- ATO Community

- Legal Database

- What's New

Log in to ATO online services

Access secure services, view your details and lodge online.

Expenses for a car you own or lease

Deductions for work-related use of your own car.

Last updated 24 June 2024

Claiming a deduction for car expenses

To claim a deduction for car expenses:

- Your vehicle must meet the definition of a car .

- You do not own or lease the car if you use it under a salary sacrifice or novated lease arrangement.

- You can claim for trips between workplaces or to perform your work duties.

- You can't claim for trips between your home and place of work, except in limited circumstances.

- You must have spent the money yourself and weren't reimbursed.

- You must have the required records.

If it's someone else's car or it's another type of vehicle (such as a truck or motorcycle), see Expenses for a vehicle that isn't yours or isn't a car .

If your travel is partly private, you can only claim a deduction for the work-related portion of your expenses.

You claim the tax deduction in your income tax return as a work-related car expense .

If you receive an allowance from your employer for car expenses, you must include it as assessable income in your tax return. The allowance amount is shown on your income statement or payment summary.

For a summary of this information in PDF format, see Car expenses (PDF, 1.5MB) This link will download a file .

Definition of a car

To claim a work-related car expense, the vehicle must be a car.

A car is a motor vehicle that carries a load of less than one tonne and fewer than 9 passengers (including the driver). This includes electric (zero emissions) and hybrid vehicles if they meet this definition. Motorcycles and similar vehicles are not cars.

If the vehicle does not meet this definition, you claim your work-related expenses using the approach for a vehicle that isn't a car .

You must own or lease the car

To claim car expenses you must own or lease the car, or hire it under a hire-purchase arrangement.

You can't claim running costs for a car you use under a salary sacrifice or novated lease arrangement. In this situation the car is usually leased by your employer from a financing company, and your employer typically pays for the running costs and claims deductions. You can claim additional expenses, like parking and tolls associated with your work use of the car.

If you use a car owned by a family member, and you can show there is a private arrangement that made you the owner or lessee of the car (even if you aren't the registered owner), you work out your car expenses as though it is your car.

If you don't own or lease the car (or don't have a private arrangement that makes you the owner or lessee), you claim your work-related expenses using the approach for a vehicle that isn't yours .

Example: private arrangement

When Rory turned 18 she bought a car from her parents for $1,000. She now pays the insurance, fuel, registration, and other running costs, and no one else uses the car. However, the registration has not been updated and the car is still registered in her mother's name.

Rory is eligible to claim her work-related car expenses even though the registration has not been changed to her name. She would be treated as the owner because she can show that:

- she bought the car from her parents

- she is now responsible for all of the ownership and running costs of the car.

Calculating your car expense deductions and keeping records

You use either of 2 methods to calculate deductions for car expenses:

Cents per kilometre method

Logbook method.

Use the calculator to work out your deduction for either method.

If you are claiming car expenses for more than one car, you can use a different method for each car. You can also change the method you use in different income years for the same car.

To calculate your deduction using this method, multiply the number of work-related kilometres you travel in the car by the rate per kilometre for that income year.

'Work-related kilometres' are the kilometres your car travels in the course of earning your assessable income.

- 2024–25: use 88 cents per kilometre

- 2023–24: use 85 cents per kilometre

- 2022–23: use 78 cents per kilometre

- 2020–21 and 2021–22: use 72 cents per kilometre

- for rates in earlier years, see Prior year tax return forms and schedules .

- You can claim a maximum of 5,000 work-related kilometres per car.

- You need to keep records that show how you work out your work-related kilometres.

If you and another joint owner use the car for separate income-producing purposes, you can each claim up to 5,000 work-related kilometres.

The cents per kilometre rate covers all car expenses, including:

- decline in value

- registration

- maintenance

- fuel costs.

You can’t add any of these expenses on top of the rate when you work out your deduction using this method.

Example: car deduction using cents per kilometre

Once per week, Johan makes a 27-kilometre round trip in his own car from his head office in the city to meet with clients. In addition, once per month he makes a 106-kilometre round trip to visit clients at another location.

When Johan consults his diary at the end of the 2023–24 income year, he works out he was at work for 47 weeks, but he missed one weekly meeting with clients as he was sick. He also determines that, although he was on leave for 5 weeks during the income year, he still made 12 × 106-kilometre round trips to visit clients.

He works out his work-related kilometres as:

Number of weekly trips × distance of weekly trip = total weekly trip kilometres

46 × 27 km = 1,242 km

Number of monthly trips × distance of monthly trip = total monthly trip kilometres

12 × 106 km = 1,272 km

Total weekly trip kilometres + total monthly trip kilometres = total trip kilometres

1,242 + 1,272 km = 2,514 km

Johan works out his deduction for the 2023–24 income year as:

2,514 km × 0.85 = $2,137

Keeping records for cents per kilometre method

If you use the cents per kilometre method, you don't need receipts.

You do need to be able to show that you own the car and how you work out your work-related kilometres. For example, you could record your work-related trips:

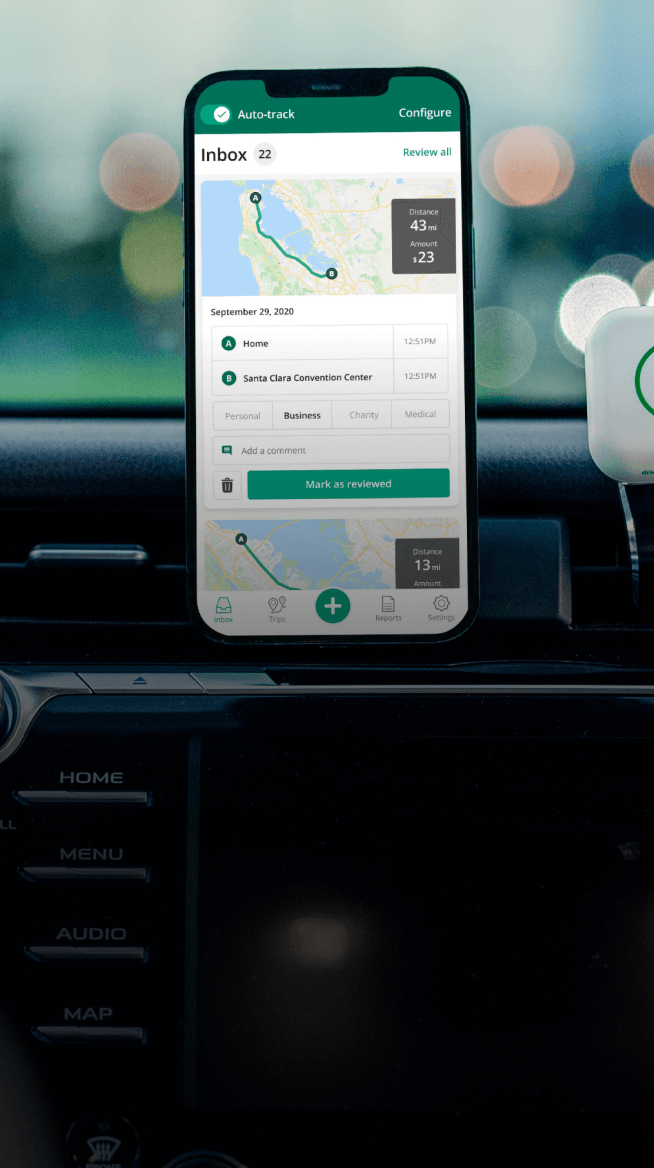

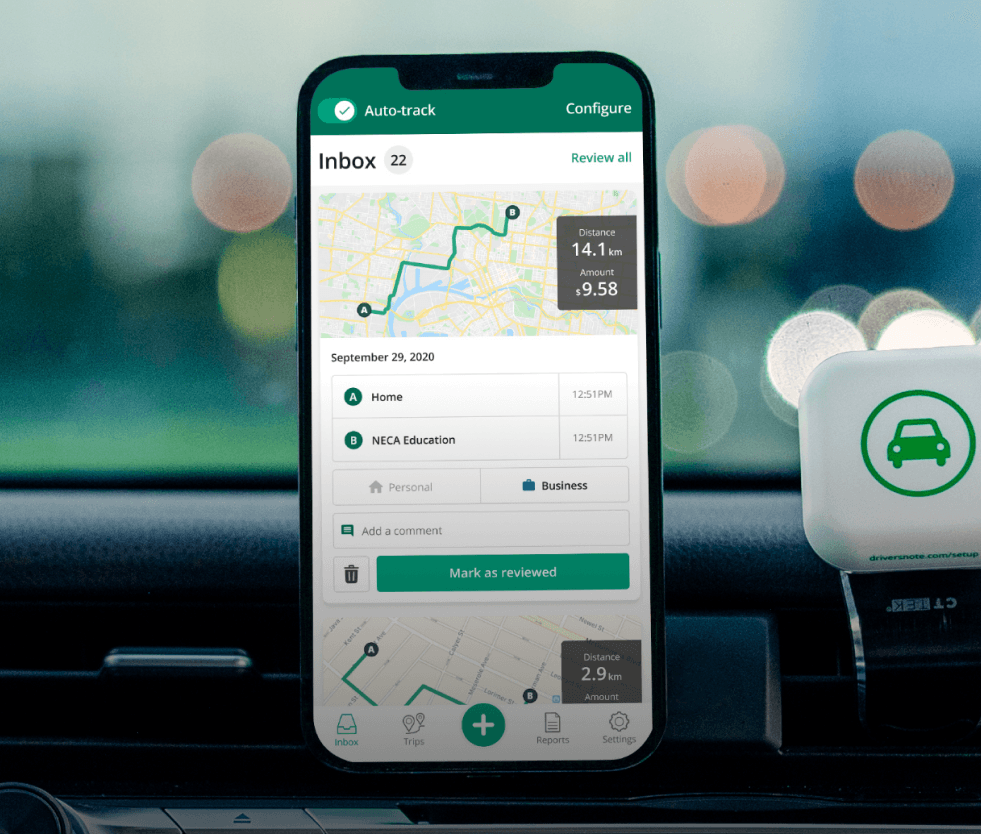

- using the myDeductions tool in the ATO app.

To calculate your deduction using the logbook method, you need to:

- keep a logbook that shows your work-related trips for a continuous period of at least 12 weeks (your logbook is valid for up to 5 income years)

- keep receipts or other records of your car expenses

- use your logbook to calculate the deductible portion of your car expenses .

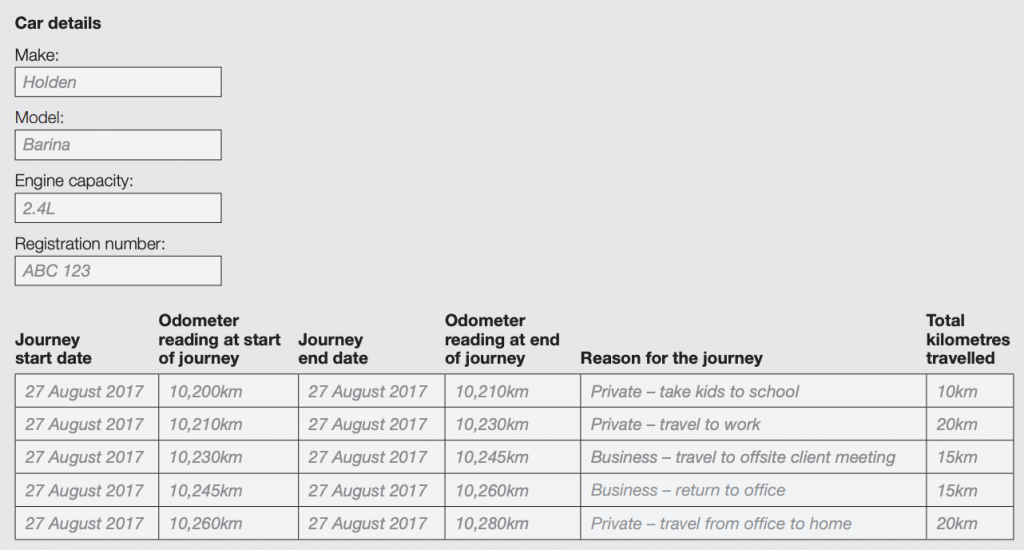

Keeping a logbook

Your logbook must:

- cover at least 12 continuous weeks and be broadly representative of your travel

- include the destination and purpose of every journey, the odometer reading at the start and end of each journey, and the total kilometres travelled during the period

- include odometer readings for the start and end of the logbook period.

Your logbook is valid for 5 years. However, if your circumstances change (for example, if you change jobs or move to a new house), and the logbook is no longer representative of your work-related use, you will need to complete a new 12-week logbook.

In each of the 4 years following the first year, you need to keep:

- odometer readings for the start and end of the full period you claim

- your work-related use percentage based on the logbook.

If you are using the logbook method for 2 or more cars, keep a logbook for each car and make sure they cover the same period.

You can keep an electronic logbook using the myDeductions tool in the ATO app, or keep a paper logbook.

You must retain your logbook and odometer records for 5 years after the end of the latest income year that you rely on them to support your claim.

Keeping records of car expenses for logbook method

You can claim running costs and decline in value of your car.

You must keep:

- receipts for your fuel and oil expenses, or a record of your reasonable estimate of these expenses based on the odometer readings for the start and end of the period for which you are claiming

- receipts for other expenses for your car – for example, registration, insurance, lease payments, services, tyres, repairs, electricity expenses and interest charges

- a record of the purchase price of the car and how you work out your claim for the decline in value of your car, including the effective life and method you use.

Electric cars - records of electricity expenses

If your car is electric, instead of keeping receipts for fuel and oil, you must keep:

- receipts for electricity from commercial charging stations

- evidence that shows you incur electricity costs to charge your car at home, such as an electricity bill and how you calculated the direct cost of charging your car

- odometer readings for the start and the end of the period that you are claiming.

Alternatively, you can use the electric vehicle (EV) home charging rate of 4.2c per kilometre to make a reasonable estimate of your home charging expenses based on your odometer readings. If you choose to use this rate but you also used commercial charging stations to charge the car during the income year, you must disregard your commercial charging station costs. They can't be claimed as a separate deduction.

Hybrid cars - records of fuel, oil and electricity expenses

If your car is a hybrid, instead of keeping receipts for fuel and oil expenses you must keep all of the following:

- receipts for your fuel and oil

- receipts for commercial charging stations

You can't use the EV home charging rate if the car you own and use for work is a hybrid.

You can't claim capital costs, such as the purchase price of your car, the principal on any money borrowed to buy it, or improvement costs (for example, adding paint protection or tinted windows).

How to calculate your deduction using a logbook

- Work out the total number of kilometres you travelled during the logbook period.

- Work out the number of kilometres you travelled for allowable work-related trips during the logbook period.

- Divide the work-related kilometres (2) by the total kilometres (1), then multiply by 100. This is your work-related use percentage.

- Add up your total expenses for the period that you are claiming.

- Multiply your work-related use percentage (3) by your car expenses (4). This is the amount you claim as a deduction.

- Tax Deductions

- Work Related Car Expenses

- Cents Per Kilometre

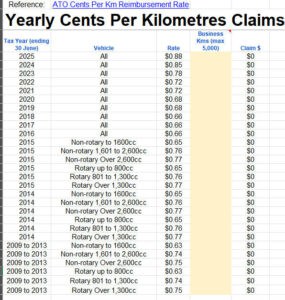

ATO Cents Per Kilometre Car Expenses

The ATO’s per kilometre car expense claim rate for 2024-25 is 88 cents per km.

- The claim rate for 2023-24 is 85 cents per km.

- The claim rate for 2022-23 is 78 cents per km.

Cents Per Km is one of the methods you can choose to satisfy the substantiation rules for individuals claiming car expenses as a tax deduction .

Jump to cents per km calculator

How To Claim Using The ATO Cents Per Kilometre Method

For up to 5,000 business kms, this claim method avoids the need to keep track of individual car expenses and receipts. A diary is recommended to keep track of the business kms.

Under this method, full substantiation (e.g. receipts for expenses) isn’t needed, however there must exist an objectively reasonable basis of facts to enable a claim.

The claim allowed is for “ Business kilometres “. Business kilometres are those travelled by car in the course of producing assessable income, or between work places. The claim method can be used by the self-employed or employees.

The cents per km claim is based on a per kilometre allowance for up to 5,000 business kilometres a year in total.

If more than 5,000 business kms is established, this claim method can still be used, but the excess over 5,000 kms is ignored.

ATO Cents Per Kilometre Rate Expense Calculator

Result: $ 0.00, result limited to maximum 5,000 kms: $ 0.00.

Spreadsheet version (xlsx) free download (all years 2009 to 2025):

The ATO’s Per Kilometre Rates Year by Year

Choosing the per km set rate car claim method.

Substantiation documents are not formally required for per km car claims. A claim for business kms using a per kilometre rate is a simple alternative to calculating a claim for actual expenses, and covers all running expenses and depreciation.

The simplicity of the claim and minimal record keeping are the main advantages.

However, this claim method only applies up to a maximum of 5,000 business kilometers. If business kms total more than 5,000, a claim can still be made, but is limited to the first 5,000 kms.

The claim method is set out in subsection 28-25(1) of the Income Tax Assessment Act 1997.

Although this claim method avoids the need to keep receipts, the Tax Office still requires some evidence supporting the reason for the claim.

A diary record would meet this objective, but certain other circumstantial evidence may suffice. If in doubt, talk to your accountant.

Once the claim method is chosen for any year, it is not locked in for later years. Taxpayers can choose from year to year which car expense claim method to use.

There is no balancing adjustment on the disposal of a car which has only been claimed on a per km basis.

Log Book Alternative

Ideally a full log book record provides the best decision basis, even though that is not required in the case of the per km method.

This is because a properly maintained log book together with a record of actual expenses enables you to compare the claim value with alternatives, and choose another method if it results in a bigger claim.

If you would like to use a log book, there is a low cost Spreadsheet Motor Vehicle Log Book Template here .

Per kilometre – multiple claimants, multiple cars, joint owners

More than one car can be included in a claim for a financial year, and more than one person can conceivably make a claim in respect of the same vehicle used at different times.

For a useful explanation of joint and same-car claims, as well as some great log book and diary tips, see Bantacs Accountants “ Claiming a motor vehicle ” (PDF)

The per kilometre claim method doesn’t prescribe specific record-keeping requirements, but the claim has to be ‘reasonable’, and you need to be able to show some logical basis for the kilometres figure derived.

Per kilometre rates 2023-24 (85¢) ( LI 2023/D12 ) Per kilometre rates 2022-23 (78¢) ( F2022L00813 ) Per kilometre rates 2020-21 and 2021-22 (72¢) ( MVE 2020/1 ) Per kilometre rates 2018-19 and 2019-20 (68¢) ( MVE 2018/1 )

Motor vehicle cents per kilometre rates – 2015-16

Per Km rate for 2015-16 is 66 cents per km , which also applies for 2016-17 and 2017-18 (up to 5,000 km) regardless of engine size.

From 1 July 2015 a single flat rate per business kilometre is used for the cents/km claim method – regardless of engine size. The amending legislation is here .

The rates set in future years are intended to more closely reflect the actual operating cost of cars.

The claim is made out by first selecting the applicable Rate per Km, and then multiplying that by the number of kilometres (up to 5,000):

$Claim = Rate (cents) x Kms

Motor vehicle cents per kilometre rates – 2014-15

Motor vehicle cents per kilometre rates – 2013-14, per km claims for 2008-9, 2009-10, 2010-11, 2011-12 and 2012-13.

This page was last modified 2024-05-01

You are using an outdated browser. Please upgrade your browser to improve your experience.

1300 829 863

- About Tax Today

- Psssst! Wanna make $20 bucks?

- COVID-19 Stimulus

- Make an appointment

- Bookkeeping Services

- Tax Ideas for Photographers

- Tax Time 2021

- Tax Return 2021

- How to prepare a logbook

Cents Per Kilometre Rates and claims

- Home Office Expenses, What you can and can’t claim

- Better Tax for all Australians

- Useful Links

- Company Tax Returns

- Claim super in my tax return

- Share Voucher

- Online Refund

- Tax Today App

- Tax by phone

- Tax Refund Calculator

- Blacktown, NSW

- Campbelltown, NSW

- Dandenong, VIC

- Erina, (Central Coast), NSW

- Mascot, NSW

- Newcastle, NSW

- Parramatta, NSW

- Penrith (Blue Mountains), NSW

- Mount Druitt (St Marys), NSW

- Upper Mount Gravatt (Garden City) Brisbane, QLD

- Goodna, Ipwsich, QLD

- Gold Coast (Southport), QLD

- Woodridge (Logan Central), QLD

Car travel expenses are tricky to claim. Getting it wrong may incur not claim at all.

Cents per kilometre is the simple method of claiming work related car expenses. the ato determine a rate each year that covers all the costs of running a car. that rate is then multiplied by the number of work related kilometres (maximum 5000km). the alternative is to use the log book method.

We suggest you keep a log book of your work related travel, no matter what method you chose to claim.

From 1 July 2015, separate rates based on the size of your car engine do not apply.

Below are the most recent years rate that can be claimed.

- 72 cents per km for 2020–21 and 2021–22

- 68 cents per km for 2018–19 and 2019–20

- 66 cents per km for 2017–18, 2016–17 and 2015–16

Below you will find the historic values of the cents per km rate.

If you use the ‘cents per kilometre’ method, multiply the number of business kms (up to 5,000) by the amount allowed for your car engine capacity.

Find your nearest branch here . Or do it online and we can pay you your refund within 3-5 working days.

What are the reasonable travel and overtime meal allowance expense amounts for the 2022-23 income year? Click Here

Instant Tax Refunds are our specialty. Call 1300 829 863 Tax Today, Australia’s leading Tax Agents that provide Instant Tax Refunds, have offices in Sydney, Melbourne and Brisbane. You can even do the tax return online.

Make An Appointment

- Choose a Branch * NSW - Blacktown NSW Campbelltown NSW - Fairfield NSW - Gosford NSW - Mascot NSW - Newcastle NSW - Parramatta NSW - Penrith NSW - St Marys QLD - Goodna QLD - Logan QLD - Southport QLD - Garden City VIC - Melbourne

- Date * DD slash MM slash YYYY

- Dateold DD slash MM slash YYYY

- Time * 9:00 am 10:00 am 11:00 am 12:00 pm 2:00 pm 3:00 pm 4:00 pm 5:00 pm

- Client Status New Client Exisitng Client

- Tax Return Type Personal Business Rental Property Bookkeeping

- First Name *

- Last Name *

- Tax File Number This is to speed up processing when you come in.

- Date of Birth To assist in identifying you with ATO.

- Mobile Number * We prefer mobile number if possible.

- Message or preferred Accountant If you want a specific Accountant, enter their name here.

- Email This field is for validation purposes and should be left unchanged.

How To Calculate Your Car Expenses

Car and Travel Expenses , Taxes

If you use your own car for work purposes, you can claim a deduction using the cents per kilometre method or logbook method. If you use someone else’s car for work purposes, you can only claim for direct costs you pay for – such as fuel.

You can claim your vehicle expenses if:

✅ You use your car in the course of performing.

✅ Your work duties you attend work-related conferences or meetings away from your normal workplace.

✅ You travel directly between two separate places of employment and one of the places is not your home.

✅ You travel from your normal workplace to an alternative workplace and back to your normal workplace.

✅ You travel from your home to an alternative workplace and then to your normal workplace.

✅ You perform itinerant work.

You can’t claim your vehicle expenses if:

❌ You can’t claim a deduction for normal daily journeys between home and work except in limited circumstances where you carry bulky tools or equipment (such as an extension ladder or cello) that: 1. your employer requires you to use for work 2. you cannot leave at work

❌ If travel is partly private, you can only claim the work-related portion.

❌ You can’t claim a deduction for car expenses that have been salary sacrificed.

❌ You can’t claim a deduction if you have been reimbursed for it.

YOU CAN CALCULATE YOUR CAR EXPENSES IN TWO WAYS: CENTS PER KILOMETRE METHOD AND LOGBOOK METHOD

CENTS PER KILOMETRE METHOD

🔘 You can claim a maximum of 5,000 business kilometres per car, using this method.

🔘 Your claim is based on 68 cents per kilometre.

🔘 You don’t need written evidence but you need to be able to show how you worked out your business kilometres (for example, by producing diary records of work-related trips).

LOGBOOK METHOD

🔘Your claim is based on the businessuse percentage of expenses for the car.

🔘 Expenses include running costs and decline in value. You can’t claim capital costs, such as the purchase price of your car, the principal on any money borrowed to buy it and any improvement costs (eg, adding paint protection and tinted windows).

🔘To work out your business-use percentage, you need a logbook and the odometer readings for the logbook period. The logbook period is a minimum continuous period of 12 weeks.

🔘 You can claim fuel and oil costs based on your actual receipts or you can estimate the expenses based on odometer records that show readings from the start and the end of the period you used the car during the year.

🔘 You need written evidence for all other expenses for the car.

Your vehicle is not considered a car if it is a motorcycle or a vehicle with a carrying capacity of:

❌ one tonne or more, such as a utility truck or panel van

❌ nine passengers or more, such as a minivan.

Keep receipts for your actual expenses. You cannot use the cents per kilometre method for these vehicles. While it is not a requirement to keep a logbook, it is the easiest way to show how you have calculated your work-related use of the vehicle.

KEEPING A LOGBOOK

Your logbook must cover at least 12 continuous weeks. If you started using your car for work-related purposes less than 12 weeks before the end of the year, you can extend the 12-week period into the next financial year.

If you are using the logbook method for two or more cars, keep a logbook for each car and make sure they cover the same period.

Your 12 week logbook is valid for 5 years. However, if your circumstances change (eg, you change jobs) and the logbook is no longer representative, you will need to complete a new 12 week logbook.

Your logbook can be electronic or paper. The example below has the details you need to keep.

CALCULATE YOUR WORK-RELATED CAR USE

Complete this section after 12 continuous weeks of logbook use

Logbook period (dd/mm/yy to dd/mm/yy)

1️⃣ Calculate the total number of kilometres travelled during the logbook period: x,xxx km

2️⃣ Calculate the number of kilometres you travelled in the course of earning your income during the logbook period: x,xxx km

3️⃣ Calculate the work-related use by dividing the amount at (b) by the amount at (a). Multiply this figure by 100.

YOUR BUSINESS USE PERCENTAGE IS: XX%

Once you’ve calculated your business use percentage, multiply it by your car expenses to figure out your claim.

Car expenses can include running costs such as fuel, oil, and servicing, registration, insurance and vehicle depreciation. You can claim fuel and oil costs based on receipts or you can estimate the expenses based on odometer records that show readings from the start and end of the period you used the car during the year.

You need written evidence for all other expenses for the car.

ATO Cents Per KM Method: How to Maximise Your Tax Return 2023-2024

Are you familiar with the ATO’s cents per KM method ?

In 2023-2024, you can be reimbursed by the Australian Tax Office for $3,000 or more, based on your car expense deductions. $10,000, and more, is available to some people.

A considerably attractive sum, don’t you think?

It’s money you could spend on a holiday this year, car accessories or to help smooth out cash flow gaps in your budget .

Today we’ll show you how to make the most of the ATO cents per KM method . We’ll also explore a few additional ideas on how to maximise your tax return.

You’ll have an action plan on how to get more money back on your taxes . Get off to a flying start on a lifetime of being smarter with your annual tax refund.

What You’ll Learn

Your Quick Guide

The below table summarises factors to compare which method suits your driving and business needs best.

ATO Cents Per KM vs. the Logbook Method: Which One is Right for You?

If you’re using your own car for business purposes, you can take advantage of a better tax return from the ATO.

Expenses incurred while driving your car for work , can be claimed as a business expense, and are therefore eligible for reimbursement from the tax office.

You can only claim a deduction if you’re using your own car:

- To earn income as a sole-trader (e.g. tradies, ride-sharing professionals).

- To undertake business trips as an employee in a company.

Now, to determine the percentage of your personal and business trips , you need to keep business mileage records.

To do this, you can choose between two methods. We’ll do our best to present their pros and cons so you can work out which one best suits your needs.

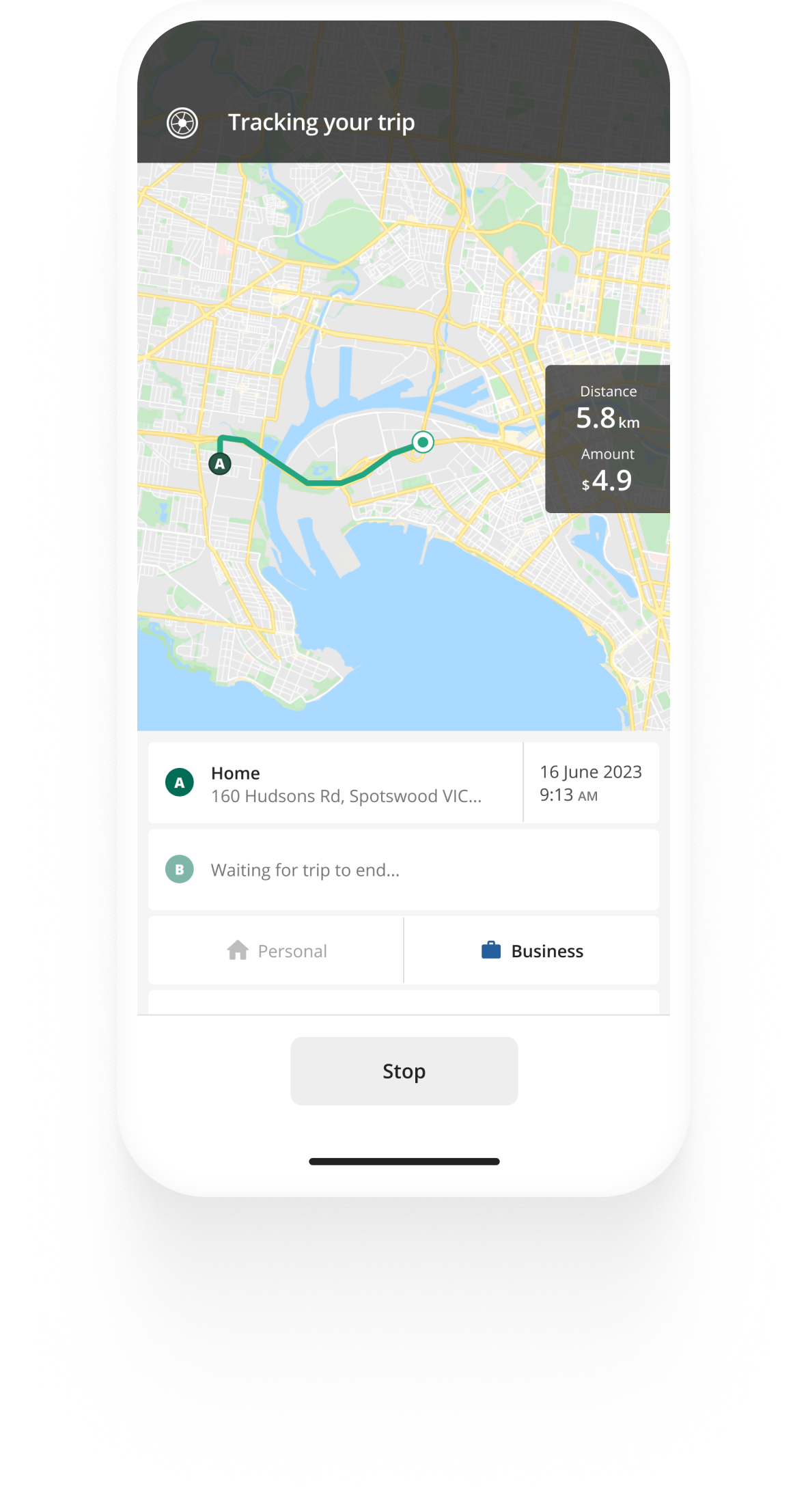

To make it even easier, check out the GOFAR app .

I’m a happy customer, it allows me to easily track my KMs and separate personal from business. Kieran Danes, Verified Customer, Jan 2021

Method 1: ATO Cents Per Kilometre Method

Perhaps you’re wondering how many kilometres you can claim without a logbook? Or what your maximum claim would be if you used the cents per kilometre method?

Well, we’re about to answer these and other questions that might be bugging you. Ready to look at the pros and cons of the cents per kilometre method ? Let’s dive right in.

- No requirement to keep a detailed logbook

- No need to keep receipts for your car expenses

- It’s easier to calculate the deduction at the end of each financial year

- All you need to do is keep diary records of your work-related trips

- You can only claim a maximum of 5,000 business kilometres annually

- Your claim is limited to a set rate, which is 85 cents per kilometre for the 2023-2024 income year

- You can’t claim separate deductions for insurance premiums and depreciation

Method 2: Logbook Method

The vehicle logbook method is a more complicated process.

But if you were wondering how to get $10K back from your taxes , keep on reading.

To get closer to that figure though, you’ll need to have some serious business mileage and learn some logbook keeping tips and tricks .

But now, let’s focus on the pros and cons!

- You can claim your actual expenses, meaning everything will be included from kilometres driven to insurance and depreciation

- It can get you a potentially bigger tax benefit

- You’re allowed to claim car depreciation as well

- You only need to reassess your logbook average every 5 years

- You need to keep a valid logbook for at least 12 weeks, so the record-keeping is more time-consuming

- You need to know the rules so you know which trips qualify as business mileage

- You need to keep receipts of all your car expenses throughout the year, and have these available to the tax office

Sample Logbook Template

Download a sample logbook template of an approved ATO-compliant logbook for your vehicle to learn which details are needed for each record. Or use the GOFAR app instead.

What Type of Vehicle You Drive Matters

This is where you’ll want to figure out which method gives you the largest tax return. Think of it this way: it depends on your current vehicle (approved by ATO) and work situation. If your work schedule is hectic round-the-clock, or you’re a forgetful person, then the logbook method isn’t the best idea. You simply won’t be able to squeeze in the required time.

Here are a few more factors to take into account:

- If you have a low-maintenance car , the cents per kilometre method will be a better fit for your needs. It’s easier to manage the day-to-day requirements, and you won’t have much use for the logbook method as your car running costs aren’t as steep.

- If you have a high-maintenance car , needing constant maintenance, the logbook method will allow you to reimburse the majority of these expenses. So, it can be worth the extra time and hassle.

- The cents per kilometre method is better for people with lower vehicle usage .

How Do I Claim My Car Expenses Using the ATO Cents Per KM Method?

As mentioned above, the cents per kilometre method allows you to get your money back on your tax return with minimal effort .

But you still need to offer proof to the ATO of how you worked out your business kilometres. Once you set your sights on a healthy tax refund, trust us, you won’t feel like you’re doing much work at all for your record-keeping. It’s that easy.

All you need to record is:

- The total kilometres you’ve driven over the course of the year

- The number of kilometres you’ve driven for business

- The number of kilometres you’ve driven for private purposes

Tracking your total kilometres is simple. Just jot down the start and end odometer readings on the day the financial year begins and ends.

Now, here’s how to calculate your tax deduction using the cents per kilometre method.

Simply multiply your business kilometres by the amount per kilometre allotted by the ATO.

We’ll translate this into numbers.

Let’s say you cover the maximum of 5,000 kilometres for the 2023-2024 financial year. This is your calculation: 5,000 kilometres x $0.85 = $4,250 .

This is how much you’d be able to claim at tax time.

It’s worth it! Down to the last penny.

If the cents per kilometre is your preferred method, keep in mind that you should opt for it in the first year you use your car for business. After that, you’re free to pick the cents per kilometre again or switch to the logbook method.

How Can You Claim $10,000+ in Deductions?

Let’s break it down in a table that shows the average kilometres that people drive for business each year and therefore the reimbursement that they’re eligible to receive in the 2023-2024 financial year.

Which Trips Qualify for a Tax Return?

If you are going to track your kilometres in order to receive a reimbursement, you need to learn how to separate the wheat from the chaff. In other words, your business kilometres from personal trips.

You need to be clear on what you can and what you can’t claim as a deduction . That is to say, which trips the ATO considers business-related and which it doesn’t .

Kilometres that count as work-related are those conducted solely for business purposes. For example, kilometres driven:

- To meet a client, visit a customer, or attend a conference.

- To attend a meeting with your accountant or lawyer.

- To visit the bank, or pick up work supplies (e.g. visiting stationery or a computer store).

- To travel between alternative offices.

In more detail, expenses you can claim, according to the ATO include:

- Fuel and Oil Costs: You can claim the cost of fuel and oil if you have records to show your work-related use of the car.

- Repairs and Servicing: If you use your car for work purposes, you can claim a deduction for repairs and servicing.

- Insurance Premiums: Premiums paid for insuring your car can be claimed if the car is used for work purposes.

- Depreciation: If you own the car and use it for work, you can claim a deduction for its decline in value.

- Lease Payments: If you lease a car and use it for work, you can claim the lease payments.

- Interest on Car Loans: If you’ve taken out a loan to purchase a car for work purposes, you can claim the interest on the loan.

- Registration: The cost of registering your car can also be claimed if it’s used for work.

- Parking Fees and Tolls: If you incur parking fees or tolls while using your car for work, these can be claimed as deductions. But, not parking fines, unfortunately.

Below are the types of driving/kilometres you CANNOT claim as work-related :

- Driving between home and work (except in limited circumstances where you’re required to transport bulky tools or equipment).

- Any trip to the post office or shop when you’re heading back home from a business-related trip. You can’t claim a deduction for any remaining kilometres from the post office or store to your home.

Want to learn more about what makes your business claim legitimate or invalid? Read: Understanding ATO Motor Vehicle Rules

Use a Logbook App to Get More Money Back on Your Taxes

An ATO logbook app is the easiest, most convenient and accurate tracking option available for Australian taxpayers. It’s the shortcut to getting your hard-earned money back into your pocket.

Finding a proven way of keeping meticulous business driving records, and you’ll be well on your way to a neatly filed tax return. That’s exactly what a logbook app does.

A logbook app such as GOFAR will track all the information you need to record under the cents per kilometre method. It’ll capture your total mileage and take snapshots of your odometer readings as you drive.

All you need to do is classify your trips as business or personal .

Hand on your heart, can it get any easier?

Only 2 days in but this is great. Sure gonna make tax time easier . It’s actually pretty entertaining seeing how well you can drive too. Loses 1 star for just general info about all the stats not being very clear for non car persons. But really cool. Thanks. Susan Yuill, Verified Customer, Mar 2021

Hear Louise Chilton’s story on how she saved time and money using the GOFAR logbook app.

Download GOFAR Logbook App to Maximise Cents per KM

But what would you say if we told you that you can even save more of your valuable time?

Enter GOFAR. The GOFAR app will automate your logbook tracking and keep detailed records of business and personal kilometres driven.

GET THE APP

GOFAR enables you to:

- Log, compute and export business expenses at the press of a button.

- Never miss a trip, thanks to its set-and-forget device that logs every trip.

- Categorise business trips in seconds.

- Keep ATO records on both iPhone and Android.

Learn more about how GOFAR can jump in and save you time. Or get GOFAR today to maximise your tax return in 2023-2024 and save hours on your kilometre logging.

Learn the Terminology

Cents Per Kilometre Method: This is a method used for calculating car expense deductions for tax purposes. Under this method, individuals can claim a set rate (determined by the ATO) for each business kilometre travelled, up to a maximum limit of kilometres per year. It does not require detailed records of all car expenses, but individuals must be able to demonstrate how they determined their business kilometres.

Logbook Method: This is another method used for calculating car expense deductions for tax purposes. With the logbook method, individuals maintain a detailed logbook over a continuous 12-week period, recording all business-related car journeys. This logbook is then used to determine the percentage of total car expenses that can be claimed as a deduction. The logbook contains information such as the date, purpose, and distance of each trip. Once established, the logbook is valid for five years , but all car expenses and odometer readings must be recorded during this period.

Editor’s Note: This article was last updated on Thursday 21st March 2024 with the latest kilometre rates and claim details from the Australian Taxation Office .

Danny Adams

Co-founder of GOFAR and with a Computer Science background from Harvard University, and a Bachelor of Aerospace, Aeronautical & Astronautical Engineering (Honours), UNSW. I want to transform data from cars into useful services so -> drivers save time & money -> emissions fall -> Australian roads are safer. So we built an ATO-compliant logbook app called GOFAR . I write to help you understand how to use GOFAR to maximise business travel . Reach out via [email protected] .

Related Posts

- Short message

- Email This field is for validation purposes and should be left unchanged.

You have 0 item in cart.

You just added:

- Cart items: 1

- Cart Subtotal: $ 0

Need an extension cable? Want to go green? Choose from these handy products:

- All online calculators

- Suggest a calculator

- Translation

PLANETCALC Online calculators

- English

Distance Cost Calculator

This calculator calculates the cost of travel by multiplying the distance traveled in kilometers (or miles) by the rate per kilometer (or mile).

Calculating the cost of distance travelled is an important task for many people, including drivers, transportation companies, and anyone who needs to budget for travel expenses. The process is fairly simple - the distance travelled is multiplied by the rate per kilometer (or mile) to determine the total cost. For example, if a driver travels 100 kilometers and the rate per kilometer is $0.50, the total cost would be $50.

There are several factors that can affect the rate per kilometer/mile, including fuel prices, vehicle maintenance costs, and labor costs. Transportation companies may also need to factor in other expenses, such as insurance and taxes, when determining their rates. In addition, some companies may offer discounts or special rates for certain types of travel or customers.

Distance Price calculator

Similar calculators.

- • Comparing prices using cost per square meter

- • Cost of one hour (or kilometer)

- • Cost per unit of volume

- • Discount calculator

- • Ton-kilometer. Conversion based on the cost of a kilometer

- • Life section ( 121 calculators )

Share this page

The information used to create this calculator is based on the car I currently own and the car running costs I've made over the last 10.38 years. The car is a Toyota Avensis. The car was purchased on the 5th of June 2008. At the time of creating this calculator the car had travelled 141,447 kilometres at the latest purchase of petrol on the 21st of October 2018. I use examples of my car running costs in this calculator to help others determine their costs.

Most car running costs have been included however I may have missed a couple of tanks of petrol, some personal tolls, parking and small purchases for the car such as a seat protector. Car running costs or revenue I've not currently considered include: value of car now, tax deductions I receive for business use, loss of interest on money used to purchase the car.

NOTE: The Car Price should be entered as a single total amount. All other amounts should be entered as the amount for a year. The calculator will extend out the yearly amounts for the number of years entered.

The following are the figures for my car: Total Cost: $72,542.67 Kilometres: 141,447 Cost per km: 51.28 cents Cost per year: $6,988

Why would anyone want to know the cost per kilometre for owning a car?

To help them make better buying decisions. Is it better to own and run a car? Is it better to take a bus, taxi, or uber? If there's more than one person in the car is it better to take the car or public transport? Is it better to buy a cheap second car to help maintain the price of the main car? What's a car cost if I hardly use it and mostly take public transport? By using the Car Running Cost Calculator and changing what you enter you can answer these and many more questions.

As an example my nearest shopping centre is 6 km away, or a 12 km return trip. Is it better for two people to take the car or bus, based on the car running cost alone? By car the car cost is roughly $6, so for 2 people the cost is $3 each. If we use the full fare Myki cost (longer than 2 hours) for zone 2 it is $5.88. A negligible saving for one person but twice as expensive as using a car for two. What about a trip into the city? The distance into the city is a 36 km return trip. The cost by car is around $18. Using Myki Zone 1 & 2 at $8.60 each or $17.20 for two the bus similar. Neither of the above take into account concession fares. Whilst it's important to factor in the time and convenience of using a car, at least now on cost alone, it's possible to make an informed comparison. One thing to keep in mind which isn't at first obvious, is if you start to use public transport more to reduce the cost of running your car, you end up increasing the running cost per kilometre. The reason is you have recurring yearly car costs you're now spreading over lower kilometres. As you use your car more your cost per kilometre will come down to a minimum point and for certain trips it's cheaper than public transport. As you use the car less the running cost per kilometre increases making public transport more cost effective. The answer of taking the car over public transport isn't always clear cut.

The knowledge gained through working out the cost per kilometre of running your car can help you make better and more informed opinions when it comes to matters that affect the public.

No matter what your reason, at least now you have the Car Running Cost Calculator and your own car running costs which can assist in answering the question, "what is the running cost of my car per kilometre?" How you use that information is up to you.

Car Price can vary depending on how you purchase your car. In my case it was the purchase price including delivery fee and stamp duty on purchase. I've excluded the first year's registration fee and include that fee in the registration cost. To get a better indication of cost I could reduce the cost by what the car is worth now. Should you purchase a car on a lease or finance the total cost including lease payments, or in the case of financing, interest should be included.

Registration

The amount you pay for car registration each year. My average cost of registration is $674.

The amount you pay for car insurance each year. My average cost for insurance is $631.

The cost to service your car each year. If you have your car serviced twice a year add both amounts together first. My average cost per year for insurance has been $446.

Estimate the cost of petrol you use in a year. If there's interest, in future I hope to revisit this calculator an enable people to enter the amount for how often they fill up their car. My average cost for petrol has been $1,757. One thing to note is I monitor petrol prices so save hundreds of dollars a year on petrol.

The cost for a set of tyres was $460 or $44 per year.

I've went through two batteries in ten years at a total cost of $259 so the cost per year for a battery is $25.

Separate from servicing I've also had to fix a windscreen, replace a globe and repair a puncture costing a total of $133.50 or around $13 per year. However, I do consider this to be good fortune. There are minor nicks and scratches that I could get repaired but don't. These could cost hundreds to repair. Others may wish to allow for these types of costs. Accidents for example can cost you your excess.

In the other category I include items I've purchased for my car such as a handsfree unit, a tray, mats, etc. at a total cost of $72.80 or around $7 a year.

Tolls may be very costly for some people, but I tend to avoid them if I can. I've only recorded tolls where I've used the car in my work so I haven't recorded all tolls. Tolls I've recorded have cost $96.72 or around $15 per year.

With parking I've again not been very good at recording. However, like tolls I tend to avoid places where I need to pay to park. Others however need to pay daily to park near their work. Parking cost has been around $4 per year.

Now I'm sure I've received a fine, or two, but honestly, I really think I've had one fine and I wrote to the relevant government department and they dismissed the fine. I'm sure there's probably been at least one more but perhaps it's just something I like to forget. If you have a lead foot, or don't like playing by the parking rules, perhaps throw in an allowance for fines.

Years is the number of years you've owned the car, or expect to own the car. I've owned my car for 10.38 years. If you want to calculate the number of years you've owned your car you can use the Days Between Dates calculator which shows the number of years between two dates.

The total number of kilometres you've driven your car or expect to drive your car. At the time of creating this calculator I had driven 141,447 kilometres. For me an interesting calculation is, since I expect to drive my car for another 10 years if it remains reliable, I'd then estimate I'll probably have driven 280,000 to 300,000 kilometres. The car will by then have a very low residual value. Assuming no major repair costs this gives me roughly the minimum cost per kilometre estimate for driving my car. The Car Running Cost Calculator will enable me to perform some what-if calculations in terms or owning a car for a longer or shorter period of time and thus the car running cost per kilometre.

Car related calculators

Car Running Cost Calculator Car Versus Public Transport Where Did I Park My Car Speed Camera Locations Petrol Cost Calculator Nearest Petrol Station Closest Petrol Station GPS Coordinates Mapz Gallon to Litre Calculator GPS Tracker For Car Braking Distance Calculator Speed/Distance/Time Calculator

The Car Running Cost Calculator comes with no warranty expressed or implied. The Car Running Cost Calculator is only for informational purposes and is not guaranteed to be error free. The information on this page is not intended to be advice.

Copyright © 2019 Online Connections

- English (UK)

- English (CA)

- Deutsch (DE)

- Deutsch (CH)

ATO Cents Per KM: 2024 Car allowance guide

What is mileage reimbursement, what counts as business mileage.

- driving to meetings or conferences that are for business but not at your typical workplace

- running errands or getting supplies for the business

- traveling from your usual workplace to a secondary or alternate place of business (i.e. a second office or a client’s office for a business meeting)

- traveling between two or more places of employment, for example, if you have more than one job

- going on customer visits

How to use the mileage reimbursement method

- how far they drove (in kms)

- the trip dates

- the trip purpose / business relation

How to use the logbook method

- operate a non-standard vehicle for business purposes, such as a van or motorcycle, or

- drive more than 5,000km for business each year,

- keeping your logbook

- keeping records and receipts of expenses

- calculating your deduction

1. Keeping a logbook.

- the odometer reading at the start and end of each trip

- the destination of each trip

- the business purpose of each trip

- total number of kilometres traveled during each period

- odometer readings for the start and end of the logbook period

2. Keeping records and receipts

- fuel and oil receipts

- registration costs

- car services and regular upkeep

- tires and general repairs

3. Calculating your deduction

To calculate the percentage of business kilometres you drove, use the following formula:, what are the car allowance rates in australia for 2024, is car allowance taxable in australia, frequently asked questions about mileage reimbursement, how many kms can you claim for reimbursement without receipts, as an employee, should i claim mileage deductions on my taxes if i drive for work, as an employer, do i have to reimburse employees for mileage at the set ato rate, what vehicle expenses are tax deductible.

- employees, if your employer doesn’t provide you with a tax-free reimbursement scheme, or

- employers, if you reimburse employees for vehicle expenses using an actual costs method.

- fuel and oil expenses

- vehicle insurances

- lease payments and interest charges

- depreciation value

- car services

- tires and repairs

- electricity charges

- capital costs, i.e. the purchase price of your car

- improvement costs, i.e. tinted windows, winter protection, etc.

- individual expenses if you’re already claiming, or being reimbursed for, mileage using a cents-per-km scheme

?)

See how to save money on business travel

?)

Make business travel simpler. Forever.

- See our platform in action . Trusted by thousands of companies worldwide, TravelPerk makes business travel simpler to manage with more flexibility, full control of spending with easy reporting, and options to offset your carbon footprint.

- Find hundreds of resources on all things business travel, from tips on traveling more sustainably, to advice on setting up a business travel policy, and managing your expenses. Our latest e-books and blog posts have you covered.

- Never miss another update. Stay in touch with us on social for the latest product releases, upcoming events, and articles fresh off the press.

?)

Everything you need to know about civil service rates for mileage allowance in Ireland

?)

Measure these 9 top KPIs for travel management success

- Business Travel Management

- Offset Carbon Footprint

- Flexible travel

- Travelperk Sustainability Policy

- Corporate Travel Resources

- Corporate Travel Glossary

- For Travel Managers

- For Finance Teams

- For Travelers

- Thoughts from TravelPerk

- Careers Hiring

- User Reviews

- Integrations

- Privacy Center

- Help Center

- Privacy Policy

- Cookies Policy

- Modern Slavery Act | Statement

- Supplier Code of Conduct

- Upcoming Cars

- Popular Cars

- Latest Cars

- Electric Cars

- Latest News

- Press Release

- Compare Cars

- Variant Explained

- Review Videos

- Compare Videos

- Variants Explained Videos

- More Videos

- Auto Expo Videos

- V3Cars YouTube Channel

- Expert Review

- Comparison Review

- Features Explained

- User Review

- Car Loan EMI Calculator

Fuel Cost Calculator

- Buy / Renew Car Insurance

- Fuel Price in India

- Apply for Car Loan

- Mileage Calculator

- Car On-Road Price

- Sell Used Car

Login to V3Cars

Sign Up to V3Cars

This is necessary to personalise results for you

OTP has been sent to

Select City

Fuel Cost Calculator India

Plan Your Fuel Budget! Use our Fuel Cost Calculator to estimate daily, monthly & yearly running costs for petrol, diesel, or CNG vehicles in India.

- Compare Costs: Easily compare fuel costs for petrol, diesel, and CNG.

- Driving Distance: Enter driving distance based on your daily/monthly/yearly running.

- Local Fuel Prices: Enter your local fuel price for accurate results.

- Customize Mileage: Input your car's specific mileage (fuel efficiency) for a personalized estimate.

- Calculate: Enter driving distance (daily/monthly/yearly), fuel type (petrol, diesel, CNG), fuel efficiency (mileage), and fuel price to see your estimated daily, monthly, and yearly fuel costs.

Fuel Price Disclaimer: The displayed fuel prices are for representation only. Update with your local gas (fuel) station prices for a more accurate estimate.

Fuel Cost Graph

Quick links.

- Mileage Calculator: Estimate Your Vehicle's Fuel Efficiency

- Sell Used Cars: Sell Your Pre-Owned Car Today

- Fuel Price in India: Check Latest Fuel Prices Across India

- Car On-road Price: Get On-road Price Estimates

- Car Loan EMI Calculator: Calculate Your Monthly Car Loan EMI

Fuel Cost Calculator FAQs

A Fuel Cost Calculator is a tool that helps you estimate the amount of money you'll spend on fuel for your car. It considers factors like the distance you plan to travel, your car's fuel efficiency (mileage) , and the current petrol, diesel, or CNG price

Using V3Cars fuel cost calculator is simple! Just enter the distance you'll be traveling (daily, monthly or yearly), and your car's mileage. On the basis of the fuel price in your city, the calculator will then estimate the daily/monthly/yearly fuel cost. Remember, our calculator also allows you to input the specific fuel price (petrol, diesel, or CNG) in your area for a more accurate estimate.

A fuel cost calculator provides an estimate. Your actual fuel cost may vary slightly depending on factors like driving conditions (city vs highway), traffic congestion, and your car's individual performance.

Fuel efficiency (mileage) refers to how far your car can travel on a single liter of fuel. It's usually measured in kilometers per liter (km/L). Cars with higher mileage are generally more fuel-efficient, meaning they spend less on fuel per kilometer traveled. Therefore, improving your car's mileage can significantly reduce your fuel costs.

- Maintaining proper tire pressure

- Avoiding unnecessary or aggressive acceleration and braking

- Removing excess weight from your car

- Keeping your car well-maintained by on-time service

To use our Fuel Cost Calculator, you'll need to enter:

- Driving distance: The distance you plan to travel (in kilometers/miles)

- Your car's fuel efficiency (mileage in kmpl/mpg/kmpg)

- Fuel price in your city. You can also enter the current fuel price in your area for a more precise estimate.

These are simple formula based calculations, based on user inputs. The accuracy of the fuel cost estimate depends on the accuracy level of the given information.

We try our best to keep the fuel prices updated daily. However, actual fuel prices may vary depending on your location and specific fuel station.

Yes, you can enter custom fuel prices in V3Cars Fuel Cost Calculator.

Change Your City

- Fuel Cost Calculator

Fuel efficiency varies from one vehicle to another. An online fuel cost calculator serves the purpose of calculating an estimated trip cost given a vehicle's mileage, distance travelled and prefered fuel type over a stipulated period of time.

How To Use A Fuel Cost Calculator?

An online fuel cost calculator helps estimate fuel cost under various transportation modes and aids in financial and budget planning. A vehicle's daily, monthly, and yearly fuel costs will automatically appear in the table. The calculator helps in understanding the per kilometre fuel cost based on the distance and mileage of a vehicle.

Users need to determine the price of petrol, diesel per unit in their area. Vehicle’s mileage depends on the type of fuel. One also needs to know how many kilometres (km) per unit of petrol or diesel the vehicle will achieve. This figure will be presented in kmpl (kilometres per litre) for petrol and diesel vehicles. Once you have the mileage, distance travelled and the fuel cost, the fuel expenditure can easily be calculated on a daily, monthly and yearly basis.

Other Calculators

Subscribe for notifications.

- Petrol/Diesel

- Home Loan Calculator

- Personal Loan Calculator

- Car Loan Calculator

- Age Calculator

- PPF Calculator

- BMI Calculator

- SIP Calculator

- Date Calculator

- Percentage Calculator

Track mileage automatically

Work-related car expenses for employees, in this article, the car allowance and the cents per kilometre method, how to log information for your work-related car expenses, will your mileage reimbursement be taxed.

Employers will often reimburse employees as they incur work-related car expenses for business-related driving. While employers can decide themselves how to reimburse these expenses, they do follow rules set by the ATO you should also be aware of.

Your employer will likely use one of these two methods of reimbursing you for your work-related car expenses. They differ in their types of compensation and payout structure.

Car allowance

If you get an ATO car allowance from your employer, it needs to be shown on your payment summary, as allowances are considered taxable income. You can use the allowance to purchase a vehicle, keep it for expenses associated with your current vehicle or spend it in any other way you see fit. The car allowance offers employees the highest level of flexibility when it comes to spending it.

When you receive a taxable car allowance, you can still deduct your business-related driving expenses at your tax return. The deduction is meant to cover the costs of running your vehicle, such as fuel, oil, tyres etc.

In case you are not reimbursed for the car operating expenses, you can claim them from the ATO on your annual tax return. You will be able to use either the cents per km method or the logbook method to deduct your eligible work-related car expenses. Read more about deducting motor vehicle expenses from the ATO .

The administrative burden of paying an allowance and accounting for all expenses afterwards can be cumbersome for a company. Instead, many employers provide a cents per kilometre rate as reimbursement. Under a cents per kilometre reimbursement arrangement, you are reimbursed at a specific rate for each kilometre you drive for business.

Why is car allowance taxable?

Car allowances are taxable because they are considered an employment benefit. You don't need to provide proof of kilometres you've driven for work to receive it, and can use it as you see fit e.g. it is not a justified reimbursement to remain untaxed.

What tax do you pay on car allowance?

Car allowance is a benefit included in your income statements or payslips, and is taxed at your income tax rate.

The cents per kilometre reimbursement

The simplest mileage reimbursement arrangement is to use a flat rate per kilometre driven. It is supposed to cover all work-related car expenses. That's what the ATO’s rate does; it is meant to cover both the costs of owning (fixed costs) and driving (variable costs) your vehicle for business-related travel.

Keep in mind that your employer can set any rate they like - they do not have to use the ATO’s rate. For rates higher than the ATO’s standard per kilometre rate, the excess is taxed as part of your income.

The cents per km 2024 rate is 88 cents, applicable for the 2024/2025 tax year.

There's a lot to be said for using a standard rate, chief among them that it's simple and avoids a fairly big administrative burden.

The vehicle you use

If you use your own car (including a leased or hired car under a hire-to-purchase agreement), you can claim all work-related travel expenses from your employer or on your tax return. The two most common methods for employee reimbursement are a cents per kilometre rate or a car allowance.

If you use someone else's vehicle , i.e. a company car for work purposes, you will be able to claim only the actual expenses you have covered for operating the car (such as fuel, maintenance and parking) as a work-related travel expense from your employer or on your tax return. You won’t be able to use the cents per km rate, as it accounts for the cost of owning a vehicle.

Kilometre tracking made easy

Trusted by millions of drivers

Automatic mileage tracking and ATO-compliant reporting.

There are no exact requirements for how you keep track of travel as an employed individual. Your employer might require you to use a certain method or provide certain records, and they need to inform you of it. A lot of people have to choose for themselves.

However, if you claim work-related car expenses from the ATO on your tax return, you need to adhere to the requirements for a logbook based on the method you use.

Most people use a mobile application to both track their trips and generate reports for them. Other alternatives are spreadsheets, like Excel or Google Sheets, that you can share with your manager and/or accountants, but then you might need to take down odometer readings every trip to figure out your mileage accurately.

This depends on how your employer processes your claim.

- If your employer provides an allowance for car expenses, this would be taxed as it is considered a benefit and needs to be declared as income.

- If your employer reimburses your specific car expenses and they are taxed as a part of your income, you can claim these as a deduction in your tax return.

- If your employer reimburses your specific car expenses and these are not taxed, you cannot claim a deduction as you have already been fully reimbursed by your employer.

Tired of logging mileage by hand?

Effortless. ATO-compliant. Liberating.

ATO Mileage Guide

- For Self-Employed

- For Employees

- For Employers

- The Cents per Kilometre Method

- The Logbook Method

- ATO Log Book Requirements

- Claim Car Expenses In 5 Simple Steps

- Calculate Your Car Expenses Reimbursement

- ATO Car Expenses Deductions

- Car Fringe Benefits Tax

- Is Mileage Reimbursement Taxed?

- Historic Cents Per KM Rates

- ATO Cents Per KM Rate 2021/2022

- ATO Cents Per KM Rate 2020/2021

Choose your Country or region

Travel Cost Calculator

Quick links, trip pricing calculator.

Travelmath provides an online cost calculator to help you determine the cost of driving between cities. You can use this data to figure out a budget for a road trip. The driving calculation is based on the average fuel efficiency of your vehicle, and you can change the gas mileage in mpg or L/100 km to match your exact make and model. Gas prices are automatically estimated based on current fluctuations, and again you can adjust these to fit your local gas station prices. Both U.S. and international units are available to make the calculations easier to use, and the output is given for both one-way and round trip travel routes.

Check the driving distance for your planned route, and see if the total driving time requires an overnight stay. If it's a long trip, you may want to research some hotels along the way . Or compare whether it's better to fly or drive to your destination.

Home · About · Terms · Privacy

- Search Please fill out this field.

- Manage Your Subscription

- Give a Gift Subscription

- Newsletters

- Sweepstakes

- Travel Tips

The Best Time to Book a Flight for Domestic, International, and Summer Travel

Here are our best tips for booking travel in 2024.

:max_bytes(150000):strip_icc():format(webp)/Stefanie-Waldek-7eed18a8c9734cb28c5d887eb583f816.jpg)

When to Book Flights for Domestic Travel

When to book flights for international travel, when to book flights for summer 2024 travel, when to book flights for holiday 2024 travel.

Buying plane tickets is something of an art form. Ideally, you want to secure your spot months in advance to avoid the inevitable price spike as your travel dates get closer. But sometimes the best time to book a flight also depends on the destination and whether it's domestic or abroad. The trends are always changing, but experts say the sweet spot for booking domestic flights is 28 days, or 60 days for international flights.

Flights generally open for booking about a year ahead of time, and the airfare will change often between then and takeoff. Although you can book just a couple of weeks before the departure date in some cases, prices are likely to be astronomical. In other cases, when you want to go somewhere popular or during a big travel weekend, flights could fill up faster than normal. Our advice: Track flight prices on Google Flights or Hopper as early as possible so you can keep an eye on cost fluctuations. Read on for more advice about when to book flights from the pros.

According to Expedia's 2024 Air Travel Hacks report , you should aim to book 28 days before your domestic flight. "Doing so can save travelers up to 24 percent compared to those who wait until the last minute, from zero to six days out," Expedia travel expert Christie Hudson tells Travel + Leisure.

For domestic trips, pricing is elevated when tickets are first released, about a year before the flight. Those prices will slowly creep downward, all the way to their lowest point in the prime booking window, after which you'll likely see a huge increase in cost for last-minute travel.

Meet the Expert

Christie Hudson is a travel expert at top booking site Expedia.

You're better off booking earlier rather than later for international travel, but the Expedia report says ideally no more than four months before your desired departure date. The sweet spot is around 60 days. "This is a big change from 2022 data, which showed the cheapest fares were secured when travelers booked four to six months out." Hudson says. "2023 data revealed that people who booked that far in advance actually paid more on average." The report says the least expensive day of the week to book is Sunday and the most expensive is Friday, for both domestic and international travel.

But there is some regional variance. Going , a platform that tracks flight prices and notifies members of good deals, has found the best months to book flights to Africa, Asia, Oceania, Europe, and Latin America, for travel about 60 days out. Here's what it says.

Africa: Book in May.

Asia: Book in August or October, followed by April or September.

Oceania: Book in November, January, or July.

Europe: Book in August, October, or November.

Latin America: Book in October.

The real trick to finding good deals on international airfare is to avoid booking your travel for peak times, which include summer and major holidays (don't forget — that includes holidays in your destination, too).

Summer is traditionally one of the most popular times of the year to travel, which means it can be tough to find a good deal on airfare. Ideally, you should book flights for summer travel as soon as possible, preferably at least six months in advance.

"The best time to book for peak season is … the opposite season," says Katy Nastro, travel expert at Going. "While most of us are scrambling to focus on our winter holiday plans, we should also keep our eyes open for some great summer fares."

She notes that the booking window for peak season ranges between three and seven months for domestic flights and four to 10 months for international trips. "And if you do book something, keep that flight alert on," says Nastro. "If it drops again, depending on your ticket type, you can call to rebook and get a refund or travel credit back with the difference."

Katy Nastro is a travel expert at Going, a website that finds flight deals to more than 900 destinations around the world.

Around the winter holidays is the priciest time to travel, Nastro says. "Your best bet is to remember the Goldilocks zones: look to book between three to seven months ahead for domestic travel and four to 10 months ahead for international travel."

Hudson advises that at the very latest, your holiday travel should be booked by mid-October. "But the biggest holiday travel savings actually come from choosing the right dates," she says. "Avoiding the busiest days like the Wednesday before Thanksgiving and the Friday and Saturday before Christmas will yield major savings."

Track flights and book your holiday tickets as soon as you find a decent deal, but make sure to book a fare that will give you a credit if you cancel (generally speaking, that means don't book basic economy). That way, if prices drop between the time of booking and your travel dates, you can cancel your original ticket and use the credit to book the cheaper fare. The only downside is you'll still have some remaining credit, but you can then use it to treat yourself to a future flight. Just don't let that credit expire.

Related Articles

- AI Travel Planner

- UK Petrol Prices

- Get the app

Magic fuel cost calculator

How it works

Enter your start & end point, enter your car model.

See the fuel price!

Download for free today!

Popular blog posts.

Download the Roadtrip app today!

Embark on your journeys with Roadtrip, the app that's transforming how you manage fuel costs globally, with a unique advantage for those in the UK:

🌍 Global Compatibility: Whether you're cruising the highways of the US, navigating the streets of Europe, or exploring the scenic routes of New Zealand, Roadtrip has you covered. This app is your global companion for all road adventures.

🇬🇧 Real-Time UK Petrol Prices: For our UK users, Roadtrip offers a special feature - real-time visibility of petrol prices at every station across the UK. From Tesco to Shell, and Sainsbury's to Applegreen, get up-to-the-minute price information, ensuring you always find the best deal.

🚗 Vehicle-Specific Calculations: Roadtrip is tailored to your vehicle. Enter your car, truck, or motorcycle's make and model for personalized fuel cost estimates that reflect your real-world consumption.

💰 Split Costs with Ease: Traveling with friends? Split fuel and other travel expenses effortlessly. Roadtrip's intuitive feature simplifies cost-sharing among your group.

🌱 Eco-Friendly Travel: Track your journey's carbon emissions and make sustainable travel choices. Roadtrip helps you minimize your environmental impact while maximizing adventure.

🗺️ Optimize Your Route: Discover the most fuel-efficient routes with Roadtrip's comparison tool. Balance cost-effectiveness and exploration for a truly memorable journey.

🔧 Multiple Vehicle Comparison: Choosing between different vehicles for your trip? Roadtrip aids you in comparing fuel costs across various options, helping you make the best decision for your needs.

✅ User-Friendly Interface: Enjoy a seamless, intuitive experience with Roadtrip. Its user-friendly design makes travel planning straightforward, even for first-timers.

Latest UK petrol prices

Latest queensland au petrol prices.

Roadtrip protects your privacy

Litres per 100 kilometres Calculate your litres per 100 km value. Click here .

- 26-Mar-2015 - Updated the default price to $1.375 / L based on local Coles Express price.

- How does E10 (ethanol) petrol compare with unleaded petrol? view

- Why the Petrol Cost Calculator. view

- Litres per 100 km Calculator. L / 100 km Calculator

Overview: The Petrol Cost Calculator enables you to quickly determine the cost of petrol for a trip. Because we don't pay for the petrol at the time of a trip, we often don't realise the cost of petrol for a trip. By making the cost of petrol apparent you can often save money by making better decisions on whether to use a car, to use public transport, to put off the trip until later, to combine trips, or even to pay a little extra locally, because if you add the cost of petrol, you will often find a cheaper item which is further away actually costs more.

Instructions: Car Description: The car description is optional and does not affect the calculation. The description field is provided so I can provide a default value and description for cars as I blog about the fuel efficiency of different cars. This will enable others with the same type of car to quicky use the default values for their own car. Distance: Enter the trip distance. A quick way to determine an estimate of the distance is to use Google maps and enter the start and end location of the trip. Google maps will return the distance of the trip. If you regularly drive the same trip then use the trip meter on your car to record the distance. Petrol Price: Enter the current petrol price. The price of petrol varies considerably and people regularly receive discount vouchers from supermarkets. I've used the figure of $1.50 to keep things simple and as of July 2013 the price is fluctuating around this price. I've found the pump price without discount at the moment can vary from around $1.30 to nearly $1.60. Litres per 100 km: A common figure used to measure fuel consumption for cars is the number of litres per 100 km. I've found when my car was brand new my car had better fuel consumption. Even with regular servicing by the manufacturer the car's fuel consumption increased. A good technique is to fill up the tank and record the distance to the next time you fill up. Record the distance and the litres. For example: I regularly fill up with around 50 litres with my car doing around 450km. To work out the litres per 100 km divide the number kilometers by 100 and then divide the number of litres by this number. E.g. 450/100 equals 4.5. Then divide 50 by 4.5 which equals 11.11. Thus I use 11.11 litres per 100 km. This is the default value used in the calculator. The advertised figure for my car when new was 10 litres per 100 km. Country travel uses less petrol per 100 km. A good figure to use is two thirds for country travel. Now you can also use the L / 100 km Calculator from the menu.

Tips: A good way to store your own petrol cost and litres per 100 km as default settings, is to do a calculation with a distance of zero. The URL in the address bar contains your settings. Now bookmark the page or add the bookmark to your mobile home screen. Your defaults settings are now saved with the bookmark. Driving in the country uses roughly a third less petrol than city driving. You can use two thirds of your litres per 100 km as an estimate. It is better however to do one or more long trips and work out the petrol used.

Online Connections Products & Services Online Connections Australian Dictionary JustLocal Speed Camera Locations

IMAGES

VIDEO

COMMENTS

85 cents per kilometre for 2023-24; 78 cents per kilometre for 2022-23; 72 cents per kilometre for 2020-21 and 2021-22; 68 cents per kilometre for 2018-19 and 2019-20; 66 cents per kilometre for 2017-18. How you use this method. To work out how much you can claim, multiply the total business kilometres you travelled by the rate.

The newly confirmed rate for the 2024/2025 tax year is $0.88 per business-related kilometre. Learn more about the cents per km 2024/2025 rate. The rate is meant to cover all expenses of owning and running your vehicle for the business portion of its use. Find the 2023/2024 cents per km rate if you will be claiming your business travel.

To work out your eligibility and entitlement, see Expenses for a car you own or lease. The cents per kilometre method uses a set rate for each work-related kilometre travelled up to a maximum of 5,000 kilometres per car, per year. For the 2022-23 income year the rate per kilometre has increased from 72c to 78c. Limitations

2024-25: use 88 cents per kilometre; 2023-24: use 85 cents per kilometre; 2022-23: use 78 cents per kilometre; 2020-21 and 2021-22: use 72 cents per kilometre; for rates in earlier years, see Prior year tax return forms and schedules. You can claim a maximum of 5,000 work-related kilometres per car.

The ATO's per kilometre car expense claim rate for 2024-25 is 88 cents per km. The claim rate for 2023-24 is 85 cents per km. The claim rate for 2022-23 is 78 cents per km. Cents Per Km is one of the methods you can choose to satisfy the substantiation rules for individuals claiming car expenses as a tax deduction. Jump to cents per km ...

A: You drive your personal vehicle for business, and your company uses the ATO's standard cents per km rate to figure out how much you should be reimbursed. You have kept records for the past month, and they show that you've driven 180km for business. The standard mileage rate is 88 cents per kilometre for 2024/2025.

Calculate your cents per km claim for car expenses by multiplying the number of business kilometres you travelled in the car by the rate per kilometre for the tax year. For example, throughout the 2024-2025 tax year, you travel a total of 3,000 km with your car for business. You will be able to claim 3,000 km x $0.88 = $2,640 in work-related ...

For the 2022-23 income year the rate was 78 cents per kilometre. For the 2020-21 and 2021-22 income years the rate was 72 cents per kilometre. The cents per kilometre deduction rate for motor vehicle expenses is now 85 cents per kilometre, commencing 1 July 2023. This rate applies to all eligible taxpayers who elect to use the cents per ...

From 1 July 2015, separate rates based on the size of your car engine do not apply. Below are the most recent years rate that can be claimed. 72 cents per km for 2020-21 and 2021-22. 68 cents per km for 2018-19 and 2019-20. 66 cents per km for 2017-18, 2016-17 and 2015-16. Below you will find the historic values of the cents per ...

YOU CAN CALCULATE YOUR CAR EXPENSES IN TWO WAYS: CENTS PER KILOMETRE METHOD AND LOGBOOK METHOD. CENTS PER KILOMETRE METHOD. 🔘 You can claim a maximum of 5,000 business kilometres per car, using this method. 🔘 Your claim is based on 68 cents per kilometre.

All you need to do is keep diary records of your work-related trips. Cons: You can only claim a maximum of 5,000 business kilometres annually. Your claim is limited to a set rate, which is 85 cents per kilometre for the 2023-2024 income year. You can't claim separate deductions for insurance premiums and depreciation.