Tourism in Italy

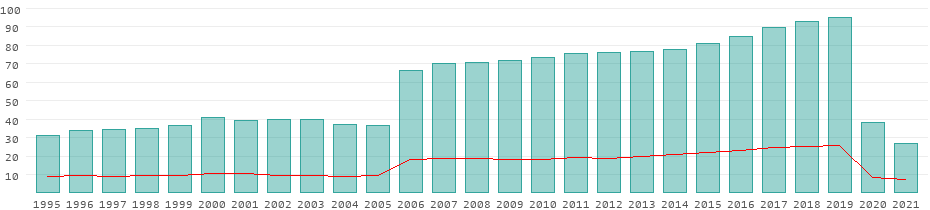

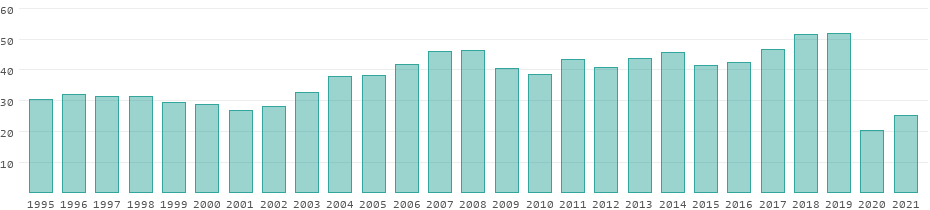

Art and culture as a tourist magnet, most popular travel destinations in italy, development of the tourism sector in italy from 1995 to 2021.

Revenues from tourism

All data for Italy in detail

No spam. We promise.

Italy Factsheet

Discover the total economic contribution that the Travel & Tourism sector brings to Italy and the world in this data-rich, two-page factsheet.

Discover the total economic contribution that the Travel & Tourism sector brings to the Italy’s economies and to the world in this data-rich, two-page factsheet.

Create an account for free or login to download

Over the next few weeks we will be releasing the newest Economic Impact Research factsheets for a wide range of economies and regions. If the factsheet you're interested in is not yet available, sign up to be notified via the form on this page .

Factsheet details

This factsheet highlights the importance of Travel & Tourism to Italy across many metrics, and features details such as:

- Contribution of the sector to overall GDP and employment

- Comparisons between 2019 and 2023

- Forecasts for 2024 and 2034

- International and domestic visitor spending

- Proportion of leisure vs business spending

- Top 5 inbound and outbound markets

This factsheet highlights the importance of Travel & Tourism to the Italy across many metrics, and features details such as:

- Contribution of the sector to overall GDP and employment in the group and globally

- Contribution of the sector to overall GDP and employment in the region and globally

This factsheet highlights the importance of T&T to this city across many metrics, and features details such as:

- Contribution of the sector to overall GDP and employment in the city

- Comparisons between 2019, 2020 and 2021, plus 2022 forecast

- Proportion of the T&T at city level towards overall T&T contribution at a country level

- Top 5 inbound source markets

Report sponsors

Research support partners.

- Skip to content

- Skip to primary sidebar

Italia Living

Live Life Italian Style

Tourism Sectors in Italy on the Rise

Featured , Travel / April 2016 by Italia Living

Luxury tourists prefer New York, Florence, Paris and Rome as their top destinations

Luxury travel is one of the highest-growth sectors currently in the international travel market. Even niche tourism sectors such as food and wine and cultural tourism, have seen a successful rise.

Although worldwide tourism grows on average 4% per year, luxury travel has risen 48% over the past five years: a trend that will likely continue in 2016, according to tourism marketing consultancy IPK International’s World Travel Monitor.

Italian hoteliers’ association Federalberghi estimates that high-end tourism and occupancy in luxury hotels in Italy will increase between 10-20% over last year, with a significant portion of tourists coming from Arab countries.

According to Conde Nast Johansen, luxury tourists prefer New York, Florence, Paris and Rome as their top destinations. The niche sector of food and wine tourism is an important part of travel in Italy, and a world leader in the sector with nearly 21,000 agritourism structures and over 6,600 farms.

A survey conducted by farmers’ association Coldiretti with polling institute Ixè revealed that more than four in 10 Italians chose a vacation in 2015 based on wine and food tourism.

Sport tourism in Italy – estimated to be worth 6.3 billion euros, with 1.5 billion in aquatic sports alone – is one of the most promising sectors for seasonal tourism in 2016, according to the National Tourism Observatory (ONT), which surveyed more than 10 million trips and 60 million reservations.

Another niche travel sector is that of weddings celebrated in Italy: 6,000 per year with English, Russian and American citizens at the top of the list of those who wish to profess their marriage vows in Italy.

As far as business travel, Italy is 4th in Europe for total meeting surface area in the business niche sector known as MICE – Meetings, Incentives, Conferences, and Events.

Related Articles

- Abruzzo Cooking School Shares the Best of the Region

- Andrea Bocelli Concert Tour Packages - July 2016

- 5 of the Most Luxurious Hotels in Rome

- The A-List “Da Ivo” Venice Experience

Article Categories

Follow us on social media.

Winter is here! Check out the winter wonderlands at these 5 amazing winter destinations in Montana

- Travel Destinations

How Much Of Italy’s Economy Is Dependent On Tourism

Published: December 12, 2023

Modified: December 28, 2023

by Kalina Sauceda

- Plan Your Trip

- Travel Guide

Introduction

Italy, known for its rich history, stunning landscapes, and vibrant culture, has long been a top tourist destination. From the ancient ruins of Rome to the picturesque canals of Venice, this country offers a diverse range of attractions that draw millions of visitors each year. But have you ever wondered how much of Italy’s economy is dependent on tourism?

In this article, we will delve into the fascinating world of Italy’s tourism industry and explore its significance to the country’s economy. We will examine the factors that contribute to Italy’s heavy reliance on tourism, the impact it has on different sectors, and the challenges associated with this dependence. Finally, we will discuss potential measures to diversify Italy’s economy and reduce its reliance on tourism.

Italy’s tourism sector plays a crucial role in the country’s overall economic landscape. With its world-renowned monuments, UNESCO World Heritage sites, and rich cultural heritage, Italy has consistently been one of the most-visited countries in the world. In 2019 alone, Italy attracted more than 94 million international tourists, generating an estimated €41 billion in revenue.

The significance of tourism to Italy’s economy cannot be overstated. It accounts for a substantial portion of the country’s GDP and employment. According to the World Travel and Tourism Council, travel and tourism directly contributed 13% to Italy’s GDP in 2019. Furthermore, the sector employs approximately 4.4 million people, representing around 16% of the total employment in the country.

Italy’s natural and cultural attractions serve as a magnet for international tourists, driving the growth of the tourism industry. The historical cities, such as Rome, Florence, and Venice, attract history enthusiasts and art lovers, while the beautiful coastal regions like the Amalfi Coast and Cinque Terre entice sun-seeking vacationers. Additionally, Italy’s reputation for excellent cuisine, fashion, and luxury goods adds to its allure as a premier tourist destination.

However, while Italy’s tourism industry has undoubtedly brought significant economic benefits, it also presents potential challenges and risks. The overreliance on tourism leaves the country vulnerable to external shocks, such as global economic downturns, political instability, natural disasters, or pandemics, as demonstrated by the impact of the COVID-19 pandemic in 2020.

In the following sections, we will delve deeper into Italy’s tourism industry, examining the key factors contributing to its dependence on tourism and the far-reaching consequences it has on the Italian economy. Join us as we explore the multifaceted relationship between Italy and its booming tourism sector.

Overview of Italy’s tourism industry

Italy’s tourism industry is one of the largest and most dynamic in the world. The country offers a wealth of attractions, including historical landmarks, UNESCO World Heritage sites, stunning coastlines, and picturesque countryside. From the iconic Colosseum in Rome to the romantic canals of Venice, there is something for every type of traveler.

Italy’s tourism infrastructure is extensive, catering to the needs of millions of visitors each year. The country boasts a wide range of accommodation options, from luxurious hotels and resorts to budget-friendly hostels and bed and breakfasts. Additionally, transportation within Italy is well-developed, with an extensive network of trains, buses, and domestic flights, making it convenient for tourists to explore different regions.

The tourism industry in Italy is supported by a strong cultural heritage and a rich history, which dates back to ancient times. The country is home to countless archaeological sites, including Pompeii, Herculaneum, and the Roman Forum, offering visitors a glimpse into the past. Furthermore, Italy is renowned for its world-class museums, such as the Uffizi Gallery in Florence and the Vatican Museums in Rome, housing priceless works of art.

The natural beauty of Italy is also a major draw for tourists. The country is famous for its stunning coastlines, such as the Amalfi Coast and the Italian Riviera, which offer breathtaking views and idyllic beach towns. Inland, visitors can explore the picturesque countryside of Tuscany, known for its rolling hills, vineyards, and charming villages.

Italy’s cuisine is revered worldwide, and food tourism is another significant aspect of the country’s tourism industry. Italian cuisine is diverse and regionally distinct, with each area offering its own specialties. From Neapolitan pizza to Tuscan pasta and Sicilian cannoli, the culinary delights of Italy are a highlight for many visitors.

In recent years, Italy has also seen a rise in niche tourism segments, such as wine tourism, fashion tourism, and eco-tourism. Wine enthusiasts flock to regions like Tuscany and Piedmont to sample renowned Italian wines, while fashion lovers flock to Milan, the fashion capital of Italy. Eco-tourism is also on the rise, with visitors seeking eco-friendly accommodations and exploring Italy’s national parks and protected areas.

Overall, Italy’s tourism industry is thriving, attracting millions of visitors from around the globe. The combination of historical sites, cultural heritage, natural beauty, and culinary excellence make Italy a top choice for travelers seeking a unique and enriching experience.

Importance of tourism to Italy’s economy

Tourism is a vital component of Italy’s economy, playing a significant role in driving economic growth, creating jobs, and generating revenue. The sector’s impact is felt across various industries and regions, making it a critical pillar of the Italian economy.

The contribution of tourism to Italy’s gross domestic product (GDP) is substantial. In 2019, the direct contribution of travel and tourism accounted for approximately 5.2% of Italy’s GDP, according to the World Travel and Tourism Council. When considering both direct and indirect impacts, the total contribution rises to around 13%.

Tourism also plays a crucial role in employment generation. The sector provides millions of jobs directly and indirectly, supporting livelihoods in various sectors such as hospitality, transportation, retail, and entertainment. In 2019, the travel and tourism industry employed around 4.4 million people, representing approximately 16% of the total employment in Italy.

The revenue generated from tourism activities contributes significantly to Italy’s balance of payments, as international visitors spend money on accommodation, transportation, food, shopping, and entertainment. In 2019, total international visitor spending reached €41 billion, making tourism one of the leading sources of foreign exchange earnings for the country.

Furthermore, tourism encourages regional development and stimulates economic growth in less economically developed areas of Italy. The presence of popular tourist destinations in regions like Tuscany, Veneto, and Campania attracts investments in infrastructure, accommodation, and services, creating employment opportunities and boosting local businesses.

Italy’s cultural heritage and historical sites are a major draw for tourists, contributing significantly to the country’s economy. The maintenance and preservation of these sites require ongoing investment, and tourism revenue plays a crucial role in financing these efforts. Additionally, revenue generated from entrance fees to museums, archaeological sites, and cultural events directly contribute to the conservation and restoration of Italy’s cultural treasures.

Moreover, the tourism industry generates a multiplier effect, impacting various sectors and supporting related businesses. Accommodation providers, restaurants, souvenir shops, transportation services, tour operators, and other tourism-related businesses all benefit from the influx of tourists. The interdependence between these sectors creates a comprehensive tourism ecosystem that drives economic activity and creates a ripple effect through the supply chain.

Overall, tourism is of utmost importance to Italy’s economy. It not only drives economic growth, but also promotes cultural preservation, regional development, and job creation. However, the overreliance on tourism also presents certain challenges and risks, as we will explore in the following sections.

Factors contributing to Italy’s dependence on tourism

Several factors contribute to Italy’s heavy reliance on tourism as a significant driver of its economy. These factors have shaped the country’s economic landscape and made it highly dependent on the tourism industry.

Historical and Cultural Significance: Italy’s rich history and cultural heritage are major attractions for tourists. The country is home to numerous UNESCO World Heritage sites, ancient ruins, and iconic landmarks that draw visitors from around the world. The historical cities of Rome, Florence, and Venice, with their architectural marvels and artistic treasures, remain perennially popular. The preservation and promotion of these historical and cultural sites have fueled the growth of Italy’s tourism industry.

Geographical Diversity: Italy’s diverse geography is another contributing factor to its dependence on tourism. From the breathtaking coastlines of the Amalfi Coast and the Italian Riviera to the picturesque countryside of Tuscany and the stunning lakes in the north, Italy offers a variety of landscapes that appeal to different types of travelers. The natural beauty of these regions, along with their outdoor activities, such as hiking, sailing, and wine tours, attracts tourists looking for unique experiences.

World-Famous Cuisine: Italian cuisine is celebrated globally, and the country’s gastronomic offerings are a major attraction for tourists. From pizza and pasta to gelato and espresso, Italian culinary traditions are deeply ingrained in the country’s culture. Italy’s vibrant food scene, with its regional specialties and world-class wines, lures food enthusiasts and gourmet travelers, contributing to the growth of food tourism in the country.

Art and Fashion: Italy’s reputation as a hub of art, fashion, and design has also played a significant role in its dependence on tourism. The country is renowned for its centuries-old art masterpieces, with museums like the Uffizi Gallery and the Vatican Museums housing invaluable works of art. Milan, as the fashion capital of Italy, attracts fashion-conscious travelers who visit to explore its boutiques, attend fashion shows, and immerse themselves in Italian style.

Proximity and Connectivity: Italy’s geographical location in the heart of Europe has made it easily accessible to travelers from all over the world. The country benefits from its well-connected transportation infrastructure, with international airports in major cities, extensive rail networks, and a comprehensive highway system. This connectivity has made it convenient for tourists to reach Italy and explore multiple destinations within the country, boosting visitor numbers and tourism revenue.

Government Support: The Italian government has recognized the economic significance of the tourism industry and has implemented policies to support its growth. Investments in infrastructure, promotion of cultural heritage, and development of tourist-friendly initiatives have contributed to Italy’s popularity as a tourist destination. The government’s commitment to preserving historical sites, improving tourism infrastructure, and facilitating visa procedures has further strengthened Italy’s position as a top choice for travelers.

While these factors have undoubtedly contributed to Italy’s dependence on tourism, it is essential to address the challenges associated with this heavy reliance. In the next section, we will explore the impact of tourism on different sectors of the Italian economy and the risks it poses.

Impact of tourism on different sectors of the Italian economy

The tourism industry in Italy has far-reaching effects on various sectors of the country’s economy, creating a significant impact on both direct and indirect beneficiaries. Let’s explore how tourism influences different sectors and contributes to their growth and development.

Hospitality and Accommodation: The hospitality sector is one of the primary beneficiaries of Italy’s booming tourism industry. Hotels, resorts, bed and breakfasts, and vacation rentals cater to the influx of tourists, providing them with a place to stay during their visit. The demand for accommodation drives investment in the construction and maintenance of hotels and accommodations, thereby creating job opportunities and supporting the local economy.

Food and Beverage: Italy’s renowned culinary culture plays a crucial role in attracting tourists. The food and beverage sector benefits from the increased visitor numbers, with tourists eager to indulge in authentic Italian cuisine. Restaurants, cafes, and street food vendors experience higher demand, leading to increased business opportunities and employment in the sector.

Retail and Shopping: Tourism contributes significantly to the retail sector in Italy. Tourists often seek out local crafts, souvenirs, and designer goods, boosting sales in shops and boutiques. Major shopping destinations such as Milan, renowned for its fashion scene, benefit from the influx of tourists who come to explore and purchase Italian-made products. This, in turn, stimulates economic activity and supports the retail sector.

Transportation: Italy’s well-developed transportation infrastructure caters to the needs of millions of tourists. The travel and tourism industry drive demand for domestic and international flights, train travel, rental cars, and public transportation. This sustained demand for transportation services leads to job creation and revenue generation in the transportation sector, benefiting airlines, railway companies, taxi operators, and other transportation service providers.

Heritage and Culture: Italy’s rich cultural heritage is a major draw for tourists, and the preservation and promotion of historical sites and cultural events contribute to the economy. Revenue generated from entrance fees to museums, archaeological sites, and cultural festivals directly support the conservation and maintenance of Italy’s cultural treasures. Investments in the restoration and preservation of historical sites create employment opportunities in the heritage sector.

Tour Operators and Travel Agencies: The tour operator and travel agency sector play a vital role in facilitating tourism in Italy. These businesses provide travel packages, organize tours, and offer guidance and assistance to tourists. Through partnerships with hotels, transportation companies, and local tour guides, these entities generate employment and stimulate economic activity in the tourism ecosystem.

Entertainment and Events: Italy’s vibrant entertainment scene, including music concerts, theater performances, film festivals, and sporting events, also benefits from tourism. Visitors attend these events, leading to increased ticket sales, hotel bookings, and restaurant patronage. The cultural and entertainment sectors thrive due to the support and spending of tourists.

Small Businesses and Local Communities: Tourism is often a lifeline for small businesses and local communities. Family-owned restaurants, artisan workshops, wineries, and local producers all benefit from the influx of tourists who seek authentic experiences and products. These small businesses contribute to the unique and authentic character of Italy’s tourism offerings.

Overall, tourism’s impact extends beyond the direct benefits to various sectors of Italy’s economy. The growth and sustenance of these sectors contribute to job creation, economic development, and the preservation of Italy’s cultural heritage.

Challenges and risks associated with Italy’s reliance on tourism

While Italy’s tourism industry brings significant economic benefits, it also exposes the country to certain challenges and risks due to its heavy reliance on this sector. Understanding these challenges is crucial for managing and diversifying the Italian economy effectively. Let’s explore some of the key challenges and risks associated with Italy’s dependence on tourism.

Seasonality and Overcrowding: Italy’s tourism is highly seasonal, with peak periods occurring during the summer months. This seasonality creates challenges for businesses that rely heavily on tourist spending, as they experience fluctuations in revenue throughout the year. Additionally, popular destinations often face issues of overcrowding, leading to strain on infrastructure, long queues at attractions, and adverse impacts on the local environment and residents’ quality of life.

Economic Vulnerability: Italy’s overreliance on tourism makes its economy vulnerable to external shocks. Economic crises, political instability, natural disasters, or pandemics, as evidenced by the COVID-19 pandemic, can severely impact the tourism industry and hamper the country’s overall economic stability. When a significant portion of the economy relies on tourism, any disruption can have a cascading effect across various sectors and lead to widespread consequences.

Environmental Sustainability: The environmental impact of tourism, particularly in popular destinations, poses significant challenges. Uncontrolled mass tourism can put a strain on natural resources, cause pollution, and contribute to the deterioration of fragile ecosystems. Italy’s iconic natural landscapes and protected areas need to be managed sustainably to ensure their preservation for future generations.

Rising Costs and Inflation: The influx of tourists often leads to a rise in prices, particularly in popular destinations. The increased demand for accommodation, transportation, and services can drive up prices, making it more expensive for both tourists and local residents. This can contribute to inflationary pressures and impact the affordability of tourism, potentially deterring travelers or redirecting them to alternative destinations.

Loss of Cultural Identity: Excessive tourism can gradually erode the unique cultural identity of local communities. As businesses cater to the demands of tourists, there is a risk of diminishing traditional practices, local crafts, and authentic experiences. Preserving the essence of local culture while simultaneously catering to tourist expectations is a delicate balance that should be carefully managed.

Dependency and Diversification: Reliance on a single industry for a significant portion of the economy limits diversification opportunities. Overdependence on tourism may hinder the development of other potential sectors and hinder efforts to create a more balanced and resilient economy. Diversification would reduce vulnerability to external shocks and create a more sustainable economic landscape.

Promotion of Sustainable Tourism: Implementing sustainable tourism practices is crucial for mitigating the risks associated with Italy’s dependence on tourism. This includes managing tourist flows, preserving cultural and environmental resources, promoting responsible travel behavior, and supporting local communities. By emphasizing sustainability, Italy can ensure a more resilient and inclusive tourism industry for the future.

Addressing these challenges and risks requires a comprehensive and strategic approach. Italy should focus on diversifying its economic base, investing in infrastructure, promoting off-peak and alternative destinations, and ensuring sustainability in tourism development. By doing so, Italy can reduce its vulnerability and create a more balanced and sustainable economy for the long term.

Measures to diversify Italy’s economy and reduce dependence on tourism

To reduce the country’s heavy reliance on tourism and create a more diversified and resilient economy, Italy can implement several measures. These measures aim to promote the development of other sectors and encourage economic growth that is less dependent on tourism. Let’s explore some strategies that can help diversify Italy’s economy:

Investing in Innovation and Technology: Italy can focus on fostering innovation and technological advancements in key sectors, such as manufacturing, information technology, and biotechnology. Encouraging research and development, providing support to startups and small businesses, and promoting collaboration between academia and industry can drive economic diversification and attract investment in high-tech industries.

Promoting Small and Medium-sized Enterprises (SMEs): Supporting the growth of SMEs is crucial for diversifying Italy’s economy. SMEs are the backbone of many sectors and can help stimulate regional development and job creation. By providing access to funding, improving business regulations, and offering mentorship and support programs, Italy can nurture entrepreneurship and foster a vibrant ecosystem of small businesses.

Strengthening the Manufacturing Sector: Italy has a long-standing tradition of excellence in manufacturing, particularly in sectors such as automotive, fashion, furniture, and machinery. Investing in advanced manufacturing technologies, promoting research and development, and fostering collaborations between manufacturers and academia can enhance Italy’s competitiveness in the global market and reduce its reliance on tourism-generated revenue.

Developing Knowledge-Based Industries: Italy can prioritize the development of knowledge-based industries, such as education, research, and creative sectors like design, architecture, and media. By investing in education and research institutions, attracting international talent, and providing support for creative industries, Italy can become a hub for knowledge-intensive activities, promoting economic diversification and long-term growth.

Expanding Export Opportunities: Italy can focus on expanding its export markets and diversifying its export portfolio. Encouraging Italian businesses to explore new markets and sectors, providing support in trade negotiations and export promotion, and fostering international business partnerships can help reduce dependency on domestic consumption and amplify the benefits of global trade.

Developing Rural and Agri-food Sectors: Italy’s agricultural heritage and quality food products offer opportunities for economic diversification. Prioritizing sustainable and high-value agricultural practices, investing in rural infrastructure, promoting organic and local food production, and supporting rural entrepreneurship can revitalize rural areas and create new avenues for economic growth beyond tourism.

Encouraging Cultural and Creative Tourism: Italy can leverage its rich cultural heritage and creative industries to attract a different type of tourist. By promoting cultural and creative tourism, which focuses on authentic experiences, local arts, crafts, and design, Italy can diversify its visitor base and attract tourists interested in cultural immersion and unique experiences that go beyond the traditional tourist hotspots.

Investing in Infrastructure and Connectivity: Enhancing Italy’s infrastructure, particularly in less-developed areas, can unlock new economic potentials. This includes improving transportation networks, expanding broadband internet access, and investing in renewable energy sources. It will create opportunities for businesses, stimulate investment, and reduce regional disparities, ultimately contributing to economic diversification.

Addressing Bureaucratic Barriers: Italy can streamline administrative processes and reduce bureaucratic obstacles to business growth. Simplifying regulations, improving transparency, and enhancing the ease of doing business can encourage investment and entrepreneurship, making Italy a more favorable destination for domestic and foreign businesses.

These measures should be implemented in a well-coordinated and long-term strategy to ensure sustainable economic diversification. By reducing dependence on tourism and fostering a more diverse economic landscape, Italy can build resilience, stimulate job creation, and navigate challenges more effectively, ultimately securing a prosperous future for the country.

Italy’s tourism industry is undeniably a vital pillar of its economy, contributing significantly to GDP, job creation, and foreign exchange earnings. The country’s rich cultural heritage, stunning landscapes, gastronomy, and renowned fashion industry have made it a top global tourist destination. However, while tourism has brought numerous benefits, it also exposes Italy to certain challenges and risks.

Italy’s heavy dependence on tourism makes its economy vulnerable to external shocks, such as economic crises, political instability, and pandemics. Additionally, the seasonality of tourism, overcrowding in popular destinations, rising costs, and potential loss of cultural identity all require careful management to ensure sustainable and responsible tourism practices.

To address these challenges, Italy must explore strategies to diversify its economy and reduce its reliance on tourism. Investing in innovation and technology, promoting SMEs, strengthening the manufacturing sector, and developing knowledge-based industries can spur economic growth and create new employment opportunities. Expanding export markets, supporting rural and agri-food sectors, encouraging cultural and creative tourism, and improving infrastructure and connectivity are additional avenues for economic diversification.

Italy should also emphasize sustainability and responsible tourism practices to preserve its cultural heritage, manage environmental impacts, and mitigate overcrowding in popular destinations. Promoting off-peak and alternative destinations, diversifying the tourism offering, and engaging local communities are key to creating a more inclusive and sustainable tourism industry.

In conclusion, while tourism remains a critical driver of Italy’s economy, the country must proactively pursue diversification strategies to reduce its vulnerability and build a more resilient economic foundation. By embracing innovation, fostering entrepreneurship, promoting sustainable practices, and investing in sectors beyond tourism, Italy can forge a path towards a prosperous and balanced future.

- Privacy Overview

- Strictly Necessary Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

What to Do About Your Current Trips

Visiting a National Park Right Now

Trips That Require Advance Planning

Is It Safe to Travel in the US?

Is It Safe to Travel to Europe?

Is It Safe to Travel to Italy?

Is It Safe to Go on a Cruise?

Is It Safe to Travel to China?

Is It Safe to Go Hiking?

What to Do If You're Stranded Abroad

US, Mexico, and Canada

Australia, New Zealand, and the South Pacific

Central and South America

Africa and the Middle East

Airline Cancellation Policies

Travel Insurance & COVID-19

Policies of Home Exchange Services

How to Cancel a Vacation

Getting Miles Back After Canceling Award Flights

How COVID-19 Could Change Travel

Future of New Zealand Tourism

How Tourism in Italy Will Change

The Future of Tourism in Italy

TripSavvy / Christopher Larson

There's no denying that Italy is one of the countries hit the hardest by the coronavirus pandemic . It was the first European country to report a terrifyingly swift spread of the disease, which overwhelmed hospitals in the northern regions of Lombardy, Piedmont, Emilia Romagna, and Veneto. As the first European country to institute a nationwide lockdown , Italy and its government made a strong statement that the health of its citizens comes before the economy. Other European countries followed, and on March 17, the European Commission placed a 30-day ban on non-essential travel to Schengen Zone countries, which was extended until May 15 and could get extended again until June 15 . Most airlines suspended service between the U.S. and Italy.

Now, the country is finally turning a corner. As of May 13, Italy reported 30,911 COVID-19 deaths and 221,216 infections , but the peak has passed, and the rate of infections has slowed. On May 12, there were 1,402 new infections and 172 deaths. On May 4, Italy entered Phase Two of the lockdown, which saw some of the harshest restrictions lifted. Italians are now allowed to go farther than 200 meters from home for reasons of work, to procure essential supplies, to visit family, and to get exercise outside. Restaurants, bars, and gelaterias can open for takeout as well as delivery, and some types of shops—including bookstores, newsstands, and children’s clothing stores—have reopened. Public parks are accessible once again. An estimated 4.5 million Italians have returned to work. More shops, museums, and churches are expected to open on May 18, and in some regions, restaurants, bars, and hair salons can reopen then too.

In cities like Rome and Florence, a sense of cautious optimism seems to be in the air. Last weekend—the first weekend since Italy entered Phase Two—Romans took to the streets on bicycles, stopping to photograph monuments usually swarmed by tourists and enjoy a gelato under the Mediterranean sun. Though many marveled at seeing the Trevi Fountain and the Spanish Steps without the crowds, there’s also anxiety about the effect of minimal tourism on the economy and how long the resulting downturn will last.

The Effect on Italian Tourism

With approximately 4.2 million Italians employed in tourism, the industry makes up roughly 13 percent of the nation’s GDP . In 2019, Italy—which has a population of 60 million—welcomed 216 million tourists. According to the Istituto Nazionale di Statistica , if it wasn’t for COVID-19, Italy might have received 80 million tourists who would have spent approximately 9.4 billion euros this spring. Until Italy reopens for tourism, the amount that the country stands to lose will only rise.

While travelers come from all over the world to enjoy all that Italy has to offer, Americans, in particular, have a long-standing love of the boot. "Italy is the most popular destination for our American travelers," says Shannon Knapp, president and CEO of the Leading Hotels of the World , a collection of top five-star hotels with 60 members in Italy. "They come to Italy for its history, culture, fashion, and obviously its famous culinary tradition. And they love to explore the different regions and experiences Italy offers. There is always something new to explore, so they love to return again and again."

It's still not clear when Italy will enter Phase Three, which is when international tourism will return. For now, anyone who comes from abroad is required to undergo a 14-day quarantine, and flights are scarce. Plus, there are still restrictions on traveling between regions. "I have a feeling that [international tourism] will start again in March or April of next year," says Fulvio De Bonis, co-founder of Imago Artis Travel , which organizes bespoke luxury tours of Italy. "As long as masks and social distancing are required, we can't express ourselves 100 percent. Italian culture is based on contact, above all physical contact. We need a cure, a vaccine."

Though Italy is doing widespread testing for the virus and its antibodies, a vaccine may still be a long way off. Until one is available, the country will have to figure out how to live with the virus while slowly restarting the economy. Unlike countries like Greece or Iceland, both of which have declared intentions to reopen for tourism this summer, Italy is taking a more cautious approach. For the moment, leisure travel is impossible, and lesser-hit regions in the south are mandating quarantines for anyone coming from the north. Still, it’s all but guaranteed that domestic tourism will return before international travel.

The Likely Rise of Domestic Travel

"This summer, we won't be on our balconies, and the beauty of Italy won't remain under quarantine. We will be able to go to the sea, to the mountains, to enjoy our cities. And it would be nice if Italians spent their vacations in Italy, even if we'll do it in a different way, with regulations and caution," Prime Minister Giuseppe Conte told Italian newspaper " Il Corriere Della Sera ."

Italians typically take off all or most of August. Still, with so many workers just starting to return from furlough, there are worries that they may have to give up or dramatically shorten their summer holidays. De Bonis, for one, is skeptical about a rise in domestic travel due to the economic hardship that so many Italians are now facing.

Still, Italians have always been big proponents of domestic travel, with city dwellers flocking to the beaches of Puglia, Tuscany, Sardinia, Sicily, to the northern lakes region, or mountains like the Dolomites and the Alps. With fewer international tourists, Italians may be more eager to revisit places like the Amalfi Coast and Capri, which have struggled with overtourism in recent years. Whereas in the past, it was almost impossible to find a hotel room available at the last minute in Capri, now travelers will likely be guaranteed to find availability, and perhaps discounts too.

Courtesy of Leading Hotels of the World

Francesca Tozzi, the general manager of the Capri Tiberio Palace , a member of Leading Hotels of the World, is hopeful that Italians will return to the island this summer. She’s preparing to reopen the hotel in June with enhanced sanitation procedures and social distancing measures in place. She expects to see around 30 percent occupancy, which will make it easier to isolate guests by alternating floors, leaving more space between the tables in the restaurant, and spacing out the lounge chairs by the pool. She and her colleagues at other top hotels in Capri and on the Amalfi Coast are coordinating their reopening dates to send a message of unity and readiness to receive guests.

“It is important to note that for Leading Hotels, Italian travelers are the second largest market for Italy. Our hotels will be well-positioned to capture the domestic drive-market demand that we expect will be significant as the shelter in place restrictions are lifted,” says Knapp, adding that web traffic to the Italian hotel pages on LHW.com is similar this May as it was last May, indicating a continued interest in traveling to Italy.

A European Travel Bubble?

Similar to the Trans-Tasman bubble between Australia and New Zealand , Europe might develop a bubble—or several—of its own. The European Commission has been working to find solutions for member countries, which might reopen travel to each other before opening up to the rest of the world. The U.K. and France have already lifted quarantine restrictions on each other, and additional so-called “corona corridors” are under negotiations. Greece, Cyprus, and Israel are working on a deal that would exempt citizens of each country from quarantining when traveling to the two other countries. According to the Daily Beast , “Malta and Italy have also expressed interest in finding a third travel partner with which to share freedoms—and tourist dollars—with the most likely partner Spain, which, like Italy, has a lot to lose if the pandemic comes back.”

Such travel bubbles would likely exclude Americans and other non-Europeans. It remains to be seen how long Americans will have to wait before being permitted to enter Italy. Of course, given the growing number of coronavirus cases and economic suffering in the U.S., Italians like De Bonis and Tozzi don’t expect to see many American tourists coming to Italy before 2021, even if they legally can.

A More Sustainable Future?

Pre-coronavirus pandemic, some of Italy’s most overtouristed destinations had already started taking steps to regulate the crowds that descend every summer. Venice announced it would be instituting a day-tripper tariff and is now considering capping the number of daily visitors, according to Forbes . Capri banned single-use plastic last spring in an effort to curb the amount of trash left by the 20,000 tourists per day who normally visit in the summer. Fed up with unprepared tourists who need to be rescued while hiking the trails of the Cinque Terre, the local authorities announced steep fines for anyone entering the parks without proper footwear last March. Now, these destinations are getting a much-needed break.

"Sustainability has to be part of the new normal for the future," says De Bonis. "By that, I mean tourism that produces something and improves the destination." He, and many others who work in the tourism industry, would love to see the end of mass tourism.

"Isn't it better to go to Venice and see canals clean?" adds Gregory Miller, executive director for the Center for Responsible Travel (CREST). "It is possible. But you can't just go back to the hundreds of thousands of people that visit in a day and the level of pollution that will occur." He and De Bonis believe Italy needs to pivot toward quality over quantity when it comes to tourism. Rather than having 30,000 visitors per day at the Vatican Museums, for example, De Bonis suggests having 10,000. "They might pay a higher ticket price because the Vatican is the Vatican—it's a magical place, completely unique. People come to Italy to visit the Vatican, and they visit it once in their life."

Concrete plans have yet to emerge, but hopefully, policymakers and those who work in the tourism industry will use this time to formulate a more sustainable model for travel post-pandemic . “How will we re-emerge? This is the most difficult moment, but it’s the moment that will project us into the future,” De Bonis says. “When everything starts again, there will be a Renaissance. We will come out stronger, more prepared, and we will rebuild.”

European Commission. " Coronavirus: Commission invites Member States to extend restriction on non-essential travel to the EU until 15 June ." May 8, 2020

World Health Organization. " Coronavirus disease (COVID-19) Situation Report - 114 ." May 13, 2020

Statista Research Department. " Total contribution as a share of GDP of the tourism industry in Italy from 2014 to 2029 ." Feb. 5, 2020

Where to Go in 2023: The Most Exciting Destinations to Explore This Year

The Future of Tourism in New Zealand

Everyone's Going to Europe This Summer—But Here's How You Can Beat the Crowds

The COVID-19 Pandemic Has Cost the Travel Industry $320 Billion Dollars

These Countries Are Allowing Vaccinated Travelers to Visit

Travel to Europe: A Reopening Timeline, Country by Country

How Hotels and Home-Exchange Services Will Adapt to a Post-Pandemic Reality

Hotels Across the World are Being Repurposed to Help Fight the Pandemic

10 Travel Trends We're Looking Forward to in 2021

Morocco Reopens Its Borders to Citizens of 67 Countries, Including the U.S.

Bali and Thailand Plan on Fully Reopening to Tourists by July

Travel to North America: A Reopening Timeline, Country by Country

Is Thailand Ready to Reopen Its Borders to Tourists?

Travel to Africa and the Middle East: A Reopening Timeline, Country by Country

Se hai scelto di non accettare i cookie di profilazione e tracciamento, puoi aderire all’abbonamento "Consentless" a un costo molto accessibile, oppure scegliere un altro abbonamento per accedere ad ANSA.it.

Ti invitiamo a leggere le Condizioni Generali di Servizio , la Cookie Policy e l' Informativa Privacy .

Accesso Consentless

Puoi leggere tutti i titoli di ANSA.it e 10 contenuti ogni 30 giorni a €16,99/anno

- Servizio equivalente a quello accessibile prestando il consenso ai cookie di profilazione pubblicitaria e tracciamento

- Durata annuale (senza rinnovo automatico)

- Un pop-up ti avvertirà che hai raggiunto i contenuti consentiti in 30 giorni (potrai continuare a vedere tutti i titoli del sito, ma per aprire altri contenuti dovrai attendere il successivo periodo di 30 giorni)

- Pubblicità presente ma non profilata o gestibile mediante il pannello delle preferenze

- Iscrizione alle Newsletter tematiche curate dalle redazioni ANSA.

Per accedere senza limiti a tutti i contenuti di ANSA.it

Scegli il piano di abbonamento più adatto alle tue esigenze.

Se hai cambiato idea e non ti vuoi abbonare, puoi sempre esprimere il tuo consenso ai cookie di profilazione e tracciamento per leggere tutti i titoli di ANSA.it e 10 contenuti ogni 30 giorni (servizio base):

Se accetti tutti i cookie di profilazione pubblicitaria e di tracciamento, noi e 750 terze parti selezionate utilizzeremo cookie e tecnologie simili per raccogliere ed elaborare i tuoi dati personali e fornirti annunci e contenuti personalizzati, valutare l’interazione con annunci e contenuti, effettuare ricerche di mercato, migliorare i prodotti e i servizi.Per maggiori informazioni accedi alla Cookie Policy e all' Informativa Privacy .

Per maggiori informazioni sui servizi di ANSA.it, puoi consultare le nostre risposte alle domande più frequenti , oppure contattarci inviando una mail a [email protected] o telefonando al numero verde 800 938 881. Il servizio di assistenza clienti è attivo dal lunedì al venerdì dalle ore 09.00 alle ore 18:30, il sabato dalle ore 09:00 alle ore 14:00.

- ANSA English

- ANSA Europa-UE

- ANSA NuovaEuropa

- ANSA America Latina

- ANSA Brasil

- ANSA China 中国

- Ansa Corporate

- Climate crisis

- General News

- Science & Tecnology

- Arts Culture and Style

- Fashion & Luxury

- Food & Wine

- All Lifestyle news

International websites

Italian tourism set for bumper summer - report

- Link copiato

ROME , 31 May 2024, 11:08

ANSA English Desk

- ALL RIGHTS RESERVED

Italy's tourism sector is set to have a bumper summer, with visitors forecast to have 216 million overnight stays at official accommodation facilities between June and August, an increase of 1.5% on last summer, according to a survey by Florence's Tourism Study Centre (Centro Studi Turistici) for the Assoturismo Confesercenti association. The report said foreign visitors will account for 105 million of those overnight stays, a rise of 2.5% on last year. It added the overnight stays in Italy were up by 3.8% in the first five months of 2024 compared to the same period last year.

ALL RIGHTS RESERVED © Copyright ANSA

Not to be missed

- {{prevPageLabel}}

- {{nextPageLabel}}

Latest news

Tennis: Sinner through to last 16 at French Open

Three young people missing due to flooding in friuli, soccer: fagioli call-up is technical choice - spalletti, salis says 'still in the pit', cbs report on us-italy refugee deal 'misleading' - govt, us trying to use courts to stop trump says salvini, gossip is women's stuff, pope reportedly said, border controls for g7 from 5 to 18/6 - interior min.

Share Article

- Print article

Osaka Expo's mascot Italia-chan debuts at design week

Milan Fashion Week

Soccer in Italy

Tractor protests in Italy

Sanremo Song Festival

Christmas in Italy

Augusto Barbera elected head of Italy's Constitutional Court

Nativity Scene and Christmas Tree in St Peter's Square

Meloni briefs Lower House ahead of European Council in Brussels

Extinction Rebellion dye canals and rivers green in Venice, Milan, Rome, Turin and Bologna

ANSA Newsletter

All of Today’s headlines, the news that matters selected for you.

ANSA News Choose the information from ANSA.it

Subscribe to read all ANSA.it news without limits

ANSA Corporate

If it is news, it is an ANSA .

We have been collecting, publishing and distributing journalistic information since 1945 with offices in Italy and around the world. Learn more about our services.

Stay connected

The Tourism Industry

- Introduction

Priority actions for promoting Italian tourism

Our analysis of the Italian tourism industry shows a picture of a sector of great potential, but which is struggling to realise that potential to the full.

Over the last sixty years, tourism has witnessed changes and developments of inconceivable proportions, polarising into two extremes :

- on the one hand, there are “all-inclusive” offers (resorts, major hotels, cruises) and artificial oases that are walled off and strictly controlled (large theme parks), which cater to the need for escape from the daily routine into a risk-free dreamworld of high quality, without contact with the local reality—a.k.a. mass tourism;

- on the other, there is travel in search of authentic experiences and excitement, involving only a minimum of organisation, in which direct contact with local populations and immersion in nature and the environment are favoured—a.k.a. experiential travel.

These two extremes are linked by a number of essential elements, including a focus on the quality of facilities and services offered, on the localities and the experience in general and the importance of time, which is limited, concentrated and not to be wasted.

Positioning of Italy

Italy ranks in top place among the countries most aspired to by travellers , but drops in the rankings when it comes to actual numbers. Italy ranks fifth in the world by number of international arrivals, with around 50 million tourists , and sixth in terms of tourist spending, equal to approximately $46 billion.

In the conviction that tourists would continue to visit Italy, attracted by the renown of its past, we have stopped investing in the present, a decision that is estimated to have cost the country in recent years around 2 per cent of GDP and 3 per cent of jobs.

Yet we are talking about the country with the greatest number of UNESCO World Heritage sites (51) , the country with the greatest number of hotel rooms in Europe and the Mediterranean country with greatest number of cruise-ship visitors.

The world scenario in which Italy as a tourist destination competes has changed profoundly in recent decades:

- the staggering expansion of new communication technologies has radically transformed supply and demand (on-line bookings and reviews, the sharing economy, etc.)

- the geographical tourist map has changed completely, shaped by the entry onto the international scene of countries that until recently were excluded from the tourist circuit, but which today are important sources of demand and strong competitors to more mature economies.

Italy does not appear to have fully adapted to these major transformations and has continued to lose market share over the last twenty years . Although the trend has affected all of the country’s most direct European competitors - France, Germany, the United Kingdom and Spain - it cannot be ignored that Italy has been affected by it much more strongly.

In 2015, Italy ranked eighth in the World Travel & Tourism Competitiveness Index prepared by the World Economic Forum, trailing Spain in first place, France in second, Germany in third and the United Kingdom in fifth. It is above all contextual factors that mostly affect the country’s ability to attract tourist flows.

There is a lack of key infrastructure, such as airports, ports and high-speed rail, but also poor maintenance of the territory , hydro-geological instability, urban decay, the perception of high crime rates in cities, low levels of local public services and the inadequacy of digital infrastructure .

Issues for the sector

Besides the strong resistance that the general economic system appears to show towards enabling tourism to grow in line with the country’s potential, other major issues exist that are specific to the sector:

- the quality of accommodation, with capacity spread equally between hotels and other accommodation, is on average not very high. The majority of hotel rooms continue to be concentrated most of all in three-star establishments (43.1%), whereas the number of luxury and superior luxury hotel rooms is negligible (3.1%). Other accommodation is characterised by the widespread presence of the informal economy

- the average size of hotels is still quite small (average 33 rooms per establishment vs. 37 in France and 47 in Spain)

- only 4 per cent of hotels belong to a hotel chain, compared to 11 per cent in Germany, 23 per cent in France, 28 per cent in Spain and 40 per cent in the U.K.

- the number of facilities advertising on the Internet is still insufficient (88.5%) and even fewer establishments permit on-line bookings (68.3%). As few as 52.8% of Italian hotels offer free Wi-Fi to their guests.

Accommodation services thus appear to cater inadequately to new tourists, who focus increasing attention on quality and sustainability:

- employment rates at Italian accommodation facilities are dropping and are among the lowest in Europe (net 40% employment rate in Italian hotels vs. 46% in France, 48% in the United Kingdom and as much as 56% in Spain)

- demand continues to be very much seasonal, with booking rates at establishments reaching 64 per cent in August, but dropping below 20 per cent in the months of January, February, November and December.

While an overhaul of accommodation services is largely needed, there has been a worrying drop in the investment capacity of establishments. Yet an analysis conducted of hotels’ financial accounts clearly shows that the capacity to invest has been the key to overcoming the crisis that since 2008 has heavily penalised the sector.

All this is accompanied by complicated governance and a regulatory and administrative framework that is highly contradictory and unstable (over the last ten years, the organisational approach to the central administration of the tourism sector, today the responsibility of the Ministry of Cultural Heritage and Activities, has changed six times).

The weakness of the Italian tourism industry emerges all the more when the focus is restricted to southern regions only . The South of Italy does not appear at all able to exploit the immense artistic, historical, cultural, natural and environmental heritage that it has. Accommodation services consist mostly of second homes and continues to cater overwhelmingly to beach tourists, a segment that is mature, of low added value and subject to strong competition from other countries with Mediterranean coasts.

Relaunching the sector

It thus appears that a turn towards greater quality can no longer be put off, through efforts involving all stakeholders in the Italian tourism industry and with special attention focused on the country’s south, which potentially represents an asset of great importance for the tourism sector of the country as a whole. To achieve this goal, the priority actions identified include:

- a national strategy that goes beyond the association of tourism and culture to embrace the industrial side of tourism

- the rationalisation of the sector’s governance, with a view to promoting greater coordination between various sectors and the many institutional levels involved in the management of the tourism industry

- boosting investment for the benefit of enterprise and to enhance tourist destinations and new tourist products

- the consolidation of accommodation services through various forms of business combination, including the creation of large groups and chains but also looser forms of collaboration for smaller establishments (consortia, associations, voluntary chains)

- the promotion of specific investments in the more dynamic segments of contemporary tourism (bicycle tourism, wellness, cruises, conventions, theme parks).

- News Releases

Tourism is Back to Pre-Pandemic Levels, but Challenges Remain

World Economic Forum, [email protected]

عربي | 日本語 | 中文 | Deutsch | Español | Français | Português

- High-income economies in Europe and Asia-Pacific continue to lead the World Economic Forum Travel and Tourism Index, with the United States, Spain and Japan topping the rankings again.

- Despite post-pandemic growth, the global tourism sector still faces complex challenges, with recovery varied by region; only marginal overall score improvements since the 2021 edition.

- Developing economies are making strides – who account for 52 out of 71 economies improving since 2019 – but significant investment is needed to bridge gaps and increase market share.

- Read the report here .

New York, USA, 21 May 2024 – International tourist arrivals and the travel and tourism sector’s contribution to global GDP are expected to return to pre-pandemic levels this year, driven by the lifting of COVID-19-related travel restrictions and strong pent-up demand, as per the new World Economic Forum travel and tourism study, released today.

Topping the 2024 list of economies are the United States, Spain, Japan, France and Australia. The Middle East had the highest recovery rates in international tourist arrivals (20% above the 2019 level), while Europe, Africa and the Americas all showed a strong recovery of around 90% in 2023.

These are some of the top findings of the Travel & Tourism Development Index 2024 (TTDI) , a biennial report published in collaboration with the University of Surrey, which analyses the travel and tourism sectors of 119 countries around a range of factors and policies.

“This year marks a turning point for the travel and tourism sector, which we know has the capacity to unlock growth and serve communities through economic and social transformation,” said Francisco Betti, Head of the Global Industries team at the World Economic Forum. “The TTDI offers a forward-looking window into the current and future state of travel and tourism for leaders to navigate the latest trends in this complex sector and sustainably unlock its potential for communities and countries across the world.”

Post-pandemic recovery

The global tourism industry is expected to recover from the lows of the COVID-19 pandemic and surpass the levels seen before the crisis. This is largely being driven by a significant increase in demand worldwide, which has coincided with more available flights, better international openness, and increased interest and investment in natural and cultural attractions.

However, the global recovery has been mixed. While 71 of the 119 ranked economies increased their scores since 2019, the average index score is just 0.7% above pre-pandemic levels.

Although the sector has moved past the shock of the global health crisis, it continues to deal with other external challenges, from growing macroeconomic, geopolitical and environmental risks, to increased scrutiny of its sustainability practices and the impact of new digital technologies, such as big data and artificial intelligence. In addition, labour shortages are ongoing, and air route capacity, capital investment, productivity and other sector supply factors have not kept up with the increase in demand. This imbalance, worsened by global inflation, has increased prices and service issues.

TTDI 2024 highlights Out of the top 30 index scorers in 2024, 26 are high-income economies, 19 are based in Europe, seven are in Asia-Pacific, three are in the Americas and one (the United Arab Emirates) is in the Middle East and North Africa region (MENA). The top 10 countries in the 2024 edition are the United States, Spain, Japan, France, Australia, Germany, the United Kingdom, China, Italy and Switzerland.

The results highlight that high-income economies generally continue to have more favourable conditions for travel and tourism development. This is helped by conducive business environments, dynamic labour markets, open travel policies, strong transport and tourism infrastructure, and well-developed natural, cultural and non-leisure attractions.

Nevertheless, developing countries have seen some of the greatest improvements in recent years. Among the upper-middle-income economies, China has cemented its ranking in the top 10; major emerging travel and tourism destinations of Indonesia, Brazil and Türkiye have joined China in the top quartile of the rankings. More broadly, low- to upper-middle-income economies account for over 70% of countries that have improved their scores since 2019, while MENA and sub-Saharan Africa are among the most improved regions. Saudi Arabia and the UAE are the only high-income economies to rank among the top 10 most improved economies between 2019 and 2024.

Despite these strides, the TTDI warns that significant investment is needed to close gaps in enabling conditions and market share between developing and high-income countries. One possible pathway to help achieve this would be sustainably leveraging natural and cultural assets – which are less correlated with country income level than other factors – and can offer developing economies an opportunity for tourism-led economic development.

“It’s essential to bridge the divide between differing economies’ ability to build a strong environment for their travel and tourism sector to thrive,” said Iis Tussyadiah, Professor and Head of the School of Hospitality and Tourism Management at the University of Surrey. “The sector has big potential to foster prosperity and mitigate global risks, but that potential can only be fully realized through a strategic and inclusive approach.”

Mitigating future global challenges

According to the World Economic Forum’s 2024 Global Risks Report, the travel and tourism sector faces various complex risks , including geopolitical uncertainties, economic fluctuations, inflation and extreme weather. Balancing growth with sustainability also remains a major problem, due to high seasonality, overcrowding, and a likely return of pre-pandemic emissions levels. The report also analyses persistent concerns about equity and inclusion. While the tourism sector offers a major source of relatively high-wage jobs, particularly in developing countries, gender parity remains a major issue for regions such as MENA and South Asia.

Despite these challenges, the sector can play a significant role in addressing them. To achieve this, decision-makers should prioritize actions such as leveraging tourism for nature conservation efforts; investing in skilled, inclusive and resilient workforces; strategically managing visitor behaviour and infrastructure development; encouraging cultural exchange between visitors and local communities; and using the sector to bridge the digital divide, among other policies.

If managed strategically, the travel and tourism sector – which has historically represented 10% of global GDP and employment – has the potential to emerge as a key contributor to the well-being and prosperity of communities worldwide.

About the Travel and Tourism Development Index 2024

The 2024 edition of the TTDI includes several improvements based on newly available data and recently developed indicators on the environmental and social impact of travel and tourism. The changes made to the 2024 Index limit its comparability to the previously published TTDI 2021. This year's report includes recalculated 2019 and 2021 results, using new adjustments. TTDI 2024 reflects the latest available data at the time of collection – end of 2023. The TTDI is part of the Forum’s broader work with industry communities actively working to build a better future enabled by sustainable, inclusive, and resilient industry ecosystems.

Notes to editors

Read the Forum Agenda also in Spanish | Mandarin | Japanese Learn about the Forum’s impact Check out the Forum’s Strategic Intelligence Platform and Transformation Maps Follow the Forum on social media: @wef | Instagram | LinkedIn | Facebook | TikTok | Weibo | Threads | WhatsApp Watch Forum videos at wef.ch/videos | YouTube Get Forum podcasts at wef.ch/podcasts | YouTube Subscribe to Forum news releases

The rebirth of tourism in Italy’s Art Cities

2023 marked an important turning point for tourism in Italy’s art cities. According to the Centre for Tourism Studies in Florence, the year ended with a return to pre-Covid levels, recording 445.3 million stays in accommodation facilities, an increase of 8.1% compared to 2022. The hotel segment saw significant growth of 9.3%, while the non-hotel segment experienced a more gradual recovery. Italian art cities recorded an online accommodation booking rate of 38.9%, ranking first in the European Union, ahead of countries such as Greece, France and Spain, and welcoming tourists mainly from the United States and the United Kingdom.

Ten must-visit art cities

Italy’s art cities continue to be a favourite destination for travellers from all over the world. Not only do they preserve centuries of history and art, but they can also be easily accessed thanks to the rail connections offered by Trenitalia. So what are the ten unmissable art cities? We discover them together with True Italian Experience, a hub offering travel experiences designed to capture Italy’s most authentic essence.

World-renowned as the city of Romeo and Juliet, Verona offers a romantic atmosphere framed by medieval and Renaissance architecture. Its Roman amphitheatre, the Arena, still hosts internationally renowned opera performances, attracting music fans from all over the world.

The fashion and design capital, Milan is a dynamic, modern city that is also rich in history and art. Milan Cathedral, with its impressive Gothic spires, and Leonardo da Vinci’s ‘Last Supper’, conserved in the convent of Santa Maria delle Grazie, are just some of the treasures on offer in this metropolis.

In addition to its famous Leaning Tower, Pisa boasts the extraordinary Piazza dei Miracoli, home to the Baptistery and the Cathedral, splendid examples of Romanesque architecture. It is also a vibrant university city with a history intertwined with scientific and cultural progress.

With its unforgettable waterfront and bustling atmosphere, Naples is a treasure trove of art, history and gastronomy. The city is a crossroads of civilisations that has left a legacy of historical monuments, such as the Castel dell’Ovo and the National Archaeological Museum, which houses some of the world’s most important collections of ancient art.

Unique in the world, Venice is famous for its picturesque canals, gondolas and extraordinary architecture. St Mark’s Basilica and the Doge’s Palace testify to the Venetian Republic’s glorious past, while the Lido offers some tranquillity with a sea view.

The birthplace of the Renaissance, Florence is an open-air museum with masterpieces by artists such as Michelangelo, Leonardo and Botticelli. The magnificent Cathedral of Santa Maria del Fiore, with its Brunelleschi dome, dominates the skyline, while the Uffizi Gallery houses some of the world’s most famous works of art.

Once a powerful maritime republic, Genoa preserves incredible heritage in its maze of alleyways. The historical centre is one of the largest in Europe, culminating in splendid Renaissance buildings along the ‘Strade Nuove’, a UNESCO World Heritage Site.

Siena is world-famous for its ‘Palio’, a horse race held in the Piazza del Campo, the city’s shell-shaped heart. This Tuscan city is renowned for its medieval architecture, the Cathedral of Santa Maria Assunta, and the Palazzo Pubblico, which houses the Museo Civico with works of art from the 14th and 15th centuries.

Turin , the elegant capital of Piedmont, is a mix of Baroque architecture, Art Nouveau and modernism. It is home to the Egyptian Museum, one of the most important in the world. The Royal Palace and the Mole Antonelliana, the city’s symbol, are other iconic landmarks that tell the story of Turin’s political and cultural importance in Italy.

The capital of Italy is truly a stage for living history. From its ancient monuments such as the Colosseum and the Pantheon to its Baroque squares and the works in the Vatican, Rome offers a journey through different eras, making it one of the world’s most fascinating cities.

Extensive connections to art cities by train

Italy’s art cities are not only known for their beauty and cultural richness, but also for often being chaotic and busy. Getting around by car is complicated, and finding a parking space can be a challenge. This is why tourists increasingly choose to travel by public transport, and to reach Italian cities by train. This is a convenient and fast solution thanks to the extensive network of connections offered by Trenitalia, True Italian Experience’s main partner. Convenience and sustainability are also combined with affordability thanks to various promotions intended to make train travel even more accessible: the most attractive offers include the Trenitalia pass for foreign citizens wishing to visit Italy on board Frecce, FrecciaLink, Intercity, Intercity Notte and EuroCity Italia-Svizzera on Italy’s domestic routes, and Italia in Tour , a perfect option for those who want to explore different cities in a short time frame, enjoying unlimited travel for 3 or 5 consecutive days on all Trenitalia’s Regionale trains. Constantly alert to the evolution of tourism and to travellers’ needs, the Passenger Business Unit of the Italian State Railways Group therefore continues to be a point of reference for those wishing to discover art cities in a comfortable and sustainable way. This is also the mission of True Italian Experience, whose main partner is Trenitalia.

Hong Kong Convention Ambassadors of 12 sectors celebrate securing 70 conventions

VisitBritain activity boosts economy by £1.26 billion

Over 260 applications from 60+ countries: Best Tourism Villages 2024 adventure kicks…

Escape the Everyday with WeRoad’s Unbeatable Bank Holiday Deals

Since you're here...

...there are many ways you can work with us to advertise your company and connect to your customers. Our team can help you design and create an advertising campaign

We can also organize a real life or digital event for you and find thought leader speakers as well as industry leaders, who could be your potential partners, to join the event. We also run some awards programmes which give you an opportunity to be recognized for your achievements during the year and you can join this as a participant or a sponsor.

Let us help you drive your business forward with a good partnership!

Yes, contact me I want to download the media kit

Comments are closed.

LATEST STORIES

Radisson Hotel Group debuts in Bihar; signs 120-room Radisson Hotel Patna

Cathay Holidays, a one-stop travel hub for premium experiences

Nujuma, Ritz-Carlton Reserve opens in ME with 63 villas in an exclusive private island oasis in the Red Sea, Saudi Arabia

Jumeirah Jabal Omar Makkah opens with 1,121 keys in Saudi Arabia

Welcome, Login to your account.

Sign in with Google

Powered by wp-glogin.com

Recover your password.

A password will be e-mailed to you.

Welcome back, Log in to your account.

SIGN UP FOR FREE

Be part of our community of seasoned travel and hospitality industry professionals from all over the world.

- LOGIN / SIGN UP

- Middle East

- UK & Europe

- USA & Canada

- Hospitality

- HR & Careers

- Luxury Travel

- MICE (Meetings, Incentives, Conferencing, Exhibitions)

- Travel Tech

- Travel Agents

- Airlines / Airports

- Conferences

- Cruising (Ocean)

- Cruising (River)

- Destination Management (DMC)

- Hotels & Resorts

- Hotel Management Company

- Hotel Technology

- HR / Appointments

- Meetings, Incentives, Conferencing, Exhibitions (MICE)

- Travel Agents (all)

- Travel Technology

- Tourism Boards

- Industry appointments

- Travel Bloggers

- Podcasts – Features

- How to join

- RSVP Portal

- Event Photos/Videos

- Competitions

- TDM Travel Show

- Middle East September 2024

- Thailand October 2024

- Destination NaJomtien BanAmphur BangSaray *NEW*

- จุดหมายปลายทาง นาจอมเทียน หาดบ้านอำเภอ บางเสร่ *NEW*

- South Australia Reward Wonders *NEW*

- Ponant Yacht Cruises and Expeditions

- Encore Tickets (Chinese Guide)

- Affordable Luxury in Thailand by Centara Hotels

- Rising Above the Oridinary by Conrad Bangkok

- The Best of Thailand

- Who is IWTA

- Philippines

- Recommend Someone

- Recommend yourself

- IWTA Awards

- TRAVEL CLUB

The state of tourism and hospitality 2024

Tourism and hospitality are on a journey of disruption. Shifting source markets and destinations, growing demand for experiential and luxury travel, and innovative business strategies are all combining to dramatically alter the industry landscape. Given this momentous change, it’s important for stakeholders to consider and strategize on four major themes:

- The bulk of travel is close to home. Although international travel might draw headlines, stakeholders shouldn’t neglect the big opportunities in their backyards. Domestic travel still represents the bulk of travel spending, and intraregional tourism is on the rise.

- Consumers increasingly prioritize travel—when it’s on their own terms. Interest in travel is booming, but travelers are no longer content with a one-size-fits-all experience. Individual personalization might not always be practical, but savvy industry players can use segmentation and hypothesis-driven testing to improve their value propositions. Those that fail to articulate target customer segments and adapt their offerings accordingly risk getting left behind.

- The face of luxury travel is changing. Demand for luxury tourism and hospitality is expected to grow faster than any other travel segment today—particularly in Asia. It’s crucial to understand that luxury travelers don’t make up a monolith. Segmenting by age, nationality, and net worth can reveal varied and evolving preferences and behaviors.

- As tourism grows, destinations will need to prepare to mitigate overcrowding. Destinations need to be ready to handle the large tourist flows of tomorrow. Now is the time for stakeholders to plan, develop, and invest in mitigation strategies. Equipped with accurate assessments of carrying capacities and enhanced abilities to gather and analyze data, destinations can improve their transportation and infrastructure, build tourism-ready workforces, and preserve their natural and cultural heritages.

Now boarding: Faces, places, and trends shaping tourism in 2024

Global travel is back and buzzing. The amount of travel fell by 75 percent in 2020; however, travel is on its way to a full recovery by the end of 2024. More regional trips, an emerging population of new travelers, and a fresh set of destinations are powering steady spending in tourism.

There’s no doubt that people still love to travel and will continue to seek new experiences in new places. But where will travelers come from, and where will they go?

We share a snapshot of current traveler flows, along with estimates for growth through 2030.

The way we travel now

Which trends are shaping traveler sentiment now? What sorts of journeys do today’s travelers dream about? How much are they willing to spend on their trips? And what should industry stakeholders do to adapt to the traveler psychology of the moment?

To gauge what’s on the minds of present-day travelers, we surveyed more than 5,000 of them. The findings reveal disparate desires, generational divides, and a newly emerging set of traveler archetypes.

Updating perceptions about today’s luxury traveler

Demand for luxury tourism and hospitality is expected to grow faster than for any other segment. This growth is being powered in part by a large and expanding base of aspiring luxury travelers with net worths between $100,000 and $1 million, many of whom are younger and increasingly willing to spend larger shares of their wealth on upscale travel options. The increase is also a result of rising wealth levels in Asia.

We dug deeper into this ongoing evolution by surveying luxury travelers around the globe about their preferences, plans, and expectations. Some widely held notions about luxury travelers—such as how much money they have, how old they are, and where they come from—could be due for reexamination.

Destination readiness: Preparing for the tourist flows of tomorrow

As global tourism grows, it will be crucial for destinations to be ready. How can the tourism ecosystem prepare to host unprecedented volumes of visitors while managing the challenges that can accompany this success? A large flow of tourists, if not carefully channeled, can encumber infrastructure, harm natural and cultural attractions, and frustrate locals and visitors alike.