An official website of the United States government

Here’s how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

Overtime, Comp Time, and Credit Hours

This Handbook page provides a brief overview of overtime, comp time, and credit hours.

There are several factors which affect how you could be compensated for working extra hours. One is your salary: if your salary is at - or close to - the maximum GS salary ($183,500 in FY23). Another factor is whether you are an , external, exempt or non-exempt employee .

You should obtain supervisor approval prior to working extra hours. And, your supervisor should understand your specific situation prior to approving overtime.

The guidance below is only a high level overview. You and/or your supervisor can reach out to PeopleOps anytime with questions about your specific situation.

Overtime and Comp Time

Overtime and comp time can be approved by your supervisor no matter what type of work schedule you have.

Overtime is when you are paid for extra hours that you work, whereas comp time is when you receive hours of leave instead of pay. To determine the maximum number of comp time hours that you can accrue per pay period, please use the , external, TTS-only, Bi-weekly Comp Time Cap Calculator .

You should use your accrued comp time before using Annual Leave. However, if the end of the leave year is approaching, your supervisor can approve your Annual Leave requests first if you are in danger of losing Annual Leave because of “ Use or Lose .”

Comp time expires one year (26 pay periods) after it is earned. When you reach the expiration date, what happens depends on whether you are an , external, exempt or non-exempt employee :

- If you are exempt: you will forfeit the leave.

- If you are non-exempt: you will be paid out the hours (at the overtime pay rate that was in effect when you earned the hours).

If you leave GSA, your comp time will follow the parameters above: either forfeited or paid out, depending on your exemption status.

Credit Hours

Note: Credit hours are only available if you are on a flexible work schedule .

You can be approved for credit hours if you want to voluntarily work additional hours to your normal/approved schedule. If you are required to work additional hours, you will receive overtime or comp time.

- You can have up to 24 credit hours accrued, at any given time.

- The hours will rollover from one pay period to the next, and they never expire.

- Credit hours cannot be converted to cash, unless you leave GSA (then they will be paid out).

Credit hours example

You are on a Gliding schedule , and you work 8 hours every day. You are not required to stay late, but you are in a productive headspace and want to work an extra hour to finish your project. You can talk to your supervisor and ask to work 1 more hour, therefore receiving 1 credit hour. You will need to request the 1 hour in HR Links, and your supervisor will need to approve it.

Religious comp time

You can request an adjustment to your work schedule for religious observances, instead of taking leave. Document your request to your supervisor, via email, in advance of the time you’ll need to miss, along with the schedule of the time you will work outside of normal hours to compensate.

Note: religious comp time does not follow the salary cap rules that are outlined in the beginning of this document. Anyone can request religious comp time, regardless of their salary and what type of work schedule they are on.

Travel comp time

When you travel in connection to TTS, the time you spend traveling may be regular time, overtime, or travel comp time, depending on when the travel occurs.

You’ll complete overtime and comp time requests after you travel because you may encounter delays. Keep a copy of your travel itinerary to help you remember your trip.

Refer to the , external, TTS-only, Compensation for Government Travel slidedeck to determine the breakdown of your hours. This slidedeck is only open to GSA employees. Please contact your Timekeeper or an HR Specialist at your agency with questions.

Note: travel comp time does not follow the salary cap rules that are outlined in the beginning of this document. Anyone can request travel comp time, regardless of their salary and what type of work schedule they are on.

Entering the overtime, comp time, and/or credit hours you will be working into HRLinks

Entering your hours is a two step process.

Step 1 - Submit a time request in HRLinks

You need to enter your overtime, comp time, or credit hours into HRLinks. To determine the maximum number of comp time hours that you can accrue per pay period, please use the , external, TTS-only, Bi-weekly Comp Time Cap Calculator . Your supervisor will be notified to approve the hours requested.

- Click on the Employee Time Requests tile

- Select Additional Time Requests

- For Overtime , you will need to select a reason you worked overtime.

- Select Additional Time Type

- Enter Start Date and End Date

- Enter Requested Hours

- Enter Comments

- Click Submit

You’ll receive emails after submitting the request, and after it is approved. There is a , external, TTS-only, step-by-step guide to submitting time requests .

Step 2 - Update your timesheet

Currently, HR Links is not connecting Comp/Credit/Overtime hours to your timesheet. This means you will need to manually add the hours you earned to your timesheet on the day(s) when you earned them. You’ll do this after your supervisor has approved the hours in step 1.

There is a , external, TTS-only, step-by-step guide on adding the hours to your timesheet . Reach out to , external, TTS-only, #people-ops if you need assistance.

Using the comp time and/or credit hours you’ve earned

You will submit a leave request , just like you do for other types of leave. When searching in HR Links for the leave type to request, the codes and leave names are:

- 041 - Comp Time Used

- 037 - Credit Hours Used

- 047 - Religious Comp Time Used

- 043 - Travel Comp Time Used

OPM Resources

- , external, Adjustment of Work Schedules for Religious Observances

- , external, Overtime Fact Sheet

- , external, Comp Time Fact Sheet

- , external, Credit Hours Fact Sheet

Handbook.tts.gsa.gov

An official website of the U.S. General Services Administration

Understanding Comp Time: Guidelines for Employers

November 15, 2023

Home » Blog » Understanding Comp Time: Guidelines for Employers

Compensatory time off, or “comp time,” is often misused by employers who don’t understand Fair Labor Standards Act (FLSA) laws. As a very specific type of compensation, financial and HR professionals need to understand how comp time works. This comprehensive comp time guideline helps you understand the rules for salaried, exempt, and hourly employees and the possible consequences of poor compliance.

What Is Comp Time?

Compensatory time allows employers to provide employees paid time off to account for hours worked beyond their regular schedule. Comp time is commonly used as part of a regulated compensatory policy for flexible work scheduling but can also be used case-by-case to manage unexpected scheduled changes.

What is a comp day?

A comp day refers to a day an employee takes off when they have accumulated enough hours of overtime.

What is travel comp time?

Travel comp time is compensatory time off for travel earned when an employee’s work requires work away from their daily workplace, and this work time is not compensated via other means.

Comp Time vs. Overtime – What’s the Difference?

Although both comp time and overtime compensate employees for extra hours worked, comp time is paid out in hours off, while overtime is paid in dollars. When an employee works over 40 hours in a week, they are entitled to either earn time and a half pay for every hour over 40 hours or time and a half in hours off.

Comp time for exempt employees

However, not all employees qualify for comp time. Only exempt workers qualify, which in most cases are government or salaried employees. In fact, government employees are the only employees who can legally be offered comp time in lieu of overtime unless state laws allow otherwise.

FLSA Comp Time

According to the Code of Federal Regulations, Compensatory time off is “paid time off the job which is earned and accrued by an employee instead of immediate cash payment for employment in excess of the statutory hours for which overtime compensation is required by section 7 of the FLSA.”

The rules governing time off require government employers to provide comp time at a rate not less than one and one-half hours for each hour of employment for which overtime compensation is required in accordance with section 7. Furthermore, comp time, in lieu of paid overtime, is limited to a public agency that is a state, a political subdivision of a state, or an interstate governmental agency. It is illegal for private sector employees to use time off in lieu of pay.

Employers must adhere to the guidelines based on maximum accrual limits, documentation of hours and use, and deadlines to use comp time within a specified timeframe. For example, limits on the total number of comp hours an employee can accrue is 240 for most salaried workers or 480 hours for workers such as firefighters and law enforcement officers. This adds further restrictions to comp hours as the 480-hour limit on accrued compensatory time can’t represent more than 320 hours of actual overtime worked, and the 240-hour limit represents not more than 160 hours.

Comp Time for Exempt vs. Non-Exempt Employees

Nonexempt employees are hourly workers entitled to receive overtime when they work over 40 hours in a week in accordance with the FLSA. In this case, it is illegal to offer private employees comp time. Exempt employees are salaried employees who are ineligible for overtime pay or comp time. This is because their salary is intended to cover extra work expected in typical salaried roles. However, although not required by law, as an employer, you have the right to offer time off to salaried workers as a reward for their hard work.

Use of Comp Time in the Public vs. Private Sector

The U.S. Department of Labor (DOL) does not allow comp time for nonexempt employees in private-sector employment. Comp time is limited to public agencies at both state and local levels. However, as mentioned, private-sector employers can offer time off as a reward for salaried employees. In this case, it is important to avoid using the term “compensatory time,” as this is a legal term used specifically in the public sector. Many companies adopt terms such as flex time or personal days to identify this form of compensation.

State Exemptions for Comp Time

Despite the above information, some states allow private sector comp time for salaried employees in lieu of overtime as long as the employee agrees. However, this can open employers up to possible lawsuits should an employee leave the company, be fired, or change their minds and expect to be compensated with extra pay. Because of this, it is imperative to understand state laws such as:

- Industries: Some states might allow comp time for specific industries, while states like California ban comp time completely.

- Accrual and usage limits: Different maximums might apply, such as New York’s 240/30-day maximum.

- Employee consent: Some states forbid comp time in the private sector, while others, like Minnesota, allow it if there is a transparent written and signed agreement.

- Conversions: How hours are converted is also often regulated by states. For example, in Washington, employers must convert unused hours to cash after two years.

- Collective bargaining agreements: Comp time rules might be governed by collective bargaining agreements in some states, outlining comp time usage and accrual.

Penalties for Comp Time Violations

Some possible consequences of comp time violations include:

- Fines of up to $10,000

- Mandatory payout based on twice the amount of back wages owed for unpaid overtime

- Legal fees for employees out of pocket due to lawsuits

- Jail time for repeat offenders

- Civil money penalties of up to $1,000 per infraction

When is Comp Time a Good Idea?

If your state allows comp time, it is essential to develop a policy and ensure you adhere to state laws. This might include the following:

- Creating terms and conditions for comp time

- Having new employees read and sign the policy indicating they accept time off in lieu of pay as part of your onboarding process

- Being clear at all levels how your policy works, when it applies, and how hours are incurred and used

- Using automated time tracking to ensure an accurate record is kept of all overtime to accrue hours and determine compensation time owed

- Tracking employee use of comp hours, especially in states where it is required to convert hours into pay after a certain period

- Remote time tracking for hybrid workplaces

- Leveraging a management approval system to avoid fraud and approve hours from anywhere to avoid disruption to operations

Applying comp time legally is easier when you have software to create a streamlined onboarding process to share company policies and track hours and overtime accurately. This ensures your comp time policies remain transparent and that hours are tracked to ensure employees receive the hours and compensation they are entitled to.

About the Author

Reduce your annual workload by 5 months

See how payroll automation reduces manual processing time

- Name This field is for validation purposes and should be left unchanged.

Related Articles

Paypro: enterprise performance management.

April 23, 2024

7 Most Common Payroll Errors – Prevention Tips

What percent of gross revenue should go to payroll.

March 22, 2024

The Federal Register

The daily journal of the united states government, request access.

Due to aggressive automated scraping of FederalRegister.gov and eCFR.gov, programmatic access to these sites is limited to access to our extensive developer APIs.

If you are human user receiving this message, we can add your IP address to a set of IPs that can access FederalRegister.gov & eCFR.gov; complete the CAPTCHA (bot test) below and click "Request Access". This process will be necessary for each IP address you wish to access the site from, requests are valid for approximately one quarter (three months) after which the process may need to be repeated.

An official website of the United States government.

If you want to request a wider IP range, first request access for your current IP, and then use the "Site Feedback" button found in the lower left-hand side to make the request.

For Agencies

Let's Talk: (844) 800 - 2211

Remembering Shay Litvak Our Co-Founder and CTO

November 1979 - September 2023

A Simple Guide To Comp Time And How To Use It

Ralitsa Golemanova

What is comp time, exactly? Compensatory time refers to the practice of compensating employees with paid time off (PTO) rather than overtime pay for hours worked above 40 in a workweek.

Let's take Tim as an example. Tim works in a grocery store, and it was a particularly busy week as people were gearing up for a three-day weekend. Tim worked an extra 10 hours that week. Instead of getting monetary compensation for those overtime hours , Tim would like paid time off to complete some personal errands.

To calculate how much paid time off Tim is owed, you would multiply 10 hours by 1.5, which equals 15 hours. Essentially, Tim will receive nearly two full days off — which he will be paid for — to use as he pleases.

Comp time is calculated by multiplying 1.5 times overtime hours worked.

1.5 x Number of Overtime Hours Worked = Comp Time

But can you do that in all cases and for all types of employees? The answer is no. There are specific situations in which you can use comp time. They depend on the type of business that you’re running, the employee’s status, and the state in which you’re located. Let's take a look at when you can use comp time, and some important considerations you'll need to keep in mind.

Is Comp Time Legal?

The Fair Labor Standards Act (FLSA) establishes the federal rules that employers in the U.S. have to respect in relation to employees. It covers terms like hours worked, minimum wage, and overtime pay, among others. The FLSA also sets the boundaries for using compensatory time off instead of overtime.

The use of comp time is also regulated on the state level , with rules diverging between states.

The legal use of compensatory time depends on the following factors:

- The status of an employee as either exempt or non-exempt according to the FLSA

- The type of organization at which the person is employed - whether it’s a private business or a public body

- The state in which the employment is conducted

Comp Time For Exempt vs Non-Exempt Employees

The FLSA regulates the handling of wages and hours for non-exempt employees . They are entitled to minimum wage and overtime pay. Typically, they are paid by the hour, but may also be salaried employees. Being non-exempt rather depends on the exact duties of the person. Often, workers in construction, maintenance and services are considered non-exempt.

According to the FLSA, compensatory time off is not legal for non-exempt employees working at private companies. They have to receive pay for any hours they have worked above the 40-hour work week. The overtime rate has to be equal to 1.5 times the regular rate of pay.

The other type of employees are called exempt , also known as salaried workers. They typically include executives, managers, and other specific professionals.

The FLSA does not require employers to pay overtime hours for exempt employees. However, employers may choose to voluntarily do so. They also have the freedom to offer comp time instead. If an exempt employee leaves the job before using their accrued compensatory time off, it is not legally required to pay the unused time.

Private vs Public Sector Employees

While using comp time in the private sector is not permitted for non-exempt employees, the practice is legal and more common in the public sector .

Federal, state, and local government agencies are allowed to offer comp time to their employees in lieu of overtime pay. Many positions in public organizations are considered non-exempt and thus fall under the FLSA’s rules about overtime. Nevertheless, such government employees may receive comp time.

In offering compensatory time off, public bodies need to adhere to strict rules. They include:

- The comp time has to be negotiated before the employee works overtime hours

- The rate for comp time has to be calculated as overtime, which means at least 1.5 times the actual worked hours

- The employee has to use the accrued comp time within a fixed number of pay periods

- If possible, there should be a labor union agreement covering comp time

In addition, there are restrictions to the number of comp time hours that different types of public employees can accrue. For most of them, the limit is 240 hours. For law enforcement, fire protection, emergency response and seasonal activities, it is 480 hours.

States Allowing Comp Time In The Private Sector

As states have additional laws regarding wages and overtime pay, some of them permit the use of comp time in the private sector for businesses not covered by the FLSA.

Often there are contradictions between the rules set in the federal laws and the state laws, or between any of the overtime laws and labor union contracts. You are required to opt in for the stipulations that provide greater protection to your employees .

Penalties For Illegal Use Of Comp Time

You can end up in a problematic situation if you fail to respect applicable state and federal laws regarding the use of comp time. Even if your employees push for this practice, you have to make sure that your company is bullet-proof in terms of potential lawsuits.

The U.S. Department of Labor is in charge of overseeing issues with overtime pay and comp time. Among the penalties that it can enforce on you in case you’ve breached the law are:

- Fines of up to $10,000 for comp time violations, as well as additional fines for repeated violations and imprisonment

- If a lawsuit against you is successful, you may have to pay twice the amount of the owed wages, plus the legal fees

- Fines for penalizing employees that file a comp time claim for unpaid wages

Is It Better To Offer Comp Time Or Overtime Pay?

A comp time policy can benefit your bottom line by helping you avoid overtime premiums. It can also give employees the time to attend to personal matters, without hurting their pocketbooks. And as you may know, flexibility bodes well for employee job satisfaction because it encourages the ever-essential work-life balance.

One downside to offering comp time is that it can lead to disputes with employees, particularly around whether they are truly exempt or non-exempt. Another challenge is managing expectations around comp time. Employees may come to expect comp time whenever they work overtime, and could put in extra hours unnecessarily in order to get those days off.

What it comes down to? Having a solid comp time policy is essential, both for your business and for your employees. It ensures fairness and transparency in offering this option for compensating overtime hours, as well as promotes a healthy company culture. Make sure employees and new hires receive this policy in writing.

If your employees are given a choice between comp time and overtime pay, which one will they choose? Employees deciding between the two, might consider:

- Their monetary position: Do they need the money? Or would they benefit more from time to take care of certain tasks or attend to personal matters?

- Employer preference: Do you, the employer, have a preference? Employees may consider how important it is to meet your needs and maintain a positive relationship with you.

- Taxes: How will overtime pay impact your employee's taxes? They may want to meet with a tax professional before making a decision.

Encourage your staff to discuss any questions with you, so they can be confident they're making a fully informed decision, and to seek the help of tax and HR professionals if they have further questions.

How To Use Comp Time In Your Business

Let’s wrap it up: when is it legal to use comp time?

You can offer comp time instead of overtime pay to your employees if:

- They are non-exempt employees

- You are managing a public sector organization

- You are in a state that allows comp time for private sector businesses not covered by the FLSA and you comply with all prerequisites for its use

Even if your employees prefer and ask for comp time instead of overtime pay, you are not legally allowed to provide them with it in situations different than the ones listed above.

If the law permits you to use compensatory time off, it’s important to set rules for applying it in advance.

Get Help With Your Payroll Needs

Handling payroll for your team can be a daunting task, and properly using overtime pay and comp time make it an even more challenging one. Luckily, Hourly , a workers' comp, payroll and time tracking platform, can help.

Besides its time tracking solution, Hourly also provides you with great tools for handling payroll and workers’ comp . You can see a full overview of hours worked by each employee and the salary that is due to them.

Hourly also syncs your payroll data directly to your workers’ comp policy so you only pay exactly what you owe on your premiums, not an estimate. Its goal is lower audit risk, faster payroll runs, and better claims and safety services for small businesses everywhere . Hourly is a licensed insurance agent with products underwritten by various insurance companies.

Ready to transform your business into a profit-pumping machine? Learn how with our monthly newsletter.

Subscription implies consent to our privacy policy.

Discover How to Calculate Payroll Accrual + Journal Entries

Benefits of the Work Opportunity Tax Credit (WOTC)

Connecticut's Minimum Wage is Going Up: What to Know

Some employers allow their employees to take time off after working extra hours. Substituting extra time off for overtime pay is known as compensation (“comp”) time. Surprisingly, in most cases, this practice is illegal due to a fear of employer abuse. However, there are possible remedies for employees who truly value comp time. To learn more about comp time, read below:

You may be familiar with the term “comp time.” Comp time refers to the practice of allowing an employee to take extra time off from work after a long week, instead of overtime pay. What you may not know, is that in most situations, the practice is illegal, if you are working for a private, non-government employer, and you are a “non-exempt” employee who is otherwise eligible for overtime pay.

For example, if you work 56 hours in a week and you get two eight-hour days off in some other week to offset the extra 16 hours, this might be illegal. You should get paid overtime for the 16 hours you worked in the first week.

There are some states that allow private employers to give employees comp time instead of overtime pay. Each state’s law is different, and the circumstances under which employees can receive comp time may be complex. If you have questions about comp time under your state’s law, you can contact the agency for wage and hour/labor standards violations in your state. You can find contact information on our site’s state government agencies page.

Yes. State or government agencies may give their employees comp time instead of overtime wages, but only if

- There is an agreement arranged by union representatives; or

- If the government employer and the employee agree to the comp time arrangement before the extra work begins (not after the fact.)

Employers may give comp time in place of regularly scheduled overtime work only for employees who must work overtime hours under flexible work schedules. Additionally, comp time may be approved instead of overtime pay for irregular or occasional overtime work.

Yes. Whether you are entitled to overtime pay for working more than 40 hours per week depends on your exemption status under the Fair Labor Standards Act (FLSA).

Exempt employees are not entitled to overtime pay. Under the FLSA, exempt employees are only entitled to receive their base salary.

Nonexempt employees must be paid overtime for time worked beyond 40 hours in a given week. Under the FLSA they are entitled to one-half times their regular rate for the overtime hours worked.

It depends. Agencies may require an exempt employee to take comp time instead of overtime for irregular or occasional overtime work, but only if the employee’s rate of basic pay is above the rate of GS-10 .

A government agency may not require mandatory comp time for wage earning employees or as a substitute for required overtime pay.

Yes. An exempt employee must use accrued comp time within 26 pay periods from the pay period in which they earned it. If it is not used within the 26 pay periods, or if the employee transfers to another agency, the employee may get the earned comp time at the overtime rate. In the alternative, they may forfeit the unused comp time off, unless the failure to use the comp time is due to an exigency of the service beyond the employee’s control.

An FLSA nonexempt employee must also use accrued comp time within 26 pay periods from the pay period during which they earned it. If it is not used within 26 pay periods or if the employee transfers to another agency before the 26 pay period, the employee must be paid for the earned comp time off at the overtime rate.

It might be frustrating to learn that you cannot have comp time, even if you and your employer both want it. But overtime laws help discourage employers from overworking employees instead of hiring people when they’re needed. A system that is voluntary and permits employees to choose the option best for them (overtime pay or time off) might seem ideal. In reality, however, most workers have little say in their hours or working conditions and are unlikely to be able to exercise an option that is not in the employer’s best interest.

Workers who want time off instead of overtime pay are not completely without options if their employers want to accommodate them. You and your employer can accomplish this goal by rearranging the work schedule within the same week that you work overtime.

For example, a worker who normally works an eight-hour day, Monday to Friday, needs to work several 10-hour days to meet a deadline. Since overtime pay only kicks in when a worker has spent more than 40 hours on the job in a particular workweek, the worker could work 10 hours each day between Monday and Thursday, and take Friday off. The worker would still be paid for a 40-hour workweek, with no overtime pay due.

Another way to achieve the same outcome is to receive overtime pay in one week, and then reduce the number of hours worked the next week so that the worker’s paycheck remains constant.

For example, if a worker who makes $10 per hour works fifty hours during the first week of their pay period, their gross weekly paycheck will amount to $550 (40 hours paid at $10, plus 10 hours paid at the time-and-a-half rate, $15.) If the worker worked only 25 hours during the second week of the pay period, the worker would earn $250 in gross pay, but their paycheck would be the same ($800) at the end of the two-week pay period. Notice, however, that under this arrangement, the employee must take time off at the time-and-a-half rate applicable to overtime hours, and not simply hour-for-hour.

As noted above, many so-called comp time arrangements do not comply with the law. You may have a claim against your employer for unpaid wages if your employer’s comp time policy doesn’t follow the law. Read below for more information about how you can file a claim for unpaid wages.

If you believe you have a claim against your employer, then you should contact a government agency or a lawyer in your area to help you determine how to proceed. Depending on how much in wages is owed you, the amount may be too small for a lawyer to pursue a case against your employer on your behalf, but there are federal and state government agencies that can help you, even if you do not have a lawyer.

If you do not get the help you need from the agencies you contact, small claims court is also an option. Because of the small amount of money involved, you may be able to pursue a claim against your employer more quickly and inexpensively in small claims court, and you will not need a lawyer.

The FLSA is enforced by the Wage & Hour Division of the U.S. Department of Labor .

Wage & Hour’s enforcement of FLSA is carried out by investigators stationed across the U.S., who conduct investigations and gather data on wages, hours, and other employment conditions or practices, to determine whether an employer has complied with the law. Where they find violations, they also may recommend changes in employment practices to bring an employer into compliance.

It is a violation to fire or in any other manner discriminate against an employee for filing a complaint or for participating in a legal proceeding under FLSA .

Willful violations may be prosecuted criminally and the violator fined up to $10,000. A second conviction may result in imprisonment. Employers who willfully or repeatedly violate the minimum wage requirements are subject to a civil money penalty of up to $1,000 for each such violation.

The FLSA makes it illegal to ship goods in interstate commerce which are produced in violation of the minimum wage, overtime pay, child labor, or special minimum wage provisions.

To contact the Wage & Hour Division for further information or to report a potential FLSA minimum wage violation, call:

Toll-Free: (866) 4USWAGE (866-487-9243) TTY: (877) 889-5627 (available Monday-Friday 8 a.m. to 5 p.m. Eastern Time) You may also contact your local WHD office .

If you need further information about your state’s comp time law or wish to report a potential state law violation, then you may wish to contact the agency in your state which handles wage and hour/labor standards violations, listed on our site’s state government agencies page.

There are several different methods for recovering unpaid wages; each method has different remedies.

The Wage & Hour Division may supervise the payment of back wages.

The Secretary of Labor may bring suit for back wages and an additional penalty, called “liquidated damages,” which can be equal to the back pay award (essentially doubling the damages) if an employer willfully violated the statute.

An employee may file a private lawsuit for back pay and an equal amount as liquidated damages, plus attorney’s fees and court costs. An employee may not bring a lawsuit if he or she has been paid back wages under the supervision of WHD or if the Secretary of Labor has already filed suit to recover the wages.

The Secretary of Labor may obtain an injunction to restrain any person from violating FLSA, including the unlawful withholding of proper minimum wage and overtime pay.

Your state law may have different methods for recovery of unpaid wages, and different remedies to be awarded to those who succeed in proving a violation. For further information, please contact the agency in your state which handles wage and hour/labor standards violations, listed on our site’s state government agencies page.

Select your state from the map below or from this list.

Copyright © 2024 Workplace Fairness, All rights reserved.

- Terms of use

- Privacy Policy

- Links Policy

- Accessibility

Madeline Messa

Madeline Messa is a 3L at Syracuse University College of Law. She graduated from Penn State with a degree in journalism. With her legal research and writing for Workplace Fairness, she strives to equip people with the information they need to be their own best advocate.

What is comp time? Examples and guidelines for employers

Maintaining a healthy work-life balance has become a top priority for many employees . So much so that, according to a study conducted by Gartner, most employees these days value work-life balance more than health benefits . To address this need, many employers are turning to alternative work arrangements such as compensatory time off , commonly known as “ comp time “.

So, what is comp time, and how does it work? Is it the same as overtime? And which guidelines and regulations do you need to keep in mind if you offer this working arrangement?

In today’s post, we will share answers to all these questions. We will also explore how using the right tech can help you create a streamlined and compliant system for tracking employee compensatory time.

Table of Contents

What is comp time?

Let’s start with the basics: What is comp time?

Comp time, short for compensatory time, is where you provide employees with additional time off from work in lieu of receiving overtime pay . It is an alternative arrangement that allows employees to accumulate extra hours worked beyond their regular schedule, which they can later use as paid time off .

Typically, comp time is offered as a benefit to employees who work more than their required hours during a given pay period , such as during busy periods or peak seasons. Instead of receiving immediate monetary compensation for the extra hours that they have worked, employees accrue comp time hours .

As with other types of flexible working arrangements (such as the 9/80 work schedule ), comp time can be a valuable tool for promoting work-life balance, increasing employee satisfaction, and providing flexibility in scheduling . However, the specific rules and regulations governing comp time can vary between states . For example, some states require employers to obtain employee consent or adhere to certain conditions when implementing comp time policies. It is therefore important that employers are familiar with the applicable laws to ensure compliance. Employers also need to establish clear guidelines, communicate effectively, and track comp time accurately to ensure a fair and transparent system for all parties involved.

How does comp time work?

Now that we’ve answered the question, “What is comp time?”, let’s explore how it works.

As we mentioned above, the specifics of how comp time works vary depending on state laws and regulations as well as internal employer policies. However, let’s take a look at what the concept means in general terms.

- Accrual . When an employee works over their contracted hours, they earn comp time. The rate at which they earn comp hours can vary. However, it is often calculated as time and a half (1.5 hours of comp time for every hour of overtime worked). For example, if an employee works 10 hours of overtime, they will accrue 15 hours of comp time.

- Accumulation . Over time, an employee accumulates earned comp hours or comp days. Employers must track these hours and maintain accurate records so that they can generate payslips at the end of each pay period. Specifically, employers need to keep a record of the date, duration, and reason for overtime worked. This data can be collected and stored using a time clock or timesheet software .

- Using comp hours . Once accumulated, employees can then request to use their accrued comp time as paid time off. Most employers establish internal guidelines for these requests to avoid scheduling or understaffing issues. It’s also a good idea to use a time clock with leave management features so that you have an established, automated process for requesting and approving time off.

- Conversion . In some cases, if comp time is not claimed within a specific period, employees can request to convert the time into monetary compensation. This conversion process ensures that employees do not accumulate excessive amounts of unused comp time.

Comp time vs. overtime

Implementing a system like the above for compensatory time can be a great way to offer flexibility to employees whilst maintaining adequate staffing levels during busy periods. However, it’s important to make sure you are complying with state and federal laws relating to overtime.

Before we explore these laws, let’s clarify the difference between comp time and overtime .

Comp time and overtime are two different approaches to compensating employees for working additional hours beyond their regular work schedule. While both options aim to address the extra time employees devote to their jobs, they differ in how compensation is provided .

- Overtime : Overtime refers to the practice of paying employees at a higher rate for every hour worked beyond a predetermined threshold, typically 40 hours per workweek. The additional pay rate, often 1.5 times the regular hourly wage, serves as a monetary form of compensation for the extra hours worked. Overtime is typically mandated by labor laws and regulations and is aimed at ensuring fair compensation for employees who exceed their standard working hours.

- Comp time : Comp time, on the other hand, involves offering employees time off from work in lieu of overtime pay. Instead of receiving extra wages, employees accumulate comp time hours for working overtime. These accrued hours can be used as paid time off at a later date. This provides employees with the flexibility to take time off while maintaining their regular pay. However, comp time policies often have limitations and guidelines, such as requiring advance notice or specifying maximum accrual limits.

Is comp time legal?

The choice between comp time and overtime often depends on legal requirements and employer policies. Some states have specific regulations governing the use of comp time. This often includes requirements for employee consent and restrictions on accumulation or usage . Employers need to ensure compliance with applicable laws and maintain transparency when implementing compensatory policies to meet the needs of both employees and the organization.

Let’s start with federal law.

In the United States, comp time is subject to the Fair Labor Standards Act (FLSA). This federal labor law covers terms like hours worked, minimum wage, and overtime pay, among others. The FLSA also sets the boundaries for using compensatory time off instead of overtime .

Under the FLSA, private sector employers are generally required to pay employees overtime wages for hours worked beyond 40 in a workweek. However, there is an exception for public sector employees, where comp time may be allowed instead of immediate overtime pay. Public sector employers, such as federal, state, and local government agencies, may offer comp time as an alternative, subject to specific conditions and regulations set by the FLSA.

You also need to make sure you check laws and regulations in your state in case there are any rules governing comp time. For example, some states require employers to obtain written agreements or provide employees with the option to choose between comp and overtime pay.

Compensatory time off guidelines

If you offer comp time, then you need to establish clear compensatory guidelines . These guidelines should determine how employees can accrue and use time off for any extra hours that they might work. This includes how they can earn comp hours and the accrual rate. It also includes any limitations on accumulation and the process for requesting and using compensatory time off.

You also need to determine which tools you will use for employee time tracking and how you will manage remote employee time tracking . Essentially, this means that you need a reliable employee clock-in system , such as an electronic time clock . This will help you maintain an accurate record of how many hours each employee works during each pay period . Without a digital system like this for employee time tracking, it will be very difficult to keep track of working hours so that you can generate accurate and timely payslips for your employees.

Finally, you need to make sure you take into account any legal restrictions and limitations . This includes employment status, the type of organization that you run, and whether there are any specific state guidelines that you need to be aware of.

Let’s take a look at these restrictions and limitations in a bit more detail.

Exempt and nonexempt employees

The first factor you need to consider before offering compensatory time off is the employment status of your workforce.

Exempt employees:

- Salaried employees are exempt from overtime pay requirements under the Fair Labor Standards Act (FLSA). As a result, they are not eligible for comp time or overtime pay.

- You can still offer additional time off benefits to exempt employees, such as vacation or personal days, to promote work-life balance and employee well-being. However, if your exempt employees work beyond their regular hours, then you are limited to other means of recognition, such as bonuses.

Nonexempt employees:

- Generally eligible for overtime pay under the FLSA.

- Time off must be accrued at a rate of 1.5 hours for every hour of overtime worked, as per FLSA guidelines.

- There are limits on the total number of comp hours that employees can accrue (e.g., 240 hours).

- Nonexempt employees must be given the opportunity to use their accrued comp hours within a reasonable period to avoid excessive accumulation.

- You must pay nonexempt employees at their regular rate of pay for the hours they take as time off.

- Employers should have clear policies and procedures in place for requesting and tracking compensatory time off. This ensures fair and consistent treatment.

Private vs. public sector employees

Comp time guidelines can also differ between private sector and public sector employees.

Private sector employees:

- Private sector employees are subject to the Fair Labor Standards Act (FLSA) regulations regarding overtime pay. Under the FLSA, private sector employers are generally required to provide overtime pay (typically 1.5 times the regular rate) for nonexempt employees who work more than 40 hours in a workweek.

- Employers working in the private sector are not typically allowed to offer comp time in lieu of overtime pay, except in certain limited circumstances or industries where specific exceptions may apply. However, these exceptions are rare and typically require prior approval or special circumstances.

- Private sector employers may still offer additional time off benefits, such as vacation or personal days, to promote work-life balance and employee well-being.

Public sector employees:

- Public sector employees have different rules regarding compensation time based on specific regulations and collective bargaining agreements. This includes government agencies and certain nonprofit organizations.

- The FLSA allows public sector employers to offer comp time at work to their nonexempt employees instead of overtime pay. Comp time is usually accrued at a rate of 1.5 hours for each hour of overtime worked.

- Employers must follow specific guidelines for accrual, usage, and limitations of compensation time. These regulations include maximum accrual limits, requirements for documentation, and provisions for using comp time within a specified timeframe.

Differences in state comp time laws

As we have already mentioned, state comp time laws in the United States can vary. It’s therefore vital that you research and understand the specific regulations that apply in your state. That way, you can be sure that your compensatory time policy complies with all requirements. As a result, you can avoid potential fines and penalties.

Here are a few common areas where state comp time laws may differ:

Some states may limit or restrict comp time to certain industries . For example, according to California’s overtime laws , comp time is generally not allowed as an alternative to overtime pay for private sector employees.

Accrual and usage limits

Certain states impose specific rules on the maximum amount of compensation time that an employee can accrue . They also regulate how employees can use these hours. For example, public sector employees in New York can accrue a maximum of 240 hours (or 30 days).

Employee consent

In some states, employers need written employee consent before implementing compensation time working arrangements. For example, in Minnesota, this written agreement must specify the terms and conditions under which comp time will be accrued and used instead of overtime pay.

Conversions

Certain states have regulations governing the conversion of unused compensation time into cash . For example, if an employee in Washington does not use accrued compensation hours within 24 months, the employer must convert it into cash compensation.

Some state laws include specific rules on how to calculate compensation time rates (regular rate vs. overtime rate). For example, according to Massachusetts law, when nonexempt employees accrue comp time, it must be calculated at a rate of 1.5 hours for each hour of overtime worked. In contrast, Alaska uses a 1:1 ratio for comp time accrual.

Collective bargaining agreements

In states with a strong union presence , collective bargaining agreements may outline specific provisions that differ from state laws. These agreements, negotiated between the employer and the union, often include specific terms and conditions for the accrual and usage of comp time.

Ensuring compliance with the right time-tracking practices

The most vital aspect of implementing a compensation time policy is making sure that you implement the right tools and practices for employee time tracking . This helps you maintain transparency, comply with state and federal labor laws, and effectively manage employee working hours.

Factorial’s time-tracking features are a great solution for this.

With our time card app you get:

- Automated time tracking . Employees can clock in and out straight from their mobile devices, eliminating the need for manual timesheets. This helps you maintain an accurate, real-time record of employee time and attendance, including accrued overtime and compensation time.

- Break tracking . Factorial’s time-tracking features also enable employees to record and track their break and rest periods. That way, you can be sure that they are taking appropriate breaks as required by labor regulations.

- Mobile and web access . Employees can access Factorial’s time card app through both mobile and web applications. As a result, they can log their work hours and breaks from any location. This is especially useful if you have remote employees.

- Manager approval . Managers can review and approve employee time entries, ensuring accuracy and compliance and promoting transparency and accountability.

- Reporting and analytics . Factorial’s reporting and analytics tools provide valuable insights into employee work hours, overtime, and attendance patterns. This makes it much easier to ensure that you are complying with labor laws. You also get access to valuable insights that can help you better manage your workforce.

Ultimately, Factorial’s time-tracking solution offers a number of appealing benefits. Notably, it helps you streamline your time management processes, improve accuracy, and ensure compliance with comp time regulations . That way, you can build a happy and productive workforce and secure your reputation as an employer that values employee health and wellbeing.

Related posts

California Workplace Violence Law: Guide

Top 14 Best HR Software of 2024

Boost your HR with software

See how Factorial powers productivity, engagement, and employee retention.

Book a free demo

What is comp time and other FAQs

Table of Contents

Compensatory time (comp time) is time off that employers grant their employees instead of giving them overtime pay.

Imagine this scenario: there’s an unexpected issue at work and you have to work overtime. As a reward, you get two options: overtime pay or compensatory time off. Let’s say you want some time off to relax.

Before you can take this compensatory time, you first have to figure out if you’re eligible, which depends on your employment type, as well as on your employer’s legal obligations.

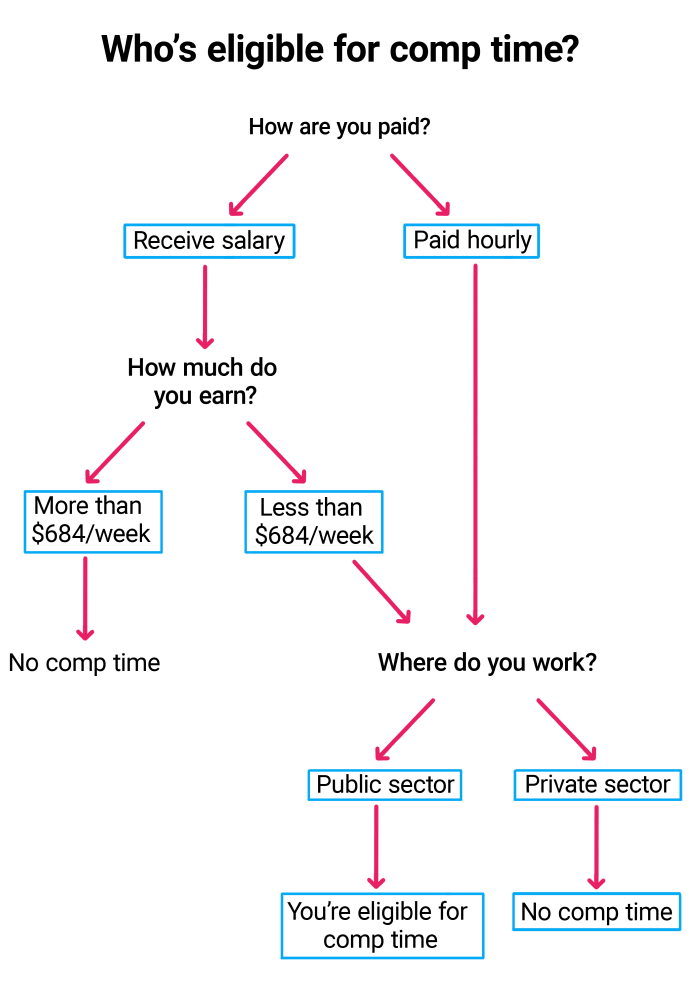

Not every employee can receive comp time. It depends on several factors, such as:

- Whether you’re an exempt or non-exempt employee

- Whether you’re a salaried or hourly employee

- Whether you work in the public or private sector.

This article will guide you through all the details about compensatory time.

What is comp time?

Compensatory time is the time off employees receive for their overtime hours, instead of getting overtime pay. The Fair Labor Standards Act (FLSA) regulates the rules of compensatory time.

Now: What is overtime?

Everything beyond working 40 hours in a given week counts as overtime. By the laws of FLSA , employers must pay non-exempt employees time and one-half for any hours worked above 40 per week.

In the case of compensatory time, the rules are not the same for everyone. Some employees are eligible for this benefit, while others aren’t.

Here’s the deal – there are two categories for employment classification:

- exempt and non-exempt employees

- salaried and hourly employees

We’ll dive into both categories and explain their details in this article.

The difference between exempt and non-exempt employees

The first category we’re going to explore is exempt and non-exempt employees.

The most important difference between these two types of workers is if they will be paid for overtime work or not. Thus, the term “exempt” means exempt from being paid overtime .

If an employee is exempt, their employer is not obligated to pay them overtime. Exempt workers must get salaries. The main categories of exempt employees are:

- professional

- administrative

- outside sales

Here’s another fact provided by the U.S. Department of Labor , which became effective January 1, 2020:

administrative, executive and professional employees, computer and outside sales employees can be exempt, if they comply with the following criteria:

- Instead of being paid per working hour, employees receive a salary

- Employees make at least $684 per week or $35,568 annually

So, non-exempt employees are eligible for overtime. It’s mandatory their employers refund each extra hour they have (if they have worked more than 40 hours in a given week).

In general, what separates exempt from a non-exempt employee is not only the job title, but the tasks performed on the job, too.

The difference between salaried and hourly employees

Comp time also depends on the fact if you’re a salaried or an hourly employee.

But, how can you tell if someone is a salaried or hourly employee ?

Hourly employees are paid for each hour they work. That’s why they need to receive overtime pay if they have worked more than 40 hours per week. There is an hourly rate, which gets multiplied by the number of hours the employee has worked.

For example, if Mary has an hourly rate of $10 and works 30 hours in a given week, her wage for that period would be $300.

Unlike hourly, salaried employees already have a set level of compensation . Besides, they do not receive overtime pay, but have other company-provided benefits. Many salaried employees are exempt from the overtime rules. In some cases, the law recognizes salaried employees as non-exempt. That’s why it’s necessary their employers pay them time and a half for any hours worked over 40 hours in a given week.

You might be wondering:

Why do some salaried employees get to be non-exempt?

It depends on their salary. By the laws of FLSA, if salaried employees are earning less than $684 per week ($35,568 per year), they are non-exempt.

Who is eligible for compensatory time?

Compensatory time is acceptable only for certain types of employees and relies on three categories:

- Whether your profession is exempt or non-exempt

- And whether you work in the private or public sector.

For example, exempt employees are not qualified for comp time – they can only receive their base salary. But non-exempt employees must get overtime pay (if they have worked more than 40 hours in a given week).

Yet, there’s one exception:

Exempt employees can get compensatory time if it’s mandatory they work more than 40 hours per week.

Usually, that happens during special projects or on weekends. In that case, their supervisor may choose to grant comp time off.

However, comp time rules are not the same for the private and public sectors.

According to the FLSA regulations, comp time for non-exempt, salaried employees is not allowed in the private sector. Unlike private, comp time is legal in the public sector.

Also, the employees of state or local government agencies may get comp time off, but only in certain conditions. Their rate has to be not less than one and one-half hours for each overtime hour worked.

If you’re qualified for comp time, you should monitor your working hours and overtime hours.

What’s the best way to track your time at work?

When it comes to time management, it doesn’t matter if you’re a salaried or hourly, exempt or non-exempt employee. What counts is how you organize your time at work and how you handle all your tasks and projects.

Our free employee hours tracker can become your perfect ally. Clockify will monitor all your daily activities. You can either click on it at the beginning of the day or enter your time manually at the end of your work day.

Moreover, there are other benefits of Clockify that can help you track your work time:

- All your time entries are synced: Let’s say you’ve started tracking your time in the browser and after a few hours went for lunch. You forgot to stop the timer, but don’t worry, you can do that on your phone, on the go. Everything gets synced between the phone apps, desktop apps and the website.

- Idle time detection: When you’re away from your computer, Clockify can detect that and will let you decide what to do with inactive time.

- Targets and reminders: if you haven’t logged enough hours, Clockify will remind you to track time.

Additional resources and information on comp time

As you can see, there are a lot of regulations and unique cases towards comp time. Depending on your occupation, as well as your employment type, there’s a chance you’ll discover some more. For example, you might be working for the Office of Personnel Management. If that is the case, here’s where you can find additional information for comp time that applies to you.

Besides, if you’re seeking any general rule about overtime and comp time, the official FLSA site is the place to go. Finally, there is a lot of useful data at the official presentation of the US Department of labor .

Comp time vs. other types of work time

- Comp time vs. overtime

If an employee has worked more than 40 hours in a given week, these extra hours count as overtime. When it comes to overtime hours, employers must pay their employees time and a half for any hours worked over 40 hours in a given week.

Compensatory time is the time employees get for their overtime hours, instead of receiving overtime pay.

- Comp time vs. flex time

Compensatory time and flex time have a whole different meaning. Comp time refers only to compensation for working overtime. On the other hand, flex time is a certain benefit for employees. It means that employees have an opportunity to choose their working hours.

- Comp time vs. credit hours

If you’re wondering what’s the difference between comp time and credit hours, here’s the thing:

Comp time is what you get when you’re working overtime. You can earn credit hours only when you voluntarily choose to work overtime. The important part is that you’ll be able to get and use credit hours only if you’re having a flexible work schedule.

- Comp time vs. PTO

You wouldn’t want to confuse comp time with PTO, which stands for Paid Time Off. Nowadays, many companies use PTO as an umbrella term for vacation , sick time and personal time.

Comp time law regulations

- California overtime law

Speaking of California, there is a unique set of regulations for overtime in this state.

Here are all the details: In California, overtime is calculated both after 8 hours of work per day and 40 hours per week.

For example, John has worked 9 hours on Tuesday, so he’s entitled to one hour of overtime. The week before, he worked 42 hours in total, which means that he’ll get paid for 2 hours overtime.

Besides, the overtime rates in California are based on regular rates. Yet, there’s a difference between hourly and salaried employees:

Hourly employees – their regular rates are the rates they receive per hour during a 40-hour workweek. In case they get two different rates, overtime is estimated as an average of the two rates (e.g. ($30+ $20) / 2 = $25).

Salaried employees – the best way to measure their rates is by dividing the annual salary by 52 weeks in a year, and 40 work hours in a week (e.g. $40,000 / 52 / 40 = $19.23).

- Can comp time expire?

Yes, comp time has its time limit. From the moment exempt employees get comp time (from the pay period in which they get it), they have the next 26 pay periods to use it. If employees don’t use comp time during that period, they may get that comp time at the overtime rate.

The rules are almost the same for the non-exempt employees – 26 pay periods. If they don’t use it during the following period, the employees must be granted the earned time off at the overtime rate.

Legal matters

- What are the most common compensatory time violations?

The most common compensatory time violations are:

- Discrimination : whenever an employer decides not to grant employees due to their race, sex or age

- Wrongful termination : if employees get fired for demanding comp time off, although these employees have the right to ask for the comp time

- Law violation : it includes each violation of state, local or federal laws.

- What should you do if you don’t get comp time pledged to you?

You might be wondering what to do in case your employer refuses to pay you compensatory time. One of your best options is filing a claim against your employer. If you’re not familiar with this process, you should contact a government agency or a lawyer.

But, finding a lawyer is not always the best option, financially speaking. Here’s the deal: it all depends on how much in wages you’ve been unpaid. If the number is too small for a lawyer to file a case against your employer on your behalf, you may consider other options. You can get in touch with federal and state governments.

In conclusion

No matter what your occupation is, you should always track overtime, especially if you’re an hourly employee working in the public sector who’s eligible for comp time (or overtime pay).

Besides, you should get informed about all the laws and regulations on compensatory time. In case your employer refuses to grant you comp time, be sure to contact a government agency or a lawyer.

Ivana Fisic is a Content Manager. She has always been passionate about writing, which is why she has finished her BA in Journalism, at the Faculty of Philosophy, Novi Sad. Ivana is always exploring new methods of how time management can help you organize your workflow more effectively.

Where does the time go?

START TRACKING TIME

with Clockify

How to Write a Vacation Request Email (+ Tips & Examples)

Get your boss to say yes to your vacation request email with our tips, samples, and examples.

Back Charge: Benefits, Disadvantages, and Tips

A back charge is the billing one party (e.g. a retailer) sends to another party (e.g. a wholesale supplier) if they incur losses due to the second party’s actions.

Manufacturing Costs: Significance, Types, and Cost Calculation

Find out about manufacturing costs and their types, and gain insights with examples. Plus, master a 5-step approach to cost calculation.

What is fixed cost: Definition, examples, relevance

Fixed costs are part of every business. Knowing about their importance can help you increase business profits and prepare for the future.

How to craft a perfect employee attendance policy

An attendance policy is a set of guidelines used to affect employee attendance and make sure everyone performs at the highest level.

What is a swing shift: Definition, benefits and tips

Heard about a swing shift job but unsure what it means? Read this article to learn what swing shifts are and how to make a swing schedule work.

FREE FOREVER • UNLIMITED USERS

Free time tracker

Time tracking software used by millions. Clockify is a time tracker and timesheet app that lets you track work hours across projects.

An official website of the United States government

Here's how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( Lock A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- A–Z Index

- Operating Status

Pay Administration

Questions and answers, what is compensatory time off for travel.

An official website of the United States government

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Office of Human Resources Management

Department of Commerce

- Our mission

- Organizational chart

- Servicing HR offices

- Policy program directory

- Staff directory

- Internships

- Federal programs

- DC Summer Youth Employment Program

- Senior professionals

- Hiring initiatives

- Frequently asked questions

- Health insurance

- Dental and vision insurance

- Flexible spending accounts

- Life insurance

- Long term care insurance

- Eligible Employees

- Legal Definitions

- Establishing Bi-Weekly Deduction

- Affordable Care Act information

- Federal employee retirement system

- Civil service retirement system

- Thrift Savings Plan

- Transit benefits

- Student loan repayment

- Domestic Partners - Eligible Benefits Programs

- Domestic Partners - Programs that Exclude Eligibility

- Employment & income verifications

- Employee personal page

- Pay periods and dates

- Overtime pay

- Carrying Over

- Charging Sick Leave to Annual Leave

- Earning Leave Chart

- Exceptions to Full Bi-Weekly Pay Period Requirement

- Loss of Leave Accruals - Nonpay Status

- Repaying Advanced Leave

- Restoring Lost Leave

- Use or Lose

- Using Advanced Leave

- Alternating Between Full and Part Time

- Liquidating Advances

- Part-Time Leave Accrual Chart

- Requesting and Using Donated Leave

- Serious Health Condition

- Unusual Work Schedules

- Alternative Position

- Equivalent Position

- FMLA - Serious Health Condition

- Impact on Probationary Status

- Irregular Schedules

- Delayed Arrival/Unscheduled Leave

- Early Dismissal

- Emergency Employees

- Heating and Cooling Failures

- Organ Donations

- Transition Leave

- Travel and Exams

- Unnecessary Excused Absences

- Premium Pay

- Working Outside of U.S.

- Calculating Leave to Restore

- Care for a Family Member

- Documents You Must Keep

- Leave Accrual While on Donated Leave

- OPM Form 630

- Other Agencies

- Rules on Donating Leave

- Types of Medical Emergencies

- Workers' Comp and Donated Leave

- Restoring Leave to Donors

- Points of Contact

- Alternative work schedules

- Dependent and elder care

- Employee Assistance Program

- Grievances and complaints

- Health and safety

- Commerce Training Options

- Commerce Learning Center

- Chief Learning Officers Council

- Individual Development Plans

- Administrative Professional Certificate Program

- Executive Leadership Development Program

- SES Candidate Development Program

- Performance planning process

- Your performance plan

- Evaluating your performance

- Writing up your accomplishments

- Cash awards

- Non-monetary awards

- Annual Honor Awards

- Performance Management System Fact sheet

- Policies for SES employees

- Pay and leave

- Executive Performance Management System

- Data on pay and performance

- Agendas and minutes

- Drug-free workplace

- Reasonable accommodation

- Pay administration

- Federal Register Notices

- Position descriptions

- Temporary promotions

- Health Savings Account

- Death Gratuity Policy

- General pay

- Premium pay

- Leave policies

- Honor Awards Program

- Contractors

- Guidelines for SES Special Act Award Nominations

- Performance Management System Definitions

- 5-Level Performance Management System

- Briefing Video

- Performance plan library

- EPMS Implementation Resources

- SES Pay and Performance Profile Data

- RPL Registration Form

- CLC Registration Instructions

- Career Transition Assistance Program

- Voluntary Early Retirement Authority

- Voluntary Separation Incentive Payment

- Adverse Actions

- Grievance Processes

- Equal Employment Opportunity

- Mediation Services/ADR Programs

- Professional Liability Insurance

- Chief Human Capital Officer

- HCMA Council

- Diversity and Inclusion

- Commerce Annual Employee Survey

- Commerce New Employee Survey

- Office of Human Resources Accountability

- Brief History

- Electronic Official Personnel Folder (eOPF) Information

- Employee surveys

- Recognition

- Labor-Management Relations

- RIF, Transfer of Function, and Furlough

- Commerce.gov

- Students and recent grads

- People with disabilities

- Compensation

- Work-life balance

- Training and Development

- Performance and awards

- Senior Executive Service

- Labor Management Forum

- Position management

- Recruitment

- Benefits policies

- Compensation policies

- Performance management

- SES policies

- Workforce reduction

- Employee relations

- Human Capital Management

- Labor-management relations

- Practitioners

Was this page helpful?

Special compensatory time off for travel.

This program allows employees to accrue compensatory time off for time spent by an employee in a travel status away from the employee’s official duty station when such time is not otherwise compensable. The travel must be officially authorized for work purposes and approved by an authorized official.

An employee as defined in Title 5 U.S.C. 5541(2), who is employed in an “Executive Agency,” as defined in 5 U.S.C. 105, ) is entitled to earn and use compensatory time off for travel regardless of whether the employee is exempt or non-exempt from the Fair Labor Standards Act (FLSA). Coverage includes employees in Senior Level (SL) and Scientific of Professional (ST) positions, Federal Wage System (or Wage Grade, WG), and commissioned (tenured) Foreign Service Officers (in pay plan FO) and Commissioned Foreign Service Officers (in pay plan FO).

Senior Executive Service members and intermittent employees (who do not have a scheduled tour of duty for leave purposes) are excluded from coverage.

Effective Dates of Coverage

Final regulations implementing compensatory time off for travel for most employees was effective May 17, 2007. Coverage for WG employees was effective April 27, 2008. Coverage for Foreign Service Officers (in pay plan FO) and Commissioned Foreign Service Officers (in pay plan FO) was effective June 8, 2006.

Creditable Travel Time

Time in a travel status includes the time the employee spends traveling between the official duty station and a temporary duty station (or the lodging in the temporary duty station) or between two temporary duty stations (or the lodging in the temporary duty station) and the “usual waiting time” that precedes or interrupts such travel.

“Usual waiting time” is the time required to arrive at the airport (or other transportation hub) for security checks-ins, etc., prior to a designated departure time.

Time spent at an intervening airport (or transportation hub) waiting for a connecting flight also is creditable time.

In the Department, “usual waiting time” is 2 hours for domestic travel and up to 4 hours for international travel.

Non-Creditable Travel Time

The following do not qualify as creditable time:

- Unusually long or extended waiting periods that occur prior to an employee’s initial departure time or between actual periods of travel if the employee is free to rest, sleep, or otherwise use the time for his/her own purposes;

- Long waiting periods that occur during an employee's regular scheduled working hours; these periods are compensable as part of the employee's regularly scheduled administrative workweek;

- Time spent traveling outside of an employee’s regular working hours to or from a transportation terminal that are within the limits of the employee’s official duty station;

- Time spent traveling in connection with the performance of union representational activities;

- Time spent traveling on a holiday or an “in-lieu-of” holiday; the employee is entitled to his or her rate of basic pay for the holiday hours; and

- Time spent at a temporary duty station between arrival and departure times; and

- Meal times.

Once an employee arrives at the temporary duty station (i.e., TDY work site, training site, or hotel at the temporary duty station), the employee is no longer considered to be in a travel status. Any time spent at a temporary duty station between arrival and departure is not creditable for earning compensatory time off for travel.

Offsetting Normal Commuting Time

When an employee travels directly between the home and a temporary duty station that is outside the limits of the employee's official duty station, the employee's normal “home-to-work/work-to-home” commuting time must be deducted from the creditable travel time.

Normal commuting time must also be deducted from the creditable travel time if the employee is required to travel outside of regular working hours between the home and a transportation hub outside the limits of the employee's official duty station.

Travel between Multiple Time Zones

When an employee’s travel involves two or more time zones, the time zone from the point of first departure must be used to determine travel status for accruing compensatory time off. For example, if an employee travels from his official duty station in Washington, DC, to a temporary duty station in Boulder, CO, the Washington, DC, time zone must be used to determine hours in a travel status. However, on the return trip to Washington, DC, the time zone from Boulder, CO, must be used to determine hours in a travel status

Timeframes for Use

An employee must use accrued compensatory time off by the end of the 26th pay period after the pay period during which it was earned and reported on the webTA.

All compensatory time off for travel must be used in the chronological order in which it was earned; that is, time earned first is used first.

Forfeiture of Unused Hours

Accumulated compensatory time that is unused by the end of the 26th pay period after the pay period in which it was earned is forfeited. Unused balances are also forfeited when an employee voluntarily transfers to another agency or separates from Federal service. Forfeited hours may not be paid or restored.

When an employee fails to use accumulated compensatory time balances within the required timeframe due to an exigency of the public service beyond the employee’s control, the time limit for using the hours may be extended for up to an additional 26 pay periods. Additional extensions are not authorized and forfeited hours may not be restored.

Exceptions to Forfeiture of Unused Hours

Unused compensatory time off for travel must be held in abeyance for an employee who separates, or is placed in a leave without pay (LWOP) status, and later returns:

- To perform service in the uniformed services (see 38 U.S.C. § 4303 and 5 CFR § 353.102) with restoration rights; and

- Due to an on-the-job injury with entitlement to injury compensation under 5 U.S.C. Chapter 81.

In these cases, the employee must use all of the compensatory time off for travel held in abeyance by the end of the 26th pay period following the pay period in which he/she returns to duty, or the compensatory time off will be forfeited.

Biweekly Salary Limitation and Aggregate Limitation on Pay

Compensatory time off for travel is not considered in applying the bi-weekly pay cap under 5 U.S.C. 5547 or the aggregate limitation on pay under 5 U.S.C.507.

Alternate Mode of Transportation

When an employee is allowed to use an alternate mode of transportation, or travels at a time/route other than what is initially approved by the authorizing official, creditable time for travel status must be estimated. The estimate is based on the amount of time the employee would have had if the mode of transportation or the time/route initially approved by the authorizing official was used. In determining the estimated amount of creditable time for travel that an employee would have had, the employee will be credited with the lesser of the:

- Estimated time in a travel status the employee would have had if the employee had traveled at the initially approved time, or

- Employee's actual time in a travel status at a time other than that initially approved.

Applying for Compensatory Time off for Travel

Employee must officially request the earning of compensatory time prior to the actual travel or within 10 calendar days of termination of the travel. The request may be submitted via the webTA Leave and Premium Pay Request functionality, Commerce Department Form CD-81, “Authorization for Paid Overtime and/or Holiday Work, and for Compensatory Overtime”, electronic mail, or memorandum. The request should estimate the number of hours the employee expects to earn. Upon the employee’s return from travel, the employee must provide a chronological record of travel information including:

- Duration of the normal home-to-work commute;

- Time and place of departure (i.e., the employee’s home or official duty station);

- Actual time spent traveling to and from the transportation terminal if the terminal is outside of the employee’s official duty station;

- Usual waiting time; and