- Customer Service

- En Español

Securities and other investment and insurance products are: not a deposit; not FDIC insured; not insured by any federal government agency; not guaranteed by TD Bank, N.A. or any of its affiliates; and, may be subject to investment risk, including possible loss of value.

©2016 TD Bank, N.A. All Rights Reserved.

By logging into your account, you agree to our Terms of Use and Privacy Policy , and the use of cookies as described therein.

Canadians - TD Canada Trust No-Fee Travellers Cheques with Visa

Contact Us - Manage Preferences Archive - Advertising - Cookie Policy - Privacy Statement - Terms of Service -

This site is owned, operated, and maintained by MH Sub I, LLC dba Internet Brands. Copyright © 2024 MH Sub I, LLC dba Internet Brands. All rights reserved. Designated trademarks are the property of their respective owners.

- Search Search Please fill out this field.

What Is a Traveler’s Check?

- How It Works

- Where to Get Traveler's Checks

- Where to Cash Traveler's Checks

- Pros and Cons

- Alternatives to Traveler's Checks

The Bottom Line

- Personal Finance

Traveler's Check: What It Is, How It's Used, Where to Buy

Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

:max_bytes(150000):strip_icc():format(webp)/Julia_Kagan_BW_web_ready-4-4e918378cc90496d84ee23642957234b.jpg)

Investopedia / Eliana Rodgers

A traveler’s check (sometimes spelled "cheque") is a once-popular but now largely outmoded medium of exchange utilized as an alternative to hard currency and intended to aid tourists. The product is typically used by people on vacation in foreign countries. It offers a safe way to travel overseas without the risks associated with losing cash. The issuing party, usually a bank, provides security against lost or stolen checks.

Traveler’s checks have increasingly been supplanted by credit cards and prepaid debit cards.

Key Takeaways

- Traveler’s checks are a form of payment issued by financial institutions.

- These paper cheques are generally used by people when traveling to foreign countries.

- They are purchased for set amounts and can be used to buy goods or services or be exchanged for cash.

- If your traveler's check is lost or stolen it can readily be replaced.

- Once widely used, traveler’s checks have largely been supplanted today by prepaid debit cards and credit cards.

How Traveler’s Checks Work

A traveler’s check is for a prepaid fixed amount and operates like cash, so a purchaser can use it to buy goods or services when traveling. A customer can also exchange a traveler’s check for cash. Major financial service institutions issue traveler’s checks, and banks and credit unions sell them, though their ranks have significantly dwindled today.

A traveler’s check is similar to a regular check because it has a unique check number or serial number. When a customer reports a check stolen or lost, the issuing company cancels that check and provides a new one.

They come in several fixed denominations in a variety of currencies, making them a safeguard in countries with fluctuating exchange rates , and they do not have an expiration date. They are not linked to a customer’s bank account or line of credit and do not contain personally identifiable information, therefore eliminating the risk of identity theft. They operate via a dual signature system. You sign them when you purchase them, and then you sign them again when you cash them, which is designed to prevent anyone other than the purchaser from using them.

Many banks, hotels, and retailers used to accept them as cash, although some banks charged fees to cash them. However, with the rising worldwide use of credit cards and prepaid debit cards—such as the Visa TravelMoney card, which offers zero liability for its unauthorized use—it is getting much harder to find institutions that will cash traveler’s checks.

History of Traveler’s Checks

James C. Fargo, the president of the American Express Company, was a wealthy, well-known American who was unable to get checks cashed during a trip to Europe. In 1891, a company employee, Marcellus F. Berry, believed that the solution for taking money overseas required a check with the signature of the bearer and devised a product for it. American Express and Visa still use the British spelling on their products.

Where to Get Traveler's Checks

Companies that still issue traveler's checks today include Visa and AAA . They often come with a purchase fee. AAA now offers members pre-paid international Visa cards instead of paper checks.

In the U.S., they are available primarily from American Express locations. You can also buy traveler's checks online from the American Express website, but you need to be registered with an account. Visa offers traveler's checks at Citibank locations nationwide, as well as at several other banks.

American Express, Visa, and AAA are among the companies that still issue traveler’s checks.

Where to Cash Traveler's Checks

If you want to convert your traveler's checks into cash (instead of spending them directly), you can often deposit them normally at your bank. Many hotel or resort lobbies will also provide this service to guests at no charge. American Express also provides a service to redeem traveler's checks that they issue online to be deposited into your bank account.

Advantages and Disadvantages of Traveler's Checks

Traveler's checks are handy for tourists who do not want to risk losing their cash or having it stolen while abroad. Because traveler's checks can be reported lost or stolen and the funds replaced, they provide peace of mind. This was particularly a concern before credit cards and ATMs were widespread and affordable worldwide for most travelers. At the same time, these paper checks are now a bit outdated and come with a fee to purchase, making them potentially more expensive and cumbersome than using plastic or electronic payments.

Replaced if lost or stolen

Widely accepted around the world

Convenient to use

They don't expire

Must have the physical check to use it

Incurs a fee to purchase

Limited number of issuers today

Alternatives to Traveler's Checks

The most obvious alternative is to use a credit or debit card issued by a bank that works worldwide and charges low or no foreign exchange fees on purchases or ATM withdrawals. If your bank doesn't allow for this or charges high fees, then prepaid travel cards are the modern version of traveler’s checks. They allow you to get local currency from ATMs and make purchases with merchants—effectively eliminating the need for traveler’s checks.

Prepaid cards are not linked to your bank account, which prevents anybody from draining your checking account if the card gets lost or stolen—and you can’t go into debt. Credit cards offer similar (or better) protection, but you might not want to use your everyday card abroad. By using a dedicated travel card, you avoid spreading your card numbers around, which means you can be less vigilant about monitoring your accounts when you get back home. Visa and MasterCard both offer prepaid cards designed for use abroad. Those cards are available online, through travel agents, and at banks or credit unions.

Travel cards should feature low ATM fees, technology that lets you operate like a local in foreign countries, emergency cash when you lose the card, and “zero liability” fraud protection. That said, prepaid cards can be expensive, so you need to compare fees against your other cards to decide whether or not a travel card makes sense.

For U.S. citizens living abroad for extended periods, maintaining checking and other bank accounts in the United States provides several advantages, and many checking accounts are friendly for foreign transactions .

Where Do You Buy Traveler's Checks?

You can buy still buy traveler's checks from Visa and a handful of other financial institutions. To buy them, visit a location or check the website of an issuing institution. You may need a photo ID in order to set up an account.

How Do You Cash Traveler's Checks?

Some hotels, resorts, and currency traders will cash traveler's checks in exchange for local currency. However, with the rising prevalence of credit and debit cards fewer locations cash traveler's checks.

What Do You Do With Traveler's Checks?

Traveler's checks are a secure way of carrying money while abroad. Many businesses in the tourism industry will cash traveler's checks, and they can also be deposited into a bank account. Because the checks can be easily replaced, they have a lower risk of theft or loss. However, traveler's checks have fallen out of favor due to the increased convenience of credit cards and prepaid debit cards.

Traveler's checks were once a popular way to carry money while vacationing abroad. They are sold in fixed denominations, and can be used for purchases or cashed like an ordinary check. Traveler's checks can be easily replaced, making them less risky than carrying large amounts of cash. However, they have fallen out of favor due to the convenience of using credit or debit cards.

Sparks, Evan. “ Nine Young Bankers Who Changed America: Marcellus Flemming Berry .” ABA Banking Journal, June 26, 2017.

Time Magazine. " Travel (April, 1956): The Host with the Most ."

American Express. " Travelers Cheques ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1214857151-7489c879345246b0bacefaf1d88a3738.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Capital One Main Navigation

- Learn & Grow

- Life Events

- Money Management

- More Than Money

- Privacy & Security

- Business Resources

All about traveler’s checks, plus modern alternatives

January 18, 2024 | 1 min video

Getting ready to travel? One thing to think about is how you’ll make purchases while you’re away. Traveler’s checks aren’t as common as they used to be. So you might want to consider modern alternatives that may offer the advantages of traveler’s checks and more.

Read on to learn more about the ins and outs of traveler’s checks. And find out about other options—for example, credit cards, prepaid cards and mobile wallets—that could help make the most of your trip.

Key takeaways

- Traveler’s checks are paper documents that can be exchanged for local currency or used to buy goods and services abroad.

- Traveler’s checks feature unique serial numbers, making them replaceable if they’re lost or stolen.

- Fees may apply when purchasing and exchanging traveler’s checks.

- There are modern alternatives to traveler’s checks that you may find more convenient.

Earn 75,000 bonus miles

Redeem your miles for flights, vacation rentals and more. Terms apply.

What is a traveler’s check?

A traveler’s check is a paper document you can use for making purchases when you’re traveling, typically in other countries. It can be used as cash or a regular check.

Traveler’s checks—you may also see them referred to as “cheques”—are generally printed with a unique serial number. This means you may be able to get a refund if your checks are lost or stolen. The checks are usually available in set denominations—$20 and $50, for example.

How do traveler’s checks work?

Traveler’s checks may be accepted at participating merchants like hotels, restaurants and stores. Just keep in mind that there could be fewer participating merchants than there used to be.

When you purchase your checks, you may notice that they have a space for two signatures:

- First signature: You might be asked to sign each of your traveler’s checks when you buy them. If not, you may want to sign them as soon as possible.

- Second signature: You’ll usually sign your traveler’s checks again when you’re making purchases.

This dual signature method is meant to provide extra security and ensure that only the purchaser is able to use them. The merchant can verify that the second signature matches the first.

How to cash in traveler’s checks

You can use traveler’s checks like cash to pay for goods and services at participating merchants. You’ll typically sign the check in front of the merchant at the time of the purchase.

While traveling, you may also be able to redeem your traveler’s checks for local currency at financial institutions or your hotel.

Potential fees associated with traveler’s checks

It’s possible that certain fees may apply to traveler’s checks. For example, you may need to pay a fee when you purchase them or when you exchange them for currency once you get to your destination. There might also be a fee for depositing unused checks into your bank account.

Where to get traveler’s checks

While traveler’s checks might be harder to find than they used to be, they’re still available. You may be able to purchase them at some banks, credit unions and travel-related service organizations.

Pros and cons of traveler’s checks

Take a look at some of the potential pros and cons of traveler’s checks:

When to use a traveler’s check

You might consider using traveler’s checks in certain situations, including:

- When you don’t have a credit or debit card. Some people may prefer to travel using modern payment options like credit and debit cards. But if you don’t have either, you may find traveler’s checks to be an acceptable alternative.

- When you can’t access an ATM. If you find yourself in a place that doesn’t have an ATM on every corner, you can instead use your checks at merchants that accept them.

- When you want to exchange them for local currency. When you get to where you’re going, you might want to have some local currency on hand. You may be able to exchange your traveler’s checks for currency at certain banks or other financial institutions.

Modern alternatives to traveler’s checks

There are a number of alternatives to traveler’s checks—options you may find faster, easier and more convenient. Here are a few to consider when you’re comparing your choices:

Credit cards

Carrying a credit card may be easier than carrying traveler’s checks. Plus, credit cards can be helpful for making large and online travel purchases like plane tickets and hotel reservations. That’s especially true with travel credit cards , which you could use to earn rewards on travel-related purchases.

Some credit cards may also come with benefits that could be useful while traveling. They might include things like protection from unauthorized charges and the ability to use a mobile app to track your purchases .

Keep in mind that foreign transaction fees may come into play when you use your credit card overseas. While this fee might vary between credit card companies, it could generally be in the range of 1%-3% of your purchase. You may also be charged a currency conversion fee. This fee is often part of a foreign transaction fee.

Some companies don’t charge foreign transaction fees. For example, none of Capital One’s U.S.-issued credit cards charge this fee. View important rates and disclosures .

If you’re traveling with your credit card, your credit card issuer may want to be alerted before you go. That’s because it might flag your purchases as fraudulent if it notices purchases made in an unfamiliar location. Thanks to the added security of its chip cards, Capital One doesn’t require this notification.

See if you’re pre-approved

Check for pre-approval offers with no risk to your credit score.

Debit cards

When you’re traveling, a debit card can be just as easy to carry around as a credit card. And like a credit card, it can help protect against fraud.

The big difference: A credit card lets you “borrow” money for purchases, while a debit card uses the money in your checking account to make purchases.

It may be helpful to carry a debit card when you’re visiting a country that generally favors cash transactions. In that case, you could use your debit card at an ATM to get cash once you’ve reached your destination. And that may be safer than bringing cash with you and exchanging it for local currency once you’ve arrived.

Keep in mind that you could be charged ATM fees when you use a debit card abroad. According to the Consumer Financial Protection Bureau (CFPB), some banks and credit unions don’t charge customers a fee for using their ATMs. But they might charge you if you’re not a customer—and that could be in addition to a fee charged by the operator of the ATM.

Also, be mindful that some banks may charge a foreign transaction fee when you make purchases abroad with a debit card. You may also be charged a currency conversion fee—often, this fee is folded into the foreign transaction fee.

Some banks, though, don’t charge foreign transaction fees. For example, Capital One doesn’t charge this fee for its 360 Checking account .

If you take a debit card on your travels, your bank may ask you to notify it beforehand. That’s because it could notice transactions made in an unfamiliar location and potentially freeze your account. Capital One doesn’t require this notification , thanks to the added security of your chip card.

Prepaid cards

Like credit cards and debit cards, prepaid cards may be easier to carry around than cash. They may also offer some protection against loss, theft or fraud once you register them.

But with a prepaid card, you don’t “borrow” money like you do with a credit card—or use money from your checking account, like with a debit card. Instead, you typically add money to a prepaid card before using it.

According to the CFPB, there are a few ways you can add funds to a prepaid card. For example, you can transfer money from your checking account or load funds at some retailers or financial institutions.

You might be charged one or more fees for using a prepaid card. The CFPB notes that if you get your prepaid card from a retailer, you should find a summary of fees on the card’s packaging. If you get your card from a different provider—online or over the phone, for example—the provider needs to share this information on paper or electronically.

Mobile wallet

You’ll probably have your phone with you when you’re traveling, right? Using a mobile wallet to make purchases is another modern alternative to traveler’s checks.

A mobile wallet is essentially a digital version of your real wallet. Depending on the wallet, you may be able to store things like credit cards, debit cards, prepaid cards, boarding passes, hotel reservations, event tickets and other types of personal data.

Mobile wallets can be convenient, allowing you to make quick and easy payments using your phone or other mobile device when you’re on the go. And they typically use advanced technology that prevents your actual account numbers from being stored in the wallet.

There are lots of mobile wallets to choose from. Researching your options could help you see which will work best while you’re traveling. Keep in mind, some merchants might not take mobile wallet payments.

Traveler’s checks in a nutshell

Traveler’s checks can be a helpful way to pay for things abroad, but there are also more modern options available today, like credit cards, debit cards, prepaid cards and mobile wallets. And with a travel credit card, you could earn rewards on your travel-related purchases.

Ready to upgrade the way you pay before your next trip? Compare Capital One travel credit cards today to find the best option for you, no matter where you’re headed.

Related Content

How do travel credit cards work.

article | February 8, 2024 | 7 min read

Should you send a credit card travel notice?

article | April 25, 2024 | 3 min read

What you should know about foreign transaction fees

article | May 23, 2024 | 7 min read

- Customer Service

Order Checks

Get paper checks for your account today.

The easiest way to order checks is through Online Banking.

- Select Account Options

- Choose "Account Services"

- Select Order Checks

At TD Bank, there's always someone to talk to about your account. Call us or come in today.

Find out more about sending money to your location of choice.

Read our range of money transfer and banking guides.

Reviews and comparisons of the best money transfer providers, banks, and apps.

Unlock efficient global money movement for your business.

A Guide to Travellers Cheques

Once a foreign currency staple, this form of prepaid funds has existed for hundreds of years, designed as a way to allow payment from one person to another across currencies. As the financial services sector continues to shift to online solutions , we look at how, where and why travellers cheques are used, as we discuss the relevance of this form of currency.

What are travellers cheques?

The history of the travellers cheque spans as far back as 1772 when the first of its kind was issued by the London Credit Exchange Company, in the UK. Over the coming centuries the concept became popularised on a global scale, with major banks and financial institutions adopting this form of travel money in the 20th century. American Express became the largest issuer of travellers cheques and continues to offer these services to customers to this day.

A safe and convenient method of payment for anyone travelling to foreign territories, these pre-printed cheques hold a fixed amount which can be used worldwide across a range of currencies. Designed to facilitate payments from one person to another, using different currencies, travellers cheques were initially seen as a more practical way for individuals to carry their spending money.

Travellers cheques had their heyday in the late 20th century, reaching peak popularity in the mid-90s, before alternatives such as credit and debit cards became more widely available and easier to manage financial transactions. It was reported in 2018 that a mere 1.5% of Britons use travellers cheques, a rapid decrease over the course of two decades.

How do you use travellers cheques?

When you first receive your travellers cheques, you will be required to sign each one before use, as a way of verifying your signature. Each cheque will have a fixed value (usually $20, $50, $100, $500 etc.) as well as a unique serial number which can typically be found in the top right corner.

It is important to take note of these serial numbers as they will be referenced in any case of lost or stolen cheques. Unlike cash, if anything happens to your travellers cheques, the original vendor will be able to issue a refund for the exact same value. This added level of security is why this payment method was seen as revolutionary when first introduced.

As well as signing upon receipt, you will also need to sign each travellers cheque when used by a retailer or exchanged for cash. The act of signing your name as a form of security is somewhat outdated, given the modern technologies in place nowadays.

When accepted by retailers, a travellers cheque will be treated like local currency, which means you should receive any change in the standard, local currency.

Where can I get travellers cheques?

Due to dwindling demand, travellers cheques are not as readily available as they once were. However, they can still be acquired from some banks and financial institutions, post offices and currency exchange offices, like Travelex.

One thing to note is you may be required to settle the handling, commission or cash-in fees that often accompany travellers cheques, and these can be expensive, amounting to 2 - 3% in some cases. This cost is another reason they are no longer as frequently used.

Where can I use travellers cheques?

Generally, travellers cheques are still accepted all over the world, albeit harder to find vendors selling them and retailers accepting them as legal tender. Consider your destination before deciding on this form of travel money: if you are travelling to major cities there is more chance of you finding somewhere to cash your cheques or use them for in-store purchases. However, more remote destinations may not be equipped or able to accept this type of funds.

How safe are travellers cheques?

The original blueprint for travellers cheques was a paper payment method which could be used as foreign currency but was more secure than handling cash. At the height of its popularity, travellers cheques were generally considered much safer than cash due to the added security of their unique serial numbers, meaning customers could cancel and replace cheques if need be. These numerical codes were a money-back guarantee for anyone whose cheques were misplaced, destroyed or stolen. Another added benefit, if your travellers cheques are intercepted, you will not be vulnerable to bank fraud, as they are in no way connected to your bank account, unlike credit or debit cards.

Financial security measures have evolved greatly since the inception of travellers cheques, however, with the introduction of PIN codes, two-factor authentication, fingerprint touch ID and facial recognition, to name a few forms of fintech security commonly available now. With this in mind, the concept of a travellers cheque no longer measures up in terms of fraud protection and data encryption.

Travellers cheque vs. Cashiers cheque: What is the difference?

In terms of appearance, a travellers cheque looks nearly identical to a standard issue cashier's cheque: but are they similar in any other ways?

A cashiers cheque is issued by a bank or financial institution and is designed to be processed quickly, by the individual whose name is printed on the cheque. Conversely, a travellers cheque is for use overseas, is loaded with prepaid foreign currency - usually USD or GBP - and does not have a name or account number printed on it, although it does require a signature. Because travellers cheques do not have any bank details printed on them, they are deemed safer than cashiers cheques in terms of potential for fraudulent use. In addition to this, they are paid for when printed, meaning it is not possible for a travellers cheque to bounce.

What are the alternatives?

Credit or debit cards.

If you are worried about travellers cheques not being widely accepted where you are going, then this form of travel money will offer more flexibility. Using your regular bank cards overseas provides a record of spending and offers maximum convenience, but there are also some frequently flagged concerns. Primarily these concerns focus on the sky-high fees and below-average exchange rates related to using your debit or credit card abroad. This isn’t always the case, however, as many banks and financial institutions offer travel credit cards, tailored to suit the needs of frequent flyers.

Travel money cards

Prepaid travel money cards are the modern equivalent to travellers cheques and have become very popular. This is largely due to the fact that they are totally separate from your regular bank account, allowing users to spend their balance freely without the worry of potential fraud or overspending. Preloaded with funds, travel money cards often help limit additional currency exchange charges. In addition to this, in spite of fluctuating currency rates, these cards let customers lock-in a favourable exchange rate ahead of time.

International bank accounts

If you are headed overseas for a sustained period of time, it could be more convenient and cost-effective to open a bank account in your destination country. You would be subject to the relevant security and eligibility checks but this decision pays off if you are making regular international money transfers or being paid in a different currency by foreign clients. Find out more about this option by reading our guide: How to Open a Bank Account Overseas.

Due to the growing alternative digital payment methods available nowadays, it seems this age-old travel money no longer measures up in terms of accessibility, cost and convenience. When travellers cheques were originally launched, ATM withdrawals were not commonplace for travellers, and digital point of sale systems had not been invented. Nowadays, it is easy to access local currency using an assortment of different payment methods such as debit or credit cards, travel money cards or money transfer apps .

The best option for anyone who is reluctant to use their debit or credit card overseas, would be to use a prepaid travel money card. Prepaid travel money cards are a safer and more widely used alternative to travellers cheques, and customers do not need to seek out a bank to use them, are not required to sign for each transaction and security measures in place are far more advanced. This method enables customers to secure multiple foreign currencies, locking in the optimum exchange rate for your currency pairing ahead of your trip abroad. Use our comparison tool to ensure you receive the most competitive exchange rates for your international money needs.

Related content

Related content.

- A Guide to Travel Money Cards Travel money cards are a popular payment method for individuals headed abroad. Customers will load funds onto the card, using the money as foreign currency when overseas, much like a debit card is used at home. Also known as travel money prepaid cards or currency cards, they facilitate free foreign transactions and overseas ATM withdrawals. May 3rd, 2024

- Revealed: Summer Cruises Increase your CO2 Emission by 4700% per KM vs Train Travel Travelling by cruise ship rather than train this summer could increase passengers’ CO2 emissions each kilometre by 4716%, MoneyTransfers.com can reveal. May 3rd, 2024

- 10 Years of Data Predicts the Go-to Holiday Destinations for Brits Now COVID Is Over To establish the expected changes to tourism and GBP(£) spend abroad going forwards, MoneyTransfers.com analysed 10 years' worth of UK travel data from the Office for National Statistics (ONS) - 2009 - 2019, to discover and predict where Brits will be travelling to in the next 10 years now that travel is well and truly back on again since Covid! May 22nd, 2024

.jpg)

- Millennial Guide For Baby Boomers & Generation X We looked over the stats for the past few years, and found that out of £1.5 billion payments abroad, 1 in 5 debit cards payments are made by the UK residents travelling abroad and credit card payments made outside the UK has increased in recent years, reaching 467 million payments. May 3rd, 2024

Contributors

April Summers

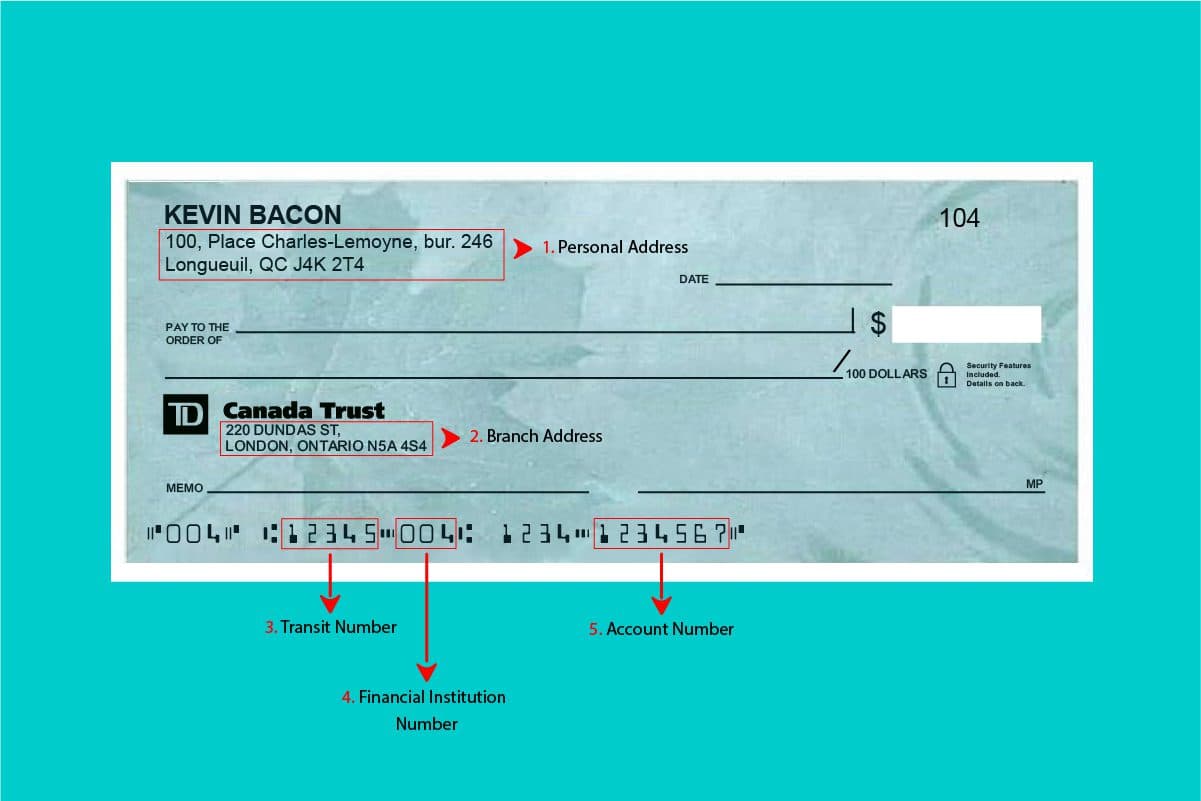

TD sample cheque: everything you need to know to find it and understand it

From pre-authorizing payments to getting paid, sample cheques still come in handy, even though Canadian use cheques far less than they used to. Periodically, you may need a TD Canada Trust sample cheque to share your banking information with someone else.

Understanding Your TD Sample Cheque

If you know what the numbers at the bottom of your TD sample cheque mean? You can probably just share those numbers without having to go looking for a sample cheque in your banking portal every time someone asks for one. For instance, your employer may need one to set you up on a payroll system.

So, here are the important features of a cheque in Canada that you can gauge with a quick look:

1. Your home address

Obviously, you don’t need to look at a sample cheque to know this information . However, those who ask you for a sample cheque will find it handy to have alongside the other details.

2. Your bank branch address

This is the address of your bank branch since TD branches offers more than one point of service.

3. The Transit Number

This five-digit number identifies the TD branch associated with your bank account.

4. The Institution Number

This three-digit number points to the financial institution you deal with, regardless of the branch you have chosen. TD’s institution number is 004.

5. Your account number (or folio number)

The account (or folio) number pinpoints your specific bank account. Without the transit number and institution number, it cannot be used to transfer money. As a result, it remains the most sensitive information relating to accessing your finances. This number varies in length depending on the financial institution, but TD account numbers always include seven digits long.

How to find your sample cheque on the TD online portal

Before the Internet, a sample cheque came out on paper with “SAMPLE” or “VOID” written on it to ensure no one would use it. If you have a chequebook, you can still do this. Despite a trend toward digital payments, Canadians still write and pay via cheques more than a billion cheques each year. In fact, a sample cheque documents all the information listed above, so you can still do it that way.

For those who don’t want to waste paper, or who simply don’t have a chequebook, you can still obtain a TD sample cheque equivalent by logging into the TD online portal. The “ Direct Deposit/Pre-Authorized Debit payment form” contains all the same information asa sample cheque. Here are the steps to download this document with just a few clicks:

- Log into your TD account through the EasyWeb portal using the following link: https://easyweb.td.com/waw/exp/

- Click on the account for which you would like a sample cheque.

- Click on “ Direct deposit form (PDF) ” on the right side of the page.

- A PDF document containing your banking information should open in your browser; all you need to do is download it.

Now you know everything you need to know about finding your TD sample cheque and interpret the different elements on it!

Julien Brault

Travellers Cheques FAQ

Travellers cheques frequently asked questions, passport and credit/debit card replacement assistance, quick links, about travelex, useful information, customer support, travelex foreign coin services limited.

- Small Business

- English Selected

TD Unlimited Chequing Account

- Monthly Fee $16.95

- Minimum monthly balance for monthly fee rebate 2 $4,000

- Transactions 3 included per month Unlimited

- Fee Rebate on select TD Credit Cards 4 First Year

What is the TD Unlimited Chequing Account?

Peace of mind comes with unlimited transactions. Enjoy unlimited everyday banking with a TD Unlimited Chequing Account.

What's in it for you:

- No monthly fee if you maintain $4000 or more in your account at the end of each day of the month 2

- Access to your money at any ATM in Canada with no TD ATM fee 5

- Keep track of your money online or on mobile by using EasyWeb, TD app or the TD MySpend app.

Open the TD Unlimited Chequing Account today!

Plan Highlights

Unlimited transactions 3 No transaction fees no matter how many times you take money out of your account

No TD ATM fee to use any ATM in Canada Use any ATM in Canada with no TD ATM fee 5

Monthly fee rebate No monthly fee if you have $4,000 or more in your account at the end of each day in the month. Seniors (60 or older) receive a $5 rebate on the monthly fee.

Free to send or request money using Interac e-Transfer ® Pay your friends back or chip in for pizza using Interac e-Transfer ®

Credit card fee rebate First year annual fee rebated for your choice of one of five select TD credit cards (up to $139) 4

TD Fraud Alerts With TD Fraud Alerts, suspicious transactions on your TD Access Card can be blocked and unblocked in real time 9

Earn big rewards on the little things Earn 50% more Stars at participating Starbucks ® stores. Simply link your eligible TD Access Card with Visa Debit with your Starbucks ® Rewards account to start earning. Conditions apply 11 . Learn more .

More details

Account Fees

Benefits of banking with TD

The TD app lets you bank and trade securely whenever it's comfortable for you. Learn more .

Paired with the TD app, use TD MySpend to keep track of your monthly spending and help improve your spending habits. Learn more .

TD Mobile Deposit

Deposit cheques as soon as you receive them so you can spend more time doing the things you want 7 . Learn more .

Direct Deposit

Access to your paycheque or pension with no holds on your money. Learn more .

- Overdraft Protection

You're covered against temporary cash shortages 8 . Learn more .

Simply Save Program

Automatically help grow your savings every time you use your TD Access Card. Learn more .

Need help finding the right TD products?

Just answer a few simple questions. We'll suggest TD products to help achieve your banking goals

Additional Account Details & Terms Information

Find out more about opening a TD account with helpful resources and information.

Account Interest Rates

How Our Interest is Calculated (PDF)

Account and Other Related Service Fees (PDF)

Everyday Finances Made Easy

Access to Basic Banking Services (PDF)

Financial Services Terms

Access Agreement (PDF)

General List of Services

Open my Account

Open online.

Fill out your secure application in approximately 5 minutes.

Book an appointment

Meet with a banking specialist in person at the branch closest to you.

Our banking specialists are ready to answer your questions and can assist you in opening an account

Have a question? Find answers here

Popular questions, helpful related questions, did you find what you were looking for.

Sorry this didn't help. Would you leave us a comment about your search?

Deposit Insurance

Your deposits may be insurable by the Canada Deposit Insurance Corporation.

Compare cards

See you in a bit

You are now leaving our website and entering a third-party website over which we have no control.

TD Bank Group is not responsible for the content of the third-party sites hyperlinked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites.

Third-party sites may have different Privacy and Security policies than TD Bank Group. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information.

TD Personal Banking

- Personal Home

- My Accounts

- Today's Rates

- Accounts (Personal)

- Chequing Accounts

- Savings Accounts

- Youth Account

- Student Account

- Credit Cards

- Aeroplan points

- Travel Rewards

- No Annual Fee

- U.S. Dollar

- Personal Investing

- GIC & Term Deposits

- Mutual Funds

- TFSA - Tax-Free Savings Account

- RSP - Retirement Savings Plan

- RIF - Retirement Income Options

- RESP - Education Savings Plan

- RDSP - Disability Savings Plan

- Precious Metals

- Travel Medical Insurance

- All Products

- New To Canada

- Banking Advice for Seniors (60+)

- Cross Border Banking

- Foreign Exchange Services

- Ways to Pay

- Ways to Bank

- Green Banking

TD Small Business Banking

- Small Business Home

- Accounts (Business)

- Chequing Account

- Savings Account

- U.S. Dollar Account

- AgriInvest Account

- Cheque Services

- Line of Credit

- Business Credit Cards

- Business Mortgage

- Canada Small Business Financial Loan

- Agriculture Credit Solutions

- TD Auto Finance Small Business Vehicle Lending

- Invest for your Business

- Advice for your Profession or Industry

- TD Merchant Solutions

- Foreign Currency Services

- Employer Services

TD Investing

- Investing Home

- Direct Investing

- Commissions and Fees

- Trading Platforms

- Investment Types

- Investor Education

- Financial Planning

- Private Wealth Management

- Markets and Research

TD Corporate

- Investor Relations

- Environment

- Supplier Information

- TD Newsroom

Other TD Businesses

- TD Commercial Banking

- TD Asset Management

- TD Securities

- TD Auto Finance

U.S. Banking

- TD Bank Personal Banking

- TD Bank Small Business Banking

- TD Bank Commercial Banking

- TD Wealth Private Client Group

- TD Bank Personal Financial Services

To be considered a “new TD Chequing customer”, you must not have an existing TD Chequing account.

New to TD Bank Summer Offer Program 2024 (Terms and Conditions)

Calculating up to $600 in cash

§ Up to $600 is calculated as follows: Offer 1: $400 cash + Offer 2: $200 cash = $600 total cash value.

Offer 1) Earn $400 in cash upon opening a new TD Unlimited Chequing Account or TD All-Inclusive Banking Plan (the "New Chequing Account") between June 4, 2024, and September 26, 2024, by completing the qualifying criteria in accordance with Offer 1 below.

Offer 2) Earn $200 based on a $10,000 balance in the New Savings Account, when a New Chequing Account customer opens a new TD ePremium Savings Account or TD Every Day Savings Account (the "New Savings Account") by September 26, 2024, and meets the qualifying criteria as set out in accordance with Offer 2 below.

Offer 1: Chequing Account $400 Cash Terms and Conditions

† The $400 cash offer is available to Canadian residents that do not have an existing TD Chequing Account, that are the age of majority at time of account opening in their province or territory who:

(a) Open a TD Unlimited Chequing Account or TD All-Inclusive Banking Plan between June 4, 2024, and September 26, 2024.

(b) Complete any two of the following with the New Chequing Account:

1. Set up a recurring Direct Deposit from their employer, pension provider or the Government with the first deposit posted to the New Chequing Account before November 30, 2024. The Direct Deposit must occur either weekly, biweekly, monthly, or twice per month.

2. Make an Online Bill Payment through TD EasyWeb or the TD app, minimum $50 before November 30, 2024.

3. Set up a recurring Pre-Authorized Debit, minimum $50 with the first Pre-Authorized Debit posted to the New Chequing Account before November 30, 2024. Pre-Authorized Debit must occur either weekly, biweekly, monthly, or twice per month. Learn more about Pre-Authorized Debit .

Whether or not a recurring Direct Deposit is acceptable for this offer is subject to our approval.

The following are not eligible for the $400 cash offer:

1. Customers who already have a TD Chequing Account that was closed on or after June 4, 2023; or

2. Customers who received any Chequing Account offers from TD in 2021, 2022, 2023; or

3. TD staff members or any TD customers who have a joint account with a TD staff member.

For any New Chequing Account that is a joint account, at least one account holder on the New Chequing Account must meet the eligibility requirements. Limit of one $400 cash offer per New Chequing Account. Limit of one $400 cash offer per customer.

The $400 will be deposited to the New Chequing Account within 12 weeks after all required conditions have been met, provided that the New Chequing Account is still open, in good standing, with all conditions continuing to be met. The monthly fee for the New Chequing Account cannot have been waived or rebated for any reason, other than maintaining the minimum monthly balance, receiving a seniors' rebate, or receiving the New to Canada 12-month fee waiver on the TD Unlimited Chequing Account, and the type of account cannot have changed, before the $400 is deposited into the New Chequing Account.

We can change, extend, or withdraw the $400 cash offer at any time, and it cannot be used in conjunction with any other offer or discount for the same product, except the TD New to Canada Banking Package. All amounts are in Canadian dollars unless otherwise noted. Other conditions may apply.

For information about transactions and a complete list of account fees, see About Our Accounts and Related Services .

Offer 2: Savings Deposit Offer Terms and Conditions

◊ The $200 is based on a $10,000 balance in the New Savings Account.

The cash offer is available to Canadian residents that are the age of majority at the time of the New Savings Account opening in their province or territory.

To earn between $50 to $1,000 in cash for the New Savings Account, a New eligible TD Chequing account customer must:

(a) Open a TD All-Inclusive Banking Plan or a TD Unlimited Chequing Account between June 4, 2024, and September 26, 2024, and

(b) Open a new TD ePremium Savings Account or TD Every Day Savings Account (the New Savings Account) within 30 days of the New Chequing Account opening, and

(c) Deposit or transfer a minimum of $2,500 or more directly into the New Savings account from another financial institution(s) within 30 days of the New Savings Account opening AND maintain the balance for 150 days.

(d) The balance of the New Savings Account at the end of the 30 days will be the "Qualifying Balance" that will be eligible to earn the cash offer noting:

- Transfers originating from existing TD accounts do not qualify for the cash offer;

- The cash offer will be awarded based on the cash amount transferred into the New Savings Account for a maximum of $1,000 in total per eligible customer:

Savings Tiered Offer

If a customer withdraws or transfers out of the New Savings Account at any time after the 30 days, such amounts will be subtracted from the Qualifying Balance. The customer may still be eligible to earn a lower cash offer, provided the customer meets a Cash Tier Minimum for the 150 days.

The up to $1,000 cash offer will be deposited to the New Chequing Account within 12 weeks after all required conditions have been met, provided that the New Chequing Account and New Savings Account is still open, in good standing, with all conditions continuing to be met.

The following are not eligible to earn the up to $1,000 cash offer:

- Customers who already had a TD Chequing Account that was closed on or after June 4, 2024,

- Customers who already have a TD Savings account as of June 4, 2024,

- Customers who had a TD Savings account that was closed on or after June 4, 2023,

- Customers who received any Savings account offer from TD in 2021, 2022, 2023; or

- TD staff members or any TD customers who have a joint account with a TD staff member.

For any New Savings Account that is a joint account, at least one account holder on the New Savings Account must meet the eligibility requirements. Maximum offer of up to $1,000 per New Savings Account. Maximum offer of up to $1,000 per customer. For information about transactions and a complete list of account fees, see About Our Accounts and Related Services. We can change, extend, or withdraw the up to $1,000 cash offer at any time.

1 You pay no monthly fee if you have the minimum monthly balance indicated or more in your account at the end of each day in the month.

2 You pay no monthly fee if you have the minimum monthly balance indicated or more in your account at the end of each day in the month.

3 For more information about transactions and a complete list of account fees, click here for Account and Other Related Service Fees . For information on our general services, please view our General List of Services .

4 Subject to credit approval. First-year Annual fee discount applies only to the Primary Cardholder for your choice of a new (to you) TD Credit Card from one of the following – TD® Aeroplan® Visa Infinite* Card, TD® Aeroplan® Visa Platinum* Card, TD First Class Travel Visa Infinite Card, TD Platinum Travel Visa Card or TD Cash Back Visa Infinite Card, provided you maintain a TD Unlimited Chequing Account in good standing for the first year. All other fees and charges applicable to the selected and approved TD Credit Card Account continue to apply.

Effective June 19, 2024

TD Unlimited Chequing Account – TD Credit Card First Year Annual Fee Rebate:

Customers with an TD Unlimited Chequing Account ("Unlimited Account") are eligible for an Annual Fee Rebate (defined below) on one Eligible TD Credit Card for the first calendar year the card is open. TD Credit Card is subject to credit approval.

The "Eligible TD Credit Cards" are: TD® Aeroplan® Visa Infinite* Card, TD® Aeroplan® Visa Platinum* Card, TD First Class Travel® Visa Infinite* Card, TD Platinum Travel Visa* Card or TD Cash Back Visa Infinite* Card.

The "Annual Fee Rebate" is:

- Up to $139 towards the Annual Fee charged for the Primary Cardholder of the Eligible TD Credit Card, or the amount of the Annual Fee charged for the Primary Cardholder if that amount is less than $139.

The amount of the Annual Fee Rebate will not exceed the Annual Fee charged to the Eligible TD Credit Card.

An Unlimited Account provides a maximum of one Annual Fee Rebate. This means:

- If you have an Unlimited Account and you have more than one Eligible TD Credit Card, only one Eligible TD Credit Card can receive an Annual Fee Rebate. We will apply the Annual Fee Rebate to the Eligible TD Credit Card with the highest annual fee, or, if multiple Eligible TD Credit Cards have the same annual fee, to the Eligible TD Credit Card opened first.

- If the Unlimited Account is a joint account, only one accountholder can receive an Annual Fee Rebate. The Annual Fee Rebate will be applied to the Eligible TD Credit Card with the highest annual fee, or, if multiple Eligible TD Credit Cards have the same annual fee, to the Eligible TD Credit Card that was opened first.

In order to receive an Annual Fee Rebate on your Eligible TD Credit Card:

- You must have an Unlimited Account at least three business days prior to the date the Annual Fee is charged. At the time the Annual Fee is charged to your Eligible TD Credit Card, the Unlimited Account and the Eligible TD Credit Card must be open and in good standing.

The Annual Fee Rebate will be applied within 2 monthly statements from the date of the statement with the Annual Fee charge.

Closing your Eligible TD Credit Card or transferring to another credit card product before the Annual Fee Rebate has been provided may result in forfeiture of an Annual Fee Rebate.

If you are no longer eligible for the Annual Fee Rebate, the Annual Fee will be charged to the TD Credit Card Account and the Annual Fee Rebate will not be applied. To learn about the amount and timing of the Annual Fee, see the Disclosure Statement for your Eligible TD Credit Card. The terms of this Annual Fee Rebate may be changed, withdrawn, or extended at any time.

This Annual Fee Rebate cannot be combined with any other Annual Fee Rebate applicable to the Eligible TD Credit Card.

5 You may pay a fee to the ATM provider, and for foreign currency withdrawals at an ATM outside of Canada you will pay the foreign exchange related fee.

7 Cheques must be drawn on a Canadian financial institution. Cheques payable in Canadian currency must be deposited to an eligible Canadian dollar account and cheques payable in U.S. currency must be deposited to an eligible U.S. dollar account.

8 Subject to approval. All overdrafts must be paid within 89 days, are subject to an interest rate of 21% per annum (subject to change) on the overdrawn amount, and that subsequent deposits to your account will automatically be applied to pay off the overdraft. Overdraft interest rate is subject to change.

9 You are responsible for ensuring the mobile phone number we have on file is accurate and notifying us of any changes. We will send the TD Fraud Alert text message instantly upon detection of suspicious activity; however, receipt of the text message may be delayed or prevented due to a variety of factors such as technology failures, service outages, multiple third-party involvement. TD Fraud Alert text messages will only be sent to customers who have a Canadian mobile phone number and a Canadian mailing address in their TD customer profile.

11 Link with Starbucks Rewards Offer & Privacy Terms

Link with Starbucks Rewards Offer:

- The terms of this Offer are in addition to the agreements that apply to the eligible TD Credit Card (including the applicable reward program term and condition linked to the eligible TD Credit Card) or the TD Access Card with Visa Debit. Depending on your TD account, your standard rates and fees continue to apply. For TD Access Cards with Visa Debit: for more information about transactions and a complete list of account fees, Account and Other Related Service Fees (PDF). For information on our general services, please view our General List of Services (PDF).

- The terms of this Offer are also in addition to the terms and conditions of the Starbucks Rewards program, available at www.starbucks.ca/terms (“ Starbucks Rewards Terms of Use ”). These terms do not alter in any way the terms and conditions of any other agreement you may have with Starbucks for other products or services, such as Starbucks Cards.

- The Starbucks Rewards program is established and operated by Starbucks Coffee Canada, Inc. or its respective subsidiaries, licensees, and affiliated companies (collectively, " Starbucks "), and allows customers to earn stars (“ Stars ”) that can be redeemed at Participating Starbucks Stores in Canada for free food and beverage items (each, a “ Reward ” and collectively “ Rewards ”). To understand your rights and obligations under the Starbucks Rewards program, you should carefully read the Starbucks Rewards Terms of Use and any other agreements that apply to the Starbucks Rewards program.

Linking to the Offer:

- You can only access this Offer in My TD Rewards which is available through your TD EasyWeb Account and/or a TD mobile app account.

- There is no fee to participate in the Offer.

- When you link eligible TD Credit Cards and TD Access Cards with Visa Debit to your Starbucks Rewards account in My TD Rewards, you opt-into the Offer.

- If you de-link from this Offer in My TD Rewards, you opt-out of the Offer and you will no longer participate in the Offer. You can opt-out of this Offer at any time. To opt-out of the Offer by de-linking, follow the instructions in My TD Rewards.

- earn bonus Stars with your eligible TD Credit Card or your TD Access Card with Visa Debit ( bonus Stars ),

- for certain eligible TD Credit Cards, you can earn bonus TD points, or Aeroplan points, as applicable for your TD Credit Card ( bonus points ),

- For select TD Credit Cards, you can redeem your TD points for Stars

Eligible TD accounts:

- Only TD Access Cards with Visa Debit can participate the Offer.

- TD Rewards Visa Card, TD Platinum Travel Visa Card, TD First Class Travel Visa Card, TD Business Travel Visa Card

- TD Aeroplan Visa Platinum Card, TD Aeroplan Visa Infinite Card, TD Aeroplan Visa Infinite Privilege Card, TD Aeroplan Visa Business Card

- TD Cash Back Visa Card, TD Cash Back Visa Infinite Card, TD Business Cash Back Visa Card

- TD Emerald Flex Rate Visa Card, TD Business Select Rate Visa Card

- TD Green Visa Card, TD Venture Visa Card

Participation in the Offer:

- For eligible TD Credit Cards Accounts, both the Primary Cardholder and any Additional Cardholder can participate.

- For TD Access Card with Visa Debit, any account holder on the same account can participate.

- You must be a member of the Starbucks Rewards program.

- You must keep your eligible TD Credit Card or your TD Access Card with Visa Debit open, active and in Good Standing.

Eligible Purchases:

- Any purchase of food, beverage(s), and/or merchandise, excluding purchases of alcoholic beverages and Starbucks Card eGifts and physical Starbucks gift cards (“ Starbucks Cards ”), at Participating Starbucks Stores (as defined below); and

- Adding funds to the Starbucks Card(s) registered to your Starbucks Rewards account (“ Reload ”) using an eligible TD Credit Card, or using a TD Access Card with Visa Debit, as applicable. To learn more about registering your Starbucks Card to your account, visit Starbucks.ca/rewards.

Participating Starbucks Stores:

- Participating Starbucks Stores are Starbucks locations in Canada that honor Starbucks Rewards. To locate stores that honor Starbucks Rewards, visit www.starbucks.ca/store-locator and look for stores that list “Redeem Rewards” as one of the store amenities.

Earning bonus Stars:

- First: You must link your eligible TD Credit Card or your TD Access Card with Visa Debit to your Starbucks Rewards account in My TD Rewards.

- Second: Add your eligible TD Credit Card or your TD Access Card with Visa Debit as a linked method of payment within the Starbucks app, and then use it to order ahead or pay at the register for an Eligible Purchase at a Participating Starbucks Store. To learn more about adding your TD Credit Card or your TD Access Card with Visa Debit as your payment method to the Starbucks app, visit Starbucks.ca/rewards

- You can also earn bonus Stars when you Reload your Starbucks Card using your eligible TD Credit Card, or your TD Access Card with Visa Debit linked to this Offer.

- Here is a chart that sets out how many bonus Stars you will earn with this Offer when you meet the terms of this Offer:

- You can check your Star balance and available Rewards, as well as any additional benefits for which you are eligible as a Starbucks Rewards member, on www.starbucks.ca/rewards or by using the Starbucks app.

- If you would like to report an error for your Stars earned under this Offer, you must contact Starbucks using the information stated below under "Additional Terms".

Earning bonus points:

- When you meet the terms set out in this Offer, select eligible TD Credit Cards (set out below) can earn bonus points on Eligible Purchases. TD Access Cards with Visa Debit do not earn bonus points.

- The number of bonus points that you can earn will depend on the type of eligible TD Credit Card you have. The bonus points you earn under this Offer are in addition to regular points you can earn under the rewards program connected to your eligible TD Credit Card.

- You can only earn bonus points on the net Eligible Purchases charged and posted to the Account. This means that credits for refunds, returned items and other similar credits for Purchases may reduce or cancel the bonus points earned.

- For TD Aeroplan Credit Cards: We will show you the number of Aeroplan points you have earned with your TD Credit Card in a particular statement period on the Account’s monthly statement. Your bonus points earned under this Offer will be included in your total points balance shown on your Account's monthly statement. Once the Aeroplan points are awarded to the Aeroplan Member Account, you can check your Aeroplan points balance directly with Aeroplan. If you would like to know about the bonus points earned under this Offer, you can contact us using the information provided below.

- For TD Rewards Credit Cards: You can see number of bonus TD points you have earned with this Offer in both TDrewards.com and My TD Rewards in real-time. You can also review your total TD points balance in your Account's monthly statement.

Redeeming TD points for Stars:

- TD Rewards Visa Card, TD Platinum Travel Visa Card, TD First Class Travel Visa Card, TD Business Travel Visa Card.

- Your eligible TD Credit Card linked to this Offer must be open, active and in Good Standing.

- Your Starbucks Rewards account must be open and active.

- You must link your eligible TD Credit Card to your Starbucks Rewards account in My TD Rewards.

- No matter which redemption option you select, we cannot reverse a redemption once the TD points are redeemed. We process your redemption request under this Offer in real-time.

- The Primary Cardholder or any Additional Cardholder can redeem TD points for Stars. We will rely on the first set of instructions we receive either from the Primary Cardholder or an Additional Cardholder to redeem TD points for Stars with this Offer. Our electronic time-keeping methods will be definitive in determining the time and date of receipt by us of any redemption instructions.

Additional Terms:

- My TD Rewards is located online in EasyWeb and in the TD mobile app. We may create new ways for you to access My TD Rewards or we may change where you can access My TD Rewards.

- This Offer may be changed, extended, or withdrawn at any time without notice. If we provide notice, we will provide it using electronic means.

- We reserve the right, in our sole discretion, with or without notice, to suspend, disqualify, limit or revoke this Offer to any person or cardholder we find or believe to be manipulating or otherwise abusing the process, fairness, integrity or operation of the Offer, including any person whose overall client relationship with us is in our opinion not in Good Standing.

- Starbucks may also restrict, cancel, or terminate any person or cardholder’s ability to participate in the Offer and such restriction, cancelation or termination may be with or without notice.

- This Offer will be in addition to any other offers available for the eligible TD Credit Cards and TD Access Cards with Visa Debit.

- We are not responsible for the Starbucks Rewards program, or the terms that govern the Starbucks Rewards program, including the expiry or cancellation of Stars, redemption conditions, benefits, features, or services of the Starbucks Rewards program, and its availability, cancellation or termination. This also includes no responsibility for the services supplied under the Starbucks Rewards program, or for any actions or omissions. We will not accept any responsibility for any loss or damages caused by goods or services supplied or requested in connection with the Starbucks Rewards program.

- Starbucks is not liable or responsible for My TD Rewards, the terms that govern your TD Access Cards with Visa Debit card, or terms that govern the eligible TD Credit Cards (including the applicable reward program term and condition linked to the eligible TD Credit Card) or any of the services and products offered/provided by The Toronto-Dominion Bank.

By choosing to participate and link an eligible TD Visa Card or TD Visa Access Card with Visa Debit, you agree TD may disclose information about your transactions as well as TD and Starbucks Rewards to Starbucks Stars in order to administer the Offer. This includes information about your TD and Starbucks Rewards memberships and balances, the time and amount of a transaction, how a transaction was completed, and any rewards points you transfer. Any information you provide directly to TD or that TD obtains about you as a TD Bank customer or participant in the Offer will be governed by The TD Privacy Policy . Any information you provide directly to Starbucks or that Starbucks obtains about you as a Starbucks customer or participant in the Offer will be governed by Starbucks’ Privacy Notice .

®The TD logo and other trademarks are the property of The Toronto-Dominion Bank or its subsidiaries.

*Trademark of Visa International Service Association; Used under license.

®Aeroplan is a registered trademark of Aeroplan Inc., used under license.

Starbucks, the Starbucks logo, and other Starbucks trademarks, service marks, graphics, and logos used in connection with the Offer are trade names, trademarks or registered trademarks of Starbucks Corporation (collectively “ Starbucks Marks ”).

All trade-marks are the property of their respective owners. For trade-mark ownership details, see www.tdcanadatrust.com/aeroplancards .

Interac e-Transfer is a registered trade-mark of Interac Corp. Used under licence.

Choose up to 3 accounts to compare

Compare upto 2 accounts.

Similar account

TD High Interest Savings Account

Reach your goals faster with a high interest rate

TD All-Inclusive Banking Plan

Limited Time $300 Gift Card offer †

TD Every Day Chequing Account

A budget-friendly account for everyday banking

TD Minimum Chequing Account

An account for those with minimal banking needs

TD Student Chequing Account

An account designed for both youths and students, with no monthly fee

U.S. Daily Interest Chequing Account

Simplify your U.S. dollar banking with this convenient, no monthly fee account

Borderless Plan

A premium account designed for frequent U.S. travellers

TD Every Day Savings Account

Ideal if you’re starting to save or want frequent access to your funds

TD ePremium Savings Account

Save more with a high interest rate and free online transfers

635th Anti-Aircraft Missile Regiment

635-й зенитно-ракетный полк

Military Unit: 86646

Activated 1953 in Stepanshchino, Moscow Oblast - initially as the 1945th Anti-Aircraft Artillery Regiment for Special Use and from 1955 as the 635th Anti-Aircraft Missile Regiment for Special Use.

1953 to 1984 equipped with 60 S-25 (SA-1) launchers:

- Launch area: 55 15 43N, 38 32 13E (US designation: Moscow SAM site E14-1)

- Support area: 55 16 50N, 38 32 28E

- Guidance area: 55 16 31N, 38 30 38E

1984 converted to the S-300PT (SA-10) with three independent battalions:

- 1st independent Anti-Aircraft Missile Battalion (Bessonovo, Moscow Oblast) - 55 09 34N, 38 22 26E

- 2nd independent Anti-Aircraft Missile Battalion and HQ (Stepanshchino, Moscow Oblast) - 55 15 31N, 38 32 23E

- 3rd independent Anti-Aircraft Missile Battalion (Shcherbovo, Moscow Oblast) - 55 22 32N, 38 43 33E

Disbanded 1.5.98.

Subordination:

- 1st Special Air Defence Corps , 1953 - 1.6.88

- 86th Air Defence Division , 1.6.88 - 1.10.94

- 86th Air Defence Brigade , 1.10.94 - 1.10.95

- 86th Air Defence Division , 1.10.95 - 1.5.98

Things to Do in Monino, Russia - Monino Attractions

Things to do in monino.

- 5.0 of 5 bubbles

- Good for Kids

- Budget-friendly

- Hidden Gems

- Good for Big Groups

- Adventurous

- Good for a Rainy Day

- Good for Couples

- Honeymoon spot

- Good for Adrenaline Seekers

- Things to do ranked using Tripadvisor data including reviews, ratings, photos, and popularity.

1. The Central Air Force Museum

View prices for your travel dates

Hotel Djaz is an excellent choice for travellers visiting Elektrostal, offering many helpful amenities designed to enhance your stay.

24 hour front desk is one of the conveniences offered at this small hotel. In addition, Hotel Djaz offers a lounge, which will help make your Elektrostal trip additionally gratifying. If you are driving to Hotel Djaz, free parking is available.

While staying at Hotel Djaz, visitors can check out Statue of Lenin (1.3 mi), which is a popular Elektrostal attraction.

Travellers looking for cafes can head to Ermitazh, 400 Krolikov, or Fabrika Obedov.

Should time allow, Electrostal History and Art Museum is a popular history museum that is relatively easy to get to.

Enjoy your stay in Elektrostal!

Reviews We perform checks on reviews. Tripadvisor’s approach to reviews Before posting, each Tripadvisor review goes through an automated tracking system, which collects information, answering the following questions: how, what, where and when. If the system detects something that potentially contradicts our community guidelines , the review is not published. When the system detects a problem, a review may be automatically rejected, sent to the reviewer for validation, or manually reviewed by our team of content specialists, who work 24/7 to maintain the quality of the reviews on our site. Our team checks each review posted on the site disputed by our community as not meeting our community guidelines . Learn more about our review moderation.

- Excellent 0

- Very Good 0

- English ( 0 )

Own or manage this property? Claim your listing for free to respond to reviews, update your profile and much more.

HOTEL DJAZ - Reviews, Photos

- Yekaterinburg

- Novosibirsk

- Vladivostok

- Tours to Russia

- Practicalities

- Russia in Lists

Rusmania • Deep into Russia

Out of the Centre

Savvino-storozhevsky monastery and museum.

Zvenigorod's most famous sight is the Savvino-Storozhevsky Monastery, which was founded in 1398 by the monk Savva from the Troitse-Sergieva Lavra, at the invitation and with the support of Prince Yury Dmitrievich of Zvenigorod. Savva was later canonised as St Sabbas (Savva) of Storozhev. The monastery late flourished under the reign of Tsar Alexis, who chose the monastery as his family church and often went on pilgrimage there and made lots of donations to it. Most of the monastery’s buildings date from this time. The monastery is heavily fortified with thick walls and six towers, the most impressive of which is the Krasny Tower which also serves as the eastern entrance. The monastery was closed in 1918 and only reopened in 1995. In 1998 Patriarch Alexius II took part in a service to return the relics of St Sabbas to the monastery. Today the monastery has the status of a stauropegic monastery, which is second in status to a lavra. In addition to being a working monastery, it also holds the Zvenigorod Historical, Architectural and Art Museum.

Belfry and Neighbouring Churches

Located near the main entrance is the monastery's belfry which is perhaps the calling card of the monastery due to its uniqueness. It was built in the 1650s and the St Sergius of Radonezh’s Church was opened on the middle tier in the mid-17th century, although it was originally dedicated to the Trinity. The belfry's 35-tonne Great Bladgovestny Bell fell in 1941 and was only restored and returned in 2003. Attached to the belfry is a large refectory and the Transfiguration Church, both of which were built on the orders of Tsar Alexis in the 1650s.

To the left of the belfry is another, smaller, refectory which is attached to the Trinity Gate-Church, which was also constructed in the 1650s on the orders of Tsar Alexis who made it his own family church. The church is elaborately decorated with colourful trims and underneath the archway is a beautiful 19th century fresco.

Nativity of Virgin Mary Cathedral

The Nativity of Virgin Mary Cathedral is the oldest building in the monastery and among the oldest buildings in the Moscow Region. It was built between 1404 and 1405 during the lifetime of St Sabbas and using the funds of Prince Yury of Zvenigorod. The white-stone cathedral is a standard four-pillar design with a single golden dome. After the death of St Sabbas he was interred in the cathedral and a new altar dedicated to him was added.

Under the reign of Tsar Alexis the cathedral was decorated with frescoes by Stepan Ryazanets, some of which remain today. Tsar Alexis also presented the cathedral with a five-tier iconostasis, the top row of icons have been preserved.

Tsaritsa's Chambers

The Nativity of Virgin Mary Cathedral is located between the Tsaritsa's Chambers of the left and the Palace of Tsar Alexis on the right. The Tsaritsa's Chambers were built in the mid-17th century for the wife of Tsar Alexey - Tsaritsa Maria Ilinichna Miloskavskaya. The design of the building is influenced by the ancient Russian architectural style. Is prettier than the Tsar's chambers opposite, being red in colour with elaborately decorated window frames and entrance.

At present the Tsaritsa's Chambers houses the Zvenigorod Historical, Architectural and Art Museum. Among its displays is an accurate recreation of the interior of a noble lady's chambers including furniture, decorations and a decorated tiled oven, and an exhibition on the history of Zvenigorod and the monastery.

Palace of Tsar Alexis

The Palace of Tsar Alexis was built in the 1650s and is now one of the best surviving examples of non-religious architecture of that era. It was built especially for Tsar Alexis who often visited the monastery on religious pilgrimages. Its most striking feature is its pretty row of nine chimney spouts which resemble towers.

Plan your next trip to Russia

Ready-to-book tours.

Your holiday in Russia starts here. Choose and book your tour to Russia.

REQUEST A CUSTOMISED TRIP

Looking for something unique? Create the trip of your dreams with the help of our experts.

IMAGES

VIDEO

COMMENTS

Other helpful tips for world travelers. Important phone numbers. Save these international numbers for emergencies: Debit card: 1-215-569-0518. Credit cards: 1-706-644-3266. Bring TD along for the trip. Download the TD Mobile Banking App for your smartphone and tablet to track your transactions while you travel.

Although TD no longer sells Travellers Cheques, we have other products and services that may suit your travelling and foreign exchange needs. For example, our TD VisaDebit and Credit Cards give you worldwide access at ATM's and retail Point of Sale anywhere Visa is accepted in over 200 countries.

For all your foreign exchange needs and more international travel tips, visit your local TD Bank or call Customer Service 24/7 at 888-751-9000. Find out how to make banking easier when traveling overseas. With a range of international travel tips on overseas banking, we can help simplify your travels.

Keep cheques safe. What to know when using Visa Travellers Cheques. Be as careful with your cheques as you would be with cash. Do not countersign the cheques until you want to use them. Keep your purchase agreement separate from your cheques. Write down cheque serial numbers and emergency contact numbers for your destinations and keep them ...

Go to the Service Center and select Order Checks. If you're not a BusinessDirect customer, you can place your reorder directly with Harland Clarke .*. However, do not order online if you're placing your first order of checks or have a change of address. Instead call us at 800-355-8123 or visit your local TD Bank.

Unlocking the Power of Travellers Cheques: A Step-by-Step Guide • Travellers Cheques Guide • Learn how to properly use Travellers Cheques by following these ...

For short-term travellers, a Canadian-based U.S. dollar chequing account with TD Canada Trust allows you to save U.S. funds and withdraw cash at TD Canada Trust branches. Long-term travellers may benefit from having both a Canadian-based U.S. dollar chequing account with TD Canada Trust and a U.S.-based checking account with TD Bank, America's ...

Posts: 2,774. Canadians - TD Canada Trust No-Fee Travellers Cheques with Visa. So I was on the TD Canada Trust side, and came across this: Quote: American Express Travellers Cheques are welcomed at establishments around the world. As a TD Visa Cardholder, you're entitled to purchase any amount you need through participating TD Canada Trust ...

1 Rebate of $3.00 U.S. on Borderless Plan monthly fee for customers who also have maintained a TD All-Inclusive Banking Plan throughout the entire month.. Effective June 19, 2024. Borderless Plan (U.S. Dollar) - TD Credit Card Annual Fee Rebate: Customers with a Borderless Plan are eligible for an Annual Fee Rebate (defined below) on one TD U.S. Dollar Credit Card Account (the "U.S. Dollar ...

Traveler's Check: A traveler's check is a medium of exchange utilized as an alternative to hard currency . Travelers often used traveler's checks on vacation to foreign countries. In 1891 ...

It can be used as cash or a regular check. Traveler's checks—you may also see them referred to as "cheques"—are generally printed with a unique serial number. This means you may be able to get a refund if your checks are lost or stolen. The checks are usually available in set denominations—$20 and $50, for example.

The easiest way to order checks is through Online Banking. Simply: Your order will be securely sent to Harland Clarke so you'll receive your order on time and without errors. You can also order online directly with Harland Clarke †, at your local TD Bank or call us at 800-355-8123. When you place your order, you will need your TD Bank account ...

If you are the issuer of the cheque, you can bring it to your TD Canada Trust branch. A representative will be able to certify the cheque (subject to available funds) while you wait. If you are the holder of a cheque that has been issued to you from a TD Canada Trust account holder, you can bring it to any local TD Canada Trust branch. The ...

Travellers cheques had their heyday in the late 20th century, reaching peak popularity in the mid-90s, before alternatives such as credit and debit cards became more widely available and easier to manage financial transactions. It was reported in 2018 that a mere 1.5% of Britons use travellers cheques, a rapid decrease over the course of two ...

Here are the steps to download this document with just a few clicks: Click on the account for which you would like a sample cheque. Click on "Direct deposit form (PDF)" on the right side of the page. A PDF document containing your banking information should open in your browser; all you need to do is download it.

Acceptance of Travellers Cheques is based on the acceptor watching the customer sign the Cheque in the lower left-hand corner, and then comparing that signature with the original signature in the upper left-hand corner. The acceptor must observe the customer signing the Cheque. If the signatures are a reasonable match, the Cheque should be ...

Enjoy unlimited everyday banking with a TD Unlimited Chequing Account. What's in it for you: No monthly fee if you maintain $4000 or more in your account at the end of each day of the month 2. Access to your money at any ATM in Canada with no TD ATM fee 5. Keep track of your money online or on mobile by using EasyWeb, TD app or the TD MySpend app.