TD Business Travel Visa* Card review

- Rates & Fees

- Eligibility

9 Earn 9 TD Rewards Points for every $1 you spend using ExpediaForTD.com

6 Earn 6 TD Rewards points for every $1 in foreign currency purchases and at restaurants and on recurring bills

2 Earn 2 TD Rewards Points for every $1 spent on all other purchases.

50% Earn 50% more TD Rewards Points at Starbucks when you link your card with your Starbucks account.

19.99% Purchase APR

22.99% Cash Advance APR

$149 Annual Fee Waived in the first year. Additional cards: $49

2.50% Foreign Transaction Fee Earn 6 TD Rewards Points for every $1 on Foreign Currency purchases

Very Good Recommended Credit Score

By Tyler Wade & Cory Santos

Updated: May 07, 2024

Play article

( mins)

( )

Quick Overview of the TD Business Travel Visa* Card

The TD Business Travel Visa* Card is a powerhouse for Canadian businesses, especially if you love to (or have to) travel. With a slew of benefits, from high rewards rates on Expedia bookings to comprehensive insurance coverage, it's a card that demands attention.

Who's the TD Business Travel Visa* Card for?

The TD Business Travel Visa* Card is ideal for Canadian businesses that frequently travel. Whether you're a small business owner or a corporate executive, the card offers a range of benefits that can enhance your travel experience. From the high rewards rates on Expedia bookings to the comprehensive insurance coverage, the TD Business Travel Visa* Card is designed to meet business travel needs and provide cardholders with peace of mind while on the go.

Pros and cons

High rewards rate : Earn up to 9 TD Rewards Points per $1 on travel bookings through ExpediaForTD.com.

Flexible redemption : No blackout dates or seat restrictions.

Comprehensive insurance : From travel medical to car rental coverage.

Special offers : Lucrative welcome bonuses and limited-time offers.

Annual fee : A $149 annual fee, though it's rebated in the first year.

TD Business Travel Visa* Card welcome bonus

Before June 3, 2024, new cardholders can earn a whopping 175,000 TD Rewards Points, equivalent to a travel value of up to $875 when booked through ExpediaForTD.com.

- Welcome Bonus of 30,000 TD Rewards Points upon the first purchase.

- Earn up to 120,000 TD Rewards Points when spending $2,500 each month for the first 12 months.

- Earn up to 25,000 TD Rewards Points by setting up new regularly recurring bill payments (maximum two).

- You can earn 30,000 more rewards by becoming a TD Small Business Banking customer when you open an Every Day Business Plan (A, B, C, or TD Unlimited Business Plan between now and October 31, 2023.

- And another 30,000 TD Rewards points if you’re approved for the TD Business Travel Visa* Card within 120 days of opening a new Business Chequing Account and process at least one transaction within the first 90 days.

- Full Annual Fee rebate for the Primary Cardholder and first two additional cardholders for the first year (a value of up to $247). Total value of $1,240.

- Plus, TD is throwing in a 12-month Uber One membership ($120 value).

How to earn TD Rewards points with the TD Business Travel Visa* credit card

Despite the $149 annual fee, the TD Business Travel Visa* Card is a lucrative travel rewards powerhouse that provides companies with impressive rewards in a wide variety of critical business travel categories. This card shines with its earn rates:

- 9 TD Rewards Points for every dollar spent on ExpediaForTD.com bookings.

- 6 TD Rewards Points for every $1 spent on foreign currency purchases, restaurant expenses and recurring bill payments.

- 2 TD Rewards Points for every $1 spent on all other eligible business purchases.

The easiest way to redeem TD Rewards is through eligible travel bookings through Expedia for TD. Business Travel Visa account managers can use TD Rewards points towards "Book Any Way" travel bookings through Expedia for TD or opt to use points for statement credits and education credits or to purchase gift cards or merchandise.

TD Business Travel Visa* Card key benefits

The TD Business Travel Visa* Card offers a range of key benefits that make it an excellent choice for frequent travelers. With this card, you can enjoy the convenience of no travel blackouts or seat restrictions, giving you the freedom to book your travel through any agency. Additionally, you have the flexibility to use your points to cover taxes and fees on your travel bookings, making it even more cost-effective. This card truly understands the needs of business travelers and aims to provide them with a seamless and hassle-free experience.

TD Business Travel Visa* Card Insurance coverage

The TD Business Travel Visa* Card offers a robust insurance package:

- Travel medical insurance : Up to $2 million coverage for the first 15 days of your trip.

- Travel accident insurance : Up to $500,000 for covered losses.

- Trip cancellation/interruption : Up to $1,500 per person for cancellations and maximum of $5,000.

- Flight/trip delay insurance : Up to $500 towards hotel and restaurant expenses.

- Lost or stolen baggage : Coverage up to $1,000 per trip.

- Car rental coverage : 48 consecutive days of coverage for auto rental collision/loss damage up to $65,000 MSRP.

- Purchase security : On most items for 90 days from purchase date against loss or damage.

- Extended warranty protection : Automatically extends manufacturer’s warranty.

Extra benefits of the Business Travel Visa* credit card from TD The card also provides a suite of benefits designed to support businesses on business trips, at the office or even when planning a company get-together. Additional features of the TD Business Travel Visa* Card include:

- The Visa SavingsEdge program offers sweet deals to grow your business on brands like Amazon Business, Budget Rent-a-car, Google Ads, Constant Contact, UPS, Zendesk and more.

- Get a free 12-month Uber One membership, valued at $120.

- Get your Starbuck ® fix - earn more at Starbucks ® by linking the card to earn 50% more TD Rewards Points and Stars.

- Save a minimum of 10% on the lowest available base rates in North America with Avis and Budget.

- Redeem your TD Rewards Points towards business purchases at Amazon.ca.

- Access TD Card Management Tool to redistribute available credit among cardholders, set restrictions on spend type, temporarily turn a Card on or off, track employees spending with up to 18 months of business transaction data and more.

How the TD Business Travel Visa* Card compares

The TD Business Travel Visa* Card falls into the travel and foreign transaction category. When considering such cards, it's crucial to compare features, fees and benefits to ensure you're getting the best value.

TD Business Travel Visa* Card Vs TD First Class Travel ® Visa Infinite* Card

These two cards are similar, so what sets them apart? Business perks vs. a focus on travel. The First Class card charges $139 for its annual fee, or $10 less than the Business Travel Visa*. The welcome bonus with Visa Infinite isn’t as enticing at 115,000 TD Rewards points and they charge 20.99% APR vs. 19.99% with the business travel card. On top of that, you earn eight TD Rewards Points, instead of nine, for every $1 in travel purchases. For some good news, both cards’ travel insurance packages are identical.

The TD First Class Travel ® Visa Infinite* also gives you an annual credit of $100 when you book at Expedia for TD. And, because you’re part of the Visa Infinite Benefits program, you’ll get access to 24/7 concierge services, luxury hotel and dining experiences and more. Ultimately, pick the card that best suits your needs.

TD Business Travel Visa* Card vs. TD ® Aeroplan ® Visa* Business Card

The TD ® Aeroplan ® Visa* Business Card’s biggest difference is Aeroplan vs. TD Rewards Points. If you love flying with Air Canada and its partner airlines, want a free first checked bag and access to the Maple Leaf Lounges in North America (though you earn one pass for every $10,000 spent), then this may be a good card for you. It charges a $149 annual fee that you can get waived in the first year. It features the same great insurance benefits, the Visa SavingsEdge program and the TD Card Management Tool. One last difference, the TD® Aeroplan® Visa* Business Card only charges 14.99% interest.

So really, which points program would you rather have?

TD Business Travel Visa* Card Vs.CIBC Aventura ® Visa* Card for Business Plus

Another business card, a different rewards program. CIBC will waive the $120 annual fee in the first year, charge 19.99% APR and has a Visa Spend Clarity for Business to track your spending, customize payment controls and use powerful reporting tools.

Much like the Expedia for TD program, you can book on any airline, every flight, every seat with points that don’t expire with the CIBC Rewards Centre. CIBC’s welcome bonus of 60,000 Aventura points doesn’t seem as strong as TD’s welcome bonus, but the dollar value is about the same (~$1,200).

A significant differentiator is the lack of emergency medical insurance with CIBC.

Is the TD Business Travel Visa worth it?

The TD Business Travel Visa* Card is a strong contender in the best business credit card category. With its massive welcome bonus (that serves as a draw to their banking products), high earn rate, great insurance coverage and business tools (TD Card Management Tool), this card stands up against some of the best. If you like the security of a big bank, a credit card you can confidently give to your employees, and want to unlock some bonuses while travelling, this card is a winner.

TD Business Travel Rewards Visa* eligibility requirements

TD has specific requirements when applying for a business credit card. For starters, the company must be a registered and operating business in Canada. Additionally, the applicant must be a Canadian resident and of the age of majority in their province/territory of residence. While these requirements seem restrictive, it still leaves the door open to freelancers and other small or part-time proprietors to open a business credit card account.

How to switch from TD Business Travel Visa* to regular

Switching your TD business card without losing points is easy. Simply call 1-800-983-8472 and speak with customer service. If you’re switching to Aeroplan though, be sure to use up as many points as possible, even if it’s to help pay off your balance.

Is the annual fee worth it?

Given the card's travel, insurance and business benefits, the $149 annual fee is justified, especially with the first-year rebate. However, it's essential to compare its pros and cons for what your business needs.

Can I use my TD Rewards Points for non-travel expenses?

Yes, you can redeem your TD Rewards Points for purchases at Amazon.ca, retail business merchandise, gift card and even to pay down the account balance.

Tyler Wade has worked in personal finance for over 5 years writing for brands like Ratehub, Forbes, KOHO, and now Money.ca.

Cory Santos is a finance writer, editor and credit card expert with over seven years of experience in personal finance. Formerly an Ontario resident, Cory currently calls sunny South Florida home, helping snowbirds find their ideal credit cards and financial products. Cory joined Wise Publishing from BestCards, with bylines in numerous print and digital publications across North America, including the Miami Herald, St. Louis Post-Dispatch, AOL, MSN, Medium and more. When he isn't scouring for the latest credit card deals and offers, Cory can be found working on his various historical research projects, jogging, or hanging out with his cats, Bentley and Cougar.

Latest Articles

1 in 3 canadians expect boc to drop rates in june, halal investing in canada, women earn less than men, even in retirement, ikea canada launches rbc purchase financing plan, canadians getting scammed in love and money, mastercard and visa to pay class action lawsuit.

The content provided on Money.ca is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter.

Exciting news for TD Rewards members

Members can earn and redeem points on vacation packages, flights, hotels, car rentals and more. Who doesn't like to save?

Sign-in using your existing TD online banking credentials.

The expedia for td program.

It's easier than ever for TD Travel or Rewards credit card holders to find and book their dream vacation on Expedia For TD.

The best part? Not only do you have the flexibility to use your TD Rewards Points to pay for all or part of your trip, but eligible TD credit cards can also earn up to 9 points for every $1 spent on travel purchases 1.

TD First Class Travel Visa Infinite *

- 8 TD Rewards Points per $1 Spent on Travel Purchases at Expedia For TD (Online/ Phone) 1

- Annual $100 TD Travel Credit on your first Eligible Travel Credit purchase of $500 that is made with Expedia For TD 2

- Birthday Bonus - earn up to 10K bonus TD Rewards Points a year (up to $50 value on Expedia For TD) 3,4

- Comprehensive Travel insurance coverage 4

TD Platinum Travel Visa *

- 6 TD Rewards Points per $1 spent on Travel Purchases at Expedia For TD (Online/Phone) 1

- Car Rental Discounts 5,6,7

TD Rewards Visa *

- 4 TD Rewards Points per $1 Spent on Travel Purchases at Expedia For TD (Online/Phone) 1

- Car rental discounts 5,6,7

TD Business Travel Visa *

- 9 TD Rewards Points per $1 when you book travel online, or 6 Points per $1 Spent on travel made by phone through Expedia For TD 1

Not only does Expedia For TD provide you with exclusive deals on travel , but y ou r TD points are worth more when redeeming them and you can earn TD points faster when purchasing travel with your TD credit card. 1,9

Explore with Options

A flight to Las Vegas? How about an all-inclusive stay at a Cancun resort? A house in Banff for a ski trip? All of these are available on Expedia For TD.

No restrictions on adventure

We don't have black-out dates or seat restrictions on flights, 8 which means you're free to book anytime you want.

Redeem and earn points on:

- Flights and packages

- Hotels, vacation rentals, car rental

- Activities and cruises

And you’ll have access to Expedia benefits

Expedia’s Price Guarantee

Find a cheaper Flight + Hotel package within 24 hours of booking or a cheaper hotel rate up to 48 hours before check-in and Expedia will refund the difference. Sign in to find out more.

Save on hotels

Exclusive offers and deals, including up to 20% off hotel stays

Fulltime support

A dedicated customer service team available 24/7 at 1-877-222-6492

How it works

Paying with TD points .

It’s easy to shop for travel: Find your ideal trip and pay with your TD Travel or Rewards Credit Card at checkout. On the billing page, select the amount of TD points you wish to redeem.

200 TD Rewards Points = $1 . .

Every 200 points are worth $1 off travel purchases on Expedia For TD. Redemptions are made in 200-point increments, and travelers need a minimum of 200 points to make a redemption.

Use points for all or part of your trip

For example, if your trip costs $1000, use 120,000 Rewards Points (worth $600). Pay the remainder with your TD credit card and earn up to additional 8 points for every $1 spent 1,9 . That is up to 32k additional points!

Automatic credit for points redeemed

When you purchase travel using TD Rewards Points your TD credit card will be charged the full amount. The dollar value of points redeemed will be credited to your account in 3-5 business days.

Already an eligible TD cardholder?

Use your existing TD online banking credentials to sign in to Expedia For TD and find your perfect trip Sign In

Earn TD Rewards Points on bookings made with your TD Travel Rewards Credit Card and pay with points by redeeming TD Rewards Points towards all or part of your trip. Sign In

Pay for travel and everyday items with your TD Travel Credit Card to earn TD Reward Points. When you're ready, you can redeem TD points to pay for all or part of your trip.

Looking to become a TD travel cardholder?

Learn more about TD’s travel credit cards and choose the one that best matches your spending habits and travel style.

1 TD First Class Travel Cardholders earn eight TD Rewards Points for every dollar spent on travel Purchases made online or by phone through Expedia For TD. TD Platinum Cardholders earn six TD Rewards Points for every dollar spent on travel purchases made online or by phone through Expedia For TD. TD Rewards Cardholders earn four TD Rewards Points for every dollar spent on travel purchases made online or by phone through Expedia For TD. TD Business Travel Cardholders earn 9 TD Rewards Points for every dollar spent on travel purchases made online through Expedia For TD and 6 TD Rewards Points for every dollar spent on travel purchases made by phone through Expedia For TD. Any returned items, refunds, rebates or other similar credits will reduce or cancel the TD Rewards Points earned on the original Travel Purchase. Fees, Cash Advances (including Balance Transfers, Cash-Like Transactions and TD Visa Cheques), interest charges, optional service, refunds, rebates or other similar credits do not earn TD Rewards Points. Other Conditions: Offer may be changed, withdrawn or extended at any time and cannot be combined with any other offer.

2 In order to receive the TD Travel Credit, the Account must be open, active and in Good Standing. An Eligible Travel Credit Purchase means: • A Hotel, Motel, Lodging, or Vacation Rental Purchase of $500.00 CAD or more made with Expedia For TD; • A Vacation Package Purchase of $500.00 CAD or more made with Expedia For TD, that includes a Hotel, Motel, Lodging or Vacation Rental booking packaged with a transportation booking. See your TD Rewards Program Terms and Conditions for more details.

3 Each year, receive a TD Rewards Birthday Bonus (“Birthday Bonus”) equal to 10% of the TD Rewards Points earned while using the TD First Class Travel® Visa Infinite* over the 12 months preceding the Primary Cardholder’s birthday, to a maximum Birthday Bonus of 10,000 TD Rewards Points. For the first year, we will only award the TD Rewards Birthday Bonus based on the TD Rewards Points earned from October 30, 2022, to your next birthday. Previously earned points on other Rewards Cards, Acquisition Bonus Points, or other Promotional Rewards Points earned do not count towards the Birthday Bonus.

4 Insurance coverages are subject to conditions, limitations and exclusions. For more information, (including information on the insurer and/or administrator) please refer to the Certificate of Insurance included with your TD Credit Cardholder Agreement.

5 Rate displayed by Expedia For TD reflects the discounted offer. No discount code needs to be applied.

6 Provided by Avis Rent A Car System ULC. Minimum discount offer subject to discount code and to terms and conditions which may change without notice. Blackout dates may apply. Base rate refers to time and kilometer/mile charges only. Taxes, fees and surcharges are extra. The Toronto-Dominion Bank is not responsible for any vehicles, services, discounts or other offers made available by Avis Rent A Car System ULC.

7 Provided by Budget Rent A Car System, Inc. Minimum discount offer subject to discount code and to terms and conditions which may change without notice. Blackout dates may apply. Base rate refers to time and kilometer/mile charges only. Taxes, fees and surcharges are extra. The Toronto-Dominion Bank is not responsible for any vehicles, services, discounts or other offers made available by Budget Rent A Car System, Inc.

8 Subject to carrier/space availability. 9 Every 200 TD Points redeemed are worth $1 in travel savings off the cost of Travel Purchases made through Expedia For TD. Redemptions can only be made in 200 TD Points increments. * Trademark of Visa International Service Association; Used under license.

Thanks for this great article – I featured it in my weekly round up in “the best of the rest”

Thanks Ross, I really appreciate the support!

Join 3,500 Canadian Subscribers!

Sign up today to learn all about the best cash back and travel rewards credit cards, plus how to maximize your rewards and loyalty programs.

- How to Choose the Right Credit Card

- How to Apply for a Credit Card

- How to Cancel a Credit Card

- Ways To Pay Off Credit Card Debt

- Why Your Credit Card Was Declined

- How to Get Out of Credit Card Debt

- What to Know About Credit Card Minimum Payments

- What Is a Credit Card and Should You Get One?

- How Do Credit Cards Work in Canada?

- What Are the Different Types of Credit Cards?

- How an International Credit Card Works

- Common Credit Card Terms and Conditions

- Credit Card Fees and Charges

- Credit Card Interest Calculator

- First-Time Home Buyer Incentive

- Tax-Free First Home Savings Account

- Home Equity Loan

- How a Reverse Mortgage Works

- Home Equity Line of Credit

- Mortgage Renewal

- Getting a Second Mortgage

- How to Refinance a Mortgage

- How Does Mortgage Interest Work?

- Realtors vs Real Estate Agents vs Brokers

- Is Canada’s Housing Market Crashing?

- Types of Houses in Canada

- First-Time Home Buyer Grants and Assistance Programs

- Types of Mortgages in Canada: Which Is Right for You?

- How Does a Mortgage Work in Canada?

- What Is an Interest Rate?

- Guaranteed Investment Certificate (GIC)

- Savings Account Guide

- Common Canadian Bank Fees and Charges

- Types of Bank Accounts in Canada

- EQ Bank Review

- Simplii Financial Review

- Tangerine Bank Review

- National Bank of Canada Review

- CIBC Review

- Scotiabank Review

- TD Bank Review

- What Is Canadian Investor Protection Fund (CIPF) Coverage?

- How Capital Gains Tax Works

- Investing for Canadian Beginners

- Understanding Asset Classes in Investing

- Understanding Fixed-Income Investments

- How to Invest in Stocks

- What Are T-Bills

- What is a Bond

- What is Registered Disability Savings Plan (RDSP)

- What Are Mutual Funds

- What is an ETF (Exchange Traded Fund)

- What Is Forex Trading

- What Is Cryptocurrency and How Does It Work

- What Is a Stock

- What is Old Age Security and How Does It Work

- What is Registered Retirement Income Funds (RRIFs)

- How a Life Income Fund (LIF) Works for Retirement

- What Is An In-Trust Account

- What Is a Locked-in Retirement Account (LIRA)

- How Much Money You’ll Need To Retire

- Defined Benefit vs. Defined Contribution Pension Plans

- Can Annuities Fund Your Retirement?

- What Is a Personal Loan?

- Personal Loan Insurance: Do You Need It?

- What Is a Secured Personal Loan?

- What Is a Payday Loan?

- What Is a Pawn Loan?

- What Is a Car Title Loan?

- Small Business Loan vs Personal Loan

- Personal Loan vs. Line of Credit

- Personal Line of Credit vs Home Equity Loan:

- Personal Line of Credit vs Car Loan

- HELOC vs Personal Loan

- Debt Consolidation vs Personal Loan

- Cash Advance vs Personal Loan

- Business Loan vs Personal Loan

- Price Matching Tips to Help You Save Big

- How to save for Wedding

- How to Save Money on Groceries

- Ways to Save on Your Next Family Vacation

- Tips to Help You Save On Gas

- How to Save Money in 8 Easy Steps

- Passive Income: What It Is and How to Make It

- Budgeting 101: How to Budget Your Money

- Ways to Make Money Online and Offline in Canada

- How Do Credit Inquiries Work?

- What is the Ideal Credit Utilization Ratio?

- What Credit Score is Needed for a Credit Card?

- How to Get a Better Credit Score

- What is a Good Credit Score in Canada?

- Credit Cards

TD First Class Travel vs TD Aeroplan: How to Choose

The main difference between TD First Class Travel and TD Aeroplan is the rewards system. Aeroplan is Air Canada’s reward program, while the TD First Class Travel card is tied to TD Rewards Points. Thinking about where you shop and how you like to redeem your points can help you decide which of these cards is the better fit.

What is TD Aeroplan?

What is td first class travel.

- TD First Class Travel vs. TD Aeroplan: Which is better?

- TD First Class Travel cards

- TD Aeroplan cards

TD Aeroplan is the name given to a group of TD credit cards that earn Aeroplan points . You can use the points to buy things like flights, hotel rooms, car rentals, merchandise and more via Air Canada’s Aeroplan redemption platform.

TD offers four Aeroplan credit cards:

- TD Aeroplan Visa Infinite .

- TD Aeroplan Visa Platinum.

- TD Aeroplan Visa Infinite Privilege.

- TD Aeroplan Visa Business.

Did you know? TD isn’t the only issuer that works with Aeroplan. American Express and CIBC also offer Aeroplan credit cards with their own earn rates and perks.

Aeroplan rewards

Each of the four Aeroplan credit cards offered by TD have slightly different earn rates and reward categories. Learn more about each card’s earn rates and spending categories below:

TD Aeroplan Visa Infinite Card

- 1.5x Aeroplan points on eligible gas, groceries and Air Canada purchases.

- 1x Aeroplan points on everything else.

- Double the points earned when you shop with partner brands and through the Aeroplan eStore.

- 50% more Aeroplan points when you shop at Starbucks (card must be linked to your Starbucks Rewards account).

TD Aeroplan Visa Platinum Card

- 1 Aeroplan point per $1.00 spent on eligible gas, groceries and Air Canada purchases.

- 1 Aeroplan point per $1.50 spent on everything else.

TD Aeroplan Visa Infinite Privilege Card

- 2x Aeroplan points on Air Canada purchases.

- 1.5x Aeroplan points on eligible gas, groceries, travel and dining purchases.

- 1.25x Aeroplan points on everything else.

TD Aeroplan Visa Business Card

- 1.5x Aeroplan points on eligible travel, dining and business purchases.

- 1x Aeroplan points on everything else.

TD Aeroplan card earn rates and categories accurate as of June 22, 2023.

Pros of TD Aeroplan

- Range of cards to choose from.

- Business card available.

- Most cards include travel insurance, such as medical, baggage delay and flight cancellation.

Cons of TD Aeroplan

- The redemption program focuses mainly on Air Canada.

- Lower earn rates than similar cards, including the TD First Class Travel card.

TD First Class Travel is another name for one of TD’s rewards cards: the TD First Class Travel Visa Infinite card. It’s the only card from TD with the name First Class Travel, but not the only card that earns TD Rewards Points. The TD Platinum Travel Visa, TD Travel Rewards Visa and TD Business Travel Visa also earn TD Rewards Points.

TD First Class Travel rewards

The TD First Class Travel Visa Infinite card earns between two and eight TD Rewards Points per CAD spent, depending on the purchase category.

- 8x TD Rewards Points on travel bookings made via the Expedia for TD platform.

- 6x TD Rewards Points on groceries and restaurants.

- 4x TD Rewards Points on recurring bill payments.

- 2x TD Rewards Points on everything else.

Pros of TD First Class Travel

- High reward earn rates compared to TD Aeroplan cards.

- Travel TD Rewards Points can be redeemed with multiple booking platforms.

- Includes travel insurance, such as medical, baggage delay and flight cancellation.

Cons of TD First Class Travel

- Only one First Class Travel card to choose from.

- Highest earn rate is only for Expedia purchases.

TD First Class Travel vs TD Aeroplan: Which is better?

TD Aeroplan beats out First Class Travel when it comes to points value. Based on NerdWallet analysis, the average value of 1 Aeroplan point is worth 2.23 cents. To compare, you can expect to get around 0.25-0.5 cents per TD Rewards Point, according to NerdWallet analysis. These values depend on the redemption method you choose.

That’s not to say TD Aeroplan cards are better than the TD First Class Travel Visa Infinite card. If you don’t fly with Air Canada, for example, Aeroplan points may not be as practical. Look at features like annual fees , reward categories, redemption options, interest rates and insurance perks when making your decision.

TD First Class Travel and TD Aeroplan cards

Td first class travel® visa infinite* card.

- Annual Fee $139 To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening. To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by June 4, 2024. Waived first year

- Interest Rates 20.99% / 22.99% 20.99% on purchases, 22.99% on cash advances.

- Rewards Rate 2x-8x Points Earn 8 TD Rewards Points† for every $1 you spend when you book travel through Expedia® For TD†. Earn 6 TD Rewards Points† for every $1 you spend on Groceries and Restaurants†. Earn 4 TD Rewards Points† for every $1 you spend on regularly recurring bill payments set up on your Account†. Earn 2 TD Rewards Points For every $1 you spend on other Purchases made using your Card†.

- Intro Offer Up to 100,000 Points Earn up to 100,000 TD Rewards Points†: Earn a welcome Bonus of 20,000 TD Rewards Points when you make your first Purchase with your Card†. Earn 80,000 TD Rewards Points when you spend $5,000 within 180 days of Account opening†. Earn a Birthday Bonus of up to 10,000 TD Rewards Points†. Account must be approved by June 3, 2024.

- Earn up to $800 in value†, including up to 100,000 TD Rewards Points† and no Annual Fee for the first year†. Conditions Apply. Account must be approved by June 3, 2024.

- Earn a welcome Bonus of 20,000 TD Rewards Points when you make your first Purchase with your Card†.

- Earn 80,000 TD Rewards Points when you spend $5,000 within 180 days of Account opening†.

- Earn a Birthday Bonus of up to 10,000 TD Rewards Points†.

- To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening.

- To receive the first Additional Cardholder first-year annual fee rebate, you must add your first Additional Cardholder by June 4, 2024.

- Earn 8 TD Rewards Points† for every $1 you spend when you book travel through Expedia® For TD†.

- Earn 6 TD Rewards Points† for every $1 you spend on Groceries and Restaurants†.

- Earn 4 TD Rewards Points† for every $1 you spend on regularly recurring bill payments set up on your Account†.

- Earn 2 TD Rewards Points For every $1 you spend on other Purchases made using your Card† plus earn an annual Birthday Bonus† of up to 10,000 TD Rewards Points.

- No travel blackouts†, no seat restrictions† and no expiry† for your TD Rewards Points as long as your account is open and in good standing.

- Each year, you will receive one $100.00 TD Travel Credit on your first Eligible Travel Credit Purchase of $500.00 or more made with Expedia For TD and posted to the Account in a calendar year.

- Interest Rates: 20.99% on purchases and 22.99% on cash advances.

- Go Places on Points: Your Points are worth more when you redeem through Expedia® For TD: Search over a million flights, hotels, packages and more! When you’re ready to book, you can redeem† your TD Rewards Points towards your travel purchase right away.

- Redeem your TD Rewards Points towards making purchases at Amazon.ca with Amazon Shop with Points. Conditions apply.

- Shop online through TDRewards.com Redeem your TD Rewards Points for great deals on a wide selection of merchandise and gift cards.

- Option to purchase TD Auto Club Membership†: and be covered 24 hours a day for emergency roadside assistance services in case something goes wrong when you are out on the road.

- Travel Medical Insurance†: Up to $2 million of coverage for the first 21 days. If you or your spouse is aged 65 or older, you are covered for the first 4 days of your trip. Additional top-up coverage is available.

- Trip Cancellation/Trip Interruption Insurance†: For Trip Cancellation, up to $1,500 of coverage per insured person, with a maximum of $5,000 for all insured persons, and for Trip Interruption, up to $5,000 of coverage per insured person, with a maximum of $25,000 for all insured persons on the same covered trip.

- To be eligible, $60,000 (individual) or $100,000 (household) annual income is required. Also, you must have a Canadian credit file and be a Canadian resident of the age of majority in the province or territory where you live.

- †Terms and conditions apply.

- This offer is not available for residents of Quebec.

- The Toronto-Dominion Bank (TD) is not responsible for the contents of this site including any editorials or reviews that may appear on this site. For complete and current information on any TD product, please click the Apply Now button.

TD® Aeroplan® Visa Infinite* Card

- Annual Fee $139

- Rewards Rate 1x-1.5x Points Earn 1.5 points† for every $1 spent on eligible gas, grocery and direct through Air Canada® purchases (including Air Canada Vacations®) made with your card. Earn 1 point† for every $1 spent on all other Purchases made with your Card.

- Intro Offer Up to 50,000 Points Earn up to 50,000 Aeroplan points†: Earn a welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card†. Earn 20,000 Aeroplan points when you spend $6,000 within 180 days of Account opening†. Plus, earn a one-time anniversary bonus of 20,000 Aeroplan points when you spend $10,000 within 12 months of Account opening†. Account must be approved by June 3, 2024.

- Earn up to $1,200 in value†, including up to 50,000 Aeroplan points† (enough for a round trip to New York City†), and additional travel benefits. Account must be approved by June 3, 2024.

- Earn a welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card†.

- Earn 20,000 Aeroplan points when you spend $6,000 within 180 days of Account opening†.

- Plus, earn a one-time anniversary bonus of 20,000 Aeroplan points when you spend $10,000 within 12 months of Account opening†.

- Earn 1.5 points† for every $1 spent on eligible gas, grocery and direct through Air Canada® purchases (including Air Canada Vacations®) made with your card.

- Earn 1 point† for every $1 spent on all other Purchases made with your Card.

- Earn points twice when you pay with your Card and provide your Aeroplan number at over 150 Aeroplan partner brands and at 170+ online retailers via the Aeroplan eStore (www.aeroplan.com/estore).

- Earn big rewards on the little things: Earn 50% more Aeroplan Points and 50% more Stars at participating Starbucks® stores. Simply link your TD Aeroplan Visa Infinite Card to your Starbucks® Rewards account. Conditions apply.

- Your Aeroplan Points do not expire as long as you are a TD® Aeroplan® Visa Infinite* Cardholder in good standing.

- Travel lightly through the airport and save on baggage fees†: Primary Cardholders, Additional Cardholders, and travel companions (up to eight) travelling on the same reservation will all enjoy their first checked bag free (up to 23kg/50lbs) when your travel originates on an Air Canada flight.

- Complimentary Visa Infinite Concierge†: On-call 24 hours a day, seven days a week, the Visa Infinite Concierge can help with any Cardholder request — big or small, to help you get the most out of life whenever you travel, shop and use your Card.

- Visa Infinite Luxury Hotel Collection†: Receive seven exclusive benefits when you book your stay through the Visa Infinite Luxury Hotel Collection featuring over 900 of the world’s most intriguing properties.

- Trip Cancellation/Trip Interruption Insurance†: For Trip Cancellation coverage of up to $1,500 per insured person, with a maximum of $5,000 for all insured persons, and for Trip Interruption coverage of up to $5,000 per insured person, with a maximum of $25,000 for all insured persons on the same covered trip.

- To be eligible, a $60,000 annual personal income or $100,000 household annual income is required. You must also be a Canadian resident and be the age of majority in the province or territory where you live.

TD® Aeroplan® Visa Platinum* Card

- Annual Fee $89 To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening and you must add your Additional Cardholders by September 4, 2024. Waived first year

- Rewards Rate 0.67x-1x Points Earn 1 point† for every $1 spent on eligible gas, grocery and direct through Air Canada® purchases (including Air Canada Vacations®) made with your card. Earn 1 point† for every $1.50 spent on all other eligible purchases† made with your Card.

- Intro Offer Up to 20,000 Points Earn up to 20,000 Aeroplan points: Earn a welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card†. Earn an additional 10,000 Aeroplan points when you spend $1,000 within 90 days of Account opening†. Conditions Apply. Account must be approved by September 3, 2024.

- Earn up to $500 in value† including up to 20,000 Aeroplan points† and no annual fee for the first year. Conditions Apply. Account must be approved by September 3, 2024.

- To receive the first-year annual fee rebate, you must activate your Card and make your first Purchase on the Account within the first 3 months after Account opening and you must add your Additional Cardholders by September 4, 2024.

- Earn 1 point† for every $1 spent on eligible gas, grocery and direct through Air Canada® purchases (including Air Canada Vacations®) made with your card.

- Earn 1 point† for every $1.50 spent on all other eligible purchases† made with your Card.

- Your Aeroplan Points do not expire as long as you are a TD® Aeroplan® Visa Platinum* Cardholder.

- Flight/Trip Delay Insurance†: Up to $500 in coverage per insured person if your flight/trip is delayed for over 4 hours.

- Delayed and Lost Baggage Insurance†: Up to $1,000 overall coverage per insured person toward the purchase of essentials such as clothes and toiletries if your baggage is delayed more than 6 hours or lost.

- Common Carrier Travel Accident Insurance†: Up to $500,000 of coverage for covered losses while travelling on a common carrier (for example, a bus, ferry, plane, train or auto rental).

- Emergency Travel Assistance Services†: Help is just a call away. Toll-free access to help in the event of a personal emergency while travelling.

- To be eligible, you must be a Canadian resident and be of the age of majority in your province/territory of residence.

TD® Aeroplan® Visa Infinite Privilege* Credit Card

- Annual Fee $599

- Rewards Rate 1.25x-2x Points Earn 2 points† for every $1 spent on eligible purchases made direct through Air Canada® purchases (including Air Canada Vacations®). Earn 1.5 points† for every $1 spent on eligible gas, grocery, travel and dining purchases. Earn 1.25 points† for every $1 spent on all other purchases made with your Card.

- Intro Offer Up to 85,000 Points Earn up to 85,000 Aeroplan points: Earn a welcome bonus of 20,000 Aeroplan points when you make your first purchase with your new card†. Earn an additional 40,000 Aeroplan points when you spend $10,000 within 180 days of Account opening†. Plus, earn a one-time anniversary bonus of 25,000 Aeroplan points when you spend $15,000 within 12 months of Account opening†. Account must be approved by June 3, 2024.

- Earn up to $2,900 in value† including up to 85,000 Aeroplan points (enough for a round trip to Honolulu†) and additional travel benefits. Conditions Apply. Account must be approved by June 3, 2024.

- Earn a welcome bonus of 20,000 Aeroplan points when you make your first purchase with your new card†.

- Earn an additional 40,000 Aeroplan points when you spend $10,000 within 180 days of Account opening†.

- Plus, earn a one-time anniversary bonus of 25,000 Aeroplan points when you spend $15,000 within 12 months of Account opening†.

- Earn 2 points† for every $1 spent on eligible purchases made direct through Air Canada® purchases (including Air Canada Vacations®).

- Earn 1.5 points† for every $1 spent on eligible gas, grocery, travel and dining purchases.

- Earn 1.25 points† for every $1 spent on all other purchases made with your Card.

- Earn points twice when you pay with your Card and provide your Aeroplan number at over 150 Aeroplan partner brands and at 170+ online retailers via the Aeroplan eStore.

- Global Airport Lounge Access†: Receive a complimentary membership to the Visa Airport Companion† Program hosted by Dragonpass International Ltd. and take advantage of six lounge visits included for each Cardholder per membership year at over 1,200 airport lounges worldwide. Enroll through the Visa Airport Companion App or through visaairportcompanion.ca

- Complimentary Visa Infinite Concierge† : On-call 24 hours a day, seven days a week, the Visa Infinite Concierge can help with any Cardholder request — big or small, to help you get the most out of life whenever you travel, shop and use your Card.

- Visa Infinite Luxury Hotel Collection†: Receive seven exclusive benefits when you book your stay through the Visa Infinite Luxury Hotel Collection featuring over 900 of the world’s most intriguing properties. Enjoy an additional 8th benefit at over 200 properties, exclusively for Visa Infinite Privilege cardholders.

- Travel Medical Insurance†: Up to $5 million of coverage for the first 31 days. If you or your spouse is aged 65 or older, you are covered for the first 4 days of your trip. Additional top-up coverage is available.

- Trip Cancellation/Trip Interruption Insurance†: For Trip Cancellation coverage of up to $2,500 per insured person, with a maximum of $5,000 for all insured persons, and for Trip Interruption coverage of up to $5,000 per insured person, with a maximum of $25,000 for all insured persons on the same covered trip.

- Flight/Trip Delay Insurance†: Up to $1,000 in coverage per insured person if your flight/trip is delayed for over 4 hours.

- Delayed and Lost Baggage Insurance†: For delayed baggage over 4 hours, up to $1,000 of coverage per insured person for the purchase of essentials, such as clothing and toiletries. For lost baggage, up to $2,500 of coverage per insured person.

- Save time at the border with NEXUS: Enroll for a NEXUS and once every 48 months get an application fee rebate (up to $100 CAD)†. Additional Cardholders can also take advantage of this NEXUS rebate.

- To be eligible, $150,000 annual personal income or $200,000 household annual income is required. Also, you must have a Canadian credit file and be a Canadian resident of the age of majority in the province or territory where you live.

TD® Aeroplan® Visa* Business Card

- Annual Fee $149 Waived first year

- Interest Rates 14.99% / 22.99% 14.99% on purchases, 22.99% on cash advances.

- Rewards Rate 1x-2x Points 2x on Air Canada purchases, including Air Canada Vacations. 1.5x on travel, dining and select business categories, such as shipping, internet, cable and phone services. 1x on everything else.

- Intro Offer Up to 60,000 Points Earn up to 60,000 Points: Earn a welcome bonus of 10,000 Aeroplan points when you make your first purchase with your new card. Plus, earn up to 45,000 Aeroplan points when you spend $2,500 in purchases each month for the first 12 months of Account opening. Plus, earn up to 5,000 Aeroplan points when you spend $250 on eligible mobile wallet Purchases within 90 days of Account opening. Account must be opened by June 3, 2024.

- Earn up to 60,000 Aeroplan points¹, with no Annual Fee in the first year¹. Conditions Apply. Account must be opened by June 3, 2024.

- Earn 2 Aeroplan points for every dollar spent on eligible purchases made directly with Air Canada, including Air Canada Vacations.

- Earn 1.5 Aeroplan points for every dollar spent on eligible travel, dining and select business categories, such as shipping, internet, cable and phone services.

- Earn 1 Aeroplan point for every dollar spent on all other eligible purchases.

- Earn points twice when paying with a TD Aeroplan Visa Business Card and providing an Aeroplan number at over 150 Aeroplan partner brands and more than 170 online retailers via the Aeroplan eStore.

- Points can be redeemed for flights, hotels, merchandise, gift cards and more. They can also be used to pay down the card’s balance.

- Linked cards earn 50% more Aeroplan points and Stars at participating Starbucks stores.

- $149 annual fee — rebated in the first year.

- Free first checked bag for up to 9 people travelling on the same reservation on Air Canada flights.

- One free one-time guest pass to Maple Leaf Lounges for every $10,000 in net purchases. Maximum of 4 passes a year.

- Reach Aeroplan Elite Status more quickly by earning 1,000 Status Qualifying Miles and one Status Qualifying Segment for every $5,000 in net purchases.

- Access online reporting, review business expenses, managing existing credit limits and apply spend controls through the TD Card Management Tool.

- Visa SavingsEdge program: save up to 25% on eligible business purchases.

- Travel benefits: travel medical insurance (up to $2 million in coverage for the first 15 days for those under 65; coverage lasts for 4 days for those 65 and older); common carrier travel accident insurance (up to $500,000 for covered losses), trip cancellation insurance (up to $1,500 per insured person; maximum of $5,000), trip interruption insurance (up to $5,000 per insured person; maximum of $25,000), flight/trip delay insurance (up to $500 if a flight or trip is delayed for longer than 4 hours), delayed and lost baggage insurance (up to $1,000 of overall coverage per insured person), auto rental collision/loss damage insurance (covers the full cost of a car rental for up to 48 days), hotel/motel burglary insurance (up to $2,500), mobile device insurance (up to $1,000 in coverage).

- Toll-free emergency travel assistance services.

- Receive a rebate of up to $100 on NEXUS enrolment application/renewal fee costs once every 48 months.

- Save a minimum of 10% on the lowest available base rates in Canada and the U.S., and a minimum of 5% on the lowest base rates internationally on qualifying car rentals at participating Avis and Budget locations.

- Visa Zero Liability protection, Verified by Visa and instant alerts to prevent fraudulent card use.

- Purchase security and extended warranty protection.

- Minimum credit limit of $1,000.

- Interest rates: 14.99% on purchases, 22.99% on cash advances.

About the Author

Georgia Rose is a lead writer on the international team at NerdWallet. Her work has been featured in The Washington Post, The New York Times, The Independent and The Associated…

13 Best Aeroplan Credit Cards in Canada for 2024

The best Aeroplan credit cards in Canada earn points for Air Canada’s loyalty program on every purchase. Aeroplan points have an average value of 2.23 cents per point.

Aeroplan vs. Air Miles: Differences and Alternatives

Aeroplan is usually an ideal choice for those who want to use points for Air Canada flights, while Air Miles is a better choice for those who want flexible point redemption options.

18 Best Travel Credit Cards in Canada for June 2024

Explore the best travel credit cards in Canada for daily spending, flexible travel rewards, big welcome bonuses and more.

12 Best TD Bank Credit Cards in Canada for 2024

The best TD Bank credit cards in Canada include several Visa Infinite options as well as co-branded travel credit cards that earn Aeroplan points.

TD Business Travel Visa* Card

Reward calculator, enter your total monthly expenses or by category.

Restaurants

Bills & Utilities

Net annual rewards the 1st year

Net annual rewards in subsequent years

Requirements

Purchase protection

Purchase security for lost or stolen items within 90 days of purchase.

Medical emergency

Travel medical insurance coverage up to $2,000,000 for the first 15 days of your trip (or 4 days if you're over 65).

Trip cancellation

For trip cancellation, receive coverage up to $1,500 per person.

Trip interruption

Up to $5,000 coverage for trip interruption.

Travel accident

Common carrier travel accident insurance of up to $500,000 also applies.

Lost or stolen baggage `insurance

Any delayed or lost baggage is covered up to $1,000.

Flight delay

Flight/trip delay insurance will cover up to $500 for over 4 hours of delay.

Auto rental coverage

For rental cars, receive 48 consecutive days of coverage for auto rental collision/loss damage.

Extended warranty

Extended warranty on all purchased items.

More rewards with additional card

Add supplementary cardholders to earn more rewards, faster.

Exclusive discounts with my favorite brands

Cardholders also receive discounts of up to 25% off purchases made as part of the Visa SavingsEdge program. Save on car rentals with discounts at Avis and Budget Rent a Car, and get 50% more TD Rewards Points and Stars at Starbucks.

Similar Cards

Review ( 0 )

Related articles.

Today, prepaid cards mean you don’t have to worry about your credit score, because anyone can apply and be approved for a prepaid card in Canada. The best prepaid cards – those that offer rewards and no fees – are almost always Mastercards. All the cards presented here are designed to make shopping safe and […]

Balance transfer credit cards are a great way to catch your breath when you’re drowning in high-interest debt. By paying off one credit card with another at a much lower rate, you can significantly reduce your monthly interest charges and get back on track financially. The Pros of Balance Transfer Credit Cards The main advantage […]

A welcome offer is a bonus offered for new credit card sign-ups, with the goal of attracting new customers. Welcome offers are often offered in a variety of forms, such as cash back, bonus points or waiving the annual fee for the first year. But the best credit card is not the same for everyone, since […]

KOHO, the fintech known for offering one of the best prepaid cards and an app full of tools to improve your finances, no longer offers a free plan. As a reminder, to order your prepaid card, you must open a KOHO account and choose a plan. The cheapest plan is now the Essential at $4 […]

- Customer Service

TD First Class SM Visa ® Signature Credit Card

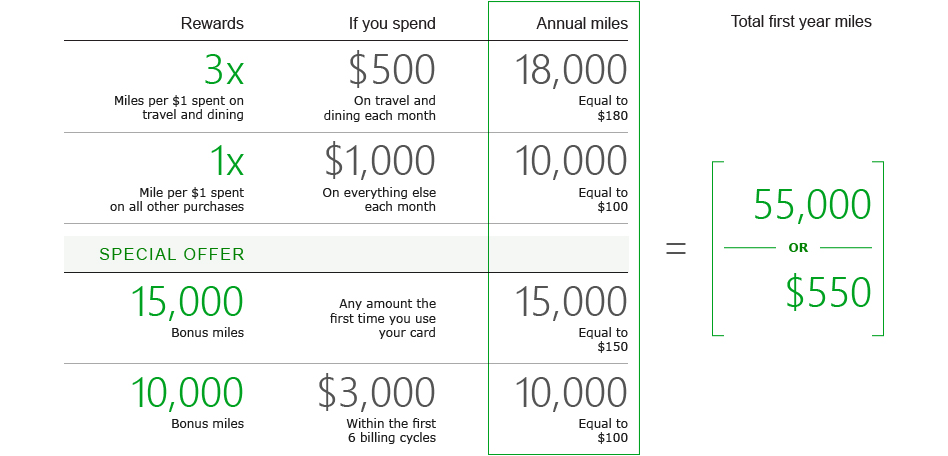

Travel rewards – Earn triple miles on travel and dining

Compare TD cards >

Read complete terms and conditions for details about APRs, fees, eligible purchases, balance transfers and program details.

Offer details, rates, fees and terms

Bonus miles offer.

Earn up to 25,000 bonus miles within the first 6 billing cycles of account opening, which equals a $250 statement credit towards travel or dining purchases

Bonus miles will be reflected on your credit card statement 6 to 8 weeks after a qualified first purchase and/or 6 to 8 weeks after $3,000 in total net purchases made within the first 6 billing cycles of your credit card account opening date. This offer is non-transferable. This online offer is not available if you open an account in response to a different offer that you may receive from us. This online offer is not available if you open an account in response to a different offer that you may receive from us.

Rewards details

3X First Class miles on travel and dining purchases , including flights, hotels, car rentals, cruises and dining, from fast food to fine dining

1X First Class miles on all other purchases – no categories or gimmicks and earn points that never expire as long as your account is open and in good standing.

Rates and fees

Need more information?

Take a look at our terms and conditions or personal cardmember agreement .

Earn unlimited points with every purchase, and triple the miles on travel

See how many miles you can earn from travel and other purchases.

Redeem your First Class miles for a statement credit toward travel and dining purchases >

To earn and redeem points, your account must be open and in good standing.

Credit Card FAQs

Manage your card, security you can count on.

Don't worry-we're protecting your every move. Our built-in chip technology helps guard you against fraud. Plus, you get the benefits of Visa Zero Liability 2

Managing your account is easy

Get the service you need, when you need it. Log in to your account or talk to a TD Bank representative 24/7 at 1-877-468-3178.

Redeem your rewards

Visit the td first class rewards site >.

- Small Business

- English Selected

TD Business Travel Visa* Card

Turn business expenses into td rewards points..

You’ve been invited to apply for an exclusive offer with the TD Business Travel Visa* Card . 1 and you could earn up to 150,000 TD Rewards points and up to $247 in Annual Fee rebates for the first year.

Your offer includes:

- A Welcome Bonus of 30,000 TD Rewards Points when you make your first purchase 1 .

- Earn 60,000 TD Rewards Points after spending $5,000 or more in the first three months 1 .

- Plus Earn a Monthly Spend Bonus of up to 60,000 TD Rewards Points 1 . You'll get 5,000 TD Reward Points each monthly billing period in which you spend $2,500 on the card for the first twelve months 1 .

- Enjoy a 100% Annual Fee rebate for the primary card and 2 additional cards issued for the same business for first year (a value of $149+$49+$49 ) 1 .

- Earn over $800 in TD Rewards and Annual Fee rebates in the first 12 months.

Apply before May 18th, 2023

At a Glance

Earn 9 TD Rewards Points 3 when you book travel online through ExpediaForTD.com 8 .

Earn 6 TD Rewards Points for every $1 you spend on Foreign Currency Purchases, Restaurant Purchases and regularly recurring bill payments made on your card 4, 5, 6 .

Earn 2 TD Rewards Points for every $1 you spend on all other eligible business purchases 7 .

Enjoy ExpediaForTD.com, your exclusive travel booking site with special offers designed just for you 8 .

With ExpediaForTD.com, you can be confident that you’ll earn the most rewards points and get the best point redemption value 8 .

No travel blackouts 9 , no seat restrictions 9 and no expiry for your TD Rewards Points as long as your account is open and in good standing 10 .

Redeem your TD Rewards Points towards making business purchases at Amazon.ca with Amazon Shop with Points. Conditions apply. See more details.

Transform your everyday business purchases into TD Rewards Points that you can also redeem for retail business merchandise, gift cards and more.

Get access to the TD Card Management Tool: An easy way to access online reporting, review your business expenses, manage your existing credit limits and apply spend controls.

Get access to an extensive suite of travel insurance.

Make managing your finances easier and more efficient.

Draw the line between business and personal spending.

Separate your professional expenses from personal expenses for easy tracking as you build business credit history.

Access the TD Card Management Tool

Set credit limits and download customizable reports to help simplify expense management and help get a clear view of your spending behaviour and balances over time.

More card benefits and features

Td rewards program benefits.

The TD Rewards Program lets you earn TD Rewards Points on your everyday business purchases and gives you the freedom and flexibility to redeem them how and when you want. Discover the possibilities at TDRewards.com

- Go places You can earn more TD Rewards Points when you book your business travel online with your TD Business Travel Visa Card through ExpediaForTD.com. You can also redeem 6 any earned TD Rewards Points towards that purchase at time of booking to pay for all or part of your trip. Or, use your TD Business Travel Visa Card to book business travel with any other travel provider of your choice. You can then redeem 11 your TD Rewards Points towards that purchase within 90 days after the purchase date. TD Rewards Points can also be used for business travel related purchases made with your Card such as airport taxes and golf fees!

- Amazon.ca Shop with Points Redeem your TD Rewards Points towards making business purchases at Amazon.ca to get what you want, when you want, quickly and easily. Conditions apply. Learn more about how you can redeem your points for all or just part of your purchase.

- Shop online through TDRewards.com Shop The Catalogue for brand-name business merchandise. You can even redeem your TD Rewards Points for a variety of brand-name retail gift cards that you can use for your business.

- Help pay down your balance You can also redeem your TD Rewards Points to help pay down your Credit Card Account balance through TDRewards.com, EasyWeb or the TD app.

At TDRewards.com you can redeem your TD Rewards Points for the rewards you want. Visit to learn more or get started todayVisit to learn more or get started today.

Visa SavingsEdge* Program

Discounts of up to 25% off for business purchases made under the Visa SavingsEdge Program 12 .

Travel benefits

- Travel Medical Insurance 13 : Up to $2 million of coverage for the first 15 days. If you or your spouse is aged 65 or older, you have coverage for the first 4 days. Additional top-up coverage is available.

- Trip Cancellation/Trip Interruption Insurance 24 : For Trip Cancellation, up to $1,500 of coverage per insured person, with a maximum of $5,000 for all insured persons; and for Trip Interruption, up to $5,000 of coverage per insured person, with a maximum of $25,000 for all insured persons on the same covered trip.

- Flight/ Trip Delay Insurance 16 : Up to $500 in coverage if your flight/trip is delayed for longer than 4 hours.

- Common Carrier Travel Accident Insurance 14 : Up to $500,000 of coverage for covered losses while travelling on a common carrier (for example: a bus, ferry, plane or train).

- Emergency Travel Assistance Services 15 : Help is just a call away. Toll-free access to help in the event of a personal emergency while travelling.

- Delayed and Lost Baggage Insurance 16 : Up to $1,000 of overall coverage per insured person toward the purchase of essentials such as clothes and toiletries, if your baggage is delayed longer than 6 hours or lost.

Review the Certificates of Insurance found in the TD Business Travel Visa * Benefits Coverage Guide .

Insurance Summary.

Automotive features

- Auto Rental Collision/ Loss Damage Insurance 17 . Use your TD Credit Card to charge the full cost of a car rental to get the Collision/Loss Damage coverage at no additional cost.

- Save with Avis® Rent A Car and Budget® Rent A Car. Use your TD Credit Card to save a minimum of 10% on the lowest available base rates 18, 19 in Canada and the U.S., and a minimum of 5% on the lowest available base rates 18, 19 internationally, on qualifying car rentals at participating Avis and Budget locations.

- Option to purchase Business TD Auto Club Membership 20 and be covered 24 hours a day for emergency roadside assistance services in case something goes wrong when you are out on the road.

Visa Zero Liability*: Shop online and in person securely with Visa Zero Liability* and be protected in the event that unauthorized transactions are made on your Card. See your Cardholder Agreement for complete information on unauthorized transactions and your responsibilities including your responsibility to protect your PIN.

Chip & PIN technology: TD Visa * Cards with Chip and PIN technology provide an added level of security through the use of a Personal Identification Number (PIN).

Purchase Security and Extended Warranty Protection 21 : You automatically have access to Purchase Security and Extended Warranty Protection, which includes coverage for most eligible new items you’ve purchased with your Card, should they be stolen or damaged within 90 days of purchase.

Verified by Visa* provides you with increased security and convenience when you shop online.

Instant Alerts. Added convenience, with TD Fraud Alerts: You can now automatically receive TD Fraud Alerts to your mobile phone any time we suspect unusual activity on your TD Business Travel Visa* Card. Simply ensure that we have your current mobile phone number listed in your TD Customer Profile. Learn more .

For more information, please refer to Cardholder Agreement . Insurance Summary

Everyday services

- Use Apple Pay wherever contactless payments are accepted: Apple Pay is accepted in a growing number of shops, restaurants, and plenty of other retailers. Many apps have also added Apple Pay to their accepted methods of payment. Just look for the Apple Pay or contactless payment symbols at the checkout.

- Emergency Cash Advances 22 : You can ask for an emergency Cash Advance in an amount up to $5,000 for your TD Business Travel Visa Card (subject to your available credit limit).

Discover great deals through Expedia For TD .

See you in a bit

You are now leaving our website and entering a third-party website over which we have no control.

TD Bank Group is not responsible for the content of the third-party sites hyperlinked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites.

Third-party sites may have different Privacy and Security policies than TD Bank Group. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information.

TD Personal Banking

- Personal Home

- My Accounts

- Today's Rates

- Accounts (Personal)

- Chequing Accounts

- Savings Accounts

- Youth Account

- Student Account

- Credit Cards

- Aeroplan Miles

- Travel Rewards

- No Annual Fee

- U.S. Dollar

- Saving and Investing

- GIC & Term Deposits

- Mutual Funds

- TFSA - Tax-Free Savings Account

- RSP - Retirement Savings Plan

- RIF - Retirement Income Options

- RESP - Education Savings Plan

- RDSP - Disability Savings Plan

- Precious Metals

- Travel Medical Insurance

- All Products

- New To Canada

- Cross Border Banking

- Foreign Exchange Services

- Ways to Pay

- Ways to Bank

- Green Banking

TD Small Business Banking

- Small Business Home

- Accounts (Business)

- Chequing Account

- Savings Account

- U.S. Dollar Account

- AgriInvest Account

- Cheque Services

- Overdraft Protection

- Line of Credit

- Business Credit Cards

- Business Mortgage

- Canada Small Business Financial Loan

- Agriculture Credit Solutions

- TD Auto Finance Small Business Vehicle Lending

- Invest for your Business

- Advice for your Profession or Industry

- TD Merchant Solutions

- Foreign Currency Services

TD Investing

- Investing Home

- Direct Investing

- Commissions and Fees

- Trading Platforms

- Investment Types

- Investor Education

- Financial Planning

- Private Wealth Management

- Markets and Research

TD Corporate

- Investor Relations

- Environment

- TD Newsroom

Other TD Businesses

- TD Commercial Banking

- TD Asset Management

- TD Securities

- TD Auto Finance

U.S. Banking

- TD Bank Personal Banking?

- TD Bank Small Business Banking?

- TD Bank Commercial Banking?

- TD Wealth Private Client Group

- TD Bank Personal Financial Services

Annual interest rates, fees and features are current as of March 29 th , 2023 unless otherwise indicated, and are subject to change. The business and business owners are jointly and severally liable for all charges made to each TD Business Card Account.

1 Welcome Bonus of 30,000 TD Rewards points ("Welcome Bonus") applies only to the new TD Business Travel® Visa Account opened for the Card with the Annual Fee of $149 issued in the name of the business (the “Account”). If you are approved, the Welcome Bonus will be awarded to the Account only after the first Purchase is charged to the Account. Limit of one (1) Welcome Bonus for the Account. We reserve the right to limit the number of Accounts opened by any one person or business. Welcome Bonus does not apply to additional Cards issued in the name of the same business. Other conditions apply.

To receive an additional 60,000 TD Rewards points ("Additional Bonus"), you must: (a) apply for a $149 Account between March 29 th , 2023 and May 18 th , 2023 and (b) have $5,000 in business purchases on $149 Account, including your first Purchase, within 90 days of Account approval. Offer may be changed, extended or withdrawn at any time without notice and cannot be combined with any other offer. To qualify for a monthly bonus of 5,000 TD Rewards points ("Monthly Bonus") in the first 12 months after Account opening (up to a total maximum of 60,000 Monthly Bonus points), eligible TD Business Travel® Visa Account Cardholders must have at least $2,500 in net purchases posted to their Account each month by the last day of each monthly billing period. Once you have earned 60,000 Monthly Bonus points during the first 12 months following Account opening, you will no longer be eligible for additional Monthly Bonus points. Purchases made during a billing period but posted after the end of that billing period will not count towards eligible spend for that month and count towards eligible spend for the next billing period. For example, if your monthly billing period is from April 15 to May 14, a purchase made on May 14 (transaction date) and posts on May 15 (posting date) will not count for eligible spend for that month and will count towards spend in the next month's billing period. If the April 15 to May 14 period was your 12th monthly billing period, then the purchase that was made on May 14 and posted on May 15 would not count toward this offer. Account must be in good standing. Please allow up to eight weeks for your bonus points to be awarded. The Annual Fee rebate portion of the offer is applicable for the first year only, for the (i) $149 Account, and the (ii) first 2 Additional Cards issued for the same business if any. The rebate of the $49 Annual Fee for the first two Additional Cards issued for the same business if any, is for the first year only. Must apply between March 29 th , 2023 and May 18 th , 2023. The Annual Fee for any subsequent $149 Accounts or Additional Cards issued to the same business will continue to apply. The Annual Fee will be rebated within 2 monthly statements from the date of the charge. The full Annual Fee will be charged to the $149 Account and the Additional Accounts (if applicable), after the first year. Offer may be changed, withdrawn or extended at any time and cannot be combined with any other offer unless otherwise indicated. This offer is not transferable. Offer may be changed, withdrawn or extended at any time and cannot be combined with any other offer unless otherwise indicated. This offer is not transferable. If you have opened an Account in the last 12 months, you will not be eligible for this offer. We reserve the right to limit the number of $149 Accounts opened by one person, and the number of Welcome Bonuses. Offers may be changed, withdrawn or extended at any time and cannot be combined with any other offer unless otherwise specified. Your Account must be in good standing at the time the Welcome Bonus, the Additional Bonus points, and the Monthly Bonus are awarded. Please allow up to 8 weeks after the conditions for each element of the offer are fulfilled for the Welcome Bonus and the Additional Bonus points, and the Monthly Bonus points to be credited to the Account associated with the Primary Business Cardholder, as designated by the Business.

2 he business and business owners are jointly and severally liable for all charges made to each TD Business Card Account.

3 Earn 9 TD Rewards Points for every $1 in Purchases of travel made online through Expedia For TD ("Online Travel Purchases") and charged to your TD Business Travel Visa Card Account ("Account"). Any returned items, refunds, rebates or other similar credits will reduce or cancel the TD Rewards Points earned on the original Online Travel Purchase. Fees, Cash Advances (including Balance Transfers, Cash-Like Transactions and TD Visa Cheques), interest charges, optional service, refunds, rebates or other similar credits do not earn TD Rewards Points. Other Conditions: Offer may be changed, withdrawn or extended at any time and cannot be combined with any other offer. Earn 6 TD Rewards Points for every $1 in Purchases of travel made by phone through Expedia For TD ("Phone Travel Purchases") and charged to your TD Business Travel Visa Card Account ("Account"). Any returned items, refunds, rebates or other similar credits will reduce or cancel the TD Rewards Points earned on the original Phone Travel Purchase. Fees, Cash Advances (including Balance Transfers, Cash-Like Transactions and TD Visa Cheques), interest charges, optional service, refunds, rebates or other similar credits do not earn TD Rewards Points. Other Conditions: Offer may be changed, withdrawn or extended at any time and cannot be combined with any other offer.

4 Earn 6 TD Rewards Points ("Foreign Currency Rebate") for every $1 in Purchases in a Foreign Currency ("Foreign Currency Purchases") charged to your TD Business Travel Visa Card Account ("Account"). Any returned items, refunds, rebates or other similar credits will reduce or cancel the TD Rewards Points earned on the original Foreign Currency Purchase, as applicable. Fees, Cash Advances (including Balance Transfers, Cash-Like Transactions and TD Visa Cheques), interest charges, optional service, refunds, rebates or other similar credits do not earn TD Rewards Points. $80,000 Cap: The Foreign Currency Rebate is only available to a $80,000 maximum net annual spend ("$80,000 Cap"). Once the $80,000 Cap has been reached for Foreign Currency Purchases, then any further Foreign Currency Purchases made on the Account will earn TD Rewards Points at the standard rebate rate of 2 TD Rewards Point that applies to all other Purchases on the Account as set out in your Cardholder Agreement ("Standard Rebate"). Applicability of Foreign Currency Rebate: The Foreign Currency Rebate is in place of, and not in addition to, the Standard Rebate. Other Conditions: Offer may be changed, withdrawn or extended at any time and cannot be combined with any other offer.

5 Earn 6 TD Rewards Points ("Restaurant Rebate") on each $1 in Purchases at restaurants ("Restaurant Purchases") charged to your TD Business Travel Visa Card Account ("Account"). Any returned items, refunds, rebates or other similar credits will reduce or cancel the TD Rewards Points earned on the original Restaurant Purchase, as applicable. Fees, Cash Advances (including Balance Transfers, Cash-Like Transactions and TD Visa Cheques), interest charges, optional service, refunds, rebates or other similar credits do not earn TD Rewards Points. $80,000 Cap: The Restaurant Rebate is only available to a $80,000 maximum net annual spend ("$80,000 Cap"). Once the $80,000 Cap has been reached for Restaurant Purchases, then any further Restaurant Purchases made on the Account will earn TD Rewards Points at the standard rebate rate of 2 TD Rewards Point that applies to all other Purchases on the Account as set out in your Cardholder Agreement ("Standard Rebate"). Applicability of Restaurant Rebate: The Restaurant Rebate is in place of, and not in addition to, the Standard Rebate. Merchant Category Codes: To earn the Restaurant Rebate, the Restaurant Purchases must be made at merchants classified through the Visa network with a Merchant Category Code ("MCC") that identifies them in the "restaurant" category. Some merchants may not be classified with a restaurant MCC and such Purchases will not earn the Restaurant Rebate as applicable. If you have questions about the MCC that applies to a Purchase, contact TD at 1-800-983-8472. Other Conditions: Offer may be changed, withdrawn or extended at any time and cannot be combined with any other offer.

6 Earn 6 TD Rewards Points ("PAP Rebate") on each $1 in payments made on a monthly or other regularly recurring basis for merchant bills, including insurance premiums, magazine/newspaper/online streaming subscriptions, membership fees and telecommunication fees, that are set up by the merchant with your consent to be automatically charged to your TD Business Travel Visa Card Account ("Account") and that are classified through the Visa network as "recurring payments" ("Pre-Authorized Payments"). You must confirm with your merchant if they can accept Pre-Authorized Payments. Any returned items, refunds, rebates or other similar credits will reduce or cancel the TD Rewards Points earned on the original Pre-Authorized Payment. Fees, Cash Advances (including Balance Transfers, Cash-Like Transactions and TD Visa Cheques), interest charges, optional service, refunds, rebates or other similar credits do not earn TD Rewards Points. $80,000 Cap: The PAP Rebate is only available to a $80,000 maximum net annual spend ("$80,000 Cap"). Once the $80,000 Cap has been reached, then any further Pre-Authorized Payments made on the Account will only earn TD Rewards Points at the standard rebate rate of 2 TD Rewards Point that applies to all other Purchases on the Account as set out in your Cardholder Agreement ("Standard Rebate"). Applicability of PAP Rebate: The PAP Rebate is in place of, and not in addition to, the Standard Rebate. Other Conditions: Offer may be changed, withdrawn or extended at any time and cannot be combined with any other offer.

7 Earn 2 TD Rewards Points ("Standard Rebate") on every $1 on all other Purchases ("Other Purchases") charged to your TD Business Travel Visa Card Account ("Account"). Any returned items, refunds, rebates or other similar credits will reduce or cancel the TD Rewards Points earned on the original Purchase. Fees, Cash Advances (including Balance Transfers, Cash-Like Transactions and TD Visa Cheques), interest charges, optional service, refunds, rebates or other similar credits do not earn TD Rewards Points. Other Conditions: Offer may be changed, withdrawn or extended at any time and cannot be combined with any other offer.

8 Expedia For TD is operated by Expedia, Inc. at ExpediaForTD.com and 1-877-222-6492. The Toronto-Dominion Bank and its affiliates are not responsible for any of the services and products offered/provided by Expedia, Inc.

9 Subject to carrier/space availability.

10 TD Rewards Points are earned for Purchases charged to the Account. Credits for refunds, returned items, rebates and other similar credits will reduce or cancel the TD Rewards Points earned by the full or partial amount originally charged to the Account. Fees, Cash Advances (including Balance Transfers, Cash-Like Transactions and TD Visa* Cheques), interest charges, optional services, refunds, rebates or other similar credits do not earn TD Rewards Points.