( EN | 中文 )

Australia & New Zealand

Middle east, north america, pacific islands.

在外地旅遊時,小小事故也可能導致重大的金錢損失。旅遊保險為你提供保障,減輕你的憂慮,讓你安心享受旅程。

全年/單次旅遊保險計劃

- 專為飛行常客而設的保險計劃,全年飛行次數不限,確保每次旅程都有足夠保障

- 設有三款不同級別的保障以滿足不同旅客的特定需要,來回旅程及單程旅遊皆受保障

- 遺失或損毀行李、個人財物、金錢、旅遊證件的賠償

- 因取消或縮短旅程、行李或交通工具延誤、更改行程等所帶來的不便

- 安排無人照顧的兒童回港

- 新冠病毒延伸保障 :海外醫療費用、住院或隔離現金津貼,行程取消和縮短

- 如旅程無可避免地延誤, 免費自動延長保單長達14日

- 全年旅游保提供達15%無索賠折扣

- 24 小時緊急援助服務

- 穿梭中國醫療保證卡計劃

Hong Kong Travel Insurance Comparison: A Complete Overview

Are you looking for the top travel insurance products in Hong Kong? With plenty of options out there, it could be a headache when choosing the right one. No matter if you’re flying to Japan, South Korea, Thailand, Taiwan, or even Singapore, y our long-awaited trip deserves the best protection, and we’ve done the hard work to get you covered with the perfect fit.

So, MoneySmart is here to rescue you from the hassle of sifting through travel insurance products. From pricing to coverage, claiming process, and special offers, we’ve dug deep to present you with the cream of the crop. So, let the adventure begin worry-free!

Read on to find out more details about how to choose the right travel insurance that fits your needs!

Table of contents: Hong Kong travel insurance comparison

What does travel insurance cover, how to compare travel insurance policies, hong kong travel insurance price overview, which travel insurance policy offers the highest coverage for medical and accident expenses, which travel insurance policy offers the highest coverage for skiing, scuba diving, or parachuting, which travel insurance policy offers the highest coverage for personal property.

- Frequently asked questions: Travel Insurance

Travel insurance coverage can differ depending on the insurance provider and policy. In general, travel insurance can help cover expenses related to trip cancellations, medical emergencies, lost or stolen baggage, and travel interruptions.

In general, travel insurance covers the 3 main types of coverage for medical and accident expenses:

- Medical coverage includes costs for accidents or illnesses during the trip, like fees for overseas doctors and follow-up visits after returning to Hong Kong.

- Personal accident coverag e provides reimbursement for death, permanent disability, and severe burns resulting from accidents during the trip.

- Emergency support coverage includes emergency medical evacuation or repatriation, visits for relatives, and more.

Comparing insurance policies is complicated. There are so many areas you can be insured in, but not all are equal in importance. So how do you know which aspects to compare?

Review your trip quickly and identify the most likely scenarios to occur

First of all, you definitely want to make sure that you’re covered in the scenarios that are more likely to occur on your trip. Sure, it’s nice to know you’re being covered for kidnapping or terrorist attacks, but statistically speaking you’re more likely to come down with a bout of food poisoning or lose your luggage. So, review your trip quickly and find out the most likely situations to happen during your trip.

Here are key areas to look out for when deciding on the best value for travel insurance:

- Medical coverage : Unless you’re invincible, there’s always the chance you’ll fall ill or get involved in an accident. Medical coverage can pay for your overseas medical expenses, as well as medical expenses incurred upon your return to Hong Kong.

- Travel mishaps : Lost luggage, missed flights, trip delays and cancellations can happen on even the most meticulously-planned of trips.

- Loss or damage to personal belongings : Get compensated if you are pickpocketed, your belongings get damaged in transit and so on.

Find your best fitted travel insurance plan

Review each plan you have come across and find out your best fitted plan. For instance, some plans may have a higher coverage on medical expenses, but not so much on personal perperty protection. After knowing which one you want, look at the premiums.

Taking an adult going on a 7-day trip to Japan as an example, the lowest premium travel plan is offered by Alliance (HK$196), while most others range from around HK$200 to HK$300.

Here you can find most popular travel insurance plans in Hong Kong. In order to compare all Hong Kong travel insurance options, we will use a 7-day insured trip to Japan of an adult as an example:

(The premium is for reference only. For the latest rate, check the travel insurance quote here.)

The premium cost ranges from HK$84.8 to HK$463. It is important to note that when comparing premiums, you should consider if the coverage provided by the travel insurance plan meets your needs and expectations. And if you’re not sure which one to choose from h ere are the 4 basic travel insurance policies in Hong Kong.

So, which travel insurance policy offers the highest coverage for medical and accident expenses? Here is the comparison of travel insurance for a 7-day single trip to Japan :

Allianz Travel – Bronze Plan [for ages 2 to 54]: HK$1,000,000 medical coverage available

The Allianz Travel – Bronze Plan offers a basic plan at a low price, providing HK$1,000,000 in medical coverage. It is important to note that this plan only covers medical expenses and does not include any other coverage.

Allianz Travel - Bronze Plan [for ages 0 to 54]

【2024 "Let's Chill" Lucky draw】Over HK$50,000 gifts are Waiting For You! Included HK$15,000 valued Club Med Travel Vouchers, HK$10,898 Samsung Galaxy S24 Ultro 512GB, etc. Click HERE for more details.

Key Features

Up to HKD 1,000,000 medical expenses

24/7 Emergency assistance services

Easy, fast, online claims process

Loadings applied: Ages 55 to 59 +100%; ages 60 to 64 +250%; ages 65 or above +500%

STARR Companies TraveLead Extra Plan: HK$1,000,000 medical coverage with trip cancellation and loss/damage of luggage coverage

STARR Companies TraveLead Extra Plan has a slightly higher price, but it offers additional coverage for trip cancellation (up to HK$25,000) and compensation for loss or damage to luggage (HK$10,000).

STARR Companies TraveLead Extra Plan

【MoneySmart Exclusive Offer】 1. 20% discount on Starr Travel Insurance 2. HK$20 AIRSIM Prepaid Card 3. Customers who successfully apply for a Starr Travel Insurance product during the promotional period will be entitled to 200 SmartPoints, if the premium reaches HK$300 or above will be entitled to 600 SmartPoints! (Equivalent to HK$60 Rewards amount) Learn More about how SmartPoints works here .

Coronavirus Disease (COVID-19) Extension (For Single-Trip and Annual Travel Policy)

Staycation Benefit (For Annual Travel Policy Only)

Travel Delay coverage up to HK$1,500

Overseas Medical Expenses coverage up to HK$1,000,000

Accidental Death or Total Permanent Disability coverage up to HK$1,000,000

Dah Sing Insurance JourneySure Travel Insurance – Gold: HK$50 YATA cash coupon available for products over HK$200

Dah Sing Insurance JourneySure Travel Insurance offers excellent medical coverage of HK$500,000, trip cancellation coverage of HK$20,000, and compensation for loss or damage to baggage up to HK$15,000. What sets it apart is the special offer of a HK$50 YATA coupon for products over HK$200.

With the coupon, you can enjoy nearly a 25% discount on a HK$200 travel insurance product.

Dah Sing Insurance JourneySure Travel Insurance - Gold

【MoneySmart Exclusive Offer】 1. Using promo code "MS202401" to enjoy 25% discount on Dah Sing Travel Insurance 2. Enjoy One Complimentary HK$100 HKTV Mall e-Coupon when apply for an Dah Sing Travel Insurance with premium HK$400 or above

Cover insurable loss of trip cancellation or curtailment due to the issuance of Amber, Red and Black Outbound Travel Alerts, Travel Agent or the operator of the Public Common Carrier bankrupt or winding up

Comprehensive delay coverage providing trip delay allowance, reimburse the paid and forfeited cost of Transport Ticket, Accommodation, group tour fees, admission fees of overseas sports, musical or other performance events

Cover leisure or amateur activities during the journey, including skiing, water skiing, rafting, parachuting, bungee jump, scuba diving, rock climbing and mountaineering

Loss of Income Protection caused by accidental bodily injury

Cover Golfer “Hold-in-One”

Zero excess for all coverage

Loss due to act of terrorism

Worldwide Emergency Assistance Services, includes unlimited benefit amount for Emergency Medical Evacuation

Personal Belongings , loss of money & camera Cover, enhanced sum insured for Camera

Family Plan covers maximum 2 parents and unlimited number of legal child(ren) aged under 18 for premium of 2 only

Rental Vehicle Excess Cover

Free and Automatic Extension of the Policy for 14 days in case the Insured Journey is forced to be extended beyond the control of the Insured Person

Personal Liability maximum HK$2,000,000

Dah Sing Insurance members can enjoy 20% premium discount

When planning for riskier activities that have a higher chance of accidents, it is important to consider getting insurance coverage specifically for those activities, including skiing, scuba diving, and parachuting.

Note that some travel insurance policies have limitations on coverage, including restrictions on height and depth. For example, if a skiing location exceeds a certain height, the travel insurance may not cover the activity. We strongly recommend thoroughly reviewing the details of insurance policies.

When searching for travel insurance policies that provide the highest coverage for skiing, scuba diving, and parachuting, there are several options to consider.

Here is the comparison of travel insurance for a 7-day single trip to Japan:

STARR Companies TraveLead Essential Plan

The STARR Companies TraveLead Essential Plan covers most high-risk activities such as skiing and scuba diving without any height or depth restrictions, providing medical coverage up to HK$500,000.

This plan is the most affordable option among all the travel insurance plans. However, it only includes medical coverage and does not offer any additional coverage. Perfect for those who want to get medical coverage only.

Coronavirus Disease ( COVID-19 ) Extension (For Single-Trip and Annual Travel Policy )

Overseas Medical Expenses coverage up to HK$500,000

Accidental Death or Total Permanent Disability coverage up to HK$600,000

BOCG Insurance Universal Voyage Travel Insurance – Silver Plan (Asia)

Apart from covering skiing, scuba diving, and parachuting, the BOCG Insurance Universal Voyage Travel Insurance – Silver Plan (Asia) also provides coverage for personal liability (HK$1,500,000), vehicle rental coverage (HK$2,500), and loss of home contents (HK$10,000).

MoneySmart Travel Insurance 101: What is loss of home contents?

Loss of home contents refers to the coverage provided by the insurance policy for the loss or damage of personal belongings and possessions while the insured person is traveling. This coverage typically includes items such as clothing, electronics, jewellery, and other personal items that may be lost, stolen, or damaged during the trip.

This is a comprehensive travel insurance product that covers not only medical expenses but also provides additional coverage for personal liability, vehicle rental, and loss of home contents.

-with no line.png)

BOCG Insurance Universal Voyage Travel Insurance - Silver Plan (Asia)

【MoneySmart Exclusive Offer】 1. 20% discount on BOCG Travel Insurance 2. Enjoy One Complimentary HK$75 Uber e-Coupon when apply for an BOCG Travel Insurance with premium HK$300 or above

Double Indemnity of Personal Accident, up to HK$1,200,000 (only applicable to Single Travel Plan).

Maximum limit for medical expenses up to HK$500,000, including the treatment expenses incurred inHong Kong within 3 months after the insured person’s return from abroad and Trauma Counselling Protection are also provided.

Protection for Dangerous Activities1, including bungee jumping, parachuting, rafting, diving, trekking & hot-air ballooning(not applicable to professional sportsmen or people engaged in competition).

If “Black Alert” is issued which results in travel delay, cancellation and curtailment etc., the irrecoverable deposits or charges will be payable. (For details, please refer to the list of Outbound Travel Alert)

If Compulsory Quarantined due to Infectious Disease or issuance of any Outbound Travel Alert2 to the destination, the period of insurance will be automatically extended.

Rental Vehicle Excess Protection, cover limit up to HK$2,500 (per event).

24-hour Worldwide Emergency Assistance , offers you medical emergency assistance service, overseas hospital admission deposit guarantee and medical evacuation to suitable hospital or country of residence.

Dah Sing Insurance JourneySure Travel Insurance – Diamond

Dah Sing Insurance JourneySure Travel Insurance – Diamond has a slightly higher premium due to its comprehensive coverage, which includes higher compensation for medical coverage, trip cancellation, loss or damage of baggage, and coverage for high-risk activities like skiing, scuba diving, and parachuting (excluded: rock climbing or mountaineering above 5,000m or scuba diving below 30 m depth).

Additionally, vehicle rental is also covered.

While it may be slightly more expensive than other travel insurance products, it offers a special promotion of a HK$50 YATA coupon, which can provide up to a 25% discount, making it a better deal.

Dah Sing Insurance JourneySure Travel Insurance - Diamond

Cruise Interruption Cover additional transport ticket and excursions tour cancellation

Losing your phone, wallet, or any other personal property can ruin your trip, but if you get travel insurance beforehand, you can be assured of being compensated for your loss!

When it comes to claims for property loss, there are certain things you need to do to meet the insurance company’s requirements. For instance, if you encounter theft or damage to your property, you should report it to the local police within 24 hours and get a written report.

And when you make a claim, you’ll need to provide receipts for the items that were lost or damaged. Make sure the receipts have the purchase date, price, model, and category of each item. Also, keep in mind that the insurance company might subtract the depreciation value of the property when calculating the coverage amount.

Here is a comparison of the travel insurance offering the highest coverage for property losses:

Zurich Get “Z” Go+ Deluxe Plan: The highest coverage for lost property

The Zurich Get “Z” Go+ Deluxe Plan offers the highest compensation for lost property, up to HK$25,000. If you have valuable property that needs to be covered, this insurance plan is worth considering.

Zurich Get “Z” Go+ Deluxe Plan

Each adult or elderly can enjoy one accompanied child1 covered 1+1 for free to maximize 1+1 synergy

Enjoy unlimited 1+1 benefits

No restriction on relationship to protect your families, friends and relatives in one single policy at ease

Personal accident and Medical expenses cover up to HKD 1,500,000 (Allow additional top-up for Personal accident and Medical expenses cover)

Aged 76 or above can enjoy 100% full coverage for free for single trip travel plan

Up to HKD 25,000 personal property coverage including mobile phone and laptop computer cover

Amateur Sports Events and Training and Bike Tour, Cruise Tour Cover and Pet Cover are available as optional benefits to cater to your needs

BOCG Insurance Universal Voyage Travel Insurance – Silver Plan (Asia) also provides coverage for lost property with compensation of up to HK$6,000. Additionally, the travel insurance policy covers up to HK$500,000 in overseas medical expenses.

Blue Cross TravelSafe Plus Global Diamond Plan

Now you can have peace of mind knowing that your lost property is covered by the Blue Cross TravelSafe Plus Global Diamond Plan. It offers up to HK$20,000 for baggage loss.

Last tip: Get your insurance as early as possible

Buying your travel insurance in haste robs you of the chance to compare the various options and get a value-for-money policy that offers enough coverage at a reasonable price. You definitely don’t want to spend too much on a policy, or get one that’s so thin it barely covers you for anything. So spend a bit of time to pick the best policy for you, taking a careful consideration of various factors, including your destination, trip duration, and planned activities.

Travel insurance protects you not just the time when you’re on holiday to enjoy life, but also the weeks before you leave Hong Kong. So, the only way you can have a trip with the peace in mind is to buy your travel insurance in advance—not in the cab, on your smartphone as you rush to the airport! Don’t forget to check out the latest offers from MoneySmart travel insurance selection.

Frequently asked questions: Travel insurance

What is travel insurance.

Travel insurance is a type of insurance that provides coverage for unexpected events that may occur while traveling, such as trip cancellation, medical emergencies, lost or stolen baggage, and travel interruption.

Do I really need travel insurance?

A: It is highly recommended to purchase travel insurance before embarking on any trip, especially if you are traveling internationally. Travel insurance can provide financial protection for unexpected events that may occur while traveling.

What does travel insurance typically cover?

Related articles.

If you haven’t made up your mind, you can check out the t ravel insurance guide : things to consider before purchasing.

Autumn is around the corner, check where you can see the best Japan autumn leaves now! (With top spots recommendation and transportation guide!)

Want to stay ahead of the crowd? Visit the MoneySmart blog for more financial tips!

MoneySmart—Your One-Stop Financial Products Platform

Homepage: www.moneysmart.hk/en/

Protect your personal data by keeping your Manulife customer website login password safe and change your password regularly. Manulife will never call you or send any SMS/email asking for your Manulife customer website login password. Stay vigilant for suspicious phone calls, emails, websites, apps, etc. allegedly related to Manulife. If you receive any calls claiming to be from Manulife, authenticate the caller’s identity (e.g. full name of the advisor and his/her Insurance/MPF Intermediary License No. or full name of the Manulife customer service officer). If the caller refuses to disclose such information, please do not continue with the conversation. Also, if you notice any suspicious transaction activities in your account with Manulife, or any account that is under your name but not set up by you, please inform us immediately. If you are in doubt, please contact us at (852) 2108 1188 (HK) / (853) 8398 0383 (Macau) or by email at [email protected] (HK & Macau) for assistance.

- Corporations

- Individual Individual Corporations

- English 繁體 简体

- Login Personal customer login Employer login Learn more about customer website

- Personal customer login

- Employer login

- Learn more about customer website

Are you looking for:

You are about to leave Manulife website

The general insurance products (“Products”) as shown in this website are underwritten by QBE Hongkong & Shanghai Insurance Limited (“QBE Hong Kong”) which is authorised and regulated in Hong Kong by the Insurance Authority (“IA”). By clicking the button “Proceed” below, you will be leaving our website to access QBE Hong Kong's website where their terms of use and privacy policies will apply to you.

General insurance

Travel Insurance

How has our travel insurance got you covered?

Up to HK$3,000,000 medical expenses

Traveling delay benefits time excess as low as 5 hours

Free automatic extension up to 14 days in case of being involuntarily delayed

No age limit applies

Covers trip cancellation and curtailment expense included Black and Red Outbound Travel Alert

No claim discount up to 15% off

Premium as low as HK$61 for a 3-Day Asia trip

Looking for more individual general insurance protection? Talk to your Insurance Advisor 2 now. Need to file a claim 3 ? Simply submit through eClaim servic e .

Our experts are here to help you!

Talk to our experts

I want to contact

Manulife customer.

- Title Mr. Mrs. Ms.

- Given name*

- Supplementary information (If any)

I have read and accepted Manulife's Terms of use and Personal Information Collection Statement including the use of my personal information provided above.

Thank you for contacting Manulife!

Dear {salutation} {firstname} {lastname} , , your personal enquiry number: {referenceid}.

We will respond within two business days to forms submitted at or before 10:00am each business day. For example, if you submit this form at or before 10:00am on a Monday, we will respond by Tuesday. Forms submitted after 10:00am on a Monday will receive a response by Wednesday.

Oops! Please excuse us, something went wrong.

Sorry, please refresh the page and try again

Other General Insurance Protection

Protect against the unexpected potential financial burden from accident

All-round protection for your home and its contents.

Extensive domestic helper coverage to enable employer to meet legal obligation

- Manulife (International) Limited (incorporated in Bermuda with limited liability) (“Manulife”) and QBE Hongkong & Shanghai Insurance Limited (“QBE Hong Kong”) have entered into an Exclusive Distribution Agreement by which Manulife shall be engaged in marketing and promotion of QBE Hong Kong’s general insurance products.

- Appropriate Manulife's licensed individual insurance agents shall be appointed and registered as QBE Hong Kong’s licensed individual insurance agents to distribute QBE Hong Kong’s general insurance products.

- Available for selected individual general insurance policy only.

Content on this webpage has been prepared by and the product(s) described is (are) underwritten by QBE Hong Kong solely but not Manulife. For the detailed terms and conditions of the products, please refer to the respective marketing collaterals and policy documents.

- Our Business

- Investor Relations

- Corporate Social Responsibility

- Tax-deductible products

- Extended Medical Support

- File a claim

- Form library

- Make a payment

- Premium Exchange Rates

- Useful calculators

- Manage your account

- Useful information

- Customer feedback

- MPF Annual Member Benefit Statement

- Plan for retirement

- Build my career

- Have a baby

- Get married

- Buy a new home

- Grow my business

Terms of Use Privacy Policy

© 2002-2024 Manulife (International) Limited (Incorporated in Bermuda with limited liability)

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used. For more details, please read our Online Terms & Conditions , Privacy Policy , Cookies Policy and Personal Information Collection Statement .

Search by category

Popular searches.

- Mobile account opening

- Mobile Cheque Deposit (MCD)

- Faster Payment System (FPS)

- +FUN Dollars

- Foreign exchange

- Hang Seng Mobile App – Simple Mode

We recommend using a computer web browser or Hang Seng Mobile App to log on for enhanced security. Please visit " Security Information Centre " for more security tips.

Travelsure Protection Plan

Multiple coverage protection to safeguard your trip.

Special notice about Hang Seng Bank’s bancassurance partnership A new insurance partnership between Hang Seng Bank Limited and Chubb Insurance Hong Kong Limited came into effect on 10 July 2023 and the insurance partnership with QBE General Insurance (Hong Kong) Limited (“QBE”) has ended on 9 July 2023. Any policies issued by QBE expiring on or after 9 July 2023 will not be renewed. You can review your insurance coverage before the expiration of policy to make sure you have a timely replacement. View arrangement details

Flash trip to China? Travelsure Protection Plan (Single Trip Cover) provides the medical expenses coverage during your trip. Premium from HKD41/day.

Plan overview

Travelsure Protection Plan (“Travel Insurance”) offers Single Trip Cover, Annual Global Cover and Annual China Cover to meet your different travel insurance needs. It also offers various protection, including trip cancellation or delay, participating in winter or water sports and more.

This Travel Insurance is underwritten by Chubb Insurance Hong Kong Limited ("Chubb").

Logon to continue applying

Quote, apply and pay

Key features

Up to hkd1,000,000 medical and personal accident coverage.

This Travel Insurance covers the medical expenses and emergency assistance arising from sickness or accident during the trip, include:

- Overseas Hospital Admission Deposit up to HKD20,000 (under Chubb Assistance – 24 Hour Worldwide Assistance Services)

- Hospital Cash benefit for hospitalisation due to Bodily Injury or Sickness (not applicable to Annual China Cover Basic Plan)

- Follow-up Medical Expenses up to 90 days after return to Hong Kong, for the treatment of the same Bodily Injury or Sickness arose during the trip

- Expenses for Trauma Counselling within 90 days from the occurrence of a traumatic event, when the Insured is the victim and sustains Bodily Injury due to that traumatic event

- Expenses for Mobility Extension for the equipment and installation/modification if the Insured sustains Permanent Total Disability arising from Bodily Injury during the trip

- Hotel accommodation and transport expenses provided that the Insured Person is recommended by Physician to convalesce immediately before continuing with the Journey after hospital confinement overseas and the original scheduled ticket is forfeited

- Transport and escort services expenses for the escorting the child back to Hong Kong, and Compassionate Visit expenses covering the transport and accommodation expenses for visiting the Insured Person who is unfit to travel, endangered or suffers from death due to Bodily Injury or Sickness (under Chubb Assistance – 24 Hour Worldwide Assistance Services)

- Accidental death, loss of limb(s), eyesight, hearing, speech or Permanent Total Disability and

- Compassionate Death Cash for sustaining Bodily Injury on the Journey leading to Accidental death or Sickness leading to death within 12 months

Up to HKD3,000 loss of Personal Cash & HKD10,000 Travel Documents coverage

This Travel Insurance covers (not applicable to Annual China Cover Basic Plan):

- Loss of cash, banknotes or cheques (excluding digital currency); and

- Replacement cost of travel documents and/or travel tickets; and

- Additional transport and/or accommodation expenses for arranging the replacement travel documents and/or travel tickets

Up to HKD50,000 Credit Card Protection (Hang Seng Credit Card exclusive)

Within the 12 months following Bodily Injury during the Journey causing Accidental death or Permanent Total Disability, this policy will reimburse the Hang Seng Credit Card bill of the Insured Person spent at the date of the accident, including credit card interest and charges at the date of the accident. The premium of this policy must be paid with the Hang Seng Credit Card of the Insured Person.

Up to HKD15,000 Personal Property coverage

This Travel Insurance covers the loss, theft or damage to your personal belongings during the trip, including baggage, laptop, mobile phone (20% excess is applied), etc. Losses must be reported to the police within 24 hours and written police report is required. For losses occurred in transport, the Public transport Carrier must be notified and written report is required.

Up to HKD1,000 Baggage Delay coverage

This coverage (applicable to Single Trip Standard Plan / Annual Global Plan only) includes the cost of purchasing essential toiletries and clothing when checked-in baggage is delayed, misdirected or temporarily misplaced by a Public Transport Carrier for at least 10 consecutive hours from the time of arrival at destination's transport terminal.

Up to HKD30,000 Trip Cancellation and Curtailment coverage

This Travel Insurance (not applicable to Annual China Cover Basic Plan) offers reimbursement of the pre-paid and unused tour or transportation fare, accommodation deposit and / or cost of admission ticket to major sporting event, musical concert, museum or theme park arising from trip cancellation and/or curtailment due to specific events.

Up to HKD2,000 Travel Delay or HKD10,000 Re-routing coverage

This Travel Insurance plan covers (not applicable to Annual China Cover Basic Plan and only one of the compensations is available):

Travel delay

- Cash Benefit for the first 6 hours and every 8 hours of travel delay; or

- Reimbursement for the additional or forfeited accommodation expenses outside Hong Kong if the delay exceeds 24 consecutive hours

Re-routing In the event of delay of a Public Transport for at least 8 consecutive hours or the unexpected issuance of Black Alert at the destination after commencement of the journey, and the journey has to be re-routed, this insurance will cover:

- The lost transport and/or accommodation expenses paid in advance or forfeited by the Insured Person after departing from Hong Kong; or

- Reasonable additional transport and/or accommodation incurred by an Insured Person to enable him or her to arrive at their scheduled destination

- Re-routing due to Black Alert is not covered in Annual China Cover Standard Plan

Up to HKD5,000 Rental Vehicle Excess coverage

This coverage (applicable to Single Trip / Annual Global Plan only) includes reimburse the insurance excess that is legally liable to be paid by the Insured Person, due to the loss or damage to a rental vehicle caused by an accident while under the Insured Person's control during the Journey.

Coverage overview

Mainland China and Macau - Basic Plan

Asia [1] and worldwide - Standard Plan

Not Applicable

Not Applicable

Global Cover

China Cover - Basic Plan

China Cover - Standard Plan

5,000 (20% excess is applicable for each and every Mobile Phone claim)

Note(s): The information above is for reference only, you can refer to the plan coverage and Policy Wording for details.

Product information

Eligibility, travelsure protection plan - single trip coverage.

Ms. Leung slipped in the lift lobby at the hotel while she was staying in Korea.

Before the trip

She applied for Travelsure Protection Plan – Single Trip Coverage

Upon hospital admission in Korea

- Her travel companion called the Chubb Assistance hotline to refer and arrange for a translator to communicate with the doctor, as they did not speak Korean

- It was diagnosed that her injury was rather severe

- The doctor advised her to get back to Hong Kong for immediate medical treatment

- The Chubb Assistance team then arranged medical repatriation for her, including the ambulance and flight arrangements back to Hong Kong

When waiting for the flight back to Hong Kong at the airport

Her mobile phone and tablet computer were stolen

When the insurance is claimed

Ms. Leung successfully claimed the following losses:

- Medical expenses in Korea

- Non-refundable prepaid cost of Booked Holidays arising from the trip curtailment

- Extra travelling expenses for medical repatriation

- Follow up medical treatment in Hong Kong

- The loss of her mobile phone and tablet computer

Total compensated amount: HKD 81,000

TravelSure Protection Plan - Annual Global Coverage

Ms. Chau was about to take off for a trip, but had to cancel due to the sudden death of an immediate family member from an acute disease.

She applied for Travelsure Protection Plan – Annual Global Coverage

Before the take off for the trip

She suffered the loss of a loved one, and her travel plan was disrupted and cancelled

She was fully compensated for the non-refundable prepaid costs of the air tickets and hotel accommodation

Total compensated amount: HKD 21,000

The payment was directly credited through autopay into her designated bank account

- This Policy is only valid for travels originating from Hong Kong

- The insured age of the Single Trip Coverage has no upper limit; the Annual Trip Coverage is only available to those under 75 years old (at the policy effective date)

Popular questions

No, customers must purchase Travelsure Protection Plan prior to your departure from Hong Kong.

Yes, Travelsure Protection Plan provides cover for business travel (limited to administrative, clerical and non-manual works only).

No. Travelsure Protection Plan does not cover injury or death caused by any labour work. So you should approach the insurer who issued your helper's employee insurance for an extension of the protection to overseas work.

Yes, Travel Insurance is designed for people going abroad as a visitor for leisure or on business trips. The scope of coverage is different from a life insurance plan.

Application

Single trip cover: there is no age limit. Annual cover: The Insured Person(s) must be between 18 to 74 years old, while child(ren) must be under 18 years old (at the policy Commencement Date or Renewal Date). Point to note when applying for child(ren) under 18 years old who do(es) not travel with parent:

- Please select "Friends/relatives" to proceed online application.

No. The travel warning issued by the World Health Organisation against a certain country or region shall have no bearing upon the protection provided by this plan. However, it is suggested that an insured should closely observe the development of the relevant situation as any orders promulgated subsequently by the government may affect the insured's journey and the protection under this plan.

Coverage related

Annual Coverage:

The insurance period of annual coverage is 1 year from the policy effective or renewal date.

Maximum coverage period for each journey (there is no limit on the number of journeys during the insurance period) is the earliest of:

- up to 60 days (inclusive of the date of departure); or

- 3 hours after the Insured Person passed through Hong Kong immigration control point on their return to Hong Kong; or

- At the end of the Period of Insurance

The maximum insurance period of single trip coverage is 6 months.

Under Basic Plan of the Annual China Cover, if the Insured Person sustains bodily injury caused by an assault during a robbery while traveling in mainland China (excluding Hong Kong SAR) or Macau SAR, which leads to death or permanent disability, the original Personal Accident benefit of HKD200,000 will be doubled to HKD400,000.

Insured Person can enjoy policy benefits under issuance of "Black Alert" or "Red Alert" in the planned destination:

(Applicable to Single Trip Coverage and Annual Global Coverage only) Before the trip:

- Trip Cancellation benefit up to HKD30,000

During the trip:

- Trip Curtailment benefit up to HKD30,000 ; or

- Re-routing (Black Alert only) up to HKD10,000; and

- Free 10-day policy extension

For "Black Alert", the Insured Person can be reimbursed the relevant loss up to the maximum Sum Insured. For "Red Alert", reimbursement will be up to 50% of the relevant loss and the maximum Sum Insured.

As long as the condition is covered under the policy, you can enjoy the insurance protection when admitted to non-designated hospitals outside the hospital list. But, please note that the guarantee of hospital admittance deposit in the case for admission to non-designated hospitals is up to HKD20,000. You must also obtain the original copy of the hospital or medical receipt with the diagnosis certified by the attending doctor and settle such medical expenses first. And then file a claim when you return to Hong Kong.

The China Emergency Card is applicable to hospital admission only. If you only visit an out-patient clinic, you need to pay the consultation fee, get a receipt and medical certificate, and then file a claim when you return to Hong Kong. Make sure the medical practitioner treating you is licensed by the competent medical authorities.

Emergency assistance and China Emergency Card

If you need any emergency assistance during your trip, please call our Chubb Assistance – 24 Hour Emergency Assistance Hotline at (852) 3723 3030 .

You'll receive an email from Chubb with instructions on how to get your China Emergency Card and how to add the Card to your Apple Wallet or Android PassWallet.

In such event, you should:

- Check the hospital list and call the Chubb 24-Hour Emergency Hotline at (852) 3723 3030 for assistance.

- Chubb Assistance China Emergency Card

- Travel document, e.g. Re-entry Permit, HKID or Passport

- Keep all hospital receipts and pass them onto Chubb Insurance Hong Kong Limited for claims handling within 30 days after you are discharged

All information provided on the hospital list is subject to change without prior notice. Please contact the 24-hour Chubb Emergency Hotline for assistance.

For cases involving hospitalisation, you must present the China Emergency Card to be eligible for the fast-track admission service. Otherwise you will have to pay the expenses first and then file a claim or contact our 24-hour emergency service for assistance.

Yes, all you need to do is just re-install the China Emergency Card to the original or new mobile device. There is no card replacement cost.

Managing policy

No, application for the Travelsure Protection Plan for the purpose of emigration will not be accepted and the policy will become invalid when you emigrate to an overseas country or territory.

Prior to the expiry date of the policy, you can call the Customer Services Hotline at (852) 3191 6668 (Mondays to Fridays, 9 a.m. to 5:30 p.m., closed on Saturdays, Sundays and Public Holidays) to apply for a policy extension. Chubb Team will review and process the policy extension request. The policy will only be effective when such application has been approved and the premium for the extended period has been paid.

To ensure a continuous coverage, your policy will be renewed automatically upon the expiry date for 1 year and the annual premium will be debited from the credit card provided. The renewal insurability is subject to the terms and conditions in the renewal notice and policy wording. If you do not wish to renew the policy, you should notify Chubb after receiving the renewal notice.

No, you should submit your claim to the Travel Industry Compensation Fund for compensation.

No, cancellation of the journey as a result of administration arrangements of the travel agency are not covered by the Travel Insurance.

In the event of trip cancellation due to unexpected outbreak of natural disaster (such as landslide, earthquake, volcanic eruption, tsunami, typhoon or hurricane) at the scheduled destination arising within 7 days before the departure date of the journey, the Travel Insurance will pay the Insured Person the Booked Holidays forfeited.

Such coverage is not applicable to Annual China Cover - Basic Plan.

Make a claim

Claim procedures.

Find details on how to submit your claim and more.

Download form

You can find all forms and documents here for our insurance policies.

Useful information

- Plan Coverage

- Plan premium

- Declaration (Single Trip Cover)

- Declaration (Annual China Cover/Annual Global Cover)

- Policy Wording(Single Trip Cover)

- Policy Wording (Annual China Cover)

- Policy Wording (Annual Global Cover)

- Hospital List & Contact Number [for Annual China cover ONLY]

- Outbound Travel Alert (OTA) currently in force

Need more help?

Call us for enquiry.

(852) 29989888

Leave us a message

You may be interested in

Other point(s) to note.

- The above general insurance plan ("this Plan") is underwritten by Chubb Insurance Hong Kong Limited (“Chubb”) which is authorised and regulated in Hong Kong SAR by the Insurance Authority. Chubb reserves the right of final approval of the policy issuance. Hang Seng Bank Limited ("Hang Seng Bank") is registered as an insurance agency by the Insurance Authority (License No.: FA3168) and authorised by Chubb for distribution of this Plan. This Plan is a product of Chubb and not Hang Seng Bank. Upon application to this Plan, insurance premium will be payable to Chubb, and Chubb will provide Hang Seng Bank with commission and performance bonus as remuneration for distribution of this Plan. The existing staff remuneration policy on sales offered by Hang Seng Bank takes into account various aspects of the staff performance instead of focusing solely on the sales amount.

- In respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between Hang Seng Bank and the customer out of the selling process or processing of the related transaction, Hang Seng Bank is required to enter into a Financial Dispute Resolution Scheme process with the customer; however, any dispute over the contractual terms of the insurance product, underwriting, claims and policy service should be resolved directly between Chubb and the customer.

- The above information is intended to be a general summary for reference only. Please refer to the policy wording for exact terms, conditions and details of the exclusions.

- Including mainland China, Bangladesh, Brunei, Cambodia, Guam, India, Indonesia, Japan, Korea, Laos, Macau SAR, Malaysia, Mongolia, Myanmar, Nepal, Pakistan, Philippines, Saipan, Singapore, Taiwan, Thailand, Tinian and Vietnam.

- Terms and Conditions apply.

JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

- Effective Date: Start Date

The departure date must be within 365 days starting from today.

*The promotion offer is subject to Terms and Conditions , please click here for further information.

| Asia | Australia, Brunei, Cambodia, China, India, Indonesia, Japan, South Korea, Laos, Macau, Malaysia, Myanmar, New Zealand, Philippines, Singapore, Taiwan, Thailand and Vietnam

| Worldwide | All destinations excluding : Cuba, Iran, Syria, North Korea, Crimea Region, Donetsk People’s Republic (DNR) Region or Luhansk People’s Republic (LNR) Region

Latest announcement: If you have already purchased “ TravelWise” Insurance Protection Plan, please click here for further information.

Please be advised that the military conflict between Russia and Ukraine may impact travel insurance coverages and benefits, and AIG Travel’s ability to provide certain travel-related assistance services, for travel to, from or within the affected areas.

Important Notice: COVID-19 is a foreseen or known event. For more details, please click here.

AIG TravelWise Insurance

AIG’s TravelWise travel insurance provides comprehensive protection for your journey and is one of the best travel insurance packages available in Hong Kong.

We cover your medical costs should you have an accident or suffer illness while on holiday worldwide, along with any losses arising from your trip being cancelled or your journey being delayed. AIG also covers loss of your baggage or personal belongings, as well as all other risks related to your travelling experience.

TravelWise holiday insurance comes with AIG Travel Assistance, our worldwide emergency service which gives you 24/7 access to a dedicated team of multi-lingual staff of doctors, nurses, medical professionals and security personnel, who can respond to your needs in the event of an emergency.

Flexible plans from HK$14.45 only

- Travel delay - 5 hours from stated departure or arrival

- Baggage delay - up to HK$2,000 maximum

- Baggage and personal effects

- Emergency medical expenses

- Personal accident - accident while in a common carrier up to HK$1.2M maximum

- Journey cancellation or interruption

- Loss of income benefits

- Compassionate visit

*All journeys must commence from Hong Kong

*The price is for reference only. You could get a quote here real time. # The above information is for reference only. For the full benefit table, please refer to our TravelWise brochure or click Buy Now .

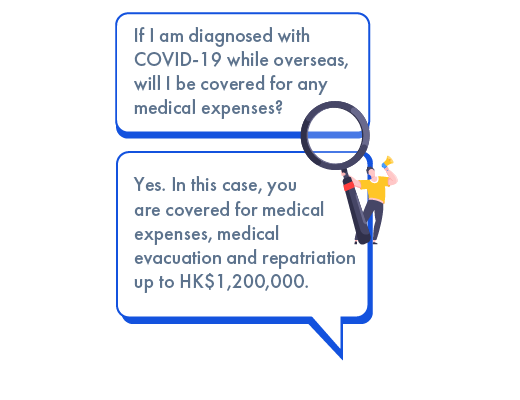

Receive COVID-19 coverage of up to HK$1,200,000

AIG TravelWise insurance is now enhanced with COVID-19 coverage. Get the same existing protection, now with COVID-19 cover including emergency overseas medical expenses, journey cancellation, curtailment and quarantine allowance if you are diagnosed with COVID-19.

As you look to explore the world again, travel safely with TravelWise for greater peace of mind.

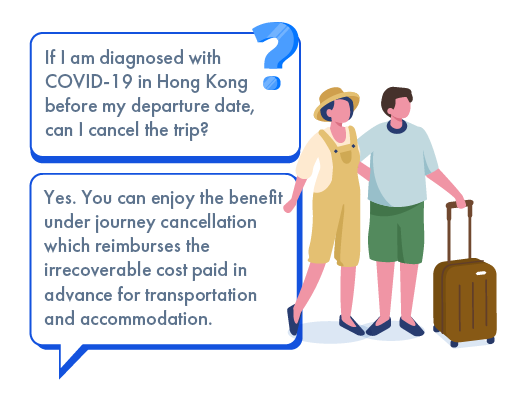

Journey cancellation cover if you are diagnosed with COVID-19 prior to departure from Hong Kong

Emergency overseas medical expenses cover, curtailment cover and quarantine allowance if you are diagnosed with COVID-19 while traveling overseas

*This is for reference only and is subject to policy terms and conditions. For the full benefit table, please click Buy Now .

Check out travel insurance plan with new COVID-19 cover

Click to compare plan coverage and benefits.

- Plan Benefits

- Coverage comparison

COVID-19 Coverage

Optional benefits.

*The above information is for reference only. For the full benefit table, please refer to our TravelWise brochure or click Buy Now .

We are here to support you in case you experience difficult situations during your journey

We understand that things can change quickly, and you might need extra support especially while abroad.

AIG offers a 24/7 toll-free travel emergency hotline to provide support if you feel unwell, or are banned from boarding your transport or from entering a country due to an emergency health condition.

Please note: Expenses incurred from third-party vendors as well as AIG administrative case fees for assistance services not covered as part of this insurance plan are the responsibility of the Policyholder.

When should I buy the travel insurance?

As soon as you have confirmed your travel route and destination, you should consider purchasing travel insurance. The policy must be purchased before your journey commencement (before you leave an immigration counter in Hong Kong), travel insurance purchased after you departed Hong Kong is considered invalid.

I purchased the annual plan of TravelWise insurance policy, will this policy cover all of my trips in this year?

TravelWise annual plan covers all of your trips during the year while trip must commence from Hong Kong with maximum 90 consecutive days per journey.

If I purchased TravelWise Deluxe single plan, will I be covered if I take hot air balloon ride?

Yes, TravelWise covers all amateur sporting activities.

I felt sick while I was travelling but I did not consult a doctor. I only saw a doctor when I came back to Hong Kong. Am I covered?

Unfortunately, your medical expenses incurred after your return to Hong Kong are not covered. Under your TravelWise single plan, we only pay for medical expenses incurred as follow-up treatment in Hong Kong if you have consulted a Legally Registered Medical Practitioner overseas for the same sickness during the insured trip.

Who is eligible to purchase?

Anyone age 70 or below on the commencement date of the policy. A policy may be purchased by an individual or a family for travel overseas for purpose of leisure and/or business, provided the trip is commences from Hong Kong.

Note : We do not cover any travel to Cuba, Iran, Syria, North Korea, the Crimea region, Donetsk People’s Republic (DNR) Region or Luhansk People’s Republic (LNR) Region.

How much premium do I have to pay?

Please press “ Buy Now ” above or refer to our TravelWise brochure for premium levels for each plan.

I travelled to Thailand for 4 days and purchased TravelWise single insurance plan. On the last day of the trip, I suffered from fibular fracture which caused me to stay 2 more days in Thailand. Will TravelWise Protection Plan cover my trip?

Yes. Cover will automatically be extended up to a maximum of 10 calendar days without paying any additional premium, in the event the journey is being unavoidably delayed. (e.g: Travel Delay and missed departure sections due to fibular fracture, and insured person can provide medical documentation to prove that he/she is not medically fit to travel)

How and when can I contact AIG Travel (emergency service team)?

You can call our emergency service team 24/7 at (852) 3516-8699

I am heading to an overseas exchange after which I will stay behind for my personal travelling. Can I only buy travel insurance only for my personal travel?

Yes, but you must purchase your Travel Insurance for the whole period (including exchange & leisure travel).

My flight will depart on 11:50pm on 1 Feb evening. When should be my policy inception date?

You must take 1 Feb as the inception date/ departure date of your Travel Insurance, and the protection will commence after the insured person passed the Hong Kong Immigration Department counter.

If I travel to multiple countries within the same trip, do I need to purchase a separate plan for each country?

If you are travelling to multiple destinations within the same trip, you can be covered under one policy. Please select the furthest region as listed under our area of coverage.

I will be travelling to Thailand this weekend, but a tsunami has just hit the tourist spot today. I want to cancel my trip. Am I covered?

If the Security Bureau issued a “Red or Black Alert” within 7 days of your journey departure date or during your journey, AIG shall reimburse you in accordance with the following “Journey Cancellation”, “Journey Curtailment” or “Journey Re-arrangement” coverage.

I originally planned to travel from Edinburgh to London then coming back to Hong Kong by air. Unfortunately the earthquake had halted the air traffic in Scotland. I chose the road transport instead to travel to London in order to catch the flight to Hong Kong. Can I claim the road transport costs?

Yes, we will reimburse you the additional road transport fares since earthquake is a natural disaster which has caused the delay or cancellation of your scheduled flight. Please ensure that you submit to us the letter from airline to prove the flight delay/ cancellation.

How can I make a claim?

In the event of loss, written notice of claim should be submitted to AIG Hong Kong within thirty (30) days after the occurrence , together with all relevant documents.

In order to help us to deal with your claims, you should provide all the supporting documents to substantiate your claim. Complete documentation will prevent any delay in your claim assessment as additional time may be required to obtain the requisite information.

Upon receipt of sufficient documents, we will assess your claim accordingly. The result of your claim submission will be sent to you shortly.

For detailed claims procedure, please check travel claims procedure .

- TravelWise Summary

- China Assist Card Hospital List

- TravelWise Policy Wording

- OTA Brochure

AIG’s 24/7 Chatbot is here to help

Travel Insurance Hotline

Online Enquiry

Leave us a message

Need Business Insurance?

General Insurance Plans Suited for Diverse Needs

Apply now to receive up to hk$400 hktvmall e-gift voucher.

For enquiry, please contact staff of CCB (Asia) or call QBE Hong Kong Customer Service Hotline at 2828 1998.

A. General Terms and Conditions:

- Unless otherwise specified, the promotion period is from January 1, 2024 to June 30, 2024 (both dates inclusive) (the “ Promotion Period ”).

- QBE Hongkong & Shanghai Insurance Limited (“ QBE Hong Kong ”) reserves the right to suspend, vary or discontinue the Promotion, and amend the Promotion and its terms and conditions at any time without prior notice. In case of any dispute, the decisions of QBE Hong Kong shall be final and conclusive.

- The Promotion cannot be used in conjunction with any other promotion offers offered by QBE Hong Kong at the same time.

- In the event of any inconsistency between the English and Chinese versions of these terms and conditions, the English version shall apply and prevail.

B. Insurance Application Offer Terms and Conditions:

- The Promotion is only available to new application(s) of designated plans (not applicable for renewal policy) which has/ have been made by an applicant successfully via the Online Banking/ Mobile Banking of China Construction Bank (Asia) Corporation Limited (the “ Bank ”) or by visiting the Bank’s branches during the Promotion Period (the " New Policy ") (“ Eligible applicant ”). For a policy(ies) which has/ have been lapsed for more than 3 months before the commencement date of Promotion Period, such policy will not be defined as a renewal policy.

- Designated plans including Home Plus Protection Package, Single Trip Travel Insurance, Annual Travel Insurance, Domestic Helper Protector, Personal Accident Protection Plus, Motor Supersurance, Shop Protection Package, Office Protection Package, SME Business Insurance Solution and Interior Renovation Prestige are underwritten by QBE Hong Kong. QBE Hong Kong reserves the right to make a final underwriting decision.

- From March 20, 2024 to June 30, 2024 (both dates inclusive), an extra HK$200 HKTVmall e-Gift Voucher (" Voucher ") will be offered to Eligible Customer who purchase the optional cover of “China Network Hospital Admission Cover” together with the Annual Travel Insurance. Stock of the Voucher is limited, and it will be given to the Eligible Customer on a first come first serve basis.

- Eligible applicant(s) must provide a valid email address during the application of a New Policy. Eligible applicants who provided an invalid or incorrect email address will not be eligible for the Voucher.

- The Voucher will be sent to the email address provided by the Eligible Customer within 6 months (counting from the month end following the date of the application).

- In order to be eligible for the Promotion, the New Policy(ies) has/ have to be effective at time when the Voucher is distributed (Not applicable to Single Trip Travel Insurance).

- The Voucher cannot be exchanged or redeemed for cash. QBE Hong Kong reserves the right to replace the Voucher with an alternative gift without prior notice.

- QBE Hong Kong is not the manufacturer of the Voucher. All enquiry(ies) or complaint(s) regarding the quality of the Voucher should be directed to the relevant supplier. QBE Hong Kong will assume no responsibility / liability in respect thereof.

- The said Voucher is non-replaceable, non-refundable, non-transferable and non-returnable. The Voucher will not be re-issued if lost or unused after its expiry date.

- This webpage (including the terms and conditions) is not a contract of insurance and is for reference only. For details of the coverage, exact terms and conditions and exclusions of the designated plan(s), please refer to the English version of the policy. Any disputes arising from the above insurance policy(ies) / product(s) shall be settled with QBE Hong Kong directly.

Disclaimers China Construction Bank (Asia) Corporation Limited (Insurance Intermediary License No: FA3132) (“the Bank”) is the appointed insurance agency of QBE Hongkong & Shanghai Insurance Limited (“QBE Hong Kong”) and China Taiping Insurance (HK) Company Limited (“CTPI(HK)”), to distribute general insurance products in Hong Kong Special Administrative Region. Relevant general insurance products are the products of the insurance companies but not the Bank. The above general insurance products are issued and underwritten by QBE Hong Kong or CTPI(HK). QBE Hong Kong and CTPI(HK) are authorized and regulated by the Insurance Authority (“IA”) to carry on general insurance business in the Hong Kong Special Administrative Region. Please refer to the sales documents, including product brochure, benefit illustration (if applicable), policy documents and provisions issued by QBE Hong Kong or CTPI(HK) for details (including but not limited to insured items and coverage, detailed terms, key risks, conditions, exclusions, important notes, policy costs and fees) of the general insurance products. QBE Hong Kong and CTPI(HK) reserve the right to decide at each of their sole discretion to accept or decline any application for general insurance product according to the information provided by the customer at the time of application. In respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between the Bank and the customer out of the selling process or processing of the related transaction, the Bank is required to enter into a Financial Dispute Resolution Scheme process with the customer; however, any dispute over the contractual terms of the general insurance product should be resolved between QBE Hong Kong or CTPI(HK) and the customer directly. Information on this website intended to be distributed in Hong Kong for reference only, and shall not be construed as an offer to sell or a solicitation of an offer or recommendation to purchase or sale or provision of any insurance product in or outside Hong Kong. You should not solely base on the above information to purchase any insurance product. You should consider whether the relevant insurance products fit your needs. Please refer to the product brochure, benefit illustration (if applicable) and policy documents and provisions for details of the relevant insurance products. Pursuant to the Insurance (Levy) Regulation (Cap. 41I) and the Insurance (Levy) Order (Cap. 41J) under the Insurance Ordinance (Cap. 41), the IA collects levies for insurance premiums from policyholders with effect from 1 January 2018. For further details, please visit the website of IA. For the latest information about the IA, please visit https://www.ia.org.hk . For the latest information about The Insurance Complaints Bureau, please visit https://www.icb.org.hk .

Risk Disclosure Customers should read the sales documents, including product brochure, benefit illustration (if applicable) and policy documents and provisions issued by relevant insurance company to understand the details of the insurance plan (including but not limited to detailed terms, conditions, coverage, exclusions, fees and product risks) and consider whether the insurance product meets their personal needs before application. Policyholders are subject to the credit risk of relevant insurance company.

- Inbound Travel Insurance - Premier Plan

- Personal AccidentSafe Insurance

- Fire Insurance

- Employees' Compensation Insurance

- BusinessSafe Insurance

- Tycoon Medical Insurance Plan

- CareForYou Flexi Plan for VHIS (Not available for new application)

- Employee Medical Care Plan (formerly known as “Employees Medical Contract”)

- Blue Cross Employee Critical Illness Care Plan New

- Cancer Screening Programme

- Preventive Checkup and Immunisation Programme

- U Care Medical Checkup Scheme

- VHIS Conversion New

- Change of Particulars

- Premium Payment Exchange Rate

- Download Files Insurance-related forms and documents, including application forms, product brochures, terms and conditions, and more

- List of Panel Hospitals

- 24-Hour Emergency Roadside Assistance

- Windscreen Repairers Network

- Travel Insurance Domestic Helper Insurance

- Pet Insurance Other General Insurance

- Motor Insurance Home Insurance

- Claim Procedures & Claim Forms

- CareForYou Flexi Plan for VHIS(Not available for new application)

- Insurance-related forms and documents, including application forms, product brochures, terms and conditions, and more

- Travel Insurance

- Domestic Helper Insurance

- Pet Insurance

- Other General Insurance

- Motor Insurance

- Home Insurance

- Super Agent

High-end VHIS

Travel Protection

Home Protection

Helper Protection

Decoration Protection

SmartPro Drive

Sports Protection

Travel Smart

- Plan Features

- Benefit Details

Latest Offer

Type of coverage, coverage highlight, total 1 day(s), policy effective date, client type, premium package, no. of insured, period of coverage per trip, use promo code.

- Product Leaflet

- Terms & Conditions

About Blue Cross

Legal notices, © copyright. blue cross (asia-pacific) insurance limited 2024. all rights reserved..

This website uses cookies for the purpose of enhancing your user experience. You can find more information on the types of cookies we collect, what we use these for, and how to manage your cookie settings in our Cookie Policy and Privacy Policy Statement .

Chat now with BC Buddy

IMAGES

VIDEO

COMMENTS

Hospital and quarantine allowance. Rental vehicle excess. Extra benefits: COVID-19 Coverage: Overseas medical expenses, hospital and quarantine allowance, trip cancellation and curtailment. Free automatic extension up to 14 days in case of being involuntarily delayed. No claims discount up to 15% off for annual travel insurance plan.

無論您是計劃一次短途或長途的旅行,QBE旅遊保險都能為您提供全面的保障,包括意外、醫療、行李、取消或延誤等風險。QBE是一家國際保險集團,擁有豐富的經驗和專業的服務,讓您安心享受旅程。立即瀏覽我們的網站,了解更多關於單次旅遊保險的資訊和報價。

In order to compare all Hong Kong travel insurance options, we will use a 7-day insured trip to Japan of an adult as an example: Product Name Premium Medical Expenses ... QBE Single Trip Travel Insurance - Silver: HK$176.8: HK$500,000: HK$20,000: HK$20,000: AXA SmartTraveller Plus Economy Plan (Single Journey) HK$179.25: HK$500,000: HK$25,000:

Compare travel insurance plans, including AXA, HSBC, Zurich, Blue Cross, AIG, and Allianz business trip travel insurance plans. Find the best travel insurance rates in Hong Kong and enjoy discounts up to 50% off now! ... QBE. Zurich. Prudential. Reset all.

Cruise Voyage. Note: For the details of the coverage, premium, major exclusions and important notes, please refer to the QBE Annual Trip Travel Insurance product brochure or QBE Single Trip Travel Insurance product brochure. Enquiry Hotline +852 2903 8308 Visit Our Branches. The information contained in this website is a only general summary.

Travel Insurance QBE Hong Kong Travel insurance plan offers a comprehensive travel protection with a range of coverage. It will be offering a COVID-19 Extension Coverage to ease your concerns and minimise the risk before, during and after your perfect get-away. Furthermore, a Staycation cover under Annual

Manulife travel insurance plan offers up to HK$1,000,000 in medical coverage and up to HK$20,000 in baggage and personal belongings coverage. View more. Talk to our experts ... ("Manulife") and QBE Hongkong & Shanghai Insurance Limited ("QBE Hong Kong") have entered into an Exclusive Distribution Agreement by which Manulife shall be ...

Key features. Up to HKD1,000,000 Medical and Personal Accident coverage. Up to HKD3,000 loss of Personal Cash & HKD10,000 Travel Documents coverage. Up to HKD50,000 Credit Card Protection (Hang Seng Credit Card exclusive) Up to HKD15,000 Personal Property coverage. Up to HKD1,000 Baggage Delay coverage. Up to HKD30,000 Trip Cancellation and ...

Flexible plans from HK$14.45 only. *All journeys must commence from Hong Kong. *The price is for reference only. You could get a quote here real time. # The above information is for reference only. For the full benefit table, please refer to our TravelWise brochure or click Buy Now.

Part of the worldwide QBE Insurance Group 33/F, Oxford House, Taikoo Place, 979 King's Road, Quarry Bay, Hong Kong ... Hong Kong or four (4) hours before the scheduled departure time of the ... Common Carrier which Insured Person has arranged to travel, whichever is the later, to commence the trip to the intended destination(s) outside Hong ...

Web site created using create-react-app. 商業客戶請聯絡昆士蘭保險香港 持牌保險中介人提供協助

Terms and Conditions for Applying Designated General Insurance Plan(s) Promotion ("Promotion") A. General Terms and Conditions: Unless otherwise specified, the promotion period is from January 1, 2024 to June 30, 2024 (both dates inclusive) (the "Promotion Period"). QBE Hongkong & Shanghai Insurance Limited ("QBE Hong Kong") reserves the right to suspend, vary or discontinue the ...

QBE HK offers a comprehensive range of non-life insurance solutions. QBE Hong Kong 昆士蘭保險香港, Hong Kong. 593 likes · 57 talking about this · 11 were here. ... QBE Hong Kong 昆士蘭保險香港, Hong Kong. 593 likes · 57 talking about this · 11 were here. 昆士蘭保險香港為企業及個人客戶提供全面的非 ...

QBE-HKSI is the Hong Kong representative of QBE Insurance; Australia's largest global insurer. QBE Insurance Group first established representation in Hong Kong during 1920, and was later merged with the Hongkong & Shanghai Insurance Co. Ltd. (HKSI) in 2001. QBE was ranked as the number 2 general insurer in Hong Kong by Net Written premium in ...

AXA General Insurance Hong Kong Limited (i.e. the merchant) is located in Hong Kong. Email: [email protected] Customer Service Hotline: (852) 2523 3061. Address: 5/F, AXA Southside, 38 Wong Chuk Hang Road, Wong Chuk Hang, Hong Kong. Business Hour: 9:00am to 5:30pm Monday to Friday, except public holidays.

Multi-trip Cover - Up to 55% Original Premium of Single-trip Cover per trip. Special Privilege for Online Enrolment. 1. 6-month Deliveroo Plus Silver Membership. Click here for the relevant terms and conditions. SmartClub members can earn 1 SmartPoint for every HK$1 net premium. 1,000 points = HK$50 reward or 200. Become SmartClub Member.

• College of Professional and Continuing Education Limited and/or Hong Kong Community College (Policy No.: 1-T0593558-PPT) Period of Insurance • 01 July 2023 to 30 June 2024 Beneficiary • Legal Estate in the event of death Customer Hotline Services Telephone Email Travel Claims Enquiry +852 2877 8608 [email protected]