About American Express Global Business Travel

American Express Global Business Travel (Amex GBT) is the world’s leading B2B travel platform, providing software and services to manage travel, expenses, and meetings and events for companies of all sizes. We have built the most valuable marketplace in B2B travel to deliver unrivalled choice, value and experiences. With travel professionals in more than 140 countries, our customers and travelers enjoy the powerful backing of American Express Global Business Travel.

Visit amexglobalbusinesstravel.com for more information about Amex GBT, and follow @amexgbt on Twitter , LinkedIn and Instagram .

- Travel management Toggle submenu Travel management solutions Egencia Overview Amex GBT Neo1 Amex GBT Neo Amex GBT Select Amex GBT Ovation Manage your corporate travel program Corporate travel policy Travel risk management Travel expense management Reporting Travel management consulting Industry Solutions Legal Transportation & Logistics

Egencia reviews

See how Egencia works

- Customer center Toggle submenu Travelers Help center Business traveler center Download the app Travel arrangers Help center Travel arranger center Training resources Travel managers Connect community Product updates Customer training

- Watch a demo

- Request a demo

- About Egencia

Egencia joins American Express Global Business Travel

American express global business travel completes acquisition of egencia from expedia group.

London, UK; Seattle, Wash – November 2, 2021 American Express Global Business Travel (GBT), the world’s leading business partner for managed travel, has successfully completed the acquisition of Egencia, the leading digital travel management platform. As part of the transaction, Expedia Group has become a shareholder in GBT. Expedia has also entered into a long-term agreement to provide accommodations supply to GBT.

GBT will accelerate investment in the Egencia brand, its people and technology. GBT and Egencia will together offer the leading solutions across every segment of business travel. Teaming Egencia with GBT’s Supply MarketPlace, one of the most comprehensive sources for content and experiences in business travel, provides customers with more value and choice and offers suppliers enhanced access to business travelers.

Paul Abbott, GBT’s CEO, said: “Bringing GBT and Egencia together will create a winning formula that will define the future of travel. We will provide unrivalled value, choice and experiences to customers. Unrivalled value because together we’ll have the best content and deliver the best savings. Unrivalled choice because no one comes close to the breadth and depth of solutions we will offer. And unrivalled experiences because we have the best people and technology in the industry.”

Mark Hollyhead, President of Egencia, said: “Today is a significant moment in realizing the next important chapter for Egencia. Becoming part of an organization totally focused on business travel will accelerate Egencia’s growth and amplify what we do best – offer technology-driven solutions that address the ever-evolving needs of business travel and its many stakeholders.”

Ariane Gorin, President, Expedia for Business, added: “We are pleased to see Egencia grow with this new opportunity, especially as business travel comes back. At Expedia Group, we empower thousands of partners around the world with our best-in-class technology and vast inventory. Closing this deal, including our long-term agreement to provide lodging supply to GBT, is an important step forward in our ambition to strengthen the entire travel ecosystem and help all of our partners achieve their aims.”

With the close of the transaction, Mark Hollyhead, President of Egencia, will continue to lead the Egencia business reporting directly to GBT CEO Paul Abbott and will join GBT’s executive leadership team.

Media contacts:

For American Express Global Business Travel Martin Ferguson [email protected]

Expedia Group Dave McNamee [email protected]

About American Express Global Business Travel

American Express Global Business Travel (GBT) is the world’s leading business partner for managed travel. We help companies and their employees prosper by making sure travellers are present where and when it matters. We keep global business moving with the powerful backing of travel professionals in more than 140 countries. Companies of all sizes, and in all places, rely on GBT to provide travel management services, organise meetings and events, and deliver business travel consulting.

Visit amexglobalbusinesstravel.com for more information about GBT, and follow @amexgbt on Twitter , LinkedIn and Instagram .

About Expedia Group

Expedia Group, Inc. companies power travel for everyone, everywhere through our global platform. Driven by the core belief that travel is a force for good, we help people experience the world in new ways and build lasting connections. We provide industry-leading technology solutions to fuel partner growth and success, while facilitating memorable experiences for travelers. Our organization is made up of four pillars: Expedia Services, focused on the group’s platform and technical strategy; Expedia Marketplace, centered on product and technology offerings across the organization; Expedia Brands, housing all our consumer brands; and Expedia for Business, business-to-business solutions and relationships across the travel ecosystem. The Expedia Group family of brands includes: Expedia®, Hotels.com®, Expedia® Partner Solutions, Vrbo®, trivago®, Orbitz®, Travelocity®, Hotwire®, Wotif®, ebookers®, CheapTickets®, Expedia Group™ Media Solutions, Expedia Local Expert®, CarRentals.com™, and Expedia Cruises™.

For more information, visit www.expediagroup.com . Follow Expedia Group on Twitter @expediagroup , and check them out on LinkedIn www.linkedin.com/company/expedia/ .

Looking for better business travel solutions? Get in touch with us.

Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Prepaid Cards

Personal Savings

Personal Checking and Loans

Business Banking

Book And Manage Travel

Travel Inspiration

Business Travel

Services and Support

Benefits and Offers

Manage Membership

Business Services

Checking & Payment Products

Funding Products

Merchant Services

Book a Flight

Where are you going, when are you going.

American Express travel portal guide

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- Connect with Holly D. Johnson on Twitter Twitter

- Connect with Holly D. Johnson on LinkedIn Linkedin

- • Credit cards

- • Rewards credit cards

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Key takeaways

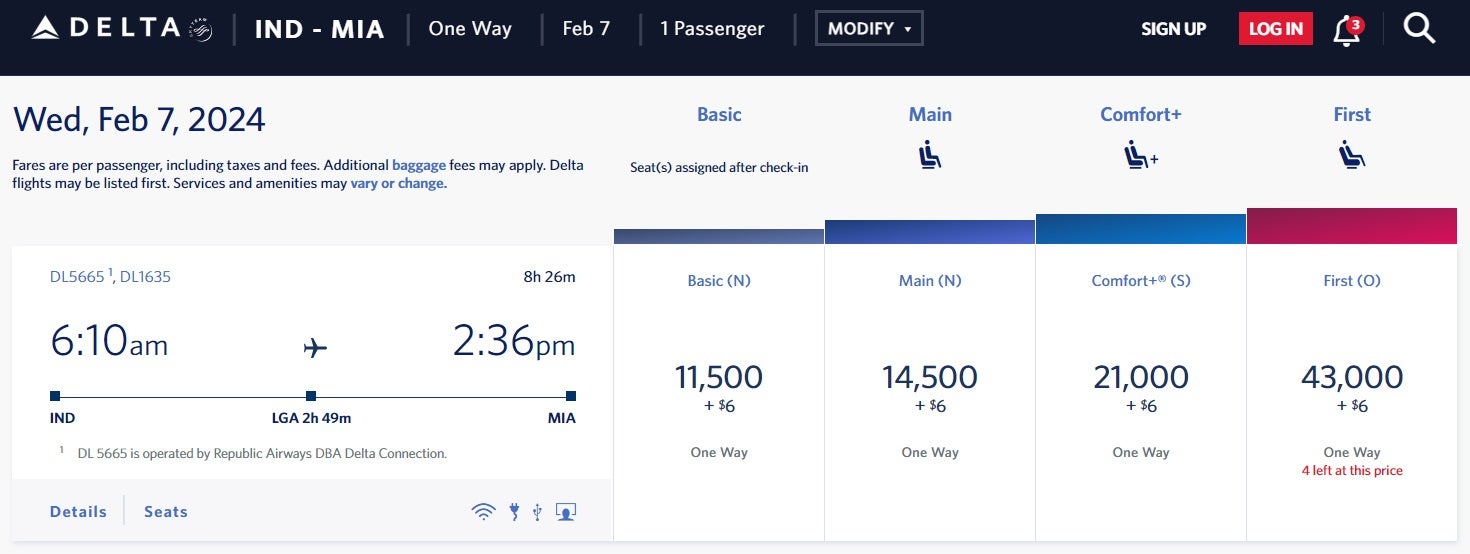

- The American Express travel portal (AmexTravel.com) lets individuals book airfare, hotel stays, cruises and more with cash or points.

- In order to book travel with rewards through this portal, you need an American Express credit card that earns Amex Membership Rewards points.

- While booking through the portal can make sense, there are scenarios where you can save points by transferring them to Amex airline and hotel partners instead.

- Make sure to familiarize yourself with Amex transfer partners so you can make an informed decision on the best ways to use your rewards.

Most popular travel credit cards let you redeem your points in more than one way, including the option to use points to book travel through a portal.

This is true of Chase Ultimate Rewards credit cards like the Chase Sapphire Reserve® and Chase Freedom Flex℠ *, both of which let you book travel directly through the Chase travel portal. But it’s also true for Citi credit cards like the Citi Prestige® Card *, which lets you book airfare, hotels and more through the Citi ThankYou travel portal.

American Express also makes it possible for cardholders to book travel through its own portal, found at AmexTravel.com. This portal works similarly to most of the other travel booking portals you can find online, with the exception that you can shop with American Express Membership Rewards points, cash or a combination of the two.

To book travel with points through AmexTravel.com, all you need is a credit card that earns points in the American Express Membership Rewards program. That said, anyone can book travel through this portal and pay with another form of payment, such as a credit card.

What are the benefits of booking through AmexTravel.com?

AmexTravel.com is a third-party booking site that works similarly to competitors like Expedia.com or Orbitz.com. You can use it to compare prices for airfare, hotels and more across the web, just like you would with another booking site.

But there are more benefits to using this portal if you’re an American Express cardholder. If you have The Business Platinum Card® from American Express , for example, you can get 35 percent of your points back (up to 1,000,000 points per calendar year) when you use rewards to book first or business class tickets or any flight with your selected airline.

Also, note that both the business version and The Platinum Card® from American Express for consumers let you earn 5X points when you purchase prepaid flights or prepaid hotels through American Express Travel (on up to $500,000 in airfare spending with the consumer card). Meanwhile, the popular American Express® Gold Card lets you earn 3X points on flights booked through AmexTravel.com.

Beyond specific cardholder benefits, AmexTravel.com makes it easy to compare flight and hotel options. You may also find offers that include additional benefits when you book a cruise through the portal, such as onboard credits or free specialty meals.

How to use the Amex travel portal to book flights and hotels

Using the Amex travel portal to book flights, hotels, cruises and other travel is a lot like using any other travel booking site. AmexTravel.com is set up to make it easy to search for travel and compare multiple flight and hotel options in one place.

Besides flights, hotels and cruises, you can also use AmexTravel.com to book rental cars and vacation packages. All you have to do is head to AmexTravel.com and enter some basic details on the travel you want to book. From there, you’ll be shown a selection you can choose from.

Cash vs. points

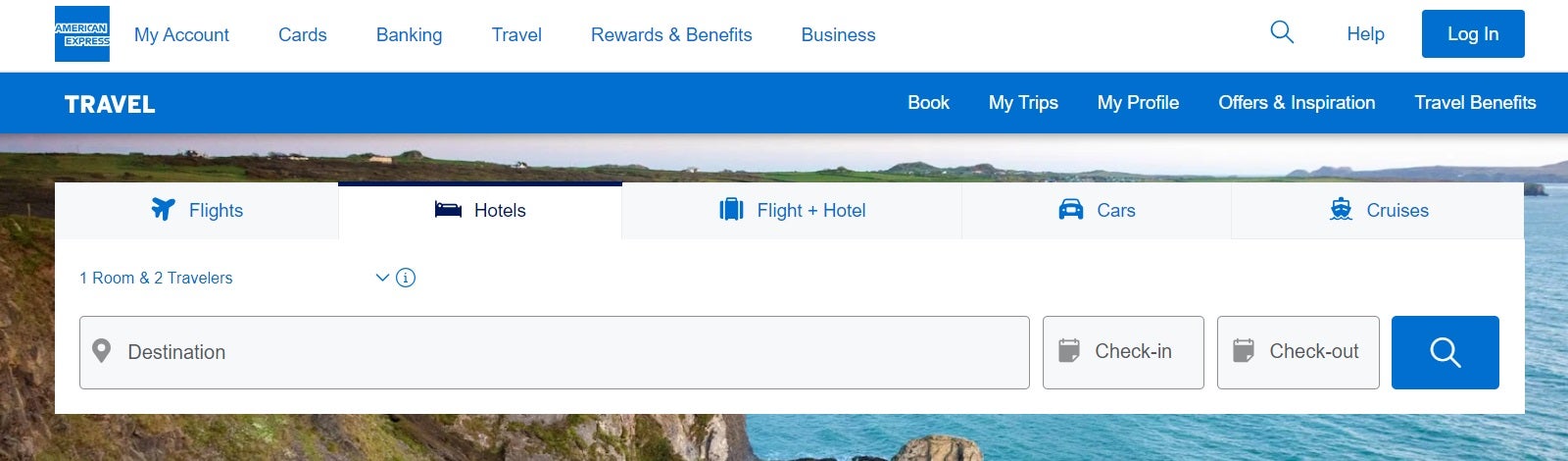

When using the Amex travel portal to pay for hotels, flights and other bookings, you have the option to pay with points, cash or a combination of the two.

To fully or partially pay with points, all you have to do is head to the American Express website and log in to your account. Once you find the travel you want and prepare to book, you can select the option to “Use only points” or to “Use points + card.” You can also pay for travel through AmexTravel.com with only your credit card as payment or use the Amex “Plan it” feature for your booking.

Once you book and choose how you want to pay, your credit card will be charged the full dollar amount of your booking. A credit for any points you used, however, will be applied to your account within 48 hours, per American Express.

Note that you’ll need at least 5,000 Membership Rewards points to pay with points. This rule makes it a little more difficult to use up any leftover points you might have from other bookings. However, it shouldn’t be too hard to reach the 5,000 point threshold for travel if you have an American Express card that earns Membership Rewards points.

When it comes to booking flights, there are a few interesting details to note. If you have an Amex card that offers access to Centurion Lounges or Delta Sky Clubs, for example, you’ll see a note showing qualification for lounge access on flights that apply. You can use Amex points to book a business or first class flight or to upgrade your flight.

You also have the option to transfer your American Express Membership Rewards points to Amex airline and hotel partners . Using the American Express travel portal may or may not be a better deal, but you do get the benefit of booking any travel you want without having to worry about award availability.

Booking flights through Amex

Before you book flights through AmexTravel.com with your points, find out if you could get a better deal by transferring your rewards to an Amex airline partner instead. Fortunately, you can easily find this out by comparing award flights with your favorite airline to what the cost would be for airfare through AmexTravel.com.

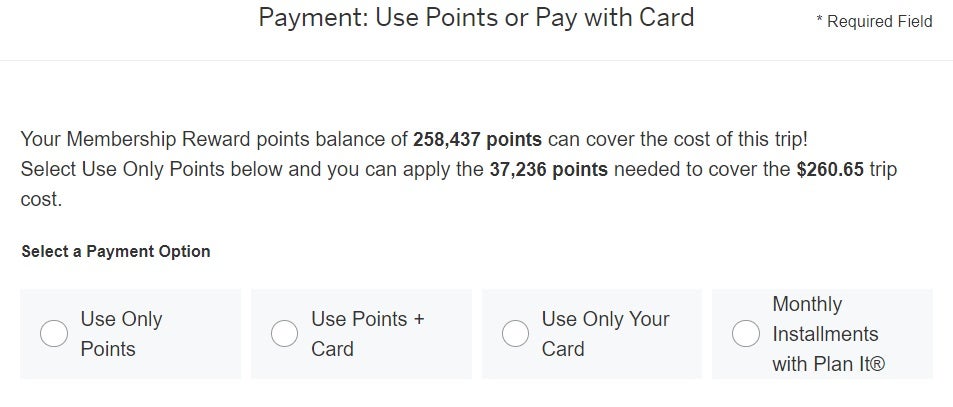

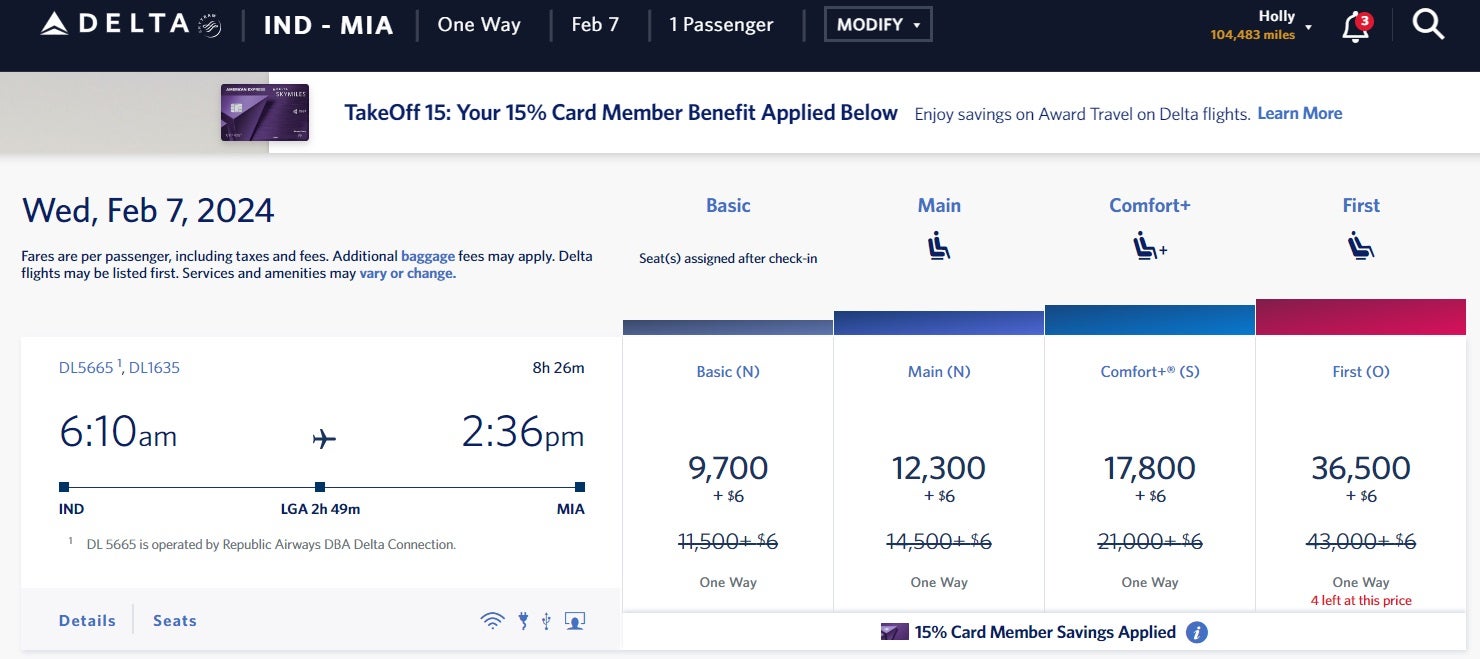

Here’s an example of how this could work. Let’s say you want to fly from Indianapolis, Indiana to Miami, Florida on Delta Air Lines on a specific travel date in February of 2024. In that case, you could easily see how many miles you would need on the Delta website by searching for the travel you want and clicking on the button that says “Shop with Miles.”

As you can see, the flight in question starts at 11,500 miles plus $6 in basic economy and 14,500 miles plus $6 in main cabin economy through the Delta website.

Interestingly, whether or not you have a Delta credit card can also come into play here. This is due to the fact that Delta credit cards offer a feature called “TakeOff 15” that automatically grants cardholders 15 percent off flights they book with miles. If you were a Delta credit card customer, this flight would cost you 9,700 miles in basic economy or 12,300 miles in main cabin economy instead.

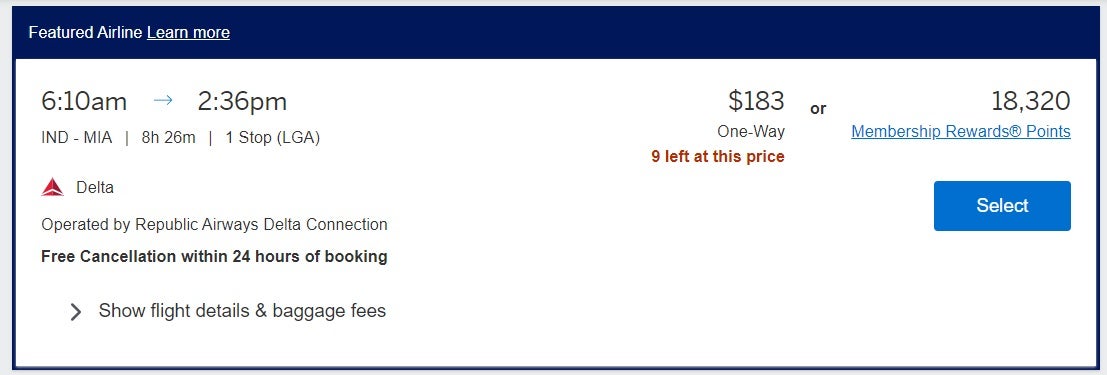

When you compare this cost to what you would pay for the same flight through AmexTravel.com, it’s easy to see where transferring your Amex points to Delta makes more sense even if you don’t have a Delta credit card. For the same flight on the same travel date, AmexTravel.com wants 18,320 miles.

In the meantime, Amex lets you transfer points to Delta Air Lines at a ratio of 1,000:1,000 in increments of 1,000. This means you would transfer as little as 10,000 Amex points to your Delta SkyMiles account (as a Delta card customer) and make this booking.

This is just one example of how transferring your Amex points to a partner can make more sense than booking a flight through AmexTravel.com. That said, you’ll want to run the numbers with each booking you make before deciding, as there may be scenarios where booking through Amex is a considerably better deal — and you won’t know unless you do the research upfront.

It can also help to familiarize yourself with Amex transfer partners ahead of time so you know what your options are.

Booking hotels through Amex

Using AmexTravel.com to book a hotel or resort stay works similarly, requiring you to enter your travel information to identify properties in the destinations you plan to visit. Once again, you can pay for your booking with points, cash or a combination of the two. You’ll need to have at least 5,000 Membership Rewards points in your account in order to pay with points.

Again, you’ll want to compare your options when deciding whether to book hotels with hotel loyalty points or directly through Amex. That’s because, in addition to the many frequent flyer programs Amex partners with, the program lets you transfer Amex points to the Choice Privileges program, Hilton Honors and Marriott Bonvoy.

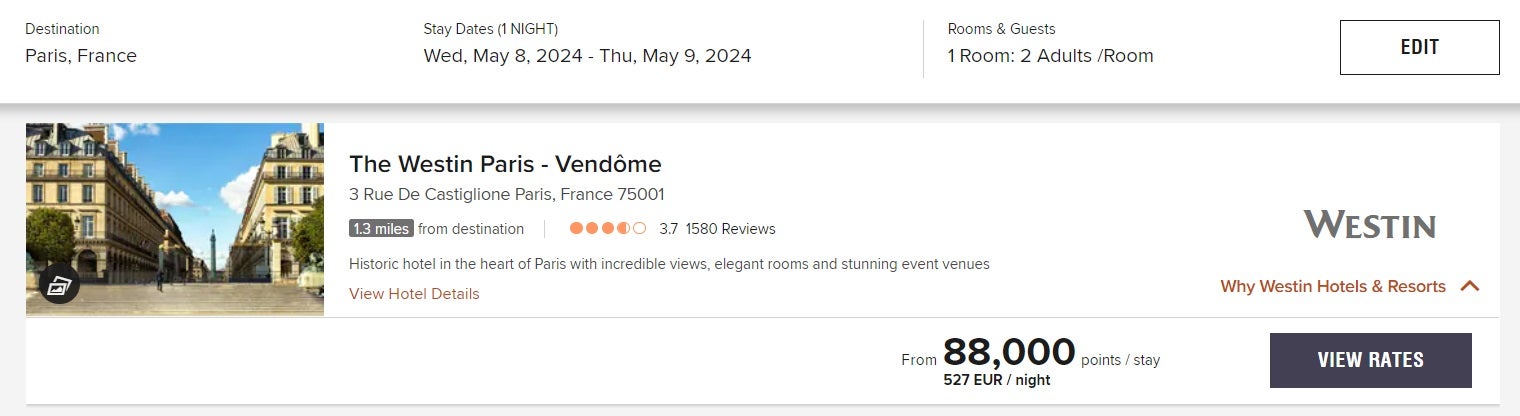

Consider the following example: Let’s say you’re planning a trip to Paris, France, and that you want to splurge with Amex points for a stay at the Westin Paris – Vendôme in May of 2024. If you do a quick search on the Marriott Bonvoy website, you can see that free night awards start at 88,000 points per night over your travel dates, and that the cash rate works out to 527 euros per night (around $570 USD, as of this writing).

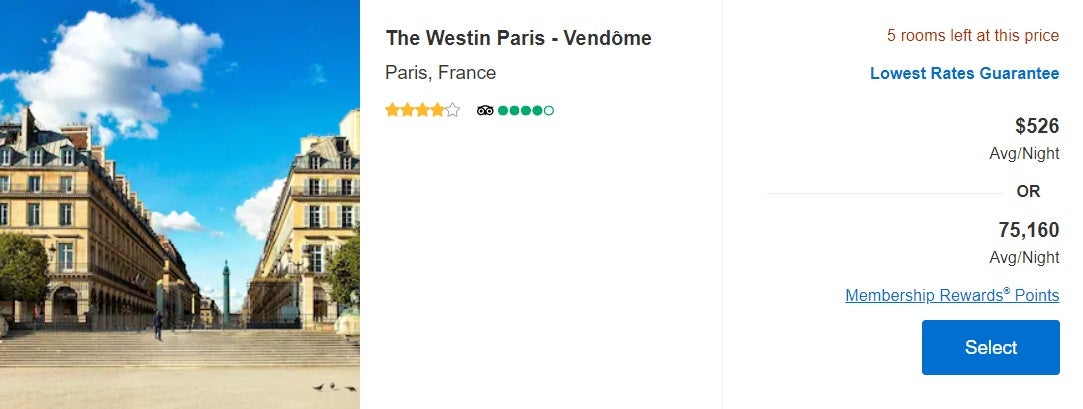

When you search for the same hotel through AmexTravel.com, however, you can see that a free night award will set you back 75,160 points.

Since Amex points transfer to Marriott Bonvoy at a ratio of 1,000:1,000, this is a scenario where you’re better off using your Amex points to book this hotel directly through the portal. In fact, doing so will save you more than 12,000 points per night.

Pay It Plan It

You can now pay for airline tickets with Pay It Plan It. Amex’s Pay It Plan It is a flexible payment option that allows cardholders to make payments on large purchases over time. With this option, cardholders can avoid interest charges and pay down balances with predictable, monthly payments.

The payment option is only for airline tickets booked through the American Express travel website. At checkout, cardholders are presented with up to three different plans to pay for any flight purchase of $100 or more. Note that the installment payment plan doesn’t have any interest associated with it, but there is a fixed monthly fee based on the card’s APR.

International Airline Program

The business and personal Platinum cards let you access a newer Amex program for frequent flyers known as the International Airline Program. This program was created to increase access to lower fares on 24 participating airlines, but it’s only good for international premium class tickets.

To search for fares that qualify, log in to your personal or business Platinum account. From there, use AmexTravel.com to search for First Class, Business Class or Premium Economy to an international destination. At that point, you may see some flight options that show an International Airline Program banner.

Amex Fine Hotels and Resorts program

Note that select premium American Express credit cards, like the Business Platinum Card from American Express and the Platinum Card from American Express, let you access an additional hotel program known as American Express Fine Hotels and Resorts .

This program lets cardholders book stays at over 1,300 luxury hotels in the world with added benefits worth up to $550 per stay. Amex Fine Hotels and Resorts perks can include:

- Daily breakfast for two people

- 4 p.m. late checkout

- Complimentary internet access

- Noon check-in, based on availability

- Room upgrades based on availability

- Unique resort amenity worth up to $100

The Amex Fine Hotels and Resorts program is available only for eligible premium cardholders. Using this program also typically means going without elite hotel benefits or points for paid stays.

Does American Express cover trip cancellations?

Individual airlines and hotels have their own policies that cover cancellations. AmexTravel.com, however, does offer the option to view all your booked travel and cancel or rebook a flight with ease using your My Trips page. You will still be subject to any change or cancellation fees imposed by the carrier if you’re not covered by a flexible policy or existing waiver.

Some American Express credit cards offer trip cancellation and interruption insurance, which could apply in some situations where you have to cancel or rebook your plans.

Popular cards that offer this benefit include the Business Platinum Card and the Platinum Card, as well as co-branded airline and hotel credit cards like the Marriott Bonvoy Brilliant® American Express® Card and the Delta SkyMiles® Reserve American Express Card .

Is booking through AmexTravel.com worth it?

Only you can decide which travel booking option works best for your needs. Regardless of the value of rewards earned, some travelers like being able to book directly through a portal that offers multiple options.

AmexTravel.com also gives customers the benefit of booking any travel available on the portal without having to find award space on a flight or search for available award nights in high-demand hotels. American Express Membership Rewards points, however, are usually worth more if you transfer them to Amex transfer partners , particularly airlines.

Either way, it makes sense to compare all your options before you book travel through AmexTravel.com. See if a transfer partner might let you book the flights you want for fewer miles, but don’t be afraid to use AmexTravel.com if you don’t want to deal with award availability or you find a better deal.

Learn more : Check out Bankrate’s travel toolkit for tips and tricks on how to maximize travel with a credit card.

*The information about the Chase Freedom Flex℠ and Citi Prestige® Credit Card has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer .

Related Articles

Guide to the American AAdvantage online shopping portal

American Express CD rates

Capital One Travel portal guide

6 ways to save money on holiday travel

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Coronavirus

- Climate Change

- Vertical Storytelling

- Corrections Policy

- College Football

- High School Sports

- H.S. Sports Awards

- Sports Betting

- College Basketball (M)

- College Basketball (W)

- For The Win

- Sports Pulse

- Weekly Pulse

- Buy Tickets

- Sports Seriously

- Sports+ States

- Celebrities

- Entertainment This!

- Celebrity Deaths

- American Influencer Awards

- Women of the Century

- Problem Solved

- Personal Finance

- Small Business

- Consumer Recalls

- Video Games

- Product Reviews

- Destinations

- Airline News

- Experience America

- Today's Debate

- Suzette Hackney

- Policing the USA

- Meet the Editorial Board

- How to Submit Content

- Hidden Common Ground

- Race in America

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

Credit cards

Amex Green Card benefits guide 2024

Tamara Aydinyan

Ashley Barnett

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Robin Saks Frankel

Published 5:13 a.m. UTC May 30, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

simonkr, Getty Images

The American Express® Green Card * The information for the American Express® Green Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. (terms apply) earns valuable American Express Membership Rewards® points in categories that include travel, transit and dining for a moderate annual fee of $150. With some travel perks and protections, the card can be a great option for occasional travelers who aren’t willing to take on a higher annual fee. However, frequent travelers will find its benefits to be lackluster compared to more premium travel cards.

All information about American Express® Green Card has been collected independently by Blueprint.

Amex Green Card overview

The American Express® Green Card * The information for the American Express® Green Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. has a welcome offer of 40,000 Membership Rewards points after spending $3,000 in purchases in the first six months of card membership. You’ll also receive an annual up to $189 statement credit for a CLEAR ® Plus membership and an annual up to $100 LoungeBuddy statement credit, available each calendar year. These perks can easily offset the $150 annual fee . Enrollment is required for select benefits.

The card earns 3 points per $1 at restaurants, 3 points per $1 on travel including flights, hotels, transit, taxis, tours, and ridesharing services and 1 point per $1 on other purchases. Membership Rewards are a highly valued currency among travelers for their ability to be transferred to a wide variety of airline and hotel transfer partners.

Major Amex Green Card benefits

Welcome bonus .

Cardholders can earn 3 points per $1 at restaurants, 3 points per $1 on travel including flights, hotels, transit, taxis, tours, and ridesharing services and 1 point per $1 on other purchases. Although the welcome bonus is not the highest the card has ever had, the reasonable spending requirement to earn it can make the offer extra appealing.

Points earned

The American Express® Green Card * The information for the American Express® Green Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. shines with its generous earning rate and broadly defined categories. You can earn:

- 3 points per $1 at restaurants.

- 3 points per $1 on travel including flights, hotels, transit, taxis, tours and ridesharing services.

- 1 point per $1 on other purchases.

The travel category is expansive and includes flights, hotels, campgrounds, car rentals, cruises, vacation rentals. Transit includes trains, taxicabs, rideshare services, ferries, tolls, parking, buses and subways.

Finally, the dining category includes takeout and delivery at U.S. restaurants.

Redemption options

Earned rewards are only as good as their redemption options and Amex’s Membership Rewards are valuable. You can transfer points to more than a dozen airline and hotel loyalty program partners. Occasional transfer bonuses to specific partners can make this all the more lucrative as the value of the redemptions will vary from program to program.

For those who prefer a more straightforward approach, points can also be redeemed for travel through Membership Rewards at a fixed rate of no more than one cent per point.

Lesser-value options include redeeming points for gift cards and shopping online, although there are better ways to use the points .

The juice can be worth the squeeze. Here’s how to maximize the benefits on the Amex Green card in the first year

Travel benefits

The American Express® Green Card * The information for the American Express® Green Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. comes with an annual CLEAR Plus statement credit so you can enjoy shorter airport security lines. It also includes an annual up to $100 LoungeBuddy statement credit when purchasing airport lounge access through the LoungeBuddy website or app (enrollment required). LoungeBuddy allows you to purchase lounge access to over 2,000 airport lounges in over 800 airports around the world.

Insurance benefits

Although less comprehensive than other travel rewards cards , the American Express® Green Card * The information for the American Express® Green Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. has some useful travel protections.

Trip delay insurance¹ will cover up to $300 per round-trip if you are delayed for more than 12 hours. You are covered up to $300 per trip (up to two claims per year) and you have to had paid for the trip with the Amex Green Card.

Baggage insurance² covers lost, damaged or stolen baggage up to $1,250 for carry-ons and up to $500 for checked bags.

Car rental loss and damage insurance³ can save you money when you use your American Express® Green Card * The information for the American Express® Green Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. to reserve and pay for your car rental. You can decline the collision damage waiver and be covered for damage to or theft of a rental vehicle in covered territories. It’s important to note that exclusions apply and the coverage is secondary.

Additional benefits

Global assist hotline⁴.

When traveling more than 100 miles from home, you can access Amex’s 24/7 emergency assistance and coordination services with your American Express® Green Card * The information for the American Express® Green Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. . The service can help with issues while traveling, such as passport assistance, emergency cash or legal or medical referrals. While you are responsible for the costs charged by third-party service providers, Amex can help connect you with the services you need.

Purchase protection⁵

New purchases paid for with your American Express® Green Card * The information for the American Express® Green Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. may be covered for 90 days from theft or damage. You’ll have purchase protection up to $1,000 per occurrence and up to $50,000 per calendar year.

Extended warranty⁶

You can get up to one extra year added to the original manufacturer’s warranty on covered purchases paid for with your American Express® Green Card * The information for the American Express® Green Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. .

Amex offers

An easy way to save cash or earn bonus points is by adding targeted Amex Offers to your American Express® Green Card * The information for the American Express® Green Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. . With the click of a button you can receive additional benefits from merchants on purchases you’re already making.

Amex event experiences

Getting tickets to concerts or exclusive events is easier with Amex’s early access benefit. Owning the American Express® Green Card * The information for the American Express® Green Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. can unlock presale ticket sales, special VIP packages and unique cardholder benefits. Previous offers include special U.S. Open Tennis Championship suite access and unique food and dining events in Napa Valley.

Amex Green vs. American Express® Gold Card : Which has better benefits?

While the American Express® Green Card * The information for the American Express® Green Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. is geared toward travelers, the American Express® Gold Card (terms apply, rates & fees ) is best for those who frequently dine out (or in!), earning 4 Membership Rewards points per $1 at restaurants, plus takeout and delivery in the U.S., 4 points per $1 at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1 point), 3 points per $1 on flights booked directly with airlines or through American Express travel and 1 point per $1 on other eligible purchases.

our partner

Blueprint receives compensation from our partners for featured offers, which impacts how and where the placement is displayed.

American Express® Gold Card

Welcome bonus

- Earn 60,000 Membership Rewards® points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership.

Regular APR

Credit score.

Credit Score ranges are based on FICO® credit scoring. This is just one scoring method and a credit card issuer may use another method when considering your application. These are provided as guidelines only and approval is not guaranteed.

Editor’s take

- Up to $240 in combined credits for Uber Cash and on select dining.

- High rewards rate on restaurants, U.S. supermarkets, and travel.

- Generous welcome bonus.

- $250 annual fee.

- Minimal travel perks.

- Complex rewards structure.

Card details

- Earn 4X Membership Rewards® Points at Restaurants, plus takeout and delivery in the U.S., and earn 4X Membership Rewards® points at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X).

- Earn 3X Membership Rewards® points on flights booked directly with airlines or on amextravel.com.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and each month automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S., totaling up to $120 per year.

- $120 Dining Credit: Satisfy your cravings and earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations. Enrollment required.

- Get a $100 experience credit with a minimum two-night stay when you book The Hotel Collection through American Express Travel. Experience credit varies by property.

- Choose the color that suits your style. Gold or Rose Gold.

- No Foreign Transaction Fees.

- Annual Fee is $250.

- Terms Apply.

The Amex Gold comes with a higher annual fee of $250 but has a bigger welcome bonus of 60,000 Membership Rewards points after spending $6,000 on eligible purchases in the first six months of card membership. The card also comes with up to $120 in annual dining credits eligible at participating locations, up to $120 in annual Uber Cash (card must be added to Uber app to receive this benefit) and an up to $100 experience credit with a two-night minimum stay when you book The Hotel Collection through Amex Travel. Enrollment is required for select benefits.

Comparing the American Express® Green Card * The information for the American Express® Green Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. and Amex Gold card benefits and deciding which is better for you comes down to your lifestyle and rewards goals as each has their draws and limitations.

Frequently asked questions (FAQs)

The American Express® Green Card * The information for the American Express® Green Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. is good for international travel as it has no foreign transaction fees, as well as trip delay ¹ , car rental insurance ³ and baggage insurance ² .

It also earns 3 points per $1 at restaurants, 3 points per $1 on travel including flights, hotels, transit, taxis, tours, and ridesharing services and 1 point per $1 on other purchases, expenses you’re likely to have when abroad.

The American Express® Green Card * The information for the American Express® Green Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. offers trip delay ¹ , baggage ² and car rental insurance ³ .

The credit limit on the American Express® Green Card * The information for the American Express® Green Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. is not specified and will vary person to person based on factors that include your credit history, current credit limits on other cards, income and existing debt.

The American Express® Green Card * The information for the American Express® Green Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. does not include Priority Pass lounge access, but it does have an up to $100 LoungeBuddy statement credit per calendar year, which can be used for day passes at participating lounges.

Whether the American Express® Green Card * The information for the American Express® Green Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. or Amex EveryDay® Credit Card * The information for the Amex EveryDay® Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer. is the better card for you depends on your spending habits and rewards goals.

The Amex EveryDay Card may be a better choice for someone who doesn’t want to pay an annual fee and is ok with earning fewer points on travel purchases but more points at U.S. supermarkets with limited additional benefits.

All information about American Express® Green Card and Amex EveryDay® Credit Card has been collected independently by Blueprint.

For rates and fees for the American Express® Gold Card please visit this page .

¹Up to $300 per Covered Trip that is delayed for more than 12 hours; and 2 claims per Eligible Card per 12 consecutive month period. Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by New Hampshire Insurance Company, an AIG Company.

²Baggage Insurance Plan coverage can be in effect for Eligible Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier (e.g. plane, train, ship, or bus) when the entire fare for a Common Carrier Vehicle ticket for the trip (one-way or round-trip) is charged to an eligible Account. Coverage can be provided for up to $1,250 for carry-on Baggage and up to $500 for checked Baggage, in excess of coverage provided by the Common Carrier (e.g. plane, train, ship, or bus). For New York State residents, there is a $10,000 aggregate maximum limit for all Covered Persons per Covered Trip. Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company.

³Car Rental Loss and Damage Insurance can provide coverage up to $50,000 for theft of or damage to most rental vehicles when you use your eligible Card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply. Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

⁴You can rely on Global Assist Hotline 24 hours a day / 7 days a week for medical, legal, financial or other select emergency coordination and assistance services while traveling more than 100 miles away from your home. Third-party service costs may be your responsibility. Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Card Members are responsible for the costs charged by third-party service providers.

⁵When an American Express® Card Member charges a Covered Purchase with their Eligible Card, Purchase Protection can help protect their Covered Purchases for up to 90 days from the Covered Purchase date if it is stolen or accidentally damaged. The coverage is limited up to $1,000 per occurrence, up to $50,000 per Card Member account per calendar year. Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company.

⁶When an American Express® Card Member charges a Covered Purchase with their Eligible Card, Purchase Protection can help protect their Covered Purchases for up to 90 days from the Covered Purchase date if it is stolen or accidentally damaged. The coverage is limited up to $1,000 per occurrence, up to $50,000 per Card Member account per calendar year. Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company.

*The information for the American Express® Green Card and Amex EveryDay® Credit Card has been collected independently by Blueprint. The card details on this page have not been reviewed or provided by the card issuer.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Tamara Aydinyan has been traveling the world with the help of miles and points for over a decade and enjoys teaching others to do the same. When she's not on the move, you can find her in Los Angeles or New York City, or on Instagram @deadlytravel.

Ashley Barnett has been writing and editing personal finance articles for the internet since 2008. Before editing for USA TODAY Blueprint, she was the Content Director for an international media company leading the content on their suite of personal finance sites. She lives in Phoenix, AZ where you can find her rereading Harry Potter for the 100th time.

Robin Saks Frankel is a credit cards lead editor at USA TODAY Blueprint. Previously, she was a credit cards and personal finance deputy editor for Forbes Advisor. She has also covered credit cards and related content for other national web publications including NerdWallet, Bankrate and HerMoney. She's been featured as a personal finance expert in outlets including CNBC, Business Insider, CBS Marketplace, NASDAQ's Trade Talks and has appeared on or contributed to The New York Times, Fox News, CBS Radio, ABC Radio, NPR, International Business Times and NBC, ABC and CBS TV affiliates nationwide. She holds an M.S. in Business and Economics Journalism from Boston University. Follow her on Twitter at @robinsaks.

Why I keep my Chase Ink Business Preferred card year after year

Credit cards Natasha Etzel

New 85K Chase Southwest credit cards’ welcome offer: It’s a scorcher

Credit cards Carissa Rawson

Why the Ink Business Unlimited is essential for small business owners

Credit cards Jason Steele

How much of my credit limit should I use?

Credit cards Louis DeNicola

American Express Platinum rental car benefits guide 2024

Credit cards Lee Huffman

What are the benefits of a business credit card?

Credit cards Sarah Brady

Secured vs. unsecured credit cards: What’s the difference?

Credit cards Michelle Lambright Black

Southwest credit card benefits guide 2024

Credit cards Julie Sherrier

Here’s how to avoid my embarrassing rookie Chase Sapphire Preferred travel redemption mistake

Ramp credit card review 2024: A corporate charge card that streamlines accounting

Americans’ travel habits and behavior in 2024

Credit cards Dawn Papandrea

American Express Platinum CLEAR® Plus benefit guide 2024

Credit cards Juan Ruiz

Citi Strata Premier vs. Wells Fargo Autograph Journey℠ Visa® Card

Is the Citi Diamond Preferred Card worth it?

Best credit cards for fair credit of June 2024

Credit cards Sarah Sharkey

Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Prepaid Cards

Personal Savings

Personal Checking and Loans

Business Banking

Book And Manage Travel

Travel Inspiration

Business Travel

Services and Support

Benefits and Offers

Manage Membership

Business Services

Checking & Payment Products

Funding Products

Merchant Services

Explore premium hotels around the world.

Platinum card® members get access to elevated benefits at over 2,200 hand-picked hotels around the world with fine hotels + resorts® and the hotel collection. terms apply..

Select locations and interests to pinpoint the right hotels for your next great escape.

Explore popular hotels that come highly recommended by Platinum Card Members.

Discover insider travel guides, emerging trends and one-of-a-kind hotels.

Enjoy elevated benefits with every booking.

With an experience credit and more, Platinum Card Members receive extra benefits at every Fine Hotels + Resorts® and The Hotel Collection property. †

When you book a Fine Hotels + Resorts®️ or The Hotel Collection stay through American Express Travel®️ you’ll earn Membership Rewards®️ points. Plus, you still earn loyalty points with hotels 1 .

Consumer Platinum Card Members get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts or The Hotel Collection † bookings with American Express Travel when you pay with your Platinum Card.*

View our latest offers, like a complimentary night or a property credit at select properties when you book at AmexTravel.com. Offers vary by property. Travel dates and terms apply.

Curated collections, endless inspiration.

Receive your Fine Hotels + Resorts® and The Hotel Collection benefits when you book with American Express Travel. Book online at AmexTravel.com . Terms apply.

*Terms and Conditions

Fine Hotels + Resorts Program: Fine Hotels + Resorts® (FHR) program benefits are available for new bookings made through American Express Travel with participating properties and are valid only for eligible U.S. Consumer, Business, and Corporate Platinum Card® Members, and Centurion® Members. Additional Platinum Card Members on Consumer and Business Platinum and Centurion Card Accounts are also eligible for FHR program benefits. Companion Card Members on Consumer Platinum and Centurion Card Accounts, Additional Business Gold and Additional Business Expense Card Members on Business Platinum and Centurion Card Accounts, and Delta SkyMiles® Platinum Card Members are not eligible for FHR program benefits. Bookings must be made using an eligible Card and must be paid using that Card, or another American Express® Card, in the eligible Card Member's name, and that Card Member must be traveling on the itinerary booked. The average total value of the program benefits is based on prior-year bookings for stays of two nights; the actual value varies. Noon check-in and room upgrade are subject to availability and are provided at check-in; certain room categories are not eligible for upgrade. The type of experience credit or additional amenity (if applicable) varies by property; the experience credit will be applied to eligible charges up to the amount of the experience credit. Advance reservations are recommended for certain experience credits. The type and value of the daily breakfast (for two) varies by property; breakfast will be valued at a minimum of US$60 per room per day. If the cost of Wi-Fi is included in a mandatory property fee, a daily credit of that amount will be applied at check-out. Benefits are applied per room, per stay (with a three-room limit per stay). Back-to-back stays booked by a single Card Member, Card Members staying in the same room or Card Members traveling in the same party within a 24-hour period at the same property are considered one stay and are ineligible for additional FHR benefits (“Prohibited Action”). American Express and the Property reserve the right to modify or revoke FHR benefits at any time without notice if we or they determine, in our or their sole discretion, that you may have engaged in a Prohibited Action, or have engaged in abuse, misuse, or gaming in connection with your FHR benefits. Benefit restrictions vary by property. Benefits cannot be redeemed for cash and are not combinable with other offers unless indicated. Benefits must be used during the stay booked. Any credits applicable are applied at check-out in USD or the local currency equivalent. Benefits, participating properties, and availability and amenities at those properties are subject to change. To be eligible for FHR program benefits, your eligible Card Account must not be cancelled. For additional information, call the number on the back of your Card.

The Hotel Collection Program: The Hotel Collection (THC) benefits are available for new bookings of two consecutive nights or more made through American Express Travel with participating properties and are valid only for eligible U.S. Consumer and Business Gold Card, Platinum Card® Members, and Centurion® Members. Additional Card Members on Consumer and Business Platinum Card Accounts, and Additional Card Members on Consumer and Business Centurion Accounts are also eligible for THC program benefits. Delta SkyMiles® Gold and Platinum Card Members are not eligible. Bookings must be made using an eligible Card and must be paid using that Card, or another American Express® Card, in the eligible Card Member's name, and that Card Member must be traveling on the itinerary booked. Room upgrade is subject to availability and is provided at check-in; certain room categories are not eligible for upgrade. The type of experience credit or additional amenity (if applicable) varies by property; the experience credit will be applied to eligible charges up to $100. Advance reservations are recommended for certain experience credits. Benefit restrictions vary by property. Benefits are applied per room, per stay (with a three-room limit per stay). Back-to-back stays booked by a single Card Member, Card Members staying in the same room or Card Members traveling in the same party within a 24-hour period at the same property are considered one stay and are ineligible for additional THC benefits (“Prohibited Action”). American Express and the Property reserve the right to modify or revoke the THC benefits at any time without notice if we or they determine, in our or their sole discretion, that you have engaged in a Prohibited Action, or have engaged in abuse, misuse, or gaming in connection with your THC benefits. Benefits cannot be redeemed for cash and are not combinable with other offers unless indicated. Benefits must be used during the stay booked. Any credits applicable are applied at check-out in USD or the local currency equivalent. Benefits, participating properties, and availability and amenities at those properties are subject to change. To be eligible for THC program benefits, your eligible Card Account must not be cancelled. For additional information, call the number on the back of your Card.

$200 Hotel Credit: Basic Card Members on U.S. Consumer Platinum Card Account are eligible to receive up to $200 in statement credits per calendar year when they or Additional Platinum Card Members use their Cards to pay for eligible prepaid Fine Hotels + Resorts® and The Hotel Collection bookings made through American Express Travel (meaning through amextravel.com, the Amex® App, or by calling the phone number on the back of your eligible Card) or when Companion Platinum Card Members on such Platinum Card Accounts pay for eligible prepaid bookings for The Hotel Collection made through American Express Travel (meaning through amextravel.com, the Amex® App, or by calling the phone number on the back of your eligible Card). Please note, access to the benefit may take up to 24 hours to take effect on your Card after Account opening. Purchases by both the Basic Card Member and any Additional Card Members on the Card Account are eligible for statement credits. However, the total amount of statement credits for eligible purchases will not exceed $200 per calendar year, per Card Account. Fine Hotels + Resorts® program bookings may be made only by eligible U.S. Consumer Basic Platinum and Additional Platinum Card Members. The Hotel Collection bookings may be made by eligible U.S. Consumer Basic and Additional Platinum Card Members and Companion Platinum Card Members on the Platinum Card Account. Delta SkyMiles® Platinum Card Members are not eligible for the benefit. To receive the statement credits, an eligible Card Member must make a new booking using their eligible Card through American Express Travel on or after July 1st, 2021, that is prepaid (referred to as "Pay Now" on amextravel.com and the Amex App), for a qualifying stay at an available, participating Fine Hotels + Resorts or The Hotel Collection property. Bookings of The Hotel Collection require a minimum stay of two consecutive nights. Eligible bookings must be processed before December 31st, 11:59PM Central Time, each calendar year to be eligible for statement credits within that year. Eligible bookings do not include interest charges, cancellation fees, property fees or other similar fees, or any charges by a property to you (whether for your booking, your stay or otherwise).

Statement credits are typically received within a few days, however it may take 90 days after an eligible prepaid hotel booking is charged to the Card Account. American Express relies on the merchant’s processing of transactions to determine the transaction date. The transaction date may differ from the date you made the purchase if, for example, there is a delay in the merchant submitting the transaction to us or if the merchant uses another date as the transaction date. This means that in some cases your purchase may not earn the statement credit benefit for the benefit period in which you made the purchase. For example, if an eligible purchase is made on December 31st but the merchant processes the transaction such that it is identified to us as occurring on January 1st, then the statement credit available in the next calendar year will be applied. Statement credits may not be received or may be reversed if the booking is cancelled or modified. If the Card Account is canceled or past due, it may not qualify to receive a statement credit. If American Express does not receive information that identifies your transaction as eligible, you will not receive the statement credits. For example, your transaction will not be eligible if it is a booking: (i) made with a property not included in the Fine Hotels + Resorts or The Hotel Collection programs, (ii) not made through American Express Travel, or (iii) not made with an eligible Card. Participating properties and their availability are subject to change. If American Express, in its sole discretion, determines that you have engaged in or intend to engage in any manner of abuse, misuse, or gaming in connection with this benefit, American Express will not have an obligation to provide and may reverse any statement credits provided to you. If a charge for an eligible purchase is included in a Pay Over Time balance on your Card Account, the statement credit associated with that charge may not be applied to that Pay Over Time balance. Instead, the statement credit may be applied to your Pay In Full balance. Please refer to AmericanExpress.com/FHR and AmericanExpress.com/HC for more information about Fine Hotels + Resorts and The Hotel Collection, respectively.

5X Membership Rewards® Points Platinum Card: Basic Card Members will get 1 Membership Rewards® point for each dollar charged for eligible purchases on their Platinum Card® or an Additional Card on their Account and 4 additional points (for a total of 5 points) for each dollar charged for eligible travel purchases on any Card on the Account (“Additional Points”), minus cancellations and credits. Eligible travel purchases are limited to: (i) purchases of air tickets on scheduled flights, of up to $500,000 in charges per calendar year, booked directly with passenger airlines or through American Express Travel (by calling 1-800-525-3355 or through AmexTravel.com); (ii) purchases of prepaid hotel reservations booked through American Express Travel; and (iii) purchases of prepaid flight+hotel packages booked through AmexTravel.com. Eligible travel purchases do not include: charter flights, private jet flights, flights that are part of tours, cruises, or travel packages (other than prepaid flight+hotel packages booked through AmexTravel.com), ticketing or similar service fees, ticket cancellation or change fees, property fees or similar fees, hotel group reservations or events, interest charges, or purchases of cash equivalents. Eligible prepaid hotel bookings or prepaid flight+hotel bookings that are modified directly with the hotel will not be eligible for Additional Points.

Bonuses that may be received with your Card on other purchase categories or in connection with promotions or offers from American Express cannot be combined with this benefit. Any portion of a charge that the Basic Card Member elects to cover through redemption of Membership Rewards points is not eligible to receive points. Additional terms and restrictions apply.

Merchants are assigned codes based on what they primarily sell. We group certain merchant codes into categories that are eligible for Additional Points. A purchase with a merchant will not earn Additional Points if the merchant’s code is not included in an Additional Points category. Basic Card Members may not receive Additional Points if we receive inaccurate information or are otherwise unable to identify your purchase as eligible for an Additional Points category. For example, you may not receive Additional Points when: a merchant uses a third-party to sell their products or services, a merchant uses a third-party to process or submit your transaction to us (e.g., using mobile or wireless card readers), or you choose to make a purchase using a third-party payment account or make a purchase using a mobile or digital wallet.

To be eligible for this benefit, the Card Account must not be cancelled. If American Express, in its sole discretion, determines that you have engaged in or intend to engage in any manner of abuse, misuse, or gaming in connection with this benefit in any way American Express may remove access to this benefit from the Account. For additional information, call the number on the back of your Card or visit americanexpress.com/rewards-info for more information about rewards.

5X Membership Rewards Points for Business Platinum Card: You will get one point for each dollar charged for an eligible purchase on your Business Platinum Card® from American Express. You will get 4 additional points (for a total of 5 points) for each dollar spent on eligible travel purchases. Eligible travel purchases include scheduled flights and prepaid flight+hotel packages made online at AmexTravel.com, minus returns and other credits. Additionally, eligible travel purchases include prepaid hotel purchases made through American Express Travel, over the phone with our Travel Consultants or made online at AmexTravel.com, minus returns and other credits. Eligible travel purchases do NOT include non-prepaid hotel bookings, scheduled flights and prepaid flight+hotel packages over the phone, vacation packages, car rentals, cruise, hotel group reservations or events, ticketing service, cancellation or other fees, interest charges, purchases of travelers checks, purchases or reloading of prepaid cards, or purchases of other cash equivalents. To be eligible for the 5x Membership Rewards® points, you must both reserve and charge the travel purchase with the same eligible Business Platinum Card®. To modify a reservation you must cancel and rebook your reservation. You can cancel and rebook your reservation on AmexTravel.com or by calling a representative of AmexTravel.com at 1-800-297-2977. Cancellations are subject to hotel cancellation penalty policies. If hotel reservations are made or modified directly with the hotel provider, the reservation will not be eligible for this 5X Membership Rewards® point benefit. To be eligible to receive extra points, Card account(s) must not be cancelled or past due at the time of extra points fulfillment. If booking is cancelled, the extra points will be deducted from the Membership Rewards account. Extra points will be credited to the Membership Rewards account approximately 6-10 weeks after eligible purchases appear on the billing statement. Bonuses you may receive with your Card on other purchase categories or in connection with promotions or offers from American Express may not be combined with this benefit. The benefits associated with the Additional Card(s) you choose may be different than the benefits associated with your basic Card. To learn about the benefits associated with Additional Card(s) you choose, please call the number on the back of your Card.

Merchants are assigned codes based on what they primarily sell. We group certain merchant codes into categories that are eligible for additional points. A purchase with a merchant will not earn additional points if the merchant’s code is not included in an additional points category. You may not receive additional points if we receive inaccurate information or are otherwise unable to identify your purchase as eligible for an additional points category. For example, you may not receive additional points when: a merchant uses a third-party to sell their products or services; or a merchant uses a third-party to process or submit your transaction to us (e.g., using mobile or wireless card readers); or you choose to make a purchase using a third-party payment account or make a purchase using a mobile or digital wallet.

Please visit americanexpress.com/rewards-info for more information about rewards.

Pay with Points: To use Pay with Points, you must charge your eligible purchase through American Express Travel to a Membership Rewards® program-enrolled American Express® Card. Eligible purchases through American Express Travel exclude non-prepaid car rentals and non-prepaid hotels. Points will be debited from your Membership Rewards account, and credit for corresponding dollar amount will be issued to the American Express Card account used. If points redeemed do not cover entire amount, the balance of purchase price will remain on the American Express Card account. Minimum redemption 5,000 points.

See membershiprewards.com/terms for the Membership Rewards program terms and conditions.

If a charge for a purchase is included in a Pay Over Time balance on your Linked Account the statement credit associated with that charge may not be applied to that Pay Over Time balance. Instead the statement credit may be applied to your Pay in Full balance. If you believe this has occurred, please contact us by calling the number on the back of your Card. Corporate Card Members are not eligible for Pay Over Time.

Terms and Conditions for the Membership Rewards® program apply. Visit membershiprewards.com/terms for more information. Participating partners and available rewards are subject to change without notice.

The value of Membership Rewards points varies according to how you choose to use them. To learn more, go to www.membershiprewards.com/pointsinfo .

American Express Travel Related Services Company, Inc. is acting solely as a sales agent for travel suppliers and is not responsible for the actions or inactions of such suppliers. Certain suppliers pay us commission and other incentives for reaching sales targets or other goals and may provide incentives to our Travel Consultants. For more information visit americanexpress.com/travelterms

California CST#1022318; Washington UBI#600-469-694

3 dream trips you can take with 100,000 Amex Membership Rewards Points

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Let’s say you recently applied for one of the most legendary cards on the market— the Platinum Card by American Express —and scored a hefty, six-figure welcome bonus.

As a well-informed credit card aficionado, you know that those American Express Membership Rewards Points are worth a measly 0.6 cents per point if you opt for a cash-back redemption, but can be worth a lot more if saved toward your next vacation. But where should you go?

Amex has so many transfer partners that it can be genuinely tricky to a) consider which partners will maximize the value of your points and b) plan out your next adventure from there. That’s why Fortune Recommends decided to do the hard work for you. From petting wombats outside Sydney to neon-soaked tours of Tokyo, here are three dream trips you can take with 100,000 Membership Rewards Points.

The Platinum Card® from American Express

See Rates and Fees

Intro bonus

Reward Rates

- 5X Earn 5x Membership Rewards® Points for flights booked directly with airlines or with American Express Travel (up to $500,000 on these purchases per calendar year)

- 5X Earn 5x Membership Rewards® Points on prepaid hotels booked with American Express Travel

- 1X Earn 1x points on other eligible purchases

- Packed with valuable potential credits for digital entertainment, Uber Cash, Walmart+ membership, and more.

- Airport lounge access with a larger network than any other card

- Membership Rewards are valuable due to their flexibility.

- The multiple potential credits can be cumbersome to track.

- Sky-high annual fee

- Some of the perks can be hard to use if they don’t align with your lifestyle.

Other benefits

- Travel benefits including hotel and car rental chain statuses, car rental insurance, trip cancellation/interruption and travel delay protection

- Consumer protections including extended warranty and return protection

1. Order life-changing ramen in Tokyo

If you’ve read our guide on the best redemption options for Membership Rewards, you’ll know that your best option—by far—is to transfer your points to an airline or hotel loyalty program.

Amex has 21 transfer partners as of this writing, including 18 airlines and three hotel chains (complete list below). Unless otherwise stated, you can transfer 1,000 Membership Rewards Points (MRP) in exchange for 1,000 partner points, meaning a 1:1 transfer rate.

Airline partners

- AeroMexico (1,000 MRP to 1,600 AeroMexico Rewards Points)

- AIR FRANCE KLM

- ANA Mileage Club

- Avianca LifeMiles

- British Airways Executive Club

- Cathay Pacific

- Delta Air Lines

- Emirates Skywards

- Etihad Guest

- HawaiianMiles

- Iberia Plus

- JetBlue TrueBlue (250 MRP to 200 TrueBlue points)

- Qantas Frequent Flyer (500 MRP to 500 Qantas Points)

- Qatar Airways Privilege Club

- Singapore Airlines KrisFlyer

- Virgin Atlantic Flying Club

Hotel partners

- Choice Privileges

- Hilton Honors (1,000 MRP to 2,000 Hilton Honors Points)

- Marriott Bonvoy

Now, how does this chart help you order comfortingly hot, gloriously authentic ramen in Tokyo?

Well, the trick to redeeming Membership Rewards Points is to know which partner has the most valuable points. Japan’s largest airline ANA, for example, has points that can sometimes be worth well over 2 cents per point (CPP) each. That means a flight from JFK to Tokyo—which would normally cost you well over $800—may cost you as little as 40,000 ANA Mileage Club Miles round trip . See the example from my own research below: