More From Forbes

Survey predicts air travel boom for 2024: what it means for passengers.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

The global aviation industry is expected to experience a significant increase in passenger traffic in 2024, according to the International Air Transport Association . This is good news for the airlines, though passengers may find that flights are even more full than they were this year.

The IATA expects 2024 to be a big year for airlines globally

200 Million More Passengers Than Pre-Pandemic

The IATA predicts that the number of passengers traveling by air will reach 4.7 billion in 2024, a jump from the 4.5 billion passengers who traveled in 2019. This increase is driven by changing travel habits. IATA survey data shows that one-third of the respondents say they are traveling more than they did before the pandemic, while about half say their travel is the same. Just 18% say they are traveling less.

Looking ahead, the survey respondents paint an even rosier picture: 44% say that they will travel more in the next 12 months than in the previous 12 months. A mere 7% say they will travel less.

Airline Profits To Take Off

More people flying is good news for airlines. The IATA says passenger revenues are expected to reach $717 billion in 2024, up 12% from $642 billion in 2023. They predict that passenger yields, a measure of revenue per passenger-mile, will be up by 1.8% over 2023.

The revenue jump will drive a better bottom line. The IATA predicts airline industry operating profits will hit $49.3 billion in 2024, a big jump from 2023’s $40.7 billion.

Best High-Yield Savings Accounts Of 2024

Best 5% interest savings accounts of 2024, more full airplanes.

Airlines love to fly aircraft that are 100% full of paying passengers. The passengers themselves may not enjoy full flights quite as much. In 2023, almost every flight I boarded was preceded by the gate agent announcing, “We’re expecting a completely full flight today,” and warning passengers about carry-on rules and boarding protocols.

Despite new aircraft deliveries, 2024 won’t provide relief for passengers hoping for a little extra space. The IATA says the load factor will be 82.6% in 2024, a slight increase from 82% in 2023.

What Could Go Wrong?

The IATA points out a number of factors that could cause their predictions to be too optimistic. Global economic uncertainty is one. High interest rates could reduce economic activity. Slow growth, high youth unemployment and volatile real estate markets could affect China’s economic recovery. Both business and leisure travel could be affected by economic headwinds.

The airlines have largely worked around the armed conflicts in Ukraine and the Middle East. An escalation in either area would almost certainly be negative for airline revenues. Should one or both conflicts be resolved peacefully, though, airlines might see higher demand and lower fuel costs.

Book Early And Often

If the status quo continues into 2024—no economic upheavals or escalated military conflicts—2024 will be a good year for airlines globally. Passengers expect to fly more, and while airlines are adding capacity, both equipment and crew staffing can’t be scaled overnight.

More flights booked to capacity will mean fewer last-minute discounts, so waiting for price drops may be less productive in 2024 than in the past.

On the plus side, healthy and profitable airlines are better for passenger experience than financially struggling ones. A solid bottom line could enable investments in equipment, amenities and other areas that benefit customers—if management decides that’s important.

Safe travels!

- Editorial Standards

- Reprints & Permissions

Join The Conversation

One Community. Many Voices. Create a free account to share your thoughts.

Forbes Community Guidelines

Our community is about connecting people through open and thoughtful conversations. We want our readers to share their views and exchange ideas and facts in a safe space.

In order to do so, please follow the posting rules in our site's Terms of Service. We've summarized some of those key rules below. Simply put, keep it civil.

Your post will be rejected if we notice that it seems to contain:

- False or intentionally out-of-context or misleading information

- Insults, profanity, incoherent, obscene or inflammatory language or threats of any kind

- Attacks on the identity of other commenters or the article's author

- Content that otherwise violates our site's terms.

User accounts will be blocked if we notice or believe that users are engaged in:

- Continuous attempts to re-post comments that have been previously moderated/rejected

- Racist, sexist, homophobic or other discriminatory comments

- Attempts or tactics that put the site security at risk

- Actions that otherwise violate our site's terms.

So, how can you be a power user?

- Stay on topic and share your insights

- Feel free to be clear and thoughtful to get your point across

- ‘Like’ or ‘Dislike’ to show your point of view.

- Protect your community.

- Use the report tool to alert us when someone breaks the rules.

Thanks for reading our community guidelines. Please read the full list of posting rules found in our site's Terms of Service.

After a Rocky Start to the Year, Experts Predict What’s Next for Air Travel in 2024

There will be more fliers and (hopefully) fewer delays and cancellations. but other aspects of air travel are less clear..

- Copy Link copied

What is known and what are the unknowns for 2024? We asked insiders.

Photo by Justin Lim/Unsplash

In 2024, more of us, apparently, are resolving to take more trips by air. Or at least that was how it was looking before two back-to-back in-flight incidents kicked off the start of the year: the Japan Airlines airplane that burst into flames after a runway collision, and the Alaska Airlines plug door blowing out that led to the global grounding of Boeing 737-9 Max planes.

This year, despite some nervousness fliers may be feeling in the aftermath of said incidents, air travel volume is expected to reach “an historic high,” with 4.7 billion air passengers expected worldwide, according to the International Air Transport Association (IATA). That exceeds not just 2023’s total of 4.4 billion, but also the pre-pandemic 2019 total of 4.5 billion.

Airlines have “come roaring back to pre-pandemic levels of connectivity,” said Willie Walsh, IATA’s director general, adding that “the speed of the recovery has been extraordinary.” Looking ahead, 44 percent of those polled in a recent IATA consumer survey say that they will travel more in the next 12 months than in the previous 12 months.

In the United States, the story is similar, said Helane Becker, an airline analyst with investment bank TD Cowen, who noted that passenger volume at Transportation Security Administration (TSA) checkpoints was up 11.6 percent in 2023, with an average of 2.3 million travelers daily—and that will rise at least 5 percent in 2024. Unless TSA adds more screeners, that could lead to longer airport lines. In peak periods “we will regularly see days when 3 million people travel through airports,” Becker said.

How will the recent safety scares affect operations? What does the higher number of travelers mean for airfares this year? And will we see additional operational struggles like the snafus that roiled holiday travel a little more than a year ago? We asked experts to weigh in. Here are their predictions for what flying will be like in 2024.

Air travel safety is being called into question amid Boeing 737-9 Max groundings

After a series of close calls at airports last year, air safety standards were already under the microscope in 2023. But when the new year began with two serious accidents, the Boeing 737-9 Max scare , which followed a crash at Tokyo’s Haneda Airport , the issue became a front-page story.

After immediately grounding 171 Boeing 737-9 Max planes in the United States and in countries with direct flights to the U.S., the FAA on January 12 said that it would be increasing its oversight of Boeing production and manufacturing. The move came one day after the FAA said that it had “formally notified Boeing that the FAA has launched an investigation into the company as a result of last Friday’s incident on a Boeing Model 737-9 MAX in which the aircraft lost a passenger door plug while in flight.”

It’s unclear how long it will be before the 737-9 Max planes can return to service. Last week, United reported that it had found loose bolts on Boeing 737-9 Max airplanes during fleet inspections, furthering concerns.

The Alaska plane is not the same version of the 737 as the Max 8, which had two fatal crashes that prompted a nearly two-year worldwide grounding of the Max series starting in 2019. But given that it is part of the same aircraft family, the incident is raising some questions among travelers about its overall safety record.

“The outcome could have been a lot worse” if the Alaska aircraft had been at cruising altitude (about 34,000 feet), said John Goglia, a former member of the National Transportation Safety Board (NTSB) and an aviation safety consultant.

The head of NTSB, Jennifer Homendy, said at a news conference following the Alaska Airlines incident that the agency is going to pore over maintenance and safety records to determine the cause of the accident, which could take some time. But she also reassured the traveling public that air travel is safe.

“We have the safest aviation system in the world,” she said, adding that the United States “sets the standard for air safety” globally.

This issue—and the concerns it has sparked—isn’t going away anytime soon, and we can expect air travel safety to be top of mind for travelers and the industry for weeks and possibly months to come.

Airlines will fix operational woes—or face the consequences

No airline has gotten got a bigger black eye over flight snafus lately than Southwest—which, despite its mega-airline size, was tripped up in late 2022 during a weather-related meltdown by its antiquated technology, including a woefully outdated crew-scheduling system. The airline paid dearly for the mess, and not just in damage to its reputation; last month, the U.S. Department of Transportation (DOT) socked it with a record $140 million fine .

But the implications for fliers go well beyond one airline: $90 million of the fine will go directly into a fund to compensate passengers who are delayed more than three hours, and industry watchers fully expect this three-hour rule will take effect across the industry. Consumer advocates say this signals a tougher stand on airline service issues that are clearly under the carrier’s control, including inadequate staffing to meet published schedules.

As Southwest CEO Bob Jordan told the Wings Club in New York last month (just as the DOT news was about to break), the airline has invested more than $1 billion in new systems that will not only help get crews to where they need to be but also enable the airline to better manage flights in bad weather. “Going forward, this is about running a great operation, and we will not stop working on it until we get it done,” Jordan said.

“The message is, if you don’t invest in the product, the consequences can be devastating,” said William McGee, senior fellow for aviation and travel at the American Economic Liberties Project. He predicts that the current leadership at DOT, “the most pro-consumer in U.S. history,” will be even more active on air passenger rights in 2024.

As part of that effort, DOT has signaled it will probe airline loyalty plans for evidence of “unfair and deceptive” practices, in response to a rise in complaints about changes in the award levels required to redeem tickets, among other things.

Don’t count on (much, if any) airfare relief

In 2023, as leisure travel rebounded to pre-pandemic levels, consumers got sticker shock as fares rose well above the rate of inflation—in some markets by as much as 15 to 20 percent—mainly because capacity was still down due to a lag in aircraft deliveries.

But heading into 2024, demand is still outpacing the number of available seats, and according to some experts, that situation may continue well into the year.

“Airfares are probably going to be higher [in 2024] because it simply comes down to supply and demand,” said Michael Derchin, a long-time Wall Street airline analyst who pens the newsletter Heard in the Hangar.

“Supply is tight and demand is high, and supply is tight for reasons that are totally out of the control of the airlines,” he said. And major aircraft manufacturers continue to have supply chain problems.

In addition, while most U.S. airlines are in the black, their costs are going up. Fuel prices have stabilized recently, but “the airlines’ single biggest cost by far is labor, accounting for about 40 percent of total expenses, and this year there’s been a significant increase in wages” thanks to airline unions’ success in bargaining for better pay and benefits, Derchin said.

The main takeaway: If you see a good flight deal, grab it. Prices aren’t likely to descend.

Hidden and ancillary fees don’t appear to be going away

Logic would dictate that if people are paying higher-than-expected prices, they should expect to get more for their money. Right? Not so fast, said Henry Harteveldt, travel industry analyst and co-founder of Atmosphere Research.

Ancillary fees, such as baggage fees and additional costs for seat selection and other services—which have drawn much criticism from Congress and the Biden administration—“are here to stay,” he said. He noted that Alaska Airlines is raising the price of checking a bag from $30 to $35 . “That has not increased in a while, and other airlines will follow suit,” he said.

Expanded international service

On the bright side, there will likely be more flight choices to destinations abroad in 2024. “Major airlines are adding international flights with a focus on restoring seasonal capacity and adding new flights to the Pacific region,” said TD Cowen’s Becker. She also cited what might be described as the Taylor Swift effect: major events that stimulate a lot of airline traffic. Watch for flights to fill up to the Paris Olympics this summer, and to destinations on the superstar’s international tour this year.

Watch CBS News

Leisure travel roars back — at a cost to consumers

By Megan Cerullo

March 30, 2022 / 4:08 PM EDT / MoneyWatch

Travelers are finally taking to the skies again, but the surge in demand is coinciding with high oil prices, driven by Russia's war on Ukraine.

As a result, airlines are having to pay more for jet fuel, and they are passing some of those increased costs along to consumers.

Gina Kramer and her daughter Frankie recently flew to Southern California to visit family they haven't seen in three years, in part because they didn't feel safe traveling during the pandemic.

"So it's going to be a family reunion of sorts," Frankie told CBS News' Danya Bacchus.

The trip is coming at a cost to the Kramers and other families that are prioritizing travel again.

Airline ticket prices are soaring, according to data from Hopper , an analytics company that tracks changes in airfare.

Prices continue to climb

The average cost of domestic roundtrip ticket was $330 in March, up 40% from the beginning of this year. Airfare is expected to continue rising 10% through May, when a round trip ticket will cost, on average, $360, according to Hopper.

Gina Kramer experienced this first hand while browsing ticket prices online, noting that the longer she delayed booking, the more prices went up.

"And if you missed a window, two days later, prices were like, $100 more," she said.

Higher prices aren't expected to deter travelers, though. An American Express Travel survey found that 72% of Americans plan to travel more this year than last.

This rise in demand is pushing up prices for nearly all-things travel-related, including hotel rooms.

"Domestic bookings are surging, hotels rates are going up nearing 2019 levels," said CBS News travel advisor Peter Greenberg. "People are now valuing travel as an experience they want to keep."

Airlines are also responding to the rebound in travel. JetBlue recently cut 27 routes , many of which it added during the pandemic to hotspots in Florida and Mexico, when Americans were more limited in where they could go.

With higher fuel prices and trips to Europe back in play, some of the routes no longer make financial sense for the airline.

"Demand to these places is waning as people feel more comfortable going to cities," said Willis Orlando, a flights specialist at Scott's Cheap Flights, an airfare deals website. "If I were in the pricing department of an airline deciding what routes are profitable, I would say maybe we don't need to double down quite so hard on South Florida."

Megan Cerullo is a New York-based reporter for CBS MoneyWatch covering small business, workplace, health care, consumer spending and personal finance topics. She regularly appears on CBS News 24/7 to discuss her reporting.

More from CBS News

Gas prices are falling along with demand, despite arrival of summer

Buying a home? Expect to pay $18,000 a year in additional costs

These 2 debt relief options won't hurt your credit, according to experts

DNC says it will pay for first lady Jill Biden's Delaware-Paris flights

- Skip to main content

- Keyboard shortcuts for audio player

Planet Money

Airline ticket prices are expected to keep rising for several reasons.

Paddy Hirsch

Summer travel could be a boom for U.S. airlines, with consumer demand surging. But a pilot shortage, worsened by the pandemic, might get in the way of a return to profitability.

Copyright © 2022 NPR. All rights reserved. Visit our website terms of use and permissions pages at www.npr.org for further information.

NPR transcripts are created on a rush deadline by an NPR contractor. This text may not be in its final form and may be updated or revised in the future. Accuracy and availability may vary. The authoritative record of NPR’s programming is the audio record.

Advertisement

Supported by

Airlines Cash In as Flexible Work Changes Travel Patterns

Untethered from desks, passengers are flying more often and in different ways. Carriers expect the new habits to endure, despite economic uncertainty.

- Share full article

By Niraj Chokshi

Markets are convulsing, and inflation is squeezing consumers. But people are still flying. A lot.

Travel didn’t slow much after summer ended, and airline executives now say they expect changing and recovering travel patterns to keep them busy through the holidays and into next year.

“Many of the demand trends we saw emerge during the pandemic are becoming more consistent and shaping our commercial focus for 2023 and beyond,” Robert Isom, the chief executive of American Airlines, told reporters and analysts on a call on Thursday to discuss the carrier’s quarterly financial results.

The airline is feeling “very bullish about overall demand, even in an uncertain economic environment,” he added. Executives at United Airlines and Delta Air Lines share that optimism.

One big reason is that the ability to work remotely, full or part time, has allowed Americans to travel more and to combine personal and professional trips — a transformation that appears to be enduring, and one that carriers are planning around, executives say.

“There’s been a permanent structural change in leisure demand because of the flexibility that hybrid work allows,” United’s chief executive, Scott Kirby, said Wednesday on a call with reporters and analysts. “This is not pent-up demand. It’s the new normal.”

Other trends also contributed to strong financial results for the three airlines in the quarter that ended in September. Lucrative corporate travel and international travel continue to rebound. And even setbacks have a silver lining: Limits on airline growth have kept flights full.

United reported a $942 million profit, compared with $695 million for Delta and $483 million for American. All expect revenue and profits in the last three months of the year to be higher than during the same period in 2019, even though they will offer fewer flights.

The benefits to the industry of travelers’ newfound flexibility extend beyond revenue. Passengers have started to spread out travel, reducing swings in demand between busy weekends and slower days midweek. Holiday travel is spreading out, too, the executives said.

Traditionally, Labor Day weekend marks the end of the busy summer season, with travel slow until it picks up for Thanksgiving and Christmas. But flexibility from remote work encouraged people to keep flying last month, United said.

The airline had as much revenue on some September days as during peak summer travel, helping to make September the third best month ever for United in revenue per seat per mile flown, a standard industry measure. And October is on track to outperform September.

Even intraday travel is changing in ways that ease pressure on airlines. At American, travelers long preferred flights that left before 8 a.m. or after 4 p.m., so the airline focused flights at either end of the weekday. But American said it had started to see a small yet notable shift toward travel in the middle of the day.

Customers who combine leisure and business travel also tend to have a closer relationship with the airline, Vasu Raja, American’s chief commercial officer, said on the Thursday call. Those customers are twice as likely as a typical business customer to enroll in American’s loyalty program and three times as likely to sign up for an American-branded credit card if they don’t already have one.

“We’re seeing people travel with a lot more intentionality,” he said. “And when that happens, those same customers are much more willing to go and earn miles so they can go and take their family on vacation, for example.”

What’s good news for airlines may be bad news for bargain-hunting travelers. Fares have fallen from their peaks over the spring and summer, but prices for holiday flights are likely to start rising rapidly, according to Hopper, the travel booking site.

Fares for Thanksgiving are expected to peak at more than $450 for an average round-trip domestic flight. Prices for Christmas flights have reached five-year highs and could rise above $580 on average, according to Hopper’s lead economist, Hayley Berg.

“We know that travelers, many of them, have not traveled either home for the holidays or for traditional vacations for three years now, and we know that demand is going to be incredibly high,” she said.

United said this week that even demand between Thanksgiving and Christmas was growing, with sales for flights during the first two weeks of December ahead of where they were in 2019.

Deals may still be available, if travelers are flexible on when and where they fly. Some flights abroad are notably cheap around Thanksgiving, for example. But even those flights are selling fast.

While the recovery in international travel and corporate travel, two profitable parts of the business, has lagged behind that of domestic travel over the past two years, airlines say both are rebounding steadily.

In some cases, the two are intertwined: At United, corporate travel is recovering faster on flights across the Atlantic Ocean than within the United States, the airline’s chief commercial officer, Andrew Nocella, said on Wednesday’s call.

“A Zoom meeting is simply less practical in a global setting,” he said.

The international rebound is driven by a strong U.S. dollar and a continued reopening of borders around the world. Delta said last week that it had more flights scheduled across the Atlantic this month than in October 2019, leading the rebound in other regions. Delta and United said they expected a rapid rise in demand for travel to Japan after its recent reopening.

At American, the rise of blended trips and travel by small and medium-size businesses has more than offset a slower rebound in travel by typically larger corporations. That’s because the people flying those blended and small-business trips are increasingly buying tickets that yield higher profits for the airline or are interested in valuable perks, like premium seats, branded credit cards or the airline’s loyalty program.

While demand is up, limits on supply are also driving higher fares and revenues — and frustrating executives.

The mainline carriers went on a pilot-hiring spree this year after making deep cuts to staffing early in the pandemic, but are still struggling to catch up on training those new hires. Delta has said it aims to get much of that training done by summer.

Mr. Isom said Thursday that American was close to achieving its goal of hiring 2,000 pilots this year and expected to catch up on training over the next year. But while American, Delta and United have mainly staffed up, the regional airlines that they rely on or own outright are struggling to recruit pilots.

Airlines have also had difficulty expanding their fleets as Boeing and Airbus struggle to overcome delays in delivering new aircraft. American said Thursday that it expected to receive 19 Boeing 737 Max 8 planes next year, down from the 27 previously foreseen. United plans to take 179 aircraft deliveries next year, but acknowledged a risk of delays.

Both carriers argued that the federal government had limited growth, too. United said air traffic controllers were stretched too thin, and American said delays in visa approvals for foreigners visiting the United States, compared with 2019, had hampered the recovery.

The constraints on the industry contributed to operational meltdowns over the past two years, including some over the summer, as airlines tried to overcome disruptions caused by weather and other factors. But airlines have made some positive changes.

About 1.4 percent of flights were canceled last month, compared with 2 percent in August, according to FlightAware, a flight-tracking website. Just over 17 percent of flights in September were delayed, compared with more than 22 percent in August.

“It’s apparent that U.S. airlines have robust demand and have improved on execution after struggles earlier this summer,” said Christopher Raite, a senior analyst at Third Bridge, a research firm.

After all the industry’s difficulties in the early stages of the pandemic, it is a moment for executives to savor, at least for now.

“We currently see no signs of demand slowing as we move into the new year,” Mr. Isom said. “But as always, we will continue to keep a close eye on the macroeconomic environment.”

Niraj Chokshi covers the business of transportation, with a focus on autonomous vehicles, airlines and logistics. More about Niraj Chokshi

Sorry, we did not find any matching results.

We frequently add data and we're interested in what would be useful to people. If you have a specific recommendation, you can reach us at [email protected] .

We are in the process of adding data at the state and local level. Sign up on our mailing list here to be the first to know when it is available.

Search tips:

• Check your spelling

• Try other search terms

• Use fewer words

Is air travel getting more expensive?

Recent increases in flight costs reflect broad inflation and higher gas prices.

Updated on Fri, November 18, 2022 by the USAFacts Team

The cost of air travel in the US is up in 2022 compared with last year. After adjusting for inflation though, the price of an average plane ticket is still decreasing over the past decade.

Air traffic declined sharply at the beginning of the pandemic, but the number of flights is now near pre-pandemic levels. However, air travel’s recovery since the COVID-19 pandemic has been turbulent. Despite fewer passengers, airlines are on time less often . And prices are on the rise thanks to higher gas prices and widespread inflation, even before the upcoming holiday travel season.

How have air fares changed?

Recent increases in inflation mean prices have increased for most common goods and services, and air fares are no exception. The overall inflation rate from September 2021 to 2022 was 8.2% for all items in the Consumer Price Index . By comparison, airline fares saw one of the greatest 12-month increases in price for items in the index, rising 42.9% over the same time period.

This increase can be attributed in part to the low cost and low demand of flights in 2021, in addition to the growth of inflation this year.

Another contributor to rising air fare prices is the increase in fuel costs. In June 2022, the average cost per gallon of fuel for airlines surpassed $4 for the first time. For Q2 of 2022, fuel costs accounted for 24.2% of domestic operating expenses for airlines, compared with 14.6% in 2021, and 34.0% of international expenses, compared with 20.0% in 2021.

While airlines can engage in hedging , or using fuel contracts to limit exposure to future price changes, unexpected or drastic changes in fuel costs will still impact an airline’s financials.

Accounting for inflation, air fares increased from 2021 to 2022, but this year’s prices overall continued a long-run decline in the cost to fly. The recent increase in prices is reflective of air travel’s recovery from the pandemic, but air fare increases have generally matched or been slightly below inflation levels.

Which airports are the most expensive to fly out of?

Of the top 50 busiest airports in the US by number of passengers, Washington Dulles International Airport in Washington, DC was the most expensive to fly out of, with an average domestic airfare from April to June 2022 of $525.70. Average domestic airline fares are influenced by the most common flight routes, seat types, and airlines for each airport, as well as regional differences in expenses.

Of the 50 busiest airports, 18 have seen current flight prices surpass 2019 prices, adjusted for inflation.

With air travel rising back to pre-pandemic levels, Americans across the country will be impacted by the increased cost of flights throughout the holidays.

Learn more about air travel and which airlines have the best on-time performance and get the facts every week by signing up for our newsletter .

Explore more of USAFacts

Related articles, gas and used car prices are over 20% above their levels last year.

What is inflation and how is it measured?

What is driving the rise in inflation?

What is the money supply, and how does it relate to inflation and the Federal Reserve?

Related Data

Average inflation rate

Data delivered to your inbox.

Keep up with the latest data and most popular content.

SIGN UP FOR THE NEWSLETTER

- Aviation and Astronautical Sciences

- Computer Science, Artificial Intelligence and Data Science

- Construction and Facilities

- Critical Infrastructure

- Cyber & Information Security

- Cyberpsychology

- Engineering

- Engineering Technologies

- Intelligence and Global Security Studies

- Management of Technology

- Occupational Safety and Health

- Uncrewed Systems

- Doctoral Degrees

- Master's Degrees

- Bachelor's Degrees

- Online Programs

- Associate Degrees

- Certificates

- Minor Degrees

- STEM Events

- Webinars and Podcasts

- Master's

- Undergraduate

- Transfer Students

- Military and Veterans

- International Students

- Admissions Counselor

- Capitol Connections

- Accepted Students

- Project Lead the Way

- Builder Culture

- Campus Life

- Clubs and Organizations

- Centers and Labs

- Online Classes

- The Capitol Commitment

- Top Employers

- Co-ops and Internships

- Professional Education

- Find a Mentor

- Career Services

- Capitol Online Job Board

- Recruiters and Employers

- Why Capitol Tech

- At a Glance

- Mission, Vision and Goals

- Diversity, Equity and Inclusion

- Washington, D.C.

- Capitol History

- Capitol Partners

- News and Events

- Visitors/Campus

- Accreditation

- Recognitions & Awards

- Current Students

- Faculty & Staff

- Alumni & Giving

- News & Events

- Capitology Blog

- Maps / Directions

International Airline Travel Demand on the Rise in Post-Pandemic Times

In a post-pandemic world, the aviation industry that once struggled is now flourishing with shifting trends and new demands of the field. International travel is one area that is seeing such demands, as it recovers from the deep deficit caused by the pandemic. In response, United Airlines has taken forward action, placing large orders for new aircraft to accommodate the growing travel expectations of a soon-to-be thriving market.

International Travel for Industry Expansion

For airlines like United, higher-margin international travel is an important financial focus, as it has accounted for approximately 39% of their passenger revenue this year alone—a notable increase from pre-pandemic times. In addition, United Airlines expects a large portion of its growth to derive from global long-haul flying, which is a direct or non-stop international flight over 6 hours. In response, the airline ordered 110 aircraft from Boeing and Airbus in preparation of this anticipated expansion of its international network. But with a backlog of orders being managed by these companies due to supply shortages and overwhelming order demands, United and other airlines will need to wait until the end of this decade for the arrival of any new aircraft.

Evolving Aviation Technology

Airlines are recognizing a shift in the technology landscape when it comes to industry changes and necessary fleet upgrades in the next several years. The airline remains committed to the 787 aircraft , as the age of these planes is a testament to Boeing’s reliability and safety, but will be adding new 787’s as well as large, narrowbody jets like the A321 to their fleet, noting this model’s “fuel efficiency, smaller carbon footprint and lower maintenance and operating costs will be a ‘game changer’” for the company. According to Skift.com , “the orders are driven, in part, by United’s need to replace older planes by the end of the decade, as well as grow at capacity-constrained airports around the world.” United Airlines owns some of the world’s oldest planes , with an average fleet age of 16.3 years, and with some purchased during the 1990s which are now over 30 years old. And with United’s recent application to become the first non-stop flight carrier from Houston, TX to Tokyo, JP, this kind of future-focused, community-driven mentality is key to the airline’s continued and sustained international success.

Trends in the Aviation Industry

The U.S. Travel Association forecasts inbound travel volume to grow 31% by the end of 2023, 18% in 2024, and to see a full volume recovery from pre-pandemic times by 2025. Currently, inbound international travel stands at 84% of its former numbers, but is estimated to return to 99% by 2024. Spending in the area of business travel is expected to reach $1.4 trillion by 2024 and $1.8 trillion by 2027, with 2023 sector spending at an approximate 32% increase. In 2022, air travel brought in $183 billion of business travel spending. With these positive increases, the aviation industry is expected to see a growing trend of success for which airlines need to be prepared, not only with proper aircraft equipment but trained pilots as well.

The Future of Aviation: BS in Aviation Program

At Capitol Technology University, we offer the education and resources you need to pursue a career in aviation. Our Bachelor of Science in Aviation Professional Pilot provides hands-on flight training and a firm foundation in flight and airport operations, ground control, safety and risk management, Federal Aviation Administration (FAA) rules and regulations, aviation technologies, and piloting skills. Additionally, our new Flight Simulation Lab will be unveiled in Fall 2024. Visit our website for more information about this exciting program and the ways to launch your aviation career today

Future of Aviation //

For a start, mobility actors should come together in a shared vision. This is where the World Bank-led Sustainable Mobility for All (SuM4All) steps in. For the first time ever, the SuM4All provides the transport sector and its modes of transport with the opportunity to speak with one voice and jointly unpack a Roadmap of Actions that is tailored to countries and cities to implement on a voluntary basis. The SuM4All includes all modes of transport, including aviation. Aviation facilitates access to countries and cities, increases multi layered efficiencies in travel and makes safety and security in travel top priorities. The aviation sector is rapidly taking gender equality at heart.

The World Economic Forum proposes that the deployment of these private sector and government innovations to address mobility challenges can contribute to an improved mobility landscape – if they are deployed in a coordinated and collaborative way that aims to optimize the entire transport system. Unfortunately to date, these efforts in many instances may be exacerbating transport issues, most notably by adding congestion and complexity while also creating inefficiencies between public and private modes of transport.

In a little over a century, our industry has gone from learning to fly, to learning to fly faster, learning to fly further, learning to fly heavier planes, and now to having 100,000 plus commercial flights occurring around the world each and every day – representing over 400 departures per hour! Aviation has truly has been at the forefront of innovation to become one of the safest and most reliable modes of transportation in the world today.

Sharing and leveraging technology and best practices from aviation and all modes of transportation will help ensure the success and sustainability of the emerging mobility sector create trust by the public and become sustainable.

Within the 2030 Agenda framework, ICAO was identified as the custodian agency of the global indicator for Passenger and Freight Volumes, by Mode of Transport. ICAO monitors and provides data to measure the progress of States building resilient infrastructure, promoting inclusive and sustainable industrialization and fostering innovation.

The air transport industry is expanding and the future of aviation is a bright one.

In 2017, airlines worldwide carried around 4.1 billion passengers. They transported 56 million tonnes of freight on 37 million commercial flights. Every day, airplanes transport over 10 million passengers and around USD 18 billion worth of goods.

This indicates the significant economic impact of aviation on the world economy, which is also demonstrated by the fact that aviation represents 3.5 per cent of the gross domestic product (GDP) worldwide (2.7 trillion US dollars) and has created 65 million jobs globally.

Aviation provides the only rapid worldwide transportation network, generating economic growth, creating jobs, and facilitating international trade and tourism.

Aviation has become the enabler of global business and is now also being recognized by the international community as an essential enabler to achieving the UN Sustainable Development Goals.

The aviation sector is growing fast and will continue to grow. The most recent estimates suggest that demand for air transport will increase by an average of 4.3% per annum over the next 20 years.

By mid-2030s no fewer than 200,000 flights per day are expected to take off and land all over the world. Imagine the first video again – but with twice as much traffic!

And this growth is not limited to passenger traffic. We anticipate that cargo traffic in terms of tonnage – to continue to grow along a similar curve.

But the growing demand for air traffic also involves challenges, not least of which are the important logistical implications in and around airports to ensure the infrastructure is able to support this growth.

The main question revolves around how we can achieve growth in a responsible and therefore sustainable way.

As the industry plans to support a near doubling of passenger and cargo numbers by 2036, demand for pilots, engineers, air traffic controllers and other aviation-related jobs is expected to rise dramatically. What is also certain is that innovations in technology and approaches will be needed to sustain this growth.

We also see that the aviation is becoming more accessible to the global population. This figure shows for each country, what percentage of the population lives within 100 km of an airport.

World wide – 51% of the population lives within 100 km of an International Airport – and 74% live within 100 km of any kind of airport.

So airspace is quickly becoming congested and air traffic is slated to double over the next two decades. In addition to air space – we have to consider airports themselves. Airports are already built up around population centres and are already operating at high capacity.

The reality is that – in order to accommodate the forecast growth - drastic improvements and efficiencies for airports and air traffic management will need to be found. For this – we need innovation.

Aviation is already known as a driving force of global technology development and innovations.

Alternative fuels can significantly change the current scenario of aviation in support of the environmental protection. The vast investment in Artificial Intelligence (AI) and Big Data could be seen as a promising way of increasing safety, efficiency and sustainability. These technologies can help improve aviation infrastructure and airspace utilization.

The future of mobility is literally taking off!

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Travel Inflation Report: June 2024

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

How airfares have changed

How hotels room rates have changed, how rental car prices have changed, how restaurant prices have changed, how the price of movies, theaters and concerts has changed, smart money move: use travel rewards cards to book, if you’re planning to travel in 2024 ….

Some good news for travelers: Airfares, car rental and hotel prices in April were down compared to the same month last year. Falling travel prices is a bright spot for customers, considering that the price of pretty much everything else is going up. In fact, average consumer prices across all items rose 3.4% year-over-year through April.

According to NerdWallet's Travel Price Index, the overall cost of travel is down 1% from the same month in 2023 and up 15% compared with April 2019 (the last fully-normal April before lockdowns). In short, expect the same trip taken this year to cost slightly less than it did this time last year, but more than it would if you had taken the trip before the pandemic.

Despite travel costs declining year-over-year, there are still things you can do to reduce the price of your trip. Check out our smart money suggestions below.

NerdWallet's Travel Price Index combines data from individual travel categories tracked by the Bureau of Labor Statistics' Consumer Price Index data, such as airfares, lodging, meals and rental cars.

Overall prices for the past 12 months through April 2024 rose 3.4% before seasonal adjustment. Still, not every individual line item experiences inflation at the same rate — especially when it comes to travel prices. Some types of trips might actually be more or less expensive than in the past, depending on if your trip involves airfare versus driving, if you’re staying in a hotel and whether it involves a rental car.

To help you better understand how travel prices have changed, NerdWallet honed in on five categories:

Car rentals.

Food away from home.

Movies, theaters and concerts.

NerdWallet then compared those costs to their same prices a month ago and a year ago. And given how significantly COVID-19 altered the state of travel, the data also compares today’s prices to the same cost of those things pre-pandemic. For example, April 2024 is compared to April 2019 as the last corresponding pre-pandemic month.

Here’s what today’s travel prices look like:

When comparing April 2024 prices versus April 2023, U.S. airfares are down 5.8%. Compared to pre-pandemic prices, airfares are about 3.2% in April 2024 versus April 2019. That's not a lot considering average prices as a whole are up by 22.7% since April 2019.

Prices for lodging away from home — including hotels and motels in U.S. cities — did increase 1% month-over-month. Though, they are actually slightly down from last year, falling by 0.4% versus April 2023.

Unlike airfares that are barely higher than pre-pandemic prices, hotel and motel prices are significantly higher than what they were pre-pandemic — though still not as high as the 22.8% all-items average increase.

High rental car prices were one of the biggest stories of pandemic-era travel. Though prices have leveled off, they are still up an astounding 36.1% versus the same month in 2019. Still, the costs are better now than they were a year ago. Car rental prices are down 10.1% year-over-year.

Food prices consistently rise nearly every month, and this month was no exception. In April 2024, the cost of food away from home was up 4.2% versus the same month in 2023.

And prices are far higher than pre-pandemic, with April 2024 prices coming in at 29.4% higher than what they were in April 2019. That's higher than the inflation rate across all items, suggesting that restaurant prices have risen more than many other categories of goods.

Like restaurants, entertainment prices see fairly consistent increases — save for a small dip in 2020. Prices are now up 22.2% from what they were in March 2019, basically in line with the general rate of inflation.

The price for tickets to movies, theaters and concerts is up 3.4% year-over-year.

Paying for travel with points and miles versus cash isn’t as daunting a task as it may seem. Frequent flyer miles and hotel points can be accrued not just for recurring travel, but through other outlets as well. Credit card rewards and welcome bonuses can be one of the most popular ways to accrue a big stash of points for a lot less effort than living your life out of a suitcase.

In addition, travel credit cards can offer various money saving perks, like:

Complimentary trip insurance .

Savings on checked bags .

Waived foreign transaction fees .

Airport lounge access .

Cash back credits that can offset the annual fee.

Here's a sampling of cards that offer travel-related statement credits.

on Chase's website

on Bank of America's website

on Citibank's application

• 10 points per $1 on Chase Dining, hotel stays and car rentals purchased through Chase.

• 5 points per $1 on air travel purchased through Chase.

• 3 points per $1 on other travel and dining not booked with Chase.

• 1 point per $1 on other purchases.

• 5 points per $1 on prepaid hotels and car rentals booked directly in the Altitude Rewards Center.

• 3 points per $1 on eligible travel purchases and mobile wallet spending on Apple Pay, Google Pay and Samsung Pay.

• 1 point per $1 on all other purchases.

• 10 ThankYou® points per $1 spent on hotels, car rentals and attractions booked through the Citi Travel site.

• 3 points per $1 on air travel and other hotel purchases.

• 3 points per $1 on supermarkets.

• 3 points per $1 on gas stations and EV charging stations.

• 3 points per $1 on restaurants.

$300 annual travel credit .

$325 annual credit.

$100 in airline incidental statement credits.

If you’re building your next vacation budget based on an early-pandemic-era trip, expect to pay far more now for pretty much every expense. Yet even though prices constantly feel like they’re getting higher, you can still save on travel with a little planning.

To avoid the costs of eating out, head to local grocery stores — which can be a fun activity on its own — or pack snacks from home. While in an airport, head to the lounge. Many credit cards have partnerships with airport lounge operators ( Priority Pass is a popular one) where you can typically expect complimentary snacks and drinks.

Methodology

NerdWallet conducted an analysis of the Bureau of Labor Statistics’ Consumer Price Index data released by the U.S. Department of Labor, which was most recently updated in May 2024 and measures prices of items like travel, groceries and cars. Prices usually change every month, but some prices change more than others.

Keep in mind, this data is based on April 2024 information, even though it is released in May 2024, so prices you actually see may have actually improved (or gotten even worse) than this data, because it lags one month behind.

And even within the realm of travel, some expenses might go up, while others might go down.

The NerdWallet Travel Price Index combines data from the Consumer Price Index, weighted by the estimated spending in each category, which is based on 2019 travel expenditure data from the BLS.

Here are the spending categories considered, and how heavily each was weighted:

Flights: 29%.

Car rental: 13%.

Lodging: 30%.

Entertainment: 7%.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024 :

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1.5%-5% Enjoy 5% cash back on travel purchased through Chase Travel, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

Up to $300 Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options.

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

- Search Please fill out this field.

- Manage Your Subscription

- Give a Gift Subscription

- Newsletters

- Sweepstakes

Flight Prices Are Predicted to Increase Through June, According to New Report

Travel app Hopper is expecting ticket prices to rise at an average of 7% a month through June.

Meena Thiruvengadam is a lifelong traveler and veteran journalist who has visited more than 50 countries across six continents. Her writing has appeared in The Wall Street Journal , Departures , TripSavvy , and other publications.

:max_bytes(150000):strip_icc():format(webp)/Meena-Thiruvengadam-0953f29450f840a786278802ac6a8162.jpeg)

Although air travel has gradually made a comeback since the start of the COVID-19 pandemic, travelers continue to navigate the virus — and the price changes that come with it.

According to the Consumer Airfare Index Report , released by travel app Hopper on Wednesday, both domestic and international airfares are currently at record lows but are expected to rise in the first half of 2022.

Currently, at around $649 roundtrip, international airfares are lower than they've ever been in January while at $234 roundtrip, domestic airline ticket prices are near historic lows as well.

However, even though it's not unusual for flight prices to dip after the holidays, Hopper is expecting ticket prices to rise much faster than usual at an average of 7% a month through June when customers can expect to pay around $315 roundtrip domestically. The hike in fare prices may be due to the omicron variant subsiding and as spring break travel is on the horizon.

In fact, the steepest single-month increase — around 11% — is expected in March, just in time for spring break .

As for those looking to leave the states, Hopper expects international flight prices to rise at a slower rate when compared to domestic airfares but still faster than usual at a 5% a month increase through June with peak fares estimated at approximately $830 round trip.

"Prices have been especially volatile between the delta and omicron variant waves, swinging nearly $200/round-trip twice over four months," Hopper said in its report, noting that airfare prices typically rise around 2% a month going into the summer months.

Fortunately, average airline ticket prices are expected to catch up to pre-pandemic levels around April, the company found.

When it comes to the destinations themselves, domestic search trends among Hopper users included flights to Orlando, Las Vegas, and Miami while those looking to fly international were searching for flights to London, Cancun, and Paris.

As for vacation spots on the rise, the travel app found that there was increasing interest in Reno, San Jose, and Kansas City. Internationally Hopper found that Dublin, Rio de Janeiro, and Santiago were the highest trending destinations.

The COVID-19 pandemic has also made last-minute trips or booking within a shorter time window. Hopper users looking to book a domestic trip are searching about 35 days before departure while those looking to travel internationally are searching for a flight about 55 days before leaving.

"Few travelers are willing to make a bet this early on booking an international trip later in the year," the report noted.

Meena Thiruvengadam loves wandering new streets and discovering the world's stories. Find her on Facebook , Instagram , or at the airport, and subscribe to her newsletter .

Related Articles

- ASSOCIATIONS

- CLIMATE CHANGE

- TRAVEL COMPANIES

- ASIA PACIFIC

- MIDDLE EAST

- NORTH AMERICA

- PHILIPPINES

- BANYAN TREE

- NORWEGIAN CRUISE LINE

- PANDAW CRUISES

- PRINCESS CRUISES

- ROYAL CLIFF

- THAI AIRWAYS

- WORLDHOTELS

- TRAVEL DEALS

Korean Air ready to fly to Lisbon

Vietjet expands Australia flights

Qatar sponsors ‘Art for Tomorrow’ event

Minor names europe and americas ceo, trip.com and tourism malaysia sign moc.

Emirates to fly to Madagascar

The 2024 Pandaw photo contest

Dusit expands Phuket portfolio

TAT Dubai targets Saudi tourism boom

AirAsia Free Seats campaign returns

40% off Holland America cruises

Time is running out to tap Club Med discount

MOVE flags lowest fares for members

CX peps up rewards when visiting Thailand

China top of the leaderboard for tourism spend

More Indians take a break in Thailand

Airline bookings to Europe soar

Steam trains clickety-clack for tourism

Steady recovery for airline connectivity

Smog and dams a threat to tourism?

Sailing on calmer waters

Is the global travel industry isolating Russia?

Will China reopen outbound travel soon?

Agoda clarifies reviewer privacy rules

European air travel on the rise

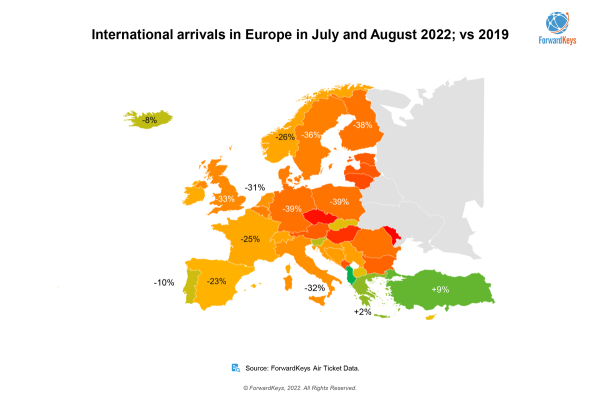

SINGAPORE, 12 September 2022: Air travel to the southeast corner of Europe substantially exceeded pre-pandemic (2019) levels in the peak summer months of July and August.

The report released by ForwardKeys at the weekend is based on a comprehensive and up-to-date database of air ticketing monitoring trends.

The two largest destinations, Turkey and Greece, exceeded pre-pandemic levels of international visitor arrivals by 9% and 2%, respectively. Air travel to Albania (a relatively small destination with less than 1% market share of European flight arrivals) was also up by 28%. While no other major country destinations recovered to the numbers seen in 2019, Slovenia, just 7% down, Iceland, 8% down, and Portugal, 10% down, came close.

The list of best performing city destinations was headed by Istanbul, which recorded a 2% increase in flight arrivals. It was followed by Athens, 7% down, Reykjavik and Porto, 8% down, and Malaga, 13% down.

Major factors driving the strong performance of Turkey include an ongoing decline in the value of the Turkish lira and its openness to the Russian market, from where direct flights to most of Europe have been banned. In the summer of 2019, Russians accounted for 4% of all arrivals to Europe, whereas in 2022, this dropped dramatically. Greece has performed strongly as a destination throughout the pandemic by implementing relatively visitor-friendly COVID-19 travel restrictions.

An analysis of origin markets reveals that within Europe, Greece has proven the most resilient, with departures for European destinations in July and August matching 2019 levels. It is followed by Poland, 9% down, Spain, 12% down, the UK, 13% down, Denmark, 14% down and Portugal 15% down. Overall, intra-European departures were 22% down.

The strongest extra-European market was the USA, just 5% down compared to 2019. It was followed by Colombia and Israel, both 9% down, South Africa, 10% down, Mexico 12% down, Canada and Kuwait, both 13% down. Overall, extra-European origin markets were 31% down.

European destinations could have attracted more visitors during the summer months if the aviation industry had been better able to cope with the surge in demand for travel during late spring and early summer. Had there been no disruption, ForwardKeys estimates that the recovery in intra-European flight bookings would have been five percentage points higher.

Despite, talk of recession and inflation damaging the prospects of a post-pandemic travel recovery, the trend remains positive. In July and August, air travel across Europe was down by 26%. However, the outlook for the next three months shows that as of 31 August, flight bookings were 21% behind the equivalent moment in 2019, with bookings for Turkey and Greece 20% and 5% ahead, respectively. The next best-booked destinations are Portugal, 3% behind, Iceland, 7% behind and Spain, 15% behind.

The strongest origin markets are led by the UK, where outbound flight demand for the next three months is just 2% down compared with before the pandemic. Spain follows it, 3% behind, the USA, 5% behind, Ireland, 6% behind, and Germany, 11% behind.

ForwardKeys VP Insights Olivier Ponti said: “The recovery from the pandemic has continued despite the travel chaos and capacity reductions caused by staff shortages. Right now, forward bookings for leisure travel show a continued recovery in air travel post-pandemic, and, encouragingly, business bookings are catching up. However, we are still cautious about the outlook because the continued war in Ukraine and the consequent impact on energy prices will negatively affect European economies, which will likely dent consumer confidence and corporate demand. That said, there is currently a concentration of flight bookings during the autumn half term peaks and Christmas, which could lead to further flight disruption if the recent recruitment difficulties experienced by the aviation industry persist.”

RELATED ARTICLES

Austrian lifts bangkok flights to 13 weekly, fti group files for insolvency.

Sign up here.

Additional reporting by Aditi Shah and Alexander Cornwell; Editing by Jamie Freed

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Business Chevron

Exclusive: MediaTek designs Arm-based chip for Microsoft's AI laptops, say sources

Taiwanese chip design giant MediaTek is developing an Arm-based personal computer chip that will run Microsoft's Windows operating system, according to three people familiar with the matter.

Why rising fuel prices might not be as bad for the airline sector as it seems

Just as airlines began their recovery from the COVID-19 pandemic, the sector was hit by another challenge—a rapid spike in fuel prices. Since the start of 2022, the price of jet fuel increased by approximately 90 percent and costs roughly 120 percent more, on average, than it did in 2021, at the time of writing. 1 U.S. Energy Information Administration (EIA); Federal Reserve Bank of St. Louis (FRED) economic data. This price increase presents a significant challenge for airlines as fuel is often the largest operating cost, accounting for around 25 percent of total costs depending on the year.

About the authors

This article is a collaborative effort by Jaap Bouwer, Alex Dichter , Guenter Fuchs, Kasey Hartung, Vik Krishnan , Darren Rivas, and Steve Saxon , representing views from McKinsey’s Travel, Logistics & Infrastructure practice.

Counterintuitively, high fuel prices might not necessarily be a bad thing for the industry. Even though it causes short-term pain, it also increases marginal costs of flying—which can foster greater capacity discipline. This, in turn, drives healthier industry economics and can help profitability.

This article examines what airlines have done in the past when fuel prices were high and offers strategies that airlines could consider to mitigate the effects of fuel price hikes. We believe this is especially important at a time when a potential recession looms and pressure is increasing for airlines to drive improved sustainability.

Sky-rocketing jet fuel

The price of crude oil and jet fuel steadily increased over the course of 2021 and reached new highs in early 2022. As of June 27, 2022, a barrel of West Texas Intermediate (WTI) crude oil is hovering around $111, up by about 135 percent since the beginning of 2021. Refined product prices have risen even more, with jet fuel now around $4 a gallon in the United States, up approximately 90 percent since the beginning of 2022, and increasing by around 215 percent since January 2021 (Exhibit 1).

Additionally, a “perfect storm” is driving increased price volatility in some local markets, such as New York. Refining capacity has come down significantly post-COVID-19 as refineries, seeing less demand, have shifted capacity away from producing jet fuel towards other fuels. Furthermore, Russia’s invasion of Ukraine contributed to lower crude oil and refined product exports, especially to Europe. These factors have pushed up prices globally for crude oil as well as for middle distillates such as diesel and jet fuel. On top of these global price increases, local logistics constraints in meeting the sudden increase in aviation demand, in places such as the Northeast United States, have caused additional local price spikes specific to jet fuel where the price per gallon has topped $8.

These steeply rising energy costs represent the next hurdle for an industry still recovering from the COVID-19 pandemic. One major US airline recently stated in its annual report that for every cent a gallon of jet fuel increases in price, the airline’s total fuel bill would increase by $40 million. 2 Niraj Chokshi and Clifford Krauss, “Fuel prices send airfares higher, but travelers seem ready to pay,” New York Times , April 15, 2022. Therefore, the recent 195-cent increase in jet fuel equates to an approximate $8 billion increase in annual fuel costs for this airline.

Would you like to learn more about our Travel, Logistics & Infrastructure Practice ?

The right medicine.

Contrary to headlines, high jet fuel prices may not be as bad for airlines as expected, for three reasons. First, the main pain points are predominantly in the short term. Carriers differ in the degree to which they hedge fuel, but many will have already sold a portion of their tickets at the assumption of lower fuel prices and must fly passengers at higher fuel prices. However, the booking window has significantly shortened during COVID-19, so the portion of tickets sold at the lower-price assumption is relatively small and represents a short-term pain point.

Second, airlines can pass on some of the price increase to consumers, as they have done in the past. Analysis of past periods with high fuel price rises suggests a positive correlation with unit revenue (Exhibit 2).

Third, higher fuel prices mean higher marginal costs of flying, which can lead to greater capacity discipline. The airline sector has been challenged in terms of shareholder value creation for a long time , and overcapacity has contributed to this. For an asset-intensive sector, entry barriers are surprisingly low—both for starting an airline and for an airline to start a new route or flight. In addition, the marginal cost of operating a flight is low. Typically, between 30 and 35 percent of an airline’s operating cost is fully flight-variable (jet fuel cost, but also airport landing and passenger charges, as well as air traffic control charges and in-flight catering). 3 This percentage differs by year, given oil price volatility, and according to each airline’s business model. Low-cost carriers feature higher marginal cost shares. This incentivizes airlines to add capacity as most of the costs have already been incurred, such as aircraft rental, flight crew salaries, and overheads—so an additional flight does not lead to significantly higher cost while allowing the airline to chase market share as a “golden ticket” to profitability. At a system level, however, that leads to overcapacity, eroding value.

With higher fuel prices, the marginal cost of operating increases, which in the past has led to more disciplined capacity deployment. Better discipline restores profitability. To illustrate, the period between 2010 and 2012 saw relatively high fuel prices—on average, the cost of jet fuel was around 70 percent higher than it had been between 2003 and 2005. But capacity discipline (measured by the ratio of available seat-mile growth to GDP growth) improved and the average operating margin in that period was significantly higher than it had been during 2003 to 2005 (Exhibit 3). 4 McKinsey analysis based on FRED economic data; U.S. Department of Transportation Form 41 via Diio Mi and OAG. While there are certainly other factors at play, including consolidation, the significantly improved margin despite higher fuel prices stands out. Higher marginal costs forced airlines to re-assess route profitability, in some instances choosing not to fly certain routes as keeping them operational would be more expensive than keeping the aircraft grounded. This led to more rationalized capacity behavior across the industry. For an industry where overcapacity is one of the key challenges to sustained profitability, this was a beneficial reaction.

A potential path forward

Although high fuel prices are painful for airlines in the short term, it is possible for airlines to remain profitable in times of high and low fuel prices, and they have done so in the past. Getting capacity deployment right is vitally important, particularly considering the increased push to be environmentally friendly and reduce emissions. Operating ghost flights is becoming untenable and flying marginally profitable markets less appealing. Higher interest rates and inflation will also create pressure as the cost of borrowing to support an unprofitable operation may compound into future earnings challenges.

Going forward, airlines could consider ways to be more disciplined in capacity deployment, and strategically focus growth on areas of current strength, and in markets where the carrier has a unique advantage, as opposed to matching the growth plans of competitors. It might also be worth considering the refresh of fuel hedging strategies that can, in some cases, soften the impact of sudden fuel price spikes.

Note: As oil prices are a commodity they will continue to fluctuate, the viewpoints in this article are reflective of the overall scenario.

Jaap Bouwer is a senior expert in McKinsey’s Amsterdam office, Alex Dichter is a senior partner in the Boston office, Guenter Fuchs is a consultant in the Southern California office, Kasey Hartung is a capabilities and insights analyst in the Waltham office, Vik Krishnan is a partner in the San Francisco office, Darren Rivas is a director of practice management in the Atlanta office, and Steve Saxon is a partner in the Shenzhen office.

Explore a career with us

Related articles.

Trying to boost corporate travel sales? Five questions for airline executives

Taking stock of the pandemic’s impact on global aviation

Turning on the revenue tap: How US airports could make the most of additional liquidity

Making it easier to fly more than one airline to your destination

Flying multiple airlines to get to your ultimate destination comes with a myriad of hassles. A global airline group led by American Airlines and British Airways is aiming to make airport transits more seamless for passengers. Oneworld plans to launch a technology platform later this year that will allow travelers to check-in, including their luggage, just once across different carriers, chief executive Nat Pieper said in an interview with Bloomberg News on Monday. He hopes the improvements will make connections more attractive while saving cost for his airline members and generating more revenue. — BLOOMBERG NEWS

Rechargeable lights recalled due to overheating

More than 1.2 million rechargeable lights are under recall in the United States and Canada following a report of one consumer death. According to a Thursday notice from the US Consumer Product Safety Commission, Good Earth Lighting’s now-recalled integrated light bars have batteries that can overheat — and cause the unit to catch on fire. That can pose serious burn and smoke inhalation risks. To date, the CPSC notes that there’s been one report of a consumer who died, although specifics of the incident were not immediately released. Another consumer was treated for smoke inhalation when the light caused a fire in their home last year, the CPSC added — and Good Earth Lighting is aware of nine additional reports of these products overheating, six of which resulted in fires and property damage. — ASSOCIATED PRESS

Advertisement

Lenders want payment to CEO of bankrupt Rite Aid reduced

Rite Aid’s main lenders are demanding a proposed $20 million payout to chief executive Jeffrey Stein be reduced before they fund the company’s exit from bankruptcy, according to people with knowledge of the situation. The pay package is one of the few remaining points of contention in negotiations that began last October when the company filed for Chapter 11, the people said. The pharmacy chain in April put off a key court hearing in order to complete a deal that would cut $2 billion in debt, resolve lawsuits related to opioid prescriptions, and end the company’s prolonged stint in bankruptcy. — BLOOMBERG NEWS

INTERNATIONAL

Government turns matchmaker in Japan

Called “Tokyo Futari Story,” the city hall’s new initiative is just that: An effort to create couples, “futari,” in a country where it is increasingly common to be “hitori,” or alone. While a site offering counsel and general information for potential lovebirds is online, a dating app is also in development. City hall hopes to offer it later this year, accessible through phone or web, a city official said Thursday. Marriage is on the decline in Japan as the country’s birth rate fell to an all-time low, according to health ministry data Wednesday. Last year there were 474,717 marriages, down from 504,930 in 2022 while births totaled 727,277, down from 770,759. — ASSOCIATED PRESS

Fewer rooftop solar installations

US residential solar installations in the first quarter fell to their lowest level in two years, as high interest rates and policy changes in the market’s biggest state dragged down demand. Installers added 1.28 gigawatts of panels in the quarter, down 25 percent from 1.7 gigawatts a year earlier, according to a report Thursday from Wood Mackenzie and the Solar Energy Industries Association. Rooftop installers have been struggling as high interest rates make their systems more costly for consumers. That’s been exacerbated by new rules in California, the country’s largest rooftop solar market, that slashed incentives for residential power. — BLOOMBERG NEWS

PHARMACEUTICALS

FDA may limit approval for Alzheimer’s drug

US drug regulatory staffers are considering a more targeted approval for Eli Lilly’s experimental Alzheimer’s disease treatment than the company wants, potentially limiting the market for a would-be blockbuster. The Food and Drug Administration staff questioned whether Lilly’s drug, donanemab, should be approved for all patients with early-stage Alzheimer’s, according to a report Thursday, or restricted to only those with moderate levels of a disease-related protein called tau. Lilly’s study excluded patients with low or no tau in their brains. The FDA will convene a panel of expert advisers Monday to discuss Lilly’s supporting evidence and whether donanemab’s benefits outweigh its risks. Donanemab would compete against Leqembi, an approved Alzheimer’s medicine from Biogen and Eisai Co. — BLOOMBERG NEWS

Trade deficit grew in April

The US trade deficit widened in April to the largest since October 2022 on a surge in imports of goods including motor vehicles, computers, and industrial supplies. The gap in goods and services trade grew 8.7 percent from the prior month to $74.6 billion, Commerce Department data showed Thursday. The value of imports rose 2.4 percent to the highest since mid-2022, while exports edged up 0.8 percent. The figures aren’t adjusted for inflation. — BLOOMBERG NEWS

Rates drop below 7 percent

The average rate on a 30-year mortgage dipped to just below 7 percent this week, little relief for prospective homebuyers already facing the challenges of rising housing prices and a relatively limited inventory of homes on the market. The rate fell to 6.99 percent from 7.03 percent last week, mortgage buyer Freddie Mac said Thursday. A year ago, the rate averaged 6.71 percent. — ASSOCIATED PRESS

RIDE HAILING

N.Y. startup to lay off drivers, switch to gig model

Revel Transit Inc., the New York-based electric vehicle ride-hailing startup, plans to lay off its driver employees and operate a gig-work model more akin to rivals Uber and Lyft. Drivers affected by the change will have the option of staying on with the company as independent contractors. The move to a contractor model will be effective in September, the company said in an email Thursday to its 1,000-plus drivers. The drivers currently receive a fixed hourly rate and benefits without needing to bring their own car. Revel will also let existing and new drivers rent from its 550-EV fleet of Teslas at $10 per hour, and will compensate them based on trips they take. The change “came in response to an overwhelming majority of drivers asking for more flexibility, which is standard in the industry,” Keith Williams, vice president of ride-share operations, said in the email. This included “offering drivers more control over where and when they drive, the ability to take breaks when and for how long they want, and for more lucrative bonuses that are easier to achieve.” — BLOOMBERG NEWS

AUDIENCE SURVEY

The world’s flying again and jets are burning fuel like it’s 2019.

Coming any minute now to a sky near you: a plane packed with people going on vacation, leaving wispy white contrails in its wake and memories of COVID-19 that seem like a bad dream.

The world is flying again. In the third quarter, 10.5 million flights are scheduled to crisscross the skies, according to industry data compiled by BloombergNEF. The International Air Transport Association is anticipating record passenger numbers this year, and planes that will be about as full as they were before the virus using record amounts of fuel.