Find Today's Best US Dollar to Euro Exchange Rates

Money transfer

Travel money

Exchange rate

Get our email alerts

We'll send you the exchange rate, best deal, and other helpful tips.

By continuing, you accept Monito's Privacy Policy and allow us to send you email alerts, as well as occasional money transfer tips, advice and marketing emails. You can unsubscribe at any time. Read our Privacy Policy.

Compare USD-EUR exchange rates and fees before your next money transfer

The usd to eur exchange rate: how much is $1 worth to a euro, conversion rates usd/eur, conversion rates eur/usd, key facts about usd and eur, about the us dollar, about the euro, where to get the best exchange rate for dollars to euros.

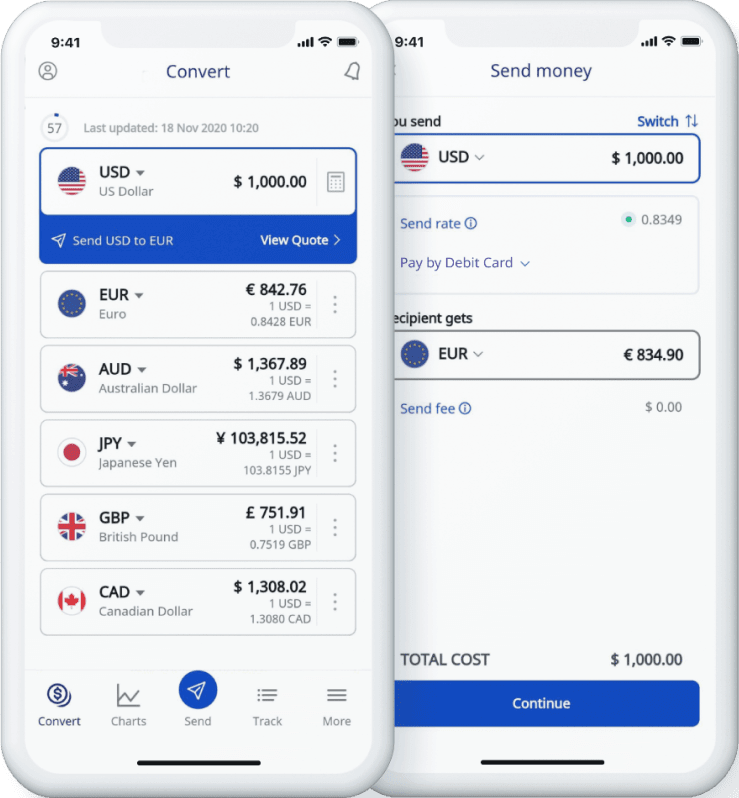

MoneyGram and Wise have fought for the top spot as the cheapest money transfer providers from the US dollar to Euro from March 2021 to March 2022 on Monito. Instarem and OFX earned the third and fourth-best spots during this 12-month period.

Big banks can send your dollars to Europe, but they often apply weak exchange rates and charge high fees. International money transfer specialists almost always offer lower transfer fees and better exchange rates when sending money to Europe.

US dollars (USD) and euros (EUR) exchange rates with other main currencies

How to get the best usd to euro exchange rate online.

Exchange rates fluctuate at every moment of the day. The cheapest money transfer provider today may not be the cheapest tomorrow, which is why Monito's comparison engine helps you to instantly compare exchange rates and fees of the best international money transfer services.

To optimize your transfer from USD to Euros:

- Check the US dollar to Euro mid-market exchange rate (i.e. the rate you see on Google or xe.com);

- Find services that convert your dollars at or near this rate, and charge low commission fees;

- Sign up for the best service on their site or app;

- Confirm your transfer and recipient details.

Find the service with the best USD to Euro exchange rate

Faq about the best usd to eur exchange rates.

1. Check the USD mid-market exchange rate against the Euro. 2. Compare services with low fees and strong rates. 3. Sign up for the best service. 4. Confirm your transfer to the Eurozone.

This answer depends on your timeframe. The US dollar has gained value against the Euro throughout 2021, making now a good time to exchange dollars for euros. In 2020, however, the dollar dropped against the Euro. With that in mind, the dollar's value in March 2022 is fair but has not reached its previous peak.

$1 US = €0.96242

On December 21st, 2016, the US dollar reached its highest value against the Euro in the ten year period between 2012 and 2022.

If you are going on holiday in the Eurozone, then the best way to get Euros is to sign up for a multi-currency travel debit card, such as the Wise Multi-Currency Card . Spend like a local and make transactions at the real mid-market exchange rate .

Other options for exchanging US dollars in Europe include:

- Using an ATM with your foreign debit card;

- Signing up for a debit card or credit card that waives foreign transaction fees .

Never use a bureaux de change at the airport and avoid withdrawing cash with a credit card. Otherwise, your bank will charge you interest daily on those cash advances.

As a general rule, no. Despite commonly heard advice, credit unions and banks have become outdated money transfer providers. New companies are offering innovative ways to obtain foreign money cheaply and digitally.

We found that America First Credit Union was converting $1 USD into 0.85019 Euros even though the mid-market exchange rate was at $1 USD = 0.90201 Euros*.

Experts at Monito have reviewed several travel money cards that convert your currency at the true mid-market exchange rate , which you can access from your phone or a debit card. Services that offer these cards include Wise , Revolut , N26 , and Monese .

*Exchange rates recorded on 3 March 2022 11:27 CEST.

Top Exchange Rate Guides

- Home ›

- Travel Money ›

Get the best euro exchange rate

Compare the latest euro exchange rates from the UK's top currency providers

How to get the best euro exchange rate

If you're travelling to Europe, it's important to shop around and compare currency suppliers to maximise your chances of getting a good deal. We can help you to find the best euro exchange rate by comparing a wide range of UK travel money suppliers who have euros in stock and ready to order online now. Our comparisons automatically factor in all costs and commission, so all you need to do is tell us how much you want to spend and we'll show you the top suppliers who fit the bill.

Are you looking to get the best euro exchange rate for your next trip abroad? At Compare Holiday Money, we compare the euro rates from dozens of top UK foreign exchange providers to help you find the most competitive currency deals online and on the high street.

We continuously scan and track the latest euro rates from a wide range of currency providers to help you find the companies offering the best deals. Our clever currency comparisons automatically factor in all costs and charges like delivery fees and commission, so all you need to do is tell us how much you want to spend and we'll show you the best euro rates available to buy online right now.

Compare deals

Some of the best travel money deals are only available when you buy online. By using a comparison site, you're more likely to see the full range of deals on offer and get the best rate.

Some of the best travel money deals are only available from specialist online currency providers who offer better euro rates than high street bureaux de change.

Always place your order online, even if you plan to collect your currency in person. Most supermarkets and high street currency suppliers offer better exchange rates if you order online beforehand.

Most supermarkets and currency suppliers offer better rates if you buy or reserve your currency online. If you're planning to buy euros in store, place your order online beforehand to guarantee the online rate.

Combine orders

If you're travelling with others, consider placing one large currency order instead of buying individually. Many currency suppliers offer enhanced rates that improve as you order more.

You'll often get better rates the more you order. If you're travelling with a group, consider placing one large currency order instead of everyone buying euros individually.

Remember, exchange rates aren't the only important factor when finding the best euro deal. Delivery costs, commission and payment surcharges can all affect the amount of money you'll receive. See our comprehensive euro travel money comparisons to find the absolute best deal with all costs and charges factored in.

Online foreign exchange providers who specialise in travel money usually offer the best euro exchange rates, and you'll get the best deals when you buy online for home delivery. If waiting isn't an option, or if you'd rather buy your euros in person, supermarkets typically offer the best euro rates on the high street - but don't just walk in off the street unannounced. Reserve your euros online (ideally the day before you want to collect them) as most supermarkets offer enhanced exchange rates on their website compared to the rates they advertise in store. By ordering online you'll lock-in the better online rate and can collect your euros in person at a time that's convenient for you.

Euro rate trend

Over the past 30 days, the Euro rate is up 0.53% from 1.1556 on 4 May to 1.1617 today. This means one pound will buy more Euros today than it would have a month ago. Right now, £750 is worth approximately €871.28 which is €4.58 more than you'd have got on 4 May.

These are the average Euro rates taken from our panel of UK travel money providers at the end of each day. You can explore this further on our British pound to Euro currency chart .

We found 17 foreign exchange providers offering euros today. The table below shows the results ordered by best euro rate, assuming you wanted to buy £750 worth of euros for home delivery.

Remember, exchange rates aren't the only important factor when it comes to getting a good currency deal. Delivery fees, payment surcharges and other hidden costs can all affect the amount of money you'll receive. See our euro travel money comparisons to help you find the best euro rate today.

Timing is key if you want to maximise your euros, but the best time to buy will depend on the current market conditions and your personal travel plans.

If you have a fixed travel date, you should start to monitor the euro rates as soon as possible in the period leading up to your departure so that you've got time to buy when the rate is looking favourable. For example, if the euro rate has been steadily increasing over several weeks or months, it could be a good time to buy while the rate is high.

Some people prefer to buy half of their euros as soon as they've booked their holiday, and the remaining half just before they depart. This can be a good way of maximising your holiday money if the exchange rate continues to rise after you've bought, but will also help to minimise your losses if the rate drops.

You could also consider signing up to our newsletter and we'll email the latest rates to you each month.

If you need your euros sooner and don't have time to wait for the rates to improve, you can still save money by comparing rates from a range of different providers before you buy. Online travel money suppliers usually have better euro rates than high street exchanges, but supermarkets are a good compromise if you want to collect your currency in person and still get a decent rate. Just remember to buy or reserve your euros first before you collect them from the store so you benefit from the supplier's better online rate.

Euro banknotes and coins

Over 340 million people use the euro every day according to the European Central Bank, making it the second most-traded currency in the world after US dollars. Twenty out of 27 EU Member States have adopted the euro as their official currency, and euros are used officially and unofficially in many non-EU countries and territories throughout Europe such as Monaco, San Marino, and Vatican City.

Euros are governed and issued by the European Central Bank which is based in Frankfurt, but the actual production of euro banknotes and coins is handled by various national banks throughout the Eurozone. Spain and Greece are responsible for printing €5 and €10 banknotes, Germany prints €100 notes, and the other EU member states are responsible for printing €20 and €50 notes.

One euro (€) can be subdivided into 100 cents (c). There are seven denominations of euro banknotes in circulation: €5, €10, €20, €50 and €100 which are frequently used, plus €200 and €500 notes which are no longer printed but are still in circulation and remain legal tender. The designs printed on each banknote are intended to be symbolic of the European Union's identity and unity, as well as highlighting the diversity and richness of different European cultures. The front of each banknote features architectural styles from different periods in Europe's history, including Classical, Gothic, Renaissance and modern, while the reverse side features bridges that represent communication and cooperation between the different countries within the European Union.

Euro coins are available in eight denominations: 1c, 2c, 5c, 10c, 20c, 50c, €1 and €2. Each EU member state is responsible for minting its own coins, and can choose their own design for the 'tails' side. For example, German coins feature the 'Bundesadler' or Federal Eagle which has been the German coat of arms since 1950, while French coins depict Marianne; an important symbol of French national identity. Next time you've got a handful of euro coins, take a look at the tails side and see if you can guess which EU country they came from!

There's no evidence to suggest that you'll get a better deal if you buy your euros in Europe. While there may be better exchange rates available in some locations, your options for shopping around may be limited once you arrive, and there's no guarantee the exchange rates will be any better than they are in the UK.

Exchange rates aside, here are some other reasons to avoid buying your euros in Europe:

- You may have to pay commission or other hidden fees to a currency exchange that you wouldn't have paid in the UK

- Your bank may charge you a foreign transaction fee if you use it to buy euros when you're abroad

- It can be harder to spot scammers and fraudulent currency exchanges in Europe

Lastly, it can be handy to have some cash on you when you arrive at your destination so you can pay for any immediate expenses like food, transport and tips. You don't want to be searching for the nearest currency exchange when you've just landed and you're desperate for a cup of tea - or a cocktail!

Twenty out of 27 EU member states have adopted the euro as their official currency. These are: Austria, Belgium, Croatia, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia and Spain.

The following European countries and territories who are not part of the EU also use the euro as their official currency: Andorra, Kosovo, Monaco, Montenegro, San Marino and Vatican City, French Guiana and Martinique, the Azores, Canary Islands, and Madeira.

Tips for saving money while visiting Europe

The most budget-friendly destinations in Europe are generally those located in the east such as Latvia, Lithuania and Estonia. In contrast: Luxembourg, Ireland and France usually top the list as some of the most expensive holiday destinations. Regardless of where you're planning to visit, you can save money during your trip by following some simple tips:

- Research your accommodation: Hotels can be expensive, so one way of saving money is to look for more budget-friendly accommodation such as hostels, holiday rentals, or even campsites. AirBnB can be an affordable option too, especially if you rent a room instead of an entire apartment; and you'll get to experience what it's like to live like a local. Salud!

- Use public transport: Make the most of any metro systems, buses, or trams to get around instead of relying on private taxis or rental cars. Many European countries also offer national and regional travel passes for public transport which can work out significantly cheaper than buying individual tickets.

- Eat like a local: Opt for local restaurants or street food vendors that offer authentic cuisine at lower prices. Avoid dining at expensive tourist restaurants, and try cooking your own meals if your accommodation has a kitchen. Not only is this a great way to save money, but it can also be a fun cultural experience to shop around in European supermarkets and cook with local ingredients.

- Plan your itinerary: Look out for free attractions such as museums, parks, churches and historical sites, and plan your itinerary around these. Many cities in Europe also offer free walking tours which can be a great way to get an overview of a new location while learning about its culture and history.

- Find discount vouchers: Many tourist attractions and activities offer discount vouchers and codes that can save you money on entry fees and other perks. Look for vouchers online; sign up to newsletters and follow the social media accounts of places you're planning to visit.

- Take cash: Using cash will help you to stick to a budget more easily than paying by card, and you'll also avoid foreign transaction fees. If you do take a card with you, look out for ATMs that are affiliated with your UK bank to avoid ATM fees, and if you're asked whether you want to pay in pounds or euros - always choose euros. If you pay in pounds the merchant can set their own exchange rate which won't be in your favour.

Choosing the right payment method

Sending money to a company you might not have heard of before can be unsettling. We routinely check all the companies that feature in our comparisons to make sure they meet our strict listing criteria, but it's still worth knowing how your money is protected in the unlikely event a company goes bust and you don't receive your order.

Bank transfer

Your money is not protected if you pay by bank transfer. If the company goes bust and you've paid by bank transfer, it's unlikely you'll get your money back. For this reason, we recommend you pay by debit or credit card wherever possible because they offer more financial protection.

Debit cards are the most popular payment method and they offer some financial protection. If you pay by debit card and the company goes bust, you can instruct your bank to make a chargeback request to recover your money from the company's bank. This isn't a legal right, and a refund isn't guaranteed, but if you make a chargeback request your bank is obliged to try and recover your money.

Credit card

Credit cards offer full financial protection, and your money is protected by law under Section 75 of the Consumer Credit Act. Section 75 states that your card issuer must refund you in full if you don't receive your order. Be aware that many credit cards charge a cash advance fee (typically around 3%) for buying currency, so you may have to weigh up the benefits of full financial protection with the extra cost of using a credit card.

We use cookies to improve your experience on our website. Please confirm you're happy to receive these cookies in line with our Privacy & Cookie Policy .

- Compare Rates

- Compare Exchange Rates

- Currency Exchange Rates

- Currency Rates Cross Table

- Exchange Rates Today

- Country Codes

- Currency Symbols

- Todays Top Movers

- Pounds to Euros

- Pounds to Dollars

- Pounds to NZ Dollars

- Pounds to AUS Dollars

- Pounds to CAD Dollars

- Pounds to Yen

- Pounds to Rands

- Euros to Pounds

- Dollars to Pounds

- Euros to Dollars

- Currency Calculator

- Historical Currency Converter

- Exchange Rate Calculator

- Market Updates (Email)

- Currency Converter App

- British Pounds

- Swiss Franc

- Australian Dollars

- Canadian Dollars

- South African Rands

- Euro Exchange

- Emigrating Overseas

- Buying Property Abroad

- Regular Overseas Payments

- International Money Transfers

- Importing High Value Assets

- Sending Money Home

- Foreign Exchange Brokers

- Money Transfer Options

- ...more in this section

- Money Transfer to Spain

- Money Transfer to Australia

- Money Transfer to Hong Kong

- Money Transfer to New Zealand

- Money Transfer to Canada

- Money Transfer to US

- Money Transfer to UK

- Money Transfer to South Africa

- Money Transfer to Germany

- Foreign Currency

- Travel Money Card

- Travellers Cheques

- Crypto Currencies

- Live Gold Prices

- Live Silver Prices

- Live Oil Prices

- Currency Affiliate Program

- Live Forex Rates and Charts

- Rates Table Live

- Money Transfer To Table

- Exchange Rate Converter

- Exchange Rates Table

- Exchange Rates Table Deluxe

- Currency Charts

- Live Currency Converter

- Live Currency Rates Ticker

- Live Forex Rates Ticker

- Live Currency Toolbar

Today's Best British Pound / Euro exchange rate: 1 GBP = 1.1736 EUR

Latest gbp/eur exchange rate data, converter, calculator tools and fx history, currency menu.

- Currency Rates

- GBP EUR Rate Alert?

- EUR GBP (Invert)

- GBP EUR History, Charts

- Compare Cash Rates

- GBP to EUR Forecast

Welcome to the Pounds to Euros page, updated every minute.

Compare today's best British Pound to Euro exchange rates

The live Pound to Euro exchange rate (GBP EUR) as of 3 Jun 2024 at 7:33 AM.

GBP/EUR Live Chart & Data

Below you can see the chart for the Euro rate today compared to the Pound.

Historical Charts & Data for Pounds to Euros

The GBP to EUR rate over a historical period can be determined using the history chart and data below:

For full history please visit GBP/EUR exchange rate history page

To convert Pounds to Euros or determine the Pound Euro exchange rate simply use the currency converter on the right of this page, which offers fast live exchange rate conversions today!

Compare Travel Money: Best EUR Tourist Exchange Rates

The best EUR exchange rate right now is 1.1563 from The Currency Club. This is based on a comparison of 25+ currency suppliers and if you were buying £500 worth of EUR for home delivery. Today's best UK deal for £500 will get you 578.15 EUR plus delivery. Check the table of travel money rates below to see more competitive deals than the high street/airport bureau de change.

Your Trust and Safety: Exchange Rates UK ONLY works with foreign exchange payment companies that are registered with the FCA .

Accuracy: The travel/tourist exchange rates were valid at Monday 3rd of June 2024 07:33:25 AM, however, please check with relevant currency exchange broker for live travel money rate. Note: You may need to refresh this page.

Click here for the full best exchange rates comparison table.

Compare Today's GBP to EUR Exchange Rate with Past Historical Rates

Some Common Questions

Handy Conversion Data Table

Gbp/eur news.

Pound to Euro End-of-Week Forecast, News: GBP/EUR Flat despite Upbeat Eurozone data

Pound to Euro Exchange Rate News, Forecast: GBP/EUR Firms Despite Improving German Sentiment

Pound to euro exchange rate flat amid data lull, pound to euro exchange rate news, forecast: gbp/eur retreats from fourteen-week high, pound to euro exchange rate news, forecast: gbp/eur climbs as july uk election announced, pound sterling news, pound to euro forecast for week ahead: where next for gbp/eur exchange rate buyers.

Pound-Dollar Exchange Rate Above 1.2750 as Dollar Retreats After Inflation-Data Relief

Pound Sterling Firm vs Euro, Dollar as UK Business Confidence Hits 8-Year Highs

Pound to Dollar Rate Trades Above 1.27 as US Economic Doubts Continue

Pound Sterling Blocked at Key Resistance Areas, Holds 2-Month Highs vs Dollar

Read all our latest exchange rate forecasts with live FX news updates as they happen!

MOST VISITED CURRENCY PAGES

GBP EUR Converter

Live currency calculator, get a free rate alert:, currency conversions.

- Copyright © 2006 - 2024 Exchange Rates UK

- Editorial and Ethics Guidelines

- Ownership/Advertising/Funding Disclosure

- Legal Disclaimer

- Language: English

- Français

- Español

- Português

- Netherlands

UK Edition Change

- UK Politics

- News Videos

- Paris 2024 Olympics

- Rugby Union

- Sport Videos

- John Rentoul

- Mary Dejevsky

- Andrew Grice

- Sean O’Grady

- Photography

- Theatre & Dance

- Culture Videos

- Fitness & Wellbeing

- Food & Drink

- Health & Families

- Royal Family

- Electric Vehicles

- Car Insurance Deals

- Lifestyle Videos

- UK Hotel Reviews

- News & Advice

- Simon Calder

- Australia & New Zealand

- South America

- C. America & Caribbean

- Middle East

- Politics Explained

- News Analysis

- Today’s Edition

- Home & Garden

- Broadband deals

- Fashion & Beauty

- Travel & Outdoors

- Sports & Fitness

- Sustainable Living

- Climate Videos

- Solar Panels

- Behind The Headlines

- On The Ground

- Decomplicated

- You Ask The Questions

- Binge Watch

- Travel Smart

- Watch on your TV

- Crosswords & Puzzles

- Most Commented

- Newsletters

- Ask Me Anything

- Virtual Events

- Betting Sites

- Online Casinos

- Wine Offers

Thank you for registering

Please refresh the page or navigate to another page on the site to be automatically logged in Please refresh your browser to be logged in

Travel money: How to get the best exchange rates on your holiday currency and top ways to pay abroad

Using your usual uk bank debit card abroad could trigger some annoying fees, article bookmarked.

Find your bookmarks in your Independent Premium section, under my profile

Sign up to Simon Calder’s free travel email for expert advice and money-saving discounts

Get simon calder’s travel email, thanks for signing up to the simon calder’s travel email.

At sterling’s 21st-century peak in 2008, £1 was worth over US$2 on the foreign exchanges. During the calamitous premiership of Liz Truss in October 2022, the pound sank almost to parity (£1=$1) against the American dollar .

The UK currency has recovered slightly, but is still only worth $1.27 or so. Sterling’s fall is mirrored against other currencies that are locked to the US$, including UAE dirhams and the dollars used in many Caribbean islands.

Shortly after the euro was introduced at the start of 2002, sterling was riding high: worth €1.65. Today it has shed almost 50 cents to around €1.17. Against the Swiss franc , the pound has fared even worse – losing half its value in 15 years, corresponding to a doubling of prices for British travellers in the Alpine confederatiion.

Given the erosion in the value of the pound, you should avoid further losses by managing your holiday finances well. If you leave it to the last moment and change money at the airport on your way out, you will be wasting your cash – which would be much better spent at your destination. In addition, the pandemic accelerated changes in how travellers transact, with contactless payment increasingly the norm.

These are the key questions and answers on holiday money.

Using a credit or debit card

This is a fast and easy method of paying your way, whether with a physical card or a card on a phone. We are now in an age when cards are used for the most minor transactions. Crucially, though, you could be losing a slice of cash every time you use your normal UK bank card abroad.

For most mainstream UK credit and debit cards, banks charge just under 3 per cent (usually 2.95 or 2.99 per cent) as a “foreign currency transaction fee”. Adding almost £3 to a £100 purchase represents free money for them at your expense.

Some also impose an additional “cash advance fee” – sometimes a flat £1.50 or a percentage of up to 5 per cent – for withdrawals from an ATM.

Check your card provider’s policy – which should be easily visible online – and if necessary get a new card specifically for overseas use.

How can I dodge the card fees?

If you are a First Direct customer, your Mastercard debit card is fee-free abroad. For other travellers who seek a simple solution, apply for a Halifax Clarity credit card and use it purely for spending overseas; it does not add transaction fees.

Online firms such as Revolut may offer a better exchange rate. Along with low-cost providers Monzo, Starling Bank and others, Revolut holders can expect fee-free cash withdrawals (usually subject to a monthly limit).

HSBC has an interesting Global Money account, available to most active UK current account holders. Using the bank’s mobile banking app (select “International Services” then “Global Money”) you can create an account that allows you to keep funds in up to 18 currencies, and spend abroad without transaction fees.

Note that an increasing number of ATMs apply their own, local transaction fees – typically €5 in Mediterranean nations. You should be warned of this before you commit to a withdrawal.

Is it best to take a credit or debit card?

Credit cards have several advantages over debit cards. UK-issued cards are covered by Section 75 of the Consumer Credit Act 1974, which makes the card provider jointly liable with the merchant for any purchases over £100. That means any goods you buy with the card must be of reasonable quality.

You are also protected against financial failure of a travel provider, whether an airline, tour operator or hotel – though if you book through an agent the legal position is cloudier.

A credit card also gives you something of a cushion; money does not leave the account immediately, and if you pay off the bill in full every month you should not face interest charges.

Debit cards may incur even higher charges for spending abroad. For example TSB adds a £1 “non-pounds purchase fee” outside the EU to its 2.99 per cent transaction fee for purchases made on a debit card. That inexpensive £16 Turkish lunch bill becomes £17.50 using a TSB debit card, increasing the cost by 9 per cent.

Check before you use your normal debit card abroad – unless you are with First Direct, whose debit cards are fee-free.

The Chase debit card makes an interesting offer: no fees plus 1 per cent cash back, though this applies only for the first year, with a maximum of £15 back per month.

Debit-card purchases are covered by the banks’ voluntary chargeback scheme, which does not offer the same degree of protection as credit cards.

Beware of Dynamic Currency Conversion

“Would you like to pay in sterling?” the waiter asks innocently. He is hoping that you will choose pounds, thereby boosting the restaurant’s profits. Dynamic Currency Conversion (DCC) means the merchant and a bank give you a terrible rate of exchange and split the profit – typically a margin of 5 to 6 per cent – between them.

Restaurants, shops and hotels are allowed to offer the “opportunity” so long as they make it clear that the cardholder has a choice, and cite the rate of exchange that will be used.

The EU-funded European Consumer Organisation, known as BEUC, adds: “It is almost impossible for a consumer to make an informed decision when presented with the DCC option, because of various ‘nudging’ strategies put in place by the DCC service providers and merchants.”

Always choose to pay with local currency, not “GBP”.

Could I face unexpected charges abroad?

Yes, depending on the location. In the UK it is illegal to charge extra for paying with a credit card, but that does not apply elsewhere.

A European Union law bans credit-card fees for EU citizens, but of course those do not apply to British travellers; charges for UK cardholders appear standard in Denmark.

Credit-card surcharges are also permitted in Australia , so long as they reflect the vendor’s costs of processing the payment. In New Zealand, fees are also common – though Consumer NZ says “anything higher than a 2.5 per cent credit card surcharge, or a 1 per cent contactless debit card charge could be excessive”.

Watch out for the ‘hold’ on a credit card

All kinds of enterprises, from car-rental firms to hoteliers concerned about your possible thirst for the contents of the minibar, demand a credit card. Without one, you might be asked for a hefty cash deposit – or simply refused service. This is because the firm wants to reserve the right to extract additional funds if you “go rogue” in some way.

If, after you have checked in the car or checked out of the hotel, they find that you have run up a charge, they want to claim it back – and the easiest way to do that is to demand “pre-authorisation” up to a certain amount.

They will exercise a “hold”, which means reserving a chunk of capacity – perhaps as much as £1,000 – from your account for contingencies.

This money will not leave your account (unless there has been some financial chicanery on your part), but it does limit your freedom of financial movement.

Pre-paid cards

These are cards which you load with currency – usually sterling, euros or dollars – and use to pay for goods and services, or to withdraw cash from ATMs. On longer trips, you can keep topping them up online from your bank account, making them good for globetrotting tourists and gap-year adventurers.

You can also hold multiple currencies on the same account; FairFX offers up to 20.

But do your homework. The key components you need to compare start with the initial fee. Some providers waive this, but often make up for it with higher charges elsewhere. Paying a fee now may actually save you more in the longer term.

Next, do you have to pay a “loading” fee to put money on the card? If so, this could prove expensive. Some companies demand 3 per cent of all the money you put on your account. Is there a flat rate or a percentage charge for using the thing?

Lastly, how quickly do your funds erode if you don’t use the card for a while? The depletion of value over time is a very useful income stream for the prepaid card issuer.

Should I take cash?

Obtaining local currency locks you into an exchange rate, and therefore you can calculate precisely how much a cup of coffee or a night’s stay costs in sterling. Cash also says less about you than plastic, eliminating the risk of credit-card fraud.

Should I take out currency in the UK or abroad?

Many people use their credit or debit cards to withdraw cash abroad. But on top of any fees added by your card provider, many operators of ATMs abroad charge you for the privilege, known as a Direct Access Fee (DAF).

Providing a fully stocked ATM on a Greek island, with all the security and maintenance issues involved, is an expensive business, they point out – and the transaction fee reflects this reality.

So buying ahead of your trip is a good plan.

Where can I find the best rates in the UK?

Foreign currency is the ultimate commodity: the euros or dollars you get cheap from a backstreet bureau de change are worth exactly the same as the notes you might buy, expensively, at your high street bank.

The best way to compare rates is to frame the question right: “how many euros will you give me for £300?” or “I need $500, how much will that cost me in sterling?”.

On your local high street, don’t expect much from banks – which now appear to regard changing money as a faff, and often restrict it to existing customers.

Travel agents often offer more competitive rates. And the Post Office is worth checking, particularly for commission-free small transactions – for example buying £20 of Turkish lira to tide you over until you can find the best local deal after arrival.

But you are almost certain to get a better deal if you shop around online through companies such as Travelex and Moneycorp, and pick up the foreign currency at an airport or ferry port.

For the best deals, it helps to be in London. Search Thomas Exchange Global for some of the best rates. You can pay online and pick up the cash at a Thomas Exchange bureau.

Currency Online Group, based at Waterloo station, offers highly competitive rates if you pay in advance and pick up from its office. Outside working hours, the UK’s first cash-to-cash foreign exchange ATM is located in the Excess Baggage office on the concourse ; it offers reasonable rates for euros and dollars from 7am to 11pm, seven days a week.

Better still, take a stroll along Britain’s finest foreign-currency artery: Queensway in London W2. Within a few hundred metres, there are two dozen bureaux de change. It takes 10 minutes to compare rates, and with lots of tourists selling euros or dollars for sterling, there’s a willingness to turn a quick profit.

All of this applies only to the major currencies: the euro and dollar, and also the Swiss franc, Canadian and Australian dollars, plus the UAE dinar. You might also want to buy in advance for Scandinavian currencies or New Zealand dollars (weak competition at the destination means rates are rarely good).

But just about every other currency counts as “exotic”, and for these locations the rule is: wait until you get to the country in question. Take clean Bank of England £20 notes (with a few £5 and £10 notes in case you need to change smaller amounts towards the end of your stay).

Turkish currency

The usual advice for European holidays – buy euros in the UK at the best rate you can find – does not apply to for the Turkish lira.

First rule: do not change in large quantities in Britain; you will get a much better rate in Turkey. If you like to have a modest amount of foreign currency for incidentals when you arrive, then as mentioned above, you could go to your local Post Office and change £20 or so into Turkish lira. You won’t get a great rate of exchange, but it will be better than your departure airport. And it is commission-free, which is handy for small transactions like this.

Once at your destination in Turkey, you will soon be able to identify the bureau de change with the best rates for sterling. Even in small towns, there are change opportunities; ask at the tourist office or a travel agency.

Change reasonably small quantities in case there is another sudden collapse of the lira. Little and often is the best way.

When you shop around, note that some places charge commission and some don’t. The sensible question to compare rates is: “How many Turkish lira will you give me for £100?”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

New to The Independent?

Or if you would prefer:

Want an ad-free experience?

Hi {{indy.fullName}}

- My Independent Premium

- Account details

- Help centre

- Money Transfer

- Rate Alerts

1 GBP to USD - Convert British Pounds to US Dollars

Xe Currency Converter

1.00 British Pound =

1.27 43195 US Dollars

1 USD = 0.784733 GBP

Convert British Pound to US Dollar

Convert us dollar to british pound, gbp to usd chart.

1 GBP = 0 USD

1 British Pound to US Dollar stats

Currency information, gbp - british pound.

Our currency rankings show that the most popular British Pound exchange rate is the GBP to USD rate. The currency code for British Pounds is GBP. The currency symbol is £.

USD - US Dollar

Our currency rankings show that the most popular US Dollar exchange rate is the USD to USD rate. The currency code for US Dollars is USD. The currency symbol is $.

Popular British Pound (GBP) Currency Pairings

The world's most popular currency tools, xe international money transfer.

Send money online fast, secure and easy. Live tracking and notifications + flexible delivery and payment options.

Xe Currency Charts

Create a chart for any currency pair in the world to see their currency history. These currency charts use live mid-market rates, are easy to use, and are very reliable.

Xe Rate Alerts

Need to know when a currency hits a specific rate? The Xe Rate Alerts will let you know when the rate you need is triggered on your selected currency pairs.

Xe Currency Data API

Powering commercial grade rates at 300+ companies worldwide

Download the Xe App

Check live rates, send money securely, set rate alerts, receive notifications and more.

Over 70 million downloads worldwide

IMAGES

VIDEO

COMMENTS

Whether you need to check the latest exchange rates, compare historical trends, or send money abroad, Xe Currency Converter is the ultimate tool for you. You can easily convert between any of the world's major currencies, including crypto and precious metals, and get the most accurate and up-to-date rates. Xe Currency Converter is free, fast, and simple to use.

Get the best currency exchange rates for international money transfers to 200 countries in 100 foreign currencies. Send and receive money with best forex rates. ... Xe Live Exchange Rates. Inverse. Amount. Edit. 1. Add currency. The world's most popular currency tools. ... Travel Expenses Calculator. Currency Email Updates. More tools ...

1 USD = 0.8852 EUR. 5 USD. 245.40 EUR Check rates. Bank of America USD to EUR rate: 1 USD = 0.8958 EUR. 26 USD. Go to full comparison. Compare for a specific amount, different pay-in and pay-out options, and see transfer speed and Monito Scores on our dedicated comparison page. See 6 more results.

Welcome to the Euro exchange rate & live currency converter page. The Euro (EUR) exchange rates represented on this page are live, updated every minute within the forex market's trading hours of ...

What is the best euro exchange rate right now? The best euro exchange rate right now is 1.1555 from Travel FX. This is based on a comparison of 17 currency suppliers and assumes you were buying £750 worth of euros for home delivery. Remember, exchange rates aren't the only important factor when finding the best euro deal.

Top 5 exchange rate need-to-knows. 1. The RIGHT cards consistently beat travel cash rates. 2. Beware charges for using credit cards to buy your travel money. 3. Avoid the debit cards from HELL - some fine you for spending abroad. 4. Don't let bureaux hold your cash for long - you've little protection.

Download the App. Keep track of live mid-market rates for every world currency on your Smartphone. That's 170+ currencies that you can convert on the go! Xe offers an assortment of travel tools for your next trip!

Below you can see the chart for the Euro rate today compared to the Pound. 1 GBP = 1.1749 EUR. 1 Pounds = 1.1749 Euros. The GBPEUR rate as of 2 Jun 2024 at 9:55 PM. 1 GBP to EUR IntraDay Range ...

At sterling's 21st-century peak in 2008, £1 was worth over US$2 on the foreign exchanges. During the calamitous premiership of Liz Truss in October 2022, the pound sank almost to parity (£1=$1 ...

Search for the best euro rate on the market: Compare exchange rates for international payments, travel money and cash buys. Live rate: 1 GBP = 1.1746 EUR ( -0.08% ) Inverted: 1 EUR = 0.8514 GBP

Latest Pound to Euro Rate and Live GBP/EUR Data Live GBP/EUR Exchange Rate Data, Calculator, Chart, Statistics, Volumes and History ... Best Cash and Travel Rates. Bid: 1.1743: Ask: 1.1749: Today ...

Check live rates, send money securely, set rate alerts, receive notifications and more. Scan me! Over 70 million downloads worldwide. GBP to EUR currency chart. XE's free live currency conversion chart for British Pound to Euro allows you to pair exchange rate history for up to 10 years.

Calculate live currency and foreign exchange rates with the free Xe Currency Converter. Convert between all major global currencies, precious metals, and crypto with this currency calculator and view the live mid-market rates. ... Travel Expenses Calculator. Currency Email Updates. More tools. ... EUR - Euro. GBP - British Pound. CAD - Canadian ...

Convert 1 British Pound to Euro with the original Universal Currency Converter from XE, the Currency Authority. Get live mid-market exchange rates, historical rates and data and currency charts for GBP to EUR. Learn more about British Pounds and Euros and set rate alerts with XE.

1.00 Euro =. 90.58 134 Indian Rupees. 1 INR = 0.0110398 EUR. We use the mid-market rate for our Converter. This is for informational purposes only. You won't receive this rate when sending money. Login to view send rates. Track currency. View transfer quote.

These are the highest points the exchange rate has been at in the last 30 and 90-day periods. 1.2772: ... GBP to EUR. GBP to GBP. GBP to JPY. GBP to CAD. GBP to AUD. GBP to CHF. GBP to CNY. ... These currency charts use live mid-market rates, are easy to use, and are very reliable. View charts.