- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

AXA Travel Insurance Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is AXA?

Axa travel insurance plans, which axa travel insurance plan is best for me, can you buy axa travel insurance online, is axa legit, what isn't covered by axa travel insurance, is axa travel insurance worth it.

- Lowest-cost plan includes some medical coverage.

- Pre-existing conditions waiver add-on available for higher-cost plans.

- No add ons are available for Silver-level policyholders.

- CFAR upgrade is only available for highest-cost plan.

In the era of staff shortages and extreme weather, your trip may not go exactly to plan. When that happens, travel insurance can be a big help. Although an insurance policy can’t prevent a delay or cancellation from happening, it can help relieve the financial burden if something unpredictable does occur on your trip.

But how do you know which insurance provider to go with? Here's a look at AXA travel insurance to help you determine if one of its plans is right for you.

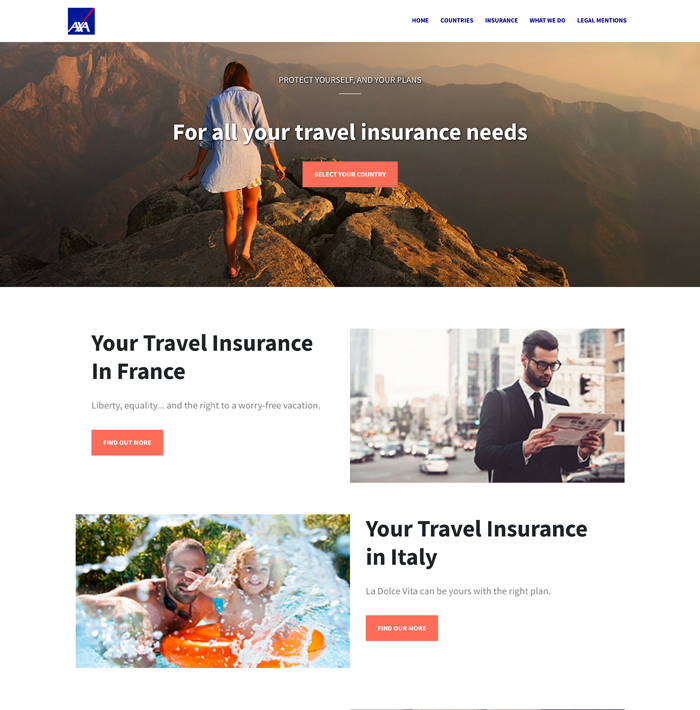

AXA is a French insurance company that does business in over 200 countries. It offers many different types of insurance, including policies for travelers. These include coverage for baggage loss , trip cancellation and interruption, emergency evacuation and emergency medical costs. Cancel for any reason coverage is also offered.

AXA Assistance USA is part of the AXA Group.

» Learn more: How much is travel insurance?

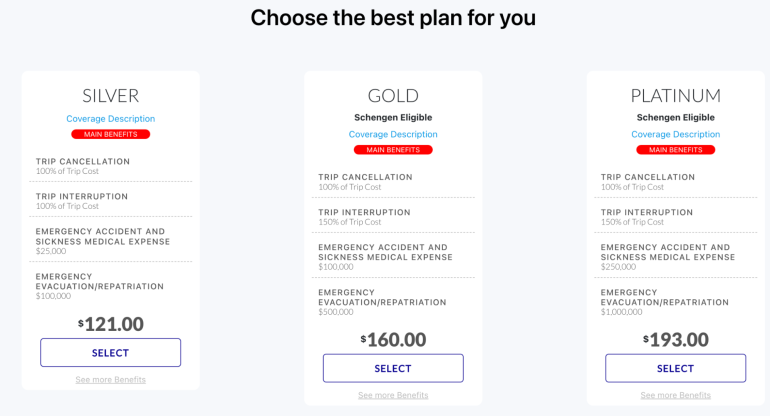

AXA Assistance USA offers travelers three insurance plans: Silver, Gold and Platinum. The plans are underwritten by Nationwide Mutual Insurance Company and their affiliates in Columbus, Ohio. Here's the coverage you can expect from each policy.

Silver: This is the least expensive plan that offers 100% trip cancellation and trip interruption coverage, $25,000 in emergency accident and sickness medical coverage and $100,000 in emergency evacuation and repatriation coverage.

Gold: The mid-range Gold policy comes with 100% trip cancellation and 150% trip interruption coverage, $100,000 in emergency accident and sickness medical coverage and $500,000 in emergency evacuation and repatriation coverage.

Platinum: The AXA Platinum travel insurance plan includes 100% trip cancellation and 150% trip interruption coverage, $250,000 in emergency accident and sickness medical coverage and $1,000,000 in emergency evacuation and repatriation coverage.

If you want to add Cancel For Any Reason coverage, you’ll need to select the Platinum plan and purchase a policy within 14 days of paying the initial trip deposit. It’ll cover 75% of the prepaid nonrefundable expenses for your travel.

If you’d like coverage for pre-existing medical conditions , a waiver is available on the Gold and Platinum plans as long as you buy coverage within 14 days of your first trip payment.

» Learn more: How does travel insurance work?

Let’s compare AXA’s plans, the costs and coverage for a 19-day trip to Indonesia that costs $1,500 for a 36-year-old traveler who lives in Utah.

Coverage and limits for the Silver-level plan include:

Trip delay: $100 per day, with a $500 maximum.

Trip cancellation: 100% of the trip cost.

Trip interruption: 100% of the trip cost.

Baggage delay: $200.

Lost baggage: $750, up to $150 per article.

Missed connection: $500.

Emergency evacuation: $100,000.

Accidental death and dismemberment: $10,000 ($25,000 if on a common carrier).

Emergency accident and medical expense: $25,000.

The plan cost for our sample trip is $55.

For $79, the Gold-level tier offers the following coverage and limits:

Trip delay: $200 per day, with a $1,000 maximum.

Trip interruption: 150% of the trip cost.

Baggage delay: $300.

Lost baggage: $1,500, up to $250 per article.

Missed connection: $1,000.

Emergency evacuation: $500,000.

Accidental death and dismemberment: $25,000 ($50,000 if on a common carrier).

Emergency accident and medical expense: $100,000.

Collision damage waiver: $35,000.

Platinum is AXA’s highest tier level. This plan includes:

Trip delay: $300 per day, with a $1,250 maximum.

Baggage delay: $600.

Lost baggage: $3,000, up to $500 per article.

Missed connection: $1,500.

Emergency evacuation: $1,000,000.

Accidental death and dismemberment: $50,000 ($100,000 if on a common carrier).

Emergency accident and medical expense: $250,000.

Collision damage waiver: $50,000.

Lost golf rounds: $500.

Lost skier days: $25 per day.

Pet boarding fees: $25 per day (up to five days).

This level of coverage costs $95.

» Learn more: The best credit cards for travel insurance benefits

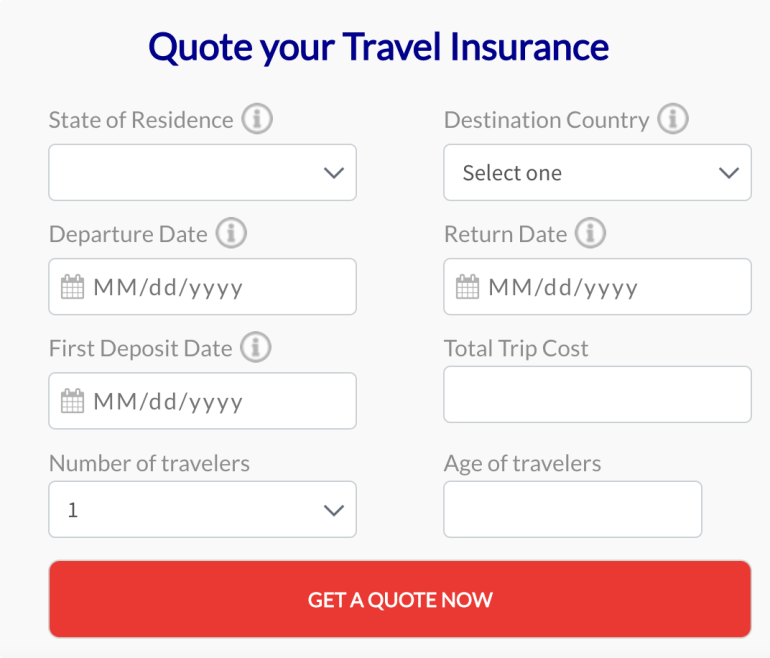

To get an AXA travel insurance quote, go to AXATravelInsurance.com and start by inputting your information in the quote box. Enter your state of residence, destination country, trip dates, date of first trip deposit, total trip cost, the number of travelers and their ages.

Once you’ve filled out the form, click on the “Get a quote now” button.

You’ll be presented with three quotes, one for each plan level. Make sure to click on the “See more benefits” link to get more information on each plan’s coverage limits. The plans with the highest coverage limits will be the most expensive.

If you need a pre-existing conditions waiver, select the Gold or Platinum plan. You’ll also have to purchase the plan within 14 days of making your initial trip deposit to be eligible.

The Gold and Platinum levels are also the two plans that offer Schengen zone coverage and a collision damage waiver . The Platinum plan is the only one that offers a Cancel For Any Reason add-on, so keep that in mind if you need more protection.

Overall, if you’re looking for emergency medical and emergency evacuation coverage specifically, the limits are good on all the plans, including the least expensive one.

To compare plans from multiple insurance providers at once, we recommend checking out Squaremouth, a travel insurance comparison site and a NerdWallet partner. The website helps you pick the right plan by displaying multiple quotes from many insurance providers, including AXA, in one spot.

AXA began in the early 19th century as a small insurance company specializing in property and casualty insurance.

Since then, the company has evolved, changing names and acquiring other insurance brands, until it became AXA in the 1980s. It is now one of the largest insurance companies in the world. In other words, yes, AXA is a legitimate travel insurance provider.

» Learn more: The best travel insurance companies

Every plan has different exclusions, so it's important to look at your coverage summary. Generally, pre-existing conditions without a previously purchased waiver are not covered.

Other limitations include:

Intentionally self-inflicted injuries.

Participation in bodily contact or extreme sports.

Traveling for the purpose of securing medial treatment.

Accidental injury or sickness when traveling against the advice of a physician.

Non-emergency treatment or surgery.

AXA handles more than 14 million cases each year, and every plan includes access to their 24/7 assistance hotline. The company is well established and has three plans for travelers to choose from.

AXA travel insurance covers several benefits including but not limited to 100% trip cancellation and trip interruption, medical emergencies, emergency evacuations, baggage delay or lost baggage, and accidental death and dismemberment. The Platinum plan also lets you add Cancel For Any Reason coverage.

AXA's least expensive plan, Silver, and its mid-range Gold policy do not have the option to add-on Cancel For Any Reason coverage. For travelers who opt to purchase the Platinum insurance plan, you can add Cancel For Any Reason coverage a la carte within 14 days of paying the initial trip deposit.

In the event that you need to make a claim, you can upload supporting documents online. If the claim is accepted, you will receive reimbursement within 30 days.

It's said that travel is the only thing you buy that makes you richer. But you don’t want to become poorer if something goes wrong before or during a trip. We don’t know what the universe has in store for us, so buying a travel insurance policy is one way we can protect our investment.

AXA offers budget, mid-range and premium policies that are easy to understand, provide adequate coverage and don’t cost a fortune.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

AXA Travel Insurance Review — Is it Worth It?

Jessica Merritt

Editor & Content Contributor

91 Published Articles 505 Edited Articles

Countries Visited: 4 U.S. States Visited: 23

Keri Stooksbury

Editor-in-Chief

35 Published Articles 3236 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Table of Contents

Why get travel insurance, travel insurance and covid-19, why purchase travel insurance from axa, types of policies available with axa, how to get a quote, how axa compares — summary, how to file a claim with axa travel insurance, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Whether you’re traveling the world or crossing state lines, travel insurance such as the policies offered by AXA Travel Insurance can offer a safety net in case you have to cancel or interrupt your trip or need support along the way for medical emergencies, lost bags, or missed connections.

For more than 60 years, AXA Travel Insurance has provided peace of mind and financial stability to travelers. With solid ratings and underwriting by Nationwide Mutual Insurance, travel insurance plans sold by AXA are backed by an A.M. Best Excellent financial strength rating. AXA offers travel insurance with trip interruption and cancellation coverage, medical emergency and evacuation benefits, lost or delayed baggage, and more.

Let’s examine AXA’s travel insurance coverage options, benefits, and service and compare it to alternatives such as credit card travel coverage and other travel insurance providers.

Travel insurance can protect what you’ve invested in an upcoming trip. When the unexpected occurs, such as a trip cancellation or medical need , travel insurance can offer the benefits you need to cover it.

You might choose travel insurance for these reasons:

- Your trip has deposits or payments that you can’t get refunded if you need to cancel your trip.

- The health insurance you use at home doesn’t work at your destination.

- You’re planning activities that aren’t covered by your health insurance.

- Medical care is subpar at your destination and you may need to be evacuated to another location with adequate medical facilities.

- You’re concerned about the possibility of lost bags, delays, or missed connections, especially if you have multiple flights or transfers.

Travel insurance isn’t necessary for every trip, such as if you’re traveling domestically where your health insurance works and you don’t have major nonrefundable expenses. But travel insurance is worth it if you’ve got a lot of nonrefundable expenses invested in your trip or you’ll need medical coverage at your destination.

COVID-19 can interrupt your travel plans, whether you get sick and have to cancel a trip, need to quarantine or get medical treatment while traveling, or plan to visit a destination with high COVID-19 numbers. While some travel insurance companies exclude COVID-19 from insurance coverage , AXA offers COVID-19 coverage as part of its travel protection plans , including trip cancellation and trip interruption and emergency medical and evacuation coverage.

Any travel insurance company you purchase a policy from should be reputable, reliable, and stable. After all, you’re relying on the company to be there for you when you need it most. It pays to verify reviews and ratings — AXA offers good reassurance in this area.

With 64 years in business, AXA has an A- Better Business Bureau rating . On the travel insurance website Squaremouth , AXA has an overall 4.22/5 rating , with 0.1% negative reviews among more than 69,000 policies sold . AXA’s travel insurance plans are backed by Nationwide Mutual Insurance, which has an A (Excellent) financial strength rating from financial rating company A.M. Best. With 6 decades in business and solid ratings , AXA is a travel insurance company you can trust.

AXA offers travel insurance with medical and emergency evacuation benefits, trip cancellation and interruption, baggage loss, and Cancel for Any Reason (CFAR) options. Let’s look at the details of AXA travel insurance policies.

AXA offers 3 levels of travel insurance : Silver, Gold, and Platinum . Each level offers different limits, but all of AXA’s policies have 100% trip cancellation coverage, emergency medical coverage and medical evacuation, baggage delay and loss, and missed connection coverage.

Let’s compare what you get with each policy:

With plans as low as $16 and minimal coverage, AXA recommends the Silver plan for domestic travel. You can cover 100% of your trip cost for trip cancellation and interruption coverage. If your travel is delayed, you can get up to $100 per day for expenses, up to $500 total, and $200 for delayed baggage.

There’s also $500 in missed connection coverage. The $25,000 in emergency medical expense coverage isn’t much, but it might be adequate for domestic travel if you’re using your primary health insurance first.

Gold plans start at $36 but add more coverage and are appropriate for cruises or Schengen travel . Like the Silver plan, the Gold plan offers up to 100% trip cancellation coverage but bumps trip interruption to 150% of your trip cost. Limits for all coverages are higher, with $200 per day and $1,000 maximum in trip delay coverage and $1,000 for missed connections. Baggage delays offer up to $300, and you can get up to $1,500 for lost baggage and personal effects.

The health coverage is also much higher at $100,000, and it adds a $50,000 non-medical emergency evacuation option on top of the $500,000 medical emergency evacuation benefit. This plan also offers an optional $35,000 collision damage waiver.

The Platinum plan , starting at $52, steps up coverage and offers additional options. You’ll get 100% trip cost coverage for trip cancellation and 150% for trip interruption. Trip delay coverage offers up to $300 per day and a $1,250 maximum, plus $600 for baggage delays and $3,000 for lost baggage and personal effects.

Emergency medical treatment is also higher at $250,000, and you’re covered for $1 million in emergency medical evacuation — $100,000 for non-medical evacuation.

The Platinum plan also offers additional coverage for sports, with $25 per day for lost skier days, $500 for lost golf rounds, and $1,000 for sports equipment rental. It also offers optional coverage for up to 75% of trip cost with Cancel for Any Reason coverage and a $50,000 collision damage waiver.

You can get a quote directly from AXA by visiting the AXA Travel Insurance website . The quote form is the first thing you’ll see on the homepage.

To start your quote, you’ll fill out the quote form, including your state of residence, destination country, travel dates, first deposit date, total trip cost, number of travelers (up to 10), and the age of travelers.

Once you fill out the form, you’ll be presented with plan options. For a 60-year-old visiting Japan and spending $2,500, we were offered a Silver ($155), Gold ($183), or Platinum ($218) plan .

If you select a Platinum plan, you will be able to add CFAR optional coverage for up to 75% of your trip cost.

With your plan and options selected, the next and final step to secure coverage is entering your traveler information including your name and contact information, then making your payment for the policy.

AXA is a good option for travel insurance, but it’s not your only option. Let’s see how AXA compares to the coverage you can get from popular travel credit cards and travel insurance competitors .

AXA vs. Credit Card Travel Insurance

Many travel credit cards offer travel insurance as a complimentary benefit, whether it’s car rental collision waivers , trip cancellation coverage , or emergency medical and evacuation benefits. This coverage can be helpful if you’re using your card to pay for your travel expenses, but it’s often not as comprehensive as the coverage you can get from a travel insurance policy like what AXA offers .

Let’s compare AXA’s best travel insurance policy against The Platinum Card ® from American Express and the Chase Sapphire Reserve ® , which both offer some of the best travel protections available with credit card benefits.

Unless you’re taking a trip with expenses higher than $10,000, the trip cancellation coverage should be about the same whether you’re using an Amex Platinum card, Chase Sapphire Reserve card, or the AXA Platinum plan. However, the AXA Platinum plan comes out ahead with 150% of your trip cost for trip interruption.

We see a major difference in coverage for emergency medical treatment and evacuation. The Amex Platinum card doesn’t offer emergency medical coverage, but you can arrange an emergency medical evacuation using the Premium Global Assist Hotline. The Chase Sapphire Reserve card offers up to $2,500 in emergency medical coverage and $100,000 for emergency evacuation. Neither of these offerings compares to the $250,000 in emergency medical coverage and $1 million in emergency medical evacuation coverage you can get from AXA Platinum.

Credit card travel insurance coverage is complimentary if you already have the card, but it is lacking in some areas. It’s a good idea to use your card’s travel insurance as a backup for trip cancellation, interruption, travel delays, or lost baggage, but use the AXA Platinum plan for its superior emergency medical and evacuation coverage.

AXA vs. Other Travel Insurance Companies

It’s always a good idea to compare travel insurance quotes across multiple providers so you can find the best price and coverage. We used Squaremouth , a travel insurance comparison website, to see how AXA’s policies compare to those of other companies.

As with the initial price quotes we pulled from AXA’s website, our sample trip on Squaremouth had:

- Traveling to Japan a month from now

- Trip cost: $2,500

- Initial trip deposit paid within the last 24 hours

- State of residence: Texas

We limited results to policies that offer at least as much coverage as the AXA Platinum policy does on major benefits:

- COVID-19 coverage

- Minimum $250,000 emergency medical benefit

- Minimum $1 million emergency medical benefit

- 100% trip cancellation

- 150% trip interruption

Each policy offered nearly identical coverage for these major benefits, and Tin Leg ‘s Silver plan had the lowest cost at $164.35, followed closely by $165.84 from HTH Worldwide ‘s TripProtector Classic plan.

If you’re mainly concerned with full coverage for trip cancellation and interruption along with $250,000 in emergency medical and $1 million for emergency medical evacuation, you can save if you go with Tin Leg .

However, the higher-priced policies offer additional coverage and options. For example, AXA Platinum offers the option to add Cancel for Any Reason coverage and includes sports equipment rentals and missed ski days or golf rounds. Tin Leg doesn’t have missed connection coverage, but Seven Corners Trip Protection Choice and AXA Platinum offer up to $1,500 for missed connections on cruises or tours.

All of the policies we quoted except for Tin Leg Silver offer employment layoff as a covered cancellation reason, and AXA Platinum allows you to cancel your trip for work reasons, though none of the other policies do. AXA Platinum also offers $100,000 in non-medical evacuation , which Tin Leg Silver and HTH Worldwide TripProtector Classic policies do not, and is much higher than the $20,000 benefit offered by the Seven Corners Trip Protection Choice policy.

AXA Platinum has a higher cost than competitors but offers more robust coverage. If you’re mainly concerned with major coverage for trip cancellation and interruption, emergency medical, and emergency evacuation, other travel insurance companies may offer a better quote. But if you want additional coverage and options such as non-medical evacuation and expanded cancellation reasons, check out the details on what AXA Platinum offers.

You can file a claim with AXA in a few ways:

- Using the claim administrator portal

If you’d like to file your claim online, you can visit the portal for Co-Ordinated Benefit Plans and enter your policy number and last name to get started.

Alternatively, you can call AXA toll-free at 888-957-5015 or collect at 727-450-8794 .

If you’d like to submit your claim via email or mail, you can download claim forms on the AXA website.

Once you download the claim form, you’ll get a list of documents required for submitting your travel insurance claim, along with mail or email info. For example, on a trip interruption claim form, AXA requires you to send in:

- Completed claim form

- Policy verification

- Booking confirmation, such as a ticket or proof of purchase

- Your original unused, nonrefundable tickets

- Your new ticket with confirmation of early return

- A cancellation statement from travel suppliers

- A medical report or physician statement if you interrupted the trip due to medical necessity

- Death certificate, if applicable

- Documentation of circumstances that led to trip interruption

- Documentation of reimbursement request expenses, such as receipts or credit card statements

You can email the form and other required documents to [email protected] or mail to:

AXA Assistance USA On Behalf of Nationwide Mutual Insurance Company and Affiliated Companies P.O. Box 26222 Tampa, FL 33623

AXA Travel Insurance is a reliable option with more than 6 decades of experience and solid ratings. There are 3 levels of coverage to choose from — Silver, Gold, and Platinum — that offer varying levels of coverage and options. AXA Travel Insurance isn’t the cheapest option, but it offers robust coverage options and reputable service, so it can be a good choice if you’re looking for enhanced travel protection.

For the premium global assist hotline benefit of The Platinum Card ® from American Express, you can rely on Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Plus, we may provide emergency medical transportation assistance and related services. Third-party service costs may be your responsibility. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. If approved and coordinated by premium global assist hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, Card Members may be responsible for the costs charged by third-party service providers.

For the car rental loss and damage insurance benefit of The Platinum Card ® from American Express, car rental loss and damage insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the commercial car rental company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. geographic restrictions apply. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

For the baggage insurance plan benefit of The Platinum Card ® from American Express, baggage insurance plan coverage can be in effect for covered persons for eligible lost, damaged, or stolen baggage during their travel on a common carrier vehicle (e.g. plane, train, ship, or bus) when the Entire Fare for a ticket for the trip (one-way or round-trip) is charged to an eligible card. Coverage can be provided for up to $2,000 for checked baggage and up to a combined maximum of $3,000 for checked and carry-on baggage, in excess of coverage provided by the common carrier. The coverage is also subject to a $3,000 aggregate limit per covered trip. For New York State residents, there is a $2,000 per bag/suitcase limit for each covered person with a $10,000 aggregate maximum for all covered persons per covered trip. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company.

For the trip delay insurance benefit of The Platinum Card ® from American Express, up to $500 per covered trip that is delayed for more than 6 hours; and 2 claims per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

For the trip cancellation and interruption insurance benefit of The Platinum Card ® from American Express, the maximum benefit amount for trip cancellation and interruption insurance is $10,000 per covered trip and $20,000 per eligible card per 12 consecutive month period. Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

For rates and fees of The Platinum Card ® from American Express, click here .

Frequently Asked Questions

Does the axa silver travel insurance plan provide coverage for a safari.

Yes, AXA’s travel insurance policies offer coverage for safaris, including emergency medical expenses. Safaris are under the sports and activities covered for emergency medical and repatriation costs and personal accidents.

Is AXA travel insurance worth it?

AXA travel insurance can be worth it if you need coverage for significant nonrefundable expenses or your health coverage doesn’t extend to your destination. Competitors may offer lower cost policies for similar major coverage, but AXA may have greater policy options, so it’s a good idea to compare your options.

Is AXA travel insurance good for a Schengen visa?

AXA recommends its Gold plan or higher for Schengen travel.

Is AXA an international insurance?

Yes, you can use AXA for international travel , with coverage for countries in Europe, Asia and Pacific islands, the U.S. and Canada, Africa and the Middle East, Latin America, and the Caribbean.

Was this page helpful?

About Jessica Merritt

A long-time points and miles student, Jessica is the former Personal Finance Managing Editor at U.S. News and World Report and is passionate about helping consumers fund their travels for as little cash as possible.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

AXA Assistance USA

Generous coverage for medical expenses and medical evacuation

Cancel for any reason (CFAR) coverage available with Platinum plan

Gold and Platinum plans can cover preexisting medical conditions

Silver plan doesn't offer any optional coverages

Unimpressive reviews from past customers

What AXA Assistance USA Is Known For

AXA Assistance USA offers three main travel insurance options that help consumers protect against various mishaps that can occur during trips within the United States and abroad. For example, the company's Silver, Gold and Platinum plans offer coverage for trip cancellations and interruptions, lost and delayed baggage, travel delays, emergency medical expenses, and more. While the basic Silver plan offers essential coverage at a more affordable price point, the Gold and Platinum plans from this provider offer more benefits and higher coverage limits overall.

Standout benefits of AXA Assistance's premium travel insurance plans include a selection of optional coverages consumers can purchase for more protection. While the Silver plan doesn't have any optional benefits, consumers who choose the Gold plan can tailor their coverage with optional rental car coverage. With the Platinum plan, travelers can add on coverage for lost ski days, lost golf rounds, sports equipment rentals and car rentals.

Platinum coverage is also the only plan from AXA Assistance that lets travelers purchase cancel for any reason (CFAR) coverage . This type of insurance reimburses travelers with 75% of their prepaid trip costs for airfare, hotels, tours and more, and it can apply when travelers cancel their trip for any reason at all.

Also note that both the Gold and Platinum plans from AXA Assistance USA provide coverage for preexisting medical conditions that existed at least 60 days before purchasing a policy. However, travelers do need to pay for their insurance coverage within 14 days of making an initial trip deposit for preexisting medical coverage to apply.

At the end of the day, there's plenty to like when it comes to the travel insurance options from this provider, whether you want essential benefits only or a premium plan with all the bells and whistles. Not only does AXA Assistance offer several plans that can suit different types of trips, but its optional coverage options make it even easier to tailor a travel insurance policy to your needs.

AXA Assistance USA for Individual Trips

Like other travel insurance providers, AXA Assistance offers several tiers of coverage to choose from. This makes it easier for travelers to select the exact amount of travel insurance protection they need with the policy limits that make sense for their trip.

The chart below provides an overview of available plans, what they include and policy limits that apply.

Available coverage from AXA Assistance USA is offered in three tiers. Where the Silver plan offers limited benefits and lower policy limits overall, the Platinum plan offers more included perks, more optional coverage options and higher policy limits overall. The Gold falls somewhere in between.

Here's an overview of the type of traveler each plan could work best for:

- Silver: While the Silver plan is the lowest tier of coverage available from AXA Assistance USA, it still offers generous benefits for medical expenses and emergency evacuation coverage. Other included perks can also protect your trip, including coverage for lost or delayed bags, missed connections, travel delays, and more. Overall, this plan is geared to travelers who want ample coverage for medical emergencies but want to pay lower premiums for their plan.

- Gold: The Gold plan from AXA Assistance USA offers higher limits than the Silver plan, especially when it comes to medical expenses and emergency medical evacuation. This makes it a solid option for people who are mostly worried about having coverage that can pay for emergency medical bills or emergency medical evacuation in the event of an injury or illness. Of course, additional benefits with this plan also come with higher policy limits as well.

- Platinum: The Platinum plan from this provider is for travelers who want the highest policy limits for medical emergencies, medical evacuation, travel delays, lost or delayed baggage, and more. This plan also has the most optional coverages that let you tailor your travel protection to your unique needs, and it's the only one from this provider that lets you purchase CFAR coverage. This additional benefit lets you cancel your trip for any reason you want and get 75% of your prepaid travel expenses back.

AXA Assistance USA Costs

The costs for a travel insurance plan can vary widely based on the company you purchase from, the ages of travelers in your group, your destination, the length of your trip and other factors. The tier of coverage you select can also impact your travel insurance premiums, especially if you opt for a premium plan with more benefits and higher levels of coverage.

We applied for travel insurance quotes for a range of example trips to help you find out approximately what you would pay with AXA Assistance USA. Note that premiums shared below do not include any optional coverages.

Reading travel insurance reviews can give you a glimpse into the experiences of past users when it comes to filing claims and receiving reimbursement. Unfortunately, this is one area where AXA Assistance USA appears to have some issues.

While the company has an A- rating with the Better Business Bureau (BBB), it is not accredited. AXA Assistance also has an average star rating of 1.47 out of 5 stars across user reviews on the BBB, and it has 35 closed customer complaints on the platform in the last three years. On other review platforms, it has a higher star rating.

The reviews below from various platforms provide a mix of positive experiences along with some of the most common customer complaints found with the company.

AXA Assistance USA Gold

Due to a personal tragedy at home my wife and I interrupted a cruise and returned home at the next port. The claim form and related documentation requested by AXA Assistance USA was emailed to their claims office on December 9th. On December 14th, I received an email from the claims adjuster confirming approval of the claim and that the payment check would be received in 10 to 15 business days. Based on my experience I would highly recommend this company. – John R. via InsureMyTrip

Policy: Gold

Absolutely terrible customer service experience. I filed my claim in January, after my flights were canceled and delayed. I did not even hear back until March! The message—delivered two months later—was garbled and incoherent. The amount of reimbursement was left blank, and the larger portion of the claim was denied, without a clear explanation of why. This is NOT what I expected when I paid over $2,000 for a policy! To date, no human spoke to me or emailed me. My calls haven't been returned, and no adequate explanation had been given. The denial "letter" simply quoted from the exclusions language of the policy but offered NO explanations as to why the exclusions purportedly applied. Extremely disappointed in the "services" offered. – Nicole via Squaremouth

Customer Review

They paid very slowly, but they eventually did pay. I took a trip to ***** in June 2022. While there, I got COVID just before I was to return. My return home was delayed by 9 days, and I had to buy a new return ticket home to *******. They do not respond to emails (other than the standard automatic "We received your correspondence, blah blah") but no personal communication until 8 to 10 weeks later. Don't bother calling because you will be put on hold for a very long time, then be disconnected. So, a grade of "F" for communication. Eventually I was contacted, however, and the claims agent asked for more information, including pdf copies of my receipts. I sent them the documentation and receipts, and to my shock, three weeks later, a check arrived in the mail with the full amount of reimbursement I had requested. I expected them to quibble over the receipts, but they didn't. Can I recommend them? No. Will I insure with them in the future? Certainly not. But to their credit they did reimburse me, and for the full amount I asked for. – William S. via Better Business Bureau

I had to cancel my trip. I ripped up my knee. I just got confirmation from AXA that I would receive a check for the full amount of the cost of the trip. I am looking forward to receiving my check. It was quite timely on their part. I would definitely recommend them and use them for my next trip. – Carl K. via InsureMyTrip

I am appalled by the poor service I have received thus far from AXA Assistance USA. The length of time to process a claim and respond to inquiries is absurd. – Sally via Squaremouth

Why Trust U.S. News Travel

Holly Johnson is an award-winning writer who has been writing about travel insurance for more than 10 years. Johnson has researched and purchased travel insurance plans for her own trips to destinations around the world, and she currently uses an annual travel insurance plan from Allianz for her own family. Johnson has two teenage girls and co-owns the travel agency Travel Blue Book . She works alongside her husband, Greg – who sells travel insurance for trips all over the world – in their family media business.

Read more about AXA Assistance USA in:

- The Cheapest Travel Insurance Companies

- The Best Cruise Insurance

- The Best Vacation Rental Travel Insurance

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Travel insurance

AXA Assistance USA travel insurance review 2024

Jennifer Simonson

Mandy Sleight

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Heidi Gollub

Published 12:39 p.m. UTC April 16, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

AXA Assistance USA

Top-scoring plan

Covers covid, medical & evacuation limits per person, what you should know.

If you travel with expensive items, AXA Assistance USA’s Platinum travel insurance plan offers $3,000 in baggage and personal effects coverage. Learn more in our AXA travel insurance review.

- Primary coverage for emergency medical benefits.

- $1 million coverage for emergency evacuation.

- Excellent lost baggage coverage of $3,000 per person.

- Best-in-class 75% “cancel for any reason” upgrade available.

- Covers lost ski and golf days due to bad weather.

- 12-hour wait before travel or baggage delay coverage applies.

- No “interruption for any reason” coverage.

- Missed connection coverage applies only to cruises and tours.

Why trust our travel insurance experts

Our team of experts evaluates hundreds of insurance products and analyzes thousands of data points to help you find the best product for your situation. We use a data-driven methodology to determine each rating. Advertisers do not influence our editorial content. You can read more about our methodology below.

- 1,855 coverage details evaluated.

- 567 rates reviewed.

- 5 levels of fact-checking.

AXA travel insurance plans

AXA Assistance USA offers travelers three comprehensive plans: Silver, Gold and Platinum. Each plan includes coverage for trip cancellation, interruption, emergency medical expense, emergency evacuation and baggage delay. Here’s a sample of the coverage you can expect from each policy.

Silver

AXA’s budget-friendly Silver plan includes the following benefits.

- Trip interruption insurance : 100% of your trip cost.

- Missed connections: $500.

- Travel medical insurance : $25,000 per person.

- Emergency medical evacuation : $100,000 per person.

- Accidental death and dismemberment: $10,000 per person.

- Baggage and personal effects: $150 per article, up to $750.

The Gold plan covers everything the Silver plan covers but increases the coverage limits.

- Trip interruption insurance: 150% of your trip cost.

- Travel medical insurance: $100,000 per person.

- Emergency medical evacuation: $500,000.

Unlike the Silver plan, the Gold plan also includes coverage for non-medical emergency evacuation and the option to purchase a collision damage waiver for rental cars.

Platinum

A benefit of AXA’s Platinum plan is that it covers sports equipment. If the airline loses your golf clubs or skis, the Platinum plan pays $25 per day for lost ski days, $500 for lost golf rounds and $1,000 for sports rental.

AXA’s Platinum plan also increases the optional collision damage waiver from $35,000 to $50,000.

And this is the only AXA travel insurance plan that gives you the option to upgrade to “cancel for any reason” (CFAR) coverage . This coverage reimburses up to 75% of your prepaid and nonrefundable trip expenses, as long as you cancel your trip at least 48 hours prior to departure.

Compare AXA travel insurance plans

Additional coverage options, “cancel-for-any-reason” (cfar) coverage.

Platinum plan policyholders have the option to purchase upgraded “cancel-for-any-reason” (CFAR) coverage, which allows you to cancel for any reason, not just those listed in your policy. CFAR coverage must be purchased within 14 days of paying the initial trip deposit. It covers up to 75% of your prepaid nonrefundable trip expenses provided you cancel your trip at least 48 hours prior to departure.

Collision damage waiver

Gold and Premium plans come with the option to purchase a collision damage waiver to cover rental car damage, collision or loss anywhere in the world. The Gold plan includes up to $35,000 in coverage while the Platinum plan offers up to $50,000.

What isn't covered by AXA travel insurance?

Like all travel insurance companies, AXA Assistance USA does not cover every incident that occurs while traveling. It’s a good idea to read your policy closely to learn what is and what is not covered.

Here are some examples of exclusions to AXA Assistance USA’s Platinum plan:

- Event cancellations.

- Travel to Afghanistan, Belarus, Burundi, Central African Republic, Chad, Congo, Crimea/Sevastopol, Eritrea, Guinea, Iran, Iraq, Lebanon, Liberia, Libya, Mali, Niger, North Korea, Pakistan, Russia, Sierra Leone, Somalia, South Sudan, Sudan, Syria, Ukraine, Venezuela and Yemen.

- War risks, civil commotion or terrorism.

- Dental treatment (except as a result of accidental injury).

- Suicide or attempted suicide.

AXA Assistance travel insurance rates

The price of AXA travel insurance will vary based on factors such as the plan you choose, your age, the length of the trip and your destination. In general, the average cost of travel insurance is 5% to 6% of your total trip cost.

Here are some sample quotes to give you an idea of how much you might pay for AXA’s Platinum plan.

Compare the best travel insurance companies of 2024

Via TravelInsurance.com’s website

Methodology

Our insurance experts reviewed 1,855 coverage details and 567 rates to determine the best travel insurance of 2024 . For companies with more than one travel insurance plan, we shared information about the highest-scoring plan.

Insurers could score up to 100 points based on the following factors:

- Cost: 40 points. We scored the average cost of each travel insurance policy for a variety of trips and traveler profiles.

- Medical expenses: 10 points. We scored travel medical insurance by the coverage amount available. Travel insurance policies with emergency medical expense benefits of $250,000 or more per person were given the highest score of 10 points.

- Medical evacuation: 10 points. We scored each plan’s emergency medical evacuation coverage by coverage amount. Travel insurance policies with medical evacuation expense benefits of $500,000 or more per person were given the highest score of 10 points.

- Pre-existing medical condition exclusion waiver: 10 points. We gave full points to travel insurance policies that cover pre-existing medical conditions if certain conditions are met.

- Missed connection: 10 points. Travel insurance plans with missed connection benefits of $1,000 per person or more received full points.

- “Cancel for any reason” upgrade: 5 points. We gave points to travel insurance plans with optional “cancel for any reason” coverage that reimburses up to 75%.

- Travel delay required waiting time: 5 points. We gave 5 points to travel insurance policies with travel delay benefits that kick in after a delay of 6 hours or less.

- Cancel for work reasons: 5 points. If a travel insurance plan allows you to cancel your trip for work reasons, such as your boss requiring you to stay and work, we gave it 5 points.

- Hurricane and severe weather: 5 points. Travel insurance plans that have a required waiting period for hurricane and weather coverage of 12 hours or less received 5 points.

Some travel insurance companies may offer plans with additional benefits or lower prices than the plans that scored the highest, so make sure to compare travel insurance quotes to see your full range of options.

AXA travel insurance FAQs

AXA travel insurance is a good option. It gets 3.5 stars out of 5 in our rating of the best travel insurance of 2024 .

Yes, AXA travel insurance offers “cancel for any reason” (CFAR) coverage as an optional upgrade to the Platinum plan. This coverage can reimburse you for up to 75% of your prepaid and nonrefundable trip expenses if you cancel your trip for any reason, as long as you cancel at least 48 hours before your scheduled departure.

CFAR coverage is only available as an optional benefit on the Platinum plan and must be purchased within 14 days of your first trip deposit.

Yes, AXA travel insurance covers both domestic and international travel.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Jennifer Simonson covers everything from business to the wine industry to international travel. Outdoor adventure, water parks and all things Texas are by far her favorite beats. Her work has appeared in Forbes, Travel + Leisure, Texas Monthly, Smithsonian Magazine, Fodor's, Lonely Planet, Slate and more. You can follow her on Instagram at @storiestoldwell.

Mandy is an insurance writer who has been creating online content since 2018. Before becoming a full-time freelance writer, Mandy spent 15 years working as an insurance agent. Her work has been published in Bankrate, MoneyGeek, The Insurance Bulletin, U.S. News and more.

Heidi Gollub is the USA TODAY Blueprint managing editor of insurance. She was previously lead editor of insurance at Forbes Advisor and led the insurance team at U.S. News & World Report as assistant managing editor of 360 Reviews. Heidi has an MBA from Emporia State University and is a licensed property and casualty insurance expert.

10 worst US airports for flight cancellations this week

Travel insurance Heidi Gollub

10 worst US airports for flight cancellations last week

Our travel insurance ratings methodology

Cheapest travel insurance of May 2024

Travel insurance Mandy Sleight

Average flight costs: Travel, airfare and flight statistics 2024

Travel insurance Timothy Moore

John Hancock travel insurance review 2024

Travel insurance Jennifer Simonson

HTH Worldwide travel insurance review 2024

Airfare at major airports is up 29% since 2021

USI Affinity travel insurance review 2024

Trawick International travel insurance review 2024

Travel insurance for Canada

Travelex travel insurance review 2024

Best travel insurance companies of May 2024

Travel insurance Amy Fontinelle

Best travel insurance for a Disney World vacation in 2024

World Nomads travel insurance review 2024

Introduction to AXA Travel Insurance

- Coverage Options Offered by AXA

- AXA Assistance USA Cost

AXA Customer Service Reviews

Compare axa travel insurance.

- Why You Should Trust Us

AXA Assistance USA Travel Insurance Review 2024

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate insurance products to write unbiased product reviews.

Travel insurance is important because it can help cover the cost of unexpected medical expenses while you're traveling. It can also reimburse you for lost or stolen baggage, canceled flights, and other unforeseeable problems that may occur while you're away from home.

Simply put, there's a lot to consider.

But not all policies are created equal, and you must understand what you're covered for before you purchase a policy. This article will look in-depth at AXA Assistance USA travel insurance. We'll discuss the costs, coverage limits, exclusions, and more to help you make an informed decision about whether or not this particular travel insurance provider is right for you.

- Trip cancellation coverage of up to 100% of the trip cost

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous medical evacuation coverage

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Up to $1,500 per person coverage for missed connections on cruises and tours

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Covers loss of ski, sports and golf equipment

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous baggage delay, loss and trip delay coverage ceilings per person

- con icon Two crossed lines that form an 'X'. Cancel for any reason (CFAR) coverage only available for most expensive Platinum plan

- con icon Two crossed lines that form an 'X'. CFAR coverage ceiling only reaches $50,000 maximum despite going up to 75%

AXA Assistance USA keeps travel insurance simple with gold, silver, and platinum plans. Emergency medical and CFAR are a couple of the options you can expect. Read on to learn more about AXA.

- Silver, Gold, and Platinum plans available

- Trip interruption coverage of up to 150% of the trip cost

- Emergency medical coverage of up to $250,000

AXA Assistance USA is among the best travel insurance companies . It covers the fundamentals of travel insurance, with coverage for trip cancellations, medical expenses, and emergency medical/non-medical evacuation. With three plans, AXA also offers coverage for travelers with various budgets.

It's worth noting that many important add-ons aren't available for AXA's cheapest Silver plan, such as pre-existing condition coverage, rental car add-ons, and Schengen travel insurance. Cancel for any reason coverage is also only available for AXA's most expensive Platinum plan.

Coverage Options Offered by AXA

AXA Assistance USA offers three levels of coverage: Silver, Gold, and Platinum. Each plan comes with different protections and varying coverage limits, with the Silver being the most basic option and Platinum offering the most premium coverage.

Some policies might even include added coverage free of charge, such as a waiver for pre-existing conditions , which is free for Gold and Platinum plans as long as you purchase your plan within 14 days of your trip deposit.

Specialized Coverage Options

The plan you purchase will determine which add-ons are available. For example, those with a Platinum plan can add CFAR (cancel for any reason) coverage , allowing you to receive a full refund if you cancel your trip within 14 days of making the initial deposit.

Or, if you want extra protection for your rental car, depending on your AXA plan, you might be able to add a collision damage waiver (CDW). Policyholders with Gold plans can add $35,000 CDW, and those with Platinum plans can include $50,000 CDW.

If you're traveling within the Schengen Territory, which is made up of 27 European countries, you may eligible for Schengen Travel Insurance, which covers you in all 27 countries. This option is only available for Gold and Platinum travelers and coverage lasts up to 90 days.

AXA Assistance USA Travel Insurance Cost

The premium you pay will depend on various factors, including the age of the travelers, destination, and total trip costs. The average cost of travel insurance is 4% to 8% of your travel costs.

After inputting some personal information, such as your age and state of residence, along with your trip details, like travel dates, destination, and trip costs, you'll get an instant quote for the plans available for your trip. And from there, it's easy to compare each option based on your coverage needs and budget.

Now let's look at a few examples to estimate AXA's coverage costs.

As of 2024, a 23-year-old from Illinois taking a week-long, $3,000 budget trip to Italy would have the following AXA travel insurance quotes:

- AXA Silver: $83

- AXA Gold: $107

- AXA Platinum: $127

Premiums for AXA plans are between 2.7% and 4.2% of the trip's cost, well below the average cost of travel insurance. It's also relatively cheap compared to many of its competitors

AXA provides the following quotes for a 30-year-old traveler from California heading to Japan for two weeks on a $4,000 trip:

- AXA Silver: $109

- AXA Gold: $128

- AXA Platinum: $153

Once again, premiums forAXA plans are between 3.6% and 3.8%, below the average cost for travel insurance.

A 65-year-old couple looking to escape New York for Mexico for two weeks with a trip cost of $6,000 would have the following AXA quotes:

- AXA Silver: $392

- AXA Gold: $462

- AXA Platinum: $550

Premiums for AXA plans are between 6.5% and 9.2%, which is roughly in line with the average cost for travel insurance. This is to be expected, as travel insurance is often more expensive for older travelers.

How to Purchase and Manage Your AXA Policy

The process of purchasing an AXA policy is simple. After obtaining your quote, you'll need to decide which of AXA's three plans you want to buy. When you pay for your plan, be prepared to provide additional personal information, like your birthday, phone number, and address.

Once you finalize your purchase, you'll have a 10-day free look period, in which you can cancel your policy and get your money back.

How to File a Claim with AXA Travel Insurance

To file a claim with AXA Assistance USA, head to the claims forms online to find the appropriate form. Once you've filled out your form and gathered the required documentation, you can email them to [email protected] or send them by mail to:

AXA Assistance USA

On Behalf of Nationwide Mutual Insurance Company and Affiliated Companies

P.O. Box 26222

Tampa, FL 33623

If you need assistance when filing claims, AXA's claims office can be reached at 1-888-957-5015 (within the U.S.) and 1-727-450-8794 (outside the U.S.). Office hours are 9:30 a.m.-5 p.m. ET on Thursdays and 8:30 a.m.-5 p.m. ET on all other weekdays.

AXA's U.S. branch has few reviews on Trustpilot and the Better Business Bureau — just over 20 between the two sites. Its UK branch has over 1,100 reviews, most of which are overwhelmingly negative. However, the quality of AXA Travel Insurance UK isn't necessarily indicative of its U.S. coverage.

In fact, on SquareMouth, where the majority of AXA U.S.'s reviews, reviews are generally positive. It received an average of 4.22 stars out of five across over 900 reviews. Customers reported that adjusting an AXA policy was easy and the customer service team was responsive. However, reviews on the claims process was more mixed, with spotty communication and long wait times.

See how AXA travel insurance compares to top travel insurance providers.

AXA Assistance USA vs. AIG Travel Guard

When comparing AXA to Travel Guard , we'll look at the coverage levels from their mid-tier plans, the Silver plan and Travel Guard Preferred plan, respectively.

With Travel Guard Preferred plan, you'll get:

- Trip cancellation coverage up to $150,000

- Trip interruption coverage up to $225,000

- Emergency medical coverage of $50,000

- Coverage for baggage loss, theft, or damage up to $1,000

- Travel delay coverage of up to $800

Comparing those Travel Guard coverages with AXA's Silver plan, you'll see that AXA's coverage limits are a bit higher. With AXA's Silver plan you'll get $100,000 in emergency medical coverage, for example. And the baggage loss coverage limit is up to $1,500.

If you're looking for greater coverage limits, AXA makes the most sense in this scenario. But premiums will also vary based on factors like the traveler's age, trip destination, and trip cost. So you'll have to run your own numbers to make a final decision.

Read our AIG Travel Insurance review here.

AXA Assistance USA vs. Allianz Travel Insurance

Allianz Travel Insurance provides single-trip and multi-trip insurance for travelers who want to go abroad for an extended period of time. And, like with all insurance, the various plans have varying degrees of coverage.

Allianz Travel Insurance's most popular single-trip option is the OneTrip Prime plan, which offers:

- Trip cancellation coverage up to $100,000

- Trip interruption coverage up to $150,000

- Emergency medical coverage for $50,000

- Coverage for baggage loss, theft or damage up to $1,000

- Travel delay coverage up to $800

Looking at AXA's mid-tier Silver plan, you'll see that, again, AXA offers more coverage for emergency medical and baggage loss, theft, or damage than Allianz Travel Insurance. That said, if cost is an essential factor for you, you'll have to get quotes using your personal trip information to make an informed decision.

Read our Allianz Travel Insurance review here.

AXA Assistance USA vs. Credit Card Travel Insurance

Already have a great travel credit card, like the Chase Sapphire Reserve or American Express Platinum? Some of the standard coverages, such as rental car insurance, may be included in the card you already have. It's a good idea to research the terms of your credit card's travel protection before purchasing a separate travel insurance policy.

If you're driving to your destination and don't have any non-refundable trip expenses, the coverage from your credit card may be enough. Another time it might work is if you have health insurance covering you while abroad and you're in good health without worrying about possible medical costs.

It's essential to remember that credit card coverage is usually secondary. This means you'll have to file a claim with the other applicable insurance before filing a claim with your credit card company.

Read our guide on the best credit cards with travel insurance here.

Why You Should Trust Us: How We Reviewed AXA Assistance USA

We researched AXA by evaluating its travel insurance plans compared to other plans from the top travel insurance companies. The aspects we looked at included, but were not limited to, different coverage options, claims limits, what is covered, available add-ons, and extra services for policy holders.

What's important when choosing a policy isn't just the price — it's making sure you're getting adequate coverage that meets your needs without breaking the bank. Filing a claim should also be easy and stress-free if you ever have to use your policy.

Read more about how Business Insider rates insurance products here.

AXA Assistance USA FAQs

If you're diagnosed with COVID-19 before a trip and need to cancel, AXA may cover your expenses. Additionally, a COVID-19 diagnosis during a trip may be covered under AXA's medical expense, trip interruption, and trip delay benefits. Be sure to review your policy to ensure coverage details.

While you may extend your coverage in certain circumstances, such as extended hospitalization, and update your travel dates prior to your departure, you can't extend AXA travel insurance plans while you're traveling.

AXA's Gold and Platinum plan cover pre-existing medical conditions as long as you purchase your policy within 14 days of your initial trip deposit. AXA's Silver plan does not cover pre-existing conditions and has a 60-day look-back period.

You can download AXA claims forms on its website and email them to [email protected].

AXA isn't the most flexible travel insurance company and isn't great at specializing, but it offers comprehensive general coverage. Its prices aren't significantly more expensive or cheaper than its competitors.

- Main content

You are using an outdated browser. Please upgrade your browser to improve your experience.

At ConsumersAdvocate.org, we take transparency seriously.

To that end, you should know that many advertisers pay us a fee if you purchase products after clicking links or calling phone numbers on our website.

The following companies are our partners in Travel Insurance: Travel Guard Insurance , Allianz Global Assistance , Travelex , TravelInsurance.com , Seven Corners , Generali Global Assistance , Trawick International , Squaremouth , and Faye .

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on the page.

For example, when company ranking is subjective (meaning two companies are very close) our advertising partners may be ranked higher. If you have any specific questions while considering which product or service you may buy, feel free to reach out to us anytime.

If you choose to click on the links on our site, we may receive compensation. If you don't click the links on our site or use the phone numbers listed on our site we will not be compensated. Ultimately the choice is yours.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity.

Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process, click here.

Product name, logo, brands, and other trademarks featured or referred to within our site are the property of their respective trademark holders. Any reference in this website to third party trademarks is to identify the corresponding third party goods and/or services.

Best Price Guarantee By Comparing Top Providers In A Single Platform

- Buy online and get instant coverage by email

- 24/7 emergency assistance worldwide

- Over 100,000 verified customers with 5-star reviews and $3.5 billion in protected trip costs

- Includes coverage from theft, trip cancellations, baggage loss and delay, medical expenses for hospital treatments

- Policies from trusted providers including: Travel Insured International, AEGIS, Global Trip Protection, Arch RoamRight and others

- Travel Insurance

AXA Travel Insurance Review

The following companies are our partners in Travel Insurance: Travel Guard Insurance , Allianz Global Assistance , Travelex , TravelInsurance.com , Seven Corners , Generali Global Assistance , Trawick International , Squaremouth , and Faye .

We sometimes offer premium or additional placements on our website and in our marketing materials to our advertising partners. Partners may influence their position on our website, including the order in which they appear on a Top 10 list.

The analyses and opinions on our site are our own and our editors and staff writers are instructed to maintain editorial integrity. Our brand, ConsumersAdvocate.org, stands for accuracy and helpful information. We know we can only be successful if we take your trust in us seriously!

To find out more about how we make money and our editorial process, click here.

How is AXA Travel Insurance rated?

Overall rating: 4.5 / 5 (excellent), axa travel insurance plans & coverage, coverage - 4.5 / 5, emergency medical coverage details, baggage coverage details, axa travel insurance financial strength, financial strength - 4.8 / 5, axa travel insurance price & reputation, price & reputation - 4.7 / 5, axa travel insurance customer assistance services, extra benefits - 4.2 / 5, travel assistance services.

- Translation Services

Emergency Medical Assistance Services

- Physician Referral

Concierge Assistance Services

- Restaurant/Event Referral and Reservation

Our Comments Policy | How to Write an Effective Comment

Customer Comments & Reviews

Related to travel insurance, top articles.

- Trip Cancellation Insurance – What is Covered?

- Do I Really Need Travel Insurance?

- Emergency Travel Insurance Coverage

- Common Parasites and Travel-Related Infectious Diseases

Suggested Comparisons

- Travel Guard Insurance vs. Travelex

- Allianz Global Assistance vs. Travel Guard Insurance

- Allianz Global Assistance vs. Berkshire Hathaway

- Allianz Global Assistance vs. Travelex

- Or via Email -

Already a member? Login

- Best Extended Auto Warranty

- Best Used Car Warranty

- Best Car Warranty Companies

- CarShield Reviews

- Best Auto Loan Rates

- Average Auto Loan Interest Rates

- Best Auto Refinance Rates

- Bad Credit Auto Loans

- Best Auto Shipping Companies

- How To Ship a Car

- Car Shipping Cost Calculator

- Montway Auto Transport Reviews

- Best Car Buying Apps

- Best Websites To Sell Your Car Online

- CarMax Review

- Carvana Reviews

- Best LLC Service

- Best Registered Agent Service

- Best Trademark Service

- Best Online Legal Services

- Best CRMs for Small Business

- Best CRM Software

- Best CRM for Real Estate

- Best Marketing CRM

- Best CRM for Sales

- Best Free Time Tracking Apps

- Best HR Software

- Best Payroll Services

- Best HR Outsourcing Services

- Best HRIS Software

- Best Project Management Software

- Best Construction Project Management Software

- Best Task Management Software