An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Explore sell to government

- Ways you can sell to government

- How to access contract opportunities

- Conduct market research

- Register your business

- Certify as a small business

- Become a schedule holder

- Market your business

- Research active solicitations

- Respond to a solicitation

- What to expect during the award process

- Comply with contractual requirements

- Handle contract modifications

- Monitor past performance evaluations

- Explore real estate

- 3D-4D building information modeling

- Art in architecture | Fine arts

- Computer-aided design standards

- Commissioning

- Design excellence

- Engineering

- Project management information system

- Spatial data management

- Facilities operations

- Smart buildings

- Tenant services

- Utility services

- Water quality management

- Explore historic buildings

- Heritage tourism

- Historic preservation policy, tools and resources

- Historic building stewardship

- Videos, pictures, posters and more

- NEPA implementation

- Courthouse program

- Land ports of entry

- Prospectus library

- Regional buildings

- Renting property

- Visiting public buildings

- Real property disposal

- Reimbursable services (RWA)

- Rental policy and procedures

- Site selection and relocation

- For businesses seeking opportunities

- For federal customers

- For workers in federal buildings

- Explore policy and regulations

- Acquisition management policy

- Aviation management policy

- Information technology policy

- Real property management policy

- Relocation management policy

- Travel management policy

- Vehicle management policy

- Federal acquisition regulations

- Federal management regulations

- Federal travel regulations

- GSA acquisition manual

- Managing the federal rulemaking process

- Explore small business

- Explore business models

- Research the federal market

- Forecast of contracting opportunities

- Events and contacts

- Explore travel

- Per diem rates

- Transportation (airfare rates, POV rates, etc.)

- State tax exemption

Travel charge card

- Conferences and meetings

- E-gov travel service (ETS)

- Travel category schedule

- Federal travel regulation

- Travel policy

- Explore technology

- Cloud computing services

- Cybersecurity products and services

- Data center services

- Hardware products and services

- Professional IT services

- Software products and services

- Telecommunications and network services

- Work with small businesses

- Governmentwide acquisition contracts

- MAS information technology

- Software purchase agreements

- Cybersecurity

- Digital strategy

- Emerging citizen technology

- Federal identity, credentials, and access management

- Mobile government

- Technology modernization fund

- Explore about us

- Annual reports

- Mission and strategic goals

- Role in presidential transitions

- Get an internship

- Launch your career

- Elevate your professional career

- Discover special hiring paths

- Events and training

- Agency blog

- Congressional testimony

- GSA does that podcast

- News releases

- Leadership directory

- Staff directory

- Office of the administrator

- Federal Acquisition Service

- Public Buildings Service

- Staff offices

- Board of Contract Appeals

- Office of Inspector General

- Region 1 | New England

- Region 2 | Northeast and Caribbean

- Region 3 | Mid-Atlantic

- Region 4 | Southeast Sunbelt

- Region 5 | Great Lakes

- Region 6 | Heartland

- Region 7 | Greater Southwest

- Region 8 | Rocky Mountain

- Region 9 | Pacific Rim

- Region 10 | Northwest/Arctic

- Region 11 | National Capital Region

- Per Diem Lookup

What is the travel charge card? The GSA SmartPay® 3 program provides charge cards to U.S. government agencies, as well as tribal governments, through master contracts that are negotiated with major banks.

There are currently more than 560 Federal agencies, organizations and Native American tribal governments participating in the program, spending $30 Billion annually, through 100 million transactions on more than three million cards.

There are three types of travel accounts:

- Individually billed accounts are issued to employees to pay for official travel and travel-related expenses. The government reimburses employees for authorized expenses. The employee is responsible for making payment to the bank.

- Centrally billed accounts are established by some agencies to pay for official travel expenses. Centrally billed accounts are paid directly by the government to the bank.

- GSA SmartPay Tax Advantage Travel accounts are new product offerings that combine an Individually Billed Account (IBA) and Centrally Billed Account (CBA), providing a means to obtain tax exemption automatically at the point of sale for rental cars and lodging charges. The combined features of CBAs and IBAs are a key characteristic of this product. When using the Tax Advantage Travel Account, charges for rental cars and lodging will be automatically billed to a CBA for payment. Charges for other travel-related purchases, such as meals and incidentals, are billed to the IBA portion of the account.

What is the benefit for federal agencies? Each agency or organization using the travel charge card receives a rebate based on sales volume. The sale refund is remitted to the organization. In addition, a separate refund is provided to agencies and organizations based on improving speed of payment.

How can travel managers make it happen? In 1988, Congress mandated that federal employees use the government travel charge card for all payments of expenses related to official government travel, with some exceptions.

Travel managers should ensure that all of their travelers use their government-issued travel charge card for all purchases of travel-related services or products such as rental cars, hotel rooms, and telephone or Internet service.

Looking for more information on SmartPay?

The GSA SmartPay program provides charge cards to U.S. government agencies/departments, as well as tribal governments, through master contracts that are negotiated with major national banks. Additionally, to contact Travel Program call 888-472-5585 or email [email protected]

- Download the complete Federal Travel Regulation

- Joint Travel Regulations

- Foreign Affairs Manual

PER DIEM LOOK-UP

1 choose a location.

Error, The Per Diem API is not responding. Please try again later.

No results could be found for the location you've entered.

Rates for Alaska, Hawaii, U.S. Territories and Possessions are set by the Department of Defense .

Rates for foreign countries are set by the State Department .

2 Choose a date

Rates are available between 10/1/2021 and 09/30/2024.

The End Date of your trip can not occur before the Start Date.

Traveler reimbursement is based on the location of the work activities and not the accommodations, unless lodging is not available at the work activity, then the agency may authorize the rate where lodging is obtained.

Unless otherwise specified, the per diem locality is defined as "all locations within, or entirely surrounded by, the corporate limits of the key city, including independent entities located within those boundaries."

Per diem localities with county definitions shall include "all locations within, or entirely surrounded by, the corporate limits of the key city as well as the boundaries of the listed counties, including independent entities located within the boundaries of the key city and the listed counties (unless otherwise listed separately)."

When a military installation or Government - related facility(whether or not specifically named) is located partially within more than one city or county boundary, the applicable per diem rate for the entire installation or facility is the higher of the rates which apply to the cities and / or counties, even though part(s) of such activities may be located outside the defined per diem locality.

An official website of the United States government Here's how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

U.S.Bank Access Online Registration Instructions

Department of Defense Travel Card Benefits

Progress informed from the past, and inspired by the future, cardholder guide.

Official travel for the Department of Defense just became easier with the Citi Department of Defense Travel Card. When you are preparing to use your new card, please read What To Do When I First Receive My New Card . For more information regarding your new card, please read the Department of Defense Cardholder Guide .

Department of Defense Travel Insurance

As a cardholder, you will receive global travel accident and lost luggage insurance so you feel safe and secure wherever you travel with a Citi ® Commercial Card.

- Travel Accident Insurance Guide

- Lost Luggage Insurance Guide

MasterCard Guide to Benefits

Visa Guide to Benefits

In addition to the card benefits provided by Citi, Visa provides card benefits such as Car Rental Insurance and Travel and Emergency Assistance. For full details, please read the Visa Guide to Benefits .

Travel Tips

For more information on your Citi Department of Defense Travel Card, please read What to do Before, During and After travel .

Online Tools

Citi's global online tool, CitiManager ® , enables you to manage business expenses from anywhere around the globe from your computer or mobile device; you can view statements online, confirm account balances, sign up for email and SMS alerts, and much more. If you have not already signed up for the CitiManager ® tool, please log on to www.citimanager.com/login and click on the 'Self registration for Cardholders' link. From there, follow the prompts to establish your account.

For more information on the CitiManager ® tool, view our CitiManager ® Cardholder Quick Reference Guide .

An official website of the United States government

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

Travel Charge Card

Usda travel charge card program.

The Office of the Chief Financial Officer (OCFO), Financial Planning and Policy, Fiscal Policy Division, Travel Section, along with representatives from agencies across USDA, is responsible for establishing and implementing travel policy and procedures as well as managing the USDA travel charge card program.

The USDA Travel Charge Card program provides travel charge cards to USDA employees through the GSA SmartPay 2 contract. The USDA travel charge card provides employees with access to government negotiated fares while allowing agencies greater visibility in to their travel spend.

Travel Charge Card Holder and Travel Charge Card A/OPC Training

All Travel Charge Card holders and Agency/Organization Program Coordinators (A/OPCs) are required to take the USDA Travel Charge Card Training on the proper use of a Government Travel Charge Card prior to receiving one. This course gives charge card holders and A/OPCs a better understanding of the policies and procedures for the Travel Charge Card and helps you and your agency maximize the benefits of the Travel Charge Card program.

Receive travel charge card training by searching for “USDA Travel Charge Card Training” on AgLearn+

Benefits of the USDA Travel Charge Card include:

- The travel charge card is accepted worldwide

- Access to discount government negotiated rates

- Built in travel insurance

- Eliminates the need for travelers to use their personal charge card

- Travelers are no longer required to carry large sums of cash

- Ability to monitor transactions and pay bill online

- Improved oversight in travel spend

- Charges are limited to travel related expenses

Travel Charge Card Policy

The USDA Travel Charge Card is a convenient method for the USDA and employees to make payments for official government travel and travel related expenses, while allowing the USDA to better manage their travel related expenses.

Other benefits of the program include:

- Safety – The USDA Travel Charge Card improves financial controls and eliminates the need for cash

- Electronic Access to Data – Provides accurate, comprehensive transaction detail with a few clicks of a button

- Worldwide Acceptance – The GSA SmartPay2 Charge Cards provide greater access to merchants because they are accepted worldwide

- Access to Government providers - Government Charge Card users are given access to GSA City Pair reduced airfares and FedRooms hotel rates

The USDA saves money on travel processing costs and generates revenue through volume of refunds with the use of the GSA SmartPay Travel Charge Card.

Eligibility

Employees who travel more than four times a year on official government business are required to use a government charge card. Please contact you’re A/OPC to discuss your eligibility to receive a travel charge card.

Card holder roles and responsibilities

Cardholders SHOULD:

- Use the charge card appropriately, in accordance with USDA policy, other laws, and governmental regulations

- Keep up to date with required program & agency-specific training, including refresher training

- Look out for communications from A/OPCs and take appropriate action

- Contact their A/OPC for questions regarding use of the card

- Immediately report a lost or stolen card

- Register for on-line access

- Use card for OFFICIAL travel expenses ONLY

- Track expenses while on travel in order to have accurate information for filing travel claims

- Keep receipts for All transactions charged on their travel charge card

- File travel claim within 5 days of returning from TDY

- Submit payment in full and on time for each monthly bill

Cardholders SHOULD NOT:

- Use the Travel Charge Card for personal use

- Obtain ATM travel advances which exceed the expected out of pocket expenditures for a trip

- Allow their monthly bill to become overdue which could result in the suspension or cancellation of the Travel Charge Card

- Wait for the receipt of their monthly bill to file travel claims

- Pay for another individuals travel expense

- Write their personal identification number (PIN) on the card or carry the pin number in their wallet

Travel Charge Card Documents

- Travel Charge Card Acceptance and Acknowledge Statement (PDF, 206 KB)

- USDA Government Travel Charge Card Regulation

- US Bank Cardholder Guide (PDF, 143 KB)

- Travel Charge Card Do’s and Dont’s (PDF, 426 KB)

- Inter-Departmental Hierarchy Transfer Request (PDF, 175 KB)

- Payment Transfer Request (XLSX, 72.2 KB)

An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock Locked padlock icon ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

Recognizing GSA SmartPay® Cards/Accounts

Learn how to identify the different types of GSA SmartPay cards/accounts.

Card/Account Type

To identify cards/accounts, it is important to know whether a card/account is a Centrally Billed Account (CBA) or Individually Billed Account (IBA).

- Agency is invoiced for purchases.

- Payments are made directly to the contractor banks by the federal government.

- Examples include purchase, fleet, and some travel cards/accounts.

- Card/account holder is invoiced directly.

- Payment is the responsibility of the card/account holder, who is then reimbursed by the agency/organization.

- Most common travel cards/accounts.

Card/Account Prefix

The prefix is the first four digits that appear on the charge card/account.

Bank Identification Number (BIN)

The BIN is the first six digits that appear on the charge card/account.

Travel Cards/Accounts

GSA SmartPay Travel cards/accounts can be used for official government travel and travel-related expenses, while allowing card/account holders access to GSA’s City Pair Program reduced airfares.

Travel Card Designs

Typically, travel cards have one of these designs:

Please note that card designs may vary.

GSA SmartPay Travel Card/Account Prefixes

The sixth digit identifies account type.

For the travel business line only, the sixth digit will identify whether the card/account is a CBA or IBA.

Travel Card/Account Tax Exemption Status

All CBA GSA SmartPay Travel cards/accounts should be exempt from state sales tax.

Some IBA GSA SmartPay Travel cards/accounts may be exempt from state taxes in select states.

Review state tax exemption information on the Tax Information by State page . To receive state tax exemption, forms, official business travel documentation, and/or a federal government identification may be required.

Purchase Cards/Accounts

In accordance with the Federal Acquisition Regulation (FAR), the GSA SmartPay Purchase card/account is the preferred method to purchase and pay for micro-purchases (FAR Part 13.201). For purchases above the micro-purchase threshold, the purchase card/account may be used as an ordering and payment mechanism, but not as a contracting mechanism.

Purchase Card Designs

Typically, purchase cards have this design:

GSA SmartPay Purchase Card/Account Prefixes

Purchase card/account tax exemption status.

All GSA SmartPay Purchase cards/accounts are CBAs and should be exempt from state sales tax.

The sixth digit identifier used to differentiate travel cards/accounts does not apply to purchase, fleet, or integrated cards/accounts.

Fleet Cards/Accounts

Use of GSA SmartPay Fleet cards/accounts enable agencies/organizations to conveniently obtain fuel and maintenance for vehicles and equipment, as well as manage tax recovery efforts and collect detailed fleet management data.

Fleet Card Designs

Typically, fleet cards have this design:

GSA SmartPay Fleet Card/Account Prefixes

Fleet card/account tax exemption status.

All GSA SmartPay Fleet cards/accounts are CBAs and should be exempt from state sales tax.

Integrated Cards/Accounts

The GSA SmartPay integrated account is a specialized card/account designed to combine the functions of the purchase, travel, and/or fleet business lines into one payment solution.

Integrated Card Designs

Typically, integrated cards have this design:

GSA SmartPay Integrated Card/Account Prefixes

Integrated card/account tax exemption status.

Most times, GSA SmartPay Integrated cards/accounts are CBAs and should be exempt from state sales tax.

Card-Not-Present Solutions

Transactions can also take place without a physical card.

Examples include:

- Declining Balance Cards.

- Ghost Cards.

- Mobile Payments.

- Single Use Accounts.

For more information on card-not-present solutions, please refer to the GSA SmartPay Strategic Payment Solutions publication .

Card-Not-Present Prefixes, BINs, and Tax Exemption Status

The prefixes, BINs, and tax exemption information detailed above for the travel, purchase, fleet, and integrated business lines also applies to card-not-present solutions.

smartpay.gsa.gov

An official website of the General Services Administration

We are an independent publisher. Our reporters create honest, accurate, and objective content to help you make decisions. To support our work, we are paid for providing advertising services. Many, but not all, of the offers and clickable hyperlinks (such as a “Next” button) that appear on this site are from companies that compensate us. The compensation we receive and other factors, such as your location, may impact what ads and links appear on our site, and how, where, and in what order ads and links appear. While we strive to provide a wide range of offers, our site does not include information about every product or service that may be available to you. We strive to keep our information accurate and up-to-date, but some information may not be current. So, your actual offer terms from an advertiser may be different than the offer terms on this site. And the advertised offers may be subject to additional terms and conditions of the advertiser. All information is presented without any warranty or guarantee to you.

This page may include: credit card ads that we may be paid for (“advertiser listing”); and general information about credit card products (“editorial content”). Many, but not all, of the offers and clickable hyperlinks (such as a “Apply Now” button or “Learn More” button) that appear on this site are from companies that compensate us. When you click on that hyperlink or button, you may be directed to the credit card issuer’s website where you can review the terms and conditions for your selected offer. Each advertiser is responsible for the accuracy and availability of its ad offer details, but we attempt to verify those offer details. We have partnerships with advertisers such as Brex, Capital One, Chase, Citi, Wells Fargo and Discover. We also include editorial content to educate consumers about financial products and services. Some of that content may also contain ads, including links to advertisers’ sites, and we may be paid on those ads or links.

For more information, please see How we make money .

Uncovering the Mystery of the US Bank Travel Portal: A Step-by-Step Guide

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money .

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Are you hopelessly over the Chase “5/24” rule ? Not sure where to look for your next big bonus ?

If so, getting the U.S. Bank Altitude™ Reserve Visa Infinite® Card could be a good deal for you. It currently comes with a 50,000 Altitude point bonus after spending $4,500 on purchases in the first 90 days of card membership.

You can’t transfer the points to travel partners, but you can redeem them for 1.5 cents per point toward airfare, hotels, and rental cars booked through the US Bank travel portal . So the bonus is worth $750 in travel (50,000 Altitude point bonus X 1.5 cents per point)!

To get the most out of your Altitude points you’ll need to first navigate the US Bank travel portal . So here is the help you need – a step-by-step guide!

Million Mile Secret Agent David shared :

I recently applied for this card and I can tell you that it’s not easy to use the travel awards! You have to jump through a lot of hoops and use a rather unfriendly portal.

And there are some strange restrictions. You can’t cancel reservations, so you just lose the points if you cancel! And you cannot pay with a combination of points and cash for plane tickets. Plus, you pay a penalty for canceling a hotel reservation even if the hotel doesn’t impose one.

Could you go into detail on those in this or the next post? I am seriously thinking of just redeeming points for statement credits to avoid future aggravation!

Thanks for the comment, David!

David is right. The US Bank travel portal is a bit different than other bank portals. The biggest downside is that you aren’t able to pay with cash and points. So you’ll need to have enough points to cover the entire booking.

And while there are some potential extra fees and restrictions, I don’t think they are extreme enough to warrant giving up 50% of your points’ potential value by redeeming them for a statement credit at 1 cent per point.

That said, everyone’s situation is different. So let’s take a look at the US Bank Altitude Reserve card and how to book Big Travel with Small Money through the US Bank travel portal .

US Bank Altitude Reserve Visa Infinite Card

Link: US Bank Altitude Reserve Visa Infinite Card

The US Bank Altitude Reserve card comes with a 50,000 Altitude point bonus (worth $750 in travel) after spending $4,500 on qualifying purchases within 90 days of account opening.

And you’ll earn:

- 3 Altitude points per $1 on travel purchases

- 3 Altitude points per $1 on mobile wallet purchases (like Apple Pay or Samsung Pay)

- 1 Altitude point on all other purchases

- $325 in travel credit every cardmember year (you can NOT get it twice before the 2nd annual fee is due)

- Complimentary membership to Priority Pass Select airport lounges, with 4 free entries per year for you and 1 guest (you will NOT get additional memberships for authorized users)

- 12 free Gogo in-flight Wi-Fi passes per calendar year

- Global Entry or TSA PreCheck fee credit of up to $100, available every 4 years

The $400 annual fee is NOT waived the first year. And authorized users are an extra $75 each per year. But the card comes with enough perks to help offset the fee.

You can redeem Altitude points for 1 cent each as a statement credit or even pay the $400 annual fee with 35,000 Altitude points . But you’ll get the most bang for your buck ( 1.5 cents per point) if you use your Altitude points to book airfare, hotels, or rental cars through US Bank’s travel portal .

You must have an existing relationship with US Bank in order to be approved for this card. But lots of accounts count as an “existing relationship” including auto loans, checking or savings accounts, and credit cards.

US Bank Travel Portal Restrictions

US Bank has slightly stricter rules than other travel portals. For example, if you book airfare through the Chase Travel Portal , you can usually get your points refunded if you cancel within the first 24 hours of booking . And after that 24-hour window, any refunds or cancellations are subject to the airline’s rules.

But flight and hotel bookings through the US Bank travel portal are immediately governed by the hotel or airline policies. So once you book travel with your Altitude points, you can NOT get them back.

If you booked airfare or a hotel that allows changes or refunds, then you might still get something back (travel voucher, etc.). How much you are refunded will depend on the fees charged by the airline or hotel. Also, US Bank could charge an additional $30 fee for flight changes and a $25 fee for hotel changes. But a US Bank phone representative I talked to said you should be able to call and get these fees waived.

All rental car reservations are non-refundable and cannot be changed . So if you’re planning on using your Altitude points for a rental car, make sure your plans are 100% set first.

How to Book Travel With the US Bank Travel Portal

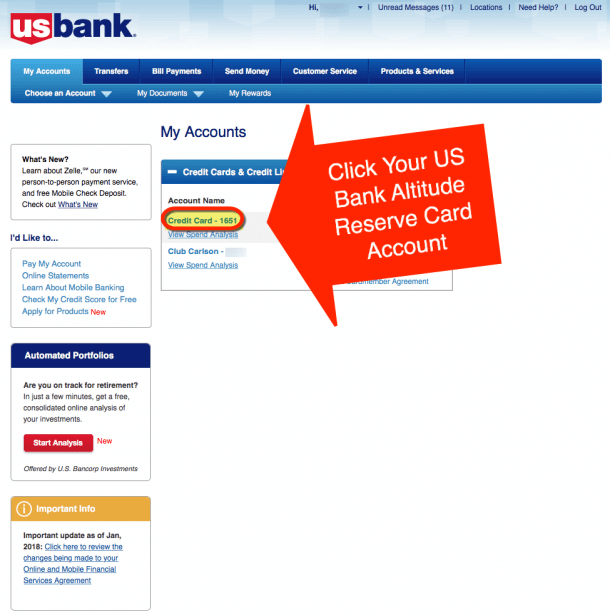

To book through the US Bank travel portal, first log into your US Bank account .

These screenshots are for booking a flight, but you’ll follow very similar steps for reserving hotels or rental cars.

Step 1. Select Your US Bank Altitude Reserve Card Account

Once you’ve logged into your account, click on your US Bank Altitude Reserve card account.

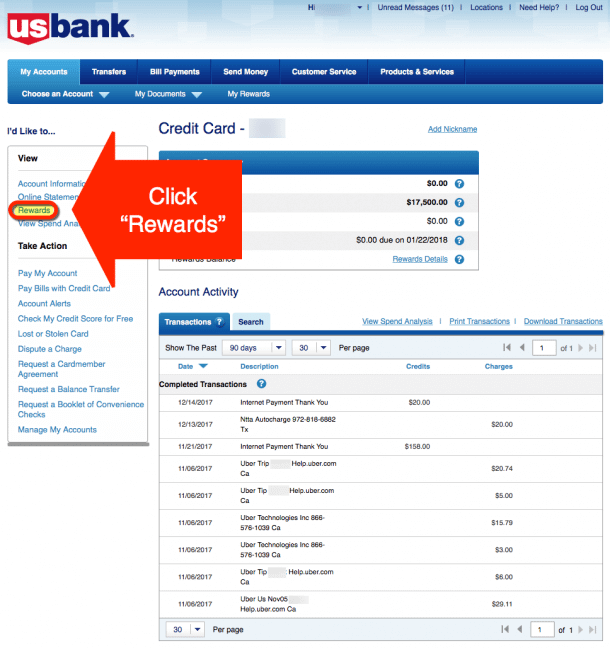

Step 2. Click the “Rewards” Link

Then, on the left side of the screen, click the “ Rewards ” link.

Step 3. Enter Your Trip’s Details

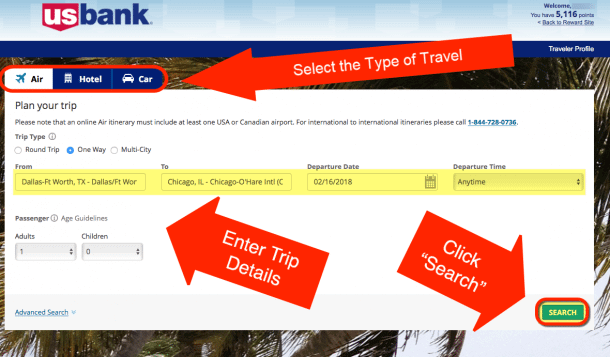

Next, pick the type of travel you want to book (flight, hotel, or rental car).

Now you’ll need to enter your trip details and click the “ Search ” button to continue.

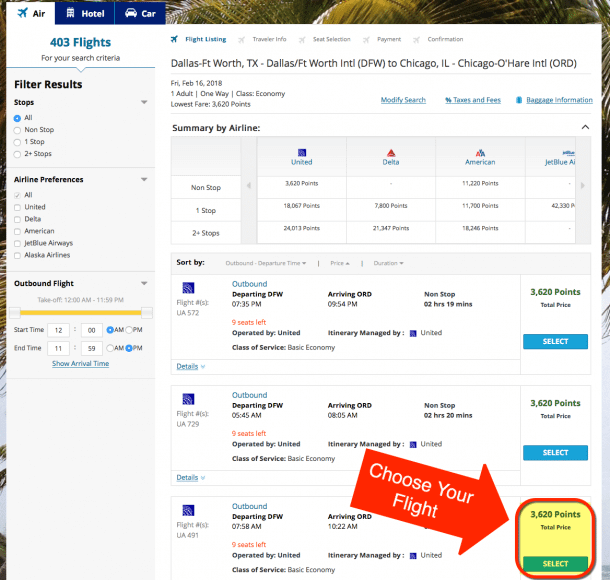

Step 4. Choose Your Flight

Choose the specific flight, hotel, or rental car you want to reserve.

If you need to, you can refine your search with the options on the left side of the screen.

Step 5. Review Your Trip Details

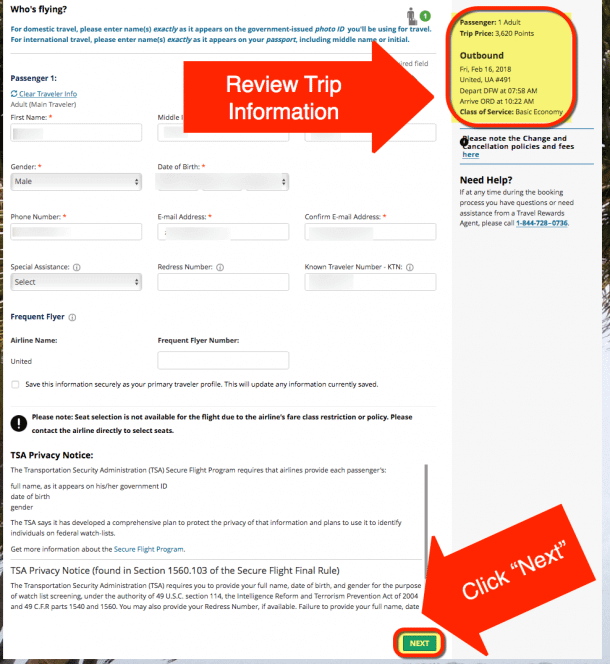

This is your chance to double check that you selected the travel you want to book.

After confirming your trip’s details, enter your personal information and click “ Next .”

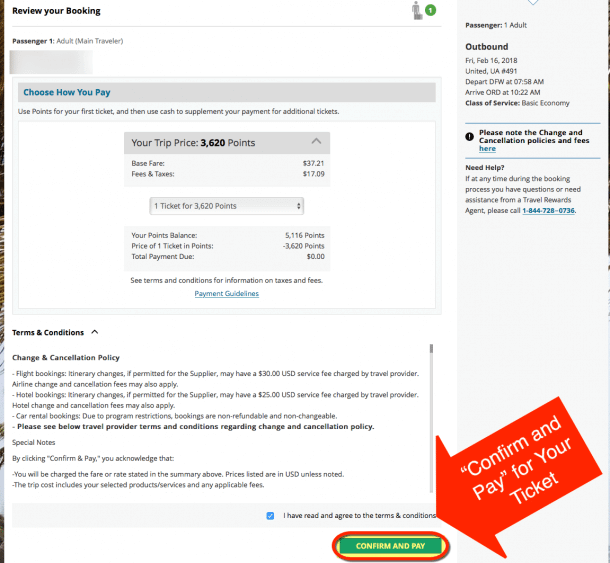

Step 6. Confirm & Pay for Your Travel

To complete your booking, agree to the terms & conditions and click the “ Confirm And Pay ” button.

And you’re finished!

Always Make Sure You’re Getting the Best Deal

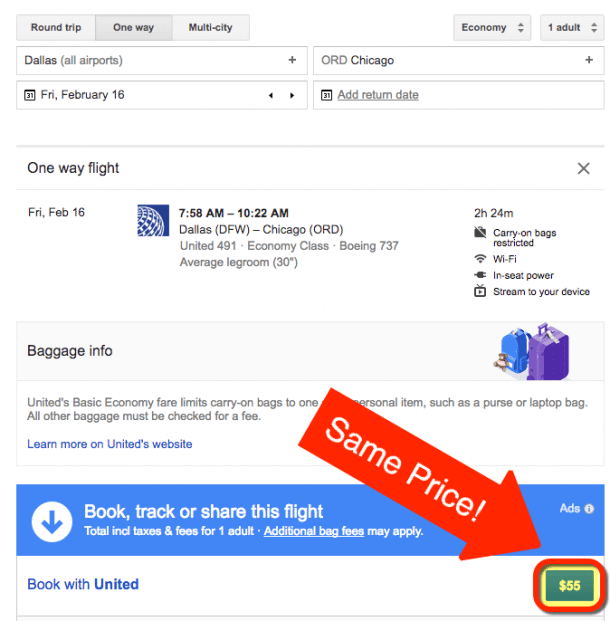

When you’re paying for travel through sites like the US Bank travel portal , it’s always a good idea to double check you’re getting the best price. I’ve written about how to find the best price for rental cars . And if you looking for deals on hotels, you’ll usually find them on the hotel’s website .

If you want to find the lowest price for airfare, I recommend using Google Flights , because it’s quick and easy to search for the flights you want. And in this case, Google Flights confirmed I am not paying more for my flight with the US Bank travel portal !

Just remember, when you’re reserving hotels or rental cars through the US Bank travel portal , you will NOT earn points. And your elite status will usually not be recognized. But booking flights with the US Bank travel portal will earn you miles. So make sure to add your loyalty number to the reservation!

Bottom Line

The US Bank Altitude Reserve card is a great card for folks in certain situations. But to get the most value for your Altitude points (1.5 cents each!), you’ll need to book your travel through the US Bank travel portal .

The US Bank travel portal is similar to other portals, but there are more restrictions . For example, you don’t have the option to pay with cash and points. And there could be extra fees charged for changes made to hotel or airfare bookings.

So make sure you read the fine print before making your travel plans!

Do you have the US Bank Altitude Reserve card? If so, what has your experience been like with the US Bank travel portal ? Let me know in the comments!

And thanks for the question, David!

Million Mile Secrets

Contributor

Million Mile Secrets features a team of points and miles experts who have traveled to over 80 countries and have used 60+ credit cards responsibly to accumulate loyalty points and travel the world on the cheap! The Million Mile Secrets team has been featured on The Points Guy, TIME, Yahoo Finance and many other leading points & miles media outlets.

More Topics

General Travel,

Join the Discussion!

Comments are closed.

You May Also Like

BonusTracker: Best credit card bonus offers

June 14, 2021 4

Best Hilton credit cards: Improved weekend night certificates, earning rates and more

June 12, 2021 2

Our Favorite Partner Cards

Popular posts.

Personal Finance

Best no annual fee travel credit cards for may 2024.

Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links. This content is created independently from TIME’s editorial staff. Learn more about it.

Travelers are back in the skies and on the roads, airplanes are taking off full, and there is likely a good chance you’re planning to travel this year or thinking about it. Whether you’re heading off on a much-deserved vacation or just getting away for a weekend, you may be looking to earn rewards on your travel spending.

But most travel credit cards come with an annual fee. That might make sense for road-warrior business travelers who are on a first-name basis with the airport check-in agent, but what if you don’t travel as often? If you’re an occasional traveler, paying an annual fee might not make sense .

In this article, we’ll cover the best travel credit cards with no annual fee.

Best No Annual Fee Travel Credit Cards: Summary

Best for thankyou points: citi rewards+® card, best for cash back on travel: card_name, best for hilton stays: card_name, best for united miles: card_name.

- Best for American miles: American Airlines AAdvantage® Mile Up® Mastercard®

Best for Delta miles: card_name

Our recommendations.

Citi Rewards+® Card

(Rates & Fees)

The Citi Rewards+® Card wouldn’t normally make a list of great travel cards, but it currently offers bonus points on some travel. Cardmembers can earn a total of five ThankYou Points on hotel, car rentals, and attractions booked through the Citi Travel portal through December 31, 2025.

If you’re invested in the Citi ThankYou Points ecosystem, the card is a must-have, not for its travel benefits, but for its point bonus on redemptions. The card offers a 10% rebate on point redemptions when you redeem your ThankYou Points. If you hold multiple ThankYou Point-earning cards and combine your ThankYou Points accounts, you get this rebate on any redemption, up to 100,000 points redeemed per year.

Here are the details of the Citi Rewards+® Card :

- Earn 20,000 bonus points after you spend $1,500 in purchases with your card within 3 months of account opening; redeemable for $200 in gift cards at thankyou.com

- Special offer: Earn 5 ThankYou® Points per $1 spent on hotel, car rentals and attractions booked on CitiTravel.com through December 31, 2025 (airfare is not included).

- 2 ThankYou Points per dollar on the first $6,000 spent per year at supermarkets and gas stations for first $6,000 per year and then 1X Points thereafter.

- 1 ThankYou Point per dollar on all other purchases.

- foreign_transaction_fee foreign transaction fee.

- $0 (Rates & Fees) annual fee.

Costco Anywhere Visa® Card by Citi

If you want a no-annual-fee card that offers cash back on travel and are a Costco member, the card_name simply can’t be beat. The Costco Anywhere Visa offers 3% cash back on travel categories including airfare, hotels, car rentals, travel agencies, cruise lines and Costco Travel. You must be a Costco member to get this card, but if you’re looking for cash back on travel, few other cards offer as much cash back on as many travel categories as the Costco Anywhere Visa.

The one quirk of the rewards earned by the Costco Anywhere Visa Credit Card is that you earn your rewards as Costco Cash. Costco Cash rewards get distributed once your February billing statement closes in the form of a credit card reward certificate. This certificate must be redeemed at Costco for merchandise or cash.

Here are the details of the Costco Anywhere Visa Card:

- 4% cash back on the first $7,000 spent each year on eligible gas and EV charging purchases worldwide and then 1% thereafter.

- 3% cash back at restaurants worldwide.

- 3% cash back on eligible travel purchases.

- 2% cash back on all other purchases at Costco and at Costco.com.

- 1% cash back on all other purchases.

- annual_fees annual fee.

Hilton Honors Card from American Express

If your travel plans have you staying within Hilton’s family of hotel brands, consider picking up the card_name . The card earns seven Hilton Honors Bonus Points per dollar spent at hotel properties within the Hilton portfolio. And you’ll get Hilton points for your everyday purchases like gas and groceries. The card earns five Hilton Honors bonus points per dollar spent at U.S. restaurants and U.S. gas stations as well. The card is also a great choice if you’re planning to travel abroad as it does not charge foreign transaction fees.

Here are the details of the Hilton Honors American Express Card:

- 7 Hilton Honors bonus points per dollar spent at any participating hotel within the Hilton portfolio.

- 5 Hilton Honors bonus points per dollar spent at U.S. restaurants, U.S. supermarkets, and U.S. gas stations.

- 3 Hilton Honors bonus points per dollar on all other eligible purchases.

- foreign_transaction_fee foreign transaction fee ( Rates & Fees ).

- annual_fees annual fee ( Rates & Fees ).

United Gateway℠ Card

Why we like it:.

United MileagePlus aficionados wanting to pad their mileage balances without paying an annual fee should take a look at the card_name . The card earns two United miles per dollar spent on United Airlines purchases, at gas stations, and on local transit and commuting.

The benefits of the card_name don’t stop with earning miles. The card also offers 25% back on United inflight and United Club premium drink purchases. And the card offers essential travel insurance coverage such as auto rental collision damage waiver, trip cancellation/interruption insurance, and purchase protection.

Here are the details of the United Gateway Card:

- 2 United miles per dollar spent on United purchases.

- 2 United miles per dollar spent at gas stations.

- 2 United miles per dollar spent on local transit and commuting.

- 1 United mile per dollar spent on all other purchases.

- foreign_transaction_fee foreign transaction fees.

- annual_fees annual fee.

- Member FDIC.

Best for American miles: card_name

Citibusiness® / aadvantage® platinum select® mastercard®.

If you want to earn American Airlines miles on your purchases with the airline, there may be no better card than the American Airlines AAdvantage® Mile Up® Mastercard® . The card earns two miles per dollar spent with American Airlines—an earning rate that matches even the airline’s most premium card_name , which carries a annual_fees annual fee. In addition to miles on American Airlines purchases, the card earns two miles per dollar spent at grocery stores.

The card_name has a unique feature among airline cards with no annual fee: The card can help you earn elite status with American Airlines. You earn one loyalty point for every one dollar you spend on purchases. Earning just 15,000 loyalty points in a year gets you Group 5 boarding privileges and a handful of preferred seat coupons. Once you earn 40,000 loyalty points in a year, you get AAdvantage Gold status, giving you access to complimentary upgrades.

Here are the details of the card_name :

- 2 AAdvantage miles per dollar spent on eligible American Airlines purchases.

- 2 AAdvantage miles per dollar spent at grocery stores, including grocery delivery services.

- 1 AAdvantage mile per dollar spent everywhere else.

- Earn 1 loyalty point for every AAdvantage mile earned from purchases.

Delta SkyMilesR Blue American Express Card

Delta Air Lines flyers can earn SkyMiles without paying an annual fee if they hold the card_name . The card_name offers two SkyMiles per dollar spent on Delta purchases and at restaurants, plus a 20% rebate on in-flight purchases. The card does not levy a foreign transaction fee ( Rates & Fees ), making it a solid option for international travelers who prefer SkyTeam.

Here are the details of the Delta SkyMiles Blue American Express Card:

- 2 Delta SkyMiles per dollar spent on Delta purchases.

- 2 Delta SkyMiles per dollar spent at restaurants.

- 1 mile per dollar spent on all other purchases.

Best No Annual Fee Travel Credit Cards Comparison Chart

Our methodology.

To find the best travel credit cards with no annual fee, we looked at the offerings from banks, U.S.-based airlines, and the major hotel chains. To be included in our list, cash back cards had to earn greater than 2% cash rewards on travel. Co-branded hotel and airline cards needed to earn at least two points per dollar on purchases with the brand. In most cases, we found that holding the no-annual-fee card that aligns with your travel brand preferences will earn you the most miles and points.

TIME Stamp: Brand loyalty can be rewarding

If you are a Costco member, the card_name offers the best travel rewards across a variety of travel purchases. If you’re not a Costco member and want a travel credit card that offers the best rewards with no annual fee, go with the entry-level card of your most used travel brand.

The information presented here is created independently from the TIME editorial staff. To learn more, see our About page.

What Is the Charles Schwab Visa Platinum Debit Card?

This debit card saved me multiple times while backpacking around the world, how i use the charles schwab investor checking account , is the charles schwab investor checking account worth it if you don’t travel, i traveled to 36 countries this past year. the card i reached for the most surprised me.

Travel credit cards are a must. But I would have missed out on valuable experiences without this debit card.

Contributor

Raina He is a contributor to CNET Money. She previously worked as an editor at CNET, focusing on credit cards, banking and loans. She graduated from the University of North Carolina at Chapel Hill with a B.A. in Media and Journalism. Before coming to CNET Money, she was an editor at NextAdvisor, a personal finance news site that shared a parent company with CNET Money.

Courtney Johnston

Senior Editor

Courtney Johnston is a senior editor leading the CNET Money team. Passionate about financial literacy and inclusion, she has a decade of experience as a freelance journalist covering policy, financial news, real estate and investing. A New Jersey native, she graduated with an M.A. in English Literature and Professional Writing from the University of Indianapolis, where she also worked as a graduate writing instructor.

The editorial content on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or services offered by our partners.

Last year, I left my job as a personal finance editor to backpack across the world . Since I’d written about dozens of credit cards, I put my skills to the test to find the best travel credit cards to use on my trip. But the card that I found the most useful surprised me.

I signed up for different credit cards with large welcome bonuses that I used to pay for my flights and hotels. These cards came with travel protections to insure my purchases and some offered perks that upgraded my experience . But the most helpful card in my wallet turned out not to be a credit card at all -- the debit card that came along with my Charles Schwab High-Yield Investor Checking Account was the unsung hero of my travels.

Yes, my credit cards helped fund my trip and were a big reason why I was able to take this year off. But my Schwab Visa Platinum debit card fulfills an incredibly useful and necessary niche that my credit cards don’t. Here’s why this dark horse of a card is a must-have for international travelers.

Unlike a credit card, the Charles Schwab Visa Platinum Debit Card isn’t a separate card you can apply for on its own. Rather, it’s the debit card associated with the Charles Schwab Investor Checking Account .

As checking accounts go, however, this Schwab account is compelling. The Investor Checking Account is a free checking account with no minimum deposits or minimum balance requirements, no monthly fees, no overdraft fees and a 0.45% APY on your account balance -- just a few reasons why it won CNET’s Editors’ Choice award for best checking account . Best of all, there are no foreign transaction fees and you get unlimited ATM fee rebates for cash withdrawals worldwide.

The card also comes with some nice benefits from Visa , such as extended warranty protection, price protection and travel accident insurance (when you pay with the card). The ability to set travel alerts and lock and unlock your card directly from the app, as well as add your card to mobile wallets, make it easy to use while traveling.

I’ve also found this bank’s customer service to be excellent. Most account actions, like setting a travel notice or locking and unlocking your debit card, can be accomplished in Schwab’s banking app. But the few times I’ve needed to call customer service, I’ve always been able to reach a human quickly and have my problem resolved without issue.

To open an Investor Checking Account, you also need to open a brokerage account with Charles Schwab. But Charles Schwab’s brokerage accounts are free to open and maintain, and you don’t need to actively use it for investing if you don’t want to. So although it’s an extra step, there’s really no downside.

The biggest benefit of this debit card is that you can withdraw money from any ATM without worrying about foreign transaction fees or ATM fees. Even if you’re used to a cashless lifestyle at home, when you’re traveling, you need cash.

This card came in handy when I went to Oktoberfest in Munich and at multiple Christmas markets in Vienna. In both places, most of the food vendor stalls were cash only. There were typically ATMs available in the near vicinity, but they were often run by third-party companies that charged fees.

Even if you travel to a country where credit cards are widely accepted -- like most of western Europe -- many smaller businesses and street vendors will take only cash, or require a minimum purchase amount to use a card.

Certain parts of Southeast Asia were similar. At the night markets of Kuala Lumpur, for example, most of the food hawker stalls took only cash or QR code mobile wallets (a different system from the mobile wallets in the US). Without a steady supply of cash, I would’ve missed out on a lot of experiences while traveling.

Some countries don’t widely accept credit cards. In Morocco, I often found that many restaurants, shops, museums and even locally run hotels and hostels accepted only cash. Basically, unless a place was a chain store or some high end establishment, I needed cash. It’s not too hard to keep $20 or $50 USD worth of local currency on hand to cover small purchases like street food or souvenirs, but needing to pay for week’s worth of lodging with cash can make for a hefty ATM withdrawal or currency exchange -- not to mention the commensurate fees, if you’re being charged for a percentage of the transaction.

Taxis and public transportation in some countries are also cash-only. And it’s also good to have some cash for emergencies if your credit cards are ever declined or if you lose access to them.

Is the Charles Schwab debit card the only way to get cash while traveling? Of course not. You can use your regular debit card at foreign ATMs -- but you might be charged a fee. You can also change dollar bills into the local currency of your destination at a bank in the US before you leave, or at a currency exchange service once you arrive. But then you’re stuck carrying all of your cash on you, which can be risky.

For me, being able to withdraw cash from any ATM, any time, without worrying about fees (after the reimbursement from Schwab) has made my travel experience much smoother. Specifically, it means:

- I can use the nearest ATM available, even in airports and “tourist trap” areas, without worrying about high fees.

- I don’t have to calculate how much money I need or carry large amounts of cash because I can withdraw cash in smaller quantities and go back for more without paying extra. This also means I’m less likely to end up with a large amount of foreign currency when I leave the country.

- I never worry about exchanging currency or finding the best exchange rate. I withdraw cash in the currency I need at a standard exchange rate every time.

During my eight-months-and-counting backpacking across Europe, Morocco and Asia, my Schwab checking account has been invaluable for managing my finances and accessing cash on my travels. And it’s not even my primary checking account .

Since I knew I wanted to use the Schwab debit card overseas, I decided to keep my money in my primary high-yield checking account that didn’t have an active debit card attached to it. As a tourist who was out and about all day in unfamiliar areas, I wanted to be cautious in case I was pickpocketed or lost my debit card. If my card was compromised before I had a chance to lock down my account, I didn’t want to risk losing more than a few hundred dollars.

So, I transferred a few hundred dollars into my Schwab account at a time and topped off the balance as I used it. I put all non-cash expenses on my credit cards -- both to earn rewards and for increased security. And of course, I made sure my credit cards were paid in full each month from my primary checking account.

This system has worked well for me so far and has helped me keep my money safe while traveling.

Even if you’re not jet setting across the globe, the Charles Schwab Investor Checking Account is still worth considering. Its ATM fee rebates work in the US as well, and while your bank likely has a domestic network of fee-free ATMs, it’s still nice to be able to use the most convenient ATM regardless of if it’s in-network. Even though credit cards are ubiquitous in America, there are still times and places you need cash.

Reimbursements aside, this account is a great checking account in and of itself, with no account fees, minimums or overdraft fees . Although its APY isn’t as high as some other high-yield checking accounts and it lacks some of the benefits of newer fintech banks (like early direct deposit ), it’s a solid option from a large and reputable institution.

Plus, if you’re interested in investing, having a Charles Schwab brokerage account linked to your checking account makes it easy to transfer money between the two. Charles Schwab’s brokerage accounts have no opening and maintenance fees and no commissions on online stock and ETF trades.

Recommended Articles

This woman slashed $12,000 in credit card debt. steal her 5 tricks, want extra money for summer travel this card has a fast pay out, is a balance transfer worth it if you can’t pay it off in time this cfp’s take may surprise you.

CNET editors independently choose every product and service we cover. Though we can’t review every available financial company or offer, we strive to make comprehensive, rigorous comparisons in order to highlight the best of them. For many of these products and services, we earn a commission. The compensation we receive may impact how products and links appear on our site.

Bank of America® Travel Rewards Credit Card review: A simple travel rewards card with basic features

Our take: The Bank of America® Travel Rewards Credit Card stands out for its simplicity: It’s a $0-annual fee card that earns simple, flat-rate rewards that you can redeem as statement credits for travel or dining.

Bank of America® Travel Rewards Credit Card: Overview

Card type: Travel

With no annual fees or foreign transaction fees, the Bank of America Travel Rewards card is an appealing choice for budget travelers or anyone who wants simplicity in their travel credit card. Although the rewards earned on this card lack the versatility you might find in cards that offer the ability to transfer rewards to loyalty programs or book travel through the card issuer’s portal, this card does allow you to redeem their points for statement credits for travel and dining, as cash back, or to purchase gift cards.

Who is the Bank of America® Travel Rewards Credit Card good for?

The Bank of America® Travel Rewards Credit Card is well-suited for budget-conscious travelers who prioritize simplicity over extravagant perks. Plus, with the card’s 0% intro APR for 15 billing cycles on purchases and balance transfers made within the first 60 days of account opening, the card can be a valuable tool for those looking to finance big-ticket purchases or consolidate their debt.

Who shouldn’t get the Bank of America® Travel Rewards Credit Card?

Those who prioritize reward flexibility, lavish travel benefits, and a substantial welcome bonus may find the Travel Rewards Credit Card less appealing. The card's modest welcome offer, and absence of transfer partners for airline or hotel loyalty programs could be drawbacks for those seeking more extensive rewards and perks.

Bank of America® Travel Rewards Credit Card: How to earn rewards

The rewards structure is easy to understand—there are no rotating categories to keep track of or activate or different rewards rates. Cardholders earn a flat 1.5 points on all purchases.

You’re also eligible to earn a modest welcome offer that’s worth 25,000 points, or $250, if you spend $1,000 in purchases in the first 90 days of account opening.

How to redeem Bank of America® Travel Rewards Credit Card points

There are only a few ways to redeem your points with the Travel Rewards Card You can use your rewards to book travel, cover travel and dining purchases, get cash-back as a statement credit, and buy gift cards.

However, when you redeem for cash or gift cards, you may not get the best value. One point is valued at 0.6 cents, so 2,500 points will only give you $15. There’s a 2,500 point minimum redemption requirement, too. The redemption value for gift cards will vary.. Travel and dining credits are typically the best value for your rewards, where a point is worth one cent.

Get a statement credit for travel or dining

To redeem points with the Bank of America Travel Rewards Credit Card, you can get a statement credit to offset eligible travel—like airlines, hotels, car rentals—and dining purchases made within the past 12 months. There’s a 2,500 point minimum redemption requirement.

When you redeem your points this way, one point is worth one cent.

Bank of America® Travel Rewards Credit Card rates and fees

- Annual fee: $0

- Foreign transaction fee: None

- Intro APR: 0% Intro APR for 15 billing cycles on purchases made in the first 60 days of account opening, then the standard variable APR will apply.

- Purchase APR: 18.24%–28.24% variable

- 0% APR balance transfer: 0% intro APR for 15 billing cycles for any balance transfers made in the first 60 days of account opening. After that, the APR is 18.24%–28.24% variable

- Balance transfer fee: 3% for 60 days from account opening, then 4% will apply

- Penalty fee: up to $40 for late payments

Additional benefits

- Free FICO Score. Through online and the mobile banking app, you can access your FICO Score from TransUnion, which is updated monthly, for free.

Credit cards similar to Bank of America® Travel Rewards Credit Card

If you’re looking for a no-annual-fee travel card with greater flexibility than the Bank of America Travel Rewards Card, there are other options to consider. Here’s a look at how some of the competition stacks up.

Capital One VentureOne Rewards Credit Card vs. Bank of America® Travel Rewards Credit Card

The Capital One VentureOne Rewards Credit Card boasts a versatile rewards program, although the rewards rate is slightly lower.. The Bank of America Travel Rewards card earns 1.5 points per dollar, the VentureOne offers a slightly lower 1.25 miles per dollar, but it does earn with 5 miles per dollar on prepaid hotels and rental cars through Capital One Travel.

The VentureOne also has a decent welcome offer for a no-annual-fee card of 20,000 miles after spending $500 on purchases within 3 months from account opening.

But the biggest benefit the VentureOne Card has over the Bank of America Travel Rewards card is the redemption flexibility. With this card, you can transfer your miles to over 15 of Capital One’s travel loyalty programs, so you can potentially wring even more value from your rewards. You can also book a trip through Capital One Travel, get reimbursed for travel purchases made within the previous 9- days, or opt for a statement credit, although like the Bank of America card, this last option is also worth less than a penny per point.

Discover it® Miles vs. Bank of America® Travel Rewards Credit Card

Just like the Bank of America Travel Rewards Card, the Discover it® Miles card dishes out 1.5 miles on general purchases, without any annual or foreign transaction fees. But a key distinction between these two cards lies in the redemption options. You cannot use your miles to make a purchase, but you can redeem them for a statement credit against a travel purchase made within the last 180 days. Or, you can simply apply your earnings as a cash-back statement credit without any travel involved. Either way, a mile is worth a penny a point. Allowing you to take cash back at the same value as a travel reimbursement is a much better option than the less than a penny per point cash-back option on the Bank of America Travel Rewards card.

The Discover it Miles card also goes the extra mile when it comes to a welcome offer. Instead of an upfront offer after meeting a minimum spending requirement, the issuer doubles the rewards you earn in the first year. For example, if you earned a total of 50,000 miles in the first year, you would earn an additional 50,000 miles at the end of the year.

Is the Bank of America® Travel Rewards Credit Card right for you?

The Bank of America Travel Rewards Card is best for those looking for a no-frills travel card who can take advantage of the card’s 0% APR offer. It’s also best for someone who wants to use the earnings on a travel rewards card solely for travel, and doesn’t mind not taking cash-back.

However, potential users should be aware of its limitations, including the limitations on redemption. Most people will fare better with a card that offers 2% cash back, which is both more rewarding and allows you to use your money on anything you’d like, travel or otherwise.

Frequently asked questions

Is it hard to get a bank of america® travel rewards credit card.

Since the Bank of America Travel Rewards Card is a rewards card, you’ll likely need a good or better FICO Score, which starts at 670 or higher.However, keep in mind there is no one set score which will guarantee you’ll be approved for a card as issuers take several factors into consideration when determining approval.

Is the Bank of America® Travel Rewards Credit Card worth it?

The Bank of America Travel Rewards credit card may be worth it for some—it’s a solid option for budget-conscious travelers seeking simple rewards who may only want to redeem their rewards for travel one way.

Please note that card details are accurate as of the publish date, but are subject to change at any time at the discretion of the issuer. Please contact the card issuer to verify rates, fees, and benefits before applying.

This story was originally featured on Fortune.com

This article may contain affiliate links that Microsoft and/or the publisher may receive a commission from if you buy a product or service through those links.

- ATM locations

- ATM locator

Estás ingresando al nuevo sitio web de U.S. Bank en español.

Featured credit card offers.

U.S. BANK CASH+ ®

Earn up to 5% cash back 2 on two categories you choose. 3

U.S. BANK ALTITUDE ® GO

Earn 20,000 bonus points worth $200. 6.

U.S. BANK VISA ® PLATINUM

Get a low intro apr for 21 billing cycles., find a credit card that fits your lifestyle., filter by card feature.

- All credit cards

- Low intro rate

- No annual fee

- Build credit

U.S. Bank Shopper Cash Rewards ® Visa Signature ® Card

Earn up to 6% cash back plus $250. 10, 11, 12.

6% cash back on your first $1,500 in combined eligible purchases each quarter with two retailers you choose 10

3% cash back on your first $1,500 in eligible purchases on your choice of one everyday category

1.5% cash back on all other eligible purchases

Credit limit

Subject to credit approval

$0 intro the first year ( $95 /year thereafter).

U.S. Bank Altitude ® Go Visa Signature ® Card

4X points on dining, takeout and restaurant delivery 7

2X points on streaming services and at grocery stores (discount stores/supercenters and wholesale clubs excluded effective September 9, 2024)

2X points at gas stations/EV charging stations (discount stores/supercenters, grocery stores and wholesale clubs excluded effective September 9, 2024)

1X point on all other eligible purchases

Plus, a $15 credit for annual streaming service purchases such as Netflix and Spotify ® . 8

0% intro APR 9 on purchases and balance transfers 5 for the first 12 billing cycles . After that, a variable APR, currently $ .

U.S. Bank Cash+ ® Visa Signature ® Card

Earn a bonus that has increased from $150 to $200 cash back. 1, 2.

Up to 5% cash back 2 on two categories you choose 3

2% cash back on one everyday category you choose

1% cash back on all other eligible purchases

0% intro APR 4 on purchases and balance transfers 5 for the first 15 billing cycles . After that, a variable APR, currently $ .

Welcome offer

Earn $150 $200 cash back.

U.S. Bank Altitude ® Connect Visa Signature ® Card

Earn 50,000 bonus points worth $500. 13.

5X points on prepaid hotels and car rentals booked directly in the Altitude Rewards Center 14

4X points on travel

4X points at gas stations and EV charging stations through September 8, 2024, after that 4X on your first $1,000 each quarter (wholesale clubs, discount stores/supercenters and grocery stores excluded)

2X points on dining, streaming services and at grocery stores (discount stores/supercenters and wholesale clubs excluded effective September 9, 2024)

$0 intro for the first year , $ /year thereafter

U.S. Bank Visa ® Platinum Card

0% intro APR 15 on purchases and balance transfers 5 for the first 21 billing cycles . After that, a variable APR, currently $ .

U.S. Bank Altitude ® Reserve Visa Infinite ® Card

Earn 50,000 bonus points worth $750 in travel. 16.

5X points on prepaid hotels and car rentals booked directly in the Altitude Rewards Center 17

3X points on travel and mobile wallet purchases on Apple Pay ® , Google Pay™ and Samsung Pay

Build credit for tomorrow. 18

Our credit-building cards let you spend just like you would with a traditional credit card. The main difference is you’ll need to make a refundable security deposit from $300 to $5,000, to set your credit limit. Spend within your limit and pay your bill when it’s due. Over time, this will help build your credit and you may be able to graduate to a traditional card.

U.S. Bank Secured Visa ® Card

Enjoy no annual fee and credit-building 18 benefits..

$300 to $5,000

U.S. Bank Altitude ® Go Secured Visa ® Card

Earn up to 4x points while building credit. 18.

4X points on dining, takeout and restaurant delivery 19

Plus, a $15 credit for annual streaming service purchases such as Netflix and Spotify ® . 20

U.S. Bank Cash+ ® Secured Visa ® Card

Build credit 18 and earn cash back. 2.

Small business credit cards

Power your business purchases..

From points to cash back, there’s a credit card with benefits made for your business.

Card partners

See more cards with rewards..

Learn about the retailers, airlines and other businesses we partner with to offer rewards credit cards.

U.S. BANK SMART REWARDS ®

Get access to more benefits..

Unlock perks with a U.S. Bank Smartly ® Checking account and credit card – like exclusive cash-back deals, checking account monthly maintenance fee waiver, and more.

Retrieve your mail offer

Accept your card offer..

Ready to take the next step? Have the confirmation number from your offer invitation handy before you get started.

Frequently asked questions

What credit score is needed to apply for a u.s. bank credit card.

U.S. Bank card credit score requirements vary by product. In general, our credit card products are for established credit with a credit score in the good to excellent range. The Secured credit card products are built for people looking to build or rebuild their credit with responsible use with fair credit score ranges.

How does a credit card work?

A credit card allows you to borrow money, with the intention you’ll pay back the lender (your bank) later on. While it sounds simple, credit can get complex.

What is a good credit score?

A credit score of 700 or above is considered good. Credit scores range from 300 to 850 – the higher, the better. Learn about the factors that affect your credit score .

How can I improve my credit score?

There are simple things you can do to build and maintain good credit. Pay your entire balance on time every month, stay below your credit limit and follow these other tips for improving your credit score .

What U.S. Bank credit cards are best for maximizing rewards?

U.S. Bank offers a variety of rewards credit cards, including cash back, travel and points rewards. You can compare and choose the best card that fits your lifestyle.

Do U.S. Bank credit cards offer contactless payment?

Yes. All U.S. Bank credit cards offer contactless chip technology that allow for enhanced security and touch-free payments, at the milllions of retail store locations that accept contactless payments.

Does U.S. Bank offer a low interest rate credit card?

U.S.Bank offers a variety of low interest rate credit cards, allowing you to choose a credit card that fits your lifestyle. To learn more, use our compare tool on this page.

What is Shopping Deals?

Shopping Deals is an online, one-stop shopping experience where customers can receive rewards when they purchase products from over 1,000 online stores.

You can access the site by logging into your eligible credit card account with your username and password and navigate to Shopping Deals through the Rewards Center. When you click any online store's listing, you'll be directed to the store website, where you can complete your purchase.

How does Shopping Deals work and why would I use it?

Once enrolled, log in at usbank.com. Click on Shopping Deals in the Rewards Center and start shopping. By using Shopping Deals on your U.S. Bank Credit Card, you will be able to earn more rewards by shopping online.

What is Real-Time Rewards?

Real Time Rewards is a redemption method offered on several U.S. Bank credit cards that enables you to instantly turn your purchases into rewards. Your mobile device can then be used to immediately redeem points toward a credit card purchase.

How do I use Real-Time Rewards on my U.S. Bank credit card to redeem?

Once enrolled, redemption is quick and easy. Make a credit card purchase, and you will receive a text with the option to redeem points toward that purchase. Reply ‘REDEEM’ to complete the redemption.

You must have enough points to cover the entire purchase in order to receive the text message to redeem. Your points will be deducted from your points balance and redeemed in the form of a credit to your monthly billing statement. See Program Rules for additional details.

For cardmembers

U.S. Bank may change APRs, fees and other account terms in the future based on your experience with U.S. Bank National Association and its affiliates as provided under the Cardmember Agreement and applicable law.

You authorize your wireless carrier to use or disclose information about your account and your wireless device, if available, to us or our service provider for the duration of your business relationship, solely to help us identify you or your wireless device and to prevent fraud. See our Privacy Policy for how we treat your data.

Account must be open and in good standing (not past due) on the closing date of the billing cycle to earn and redeem rewards and benefits. Upon approval, please refer to your Cardmember Agreement or Rewards Program Rules in the online Rewards Center by logging into usbank.com for additional information.

Net Purchases are Purchases minus credits and returns. Not all transactions are considered to be Purchases and eligible to earn rewards, such as transactions posting as Convenience Checks; Balance Transfers; Advances (including ATM withdrawals, wire transfers, traveler's checks, money orders, foreign cash transactions, betting transactions, and lottery tickets); interest charges and fees; credit insurance premiums; and transactions to (i) fund certain prepaid card products, (ii) buy currency from the U.S. Mint, or (iii) buy cash convertible items. Upon approval, see your Cardmember Agreement for details. Purchases qualify for rewards based on how merchants choose to classify their business and we reserve the right to determine which purchases qualify.

One-time $200 bonus will be awarded for redemption when you are approved for a new U.S. Bank Cash+ ® Visa Signature® Card and after eligible net purchases totaling $1,000 or more are made to your account within 90 days from account opening. Please allow 6-8 weeks after you have met the spend requirement for your bonus to be credited to your rewards balance. Existing and previous Cash Rewards accounts do not qualify for this one-time bonus. One-time bonus cash does not apply toward account upgrades. This offer may not be combined with any other bonus offer. Offer is subject to credit approval.

Cash back is redeemed in the form of a statement credit or a deposit made to your U.S. Bank Savings, Checking or Money Market Account based on your designation, or as a U.S. Bank Rewards Card ($25 minimum redemption on cash back). Subject to applicable law, you may not redeem Cash back, and you will immediately lose all of your Cash back, if your Account is closed to future transactions (including, but not limited to, due to Program misuse, failure to pay, bankruptcy, or death). Cash rewards will expire at the end of the calendar month 36 months after the billing cycle in which they were earned.

Cardmember must enroll each quarter into categories of their choice, or all net purchases will earn no more than 1% cash back. You will earn 5% cash back on your first $2,000 in combined net purchases (purchases minus returns or credits) in your two chosen 5% categories and 2% cash back in your chosen 2% category. Purchases over $2,000 in the 5% categories will earn 1% cash back. There are no limits on your 2% or 1% cash back earnings. Transactions qualify for 5% or 2% cash back based on how merchants classify the transaction. In addition to earning 1% cash back for every $1 in eligible Net Purchases, Cash+ Cardmembers will earn an additional 4% cash back for every $1 in eligible Net Purchases spent on prepaid air, car and hotel reservations in the travel center using your Cash+ Card. Please allow 1-2 statement billing cycles for your bonus cash back to appear on your credit card statement. Refer to the Rewards Center for full details.

The 0% introductory APR applies to purchases and is valid for the first 15 billing cycles. The 0% introductory APR applies to balance transfers made within 60 days of account opening and is valid for the first 15 billing cycles. The introductory rate does not apply to cash advances. Thereafter, the APR may vary. The current undiscounted variable APR for Purchases and Balance Transfers is $ based on your creditworthiness. The variable APR for Cash Advances 29.99%. Cash Advance fee: 5% of each advance amount, $10 minimum. Convenience Check fee: 3% of each check amount, $5 minimum. Cash Equivalent fee: 5% of each cash amount, $10 minimum. Balance Transfer fee: 3% of each transfer amount, $5 minimum. There is a $1 minimum interest charge where interest is due. Annual fee: $0. Foreign Transaction fee: 3% of each foreign purchase transaction or foreign ATM advance transaction in U.S. Dollars. 3% of each foreign purchase transaction or foreign ATM advance transaction in a Foreign Currency. U.S. Bank ExtendPay® Fees: A monthly fee not to exceed 1.6% of the original principal amount in a U.S. Bank ExtendPay ® Plan or U.S. Bank ExtendPay ® Loan. This fixed fee is disclosed upon enrollment and charged each month that you owe the applicable ExtendPay balance. ExtendPay Fees are calculated based upon the original principal amount, Purchase APR, and other factors. When you make a payment, the amount up to your Minimum Payment is applied first to the monthly payment obligation for ExtendPay Plans and ExtendPay Loans if any, and then to non-Fixed Payment Program balances in the order of the lowest to highest APR. Any amount over your Minimum Payment is applied to balances in the order of highest to lowest APR.

Balance Transfers transactions from other U.S. Bank National Association accounts are not permitted. You may cancel a balance transfer request within 10 days of account opening by calling 800-285-8585.

One-time 20,000 bonus Points will be awarded if you are approved for a new U.S. Bank Altitude Go Visa Signature Card and eligible Net Purchases totaling $1,000 or more are made to your Account within 90 days after Account opening. Points are earned on eligible Net Purchases. Please allow 6-8 weeks for your bonus Points to be credited to your Account. Existing or previous U.S. Bank Altitude Go Visa Signature cardmembers are not eligible if you have received a new account bonus for this product in the last five years. Use of the Card is subject to terms and conditions of the U.S. Bank Altitude Go Visa Signature Cardmember Agreement, which is provided at Account opening and may be amended from time to time. This offer may not be combined with any other bonus offer.

Points are earned on eligible Net Purchases. U.S. Bank Altitude Go Visa Signature Cardmembers will earn 1 Point for every $1 in Net Purchases. In addition, you will earn 3 Points (4 Points total) for every $1 on restaurant, fast-food restaurant and bar purchases. You will earn 1 Point (2 Points total) for every $1 on qualifying streaming subscription service purchases. Refer to Program Rules or usbank.com/AltitudeGoBenefits for official list of qualifying streaming services merchants. IMPORTANT CHANGE : You will earn 1 Point (2 Points total) for every $1 on grocery store, supermarket, gas station and electric vehicle charging station purchases. Effective September 9, 2024 , grocery store and supermarket purchases at discount stores/supercenters such as Target and Walmart and wholesale clubs will be excluded. Gas station and electric vehicle charging station purchases at discount stores/supercenters, wholesale clubs and grocery stores/supermarkets will be excluded. Please allow 1-2 statement billing cycles for your bonus Points to appear on your credit card statement. Refer to the Rewards Center for full details.

An automatic statement credit of $15 per 12-month period will be applied to your U.S. Bank Altitude Go Visa Signature Card Account within 2 statement billing cycles following 11 consecutive calendar months of eligible streaming service purchases, such as Netflix, Hulu, Apple Music, if the Account is in good standing (open and able to use). Purchases qualify based on how merchants choose to classify their business and we reserve the right to determine which purchases qualify. Refer to Program Rules or usbank.com/AltitudeGoBenefits for official list of qualifying streaming services merchants. We reserve the right to adjust or reverse any portion or all of any streaming services credit for unauthorized purchases or transaction credits.

The 0% introductory APR applies to Purchases and is valid for the first 12 billing cycles. The 0% introductory APR applies to Balance Transfers made within 60 days of account opening and is valid for the first 12 billing cycles. The introductory rate does not apply to cash advances. Thereafter, the APR may vary. The current undiscounted variable APR for Purchases and Balance Transfers is $ based on your creditworthiness. The variable APR for Cash Advances is 29.99%. Cash Advance fee: 5% of each advance amount, $10 minimum. Convenience Check fee: 3% of each check amount, $5 minimum. Cash Equivalent fee: 5% of each cash amount, $10 minimum. Balance Transfer fee: 3% of each transfer amount, $5 minimum. There is a $1 minimum interest charge where interest is due. Annual fee: $0. Foreign Transaction fee: $0. U.S. Bank ExtendPay ® Fees: A monthly fee not to exceed 1.6% of the original principal amount in a U.S. Bank ExtendPay ® Plan or U.S. Bank ExtendPay ® Loan. This fixed fee is disclosed upon enrollment and charged each month that you owe the applicable ExtendPay balance. ExtendPay Fees are calculated based upon the original principal amount, Purchase APR, and other factors. When you make a payment, the amount up to your Minimum Payment is applied first to the monthly payment obligation for ExtendPay Plans and ExtendPay Loans if any, and then to non-Fixed Payment Program balances in the order of the lowest to highest APR. Any amount over your Minimum Payment is applied to balances in the order of highest to lowest APR.