Personal Loans

Business Loans

Credit Cards

10 Of The Best Travel Credit Cards in Australia in 2024

- Compare travel credit cards based on foreign exchange fees, travel perks and more.

- Plus get expert tips on using your credit card overseas from a veteran frequent flyer.

Featured offer: American Express® Platinum Edge Credit Card

$0 annual card fee (usually $195) in first year when you apply online and are approved. T&Cs apply, new members only. Plus, get $200 each year to spend on eligible domestic and international flights, hotels or car hire with American Express Travel.

Top travel credit cards in Australia

Bankwest Breeze Zero Platinum Mastercard

Bankwest breeze platinum mastercard, coles rewards mastercard, hsbc low rate credit card, american express platinum, bendigo bank ready credit card, latitude 28° global platinum mastercard, westpac lite card, ing orange one rewards platinum, american express platinum edge.

- International transaction fee: 0%

- Interest rate on purchases: 14.99% p.a.

- Up to 55 interest-free days

- Annual card fee: $0

- Complimentary international travel insurance: Included

What to know about the card

What’s good? By any standard, the Bankwest Breeze Zero Platinum Mastercard is a low-cost credit card that will save travellers money, with a 0% foreign transaction fee, a relatively low ongoing interest rate on purchases and no annual credit card fee . Yet it still comes with complimentary credit card travel insurance , a travel perk rarely found on low-cost cards.

What’s not so good? Despite being positioned as a ‘Platinum’ card, aside from the complimentary travel insurance, the card offers little in the way of perks and rewards.

- Interest rate on purchases: 19.99% p.a.

What’s good? Another low cost card (assuming you repay the card balance in full each statement period) with no foreign transaction fees. There are no hoops to jump through to avoid the annual fee, which is rare for a card offering complimentary travel insurance.

What’s not so good? There’s not much to dislike here if you want a low-fee card. That said, the interest rate is on the high side. For travellers covering the cost of a holiday across multiple statement periods, this could be an issue.

- International transaction fee: 0% on purchases

- Interest rate on purchases: 27.49% p.a.

- Complimentary international travel insurance: Not included

What’s good? No international transaction fees and no annual fee, plus a couple of other eye-catching travel perks: Access to global roaming data from eligible telco networks in 150 countries; and a flight delay pass which offers access to airport lounges if your flight is delayed.

What’s not so good? Even by credit card standards, Latitude’s 28° Global Platinum Mastercard has a remarkebly high interest rate, meaning carrying a balance could be extremely expensive of you have a revolving balance.

- Interest rate on purchases: 0% p.a. for 12 months, then 12.99% p.a.

- Annual card fee: $69

What’s good? Offers the same travel-friendly advantages as Bankwest’s Breeze Zero Platinum Mastercard but with a slightly lower ongoing interest rate that’s waived for the first 12 months. This could be an option for new cardholders looking to pay off an expensive trip over time with what is effectively an interest-free credit card for the first year.

What’s not so good? There’s an annual fee and also relatively few card perks (not surprising given the annual fee is fairly modest).

- Annual card fee: $99

What’s good? This is one of the 0% international purchase fee credit cards that also offers rewards points (Flybuys), with a sign-up bonus of 50,000 points if you apply by 30 June 2024 and spend $3,000 on eligible purchases within 3 months of approval.

What’s not so good? There’s an annual fee – it’s not massive for a rewards credit card but there are other cards out there arguably offering more travel perks (e.g complimentary travel insurance) with no annual fee.

- Interest rate on purchases: 12.99% p.a.

- Complimentary international travel insurance: Not included, but comes with domestic travel cover.

What’s good? The HSBC Low Rate Credit Card comes with no international transaction fees and a low interest rate on purchases of 12.99% p.a. It also offers domestic travel insurance, and an offer of 0% on balance transfers for 20 months.

What’s not so good? The annual fee takes some of the gloss off what is otherwise a low-cost, low-frills card. The cash advance rate is 25.99% which is very high if you need to withdraw cash using your card.

- Interest rate on purchases: 9.90% p.a.

- Up to 45 interest-free days

- Annual card fee: $108 ($9 monthly)

What’s good? The 0% fee on international transactions is the standout feature, along with the low interest rate on purchases (one of the lowest available of any card with no foreign transaction fees).

What’s not so good? For a card with a ‘Lite’ offering, the annual fee (charged monthly) is not particularly ‘Lite’. There’s also no cash advance option. Although expensive, a cash advance facility can be handy when travelling if you need cash from an ATM in an emergency.

- International transaction fee: 0% (subject to eligibility criteria)

- Interest rate on purchases: 16.99% p.a.

- Annual card fee: $149

What’s good? ING’s Orange One Rewards Platinum ticks two major boxes for travellers: No foreign transaction fees (although there’s a big asterisk on this) and complimentary travel insurance is included. There’s also a credit card cashback offer with the potential to earn cardholders up to $360 per year, comfortably enough to offset the card’s annual fee.

What’s not so good? The main caveat with this card is that the 0% international transaction fee is conditional on the cardholder also having one of ING’s Orange Everyday accounts, depositing at least $1,000 into it each month and making at least five card purchases each month. It’s not an insurmountable hurdle but it’s not ideal unless you already have ING as your main bank.

- International transaction fee: 3%

- Interest rate on purchases: 23.99% p.a.

- Annual card fee: $195 (waived in the first year)

What’s good? Amex’s Platinum Edge Credit Card also offers plenty of travel perks but with a much lower annual fee than the Platinum Card. Cardholders get complimentary travel insurance, a $200 travel credit (completely offsetting the card’s annual fee), plus 2 rewards points per $1 spent on purchases in a foreign currency (overseas and online).

What’s not so good? The 3% currency conversion fee is high compared to other cards, as is the interest rate on purchases. This is another card that could be expensive if not used strategically.

- Interest rate on purchases: n/a

- Up to 44 cash flow days

- Annual card fee: $1,450

- Plus new card members get 150,000 bonus points when they apply online by 25 June 2024, are approved and spend $5k on eligible purchases within the first 3 months of approval. T&Cs apply.

What’s good? The American Express Platinum card is certainly not a cheap option, but it arguably offers more frequent flyer travel perks than any other card in Australia: complimentary travel insurance, an annual $450 travel credit, a $400 dining credit, lounge access, up to 2.25 rewards point per $1 spent on eligible purchases, bonus sign up points subject to conditions), plus a lot more. It’s also a charge card , meaning there are no interest costs but the balance must be cleared in full each month.

What’s not so good? The $1,450 annual fee is a lot, so you really need to be taking advantage of the rewards to offset that cost. The 3% currency conversion fee on American Express credit cards is also high, meaning it’s perhaps a card best used for booking travel, and left in your wallet while spending overseas.

How to compare travel credit cards: 6 key questions to ask

What’s the foreign transaction fee.

It will be somewhere between 0% and 3% of the transaction value depending on the card. If you spend a lot overseas, it’s worth minimising this fee as much as possible.

Will the card be accepted where I’m travelling?

Mastercard and Visa are accepted almost everywhere. Amex is a bit more limited but still widely accepted in the countries Australians travel to in numbers.

What’s the interest rate?

Ideally you’ll be clearing the balance of the card within the interest-free period, but if not, a lower interest rate will help you minimise your travel costs.

What’s the annual card fee?

There are some travel credit cards with no annual fee that offer benefits for travellers, but most do come with a fee. If there is a fee, look carefully at what you’re getting in return.

Is travel insurance included?

A credit card that comes with travel insurance included could save you hundreds of dollars if it means you don’t need to purchase a separate travel insurance policy. Pay attention to what is covered by the policy and if it’s suitable for you.

Are there any other travel benefits thrown in?

Some travel credit cards offer lounge access (usually a limited number of passes per year), plus travel discounts credits you can put towards flights, accommodation and dining. These can be a nice ‘cherry on top’ if the rest of the card fits the bill.

Expert tips for using your credit card while travelling

Insider tips from Money.com.au’s credit cards expert (and frequent flyer), Brad Kelly.

Cover as many of your costs as you can before you travel

As soon as you leave Australia (or buy from an overseas retailer) you become a much more profitable customer for your bank because of the fees they charge.

Avoid foreign exchange fees by prepaying for as many expenses as you can (e.g. your accommodation) assuming you can do so in AUD.

Get clear on fees

If you’re going to be spending overseas regularly, it’s worth seriously considering a credit card with 0% foreign transaction fees . This could save you up to 3.65% on every transaction. This fee is often overlooked when people apply for a credit card .

Also be clear on what you’ll be charged for using an ATM. Chances are it will be a lot.

Make sure you ‘trigger’ your card’s travel insurance

Even if your credit card comes with travel insurance, there’s a good chance it won’t cover your trip automatically. You usually need to trigger the cover, in many cases by booking the travel/accommodation using the card itself. If you pay in full with card points (e.g. with Qantas credit card points ), that mightn’t be enough to trigger the insurance – you usually need to make an actual card purchase.

Don’t withdraw cash overseas using your credit card

Using a credit card to withdraw cash at an overseas ATM is going to be very expensive. You’ll be stung with a fee from the local ATM operator (unless it happens to be a Westpac card and the ATM is part of the Global ATM alliance), a foreign transaction fee, plus a cash advance fee. You won’t get any interest-free days, meaning you’ll immediately be paying a high rate of interest on the funds you withdrew. Basically unless it’s an emergency, don’t go near an ATM with your credit card.

Brad Kelly , Money.com.au's credit card expert

Don’t accept the “Do you want to pay in Australian Dollars” option

A lot of people get caught out by this one. When you’re making a card payment overseas, a lot of the time you’ll get the option to pay in the local currency or have the amount converted to Australian dollars.

Paying the AUD amount shown would seem like the sensible choice here, but trust me, it’s almost always a rip off. That option involves what’s called dynamic currency conversion which means the conversion rate is determined by the merchant and it’s usually a much worse rate than what your credit card provider will give you if you pay in the local currency.

Bring the physical card with you

In Australia we’re very used to paying through a phone or watch using the likes of Apple Pay and Google Pay. But that kind of payment is not as widely accepted overseas. You’ll need to use the physical card and, for a dose of nostalgia, you may even need to insert it into a card chip reader and enter a PIN.

You will also likely need to have the physical card if you’re using your card for pre-authorisation when checking into a hotel or renting a car.

Have at least one backup payment option

When it comes to travel in particular, one card does not fit all. You might like the idea of using a single card for all your spending, but there are situations when a debit card will be better. Having a card from a different financial institution can also be a life-saver if your primary bank has an outage while you’re away.

You've got to be a bit strategic about how you’ll spend money overseas. So plan ahead. The truth is, if you don’t, the potential for getting walloped with fees or being massively inconvenienced is far greater than it is when you’re using your card in Australia.

Sean Callery

Reviewed by.

Credit Cards Expert

As featured in.

No Foreign Transaction Fee Credit Cards

A credit card with no fx fees is an easy way to save 2-3% on overseas purchases when you're travelling or shopping online..

In this guide

The lowdown on Finder Score

Number crunching the finder score, how do credit cards with no foreign transaction fees work, finder credit card award winner, how to compare no foreign transaction fee credit cards, more credit card tips for travellers, frequently asked questions.

To qualify for this category, credit cards must:

- Be available to general consumers.

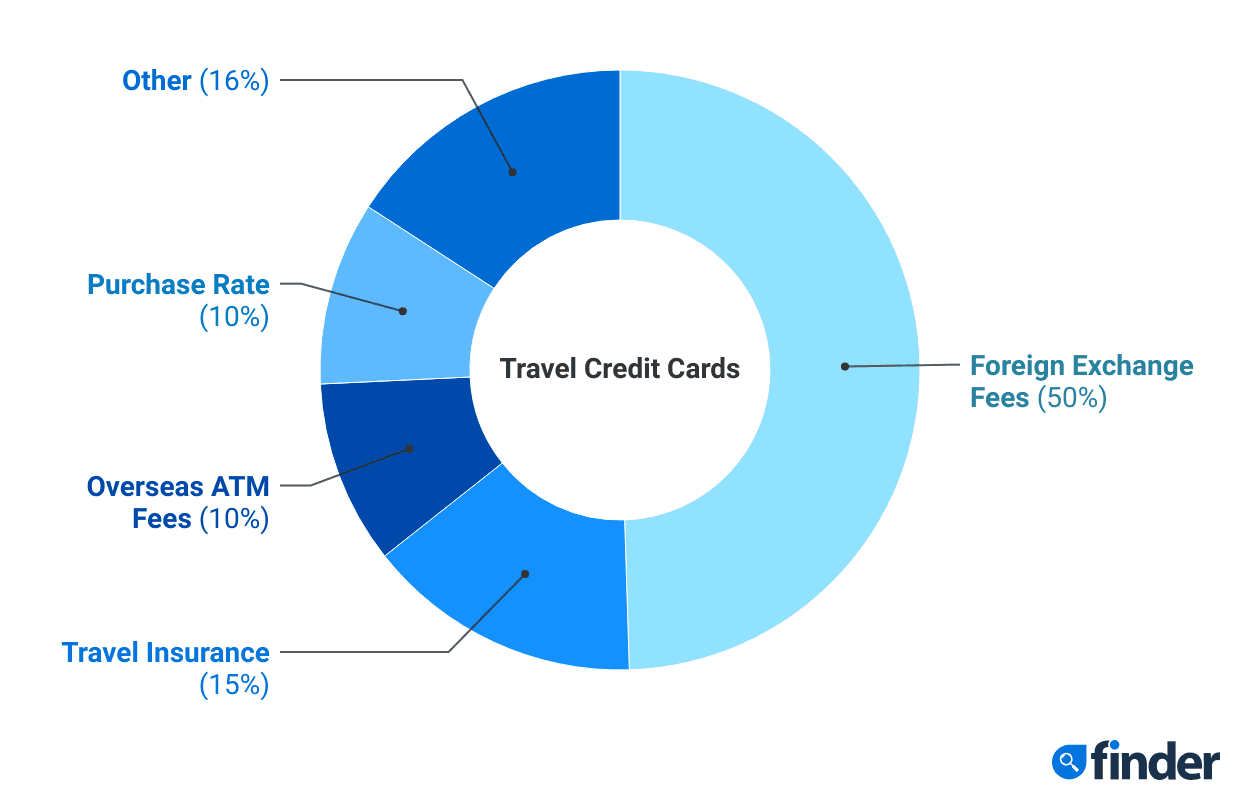

We analyse 300+ credit card products and assess six features, assigning them scores out of 10. Scores are weighted according to their importance within the product category.

The methodology is designed by our insights and editorial team. Commercial partnerships carry no weight, all products in the database are scored objectively.

The same card will receive a different score within each category, depending on the features being assessed (e.g.Travel Credit Cards, Balance Transfer),

Our intention is to enable informed financial decision-making without the need to analyse numerous individual data points. Please do consider your own financial circumstances when making a decision.

- 9+ Excellent - These cards offer lower currency conversion fees and relevant perks for travellers like insurance and ATM access.

- 7+ Great - Reasonable cards for travellers, however can potentially charge higher fees. 5+ Satisfactory - While eligible to be used to travellers internationally, these cards may charge currency conversion, overseas ATM withdrawal and ongoing fees.

- Less than 5 – Basic - These cards should be used for international purchases only in the event of an emergency.

Why you can trust Finder's credit card experts

When you travel or shop online with an overseas business, many cards charge a foreign transaction fee of around 2–3% of the purchase amount. But credit cards with 0% foreign transaction fees waive this cost or give you a rebate, helping you save money on international transactions.

How much can I save with a 0% foreign transaction fee card?

It depends how much you spend overseas and the fees you would pay if you used a different card. But as an example, if you spent $2,000 on a card with a 3% international transaction fee, it would cost you $60. If you had a card with a 0% foreign transaction fee you wouldn't pay anything, so you'd save the full $60.

And if you had a credit card with a higher fee of 3.4% on international transactions, you'd save even more ($68 in this example).

Keep in mind that the cost of foreign transaction fees may not be obvious straight away, as they are added as separate transactions on your credit card account.

The Australian Competition and Consumer Commission (ACCC) has also warned people that some major online brands will charge foreign transaction fees, even if the website ends in .com.au or the price is shown in Australian dollars.

If buying overseas items or travelling overseas, consider an international transaction fee-free credit or debit card. Make sure to compare fees and charges of different options.” – ACCC, ACCC website

The Bankwest Zero Platinum Mastercard was named the Best Travel Credit Card at the 2024 Finder Awards. Another consecutive win for the Bankwest Zero Platinum as it offers a combination of no foreign transaction fees, no annual fee and comprehensive overseas travel insurance. Its 14.99% interest rate on purchases scored well and helped establish it as a card that travellers can use save money on a range of costs.

0% fee requirements

Certain credit cards automatically waive foreign transaction fees when you make an international purchase.

Others offer a rebate on foreign transaction fees when you meet specific requirements, such as spending a set amount per month. If that's the case, you could still be charged a fee if you don't meet the requirements.

Annual fees

Annual fees typically range from $29 to $400 or more for higher-end cards. You can weigh this cost against the value you'd get from 0% foreign transaction fees and any other perks to help choose a card.

If the 0% foreign fee savings aren't as much as you thought, you could be better off comparing $0 annual fee credit cards . You could also consider a card that offers both no foreign transaction fees and no annual fee, although there are only a few of these on the market.

Interest rates

Interest rates on these cards range from around 10% to 27% for purchases. If you pay off your credit card as you go – or pay the total by the due date on your statement – you'll typically get interest-free days on your purchases .

But if you end up carrying over a balance, a low rate credit card could be a more cost-effective option.

Other travel benefits

Some cards offer additional perks when you're travelling, which can include:

- Complimentary travel insurance

- Airport lounge access

- Reward points for your spending

If there's another benefit you want, you could use Finder's table filters to narrow down your comparison of 0% foreign transaction fee cards. Just make sure you check what requirements you need to meet to use the perks.

Security features

Australian credit cards offer zero liability for fraudulent transactions and 24-hour emergency support services. Most also offer fraud-monitoring services.

Other security features can include virtual cards, transaction limits for overseas spending, temporary account blocks and extra online security through Visa Secure, Mastercard SecureCode or American Express SafeKey.

Overseas ATM withdrawal fees

Overseas ATM fees typically cost around $5 or between 2-3% of the total transaction. And that's not including any charges added by the overseas ATM operator.

There are credit cards that offer $0 international ATM withdrawals, but keep in mind that you'll still pay cash advance fees and any third-party charges.

Cash advance costs

When you use a credit card to withdraw cash, buy foreign currency or make any other cash advance transaction, you'll pay a fee worth around 2-4% of the transaction. You'll also be charged interest at the cash advance rate, which is higher than the purchase rate on most credit cards.

If you need to get cash when you're overseas, you can avoid these costs by using a debit card or prepaid travel card instead.

Want to use your credit card in Australia as well?

The range of credit cards that offer no foreign transaction fees means it's worth looking for other features that you want on your credit card. For example frequent flyer points , 0% interest rate offers , cashback bonuses or something else. The key is to find a card with features that add value when you're shopping in Australia and overseas.

When you're planning to use your card overseas spending, keep the following details in mind:

- Daily cash withdrawal limits. Some credit card providers have a limit on the amount you can withdraw from an ATM using your credit card – and it could be lower than your available credit limit. Check your credit card account details through Internet or mobile banking, or call your provider for specific information on these limits.

- Global ATM alliance networks. Many Australian credit card providers have ATM alliance networks that extend around the world and allow you to get cash out overseas without paying an ATM withdrawal fee. For example, a credit card from Westpac, St.George, BankSA or Bank of Melbourne gives you access to the Global ATM Alliance network, which includes Westpac NZ (New Zealand), Barclays (UK), Bank of America (US) and Deutsche Bank (Germany and Spain).

- Exchange rates. Currency exchange rates will apply when you use an Australian credit card for a transaction in another currency. This rate can fluctuate daily, making it harder to work out the cost in Australian dollars (until it's added to your transaction list). Check with your credit card provider to find out when exchange rates are updated, or just keep an eye on your transaction list and available balance to work out how much you've spent once the transaction is converted to Australian dollars.

Meet our money expert Graham Cooke

Graham heads Finder's insights team and specialises in a variety of financial topics, including credit cards, loans, insurance and investing. He regularly appears on TV including ABC News, Sunrise and Today, and edits Finder's Insights column.

Graham's top credit card tips

- Credit cards often charge a significant foreign transaction fee, so check your card's terms before you travel.

- A card with low or no international transaction fees could help you save when travelling or shopping online with overseas businesses.

- You could also consider debit cards which offer low transaction fees or refund ATM charges.

What exactly is currency conversion?

When you use a credit card to make a transaction in another currency, it will be converted back to Australian dollars based on the exchange rate that's applicable for your credit card. For example, if you spent US$100 and the exchange rate was US$0.67 to AUD$1, this transaction would show up on your credit card account as AUD$148.85 (to the nearest cent).

If I'm given the choice, what currency should I pay in?

Sometimes when you're travelling, a business will give you the option of paying in the local currency or in Australian dollars. If you choose to pay in Australian dollars, the transaction will be processed using Dynamic Currency Conversion. This usually costs you a lot more than paying in the local currency.

According to the ACCC, this is because overseas banks "usually add a mark-up to the exchange rate". And depending on your credit card, you could still be charged an international transaction fee.

Realistically, how many travel money options do I need?

It's often useful to have a couple of different ways to spend money when you're travelling. As well as a credit card, you may want to buy foreign currency before you go or take a debit card in case you end up needing cash. Another option is getting a prepaid travel card that lets you spend money in different currencies so you can avoid foreign transaction fees.

Amy Bradney-George

Amy Bradney-George was the senior writer for credit cards at Finder, and editorial lead for Finder Green. She has over 16 years of editorial experience and has been featured in publications including ABC News, Money Magazine and The Sydney Morning Herald. See full profile

More guides on Finder

The National Seniors Credit Card has a low 8.99% p.a. variable interest rate and a $40 annual fee that helps support the organisation. Here’s how its other features compare.

The Wizitcard offers an alternative to traditional credit cards and buy now pay later, with no interest charges, a monthly fee and a virtual account – is it right for you?

Discover exactly how the average Australian uses their credit card.

Available to firefighters and other emergency service workers, the Firefighters Mutual Bank credit card offers low-cost features.

A limited number of payment platforms give you a way to pay rent with a credit card, but are the costs worth it?

While there isn't one best credit card, you can find a card that suits your needs by comparing the features, deals and offers that are trending here.

When you apply for a credit card online, you could receive a response within 60 seconds. Find out how you to find a card that you're eligible for and increase your chances of approval.

While a credit card is linked with a line of credit, a debit card is connected to your own money. Compare the differences between the card types in this guide.

Calculate how much you're paying in interest based on your current credit card repayments and discover how much you should pay each month to meet your financial goal.

Ask a Question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

140 Responses

I am looking for a business credit card with 0% international transaction fees.

Thanks for getting in touch!

As of this writing, we don’t have a list of business credit cards with 0% foreign transaction fees. If you are still looking for business credit cards , you can use our comparison table to help you find the card that suits you. On the page you’ll also read information about:

- Who is responsible for the credit card? Personal vs business credit card liability

- How to compare business credit cards

- Pros and cons of business credit cards

- How to apply for a business credit card

When you are ready, press the ‘Go to site’ button to apply. As a friendly reminder, read the eligibility criteria, features, and details of the card, as well as the Product Disclosure Statement and Terms and Conditions before committing to the product.

Hope this helps!

Best, Nikki

I withdrew money from an ATM in the Philippines and the machine said it was temporarily closed, and no money came out. I wrote the time down and the date. When I got back to Australia, 28 degrees said that I put my chip in and so the transaction was valid. I wrote back that no money came out of the machine, and all machines have cameras now, so they should be able to see I got no money. Can I take this to AFCA as I should not be to blame and it has to be on camera.

Hi Nicholas,

Thanks for getting in touch and sorry to hear about what happened. You can check and inquire with AFCA how to handle the situation but make sure you have all supporting documents to validate your claim. Hope this helps!

I love to travel and hate paying any fees overseas. About 10 years ago I was away for 4 months and with the total fees I paid along the way I could have stayed away much longer, so since then I’ve searched high and low for credit/debit cards to use.

I found 28 degrees first and that was fantastic until they changed the fee structure for having a positive amount on the card itself and using ATM’s, so I stopped using that one. Plus they introduced some fees for paying the card off if it went into debt.

The past few years I’ve used a Citibank debit card and that has been fantastic. I’ve paid no fees at all and it’s very simple to get hold of with no extra banking requirements to keep it – like put X amount per month in the account. I use it overseas and that’s pretty much it. Plus if you do use it in Australia at some restaurants you get a free bottle of wine!!

Recently I changed banks and joined ING. I heard they had a similar card (Orange everyday Visa) and I managed to get hold of that as well. I’m not 100% sure if you have to deposit at least $1000 per month to get the benefit of no fee’s but as I’ve joined that bank that part is done anyway. Certainly worth a look but double check those rules.

I would strongly suggest having a look at both the cards above as they are excellent for travel and not paying fees. I wouldn’t travel without them!

Also, I tried an NAB travel card before and that was a total waste of time due to the poor conversion rates the banks charge, and checking other banks “Travel Cards” I found the same thing. They sound good but you are not getting the best rates on conversion and to add to a bad conversion in Thailand a few years ago I was slugged $8 a time at the ATM. Hope that helps someone! Happy travels.

Thanks for reaching out for sharing your experience on credit cards. Feel free to get in touch with us again should you need any assistance.

If I had a Bankwest or 28 Degree card and wanted to purchase, whilst in Australia, a cruise costing several thousand $US dollars with an overseas company using that card would I be charged a conversion and/ or an overseas transaction fee?

Thank you for getting in touch with Finder.

For the Latitude 28 Degrees Platinum Mastercard , there’s 0% of transaction value under the foreign currency conversion fee.

If you have a Bankwest Zero Mastercard , then you will be charged 2.95% of transaction value as the foreign currency conversion fee. However if you have a Bankwest Zero Platinum Mastercard then NO foreign transaction fee.

As a friendly reminder, while we do not represent any company we feature on our pages, we can offer you general advice.

I suggest that you also verify this info with your bank/credit card issuer before you make your dollar transaction.

I hope this helps.

Have a great day!

Cheers, Jeni

I want a credit card for an overseas trip. Points on velocity would be great, as would no international currency transfer fees. Any suggestions, please? I’ve never had a credit card, just debit cards.

Thanks for your inquiry.

If you are looking for no foreign transaction fees options, please feel free to check our frequent flyer credit cards that don’t charge foreign transaction fees.

I recommend that you check the details of the credit card you’re interested in, its eligibility criteria as well as the Product Disclosure Statements/Terms and Conditions before you apply.

Also if you can, contact first the issuing bank and discuss your options and chances of approval before you send anything final for your application. Just apply for one credit card at a time and ensure your eligibility before submitting your final application. This way you can avoid credit enquiries on your file.

Cheers, Rench

How likely would you be to recommend Finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

- Join CHOICE

Travel money cards with the lowest fees

We look at seven travel money cards from the big banks and airlines..

Prepaid travel money cards are offered by major banks, airlines and foreign exchange retailers like Travelex. Before travelling overseas, you load money into the card account, which locks in the exchange rate for foreign currencies at that time.

You can then use the card for purchases and cash withdrawals just like a debit or credit card, usually wherever Visa and Mastercard are accepted.

You can reload money on-the-go via an app or website, and if the card is lost or stolen, it can be replaced (usually at no cost to you).

Prepaid travel money cards also give you assurance that you're not handing the details of your everyday banking account to merchants you're not familiar with, and they provide easy access to cash when you want some, says Peter Marshall, head of research at money comparison website Mozo .

CHOICE tip: Travel money cards are best for longer trips. They're usually not worth your while if you're only taking a short trip, as some have closure, cash out and inactivity fees.

Travel money card fees

A major difference between prepaid travel cards and debit or credit cards is their fees. Some costs aren't immediately apparent, such as hefty margins built into the exchange rates.

And although fees have come down since we looked at these cards two years ago, you still need to watch out for:

- fees to load the card – either a percentage of the total or a flat fee

- ATM withdrawal fees

- a cross currency fee or margin when you use the card in a currency you haven't preloaded

- further fees if you close the account or haven't used the card for a period of time.

Travel money card with the lowest fees and best exchange rate

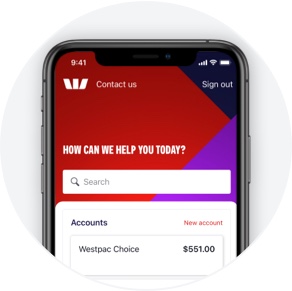

Westpac worldwide wallet.

Westpac closed its Global Currency Card in July 2021 and offers its new card in partnership with Mastercard. It's also available from Bank of Melbourne and BankSA.

Currencies: AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD, ZAR.

Key features:

- No loading, reloading, closing or inactivity fees.

- Free to use it in network ATMs in Australia and partner ATMs overseas in a range of countries including the UK, US and New Zealand.

- A charge applies at non-Westpac and non-partner ATMs in Australia and overseas.

- Best exchange rates for the US dollar, the Euro and GBP in our comparison.*

- The only card that lets you preload the South African rand.

Other travel money cards

Next to the Westpac Worldwide Wallet, there are six other travel money cards available.

Australia Post Travel Platinum Mastercard

Available online or at post offices.

Currencies : AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD, AED.

- Fee to reload the card via BPay, debit card or instore, but free via online bank transfer.

- Closure fee.

- Fees for ATM withdrawals in Australia and overseas.

Cash Passport Platinum Mastercard

It's issued by Heritage Bank and is available online and from a number of smaller banks and credit unions (like Bendigo Bank and Bank of Queensland) as well as travel agents.

- Fee to reload with a debit card or instore, but free via BPay.

CommBank Travel Money Card

CommBank Travel Money Card (Visa)

As NAB and ANZ have closed their travel money cards, this is the only other travel money card available from a major bank. This card has the largest variety of currencies that can be preloaded.

Currencies : AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD, AED, VND, CNY.

- Fee if you make a purchase with currencies not preloaded.

- Fee for withdrawals at overseas ATMs.

Qantas Travel Money Card

Qantas Travel Money Card (Mastercard)

The only travel money card offering from an airline. It can be added as a feature to your Qantas Frequent Flyer card, so you don't need a dedicated card, and you can earn points using it.

- Free to reload via bank transfer or BPay, but there's a reload fee if using debit card.

Travelex Money Card

Travelex Money Card (Mastercard)

Travelex is an international foreign exchange retailer. In Australia, it operates more than 140 stores at major airports and shopping centres, across CBDs and in the suburbs. It was the card with the best exchange rate for New Zealand dollars.*

Currencies : AUD, USD, NZD, EUR, GBP, SGD, THB, JPY, HKD, CAD.

Fees :

- Load fee instore, but free via Travelex website or app.

- Reload fee instore or via BPay, but free via Travelex website or app.

- Closure fee and monthly inactivity fee (if not used for 12 months).

Travel Money Oz Currency Pass

Travel Money Oz Currency Pass (Mastercard)

The Travel Money Group is owned by Flight Centre and is a foreign exchange retailer.

- Reloading the card via an online bank transfer or instore is free, but there's a fee if you reload via BPay, debit card or credit card.

- Cash out (closure) fee.

Travel money card tips

- Make sure the card allows the currencies you'll need, and also consider stopovers. For example, the South African rand is only supported by the Westpac card.

- Try to load your card with the right currencies and amounts on days with good exchange rates.

- Make sure you know how to reload your card if you run out of funds while overseas.

- It may be more convenient to choose a card that has an app that can be linked to your bank account.

- Avoid loading more money than you'll need as there may be fees and exchange rate margins to get the unused money back.

- Remember to cancel the card once you're finished your trip, especially if it has inactivity fees.

- Be mindful that you still may need a credit card, as travel money cards may not be accepted as security for hotels and car rental agencies.

Stock images: Getty, unless otherwise stated.

Join the conversation

To share your thoughts or ask a question, visit the CHOICE Community forum.

Please remember to check junk and spam folders for your emailed reply.

Have you joined our free CC Inner Circle?

Delivered once a month to your inbox, you’ll get expert money tricks, rewards point hacks, perks and more!

Click to join the Inner Circle

Regards Pauline + the Creditcard crew

Hi, I’m a personal finance expert who loves to help you out! I’ll answer your question within a business day. Pinky swear.

We ask for your email so we can respond to you directly. We won’t share your personal data. For more information, see our privacy policy.

Love perks and rewards? Join our free CC Inner Circle for exclusive offers, points boosters & more. Unsubscribe anytime..

Credit cards with no international fees

International fees on credit cards are also called foreign transaction fees or currency conversion fees. They’re charged when you pay for something overseas, whether it’s online or in person, usually at 2-3% of the transaction. But they can be avoided!

If you withdraw money from an overseas ATM, you may also have to have to pay a withdrawal fee (to the ATM operator and to your credit card provider). Note: If you want to earn points on your travel spending, check out our monthly update of the Best Frequent Flyer cards, and our list of Frequent Flyer credit cards here .

A solution: ‘No foreign transaction fee’ credit cards

Other ‘no foreign transaction fee’ credit cards.

Some credit cards waive the foreign transaction fee as one of their features. It’s often the case with high-tiered cards that come with a bunch of perks, rewards and higher annual fees.

But, if you spend overseas frequently, it might be worth comparing and deciding whether your spending makes the ongoing costs of the cards worth it.

There are also cards that offer reasonable annual fees, no currency conversion fees and other bonuses like 0% interest offers, and even repayment instalment plans that rival Buy Now Pay Later schemes.

So, it’s all about comparing to see which card works best for you and how much you spend.

Here’s an example of how much you could save on currency conversion fees in one month:

As a one-off purchase, the smaller amounts might not seem that bad. But if you frequently shop online, those small amounts add up over the course of a year. An overseas family holiday can easily cost $200 extra just in conversion fees.

And that’s not including any ATM charges for withdrawing cash while you’re overseas.

BankWest also waive international fees on their Bankwest More Platinum credit card. We’ve picked the two above however, as they have more overall benefits, as well as the waived foreign transaction fees.

Credit Card International Fees by Brand

Alternative: wise travel money card, different types of cards for travellers.

Credit cards marketed to frequent travellers will often have low or non-existent foreign currency charges. In particular, a number of Gold and Platinum cards offer this feature (for example the BankWest Platinum range).

These cards will still have administrative costs, however, and they will tend to have either higher annual fees (though the BankWest Zero Platinum card has none) or higher interest rates, so work out whether this is actually going to save money on a card-by-card basis.

A Platinum card can be an option if you would use features such as frequent flyer points, travel insurance, extended warranty or purchase protection (if buying within Australia), so just because the card charges an annual fee doesn’t mean it is automatically more expensive if you would use those extras.

You can also check if the card has competitive exchange rates as part of their frequent traveller features.

Need travel insurance? Maybe your card covers it.

Plenty of cards offer complimentary travel insurance as one of their handy little perks.

To compare cards and the insurances they include, you can see our free travel insurance comparison , which highlights all the key features for major credit cards and credit card providers.

Credit cards can be a super economical way of insuring yourself while you travel, and it’s often activated automatically as long as you buy your tickets or certain travel expenses on the credit card.

There are a few tips to remember though:

- Purchase the tickets with the card, or the insurance may not be activated.

- Don’t expect to be covered automatically for pre-existing conditions. If you have asthma, diabetes or some other condition check whether you need separate or additional cover and pay any applicable surcharge to ensure you’re properly covered.

- Always, always keep the credit card statement showing the purchase of your flights and/or accommodation to hand, as some credit cards require a copy of this before paying out on a claim.

- If you insist on separate travel insurance, take the advice of trusted websites like Finder.com.au and shop around for the best deal, making sure you’re covered for everything you want to be. Also make sure you understand any exclusions, such as adventure sports or Acts of God in any policy before you sign.

Read more about credit card travel insurance here .

If you choose prepaid, use it wisely

Foreign currency prepaid credit cards are pre-loaded with foreign currencies up to a certain value. These cards can allow you to lock in an exchange rate, and can offer reasonable exchange rates (see below for a word of caution about that).

Qantas Cash and Virgin’s Global Wallet are both examples of prepaid travel cards. With each option, you can pre-load foreign currencies on to the card, allowing you to lock in an exchange rate on each pre-loaded amount. You can then use the card to make overseas and domestic purchases. This can save you a huge amount in foreign conversion fees often charged by standard credit cards.

Qantas Cash and Global Wallet also allow you to earn rewards points on their respective loyalty programs, and can allow for faster check-in and boarding. To find out more about Qantas Cash and Global Wallet, what each one offers, and how they stack up against each other, read our post here .

If you’re choosing a prepaid travel card, be aware of the small print and any fees that might apply. Remember, you might have to pay ATM fees to withdraw money at ATMs both in Australia and overseas.

Fees to be aware of:

- Application fee: There is no fee to apply for a Qantas Cash card or Global Wallet.

- Top up/Reload fee: No top up fee on Qantas Cash or Global Wallet.

- Monthly service fee: No monthly service fee on Qantas Cash or Global Wallet.

- Inactivity fee: While Qantas Cash does not charge an inactivity fee, Global Wallet charges a $1 inactivity fee if the card remains inactive for 12 months or more.

- Currency conversion fee: If you use Qantas Cash or Global Wallet to pay for something in a currency that is not loaded on your wallet, you will pay a 3% currency conversion fee.

Use prepaid as a backup, and watch the exchange rate

If you do go with a prepaid option, make sure you understand its fees and its terms and conditions, and we’d still recommend having at least one back-up card for the time you’re away. This can ensure you’ll always have access to cash should anything happen.

A recent analysis also found a massive $193 difference in cost between providers based on different exchange rates they used. That means whether you get the card at Australia Post, ANZ, NAB or elsewhere, the currency exchange rate will be different and will vary depending on where you’re going and which currencies you’re loading.

Deciding on the right overseas-friendly credit card

So, does it sound like you should be exploring your options when it comes to overseas cash access? You’d definitely be right, and you’ve found the perfect place to start here, by comparing the transaction fees that major card providers offer.

Once you’ve had a look at the fees your bank charges, you can decide whether you should apply to another bank for a card with no international fees.

Far from just believing that your current bank will look after you while you’re overseas, if you explore your options you might discover that another provider offers a better solution for you while you’re overseas.

For standard credit cards, the foreign currency transaction fees are usually calculated as a percentage of the purchase amount (because that’s the amount exchanged in foreign currency on each transaction). The table above lists the current fees charged by major credit card providers for overseas transactions.

We’ve found that the only way to avoid annoying foreign transaction fee is:

- To use cash in the local currency (but be aware of ATM withdrawal fees),

- To use one of the selected cards above that doesn’t charge a transaction fee,

- To use local debit or credit card (but this may only be an option if you have been living overseas for quite some time already).

Pauline Hatch

Pauline is a personal finance expert at CreditCard.com.au, with 8 years in money, budgeting and property reporting under her belt. Pauline is passionate about seeing Aussies win by making their money – and their credit cards – work smarter, harder and bigger.

You might be interested in

Best reward credit card deals for june 2024, tips & guides, complete guide to the velocity frequent flyer program, top frequent flyer credit card deals for june 2024 – up to 170,000 bonus points, recently asked questions.

Something you need to know about this card? Ask our credit card expert a question.

26 comments (showing the latest 10 Q&As)

Fazal hameed, featured balance transfer credit cards.

Purchase Rate

Balance Transfer

Your savings • The annual fee is charged in the first month. • You only pay the minimum monthly payment of your overall balance each month. • You do not spend or withdraw cash on the card until the balance transfer period ends or is paid in full. • All other fees and charges that may apply are excluded. When there is no interest savings or a negative interest saving after the introductory period, the calculator will display $0.">

NAB Low Rate Credit Card – Balance Transfer Offer

0% on balance transfers for 28 months.

2% BT fee applies; reverts to 21.74% p.a. Enjoy $0 annual fee for the first year ($59 thereafter) plus, low variable purchase rate of 13.49%. New members only.

Low variable purchase rate of 13.49% p.a. No annual fee for the first year and get a free additional cardholder.

Purchase rate

Balance transfer.

Go to offer

save card more info

Featured Rewards Credit Cards

$1 earn rate

Bonus Points

Points earning • 30 days is indicative of 1 month • Point caps are reset every statement period, which we have also assumed to be 1 month • There is a fixed monthly spend for 365 day. • Your monthly spend is multiplied by the earn rate for that 12 months. • You’ll be getting the highest earn rate for spending (if the card has tiered earn rates). • Points capping is factored in, if applicable, as is any sign-up bonus. Bear in mind though, terms and conditions always apply to points earning and sign-up bonus points.">

Qantas Premier Platinum Credit Card

Limited time super-sized Qantas Points

Earn 70k when you spend $3,000 within the first 3 months, plus 30k when you haven’t earned Qantas Points with a credit card in the last 12 months. 0% p.a. on balance transfers for 12 months with a 2% BT fee. Save 20% on flights for you and 8 friends. Complimentary travel insurance.

Up to 100,000 bonus Qantas Points

Earn 70,000 when you spend $3,000 within the first 3 months, plus 30,000 when you haven’t earned Qantas Points with a credit card in the last 12 months. 0% p.a. on balance transfers for 12 months with a 2% BT fee. Discounted annual fee for the first year.

Earn rate per $1

Bonus points, anz rewards platinum credit card, 100,000 extra anz reward points and $50 back.

Low fees, big points and perks galore: Bonus points are worth a $400 Gift Card from Bunnings, Woolworths, Myer, and more (min spend and T&Cs apply). Earn up to 1.5 points per $1 on eligible purchases to redeem for merch, cash back, gift cards and travel. Get complimentary overseas and domestic travel insurance and rental vehicle excess cover in Australia.

100,000 extra ANZ Reward Points and $50 back when you spend $2,000 on eligible purchases in the first 3 months from approval. Complimentary International Travel Insurance and Interstate Flight Inconvenience Insurance.

Qantas American Express Ultimate Credit Card

Up to 90,000 bonus qantas points.

Spend $3,000 within the first 3 months (70,000 pts) + 20,000 pts in your second year upon fee renewal. $450 Qantas Travel Credit to use on eligible domestic or international Qantas flights each year. Two complimentary The Centurion® Lounge entries each year plus travel insurance covers. T&Cs apply.

Spend $3,000 within the first 3 months (70,000 pts) + 20,000 pts in your second year upon fee renewal. $450 Annual Qantas Travel Credit. Two complimentary The Centurion® Lounge entries each year plus travel insurance covers. Add 4 additional cardholders for free.

• The annual fee is charged in the first month. • You only pay the minimum monthly payment of your overall balance each month. • You do not spend or withdraw cash on the card until the balance transfer period ends or is paid in full. • All other fees and charges that may apply are excluded. When there is no interest savings or a negative interest saving after the introductory period, the calculator will display $0.'> Filter your savings

Adjust the filters to see how much you could save with a balance transfer to a new credit card

My transfer amount $5000

My interest rate 19.49%, my annual fee $50.

- Recalculate

Make sure you can get approved for the Loading...

- Have your personal details ready to complete the online application

- Proceed to application Proceed to application

- I’m not eligible

Make sure you can get approved for the Westpac Low Rate Credit Card

- If you are not redirected click here to continue

- Copyright 2005-2021 CreditCard.com.au Pty Ltd

- ABN: 76 646 638 146

- ACR: 528318

- AFCA: 80717

Select the reward programs you like

Select the features you like

Adjust the filters to see how much points you could earn over 12 months

My monthly card spend $5000

Rewards program

Benefits i like

- All reward programs

- Airport lounge access

- Balance transfers

- Bonus points offer

- No annual fee

- No foreign transaction fee

- Overseas travel insuarance

- Uncapped points earn

Thank you for taking the time to provide feedback.

Our credit card experts will review your feedback and take action within 1 business day to address or respond to the issue.

Regards Pauline Hatch Personal Finance Expert

By submitting this feedback you agree to our privacy policy.

Thank you for taking the time to let us know that your credit card is not listed on our site.

Our credit card experts will review your listing and ensure that the card is present on the site over the coming weeks.

By submitting this form you agree to our privacy policy.

Editorial note: We may not cover every product in this category. For more information, see our Editorial guidelines .

Best travel money cards in 2024.

Travel money cards are essential when travelling overseas.

They allow you to easily make payments whilst travelling overseas. They make paying easier for shops, restaurants, hotels and ATMs.Travel money cards work in a similar way to ATM cards. They use a pin when you purchase goods or services overseas.

In this guide, we have compared travel money cards to help you make the best selection for your next trip.

Best Travel Money Cards:

- Wise Travel Card Best Exchange Rates

- Revolut Best for Low Fees

- Travelex Money Card Best All Rounder

- Bankwest Breeze Platinum Best Travel Credit Card

- Pelikin Student Traveller Card Best Student Card

- HSBC Everyday Global Travel Card Best Travel Card by Bank

- Qantas Travel Money Card Best Reward Benefits

Wise Travel Card - Great Exchange Rates

- 40+ currencies available

- Best exchange rates globally

- One of the lowest conversion fee on the market

- No international transaction fees

- No annual or monthly fees

- Extremely low costs to send money overseas

Wise Travel Card

- Cross currency conversion fees are between 0.24–3.69%. AUD to USD, EUR or GBP was 0.42%, which is one of the lowest on the market

- Free cash withdrawals up to $350 every 30 days. However after that, Wise charge a fixed fee of $1.50 per transaction + 1.75%

- Daily ATM withdrawal is $2,700

- Issue up to 3 virtual cards for temporary usage

- It takes between 7 to 14 business days to receive your card

- Can be used wherever MasterCard is accepted

The Wise Travel Card is great for frequent travellers as it offers over 40 currencies at the inter-market exchange rate, which is the cheapest rate globally. In addition you can buy goods online from overseas with no transaction fee plus get the best exchange rate. However if you use ATMs frequently this is not the card to use due to the fees. Finally Wise Travel Card lets you transfer money to an overseas bank account with extremely low fees and the best exchange rate.

Our Wise Travel Card Review

Revolut - Low Fees

- 30+ currencies available

- One of the best exchange rates globally

- No annual or monthly fees for standard membership

- No initial card fee

- Instant access to a range of cryptocurrencies

Read our Revolut Card Review

Revolut Travel Card

- No fee ATM withdrawals up to A$350, or 5 ATM withdrawals, whichever comes first, per rolling 30 day period and 2% of withdrawal amount (minimum charge of A$1.50) after that

- Exchanging currency on the weekend can incur a 1% mark-up fee

- Fees on international money transfers were introduced in April 2021.

- Can be used wherever Visa is accepted

The Revolut Travel Card is a decent option for those who travel a lot as it offers over 30 currencies at a great exchange rate, which is the cheapest rate globally. However if you exchange currency on the weekend you can incur a one-percent mark-up fee. In addition they have introduced fees for international transfers. Finally if you use ATMs frequently this is not the card to use due to the fees.

Travelex Money Card - Best All Rounder

Best features.

- Unlimited free ATM withdrawals

- 24/7 Emergency Assistance

- Initial and replacement card are free

- Lock in up to 10 currencies

Read our Travelex Travel Card Review

Travelex Money Card

- Minimum load of $100 and maximum load of $100,000

- Can be used wherever Mastercard is accepted

- Fees include a $10 closure fee, $5 for an additional card and $4 inactivity monthly fee.

- While Travelex don't charge ATM fees, some ATM operators may charge their own fees.

- Currencies that can be loaded are AU$, US$, EU€, GB£, NZ$, TH฿, CA$, HK$, JP¥, SG$

- If your card is lost or stolen you can access cash in your account through Moneygram or Western Union agents, with no charge

- Boingo hotspots offer free wifi and you can look at their number of free hotspots per country on this map

The Travelex Card is a good all rounder.

You can use it to take money out of the ATM, for merchant purchases like restaurants and even for online shopping in foreign currency. While the exchange rates aren't as good as the Wise or Revolut Card abroad , the support network if the card is lost or stolen is very good.

Bankwest Breeze Platinum Credit Card - Lowest Interest Rate

- Lowest interest rate at 9.90%

- No international transaction fees on purchases

- 0% p.a. on purchases and balance transfers for the first 15 months

- Up to 55 days interest free on purchases

- Low annual fee

- Complimentary international travel insurance

Bankwest Breeze Platinum Credit Card

- Free annual fee first year, then $69 annual fee

- 55 interest free days

- Free international travel insurance that includes the basics but does not cover cancellation costs, pre existing conditions and travellers over 80

- $6,000 minimum credit card

- 0% p.a. on purchases and balance transfers for the first 15 months, then reverts to 9.90%

- 21.99% interest rate on purchases and cash advances

- Cash advance fee of the higher of $4 or 2% of cash advance

The Bankwest Breeze Platinum is a great no frills credit card that offers ‘no foreign transaction fees’ and the lowest interest rate on the market, at 9.90%. These two factors alone will save you hundreds of dollars when travelling overseas.

In addition it has a low annual fee and complimentary international travel insurance. Finally for its price point it is a great value credit card that will be accepted most places around the world.

HSBC Everyday Global Debit Card

- No initial card or closure fees

- No monthly or account fees

- No international ATM fees

- No cross currency conversion fees

- Lock in very competitive exchange rates before travel

- No maximum balance

- Earn 2% cashback

- 10 Currencies can be loaded are AUD, USD, GBP, EUR, HKD, CAD, JPY, NZD, SGD, CNY (currency restrictions apply to CNY)

- Awarded 5 gold stars by CANSTAR in 2021 for Outstanding Value

- Very competitive exchange rates on all currencies when you have currencies already loaded on your card

- ATMs within Australia need to be HSBC and overseas they need to display a VISA or VISA Plus logo, not be be charged fees

- Earn 2% cash back when you tap and pay with Visa pay wave, Apple Pay or Google Pay for purchases under $100. With a maximum of $50 cash back per month. In addition you need to deposit $2,000 or more into your Everyday Global Account each calendar month.

- Daily maximum ATM withdrawal is $2,000

- Fraud protection covered by Visa Zero Liability

The HSBC Everyday Global Debit Card is a good option to take travelling and to spend money in Australia with no international transaction fees, international ATM fees and monthly fees. In addition there is no maximum balance on currencies held and a 2% cash back incentive when you tap and pay under $100.

Finally it is one of the only travel cards that offers Chinese Yuan. To avoid ATM fees you need to find HSBC branches in Australia and only use ATMs overseas with a VISA or VISA Plus logo.

Best Student Card

Pelikin student traveller card.

- Use promo code SMONEY10 for a $10 discount

- Up to 15% off international flights

- A globally accepted virtual student ID card

- 2% cash back on food & drinks, transport and accommodation

- Over 150,000 discounts worldwide

- $30 for 12 months

- 20+ currencies available

- Split bills, pay and get paid instantly

Pelikin is one of the only travel cards in Australia specifically for students. While it has a small annual fee, the range of discounts and offers more than make up for it.

The app is relatively easy to use and card arrives in under a week.

Best Rewards Card

Qantas travel money card.

- No monthly fees, purchase fees and currency conversion fees

- No load fees if you pay by bank transfer or BPay

- Locked in exchange rates: 4%+ margin on exchange rates

- Earn 1.5 Qantas points for every AU$1 spent in foreign currency

- 10 currencies offered USD, GBP, EUR, THB, NZD, SGD, HKD, CAD, JPY, AED

- Free Australia ATM withdrawals

- 0.5% fee debit card reload fee

- ATM fees overseas (USD 1.95; GBP 1.25; EUR 1.50; THB 70; NZD 2.50; SGD 2.50; HKD 15.00; CAD 2.00; JPY 160; AED 6.50)

- Minload of $50 and max of $20,000

- Available to 16 year olds, has a lower age restriction than most credit cards (18 year olds)

Qantas Travel card is a great option to spend foreign currency overseas if you are already a loyal Qantas customer and use your frequent flyer points regularly on flights, accommodation or gifts. The fees are low, the exchange rate is average however the ATM fees are expensive and will easily add up.

Other popular travel money cards

Aside of the Top 5 travel money cards, there are many more options to consider. These include well known brands such as the Commonwealth Bank and Travelex and less known services like Up Bank and Revolut.

Here is a rundown of their best features, fees and available currencies:

- 13 currencies available, including Vietnamese Dong and Chinese Yuan

- No issue fee, load fees, closure and card replacement fees

- Additional card offered

- Can be accessed through Commonwealth Bank app

Commonwealth Bank Travel Money Card

- $3.50 fee at ATMs overseas

- 13 currencies offered USD, GBP, EUR, THB , NZD, SGD, HKD, CAD, JPY, AED, AUD, VND & CNY

- Minload of $1 and max of $100,000

- Available to 14 year olds, has a lower age restriction than most credit cards (18 year olds)

- When you use your card for a purchase or withdrawal in a currency that is not loaded, or when they automatically transfer funds between the currencies on your card to enable the completion of the transaction at the Visa retail exchange rate plus 4%

- To transfer money between currencies or a transaction account, it will be at the bank rate which is normally 4% above the market value

The Commonwealth Bank travel money card is great if you are already a Commonwealth bank customer who banks online and knows exactly how much money in each country you want to spend. However if you need to transfer between currencies or make a purchase in a currency you don't have funds loaded, then you can get an additional expensive charge. Watch how many withdrawals at ATMs you make as well to keep the costs down.

- Exchange rates most competitive for USD, GBP and THB

- No fee on initial card or load (not BPay)

- No fee on reloads via bank transfers

- No monthly or inactivity fees

- Card is valid for 5 years

Travel Money Oz Currency Pass

- 1.1% reloading fee via Travel Money Oz Login or with debit or credit card

- 1% reloading fee for BPay

- $10 closure fee and replacement card fee

- 2.95% on withdrawals from Australian ATMs is expensive

- Roughly $3.50 on withdrawals from overseas ATMs is expensive.

- $3.99 + 5.95% fee on cross currency transactions

- 10 Currencies can be loaded are USD, EUR, GBP, NZD, CAD, HKD, JPY, SGD, THB & AUD

- Exchange rates for SGD and CAD are the least competitive

- Minload of $20 and max of $10,000

- Only 1 card per account

- According to the website they won't take online orders if you are departing within 14 days as the card can take up to 2 weeks for delivery.

The Travel Money Oz travel money card seems to be an outdated version of the Travelex or Australia Post travel card as it does not offer Global Emergency Assistance or Boingo hotspots. However exchange rates and fees are similar to Travelex, so if you are travelling to the US, UK or Thailand, this is a great card to pay for accommodation and things in shops. We would avoid using it at any ATM, to save costs.

- No ATM fees in Australia or internationally

- No minimum monthly deposit

- No account keeping fees

- Can be used in Australia as an EFTPOS card

- Available to 14 year olds and older

Macquarie Travel Card

- $2,000 daily limit for ATM withdrawals

- Simple and easy to work out costs for account

- Exchange rates are MasterCard exchange rates, which are normally 4%+ market rate.

- 90-day theft and damage protection on eligible purchases and stolen wallet protection up to $500

- Can be used in Australia to buy goods overseas and not pay international transaction fees

- Get discounts of up to 10% on eGift cards to use at over 50 leading retailers

The Macquarie Travel Card is a very good option to take overseas for ATM withdrawals as they are all free. In addition in Australia you can buy goods online and not pay an international transaction fee. Furthermore you can use the card like a normal debit card in Australia with no hefty fees or monthly minimum deposits. However the exchange rate is the MasterCard rate which is normally 4%+ above the market rate. Finally we would recommend this card for cash withdrawals at ATMs internationally but not paying for accommodation due to the added margin on the MasterCard exchange rate.

- Cheapest way to send money overseas through a bank

- UI and UX better than traditional banks making it super easy to use

- Competitive savings interest rate

Up Bank Travel Card

- Backed by Bendigo Bank and Adelaide Bank and partnered with Wise so it has financial backing and access to the cheapest exchange rates to send money overseas

- Nifty online tools to help you track spending, budget and save. These include a detailed transaction history often including a company logo, when you paid down to the minute and the suburb where the transaction was made. In addition it has a ‘Regulars feature that detects regular billers and estimate of upcoming bills so you get a heads-up before they are due

- Good savings account interest rates of 1.85% (0.10% base rate plus 1.75% bonus). Bonus interest is easily unlocked after making five successful card or digital wallet purchases each month

The Up Bank Travel Card is aimed at younger markets who are looking to save on bank costs and receive online tools to help them budget and save for their goals. It is also able to be used overseas at any ATM without fees, no international fees and is the cheapest way to send money overseas through a bank due to their partnership with Wise (the largest money transfer company in the world). In addition the exchange rates are Mastercard rates which are normally 4% above interest rates. Finally, while this card is very useful domestically and for ATMs overseas we would not recommend it for big ticket items overseas as it is an expensive card to use.

- No foreign transaction fees

- No fee on initial card, load, unload or inactivity fees

- No cross currency transactions fees

- Lock in exchange rates before you leave

- Exchange rates most competitive for USD, GBP, EUR and CAD and JPY

- No ATM fee at 50,000 Global Alliance ATMs worldwide

- Free additional card

- Flight delay pass

Westpac Travel Money Card

- 11 Currencies can be loaded are USD, EUR, GBP, NZD, CAD, HKD, JPY, SGD, THB, AUD & ZAR

- $2,000 maximum limit on ATM withdrawals overseas within 24 hours

- $50,000 maximum limit on currencies loaded on to travel card

- $3 roughly for ATMs that are not within the Non Westpac Global Alliance

- If you run out of one currency on the card, you can pay with other currencies without the expensive cross currency transaction fee

- No foreign transaction fees, initial card, load, unload or inactivity fees

- According to the Westpac it can take upto 8 business days to receive the travel card

- Secure from fraudulent transactions with Mastercard Zero Liability protection

- 2 cards per account for free

The Westpac Travel Card is a no frills handy travel card with very low fees, no foreign transaction fees, access to some free ATMs worldwide and competitive exchange rates, especially on USD, EUR, GBP, CAD and JPY. In addition it has the South African Rand (ZAR) which is not common in prepaid travel cards. Finally it has access to a flight delay pass in case your flights are delayed and you need to access airport lounges.

- Linked to ANZ Rewards program

- 7 types of insurance for free

- 55 days interest free

- Good security on card purchases

ANZ Travel Adventure Card

- 20.24% interest on purchases and cash advances

- $120 annual fee

- No international transaction fees in person or online

- Offer 7 types of insurance for free

- ANZ Reward points can be used to buy gift cards, swap for Virgin or Singapore airline points or cash into your account.

- Earn 1.5 Reward points per $1 spent on eligible purchases up to $2,000 per statement period

- ATM fees at non ANZ ATMs

- Minimum credit of $6,000

If you utilize rewards points then the ANZ Travel Adventure Card might be suitable for you. Reward points can be used to buy a wide range of gift cards, swap for Virgin or Singapore airline points or cash into your account. In addition no international transaction fees are charged for purchases online or whilst you travel overseas. Finally this card is not recommended for cash withdrawals as the interest rate of 20.24% will eat up any savings.

- No ATM fees

- Can be used in Australia with no additional costs

- No fees for paying via bank transfer or Bpay

- Transfer limits can be set by user

ING Orange Everyday Account Debit Card

- As long as you you deposit at least $1000 and make at least 5 payments each month ING will waive international transaction fees and refund overseas ATM withdrawal fees

- Can be used in all countries

- Works with Apple Pay and Google Pay

- Visa currency conversion rates apply, which are normally 4% above market

The ING Orange Everyday Account Debit Card is a good card for most Australians travelling overseas for ATM access, with no fees. It also allows you to to buy goods online without an international transaction fee.

Furthermore you can use it in Australia for free and there are no fees to get your initial card, for account keeping or to top up your card. A word of caution however, if you travel overseas for longer than 1 month, you still need to deposit at least $1,000 and make at least 5 payments each month to get the rebates.

- Initial card and replacement cards are free

- Increased protection with Mastercard Zero Liability

- Access to cash from your account through the Global Emergency Assistance, if your card is lost or stolen

Australia Post Travel Money Card - Platinum Mastercard

- 1.1% Admin fee for instore loads, including initial load

- $5 fee for reloads via debit bank card

- $10 closure fee

- $3.50 on withdrawals from overseas ATM is expensive

- Currencies that can be loaded are USD, EUR, GBP, NZD, THB, CAD, HKD, JPY, SGD , AED and AUD

- Minload of $100 and max of $100,000

- If your card is lost or stolen you can access cash that is in your account through Moneygram or Western Union agents, with no charge

- Boingo hotspots offer the free wifi and you can look at their number of free hotspots per country on this map

The Australia Post travel money card is a popular option for Australian travellers due to the convenience of stores. However we would recommend the Australia Post travel money card for paying in shops or accommodation as it is costly to withdraw cash from ATMS. As the Australia Post travel money card is fee heavy we recommend not making withdrawals at ATMs or making cross currency transactions to keep additional fees down.

- Up to 11 currencies available

- Manage your account and card online

- 24/7 global assistance

- Access to emergency cash

- Free additional card when ordered at time of purchase

- Can be used at millions of locations worldwide – wherever Mastercard purchase symbol is displayed

Greater Bank Cash Passport Platinum Mastercard

- $5 fee for reloads via debit bank card, FREE reloads via BPAY

- Admin fee of up to the greater of 1.1% of the load/reload amount or $15 for in-store purchases

- Debit card load fee 0.5% of the amount loaded, per Debit Card Load transaction

- Domestic ATM fee 2.95% of value Withdrawn

- International ATM fee USD 2.50, EUR2.50, GBP 2.00,NZD 3.50, THB80.00, CAD 3.50,HKD 18.00, JPY260.00, SGD3.50, AED 10.00, AUD 3.50

- Minimum load of AUD100 and a Maximum of AUD100,000

The Cash Passport is one of the most popular travel cards in the Australian market. With Greater Bank, you can purchase it online and at one of their branches, then download the app or use the website to manage your card. While the card may be useful for international purchases, be mindful when using an ATM both locally or overseas as the fees can add up if you are withdrawing money often.

Learn more about the Cash Passport Platinum Mastercard through Greater Bank .

The best travel card in Australia depends on its use, for ATM withdrawals it is ING Orange , for best exchange rates it is Wise Travel Card, the best credit card is Bankwest Breeze Platinum , for overall best card by a bank its HSBC Global and the best rewards card is the Qantas Travel card .

A travel money card is safer than cash overseas and if you select a Wise travel card , it is the best exchange rate as well. Most places around the world accept MasterCard or Visa, so you should be able to pay for all your purchases by card.

Yes you can use all travel cards in Australia but you might choose not to due to the fees. ING , Macquarie , Up , Citibank are all good examples of travel money cards that do not charge for ATM withdrawals in Australia. However examples of travel money cards that charge $3.50 per Australian ATM withdrawal include Travelex , Australia Post and Travel Money Oz .

Both if you buy your cash from S Money and pay with a Wise card overseas, as they both use the exchange rate you see online and charge very low fees. However if you buy your foriegn currency at the airport, you are paying top prices so using a card is cheaper.