e-filing and Centralized Processing Center

e-Filing of Income Tax Return or Forms and other value added services & Intimation, Rectification, Refund and other Income Tax Processing Related Queries

1800 103 0025 (or)

1800 419 0025

+91-80-46122000

+91-80-61464700

08:00 hrs - 20:00 hrs

(Mon to Fri)

Tax Information Network - NSDL

Queries related to PAN & TAN application for Issuance / Update through NSDL

+91-20-27218080

07:00 hrs - 23:00 hrs

AIS and Reporting Portal

Queries related to AIS, TIS, SFT Preliminary response, Response to e-campaigns or e-Verification

1800 103 4215

09:30 hrs - 18:00 hrs

(Monday to Friday)

- Guidance to file Tax Return

- Return / Forms applicable to me

- Deductions on which I can get tax benefit

- Update my profile details

- Assisted filing

- Guidance to file Tax return

- Registration

- Service Available

- API Specifications

- Central & State Government Department/Approved Undertaking Agency

- RBI Approved Banks

Instant e-PAN

A video demonstrating how to use the following features in the Instant e-PAN service: Apply for an e-PAN, Update PAN

A video demonstrating how to use the following features in the Instant e-PAN service: Apply for an e-PAN, Update PAN details as per Aadhaar e-KYC, Check request status of e-PAN applied for, and view/download e-PAN (before and after login).

Follow us on

Last reviewed and updated on : current time

This site is best viewed in 1024 * 768 resolution with latest version of Chrome, Firefox, Safari and Microsoft Edge.

Copyright @ Income Tax Department, Ministry of Finance, Government of India. All Rights Reserved.

AI Summary to Minimize your effort

e PAN Card Download - How to Download e PAN Card?

Updated on : Jul 29th, 2024

An e-PAN card is a digital PAN (Permanent Account Number) card that can be used as proof of identification. It is easier and more convenient to use an e-PAN card than a physical PAN card, as it can be stored digitally. You will receive the e-PAN card in your email after you apply for it. However, you can also download your e-PAN card in various ways, store it digitally and use it wherever a PAN card is required.

e-PAN card download

After applying for the e-PAN card, you can download it once it is generated. Usually, the e-PAN card will be generated and allotted after 15 days of its application on the NSDL or UTIITSL website . The instant e-PAN card applied on the Income Tax website will be generated within 10 minutes of its application.

However, please note that you can download the e-PAN card from the NSDL website only when you have applied for it on the NSDL website. Similarly, you can download the e-PAN card from the UTIITSL website only when you have applied for it on the UTIITSL website. The instant e-PAN card applied on the Income Tax website can be downloaded only through the Income Tax e-Filing website.

How to download e-PAN card online?

You can download the e-PAN card on the NSDL, UTIITSL or the Income Tax website using the acknowledgement number or the PAN number. The steps to download an e-PAN card from different websites are detailed below.

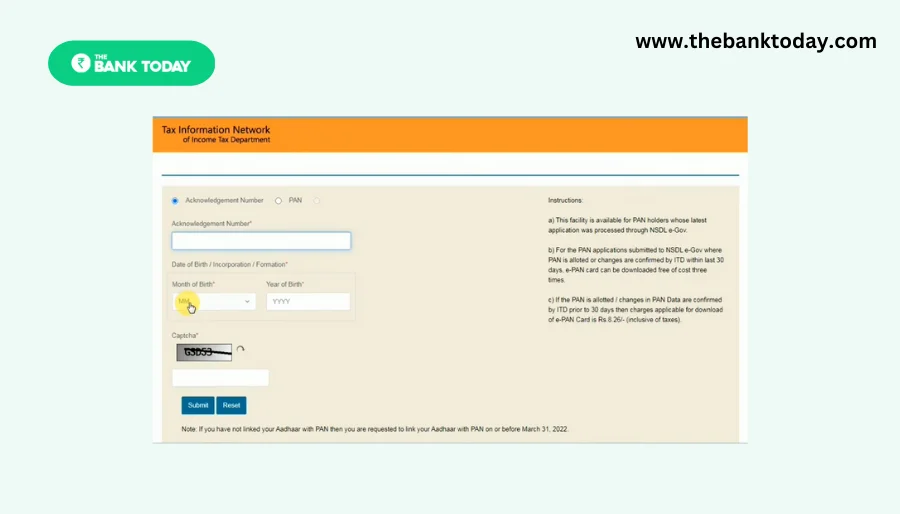

Download e-PAN card NSDL

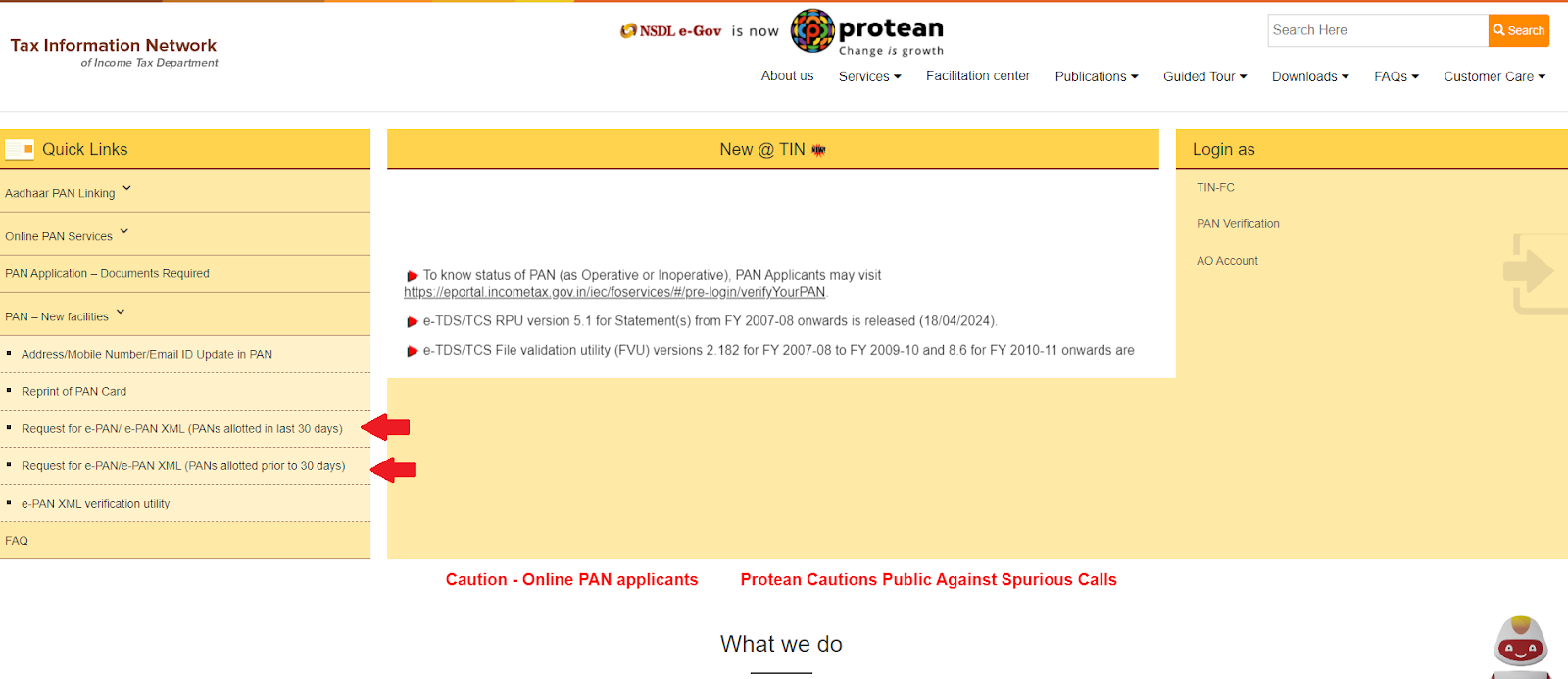

Step 1: Visit the NSDL Protean portal .

Step 2: Click on ‘PAN-New facilities’ under ‘Quick Links’.

Step 3: Select the ‘Download e-PAN/e-PAN XML (PANs allotted in last 30 days)’ or the ‘Download e-PAN/e-PAN XML (PANs allotted prior to 30 days)’ option, as applicable.

Step 4: Choose ‘Acknowledgement Number’, enter the acknowledgement number, date of birth, and captcha code and click ‘Submit’.

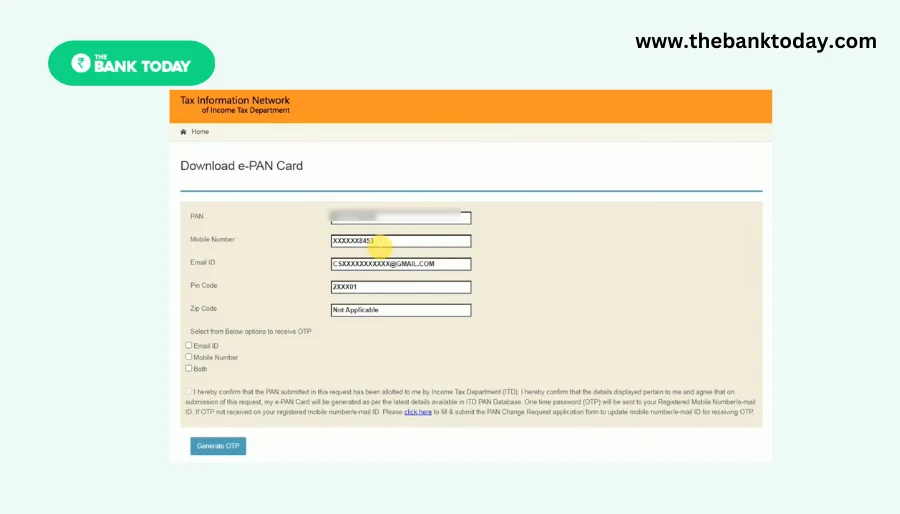

Step 5: Select email ID, mobile number or both and click on the ‘Generate OTP’ button.

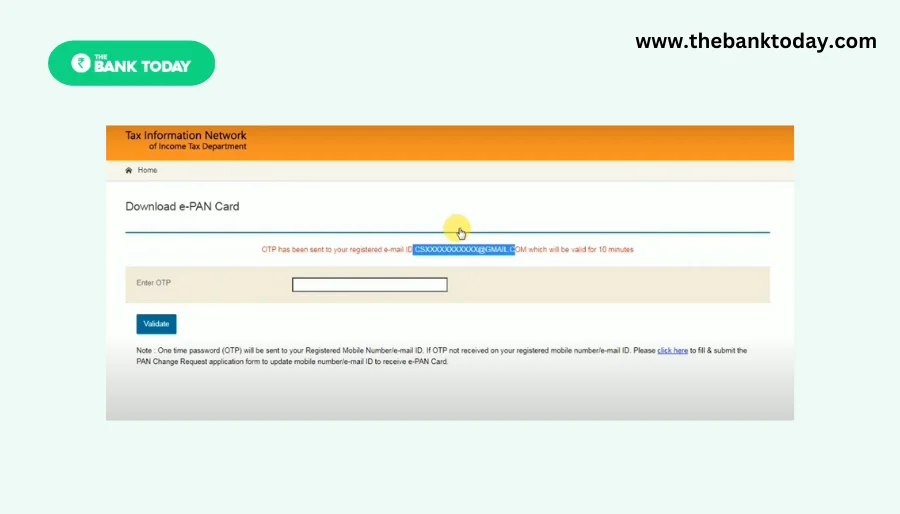

Step 6: Enter the OTP received on your email ID, mobile number or both, and click ‘Validate’.

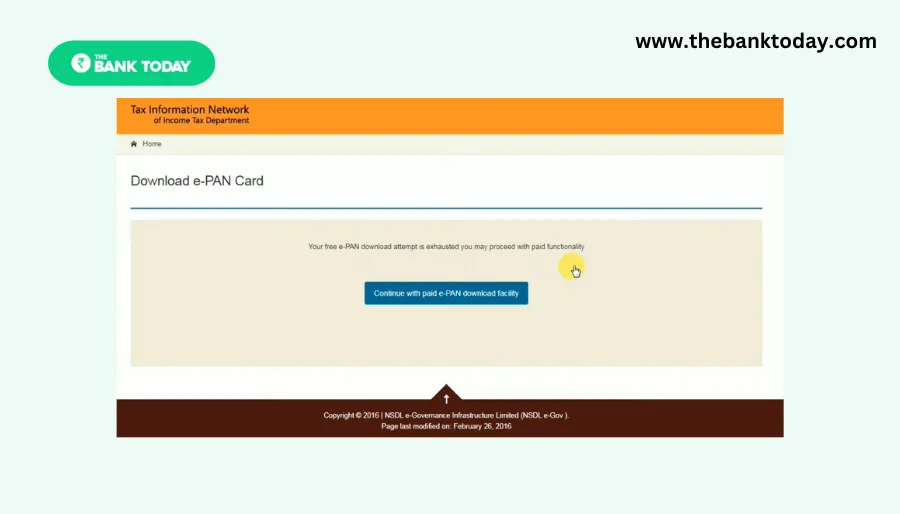

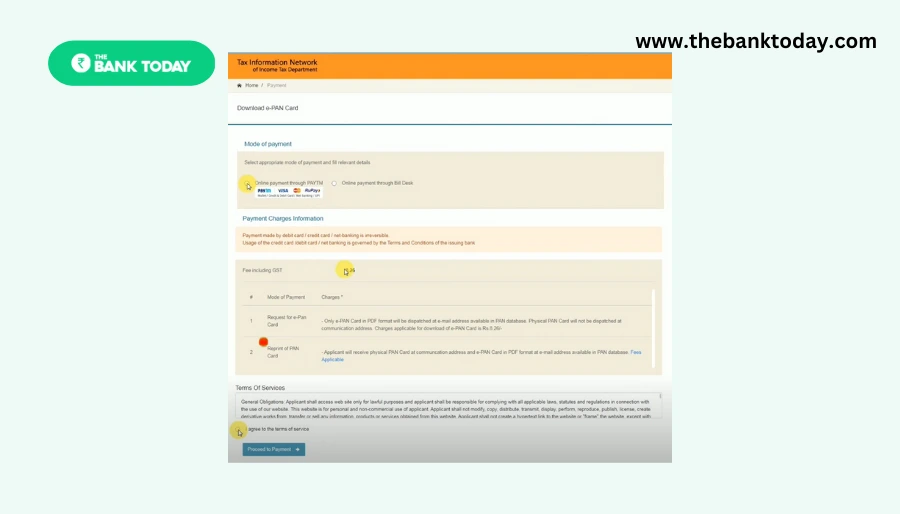

Step 7: Click on the ‘Download PDF’ button. However, you can download the e-PAN card for free within 30 days of its allotment. If you want to download the e-PAN card after 30 days of its allotment, you will have to click on the ‘Continue with paid e-PAN download facility’ and pay the fee of Rs.8.26 to download the e-PAN card.

The pdf file of your e-PAN card will get downloaded. You must enter the e-PAN card password to access the e-PAN card.

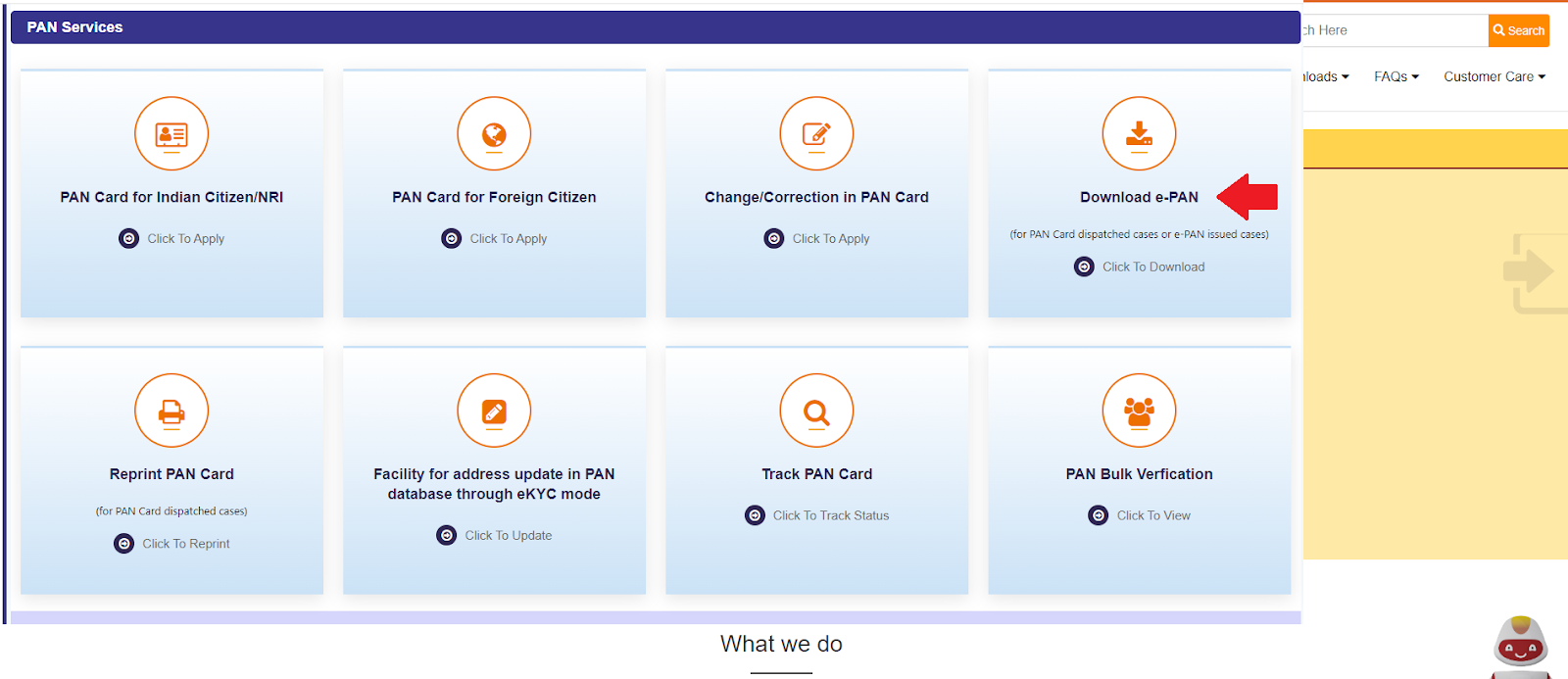

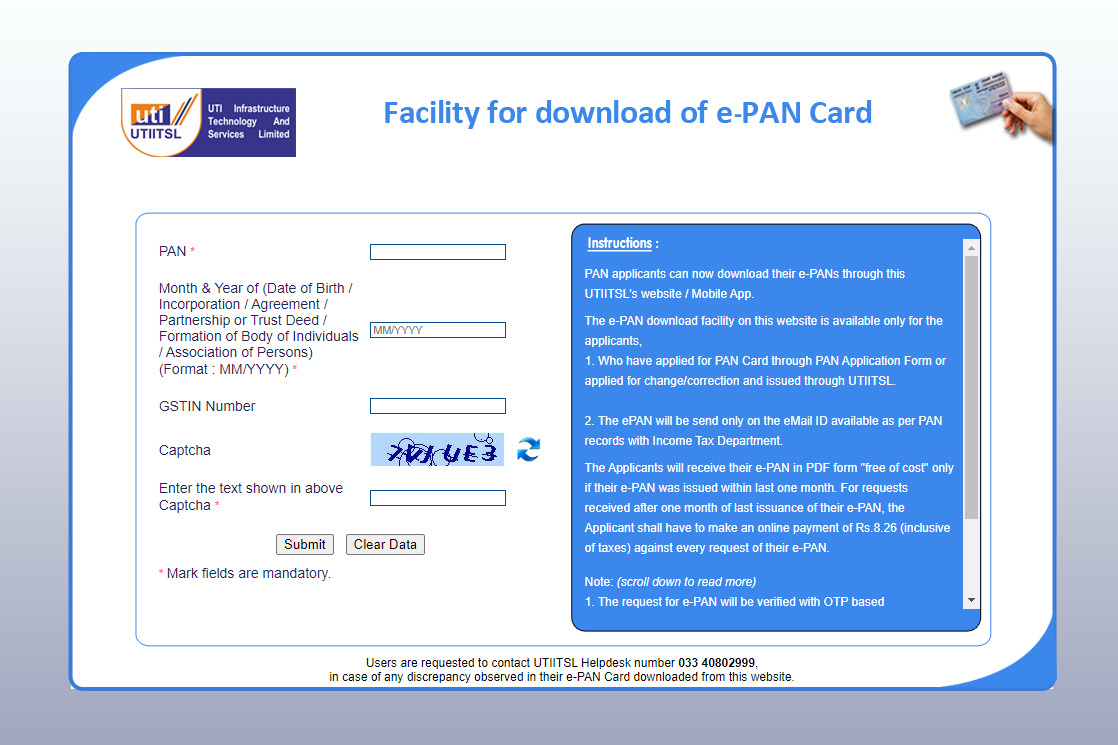

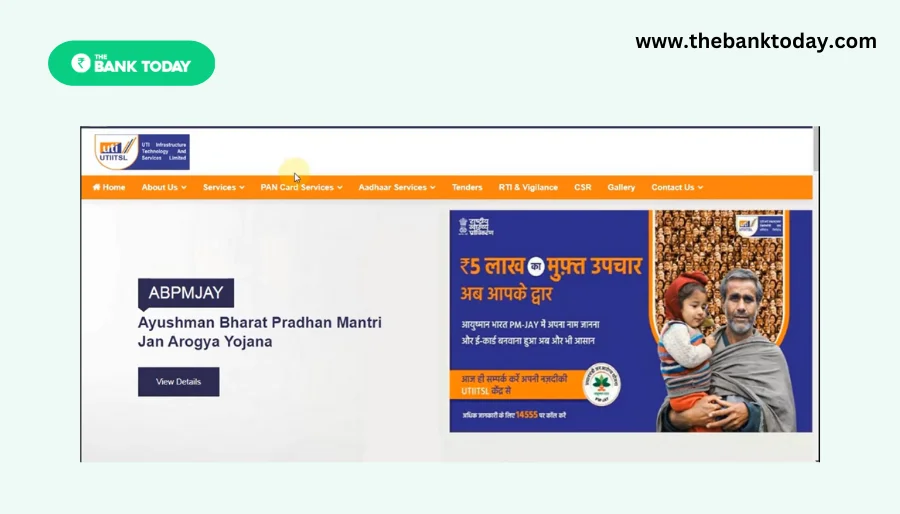

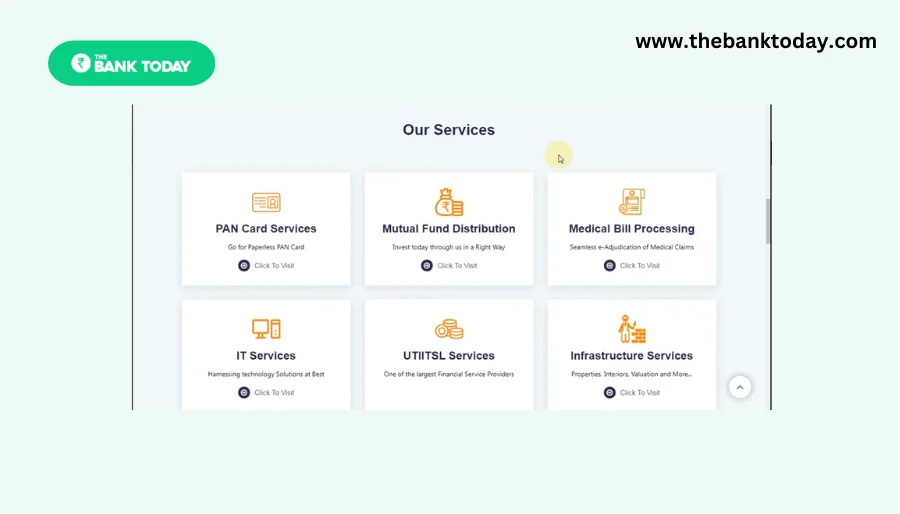

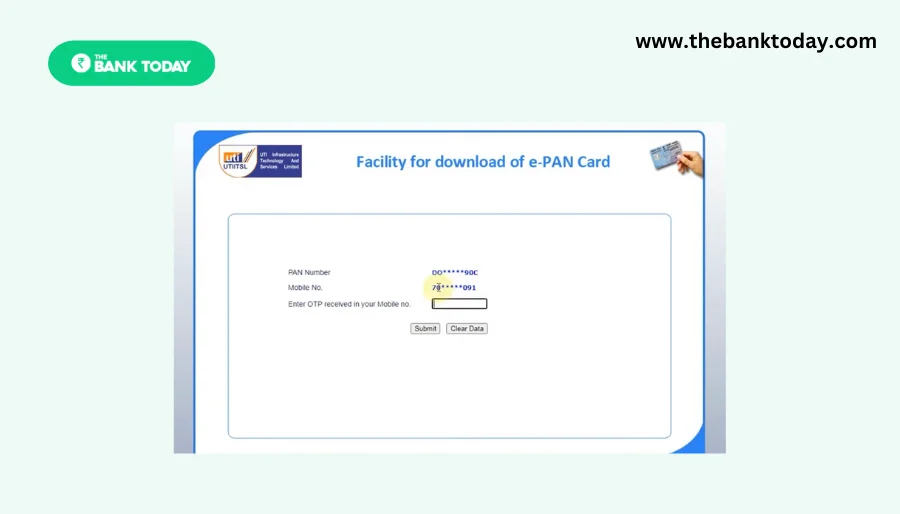

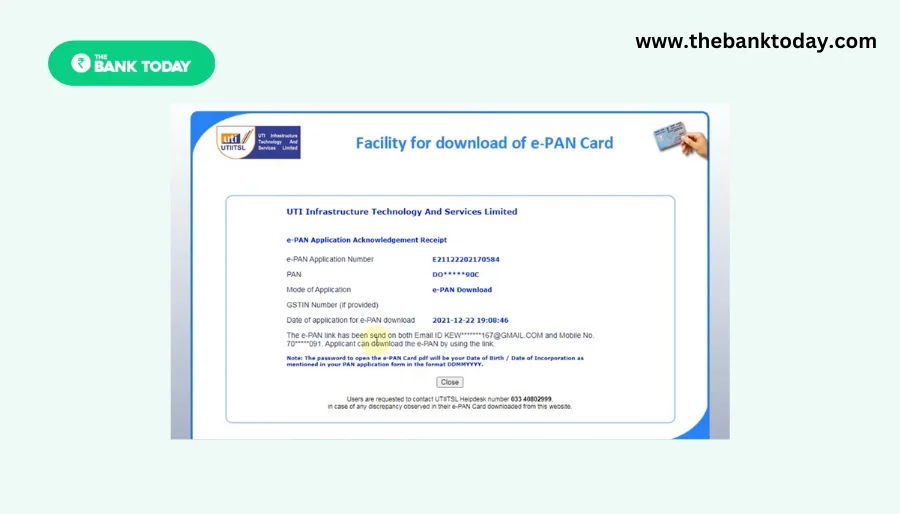

Download e-PAN card UTI/ UTIITSL

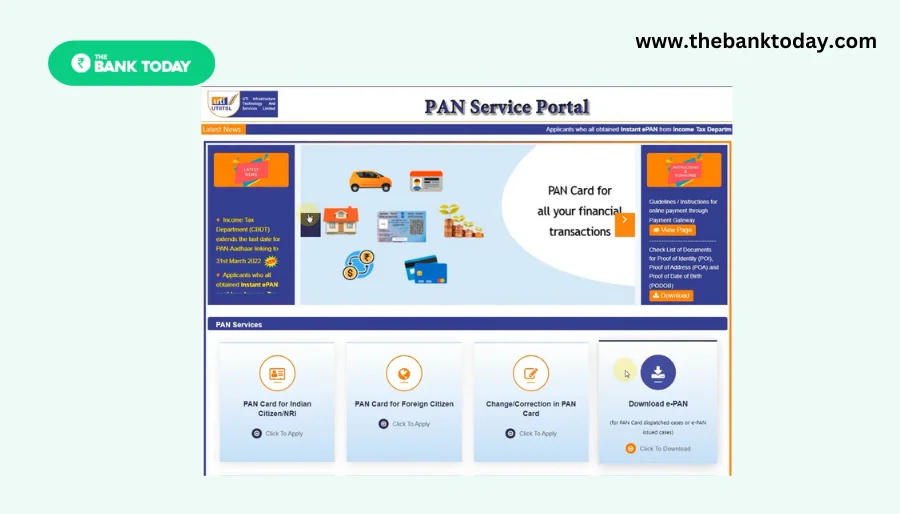

Step 1: Go to the official UTIITSL portal .

Step 2: On the homepage, navigate to the ‘Download e-PAN’ tab and click on ‘Click to Download’.

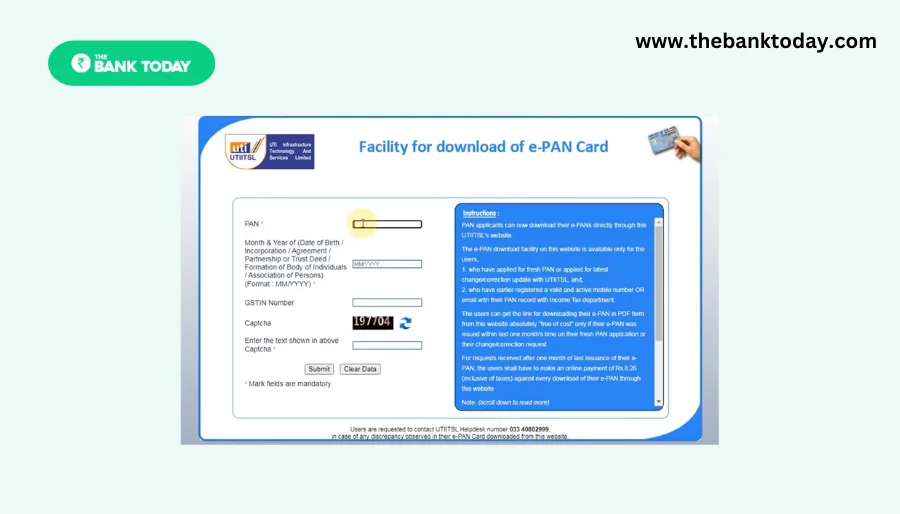

Step 3: Enter the PAN, date of birth, GSTIN number if applicable, and captcha code and click the ‘Submit’ button.

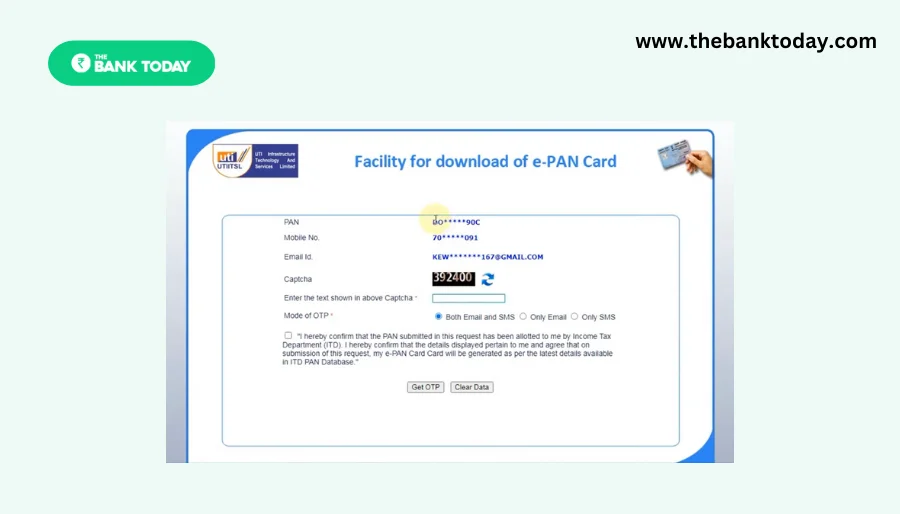

Step 4: You will receive a link on your email ID.

Step 5: Click on the link to download your e-PAN card using the OTP.

However, you can download the e-PAN card for free within 30 days of its allotment. If you want to download the e-PAN card after 30 days of its allotment, you will have to pay the fee of Rs.8.26 to download the e-PAN card.

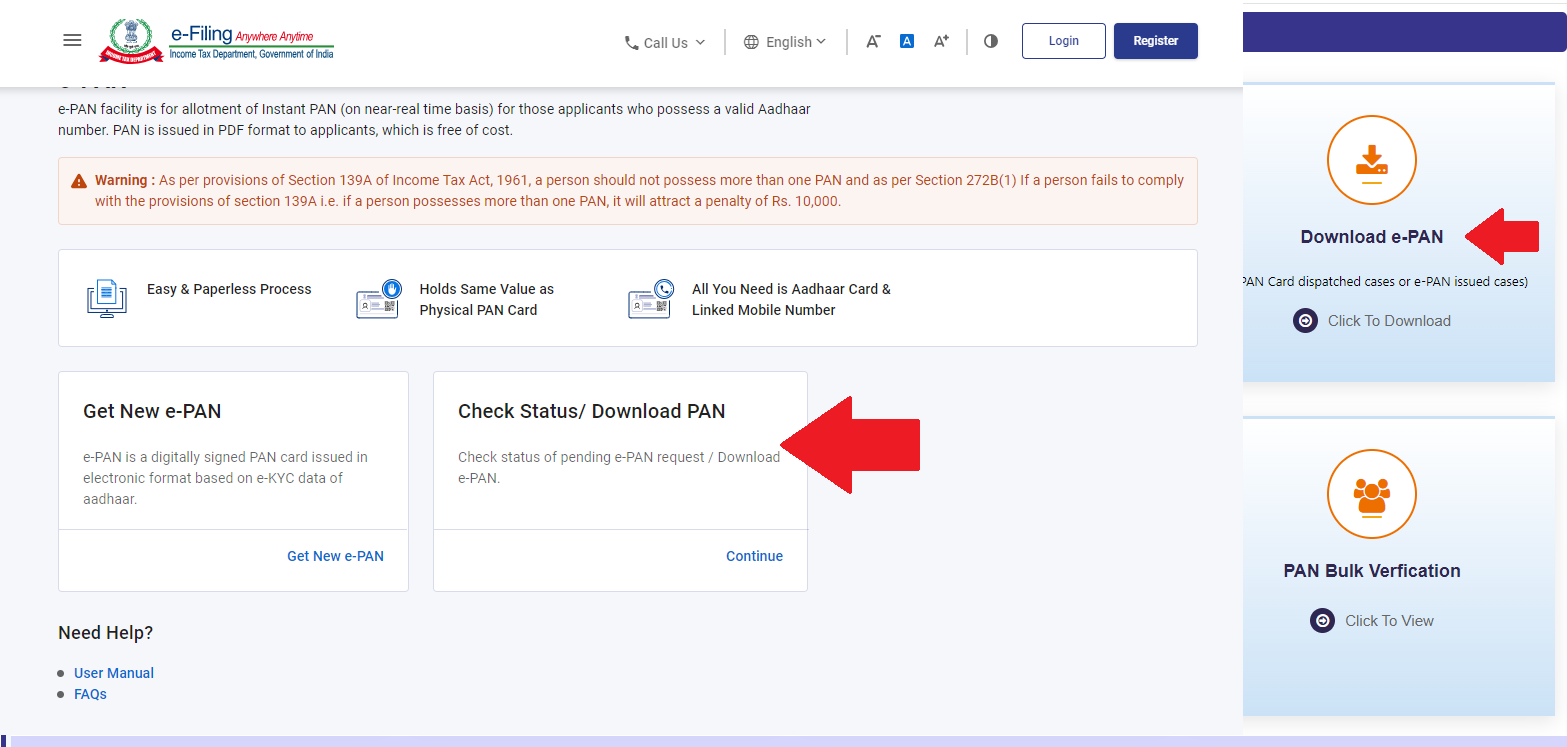

e-PAN card download Income Tax

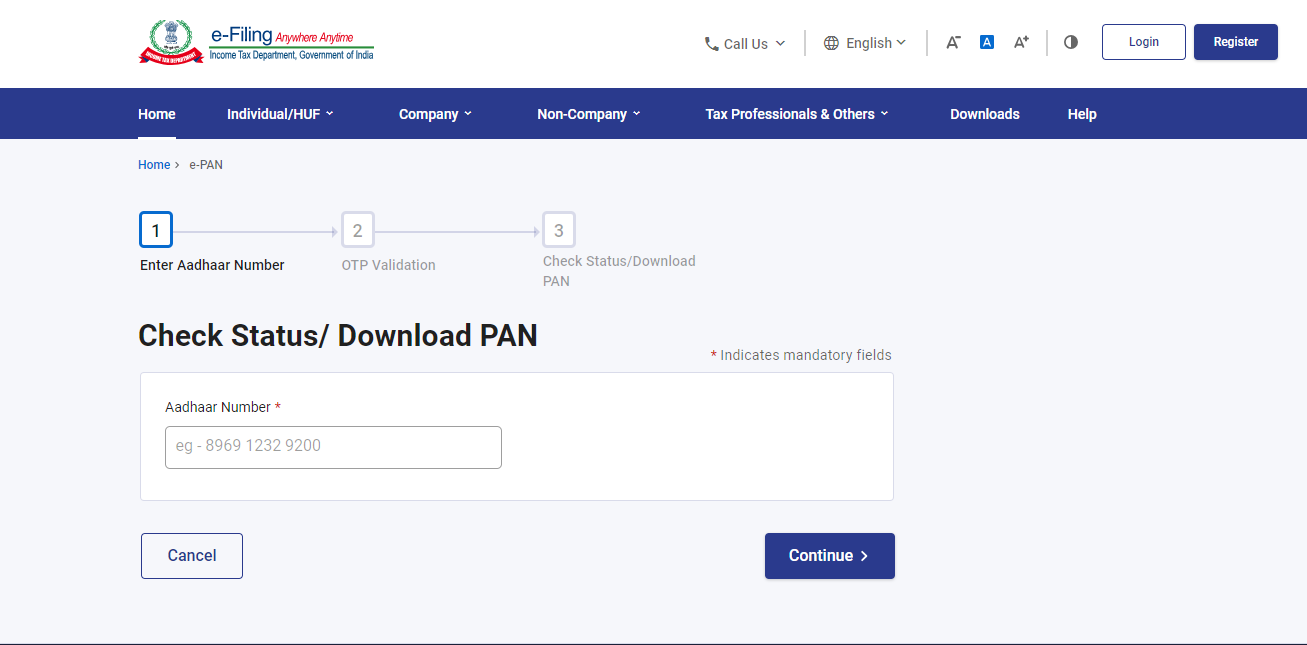

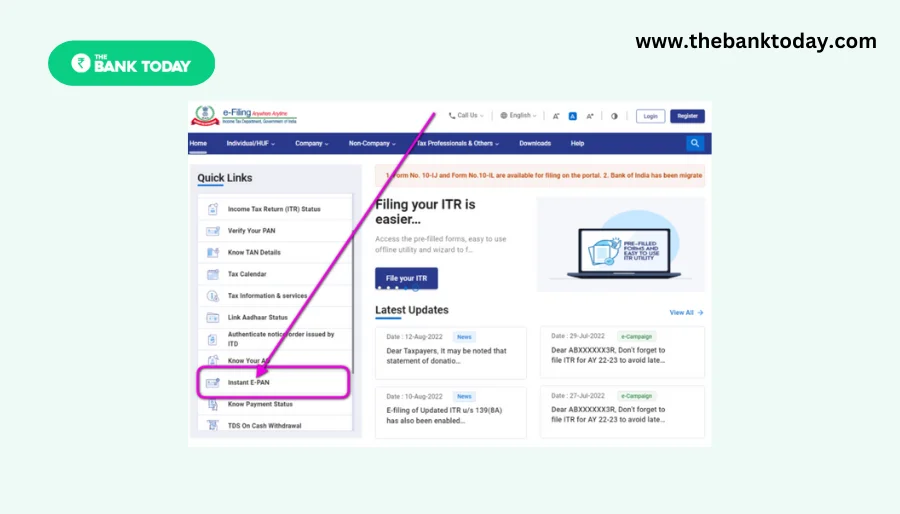

Step 1: Visit the Income Tax e-Filing website .

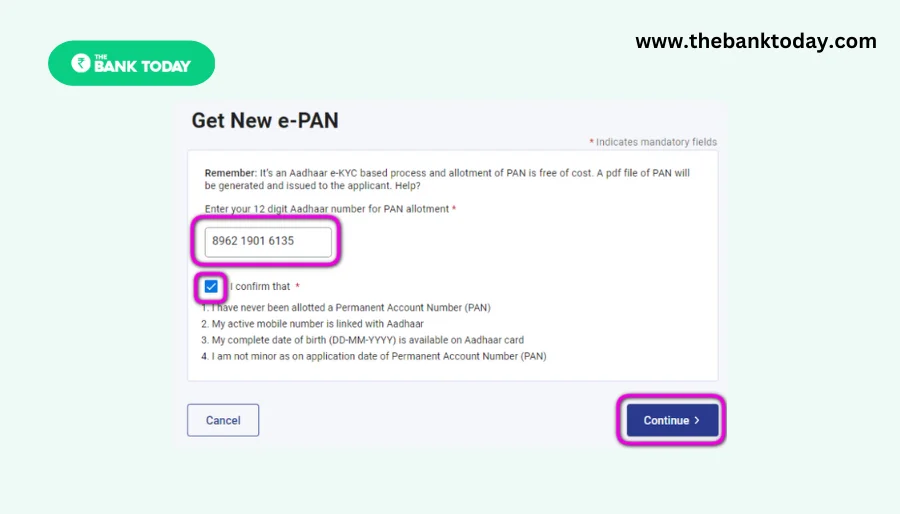

Step 2: Select the ‘Instant E-PAN’ option under ‘Quick Links’ heading.

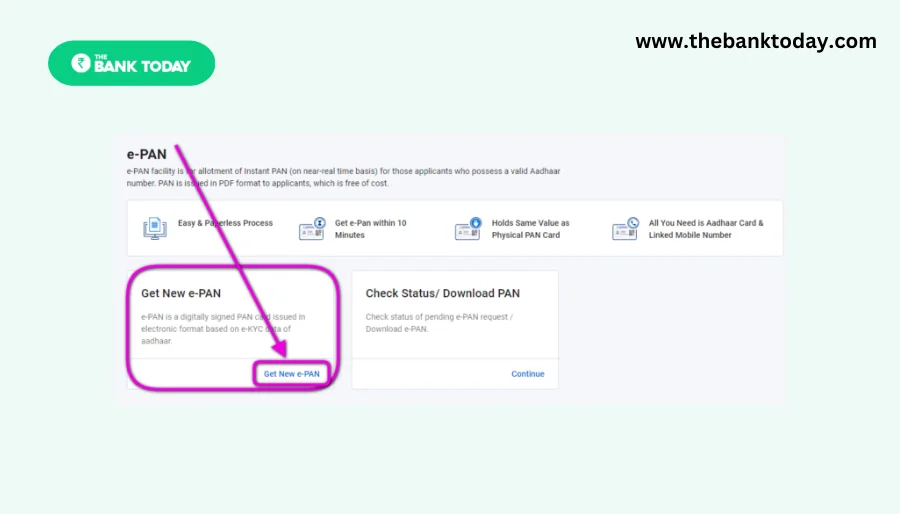

Step 3: Click on ‘Continue’ under the ‘Check Status/ Download PAN’ tab.

Step 4: Enter your Aadhaar number and click ‘Continue’.

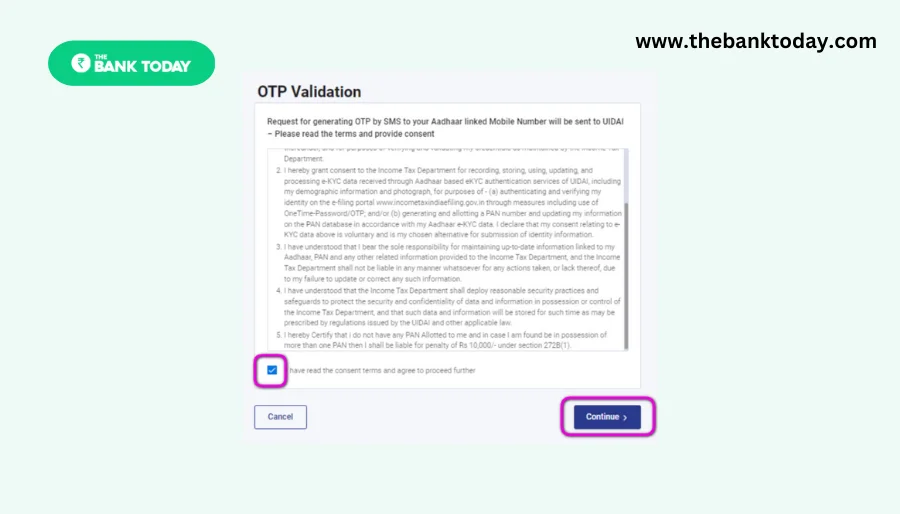

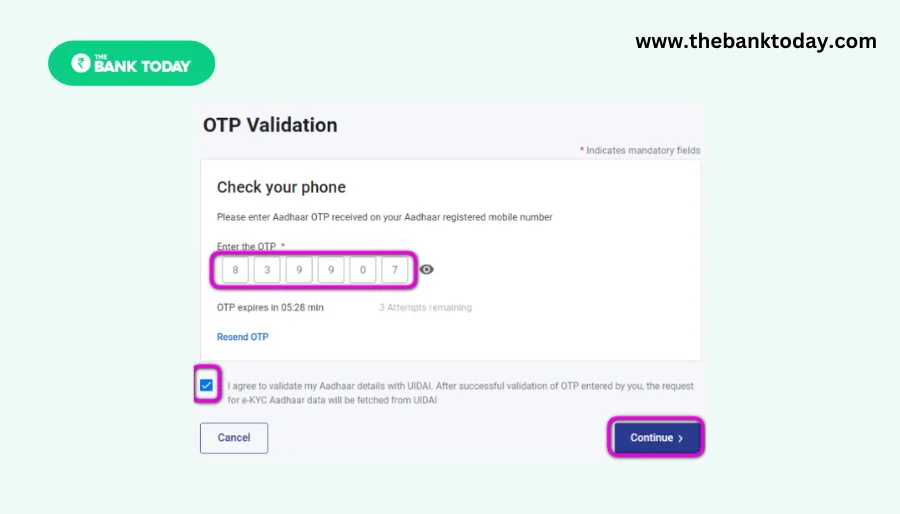

Step 5: Enter the OTP received on your Aadhaar registered mobile number, select the check box and click ‘Continue’.

Step 6: Click on the ‘Download e-PAN’ button to download the e-PAN card.

How to download e-PAN card without PAN number?

When you have applied for the e-PAN card on the NSDL website, you can download it without a PAN number by following the below process:

- Visit the NSDL portal .

- Select the ‘Acknowledgement Number’, and enter the acknowledgement number, date of birth, and captcha code.

- Select the mode of receiving OTP, and enter the OTP to download your e-PAN card.

When you apply for an instant e-PAN card by entering your Aadhaar number, you can download your e-PAN card after 10 minutes of its application without a PAN number by following the process:

- Visit the Income Tax website .

- Click on ‘Continue’ under the ‘Check Status/ Download PAN’ tab.

- Enter your Aadhaar number and click ‘Submit’.

- Enter the OTP, tick the check box and click ‘Submit’.

- Click on the ‘Download e-PAN’ button to download your e-PAN card without a PAN number.

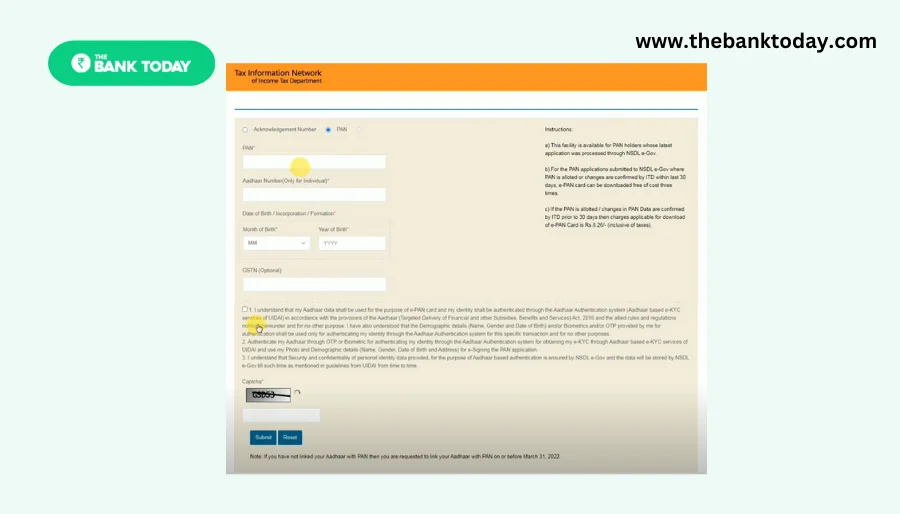

How to download e-PAN card with PAN number?

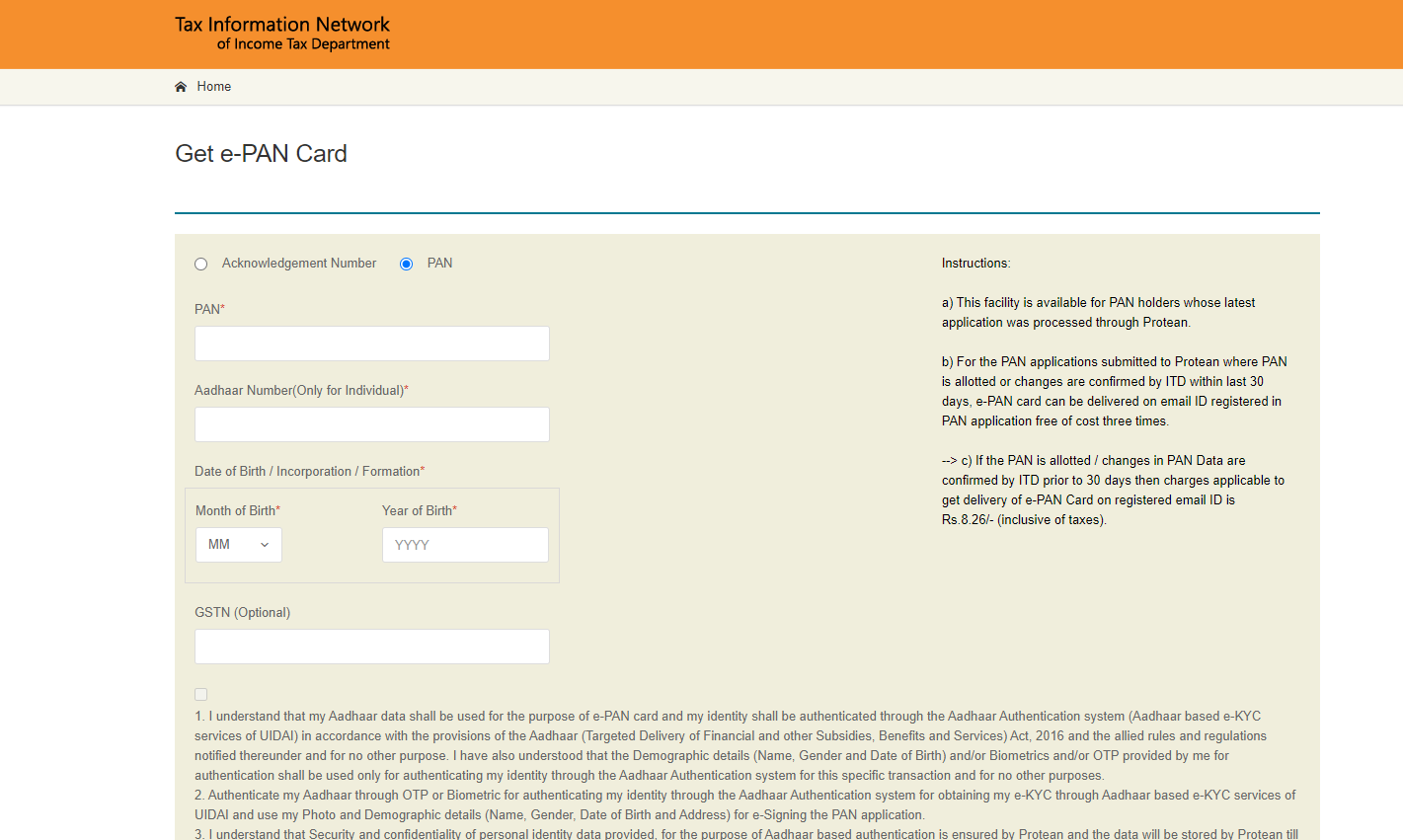

When you have applied for the e-PAN card on the NSDL website, you can download it by entering your PAN number by following the below process:

- Select ‘PAN’, and enter the PAN number, date of birth, Aadhaar number (if applicable) and captcha code.

When you have applied for the e-PAN card on the UTIITSL website, you can download it by entering your PAN number by following the below process:

- Visit the UTIITSL portal .

- Enter the PAN number, date of birth, GSTIN (if applicable) and captcha code.

- Click on the link received on your email ID, and enter OTP to download your e-PAN card.

e-PAN card download by Aadhaar number

When you have applied for an instant e-PAN card, you can download it by entering your Aadhaar number by following the below process:

- Click on ‘Continue’ under the ‘Check/ Download PAN’ tab.

Download e-PAN card with acknowledgement number

When you have applied for the e-PAN card on the NSDL website, you can download it by entering the acknowledgement number by following the below process:

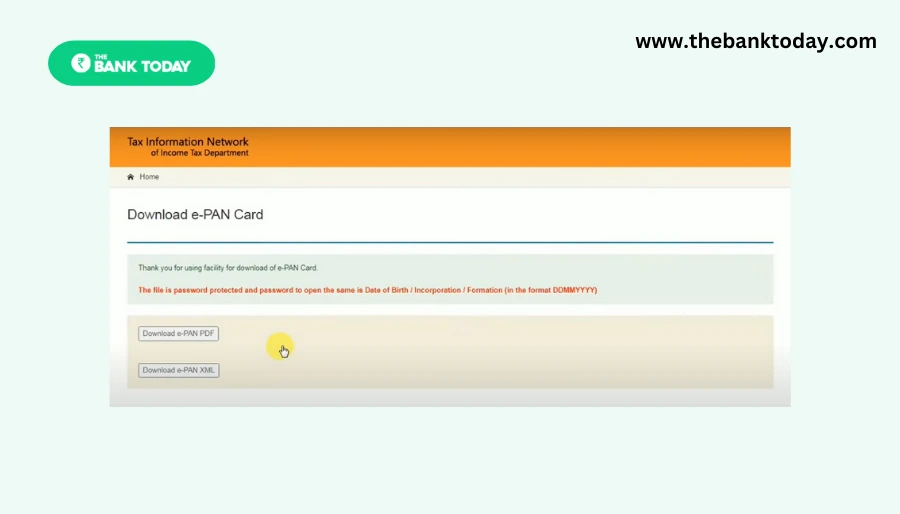

e-PAN card download Password

When you download the e-PAN card from the NSDL, UTIITSL or the Income Tax website, enter the e-PAN card download password to open the downloaded pdf file and access your e-PAN card. The password to open the e-PAN card pdf file is your date of birth or date of incorporation in the following format: DDMMYYYY .

Downloading your e-PAN card from the NSDL, UTIITSL, or the Income Tax website is easy. You only need your acknowledgement number, PAN number or the Aadhaar number and date of birth to download your e-PAN card. Once you download your e-PAN card, you can submit it as proof of identity for any financial transactions or other purposes.

Related PAN Content: 1. PAN Card Download 2. Link Aadhaar to PAN 3. Duplicate PAN Card 4. Pan Card Status 5. PAN Card Password 6. Check PAN Card Status by Mobile Number 7. Instant PAN Card Through Aadhaar 8. PAN Card Apply Online 9. PAN Card Customer Care Number 10. PAN Card Fraud 11. e PAN Card 12. What to do if you have two PAN 13. PAN Card Form 49A 14. Aadhaar Card Pan Card Link Status 15. PAN Aadhaar Link Penalty 16. Minor PAN Card 17. Landlord’s PAN Mandatory for HRA Exemption 18. Link PAN Card with Bank Account Number 19. PAN Card for Students 20. Surrender PAN Card or PAN Card Cancellation 21. Check PAN Active Or Inactive

Frequently Asked Questions

You can download your e-PAN card from the NSDL, UTIITSL or the Income Tax Website. You can visit the website where you applied for the e-PAN card, i.e., NSDL, UTIITSL or Income Tax website and click on the 'Request for e PAN card' or 'Download e PAN card' option and enter the required details to get your PAN card.

You cannot download your PAN card without OTP. You must enter the OTP to download your e-PAN card from the NSDL, UTIITSL or Income Tax website.

Yes. You can get a PDF copy of your PAN card (e-PAN card) online from the NSDL, UTIITSL or the Income Tax website by clicking on the 'Request for e PAN Card' or 'Download PAN card' option.

Yes, an e-PAN card is valid and has the same legality as a physical PAN card. It can be used as proof of identity or address.

Yes, the download of the e-PAN card is free when applied for it and downloaded from the Income Tax website. The download of an e-PAN card is free on the NSDL and UTIITSL websites when the e-PAN card is downloaded within 30 days of its allotment. If you download the e-PAN card after 30 days of its allotment, you will have to pay a fee of Rs.8.26 to download the e-PAN card.

About the Author

Mayashree Acharya

I am an advocate by profession and have a keen interest in writing. I write articles in various categories, from legal, business, personal finance, and investments to government schemes. I put words in a simplified manner and write easy-to-understand articles. Read more

Quick Summary

Was this summary helpful.

Clear offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. Clear serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India.

Efiling Income Tax Returns(ITR) is made easy with Clear platform. Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing.

CAs, experts and businesses can get GST ready with Clear GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. Clear can also help you in getting your business registered for Goods & Services Tax Law.

Save taxes with Clear by investing in tax saving mutual funds (ELSS) online. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. Download Black by ClearTax App to file returns from your mobile phone.

Cleartax is a product by Defmacro Software Pvt. Ltd.

Company Policy Terms of use

Data Center

SSL Certified Site

128-bit encryption

Request for Reprint of PAN Card

Instructions : --> 1. This facility can be availed by those PAN holders whose latest PAN application was processed through Protean (formerly NSDL e-Governance Infrastructure Limited) or have obtained PAN using �Instant e-PAN� facility on e-filling portal of ITD. 2. Click here to download e-PAN card free of cost (For PANs allotted/changes confirmed by ITD in last 30 days). 3. Charges for Reprint of PAN card: � For dispatch of PAN card within India(inclusive of taxes) - Rs 50.00 � For dispatch of PAN card outside India(inclusive of taxes) - Rs 959.00 4. PAN card will be dispatched to the communication address as per the latest details available with Income Tax Department.

Note: If you have not linked your Aadhaar with PAN then you are requested to link your Aadhaar with PAN on or before March 31, 2020.

Note: If you have not linked your Aadhaar with PAN then you are requested to link your Aadhaar with PAN on or before March 31, 2022.

Thank you for signing up!

How to Download e-PAN Card Online

Eligibility for instant e-pan, downloading e-pan card from nsdl, downloading e-pan card from utiitsl, downloading instant pan card through aadhaar card.

In today's digital age, obtaining essential documents like a PAN card has become easier than ever. With the introduction of e-PAN or instant PAN card , individuals can now download their PAN card online within 48 hours, without any charges. This virtual PAN card carries all the necessary information of the cardholder and can be used for various purposes such as filing income tax returns, opening a savings account, applying for a debit or credit card, and more. In this comprehensive guide, we will walk you through the step-by-step process of downloading your e-PAN card from both the NSDL and UTIITSL portals.

Before we delve into the process of downloading an e-PAN card, let's first understand the eligibility criteria for applying for one. The following requirements must be met:

- Individual taxpayers, not corporations, trusts, or associations, can apply for an instant pan card.

- An actual PAN card is not required for an applicant.

- A valid Aadhaar card is required for the application.

- The mobile phone number of the applicant must be connected to the Aadhaar card.

- A valid Aadhaar card is required for all applicants.

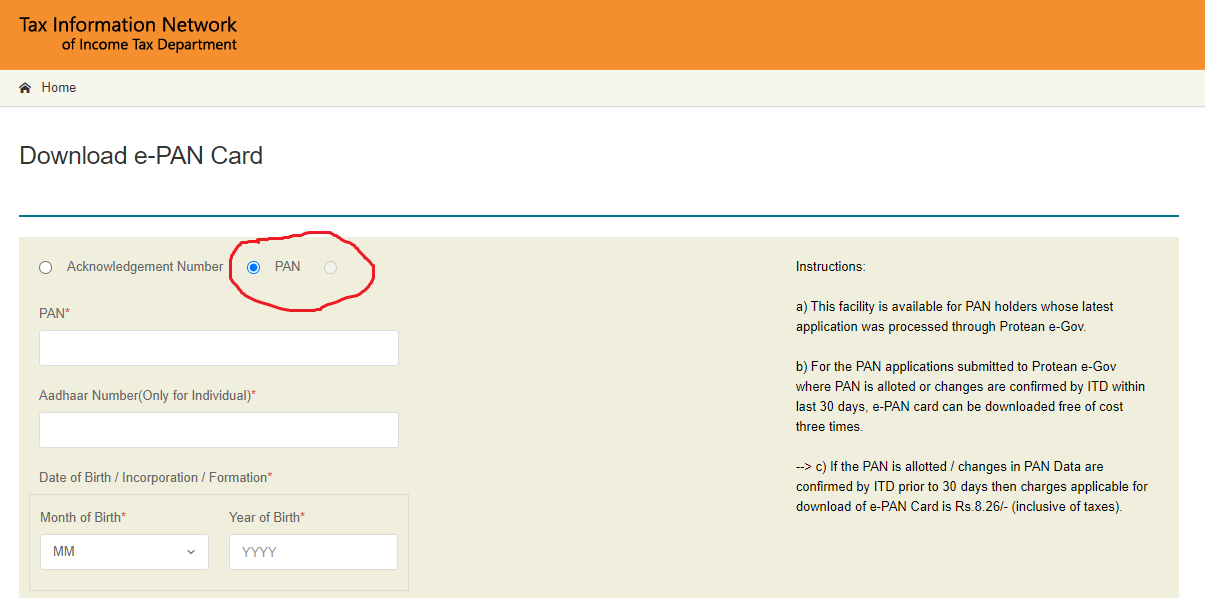

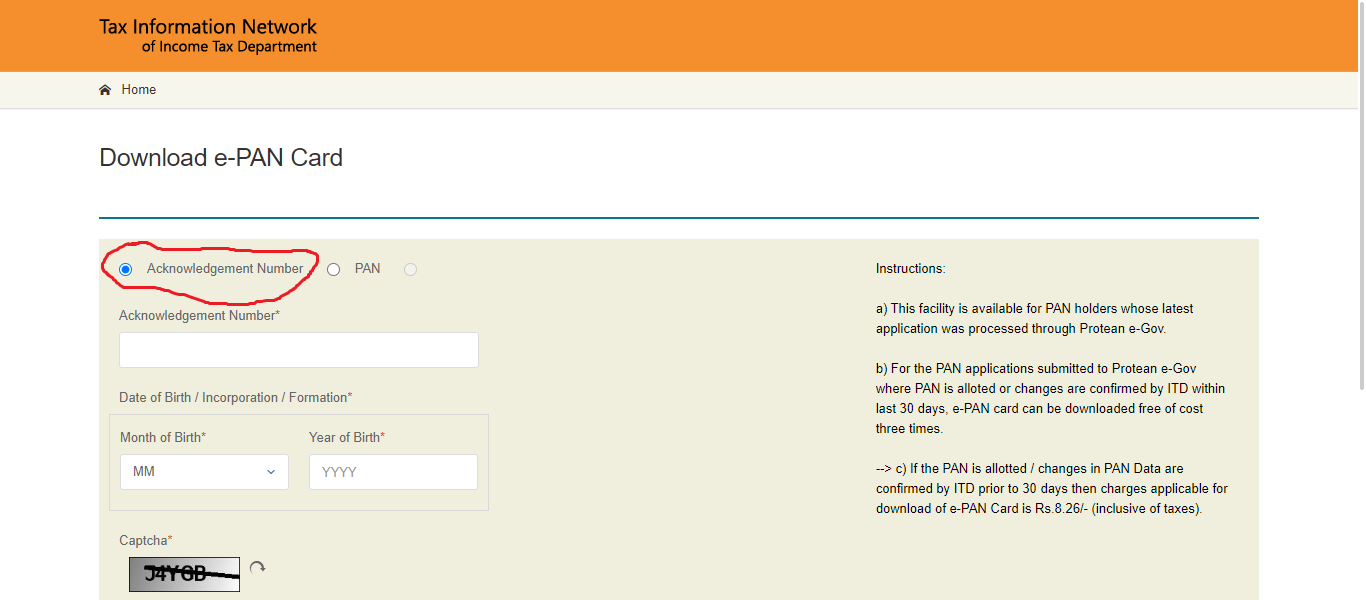

The NSDL portal offers a convenient way to download your e-PAN card. There are two methods to do so – using the Acknowledgement Number or using the PAN number. Let's explore both methods in detail:

Method 1: Using the Acknowledgement Number

- Visit the NSDL website

- On the homepage, select the 'Download e-PAN/e-PAN XML' option.

- Now, you will be presented with two choices – 'Acknowledgement Number' or 'PAN'. Choose the 'Acknowledgement Number' option.

- Fill in the required details, including your Acknowledgement Number, Full Name, Date of Birth, Captcha code, and click on 'Submit'.

- Once the details are verified, you can download your e-PAN card instantly.

Method 2: Using the PAN Number

- Select the 'Download e-PAN/e-PAN XML' option on the homepage.

- This time, choose the 'PAN' option.

- Enter your PAN Number, Full Name, Date of Birth, Captcha code, and click on 'Submit'.

- After the verification process, you can download your e-PAN card immediately.

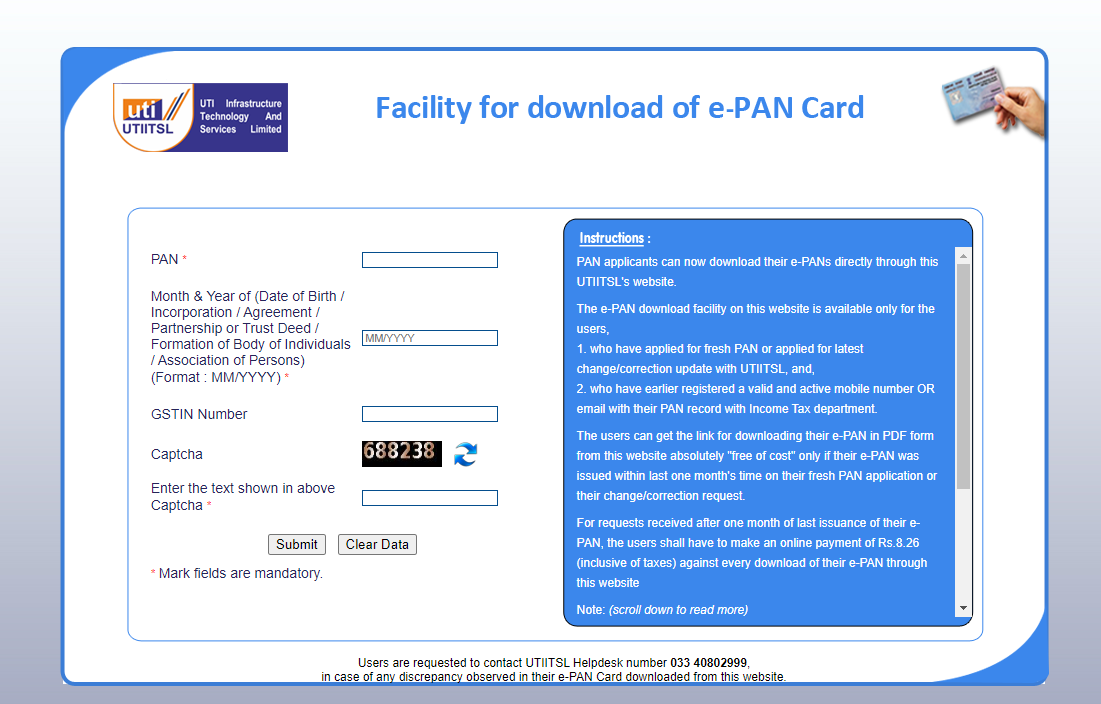

UTIITSL (UTI Infrastructure Technology and Services Limited) is an alternate gateway for applying for a new PAN card or making changes to an existing PAN card. Here's how you can download your e-PAN card from the UTIITSL portal:

- Go to the UTIITSL ePAN downloading webpage

- On the webpage, enter the required information such as PAN, Date of Birth/Incorporation, GSTIN (optional), and the security code. Then, click on 'Submit'.

- Verify that the mobile number and email address displayed against your PAN are correct.

- Enter the security code and check the declaration box.

- An OTP (One-Time Password) will be sent to your registered phone number/email ID. Enter the OTP and click on 'Submit'.

- If the PAN issuance duration exceeds one month, you may be required to pay a fee of Rs. 8.26 online.

- Once the processing is complete, you can instantly obtain your e-PAN card.

If you prefer downloading your e-PAN card using your Aadhaar card number, follow the steps below:

- Visit the official website of Income Tax India .

- Select the "Instant E-PAN" option under the 'Quick Links' section.

- On the next page, choose the 'Check Status / Download PAN' option and click on 'Continue'. You will be redirected to a new page.

- Enter your 12-digit Aadhaar number and submit it.

- Authenticate your request by entering the OTP received on your registered phone number.

- Once your authentication is successful, you will be directed to a new page where you can view and download your e-PAN card.

Congratulations! You have successfully downloaded your e-PAN card using your Aadhaar card.

Now that you have a comprehensive understanding of how to download your e-PAN card from both the NSDL and UTIITSL portals, you can easily obtain this essential document hassle-free. Remember to keep your PAN card safe and secure as it is an essential identification document and is required for various financial and official transactions.

- Capital Gains Tax

Recent Blog

Section 281 of Income Tax Act

Essential Guide to Filing Tax Evasion Complaints in 2024

Simple Guide to Section 269ST of the Income Tax Act

Don't Miss Out: Avoid Big Fines for Late ITR E-verification with This Guide

Made a Mistake on Your Tax Return? Here's How to Fix It!

Frequently asked questions, what is an e-pan card.

An e-PAN card is a digitally signed electronic version of the Permanent Account Number (PAN) card issued by the Income Tax Department of India.

What are the benefits of downloading an e-PAN card online?

Downloading an e-PAN card online offers convenience, quick access to your PAN details, and eliminates the need for carrying a physical PAN card.

How can one download an e-PAN card online?

You can download an e-PAN card online through the official website of the Income Tax Department of India or the UTIITSL or NSDL portals.

What information is required to download an e-PAN card online?

To download an e-PAN card online, you need to provide your PAN number, Aadhaar number, and other relevant details as per the requirements of the respective portal.

Is it necessary to register on the Income Tax Department's website to download an e-PAN card?

No, registration on the Income Tax Department's website is not mandatory to download an e-PAN card. However, you need to provide your PAN and Aadhaar details for authentication.

The Tax Heaven

Subscribe to the exclusive updates, the tax heaven:.

Kanakkupillai Learn – India's Top Business Consulting Company

- +91 7305345345

- [email protected]

- Over 35,146 Startups and MSMEs Assisted

- Rated 4.8 out of 5 on Google Reviews

- 99.9% Satisfaction Guarantee

Download Your ePAN Card from NSDL and UTITSL Portals

- Post author: Sumitha

- Post published: October 18, 2023

- Post category: General

Last Updated on November 4, 2023 by Sumitha

Download ePAN Card

The ePAN card , or electronic Permanent Account Number card , is a digitally signed version of the PAN card issued by the Indian Income Tax Department. It serves as a valid proof of the allocation of your PAN. If you’ve recently received your PAN card or need to re-download it, you can do so through the NSDL or UTITSL portals. This article will guide you through downloading your ePAN card from these two official platforms.

Downloading ePAN Card through the NSDL Portal

The NSDL portal offers two pathways for downloading your ePAN card: one for PANs issued within the last 30 days and the other for older PANs. Here are the steps for each:

For PANs Issued in the Last 30 Days:

- Visit the official NSDL website by going to https://www.tin-nsdl.com/ .

- Click on ‘Download e-PAN card (For PAN allotted in last 30 days).’

- Provide your Acknowledgment Number and the displayed Captcha Code.

- Click ‘Submit.’

- You will be given three options to receive an OTP: through E-mail ID, Mobile Number, or both. Select your preferred option and click ‘Generate OTP.’

- Once you receive the OTP, enter it and click ‘Validate.’

- After successful validation, you can click ‘Download PDF.’

- The downloaded PDF will be password-protected, with the password being your Date of Birth, Date of Incorporation, or Date of Formation in the DDMMYYYY format.

For Older PANs (More Than 30 Days Old):

- Visit the official NSDL website at https://www.tin-nsdl.com/ .

- Click on ‘Download e-PAN card (For PAN allotted older or more than 30 days).’

- Provide the following details: PAN, Month and Year of Birth, and GSTN (optional).

- After entering these details, click ‘Submit.’

- Your ePAN card can be downloaded after clicking ‘Submit.’

Downloading ePAN Card through UTITSL Portal

UTIITSL, or UTI Infrastructure Technology And Service Limited, also offers a platform for downloading your ePAN card. Here’s how you can do it:

- Visit the UTIITSL portal by going to https://www.myutiitsl.com/PAN_ONLINE/ePANCard .

- Provide the required information: PAN Number, Date of Birth/Incorporation/Agreement/Partnership or trust deed/Formation of BOI/AOP in MM/YYYY format, and GSTIN (optional).

- Enter the displayed Captcha.

- After filling in these details, click ‘Submit.’

- Upon successful submission, a link will be sent to your registered mobile number via SMS and/or to your registered e-mail address.

- Click on the link and download the ePAN card using the OTP received on your mobile or e-mail.

Important Note:

Keep in mind that downloading the ePAN card is free of charge if it was issued within the last month due to a fresh PAN application or change/correction request. However, in other cases, you will be required to make an online payment of INR 8.26 for each download of the ePAN card through the UTITSL portal.

Conclusion:

Downloading your ePAN card is now easier than ever, thanks to the NSDL and UTITSL portals. These user-friendly platforms provide a convenient and secure way to access your digitally signed PAN card whenever needed. Whether your PAN is brand new or older, following these step-by-step instructions will ensure your ePAN card is readily available for your financial and official needs.

1. Is the ePAN card equivalent to the physical PAN card?

Yes, the ePAN card is a legally valid alternative to the physical PAN card.

2. Can I download my ePAN card from any device?

Yes, as long as you have an internet connection, you can download it from any device.

3. Is there a fee for downloading the ePAN card?

It’s free if issued within the last month; otherwise, there’s a nominal charge.

4. What if I forgot my password for the downloaded ePAN PDF?

The password is your Date of Birth or Date of Incorporation (DDMMYYYY).

5. Can I download my ePAN card using my GSTIN?

GSTIN is optional; you can download it without providing it.

6. How long does it take to receive the OTP for ePAN download?

OTPs are usually sent instantly to your chosen option (email or mobile).

7. What if I’ve changed my mobile number or email since applying for PAN?

Contact the Income Tax Department to update your details.

8. Is ePAN card acceptance the same as the physical card?

Yes, businesses and authorities accept the ePAN card as valid proof.

9. Can I download an ePAN card for my minor child?

Yes, you can download the ePAN card for your minor child.

10. Is it mandatory to have an ePAN if I already have a physical PAN card?

No, it’s optional, but it provides added convenience for digital transactions.

Please Share This Share this content

- Opens in a new window

You Might Also Like

DTAA – Provisions and Implications

Types of NGO Registration in India and Its Benefits

Unpacking India’s Economic Resilience: An In-Depth Look at the 2023 GDP

How to Download e PAN Card on NSDL or UTIITSL?

In the digital age, the convenience of accessing important documents online has become a necessity. The e-PAN card, or electronic Permanent Account Number card, is no exception. If you are looking to download your e-PAN card through NSDL, this guide will walk you through the process step by step.

What is e-PAN card and its importance?

Before diving into the download process, let us understand what an e-PAN is, why it is important, and how it relates to your CIBIL Score . The e-PAN is a digitally signed, secure version of the physical PAN card. It serves as a valid proof of identity and simplifies various financial transactions, contributing positively to your CIBIL Score.

How to download an e-PAN card – Step-by-step guide?

Here are the steps for e-PAN download through NSDL:

- Visit the NSDL portal To initiate the process, visit the official NSDL website. Navigate to the e-PAN section, which is designed for electronic PAN card services.

- Fill in the required details Click on the 'e-PAN download' option and enter the necessary details. Ensure that you provide accurate information, including your PAN card number , date of birth, and Aadhaar details.

- Validate with OTP Upon entering the required information, you will receive an OTP on your registered mobile number. Enter the OTP to validate your identity and proceed to the next step.

- Complete the authentication process NSDL will authenticate your details against the Aadhaar database. Ensure that your Aadhaar details are up to date for a smooth authentication process.

- Download e-PAN Once the authentication is successful, you will be directed to the download section. Click on the 'Download e-PAN' option, and your electronic PAN card will be saved to your device.

Downloading an e-PAN card from the UTIITSL portal

To download your e-PAN card from the UTIITSL portal, follow these steps:

- Access the official UTIITSL portal.

- Locate and click the "Download e-PAN" tab on the homepage.

- Enter your PAN, date of birth, GSTIN (if applicable), and captcha code. Submit the information.

- An email containing a download link will be sent to your registered email address.

- Click the link and enter the required OTP to download your e-PAN card.

Please note that e-PAN cards can be downloaded free of charge within 30 days of issuance. A fee of Rs. 8.26 is applicable for downloads after this period.

Downloading an e-PAN card from the Income Tax portal

To download your e-PAN card from the Income Tax e-Filing website:

- Visit the Income Tax e-Filing website.

- Under the "Quick Links" section, select "Instant E-PAN".

- Click "Continue" under the "Check Status/Download PAN" tab.

- Enter your Aadhaar number and click "Continue".

- Verify your identity by entering the OTP sent to your registered mobile number.

- Click the "Download e-PAN" button to obtain your e-PAN card.

Downloading an e-PAN card without a PAN number

If you have applied for an e-PAN card through the NSDL or Income Tax portals and do not have your PAN number, you can download it as follows:

NSDL portal

- Access the NSDL portal.

- Select the "Acknowledgement Number" option.

- Enter the acknowledgement number, date of birth, and captcha code.

- Verify your identity by entering the OTP.

- Download your e-PAN card.

Income tax portal

- Visit the Income Tax website.

- Enter your Aadhaar number and submit.

- Click the "Download e-PAN" button.

Downloading an e-PAN card with a PAN number

To download your e-PAN card using your PAN number:

- Select the "PAN" option.

- Enter your PAN number, date of birth, Aadhaar number (if applicable), and captcha code.

UTIITSL portal

- Access the UTIITSL portal.

- Enter your PAN number, date of birth, GSTIN (if applicable), and captcha code.

- Click the link sent to your registered email address.

- Enter the OTP to download your e-PAN card.

Downloading an e-PAN card using an Aadhaar number

If you applied for an instant e-PAN card, you can download it using your Aadhaar number:

- Click "Continue" under the "Check/Download PAN" tab.

Downloading an e-PAN card with an acknowledgement number

To download your e-PAN card using your acknowledgement number:

e-PAN card download password

To open your downloaded e-PAN card PDF file, you will need a password. This password is either your date of birth or date of incorporation in the DDMMYYYY format.

Downloading your e-PAN card is straightforward and requires either your acknowledgement number, PAN number, or Aadhaar number along with your date of birth. Once downloaded, your e-PAN card can be used as proof of identity for various financial and other transactions.

How to check e-PAN card status?

To check the status of your e-PAN card, you can follow these steps:

- Visit the official website of e-Filing of the Income-tax department at www.incometaxindiaefiling.gov.in

- Click on the link ‘Instant E-PAN through Aadhaar’

- On the next webpage, click ‘Check Status/Download PAN’

- Fill in your Aadhaar number in the given box

- Verify with the OTP sent to your mobile number

- Check the status of your PAN or download it

This process will help you verify the status of your e-PAN card application. If you have already applied, you will be able to track its progress using your Aadhaar details.

Details mentioned on e-PAN card

The e-PAN (Electronic Permanent Account Number) card contains essential details similar to a physical PAN card. These details typically include:

- PAN : A unique alphanumeric identifier assigned to an individual or entity for tax purposes.

- Name of the PAN card holder : The full name of the individual or entity to whom the PAN card is issued.

- Date of birth/incorporation : For individuals, the date of birth is mentioned, while for entities, the date of incorporation is provided.

- Photograph : A digital photograph of the PAN card holder.

- Signature : A digital signature of the PAN card holder.

- Father's name : The name of the father of the individual PAN card holder (in case of individuals).

- QR code : A QR code that contains encoded information related to the PAN card.

- Issue date : The date when the PAN card was issued.

- Validity : The validity period of the PAN card.

- Aadhaar number (if linked) : In some cases, the Aadhaar number may also be mentioned if it is linked with the PAN card.

Eligibility to apply for e-PAN

To apply for an e-PAN, you need to meet certain eligibility criteria. Here are the prerequisites:

- You must be an individual taxpayer (not a company or a Hindu Undivided Family).

- You should not already hold a PAN.

- You must have a valid Aadhaar card.

- Your mobile number must be linked with your Aadhaar .

- You must not be a minor at the time of the request.

- You should not fall under the definition of Representative Assessee as per Section 160 of the Income Tax Act.

Remember that generating an e-PAN is free of cost, an online process, and does not require any physical paperwork.

Why choose NSDL for e-PAN download?

National Securities Depository Limited is a trusted platform authorised by the government for various financial services, including the issuance of PAN cards. Choosing NSDL ensures the security and authenticity of your e-PAN card.

Downloading your e-PAN through NSDL is a straightforward process that enhances accessibility and convenience. By following these steps and tips, you can secure your electronic PAN card quickly and efficiently. Embrace the digital era by simplifying your financial transactions with the e-PAN card downloaded through NSDL.

In conclusion, make sure to keep your PAN-related information secure and updated for a hassle-free experience. The digital revolution has made it easier than ever to access crucial documents, and with NSDL, you can trust the process of e-PAN download for a secure and swift experience.

Bajaj Finserv App for All Your Financial Needs and Goals

Trusted by 50 million+ customers in India, Bajaj Finserv App is a one-stop solution for all your financial needs and goals.

You can use the Bajaj Finserv App to:

- Apply for loans online, such as Instant Personal Loan, Home Loan, Business Loan, Gold Loan, and more.

- Explore and apply for co-branded credit cards online.

- Invest in fixed deposits and mutual funds on the app.

- Choose from multiple insurance for your health, motor and even pocket insurance, from various insurance providers.

- Pay and manage your bills and recharges using the BBPS platform. Use Bajaj Pay and Bajaj Wallet for quick and simple money transfers and transactions.

- Apply for Insta EMI Card and get a pre-approved limit on the app. Explore over 1 million products on the app that can be purchased from a partner store on No Cost EMIs.

- Shop from over 100+ brand partners that offer a diverse range of products and services.

- Use specialised tools like EMI calculators, SIP Calculators

- Check your credit score , download loan statements and even get quick customer support—all on the app.

Download the Bajaj Finserv App today and experience the convenience of managing your finances on one app.

Do more with the Bajaj Finserv App!

UPI , Wallet, Loans, Investments, Cards, Shopping and more

1. Bajaj Finance Limited (“BFL”) is a Non-Banking Finance Company (NBFC) and Prepaid Payment Instrument Issuer offering financial services viz., loans, deposits, Bajaj Pay Wallet, Bajaj Pay UPI, bill payments and third-party wealth management products. The details mentioned in the respective product/ service document shall prevail in case of any inconsistency with respect to the information referring to BFL products and services on this page.

2. All other information, such as, the images, facts, statistics etc. (“information”) that are in addition to the details mentioned in the BFL’s product/ service document and which are being displayed on this page only depicts the summary of the information sourced from the public domain. The said information is neither owned by BFL nor it is to the exclusive knowledge of BFL. There may be inadvertent inaccuracies or typographical errors or delays in updating the said information. Hence, users are advised to independently exercise diligence by verifying complete information, including by consulting experts, if any. Users shall be the sole owner of the decision taken, if any, about suitability of the same.

Frequently asked questions

Yes, downloading e-PAN is free of cost. You can obtain it digitally without any charges.

You can apply for an e-PAN card online through the official NSDL or UTIITSL website by filling out the application form and submitting required documents.

The processing time for e-PAN varies but usually takes around 15 to 20 working days from the submission of the application.

Yes, e-PAN is a valid ID proof recognised by various institutions and authorities for official purposes.

No, there is no expiry date for the e-PAN card. Once issued, it remains valid indefinitely, serving as a permanent identification document.

To check your CIBIL score, you will need a valid and original PAN card. It acts as a government-approved identity proof linked to your financial accounts.

The CIBIL score is not directly influenced by whether you have a physical PAN card or an e-PAN card. The score is determined based on your credit history, repayment behaviour, and other financial factors. As long as you have a valid PAN number and a credit history, you can check your CIBIL score.

You can download your e-PAN without an OTP by providing your PAN, Aadhaar number, date of birth, and optionally GSTIN. This is possible if your PAN was processed through Protean.

Yes, you can obtain a copy of your PAN card online. This is known as an e-PAN. You'll need your PAN, Aadhaar number, date of birth, and optionally GSTIN to request it.

Yes, the e-PAN card is a legally valid document equivalent to a physical PAN card. It contains a QR code with your details and is accepted for all tax-related purposes.

Related videos

5 important factors that affect your credit score

Leveraging your CIBIL Score to get a personal loan

Features and benefits of Credit Pass

How to check if your CIBIL report is accurate

Please wait.

Your page is almost ready

- Credit Cards

- Calculators

- Govt. Schemes

- Govt. ID Cards

PAN Card Download

The Permanent Account Number (PAN) is a unique 10-digit alphanumeric code issued by the Indian Income Tax Department. Today, it has become an important need for every citizen of India.

Lost your PAN card or need a digital version? Don’t worry! You don’t need to fill out lengthy forms or wait weeks for a replacement. The Income Tax Department now lets you download or reprint an e-PAN with just a few clicks.

Prerequisites

Before downloading the PAN online, you must know about what to keep handy. This will make sure that you do not face any difficulty during the process.

- PAN Number : You must know your existing PAN number to proceed.

- Aadhaar Number : Your Aadhaar must be linked with your PAN.

- Mobile Number: The mobile number linked with your Aadhaar will receive an OTP for verification.

Primarily, there are three main methods (Through NSDL , UTIITSL , e-Filing Portal ) available for individuals to download their PAN (Permanent Account Number) card online.

How To Download a PAN Card using NSDL?

- Step 1 : Start the process by going to the official website of NSDL e-Gov - https://www.protean-tinpan.com/ .

- Step 2 : On the landing page, go to the “ Quick Links ” section and click on “PAN-New facilities”, you will get a drop-down menu.

- Step 3 : From the drop-down menu, click on ‘ Download e-PAN/e-PAN XML (PANs allotted in last 30 days )’ or ‘ Download e-PAN/e-PAN XML (PANs allotted prior to 30 days) ’, according to your application date. Then you will be directed to a new page.

- Step 4 : On the new page, you can choose either PAN number, or Acknowledgement number to proceed further. You will be prompted to enter various details such as your PAN number, Aadhaar details, date of birth, and captcha code.

- Step 5 : After entering your details, click on the “ Generate OTP ” button. Shortly after, you will receive a One-Time Password (OTP) on your registered mobile number. This OTP is a crucial security measure to verify your identity and proceed with the download.

- Step 6 : Once you’ve received the OTP, enter it into the designated field on the NSDL website and click on the “ Submit ” button. You will then be able to download your e-PAN card in PDF format.

How To Download a PAN Card using UTIITSL?

- Step 1 : Open your preferred web browser and visit the official UTIITSL website - https://www.utiitsl.com/ .

- Step 2 : On the UTIITSL website, locate the section specifically dedicated to PAN services . Now click on the “ Download e-PAN ” option.

- Step 3 : You will be required to input your PAN number, date of birth, and GSTIN (if applicable) into the respective fields. Ensure to double-check the accuracy of the information provided before proceeding.

- Step 4 : After entering your details, UTIITSL will send a download link to your registered mobile number or email address. This link will enable you to access your e-PAN card.

- Step 5 : Click on the download link received and follow the on-screen instructions to download your e-PAN card.

How To Download a PAN Card using an Income Tax e-Filing Portal?

- Step 1 : Pop over to the official Income Tax e-filing website .

- Step 2 : In the Quick Links section, click on the " Instant e-PAN " option.

- Step 3 : Look for a tab or section labeled something like “Check Status/Download PAN” and click “ Continue .”

- Step 4 : Type in your Aadhaar number and hit that “ Continue ” button again.

- Step 5: Check your phone! You should have a text with a special one-time code (OTP) from Aadhaar. Enter that code on the website and click “ Continue .”

- Step 6 : Now you should see the status of your e-PAN. If it’s ready for you, there’ll be a “ Download e-PAN ” button – give it a click and your e-PAN is yours!

Download e-PAN from NSDL and UTIITSL

Get your e-PAN card hassle-free! Download your PAN card online from NSDL or UTIITSL instantly. Follow simple steps to obtain your electronic PAN card conveniently and securely.

What is a PAN Card?

Permanent Account Number (PAN) is a unique identification number issued by the Government of India to Indian Tax Payers. It is issued by the IT department.

A Pan Card is a Alphanumeric code that groups an individuals IT Transaction, tax payments, TDS credit, and other transactions.

PAN is very important for the financial health of a country. Since, it is linked to an individual, it can be used a proof for financial transactions. By linking financial transactions to PAN, the government is able to prevent tax evasion. PAN plays an important role in preventing money laundering.

In order to facililate PAN processing, government has two prominent portals – NSDL and UTIITSL. Applicants can apply for PAN card at any of these centers and get them approved within a week.

Once the PAN no is allotted, the applicants are notified through Email and SMS. With their PAN number, they can download the e-pan version from these portals until the hard copy reaches the address.

Here are the steps in downloading the e-PAN card

Downloading from NSDL

- Visit the link https://www.onlineservices.nsdl.com/paam/requestAndDownloadEPAN.html

- There are two options that you can see – Acknowledgment number and PAN no

- Enter the PAN no in the PAN option

- Enter your Aadhar No, DOB, and GSTN (Optional)

- Select the acceptance checkbox, complete the captcha and click on submit

- The PDf version of your PAN card will appear on the screen and you download it

- You can also use the acknowledgement number sent to download your e-PAN

- Follow the same process as above and you can download the same

- The downloaded e-PAN card will be password protected. The user must enter their DOB as the password in order to access

Downloading e-PAN through UTIITSL Portal

- Click the link https://www.pan.utiitsl.com/PAN_ONLINE/ePANCard

- Enter the PAN card number and Date of Birth

- Enter the captcha and hit submit

- A download link will be sent to user’s registered number via SMS or email

- By clicking on that link, you can obtain their e-PAN

- If the user’s mobile number and email are not registered, the user should do first by submitting a correction form before using e-PAN facility

- Users will be able to download e-PAN three times

Who can download these e-PAN?

- This facility was developed to PAN holders whose application was processed through NSDL or UTIIISL

- The download option is available three times for applications submitted to either of portals and PAN no alloted by ITR in the last 30 days

- If the data exceeds 30 days, then the user must pay the applicable download charges

How can I update PAN Card information?

- User must visit NSDL or UTIITSL portal and select Update PAN section

- Choose select and update the correction

- A Copy of address proof and identify proof document are required to complete the requirement

- UAN Employee Login

- UAN Password Reset

- UAN Passbook

- EPFO Employer Login

- Check EPF Balance

- Withdraw PF

- PF Claim Status

- Download e-pan

- Aadhar Card Download

- UAN Card Download

- Link PAN & Aadhar Card

- +919643203209

- [email protected]

For Indian Entrepreneur

- Private Limited Company

- Public Limited Company

- Limited Liability Partnership

- One Person Company (OPC)

- Sole Proprietorship

- Partnership

- Hindu Undivided Family (HUF), HUF Deed

- E-Commerce Business

- Company Registration in UK New

- Company Registration in USA New

For Foreign Entrepreneur

- Indian Subsidiary

- Company Registration by Foreigner

Special Entities

- Non Profit Organization

- Nidhi Company

- Producer Company

Tax Registrations

- GST Registration

- GST Modification

PAN Application

- TAN Application

Other Registration

- IEC Registration

- IEC Modification

- ESIC Registration

- Digital Signature

- DIN Application

- EPF Registration

- SSI/MSME/Udyog Aadhar Registration

- GST Returns

- Income Tax Returns

- TDS Returns

- TDS Returns Revision

- ESI Returns

Annual Filings

- Private Limited Company Annual Filing

- LLP Annual Filing

- Public Limited Company Annual Filing

- OPC Annual Filing

- NPO/Section 8 Company Annual Filing

- Nidhi Company Annual Filing

- Producer Company Annual Filing

- Trust Annual Filing

Change Services

- Add A Director

- Removal/Resignation of Director

- Add/Remove a Partner in LLP

- Change in LLP Agreement

- Change of Registered Office Address

- Increase in Authorized Capital

- Change in DIN

- Surrender Your DIN

- Appointment of Auditors

- Share Transfer & Transmission

- Company Name Change

- LLP Name Change

- MOA/AOA Amendment

- MOA/AOA Printing

- Strike Off Company

- Strike Off LLP

- Dissolution of Firms

- Strike Off OPC

Legal Drafting

- Download Library

- Customized Drafting

- GST LUT Letter of Undertaking New

- GST Cancellation

- ROC Search Report New

- Commencement of Business (INC 20A) Filing New

- Trademark Registration

- Trademark Objections

- Trademark Assignment

- Trademark Renewal

- Trademark Opposition

- Trademark Withdrawal

- Trademark Rectification

- Trademark Watch Services

- International Trademark Registration

- Copyright Application

- Patent Registration

Designing & Marketing

- Logo Designing New

- Digital Marketing New

- --> Accounting

- --> Payroll

- --> CMA Report Prepartion

- --> Business Plan Preparation (Project Report)

- --> +919643203209

- --> [email protected]

- Posted On July 25, 2024

- Posted By By Zarana Mehta

- Articles - Income Tax

- Income Tax India

- Password for PAN Card

How to Download E PAN Card using NSDL Portal?

Table of Content

Introduction

The Income Tax Department gives everyone a 10-digit code called a Permanent Account Number (PAN). People use their PAN card for financial activities and paying taxes. It also helps the department track financial transactions. This article explains what an E-PAN is, how to download it using the NSDL Portal, and answers frequently asked questions about E-PAN card downloads.

What is E PAN Card?

The digital version of your physical PAN card, known as an e-PAN, is used for e-verification and saves your PAN information on your device. To get a new PAN, Indian citizens and NRIs must fill out Form 49A, while foreigners use Form 49AA. Submit these forms with required documents to the Income Tax PAN Services Unit. You can apply for an e-PAN through NSDL or UTIITSL portals, or quickly get one using your Aadhaar card.

The NSDL portal has two ways to download an e-PAN card: for PANs issued in the last 30 days and for PANs issued more than 30 days ago. Here’s how to download it in both cases:

Download an e-PAN card (for PANs issued within the last 30 days)

- Visit to NSDL Portal and Login to the Portal.

- Select ‘Download e-PAN card’ from the drop-down menu (For PAN allotted in last 30 days).

- Fill out the Acknowledgement Number and Captcha Code fields.

- Click the ‘Submit’ button.

- E-mail ID, Mobile Number, or Password are the three choices for receiving OTP.

- To receive an OTP, choose one of the options and click ‘Generate OTP.’

- The OTP will be sent to the address specified in the selection.

- Click ‘Validate’ after entering the OTP.

- Click ‘Download PDF’ after successful validation.

Note: The password for the PDF file you just downloaded is your date of incorporation / date of birth / date of formation in DDMMYY.

Download an e-PAN card (applicable to PANs issued more than 30 days ago)

- Select ‘Download e-PAN card’ from the drop-down menu (For PAN allotted older or more than in last 30 days).

- The following information is required: PAN, month and year of birth; GSTN (optional); and address.

- Click ‘Submit’ after filling in the above information.

- The e-PAN card can be downloaded after clicking ‘Submit.’

Process to Download PAN Card online using UTIITSL Portal

The following is a step-by-step approach for downloading the e-PAN from UTIITSL’s official website:

- Visit to UTIITSL Portal .

- Next, fill in the required information, including your PAN number, GSTIN number, date of birth, and captcha.

- Press the ‘Submit’ button.

- Your phone number and email address will be displayed on the next page. Check that the information is correct and then input the captcha.

- Accept the terms and restrictions of the One Time Password (OTP) method.

- Select ‘Get OTP’ from the drop-down menu.

- Enter the OTP and complete the payment on the next page.

- After you have made your payment, you will be able to download your e-PAN.

Eligibility criteria for E PAN Card Application

- You must be a citizen of India.

- You must be a self-employed individual.

- An Aadhaar card is the required document for E-PAN Card Application.

- Your Aadhaar card information must be current.

- Your Aadhaar card should be connected to your phone number.

Applicants that are eligible to download PAN Card online using UTIITSL Portal

- Individuals who applied for a new PAN through UTIITSL.

- Those who have applied through UTIITSL for the most recent PAN revisions, corrections, or upgrades.

- The person who had previously registered with the Income Tax Department a legitimate and active mobile number or e-mail ID with their PAN information.

FAQs on E PAN Card Download

1. what information can be found on e-pan.

On the e-PAN, the following information is included:

- Permanent Account Number Information

- Date of your birth

- Father’s Name

- Your Signature

2. What should I do if I don’t obtain an OTP?

You can try restarting the page and entering your information again to get another OTP. If you still haven’t received your OTP, you can contact UIDAI.

3. Is it possible to get a PAN even if my Aadhaar card is inactive?

No, you must have an active Aadhaar card to apply for a PAN.

4. How do I get a copy of my old PAN card using my PAN?

You can download your old PAN Card by using the Income Tax Department of India’s ‘Reprint PAN Card’ option from either the NSDL or UTITTSL Portal.

5. Is the e-PAN a legitimate document?

Like a traditional PAN Card, an e-PAN Card is a valid document.

6. Is it possible for me to have more than one PAN?

No, there cannot be more than one PAN at a time. Having more than one PAN is illegal and may result in a penalty.

Know More: E-PAN – A new and easy way to get your PAN

POPULAR ARTICLES

- All you need to know on Disqualification of…

- All you need to know on Rights and Duties of…

- Process of shifting a Registered Office from one…

- A guide on Section 111A and 112A of Income Tax Act

- “What is Ordinary Resolution and Special…

RECENT ARTICLES

- COMPLIACE CALENDAR FOR THE MONTH OF AUGUST 2024

- The Legal Dynamics of LLP Registration Simplified

- Rights of the Shareholders of a Company

BROWSE BY TOPICS

- 46th GST Council Meeting

- 47th GST Council Meeting

- 48th GST Council Meeting

- Article- Copyright

- Articles – Company Law

- Articles – Entrepreneurship

- Articles – GST

- Articles – Income Tax

- Articles – Non Residents

- Articles – Tradmark

- Company law

- Designing and Marketing

- Digital Marketing

- Entrepreneurship

- GST Council Meeting

- Human Resources

- Logo Designing

- Non residents

- Notifications

- Notifications – Company Law

- Notifications – Entrepreneurship

- Notifications – GST

- One Person Company

- Uncategorized

Easily apply for Permanent Account Number (PAN) with Ebizfiling at an Affordable Price.

About Ebizfiling -

Author: zarana-mehta

Zarana Mehta is an MBA in Finance from Gujarat Technology University. Though having a masters degree in Business Administration, her upbeat and optimistic approach for changes led her to pursue her passion i.e. Creative writing. She is currently working as Content Writer at Ebizfiling.

Follow Author

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Notify me of followup comments via e-mail. You can also subscribe without commenting.

Kalla swathi

Excellent service indeed.. I appreciate the entire team for incorporating my company very well

Peoplestrat

Well coordinated effort to file our first GST return. Thanks to the team.

Rohit Chaudhary

Very good service and good support thank you ebizfiling.

July 30, 2024 By Komal S

- Compliance Calendar

- Due dates for GST Returns

- Due dates for Income tax Returns

- Monthly compliance calendar

COMPLIANCE CALENDAR FOR THE MONTH OF AUGUST 2024 Timely payment of taxes provides several advantages, including cost savings and avoidance of financial problems such as low credit scores and penalties for non-compliance. Below, we outline the key compliance obligations for […]

July 25, 2024 By Komal S

Frequently Asked Questions about ESI Return Introduction The Employees’ State Insurance (ESI) Act is a significant piece of legislation in India that provides social security and healthcare benefits to employees. As an employer, it is crucial to understand the ESI […]

July 24, 2024 By Komal S

- Business Consulting Service

- Tax Consulting Service

How do Tax Consulting Services Assist NRI Companies? Introduction A large number of Non-Resident Indians (NRIs) are investing in India as the globe becomes more globalized. NRIs must abide by Indian tax regulations because investments come with taxes. Tax […]

Hi, Welcome to EbizFiling!

Hello there!!! Let us know if you have any Questions.

Thank you for your message.

How to Download e-Pan Card Free in Less Than 10 Minutes?

Applicants who have applied for a new PAN Card or made corrections to their existing PAN can download e-PAN card in less than 10 minutes. This service is provided through the NSDL, UTIITSL, and e-Filing portals.

Nowadays, a PAN card is important for any kind of account opening related to money. Whether it is to open a bank account or to open a Demat account or to open a trading account. For all these government has made it mandatory to submit a PAN card. Pan Card details are required for property dealing and jewelry deals.

Keeping the need for Pan cards by people in every deal in mind, the Government has started the facility to download the e-Pan card in less than 10 minutes. That too is completely free. This pan card is in digital form so it is called an e-Pan Card.

For your convenience, we will explain all the methods briefly. Before we begin, let us first define PAN and its significance.

- 1 What is A PAN Card? How is it useful?

- 2.1 Step-1: Visit the official website

- 2.2 Step-2: Select the preferred option

- 2.3 Step-3: Confirm your details

- 2.4 Step-4: Enter OTP

- 2.5 Step-5: Download e-Pan Card

- 3.1 Step-1: Visit the Official Website

- 3.2 Step-2: Fill in the Facility to Download e-PAN Card Form

- 3.3 Step-3: Confirm Pan Details

- 3.4 Step-4: Enter OTP

- 3.5 Step-5: Make Payment

- 3.6 Step-6: Download e-Pan Card

- 4.1 Step-1: Visit the Official Website

- 4.2 Step-2: Select the Instant e-PAN option

- 4.3 Step-3: Click Get New e-Pan

- 4.4 Step-4: Enter Aadhar Number

- 4.5 Step-5: Confirm the OTP Validation

- 4.6 Step-6: Enter OTP

- 4.7 Step-7: Confirm the details

- 4.8 Step-8: Download PAN Card

- 5 What is the Password for e-PAN Card?

- 6 A 50 Rs Fee is Required to Order the PVC PAN Card

- 7 Frequently Asked Questions (FAQs)

What is A PAN Card? How is it useful?

PAN is a tax identification number that gets issued to Indian taxpayers. The Indian Income Tax Department issues a PAN Card, which is a national identification card.

A PAN number is a 10-digit alphanumeric code used to combine all of an individual’s IT transactions. Tax payments, TDS/TCS credits, and other comparable financial transactions.

PAN is essential to our country’s economic well-being. It can be used as proof of identity for financial transactions because it is linked to an individual. The government can follow the movement of money and thereby combat tax evasion by tying all financial transactions to a person’s PAN. PAN is critical in combating the threat of black money and money laundering.

The government has 3 main portals to enable faster processing of PAN applications: the NSDL, the UTIITSL, and the e-Filing (income tax portal). Applicants can apply for a PAN online using these portals and get it granted in less than a week.

Applicants are advised of their PAN number by SMS and email once they have been authorized. While waiting for their real PAN card to be issued by post, applicants can easily obtain their e-PAN document using their new PAN number.

In this article, we will learn how we can download the e-Pan card in less than 10 minutes. We will discuss three government portals provided to download the e-Pan Card. And also we will know where and how we can use the e-Pan Card.

Download the e-Pan Card from the NSDL portal

Step-1: visit the official website.

First of all, you have to visit the official website of the NSDL portal to download the e-Pan Card. The official URL of the NSDL portal is – https://www.onlineservices.nsdl.com/paam/requestAndDownloadEPAN.html

Step-2: Select the preferred option

After opening the website of the NSDL portal you will see the two options Acknowledgement Number and PAN number.

For the Acknowledgement Number option:

If you have an Acknowledgement Number then you can select this option in this option you have to enter your Acknowledgement Number, Month of Birth, and Year of Birth and solve the Captcha. After filling in the details simply you have to click the submit button.

For the PAN Number option:

If you don’t have your Acknowledgment Number simply you can select the PAN option. In this option, you will need to enter your PAN number, Aadhaar Number, Date of Birth, and GSTN (optional) and then solve the captcha. And you should read the instructions carefully and then click the checkbox of declaration. After that click the submit button.

Note: (1) if you don’t have a PAN number or you forgot your PAN number then you can call 1961 (which is an income tax helpline number) to get your PAN number after providing your details to them.

(2) If you haven’t linked your Aadhar with your Pan then you are advised to link your Aadhaar with your PAN on or before June 30, 2023.

Step-3: Confirm your details

After clicking on the submit button you will see your details like the last four digits of your mobile number, the first two characters of your registered email id, the first and last digits of your pin code and you will also see your Pan number.

After that, you will see the options to receive the OTP that is in your Email Id, Mobile Number, or both. You can select your preferred option. Here we are selecting the Email Id option.

After that, you have to click the confirmation checkbox and then click the Generate OTP button.

Step-4: Enter OTP

As soon as you click on the Generate OTP button you will receive an OTP in your selected mode to receive OTP. In our case, we have selected the email Id option so we will receive OTP in our email Id through the mail.

You have to enter the received OTP in the prescribed input option. You should enter the OTP as soon as possible because the OTP is valid only for 10 minutes. After filling in the OTP in the input field click the validate button.

Step-5: Download e-Pan Card

Now you can download an e-pan card for free.

You can download your free e-pan card only two or three times after that you have to pay some amount to download the e-pan card. The amount is only 8.26 Rupees which is not a big amount.

If you see the below option then you should click “Continue with paid e-Pan Download Facility”.

After clicking the button you will be redirected to select the payment options. After you have selected the payment option you will have to pay the required amount and charges for e-Pan Card. After that, you have to agree to the terms and conditions. And then click the Proceed to Payment button.

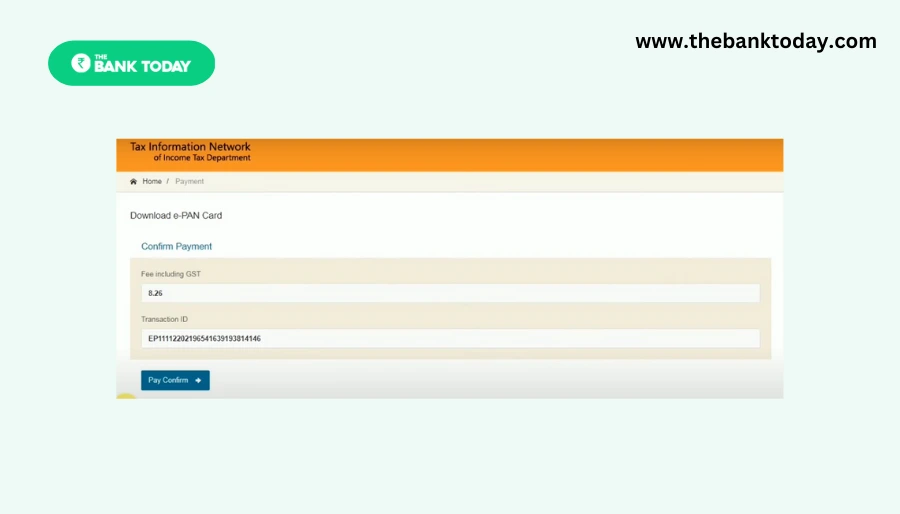

After that, you will have to click the Pay Confirm button. And then you see a pop-up window where you have to enter your UPI number to make the payment successful.

After making payment you have to wait for 5 minutes in this interval you don’t have to refresh or close the page. You will be automatically redirected to the successful page here you only have to click the Continue button.

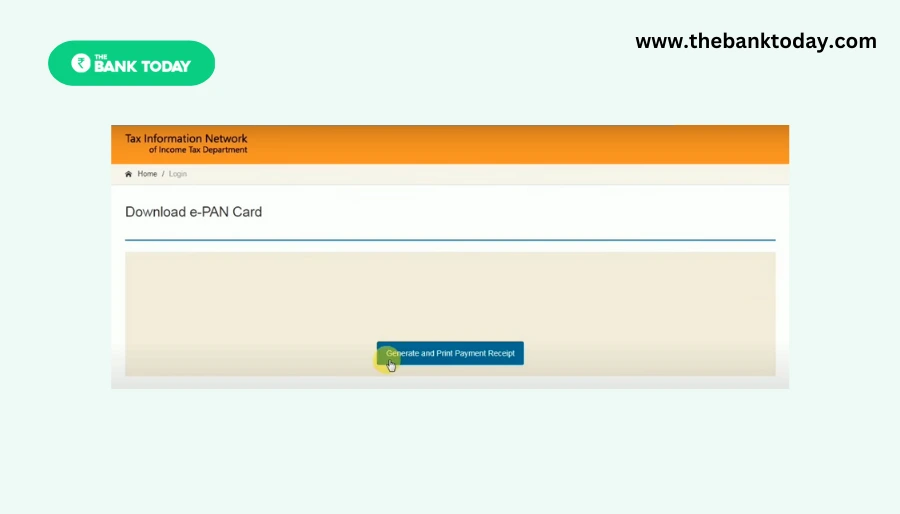

After that, you have to click the Download Payment Receipt button. Your receipt will appear in the next window.

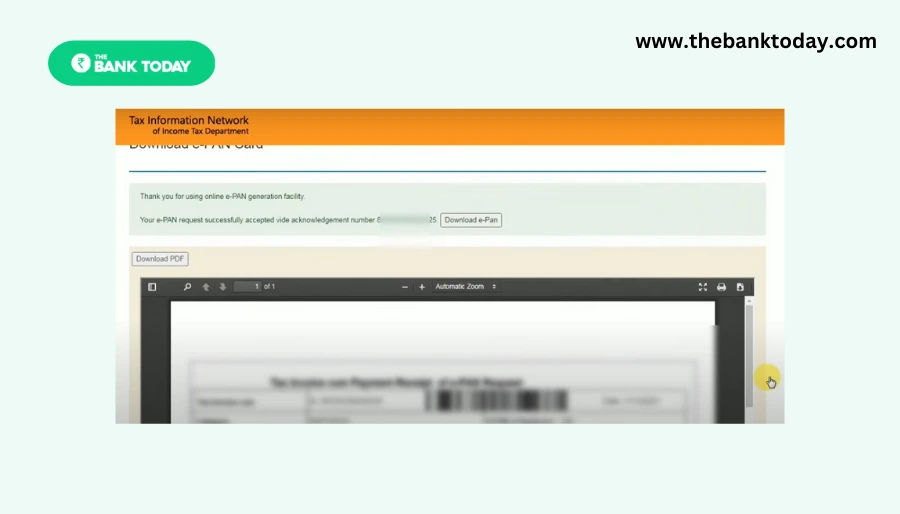

In this window, you will see an option to download the e-Pan Card. Click that option.

After clicking the Download e-Pan Card button you will see two ways to download your e-Pan card. The first is Download e-Pan Card PDF and the second one is Download e-Pan Card XML.

You will need to click the Download e-Pan PDF option. And then your e-Pan will be downloaded.

Note: Your PDF will be password protected and the password for the PDF file is your date of birth. But the date of birth should be entered without the oblique symbol or slash symbol.

Download the e-Pan Card from the UTIITSL Portal

Step-1: visit the official website.

To download e-Pan Card you will need to visit the official website of the UTIITSL portal. The official URL for the portal is https://utiitsl.com

Scroll down to the “Our Services” section and in that section, you will see the Pan Card Services option click that option.

Step-2: Fill in the Facility to Download e-PAN Card Form

As soon as you click the Pan Card services option you will be redirected to the Pan Card service Page.

After that, scroll down and click the Download e-Pan Card option. And then you will be redirected to a new page where you have to fill in your PAN details. Here you have to enter your Pan Card Number, date of birth, and GSTIN Number (which is optional) and after that fill in the captcha and click the submit button.

Remember, in the date of birth input field, you only have to fill in the month and year of your birth.

Step-3: Confirm Pan Details

Now you will see your details like your Pan Number, Mobile Number, and Email Id. Check all the details carefully and confirm the details. After filling the captcha you have to select the mode to receive the OTP. Here you can select either Only Email or Only SMS or you can select the both email and SMS option. And click the confirm checkbox. After filling in the input fields click the Get OTP button.

In the above step, we have selected the only SMS mode to receive the OTP. So, we have to enter the OTP in the prescribed input field which we have received in our registered mobile number. After that click the Submit button.

Step-5: Make Payment

As soon as you click the submit button you will be redirected to the payment gateway. Where you have to pay Rs. 8.26 to download e-Pan Card. Here you have to enter your Mobile number and Email Id to receive the link to download e-Pan Card.

For payment, you have two gateways PayU and BillDesk you can select any one of the following. And then click the Confirm Payment.

As soon as you click the confirm payment option you will see the payment options and you can select any of the following options and make payment.

Step-6: Download e-Pan Card

As soon as your payment gets completed you will see a confirmation page where you see a message that your e-Pan is sent to your email id and the download link is sent to your registered mobile number.

e-Filing Pan card Download portal

If you are 18 years old or above 18 and your mobile number is linked with your Aadhaar number then you can make and download e-Pan Card within 10 minutes. For that just follow the below steps:

Open the official website of e-Filing income tax on your computer or mobile phone. The official link for the portal is- https://www.incometax.gov.in/iec/foportal

Step-2: Select the Instant e-PAN option

On the homepage, you see the Quick Links sidebar on the left side. In this list, after scrolling a little bit down you will see the Instant e-PAN option. Click that option.

Step-3: Click Get New e-Pan

After clicking the Instant e-PAN option you will be redirected to the new page where you will have to click the Get New e-PAN option.

Step-4: Enter Aadhar Number

On this page, you will have to complete the three tasks-

- Enter your 12 digits Aadhaar Number in the prescribed input field.

- Now click the “I Confirm that *” checkbox option. After reading the below instructions

- (1) I have never been allotted a Permanent Account Number (PAN)

- (2) My active mobile number is linked to my Aadhaar

- (3) My complete date of birth (DD-MM-YYYY) is available on my Aadhaar Card

- (4) I am not a minor as on the application date Permanent Account Number (PAN)

Step-5: Confirm the OTP Validation

You will be asked to confirm the terms and conditions to use your Aadhaar card details and to send OTP. On the screen, you will see some instructions that you have to carefully read, and then click the checkbox to confirm the terms.

Step-6: Enter OTP

Now you will receive a 6 digits OTP message in your mobile number which is linked with your Aadhaar number that you have to enter in the prescribed input field for OTP.

And below you have to confirm the checkbox which says that you are agreeing to grant permission to validate the Aadhaar details from the UIDAI portal. And then click the continue Button.

Step-7: Confirm the details

Now on the screen, you will see your Aadhaar details like your registered name, Photo, date of Birth, gender, etc. Check them carefully.

If you want the same details on your e-Pan Card then click the confirmation checkbox after reading the instructions carefully. And then click the Continue button.

Now with this way, your request to download e-PAN card is completed. Regarding this, you will see a message on the screen “Your Request for e-PAN has been submitted successfully. On this message, you will get an Acknowledgment Number which you can use as a receipt number also. Write down this number for future use.

Step-8: Download PAN Card

You can download your e-PAN card within minutes of applying. This is how-

- Go to the homepage of the e-filing website.

- Under Quick Links, click on the link for Instant E-PAN from the list of available links.

- Check Status/ Download PAN box appears on the next page. In this, click on the button Continue below.

- On the next page, enter your 12-digit Aadhaar number and click on the Continue button.

- A 6-digit OTP number comes on your mobile, put it in the OTP box.

- If the message Successfully allotment of e-PAN appears, then two links are also visible beside it.

- By clicking on View e-PAN, you can view your PAN card and know the PAN number.

- You can download a PDF copy of your PAN card by clicking on Download e-PAN card. Save it and keep it. You can take a print of it whenever required and submit it where asked. You can also get its color photo taken out and laminated.

What is the Password for e-PAN Card?

The download PDF of the e-PAN card comes with password protection. And the password to open the e-PAN PDF is your date of birth (applicant’s date of birth) which is 8 characters long. For example, if you were born on February 21, 1996, then your password will be “21021996”. After entering the password you will be able to see your e-PAN Card.

Note: If you have applied for an e-PAN card recently then you can see the status for a new e-PAN card pending. So in that case you have to wait for a minimum of 10 minutes and then again check the status of your e-PAN card.

A 50 Rs Fee is Required to Order the PVC PAN Card

Now if you want to order an e-PAN card home then you have to pay a 50 Rs amount as a fee to order a PVC PAN Card to your home. The payment can be done in any mode such as you can pay through online UPI, Credit/Debit Card, or Net Banking also.

So readers these are the above ways you can download e-Pan Card free. To learn about Banking related services you can read these articles –

- What is the Use of Pan Card in 2023? Benefits Explained in a Simple Way

- How to link Pan Card with a Bank account in 2023?

- How to check the balance of Chhattisgarh Gramin Bank in 2023

- Application to link mobile number in the bank in 2023

- Application to link Aadhaar card in the bank in 2023

- What is the Difference Between Login Password And Profile Password in 2023?

- How to Create a Net Banking Password in 2023

Frequently Asked Questions (FAQs)

How many days will it take to download e pan.

For an e-Pan card, it takes only 10 minutes to download but if you want to get a PVC Pan Card then you have to wait 15-20 days.

Is an instant e-PAN card valid?

Is e-PAN a valid form of PAN? Yes, e-PAN is valid proof of PAN. e-PAN contains a QR code having demographic details of PAN applicants such as name, date of birth, and photograph. These details are accessible through a QR code reader.

Can we get a PAN card in 10 minutes?

Applying for PAN online is simple and easy if you have an Aadhaar card. You can then apply for an instant e-PAN online within 10 minutes through the Income Tax portal, NSDL site, or UTIITSL site .

Is ePAN valid without a signature?

No, because the signature is mandatory for PAN Card. Without a signature, a PAN Card is considered invalid and not eligible for online PAN verification.

What are the fees for an ePAN card?

e-PAN is free to download an e-PAN for the first two times after that fee of Rs 8.26 is to be paid to download the e-PAN card.

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

MTFs, advanced charts, advisory & more—right at your fingertips.

Invest in top performing funds at 0% commission

Apply for IPOs within few clicks!

Invest in fixed-income instrument with low risk

Enjoy easy diversification with flexible investment

Invest in top US stocks

Trade F&O contracts across segments along with far expiry contracts

Expand your trading horizons with global currency trading!

Diversify your portfolios beyond traditional securities

A go-to app for traders and investors.

A desktop platform designed to execute trades at lightning fast speed.

A trading terminal designed exclusively for derivatives traders.

Go-to platform for the fast and flexible traders.

Build your own trading terminal for FREE.

Trade directly from TradingView charts with Tv.5paisa.

Embed 5paisa trading button to your website.

Trade like a pro - Access charts, Analyse Patterns and Execute Orders.

- Market Movers

- Popular Stocks

Lorem ipsum dolor sit amet. Sit galisum voluptas ex

- Mutual Funds

- Partner with us

- Futures & Options

- Stock Market Guide

- How To Download Pan Card Online

- How to Download PAN card (e-PAN card) online?

Last Updated: 27 Mar, 2024 03:20 PM IST

Want to start your Investment Journey?

Introduction, e-pan download from the national securities depository limited (nsdl) website, e-pan download from the uti infrastructure technology and services limited website (utiitsl), e-pan download from the income tax department website, e-pan card download using pan number.

In today’s digital age, everything is done virtually, from ordering food, paying bills, conducting meetings, and even closing business deals. Given the scenario carrying an important and mandatory, yet small document like a PAN card can be inconvenient and prone to damage, and worse, loss.

Now, the Income tax department has allowed PAN holders to download their e-PAN cards. An e-PAN card is a soft copy of your PAN card which can be stored virtually. All you need to do is visit the NSDL or UTIITSL or the Income tax department’s website to download it, which is done easily by using the acknowledgement number (in case of a new or duplicate PAN) or the PAN number. An acknowledgement number is a 15-digit number that you receive when you apply for a PAN card or its duplicate.

Here are the different ways of obtaining an e-PAN card.

PAN applicants can download their e-PAN through the NSDL website. The following steps specify the way to successfully download your e-PAN card.

1. Visit the NSDL portal for online services and click on ‘Download ePan’. You can also click on https://www.onlineservices.nsdl.com/paam/requestAndDownloadEPAN.html

2. Enter the 15-digit acknowledgement number received during the PAN application.

3. Enter the captcha and click on ‘Submit’.

4. Generate an OTP. It will be sent on our mobile phone or email based on your selection.

5. Click on ‘Validate’ after entering the OTP.

6. Next, click on ‘Download PDF’.

7. The downloaded PDF document is password protected. The password is your birthdate in the DDMMYYYY format.

8. Enter the password to open the PDF.

PAN card holders can now download their e-PANs right from the UTIITSL's website. This facility is available for users that have applied for a fresh PAN card or requested corrections or updations with UTIITSL. Additionally, registered users with the Income Tax department that possess a valid and active mobile number OR email can download their e-PAN. The steps are as below:

1. Visit the official UTIITSL portal. Click on ‘PAN card services’ and then click on ‘Download e-PAN’ OR you can click on https://www.pan.utiitsl.com/PAN_ONLINE/ePANCard

2. Enter your PAN number, GSTIN number if applicable, and date of birth.

3. Enter the captcha in the space given.

4. A link will be sent to your mobile number and email ID.

5. Open the link and complete the OTP authentication process.

6. You can now download the e-PAN card.

To download your e-PAN from the income tax website, you will need a valid Aadhar card. Follow these easy steps to download your e-PAN card.

1. Visit the income tax e-filing homepage (https://www.incometax.gov.in/iec/foportal) and click on Instant e-PAN.

2. On the e-PAN page, click on ‘Continue’ on the Check Status/Download e-PAN box.

3. You will be on the Check Status/Download e-PAN page. Enter your 12-digit Aadhar number and click on ‘Continue’.

4. You will be sent a 6-digit OTP on your mobile number registered with your Aadhar. Enter the OTP and click on ‘Continue’. Note that OTP is valid only for 15 minutes. A maximum of three attempts are allowed.

5. You will see the ‘Current status of your e-PAN Request’ page next. If the new e-PAN has been allotted, you can download it by clicking on the tab ‘Download e-PAN’.

By following these steps you can download your e-PAN card using your PAN card number from the NSDL or UTIITSL websites.

1. NSDL website

Note that this facility is available for those PAN holders whose allotment is 30 days or older.

● On the NSDL website, click on ‘Download e-PAN card’ or click on the link below https://www.onlineservices.nsdl.com/paam/requestAndDownloadEPAN.html

● Choose the PAN option on the page.

● Enter the PAN, Aadhar, and date of birth details in the respective fields.

● The GSTIN number is optional.

● Click on submit after filling in all the fields.

● You can now download the e-PAN card.

2. UTIITSL website

You can download e-PAN from this website only if:

● You have applied for a new PAN on this website

● You have applied for the latest changes, updates, or corrections on this website

● Your active mobile number or email is registered with the Income Tax department.

Follow these steps to download your PAN card.

1. Visit https://www.pan.utiitsl.com/

2. Click on ‘Download e-PAN’ under PAN Services.

3. In the new window, enter the mandatory fields viz – PAN, Date of birth for individual or date of incorporation of the entity or formation of associations as the case may be.

4. GSTIN Number (not compulsory)

5. Enter Captcha and click on ‘Submit.’

6. A link would be sent to the registered mobile number as an SMS or email.

7. You can download the e-PAN card by clicking on the link and entering the OTP received on mobile or email ID.