- Specialisms Specialisms Marine Marine Trade ROV’S & Sub Sea Equipment Hull and Machinery Protection and Indemnity (P&I) Marine Liability Luxury Yachts & Boats Education Independent Schools Pupil Insurances Special Schools Property & Construction Property Owners Construction & Property Development Blocks of Flats Technology Life Science & Biomedical Visitor Attractions & Heritage Museums & Visitor Attractions Heritage Properties Charities & Not For Profit

Commercial Combined Insurance

Cyber Insurance

Health Insurance

- Private Client Private Client Your Home & Property High-Value Household & Contents Jewellery & Art Fine Wine Building Works & Renovations Holiday & Second Homes Luxury Yachts & Boats For You & Your Family Travel Motor

Meet the Team

Our Companies

- Claims Support

- News & Insights News & Insights Private Client Resources Commercial Resources Covid-19 Credit Risk Analyser Risk Management

The Difference Between Institute Cargo Clauses A, B and C

Institute Cargo Clauses are a component of marine insurance that was originally developed by the International Chamber of Commerce , a body governing businesses across the globe. These clauses were first introduced in 1982, but since then have altered in light of changes in global business, risk and threat levels.

These clauses are an integral part of cargo insurance and are something that every shipping company should be familiar with. There are three main categories of Institute Cargo Clauses: A, B, and C.

The Purpose of Institute Cargo Clauses

Within the context of marine insurance , Institute Cargo Clauses serve a specific purpose. This is to specify what is and is not covered when there is damage or loss to the shipment.

Cover can include anything from the cargo to the container that holds it and even the transportation used to ship said cargo. The difference in coverage is detailed by each different category of clause: A, B, and C. Clause C is the most restrictive of the three, with A being the broadest.

Institute Cargo Clause A

As stated above, Institute Cargo Clause A is the widest coverage you can purchase, also known as an ‘All Risks’ Cargo insurance policy. For this reason, it is the most expensive of the three.

What exactly does it cover? Clause A covers maximum risks . It can cover the cargo, container, and transportation, and any exclusions can be found in the General Exclusion Clauses.

Institute Cargo Clause B

This clause is a more restrictive kind of coverage. For this reason, you should expect to pay a moderate premium. In the case of this clause, you might only request for the more valuable items in your cargo to be covered or for partial cargo coverage.

Institute Cargo Clause C

This clause, of course, is the most restrictive of the three. It covers only very limited risks. Furthermore, most of the situations covered must happen during carriage. The main aspects of cover include:

- General average

- Fire / explosion

- Vessel grounding / capsizing

- General average sacrifice

The Differences Between Institute Cargo Clauses A, B, and C

The main differences between the three levels of Institute Cargo Clauses are what they cover, and in what circumstances said items are covered. Each clause sets forth detailed parameters for what it does and doesn’t cover. Because of the difference in cover the premium payable for each will vary.

Institute Cargo Clauses: Your Guide

Institute Cargo Clauses are an important part of marine insurance, and every company needs to remain informed when deciding which type of cover it wants or needs.

About the author

If you have any questions about the different cargo clauses then please get in touch with our marine expert, Laura, using the details below.

Laura Walton Dip CII Account Executive 0117 930 1688 | 07471038 915 [email protected]

Hayes Parsons Insurance Brokers is a trading name of Hayes Parsons Limited which is authorised and regulated by the Financial Conduct Authority (FRN 311881) for general insurance business. Registered in England and Wales Company No. 816448 at 1st Floor, One The Square, Temple Quay, Bristol, BS1 6DG.

If you wish to register a complaint, please contact the Compliance and Training Manager on [email protected] . If you are unsatisfied with how your complaint has been dealt with, you may be able to refer your complaint to the Financial Ombudsman Service (FOS). The FOS website is www.financial-ombudsman.org.uk .

Useful Links

Specialisms, essential sme, private client.

0117 929 9381 | [email protected] | 1st Floor, One The Square, Temple Quay, Bristol, BS1 6DG.

Part of the Hayes Parsons Group

The Science of Institute Time Clause in Maritime Insurance: A Comprehensive Overview with Case Studies

Marine insurance plays a vital role in safeguarding the interests of shipowners and cargo owners against potential risks and perils associated with maritime transportation. One crucial component of marine insurance is the Institute Time Clause (ITC) . The ITC serves as a fundamental provision in marine insurance policies, outlining the scope of coverage and the time-related aspects of the policy. In this post, we would explore Institute Time Clause, its significance, and explore real-world case studies to gain a practical understanding of its application.

Understanding the Institute Time Clause: The Institute Time Clause is a standard provision used in marine insurance policies that defines the duration of coverage. It determines the period during which an insurer is liable for losses and damages to the insured vessel or cargo. The ITC also establishes whether coverage is provided during transit, when the vessel is at rest, or both.

Key Features and Provisions:

Perils Covered: The ITC specifies the perils or risks that are covered under the insurance policy. These may include collisions, fires, piracy, theft, jettison, natural disasters, and other events that can cause damage to the insured vessel or cargo.

Duration of Coverage: The ITC outlines the specific time period during which the coverage is in effect. It differentiates between two main situations: "time on risk" and "time off risk." Time on risk refers to the period when the vessel is underway, exposed to the risks covered by the policy. Time off risk, on the other hand, refers to the period when the vessel is not exposed to the covered risks, typically when it is moored or at anchor.

Suspension and Continuation Clauses: The ITC may include suspension and continuation clauses. Suspension clauses suspend the coverage during specific events, such as war, strikes, or political unrest. Continuation clauses, on the other hand, ensure that coverage continues despite the occurrence of specific events, such as accidents or damage to the vessel, during the voyage.

Warranties and Compliance: The ITC may contain warranties that require the insured party to comply with certain conditions or risk forfeiting the coverage. These conditions may relate to vessel seaworthiness, crew qualifications, adherence to safety regulations, or other factors that affect the risk profile of the insured party.

Case Study 1: Collision at Sea In a case where two vessels collide, causing significant damage, the ITC would come into play. The ITC would determine the coverage for the respective vessels based on the specific provisions and time on/off risk conditions stated in the policy. The insurer would assess the extent of damage and ascertain the liability of each vessel involved, accordingly providing compensation to the affected parties.

Case Study 2: Cargo Theft during Transit Suppose a cargo shipment is stolen while in transit. The ITC would dictate whether the theft is covered under the policy. If the policy includes coverage for theft, the insured party can file a claim based on the provisions outlined in the ITC. The insurer would investigate the incident, assess the loss, and provide compensation as per the terms and conditions of the policy.

The Institute Clauses , also known as the Institute Time Clauses, are insurance clauses that have been developed and approved by the Technical and Clauses Committee of the Institute of London Underwriters. These clauses outline the specific terms and conditions of insurance policies, including the coverage and exclusions related to different types of risks.

The Institute Clauses, sometimes referred to as London Clauses or English Clauses , serve as the foundation for insurance contracts in many countries. The selection of specific clauses for a particular policy depends on factors such as the nature of the insured subject matter and the associated risks.

There are several types of Institute Clauses, including:

Institute Hull Clauses: These clauses were first introduced in 1983 and are used for Hull and Machinery policies. They consist of 26 clauses and were revised in 1995. However, they are currently being replaced by the International Hull Clauses.

International Hull Clauses: Introduced in 2002 after extensive consultation with ship owning associations, insurers, average adjusters, and brokers, these clauses are designed to meet the evolving needs of the global market and legal developments in the UK. They were also updated to comply with the International Safety Management (ISM) Code, which applies to most commercial hulls, including cargo vessels over 500 gross tons (GT). The International Hull Clauses are organised into three sections: Part 1 covers the Principal Insuring Conditions, Part 2 includes additional clauses, and Part 3 outlines claims handling procedures and the responsibilities of the insured and the insurer.

Cargo Clauses: Cargo insurance provides coverage for goods in transit. There are three main types of cargo coverage:

a) Old Cargo Clauses: These are the earlier versions of cargo insurance clauses. b) Institute Cargo Clauses (A), (B), and (C): These clauses offer different levels of coverage for cargo, with Clause A providing the most comprehensive coverage and Clause C offering more limited coverage. c) War and Strike Clauses: These clauses specifically address risks related to war and strikes that may impact cargo shipments.

Overall, the Institute Clauses establish the terms and conditions of insurance policies, ensuring that both the insurer and the insured have a clear understanding of the coverage and exclusions provided.

These new clauses have distinct exclusions that are important to note:

- Free of Capture and Seizure Clause (F.C.&S. Clause) : This clause excludes the risks associated with war. It ensures that the insurance coverage does not extend to losses or damages caused by war-related events such as capture or seizure.

- Free of Strikes, Riots, and Civil Commotions Clause (F.S.R.&C.C. Clause): This clause excludes the risks associated with strikes, riots, and civil commotions. It means that losses or damages resulting from these events are not covered by the insurance policy.

- Exclusion of Delay and Inherent Vice : These new clauses also exclude the risks of delay in delivery and losses caused by inherent vice. This means that if there is a delay in the delivery of the insured goods or if the goods deteriorate due to their inherent characteristics, such losses or damages will not be covered by the insurance policy.

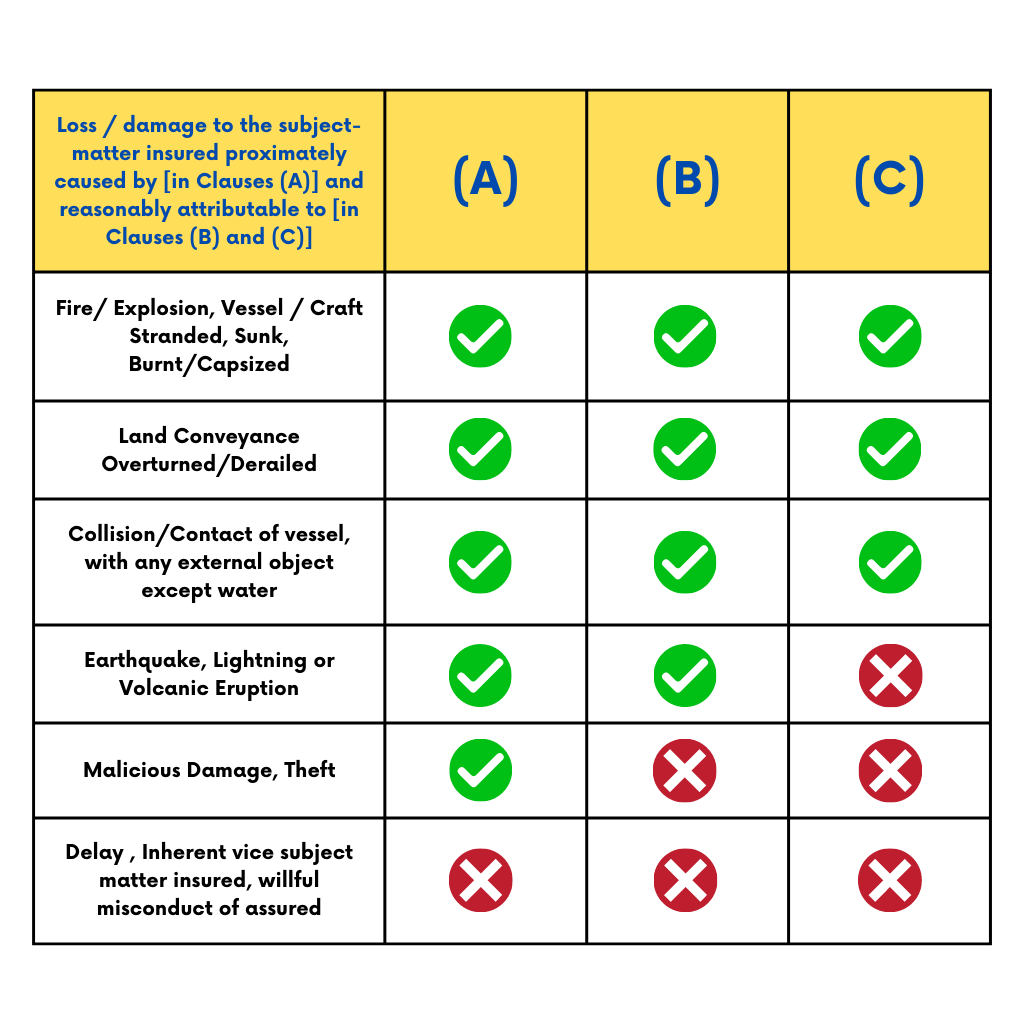

The table below shows a comparison of the items covered by Institute Clauses A, B and C.

In addition to the Institute Cargo Clauses A, B, and C, there are other Institute Clauses that are relevant to cargo insurance. To obtain further information about these clauses, please refer to the document provided in this link: [Click here (PDF, 125kb)].

War and Strike Clauses: These clauses serve as supplementary provisions to the Institute Cargo Clauses A, B, and C, and their coverage is outlined as follows.

Scope of Institute War Clauses: The Institute War Clauses provide coverage for:

- Risks that are excluded by the FC&S Clause in the Institute Cargo Clauses.

- Losses or damages to the insured interest caused by hostilities, warlike operations, civil war, revolution, rebellion, insurrection, or civil strife, including damages resulting from mines, torpedoes, bombs, or other war-related devices.

- General Average (GA) and salvage charges incurred for the purpose of avoiding or mitigating losses covered by these clauses.

However, it is important to note that these clauses specifically exclude losses, damages, or expenses arising from the hostile use of any weapon involving atomic/nuclear fission or fusion, or any other radioactive reactions.

Scope of Institute Strike Clauses:

- They cover losses or damages to the insured property caused by strikers, locked-out workers, individuals involved in labor disturbances, riots, civil commotions, or acts of malice.

- They do not cover losses or damages directly caused by delays, inherent vice, or the nature of the insured property. Additionally, losses or damages caused by hostilities, warlike operations, civil war, revolution, rebellion, insurrection, or civil strife arising thereof are not covered by these clauses.

It should be noted that in the United States and certain other regions, the American Institute Clauses, also known as the American Clauses, are utilized instead of the London Clauses. The American Clauses may differ from the London Clauses in their provisions and terms.

Marine cargo policies typically include several exclusions, which are important to understand. Here are some of the common exclusions:

- Loss caused by willful misconduct of the insured.

- Ordinary leakage, loss in weight or volume, or normal wear and tear. These are considered typical trade losses that are expected and not accidental in nature.

- Loss caused by the inherent characteristics or nature of the subject matter. For example, perishable goods like fruits and vegetables may deteriorate without any accidental cause, which is known as "inherent vice."

- Loss caused by delays, even if the delay is caused by a covered risk.

- Loss or damage due to inadequate packing.

- Loss arising from the insolvency or financial default of vessel owners, operators, etc.

- War and related perils. These risks can be covered by paying an additional premium.

- Strikes, riots, lockouts, civil commotions, and terrorism (SRCC). Coverage for these risks can also be obtained by paying an extra premium.

If you are an individual trying to export goods, one practical way to insure your cargo is to consult a freight forwarder and have them arrange insurance on your behalf. Many freight forwarders have their own master policy through which they can issue insurance.

The freight forwarder will determine the premium based on the value of your commercial invoice to the buyer, adding a 10% margin. For instance, if your invoice value is $500,000, the freight forwarder will calculate the premium based on 110% of this value, which is $550,000. The additional 10% accounts for the potential loss of the buyer's potential profit.

Upon issuing the insurance certificate, it is crucial that you receive it as proof that you have insured the cargo under CIF or CIP terms for the correct value and coverage. The buyer may require this proof. Remember, you can insure the cargo under any delivery term, such as EXW, FCA, CPT, DAT, DAP, DDP, FAS, FOB, CFR, and bear the expenses yourself. Marine insurance is not limited to just CIF/CIP terms.

Here are a few case studies related to Institute Time Clauses in maritime insurance:

Case Study 1 : Machinery Breakdown A cargo ship was transporting machinery equipment when one of the engines experienced a sudden breakdown. The repair process took several weeks, causing a significant delay in the delivery of the cargo. As per the Institute Time Clauses, the insurer covered the loss of time and expenses incurred during the repair period, ensuring compensation for the insured's financial losses due to the machinery breakdown and resulting delay.

Case Study 2: Piracy Attack A vessel carrying a valuable cargo was hijacked by pirates while sailing through a high-risk area. The crew was held captive for several days until a ransom was paid for their release. Under the Institute Time Clauses, the insurer covered the loss of time and expenses incurred during the incident, including the costs associated with the crew's captivity and the subsequent vessel recovery process.

Case Study 3: Collision and Salvage Two ships collided in a congested port area, resulting in damage to both vessels and the cargo they were carrying. The damaged vessels had to be towed to a safe location and underwent extensive salvage operations. The Institute Time Clauses provided coverage for the costs associated with salvage, temporary repairs, and the delay in delivering the cargo due to the collision.

Case Study 4: Fire on Board A fire broke out in the cargo hold of a container ship, causing significant damage to the cargo and requiring immediate action to extinguish the fire. The Institute Time Clauses covered the costs of firefighting, salvage operations, temporary repairs, and the resulting delay in cargo delivery caused by the fire incident. These case studies demonstrate how the Institute Time Clauses in maritime insurance policies can provide coverage for various scenarios, such as machinery breakdowns, piracy attacks, collisions, and fires. It is important for insured parties to carefully review their specific policy terms and conditions to understand the extent of coverage and exclusions applicable to their particular situation.

The Institute Time Clause is a crucial aspect of marine insurance policies that defines the duration and scope of coverage for vessels and cargo. Understanding the ITC provisions is essential for shipowners and cargo owners to ensure adequate protection against maritime risks. By exploring case studies, we have seen how the ITC can be applied in real-world scenarios to determine coverage and provide compensation for losses and damages. To ensure proper coverage, it is essential to consult with insurance professionals and carefully review the Institute Time Clause within marine insurance policies.

Happy Sailing & Happy Learning! Think Family, Safety First!

Particular Average Clause in Marine Cargo Insurance: What You Need to Know

Marine cargo insurance is an essential component of the shipping industry, protecting cargo owners against the potential loss or damage of their goods during transit. One important aspect of this insurance is the average clause. It is a complex provision that can vary significantly depending on the specific terms of the insurance policy.

Understanding the particular average clause is essential for cargo owners and insurers alike, as it can have a significant impact on the cost of insurance premiums and the level of protection provided to cargo during transit. This article will explore the key features of the particular average clause in marine cargo insurance, including its purpose, scope and limitations. By providing a clear and concise overview of this important provision, readers will be better equipped to navigate the complex world of marine cargo insurance and protect their goods during transit.

Thanks for choosing BimaKavach for Free Get Quote Insurance needs. We are finalising the chosen quote with the insurer. Our relationship manager will call you to guide you along. In case, you wish to connect with us for any help, feel free to mail us at [email protected]

Understanding the Particular Average Clause in Marine Cargo Insurance

Businesses need to understand the particular average clause and ensure that their insurance policy covers them adequately. Failure to do so could result in significant financial losses in the event of partial loss or damage to the cargo. The Particular Average Clause specifies how a marine insurance policy covers the expenses incurred due to partial damage or loss of cargo during transit. As per the particular average clause, the insurer will only pay out if the loss or damage exceeds a certain percentage of the total insured value of the cargo. This percentage is usually set at 3% or 5% depending on the policy terms.

The following are some essential points to keep in mind regarding the Particular Average Clause:

- The clause applies to partial losses or damages to cargo that are not covered under the General Average Clause.

- The clause covers damages caused by natural calamities such as storms, lightning, and thunder, among others.

- It also covers damages due to accidents such as collisions, grounding, and other types of accidents that are not caused by the negligence of the carrier.

- The clause does not apply to damages caused by the inherent nature of the goods, such as spoilage or decay.

- The insurance company will pay the insured party for the actual loss or damage incurred, subject to the terms and conditions of the policy.

It is essential to note that the Particular Average Clause is not a standard clause and may vary from one policy to another. Therefore, it is crucial to read and understand the terms and conditions of the policy before signing up for it.

Types of Losses Covered under Particular Average Clause

Under the Particular Average Clause in marine cargo insurance, losses that occur during the transit of goods are covered. These losses are usually divided into two categories: total losses and partial losses.

Total losses occur when the entire shipment is lost or damaged to the extent that it cannot be delivered to the consignee. In such cases, the entire value of the shipment is paid out to the insured party.

Partial losses occur when only a portion of the shipment is lost or damaged. This can be further classified into two types of losses:

- Particular Average : This type of loss occurs when the damage is caused by a specific peril, such as fire, collision, or theft. In such cases, the insurer will only pay for the loss or damage caused by the particular peril.

2. General Average : This type of loss occurs when the entire shipment is put at risk to save the ship or cargo from a common danger. For example, if the ship is in danger of sinking and cargo is jettisoned to save the ship, the cost of the jettisoned cargo is shared by all parties involved in the voyage.

In addition to the above, losses caused by natural disasters such as storms, floods, and earthquakes are also covered under the Particular Average Clause. However, losses caused by war, strikes, and riots are typically excluded from coverage.

Exceptions and Limitations of Particular Average Clause

The particular average clause in marine cargo insurance covers partial losses that result from damage or expenses incurred during transportation. However, there are certain exceptions and limitations to this clause that should be considered before purchasing marine cargo insurance.

Percentage Deductible: Many marine cargo insurance policies include a percentage deductible. This means that the insured is responsible for bearing a certain percentage of the loss before the insurance company compensates a claim. For example, if there is a 3% deductible and the loss is Rs. 100,000, the insured would bear the first Rs. 3,000 of the loss, and the insurance would cover the remaining Rs. 97,000.

Exclusions for Certain Causes of Loss: Some Marine Cargo Insurance policies may exclude coverage for specific causes of loss, such as inherent vice (the natural characteristics of the goods that make them susceptible to damage), delay, insufficiency of packing, and inadequate stowage.

Unseaworthiness or Unfitness : If the loss or damage is a result of the unseaworthiness or unfitness of the vessel or carrier, the insurer may deny coverage. The insured must ensure that the vessel carrying the goods is in suitable condition for the intended journey.

Inadequate Packaging : Insurers may exclude coverage for losses caused by inadequate packaging. The insured is usually expected to take reasonable measures to ensure that the goods are adequately packed to withstand the normal rigours of the transportation process.

Delayed Shipments : Some policies may exclude coverage for losses due to delay, emphasizing that the insurance is intended to cover actual physical loss or damage to the goods.

Concealed Damage : If the damage to the goods is not immediately apparent upon delivery and is discovered later, there may be limitations on the coverage. Timely reporting of any loss or damage is typically a requirement for coverage.

Case Studies: Application of Particular Average Clause

The particular average clause in marine cargo insurance is a crucial aspect of the policy, as it determines the amount of compensation that the insured party will receive in case of partial loss or damage to the cargo. Here are some case studies that illustrate the application of the particular average clause:

Case Study 1: Damage to a Container of Electronics

A container of electronics was being transported from China to the UK, and during the voyage, the ship encountered heavy weather conditions. As a result, the container suffered partial damage, and some of the electronic items were destroyed. The insured party filed a claim under the particular average clause, and the insurer agreed to compensate for the partial loss of the cargo.

Case Study 2: Loss of Cargo Due to Fire

A ship carrying a consignment of chemicals caught fire, and the cargo was completely destroyed. However, the particular average clause in the marine cargo insurance policy only covered partial loss or damage to the cargo. Therefore, the insured party was not entitled to any compensation under the policy.

Case Study 3: Damage to Cargo During Loading and Unloading

During the loading and unloading of a container of machinery, some of the items were damaged due to mishandling. The insured party filed a claim under the particular average clause, and the insurer agreed to compensate for the partial loss of the cargo.

Case Study 4: Damage to Cargo Due to Improper Packaging

A container of fragile items was not properly packaged, and as a result, some of the items were damaged during the voyage. The insurer denied the claim under the particular average clause, as the damage was caused due to the insured party's negligence in packaging the cargo.

From the discussion above, we have seen how the Particular Average Clause protects the interests of both the insurer and the insured and ensures that the losses are shared proportionally. It is important to note that the clause only covers losses that are caused by specific perils such as fire, collision, and grounding. The insured must prove that the loss was caused by one of the specified perils for the claim to be valid. Furthermore, the insured must take reasonable measures to prevent or minimize the loss. Failure to do so may result in the claim being rejected.

Frequently Asked Questions

- What is the difference between Particular Average and General Average?

The Particular Average clause covers partial losses or damages to cargo caused by a specific peril, while the General Average clause covers losses or damages that are intentionally incurred for the common benefit of all parties involved in the shipment, such as jettisoning cargo to lighten a ship in distress.

2. What is the General Average clause in marine cargo insurance?

The General Average clause in marine cargo insurance is a provision that requires all parties involved in a shipment to share the cost of losses or damages that are intentionally incurred for the common benefit of all parties, such as jettisoning cargo to lighten a ship in distress.

3. What is a shut-out cargo in marine insurance?

Shut-Out cargo in marine insurance refers to cargo that is left behind at the port of loading due to overbooking or other reasons beyond the control of the shipper or the carrier. It is also known as Rolled cargo or Overcarried cargo.

What is a Marine Insurance?

Elements of Marine Insurance

Subscribe to our Newsletter

Be the first to know about releases and industry news and insights.

Clauses Covered in Marine Insurance

The world of commerce thrives on the seamless movement of goods across continents and through diverse landscapes. Whether your shipment traverses the vast oceans, soars through the skies, or navigates inland waterways, a crucial element ensures its well-being: marine insurance .

This complex world, however, rests on a foundation of intricate clauses that define the scope of coverage and responsibilities of both parties. Understanding these marine insurance clauses is paramount for any individual or organisation engaged in international trade.

By understanding the intricacies of the specific inclusions and exclusions of these clauses under the various types of marine insurance plans, you can navigate the potential risks and ensure your valuable cargo arrives safely at its destination.

Different Clauses in Marine Insurance Policy

Understandably, marine cargo insurance plays a crucial role in protecting the interests of stakeholders involved in international cargo trade. However, the intricate world of marine insurance policies can be overwhelming for the uninitiated.

Understanding the key clauses within a policy is essential to navigating this complex landscape effectively.

Here's a breakdown of some of the most important clauses in marine insurance:

Institute Cargo Clauses

These standard clauses define the scope of coverage for cargo insurance. Different versions offer varying levels of protection:

ICC (A): Covers all risks except those specifically excluded (e.g., war, nuclear peril, inherent vice).

ICC (B): Covers named perils (e.g., fire, stranding, collision, theft).

ICC (C): Covers only a limited number of specific perils (e.g., fire, stranding, collision).

Suppose you are shipping a container of electronics from India to the US. You choose ICC (A) coverage, which protects your cargo from all risks except those explicitly excluded. If a storm damages the container and your electronics are destroyed, you can file a claim under the ICC (A) clause.

Valuation Clause

This marine insurance policy clause establishes the insured property's agreed-upon value, which determines the amount paid in case of marine losses . This value can be based on purchase price, market value, or other agreed-upon criteria.

For instance, based on its market value, you have insured your shipment for ₹50 lakhs. If the shipment is lost at sea, the insurance company will pay you ₹50 lakhs, as per the valuation clause.

'At' and 'From' Clause

This clause specifies the geographical scope of the insurance coverage. It defines the point at which the insurance attaches (e.g. when cargo is loaded onto the ship) and the point at which it terminates (e.g. when cargo is unloaded at the destination).

For example, the 'at and from' clause in your cargo insurance policy might state that coverage starts "at a warehouse, India" and ends "at a warehouse, Shanghai." This means your cargo is protected from the moment it leaves the warehouse in India until it arrives at the warehouse in Shanghai.

Sue and Labour Clause

This clause encourages the insured party to take all reasonable steps to minimise losses and prevent further damage to the insured property. The insurance company will reimburse reasonable expenses incurred in these efforts.

For instance, during a storm at sea, your cargo ship suffers damage. You take immediate steps to secure the cargo and prevent further losses. The sue and labour clause allows you to claim reimbursement from the insurance company for these expenses.

Warehouse to Warehouse Clause

This clause extends coverage beyond the maritime transit, protecting the insured property from the origin warehouse to the destination warehouse. This provides additional protection for the cargo during the pre-shipment and post-discharge stages.

For example, your cargo insurance includes a warehouse-to-warehouse clause. This means your electronics are protected from the moment they are packed at the warehouse in India until they are delivered and safely stored at the warehouse in any other country.

Memorandum Clause

This marine cargo insurance clause excludes certain inherent risks associated with the nature of the insured property. The insurance policy does not cover these risks. Examples include ordinary wear and tear, inherent vice (e.g., spoilage of perishable goods), and ordinary leakage.

For instance, you ship a container of oranges. The memorandum clause in your insurance policy excludes spoilage due to inherent vice. If the oranges spoil during the voyage due to their inherent nature, you cannot claim for the loss under the insurance policy.

Change of Voyage Clause

This clause allows for deviations from the planned voyage within specified limits without invalidating the insurance coverage. This flexibility can be helpful in unforeseen circumstances.

For example, during the voyage, if your cargo ship is diverted to another port due to bad weather, the change of voyage clause allows this deviation without affecting your insurance coverage.

Inchmaree Clause

The Inchmaree Clause, also known as the Negligence Clause, is a common clause found in marine insurance policies, particularly those covering the hull and machinery of vessels. It expands the scope of coverage beyond the traditional perils of the sea, protecting losses and damage caused by:

Negligence of the captain, crew members, or other personnel responsible for the vessel's operation. This includes errors in navigation, maintenance, or handling of cargo.

Defects in the hull, machinery, or equipment of the vessel. This can include latent defects, wear and tear, and design flaws.

Bursting of boilers, breakage of shafts, or other latent defects in machinery or boilers.

Jettison Clause

The Jettison Clause is another important clause found in marine insurance policies, particularly those covering cargo. It provides coverage for the loss of cargo that is deliberately thrown overboard to save the ship and remaining cargo in a maritime emergency.

The loss of jettisoned cargo is considered a general average loss, and the owners of the remaining cargo contribute to compensate the owner of the sacrificed cargo.

Why Understanding These Marine Cargo Insurance Clauses is Important?

Being aware of these important clauses of marine insurance policy is crucial for several reasons:

Choosing the right coverage: By understanding the scope of each clause, you can choose the level of protection that best suits your needs and risk profile.

Avoiding disputes: Knowing your rights and obligations under the policy can help you avoid disputes with your insurance company regarding claims.

Filing claims effectively: Understanding the claims process and the relevant clauses can help you file accurate and complete claims, leading to faster settlements.

Managing risks: By understanding the covered and excluded risks, you can make informed decisions about risk mitigation strategies.

Wrapping Up

Marine insurance is a complex subject, but understanding the key clauses within your policy can significantly improve your experience. Even understanding cargo insurance policy, which is one of marine insurance’s categories, is crucial for those dealing with international cargo on a regular basis.

Hence, by familiarising yourself with these clauses and consulting with a qualified insurance professional, you can confidently navigate this complex landscape and ensure your valuable assets are adequately protected throughout their journey.

Tata AIG offers customised marine insurance plans at reasonable premium costs.

Disclaimer / TnC

Your policy is subjected to terms and conditions & inclusions and exclusions mentioned in your policy wording. Please go through the documents carefully.

Related Articles

Marine insurance premium: calculation and compensation explained, essential things to know about marine insurance, importance of marine insurance in international trade, how can i ensure i am compliant with marine insurance clauses.

To ensure you are compliant with marine insurance clauses, you should: Read your policy carefully: Take the time to read and understand all of the clauses in your policy carefully. Consult with a qualified insurance professional: If you are unsure about any of the clauses in your policy, you should consult with a qualified insurance professional, who can explain them to you. Maintain proper documentation: Keep accurate records of all relevant documentation, such as voyage plans, cargo manifests, and maintenance records. Comply with all applicable laws and regulations: Ensure you comply with all applicable laws and regulations governing maritime transportation.

What is the purpose of marine insurance clauses?

Marine insurance clauses serve several important purposes: Defining the scope of coverage: Clauses clearly define what is covered and what is not covered by the insurance policy. Clarifying responsibilities: Clauses outline the rights and obligations of both the insured party and the insurance company. Managing risks: Clauses help to identify and manage potential risks associated with maritime transportation.

BEWARE OF SPURIOUS PHONE CALLS AND FICTIOUS / FRADULENT OFFERS IRDAI or its officials do not involve in activities like selling insurance policies, announcing bonus or investment of premiums. Public receiving such phone calls are requested to lodge a police complaint. Insurance is the subject matter of the solicitation. For more details on benefits, exclusions, limitations, terms and conditions, please read sales brochure / policy wording carefully before concluding a sale. Trade logo displayed above belongs to TATA Sons Private Limited and AIG and used by TATA AIG General Insurance Company Limited under License. 2008, TATA AIG General Insurance Company Limited, all rights reserved. Registered Office : Peninsula Business Park, Tower A, 15th Floor, G.K.Marg, Lower Parel, Mumbai - 400 013, Maharashtra, India. CIN: U85110MH2000PLC128425. IRDA of India Regn. No. 108. Toll Free Number : 1800 266 7780 / 1800 22 9966 (only for senior citizen policy holders). Email Id – [email protected] . Category of Certificate of Registration: General Insurance.

- Contracts and clauses

- BIMCO clauses

War Risks Clause for Voyage Chartering 2013 (VOYWAR 2013)

- Featured Item

- Voyage charter

BIMCO War Risks Clause for Voyage Chartering 2013 (VOYWAR 2013)

(a) For the purpose of this Clause, the words:

(i) "Owners" shall include the shipowners, bareboat charterers, disponent owners, managers or other operators who are charged with the management of the Vessel, and the Master; and

(ii) "War Risks" shall include any actual, threatened or reported:

War, act of war, civil war or hostilities; revolution; rebellion; civil commotion; warlike operations; laying of mines; acts of piracy and/or violent robbery and/or capture/seizure (hereinafter “Piracy”); acts of terrorists; acts of hostility or malicious damage; blockades (whether imposed against all vessels or imposed selectively against vessels of certain flags or ownership, or against certain cargoes or crews or otherwise howsoever), by any person, body, terrorist or political group, or the government of any state or territory whether recognised or not, which, in the reasonable judgement of the Master and/or the Owners, may be dangerous or may become dangerous to the Vessel, cargo, crew or other persons on board the Vessel.

(b) If at any time before the Vessel commences loading, it appears that, in the reasonable judgement of the Master and/or the Owners, performance of the Contract of Carriage, or any part of it, may expose the Vessel, cargo, crew or other persons on board the Vessel to War Risks, the Owners may give notice to the Charterers cancelling this Contract of Carriage, or may refuse to perform such part of it as may expose the Vessel, cargo, crew or other persons on board the Vessel to War Risks; provided always that if this Contract of Carriage provides that loading or discharging is to take place within a range of ports, and at the port or ports nominated by the Charterers the Vessel, cargo, crew, or other persons on board the Vessel may be exposed to War Risks, the Owners shall first require the Charterers to nominate any other safe port which lies within the range for loading or discharging, and may only cancel this Contract of Carriage if the Charterers shall not have nominated such safe port or ports within 48 hours of receipt of notice of such requirement.

(c) The Owners shall not be required to continue to load cargo for any voyage, or to sign bills of lading, waybills or other documents evidencing contracts of carriage for any port or place, or to proceed or continue on any voyage, or on any part thereof, or to proceed through any canal or waterway, or to proceed to or remain at any port or place whatsoever, where it appears, either after the loading of the cargo commences, or at any stage of the voyage thereafter before the discharge of the cargo is completed, that, in the reasonable judgement of the Master and/or the Owners, the Vessel, cargo, crew or other persons on board the Vessel may be exposed to War Risks. If it should so appear, the Owners may by notice request the Charterers to nominate a safe port for the discharge of the cargo or any part thereof, and if within 48 hours of the receipt of such notice, the Charterers shall not have nominated such a port, the Owners may discharge the cargo at any safe port of their choice (including the port of loading) in complete fulfilment of the Contract of Carriage. The Owners shall be entitled to recover from the Charterers the extra expenses of such discharge and, if the discharge takes place at any port other than the loading port, to receive the full freight as though the cargo had been carried to the discharging port and if the extra distance exceeds 100 miles, to additional freight which shall be the same percentage of the freight contracted for as the percentage which the extra distance represents to the distance of the normal and customary route, the Owners having a lien on the cargo for such expenses and freight.

(d) If at any stage of the voyage after the loading of the cargo commences, it appears that, in the reasonable judgement of the Master and/or the Owners, the Vessel, cargo, crew or other persons on board the Vessel may be exposed to War Risks on any part of the route (including any canal or waterway) which is normally and customarily used in a voyage of the nature contracted for, and there is another longer route to the discharging port, the Owners shall give notice to the Charterers that this route will be taken. In this event the Owners shall be entitled, if the total extra distance exceeds 100 miles, to additional freight which shall be the same percentage of the freight contracted for as the percentage which the extra distance represents to the distance of the normal and customary route.

(e) (i) The Owners may effect War Risks insurance in respect of the Vessel and any additional insurances that Owners reasonably require in connection with War Risks and the premiums therefor shall be for their account.

(ii) If, pursuant to the Charterers' orders, or in order to fulfil the Owners’ obligation under this Charter Party, the Vessel proceeds to or through any area or areas exposed to War Risks, the Charterers shall reimburse to the Owners any additional premiums required by the Owners’ insurers. If the Vessel discharges all of her cargo within an area subject to additional premiums as herein set forth, the Charterers shall further reimburse the Owners for the actual additional premiums paid from completion of discharge until the Vessel leaves such area or areas. The Owners shall leave the area or areas as soon as possible after completion of discharge.

(iii) All payments arising under this Sub-clause (e) shall be settled within fifteen (15) days of receipt of Owners’ supported invoices.

(f) The Vessel shall have liberty:

(i) to comply with all orders, directions, recommendations or advice as to departure, arrival, routes, sailing in convoy, ports of call, stoppages, destinations, discharge of cargo, delivery, or in any other way whatsoever, which are given by the government of the nation under whose flag the Vessel sails, or other government to whose laws the Owners are subject, or any other government of any state or territory whether recognised or not, body or group whatsoever acting with the power to compel compliance with their orders or directions;

(ii) to comply with the requirements of the Owners’ insurers under the terms of the Vessel’s insurance(s);

(iii) to comply with the terms of any resolution of the Security Council of the United Nations, the effective orders of any other Supranational body which has the right to issue and give the same, and with national laws aimed at enforcing the same to which the Owners are subject, and to obey the orders and directions of those who are charged with their enforcement;

(iv) to discharge at any alternative port any cargo or part thereof which may expose the Vessel to being held liable as a contraband carrier;

(v) to call at any alternative port to change the crew or any part thereof or other persons on board the Vessel when there is reason to believe that they may be subject to internment, imprisonment, detention or similar measures;

(vi) where cargo has not been loaded or has been discharged by the Owners under any provisions of this Clause, to load other cargo for the Owners' own benefit and carry it to any other port or ports whatsoever, whether backwards or forwards or in a contrary direction to the ordinary or customary route.

(g) The Charterers shall indemnify the Owners for claims arising out of the Vessel proceeding in accordance with any of the provisions of Sub-clauses (b) to (f) which are made under any bills of lading, waybills or other documents evidencing contracts of carriage.

(h) When acting in accordance with any of the provisions of Sub-clauses (b) to (f) of this Clause anything is done or not done, such shall not be deemed to be a deviation, but shall be considered as due fulfilment of the Contract of Carriage.

Explanatory notes

The BIMCO CONWARTIME and VOYWAR War Risks Clauses, respectively for time and voyage charter parties, were last revised in 2004. However, as a result of views recently expressed by the courts, changes in trading practices during the intervening years and insurers’ response to user demands for specialist cover, a review has been undertaken to determine the basis and extent of changes required to ensure that the provisions remain in line with commercial needs. As a result, the Clauses have been updated and will be incorporated into all new and revised BIMCO charter parties and other documents.

BIMCO recommends that members using standard charter parties or other contracts with the existing 2004 edition (or earlier) of the War Risks Clauses replace these versions with the new 2013 edition.

The revision was conducted in parallel with a review of the BIMCO Piracy Clauses to ensure consistency between provisions common to both sets of Clauses.

The following is a summary of the main changes to VOYWAR.

In contrast to CONWARTIME, where a war risk may exist before or after a charter party has been concluded, VOYWAR focuses on the position before loading or after the voyage has commenced.

This approach is maintained in the updated Clause as set out at sub-clauses (b) and (d).

The test in sub-clause (a) for determining the extent of a risk has been brought into line with the time charter provision and is to be measured by reference to the level of danger. As with the time charter clause, piracy now includes “violent robbery and/or capture/seizure”. Updated provisions covering insurance, additional insurances and the allocation of party liability for payment, are set out at sub-clause (e). The standard indemnity provision for third party claims has been inserted at sub-clause (g). As this specifically refers to “bills of lading, waybills or other documents evidencing contracts of carriage”, the reference in sub-clause (c) to signing bills of lading has been brought into line with the wording in sub-clause (g).

A number of other minor and consequential amendments have been made to ensure consistency and improve the text.

Related Help & Advice

Bills of lading advice, time charter advice, voyage charter advice, booking notes, general average, miscellaneous, create or edit a contract.

The one-stop digital shop for all the standard maritime contracts and clauses you’ll ever need.

Related publication

Check before fixing.

Related training

Maritime chartering academy.

- Shanghai, China

- 21 October, 2024

Latest Related News

No related news was found

ELSEWHERE ON BIMCO

Holiday calendar.

BIMCO's Holiday Calendar covers general holidays in over 150 countries, plus local holidays and working hours in more than 680 ports around the world.

Learn about your cargo

For general guidance and information on cargo-related queries.

- Contact us online

- Contact us by phone

Your message was sent successfully!

We will respond to your query shortly.

Please select a reason for contacting BIMCO from the list above to find the best contact number

Contact Switchboard on:

Lines are open Mon-Thurs 08:30-17:00 (CET) Fri 08:30-16:00 (CET)

Contact SmartCon support on:

Lines are open Monday - Friday

Contact Shipping KPI Support on:

Lines are open

Contact Membership on:

Lines are open 09:00-17:00 (CET)

Contact Athens Office on:

Contact Brussels Office on:

Contact Houston Office on:

Contact London Office on:

Contact Shanghai on:

Lines are open 09:00-17:00 CST

Contact Singapore Office on:

Contact Training on:

Contact Support & Advice on:

Contact IT support on:

Lines are open 09:00 until 17:00 (CET)

Contact Communications on:

COMMENTS

1/10/83 INSTITUTE VOYAGE CLAUSES HULLS This insurance is subject to English law and practice 1 NAVIGATION 1.1 The vessel is covered subject to the provisions of this insurance at all times and has leave to sail or navigate with or without pilots, to go on trial trips and to assist and tow vessels or craft in

Understand the nuances of Institute Cargo Clauses A, B, and C in marine insurance. Explore the purpose, coverage, and differences between these clauses. Navigate the complexities of cargo insurance effectively

Institute Voyage Clauses, Hulls. By N. Geoffrey Hudson, Tim Madge, Keith Sturges. Book Marine Insurance Clauses. Edition 5th Edition. First Published 2012. Imprint Informa Law from Routledge. Pages 10. eBook ISBN 9781315874364. ABSTRACT.

1.1 The Vessel is covered subject to the provisions of this insurance at all times and has leave to sail or navigate with or without pilots, to go on trial trips and to assist and tow vessels or craft in distress, but it is warranted that the Vessel shall not be towed, except as is customary or to the first safe port or place when in need of ass...

BIMCO adopts new CII clause for Voyage Charter Parties 13 October 2023. The shipping industry is facing an increase in new regulations from the International Maritime Organization (IMO) and the European Union (EU) and an increase in the urgency to decarbonise. To support the industry, BIMCO has developed a new CII Clause for Voyage Charter ...

The insurance only applies to voyages that commence during the period of insurance specified in the schedule, or during any subsequent period that we have accepted payment for. 2.

To support the industry, BIMCO has developed a new CII Clause for Voyage Charter Parties. The clause was adopted by BIMCO's Documentary Committee on 11 October and is the latest addition to BIMCO's portfolio of carbon clauses.

Ecrit et mentions obligatoires du contrat au voyage. Le contrat est établi par écrit. Outre les clauses obligatoires définies par le code du travail, il comporte les clauses obligatoires propres à l'engagement maritime (art. L. 5542-3-I).

BIMCO adopts new CII clause for Voyage Charter Parties 13 October 2023. The shipping industry is facing an increase in new regulations from the International Maritime Organization (IMO) and the European Union (EU) and an increase in the urgency to decarbonise. To support the industry, BIMCO has developed a new CII Clause for Voyage ...

In many countries, the main primary legislation implementing MARPOL Annex VI is the legislation on merchant shipping (for example, Merchant Shipping Act or Navigation Act). But it may also be the legislation on protection of the seas or prevention of pollution from ships (for example, Marine Pollution Prevention Act).

These clauses are the clauses of an additional insurance to the Ocean Marine Cargo Insurance of the Company. In case of conflict between any clauses of these clauses and the ocean marine cargo clauses, these clauses shall prevail.

2. This insurance covers general average and salvage charges, adjusted or determined according to the contract of carriage and/or the governing law and practice, incurred to avoid or in connection with the avoidance of loss from any cause except those excluded in Clauses 4, 5, 6 and 7 below.

One crucial component of marine insurance is the Institute Time Clause (ITC). The ITC serves as a fundamental provision in marine insurance policies, outlining the scope of coverage and the time-related aspects of the policy.

The Particular Average Clause specifies how a marine insurance policy covers the expenses incurred due to partial damage or loss of cargo during transit. As per the particular average clause, the insurer will only pay out if the loss or damage exceeds a certain percentage of the total insured value of the cargo.

BIMCO adopts new CII clause for Voyage Charter Parties 13 October 2023. The shipping industry is facing an increase in new regulations from the International Maritime Organization (IMO) and the European Union (EU) and an increase in the urgency to decarbonise. To support the industry, BIMCO has developed a new CII Clause for Voyage Charter ...

Les clauses obligatoires du contrat d'engagement maritime sont : Les noms et prénoms du marin, sa date et son lieu de naissance, son numéro d'identification ; le lieu et la date de la conclusion du contrat ; les noms et prénoms ou raison sociale et l'adresse de l'armateur ; les fonctions qu'il exerce ; le montant des salaires et accessoires ; l...

Understand voyage deviation in marine insurance, its implications, legal aspects, & how insurers handle it. Safeguard your voyage with proactive measures.

YOU ALWAYS. either. 1.1 As per the transit clauses contained within the contract of insurance, or. 1.2 on completion of unloading from the carrying vehicle or other conveyance in or at the final warehouse or place of storage at the destination named in the contract of insurance, 1.3 on completion of unloading from the carrying vehicle or other ...

A voyage deviation in marine insurance refers to a change in the route of the ship from the previously mapped route. In simple words, it means that the insured ship has deviated from the originally decided path mentioned in the policy document.

intermediate port or place there is an abandonment of the adventure originally contemplated the voyage shall thereupon be deemed to be terminated. No claim under this Clause I I shall in any case be allowed where the loss was not incurred to avoid or in connection with the avoidance of a peril insured against. DEDUCTIBLE 10.1. No claim arising ...

Here's a breakdown of some of the most important clauses in marine insurance: Institute Cargo Clauses. These standard clauses define the scope of coverage for cargo insurance. Different versions offer varying levels of protection: ICC (A): Covers all risks except those specifically excluded (e.g., war, nuclear peril, inherent vice).

In contrast to CONWARTIME, where a war risk may exist before or after a charter party has been concluded, VOYWAR focuses on the position before loading or after the voyage has commenced. This approach is maintained in the updated Clause as set out at sub-clauses (b) and (d).

Marine Open Insurance Policy (Commercial) INSTITUTE CARGO CLAUSES (A) RISKS COVERED. 1. Risks Clause. This insurance covers all risks of loss of or damage to the subject-matter insured except as provided in Clauses 4, 5, 6 and 7 below. 2. General Average Clause.