Class Travel Visa Infinite Card is better if you prefer to redeem points for Amazon purchases or at Starbucks. However, if you’d rather redeem points for merchandise, an Aeroplan card might be worth considering.

That said, if you plan to use this card for business purposes, the TD Aeroplan card is best since the TD First Class Travel Visa Infinite is a single card you’re planning to use this card for business purposes, the TD Aeroplan card is best since the TD First Class Travel Visa Infinite is a single card and is meant for individuals, not businesses.

- Best Credit Cards

- Best Travel Credit Cards

- Best Airport Lounge Access Credit Cards

- Best Cash Back Credit Cards

- Best Credit Cards for Bad Credit

- Best Aeroplan Credit Cards

- Best No Foreign Transaction Fee Credit Cards

- Best Rewards Credit Cards

- Best Mastercards

- Best Student Credit Cards

- Best Secured Credit Cards in Canada

- Best Business Credit Cards

- Best of Instant Approval Credit Cards

- Best Prepaid Credit Cards

- Best No-Annual-Fee Credit Cards

- Best Low-Interest Credit Cards

- Best Neo Financial Credit Cards

- Best Visa Cards

- Best Air Miles Credit Cards

- TD Aeroplan Visa Infinite Privilege Review

- EQ Bank Card Review

- TD Aeroplan Visa Platinum Card Review

- Scotiabank Platinum American Express Card

- KOHO Prepaid Mastercard Review

- MBNA Rewards World Elite Mastercard

- MBNA True Line Mastercard Review

- The American Express Business Edge Card Review

- TD First Class Travel Visa Infinite Card

- TD Rewards Visa Card Review

- RBC Avion Visa Infinite Review

- Scotiabank Gold American Express Card

- Neo Secured Credit Card Review

- Home Trust Secured Visa Review

- American Express Aeroplan Card Review

- Tangerine Money-Back Card Review

- TD Cash Back Visa Infinite

- TD Platinum Travel Visa Card Review

- Scotiabank Scene+ Visa Card

- Credit Card Interest Calculator

- Credit Card Minimum Payment Calculator

- Credit Card Expiration Dates: What You Need To Know

- What Is The Highest Limit Credit Card In Canada?

- What Is The Highest Credit Score Possible?

- Money transfer from Credit Card to the Bank

- How To Get Cash From A Credit Card At An ATM

- The Stack Mastercard Is No More

- How Is Your Credit Card Interest Calculated?

- How To Pay Your Mortgage With A Credit Card

- Does Applying For A Credit Card Hurt Your Credit?

- How To Check Your Credit Card Balance

- Cathay Pacific and Neo Financial Are Launching A Credit Card

- 4 Ways To Consolidate Credit Card Debt

- How To Get A Business Credit Card

- Canceling Credit Cards: Will I Get My Annual Fee Back?

- Can I Use A Personal Card For Business Expenses?

More from

Air canada aeroplan: the ultimate guide, 5 ways to save money on your next airfare purchase, what’s the best day & time to book flights, what is premium economy (and is it worth it), how to redeem aeroplan points, how to use google flights to find cheaper flights.

Courtney Reilly-Larke is the deputy editor of Forbes Advisor Canada. Previously, she was the associate editor of personal finance at MoneySense. She was also managing editor of Best Health Magazine and has contributed to publications such as Cottage Life and Blog TO. She currently lives in Toronto.

Advertiser Disclosure

Bankrate.com is an independent, advertising-supported comparison service. The offers that appear on this site are from companies from which Bankrate.com receives compensation. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval, also impact how and where products appear on this site. Bankrate.com does not include the entire universe of available financial or credit offers.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Best business credit cards of June 2024

- • Business credit cards

- • Credit card debt

- • Credit scores

- • Building credit

- • Credit cards

- • Rewards credit cards

The listings that appear on the website are from credit card companies from which Bankrate receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). This site does not include all credit card companies or all available credit card offers. Here's an explanation for how we make money.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Business credit cards are a popular option for entrepreneurs who need short-term financing to help start or grow their businesses.

The best business credit cards provide a revolving line of credit you can use for any business-related need. Use them for working capital, inventory or to cover your business travel costs. These cards also come with additional features, such as generous rewards programs, expense tracking and money-saving perks.

Our experts have reviewed hundreds of options and compared their features to determine the best business credit cards for May 2024.

View card list

Table of contents

Why choose bankrate.

We helped over 300,000 users compare business cards in 2023

We evaluated over 40 business perks

Over 47 years of experience helping people make smart financial decisions

The Bankrate Promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money and how we rate our cards .

Best Business Credit Cards of June 2024

- Best business card for earning rewards on office expenses: Ink Business Cash® Credit Card

- Best business card for no balance transfer fee: Capital One Spark Cash Select for Excellent Credit Card

- Best business card for large welcome offer: Ink Business Unlimited® Credit Card

- Best no-annual-fee business card: The Blue Business® Plus Credit Card from American Express

- Best business card for reward category flexibility: American Express® Business Gold Card

- Best business card for large purchases: Ink Business Premier® Credit Card

- Best business card for flat-rate cash back: American Express Blue Business Cash™ Card

- Best business card for luxury travel perks: The Business Platinum Card® from American Express

- Best business card for fair credit: Revenued Business Card

- Best business card for flexible travel redemption: Ink Business Preferred® Credit Card

- Best for annual cash bonus: Capital One Spark Cash Plus

- Best business card for travel perks and credits: Capital One Venture X Business Rewards Credit Card

- Best for Hilton benefits: The Hilton Honors American Express Business Card

- Best business card for Bank of America customers: Bank of America® Business Advantage Unlimited Cash Rewards Mastercard® credit card

- Best business card for easy rewards redemption: Capital One Spark Miles for Business

- Best for United airline benefits: United℠ Business Card

- Best for potentially high credit limit: Capital on Tap Business Card

Additional options:

- Best for no foreign transaction fee: Capital One Spark Classic for Business

- Best business card for automatic bonus categories: U.S. Bank Business Leverage® Visa Signature® Card

- What is a business credit card?

- Tips on choosing a business credit card

- What people say about the best business credit cards

- In the news

How we assess the best business credit cards

- Frequently asked questions

- Ask the experts

Credit range

A FICO score/credit score is used to represent the creditworthiness of a person and may be one indicator to the credit type you are eligible for. However, credit score alone does not guarantee or imply approval for any financial product.

0 ? 'Showing ' + filterMatchedProductTiles + ' results' : ' '">

Sorry, no cards match these filters

You can still get a personalized list of cards that fit your credit profile in just a few minutes.

You might also consider these cards

Card categories

Best for earning rewards on office expenses

Ink Business Cash® Credit Card

Bankrate score

Our writers, editors and industry experts score credit cards based on a variety of factors including card features, bonus offers and independent research. Credit card issuers have no say or influence on how we rate cards.

Intro offer

Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening.

Earn up to $750 bonus cash back

We calculate this number by multiplying the card's intro offer by Bankrate's valuation of this issuer's rewards program , showing you how much your points or miles are worth in dollars.

Rewards Rate

Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year. Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. Earn 1% cash back on all other card purchases with no limit to the amount you can earn.

Regular APR

18.49% - 24.49% Variable

- 5% Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year

- 2% Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year

- 1% Earn 1% cash back on all other card purchases with no limit to the amount you can earn

What we love: Few cash back business cards offer such a high rewards rate on office expenses. Even though the card’s maximum cash back rate only applies to the first $25,000 spent in each bonus category each account anniversary year (then 1 percent), the sign-up bonus, redemption value and additional perks all help make this a standout option for business owners looking for maximum value without paying an annual fee. Learn more: How the Ink Business Cash can earn you high rewards on your business needs Alternatives: If most of your monthly business expenses go beyond routine office supplies, you may find that a flat-rate card like the Ink Business Unlimited® Credit Card offers more value and still has additional Chase perks.

- The value of the sign-up bonus is superb for a card without an annual fee.

- The card’s rewards are generous and the categories are useful for small- and mid-sized businesses.

- The card’s bonus cash back has a spending cap, which might limit the card’s usefulness for larger business budgets.

- There’s no intro APR on balance transfers, which hurts the card’s up-front value for business owners who want to pay down debts.

- Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening

- Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year

- Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. Earn 1% cash back on all other purchases

- 10% Business Relationship Bonus If you have the Ink Business Cash card plus a Chase Business Checking account on your first card anniversary

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- No Annual Fee

- Redeem rewards for cash back, gift cards, travel and more through Chase Ultimate Rewards®.

- 0% introductory APR for 12 months on purchases

- Member FDIC

Best for no balance transfer fee

Capital One Spark Cash Select for Excellent Credit

- Earn a $750 bonus when you spend $6,000 in the first 3 months of account opening

Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel. Earn unlimited 1.5% cash back for your business on every purchase, everywhere — with no limits or category restrictions.

18.49% - 24.49% (Variable)

- 5% Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel

- 1.5% Earn unlimited 1.5% cash back for your business on every purchase, everywhere — with no limits or category restrictions

What we love: The Capital One Spark Cash Select for Excellent Credit is not just a great no-annual-fee card but also an excellent card for transferring balances at no additional cost. It’s a rewarding, low-cost choice for businesses that meet the credit requirements and want a card with flexible utility. Learn more: Why I love the Capital One Spark Cash Plus credit card Alternatives: If the credit score requirement for the Spark Select is a bit too high, the Brex 30 Card could be a good alternative. Not only does it not require a credit history, but it also doesn’t require a personal guarantee, while offering rewards and a potentially high credit limit.

- You can get an upgraded welcome bonus of $750 when you spend $6,000 within the first three months of account opening.

- You can also earn boosted cash back on hotels and rental cars when you book them through the Capital One Travel portal.

- Other business cards have higher flat cash back rates, even for excellent credit.

- The card lacks transfer partners, limiting its redemption options compared to top competing business cards.

- Earn unlimited 1.5% cash back for your business on every purchase, everywhere — with no limits or category restrictions

No annual fee

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel

- Rewards won't expire for the life of the account

- Redeem your cash back rewards for any amount

- Free employee cards, which also earn unlimited 1.5% cash back on all purchases

- $0 Fraud Liability for unauthorized charges

Best for large welcome offer

Ink Business Unlimited® Credit Card