- All Solutions

- Audience measurement

- Media planning

- Marketing optimization

- Content metadata

- Nielsen One

- All Insights

- Case Studies

- Perspectives

- Data Center

- The Gauge TM – U.S.

- Top 10 – U.S.

- Top Trends – Denmark

- Top Trends – Germany

- Women’s World Cup

- Men’s World Cup

- News Center

Client Login

News Center > Marketing performance

Nielsen data reveals australia’s changing travel trends and the brands spending big to attract aussie tourists, 3 minute read | june 2023.

- Industry’s biggest ad spenders revealed as travel marketing budgets jump 60% YOY

- Top local and OS destinations

- Most popular Aussie travel websites

- States and territories spending the most to attract travellers

Sydney – June 5, 2023 – Ahead of the upcoming King’s Birthday long weekend, Nielsen has released a comprehensive analysis of the shifting travel preferences of Australians, the sites they visit online to inspire and plan their getaways, and the industry heavy-hitters spending big to attract them.

Latest Nielsen Consumer and Media View (CMV) data reveals Australians’ growing interest in domestic travel, online travel bookings, and an increased desire for travel in general.

According to the data, 76% of Australians “display a keen interest in visiting new places,” with a significant majority showing a preference for “nature-centric experiences” (64%), “coastal proximity” (59%), and “exploration of secluded, off-the-beaten-track locations” (54%).

Nielsen CMV data also reveals a surge in travel interest among younger Aussies (25 to 39), with 30% planning some sort of travel – a statistic that makes this demographic 10% more likely to travel than the average Australian.

In terms of online booking trends, both domestic (34%) and overseas (29%) travel packages are predominantly booked through online platforms, reflecting a significant growth over recent years. The preferred platforms among Australians include Booking Holdings Network (37%), TripAdvisor (27%), Virgin Travel and Tourism (20%), and Expedia (15%) for travel packages, while Booking.com (30%), Airbnb (17%), and Hotels.com (10%) lead in accommodation bookings.

Data from Nielsen Digital Content Ratings (DCR) also highlights the strength of Uber and Qantas in the sector, with 6.74 million and 5.88 million users respectively in March, and only slight decreases in April, with the added bonus of high average user engagement times. Booking Holdings Network also emerged as a significant player, becoming the third-largest platform in terms of users.

Average user engagement time on most travel platforms was consistent from March to April, although Uber and Airbnb did see an increase. On average, Uber users spent just over 22 minutes interacting with the platform, while Airbnb users spent roughly 17-and-a-half minutes on the platform.

While 42% of Australians expressed their inclination towards domestic holidays, there’s a noticeable rise in interest for international travel. Over the next year, 35% of Australians aim to venture abroad, marking a noteworthy uptick of 11% compared to the data from two years ago.

Among those with international travel plans, popular destinations of choice comprise of Europe (39%), North America – specifically the USA or Canada (24%), the UK (23%), and New Zealand (18%).

In addition, Nielsen Ad Intel data also shows that between April 2021 and March 2022 the travel and tourism industry spent $381 million on advertising in Australia. However, post-COVID, that increased by 60%. In the last year, the sector has poured more than $608 million into advertising, with Qantas, Stayz, Airbnb, Flight Centre, and Virgin Australia topping the list of the biggest tourism and travel advertisers over that time.

When it comes to the nation’s domestic tourism boards, the agencies with the deepest ad pockets over the last 12 months were Tourism & Events Queensland, followed by Visit Victoria, Destination NSW, Western Australian Tourism Commission, South Australian Tourism Commission, Tourism Tasmania, and Northern Territory Tourist Commission.

About Nielsen

Nielsen shapes the world’s media and content as a global leader in audience measurement, data and analytics. Through our understanding of people and their behaviours across all channels and platforms, we empower our clients with independent and actionable intelligence so they can connect and engage with their audiences – now and into the future. Nielsen operates around the world in more than 55 countries.

Learn more at www.nielsen.com and connect with us on social media (Twitter, LinkedIn, Facebook and Instagram).

Media Contact Dan Chapman Assoc. Director, Communications, Nielsen APAC [email protected] +61 404 088 462

Find the right solution for your business

In an ever-changing world, we’re here to help you stay ahead of what’s to come with the tools to measure, connect with, and engage your audiences.

How can we help?

Check your browser settings and network. This website requires JavaScript for some content and functionality.

Bulletin – December 2022 Australian Economy The Recovery in the Australian Tourism Industry

8 December 2022

Angelina Bruno, Kathryn Davis and Andrew Staib [*]

- Download 940 KB

The Australian tourism industry is gradually recovering from the COVID-19 pandemic that brought global travel to an unprecedented standstill. International tourism fell sharply in early 2020 and has only slowly recovered since restrictions were lifted in the first half of this year. By contrast, domestic tourism spending bounced back quickly as local restrictions eased and is now above pre-pandemic levels. This article outlines the recovery in the Australian tourism industry following the pandemic, the challenges the industry has faced in reopening, and the uncertainties around the outlook for the tourism industry over the next few years.

Introduction

Restrictions to contain the spread of COVID-19 and precautionary behaviour by consumers significantly disrupted the movement of people both domestically and internationally during the pandemic period. This had a devastating impact on many Australian businesses that provided services to domestic or international tourists. Nevertheless, many of these businesses have shown considerable resilience and flexibility, aided by a range of government support packages, and are now expanding to service the recovery.

This article presents a snapshot of the tourism industry through the pandemic, before focusing on the recovery over the past year. While international tourism is recovering only slowly, domestic tourism spending has rebounded strongly – to above pre-pandemic levels – as many Australians have chosen to take domestic rather than overseas holidays. The article draws on information from the Bank’s regional and industry liaison program to discuss the challenges the tourism industry has faced in meeting this sudden increase in demand, and the outlook for tourism activity over the next few years. Many tourism businesses have found it difficult to quickly scale up to meet demand, and these supply constraints have limited tourism activity and led to higher prices. Looking ahead, a continued recovery in tourism activity is expected as supply-side issues are gradually resolved and international tourism picks up further. However, there are a number of uncertainties around the timing and extent of this recovery.

International tourism

The onset of the COVID-19 pandemic led to a sharp drop in international tourism, as governments around the world implemented travel and border restrictions (Graph 1). In April 2020, international tourism arrivals declined globally by around 90 per cent and Australia’s international tourist arrivals effectively came to a standstill for several months.

The timing and extent of the recovery in international tourism has been uneven across the world, as national governments removed restrictions at a different pace. Globally, international tourism arrivals picked up to be around three-quarters of their pre-pandemic levels by September 2022. In Australia, international tourist arrivals rose slightly in mid-2021 under the temporary operation of the Australia–New Zealand travel bubble, and also in November 2021 as border restrictions eased in some parts of the country. However, it wasn’t until February 2022 – when Australia removed border restrictions for vaccinated persons – that arrivals began to substantially pick up. Since July 2022, people have been able to travel to and from Australia without being required to declare their vaccination status.

Short-term overseas arrivals to Australia (which include tourists but also those visiting for less than 12 months for business, education and employment purposes) picked up to be around half of pre-pandemic levels by September 2022 (Graph 2). However, short-term departures of Australian residents have picked up more quickly than short-term arrivals of overseas visitors, and so the net outflow of travellers has been larger than pre-pandemic levels in recent months.

Reasons for travel

The recovery in short-term travel to and from Australia has been particularly pronounced among those visiting friends and relatives (VFR) (Graph 3). VFR accounted for just over half of all international visitors’ spending over the year to June 2022, whereas it accounted for just under one-fifth in 2019 (Table 1). Short-term travel for business and education purposes has also picked up. However, the recovery in outbound business travel (including conventions and conferences) has outpaced inbound business travel, with relatively few major business events held in Australia in 2022. Short-term travel for employment reasons has almost fully recovered to its 2019 levels. By contrast, the number of visitors arriving in Australia for holidays has picked up only slightly, to be around one-third of its pre-pandemic level (holiday visitors accounted for only 10 per cent of international visitor spending over the year to June 2022, compared to nearly 40 per cent in 2019).

Working holiday makers and international students who are in Australia for more than a year are not included in the short-term arrivals data, but they make a significant contribution to tourism spending. According to Hall and Godfrey (2019), visitors who state the main purpose of their trip as education stay longer and spend more than leisure and business tourists. International students and individuals on working holiday visas have a high propensity to travel within Australia, and often their friends and relatives come to visit. The number of international students and working holiday visa holders in Australia has risen to be around two-thirds and one-half of their pre-pandemic levels in the September quarter of 2022, respectively.

The recovery in international visitors to Australia has been uneven across source countries, reflecting both travel restrictions and the quicker recovery in VFR relative to other types of travel (Graph 4). The recovery in the number of visitors from India, New Zealand and the United Kingdom has been faster than for other countries, possibly due to the close relationships residents from those countries have with Australian residents (in the 2021 Census, England and India were the top two countries of birth for Australian residents, other than Australia). While there has been a notable pick-up in people from India visiting friends and relatives, there has also been a pronounced recovery in the number of Indian students coming to Australia. By contrast, the number of Chinese visitors remains more than 90 per cent below pre-pandemic levels, due to ongoing travel restrictions to control the spread of COVID-19 in China. This is significant for the Australian tourism sector as, prior to the pandemic, Chinese visitors were the largest source of tourist spending and contributed around 20 per cent of total leisure travel exports in 2019 (or nearly 30 per cent if education-related travel is included).

Domestic tourism

Domestic tourism activity was severely disrupted by the COVID-19 pandemic, due to the introduction of strict restrictions on household mobility (‘lockdowns’) across the country in March 2020 (Graph 5). At the same time, a number of states and territories implemented interstate border restrictions and quarantine arrangements. As a result, domestic tourist visitor numbers declined sharply. By April 2020, domestic tourist numbers were less than 20 per cent of pre-pandemic levels.

The first lockdown ended for most parts of the country by the end of May 2020, although some restrictions on household activity and state border closures remained in place for an extended period of time. Melbourne re-entered lockdown for much of the second half of 2020. By the end of that year, however, a number of states and territories had eased restrictions and reopened domestic borders, allowing domestic visitor numbers to recover to around 80 per cent of pre-pandemic levels over the 2020/21 summer and the 2021 Easter holidays (Graph 6).

A third major disruption emerged in mid-2021, as a sharp rise in the number of Delta-variant cases led to the reintroduction of lockdowns in New South Wales, Victoria and the ACT. Around half of the Australian population were under significant restrictions for most of the September quarter of 2021 and domestic visitor numbers declined to around 40 per cent of pre-pandemic levels.

Domestic tourism numbers rebounded again during the 2021/22 summer holidays as health restrictions eased once more, but not to the levels of the previous year; the Omicron outbreak in early 2022 tempered activity somewhat. As concerns about Omicron abated, domestic visitor numbers again recovered, and have been around 85 per cent of pre-pandemic levels since Easter 2022.

While domestic visitor numbers remain below pre-pandemic levels, total domestic tourism spending and the average spend per visitor have been above pre-pandemic levels since March 2022. Some liaison contacts report that domestic travellers are staying longer than they did before the pandemic and spending patterns have become more like those on overseas holidays, with domestic tourists spending more on tours and experiences to explore Australia. This higher spending also reflects an increase in domestic travel prices (see below).

The recovery in domestic tourism spending in 2022, to around or above pre-pandemic levels, is evident in all states and territories (Graph 7). Naturally, states that experienced longer and stricter COVID-19 restrictions had much more significant declines in tourism activity over 2020 and 2021. Western Australia experienced the least disruption to the tourism industry, partly due to having fewer restrictions on movement, but also because the closed state border meant that more Western Australians were holidaying in their own state. In recent months, the Northern Territory and Queensland have been the recipients of domestic tourism spending well above 2019 levels, perhaps because these travel destinations are regarded as closer substitutes for overseas holidays.

Travel to regional areas recovered more quickly and fully than travel to capital cities (Graph 8). Regional areas were less affected by lockdowns and liaison suggests that travellers preferred to avoid more densely populated areas. There was also a shift towards driving holidays, which has greatly benefited regions within two to three hours’ drive from capital cities.

Challenges in reopening the Australian tourism industry

While pandemic-related declines in domestic and international tourism weighed heavily on the Australian tourism industry, many businesses have proved resilient and have experienced a strong rebound in demand from domestic tourists in recent months. Nevertheless, many businesses have found it difficult to scale up to meet this demand, and supply constraints have acted to limit tourism activity and led to higher prices.

In 2022, the biggest constraint on the recovery in tourism activity has been difficulty finding sufficient labour to service tourism demand. The tourism industry lost a large number of experienced staff during the pandemic – and so when domestic tourism recovered, the sector had to rapidly hire workers in a tight labour market. Online advertisements for tourism jobs rose to record highs by mid-2022 (Graph 9). These jobs have been difficult to fill. Liaison contacts have suggested that many of the Australians who had worked in the tourism industry prior to the pandemic have since found jobs in other industries. Moreover, many tourism-related jobs had previously been filled by international students and, particularly in regional locations, working holiday makers – many of whom left Australia during the pandemic and have been slow to return. On top of the difficulties in attracting and retaining staff, illness-related absenteeism has been elevated more broadly through 2022.

Tourism businesses in many regional areas have had additional difficulties attracting staff, partly due to a shortage of housing. An increase in net migration to these areas has contributed to very low rental vacancy rates in many popular tourist areas. In response, some holiday accommodation providers have resorted to housing their own staff.

There have also been some changes in consumer behaviour resulting from the pandemic that have made it harder for tourism businesses to plan and have sufficient staff available to meet demand. Trends such as increased working from home and a reduction in business-related day trips have created a larger gap between peak and off-peak periods for many tourism businesses. There are also sharper peaks and troughs in demand because there are fewer international tourists, who often travel at different times to domestic travellers (e.g. filling accommodation mid-week and outside school holidays). Booking lead times substantially shortened during the pandemic, though there is some evidence that perhaps these are lengthening out again. Nevertheless, booking lead times have always been shorter for domestic travel than international travel, so the change in the composition of travellers has made it more difficult for tourism businesses to plan ahead.

While labour has been a constraint across most of the tourism industry, a lack of capital equipment has been an additional constraint for some businesses. Many tourism-related businesses sold off or retired vehicles, boats, aircraft and other equipment during the pandemic when they could not operate and were in need of cash (Grozinger and Parsons 2020). The sudden and stronger-than-anticipated recovery in domestic tourism in 2022, combined with supply chain issues delaying the manufacture and delivery of new equipment and vehicles, has meant that many businesses did not have the capital equipment they need to service the increase in demand.

These supply-side constraints (in both labour and capital) have limited the tourism industry’s ability to ramp up to meet demand. Liaison suggests many tourism operators are operating below their previous capacity – for example, many have had to limit their operating hours because of lack of staff, and some accommodation providers have not been able to offer all their rooms for booking as they do not have enough staff to service them. Labour shortages and supply chain delays have also weighed on aviation capacity and contributed to a decline in domestic airlines ‘on-time performance’ over 2022 (Graph 10).

Similar constraints are also weighing on the recovery in international tourism. Contacts suggest that the recovery has been held back by limited flight availability, the higher cost of travel insurance and, in many cases, the higher cost of flights. Liaison contacts have indicated that delays in visa issuance in 2022 have also been a barrier for those seeking to travel to Australia. Over the past few months, however, visa processing times have shortened somewhat, and visa processing for applicants located overseas – including applicants for visitor, student and temporary skilled visas – have been given higher priority to allow more people to travel to Australia (Department of Home Affairs 2022).

The supply-side constraints in the tourism industry, combined with a strong pick-up in domestic demand and the higher cost of inputs such as fuel, have led to a sharp increase in domestic travel prices (Graph 11). Liaison contacts suggest that consumers have been relatively accepting of price rises for services essential to travel, such as accommodation. However, smaller operators – particularly in highly discretionary services, such as tours – have had less scope to increase their prices, and their margins have been squeezed by the higher costs of inputs such as food, fuel, energy and insurance costs. Prices for overseas travel have also increased significantly in recent quarters, as demand for flights has outstripped capacity, alongside rising jet fuel costs and increases in prices for international tours (ABS 2022).

The outlook

Looking ahead, tourism activity is expected to continue to recover as supply-side issues are slowly resolved and international tourism picks up further. Most liaison contacts suggest a full recovery will not occur until at least mid-2023; many expect it to take a few more years. There are a number of factors that will affect the timing and extent of the ongoing recovery in tourism, including:

- The easing of supply-side constraints : It is unclear how long it may take for some of the supply-side constraints in the industry to ease, including whether planned changes in flight availability will be sufficient to meet changes in demand, and whether the sector will be able to fill more job vacancies over time and as migration returns.

- The return of international students and working holiday visas : Many people have recently had working holiday visas approved and are expected to arrive over the coming year. Liaison contacts also expect international student numbers to increase over the next few years. The return of working holiday and student visa holders will increase demand for tourism services, and will likely alleviate labour shortages as they take jobs in the sector.

- Australians’ preferences for domestic and international travel : Demand for Australia’s tourism services may decline if Australians’ preference for overseas rather than domestic holidays picks up before international inbound tourism demand increases further. It is possible that cost-of-living pressures, combined with the higher cost of international travel, could lead Australian households to continue to prefer domestic holidays for a time. Nevertheless, many households have significant savings and pent-up demand for international travel after planned trips have been deferred over the past few years.

- The global economic outlook : Global economic conditions and the exchange rate affect decisions about whether to travel the long distance to Australia (as they have in the past) (Dobson and Hooper 2015). Financial concerns and the rising cost of living could make expensive, long-haul travel less attractive.

- The timing and extent of recovery in Chinese tourism : As noted above, China accounted for a large share of tourism spending prior to the pandemic. The outlook for Chinese tourism (and international students from China) remains highly uncertain and will depend on a number of factors, including China’s policies to restrict the spread of COVID-19 , the outlook for the Chinese economy and the travel preferences of Chinese tourists more generally.

Restrictions to contain the spread of COVID-19 and precautionary behaviour significantly disrupted the movement of people both domestically and internationally throughout the pandemic. Since restrictions have eased, international travel has been slow to recover, but domestic tourism spending has rebounded to be above pre-pandemic levels and many tourism service providers are currently operating at capacity. Looking ahead, tourism activity is expected to continue to recover, as supply-side issues are slowly resolved and international tourism picks up further. Australia remains an attractive destination for both domestic and international tourists, and the resilience and flexibility demonstrated by Australian tourism businesses in recent years bode well for the opportunities and challenges that lie ahead.

The authors are from the Regional and Industry Analysis section of Economic Analysis Department. The authors are grateful for the assistance provided by others in the department, in particular Aaron Walker and James Holloway. [*]

ABS (Australian Bureau of Statistics) (2022), ‘Main Contributors to Change’, Consumer Price Index , June.

Department of Home Affairs (2022), ‘Visa processing times’, viewed 14 November 2022. Available at <https://immi.homeaffairs.gov.au/visas/getting-a-visa/visa-processing-times>.

Dobson C and Hooper K (2015), ‘ Insights from the Australian Tourism Industry ’, RBA Bulletin , March, pp 21–31.

Grozinger P and Parsons S (2020), ‘ The COVID-19 Outbreak and Australia’s Education and Tourism Exports ’, RBA Bulletin , December.

Hall R and Godfrey A (2019), ‘Edu-tourism and the Impact of International Students’, International Education Association of Australia, 3 May.

Home » News » New data unveils top travel trends for Aussies in 2023

New data unveils top travel trends for Aussies in 2023

The latest Nielsen Consumer and Media View (CMV) data has revealed Australians’ growing interest in domestic travel, online travel bookings, and an increased desire for travel in general.

According to the data, 76 per cent of Australians “display a keen interest in visiting new places,” with a significant majority showing a preference for “nature-centric experiences” (64 per cent), “coastal proximity” (59 per cent), and “exploration of secluded, off-the-beaten-track locations” (54 per cent).

Nielsen CMV data also reveals a surge in travel interest among younger Aussies (25 to 39), with 30 per cent planning some sort of travel – a statistic that makes this demographic 10 per cent more likely to travel than the average Australian.

In terms of online booking trends, both domestic and overseas travel packages are predominantly booked through online platforms, reflecting significant growth over recent years.

The preferred platforms among Australians include Booking Holdings Network (37 per cent), TripAdvisor (27 per cent), Virgin Travel and Tourism (20 per cent), and Expedia (15 per cent) for travel packages, while Booking.com (30 per cent), Airbnb (17 per cent), and Hotels.com (10 per cent) lead in accommodation bookings.

Data from Nielsen Digital Content Ratings (DCR) also highlights the strength of Uber and Qantas in the sector, with 6.74 million and 5.88 million users respectively in March, and only slight decreases in April, with the added bonus of high average user engagement times. Booking Holdings Network also emerged as a significant player, becoming the third-largest platform in terms of users.

Average user engagement time on most travel platforms was consistent from March to April, although Uber and Airbnb did see an increase. On average, Uber users spent just over 22 minutes interacting with the platform, while Airbnb users spent roughly 17-and-a-half minutes on the platform.

While 42 per cent of Australians expressed their inclination towards domestic holidays, there’s a noticeable rise in interest for international travel. Over the next year, 35 per cent of Australians aim to venture abroad, a noteworthy uptick of 11 per cent compared to the data from two years ago. Among those with international travel plans, popular destinations of choice comprise of Europe (39 per cent), North America – specifically the USA or Canada (24 per cent), the UK (23 per cent), and New Zealand (18 per cent).

In addition, Nielsen Ad Intel data also shows that between April 2021 and March 2022 the travel and tourism industry spent $381 million on advertising in Australia. However, post-COVID, that increased by 60 per cent. In the last year, the sector has poured more than $608 million into advertising, with Qantas, Stayz, Airbnb, Flight Centre, and Virgin Australia topping the list of the biggest tourism and travel advertisers over that time.

When it comes to the nation’s domestic tourism boards, the agencies with the deepest ad pockets over the last 12 months were Tourism & Events Queensland, followed by Visit Victoria, Destination NSW, Western Australian Tourism Commission, South Australian Tourism Commission, Tourism Tasmania, and Northern Territory Tourist Commission.

Email the Travel Weekly team at [email protected]

Latest news.

- Tour Operators

TTC’s hosting a masterclass series for Aussie agents unlocking the secrets of its five brands

TTC Tour Brands is hosting a Masterclass series this May and June to make it ‘easy-as’ for agents to unlock all the tips and tricks of selling across its five brands. Across weekly Wednesday sessions TTC Tour Brands is shining a spotlight on selling its brands and Groups. Each Masterclass will provide a 15–20-minute key insight session […]

Dorsett Melbourne appoints new director of sales Maggie Wong

This top female team at the Dorsett Melbourne aims to take the hotel to new heights - even the lucky eighth floor.

Western Sydney Tourism unveils fresh board ahead of ’26 airport opening

'Connect-Stay-Experience', that's the Western Sydney's tourism taskforce's motto. We sort of prefer 'West Is Best'!

- Travel Agents

From Olympians to mindset coaches, Helloworld’s OMC conference wraps in style

Say hello to a good time and make sure you're at 2025's edition!

Bunnik Tours welcomes KJ Phillips as the new BDM for QLD

We apologise in advance for winding Karen up as our State of Origin sledging begins to ramp up.

Drifter to usher in new age of affordable hybrid accommodation in Christchurch

Sort of like a hostel, but far, far ritzier!

- Food & Beverage

Icebergs restaurateur Terzini joins Mangan at Sydney International Airport

Forget McDonald's or the sushi that's been there all day, dining at Sydney Airport just got a whole let better!

- Destinations

Sabi Sabi Earth Lodge: A beacon of luxury in the Kruger

If the lead image wasn't enough to convince you this is next-level luxury, take a peep inside.

- Conferences

Delegates ready for Africa’s travel showcase Travel Indaba at Durban ICC

How's it? We've requested a bag full of biltong on our reporter's return from this shindig.

APT’s world-first hydraulic-powered restaurant and bar ‘will be the envy of river cruises’

It may have been laughed off at first mention in the APT offices, but now it's here, APT are on top of the game!

Administrators appointed in wake of Air Vanuatu collapse – but there is hope

Another one bites the dust. We hope you sang to the tune when reading that!

South Australian beach crowned best ‘hidden gem’ in the country

Stoked baby! Or was that a typo?

- Road & Rail

Avalon Airport champions low-cost rail connection from Melbourne CBD

Avalon rail connection? Bring it on! In two years, say officials, but we say they've got Buckley's.

- Sustainability

2024 Green Revolution Summit brings travel heavyweights into green fuel discussion

It's almost like the organisers read our article on sustainable fuel this week.

Wendy Wu Tours first China mega-famil for 100 travel agents will be full of Wow!

China travel guru Wendy Wu should have no trouble ordering 100 dumplings for key travel agents on her mega famil.

Oaks Hotels & Resorts gets behind Netball’s Suncorp Super League

So Netball Australia draws its moral line somewhere between Gina Rinehart and Oaks Hotels & Resorts.

Tourism Australia appoints new regional general manager United Kingdom

Expat Aussie Andrew Boxall steps off a Flight Centre gig to plant the flag as UK Tourism Australia GM.

Chef Alessandro Pavoni unveils Cibaria at Manly Pacific MGallery Collection

Only problem is you'll get stuck on the Spit Bridge on the way back, after you finish your meal.

Hotel Review: Atlantis The Royal – Stunning in every sense

You can look but you can't touch. At least that's what it feels like when reading an article on this masterpiece.

Flight Centre’s Big Red Sale starts today

Flight Centre taking inspiration from Qantas' Red tail sale yesterday, someone's gotta change for the next round.

Aurora Expeditions announces savings for solo travellers

Save your money and travel and go solo, just don't spend it all buying friends at the bar.

Etihad and Tourism officials launch free Abu Dhabi Stopover

Etihad's giving you free hotel stays on your stopover while Qantas pays fines for ripping people off.

New MSC Australia boss talks hot topics for local cruisers, including the Caribbean

New MSC Australia boss, Antonio Paradiso, spills the Caribbeans on where he expects Aussie cruisers will go next.

Contiki’s latest campaign inspires travellers to engage with the world around them

Hands off! Influencers invited on holiday and told not to post anything. We can assure you they're back at it now.

Aussies a hit on the conference floor for IPW 2024

Diana Ross on opening night, Keanu's Dogstar band and a dozen lobster rolls. All in a week's work at IPW 2024.

Disney excited about prospects of cruise business as Disney Treasure nears completion

Disney's booming cruising business is set to knock Disneyland experiences out of the park.

Scoot’s first E190-E2 flights take off between Krabi and Hat Yai

When flying's a pitch. Airline lite Scoot offers a standard seat pitch of 29” on its new 112-seater.

Premium hotel operator ERDI launches it’s own academy in heart of Melbourne

ERDI expects to be shaken not stirred with the launch of its ERDI Academy in its Melbourne hotels.

Tropical North Queensland action-packed events calendar for adventure enthusiasts

Sporting enthusiasts and adventure seekers are gearing up for an action-packed year in Tropical North Queensland, with a lineup of sports events and adrenaline-pumping experiences set to take centre stage in 2024. Leading the charge is the highly-anticipated return of the Crankworx World Tour ‘Paradise Edition’ to Cairns from 22-26 May 2024. The mountain biking […]

Singapore Airlines Group first to receive SAF from Neste as AU/NZ play catchup

Singapore leaving many in their green dust. Here in Australia, we're hoping for a tortoise and the hare type outcome

Qantas Red Tail sale discounts more than 200,000 fares

Qantas marketers forever thankful to the team who chose the red and white colours. How else would they name a sale!

- Health & Wellness

Bannisters by the Sea unveils retreat style package for new mothers

Three hours in the car with a newborn from Sydney might be tough, but trust us, it'll be worth it when you arrive.

Nothing Bonza can do to prevent loss of planes, ACCC concerned by latest aviation developments

Going, going, gone. It seems...

APT offers destination incentives to enjoy the Best of Asia

Whether its a cocktail by the beach or a hike through the mountains, APT has you covered. You'll find us at the beach!

Disney Days returns with Inside Out 2 showing in Sydney, Brisbane, Melbourne and Auckland

Time is running out for agents to register their Expression of Interest to an exclusive screening of the much-anticipated Disney and Pixar film, Inside Out 2, hosted by Disney Destinations Australia/New Zealand team and partner United Airlines. Places are limited and applications must be in by 17 May. In addition to the screening of the […]

- Travel DAZE

Get ready to roll the marketing dice with Susan Coghill: Travel DAZE EXEC 2024

It's heating up in Cairns and we're not talking about the weather! Get ready for a marketing masterclass with Susan.

You are using an outdated browser

Please upgrade your browser or activate Google Chrome Frame to improve your experience.

Signing in with LinkedIn

Please wait while we sign you in with LinkedIn.

This may take some time.

Please be patient and do not refresh the page.

(A new window from LinkedIn should open for you to authorize the Travel Weekly login. If you don't see this please check behind this window, and if it is still not there check your browser settings and turn off the pop-up blocker.)

SUBSCRIBE NOW FOR FREE

Never miss a story again. Sign up for daily newsletter now.

Our Organisation

Our Careers

Tourism Statistics

Industry Resources

Media Resources

Travel Trade Hub

News Stories

Newsletters

Industry Events

Business Events

Consumer research

- Share Share on Facebook Share on Twitter Share on WhatsApp Copy Link

Explore the wide range of reports published by Tourism Australia, which cover key findings from Tourism Australia's commissioned research from a broad range of sources.

Additional global research undertaken in 2022 identifies the granular tourism experiences in demand post-pandemic across 20 markets.

While research has predominately focused on understanding international consumer demand, Tourism Australia has also included the domestic market in this research since 2016, whilst collaborating with State and Territory partners. Based on information gathered by the Consumer Demand Project Tourism Australia produces traveller profiles which are released annually to provide insights into the travel preferences and behaviours of consumers. Market specific traveller profiles are available on the market regions pages .

Undertaken in 2022 as the world opened back up to travel, Tourism Australia’s large-scale Future of Demand research was designed to support Australia’s tourism industry, to make decisions about where demand exists and ways to maximise the opportunities across 20 markets including Australia, New Zealand, Indonesia, Singapore, Malaysia, Hong Kong, China, South Korea, Japan, India, USA, Canada, United Kingdom, Germany, France and Italy, as well as the emerging markets of Taiwan, Thailand, Philippines and Vietnam.

Tourism Australia launched the Travel Sentiment Tracker in April 2020 as a new piece of research to help us understand shifting consumer behaviour and travel sentiment around COVID-19 and travel restrictions, across 16 markets including Australia, New Zealand, Indonesia, Singapore, Malaysia, Hong Kong, China, South Korea, Japan, India, USA, Canada, United Kingdom, Germany, France and Italy. Given the reopening of borders and commencement of travel, this additional research stopped in June 2022.

Insights from Tourism Australia’s research have been used extensively to inform and support development of Tourism Australia’s strategic direction and campaign development, as well as to inform the tourism industry of potential opportunities to build the value of Australian tourism.

Our target audiences

Our target audience is High Yield Travellers (HYT). They are willing to travel out of their region and spend more during their trip.

Future of Demand

The future of demand research has been designed to support australia’s tourism industry, to make decisions about where demand exists and ways to maximise the opportunities..

Find out more about how corporate business events decision makers view Australia, and the factors that motivate them to choose the destination for corporate events.

Discover more.

We use cookies on this site to enhance your user experience. Find out more .

By clicking any link on this page you are giving your consent for us to set cookies.

Acknowledgement of Country

We acknowledge the Traditional Aboriginal and Torres Strait Islander Owners of the land, sea and waters of the Australian continent, and recognise their custodianship of culture and Country for over 60,000 years.

*Disclaimer: The information on this website is presented in good faith and on the basis that Tourism Australia, nor their agents or employees, are liable (whether by reason of error, omission, negligence, lack of care or otherwise) to any person for any damage or loss whatsoever which has occurred or may occur in relation to that person taking or not taking (as the case may be) action in respect of any statement, information or advice given in this website. Tourism Australia wishes to advise people of Aboriginal and Torres Strait Islander descent that this website may contain images of persons now deceased.

- Travel Guides

- Top Destinations

- Inspiration & Ideas

- Booking Tips

- Packing Guide

- Where to stay

- At The Airport

- How-to Guides

- First Times

- Travel Community

- World Flavours

- Travel Products

Top 2022 Australia travel trends

Australia continues their aggressive reopening to the world, in this new era of travel, we can expect it to look a little different. While some things have remained the same since Australia travel slowed, both local and international, there is an eagerness to get back to the norm prior to the pandemic.

There are still the gloriously wide-open spaces and a very eager tourism industry eager to welcome guests. With that in mind, we wanted to include some insights from Tourism Australia’s Consumer Demand Project (CDP), which aims to understand how travellers choose a holiday destination, and what motivates them to travel.

READ MORE : We put together a simple Australia travel guide to help your planning

The latest findings have the usual focus on safety as the most important factor when planning a holiday, but also highlights some interesting finds about what the future of travel in the country could look like. When it comes to Australia travel, nearly 80 % of all travellers consider the country as a safe destination to visit, while 62 % see it as less impacted by the pandemic than most other countries – meaning a potential quick rebound for overseas travel to Australia.

Here are 3 trends that we thought were really interesting.

Australia travel trends 1: Travellers will focus on getting away from it all

Both local and overseas travellers to Australia may look to unplug and get away from the hustle and bustle of life. In today’s modern world, switching off is an ultimate indulgence and as a result more remote retreats and tiny houses have opened in regional areas across the country complementing Australia’s already incredible camping options.

Some of the options available are:

Tiny-home stays

While hundreds of petite abodes are now on offer across the country, some of the latest include South Australia’s Eco Eyre , two architect-designed eco-pods fitted with everything you need for a blissful beachside stay on the Eyre Peninsula.

There are also other options like Unyoked, which offers a natural remedy to modern life, with the latest of its tiny homes sitting among fragrant gums near Byron Bay on the New South Wales North Coast. Over in Western Australia, Windows Estate’s Petite Eco Cabin nestles among the vines of the Margaret River region.

Remote retreats

Only a layer of canvas separates you from some of Australia’s richest flora and fauna at lauded Bamurru Plains , set on the edge of Kakadu National Park in the Northern Territory. Come to be humbled by nature, with a good dose of luxury and fine dining.

Look at Western Australia, which is your gateway to swimming with whale sharks and humpbacks on Ningaloo Reef. You can also book luxury coastal retreats on newly opened Ettrick Rocks on Tasmania’s King Island promise wild and windswept vistas, and easy access to some of the country’s best cheese and seafood.

READ MORE : Here are some unique Australia tourist attractions for all travellers

Australia travel trends 2: Sustainability and regenerative travel

Today’s travellers are more aware than ever of the impacts of their adventures. In recent years, there has been a renewed focus on regenerative travel across Australia, which has seen more and more operators increase their focus on providing a sustainable and respectful experience for guests.

Whether you go slowly, tread lightly or give back, regenerative travel not only makes your trips more memorable, but also ensures that the destinations you travel to can be enjoyed by future generations of locals and visitors.

Help rewild Australia with your hotel stay

The team at Arkaba Conservancy are on a mission to protect wildlife through safaris of another kind in South Australia’s immense outback. Guests can hike to spot emus and wedge-tailed eagles, quolls and kangaroos. A percentage of Arkaba’s profits fund conservation projects, and you can accompany ecologists in the field, monitoring wildlife and surveying the land.

Similarly, all proceeds from your stay at Mornington Wilderness Camp are funnelled into protecting wildlife in the Kimberley region the tented retreat calls home. Enlist in research and land-management tours to spot Gouldian finches and red goshawks, or even join the lodge’s citizen science program.

Explore the wildlife conservation project

In Queensland, Mon Repos near Bundaberg is home to the largest concentration of nesting marine turtles on the eastern Australian mainland. Visit the Mon Repos Turtle Centre year-round to learn about its conservation, research and education projects.

Further south in New South Wales, informative hands-off visits to the Koala Hospital Port Macquarie support the rescue, rehabilitation and release of the adorable marsupials in its care.

In Tasmania, the fees to visit Devils@Cradle fund protection of the island state’s endangered Tasmanian devils, which roam the reserve’s vast natural habitat on the edge of UNESCO World Heritage-listed Cradle Mountain–Lake St Clair National Park.

Sign up for a citizen science tour

A number of citizen-science projects and tours empower visitors to collect and analyse data from nature on behalf of environmental researchers. From Victoria to the Northern Territory, Echidna Walkabout’s conservation tours let you monitor wildlife and restore habitats.

The newest tour, Island Birds & Whale Sharks , is an eight-day expedition off the coast of Exmouth in Western Australia’s Ningaloo region.

Travellers can track dolphin movements between pods on a private multi-day tour with Exceptional Kangaroo Island .

The South Australian operator’s Conservation Connection experience unites visitors to Kangaroo Island with top naturalists and researchers, providing unparalleled access to native wildlife.

Queensland’s FNQ Nature Tours ’ four-day Nature, Wildlife and Conservation Safari allows visitors to survey threatened spotted-tail quolls through the Wet Tropics World Heritage Area.

Australia travel trends 3: Australia’s extensive indigenous history

In recent years there has been a significant growth in the number of Aboriginal and Torres Strait Islander owned and operated travel experiences, and with it, Australia travel is seeing a more diverse range of experiences on offer. From wine and bush tucker tasting in the Margaret River, to Indigenous snorkelling tours of the Great Barrier Reef, Indigenous stargazing and relaxing hot springs experiences, there are unique and unexpected new experiences opening right across the country, all highlighting a whole new side of the world’s oldest living culture.

Before the pandemic, according to the International Visitor Survey, in 2019 alone, approximately 1.35 million international visitors took part in an Indigenous experience on their holiday – a figure that has grown by 5% each year, for the six years before it.

Take a dip in an incredible new hot spring

We all deserve a bit of pampering. There’s no better place to treat yourself than at the new Talaroo Hot Springs in Queensland’s Gulf Savannah region, where extraordinary geological wonders meet Aboriginal hospitality provided by its Ewamian Traditional Owners.

Sign up for new women-led Indigenous experiences

East Arnhem Land is one of the world’s last wilderness frontiers. Remote and beautiful, it nurtures a thriving Aboriginal community that female visitors can glimpse on Gay’Wu – The Dilly Bag Tour for Women . The five-day experience is hosted by Yolngu women who share their philosophies and tales of Aboriginal astrology, as well as inducting you into healing ceremonies while revealing traditional arts and medicinal native plants.

On the New South Wales North Coast, Arakwal Bundjalung Elder Delta Kay has launched walking tours in the Byron Bay region that offer similar insights, discussing the impact of colonisation on her ancestors, while providing lessons in Bundjalung language and sharing traditional tools and artefacts.

Learn the Indigenous stories of Sydney on a new bridge climb

Climbing one of the world’s most recognisable structures is a goosebump-inducing experience. Tackling the steps of the Sydney Harbour Bridge with an Aboriginal guide on BridgeClimb Sydney’s Burrawa Climb takes the occasion to new heights. Enjoy a bird’s-eye view over some of the city’s most significant Aboriginal sites while discovering Dreaming stories and learning the indigenous history of the New South Wales capital.

Taste native ingredients

Take a stroll on the tidal flats of King Sound in Western Australia’s Dampier Peninsula with Bardi man Terry Hunter of Borrgoron Coast to Creek Tours and discover the secret to sampling fresh oysters with the use of fire. On South Australia’s Fleurieu Peninsula, join a Traditional Custodian from Kool Tours to learn about the bush foods and medicines traditionally used by the Ngarrindjeri/Ramindjeri people.

In New South Wales, the new Firescreek Aboriginal Storytelling and Wine Tasting Experience led by Darkinjung Elder Kevin ‘Gavi’ Duncan takes guests on a sensory adventure blending bush foods, music and Dreaming stories. The experience is paired with a botanical wine tasting.

Get your adrenaline pumping

In New South Wales, join a Traditional Custodian from Wajaana Yaam Gumbaynggirr Adventure Tours for a new stand-up paddleboarding adventure on the culturally significant waterways of the Coffs Coast.

Further south, Wormi guides from Sand Dune Adventures lead exhilarating quad-bike adventures on Aboriginal lands in the Port Stephens area.

Choose your Australia travel plans wisely

2022 has a lot of potential for travel and Australia should definitely be in your travel plans. Whether it is to step away from work for a while or discover the natural and cultural background of the country, it is a smart choice.

- travel trends

RELATED ARTICLES

Discover the best cities in spain to visit in 2024, embracing sustainable travel: a guide to eco-friendly journeys and green tourism, phuket beaches you have to visit in 2024, latest articles, can you travel while taking weight loss medication, 10 travel hacks you have to know in 2024, most popular, mobile travel apps are growing in apac as the world embraces travel again, 14 best ideas on how to travel for cheap, best retro games for long flights, discovering kuching: a comprehensive travel guide for your sarawak adventure.

- Privacy Policy

- Terms Of Use

Copyright © 2024 Travel Wanderlust - All Rights Reserved.

Travel, Tourism & Hospitality

Domestic tourism in Australia - statistics & facts

Domestic travel behavior in australia, australia’s domestic travel hotspots, key insights.

Detailed statistics

Leading holiday destinations of domestic overnight visitors Australia 2023

Leading business trip destinations of domestic overnight visitors Australia 2023

Domestic visitor contribution to direct tourism GDP Australia FY 2014-2023

Editor’s Picks Current statistics on this topic

Current statistics on this topic.

Number of domestic visitor nights Australia 2023, by accommodation type

Domestic overnight tourist trip expenditure Australia 2023, by state or territory

Events attendance of overnight tourists to Sydney, Australia FY 2023, by visitor type

Related topics

Tourism in anz.

- Travel and tourism industry in Australia

- Travel accommodation in Australia

- Camping and caravanning in Australia

- Restaurant and food service in Australia

- Travel and tourism in New Zealand

- Hotel industry recovery post COVID-19 in New Zealand

- Tourism worldwide

- Sustainable tourism worldwide

- Luxury travel and tourism worldwide

- Hotel industry worldwide

- Cruise industry worldwide

Recommended statistics

- Basic Statistic Direct tourism GDP Australia FY 2006-2023

- Basic Statistic Domestic visitor contribution to direct tourism GDP Australia FY 2014-2023

- Basic Statistic Domestic tourism share of direct tourism GDP Australia FY 2014 to 2023

- Premium Statistic Number of domestic overnight visitors Australia 2014-2023

- Premium Statistic Number of domestic day visitors Australia 2014-2023

Direct tourism GDP Australia FY 2006-2023

Direct tourism gross domestic product (GDP) in Australia from financial year 2006 to 2023 (in billion Australian dollars)

Domestic visitor contribution to direct tourism gross domestic product (GDP) in Australia from financial year 2014 to 2023 (in billion Australian dollars)

Domestic tourism share of direct tourism GDP Australia FY 2014 to 2023

Domestic tourism share of the direct tourism gross domestic product (GDP) in Australia from financial year 2014 to 2023

Number of domestic overnight visitors Australia 2014-2023

Number of domestic overnight visitors in Australia from 2014 to 2023 (in millions)

Number of domestic day visitors Australia 2014-2023

Number of domestic day visitors in Australia from 2014 to 2023 (in millions)

Domestic overnight trips

- Premium Statistic Leading destinations of domestic overnight visitors Australia 2023

- Premium Statistic Leading destinations for domestic overnight visitor expenditure Australia 2023

- Premium Statistic Number of domestic overnight visitors Australia 2023, by state visited

- Premium Statistic Number of domestic overnight visitors Australia 2023, by purpose of visit

Leading destinations of domestic overnight visitors Australia 2023

Leading destinations visited by domestic overnight visitors in Australia in 2023 (in 1,000s)

Leading destinations for domestic overnight visitor expenditure Australia 2023

Leading destinations for domestic overnight visitor expenditure in Australia in 2023 (in billion Australian dollars)

Number of domestic overnight visitors Australia 2023, by state visited

Number of domestic overnight visitors in Australia in 2023, by state visited (in millions)

Number of domestic overnight visitors Australia 2023, by purpose of visit

Number of domestic overnight visitors in Australia in 2023, by purpose of visit (in millions)

Domestic day trips

- Premium Statistic Leading destinations of domestic visitors on day trips Australia 2023

- Premium Statistic Leading destinations for domestic day visitor expenditure Australia 2023

- Premium Statistic Number of domestic day visitors Australia 2023, by state visited

- Premium Statistic Number of domestic day visitors Australia 2023, by purpose of visit

Leading destinations of domestic visitors on day trips Australia 2023

Leading destinations visited by domestic visitors on day trips in Australia in 2023 (in 1,000s)

Leading destinations for domestic day visitor expenditure Australia 2023

Leading destinations for domestic day visitor expenditure in Australia in 2023 (in billion Australian dollars)

Number of domestic day visitors Australia 2023, by state visited

Number of domestic day visitors in Australia in 2023, by state visited (in millions)

Number of domestic day visitors Australia 2023, by purpose of visit

Number of domestic day visitors in Australia in 2023, by purpose of visit (in millions)

Domestic tourism in New South Wales

- Premium Statistic Number of domestic overnight visitors NSW Australia 2023, by region visited

- Premium Statistic Domestic overnight visitor expenditure NSW Australia 2023, by region visited

- Premium Statistic Number of domestic overnight visitors NSW Australia 2023, by purpose of visit

- Premium Statistic Number of domestic visitors Sydney, Australia 2014-2023, by type of trip

- Premium Statistic Number of domestic overnight visitors Sydney, Australia 2014-2023, by purpose

Number of domestic overnight visitors NSW Australia 2023, by region visited

Number of domestic overnight visitors to New South Wales, Australia in 2023, by region visited (in millions)

Domestic overnight visitor expenditure NSW Australia 2023, by region visited

Domestic overnight visitor expenditure in New South Wales, Australia in 2023, by region visited (in million Australian dollars)

Number of domestic overnight visitors NSW Australia 2023, by purpose of visit

Number of domestic overnight visitors to New South Wales, Australia in 2023, by purpose of visit (in millions)

Number of domestic visitors Sydney, Australia 2014-2023, by type of trip

Number of domestic visitors to Sydney, Australia from 2014 to 2023, by type of trip (in millions)

Number of domestic overnight visitors Sydney, Australia 2014-2023, by purpose

Number of domestic overnight visitors to Sydney, Australia from 2014 to 2023, by purpose of visit (in 1,000s)

Domestic tourism in Queensland

- Premium Statistic Number of domestic overnight visitors Queensland Australia 2023, by region visited

- Premium Statistic Domestic overnight visitor expenditure Queensland Australia 2023, by region visited

- Premium Statistic Number of domestic overnight visitors Queensland Australia 2023, by purpose of visit

- Premium Statistic Number of domestic visitors Brisbane, Australia 2018-2023, by type of trip

- Premium Statistic Number of domestic overnight visitors Brisbane, Australia 2018-2023, by purpose

Number of domestic overnight visitors Queensland Australia 2023, by region visited

Number of domestic overnight visitors to Queensland, Australia in 2023, by region visited (in millions)

Domestic overnight visitor expenditure Queensland Australia 2023, by region visited

Domestic overnight visitor expenditure in Queensland, Australia in 2023, by region visited (in million Australian dollars)

Number of domestic overnight visitors Queensland Australia 2023, by purpose of visit

Number of domestic overnight visitors to Queensland, Australia in 2023, by purpose of visit (in millions)

Number of domestic visitors Brisbane, Australia 2018-2023, by type of trip

Number of domestic visitors to Brisbane, Australia from 2018 to 2023, by type of trip (in millions)

Number of domestic overnight visitors Brisbane, Australia 2018-2023, by purpose

Number of domestic overnight visitors to Brisbane, Australia from 2018 to 2023, by purpose of visit (in 1,000s)

Domestic tourism in Victoria

- Premium Statistic Number of domestic overnight visitors Victoria Australia 2023, by region visited

- Premium Statistic Domestic overnight visitor expenditure Victoria Australia 2023, by region visited

- Premium Statistic Number of domestic overnight visitors Victoria Australia 2023, by purpose of visit

- Premium Statistic Number of domestic visitors Melbourne, Australia 2018-2023, by type of trip

- Premium Statistic Number of domestic overnight visitors Melbourne, Australia 2018-2023, by purpose

Number of domestic overnight visitors Victoria Australia 2023, by region visited

Number of domestic overnight visitors to Victoria, Australia in 2023, by region visited (in millions)

Domestic overnight visitor expenditure Victoria Australia 2023, by region visited

Domestic overnight visitor expenditure in Victoria, Australia in 2023, by region visited (in million Australian dollars)

Number of domestic overnight visitors Victoria Australia 2023, by purpose of visit

Number of domestic overnight visitors to Victoria, Australia in 2023, by purpose of visit (in millions)

Number of domestic visitors Melbourne, Australia 2018-2023, by type of trip

Number of domestic visitors to Melbourne, Australia from 2018 to 2023, by type of trip (in millions)

Number of domestic overnight visitors Melbourne, Australia 2018-2023, by purpose

Number of domestic overnight visitors to Melbourne, Australia from 2018 to 2023, by purpose of visit (in 1,000s)

Domestic tourism in Western Australia

- Premium Statistic Number of domestic overnight visitors Western Australia 2023, by region visited

- Premium Statistic Domestic overnight visitor expenditure Western Australia 2023, by region visited

- Premium Statistic Number of domestic overnight visitors Western Australia 2023, by purpose of visit

- Premium Statistic Number of domestic visitors Perth, Australia 2018-2023, by type of trip

- Premium Statistic Number of domestic overnight visitors Perth, Australia 2018-2023, by purpose

Number of domestic overnight visitors Western Australia 2023, by region visited

Number of domestic overnight visitors to Western Australia in 2023, by region visited (in millions)

Domestic overnight visitor expenditure Western Australia 2023, by region visited

Domestic overnight visitor expenditure in Western Australia in 2023, by region visited (in million Australian dollars)

Number of domestic overnight visitors Western Australia 2023, by purpose of visit

Number of domestic overnight visitors to Western Australia in 2023, by purpose visit (in millions)

Number of domestic visitors Perth, Australia 2018-2023, by type of trip

Number of domestic visitors to Perth, Australia from 2018 to 2023, by type of trip (in millions)

Number of domestic overnight visitors Perth, Australia 2018-2023, by purpose

Number of domestic overnight visitors to Perth, Australia from 2018 to 2023, by purpose of visit (in 1,000s)

Domestic tourism in South Australia

- Premium Statistic Number of domestic overnight visitors South Australia 2023, by region visited

- Premium Statistic Domestic overnight visitor expenditure South Australia 2023, by region visited

- Premium Statistic Number of domestic overnight visitors South Australia 2023, by purpose of visit

- Premium Statistic Number of domestic visitors Adelaide, Australia 2018-2023, by type of trip

- Premium Statistic Number of domestic overnight visitors Adelaide, Australia 2018-2023, by purpose

Number of domestic overnight visitors South Australia 2023, by region visited

Number of domestic overnight visitors to South Australia in 2023, by region visited (in 1,000s)

Domestic overnight visitor expenditure South Australia 2023, by region visited

Domestic overnight visitor expenditure in South Australia in 2023, by region visited (in million Australian dollars)

Number of domestic overnight visitors South Australia 2023, by purpose of visit

Number of domestic overnight visitors to South Australia in 2023, by purpose of visit (in millions)

Number of domestic visitors Adelaide, Australia 2018-2023, by type of trip

Number of domestic visitors to Adelaide, Australia from 2018 to 2023, by type of trip (in millions)

Number of domestic overnight visitors Adelaide, Australia 2018-2023, by purpose

Number of domestic overnight visitors to Adelaide, Australia from 2018 to 2023, by purpose of visit (in 1,000s)

Domestic tourism in Tasmania

- Premium Statistic Number of domestic overnight visitors Tasmania Australia 2023, by region visited

- Premium Statistic Domestic overnight visitor expenditure Tasmania Australia 2014-2023

- Premium Statistic Number of domestic overnight visitors Tasmania Australia 2023, by purpose of visit

- Premium Statistic Number of domestic visitors Hobart, Australia 2018-2023, by type of trip

- Premium Statistic Number of domestic overnight visitors Hobart, Australia 2018-2023, by purpose

Number of domestic overnight visitors Tasmania Australia 2023, by region visited

Number of domestic overnight visitors to Tasmania, Australia in 2023, by region visited (in millions)

Domestic overnight visitor expenditure Tasmania Australia 2014-2023

Domestic overnight visitor expenditure in Tasmania, Australia from 2014 to 2023 (in billion Australian dollars)

Number of domestic overnight visitors Tasmania Australia 2023, by purpose of visit

Number of domestic overnight visitors to Tasmania, Australia in 2023, by purpose visit (in millions)

Number of domestic visitors Hobart, Australia 2018-2023, by type of trip

Number of domestic visitors to Hobart, Australia from 2018 to 2023, by type of trip (in millions)

Number of domestic overnight visitors Hobart, Australia 2018-2023, by purpose

Number of domestic overnight visitors to Hobart, Australia from 2018 to 2023, by purpose of visit (in 1,000s)

Further reports Get the best reports to understand your industry

Get the best reports to understand your industry.

- Travel and tourism in Australia

- London as a UK tourism hotspot

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

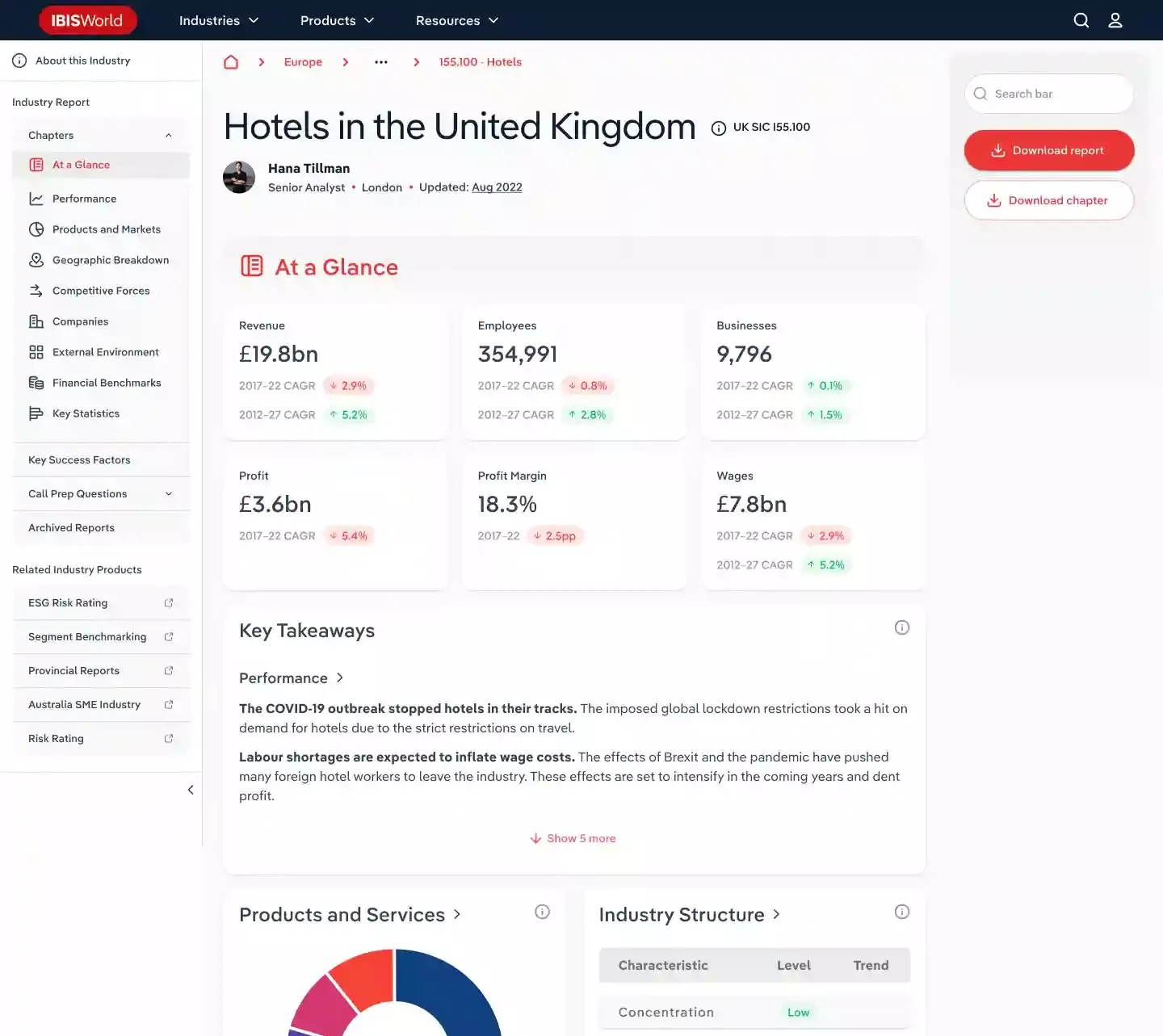

Tourism in Australia - Market Size, Industry Analysis, Trends and Forecasts (2024-2029)

Instant access to hundreds of data points and trends.

- Market estimates from

- Competitive analysis, industry segmentation, financial benchmarks

- Incorporates SWOT, Porter's Five Forces and risk management frameworks

- PDF report or online database with Word, Excel and PowerPoint export options

100% money back guarantee

Industry statistics and trends.

Access all data and statistics with purchase. View purchase options.

Tourism in Australia

Industry Revenue

Total value and annual change from . Includes 5-year outlook.

Access the 5-year outlook with purchase. View purchase options

Trends and Insights

Market size is projected to over the next five years.

Market share concentration for the Tourism industry in Australia is , which means the top four companies generate of industry revenue.

The average concentration in the sector in Australia is .

Products & Services Segmentation

Industry revenue broken down by key product and services lines.

Ready to keep reading?

Unlock the full report for instant access to 30+ charts and tables paired with detailed analysis..

Or contact us for multi-user and corporate license options

Table of Contents

About this industry, industry definition, what's included in this industry, industry code, related industries, domestic industries, competitors, complementors, international industries, performance, key takeaways, revenue highlights, employment highlights, business highlights, profit highlights, current performance.

What's driving current industry performance in the Tourism in Australia industry?

What's driving the Tourism in Australia industry outlook?

What influences volatility in the Tourism in Australia industry?

- Industry Volatility vs. Revenue Growth Matrix

What determines the industry life cycle stage in the Tourism in Australia industry?

- Industry Life Cycle Matrix

Products and Markets

Products and services.

- Products and Services Segmentation

How are the Tourism in Australia industry's products and services performing?

What are innovations in the Tourism in Australia industry's products and services?

Major Markets

- Major Market Segmentation

What influences demand in the Tourism in Australia industry?

International Trade

- Industry Concentration of Imports by Country

- Industry Concentration of Exports by Country

- Industry Trade Balance by Country

What are the import trends in the Tourism in Australia industry?

What are the export trends in the Tourism in Australia industry?

Geographic Breakdown

Business locations.

- Share of Total Industry Establishments by Region ( )

Data Tables

- Number of Establishments by Region ( )

- Share of Establishments vs. Population of Each Region

What regions are businesses in the Tourism in Australia industry located?

Competitive Forces

Concentration.

- Combined Market Share of the Four Largest Companies in This Industry ( )

- Share of Total Enterprises by Employment Size

What impacts market share in the Tourism in Australia industry?

Barriers to Entry

What challenges do potential entrants in the Tourism in Australia industry?

Substitutes

What are substitutes in the Tourism in Australia industry?

Buyer and Supplier Power

- Upstream Buyers and Downstream Suppliers in the Tourism in Australia industry

What power do buyers and suppliers have over the Tourism industry in Australia?

Market Share

Top companies by market share:

- Market share

- Profit Margin

Company Snapshots

Company details, summary, charts and analysis available for

Company Details

- Total revenue

- Total operating income

- Total employees

- Industry market share

Company Summary

- Description

- Brands and trading names

- Other industries

What's influencing the company's performance?

External Environment

External drivers.

What demographic and macroeconomic factors impact the Tourism in Australia industry?

Regulation and Policy

What regulations impact the Tourism in Australia industry?

What assistance is available to the Tourism in Australia industry?

Financial Benchmarks

Cost structure.

- Share of Economy vs. Investment Matrix

- Depreciation

What trends impact cost in the Tourism in Australia industry?

Financial Ratios

- 3-4 Industry Multiples (2018-2023)

- 15-20 Income Statement Line Items (2018-2023)

- 20-30 Balance Sheet Line Items (2018-2023)

- 7-10 Liquidity Ratios (2018-2023)

- 1-5 Coverage Ratios (2018-2023)

- 3-4 Leverage Ratios (2018-2023)

- 3-5 Operating Ratios (2018-2023)

- 5 Cash Flow and Debt Service Ratios (2018-2023)

- 1 Tax Structure Ratio (2018-2023)

Data tables

- IVA/Revenue ( )

- Imports/Demand ( )

- Exports/Revenue ( )

- Revenue per Employee ( )

- Wages/Revenue ( )

- Employees per Establishment ( )

- Average Wage ( )

Key Statistics

Industry data.

Including values and annual change:

- Revenue ( )

- Establishments ( )

- Enterprises ( )

- Employment ( )

- Exports ( )

- Imports ( )

Frequently Asked Questions

What is the market size of the tourism industry in australia.

The market size of the Tourism industry in Australia is measured at in .

How fast is the Tourism in Australia market projected to grow in the future?

Over the next five years, the Tourism in Australia market is expected to . See purchase options to view the full report and get access to IBISWorld's forecast for the Tourism in Australia from up to .

What factors are influencing the Tourism industry in Australia market trends?

Key drivers of the Tourism in Australia market include .

What are the main product lines for the Tourism in Australia market?

The Tourism in Australia market offers products and services including .

Which companies are the largest players in the Tourism industry in Australia?

Top companies in the Tourism industry in Australia, based on the revenue generated within the industry, includes .

How many people are employed in the Tourism industry in Australia?

The Tourism industry in Australia has employees in Australia in .

How concentrated is the Tourism market in Australia?

Market share concentration is for the Tourism industry in Australia, with the top four companies generating of market revenue in Australia in . The level of competition is overall, but is highest among smaller industry players.

Methodology

Where does ibisworld source its data.

IBISWorld is a world-leading provider of business information, with reports on 5,000+ industries in Australia, New Zealand, North America, Europe and China. Our expert industry analysts start with official, verified and publicly available sources of data to build an accurate picture of each industry.

Each industry report incorporates data and research from government databases, industry-specific sources, industry contacts, and IBISWorld's proprietary database of statistics and analysis to provide balanced, independent and accurate insights.

IBISWorld prides itself on being a trusted, independent source of data, with over 50 years of experience building and maintaining rich datasets and forecasting tools.

To learn more about specific data sources used by IBISWorld's analysts globally, including how industry data forecasts are produced, visit our Help Center.

Deeper industry insights drive better business outcomes. See for yourself with your report or membership purchase.

Discover how 30+ pages of industry data and analysis can give you the edge you need..

Australia & New Zealand travel and tourism statistics in 2023

By Kevin Tjoe — 29 Jun 2023

studies travel statistics

With the global travel restrictions gradually easing, the year 2022 witnessed a reset for the travel and tourism industry in Australia and New Zealand (ANZ). Both countries have welcomed tourists back, eagerly embracing the return of travellers and reinvigorating their local economies. As we look ahead to 2023 and beyond, it is evident that people’s perceptions and travel habits in these regions have undergone a significant shift.

In this article, we’ll dive into the key travel and tourism trends that will shape the industry in Australia and New Zealand in 2023. These statistics serve as a valuable resource for tour and activity operators in these countries, providing insights to adapt their businesses to the latest trends specific to the local market. From travel intentions and behaviours to preferences and emerging technologies, understanding these trends will empower industry professionals to meet the evolving needs and desires of travellers in Australia and New Zealand.

The tourism and travel statistics below were gathered from a survey conducted by Rezdy.

1. Travel intentions and behaviours

Discover the latest trends in travel intentions and behaviours that have shaped the industry in recent times. Gain insights into the shifting preferences of travellers, their booking habits, and the factors influencing their travel decisions such as the impact of cost of living pressures and willingness to spend more on experiences.

By understanding these trends, operators can tailor their offerings to align with the evolving needs and preferences of ANZ travellers.

Travel plans and bookings:

- 90% of Australians plan to travel domestically or internationally in 2023 ( Travel Weekly )

- Over 50% of Australians are planning to take a holiday in the next three months, but 52% haven’t booked anything yet ( News Corp )

- 32% of travellers booked more than seven months in advance, compared to 20% the previous year ( News Corp )

- 56.86% plan on travelling to a country they haven’t visited before ( Travel Weekly )

- 58% of respondents say their travel plans remain the same despite the cost of living pressures ( Travel Weekly )

- 60% of respondents are willing to spend more on experiences while on holiday ( Travel Weekly )

- 1 in 4 Gen Zers are looking for a bucket-list type holiday. The value of experts and great service is in high demand since Gen Zers are planning to “go all out”. That means a significant opportunity to build loyalty, particularly with younger travel segments ( News Corp )

- 1 in 4 consumers are planning the same number of holidays in 2023 as in 2022 ( Skyscanner AU )

- 46% are thinking of going on more trips next year ( Skyscanner AU )

- 69% plan to spend the same or more on travel abroad in 2023 ( Skyscanner AU )

- 46% of Australians plan to splash the cash to make sure every experience while travelling is the absolute ultimate ( Finder )

- 75% of travellers in the Asia Pacific (APAC) region are keen to travel as much as possible in the near future and search interest in “international accommodation” are rising by 144% in Australia and 181% in New Zealand ( Think with Google )

- 48% of people said social media influences where they go next ( Skyscanner AU )

- The preferred platforms among Australians include Booking Holdings Network (37%), TripAdvisor (27%), Virgin Travel and Tourism (20%), and Expedia (15%) for travel packages ( Nielsen )

Influence of streaming services:

- 69% of Australians have considered and 29% have booked trips to destinations after seeing them on streamed shows or movies ( Expedia Travel Trends )

- 26% of Australians say the influence of streaming services on their travel plans has increased in the last 12 months ( Expedia Travel Trends )

- 61% of Kiwis have considered booking a trip to a destination after seeing it in a streamed movie or show, while 21% have already booked ( Expedia )

- 20% of Kiwis said the influence of streaming services on their travel plans had increased over the last 12 months ( Expedia )\

- Set-jetters/Binge tourism: over two-thirds (69%) of Australians consider and book trips to destinations after seeing them on streamed shows or movies ( TheLatch)

2. Inbound and outbound travel

Australia’s biggest percentage of inbound travellers come from:

- United Kingdom

- United States

- New Zealand

( Think with Google )

Australia’s popular outbound destinations in 2023:

Emerging destinations from Australia for families and couples: