Travel Industry Economics

A Guide for Financial Analysis

- © 2021

- Latest edition

- Harold L. Vogel 0

Vogel Capital Management, New York, USA

You can also search for this author in PubMed Google Scholar

- Provides a holistic and fully integrated guide to all major travel and and tourism-related financial and marketing operations

- Includes extensive charts, tables and notes to illustrate major trends and and characteristics in an easy-to-follow format

- Offers students a comprehensive and comprehensible accessible introduction placed in historical context

- Includes featured readings that can serve as sources for class discussions, research projects, and term papers

2465 Accesses

4 Citations

This is a preview of subscription content, log in via an institution to check access.

Access this book

- Available as EPUB and PDF

- Read on any device

- Instant download

- Own it forever

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

- Durable hardcover edition

Tax calculation will be finalised at checkout

Other ways to access

Licence this eBook for your library

Institutional subscriptions

Table of contents (8 chapters)

Front matter, introduction, economic perspectives.

Harold L. Vogel

Getting There

Water and wheels, being there, doing things there, amusement/theme parks and resorts, performance and policy, back matter.

- airline industry finance

- hotel industry finance

- tourism industry finance

- casino industry finance

- amusement industry finance

- cruise industry finance

About this book

Authors and affiliations, about the author.

Harold (Hal) L. Vogel was the senior entertainment industry analyst at Merrill Lynch and was inducted into the Institutional Investor magazine’s All-America Research Team Hall of Fame. He is a chartered financial analyst (C.F.A.) and served on the New York State Governor’s Motion Picture and Television Advisory Board, as an adjunct professor at Columbia University’s Business School, and taught at the Cass Business School in London. He earned his Ph.D. in financial economics from the University of London and currently runs an independent investment and consulting firm in New York City while often writing and speaking on investment topics related to travel and tourism, entertainment and media, and extreme market events. His books include Entertainment Industry Economics 10th edition (2020), published by Cambridge University Press, Financial Market Bubbles and Crashes: Features, Causes, and Effects, second edition (2018) published by Palgrave Macmillan, and Travel Industry Economics 4th edition (2021) published by Springer.

Bibliographic Information

Book Title : Travel Industry Economics

Book Subtitle : A Guide for Financial Analysis

Authors : Harold L. Vogel

DOI : https://doi.org/10.1007/978-3-030-63351-6

Publisher : Springer Cham

eBook Packages : Economics and Finance , Economics and Finance (R0)

Copyright Information : The Editor(s) (if applicable) and The Author(s), under exclusive license to Springer Nature Switzerland AG 2021

Hardcover ISBN : 978-3-030-63350-9 Published: 14 May 2021

Softcover ISBN : 978-3-030-63353-0 Published: 14 May 2022

eBook ISBN : 978-3-030-63351-6 Published: 13 May 2021

Edition Number : 4

Number of Pages : XV, 415

Number of Illustrations : 61 b/w illustrations, 15 illustrations in colour

Topics : Industrial Organization , International Finance , Business Finance , Industries

- Publish with us

Policies and ethics

- Find a journal

- Track your research

An official website of the United States government

- Special Topics

Travel and Tourism

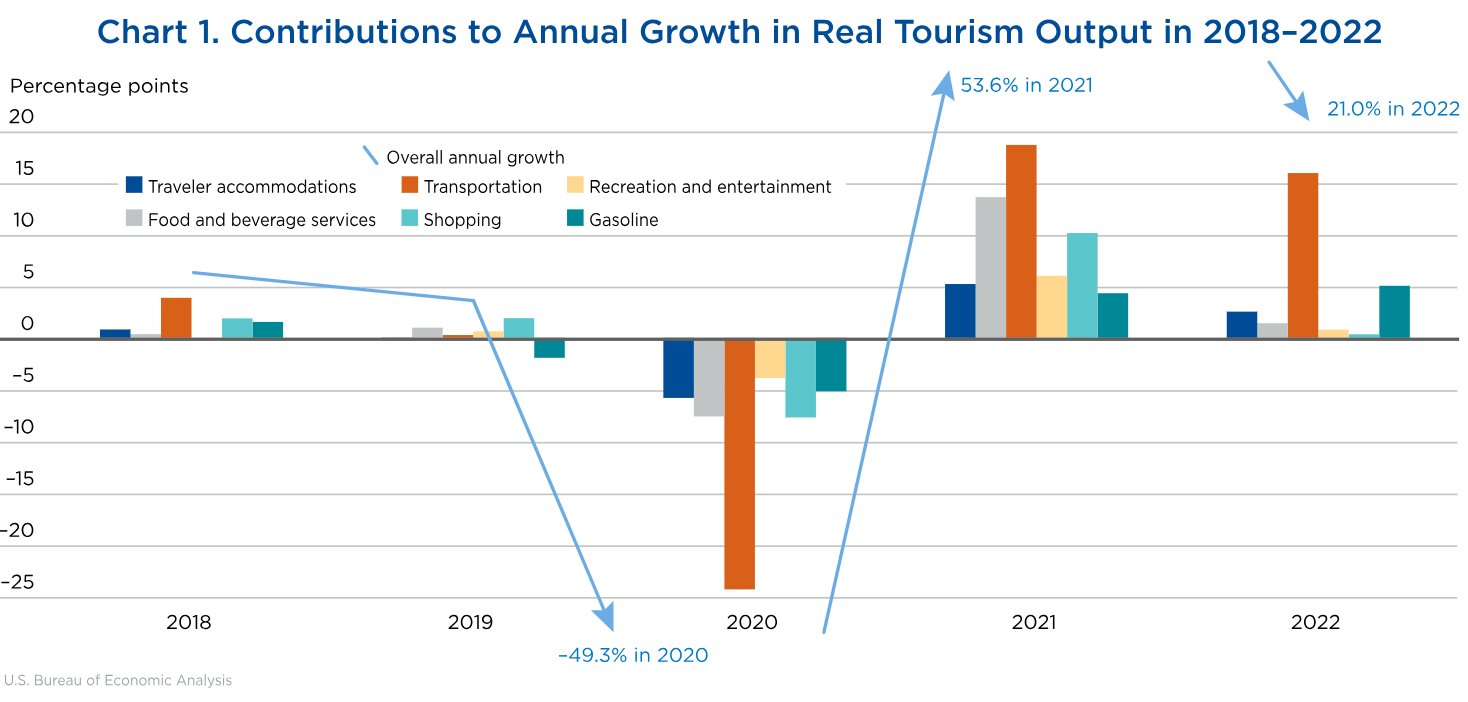

Travel and tourism satellite account for 2018-2022.

The travel and tourism industry—as measured by the real output of goods and services sold directly to visitors—increased 21.0 percent in 2022 after increasing 53.6 percent in 2021, according to the most recent statistics from BEA’s Travel and Tourism Satellite Account.

Data & Articles

- U.S. Travel and Tourism Satellite Account for 2018–2022 By Hunter Arcand and Paul Kern - Survey of Current Business April 2024

- "U.S. Travel and Tourism Satellite Account for 2015–2019" By Sarah Osborne - Survey of Current Business December 2020

- "U.S. Travel and Tourism Satellite Account for 2015-2017" By Sarah Osborne and Seth Markowitz - Survey of Current Business June 2018

- Tourism Satellite Accounts 1998-2019

- Tourism Satellite Accounts Data A complete set of detailed annual statistics for 2017-2021 is coming soon -->

- Article Collection

Documentation

- Product Guide

Previously Published Estimates

- Data Archive This page provides access to an archive of estimates previously published by the Bureau of Economic Analysis. Please note that this archive is provided for research only. The estimates contained in this archive include revisions to prior estimates and may not reflect the most recent revision for a particular period.

- News Release Archive

What is Travel and Tourism?

Measures how much tourists spend and the prices they pay for lodging, airfare, souvenirs, and other travel-related items. These statistics also provide a snapshot of employment in the travel and tourism industries.

What’s a Satellite Account?

- TTSA Sarah Osborne (301) 278-9459

- News Media Connie O'Connell (301) 278-9003 [email protected]

Towards resilience and sustainability: Travel and tourism development recovery

The travel and tourism sector is slowly beginning to recover. Image: Unsplash/Eva Darron

.chakra .wef-1c7l3mo{-webkit-transition:all 0.15s ease-out;transition:all 0.15s ease-out;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;outline:none;color:inherit;}.chakra .wef-1c7l3mo:hover,.chakra .wef-1c7l3mo[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.chakra .wef-1c7l3mo:focus,.chakra .wef-1c7l3mo[data-focus]{box-shadow:0 0 0 3px rgba(168,203,251,0.5);} Kate Whiting

.chakra .wef-9dduvl{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-9dduvl{font-size:1.125rem;}} Explore and monitor how .chakra .wef-15eoq1r{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;color:#F7DB5E;}@media screen and (min-width:56.5rem){.chakra .wef-15eoq1r{font-size:1.125rem;}} Travel and Tourism is affecting economies, industries and global issues

.chakra .wef-1nk5u5d{margin-top:16px;margin-bottom:16px;line-height:1.388;color:#2846F8;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-1nk5u5d{font-size:1.125rem;}} Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:, davos agenda.

Listen to the article

- The World Economic Forum has published its inaugural Travel and Tourism Development Index .

- It focuses on the growing role of sustainability and resilience in travel and tourism growth.

- Recovery for the sector is uneven and tourist arrivals in January 2022 were still 67% below 2019 levels, according to the World Tourism Organization.

- Here are some key findings from the index on how the sector can build back better.

In 2018, international tourism grew for the ninth consecutive year. Tourist arrivals reached 1.4 billion and generated $1.7 trillion in export earnings, according to the World Tourism Organization (UNWTO).

Travel and tourism: post-pandemic

The picture looked very different two years later, as COVID-19 lockdowns hit the travel and tourism (T&T) sector hard. In 2020 alone, it faced losses of $4.5 trillion and 62 million jobs , impacting the living standards and well-being of communities across the globe.

While the roll-out of COVID-19 vaccines and easing of restrictions means a recovery has now started, it’s proving gradual and uneven largely due to variations in vaccine distribution, and because of Omicron and its BA.2 subvariant. And customers are not only being more cautious when it comes to health, but also around the impact of travel on the environment and local communities.

International tourist arrivals rose by 18 million in January 2022 compared with a year earlier. This equals the increase for the whole of 2021 from 2020, but January’s numbers were still 67% below the same month in 2019, according to the UNWTO.

The war in Ukraine has added to instability and economic disruption for the sector. Against this backdrop, the World Economic Forum’s inaugural Travel and Tourism Development Index reflects the growing role of sustainability and resilience in T&T growth, as well as the sector’s role in economic and social development more broadly.

The TTDI benchmarks and measures “the set of factors and policies that enable the sustainable and resilient development of the T&T sector, which in turn contributes to the development of a country”. The TTDI is a direct evolution of the long-running Travel and Tourism Competitiveness Index (TTCI), with the change reflecting the index’s increased coverage of T&T development concepts, including sustainability and resilience impact on T&T growth and is designed to highlight the sector’s role in broader economic and social development as well as the need for T&T stakeholder collaboration to mitigate the impact of the pandemic, bolster the recovery and deal with future challenges and risks. Some of the most notable framework and methodology differences between the TTCI and TTDI include the additions of new pillars, including Non-Leisure Resources, Socioeconomic Resilience and Conditions, and T&T Demand Pressure and Impact. Please see the Technical notes and methodology. section to learn more about the index and the differences between the TTCI and TTDI.

The Travel and Tourism Development Index 2021

The index covers 117 economies, which accounted for around 96% of the world’s direct T&T GDP in 2020. It measures the factors and policies that will enable sustainable and resilient development of the sector.

These include everything from business, safety and health conditions, to infrastructure and natural resources, environmental, socioeconomic and demand pressures.

“As the sector slowly recovers, it will be crucial that lessons are learned from recent and current crises and that steps are taken to embed long-term inclusivity, sustainability and resilience into the travel and tourism sector as it faces evolving challenges and risks,” says the publication, a collaboration between many of the sector’s stakeholders.

The index consists of five subindexes, 17 pillars and 112 individual indicators, distributed among the different pillars, as shown below.

On average, scores increased by just 0.1% between 2019 and 2021, reflecting the difficult situation facing the sector. Only 39 out of 117 economies covered by the index improved by more than 1.0%, while 27 declined by over 1.0%.

Nine of the top 10 scoring countries are high-income economies in Europe or Asia-Pacific. Japan tops the ranking, with the United States in second, followed by Spain, France, Germany, Switzerland, Australia, the United Kingdom and Singapore. Italy completes the top 10, moving up from 12th in 2019.

Viet Nam experienced the greatest improvement in score, with a rise of 4.7% lifting it from 60th to 52nd on the overall index. Indonesia achieved the greatest improvement in rank, increasing its score by 3.4% to climb from 44th to 32nd, while Saudi Arabia achieved the second greatest improvement in rank, moving up to 33rd from 43rd as its score rose by 2.3%.

Rebuilding travel and tourism for a sustainable and resilient future

Here are some of the key findings from the publication:

1. The need for travel and tourism development has never been greater

The sector is a major driver of economic development, global connectivity and the livelihood of some of the populations and businesses most vulnerable to, and hard hit by, the pandemic. In 2019, T&T’s direct, indirect and induced GDP accounted for about 10% of global GDP . For many emerging economies, T&T is a major source of export revenue, foreign exchange earnings and investment. Research has shown that T&T growth can support social progress and create opportunities and well-being for communities, so supporting travel and tourism development and recovery will be critical.

2. Shifting demand dynamics have created opportunities and a need for adaptation

In the shorter term, challenges such as reduced capacity, geopolitical tensions and labour shortages are slowing recovery. However, opportunities have been created in markets such as domestic and nature-based tourism, the rise of digital nomads and “bleisure” travel – the addition of leisure activities to business travel. Many countries have provided incentives to boost domestic tourism. For example, Singapore, South Korea, Japan and Hong Kong SAR, China, have rolled out programmes that provide discounts, coupons and subsidies for domestic travel. The trends towards more rural and nature-based tourism offer an opportunity for less-developed economies to harness the benefits of travel and tourism given that the distribution and quality of natural assets are less tied to performance in economic development, with natural resources being one of the few pillars where non-high income economies typically outperform high-income countries. The travel and tourism sector stakeholders’ ability to adapt under these conditions highlights its capacity for adaptation and flexibility.

3. Development strategies can be employed to help the sector build back better

Amid the current challenges, shifting demand dynamics and future opportunities and risks, a more inclusive, sustainable and resilient travel and tourism sector can be – and needs to be – built, says the publication. But this calls for thoughtful and effective consideration. It also requires leveraging development drivers and strategies. This can be done by: restoring and accelerating international openness and consumer confidence through, for example, improved health and security; building favourable and inclusive labour, business and socioeconomic conditions; focusing more on environmental sustainability; strengthening the management of tourism demand and impact; and investing in digital technology.

A note on the methodology

Most of the dataset for the Travel & Tourism Development Index (TTDI) is statistical data from international organizations, with the remainder based on survey data from the World Economic Forum’s annual Executive Opinion Survey, which is used to measure concepts that are qualitative in nature or for which internationally comparable statistics are not available for enough countries. The index is an update of the Travel & Tourism Competitiveness Index (TTCI), but due to the altered methodology, framework and other differences, the 2021 TTDI should not be compared to the 2019 TTCI. To help address this, the 2019 results were recalculated using the new framework, methodology and indicators of the TTDI. Therefore, all comparisons in score and rank throughout this report are between the 2019 results and the 2021 results of the TTDI. Data for the TTDI 2021 was collected before the war in Ukraine.

Have you read?

How quickly is tourism recovering from covid-19, this is how the covid-19 crisis has affected international tourism, what covid-19 taught us about collaboration – 7 lessons from the frontline, don't miss any update on this topic.

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The agenda .chakra .wef-n7bacu{margin-top:16px;margin-bottom:16px;line-height:1.388;font-weight:400;} weekly.

A weekly update of the most important issues driving the global agenda

Travel Will Inject a Record $11 Trillion Into the Global Economy This Year: Report

Tourism is expected to become a $16 trillion industry by 2034, the world travel & tourism council says., rachel cormack.

Digital Editor

Rachel Cormack's Most Recent Stories

- This New 121-Foot Explorer Yacht Brings Luxury to Bluewater Cruising

- Wally Just Launched Its First 110-Foot Sailing Yacht

- This $525,000 Boba Fett Is Now the World’s Most Expensive Vintage Toy

- Share This Article

All your jet-setting and hotel-hopping is having a significant effect on the global economy.

Related Stories

- Inside the BVI’s Hottest New Property, a $35,000-Per-Night Villa Carved Into a Cliff

7 Fresh Hotel Openings and Renovations Hitting New England This Summer

This expedition cruise along the british isles lets you vacation like a royal.

The 14-figure sums can be broken down into three types of travel transactions, Bloomberg notes. Direct travel spending includes things like hotels, tours, and transportation, as well as public investment in these types of services. Indirect travel spending covers the expenses of those businesses, such as sheets and towels or the ingredients for the breakfast buffet. Finally, induced spending accounts for the trickle-down effects of hospitality employees.

In total, 142 out of the 185 surveyed countries are expected to exceed their 2019 tourism performance levels in 2024. Almost all nations are expected to see year-over-year growth, too. As a result, records are likely to be broken on a local level as well as a global.

Rachel Cormack is a digital editor at Robb Report. She cut her teeth writing for HuffPost, Concrete Playground, and several other online publications in Australia, before moving to New York at the…

Read More On:

- United States

More Destinations

Brussels and Berlin Are Two of This Summer’s Travel Hot Spots—Here’s Why

How Soaring U.S. Hotel Rates Are Making Dallas a Luxury Travel Hot Spot

A Week of Auto Tradition

AUG 14 - 19 Behind-the-scenes access to a remarkable week honoring automotive brilliance.

Give the Gift of Luxury

Latest Galleries in Destinations

Kalmar Beyond Adventure’s Porsche Safari in Photos

Oceaya in Photos

More from our brands, june 2024: the latest beauty executive moves at about-face, ever/body, the estée lauder cos. and more, aaron judge’s bat booms after april gloom to beat gehrig record, syndicado to sell álvaro f. pulpeiro’s dystopian eco-thriller ‘petroleo’ about the ‘hidden and intricate world’ of the oil industry (exclusive), president of philadelphia’s university of the arts resigns after school’s sudden closure, the best yoga mats for any practice, according to instructors.

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Search ITA Search

2020 Travel and Tourism Industry Impact on the U.S. Economy

Total economic output generated by travel and tourism in the united states decreased 50% in 2020 from 2019, decline in travel and tourism gdp accounted for more than half of the decline in u.s. gdp in 2020, decline in total tourism-related employment accounted for more than a third of the total employment decline in the united states in 2020 .

The National Travel and Tourism Office’s (NTTO) Travel & Tourism Satellite Account, produced annually by the Bureau of Economic Analysis, is the official U.S. Government estimate of the economic impact of the travel and tourism industry in the United States. The latest TTSA shows that in Calendar Year 2020:

Total economic output generated by travel and tourism fell $982.5 billion (-50.1%) from 2019 ($1.96 trillion) to 2020 ($978.4 billion).

- Among those sectors hardest hit, passenger air transportation services output declined by nearly $214.7 billion in 2020, followed by food services and drinking places/restaurants (down $131.1 billion), traveler accommodations (down $124.6 billion), and tourism-related shopping (down $123.5 billion).

- These four sectors accounted for 60.4% of the decline in total tourism-related output in 2020.

Total tourism-related employment declined from 9.5 million in 2019 to 6.3 million in 2020. This decline of 3.2 million in total tourism-related employment accounted for 34.2% of the overall 9.3 million employment decline in the United States from 2019 to 2020.

- Among those sectors hardest hit, employment supported by food services and drinking places declined by 972,000 in 2020, followed by traveler accommodations (down 685,000), air transportation services (down 338,000), and participant sports (down 262,000).

- These four sectors accounted for 70.8% of the decline in total tourism-related employment in 2020.

Travel and tourism value added, or GDP, (in nominal terms, not inflation adjusted) declined from $624.7 billion (2.9% of GDP) in 2019 to $356.8 billion (a historic low of 1.7% of GDP) in 2020 .This $267.9 billion decline in travel and tourism GDP accounted for more than half (56.0%) of the overall $478.8 billion decline in U.S. GDP from 2019 to 2020.

Domestic travel demand by resident households declined by 53.2% from 2019 to 2020. At the same time, domestic business travel demand declined by 40.9%; domestic government travel demand declined by 33.6%; and travel demand by nonresidents (international visitors in the United States) declined 82.4% — accounting for a fifth (20.7%) of the overall decline in total travel demand from 2019 to 2020.

Learn more on NTTO’s Travel and Tourism Satellite Account (TTSA) Program Page .

Travel and Tourism Satellite Accounts (TTSAs) allow the United States to measure the relative size and importance of the travel and tourism industry, along with its contribution to gross domestic product (GDP). Approved by the United Nations in March 2002 and endorsed by the U.N. Statistical Commission, TTSAs have become the international standard by which travel and tourism is measured. In fact, more than 50 countries around the world use travel and tourism satellite accounting.

View BEA’s Travel and Tourism Satellite Account .

Travel, Tourism & Hospitality

Global tourism industry - statistics & facts

What are the leading global tourism destinations, digitalization of the global tourism industry, how important is sustainable tourism, key insights.

Detailed statistics

Total contribution of travel and tourism to GDP worldwide 2019-2033

Number of international tourist arrivals worldwide 1950-2023

Global leisure travel spend 2019-2022

Editor’s Picks Current statistics on this topic

Leading global travel markets by travel and tourism contribution to GDP 2019-2022

Travel and tourism employment worldwide 2019-2033

Further recommended statistics

- Basic Statistic Total contribution of travel and tourism to GDP worldwide 2019-2033

- Basic Statistic Travel and tourism: share of global GDP 2019-2033

- Basic Statistic Leading global travel markets by travel and tourism contribution to GDP 2019-2022

- Basic Statistic Global leisure travel spend 2019-2022

- Premium Statistic Global business travel spending 2001-2022

- Premium Statistic Number of international tourist arrivals worldwide 1950-2023

- Basic Statistic Number of international tourist arrivals worldwide 2005-2023, by region

- Basic Statistic Travel and tourism employment worldwide 2019-2033

Total contribution of travel and tourism to gross domestic product (GDP) worldwide in 2019 and 2022, with a forecast for 2023 and 2033 (in trillion U.S. dollars)

Travel and tourism: share of global GDP 2019-2033

Share of travel and tourism's total contribution to GDP worldwide in 2019 and 2022, with a forecast for 2023 and 2033

Total contribution of travel and tourism to GDP in leading travel markets worldwide in 2019 and 2022 (in billion U.S. dollars)

Leisure tourism spending worldwide from 2019 to 2022 (in billion U.S. dollars)

Global business travel spending 2001-2022

Expenditure of business tourists worldwide from 2001 to 2022 (in billion U.S. dollars)

Number of international tourist arrivals worldwide from 1950 to 2023 (in millions)

Number of international tourist arrivals worldwide 2005-2023, by region

Number of international tourist arrivals worldwide from 2005 to 2023, by region (in millions)

Number of travel and tourism jobs worldwide from 2019 to 2022, with a forecast for 2023 and 2033 (in millions)

- Premium Statistic Global hotel and resort industry market size worldwide 2013-2023

- Premium Statistic Most valuable hotel brands worldwide 2023, by brand value

- Basic Statistic Leading hotel companies worldwide 2023, by number of properties

- Premium Statistic Hotel openings worldwide 2021-2024

- Premium Statistic Hotel room openings worldwide 2021-2024

- Premium Statistic Countries with the most hotel construction projects in the pipeline worldwide 2022

Global hotel and resort industry market size worldwide 2013-2023

Market size of the hotel and resort industry worldwide from 2013 to 2022, with a forecast for 2023 (in trillion U.S. dollars)

Most valuable hotel brands worldwide 2023, by brand value

Leading hotel brands based on brand value worldwide in 2023 (in billion U.S. dollars)

Leading hotel companies worldwide 2023, by number of properties

Leading hotel companies worldwide as of June 2023, by number of properties

Hotel openings worldwide 2021-2024

Number of hotels opened worldwide from 2021 to 2022, with a forecast for 2023 and 2024

Hotel room openings worldwide 2021-2024

Number of hotel rooms opened worldwide from 2021 to 2022, with a forecast for 2023 and 2024

Countries with the most hotel construction projects in the pipeline worldwide 2022

Countries with the highest number of hotel construction projects in the pipeline worldwide as of Q4 2022

- Premium Statistic Airports with the most international air passenger traffic worldwide 2022

- Premium Statistic Market value of selected airlines worldwide 2023

- Premium Statistic Global passenger rail users forecast 2017-2027

- Premium Statistic Daily ridership of bus rapid transit systems worldwide by region 2023

- Premium Statistic Number of users of car rentals worldwide 2019-2028

- Premium Statistic Number of users in selected countries in the Car Rentals market in 2023

- Premium Statistic Carbon footprint of international tourism transport worldwide 2005-2030, by type

Airports with the most international air passenger traffic worldwide 2022

Leading airports for international air passenger traffic in 2022 (in million international passengers)

Market value of selected airlines worldwide 2023

Market value of selected airlines worldwide as of May 2023 (in billion U.S. dollars)

Global passenger rail users forecast 2017-2027

Worldwide number of passenger rail users from 2017 to 2022, with a forecast through 2027 (in billion users)

Daily ridership of bus rapid transit systems worldwide by region 2023

Number of daily passengers using bus rapid transit (BRT) systems as of April 2023, by region

Number of users of car rentals worldwide 2019-2028

Number of users of car rentals worldwide from 2019 to 2028 (in millions)

Number of users in selected countries in the Car Rentals market in 2023

Number of users in selected countries in the Car Rentals market in 2023 (in million)

Carbon footprint of international tourism transport worldwide 2005-2030, by type

Transport-related emissions from international tourist arrivals worldwide in 2005 and 2016, with a forecast for 2030, by mode of transport (in million metric tons of carbon dioxide)

Attractions

- Premium Statistic Leading museums by highest attendance worldwide 2019-2022

- Basic Statistic Most visited amusement and theme parks worldwide 2019-2022

- Basic Statistic Monuments on the UNESCO world heritage list 2023, by type

- Basic Statistic Selected countries with the most Michelin-starred restaurants worldwide 2023

Leading museums by highest attendance worldwide 2019-2022

Most visited museums worldwide from 2019 to 2022 (in millions)

Most visited amusement and theme parks worldwide 2019-2022

Leading amusement and theme parks worldwide from 2019 to 2022, by attendance (in millions)

Monuments on the UNESCO world heritage list 2023, by type

Number of monuments on the UNESCO world heritage list as of September 2023, by type

Selected countries with the most Michelin-starred restaurants worldwide 2023

Number of Michelin-starred restaurants in selected countries and territories worldwide as of July 2023

Online travel market

- Premium Statistic Online travel market size worldwide 2017-2028

- Premium Statistic Estimated desktop vs. mobile revenue of leading OTAs worldwide 2023

- Premium Statistic Number of aggregated downloads of leading online travel agency apps worldwide 2023

- Basic Statistic Market cap of leading online travel companies worldwide 2023

- Premium Statistic Estimated EV/Revenue ratio in the online travel market 2024, by segment

- Premium Statistic Estimated EV/EBITDA ratio in the online travel market 2024, by segment

Online travel market size worldwide 2017-2028

Online travel market size worldwide from 2017 to 2023, with a forecast until 2028 (in billion U.S. dollars)

Estimated desktop vs. mobile revenue of leading OTAs worldwide 2023

Estimated desktop vs. mobile revenue of leading online travel agencies (OTAs) worldwide in 2023 (in billion U.S. dollars)

Number of aggregated downloads of leading online travel agency apps worldwide 2023

Number of aggregated downloads of selected leading online travel agency apps worldwide in 2023 (in millions)

Market cap of leading online travel companies worldwide 2023

Market cap of leading online travel companies worldwide as of September 2023 (in million U.S. dollars)

Estimated EV/Revenue ratio in the online travel market 2024, by segment

Estimated enterprise value to revenue (EV/Revenue) ratio in the online travel market worldwide as of April 2024, by segment

Estimated EV/EBITDA ratio in the online travel market 2024, by segment

Estimated enterprise value to EBITDA (EV/EBITDA) ratio in the online travel market worldwide as of April 2024, by segment

Selected trends

- Premium Statistic Global travelers who believe in the importance of green travel 2023

- Premium Statistic Sustainable initiatives travelers would adopt worldwide 2022, by region

- Premium Statistic Airbnb revenue worldwide 2017-2023

- Premium Statistic Airbnb nights and experiences booked worldwide 2017-2023

- Premium Statistic Technologies global hotels plan to implement in the next three years 2022

- Premium Statistic Hotel technologies global consumers think would improve their future stay 2022

Global travelers who believe in the importance of green travel 2023

Share of travelers that believe sustainable travel is important worldwide in 2023

Sustainable initiatives travelers would adopt worldwide 2022, by region

Main sustainable initiatives travelers are willing to adopt worldwide in 2022, by region

Airbnb revenue worldwide 2017-2023

Revenue of Airbnb worldwide from 2017 to 2023 (in billion U.S. dollars)

Airbnb nights and experiences booked worldwide 2017-2023

Nights and experiences booked with Airbnb from 2017 to 2023 (in millions)

Technologies global hotels plan to implement in the next three years 2022

Technologies hotels are most likely to implement in the next three years worldwide as of 2022

Hotel technologies global consumers think would improve their future stay 2022

Must-have hotel technologies to create a more amazing stay in the future among travelers worldwide as of 2022

- Premium Statistic Travel and tourism revenue worldwide 2019-2028, by segment

- Premium Statistic Distribution of sales channels in the travel and tourism market worldwide 2018-2028

- Premium Statistic Inbound tourism visitor growth worldwide 2020-2025, by region

- Premium Statistic Outbound tourism visitor growth worldwide 2020-2025, by region

Travel and tourism revenue worldwide 2019-2028, by segment

Revenue of the global travel and tourism market from 2019 to 2028, by segment (in billion U.S. dollars)

Distribution of sales channels in the travel and tourism market worldwide 2018-2028

Revenue share of sales channels of the travel and tourism market worldwide from 2018 to 2028

Inbound tourism visitor growth worldwide 2020-2025, by region

Inbound tourism visitor growth worldwide from 2020 to 2022, with a forecast until 2025, by region

Outbound tourism visitor growth worldwide 2020-2025, by region

Outbound tourism visitor growth worldwide from 2020 to 2022, with a forecast until 2025, by region

Further reports

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

The state of tourism and hospitality 2024

Tourism and hospitality are on a journey of disruption. Shifting source markets and destinations, growing demand for experiential and luxury travel, and innovative business strategies are all combining to dramatically alter the industry landscape. Given this momentous change, it’s important for stakeholders to consider and strategize on four major themes:

- The bulk of travel is close to home. Although international travel might draw headlines, stakeholders shouldn’t neglect the big opportunities in their backyards. Domestic travel still represents the bulk of travel spending, and intraregional tourism is on the rise.

- Consumers increasingly prioritize travel—when it’s on their own terms. Interest in travel is booming, but travelers are no longer content with a one-size-fits-all experience. Individual personalization might not always be practical, but savvy industry players can use segmentation and hypothesis-driven testing to improve their value propositions. Those that fail to articulate target customer segments and adapt their offerings accordingly risk getting left behind.

- The face of luxury travel is changing. Demand for luxury tourism and hospitality is expected to grow faster than any other travel segment today—particularly in Asia. It’s crucial to understand that luxury travelers don’t make up a monolith. Segmenting by age, nationality, and net worth can reveal varied and evolving preferences and behaviors.

- As tourism grows, destinations will need to prepare to mitigate overcrowding. Destinations need to be ready to handle the large tourist flows of tomorrow. Now is the time for stakeholders to plan, develop, and invest in mitigation strategies. Equipped with accurate assessments of carrying capacities and enhanced abilities to gather and analyze data, destinations can improve their transportation and infrastructure, build tourism-ready workforces, and preserve their natural and cultural heritages.

McKinsey Live event: Faces, places, and trends: The state of tourism & hospitality

Thursday, June 13 at 10:30 a.m EDT / 4:30 p.m CET

Now boarding: Faces, places, and trends shaping tourism in 2024

Global travel is back and buzzing. The amount of travel fell by 75 percent in 2020; however, travel is on its way to a full recovery by the end of 2024. More regional trips, an emerging population of new travelers, and a fresh set of destinations are powering steady spending in tourism.

There’s no doubt that people still love to travel and will continue to seek new experiences in new places. But where will travelers come from, and where will they go?

We share a snapshot of current traveler flows, along with estimates for growth through 2030.

The way we travel now

Which trends are shaping traveler sentiment now? What sorts of journeys do today’s travelers dream about? How much are they willing to spend on their trips? And what should industry stakeholders do to adapt to the traveler psychology of the moment?

To gauge what’s on the minds of present-day travelers, we surveyed more than 5,000 of them. The findings reveal disparate desires, generational divides, and a newly emerging set of traveler archetypes.

Updating perceptions about today’s luxury traveler

Demand for luxury tourism and hospitality is expected to grow faster than for any other segment. This growth is being powered in part by a large and expanding base of aspiring luxury travelers with net worths between $100,000 and $1 million, many of whom are younger and increasingly willing to spend larger shares of their wealth on upscale travel options. The increase is also a result of rising wealth levels in Asia.

We dug deeper into this ongoing evolution by surveying luxury travelers around the globe about their preferences, plans, and expectations. Some widely held notions about luxury travelers—such as how much money they have, how old they are, and where they come from—could be due for reexamination.

Destination readiness: Preparing for the tourist flows of tomorrow

As global tourism grows, it will be crucial for destinations to be ready. How can the tourism ecosystem prepare to host unprecedented volumes of visitors while managing the challenges that can accompany this success? A large flow of tourists, if not carefully channeled, can encumber infrastructure, harm natural and cultural attractions, and frustrate locals and visitors alike.

Now is the time for tourism stakeholders to combine their thinking and resources to look for better ways to handle the visitor flows of today while properly preparing themselves for the visitor flows of tomorrow. We offer a diagnostic that destinations can use to spot early-warning signs about tourism concentration, along with suggestions for funding mechanisms and strategies to help maximize the benefits of tourism while minimizing its negative impacts.

Six trends shaping new business models in tourism and hospitality

As destinations and source markets have transformed over the past decade, tourism and hospitality companies have evolved, too. Accommodation, home sharing, cruises, and theme parks are among the sectors in which new approaches could present new opportunities. Stakeholders gearing up for new challenges should look for business model innovations that will help sustain their hard-won growth—and profits.

Unbundling offerings, cross-selling distinctive experiences, and embracing data-powered strategies can all be winning moves. A series of insight-driven charts reveal significant trends and an outlook on the future.

RELATED ARTICLES

The future of tourism: Bridging the labor gap, enhancing customer experience

The promise of travel in the age of AI

From India to the world: Unleashing the potential of India’s tourists

- Business & Money

Enjoy fast, free delivery, exclusive deals, and award-winning movies & TV shows with Prime Try Prime and start saving today with fast, free delivery

Amazon Prime includes:

Fast, FREE Delivery is available to Prime members. To join, select "Try Amazon Prime and start saving today with Fast, FREE Delivery" below the Add to Cart button.

- Cardmembers earn 5% Back at Amazon.com with a Prime Credit Card.

- Unlimited Free Two-Day Delivery

- Streaming of thousands of movies and TV shows with limited ads on Prime Video.

- A Kindle book to borrow for free each month - with no due dates

- Listen to over 2 million songs and hundreds of playlists

- Unlimited photo storage with anywhere access

Important: Your credit card will NOT be charged when you start your free trial or if you cancel during the trial period. If you're happy with Amazon Prime, do nothing. At the end of the free trial, your membership will automatically upgrade to a monthly membership.

Return this item for free

Free returns are available for the shipping address you chose. You can return the item for any reason in new and unused condition: no shipping charges

- Go to your orders and start the return

- Select your preferred free shipping option

- Drop off and leave!

Download the free Kindle app and start reading Kindle books instantly on your smartphone, tablet, or computer - no Kindle device required .

Read instantly on your browser with Kindle for Web.

Using your mobile phone camera - scan the code below and download the Kindle app.

Image Unavailable

- To view this video download Flash Player

Follow the author

Travel Industry Economics: A Guide for Financial Analysis 4th ed. 2021 Edition

Purchase options and add-ons.

- ISBN-10 3030633500

- ISBN-13 978-3030633509

- Edition 4th ed. 2021

- Publisher Springer

- Publication date May 14, 2021

- Language English

- Dimensions 6.14 x 0.94 x 9.21 inches

- Print length 430 pages

- See all details

Popular titles by this author

Editorial Reviews

From the back cover.

The fourth edition of this well-established text updates, refreshes, and significantly broadens the coverage of tourism economics. It includes new sections on travel law and applications of big data and artificial intelligence technologies as well as additional material on demographic spending patterns, the online travel agency business, the pandemic’s effects and affects on industry finances, expanded coverage of the cruise line industry, and information on the damage to tourist destinations caused by excessive pollution and traffic.

About the Author

Harold (Hal) L. Vogel was the senior entertainment industry analyst at Merrill Lynch and was inducted into the Institutional Investor magazine’s All-America Research Team Hall of Fame. He is a chartered financial analyst (C.F.A.) and served on the New York State Governor’s Motion Picture and Television Advisory Board, as an adjunct professor at Columbia University’s Business School, and taught at the Cass Business School in London. He earned his Ph.D. in financial economics from the University of London and currently runs an independent investment and consulting firm in New York City while often writing and speaking on investment topics related to travel and tourism, entertainment and media, and extreme market events. His books include Entertainment Industry Economics 10th edition (2020), published by Cambridge University Press, Financial Market Bubbles and Crashes: Features, Causes, and Effects, second edition (2018) published by Palgrave Macmillan, and Travel Industry Economics 4th edition (2021) published by Springer.

Product details

- Publisher : Springer; 4th ed. 2021 edition (May 14, 2021)

- Language : English

- Hardcover : 430 pages

- ISBN-10 : 3030633500

- ISBN-13 : 978-3030633509

- Item Weight : 1.79 pounds

- Dimensions : 6.14 x 0.94 x 9.21 inches

- #1,434 in Air Travel Reference (Books)

- #1,785 in Industrial Management & Leadership

- #3,299 in Business Finance

About the author

Harold l. vogel.

Discover more of the author’s books, see similar authors, read author blogs and more

Customer reviews

Customer Reviews, including Product Star Ratings help customers to learn more about the product and decide whether it is the right product for them.

To calculate the overall star rating and percentage breakdown by star, we don’t use a simple average. Instead, our system considers things like how recent a review is and if the reviewer bought the item on Amazon. It also analyzed reviews to verify trustworthiness.

No customer reviews

- Amazon Newsletter

- About Amazon

- Accessibility

- Sustainability

- Press Center

- Investor Relations

- Amazon Devices

- Amazon Science

- Sell on Amazon

- Sell apps on Amazon

- Supply to Amazon

- Protect & Build Your Brand

- Become an Affiliate

- Become a Delivery Driver

- Start a Package Delivery Business

- Advertise Your Products

- Self-Publish with Us

- Become an Amazon Hub Partner

- › See More Ways to Make Money

- Amazon Visa

- Amazon Store Card

- Amazon Secured Card

- Amazon Business Card

- Shop with Points

- Credit Card Marketplace

- Reload Your Balance

- Amazon Currency Converter

- Your Account

- Your Orders

- Shipping Rates & Policies

- Amazon Prime

- Returns & Replacements

- Manage Your Content and Devices

- Recalls and Product Safety Alerts

- Conditions of Use

- Privacy Notice

- Consumer Health Data Privacy Disclosure

- Your Ads Privacy Choices

- Global City & International State Travel

- Global Travel Service

- Air Passenger Forecasts

- Custom Forecasts

- Cruise Forecasts

- Visitor Economy

- Travel Industries

- Marketing Investment

- Events & Projects

- Testimonials

- Budget Analysis

- Policy Analysis

- Marketing Allocation Platform

- Project Feasibility

- In the News

- Client Login

- Oxford Economics

Global Travel Services

Global travel data, forecasts, and intelligence.

Unlock the power of economics

- Travel Data and Forecasts

- Economic Impact

- Policy & Market Analysis

- Symphony Login

- Book a Symphony Demo

Level-up with industry-leading custom forecast models and access the most comprehensive geographic travel trend data available.

Proving economic value through rigorous analysis of visitor, event and destination marketing contributions.

Informing critical policy and investment decisions with a solid foundation of opportunity, cost and benefit economic analysis.

The Symphony Intelligence Platform is a comprehensive, interactive hub for all of your data sources, backed by Tourism Economics' industry expertise.

Get the Industry Newsletter

Latest research.

Airbnb's Impact on Major UK Events

State of the Sports Tourism Industry Report

Impact of Cruise Tourism Globally

Destination Promotion: A Catalyst for Community Vitality

STR, Tourism Economics Nail Recovery Predictions

Case Studies

Featured Clients

American Gaming Association

Atlanta Braves

Bain and Company

California Travel Association

Dallas Fort Worth Airport

Destination Canada

Destinations International

Dubai Department of Tourism & Commerce Marketing

Empire State Development

Ernst & Young

European Travel Commission

Google Inc.

Greater Houston Convention and Visitors Bureau

Hilton Worldwide Holdings

Las Vegas Convention and Visitors Authority

Longwoods International

Marriott International

MasterCard (Global Products & Solutions)

MGM Resorts International Global Gaming Development LLC

NBC Universal

Philadelphia CVB

PricewaterhouseCoopers (UK - TE)

Rock & Roll Hall of Fame

Sandals Resorts International

TripAdvisor

US Travel Association

Visit California

World Travel and Tourism Council

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Biden Economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Student Loans

- Personal Loans

- Car Insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Asking for a Trend

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

U.s. business travel industry responsible for 2% of u.s. gdp and 3.5% of employment in latest full-year figures.

GBTA study reveals for every 1% of growth in business travel, the U.S. economy sees nearly 60,000 jobs, $2.9 billion in paid wages, $1.2 billion in tax revenue and $4.8 billion in new GDP

ALEXANDRIA, Va., June 05, 2024 --( BUSINESS WIRE )--The Global Business Travel Association ( GBTA ) today unveiled a new study , the " GBTA U.S. Economic Impact Study: Business Travel’s Impact on Jobs and the U.S. Economy, " which quantifies the significant economic impact of traveling for work in the U.S. The report shows the business travel industry provided a major boost to the U.S. economy in 2022*, the latest full year for which a complete set of data is available for analysis.

The U.S. was the nation that spent the most on business travel in 2022 1 , with expenditures totaling $421.1 billion USD and resulting in $119 billion in tax receipts. It also supported 6 million jobs and represented 3.5% of total employment. GBTA’s economic impact study also shows that for every dollar spent on business travel, $1.15 was returned to the U.S. economy as net-new gross domestic product (GDP). Additionally, of the direct jobs supported by business travel, 38% were in food services, 19% in accommodations and 11% in transportation and warehousing. The study also includes profiles of U.S. business travelers to better understand their characteristics, behavior, motivations and spending patterns.

The study methodology estimates total annual business travel spending in the U.S. in 2022 and uses a standard economic model to translate business travel spending into its impact on GDP, jobs, wages and taxes.

The U.S. is anticipated to be a top one or two market worldwide for spending again in 2024, according to GBTA’s latest industry forecast 2 . Although final data is not yet available beyond 2022, estimates from GBTA’s latest Global Business Travel Index™ (BTI) point to U.S. business travel spending for 2023 to increase around 7% above 2019 totals, indicating a robust recovery for the industry. On a global basis similar growth is expected, with business travel spending anticipated to surpass $1.5 trillion in 2024.

"The data shows that business travel is a substantial contributor to the health of the U.S. economy, and therefore also a key driver for the global economy," said Suzanne Neufang, CEO, GBTA. "Business travel supports millions of jobs and delivers billions in tax revenue, which is why it is important for policymakers to consider the impact on the industry when devising economic policies – and for sustainable solutions to be prioritized, funded and developed to help us abate travel’s hardest-to-abate sectors."

Additional study highlights for U.S. business travel in 2022 include:

A total of 429.9 million business trips were taken within the U.S.

An estimated 67% of trips were taken for transient purposes : sales, client service, government and military travel, and travel for construction or repair. The remaining 33% represents conference and event travel.

Business travelers are traveling longer for each trip : 4.1 days in 2022 (versus 3.3 days as cited in 2017 GBTA research).

The amount spent per business trip averaged $632 , with 34% spent on lodging ($214), representing the largest single category for spending.

The average age of U.S. business travelers is 44.3 years .

One-third (33.9%) have an annual household income below $50,000 and 31.5% above $100,000, with the remaining third falling in between.

Blended travel − where business and leisure trips are combined − made up over a third of all travel (33.8%). Travelers stay for 4.4 days on average during "bleisure" trips, and although men were more likely to travel for business overall, proportionally, women added a leisure component to their business travel at a much higher rate than men in 2022.

The top 15 states ranked by overall business travel destination spending accounted for 65% of total U.S. business travel expenditures (in descending order):

California and New York were the top markets for business travel spending with $35.62 billion and $23.31 billion, respectively. Nevada ranked first among the top 15 states in terms of its ratio of business travel spend to GDP, with $6 billion of business travel spend comprising 3.2% of the state's GDP.

Click here to download the complete GBTA U.S. Economic Impact Study.

For more information about GBTA Research, visit GBTA’s web page or reach out to [email protected] .

Notes to editors:

*The GBTA study focuses on 2022, the last full year for which a complete set of data is available for analysis, and was compared to other economic data for the same period. The economic impacts described in the study are based on domestic traveler spending as measured by (1) Longwoods International, GBTA, and Rockport Analytics, (2) international spending from the National Travel & Tourism Office (NTTO) and (3) meeting spending derived from The Economic Significance of Meetings to the U.S. Economy.

About the Global Business Travel Association

The Global Business Travel Association ( GBTA ) is the world’s premiere business travel and meetings trade organization headquartered in the Washington, D.C. area and serving stakeholders across six continents. GBTA and its 8,000+ members represent and advocate for the $1.357 trillion global travel business and meetings industry. GBTA and the GBTA Foundation deliver world-class education, events, research, advocacy and media to a growing global network of more than 28,000 travel professionals and 125,000 active contacts. For more information, visit gbta.org and gbtafoundation.org .

1 2023 GBTA Business Travel Index Outlook report 2 2023 GBTA Business Travel Index Outlook report

View source version on businesswire.com: https://www.businesswire.com/news/home/20240605618469/en/

MEDIA INQUIRIES: Debbie Iannaci, GBTA PR, [email protected] Niveen Saleh, Fire on the Hill PR, [email protected]

China’s Tourists to Spend Nearly $1 Trillion on Holidays at Home

- Chinese tourist spending is important travel recovery marker

- Chinese $1 trillion spend on mainland trips hits all-time high

Tourists visit the ecological lotus pond in Huaying city, Sichuan province.

Photographer: CFOTO/Future Publishing/Getty Images

Chinese tourists are making up for the lost holidays of the past few years, splashing cash on travel at home and abroad, putting spending on track to exceed pre-pandemic levels for the first time — an important benchmark in the industry’s recovery.

Chinese holidaymakers will spend 1.8 trillion yuan ($250 billion) this year on trips internationally — about 10% more than they did in 2019, according to data from the World Travel and Tourism Council , an industry group that conducts travel research. Chinese tourists embarking on adventures closer to home are also forecast to pump a record 6.79 trillion yuan into the mainland economy this year, also topping the pre-pandemic level, according to a council report conducted with Oxford Economics .

Kentucky tourism continues record-setting pace in 2023 with nearly $14 billion in economic impact

F RANKFORT, Ky. (AP) — Kentucky's tourism industry stayed on its record-setting pace in 2023, generating an economic impact approaching $14 billion while sustaining nearly 100,000 jobs, Gov. Andy Beshear said Thursday.

Travelers visiting the Bluegrass State last year spent $9.7 billion as tourism continued its post-pandemic momentum as a key contributor to Kentucky's growing economy, the Democratic governor said.

“We’re welcoming people to our new Kentucky home, one filled with opportunity and prosperity," Beshear said during his weekly news conference. "Where we want you to come see what we have to offer, and then we want you to move your family here to be a part of it.”

The governor joined tourism leaders at Castle & Key Distillery to celebrate the second straight record-breaking year for tourism in Kentucky. In 2022, the tourism sector bounced back from the COVID-19 pandemic to generate an economic impact of nearly $13 billion and was responsible for 91,668 jobs.

Last year was even better, with the statewide tourism industry producing $13.8 billion in economic impact and the sector sustained 95,222 jobs, Beshear said. The study by Tourism Economics determined that 79.3 million travelers visited Kentucky in 2023, up 4.5% from the prior year, he said.

Kentucky's attractions include horse farms and bourbon distilleries as well as outdoor adventure, history, arts and cultural draws. Kentucky is also home to Mammoth Cave National Park.

Bourbon tourism is flourishing, with attendance surpassing 2.5 million visitors last year along the Kentucky Bourbon Trail and the Kentucky Bourbon Trail Craft Tour, which showcases smaller distilleries. Bourbon tourists tend to spend more and stay longer compared to other attractions, the bourbon industry says.

“With distilleries now in 42 counties, bourbon tourism is resurrecting Main Streets across the commonwealth and pouring much-needed revenue into local coffers. And there’s more to come,” said Eric Gregory, president of the Kentucky Distillers’ Association.

Spirit makers have invested big sums into new or expanded visitor centers to play up the industry’s heritage and allow guests to soak in the sights and smells of bourbon-making.

Communities across Kentucky registered robust tourism numbers last year.

Beshear said tourism generated $4.2 billion of economic impact last year in Jefferson County, which includes Louisville, the state's largest city. In Boone, Campbell and Kenton counties — just south of Cincinnati — the combined economic impact of tourism was $2.1 billion, he said. It was $1.6 billion in Fayette County, home to Lexington, the state's second-largest city. In Warren County, tourism brought in $477 million of economic impact, and in McCracken County it generated $319 million.

State Tourism Commissioner Mike Mangeot thanked tourism officials statewide for their role in the sector's success, along with the thousands of leisure and hospitality industry workers. The tour guides, restaurant workers, hotel desk clerks and others are “the frontline ambassadors,” he said.

- Election 2024

- Entertainment

- Newsletters

- Photography

- Personal Finance

- AP Investigations

- AP Buyline Personal Finance

- AP Buyline Shopping

- Press Releases

- Israel-Hamas War

- Russia-Ukraine War

- Global elections

- Asia Pacific

- Latin America

- Middle East

- Election Results

- Delegate Tracker

- AP & Elections

- Auto Racing

- 2024 Paris Olympic Games

- Movie reviews

- Book reviews

- Personal finance

- Financial Markets

- Business Highlights

- Financial wellness

- Artificial Intelligence

- Social Media

Expect the cost of your airfare to continue to rise, an aviation trade group and industry heads warn

FILE - A Boeing 777X plane takes off at the Farnborough Air Show fair in Farnborough, England, on July 18, 2022. The cost of your next flight is likely to go up. That’s the word from the International Air Transport Association, which held its annual meeting Monday June 3, 2024 in Dubai, home to the long-haul carrier Emirates. (AP Photo/Frank Augstein, File)

- Copy Link copied

DUBAI, United Arab Emirates (AP) — The cost of your next flight is likely to go up.

That’s the word from the International Air Transport Association, which held its annual meeting Monday in Dubai, home to the long-haul carrier Emirates.

While carriers recover from the groundings worldwide from the coronavirus pandemic, industry leaders told journalists that there are several costs likely to push those ticket prices ever higher.

Part of that comes from worldwide inflation, an ongoing problem since the pandemic started. Jet fuel costs, roughly a third of all airline expenses, remain high. Meanwhile, a global push for the aviation industry to decarbonize has more carriers fighting for the little amount of so-called sustainable aviation fuel, or SAF, available in the market.

“The airlines will continue to do everything they can to keep costs in control as much as possible for the benefit of consumers,” said Willie Walsh, the director-general of the the International Air Transport Association, an industry-trade group. “But I think it’s unrealistic to expect that airlines can continue to absorb all of the costs. ... It’s not something we like to do, but it’s something we have to do.”

Also pressuring the industry is a pandemic hangover in aircraft production as well, they say. Carriers now keep older planes that burn more fuel flying longer. There also aren’t enough new aircraft to expand routes and increase supply to bring down overall prices.

That warning comes as the IATA estimates globally, airline revenue will reach nearly $1 trillion in 2024, a record high. There will be 4.96 billion travelers on airplanes this year, with total expenses for carriers reaching $936 billion — another record high.

But industry profits also are expected to be nearly $60 billion this year.

In particular, Emirates, a main driver for Dubai’s economy, saw record profits of $4.7 billion in 2023 off revenues of $33 billion.

The Emirates’ results track with those for its base, Dubai International Airport . The world’s busiest airport for international travelers had 86.9 million passengers last year, surpassing numbers for 2019 just before the coronavirus pandemic grounded global aviation.

The airport now plans to move to the city-state’s second, sprawling airfield in its southern desert reaches in the next 10 years in a project worth nearly $35 billion .

Tim Clark, the airline’s president, obliquely acknowledged that Monday by saying that he didn’t want people to “get boxes of tissues out and play the violins” when warning that the industry’s profit margins sit in the low single digits. However, he contended that as airlines have grown larger and carriers consolidated, cost savings have quietly been passed onto consumers now able to book flights across the world.

“It is quite amazing that ticket prices are where they are today,” Clark said. “I think the value-for-money proposition that the consumers have had the benefit from for many decades is something that is one of those hidden bits of the narrative.”

Yvonne Manzi Makolo, the CEO of RwandAir, also highlighted the taxes and fees imposed on carriers by the countries they operate in. She specifically cited those paid by carriers flying out of African nations as “already ridiculous.”

STR, Tourism Economics Say Cost of Living Impacts Hotel Performance

The hotel industry’s performance is being impacted by reduced travel volume caused by the rising cost of goods and services.

So said STR , a provider of data, analytics and insights for the global hospitality industry, and Tourism Economics , a provider of intelligence on the economy and the travel sector, in a Monday (June 3) press release about their 2024-25 U.S. hotel forecast.

The companies have downgraded their forecast, pointing to lower-than-expected hotel performance so far in 2024 and lessened growth forecasts for the rest of the year, according to the release.

In their forecast, the companies downgraded their projected gains in average daily rate (ADR) by 1.0 percentage point and in revenue per available room (RevPAR) by 2.1 percentage points, the release said. They now expect occupancy for the year to decline, after previously expecting year-over-year growth.

The companies also made downward adjustments in their projections for hotel performance in 2025, with their projected gains in ADR down 0.8 percentage points and in RevPAR down 0.9 percentage points, per the release. They left their occupancy growth projection for 2025 in place.

During the first four months of 2024, STR and Tourism Economics saw a “bifurcation in hotel performance” that they “don’t believe will abate soon,” Amanda Hite , president of STR, said in the release.

“The increased cost of living is affecting lower-to-middle income households and their ability to travel, thus lessening demand for hotels in the lower price tier,” Hite said. “The Upscale through Luxury tier is seeing healthy demand, but pricing power has waned given changes in mix and travel patterns and to a lesser extent, economic conditions.”

Aran Ryan , director of industry studies at Tourism Economics, said in the release that both middle- and lower-income consumer spending and business investment have been pressured by interest rates that are still elevated and wage growth that has slowed.

“Looking beyond this near-term pull-back in demand at lower-tier properties, we expect moderate travel growth to resume, supported by a tempered economic expansion and the continued rebound of group , business and international travel,” Ryan said.

During an April earnings call, Wyndham Hotels & Resorts CEO Geoff Ballotti said the hotel chain has some “concern” about middle-income guest traffic weighing on the summer travel season.

“But what we’re seeing is that that middle-income guest is more employed, and we look at their wages and their savings, it’s they’re higher than they were back in pre-COVID levels,” Ballotti said during the April 25 call. “Their home prices are up, their stocks are up, their deposit levels are stable and they’re in good shape.”

Hotel chain Marriott International said May 1 during its quarterly earnings call that it saw its RevPAR increase 4.2% year over year during the first quarter, driven largely by growth in international markets.

“While overall industry RevPAR growth is normalizing post-COVID, we continue to gain RevPAR index across our portfolio and increase our market share of global hotels,” Marriott President and CEO Anthony Capuano said during the call.

Recommended

Trending news, the big story, featured news, partner with pymnts.

We’re always on the lookout for opportunities to partner with innovators and disruptors.

IMAGES

VIDEO

COMMENTS

Monthly member-exclusive summary of the latest economic, consumer and travel indicators, trends and analysis featuring key highlights from the U.S. Travel Insights Dashboard. ... The dashboard is the most comprehensive and centralized source for high-frequency intelligence on the U.S. travel industry, tracking industry performance, travel ...

The U.S. Travel Insights Dashboard is the most comprehensive and centralized source for high-frequency intelligence on the U.S. travel industry and broader economy. The dashboard is updated the last week of every month. Member log-in required. U.S. Travel's Economic Impact Map tells the story of travel's economic impact by state and ...

In this book Harold L. Vogel comprehensively and holistically examines the business economics and investment aspects of major components of the travel industry, including airlines, hotels, casinos, amusement and theme parks, cruise lines, and tourism.

In 2023, the Travel & Tourism sector contributed 9.1% to the global GDP; an increase of 23.2% from 2022 and only 4.1% below the 2019 level. In 2023, there were 27 million new jobs, representing a 9.1% increase compared to 2022, and only 1.4% below the 2019 level. Domestic visitor spending rose by 18.1% in 2023, surpassing the 2019 level.

Governments have generally played a limited role in the industry, with partial oversight and light-touch management. COVID-19 has caused an unprecedented crisis for the tourism industry. International tourist arrivals are projected to plunge by 60 to 80 percent in 2020, and tourism spending is not likely to return to precrisis levels until 2024.

The tourism industry can make the most of available tech to draw customers, resolve existing pain points, and set the stage for a sustainable future. ... European Union, 11 percent of tourism jobs are likely to go unfilled; in the United States, that figure is 7 percent. 7 Travel & Tourism economic impact 2022: Staff shortages, WTTC, August 2022.

The International Trade Administration's National Travel and Tourism Office provides an updated overview of the state of the travel and tourism industry as shown in four fact sheets. Fast Facts: Economic impact of the travel and tourism industry, international trade, global market share, top source markets for arrivals and travel exports ...

In this path-breaking book Harold L. Vogel examines the busi-ness economics of each of the major travel industry segments with coverage of airlines, hotels, cruise lines, railroads, buses, automobiles, casinos, amuse-ment/theme parks, and tourism. The result is a concise, up-to-date reference guide for financial analysts, economists, industry ...

978-1-107-02562-2 - Travel Industry Economics: A Guide for Financial Analysis: Second Edition Harold L. Vogel Frontmatter More information. Preface We are, it seems, all born with a natural curiosity - with an urge to travel. Whatnormalinfant,confinedtocriborplaypen,doesn'tsoonwanttoexplore

Travel and Tourism Satellite Account for 2018-2022. The travel and tourism industry—as measured by the real output of goods and services sold directly to visitors—increased 21.0 percent in 2022 after increasing 53.6 percent in 2021, according to the most recent statistics from BEA's Travel and Tourism Satellite Account. Read the Article.

The World Economic Forum has published its inaugural Travel and Tourism Development Index. It focuses on the growing role of sustainability and resilience in travel and tourism growth. Recovery for the sector is uneven and tourist arrivals in January 2022 were still 67% below 2019 levels, according to the World Tourism Organization.

'Travel Industry Economics provides a clear, concise, and indispensable analysis of the financial and economic aspects of the travel industry. Travel and tourism are a substantial part of our economy and jurisdictions around the world fiercely compete for that expenditure. Perhaps nowhere is this competition more evident than in casino gambling.

for the latest economic data and our full State of the Travel Industry. Economic Impact of the U.S. Travel Industry 2023 NATIONAL DATA ** Percent recovered to 2019 is adjusted for inflation SOURCE: Tourism Economics, U.S. Travel Association and U.S. Department of Commerce AT $ TAX In 2023, travel supported more than But still has more than ...

In this book Harold L. Vogel comprehensively and holistically examines the business economics and investment aspects of major components of the travel industry, including airlines, hotels, casinos, amusement and theme parks, cruise lines, and tourism. The book is designed as an economics-grounded text that uniquely integrates reviews of each sector's history with economics, accounting, and ...

Getty. All your jet-setting and hotel-hopping is having a significant effect on the global economy. The folks at the World Travel & Tourism Council (WTTC) estimate that the travel industry will ...

The National Travel and Tourism Office's (NTTO) Travel & Tourism Satellite Account, produced annually by the Bureau of Economic Analysis, is the official U.S. Government estimate of the economic impact of the travel and tourism industry in the United States. The latest TTSA shows that in Calendar Year 2020:

In 2022, the global online travel market amounted to as much as 474.8 billion U.S. dollars, a figure that was forecast to exceed one trillion U.S. dollars by 2030. Some of the leading travel ...

The result is a concise, up-to-date reference guide for financial analysts, economists, industry executives, and teachers and students interested in the economics, finance, and marketing of travel-related goods and services in the United States and overseas.

Joe Nellis, Cranfield University 'Travel Industry Economics provides a clear, concise, and indispensable analysis of the financial and economic aspects of the travel industry. Travel and tourism are a substantial part of our economy and jurisdictions around the world fiercely compete for that expenditure. Perhaps nowhere is this competition ...

Now boarding: Faces, places, and trends shaping tourism in 2024. Global travel is back and buzzing. The amount of travel fell by 75 percent in 2020; however, travel is on its way to a full recovery by the end of 2024. More regional trips, an emerging population of new travelers, and a fresh set of destinations are powering steady spending in ...

tourism flow challenges associated with the growth in travel, including high seasonality and overcrowding. Looking at ranking results, more mature, high-income T&T economies in Europe and Eurasia (Europe) and, to a lesser extent, Asia-Pacific make up most of the top rankings in the 2024 TTDI edition. Among the top 30 scorers, 19 are from Europe,

Harold (Hal) L. Vogel was the senior entertainment industry analyst at Merrill Lynch and was inducted into the Institutional Investor magazine's All-America Research Team Hall of Fame. He is a chartered financial analyst (C.F.A.) and served on the New York State Governor's Motion Picture and Television Advisory Board, as an adjunct professor at Columbia University's Business School, and ...

Level-up with industry-leading custom forecast models and access the most comprehensive geographic travel trend data available. Economic Impact. Proving economic value through rigorous analysis of visitor, event and destination marketing contributions. Policy & Market Analysis.

GBTA study reveals for every 1% of growth in business travel, the U.S. economy sees nearly 60,000 jobs, $2.9 billion in paid wages, $1.2 billion in tax revenue and $4.8 billion in new GDP ...

CNN —. The United States has just won a significant honor - being named the world's best country for travel and tourism in 2024 by the World Economic Forum. The rankings are determined by a ...

3:17. Chinese tourists are making up for the lost holidays of the past few years, splashing cash on travel at home and abroad, putting spending on track to exceed pre-pandemic levels for the first ...

The study by Tourism Economics determined that 79.3 million travelers visited Kentucky in 2023, up 4.5% from the prior year, he said. ... Kentucky's tourism industry stayed on its record-setting ...

Part of that comes from worldwide inflation, an ongoing problem since the pandemic started. Jet fuel costs, roughly a third of all airline expenses, remain high. Meanwhile, a global push for the aviation industry to decarbonize has more carriers fighting for the little amount of so-called sustainable aviation fuel, or SAF, available in the market.

So said STR, a provider of data, analytics and insights for the global hospitality industry, and Tourism Economics, a provider of intelligence on the economy and the travel sector, in a Monday ...