- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Best Travel Insurance for Visiting the U.S.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

Travel insurance basics

Best visitors insurance policies, for the lowest price: trawick international, for customizing options: worldtrips, for pre-existing conditions: worldtrips, for highest medical coverage limit: img, other options to consider, the bottom line.

Since health care can be expensive in the U.S., it’s important that visitors have insurance coverage, aka visitors insurance or travel medical insurance, in case something happens that requires medical attention mid-trip.

Whether you have coverage for travel in the U.S. depends on your health care plan in your home country. But if you don't, you'll need to buy a policy from a third-party insurance provider. Several companies sell this kind of visitor insurance, and each company and policy is a bit different. Let’s look at which is best for you.

First, a few basics about visitor insurance. Two kinds are available: travel medical insurance and trip insurance.

Travel medical insurance covers medical expenses that you may incur while traveling internationally, like a visit to the doctor, a trip to the hospital and medical evacuation and repatriation.

Trip insurance usually covers limited medical expenses like emergency care and can compensate you if your trip is delayed, you need to leave the trip early or you have to cancel the trip. It is designed to help you protect the investment you’re making as you prepare to travel.

Standard trip insurance might not cover a visit to the doctor unless it is an emergency.

It’s important to make sure any pre-existing conditions are covered if the visitor has any. Some policies exclude them.

» Learn more: How to find the best travel insurance

With so many kinds of visitors insurance policies, which is the best?

To make comparisons, we got quotes from several companies using Squaremouth , a website to search for different types of travel insurance in one place.

The parameters we set are for a 49-year-old citizen and resident of Spain traveling to the U.S. on May 1-31, 2024.

The quotes don't include cancellation coverage; these examples are for medical coverage only. To get a quote, the hypothetical deposit for the trip was paid on Feb. 15.

Since we’re looking for a policy that will cover medical care for visitors, there are several medical filters to select: emergency medical ($100,000 or more), medical evacuation ($100,000 or more) and coverage for pre-existing medical conditions.

The search came up with nine results ranging in price from $74.40 to $179.18.

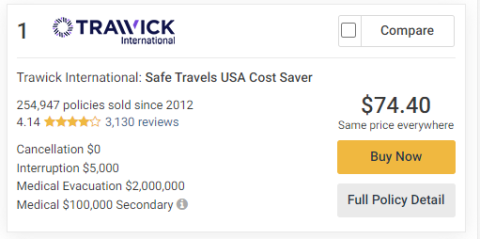

The policy with the lowest cost was the Trawick International 's Safe Travels USA Cost Saver at $74.40.

Trawick policies use the FirstHealth PPO network.

The policy as quoted has a $250 deductible and includes $100,000 in emergency medical, $2 million in medical evacuation and $5,000 in interruption coverage. It has limited coverage for pre-existing conditions.

It is possible to change the deductible to as little as $0 or raise it to $5,000.

The same company has another policy, the Trawick International Safe Travels USA Comprehensive policy, that is better at covering pre-existing conditions and costs a little more — $89.59.

The general coverage is the same as the less expensive policy, and the Safe Travels USA Comprehensive option adds coverage for acute onset of a pre-existing condition. it is possible to change the deductible amount to $0 or go up to $5,000.

» Learn more: The best travel credit cards right now

Some policies are sold as is, while others allow some flexibility depending on what is important to you.

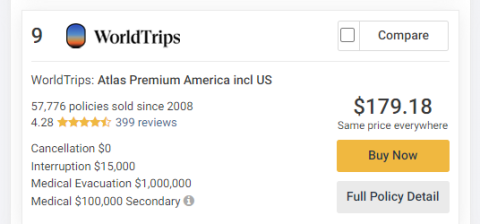

The WorldTrips Atlas Premium America policy for $179.18 allows a lot of customization.

It was also the most expensive of the nine policies Squaremouth suggested.

It’s possible to customize the emergency medical coverage and pre-existing condition coverage and medical deductible. The policy also includes $15,000 in trip interruption coverage, the highest of any of the nine policies available.

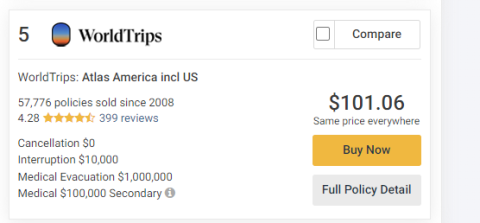

If the traveler has a pre-existing condition, policies from WorldTrips Atlas America are your best bet. The WorldTrips Atlas America policy in our comparison costs $101.06.

The policy as quoted covers $100,000 in emergency medical care and $25,000 in medical evacuation for an unexpected recurrence of a pre-existing condition.

The deductible is also available for customization from $0 to $5,000.

The PPO network for Atlas America Insurance is United Healthcare.

The WorldTrips Atlas Premium America policy mentioned above is also good for pre-existing condition coverage.

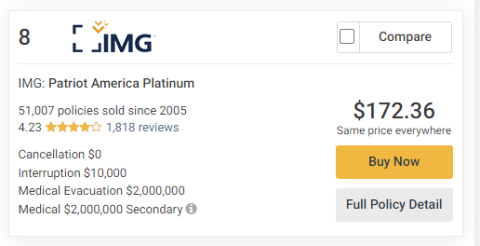

While eight of the nine policies had $100,000 in secondary medical coverage, one had a limit of $2 million.

The IMG Patriot America Platinum policy has a premium of $172.36 along with a high medical evacuation limit of $2 million and interruption coverage of $10,000.

If $2 million in medical coverage is not enough, it’s possible to increase that amount to an $8 million policy limit.

It’s not possible to change the level of coverage for preexisting conditions from the high $1 million limit in emergency medical care and $25,000 in medical evacuation for an unexpected recurrence.

It is possible to change the deductible from $0 all the way up to $25,000.

Our comparison also included policies from two additional companies, Seven Corners and Global Underwriters .

Seven Corners had two policies come up in the results, the Seven Corners Travel Medical Basic for $98.27 and the Seven Corners Travel Medical Choice policy for $136.71. Both of the Seven Corners policies include coverage for hurricane and weather, and the less expensive policy covers acts of terrorism.

Having insurance to cover unexpected medical expenses for anyone visiting the U.S. can be a smart money move.

An illness or accident could cause financial problems for visitors because of potentially having to pay for full health care costs. When planning your travel, be sure to check your current health insurance to find out if it will cover you in the U.S.

For a monthlong stay in the U.S., the lowest-priced visitors insurance policy was around $75 (Trawick International Safe Travels USA Cost Saver) and the highest was about $180 (WorldTrips Atlas Premium America). That’s about $2.42 or $5.81 a day, depending on the policy.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

85,000 Earn 85,000 bonus points after spending $3,000 on purchases in the first 3 months from account opening.

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova; North Korea; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Safer travel starts with travel protection

If you are a travel agent or were referred by one, enter the ACCAM number below.

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

If your trip involves multiple destinations, please enter the destination where you’ll be spending the most time. It is not required to list all destinations on your policy.

Age of Traveler

Ages: {{quote.travelers_ages}}

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

At Allianz, we continue to show our commitment to sports through our sponsorship with the International Olympic Committee and the International Paralympic Committee. Read More >>

Entry Requirements & COVID-19 Travel Resources

Confused about entry requirements for your destination? Our interactive map shows current travel rules and restrictions for each destination, including info on COVID-19 testing, necessary travel documents and quarantine periods.

Find out how our Epidemic Coverage Endorsement can protect your next trip from certain losses related to COVID-19.

Why do I need travel insurance?

Because sometimes..., you have to cancel a trip last-minute..

Travel insurance can reimburse you for your prepaid, non-refundable trip costs — including vacation rentals, car rentals, hotels and flights — if you have to cancel for a covered reason.

Travel delays leave you stranded.

Travel insurance can reimburse you for eligible meals, accommodation and transportation expenses during a covered delay.

You get sick or hurt when you're far from home.

Travel insurance can reimburse you for care following a covered medical emergency while traveling. We can even arrange and pay for a medical evacuation if needed.

Fender-benders are unavoidable.

Renting a car means taking on a big financial risk; even a tiny scrape can cost you hundreds. Low-priced rental car insurance lets you drive worry-free.

You need help in a hurry.

Whether you're planning a week-long road trip or a weekend getaway, you never know what might happen. Travel insurance gives you access to our 24-Hour Assistance hotline for expert, personalized support in a crisis.

Why go with Allianz Travel Insurance?

As a world leader in travel protection, we help more than 70 million people answer the call of adventure with confidence every year.

We're Protecting You

From protection for trip cancellation to medical bills abroad, our benefits are designed to help you explore reassured.

We're There For You

We've got your back with award-winning 24/7 assistance and a worldwide network of prescreened hospitals to help you get the right care.

We're Built For You

From our Allyz ® TravelSmart app to proactive SmartBenefits, we innovate for the way you travel today - and tomorrow.

TRAVEL RESOURCES

How Travel Insurance Works

How the Cancel Anytime Upgrade Works

What Does Rental Car Insurance Cover?

Is It Too Late to Buy Travel Insurance?

The Comprehensive Guide to Annual Travel Insurance

The Top Travel Apps That You Need This Summer

Travel Insurance with Emergency Medical Benefits

Destination Guide: Croatia

Travel Insurance & COVID-19: The Epidemic Coverage Endorsement Explained

More Travel Resources »

LATEST COVERAGE ALERTS

The events listed below are considered "known and foreseeable" for travel insurance purposes on the date listed next to the event. Please consult your policy for more information.

More Coverage Alerts »

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

Find the Best Travel Insurance & Avoid Costly Surprises

- 22 Top-Rated Providers

- Side-by-Side Comparison

- 3 Million+ Travelers Insured

Standard Single Trip Policies

- The most popular and comprehensive travel insurance plan

- Covers cancellations, medical emergencies, delays, and luggage

- Protection from the time you purchase to the date you return

Annual / Multi Trip Policies

- Cost-effective option for travelers taking multiple trips a year

- Includes common medical, delay, and luggage benefits

- May require add-ons from trip cancellation or interruption

Cruise Insurance Policies

- Offers comprehensive trip protection on land and at sea

- Includes high travel medical insurance coverage limits

- Protects against hurricanes, inclement weather, and more

Adventure & Sports Policies

- Essential for travelers partaking in high-risk activities

- Provides protection for lost or delayed sports equipment

- Strong coverage for cancellations and medical emergencies

Compare and Save in Minutes

Whether you’re heading abroad or staying local, we make it easy to find the best travel insurance plan for your next adventure. No bias. No hidden fees. Just the best trip protection quotes from the country’s leading providers.

Tell us some basic information about your next trip. We’ll use these details to help narrow your search and show the plans that best fit your needs.

Easily see how plans from the best travel insurance providers compete on cost and coverage. Use filters and sort results to uncover the right plan for you.

Get peace of mind at the lowest possible price. We partner with leading providers to offer you the best policies at the best value, guaranteed.

Why Trust Squaremouth?

When selecting a travel insurance provider, it's crucial to compare options. Obtain quotes from three to five insurers to ensure the best coverage and value. While it may seem time-consuming, this process can result in significant savings.

That's why we're here – over the past two decades, our industry-leading comparison engine has helped millions of travelers find highly-rated insurance plans and protect their trip expenses.

Our industry-leading comparison platform , enriched by customer reviews, displays unbiased results based on your specific trip details. If you run into any trouble, our multi-award-winning customer service team is just a phone call away.

- Helped more than 3 million travelers

- 20+ years serving the travel community

- Intuitive & user-friendly comparison engine

- More plans and top-rated providers than the competition

- Prices are regulated by law; you won't find a lower price anywhere else

- Multi award-winning customer service team

- 140,000+ customer reviews

Save With Squaremouth

We've helped more than 3 million travelers find the best policy for their trip.

Key Travel Insurance Benefits

Most trip insurance policies are comprehensive, including coverage for cancellations, medical emergencies, travel delays, and lost luggage, among other benefits.

What Coverage is the Most Important?

Squaremouth customer reviews.

More than 99% of customers would recommend Squaremouth to others. Read what a few of them had to say about their recent experience buying travel insurance.

Easy to compare

"I liked the comparison tool to see how the different policies stack up."

Robyn from MD 05/31/2024

Stress free!

"I was so thankful to find this website. Appreciated being able to talk to a real person. Very helpful!"

Susan from GA 05/27/2024

Comprehensive comparison

"Nice to have a large selection of policies and to be able to easily compare them."

Jeffrey from MD 05/14/2024

Great resource for travel insurance

"Website was easy to navigate. Numerous options for insurance. Excellent filter opportunities."

Rosemary from WA 05/05/2024

Rosemary from WA 5/5/2024

Featured Articles

Our topic experts keep a constant pulse on the travel industry so we can provide the most current information and recommendations based on today's traveler needs.

What Type of Insurance Do I Need?

Plans can range in terms of cost and coverage, so it’s important to identify your specific needs before comparing options. Discover the different types of travel insurance policies you should consider for your upcoming trip.

10 Ways to Get Great Coverage For Less

When it comes to travel insurance, more expensive does not necessarily mean better. We uncover 10 proven tactics you can use during your search to lower premiums without sacrificing protection.

Travel Insurance FAQs

Here are some of the most frequently asked questions from travelers like you.

Is Travel Insurance Mandatory for International Travel?

Travel insurance is not typically required when traveling overseas. The majority of travel insurance customers purchase their plans voluntarily for peace of mind and financial protection. With that said, some destinations or organized tours may require proof of international health insurance that lasts for the duration of your trip.

What Does Travel Insurance Cover?

Comprehensive travel insurance coverage is designed to protect against common disruptions that may impact a trip. Most travel insurance plans will provide coverage for trip cancellations, medical emergencies, travel delays, missed connections, accidental death and dismemberment, and lost luggage.

How Much Does Travel Insurance Cost?

In general, comprehensive travel insurance coverage costs between 5% and 10% of the total trip cost. The cost of a policy depends on four primary factors: trip cost, traveler age, trip length, and coverage amounts. A policy without cancellation coverage will be significantly less expensive. We recommend comparing plans from multiple providers to find the best priced plan for your trip.

What Should I Look for When Comparing Travel Insurance?

There’s no one-size-fits-all policy when it comes to travel insurance. When comparing plans, you should consider the following:

- Benefits: The situations and expenses that are covered by a travel insurance policy.

- Coverage Limits: The maximum dollar amount that will be reimbursed within each benefit.

- Exclusions: Specific activities, expenses, and scenarios that are not covered in the event of a claim.

- Premium: The cost of the policy for your specific trip.

- Provider Reputation: Based on past customer reviews regarding interactions with assistance services and the claims experience.

Does Travel Medical Insurance Cover International Trips?

Yes, travel medical insurance provides coverage for unexpected medical expenses that you may experience during a trip. This can include ambulance rides, hospital stays, doctor visits, and emergency medical evacuations.

Medical coverage is the most popular benefit among travelers because most primary health care plans, such as Medicare or an employer-sponsored plan, don’t offer coverage overseas. Traveling without proper health insurance could lead to thousands of dollars in out-of-pocket expenses.

Are Pre-Existing Conditions Covered by Travel Insurance?

Coverage for pre-existing medical conditions varies among travel insurance policies. While many plans won’t offer coverage for existing injuries or illnesses, some plans may offer Pre-Existing Condition waivers if certain conditions are met, such as purchasing the policy within a specified time frame from booking the trip.

Will My Policy Cover Trip Cancellations?

Yes, many comprehensive travel insurance plans cover cancellations under specified circumstances, such as sudden illness, injury, or death of a family member, natural disasters, or unexpected work obligations. Most policies that include the Trip Cancellation benefit offer 100% reimbursement for all prepaid, non-refundable trip costs.

What’s the Difference Between Single-Trip and Annual Travel Insurance?

Single-trip travel insurance covers a specific journey for a set duration, offering protection for that trip only. This is the most popular type of travel insurance among Squaremouth users. In contrast, Annual Travel Insurance provides coverage for multiple trips within a year. Annual plans can be cost-effective for frequent travelers and less of a hassle than purchasing multiple single-trip plans.

What's the Process for Filing a Travel Insurance Claim?

To file a trip insurance claim, follow these steps:

- Contact your insurer: Notify them as soon as possible about the incident.

- Gather documentation: Collect relevant documents, such as police reports, medical records, or receipts for expenses incurred.

- Complete the claim form: Fill out the insurer's claim form with accurate details.

- Submit supporting documents: Attach all required documents to substantiate your claim.

- Keep records: Maintain copies of all submissions and correspondence for your records.

- Follow up: Stay in touch with the insurer for updates on your claim status.

- Be honest and thorough: Provide clear and truthful information to expedite the process.

Remember, the process may vary by insurer, so review your policy or contact your insurance provider for specific instructions. Learn more about what can be covered and how to file a travel insurance claim .

Where Can I Buy Travel Insurance?

Travelers can purchase travel insurance directly from providers, through a comparison site like Squaremouth, or directly through a travel supplier when booking. Credit cards and travel agents are other sources to consider. Choosing the right travel insurance company can take time. We recommend comparing plans from at least 3-5 providers before buying.

You are about to leave geico.com

When you click "Continue" you will be taken to a site owned by , not GEICO. GEICO has no control over their privacy practices and assumes no responsibility in connection with your use of their website. Any information that you provide directly to them is subject to the privacy policy posted on their website.

Travel Insurance

Get a travel insurance quote and protect your next trip

For flight insurance protection:

Aircare Flight Quote

For all-in-one trip insurance protection:

ExactCare Travel Quote

Manage Your Travel And Flight Insurance

Manage your policy online

Need a travel insurance quote?

Existing policyholder?

Take the worry out of your travels with affordable flight or trip insurance.

Looking to plan the vacation of a lifetime or flying home for the holidays? Trip insurance and flight insurance can provide the peace of mind you need for your next journey. The GEICO Insurance Agency, with Berkshire Hathaway Travel Protection (BHTP), offers comprehensive travel insurance coverage, with prompt service and global assistance. Get an online travel insurance quote today and confidently protect your next adventure.

AirCare Flight Insurance

If you only need to protect your travel costs for a flight, AirCare may be what you need. With affordable coverage for both domestic and international flights, AirCare flight insurance helps you plan with peace of mind.

ExactCare Travel Insurance

If you want to cover your flight and other trip arrangement's ExtraCare can help. An ExactCare Travel Insurance policy can help with the unexpected like:

- Trip Cancellations/Interruptions/Delays

- Lost/Stolen travel documents

- Unexpected medical expenses

What's the difference between flight insurance and travel insurance?

The main difference is that a flight insurance policy only covers your airfare. On the other hand, a travel insurance policy helps protect your flight as well as other parts of your trip. While you're planning your next trip, think about where you're going and what you'll be doing. Once you have that, it'll be easier to choose which policy works best for your trip.

What does a flight insurance policy cover?

AirCare Flight Insurance has a variety of benefits including emergency travel assistance, 24/7/365. Some common flight coverages are:

- Airfare incase flights are cancelled or you miss a connection

- Personal items like lost or delayed luggage

- Flight delays in your departure (at the gate or on the tarmac)

AirCare Quote

What does a travel insurance policy cover?

ExactCare Travel Insurance provides all-in-one travel protection, with family friendly pricing and worldwide emergency travel assistance 24/7/365. Common things covered by travel insurance are:

- Trip cancellation or interruption

- Personal items like passports and luggage

- Medical costs like hospital and doctor expenses, medical evacuations, and more

ExactCare quote

What is not covered by travel insurance?

Your coverage is based on the plan you choose. However, in general some things that aren't normally covered by travel insurance are:

- Action and team sports, for example auto racing, pro sports travel, or other extreme sport activities

- Travel to get medical care

- Trip Cancellation because you changed your mind

For more information, please check your policy.

Is travel or trip insurance worth the cost?

Travel insurance can help protect your vacation or trips from unexpected things happening. You can travel without trip insurance but doing so brings greater risk if something goes wrong or you encounter unexpected delays. Flight insurance or trip insurance coverage can include things like flight cancellation, lost luggage, trip cancellation, emergency medical transportation, and more. Learn more about travel insurance and why you should get a travel insurance quote today!

How much does travel insurance cost?

Travel insurance typically costs 5 to 10 percent of your total trip cost, though that can be influenced by several things.

- The cost of the trip

- The length of your trip and destination

- The amount of coverage selected

- The number of travelers covered under the policy

Worldwide service and claims information.

It's easy to manage your travel insurance..

Berkshire Hathaway Travel Protection (BHTP) has made it easy to manage your travel insurance. You can:

- Visit Berkshire Hathaway Travel Protection's website

- Email [email protected]

Is travel insurance worth it?

Yes. Things happen that are out of your control. Whether it's your flight being cancelled or delayed to a family emergency. Life happens and that's how travel insurance can help. Plan for the unexpected with a travel insurance policy so you can rest easy knowing you're covered.

Travel Insurance: Get the answers you're looking for.

- What travel insurance plans are available? BHTB offers AirCare (flight only) and 3 main plans: ExactCare Value, ExactCare, and ExactCare Extra. ExactCare Value provides great traveling insurance coverage for budget minded travelers. You can rest easy knowing you're covered for things like trip cancellation, trip interruption, and medical expenses. The main difference is the maximum amount that will be covered. ExactCare and ExactCare Extra's insurance cover the same things as ExactCare Value and add coverage for missed connections and accidental death & dismemberment. The overall amount covered is also increased for each plan respectively.

- Can I get trip insurance for an extended overseas stay? Yes. We can help you with getting insurance for overseas. Please visit our overseas insurance page for information about all the options we have for you!

- Is there travel insurance that can cover my vehicle while traveling to Mexico? Your US auto insurance policy won't cover your vehicle when you drive into Mexico. We're here to help you find the Mexico car insurance you need to insure your car.

- Tips for saving money on your next vacation. No one wants to overpay things. We're here to help. Check out our 5 ways to save your money on your next family vacation.

- Where you're going

- Number of days you're traveling

- Cost of your overall trip

- Coverage you pick

- Number of people covered under your policy

If you choose to get a rate quote or service your policy online, you will be taken to the Berkshire Hathaway Travel Protection website which is owned by Berkshire Hathaway Specialty Insurance Company, not GEICO. Any information that you provide directly to Berkshire Hathaway Specialty Insurance Company on its website is subject to the privacy policy posted on their website, which you should read before proceeding. GEICO assumes no responsibility for their privacy practices or your use of their website.

ExactCare is provided through Berkshire Hathaway Global Insurance Services, LLC. ExactCare and AirCare are underwritten by Berkshire Hathaway Specialty Insurance Company. Both coverages are secured through the GEICO Insurance Agency, LLC.

Benefits may vary by jurisdiction. Please contact a representative to confirm availability.

Please note:

The above is meant as general information and as general policy descriptions to help you understand the different types of coverages. These descriptions do not refer to any specific contract of insurance and they do not modify any definitions, exclusions or any other provision expressly stated in any contracts of insurance. We encourage you to speak to your insurance representative and to read your policy contract to fully understand your coverages.

Colorado Language Preference

Are you a resident of or looking for insurance in the State of Colorado?

We are temporarily unable to provide services in Spanish for Colorado residents. You will now be directed to an English experience.

Estamos encantados de ofrecer nuestra nueva version del sitio web en Español. Apreciamos su paciencia mientras seguimos mejorando su experiencia.

Freephone our UK Team

0800 072 6778

Sales & Service

Monday to Friday: 8:30am to 8pm Saturday: 9am to 5:30pm Sunday: 10am to 5:00pm

Monday to Friday: 9am to 7pm Saturday: 9am to 5:30pm

Bank Holiday Opening Hours:

6th May: 9am-5pm 27th May: 9am-5pm

Travel Insurance

Medical travel insurance, seniors travel insurance, europe travel insurance, worldwide travel insurance, coronavirus travel insurance, travel insurance for the usa.

- Unlimited medical emergency expenses¹

- Up to £10K cancellation cover

- 24/7 emergency medical helpline

Covered 27 million+ travellers

Trusted for 20+ years

24/7 emergency helpline

Looking for travel insurance for a USA trip? Whether you’re planning to shop in New York, gaze at the Grand Canyon, or take in some history in D.C. we’ve got the right USA travel insurance policy for you.

What is USA travel insurance and why do you need it?

The USA has long been one of the most popular holiday destinations for UK travellers. However, the States has some of the most expensive emergency medical care in the world . Meaning things can get costly if something unexpected happens.

Don’t worry, our USA travel insurance has got you covered:

- Buy it, then get on with enjoying your adventure: With cover for hospital expenses, personal belongings and legal costs, you can relax. What’s more, our 24-hour emergency assistance team will be available to call, day or night, if you need them

- Cover for your pre-existing medical conditions: We will consider all pre-existing medical conditions. Let us know some details and we will send you a quote. Find out more about medical travel insurance or contact our helpful team

- Tailor your policy to you and your trip: Our policies already have over 100 sports and activities covered. Plus we have extra cover available for things like extreme sports , winter sports , cruises and golf . Or if you’re looking to take the whole family away, we’ve got family US travel insurance policies

- Go for a single trip or annual policy: If you’re planning on going away more than once this year, an annual travel policy might save you time and money. If this is your one getaway of the next 12 months, our single trip policies may be best for you.

Cover varies based on the policy you buy. Our policy wording includes details of what is and isn’t covered and other terms and conditions.

Get a quote for travel insurance to the USA today:

What does InsureandGo’s USA travel insurance cover?

Our policies come with over 100 sports and activities included and our 24-hour emergency medical assistance team at the end of the phone. Find out what else is covered with our USA travel insurance:

What’s covered?

All our travel insurance to USA policies include:

- Medical and hospital expenses cover

- Cover for cancellation of your trip

- Over 100 sports and activities covered (see your policy wording for a full list of activities)

- Personal belongings and baggage cover

- Personal money, passports and travel documents cover

- Accommodation cover

- Legal expenses cover

- Delayed departure cover

- Personal accident cover

- Our 24-hour emergency assistance team , available to call, day or night

Find out about our optional add ons for activities like extreme sports , winter sports , cruises and golf .

We will consider all pre-existing medical conditions, find out more about medical travel insurance . The excess and amount of cover available varies depending on the level of USA travel insurance you buy. Make sure you have a look at our policy wording to see the full terms and conditions, including what is and isn’t covered.

What’s not covered?

We aim to provide as much cover as we can on our policies. However, there are some situations no travel insurance will cover. For example:

- You cannot cover events or reasons to claim which took place before you booked the trip or purchased insurance. Insurance exists to cover unexpected events outside of the insured’s control

- Claims which are less than the excess for that section of cover. For example, you cannot claim a £40 lost item if your baggage excess is £60

- All of our travel insurance America policies include cover for cancellation of your trip, but there may be some exclusions. For example, you won’t be covered to cancel if you simply decide not to go

To check the policy exclusions and what is and isn’t included, take a look at our policy wording .

The best travel insurance for your USA trip

Looking for the best travel insurance for USA visitors? We have a wide range of policies to choose from:

- Single trip USA travel insurance : Perfect if you’re only planning one trip this year. You tell us where you’re going and for how long and we give you a tailored quote

- Annual travel insurance : If you’re going away more than once in the next 12 months, you could save time and money with multi-trip travel insurance. Pick our worldwide option, covering the USA, Canada, Mexico and the Caribbean, and you can cover your trip to America plus any other trips for the year

- Family travel insurance for the USA : Holiday cover for every member of the family, all under the same policy – simple! Cover every generation, from kids to grandparents (and even great grandparents)

- Optional sports and activity cover: Our travel insurance for the USA includes cover for over 100 sports and activities at no extra cost. Meaning you can get up to more on your holiday. If you’re looking to do something a little different, we offer extra cover for extreme sports , winter sports , cruises and golf

Take a look at the specific policy wording for more information on what is and isn’t included.

How to book our travel insurance for the USA

When looking for the best travel insurance for the USA, we know the options can be overwhelming. That’s why we like to keep things simple:

1. Tell us about you and your trip

Tell us when you’re off, who you’re looking to cover and a little info about any pre-existing medical conditions. We will use these details to ensure we provide you with the right level of cover for your trip.

Start your quote today online or call our team:

2. We’ll send you your quote

Get your quote and you can either go ahead and book or save the details for whenever you’re ready to buy your policy.

“Whether it’s a return visit to your favourite place or a one-off trip of a lifetime, the USA is a bucket list destination! With high healthcare costs in the US if something goes wrong, it’s important to make sure you’re covered before setting off on your holiday. We can help make sure you get the right cover for you, get in touch with our team now .” Letitia Smith – Travel Insurance expert

USA travel insurance with pre-existing medical condition cover

At InsureandGo, we’ll consider covering all medical conditions. Our online medical screening process is simple and we’ll quickly be able to give you a quote.

A pre-existing medical condition is any illness or condition that has occurred before you take out an insurance policy. Your policy won’t always cover you for existing medical conditions as standard and you’ll need to declare them before you buy it.

Medical costs in the USA are famously expensive and foreign visitors don’t get free healthcare, even if you come from a country with a system like the NHS. Also bear in mind that A&E (or ER, as they call it in the USA) isn’t free either. So in an emergency situation the costs can quickly add up. If you’re considering travel medical insurance for the USA, it’s sensible to check your cancellation, repatriation and medical evacuation cover. For more information, read our travel insurance for pre-existing medical conditions page and refer to policy wording .

Frequently asked questions on travel insurance for the USA

Do you need travel insurance for usa.

Although travel insurance isn’t mandatory for the USA, it is highly recommended that you take out a policy. If something goes wrong on your trip and you don’t have a policy to cover you, you could rack up high costs that leave you out of pocket. America is known for having some of the world’s most expensive emergency medical care. Buying a single trip or annual multi-trip policy is important to make sure you’re covered.

Do I need a visa for the USA?

The UK is part of the visa waiver programme with the USA, meaning UK citizens with a valid passport don’t need a visa to travel to the USA. You need to get an Electronic System for Travel Authorisation (ESTA) , which allows travellers up to 90 days in the USA.

Do you need a Global Health Insurance Card (GHIC) and travel insurance to visit the USA?

Although it’s called a ‘Global’ Health Insurance Card, a GHIC doesn’t cover the USA. It is mainly for use in EU countries. The best way to ensure you’re covered if something unexpected happens on a holiday to America, is by purchasing a travel insurance policy.

Remember, even if you are travelling to a country covered by the GHIC scheme, it is recommended that you also buy travel insurance. This will protect you from any costs that aren’t covered by the card. Find out more information about EHIC and GHIC cards on the NHS website .

How much is travel insurance for USA?

The price of your travel insurance to the USA will depend on various things. These include:

- Where you’re travelling to and if you’re visiting any other countries

- How long you will be staying

- If you want a single trip or annual multi-trip travel insurance policy

- Pre-existing medical conditions

- Level of policy cover

- Any policy add-ons

Get your quote today and get ready for your trip to the USA!

What travel insurance do I need for the USA?

Make sure you choose travel insurance that covers the USA, as some policies do not. You should also keep these pointers in mind:

- It’s important to check the level of medical cover. The government advises at least £2 million of medical cover when travelling to the USA. Our policies start at £5 million

- When choosing US travel insurance, think about the cost of your holiday and what you’ll be taking with you. You need to know you’re covered if anything happens

- Travelling as a family? Cover everyone under one policy with our family holiday insurance

- Consider whether you want a single trip or annual multi-trip policy

Why is travel insurance to the USA so expensive?

Travel insurance to the USA can be more expensive than for Europe. This is because of higher claims costs if anything unexpected happens. Medical treatment can be very expensive in the USA and it can also cost a lot if someone needs emergency transport back to the UK. This means policies that cover the US can be a bit more costly.

Can I buy USA travel insurance after booking my trip?

Have you left buying your USA travel insurance until the last minute? Don’t worry! We make getting covered quick and simple, so you can focus on looking forward to your holiday. Get your quote now.

You’re able to purchase a last minute US travel insurance policy on the same day as you head off. As long as you haven’t been through customs or left the UK yet. Just remember, we can’t cover you for any potential claims that you’re aware of before you buy the policy (e.g. a cancelled flight). For more information, read our policy wording .

Does Mexico come under the USA in travel insurance?

If you’re visiting Mexico or another country on your US trip, there are two easy ways to ensure you’re covered:

- If you’re buying a single trip policy , just tell us the countries you’ll be visiting and we’ll give you a quote to cover your whole trip

- If you’re after an annual multi-trip policy , make sure you pick our Worldwide cover including USA, Canada, Mexico and the Caribbean

What if I have to go to the hospital in the USA?

It’s important that you have travel insurance for the USA to cover unexpected issues while you’re away.

Medical costs in the USA are famously expensive. Most hospitals are large and privately run. If your medical emergency isn’t serious enough to warrant a visit to the hospital, you may be able to contact them and ask for a local physician. They may be able to offer cheaper treatment.

If a hospital discovers you have no insurance, they may transfer you to a welfare hospital if one is nearby. However, there aren’t many available, especially in more rural areas, and they may have very long waiting times. If you have a pre-existing medical condition, visit our page on travel medical insurance for more information. Or you can contact us online .

Can InsureandGo help if I need medical treatment while in the United States?

Our US travel insurance comes with access to our 24-hour emergency assistance team. Meaning there will always be someone here to help you if you become ill or are injured while abroad.

You can give our team a call any time, day or night, as part of your USA travel insurance policy.

Who can buy USA travel insurance?

All our USA travel insurance policies are available to UK residents. This means:

- Someone who has been living in the UK or the Channel Islands for at least six of the last 12 months

- They must be in the UK at the time of purchase

- All trips must start and end in the UK

Unfortunately, we can’t provide cover to anyone who doesn’t fit this description. Get a quote online or browse our policy documents for more information.

Frequently asked questions

If you’ve got more questions about how our USA travel insurance works, or more general travel insurance queries, have a read through our FAQs .

Travel advice

Our travel advice section offers handy tips and guides to specific countries, from what documents you need to what you might visit while you’re there.

Travel insurance reviews

If you want to know what our customers think of us, and why they rate us so highly, have a read through some of the reviews they’ve left us.

- Unlimited emergency medical expenses available on Black level policies.

- InsureandGo’s Gold achieved a Which? Best Buy.

Winter is here! Check out the winter wonderlands at these 5 amazing winter destinations in Montana

- Travel Destinations

- United States

Which Travel Insurance Is Best For The USA

Published: December 18, 2023

Modified: December 28, 2023

by Fionna Boyles

- Safety & Insurance

- Travel Essentials & Accessories

Introduction

Understanding the importance of travel insurance for your trip to the usa.

When planning a trip to the United States, it’s essential to consider various aspects to ensure a smooth and enjoyable experience. Among these considerations, securing the right travel insurance holds significant importance. Travel insurance provides a safety net, offering financial protection and peace of mind during unexpected events, such as medical emergencies, trip cancellations, or lost luggage. Navigating the myriad of options to find the best travel insurance for your trip to the USA can be overwhelming, but with the right information, you can make an informed decision that aligns with your specific needs.

In this comprehensive guide, we will delve into the intricacies of travel insurance, explore the factors to consider when choosing a plan for travel to the USA, and compare some of the top travel insurance options available. Whether you’re planning a leisurely vacation, a business trip, or an extended stay in the United States, understanding the nuances of travel insurance will empower you to select the most suitable coverage for your journey.

Understanding Travel Insurance

Travel insurance serves as a safeguard against unforeseen circumstances that could disrupt or derail your trip. It typically encompasses a range of coverage, including trip cancellation or interruption, medical emergencies, evacuation, and baggage loss or delay. Understanding the components of travel insurance is crucial for making an informed decision when selecting a policy for your travels to the USA.

Key Components of Travel Insurance:

- Trip Cancellation or Interruption: This coverage provides reimbursement for prepaid, non-refundable trip expenses if you need to cancel or cut short your trip due to covered reasons, such as illness, severe weather, or a terrorist incident.

- Medical Coverage: In the event of illness or injury during your trip, medical coverage ensures that you receive necessary medical treatment, including hospital stays, doctor visits, and prescription medications.

- Emergency Medical Evacuation: This feature covers the cost of emergency transportation to the nearest adequate medical facility in the event of a severe illness or injury.

- Baggage and Personal Belongings: If your luggage is lost, stolen, or damaged during your trip, this coverage provides reimbursement for the value of your belongings.

It’s important to carefully review the specific details and exclusions of each coverage type within a travel insurance policy to ensure that it aligns with your individual needs and the nature of your trip. Additionally, understanding the limitations, deductibles, and claim procedures associated with each coverage component is essential for a comprehensive grasp of your policy.

By gaining a thorough understanding of the various facets of travel insurance, you can make well-informed decisions and select a policy that offers the necessary protection and peace of mind for your travels to the USA.

Factors to Consider When Choosing Travel Insurance for the USA

When selecting travel insurance for your trip to the United States, several essential factors warrant careful consideration to ensure that you secure the most suitable coverage. Understanding these key factors will empower you to make an informed decision and obtain the protection you need for a worry-free travel experience.

1. Trip Duration and Frequency: Consider the length of your stay in the USA and how frequently you travel. If you embark on multiple trips throughout the year, an annual multi-trip policy may be more cost-effective than purchasing separate coverage for each trip.

2. Coverage for Pre-Existing Conditions: If you have pre-existing medical conditions, ensure that the policy provides adequate coverage for related medical treatment and emergencies during your trip to the USA.

3. Medical Coverage Limits: Evaluate the maximum coverage limits for medical expenses, including hospitalization, emergency services, and medical evacuation, to ensure that the policy offers sufficient protection based on your health needs and the potential costs of medical care in the USA.

4. Trip Cancellation and Interruption Coverage: Assess the extent of coverage for trip cancellation or interruption, considering factors such as the total cost of your trip, non-refundable expenses, and the reasons covered for trip disruption.

5. Coverage for High-Risk Activities: If your trip to the USA includes adventurous or high-risk activities such as skiing, scuba diving, or mountain climbing, verify that the policy includes coverage for these activities to mitigate associated risks.

6. Lost or Delayed Baggage Coverage: Evaluate the reimbursement limits for lost, stolen, or delayed baggage, as well as any coverage for essential items in the event of baggage delay.

7. Emergency Assistance Services: Ensure that the policy includes 24/7 emergency assistance services, such as access to a global network of medical providers and multilingual support, to receive timely assistance in case of emergencies while in the USA.

8. Exclusions and Limitations: Thoroughly review the policy’s exclusions and limitations to understand scenarios or circumstances not covered by the insurance, enabling you to make informed decisions and take necessary precautions during your travels.

By carefully assessing these factors and aligning them with your specific travel needs and preferences, you can select a travel insurance policy that provides comprehensive coverage and peace of mind for your journey to the United States.

Comparison of Top Travel Insurance Plans for the USA

When considering travel insurance plans for your trip to the USA, it’s essential to explore the offerings of reputable providers to identify the most suitable coverage. While numerous insurance companies offer travel insurance, comparing the features, benefits, and limitations of the top plans can help you make an informed decision.

1. Allianz Global Assistance: Allianz offers comprehensive travel insurance plans with customizable options, including coverage for trip cancellation, emergency medical expenses, and baggage loss. Their plans also provide 24/7 travel assistance services for added convenience and support during your trip to the USA.

2. World Nomads: World Nomads is known for its flexible and adventure-friendly travel insurance plans, making it an ideal choice for travelers engaging in high-risk activities or seeking coverage for various destinations within the USA. Their policies cater to diverse travel styles and offer coverage for medical emergencies, trip interruptions, and adventurous pursuits.

3. Travel Guard (by AIG): Travel Guard provides a range of travel insurance options, including single trip and annual plans, with features such as trip cancellation coverage, emergency medical assistance, and coverage for lost or delayed baggage. Their plans are designed to address the specific needs of travelers visiting the USA for leisure or business purposes.

4. Travelex Insurance Services: Travelex offers customizable travel insurance plans with varying levels of coverage, allowing travelers to tailor their policies to suit their individual requirements. Their plans encompass benefits such as trip cancellation, emergency medical coverage, and assistance services, providing comprehensive protection for trips to the USA.

5. IMG (International Medical Group): IMG specializes in providing travel medical insurance for individuals and families visiting the USA. Their plans focus on medical coverage, emergency medical evacuation, and access to a global network of healthcare providers, ensuring that travelers receive essential medical support during their stay in the USA.

When comparing these top travel insurance plans, it’s crucial to assess the specific features, coverage limits, and exclusions of each policy in relation to your travel needs and preferences. By carefully evaluating the offerings of reputable insurance providers, you can select a plan that aligns with the nature of your trip and provides the necessary protection for your travels to the United States.

Securing the right travel insurance for your journey to the United States is a vital aspect of trip planning, offering financial protection and peace of mind in the face of unforeseen events. By understanding the nuances of travel insurance and considering essential factors when choosing a policy, you can make informed decisions that align with your specific travel needs and preferences.

When comparing top travel insurance plans for the USA, it’s crucial to assess the breadth of coverage, limitations, and additional benefits offered by reputable insurance providers. Whether you prioritize comprehensive medical coverage, protection for high-risk activities, or assistance services during your trip, selecting a plan that caters to your individual requirements is paramount.

As you embark on your journey to the USA, remember that travel insurance serves as a safety net, providing support and financial security in the event of medical emergencies, trip disruptions, or unforeseen mishaps. With the right travel insurance in place, you can explore the diverse landscapes, vibrant cities, and cultural experiences that the United States has to offer, knowing that you are prepared for the unexpected.

Ultimately, the best travel insurance for your trip to the USA is one that aligns with your unique travel itinerary, health considerations, and preferences, offering comprehensive coverage and reliable support throughout your travels. By prioritizing thorough research and careful consideration of your specific needs, you can embark on your journey with confidence, knowing that you have chosen the most suitable travel insurance to safeguard your adventure in the United States.

- Privacy Overview

- Strictly Necessary Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

The best travel insurance policies and providers

It's easy to dismiss the value of travel insurance until you need it.

Many travelers have strong opinions about whether you should buy travel insurance . However, the purpose of this post isn't to determine whether it's worth investing in. Instead, it compares some of the top travel insurance providers and policies so you can determine which travel insurance option is best for you.

Of course, as the coronavirus remains an ongoing concern, it's important to understand whether travel insurance covers pandemics. Some policies will cover you if you're diagnosed with COVID-19 and have proof of illness from a doctor. Others will take coverage a step further, covering additional types of pandemic-related expenses and cancellations.

Know, though, that every policy will have exclusions and restrictions that may limit coverage. For example, fear of travel is generally not a covered reason for invoking trip cancellation or interruption coverage, while specific stipulations may apply to elevated travel warnings from the Centers for Disease Control and Prevention.

Interested in travel insurance? Visit InsureMyTrip.com to shop for plans that may fit your travel needs.

So, before buying a specific policy, you must understand the full terms and any special notices the insurer has about COVID-19. You may even want to buy the optional cancel for any reason add-on that's available for some comprehensive policies. While you'll pay more for that protection, it allows you to cancel your trip for any reason and still get some of your costs back. Note that this benefit is time-sensitive and has other eligibility requirements, so not all travelers will qualify.

In this guide, we'll review several policies from top travel insurance providers so you have a better understanding of your options before picking the policy and provider that best address your wants and needs.

The best travel insurance providers

To put together this list of the best travel insurance providers, a number of details were considered: favorable ratings from TPG Lounge members, the availability of details about policies and the claims process online, positive online ratings and the ability to purchase policies in most U.S. states. You can also search for options from these (and other) providers through an insurance comparison site like InsureMyTrip .

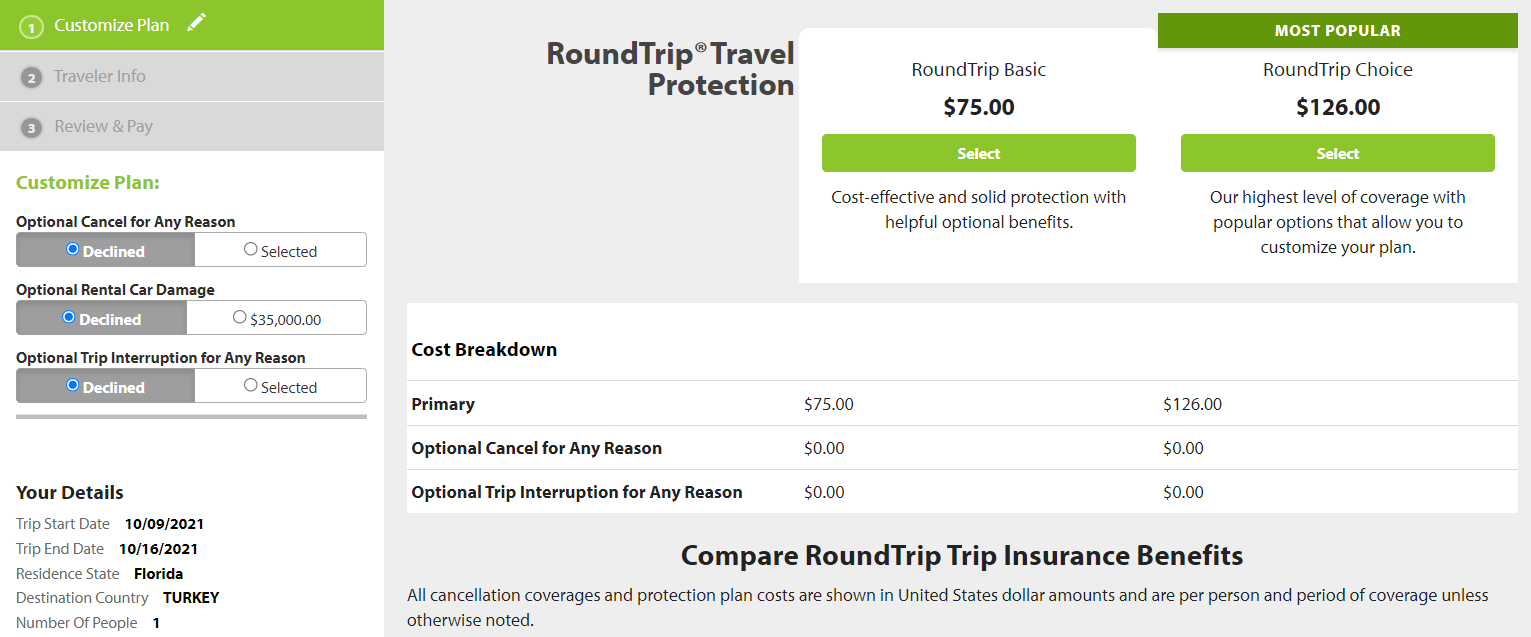

When comparing insurance providers, I priced out a single-trip policy for each provider for a $2,000, one-week vacation to Istanbul . I used my actual age and state of residence when obtaining quotes. As a result, you may see a different price — or even additional policies due to regulations for travel insurance varying from state to state — when getting a quote.

AIG Travel Guard

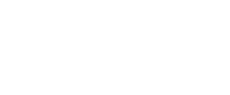

AIG Travel Guard receives many positive reviews from readers in the TPG Lounge who have filed claims with the company. AIG offers three plans online, which you can compare side by side, and the ability to examine sample policies. Here are three plans for my sample trip to Turkey.

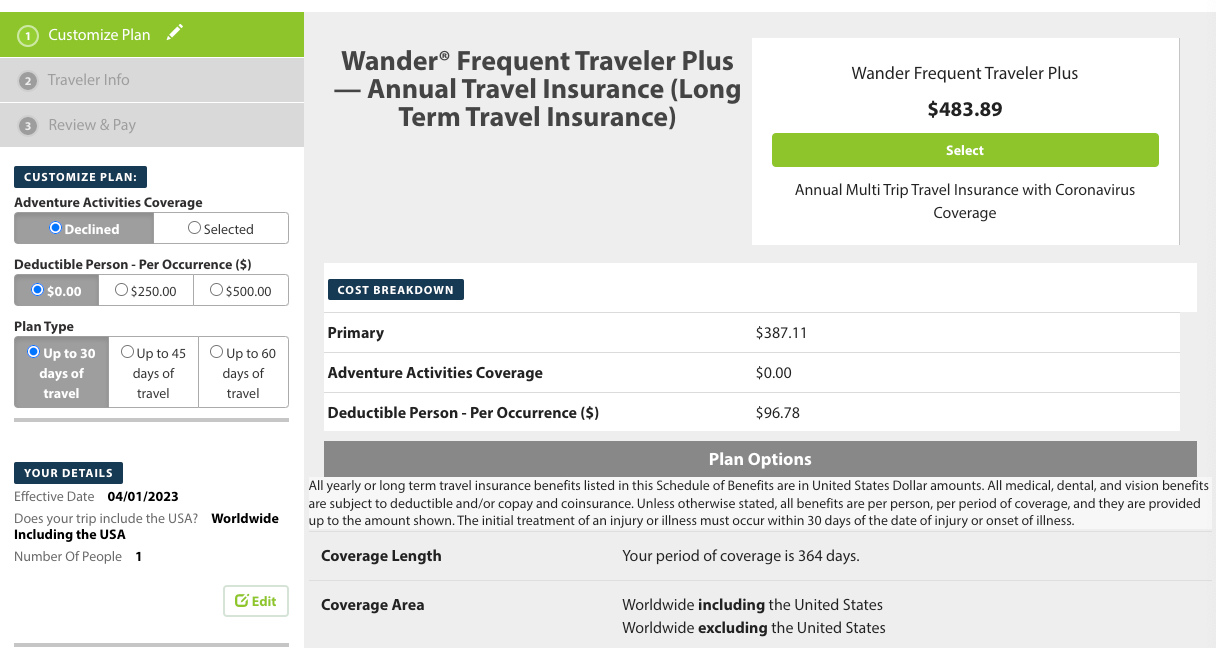

AIG Travel Guard also offers an annual travel plan. This plan is priced at $259 per year for one Florida resident.

Additionally, AIG Travel Guard offers several other policies, including a single-trip policy without trip cancellation protection . See AIG Travel Guard's COVID-19 notification and COVID-19 advisory for current details regarding COVID-19 coverage.

Preexisting conditions

Typically, AIG Travel Guard wouldn't cover you for any loss or expense due to a preexisting medical condition that existed within 180 days of the coverage effective date. However, AIG Travel Guard may waive the preexisting medical condition exclusion on some plans if you meet the following conditions:

- You purchase the plan within 15 days of your initial trip payment.

- The amount of coverage you purchase equals all trip costs at the time of purchase. You must update your coverage to insure the costs of any subsequent arrangements that you add to your trip within 15 days of paying the travel supplier for these additional arrangements.

- You must be medically able to travel when you purchase your plan.

Standout features

- The Deluxe and Preferred plans allow you to purchase an upgrade that lets you cancel your trip for any reason. However, reimbursement under this coverage will not exceed 50% or 75% of your covered trip cost.

- You can include one child (age 17 and younger) with each paying adult for no additional cost on most single-trip plans.

- Other optional upgrades, including an adventure sports bundle, a baggage bundle, an inconvenience bundle, a pet bundle, a security bundle and a wedding bundle, are available on some policies. So, an AIG Travel Guard plan may be a good choice if you know you want extra coverage in specific areas.

Purchase your policy here: AIG Travel Guard .

Allianz Travel Insurance

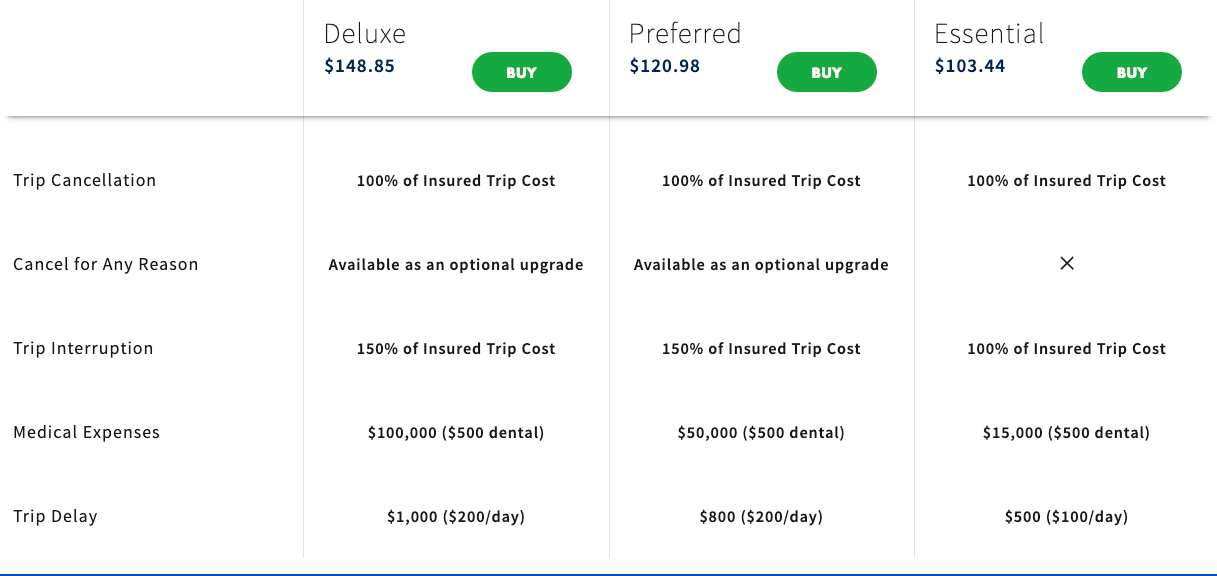

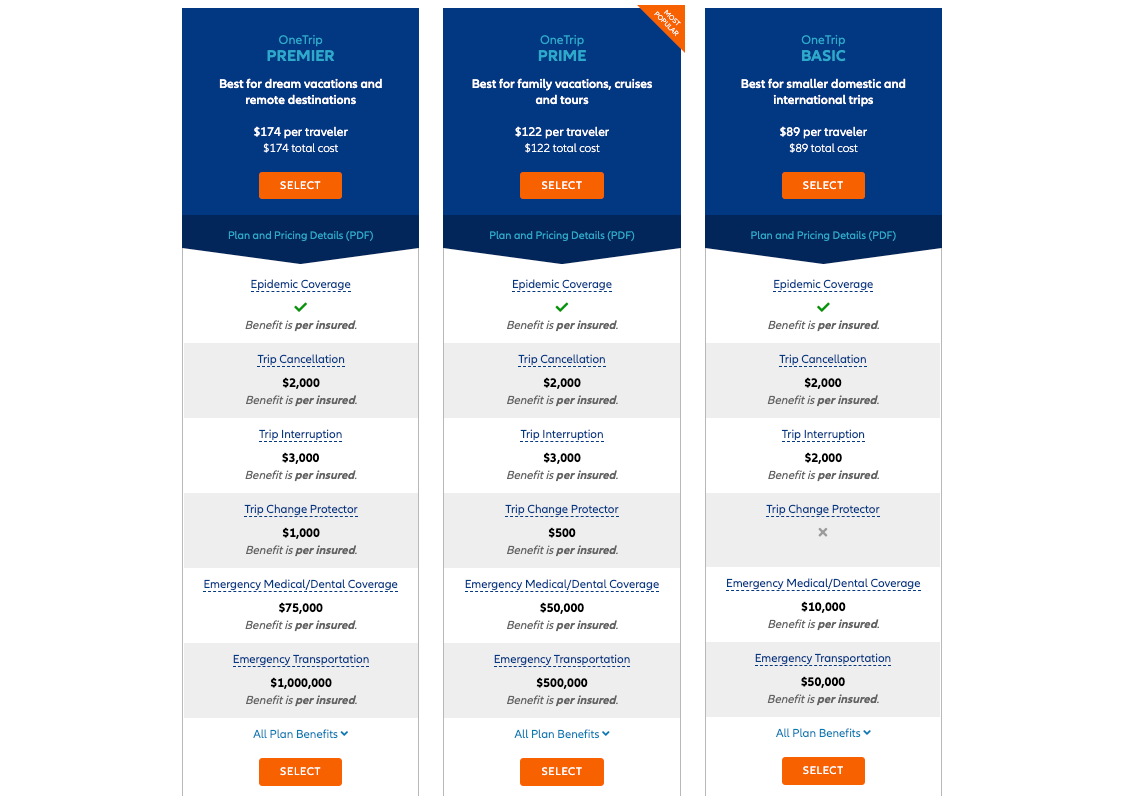

Allianz is one of the most highly regarded providers in the TPG Lounge, and many readers found the claim process reasonable. Allianz offers many plans, including the following single-trip plans for my sample trip to Turkey.

If you travel frequently, it may make sense to purchase an annual multi-trip policy. For this plan, all of the maximum coverage amounts in the table below are per trip (except for the trip cancellation and trip interruption amounts, which are an aggregate limit per policy). Trips typically must last no more than 45 days, although some plans may cover trips of up to 90 days.

See Allianz's coverage alert for current information on COVID-19 coverage.

Most Allianz travel insurance plans may cover preexisting medical conditions if you meet particular requirements. For the OneTrip Premier, Prime and Basic plans, the requirements are as follows:

- You purchased the policy within 14 days of the date of the first trip payment or deposit.

- You were a U.S. resident when you purchased the policy.

- You were medically able to travel when you purchased the policy.

- On the policy purchase date, you insured the total, nonrefundable cost of your trip (including arrangements that will become nonrefundable or subject to cancellation penalties before your departure date). If you incur additional nonrefundable trip expenses after purchasing this policy, you must insure them within 14 days of their purchase.

- Allianz offers reasonably priced annual policies for independent travelers and families who take multiple trips lasting up to 45 days (or 90 days for select plans) per year.

- Some Allianz plans provide the option of receiving a flat reimbursement amount without receipts for trip delay and baggage delay claims. Of course, you can also submit receipts to get up to the maximum refund.

- For emergency transportation coverage, you or someone on your behalf must contact Allianz, and Allianz must then make all transportation arrangements in advance. However, most Allianz policies provide an option if you cannot contact the company: Allianz will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Allianz Travel Insurance .

American Express Travel Insurance

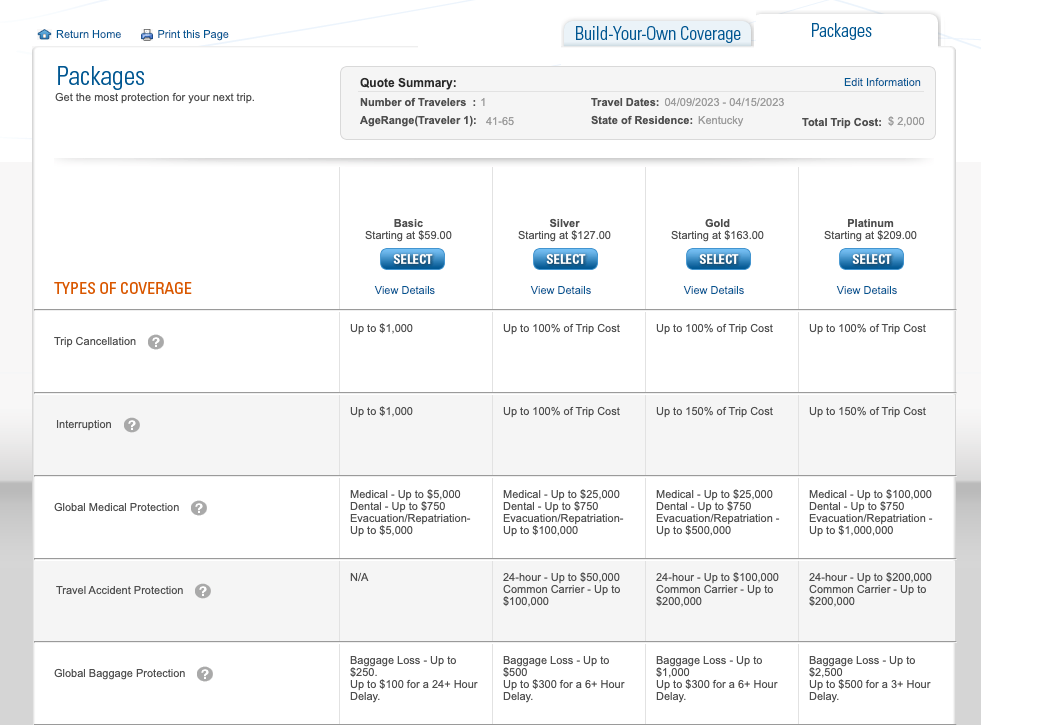

American Express Travel Insurance offers four different package plans and a build-your-own coverage option. You don't have to be an American Express cardholder to purchase this insurance. Here are the four package options for my sample weeklong trip to Turkey. Unlike some other providers, Amex won't ask for your travel destination on the initial quote (but will when you purchase the plan).

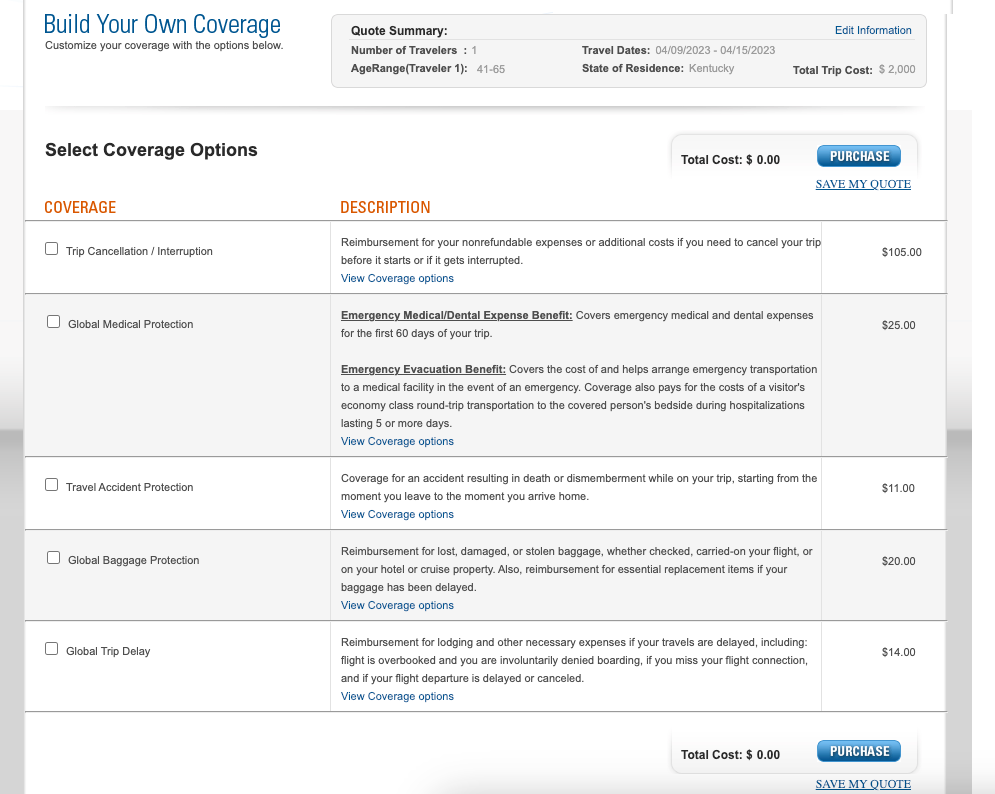

Amex's build-your-own coverage plan is unique because you can purchase just the coverage you need. For most types of protection, you can even select the coverage amount that works best for you.

The prices for the packages and the build-your-own plan don't increase for longer trips — as long as the trip cost remains constant. However, the emergency medical and dental benefit is only available for your first 60 days of travel.

Typically, Amex won't cover any loss you incur because of a preexisting medical condition that existed within 90 days of the coverage effective date. However, Amex may waive its preexisting-condition exclusion if you meet both of the following requirements:

- You must be medically able to travel at the time you pay the policy premium.

- You pay the policy premium within 14 days of making the first covered trip deposit.

- Amex's build-your-own coverage option allows you to only purchase — and pay for — the coverage you need.

- Coverage on long trips doesn't cost more than coverage for short trips, making this policy ideal for extended getaways. However, the emergency medical and dental benefit only covers your first 60 days of travel.

- American Express Travel Insurance can protect travel expenses you purchase with Amex Membership Rewards points in the Pay with Points program (as well as travel expenses bought with cash, debit or credit). However, travel expenses bought with other types of points and miles aren't covered.

Purchase your policy here: American Express Travel Insurance .

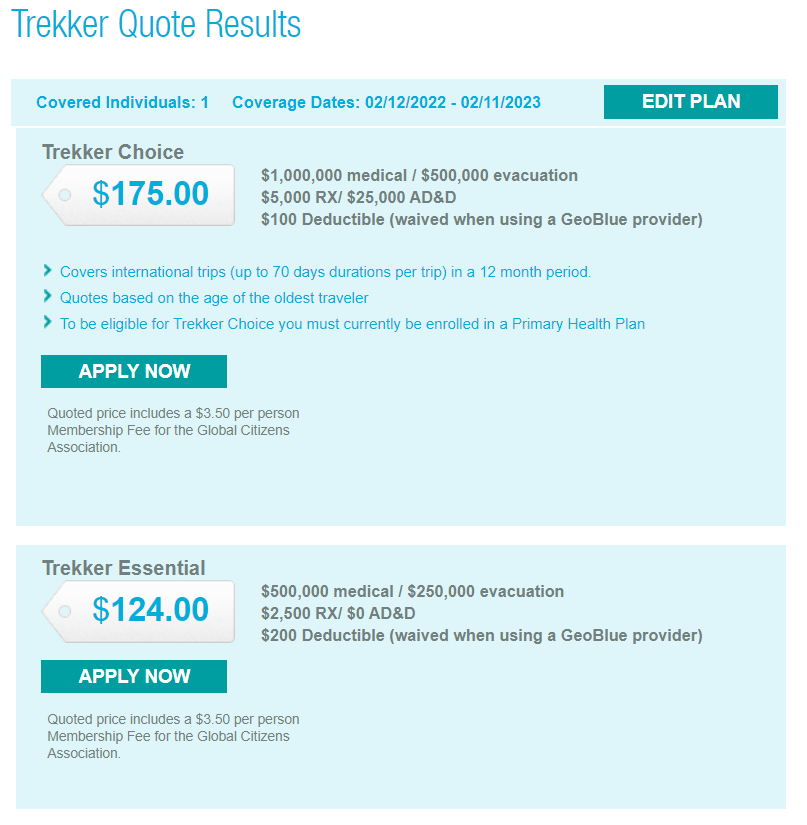

GeoBlue is different from most other providers described in this piece because it only provides medical coverage while you're traveling internationally and does not offer benefits to protect the cost of your trip. There are many different policies. Some require you to have primary health insurance in the U.S. (although it doesn't need to be provided by Blue Cross Blue Shield), but all of them only offer coverage while traveling outside the U.S.

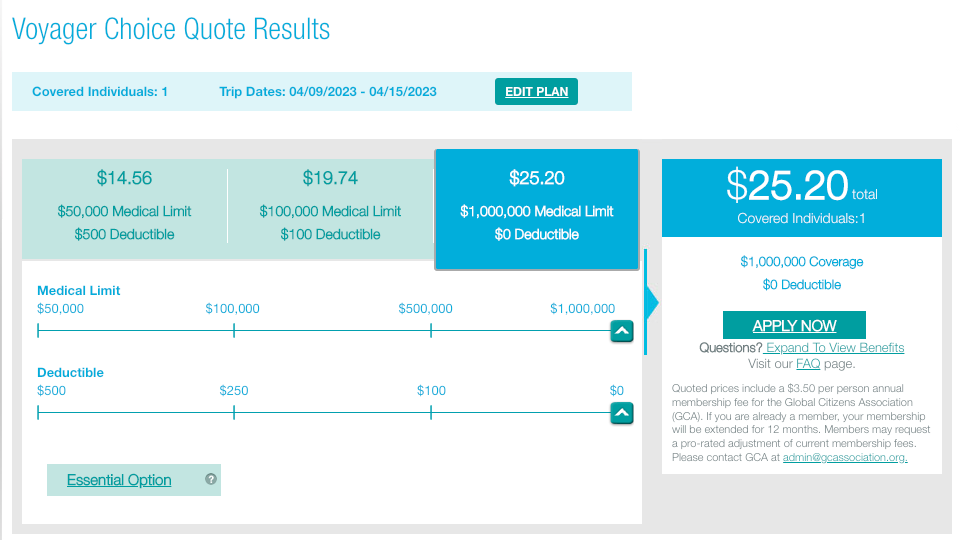

Two single-trip plans are available if you're traveling for six months or less. The Voyager Choice policy provides coverage (including medical services and medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger and already have a U.S. health insurance policy.

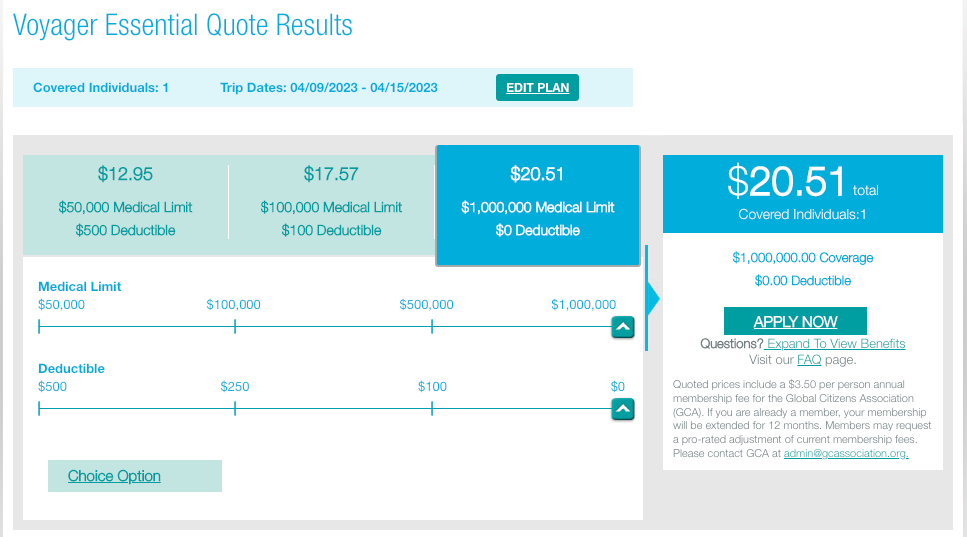

The Voyager Essential policy provides coverage (including medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger, regardless of whether they have primary health insurance.

In addition to these options, two multi-trip plans cover trips of up to 70 days each for one year. Both policies provide coverage (including medical services and medical evacuation for preexisting conditions) to travelers with primary health insurance.

Be sure to check out GeoBlue's COVID-19 notices before buying a plan.

Most GeoBlue policies explicitly cover sudden recurrences of preexisting conditions for medical services and medical evacuation.

- GeoBlue can be an excellent option if you're mainly concerned about the medical side of travel insurance.

- GeoBlue provides single-trip, multi-trip and long-term medical travel insurance policies for many different types of travel.

Purchase your policy here: GeoBlue .

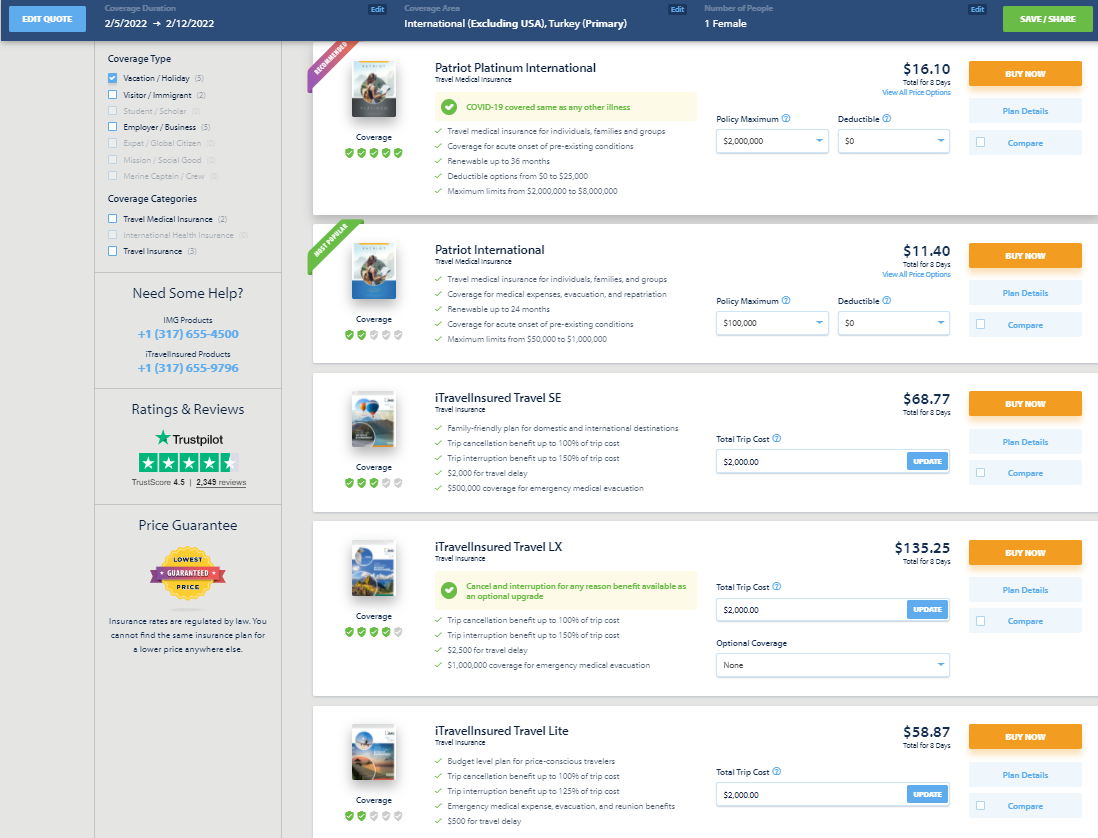

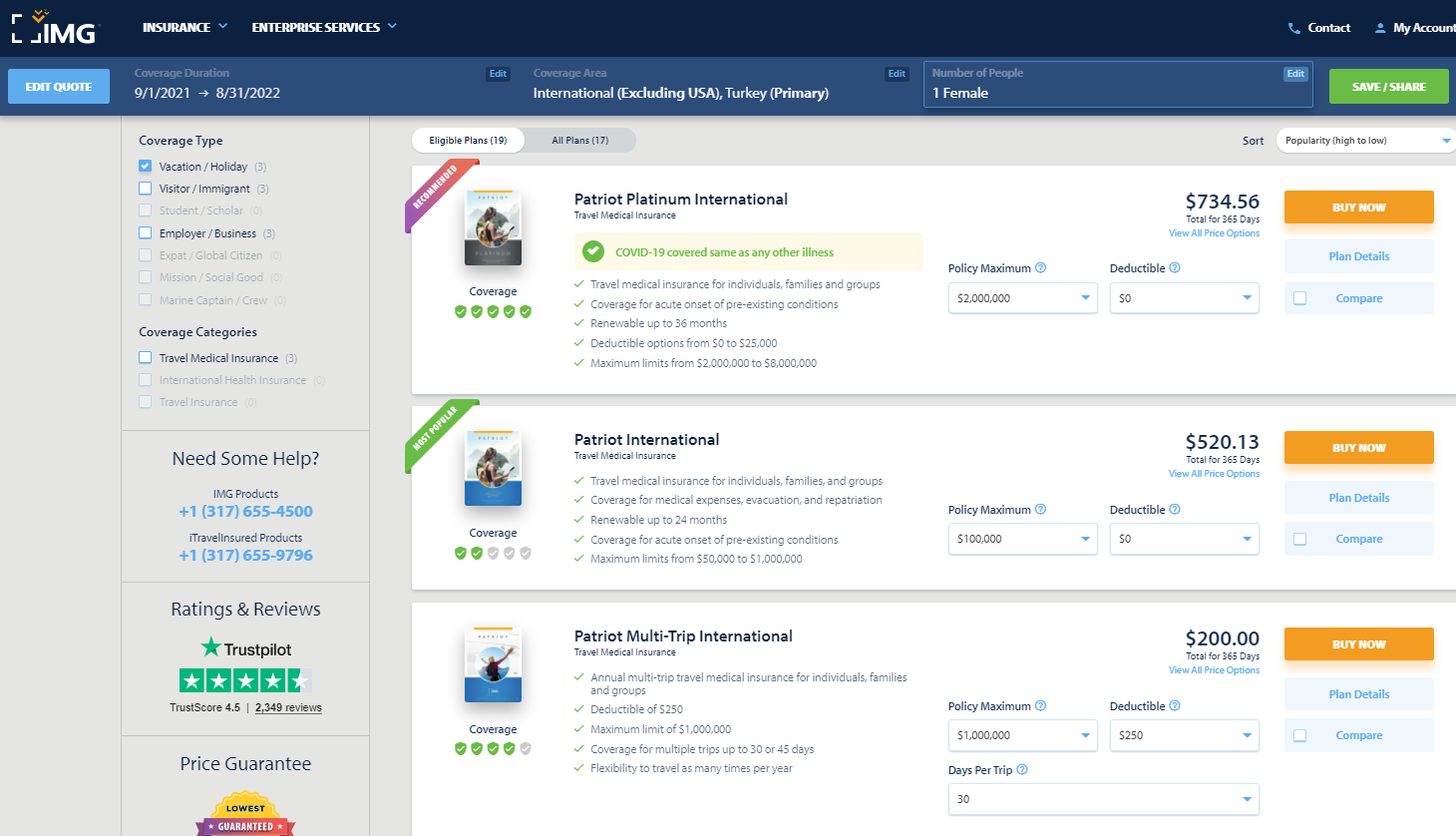

IMG offers various travel medical insurance policies for travelers, as well as comprehensive travel insurance policies. For a single trip of 90 days or less, there are five policy types available for vacation or holiday travelers. Although you must enter your gender, males and females received the same quote for my one-week search.

You can purchase an annual multi-trip travel medical insurance plan. Some only cover trips lasting up to 30 or 45 days, but others provide coverage for longer trips.

See IMG's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Most plans may cover preexisting conditions under set parameters or up to specific amounts. For example, the iTravelInsured Travel LX travel insurance plan shown above may cover preexisting conditions if you purchase the insurance within 24 hours of making the final payment for your trip.

For the travel medical insurance plans shown above, preexisting conditions are covered for travelers younger than 70. However, coverage is capped based on your age and whether you have a primary health insurance policy.

- Some annual multi-trip plans are modestly priced.

- iTravelInsured Travel LX may offer optional cancel for any reason and interruption for any reason coverage, if eligible.

Purchase your policy here: IMG .

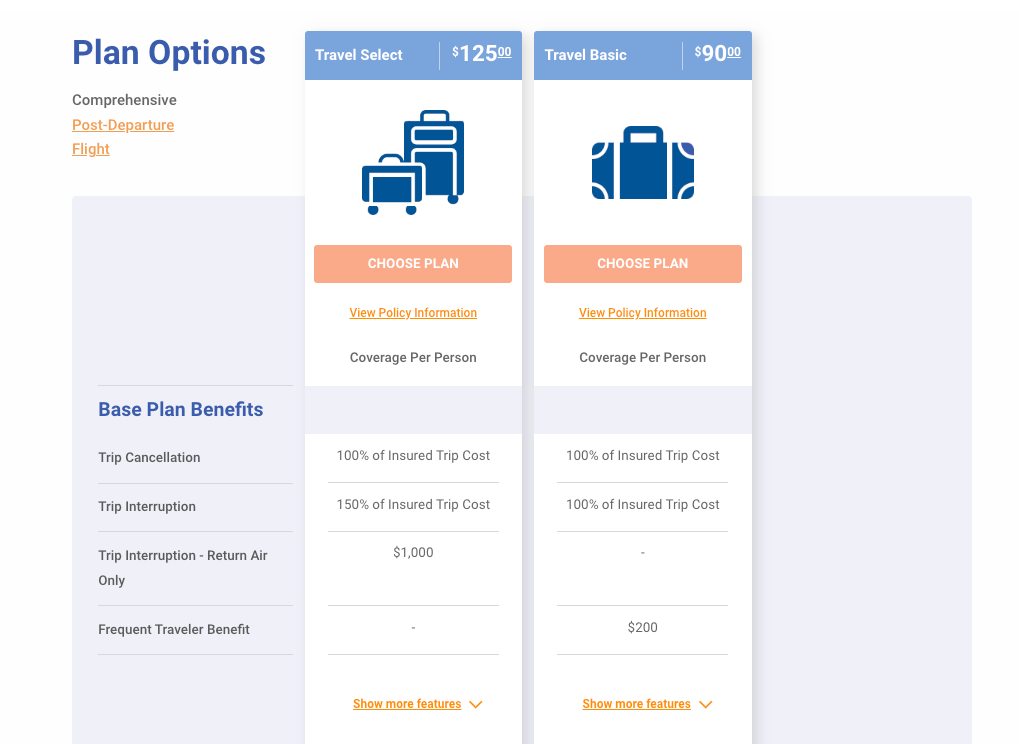

Travelex Insurance

Travelex offers three single-trip plans: Travel Basic, Travel Select and Travel America. However, only the Travel Basic and Travel Select plans would be applicable for my trip to Turkey.

See Travelex's COVID-19 coverage statement for coronavirus-specific information.

Typically, Travelex won't cover losses incurred because of a preexisting medical condition that existed within 60 days of the coverage effective date. However, the Travel Select plan may offer a preexisting condition exclusion waiver. To be eligible for this waiver, the insured traveler must meet all the following conditions:

- You purchase the plan within 15 days of the initial trip payment.

- The amount of coverage purchased equals all prepaid, nonrefundable payments or deposits applicable to the trip at the time of purchase. Additionally, you must insure the costs of any subsequent arrangements added to the same trip within 15 days of payment or deposit.

- All insured individuals are medically able to travel when they pay the plan cost.

- The trip cost does not exceed the maximum trip cost limit under trip cancellation as shown in the schedule per person (only applicable to trip cancellation, interruption and delay).

- Travelex's Travel Select policy can cover trips lasting up to 364 days, which is longer than many single-trip policies.

- Neither Travelex policy requires receipts for trip and baggage delay expenses less than $25.

- For emergency evacuation coverage, you or someone on your behalf must contact Travelex and have Travelex make all transportation arrangements in advance. However, both Travelex policies provide an option if you cannot contact Travelex: Travelex will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Travelex Insurance .

Seven Corners

Seven Corners offers a wide variety of policies. Here are the policies that are most applicable to travelers on a single international trip.

Seven Corners also offers many other types of travel insurance, including an annual multi-trip plan. You can choose coverage for trips of up to 30, 45 or 60 days when purchasing an annual multi-trip plan.

See Seven Corner's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Typically, Seven Corners won't cover losses incurred because of a preexisting medical condition. However, the RoundTrip Choice plan offers a preexisting condition exclusion waiver. To be eligible for this waiver, you must meet all of the following conditions:

- You buy this plan within 20 days of making your initial trip payment or deposit.

- You or your travel companion are medically able and not disabled from travel when you pay for this plan or upgrade your plan.

- You update the coverage to include the additional cost of subsequent travel arrangements within 15 days of paying your travel supplier for them.

- Seven Corners offers the ability to purchase optional sports and golf equipment coverage. If purchased, this extra insurance will reimburse you for the cost of renting sports or golf equipment if yours is lost, stolen, damaged or delayed by a common carrier for six or more hours. However, Seven Corners must authorize the expenses in advance.

- You can add cancel for any reason coverage or trip interruption for any reason coverage to RoundTrip plans. Although some other providers offer cancel for any reason coverage, trip interruption for any reason coverage is less common.

- Seven Corners' RoundTrip Choice policy offers a political or security evacuation benefit that will transport you to the nearest safe place or your residence under specific conditions. You can also add optional event ticket registration fee protection to the RoundTrip Choice policy.

Purchase your policy here: Seven Corners .

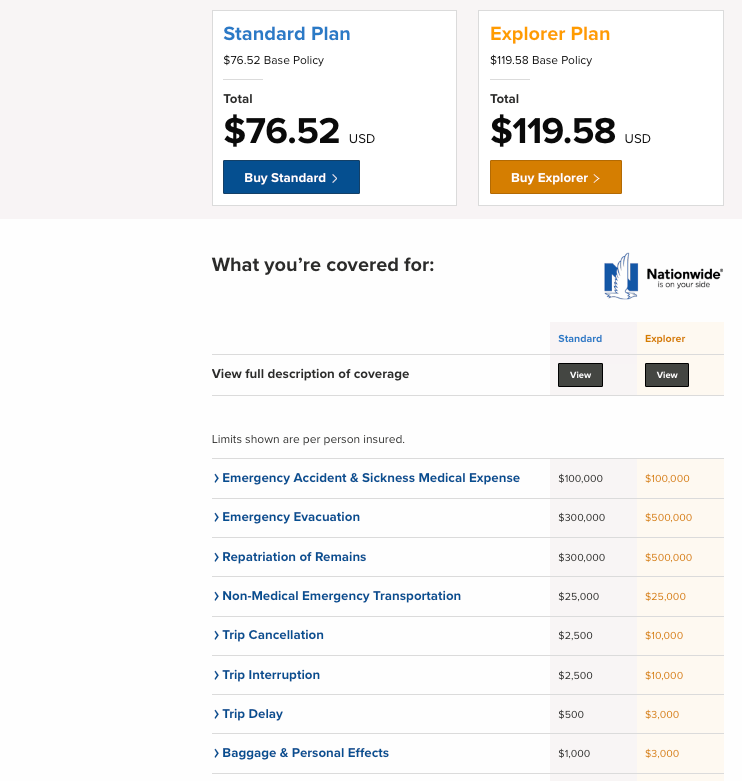

World Nomads

World Nomads is popular with younger, active travelers because of its flexibility and adventure-activities coverage on the Explorer plan. Unlike many policies offered by other providers, you don't need to estimate prepaid costs when purchasing the insurance to have access to trip interruption and cancellation insurance.

World Nomads offers two single-trip plans.

World Nomads has a page dedicated to coronavirus coverage , so be sure to view it before buying a policy.

World Nomads won't cover losses incurred because of a preexisting medical condition (except emergency evacuation and repatriation of remains) that existed within 90 days of the coverage effective date. Unlike many other providers, World Nomads doesn't offer a waiver.

- World Nomads' policies cover more adventure sports than most providers, so activities such as bungee jumping are included. The Explorer policy covers almost any adventure sport, including skydiving, stunt flying and caving. So, if you partake in adventure sports while traveling, the Explorer policy may be a good fit.

- World Nomads' policies provide nonmedical evacuation coverage for transportation expenses if there is civil or political unrest in the country you are visiting. The coverage may also transport you home if there is an eligible natural disaster or a government expels you.

Purchase your policy here: World Nomads .

Other options for buying travel insurance

This guide details the policies of eight providers with the information available at the time of publication. There are many options when it comes to travel insurance, though. To compare different policies quickly, you can use a travel insurance aggregator like InsureMyTrip to search. Just note that these search engines won't show every policy and every provider, and you should still research the provided policies to ensure the coverage fits your trip and needs.

You can also purchase a plan through various membership associations, such as USAA, AAA or Costco. Typically, these organizations partner with a specific provider, so if you are a member of any of these associations, you may want to compare the policies offered through the organization with other policies to get the best coverage for your trip.

Related: Should you get travel insurance if you have credit card protection?

Is travel insurance worth getting?

Whether you should purchase travel insurance is a personal decision. Suppose you use a credit card that provides travel insurance for most of your expenses and have medical insurance that provides adequate coverage abroad. In that case, you may be covered enough on most trips to forgo purchasing travel insurance.

However, suppose your medical insurance won't cover you at your destination and you can't comfortably cover a sizable medical evacuation bill or last-minute flight home . In that case, you should consider purchasing travel insurance. If you travel frequently, buying an annual multi-trip policy may be worth it.

What is the best COVID-19 travel insurance?

There are various aspects to keep in mind in the age of COVID-19. Consider booking travel plans that are fully refundable or have modest change or cancellation fees so you don't need to worry about whether your policy will cover trip cancellation. This is important since many standard comprehensive insurance policies won't reimburse your insured expenses in the event of cancellation if it's related to the fear of traveling due to COVID-19.