Bring on the benefits.

Daily cash that grows in a savings account. 1.

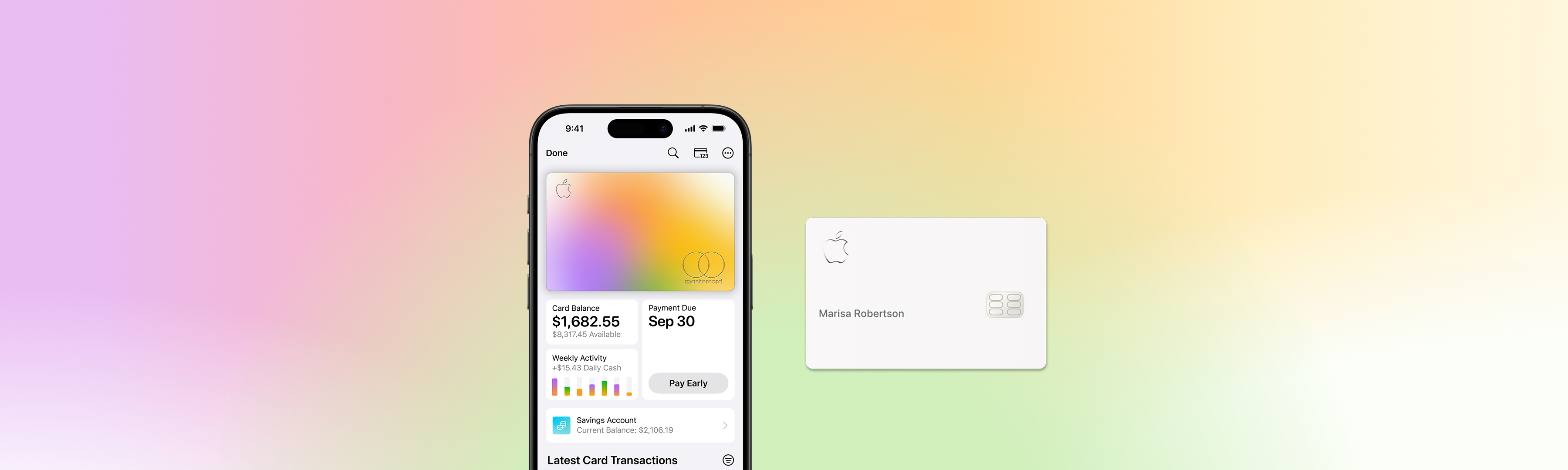

With Savings, you can choose to send your Daily Cash to a high-yield Savings account where it can earn 4.40% annual percentage yield (APY). 2 And because it’s all built into the Wallet app, it’s simple to get started. All it takes is a few steps to open an account and you're in.

Get started with savings

Just remember 3, 2, and 1%.

No matter where you shop with Apple Card, you always get unlimited Daily Cash back. That's real cash 3 you get back every day. Use it right away 4 with Apple Pay, send it to a friend with Apple Cash, 5 or watch it grow in a high-yield Savings account. Buy anything from Apple — including services like Apple Music or Apple TV, games and apps from the App Store, even in-app purchases — and enjoy 3% cash back.

cash back with Apple and select merchants when you use Apple Card with Apple Pay. 6

Get 3% back on everything you buy from Apple and at select merchants when you use Apple Card with Apple Pay.

cash back when you use Apple Pay.

Use Apple Pay wherever you see one of these symbols.

cash back when you use the titanium card or your virtual card number wherever Mastercard is accepted.

Learn how to order your titanium card

Grow your Daily Cash in a Savings account. 1

Apple Card gives you up to 3% unlimited Daily Cash back on every purchase. That’s real cash you can use right away, to send to a friend or use wherever Apple Pay is accepted when you send Daily Cash to Apple Cash. And with Savings, you can choose to send your Daily Cash into a high-yield Savings account where it can earn 4.40% annual percentage yield (APY). Add money from your bank account to Savings at any time, directly in the Wallet app. If you need to move money out, withdrawals to Apple Cash are typically instant, and usually take 1-3 business days with other bank accounts. 7 No minimum deposits, fees, or balances required. 8 And, you’re covered by FDIC insurance. 9

Open a Savings account

Enroll in Savings

Healthy finances. Family style.

Share the benefits of Apple Card with anyone in your Family Sharing group — whether it’s a partner, a child, or someone else you trust. 10 It’s a great way for everyone on the account to work toward healthy finances together. Add a Co-Owner 11 to build credit as equals 12 and manage the account together. You can also add kids and young adults as Participants. 13 And if a Participant is over 18, they can have the option to start building their own credit history. 14 Plus, everyone gets to enjoy their own unlimited Daily Cash back when they use Apple Card for their purchases. 15

Learn how to add someone to your Apple Card Family

Pay for new Apple products over time, interest-free. 16

Apple Card Monthly Installments lets you buy new Apple products, like iPhone, Mac, iPad, and more, and pay them off with interest-free monthly payments. You get 3% Daily Cash back, all up front. Simply choose Apple Card Monthly Installments as your payment option when you make your purchase at an Apple Store, in the Apple Store app, or on apple.com.

Learn more about Apple Card Monthly Installments

Accepted globally, with no foreign transaction fees. 17

Because Apple Card is part of the Mastercard network, it's accepted anywhere in the world. Plus, you have access to Mastercard benefits, like identity theft protection. And because Apple Card is designed to have no fees at all, you won't get charged any foreign transaction fees.

See all Mastercard benefits for Apple Card customers

Apple Card Support

Apply for Apple Card

It takes just minutes to apply for Apple Card in the Wallet app on your iPhone.

- Learn how to apply

Activate your card

Request a titanium Apple Card and see how to activate it on your iPhone when it arrives in the mail.

- See how to activate your card

Make purchases

See how to pay with Apple Card using Apple Pay, or how to use your virtual card number or titanium card.

- Buy with Apple Card

Get unlimited Daily Cash with Apple Card

Learn how you can receive a percentage of every purchase you make with Apple Card back as Daily Cash.

- Learn about Daily Cash

Check your spending activity

See transactions, see your balance, and track how much you spend.

- Learn about spending activity

Avoid high interest charges

See how interest can affect your financial health and learn how to lower interest charges with Apple Card's payment options.

- Avoid interest charges

Request a credit limit increase

To request a higher credit limit on your Apple Card, you can chat with a specialist.

- Learn about credit details

Share Apple Card with your family

Build credit together, create spending limits, and learn healthy financial habits.

- Learn about Apple Card Family

Financial hardship support for Apple Card

Learn more about assistance plans and payment options if you are experiencing financial hardship.

About Apple Card payment assistance

Learn how to set up Apple Pay, make secure purchases, manage your payment cards, and more.

- Get started

Learn how to set up Apple Cash, send and receive money in Messages or Wallet, and get Daily Cash on purchases.

- Find out more

Search for more topics

Apple Communities

Find answers, ask questions, and connect with other Apple users.

- Ask or search now

Get Support

We can help you find the best support options.

Support app

Get personalized access to solutions for your Apple products.

- Download the Apple Support app

Personal Finance

Apple credit card review: is it worth it.

Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links. This content is created independently from TIME’s editorial staff. Learn more about it.

If you love Apple products and have an Apple computer, iPhone, iPad, and other Apple devices, you may be interested in the Apple Card. The Apple credit card is a cash back card paying up to 3% cash back, with the best rewards for purchases from Apple or using Apple Pay. Those already ingrained in the Apple ecosystem can reap the best of this card’s rewards and benefits. Here is a closer look at how the Apple Card works to help you decide if it could suit your spending needs.

TIME's Take

The Apple Card is a good deal for purchases from Apple and using Apple Pay. Cardholders earn 3% back on purchases from Apple, 2% back when using Apple Pay anywhere it’s accepted, and 1% everywhere else. The card has no fees or costs aside from interest charges if you carry a balance. It’s a good option if you use Apple Pay regularly or make regular payments to Apple, but the 1% rate everywhere else isn’t very exciting.

Who is the card for?

This card is best for shoppers who regularly use Apple Pay with their Apple Watch or iPhone. It’s also good for Apple subscriptions, such as Apple TV, Apple Music, and iCloud. If you or your household are all-in on the Apple ecosystem and periodically buy iPhones, Apple Watches, Apple computers, and other gear from Apple.com or the Apple Store, you’ll get the best cash back the card has to offer.

If you don’t frequently use Apple Pay or buy from Apple, you can find better deals with other 2% cash back cards, such as the PayPal credit card. If you don’t pay off your balance monthly, interest charges will likely be more than your rewards, which is common with most rewards cards.

Behind the scenes, the card is issued and managed by Goldman Sachs. When applying for a new account, there is no initial impact on your credit score. If approved, it will affect your credit score .

Rewards structure

The Apple Card features three reward rate tiers, depending on where and how you shop.

The top 3% rate is reserved for purchases at Apple and directly from select partners. As of this writing, 3% merchants include Apple, Ace Hardware, Duane Reade, Exxon, Mobil, Nike, Panera Bread, T-Mobile, Uber, Uber Eats, and Walgreens.

The 2% back rate is for any purchase made using Apple Pay. If you can tap to pay, you can likely use Apple Pay. Most large chains, including grocery stores, drugstores, and many more accept digital payments with Apple Pay.

Earning 1% using the physical card everywhere else isn’t great, but it’s better than nothing. Savvy credit card users may use the Apple Card and another favorite cash back card to maximize their rewards. Even if you just use the card for Apple purchases, it could be a good deal for you, as there is no annual fee.

Additional hidden perks

The biggest perks are the almost non-existent fees. There is no annual fee, penalty fees, transaction fees, or any other fees. The only charge is interest if you carry a balance. And if you use the card for large Apple purchases, you may qualify for zero interest on those purchases.

You can make monthly installment payments with no interest when buying a new Mac, iPhone, iPad, Apple Watch, AirPods, Apple TV, or other qualifying Apple products directly from Apple. You still earn the 3% cash back. There is no additional application required. You just have to choose Apple Card Monthly Installments at checkout.

Apple Card cash back rewards are paid daily, known as Daily Cash. You can use your cash back rewards to lower your credit card balance (statement credit), deposit to a linked bank account, or store with an Apple Cash card, enabling you to spend wherever Apple Pay is accepted.

What could be improved

The card doesn’t have many cons, thanks to its low fees. The biggest drawback is the 1% cash back rate on purchases made with the physical card, as you can earn more with competing cards. It’s also not very helpful to people who don’t use iPhone or Apple Watch, as you can’t earn the 2% back from Apple Pay.

The card also lacks purchase protection and travel insurance benefits, which are important protections for many credit card users.

Alternatives to the Apple credit card

Here’s a look at the best credit cards to consider as an alternative to the Apple Card, including 0% APR cards for new customers. All cards below are no annual fee credit cards and offer cash back rewards.

For rates and fees of the card_name , please visit this URL .

Frequently asked questions (FAQs)

How do i apply for an apple card.

Go to the Apple Card website and complete the application for an Apple credit card. Applying takes only a few minutes if you have your information handy.

Does applying for an Apple Card hurt credit?

Applying for an Apple Card doesn’t harm your credit score. There’s no impact on your credit score unless you accept your offer and sign up for an account.

How can I pay my Apple credit card?

The easiest way to pay is with the Apple Wallet app. You can also pay through the Apple Card website. If your iPhone or iPad isn’t available, you can make a payment by contacting Apple support. Payments can be made from a connected bank account or your Apple Cash balance.

How can I reach Apple Credit Card customer service?

The best way to reach Apple Card customer support is by calling the number on the back of your card. The current toll-free number for Apple Card support is 877-255-5923.

What are the key things to know about the Apple Card's cash back program?

You’ll earn 3% back on purchases from Apple and partner merchants, 2% back using Apple Pay, and 1% everywhere else. Cash back is earned daily and can lower your card balance, increase your Apple Cash balance, or be deposited to a linked bank account.

How can I log in to my Apple Card account online?

Go to card.apple.com or use the Apple Wallet app to view your online account, including your balance, payment due dates, Apple purchase installment plan, and other card details.

The information presented here is created independently from the TIME editorial staff. To learn more, see our About page.

A simpler, smarter credit card.

Whether you buy things with Apple Pay or with the laser‑etched titanium card, Apple Card can do lots of things no other credit card can do.

Apply in as little as a minute to see if you are approved with no impact to your credit. *

Choose to automatically save your Daily Cash in a Savings account and watch it grow over time. 1

See each purchase go through right away. No waiting. No wondering.

No hidden fees. 2

No annual fees.

No late fees. 3

No foreign-transaction fees.

No over-the-limit fees.

No returned-payment fees.

No setup fees.

No maintenance fees.

No reward-redemption fees.

No fees. Period.

Get unlimited Daily Cash back with every purchase.

Tap to see your summary — by week, by month, or by year.

Easily pin down your spending with Maps. 4

Find any transaction with a quick and easy search.

See your spending by color and category.

View item-by-item receipts from your Apple services.

Get 2% Daily Cash back every time you pay with your iPhone or Apple Watch.

Simple, secure, magical card activation.

It’s hard to steal a credit card number when it’s locked away.

Your purchase history. For your eyes. 5 Not ours.

Stop fraudulent activity in its tracks.

Take the guesswork out of interest payments. 6

Pay off your balance faster with smart payment suggestions.

End-of-the-month payment due dates. Not wait-did-I-miss-it due dates.

Payment reminders. (Just in case you need them.)

See full details of your Apple Card Monthly Installments right in the Wallet app. 7

You decide who’s in your Apple Card Family. 8 They can use Apple Card right away. 9

Co‑Owners. 10 Build credit as equals. 11

Apple Card Family Participants 12 18 and over can build their own credit. 13 Score!

Apple Card Family. Daily Cash back for all. 14

Ask us anything, 24/7. Just call or text.

Get started with Apple Card.

Apply in minutes to see if you are approved with no impact to your credit score. *

- Is Apple Card the Best Credit Card for You?

- Benefits and Features

- Annual Fee and Other Costs

- How the Card Compares

Apple Card Review 2024

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: U.S. Bank Altitude® Reserve Visa Infinite® Card, Citi® Double Cash Card. The details for these products have not been reviewed or provided by the issuer.

The Apple Card launched to much fanfare in 2019, promising an effortless, fee-free way to earn high cash-back rewards and track spending. It's since added new features, including access to a high-yield savings account.

But unless you're a true Apple aficionado, you'll likely do better with one of the best cash-back credit cards .

Earns 1-3% cash back

15.99% - 26.99% Variable

No Credit History

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Strong cash-back earning when you use Apple Pay

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Cash back is paid daily into your account

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. No annual fee, late fees, or foreign transaction fees

- con icon Two crossed lines that form an 'X'. No welcome bonus

- con icon Two crossed lines that form an 'X'. Requires an Apple device to earn the most cash back

- con icon Two crossed lines that form an 'X'. Few benefits compared to other rewards credit cards

The Apple Card, issued by Goldman Sachs, is an interesting option for Apple loyalists, earning up to 3% cash back and offering unique features you won't find on other cards. But its lack of welcome bonus and reliance on using Apple Pay to earn the most rewards may be a turnoff for some.

- Earn 3% cash back when you use your Apple Card to shop at Apple and select merchants (including Nike, Uber, and Walgreens)

- Earn 2% back when you pay for purchases with Apple Pay

- Earn 1% back on other purchases when you use your physical card or pay online using your card number instead of Apple Pay

- 0% APR installment financing on select Apple purchases

- No annual fee, over-the-limit fee, foreign transaction fees, or late fees

- Apple Card Family allows up to 5 members of your household to be authorized users on your account

Apple Card Overview

Apple is well known for its innovative technology, so it's no surprise the Apple Card is equally unique in the credit card space. In fact, it's not even a physical card (unless you want it to be) — one of the card's main selling points is its convenient digital interface that lives right on your iPhone in the Apple Wallet app.

This brings us to a big limitation: Unless you have an iPhone, there's really no reason to consider the Apple Card. That's because you'll need to use the card with Apple Pay to earn a high rate of cash back. While the laser-etched physical card you can request is definitely cool, you'll only earn 1% cash back when you swipe it — a poor rate of return, considering many competing credit cards earn 2% cash back everywhere.

But if you do have an iPhone (or use Apple Pay online, or with an Apple Watch), the Apple Card is a compelling option. When you use the card with Apple Pay, you'll earn 3% cash back on purchases made from Apple and at select merchants, including Uber, Exxon Mobil, and Walgreens, and 2% cash back on all other Apple Pay transactions. Any other purchases made with the physical card earn 1% cash back.

And the Apple Card actually earns cash, in real time. "Daily Cash" is Apple's version of cash back, and you'll earn it on every transaction and see it in your Apple Cash balance each day. From there, you can spend it on purchases using Apple Pay, apply it as a credit toward your card balance, invest it in a linked Apple high-yield savings account, or pay a friend who also uses Apple Cash.

The card comes packed with other nifty features, including color-coded spending categories, an integration with Apple Maps to see where you spent money, a slider tool that shows you how much interest you'll be charged based on your payment amount, and the ability to share the card with others through Apple Card Family.

Plus, there are no fees to worry about: No annual fee, late fees, or foreign transaction fees. While there are plenty of great no-annual-fee credit cards on the market, the complete lack of fees on the Apple Card makes it stand out.

However, there's another significant drawback. The Apple Card doesn't offer a welcome bonus, which is unusual for a rewards credit card , even one without an annual fee. This, combined with the requirement to use the card with Apple Pay to earn competitive cash back, makes the card much less appealing.

You'll want to closely compare the Apple Card to cards like the Wells Fargo Active Cash® Card , which earns 2% cash rewards on purchases and comes with a welcome offer of a $200 cash rewards bonus after spending $500 in purchases in the first three months from account opening. Or, if you already use Apple Pay, consider the U.S. Bank Altitude® Reserve Visa Infinite® Card , which earns 3 points per dollar for all mobile wallet purchases (worth up to 4.5% back toward travel) and offers 50,000 points after you spend $4,500 on purchases in the first 90 days of account opening.

Apple Card Rewards

Apple card welcome bonus offer.

The Apple Card doesn't offer a welcome bonus.

How to earn rewards from the Apple Card

You'll earn the most rewards from the Apple Card when you use it with Apple Pay (on your iPhone, with an Apple Watch, or online). Otherwise, if you use the physical card, you'll earn 1% cash back.

Using the card with Apple Pay, cardholders earn:

- 3% Daily Cash back on purchases from Apple (including merchandise, accessories, App Store purchases, and services like Apple Music and Apple TV+)

- 3% Daily Cash back at Ace Hardware, Duane Reade, Exxon, Mobil, Nike, Panera Bread, T-Mobile, Uber, Uber Eats, and Walgreens

- 2% Daily Cash back on all other purchases made using the card with Apple Pay

Apple says Apple Pay is accepted by 85% of US merchants, but you might have trouble using it at smaller stores or even some large ones such as Walmart and Home Depot. One upside to Apple Pay is its safety and security; you don't need to touch anything to use it, and transactions require unlocking your Apple Wallet using Face ID or your passcode.

There are a few restrictions to keep in mind with some of the participating 3% merchants:

- Ace Hardware: 3% Daily Cash is available in the U.S. when using the Apple Card with Apple Pay online, in the mobile app, and at participating stores listed at acehardware.com/applecard (excludes online and mobile app gift card purchases and purchases from third-party merchants using independent point-of-sale systems within a participating Ace Hardware store).

- Exxon/Mobil: 3% Daily Cash is available in the US when using the Apple Card with Apple Pay (where available) at Exxon- or Mobil-branded pumps and attached convenience stores; you can pay at the pump with Apple Pay by using the Exxon Mobil Rewards+ mobile app or contactless payment (excludes purchases at third-party merchants, including independent car washes, located within an Exxon- or Mobil-branded location or the attached convenience store).

- Nike: 3% Daily Cash is not available at Nike-branded stores outside the U.S.

- Panera Bread: 3% Daily Cash is not available at Panera locations outside the U.S., and excludes orders made on third-party apps, plastic gift card purchases made online, and gift cards purchased through the Bulk Gift Card program.

- T-Mobile: 3% Daily Cash is available in T‑Mobile U.S. stores, and bill payments and AutoPay on t‑mobile.com and in the T‑mobile app (authorized T‑Mobile dealers, Sprint account payments, and purchases made through any Sprint checkout, including those at T‑Mobile U.S. stores, are not eligible).

- Walgreens: 3% Daily Cash is not available at Sprint Express and independent health service providers, including Walgreens Optical and Walgreens Hearing, or for orders made on third‑party delivery apps.

How to use rewards from the Apple Card

The Apple Card has a big advantage when it comes to ease of redeeming rewards. As the name implies, Daily Cash is deposited to your Apple Cash account every day and is available for you to use immediately. Even the best credit cards don't have this feature; in many cases, you'll have to wait until your billing cycle closes to receive and redeem your rewards.

Daily Cash from your Apple Card is deposited to your Apple Cash card in your Apple Wallet account, and from there use it just like cash to buy merchandise, pay down your credit card balance, or pay friends back if they also have an Apple Cash account set up.

Alternately, cardholders can open a Apple Savings account , which currently pays 4.40% APY (Average Percentage Yield) — a very strong rate of return. Your Daily Cash will be deposited to your Apple Savings account once it's set up.

Apple Card Benefits and Features

Unlike many top rewards credit cards, the Apple Card doesn't offer common perks like purchase protection, extended warranty, travel insurance , or cell phone protection . That said, it does offer useful benefits that can help you save money on interest and streamline your finances.

Easy application and card use

To apply for the card, you can simply open the Apple Wallet app and press the "+" icon. Once you're approved, you can start using your card through Apple Pay immediately, and if you wish, you can also request a physical card in the mail. Even though using the actual card only earns 1% cash back (so you'll probably want to avoid this), it is a pretty slick-looking card.

Track spending and save on interest

Apple says it wants to help users with their financial health by making it easy to see how much they're spending or saving. To that end, there's no separate app or website to log into if you want to see your transactions, spending totals, or even where you've spent money — it's all accessible via the Wallet app.

Another neat feature is Apple's payment calculator, which also lives in the Wallet app. When you're ready to make a payment, a sliding tool helps you see how much interest you'd pay based on the payment amount you choose, instead of just listing the minimum payment due.

Apple Savings

The best high-yield savings accounts pay a higher interest rate than regular savings accounts, and Apple's new Savings account for Apple Card customers is no exception. It currently offers 4.40% APY, which is competitive with popular national brand high-yield savings accounts like SoFi Checking and Savings , Discover Online Savings , and Capital One 360 Performance Savings .

Choosing to deposit the Daily Cash earned from your Apple Card to Apple Savings is effortless, which is great if you don't already have automated transfers to a high-yield savings account set up. You can also transfer more funds to Apple Savings from your Apple Cash balance, from the bank account linked to your Apple Card, or from a different bank account.

Apple Card Family

Apple allows you to share your card with one co-owner and up to four other participants in a single account. Co-owners must be 18 or over and can manage and share responsibility for the account, and equally build credit history. Participants aged 18 and up can also build credit history, and those aged 13 to 17 can spend within limits and earn daily cash.

Apple Card Monthly Installments

Apple Card cardholders have the option to set up interest-free monthly installments when they use the card for eligible purchases from Apple.com, the Apple Store, or the Apple Store App. To set up a payment plan, choose Apple Card Monthly Installments as your payment method at checkout.

Depending on the product you buy (there's a list of eligible items here ), you'll get a 0% APR for six, 12, or 24 months with one installment due each month. This is a handy feature if you're the type of person who always wants the latest iPhone or AirPods. But keep in mind there are plenty of zero-interest credit cards that offer an intro 0% APR on new purchases for up to 21 months.

Apple Card Annual Fee and Other Costs

The Apple Card doesn't charge fees for anything, which is a refreshing change from most other rewards cards. You won't pay an annual fee, foreign transaction fee s, late payment fees, or over-limit fees.

You will, however, pay interest if you carry a balance (currently a 15.99% - 26.99% Variable APR). But you can avoid interest by paying your card balance in full each month, or if that's not possible, using the interest calculator tool in the Wallet app can help you make better-informed decisions about payment amounts.

Compare the Apple Card

The Apple Card is cool and flashy, but it's only the best card for the purchase on certain occasions. The cards we review below offer more consistent benefits, meriting comparison as you evaluate your card options.

Wells Fargo Active Cash® Card vs. Apple Card

The Wells Fargo Active Cash® Card is a flat-rate cash-back card that earns 2% cash rewards on all purchases. This $0 annual fee card comes with a 0% intro APR on purchases and qualifying balance transfers for 15 months from account opening (then a 20.24%, 25.24%, or 29.99% variable APR).

Wells Fargo offers some of the best complimentary cellphone protection across the credit card industry, and this card is no exception. The Wells Fargo Active Cash® Card comes with cellphone insurance, access to the Visa Signature® concierge, roadside dispatch, travel, and emergency assistance services, emergency cash disbursement and card replacement, and access to the Visa Signature Hotel Collection.

Read more about this card in our Wells Fargo Active Cash card review .

Citi® Double Cash Card vs. Apple Card

The Citi® Double Cash Card is another great $0 annual fee credit card to consider. This card offers 1 point per dollar (1% cash back) when you make a purchase, followed by another 1 point per dollar (1% cash back) when you pay off the purchase.

New cardholders are eligible for a welcome bonus of $200 cash back, fulfilled as 20,000 ThankYou® Points, after spending $1,500 on purchases in the first six months of account opening. They'll also have access to a 0% intro APR on balance transfers for 18 months, then a 19.24% - 29.24% Variable APR.

Read more about this card in our Citi Double Cash card review .

Apple Credit Card Frequently Asked Questions (FAQ)

The Apple Card is worth it if you're an iPhone user who frequently buys Apple products or shops at participating merchants that earn 3% Daily Cash back. But if you don't usually shop at these merchants, or frequent stores that don't accept Apple Pay, the Apple Card is probably not for you.

When you apply for the Apple Card through the Wallet app and get approved, your virtual card is immediately active and ready to use through Apple Pay. However, if you request a physical card through the mail, you'll just need to hold your phone close to its packaging when you receive it. Your phone will automatically activate the card.

The easiest way to apply for Apple Card is through the Wallet app on your iPhone. However, you can also apply online by signing in with your Apple ID and providing the required details that way.

To make a payment on your Apple Card, you'll first need to link a bank account in your Apple Wallet or by signing in at card.apple.com . Then you can make a payment through either platform. You can also make payments from your Apple Cash card balance.

Yes, the Apple Card is a credit card. It's issued by Goldman Sachs and operates on the Mastercard network.

If you need your credit card number, you'll find it in your Apple Wallet when you select your Apple Card, in the top menu with the little credit card and number icon. The card number isn't printed on your Apple Card, which makes it even more secure.

Why You Should Trust Us: How We Reviewed the Apple Card

Business Insider's credit card team reviewed the Apple Card in comparison to similar no-annual-fee cash-back cards and to cards from stores that stock Apple products (like Amazon and Costco). We evaluated several factors, including:

- Ease of use — Does the card make it easy to earn and redeem rewards? Are there hoops to jump through, useful bonus categories, spending caps, or other restrictions?

- Earning potential — Is there a welcome bonus, and is it competitive with similar cards? Are the card's earning rates as good or better than cards in the same category?

- Benefits — Does the card offer useful benefits that save cardholders money, time, or effort? Are there perks that are unique to the card?

- Fees — Is there an annual fee, or other charges like foreign transaction fees and late fees? Does the card charge a high APR when you carry a balance?

Read more about how we rate credit cards at Business Insider for a deeper dive into our methodology.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

- Main content

The best cards for trip cancellation and interruption insurance — and what it actually covers

Planning and taking a trip can be exciting, but unexpected events can disrupt even the most meticulously organized vacations. Sudden illness, severe weather and unforeseen circumstances can throw a spanner in the works, forcing you to change your plans and seek compensation.

In this guide, we will explore the best credit cards that offer trip cancellation and interruption insurance , shedding light on what these policies cover and providing you with peace of mind for your next adventure.

Best credit cards for trip cancellation and interruption insurance

- Chase Sapphire Reserve : Best for travelers who want the most travel protections

- Chase Sapphire Preferred Card : Best for travelers looking for a sub-$100 annual fee

- Capital One Venture X Rewards Credit Card : Best for Capital One loyalists

- United Club Infinite Card : Best for United loyalists

- IHG One Rewards Premier Credit Card : Best for IHG loyalists

- World of Hyatt Credit Card : Best for Hyatt loyalists

- Ink Business Preferred Credit Card : Best for business travelers

- The Platinum Card® from American Express : Best when traveling with non-family companions

The cards listed above are our top picks for trip cancellation and interruption insurance. But many other cards — including some Bank of America and Barclays cards — also offer trip cancellation and interruption protection.

Related: Credit cards with trip cancellation insurance

What is trip cancellation and trip interruption insurance?

Trip cancellation and interruption insurance may reimburse nonrefundable, prepaid trip expenses when you cancel or alter your trip due to a covered situation. In some cases, you may even be covered for select additional costs. But maximum coverage amounts, the types of covered situations and eligible expenses vary from card to card.

Generally, trip cancellation insurance provides reimbursement when you must cancel a trip before its departure date. Meanwhile, trip interruption insurance may refund you if an ongoing trip is interrupted or canceled.

Although you can buy separate travel insurance that will provide a partial refund if you cancel your trip for any reason , trip cancellation and interruption insurance doesn't typically work the same way. Instead, trip cancellation and interruption insurance typically has specific covered losses and exclusions that define the situations in which you can claim reimbursement (and these vary from card to card).

Many different types of cards — including some credit cards with no annual fee — offer trip cancellation and interruption insurance when you purchase travel with your card. The remainder of this guide details some of our favorite cards that offer trip cancellation and interruption benefits. Of course, benefits frequently change. So it's best to look at your card's guide to benefits before booking to understand your card's protections.

Related: Why you might actually need road trip travel insurance

What is the difference between trip cancellation and trip interruption coverage?

The main difference between trip cancellation and trip interruption coverage is timing. Trip cancellation insurance protects your trip from when you make the initial payment to the time of your scheduled departure. In contrast, trip interruption insurance covers your trip from the day of your scheduled departure to your scheduled return date.

Does credit card insurance cover natural disasters?

Generally, trip cancellation and trip interruption insurance will cover nonrefundable expenses if you need to cancel your trip (or the remainder of your trip) due to a natural disaster. However, credit card insurance policies vary, so check your benefits guide for specific exclusions.

Note that you must book your trip before the natural disaster starts to be covered. If a storm or hurricane is named and you book your trip afterward, you likely won't be covered.

Related: 4 times your credit card's travel insurance can help with travel woes, and 7 times it won't

Premium Chase credit cards

Chase credit cards offer some of the best credit card travel protections. The Chase cards in the table below provide trip cancellation and interruption insurance with relatively high maximum coverage amounts.

To help you understand this benefit, let's consider the specific protection provided by the Chase Sapphire Preferred Card as described in its guide to benefits . The other Chase cards listed in the above table provide similar benefits, but check your card's guide to benefits to ensure your coverage is the same.

When you use an eligible Chase card (like the Chase Sapphire Preferred Card ) to pay for select travel expenses, you and your immediate family may be eligible for trip cancellation and interruption protection. You must charge all or a portion of the cost to your Chase credit card (including bookings made with points through the Chase Ultimate Rewards portal associated with your account).

Eligible trip cancellation or interruption events

You'll only be eligible for reimbursement if certain events cause the cancellation or interruption of your travel arrangements. For example, Chase may provide trip cancellation and interruption coverage for the following circumstances:

- You or your traveling companion experience accidental bodily injury, death or sickness that prevents travel

- An immediate family member of you or your traveling companion dies or experiences accidental bodily injury or sickness that is life-threatening, requires hospitalization or requires care by you or your traveling companion

- Severe weather that would prevent a reasonable and prudent person from beginning or continuing on a trip (the weather must meet specific requirements regarding timing, location and effect on your trip)

- Named storm warning

- Change in military orders for you or your spouse

- A call to jury duty or a court subpoena that you can't postpone or waive

- Your or your traveling companion's permanent residence is uninhabitable, burglarized or damaged by fire or flood

- Your or your traveling companion's lodging at your destination becomes uninhabitable

- Your or your traveling companion's host at your trip's destination dies or is hospitalized

- A physician or a competent governmental authority having jurisdiction requires you or your traveling companion to quarantine due to health reasons

- You or your traveling companion miss at least 20% of your trip or the departure of a prepaid cruise or tour due to an organized strike affecting public transportation

Related: 6 lesser-known Chase Sapphire Reserve travel and shopping benefits

Additionally, Chase may provide trip cancellation coverage for the following events:

- Terrorist incident within 25 miles of your or your traveling companion's place of permanent residence within 30 days of your scheduled departure date

- U.S. government travel warning due to terrorism for the immediate vicinity of your or your traveling companion's place of permanent residence within 10 days of your scheduled departure

- Terrorist incident within 25 miles of an airport, booked lodging or destination host's location as listed on your itinerary within 30 days of your scheduled arrival

- U.S. government travel warning due to terrorism for a geographic area within 25 miles of an airport, booked lodging or destination host's location that's in effect within 30 days of your scheduled departure

Finally, Chase may provide trip interruption coverage for the following events:

- Terrorist incident within 25 miles of an airport, booked lodging or destination host's location as listed on your itinerary while on a trip

- A U.S. government travel warning due to terrorism for a geographic area within 25 miles of an airport, booked lodging or a destination host's location that is issued during your or your traveling companion's trip

Related: Your guide to Chase's trip insurance coverage

Excluded reasons for trip cancellation or interruption

However, you won't be eligible for reimbursement if any of the following directly or indirectly cause (or result from) the trip cancellation or interruption:

- A change in plans, financial circumstances and any business or contractual obligations

- A preexisting condition or any other event that occurs or commences before the trip's initial deposit date or booking date

- Any loss due to voluntarily surrendering unused vouchers, tickets, credits, coupons or travel privileges from the travel supplier before their expiration date

- Travel after the 26th week of pregnancy, travel when any multiple pregnancy occurs before the initial deposit date or booking date of the trip, or travel during any pregnancy associated with an assisted reproductive program

- Any loss for any trip booked while on a waiting list for specified medical treatment or booked to obtain medical treatment

- Disinclination to travel due to civil unrest

- Failure to obtain necessary visas, passports or other documents required for travel

- Commission or attempted commission of any illegal act

- Suicide, attempted suicide or intentionally self-inflicted injury

- Being under the influence of any narcotic, legal recreational marijuana or other controlled substance at the time of a loss (except if the narcotic or other controlled substance is taken as prescribed by a physician)

- Disinclination to travel, a country closing its borders or a travel supplier canceling or changing travel arrangements due to an epidemic or pandemic

- Default of the common carrier resulting from financial insolvency or financial insolvency of a travel agency, tour operator or travel supplier

- War, undeclared war, civil war, insurrection, rebellion, revolution, warlike acts by a military force or personnel, any action taken in hindering or defending against any of these, the destruction or seizure of property for a military purpose or any consequences of any of these acts (war does not include terrorism)

Additionally, Chase won't provide trip cancellation coverage for trips booked to any area associated with terrorist activity. Plus, trip interruption coverage won't be provided for loss caused by or resulting from:

- Travel arrangements that a travel supplier cancels or changes unless the cancellation results from severe weather or an organized strike affecting public transportation

- Any terrorist incident or travel warning within 25 miles of your or your traveling companion's place of permanent residence within 30 days before the initial deposit date or booking date of the trip

- A terrorist incident within 25 miles of an airport, booked lodging or destination host's location within 30 days of your initial deposit date or booking date of the trip

Related: Should you get travel insurance if you have credit card protection?

What expenses are covered?

In general, Chase will only reimburse you for eligible nonrefundable, prepaid travel expenses charged by a travel supplier or redeposit fees imposed by a rewards program administrator. However, for trip interruption, Chase may also reimburse you for the following:

- Change fees

- Costs to return a rental vehicle to the closest rental agency

- Costs to return your vehicle to your closest leased or owned residence

- Ground transportation expenses up to $250 to directly transport you for necessary medical treatment (excluding transportation in vehicles operated by a medical facility or specifically designed to transport sick or injured individuals)

- Prepaid, unused and nonrefundable land, air or sea arrangements (if you must postpone a trip due to a covered loss and set a new departure date)

But, if your trip cancellation or interruption results in a credit from a travel supplier, you will not receive any payment for that portion of the eligible travel expenses until the credit expires. And additional transportation expenses will not be reimbursed, including the difference in cost between the original fare or any new fare to return home or rejoin the trip.

Official application link: Chase Sapphire Reserve Official application link: Chase Sapphire Preferred Card Official application link: United Club Infinite Card Official application link: IHG One Rewards Premier Credit Card Official application link: World of Hyatt Credit Card Official application link: Ink Business Preferred Credit Card

Other select Chase credit cards

Several other Chase cards, including the United Explorer Card , Chase Freedom Flex and Chase Freedom Unlimited , also provide trip cancellation and interruption insurance.

However, these cards have far fewer covered expenses than the Chase cards discussed in the previous section. In particular, these cards only cover nonrefundable prepaid passenger fares.

The Chase Freedom Flex guide to benefits , for instance, covers you in similar cases as the more premium Chase cards above:

- Nonrefundable prepaid travel expenses charged by a cruise line, airline, railroad or another common carrier

- Change fees to a travel supplier (if you interrupt your travel instead of canceling)

- Redeposit fees to a rewards program administrator

- Ground transportation expenses up to $250 for transport to necessary medical treatment (excluding transportation in vehicles operated by a medical facility or specifically designed to transport sick or injured individuals; only for trip interruption)

- Prepaid unused nonrefundable land, air or sea arrangements (if you must postpone a trip due to a covered loss and set a new departure date)

Chase may reimburse you up to $1,500 per person per trip. However, there is a reimbursement cap of $6,000 for all covered persons on the same trip.

Related: Here's why 1 TPG staffer buys an annual travel insurance policy, even though his credit cards offer travel protections

Capital One Venture X Rewards Credit Card

You can get up to $2,000 per insured person in trip cancellation and interruption protection when you use the Capital One Venture X to pay for nonrefundable common carrier tickets.

Your spouse or domestic partner and your dependent children are eligible for coverage when you pay for the entire cost of common carrier transportation (less redeemable certificates, vouchers or coupons) with your Venture X account.

The list of eligible trip cancellation or interruption events for coverage is short and simple with the Venture X. You may be covered if one of the following applies:

- You or an immediate family member dies or experiences accidental bodily injury, disease or physical illness that prevents you from traveling (as verified by a physician)

- Your common carrier defaults as a result of financial insolvency

Related: Does paying the taxes and fees on award flights trigger trip protections?

Even if one of the above losses applies, you won't be covered if any of the following caused or led to the loss:

- A preexisting condition

- Accidental bodily injuries from participation in interscholastic or professional sports events, racing or speed contests or uncertified scuba diving

- Cosmetic surgery (unless necessary due to a covered loss)

- Being under the influence of drugs (except as prescribed by a physician) or alcohol

- Traveling against the advice of a physician, while on a waiting list for specified medical treatment, to obtain medical treatment or in the third trimester (seventh month or after) of pregnancy

- Suicide, attempted suicide or intentionally self-inflicted injuries

- Declared or undeclared war (war does not include acts of terrorism)

- An insured person's emotional trauma, mental or physical illness, disease, pregnancy, childbirth or miscarriage, bacterial or viral infection or bodily malfunctions (except physical illness or disease which prevent travel and bacterial infection caused by accident or from accidental consumption of a substance contaminated by bacteria)

Related: 7 times your credit card's travel insurance might not cover you

The Venture X's trip cancellation and interruption protection won't cover as much as the premium Chase cards discussed above. According to the Venture X guide to benefits , Capital One will only reimburse up to $2,000 per insured person for the following:

- Your nonrefundable common carrier ticket (but only once any unused credit voucher you get from the common carrier expires)

- Change or cancellation fees on common carrier tickets

Learn More: Capital One Venture X

Select American Express cards

Some Amex cards offer trip cancellation and interruption insurance of up to $10,000 per trip (up to $20,000 per card per 12 consecutive months). Here's a list of some of these cards:

- The Platinum Card from American Express * (including most Amex Platinum varieties )

- The Business Platinum Card® from American Express *

- Delta SkyMiles® Reserve American Express Card *

- Delta SkyMiles® Reserve Business American Express Card *

- Marriott Bonvoy Brilliant® American Express® Card *

- Hilton Honors American Express Aspire Card *

The information for the Hilton Aspire Amex Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

*Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

You can find benefit guides for these cards on Amex's website .

You, your family members and your traveling companions may be covered when you charge the full cost of round-trip common carrier transportation to an eligible Amex card. You'll also get coverage when you use an eligible Amex card in combination with Membership Rewards points or redeemable certificates, vouchers, coupons or discounts awarded from a loyalty program.

For coverage purposes, round-trip travel may consist of one-way tickets or a combination of round-trip and one-way tickets.

Related: Which is the best American Express credit card for you?

Based on the benefits guide for the above-mentioned Amex cards, covered losses include trip cancellations or trip interruptions that result from the following:

- Accidental bodily injury, death or sickness (including of a covered traveler's family member)

- Inclement weather that would prevent a reasonable and prudent person from traveling or continuing on a trip

- Change in military orders (including of a covered traveler's spouse)

- Terrorist action or hijacking

- Call to jury duty or subpoena by the courts that can't be postponed or waived

- A dwelling that becomes uninhabitable

- Quarantine imposed by a physician for health reasons

Related: Should you purchase travel insurance for your vacation rental?

For Amex's trip cancellation and interruption insurance, coverage does not apply to any accident, accidental bodily injury or loss caused by or resulting directly or indirectly from the following:

- Preexisting conditions

- Suicide, attempted suicide or intentionally self-inflicted injury by the traveler

- A declared or undeclared war

- Mental or emotional disorders (unless hospitalized)

- Participation in a sporting activity (with a salary or prize money) by the traveler

- Intoxication by the traveler at the time of an accident (as defined by the laws of the location where the accident occurs)

- The traveler is under the influence of any narcotic or other controlled substance at the time of an accident (unless taken as prescribed by a physician)

- Commission or attempted commission of any illegal or criminal act by the traveler

- The traveler parachutes from an aircraft or engages or participates in a motorized vehicular race or speed contest

- Dental treatment, except as a result of accidental bodily injury to sound, natural teeth

- Any nonemergency treatment, surgery or routine physical examination

- Hearing aids, eyeglasses or contact lenses

- The traveler is incarcerated

- Loss due to intentional acts by the traveler

- Financial insolvency of a travel agency, tour operator or travel supplier

Related: Will your travel insurance cover you in case of vendor bankruptcy?

If a covered loss causes you to cancel your trip, Amex may reimburse you for the nonrefundable amount you paid to a travel supplier with your eligible card.

However, suppose a covered loss causes you to interrupt your trip. In that case, Amex may reimburse you for the nonrefundable amount paid to a travel supplier with your eligible card for the following:

- The forfeited, nonrefundable, prepaid land, air and sea transportation arrangements that eligible travelers missed

- Additional transportation expenses incurred by eligible travelers, less any available refunds (not to exceed the cost of an economy-class ticket by the most direct route to rejoin the trip or return to the trip's origin)

Now, suppose a covered loss causes you to temporarily postpone transportation by a common carrier for a covered trip and set a new departure date. In that case, Amex will reimburse you for the following:

- Additional expenses incurred to purchase tickets for the new departure (not to exceed the difference between the original fare and the economy fare for the rescheduled trip by the most direct route)

- Unused, nonrefundable land, air and sea arrangements paid to a travel supplier

Official application link: The Platinum Card from American Express Official application link: The Business Platinum Card from American Express Official application link: Delta SkyMiles Reserve American Express Card Official application link: Delta SkyMiles Reserve Business American Express Card Official application link: Marriott Bonvoy Brilliant American Express Card

Visa Infinite cards

Although some Visa Infinite cards offer their own trip cancellation and interruption insurance, all Visa Infinite credit cards issued by U.S. banks provide a basic level of protection.

Visa Infinite cards offer trip cancellation and interruption protection covering the cardholder (you) and your immediate family when you purchase common carrier travel with your card. This benefit can reimburse up to $2,000 per trip for nonrefundable common carrier fares if you must cancel or interrupt your trip for a covered reason.

You can see a quick overview of the Visa Infinite protections on Visa's website . However, your card's guide to benefits will have the full details.

Related: How to choose the best Visa card for you

Who is covered?

Who is covered by credit card trip cancellation and interruption insurance varies greatly. For example, eligible premium Chase cards cover the cardholder and immediate family members when the cardholder pays for all or a portion of a trip with their card account or rewards associated with their account. For these cards, an immediate family member is someone with any of the following relationships to the cardholder:

Spouse, and parents thereof; sons and daughters, including adopted children and stepchildren; parents, including stepparents; brothers and sisters; grandparents and grandchildren; aunts or uncles; nieces or nephews; and Domestic Partner and parents thereof, including Domestic Partners or Spouses of any individual of this definition.

Immediate family members also include legal guardians or wards for premium Chase cards. And the guide to benefits for the Chase Sapphire Preferred notes that immediate family members do not need to travel with the cardholder for benefits to apply.

On the other hand, eligible American Express cards cover the cardholder, their family members and traveling companions. The guide to benefits for eligible Amex cards defines a traveling companion as "an individual who has made advanced arrangements with you or your Family Members to travel together for all or part of a Covered Trip" and family members as:

A spouse, Domestic Partner, or unmarried dependent child up to age 19 (or under age twenty-six (26) if a full time student at an accredited college or university).

So although Amex will cover traveling companions, you'll need to charge their common carrier fares to your eligible Amex card. On the other hand, Chase doesn't cover traveling companions but does provide a broad interpretation of family and doesn't require round-trip common carrier travel.

Related: Does credit card travel insurance cover authorized users?

How do I file a trip cancellation or trip interruption insurance claim?

- Contact your issuer: Call your credit card's benefits administrator or start a claim online. Even if you believe your insurance will cover you after reading your card's guide to benefits, it is usually a good idea to call the number on the back of your card. Doing so will let you ensure you're covered, learn about deadlines for making your claim and determine what documents you'll need to collect.

- Submit on time: Most claims must be made within 20-60 days of the cancellation to be eligible for reimbursement, depending on your specific card issuer's guidelines.

- Present evidence: After you present your claim, a benefits administrator will give you further instructions to file your claim. It'll help to submit physical documentation with your claim (such as receipts, doctor's notes and weather advisories), plus anything else that can help validate your claim.

A benefits administrator can usually walk you through specific steps to make your claim. Luckily, many card issuers also allow you to make claims online, so you may not even need to hop on the phone to send any physical documents.

Related: Comparing travel protections with the Chase Sapphire Reserve and Amex Platinum

Bottom line

The trip cancellation and interruption insurance provided by select cards can come in handy when something unexpected forces you to cancel or interrupt a trip.

However, there are many exclusions. So it pays to read the guide to benefits on your favorite cards. By doing so, you can determine the best card for booking flights and consider whether it's better to rely on the travel insurance provided by your card or purchase travel insurance .

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Additional reporting by Ryan Wilcox and Emily Thompson.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

10 Credit Cards That Provide Travel Insurance

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Travel insurance helps you get your money back when things go wrong with your trip. And it remains a debate: Do you really need it, and is it worth it?

Personally, I’ve often skipped travel insurance, preferring to put the extra money toward my trip. Yet as I pulled into the airport after a winter ski trip to Jackson Hole, Wyoming, in my SUV rental, a snowplow kicked up a rock and a crack extended across the windshield. And just like that, I got in the dreaded rental car accident .

Thankfully, I had rented my car with my Delta SkyMiles® Gold American Express Card , which covered rental car windshield reimbursement. Note that I had also specifically opted out of the car rental's insurance coverage offered at the counter, which is a requirement in order to allow my credit card coverage to kick in. Terms apply.

» Learn more: The best travel credit cards right now

A number of credit cards provide various types of travel insurance (including trip cancellation, trip interruption and car rental loss and damage insurance) when you use your card to pay for flights, rental cars and other travel expenses. So do you need additional travel insurance? Maybe not.

What does your travel insurance cover?

First, let’s look at the different types of coverage that your credit card may offer to help protect your trip, from your bags to your rental car to your health.

Baggage delay . If your luggage doesn’t arrive when you do, you may receive a reimbursement to offset the costs of having to purchase new attire and other items you may need. The length of delay required and the coverage offered varies by card.

Lost/damaged baggage . If your bags are lost or damaged by a carrier, or items have been stolen from your baggage, your provider may provide monetary compensation.

Trip delay . If your trip on a common carrier is delayed, you may receive monetary compensation to help cover meals, hotels, transportation and necessary purchases up to a certain amount per ticket.

Trip cancellation . If you need to cancel a prepaid, nonrefundable trip, you may receive compensation to offset the lost funds. This benefit generally applies to cancellations for covered reasons, which vary by card.

Trip interruption . If you miss a portion of your trip due to a covered reason, this benefit will reimburse you for any unused, prepaid, nonrefundable reservations (i.e., excursions, hotel nights).

Medical treatment . If you are hurt while traveling and require medical treatment, medical expenses may be covered up to a certain dollar amount.

Medical evacuation . If your illness or injury requires you to return home immediately for care, the insurance coverage through your card may cover the costs.

Travel accident insurance. In the case of accidental death or dismemberment, your credit card may provide coverage to you or to your beneficiary

Rental car insurance. This coverage provides protection to your rental car against theft and damage. Coverage may be primary or secondary to your personal auto insurance, depending on the card.

» Learn more: Should you insure your cruise?

Popular credit cards with travel insurance

Some of the best travel rewards cards include various forms of travel insurance. These are a few of our favorite cards that offer certain types of coverage. If you have a different travel rewards card, it’s a good idea to check the benefits of your card before assuming that it either does or doesn’t have any of the coverage listed here.

1. Chase Sapphire Reserve®

Trip cancellation: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

Trip interruption: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

Trip delay: Up to $500 per ticket for delays more than six hours.

Baggage delay: Up to $100 per day for five days.

Lost luggage: Up to $3,000 per passenger.

Travel accident: Up to $1,000,000.

Rental car insurance: Up to $75,000.

2. Chase Sapphire Preferred® Card

Trip delay: Up to $500 per ticket for delays more than 12 hours.

Travel accident: Up to $500,000.

Rental car insurance: Up to the actual cash value of the car.

3. Marriott Bonvoy Brilliant® American Express® Card

Lost luggage: Up to $2,000 for checked bag and up to $3,000 for checked and carry-on bag. New York state residents get $2,000 per bag, up to a maximum of $10,000 for all covered persons per trip.

Travel accident insurance. Up to $500,000.

Trip delay insurance: Up to $500 per trip. Maximum benefit of $1,000 per 12-month period.

Trip cancellation: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

Trip interruption: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

4. Marriott Bonvoy Boundless® Credit Card

Baggage delay: Up to $100 per day for five days for essential purchases like toiletries and clothing for delays of over six hours.

Lost luggage: Up to $3,000 per passenger for checked or carry on luggage.

Damaged luggage: Up to $3,000 per passenger for checked or carry on luggage.

5. Southwest Rapid Rewards® Plus Credit Card

Baggage delay: Up to $100 per day for three days.

Travel accident insurance: Up to $250,000 to $500,000 (Visa Platinum and Visa Signature, respectively).

Rental car insurance: Up to actual cash value of vehicle.

Travel and emergency assistance services: Assistance and referral via the Benefit Administrator, cardholder is responsible for all costs.

6. United℠ Explorer Card

Trip cancellation: Up to $1,500 per person and $6,000 per trip.

Trip interruption: Up to $1,500 per person and $6,000 per trip.

Rental car insurance: Covers damage or theft with restrictions.

7. Delta SkyMiles® Gold American Express Card

Lost carry on luggage: Up to $1,250 per person for carry on baggage while in direct transit to or from a common carrier terminal, while traveling on a common carrier or while at a common carrier terminal.

Lost checked luggage: Up to $500 per person while traveling on a common carrier.

Rental car insurance: Up to $50,000.

Terms apply.

8. The Platinum Card® from American Express

Trip delay: Up to $500 per trip for delays more than 6 hours.

9. Capital One Venture Rewards Credit Card

Lost luggage: Up to $3,000 per passenger. For New York state residents, coverage is limited to $2,000 per bag.

Travel accident insurance: Up to $250,000.

Rental car insurance: Covers damage or theft with restrictions. Eligible rental periods are limited to 15 consecutive days in the cardholders home country or 32 consecutive days outside it.

10. Hilton Honors American Express Aspire Card

Baggage delay: Up to $100 per carrier for three days.

Do I need additional travel insurance?

Even with the coverage listed above, some credit cards offering travel insurance benefits may not provide enough insurance for your needs. For example, if you have paid $10,000 for a vacation using your card and trip cancellation is not offered, you may want to purchase additional coverage. Likewise, if you book a very expensive trip but your card only covers $10,000 in trip cancellation coverage, you may want to consider additional coverage.

American Express offers full travel insurance options through AmEx Assurance . This specific benefit is available to all travelers and does not require an American Express card. You can pick and choose the coverage you want, and a quote will be processed based on your age, trip expense and days traveling.

For example, here's what we found when requesting insurance for a two-day trip that costs $1,000. You can decide what coverage you'd like and see the full cost of your options:

The quote we received covered 100% reimbursement for cancellation, then offered different levels for other types of coverage.

Medical protection was available for $25,000 to $100,000.

Travel accident protection was available for $250,000 to $1,500,000.

Baggage protection was available for up to $500 to $2,500.

Trip delay coverage was offered for $150 to $1,000 per day, depending on selecting basic, silver, gold or premium options.

When renting a car, be sure to check the specific requirements of your credit card, which may vary by location and type of vehicle.

So do you need travel insurance? A good rule of thumb is if the amount you could lose is more than you want to lose (or can afford to lose) if something goes wrong, get the insurance. For a list of travel insurance companies that provide online quotes, read more about how to find the best travel insurance .

» Learn more: Does trip insurance cover award flights?

Cards with travel insurance, recapped

If you are concerned about an upcoming trip and want to be fully protected, combine your travel credit card insurance with a build-your-own plan to cover what your credit card does not.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Looks like no one’s replied in a while. To start the conversation again, simply ask a new question.

Apple Card > Mastercard Travel & Lifestyle Services > Rental Car Collision Damage Waiver

This has sort of been asked, but not as specifically as I'm about to. A benefit of the Apple Card is access to the Mastercard Travel & Lifestyle Services ( https://www.mastercard.com/apple-card-mastercard-benefits.html ). Through Mastercard Travel & Lifestyle Services, I'm told by their representatives that Apple Card holders are what's called "World Elite" cardholders (verified in my profile on that site). As "World Elite" cardholders, I'm told that we get the "Rental Car Collision Damage Waiver" included in the cost of our rental, presuming we use the Apple Card to both book and pay for that rental car. The problem is that when I try and talk to the Mastercard Travel & Lifestyle Services insurance "specialists," which are yet another third party, they can neither verify that the waiver is included in the rental price, nor can they provide me with any copy of the waiver or agreement. This lack of specificity and assurance is troubling, as I'm traveling to Ireland in the fall, and have booked a car through the Mastercard Travel & Lifestyle Services site.

Can anybody shed more light on this topic?

Rental Car Insurance

Mastercard Travel & Lifestyle Services

Posted on Aug 25, 2021 2:03 PM

Posted on Aug 25, 2021 2:39 PM

Hi, I’ve investigated this benefit in the past, but not recently (probably last six months) and I was told by a Goldman Sachs support team member that the MasterCard benefits are limited to just those linked to in the Apple Card in the Wallet App on your iPhone. You can also view the benefits applicable to the Apple Card at this link,

https://www.mastercard.com/apple-card-mastercard-benefits.html

Unfortunately I do not see a rental car insurance benefit. Please reach out to the Goldman Sachs Apple Card support team for verification and additional information. Here is there contact information,

CONTACTING — Goldman Sachs Bank

• Using Messages; chat with an Apple Card specialist

• Calling us toll-free at 877-255-5923; or

• Writing to us at Lockbox 6112, P.O. Box 7247, Philadelphia, PA 19170-6112.

I’m told through other sources that the reason the higher level benefits are not applicable to the Apple Card is that it’s a no annual fee card.

I hope this helps.

Similar questions

- Does Apple Card provide rental car insurance coverage, as many (but not all) credit cards do? It used to be common for credit card companies to provide accident coverage for rental cars purchased through the card in question. This is quite handy and I'm disappointed that my other credit card stopped providing this service. Is it offered by Apple Card? 19599 1

- Applecare does not list the associated payment method I bought applecare for my iphone at an apple store. For the payment method, I used a personal card. I am now trying to change the payment method to another card. I looked at my settings and also the apple store app on my iPhone but my original payment method is not listed (regardless, I am charged monthly). I called customer support but they offer me to wait until the day my monthly contract ends and then call them back and switch payment methods. This is very rudimentary. I don't want to wait that long. TOPIC IS NOT DEVELOPER FORUMS, it is AppleCare related. Of course, it is not listed as an option. 170 1

- Brick and mortar store would not take Apple Card I flew into Columbus Ohio this weekend, walked to the Budget Car Rental counter to rent a vehicle previously reserved via Expedia. When the Budget Car Rental employee asked for a credit card, I pulled my Apple Card out of my billfold, and before I could hand it to them instantly said “We don’t accept Apple Cards. Do you have another card?” I mentioned that it was a Mastercard and is accepted everywhere that Mastercards are accepted. They said”we accept Mastercard, just not Apple Card Mastercards. You can read that in the fine print of our contracts.” Understand that the card was never run, I never got to hand it to the person. Dumbfounded, I pulled out a Mastercard from a different source, and paid for my contract. This left me concerned and left me wondering if there are other vendors that can pick and choose which Mastercards to accept. Do I need to carry another card? please help me understand and thanks in advance. 421 7

Loading page content

Page content loaded

Aug 25, 2021 2:39 PM in response to scott.unzicker

Aug 26, 2021 8:10 AM in response to Jeff Donald

Jeff - Thanks for your time and help!

I booked the car through the Mastercard Travel & Lifestyle Services site which is, indeed, linked on the card benefits page. That would lead me to believe that I'd then be entitled to the "Rental Car Collision Damage Waiver". I'll give GS a call and see what they have to say.

Aug 26, 2021 8:26 AM in response to scott.unzicker

Hi, glad I could assist. Here’s the Apple Card support team contact info at GS,

CONTACTING — Goldman Sachs Bank

MASTERCARD BENEFIT INQUIRIES

Within the U.S.: 1-800-Mastercard (1-800-627-8372) | Outside the U.S.: Mastercard Global Service Phone Numbers

Availability of insurance benefits on your card may vary by card issuer. Please refer to your issuing financial institution for complete insurance benefit coverage terms, conditions and exclusions.

*Offer availability will vary for cardholders when located outside of the contiguous United States.

1. Peacock Ends 3/31/2025, subject to early termination. Must use qualifying Mastercard World or World Elite credit card and subscribe to a full-priced Peacock Premium plan directly from Peacock to receive a $3.00 monthly statement credit. Statement credit ends when user no longer meets eligibility requirements. Excludes current Peacock Premium and Premium Plus subscribers. Additional eligibility restrictions, exclusions, and terms apply. For full terms, see www.peacocktv.com/offer-terms/mastercard . ↩

2. Instacart Ends 3/31/2025, subject to early termination. Add an eligible U.S. World or World Elite Mastercard credit card and subscribe as a new Instacart+ member to receive a free two-month trial and a $10 Instacart coupon on your second qualifying order each month. Must have an active Instacart+ membership paid for with an eligible card and complete one qualifying Instacart order each month. By redeeming this offer, you agree to the Instacart+ terms , and if you select a paid plan, your Instacart+ membership will auto-renew and the applicable membership fee will be billed automatically to any payment method on file until you cancel. Additional terms apply. Please visit www.instacart.com/p/mastercard-offer . ↩