Please turn on JavaScript in your browser It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Guide to chase sapphire® travel insurance.

Planning a vacation or honeymoon can be exciting. That excitement might include the worries that something unexpected could interrupt those plans. The following overview of Chase Sapphire travel protections may make your next trip less stressful if you are a cardmember.

How does Chase Sapphire travel protection work

Certain benefits that may give you peace of mind when using your card for travel are available to Sapphire Reserve and Sapphire Preferred ® cardmembers:

- Travel and Emergency Assistance Services: If you run into a problem away from home, call the Benefit Administrator for legal and medical referrals or other travel and emergency assistance. (You will be responsible for the cost of any goods or services obtained.)

- Trip Delay Reimbursement: If your common carrier travel is delayed more than 12 hours (six hours for Sapphire Reserve) or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging, up to $500 per ticket.

- Trip Cancellation / Interruption Insurance: If your trip is canceled or cut short by sickness, severe weather and other covered situations, you can be reimbursed up to $10,000 per person and $20,000 per trip for your pre-paid, non-refundable travel expenses, including passenger fares, tours and hotels.

- Baggage Delay Insurance: Reimburses you for essential purchases like toiletries and clothing for baggage delays over six hours by passenger carrier up to $100 a day for 5 days.

- Lost Luggage Reimbursement: If you or an immediate family member check or carry-on luggage that is damaged or lost by the carrier, you're covered up to $3,000 per passenger.

- Auto Rental Collision Damage Waiver: Decline the rental company's collision insurance and charge the entire rental cost to your card. For Sapphire Reserve cardmembers, coverage is primary and provides reimbursement up to $75,000 for theft and collision damage for rental cars in the U.S. and abroad. Sapphire Preferred Cardmembers can be reimbursed up to the actual cash value of the vehicle, but coverage excludes certain cars, such as high value and exotic vehicles.

- Travel Accident Insurance: When you pay for your air, bus, train or cruise transportation with your card, you are eligible to receive accidental death or dismemberment coverage of up to $500,000 ($1,000,000 for Sapphire Reserve).

Additional Benefits covered with Chase Sapphire Reserve travel insurance

Certain travel reimbursement, cancellation protection and emergency services are available to Chase Sapphire Reserve ® cardmembers on eligible travel booked with their credit card. Here’s some more information about the benefits offered with the card.

Emergency Evacuation and Transportation

If you or a member of your immediate family are injured or become sick during a trip far from home that results in an emergency evacuation, you can be covered for medical services and transportation up to $100,000.

Roadside Assistance

If you have a roadside emergency, you can call for a tow, jumpstart, tire change, locksmith or gas. You’re covered up to $50 per incident 4 times a year.

Emergency Medical and Dental Benefit

If you're 100 miles or more from home on a trip, you can be reimbursed up to $2,500 for medical expenses if you or your immediate family member become sick or injured.

If you have a Sapphire credit card, travel protection applies to plane tickets, rental cars and cruise line reservations booked using a Sapphire card or Ultimate Rewards ® points. You will be able to claim reimbursement for trip cancellations or interruptions, lost luggage, baggage that’s delayed or flight delays.

Whether it’s a long-awaited vacation or flying across the country to see family for the holidays, the Chase Sapphire family of cards offers benefits to give travelers more confidence in their plans.

- card travel tips

- credit card benefits

What to read next

Credit card basics how to find your frequent flyer number.

How do you find your frequent flyer number? Learn several ways you may be able to track down your number so you can use it when booking that flight.

credit card basics The Chase Sapphire Lounge at the Sundance Film Festival

Discover the perks and benefits of being a Sapphire Reserve cardmember at Sundance Film Festival.

credit card basics Priority Pass San Diego: What to know

There is one lounge in the San Diego airport that is in the Priority Pass network, plus two spa locations and a restaurant.

credit card basics What to know about Denver airport United lounges

Airport lounges can offer a little extra comfort while you’re traveling. Learn about the United lounges at Denver airport as well as other amenities.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

- Chase Sapphire Reserve

Full List of Travel Insurance Benefits for the Chase Sapphire Reserve Card [2023]

Christine Krzyszton

Senior Finance Contributor

310 Published Articles

Countries Visited: 98 U.S. States Visited: 45

Director of Operations & Compliance

1 Published Article 1178 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

![trip cancellation insurance chase Full List of Travel Insurance Benefits for the Chase Sapphire Reserve Card [2023]](https://upgradedpoints.com/wp-content/uploads/2020/01/Chase-Sapphire-Reserve-Upgraded-Points-LLC-Large-9.jpg?auto=webp&disable=upscale&width=1200)

Table of Contents

Chase sapphire reserve card — travel insurance benefits and protections, how to file a claim, everything else you need to know, why we like the chase sapphire reserve overall, alternative travel rewards cards, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Few credit cards can compete with the Chase Sapphire Reserve ® when you’re looking for a premium travel rewards credit card. There are also few, if any, travel rewards cards that offer a better selection of travel insurance benefits.

Travel insurance benefits and protections that come with your credit card can provide valuable assistance if your trip is disrupted, reimburse you for expenses if things go wrong during your journey, and much more.

It’s become increasingly more important to have a level of travel insurance for peace of mind and to make you whole after an unexpected event. While the travel insurance that comes on your credit card is not meant to take the place of a comprehensive travel insurance policy , it can provide sufficient coverage for most trips you make.

Today, we’ll dive deep into the assortment of travel insurance benefits that come with the Chase Sapphire Reserve card.

We’ll also look at how the coverages work, glance at the process for filing a claim if something does go wrong, and in the end, give you all the other reasons we like the card for frequent travelers.

There are so many reasons we like the Chase Sapphire Reserve card overall and we’ll cover those later in our article. For now, we’re going to jump right into the focus of our review, the travel insurance benefits and protections offered on the card.

Some benefits or protections can save you money , others provide assistance during your travels, and yet others offer peace of mind .

Here is our breakdown of the travel insurance coverages that can be found on your Chase Sapphire Reserve card.

Auto Rental Collision Damage Waiver

The auto rental insurance coverage on your Chase Sapphire Reserve card could save you hundreds of dollars on your car rental bill. Simply reserve and pay for your car rental with the card, decline the car rental agency’s collision damage waiver (CDW) or loss damage waiver (LDW) coverage, and receive primary car rental coverage for theft or damage to the rental car.

Primary coverage means that you do not have to file a claim with another insurance company first.

Additional coverage includes loss of use charges and reasonable and customary towing charges.

You and authorized drivers listed on the rental agreement are covered.

Coverage limitations and conditions apply, including:

- $75,000 coverage limit

- Rental period cannot exceed 31 days

- Liability coverage and the loss of personal items are not covered

- Expenses reimbursed by other insurance are not covered

- Antique vehicles, vans that carry more than 9 people, motorcycle/bikes, limos, and recreational vehicles are not covered

Bottom Line: The Chase Sapphire Reserve card comes with primary car rental insurance. If a car rental agency charges $20 per day for this coverage, you could save $140 on a 7-day rental by declining the rental car agency’s collision damage waiver or loss damage waiver coverage.

Trip Cancellation and Trip Interruption

When you pay for your trip partially or in full with your Chase Sapphire Reserve card, with Ultimate Rewards points earned on your card, or a combination of both, you could receive a benefit if your trip has to be canceled or is disrupted for a covered reason.

Examples of covered events could include:

- Severe weather that prevents you from beginning a trip or keeps you from continuing your travels

- Illness or death of an immediate family member or travel companion

- Certain legal obligations

Examples of expenses reimbursed include:

- Prepaid non-refundable expenses charged by a travel supplier, such as a tour operator, airline, or other common carriers

- Non-refundable prepaid expenses charged by rental car or travel agencies

- Under trip interruption, $250 for emergency ground transport

The trip cancellation/interruption coverage that comes with the Chase Sapphire Reserve card pays up to $10,000 per person, per trip , up to $20,000 per occurrence, and up to a maximum of $40,000 in a 12-month period.

Examples of losses that would not be covered could include:

- Cancellation by the travel provider (unless due to severe weather)

- You change your plans

- Preexisting conditions

- Financial insolvency of the travel provider

- Losses that occur on trips exceeding 60 days

Hot Tip: The trip cancellation and trip interruption insurance that comes with a credit card, including the Chase Sapphire Reserve card, does not cover voluntary trip cancellations. If you think you might have to cancel a trip, you should purchase Cancel for Any Reason Insurance which provides coverage regardless of the reason for cancellation.

Trip Delay Reimbursement

Trip delays of more than 6 hours or an overnight stay trigger the trip delay reimbursement coverage on your Chase Sapphire Reserve card. You and your eligible family members could receive up to $500 for each purchased ticket , per trip, for unreimbursed expenses for incidentals, lodging, and meals.

Lost Luggage Reimbursement

If your checked or carry-on luggage is lost, stolen, or damaged, you could receive up to $3,000 per person , per trip. There is a sub-limit of $500 included in the $3,000 maximum for valuable items such as jewelry watches, and specific electronics.

Baggage Delay

When your bags are delayed for more than 6 hours , you could receive up to $100 per day for 5 days for reimbursement of essentials such as clothing, toiletries, and a cell phone charger.

Roadside Assistance

Make just a call if you have a roadside emergency and receive assistance with services such as flat tire replacement, emergency fuel, jump-start service, towing, lock-outs, and more.

The number of covered service calls each 12-month period is limited to 4 and the maximum coverage is $50 per service call. Any charges over that amount will be charged to the Chase Sapphire Reserve card.

Emergency Evacuation and Transportation

Pay for at least a portion of your common carrier trip with your Chase Sapphire Reserve card. Then, if you or an immediate family member become injured or sick during your travels and need emergency evacuation, the card could provide up to $100,000 in coverage .

Trips must be at least 5 days in length , not more than 60 days, and the traveler must be more than 100 miles from home.

This is not reimbursement coverage — you must call the benefits administrator at the time of the incident to initiate emergency transport.

Emergency Medical and Dental Benefit

It’s rare to find any medical or dental coverage provided on a credit card, but the Chase Sapphire Reserve card offers this benefit for its cardholders and qualifying family members.

Here’s how the coverage works:

- Provides up to $2,500 ($50 deducible) for emergency medical or dental services during a covered trip

- Up to $75 per day for 5 days for a hotel if ordered by the attending physician

- Emergency medical/dental services, hospital room, ambulance, medicines, and supplies are examples of covered items

- The trip must be more than 100 miles from your residence

Travel Accident Insurance

Travel Accident Insurance is a benefit seldom ever used but it can provide peace of mind knowing that if a covered death or dismemberment occurred during you or your family’s common carrier trip, there could be a benefit provided.

The card comes with up to $1,000,000 in coverage.

Travel and Emergency Assistance

Whether you need assistance planning your trip or need help during your travels, you’ll have access to a dedicated phone line 24/7 . Receive assistance such as help securing emergency transportation, translation, medical, and legal referrals, help with lost passports, or emergency ticket replacement.

The cost of the actual services received is the responsibility of the cardholder.

Bottom Line: The Chase Sapphire Reserve card comes with one of the best collections of travel insurance benefits and protections available. To learn about additional credit cards also offering travel insurance, check out our list of the best credit cards for travel insurance .

The best time to think about filing a travel insurance claim is before an event happens . Before setting off on your trip, it’s wise to take a few minutes to learn how you or your travel companions could receive assistance, should your trip be disrupted.

Reviewing the process of how to contact the claims administrator en route, should it become necessary, could save you money and frustration after the fact for not following the correct procedure for coverage to be valid.

Reviewing the claims process in advance also makes it easier to gather needed information at the time of disruption, such as photos or a statement from the travel provider, versus trying to secure the needed documentation once you’ve arrived home from a disrupted trip.

Here’s what you’ll need to know about filing a claim for Chase credit card travel insurance benefits and/or protections.

Time Is of the Essence

Each specific travel insurance coverage has stated time limits to report a claim, submit the completed and signed claim form, and for supplying all of the required documentation. Failing to do so could jeopardize the processing of your claim.

The best rule of thumb is to contact the claims administrator as soon as an event occurs . This action can also help you receive proper instructions on how to proceed to make sure your expenses will be covered.

Documentation Is Important

You will be asked to submit documentation for your claim to be processed properly. Keep in mind that Chase is not processing your claim as the card issuer utilizes a third-party claims administrator .

You could be asked to provide any of the following information:

- A completed and signed claim form

- Your credit card statement that includes the last 4 digits of the card and receipts showing you paid for the trip/car rental with the eligible card and/or associated points

- A copy of your common carrier ticket and itinerary

- Any related medical documents and/or death certificate

- Documentation from the travel provider as to why the trip was interrupted, canceled, or delayed

- Receipts for purchases and food expense receipts over $50

- Copy of the travel provider’s cancellation or refund policy

- Any additional documentation requested by the benefit administrator

Hot Tip: The claims process will be easier if you have saved receipts, kept travel provider cancellation/refund policy documentation, and have copies of your ticket information and itineraries.

Our list of Chase Sapphire Reserve card travel insurance benefits is an overview only. We have also abbreviated the coverage descriptions. You will need to access the official Guide to Benefits for the card for terms, conditions, current coverage limits, and claim procedures.

Also, note that most travel insurance benefits that come with credit cards are normally secondary to other insurance you might have that would otherwise cover the loss. If you are compensated by an airline for lost luggage, for example, you would only have coverage via your credit card for any excess loss you incurred above the airline’s payment (up to the limits of coverage).

In addition to having one of the best travel insurance offerings among credit cards, the Chase Sapphire Reserve card comes with strong earnings, redemption options, statement credits, and additional benefits.

Here are some of the reasons we like this premium travel rewards card.

A top player in the high-end premium travel credit card space that earns 3x points on travel and dining while offering top luxury perks.

If you’re looking for an all-around excellent travel rewards card, the Chase Sapphire Reserve ® is one of the best options out there.

The card combines elite travel benefits and perks like airport lounge access , with excellent point earning and redemption options. Plus it offers top-notch travel insurance protections to keep you covered whether you’re at home or on the road.

Don’t forget the $300 annual travel credit which really helps to reduce the annual fee!

- 10x total points on hotels and car rentals when you purchase travel through Chase TravelSM immediately after the first $300 is spent on travel purchases annually

- 10x points on Lyft purchases March 31, 2025

- 10x points on Peloton equipment and accessory purchases over $250 through March 31, 2025

- $550 annual fee

- Does not offer any sort of hotel elite status

- Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s $1,125 toward travel when you redeem through Chase Travel SM .

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel SM immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel SM . For example, 75,000 points are worth $1125 toward travel.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass TM Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck ®

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Member FDIC

- APR: 22.49%-29.49% Variable

- Foreign Transaction Fees: $0

Chase Ultimate Rewards

The Chase Sapphire Reserve card earns valuable, flexible Ultimate Rewards points on every purchase you make.

Here’s how you’ll earn points on the card:

- 10x earnings on car rentals, hotels, and dining booked via Chase Travel

- 5x earnings on air travel

- 3x earnings on all other travel and dining

- 10x earnings on Lyft rides (through March 2025)

- 1x earnings on all other purchases

When it comes time to redeem your Ultimate Rewards points , you’ll have several options offering various values:

- Transfer Ultimate Rewards points to Chase airline and hotel partners to redeem for award tickets or free hotel nights

- Redeem via the Chase travel portal for 1.5 cents each

- Redeem for a statement credit or cash-back at 1 cent each

- Pay Yourself Back to redeem your points for a statement credit at 1.25 to 1.5 each from a list of eligible purchases that rotates

- Redeem for gift cards, experiences, merchandise, or at Amazon and Apple

Other redemption values vary, but always strive to receive no less than 1 cent per point redeemed as you can cash out points for that amount. Transferring Ultimate Rewards points to travel partners can potentially result in the most value for your points. You may also find good value via the Chase travel portal utilizing points at 1.5 cents each for inexpensive flights.

Statement Credits

Receiving statement credits for purchases you’ll be making anyway is an effective way to offset the card’s annual fee. Here are the statement credits you can expect from the Chase Sapphire Reserve card:

- $300 Travel Statement Credit — Each card anniversary year, you’ll receive reimbursement for your travel purchases in the form of a statement credit of up to $300.

- Global Entry, NEXUS, or TSA PreCheck Fee Reimbursement — Once every 4 years, you can receive up to $100 reimbursement for Global Entry fees, $50 for NEXUS enrollment, or $78 for TSA PreCheck.

Additional Benefits

- Complimentary Priority Pass Select Membership — Enjoy access to over 1,400 airport lounge and lounge-alternative properties worldwide with your membership. You’ll also be able to bring in 2 additional guests at no extra charge.

- Complimentary DoorDash DashPass Subscription — You’ll have free delivery on all orders $12 or more and discounted fees (over $100 value). Activate by December 31, 2024.

- No Foreign Transaction Fees — A typical foreign transaction fee can be 3% of your transaction. You won’t have any such fees on your foreign purchases when you use your Chase Sapphire Reserve card.

- Purchase Protection — Use your card to purchase an eligible item and if that item is damaged, stolen, or experiences “involuntary and accidental parting” you could receive up to $10,000 per claim, for a maximum of $50,000 per year . The coverage is valid for 120 days from the purchase date. Gifts purchased for others are also covered.

- Return Protection — If the merchant will not take back any eligible item within 90 days after the purchase date, you could receive up to $500 per item, $1,000 maximum per year.

- Extended Warranty — The manufacturer’s warranty of 3 years or less will be extended for 1 additional year for eligible items. Coverage is limited to $10,000 per claim, $50,000 per account.

Bottom Line: With powerful earning and redemption options, statement credits for specific purchases, worldwide lounge access, and a long list of travel and shopping benefits/protections, the Chase Sapphire Reserve card can be worth the annual fee.

While we think the Chase Sapphire Reserve card is an excellent choice for a travel rewards card, here are a couple of equally appropriate alternatives for the frequent traveler.

The Platinum Card ® from American Express

The Amex Platinum reigns supreme for luxury travel, offering the best airport lounge access plus generous statement credits, and complimentary elite status.

Apply With Confidence

Know if you're approved with no credit score impact.

If you're approved and accept this Card, your credit score may be impacted.

When it comes to cards that offer top-notch benefits, you’d be hard-pressed to find a better card out there than The Platinum Card ® from American Express.

Make no mistake — the Amex Platinum card is a premium card with a premium price tag. With amazing benefits like best-in-class airport lounge access , hotel elite status, and tremendous value in annual statement credits, it can easily prove to be one of the most lucrative cards in your wallet year after year.

- The best airport lounge access out of any card (by far) — enjoy access to over 1,400 worldwide lounges, including the luxurious Amex Centurion Lounges, Priority Pass lounges, Plaza Premium Lounges, and many more!

- 5x points per dollar spent on flights purchased directly with the airline or with AmexTravel.com (up to $500,000 per year)

- 5x points per dollar spent on prepaid hotels booked with AmexTravel.com

- $695 annual fee ( rates and fees )

- Airline credit does not cover airfare (only incidentals like checked bags)

- Earn 80,000 Membership Rewards ® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards ® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards ® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts ® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card ® . The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card ® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- The American Express Global Lounge Collection ® can provide an escape at the airport. With complimentary access to more than 1,400 airport lounges across 140 countries and counting, you have more airport lounge options than any other credit card issuer on the market. As of 03/2023.

- $155 Walmart+ Credit: Save on eligible delivery fees, shipping, and more with a Walmart+ membership. Use your Platinum Card ® to pay for a monthly Walmart+ membership and get up to $12.95 plus applicable taxes back on one membership (excluding Plus Ups) each month.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card ® .

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $189 CLEAR ® Plus Credit: CLEAR ® Plus helps to get you to your gate faster at 50+ airports nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Card. CLEARLanes are available at 100+ airports, stadiums, and entertainment venues.

- Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 year period for TSA PreCheck ® application fee for a 5-year plan only (through a TSA PreCheck ® official enrollment provider), when charged to your Platinum Card ® . Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card ® . That's up to $50 in statement credits semi-annually. Enrollment required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card ® to your Resy profile.

- $695 annual fee.

- Terms Apply.

- APR: See Pay Over Time APR

- Foreign Transaction Fees: None

American Express Membership Rewards

Also packed with a generous collection of travel insurance benefits , the Amex Platinum card shines as a companion for the frequent traveler.

Its lounge access benefits are second to none, plus it offers hotel program elite status, rental car perks , and statement credits for specific purchases. It also earns valuable, and flexible, Membership Rewards points via a generous bonus earnings on eligible travel.

Chase Sapphire Preferred ® Card

A fantastic travel card with a huge welcome offer, good benefits, and perks for a moderate annual fee.

The Chase Sapphire Preferred ® card is one of the best travel rewards cards on the market. Its bonus categories include travel, dining, online grocery purchases, and streaming services, which gives you the opportunity to earn lots of bonus points on these purchases.

Additionally, it offers flexible point redemption options, no foreign transaction fees, and excellent travel insurance coverage including primary car rental insurance . With benefits like these, it’s easy to see why this card is an excellent choice for any traveler.

- 5x points on all travel booked via the Chase Travel portal

- 5x points on select Peloton purchases over $150 (through March 31, 2025)

- 5x points on Lyft purchases (through March 31, 2025)

- $95 annual fee

- No elite benefits like airport lounge access or hotel elite status

- Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That’s over $900 when you redeem through Chase Travel SM .

- Enjoy benefits such as 5x on travel purchased through Chase Travel SM , 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel SM . For example, 75,000 points are worth $937.50 toward travel.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- APR: 21.49%-28.49% Variable

If you’re looking for a travel rewards credit card but are reluctant to pay a high annual fee, or you won’t use all of the benefits offered on the Chase Sapphire Reserve card, you might want to consider the Chase Sapphire Preferred card .

The Chase Sapphire Preferred comes with many of the travel insurance benefits and protections offered by the Chase Sapphire Reserve card and it’s one of our favorite travel rewards cards.

Capital One Venture X Rewards Credit Card

The Capital One Venture X card is an excellent option for travelers looking for an all-in-one premium credit card.

The Capital One Venture X Rewards Credit Card is the premium Capital One travel rewards card on the block.

Points and miles fans will be surprised to see that the Capital One Venture X card packs quite the punch when it comes to bookings made through Capital One, all while offering the lowest annual fee among premium credit cards.

Depending on your travel goals and preferences, the Capital One Venture X card could very well end up being your go-to card in your wallet.

- 10x miles per $1 on hotels and rental cars purchased through Capital One Travel

- 5x miles per $1 on flights purchased through Capital One Travel

- 2x miles per $1 on all other purchases

- $395 annual fee ( rates & fees )

- Does not offer bonus categories for flights or hotel purchases made directly with the airline or hotel group, the preferred booking method for those looking to earn elite status

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- Use your Venture X miles to easily cover travel expenses, including flights, hotels, rental cars and more—you can even transfer your miles to your choice of 15+ travel loyalty programs

- Elevate every hotel stay from the Premier or Lifestyle Collections with a suite of cardholder benefits, like an experience credit, room upgrades, and more

- Receive up to a $100 credit for Global Entry or TSA PreCheck ®

- APR: 19.99% - 29.99% (Variable)

Capital One Miles

The newest premium travel rewards card on the block is the Capital One Venture X card . We like that the card comes with an annual $300 credit for travel purchased via Capital One Travel .

The card’s annual fee is also lower than most premium travel rewards cards but you’ll still find travel insurance , worldwide lounge access , Global Entry or TSA PreCheck fee reimbursement, stellar earnings on travel, cell phone protection , and a respectable 2x earnings on all other purchases.

While the high annual fee may be off-putting, the Chase Sapphire Reserve card is packed with plenty of benefits to justify the expense — if you’ll utilize the majority of those benefits.

Our focus today was on travel insurance benefits that alone could save you money, provide compensation, and/or reimbursement if your trip is disrupted. But there is additional value in all the other benefits offered on the card .

A Priority Pass Select membership, for example, will set you back as much as $469 each year, plus $35 for each guest, per visit. The Priority Pass membership that comes with the Chase Sapphire Reserve card offers unlimited access for the cardholder and allows 2 additional guests at no charge.

The card also comes with a $300 travel credit , and up to $100 for Global Entry, NEXUS. or TSA PreCheck fees.

If you can utilize the benefits, the card can be worth it.

All information and content provided by Upgraded Points is intended as general information and for educational purposes only, and should not be interpreted as medical advice or legal advice. For more information, see our Medical & Legal Disclaimers .

For Capital One products listed on this page, some of the above benefits are provided by Visa ® or Mastercard ® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Enrollment required through Capital One website or mobile app. Upon enrollment, eligible cardholders will remain at upgraded status level through December 31, 2024. Please note, enrolling through the normal Hertz Gold Plus Rewards enrollment process (e.g. at Hertz.com) will not automatically detect a cardholder as being eligible for the program and cardholders will not be automatically upgraded to the applicable status tier. Additional terms apply.

For rates and fees of The Platinum Card ® from American Express, click here .

Frequently Asked Questions

Does the chase sapphire reserve card have travel insurance.

The Chase Sapphire Reserve card has one of the best travel insurance packages available.

You’ll find a collection of travel insurance coverages that include primary car rental insurance, trip cancellation/interruption, lost and delayed baggage coverage, emergency evacuation and medical, roadside assistance, and more.

Is the Chase Sapphire Reserve card worth the annual fee?

If you will utilize the benefits offered on the Chase Sapphire Reserve card, the card is definitely worth it.

In fact, we’ve estimated that the card offers benefits that could be valued at nearly $3,500.

Does the Chase Sapphire Reserve card have primary car rental insurance?

The Chase Sapphire Reserve card does offer primary car rental insurance.

Primary car rental insurance does not require that you file a claim with your own car insurance company insurance first. If a covered event occurs, you will have coverage on your Chase Sapphire Reserve card.

You must pay for the entire rental with your Chase Sapphire Reserve card and decline the rental car agency’s collision damage waiver coverage for coverage to be valid.

Can I have more than 1 Chase Sapphire credit card?

While you can have more than 1 Chase credit card, you can only be the primary cardholder on 1 Chase Sapphire credit card, either the Chase Sapphire Reserve card or the Chase Sapphire Preferred card. You could, however, be an authorized user on another Sapphire card.

Which card is better, the Chase Sapphire Preferred card or the Chase Sapphire Reserve card?

Both the Chase Sapphire Preferred card and Chase Sapphire Reserve card offer benefits for the frequent traveler.

The better card for you will depend on your spending mix, your preferred redemption options, your tolerance for paying an annual fee, and the level of travel benefits/protections you will use on the card.

To assist you further, we’ve put together a detailed article comparing the 2 cards. Access our article on the Chase Sapphire Reserve card vs. the Chase Sapphire Preferred card .

Was this page helpful?

About Christine Krzyszton

Christine ran her own business developing and managing insurance and financial services. This stoked a passion for points and miles and she now has over 2 dozen credit cards and creates in-depth, detailed content for UP.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![trip cancellation insurance chase IHG® Rewards Club Select Credit Card — Full Review [2024]](https://upgradedpoints.com/wp-content/uploads/2018/03/IHG-Select-Card.jpg?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Your Benefits Get the Most Out of Your Marriott Bonvoy ® Credit Card

Useful features whether you’re traveling across town or around the globe, contactless checkout.

Simply tap to pay with your contactless Chase Visa card Opens in new window . Just look for the Contactless Symbol at checkout, then tap your contactless card on the checkout terminal. It's fast, easy and secure!

Global Acceptance

The Marriott Bonvoy Credit Card is accepted in many places worldwide. So you can use your card — and keep earning points faster — virtually anywhere.

Lost Luggage Reimbursement

If you or an immediate family member check or carry on luggage that is damaged or lost by the carrier, you're covered up to $3,000 per passenger. ** Asterisk, same page link to footnote

Auto Rental Collision Damage Waiver

Decline the rental company's collision insurance and charge the entire rental cost to your card. Coverage is provided for theft and collision damage for most cars in the U.S. and abroad. In the U.S., coverage is secondary to your personal insurance. ** Asterisk, same page link to footnote

Trip Cancellation/ Interruption Insurance

If your trip is canceled or cut short by sickness, severe weather and other covered situations, you can be reimbursed up to $5,000 per person and $10,000 per trip for your pre-paid, non-refundable travel expenses, including passenger fares, tours and hotels. ** Asterisk, same page link to footnote

Trip Delay Reimbursement

If your common carrier travel is delayed more than 12 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging, up to $500 per ticket. ** Asterisk, same page link to footnote

Travel and Emergency Assistance Services

If you run into a problem away from home, call the Benefit Administrator for legal and medical referrals or other travel and emergency assistance. (You will be responsible for the cost of any goods or services obtained.) ** Asterisk, same page link to footnote

** Same page link asterisk reference These benefits are available when you use your card. Restrictions, limitations and exclusions apply. Most benefits are underwritten by unaffiliated insurance companies who are solely responsible for the administration and claims. There are specific time limits and documentation requirements. Please refer to your Guide to Benefits for a full explanation of coverages, or call the number on the back of your card for assistance. Marriott Bonvoy ® is not responsible for the benefits described in the Guide to Benefits.

Keeps You Secure When Using Your Marriott Bonvoy ® Credit Card

Extended warranty protection.

Extends the time period of the manufacturer's U.S. warranty by an additional year, on eligible warranties of three years or less. ** Asterisk, same page link to footnote

Fraud Protection

Zero Liability Protection means you won't be held responsible for unauthorized charges made with your card or account information. 7 Opens overlay Link to footnote

Purchase Protection

Covers your new purchases for 120 days against damage or theft up to $500 per claim and $50,000 per account. ** Asterisk, same page link to footnote

24/7 Cardmember Services Are Here to Assist You at a Moment’s Notice

Dedicated customer service.

As a Cardmember, you have access to a dedicated customer service line. Call 1-800-338-5960 (24-hour Cardmember service) or our international collect number 1-302-594-8200 .

Visa Signature ® Concierge 8 Opens overlay Link to footnote Service

Complimentary personal assistance anytime, anywhere — from last-minute restaurant reservations to planning a special occasion, your 24/7 concierge can help. Call 1-800-953-7392 .

Emergency Cash and Card Replacement

Emergency cash advance or a card replacement — 24 hours a day, seven days a week.

Lost/Stolen Card Reporting

Enjoy peace of mind knowing that if your card is ever lost or stolen, assistance is only a phone call away.

Account Alerts 9 Opens overlay Link to footnote

Personalized Account Alerts allow you to track your balance, payments and available credit by your choice of email, text message or voice mail.

» SIGN UP TODAY Opens in new window

The Contactless Symbol and Contactless Indicator are trademarks owned by and used with the permission of EMVCo, LLC.

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Best Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Find the best credit card for you

How to use the chase sapphire reserve travel credit, you can earn up to $300 annually with this flexible and easy-to-use benefit..

The Chase Sapphire Reserve® is loaded with luxury perks like airport lounge access , travel protections and the ability to earn transferrable travel rewards — but it also has a hefty $550 annual fee. Thankfully, you can recoup over half of that fee thanks to the card's easy-to-redeem travel credits, which can provide up to $300 of value every year.

If you've ever been tempted to sign up for the Chase Sapphire Reserve, now could be an excellent time to give in. Thanks to a limited-time bonus offer, new card members can earn 75,000 bonus points after spending $4,000 in the first three months from account opening. This bonus is 25% higher than the standard offer, making one of the best travel credit cards even better.

How to maximize the Chase Sapphire Reserve travel credit

How does the chase sapphire reserve travel credit work, what triggers the chase sapphire reserve travel credit, when does the chase sapphire reserve travel credit reset, alternate cards with travel credits, bottom line, chase sapphire reserve®.

Earn 5X total points on flights and 10X total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3X points on other travel and dining & 1 point per $1 spent on all other purchases plus, 10X points on Lyft rides through March 2025

Welcome bonus

Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

Regular APR

22.49% - 29.49% variable

Balance transfer fee

5%, minimum $5

Foreign transaction fee

Credit needed.

Terms apply.

Read our Chase Sapphire Reserve® review.

The Chase Sapphire Reserve's annual travel credit couldn't be any easier to get — simply use your card to make eligible travel purchases and the first $300 lands in your account as statement credits. Unlike many other cards with a similar benefit, you don't have to make these purchases through a specific site or rewards portal to earn the credit.

This card offers a generous return on travel spending, however, the first $300 in travel purchases won't earn points. Frankly, this is a small sacrifice for the opportunity to be reimbursed for over half of the card's annual fee. According to the card's terms, the statement credit will be posted to your account the same day as the eligible travel purchase posts.

Airfare and hotel bookings are just the beginning of what transactions qualify for this credit. These are some of the purchase categories that should count toward your $300 annual credit:

- Car rental agencies

- Cruise lines

- Travel agencies

- Discount travel sites

- Campgrounds

- Toll bridges and highways

- Parking lots and garages

Whether a purchase triggers the travel credit depends on how the merchant codes the transaction. While this shouldn't be a common issue, it's possible certain travel services purchased as part of a packaged offer may not qualify for the credit.

You can add authorized users to your Sapphire Reserve account for $75 per person each year, and authorized user purchases will trigger the credit. However, there is still only a single travel credit per account, not per card. So if the primary accountholder spends $300 in travel on their card and an authorized user spends $300 in travel, only the first $300 in combined travel purchases will be reimbursed.

The Sapphire Reserve's travel credit resets every card member year — not the calendar year. If you want to know how much of your credit you've used, you can call the number on the back of your card or find the information easily online on your Chase Ultimate Rewards® account page.

The Platinum Card® from American Express is a leader when it comes to offering cardholders travel credits. However, the Amex Platinum's credits can require enrollment or activation, which puts a barrier between you and your credits that doesn't exist with the Sapphire Reserve. That said, you can earn well over $1,000 back every year with this card for purchases that include airline fees, digital entertainment, hotels, CLEAR membership and much more. Terms apply.

The Platinum Card® from American Express

Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year, 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel, 1X points on all other eligible purchases

Earn 80,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

See Pay Over Time APR

Credit Needed

Excellent/Good

See rates and fees , terms apply.

Read our The Platinum Card® from American Express review .

The U.S. Bank Altitude® Reserve Visa Infinite® Card has a higher annual credit and lower annual fee compared to the Sapphire Reserve. Every year, cardholders can take advantage of up to $325 in dining and travel credits, which covers all but $75 of this card's $400 annual fee. If you have the U.S. Bank Altitude Reserve card , it would be difficult not to fully use this credit every year.

U.S. Bank Altitude® Reserve Visa Infinite® Card

5X points on prepaid hotels and car rentals booked through the Altitude Rewards Center; 3X points on every $1 on eligible travel and mobile wallet spending

Earn 50,000 bonus points (worth about $750 in travel) after spending $4,500 within the first 90 days of account opening

22.24% to 29.24% (Variable)

3% of the amount of each transfer, with a $5 minimum

See rates and fees , terms apply.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

The Chase Sapphire Reserve has loads of luxury benefits and a pricey $550 annual fee to go along with these perks. However, it has an easy-to-use annual travel credit that allows card members to earn up to $300 back every card anniversary year for eligible travel purchases.

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every credit card review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of credit cards . While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

For rates and fees of the Platinum Card® from American Express, click here .

- Citi Strata Premier Card replaces Citi Premier: Enjoy travel insurance and other new benefits Jason Stauffer

- These are the best homeowners insurance companies in Florida Liz Knueven

- First-time homebuyer grants: What you need to know Kelsey Neubauer

What’s covered by credit card travel accident and emergency evacuation insurance?

MSN has partnered with The Points Guy for our coverage of credit card products. MSN and The Points Guy may receive a commission from card issuers.

Editor’s note: This post has been updated with new information and offers.

Many perks available from your credit cards are well-known and well-utilized. However, benefits such as trip cancellation insurance , delayed baggage insurance , lost baggage insurance , and trip delay protection can quite literally save the day and justify paying an annual fee.

Today, we’ll explain a couple of lesser-known benefits that you hopefully won’t have to use but, if needed, can protect you from extreme financial hardship and ensure your family and loved ones are provided for if something happens to you. You can easily find the coverage and terms of any protection your credit card offers by doing a quick web search for the card’s updated benefits guide.

Travel accident insurance

Often called common carrier insurance , this is a policy that pays in case of death, losing eyesight or losing a limb(s) while on a plane, train, ship or bus licensed to carry passengers and available to the public. A few cards also have travel accident insurance that offers protection for the entire duration of a trip (up to 31 days long) but pays out less than the common carrier insurance policies. To be eligible, you typically have to pay for the entire fare with the credit card.

Different credit cards have different payment tables for how much your beneficiary would receive in case of death, losing one limb, losing two limbs, losing sight in one eye or becoming legally blind. Coverage is also typically extended to authorized users on the account, spouses, domestic partners, and dependent children of the cardholder on trips paid for with the card.

By default, the beneficiaries in order of precedence are spouse, then children, then estate. You can submit a letter to the card issuer to establish another beneficiary.

Emergency evacuation insurance

In the past, when traveling to remote destinations like the Maldives and Fiji, I bought third-party emergency medical evacuation insurance , not realizing the cards I already had would have covered me. There are a few crucial aspects of emergency evacuation insurance offered by credit cards that you need to understand and follow so you don’t compound your medical situation with the stress of financial hardship:

- Everything must be approved and coordinated through a benefits administrator. This is who you or your companions should call when things first start looking like you’ll need assistance. Nothing that you decide to pay for on your own will be reimbursed.

- Evacuation does not mean repatriation. You won’t be evacuated back to the U.S. if you’re far overseas. Most policies state you’ll be moved to the nearest medical facility capable of proper care.

- Preexisting conditions may lead to your request for evacuation at the credit card provider’s expense being denied. Read your credit card’s full terms and benefits guide to see which exclude these conditions and the credit card’s definition of a pre-existing condition.

- The coverage is only for the cost of evacuation and medical care during transportation. You still need medical insurance to pay the doctors and staff who provide you care once you’re back on the ground.

- Some cards have country exclusions, so don’t expect to head into Syria or Afghanistan and rely on your credit card benefits administrator to get you to a hospital.

To get all the relevant information, make sure you download and read the entire section of the benefits guide pertaining to these coverages. Here are a few cards offering travel accident and/or emergency evacuation insurance.

Related: The best credit cards with travel insurance

The Platinum Card® from American Express

The Amex Platinum card removed travel accident insurance in 2020. However, the card still offers one of the most generous emergency evacuation insurance of any card. There’s no cost cap and benefits are extended to immediate family and children under 23 (or under 26 if enrolled full-time in school). Best of all, you don’t even have to use the card to pay for the trip.

You must be on a trip less than 90 days in length and at least 100 miles away from your residence. A Premium Global Assist (PGA) administrator must coordinate everything to not incur any cost. The benefit will also pay economy airfare for a minor under 16 to be returned home if left unattended, pay for an escort to accompany that minor if required to get them home, and get a family member to the place of treatment if hospitalization of more than 10 consecutive days is expected.*

Other American Express cards offer access to the Premium Global Assist Hotline. However, anything they coordinate will be at your expense. Make sure you read your Amex card’s benefits guide carefully.

For more details, see our full review of the Amex Platinum .

Related: Your complete guide to Amex travel protections

*Eligibility and benefit level varies by card. Terms, conditions and limitations apply. Visit americanexpress.com/benefitsguide for details. If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, cardmembers are responsible for the costs charged by third-party service providers.

Apply here: Amex Platinum

Chase Sapphire Reserve® and Chase Sapphire Preferred® Cards

The Chase Sapphire Reserve offers two different travel accident insurance benefits : common carrier travel accident insurance and 24-hour travel accident insurance. The former applies while riding as a passenger in, entering or exiting any common carrier. The latter applies any time during your trip — but you cannot be paid out on both the common carrier and 24-hour policies.

If you use your Chase Ultimate Rewards points to book your trip, you are covered under the card’s benefits.

People eligible for coverage include “you, your spouse, your spouse’s or domestic partner’s children, including adopted children or stepchildren; legal guardians or wards; siblings or siblings-in-law; parents or parents-in-law; grandparents or grandchildren; aunts or uncles; nieces or nephews.” Chase pays up to $1,000,000 for a common carrier loss and up to $100,000 for a 24-hour policy loss based on the following table:

Some interesting exclusions with Chase that would prevent a payout include the insured person participating in a motorized vehicular race or speed contest, the insured person participating in any professional sporting activity for which they received a salary or prize money or if the insured person traveling or flying on any aircraft engaged in flight on a rocket-propelled or rocket-launched aircraft.

The Chase Sapphire Reserve also offers emergency evacuation insurance. If at least a portion of your or an immediate family member’s trip was paid for with the card, you’re eligible for up to $100,000 in emergency medical evacuation. Your covered trip must be between five and 60 days and be at least 100 miles from your residence. If you are hospitalized for more than eight days, the benefits administrator can arrange for a relative or friend to fly round-trip in economy class to your location. You can also be reimbursed for the cost of an economy ticket home if your original ticket cannot be used. In a worst-case situation, the benefit also pays up to $1,000 to repatriate your remains.

The Chase Sapphire Preferred Card offers the same travel accident insurance as the Reserve, except with lower payouts on the common carrier policy. The benefits pay up to $500,000 for a common carrier loss and up to $100,000 for a 24-hour policy loss based on the following table:

For more details, see our full reviews of the Chase Sapphire Reserve and Chase Sapphire Preferred .

Related: Your guide to Chase’s trip insurance coverage

Apply here: Chase Sapphire Reserve and Chase Sapphire Preferred

United Club Infinite Card

The top-tier United Club Infinite Card offers both travel accident insurance and emergency evacuation insurance. The travel accident insurance benefits pay up to $500,000 for a common carrier loss.

The card also carries the same benefit as the Chase Sapphire Reserve for emergency evacuation coverage, with up to $100,000 of coverage provided for evacuation.

For more details, see our full review of the United Club Infinite Card .

Apply here: United Club Infinite

Bottom line

We hope none of us perfectly ever have to worry about either of these policies, but it’s nice to have peace of mind if you or your family need emergency assistance. This reassurance is just one more reason to ensure one of these cards is always in your wallet when traveling. The benefit guides of all cards are updated regularly, so make sure you don’t toss them in the trash when updates show up in the mail and read the online guides for the latest terms and conditions.

Additional reporting by Emily Thompson and Stella Shon.

SPONSORED: With states reopening, enjoying a meal from a restaurant no longer just means curbside pickup.

And when you do spend on dining, you should use a credit card that will maximize your rewards and potentially even score special discounts. Thanks to temporary card bonuses and changes due to coronavirus, you may even be able to score a meal at your favorite restaurant for free.

These are the best credit cards for dining out, taking out, and ordering in to maximize every meal purchase.

Editorial Disclaimer: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airlines or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Trip Cancellation Insurance Explained

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is trip cancellation insurance?

Covered reasons for trip cancellation, what is not covered by trip cancellation insurance, cancel for any reason trip insurance, is trip cancellation insurance expensive, different ways to get trip cancellation insurance, which insurance coverage is best for me.

When booking travel, particularly expensive trips consisting of nonrefundable reservations, it makes sense to consider trip cancellation insurance since it can protect your deposit if your plans do not materialize due to unforeseen events. However, not every reason for canceling a trip will qualify for coverage, so you’ll want to familiarize yourself with the basics of trip cancellation insurance.

Trip cancellation coverage can be purchased as part of a comprehensive travel insurance policy , or you can receive it for free when you hold certain premium credit cards. The benefit is designed to protect prepaid, nonrefundable reservations, including flights, hotel reservations and other bookings if the trip is canceled due to an extraordinary circumstance. Each policy will state exactly which events are considered valid reasons for cancellations.

With COVID-19 still affecting travel plans, you’ll want to pay close attention to which reasons for cancellation due to the pandemic are valid. For example, wanting to cancel a trip you booked a while ago because your destination now has rising COVID-19 numbers and you’re afraid to travel is not likely a valid reason.

If you want to be able to cancel a trip for truly any reason, consider the Cancel For Any Reason supplemental upgrade when purchasing your insurance policy. CFAR will allow you to get up to 75% of your trip investment back as long as the trip is cancelled at least two days before departure.

» Learn more: Does my travel insurance cover the coronavirus?

Imagine you’ve booked a two-week vacation to Italy costing $5,000 ($1,000 flight, $3,500 hotel and $500 excursions), all of which is nonrefundable. Then, a week before your departure date, you fall and break your leg.

So, what does trip cancellation insurance cover?

If you have trip cancellation insurance, you’ll be able to get your entire prepaid, nonrefundable trip cost back (as long as the entire amount was insured), since injuries that necessitate medical treatment and prevent you from taking your trip qualify as a covered reason.

Other covered reasons include death of your traveling companion, inclement weather that results in disrupted service, jury duty, terrorist incident, job termination and other extraordinary events.

Although this is not an entire list of all the covered reasons, generally the cancellation must be due to unforeseen circumstances to qualify for a reimbursement. Review the fine print of your policy for the details of exactly which reasons are covered. When seeking reimbursement, you’ll need to submit claims to the insurance provider to substantiate your claim.

Although a wide range of reasons allow you to receive your prepaid, nonrefundable travel expenses back in the event of a trip cancellation, there are important exclusions to know about.

Trip cancellation insurance will not cover losses arising from self-harm, foreseeable events, acts of war, taking part in activities considered dangerous (e.g., skydiving, bungee jumping, endurance races, etc.), a felony, childbirth, dental treatment and more.

» Learn more: How to find the best travel insurance

So what if you want the flexibility to cancel your trip for reasons other than those covered by your policy? For that, you're going to need the CFAR insurance mentioned above.

CFAR is often available as an add-on to travel insurance policies, and while it can come in handy if you want to cancel your trip just because, you're not likely to get all your money back.

Most CFAR policies will only reimburse 75% of your nonrefundable travel expenditures.

» Learn more: Best travel insurance with Cancel For Any Reason Coverage

The price of trip cancellation insurance can vary based on the traveler’s age, destination, length of trip, cost of trip and insurance company.

Using the same $5,000, two-week trip to Italy as mentioned above, a search of policies on SquareMouth (a NerdWallet partner) ranged from $115 to $470, representing 2.3% to 9.4% of the total trip cost.

» Learn more: How much is travel insurance?

All policies provide 100% coverage of the trip cost, however the more expensive plans usually have higher limits on benefits like medical evacuation.

If you’re only looking for trip cancellation coverage and no other protections, a policy equating to 2.3% of the total trip expenses seems reasonable.

On your travel credit card

Trip cancellation coverage can be included as part of a comprehensive travel insurance plan or offered as a benefit on premium travel credit cards.

For example, the Chase Sapphire Reserve® will reimburse you or your immediate family members up to $10,000 per trip. The Business Platinum Card® from American Express and many other American Express cards also offer up to $10,000 in trip cancellation coverage. Terms apply.

These premium cards also offer other insurance benefits like trip interruption coverage, emergency assistance services, trip delay and more.

If you travel often and typically purchase trip cancellation coverage, consider applying for one of the cards that offer complimentary travel insurance . Not only will you get trip insurance benefits, but you will also get other travel perks and statement credits that can partly offset the annual fee.

Supplement by purchasing policies out-of-pocket

If the coverage limits offered on the cards aren’t sufficient or you’re looking for more protections (e.g., coverage for emergency medical expenses), you’d be better off with a travel insurance . Although you’d incur an additional cost for purchasing a comprehensive plan, you’d have many more benefits not commonly found in the insurance policies offered by the credit cards.

A comprehensive trip cancellation policy is likely to cover canceled flights so long as the flight or flights are nonrefundable and are a part of the total, prepaid expenses covered by your policy. Insurance provided by travel cards typically includes trip delay or cancellation coverage so long as you used that card to pay for your flight reservations.

If you're forced to cancel your trip due to extraordinary circumstances beyond your control, travel insurance will provide coverage for some or all of your nonrefundable travel expenditures, depending on your policy. Covered events will vary, so be sure to review the terms of any plan you intend to purchase.

Trip cancellation insurance is available for purchase from a wide range of companies and is often included as a benefit on travel credit cards. Under certain circumstances, it provides coverage for prepaid travel expenses in the event that you cannot complete your trip as planned.

A comprehensive trip cancellation policy is likely to cover canceled flights so long as the flight or flights are nonrefundable and are a part of the total, prepaid expenses covered by your policy.

Insurance provided by travel cards

typically includes trip delay or cancellation coverage so long as you used that card to pay for your flight reservations.

If you’re going on a trip consisting of costly flights, hotel reservations and excursions and would like to protect your prepaid, nonrefundable deposit but do not need any other coverage, a minimally priced trip cancellation insurance policy is a good choice.

If you have a premium travel credit card , check if you already have trip cancellation insurance as a benefit before you purchase a policy.

However, if you’re looking for additional coverage like travel medical insurance , and/or a basic plan doesn’t have adequate limits, consider a comprehensive travel insurance policy from providers such as AAA , Allianz , and AIG . Read NerdWallet's full analysis of the best travel insurance companies here .

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

How to book travel (and save points) with Chase Travel

Editor's note : This is a recurring post, regularly updated with the latest information.

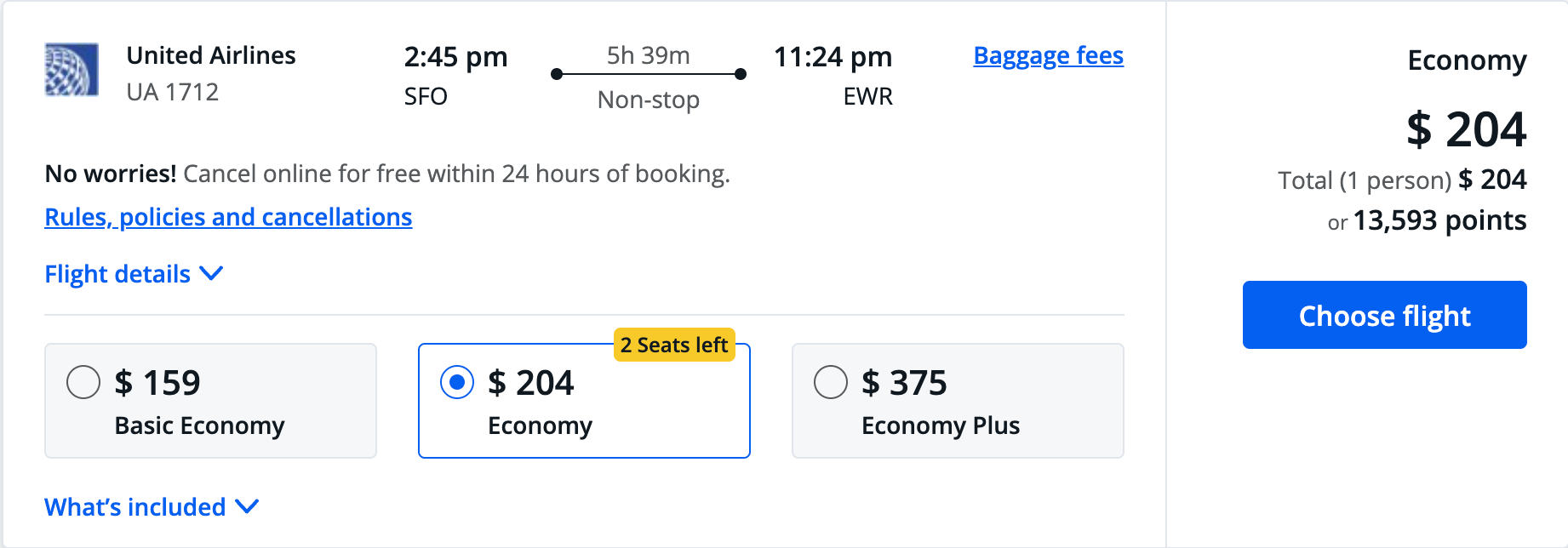

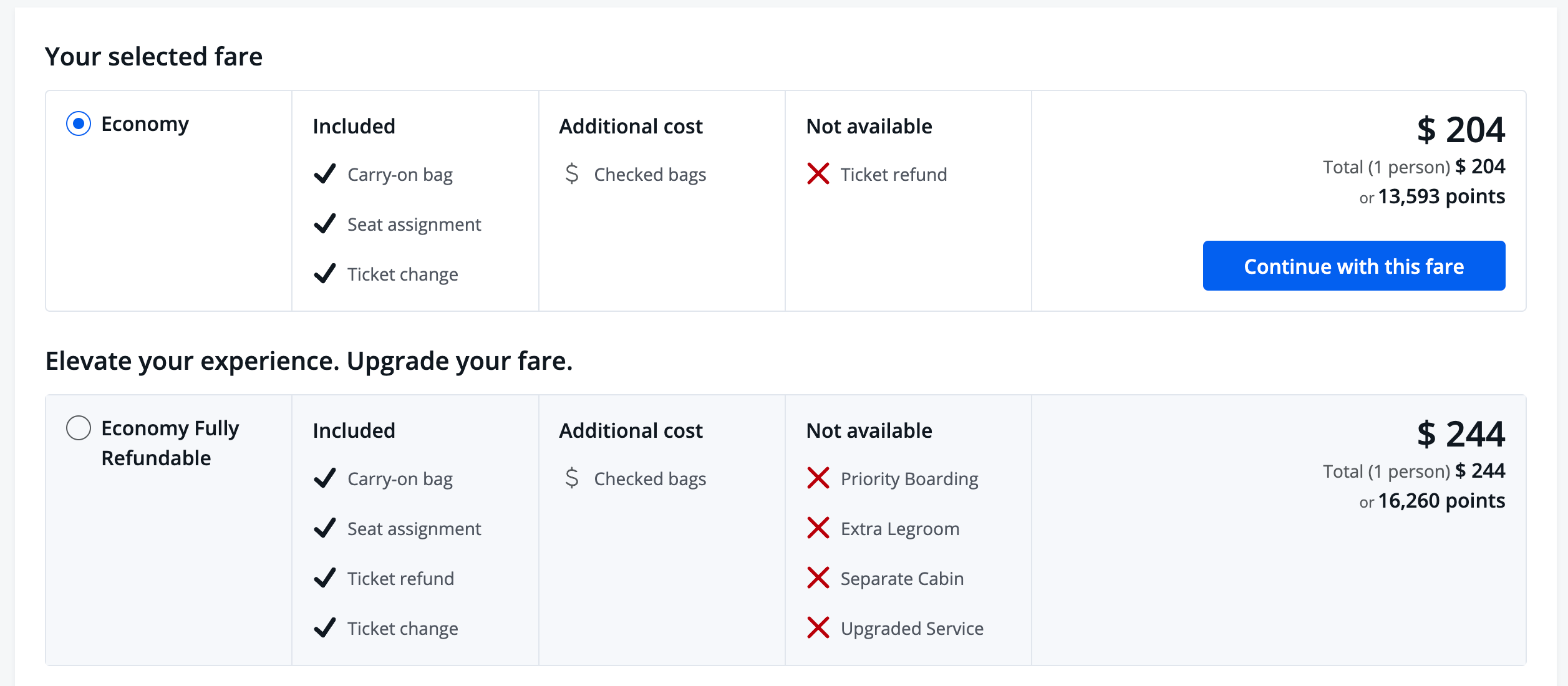

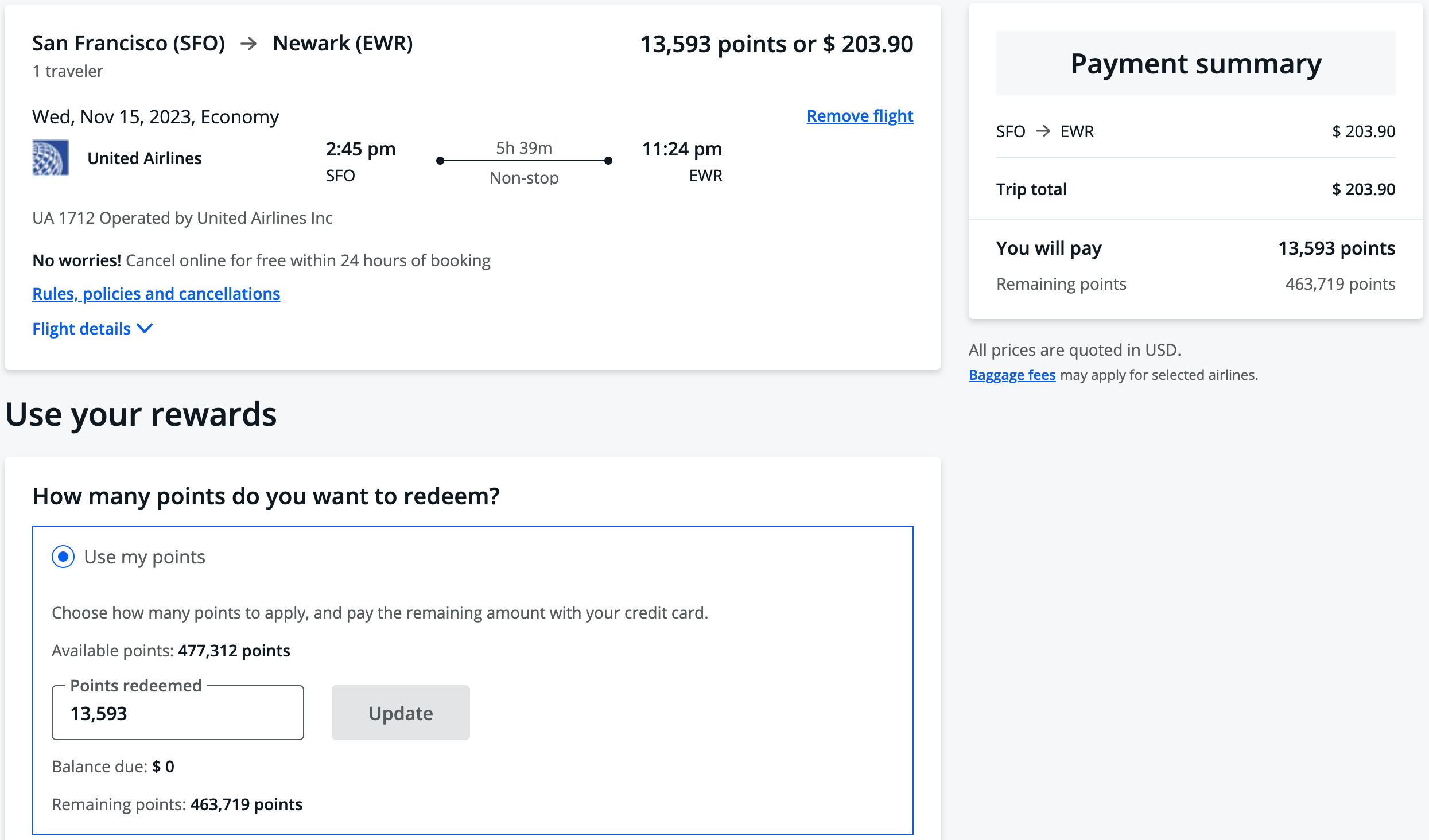

Chase Ultimate Rewards is one of the best flexible rewards currencies available, and you can get some incredible value from your Ultimate Rewards points .

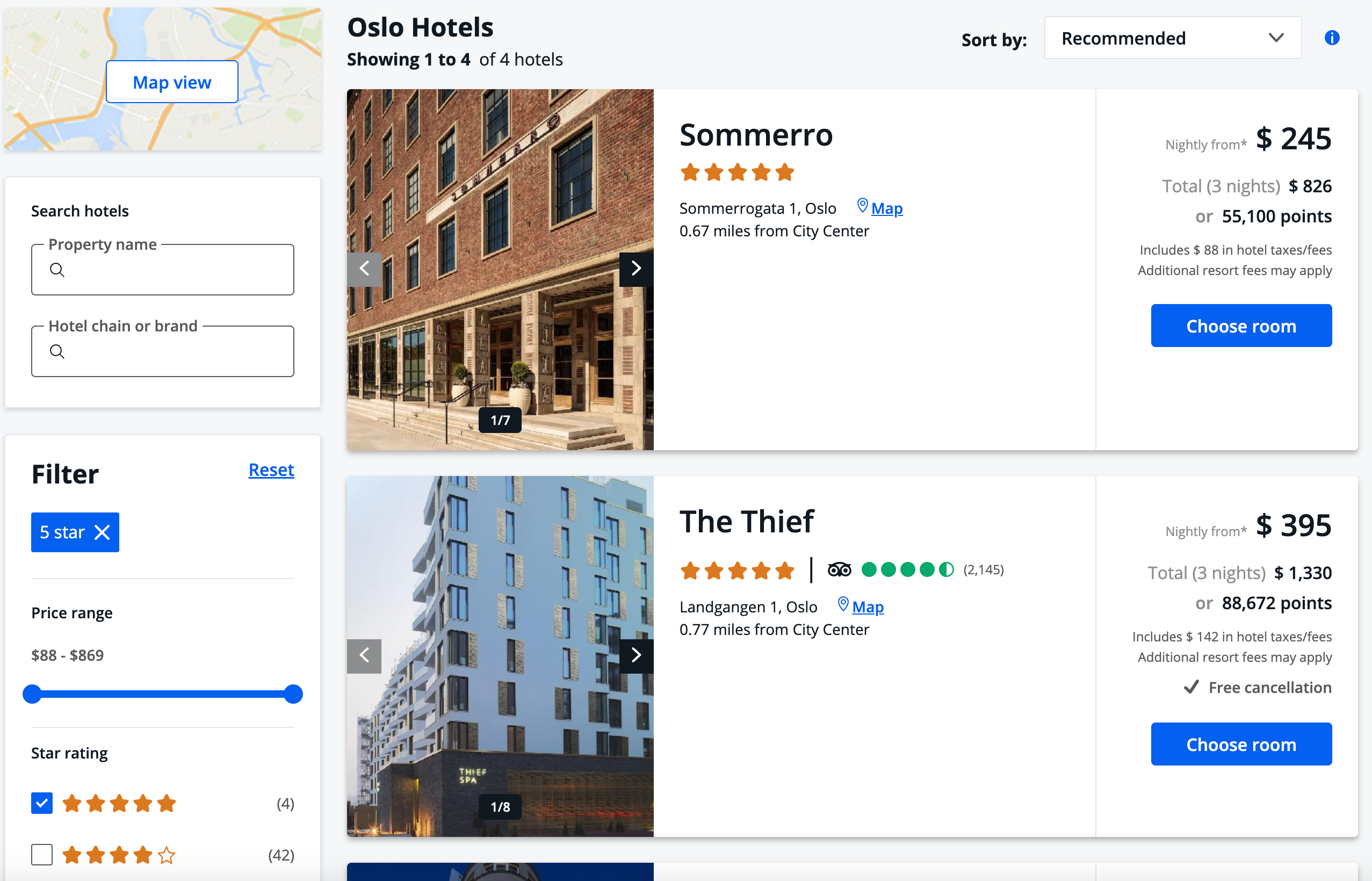

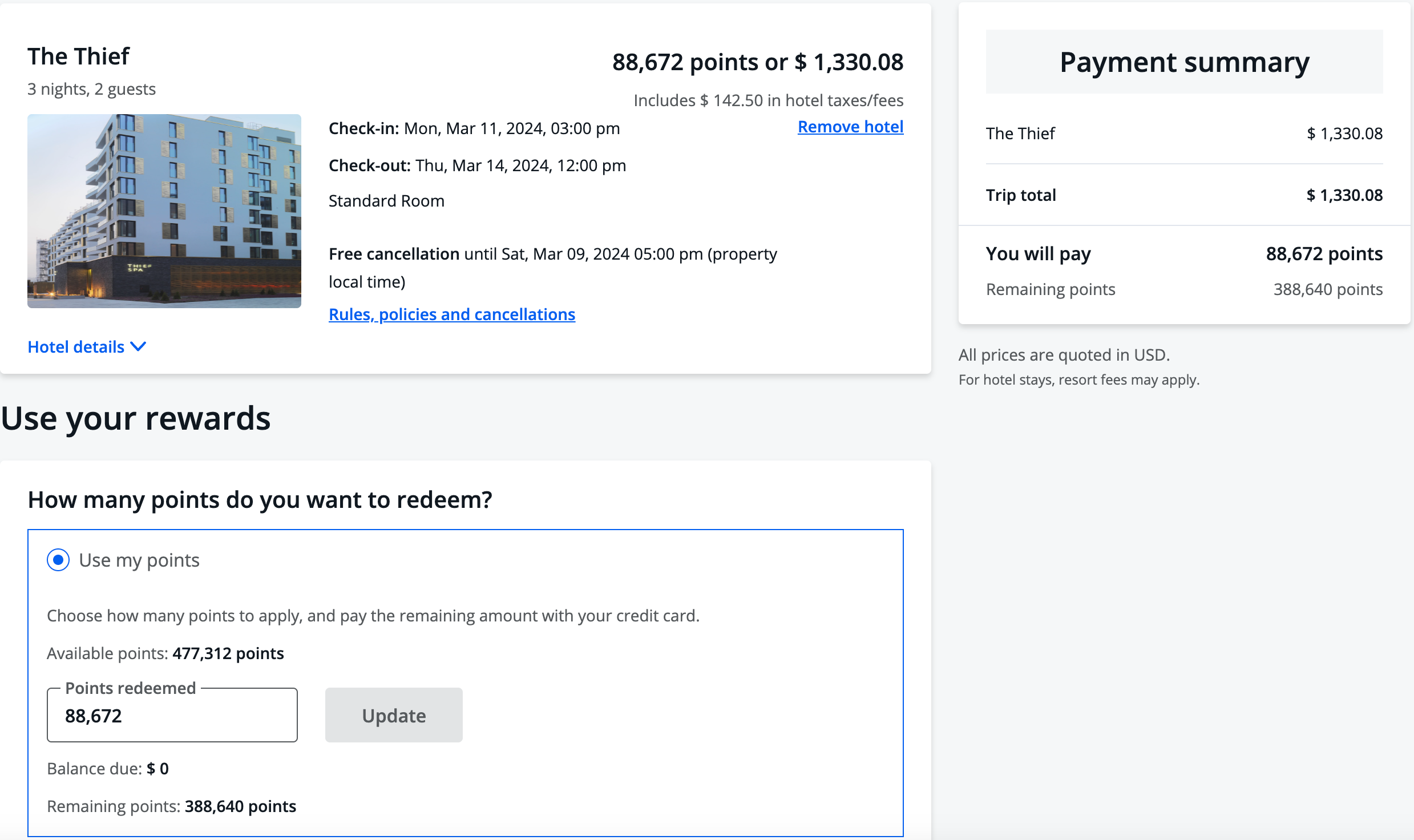

Generally, we recommend transferring Chase points to the program's airline and hotel partners for award bookings. However, sometimes redeeming Ultimate Rewards points for paid travel through Chase Travel℠ is more advantageous. This option can save you money, particularly when traditional award space is unavailable, as you can book almost any available flight or hotel through Chase Travel.

Here's what you need to know about Chase Travel.

Related: New Chase Sapphire Preferred offer: Earn 75,000 of the most valuable points

What is Chase Travel?

To maximize your Ultimate Rewards points, it's often best to transfer them to partner programs like United MileagePlus , World of Hyatt or British Airways Executive Club for award reservations. However, it's important to compare the points needed for a direct booking through Chase Travel to those required for an award booking. Sometimes, booking through the portal can be beneficial, as the points price is tied to the cash cost of the flight or hotel stay, potentially resulting in lower point requirements.

However, you need to have some Chase points before using Chase Travel. If you're unfamiliar with Chase's most popular cards and welcome offers, here are a few current ones to be aware of.

Ink Business Preferred® Credit Card

The Ink Business Preferred® Credit Card is a TPG favorite. It currently comes with one of the highest sign-up bonuses from Chase — 100,000 bonus points after you spend $8,000 on purchases in the first three months of account opening.

Based on our valuations , the bonus points alone are worth $2,050. However, you can redeem these points through Chase Travel for a fixed value of 1.25 cents apiece.

Read more: Ink Business Preferred Credit Card review: A great all-around business card

Chase Sapphire Preferred® Card

The Chase Sapphire Preferred® Card is another fantastic addition to your wallet. For a limited time, you'll earn an elevated 75,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. The bonus is worth $1,538 based on TPG valuations .