Voyager Therapeutics, Inc. (VYGR) SEC Filing 10-K Annual Report for the fiscal year ending Sunday, December 31, 2023

Sec filings, vygr valuations.

- Select PDF Feature:

- Include Exhibits

- Highlight YoY Changes

- Highlight Sentiment

August 2024

February 2024

January 2024

Last10K.com | 10-K Annual Report Wed Feb 28 2024

Voyager therapeutics, inc..

EXHIBIT 99.1

Voyager Therapeutics Reports Fourth Quarter and Full Year 2023 Financial and Operating Results

– Company had approximately $431 million in pro-forma cash as of December 31, 2023, adjusted for $100 million consideration from Novartis agreements and $100 million public offering –

– Strong cash position and anticipated milestones/reimbursements provide runway into 2027, potentially enabling the generation of clinical data from multiple programs –

– Lead development candidates selected in Friedreich’s ataxia gene therapy program in collaboration with Neurocrine Biosciences, triggering $5 million milestone payment, and in wholly-owned SOD1 ALS gene therapy program –

- Conference call at 4:30 p.m. ET today -

“As of December 31, 2023, Voyager had approximately $431 million in pro-forma cash on the balance sheet, adjusted for the Novartis agreements and public offering in January 2024. We expect this funding to support the generation of clinical data across multiple programs, with the potential for significant value creation,” said Alfred W. Sandrock, Jr., M.D., Ph.D., Chief Executive Officer of Voyager. “We expect to advance at least four wholly-owned and partnered programs into the clinic by the end of next year. Our most advanced program, the anti-tau antibody VY-TAU01 for Alzheimer’s disease, is expected to reach IND in the first half of this year, and we anticipate generating key tau PET imaging data in the second half of 2026.”

Key Milestones Achieved in Q4 2023 and Subsequent Period:

Please wait while we load the requested 10-K report or click the link below:

https://last10k.com/sec-filings/report/1640266/000155837024001988/vygr-20231231x10k.htm

View differences made from one year to another to evaluate Voyager Therapeutics, Inc.'s financial trajectory

Compare this 10-K Annual Report to its predecessor by reading our highlights to see what text and tables were removed , added and changed by Voyager Therapeutics, Inc..

Assess how Voyager Therapeutics, Inc.'s management team is paid from their Annual Proxy

- Voting Procedures

- Board Members

- Executive Team

- Salaries, Bonuses, Perks

- Peers / Competitors

SEC Filing Tools

Read 10-K Annual Reports Better Last10K.com and Stocksnips.net computationally analyzes management discussions inside annual and quarterly reports to determine if they are bullish , bearish or neutral on the company's finances and operations. View Rating for FREE "> Rating Learn More

We provide 5 of these remarks for FREE. To see all the remarks without having to find them in the 10-K Annual Report, become a member of Last10K.com

Because of the numerous risks and uncertainties associated with pharmaceutical product development, we are unable to accurately predict the timing or amount of increased expenses.

Revenue is recognized using input-based measurements, which involves the measurement of progress toward each performance obligation based on the actual costs incurred compared to total projected costs.

The effects of material revisions in estimates, if any, will be reflected in the financial statements prospectively from the date of change in estimates.

We also anticipate the cost of goods and services and the levels of compensation paid to employee will increase due to inflationary conditions existing in the general economy.

The consideration allocated to each performance obligation is recognized as revenue when control is transferred for the related goods or services.

We believe this trial could... Read more

Our expenses increased during the... Read more

The increase was primarily due... Read more

We expect to continue to... Read more

●approximately $1.1 million for decreased... Read more

If we raise additional funds... Read more

Debt financing and preferred equity... Read more

A significant portion of revenue... Read more

During the year ended December... Read more

Net cash provided by financing... Read more

We evaluate the measure of... Read more

We have funded our operations... Read more

We expect our expenses to... Read more

On an ongoing basis, we... Read more

“Risk Factors” and under “Forward-Looking... Read more

We identified a lead development... Read more

We may never generate the... Read more

We enter into agreements in... Read more

We estimate the transaction price... Read more

Our agreements to license intellectual... Read more

Some of our programs are... Read more

The amount of variable consideration... Read more

Under our agreements with Neurocrine,... Read more

The cash used in operating... Read more

At the inception of each... Read more

Accordingly, we will need to... Read more

For the foreseeable future, we... Read more

At the end of each... Read more

The joint steering committee with... Read more

We promoted our tau silencing... Read more

Furthermore, we expect to incur... Read more

If our development efforts are... Read more

Our proprietary pipeline also includes... Read more

We also have non-cancelable operating... Read more

We utilize key assumptions to... Read more

As our development programs progress... Read more

Pursuant to such agreements, we... Read more

We base our estimates on... Read more

Until such time, if ever,... Read more

However, at this time, we... Read more

As of June 30, 2023,... Read more

●approximately $0.7 million for increased... Read more

Additionally, in determining the standalone... Read more

●approximately $18.5 million for external... Read more

We utilize either the most... Read more

Collaboration revenue was $250.0 million... Read more

We may also be required... Read more

We enter into license, option,... Read more

We also received an upfront... Read more

Other income, net of approximately... Read more

●employee-related expenses including salaries, benefits,... Read more

We allocate the transaction price... Read more

In January 2019 and January 2023, we... Read more

●approximately $13.2 million for increased... Read more

We must develop assumptions that... Read more

Our wholly-owned prioritized pipeline programs... Read more

We recognize revenue in accordance... Read more

Actual results may differ from... Read more

We did not have, during... Read more

To date, we have not... Read more

We do not believe that... Read more

Our pipeline includes programs for... Read more

●we are required by the... Read more

Our product revenues, if any,... Read more

We are a biotechnology company... Read more

General and administrative expenses consist... Read more

We are advancing our own... Read more

To the extent that we... Read more

Costs for certain activities, such... Read more

We anticipate that our collaborative... Read more

Given the nature of the... Read more

Net cash used in operating... Read more

Despite reporting $132.3 million in... Read more

Changes in our estimates of... Read more

Net cash provided by operating... Read more

●costs of funding research performed... Read more

We have also entered into... Read more

In addition, if we obtain... Read more

These contracts generally are cancelable... Read more

We focus on leveraging our... Read more

For performance obligations which consist... Read more

Identifying potential product candidates and... Read more

Milestone payments that are not... Read more

Our contracts often include development... Read more

The increase in collaboration revenue... Read more

Net cash used in investing... Read more

In certain instances, we are... Read more

Net cash provided by investing... Read more

Other significant costs include corporate... Read more

As a smaller reporting company,... Read more

As described further below, in... Read more

We do not have any... Read more

Financial Statements, Disclosures and Schedules Inside this 10-K Annual Report

Material Contracts, Statements, Certifications & more Voyager Therapeutics, Inc. provided additional information to their SEC Filing as exhibits

Ticker: VYGR CIK: 1640266 Form Type: 10-K Annual Report Accession Number: 0001558370-24-001988 Submitted to the SEC: Wed Feb 28 2024 4:01:51 PM EST Accepted by the SEC: Wed Feb 28 2024 Period: Sunday, December 31, 2023 Industry: Biological Products No Disgnostic Substances

Intrinsic Value Calculator

Our Intrinsic Value calculator estimates what an entire company is worth using up to 10 years of financial ratios to determine if a stock is overvalued or not

Never Miss A New SEC Filing Again

Receive an e-mail as soon as a company files an Annual Report, Quarterly Report or has new 8-K corporate news

We Highlighted This SEC Filing For You

Read positive and negative remarks made by management in their entirety without having to find them in a 10-K/Q

Widen Your SEC Filing Reading Experience

Remove data columns and navigations in order to see much more filing content and tables in one view

Uncover Actionable Information Inside SEC Filings

Read both hidden opportunities and early signs of potential problems without having to find them in a 10-K/Q

Adobe PDF, Microsoft Word, Excel and CSV Downloads

Export Annual and Quarterly Reports to Adobe Acrobat (PDF), Microsoft Word (DOCX), Excel (XLSX) and Comma-Delimited (CSV) files for offline viewing, annotations and analysis

Financial Stability Report

Our Financial Stability reports uses up to 10 years of financial ratios to determine the health of a company's EPS, Dividends, Book Value, Return on Equity, Current Ratio and Debt-to-Equity

Get a Better Picture of a Company's Performance

See how over 70 Growth, Profitability and Financial Ratios perform over 10 Years

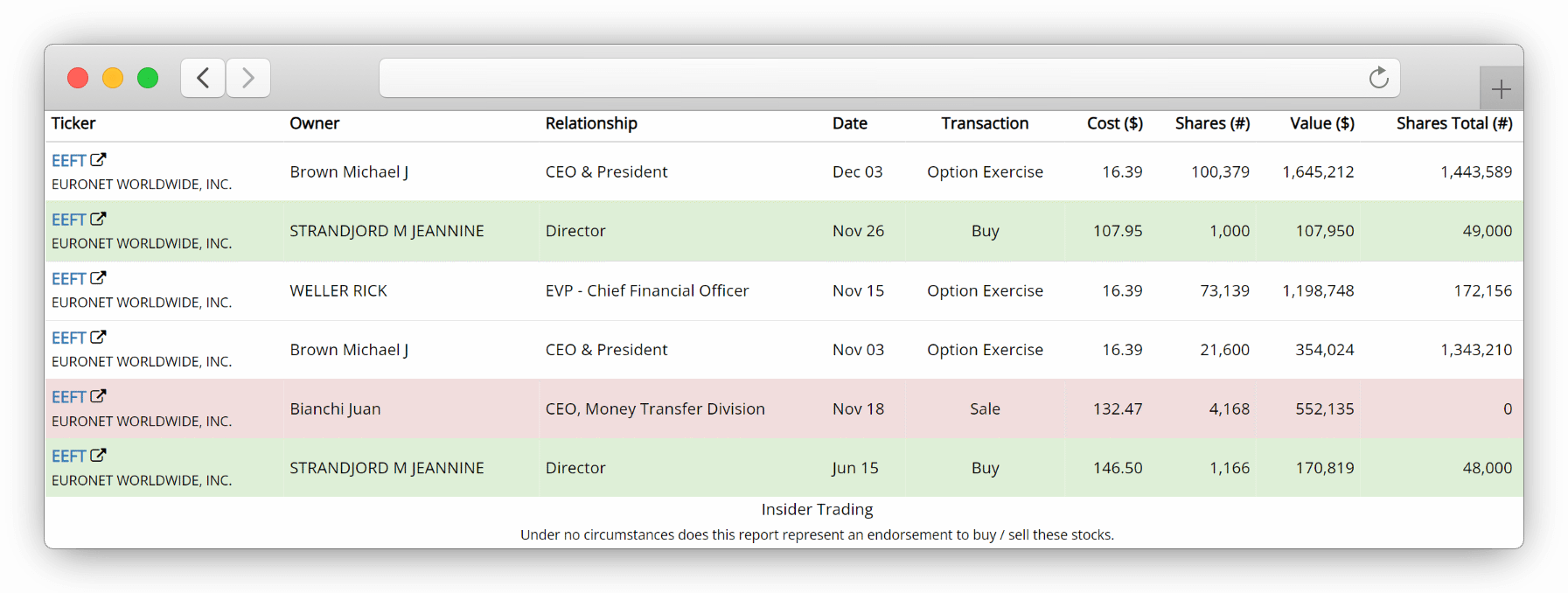

See when company executives buy or sell their own stock

Use our calculated cost dollar values to discover when and how much registered owners BUY , SELL or excercise their company stock OPTIONS aggregated from Form 4 Insider Transactions SEC Filings

See how institutional managers trade a stock

View which hedge funds, pension / retirement funds, endowments, banks and insurance companies have increased or decreased their positions in a particular stock. Includes Ownership Percent, Buy versus Sell comparison, Put-Call ratio and more

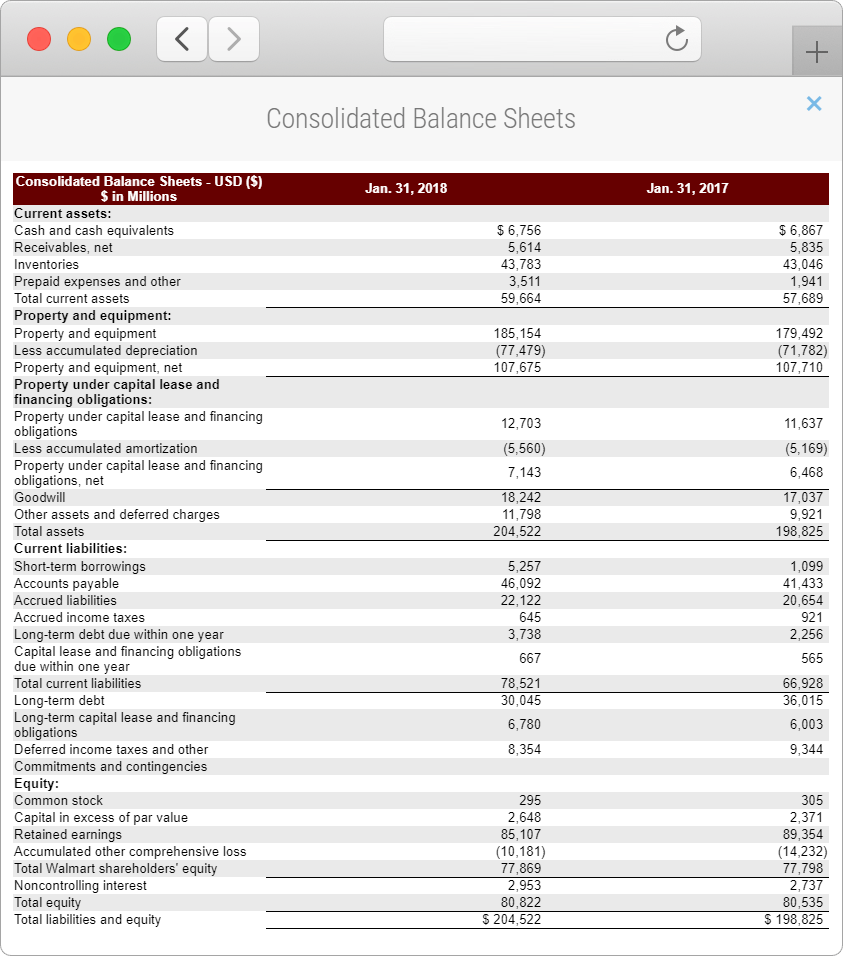

FREE Financial Statements

Get one-click access to balance sheets, income, operations and cash flow statements without having to find them in Annual and Quarterly Reports

SEC Filing Exhibit

Loading SEC Filing Exhibit...

SEC Filing Financial Summary

Loading SEC Filing Financial Summary...

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Biden Economy

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds Rates

- Top Mutual Funds

- Options: Highest Open Interest

- Options: Highest Implied Volatility

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Stock Comparison

- Advanced Chart

- Currency Converter

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Credit Card Offers

- Best Free Checking

- Student Loans

- Personal Loans

- Car insurance

- Mortgage Refinancing

- Mortgage Calculator

- Morning Brief

- Market Domination

- Market Domination Overtime

- Asking for a Trend

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Financial Freestyle

- Capitol Gains

- Living Not So Fabulously

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Voyager therapeutics, inc. (vygr).

- Previous Close 6.49

- Bid 6.53 x 200

- Ask 6.56 x 100

- Day's Range 6.45 - 6.68

- 52 Week Range 6.06 - 11.72

- Volume 259,637

- Avg. Volume 427,080

- Market Cap (intraday) 357.193M

- Beta (5Y Monthly) 0.96

- PE Ratio (TTM) 24.26

- EPS (TTM) 0.27

- Earnings Date Nov 4, 2024 - Nov 8, 2024

- Forward Dividend & Yield --

- Ex-Dividend Date --

- 1y Target Est 17.63

Voyager Therapeutics, Inc. Overview Biotechnology / Healthcare

Voyager Therapeutics, Inc., a biotechnology company, focuses on the treatment of gene therapy and neurology diseases. The company's lead clinical candidate is VY-TAU01, an anti-tau antibody program for the treatment of alzheimer's disease. Its product pipeline includes superoxide dismutase 1 silencing gene therapy, which is in preclinical trial for the treatment of amyotrophic lateral sclerosis; tau silencing gene therapy, which is in preclinical trial for the treatment of alzheimer's disease; and vectorized anti-amyloid antibody, a gene therapy targeting anti-amyloid for the treatment of alzheimer's disease and is in preclinical trial. In addition, the company develops VY-FXN01, which is in preclinical trial to treat friedreich's ataxia; and GBA1 gene replacement to treat parkinson's disease and is in preclinical trial. Further, it provides research program for the treatment of Huntington's disease. The company has collaboration and license agreements with Alexion; AstraZeneca Rare Disease; Novartis Pharma AG; Neurocrine Biosciences, Inc; and Sangamo Therapeutics, Inc. Voyager Therapeutics, Inc. was incorporated in 2013 and is headquartered in Lexington, Massachusetts.

Full Time Employees

December 31

Fiscal Year Ends

Biotechnology

Recent News: VYGR

Voyager Therapeutics to Present at Multiple Upcoming Investor Conferences

Voyager Therapeutics, Inc. (NASDAQ:VYGR) Just Released Its Second-Quarter Results And Analysts Are Updating Their Estimates

Voyager Therapeutics to Present at Canaccord Genuity 44th Annual Growth Conference & Private Company Showcase

Voyager Therapeutics (VYGR) Reports Q2 Loss, Tops Revenue Estimates

Voyager therapeutics: q2 earnings snapshot.

Voyager Therapeutics Reports Second Quarter 2024 Financial and Operating Results

Voyager Therapeutics Announces Second Quarter 2024 Conference Call and Webcast

Voyager Therapeutics Announces Inducement Grants Under Nasdaq Listing Rule 5635(c)(4)

Voyager Therapeutics, Inc. (NASDAQ:VYGR) is definitely on the radar of institutional investors who own 49% of the company

Voyager Therapeutics to Present at Multiple Virtual Investor Conferences

Voyager Therapeutics Announces Appointment of Nathan Jorgensen as Chief Financial Officer

Voyager Therapeutics Announces First Participants Dosed in Single Ascending Dose Trial of VY-TAU01 for the Treatment of Alzheimer’s Disease

Performance overview: vygr.

Trailing total returns as of 8/29/2024, which may include dividends or other distributions. Benchmark is S&P 500 .

1-Year Return

3-year return, 5-year return, compare to: vygr.

Select to analyze similar companies using key performance metrics; select up to 4 stocks.

Statistics: VYGR

Valuation measures.

Enterprise Value

Trailing P/E

Forward P/E

PEG Ratio (5yr expected)

Price/Sales (ttm)

Price/Book (mrq)

Enterprise Value/Revenue

Enterprise Value/EBITDA

Financial Highlights

Profitability and income statement.

Profit Margin

Return on Assets (ttm)

Return on Equity (ttm)

Revenue (ttm)

Net Income Avi to Common (ttm)

Diluted EPS (ttm)

Balance Sheet and Cash Flow

Total Cash (mrq)

Total Debt/Equity (mrq)

Levered Free Cash Flow (ttm)

Research Analysis: VYGR

Earnings per share, analyst recommendations.

- Underperform

Analyst Price Targets

People also watch.

- Screening Tools

- Document Search

- Table Tools

- Collaboration

- Organization

Voyager Therapeutics Inc. Watch

Warning: Large portions of this site require JavaScript enabled in order to function properly. Please make sure JavaScript is enabled in your browser.

Please let us know at [email protected] if you have any questions or concerns.

- Categorized

- Chronological

- Ownership by Owner

- Insider Transactions

- Institutional Owners

- Transcripts

- Your Highlights

Search in Documents

Key exhibits.

- Articles of Inc. & Bylaws

- Credit Agreements

- Material Contracts

- Plans of Reorganization

- Underwriting Agreements

External Links

- Google Finance

Financials Filter

Prospectuses and registrations filter, ownership filter, news filter, proxies filter, other filter.

- © 2024 BamSEC, LLC

- Privacy Policy

- Terms of Service

- Help Center

Voyager: Anti-Tau Antibody Differentiation For AD Treatment Could Boost Prospects

- Voyager Therapeutics, Inc. initial safety and PK data from the phase 1a study using VY7523 for the treatment of patients with Alzheimer's Disease expected 1st half of 2025.

- Targeting the C-terminal for AD patients instead of N-terminal domain could end up resulting in a significantly greater reduction of tau protein.

- The global Alzheimer's Disease Therapeutics market is expected to reach $30.8 billion by 2033.

- Another shot on goal in possibly targeting Alzheimer's Disease effectively would be with the use of the tau silencing gene therapy with a vectorized siRNA.

- Looking for more investing ideas like this one? Get them exclusively at Biotech Analysis Central. Learn More »

SolStock/E+ via Getty Images

Voyager Therapeutics, Inc. ( NASDAQ: VYGR ) is in the process of developing its anti-Tau antibody VY7523 for the treatment of patients with Alzheimer's Disease [AD] in a phase 1a single-ascending dose [SAD] study. The reason investors should keep an eye on this biotech is because it is expected that it will release safety and pharmacokinetic data from this healthy volunteer study in the 1st half of 2025. This will be a major inflection point for it because it will determine whether this drug is safe for patients to take and if drug exposure for a certain period of time is experienced. Should everything go well with this initial data set, then it opens the door for two other catalysts for investors to look forward to.

One would be the initiation of a phase 1b multiple-ascending dose [MAD] study for the treatment of patients with early AD. The second of which, would then be the release of initial clinical data expected from this study. This will be Tau PET imaging data to see if the drug is actually working as intended. The AD space is quite difficult to conquer, that's why it is not only going to rely on VY7523 as an anti-Tau antibody only. It is also in the process of developing a tau silencing gene therapy as well. The point of this is to reduce tau messenger RNA [mRNA] in hopes of offering a “one and done” type of treatment option for these patients. As far as the long-term outlook for this biotech, it is there.

That's because it is advancing its own gene therapy, known as VY9323, for the treatment of patients with SOD1 amyotrophic lateral sclerosis [ALS]. The importance of this is the ability to use its TRACER capsid delivery platform to target this patient population. Two addition proof-of-concepts could be expanded based on a partnership with Neurocrine Biosciences ( NBIX ) to target patients with Parkinson's Disease [PD] and Friedreich's Ataxia [FA]. The point here is that all three IND submissions, to begin studies for all of these programs using its TRACER capsid delivery program, are expected in 2025. What's ideal is that this company has plenty of cash runway to operate its business into 2027.

VY7523 For The Treatment Of Patients With Early Alzheimer's Disease

As I stated above, the goal of Voyager Therapeutics is to develop the use of anti-tau antibody VY7523 for the treatment of patients with AD. The use of this monoclonal antibody is being advanced in the ongoing phase 1a single ascending-dose [SAD] randomized, double-blind, placebo controlled trial in healthy adult volunteers. Before going over this entire program, plus any possible catalysts to come out of it, I believe it is first important to go over what this disease is and what the possible market opportunity for it could be.

Alzheimer's Disease [AD] is a type of disorder characterized as a type of dementia that causes loss of memory and other cognitive functions. Besides this causing a problem with patients being able to remember things or think, it interrupts daily function living tasks. The global Alzheimer's Disease Therapeutics market is expected to reach $30.8 billion by 2033 . This is a massive market opportunity and the truth is, that it is expected to continue to grow over the coming years. Consider that in 2020 there were as many as 5.8 million Americans that were living with AD, but this number is expected to triple to 14 million people by 2060 . However, the focus of this company is to specifically eventually target early AD patients. This would still be a pretty sizeable population for Voyager to use VY7523 towards. That's because it is believed that about 50% of AD patients have mild [early-stage] disease.

To see if VY7523 will work as an anti-tau antibody, it had deployed the phase 1a SAD trial . This adult healthy volunteer study is expected to enroll up to a total of 48 patients across several dosing cohorts. The main thing to note about this clinical candidate is that it is a monoclonal antibody, which has been developed to target tau protein, which is a pathological biomarker of AD. Wait a second, haven't numerous companies that targeted AD using this tau pathology failed in the past? They have failed, but the thing to note about Voyager is that it, along with other companies, are moving away from the targeting of the N-terminal domain approach . While binding with high affinity is present targeting this domain, there is no downstream activity on biomarkers.

This is where VY7523 can differentiate itself, especially since it is targeting another domain with high affinity [strong binding], which is the C-terminal one. Thus, the targeting of the mid-domain region of a tau protein could end up resulting in a greater reduction of tau protein against pathological AD. Whether this ends up being proven in humans in the phase 1a healthy volunteer study remains to be seen. However, what has been presented thus far in a preclinical model has been pretty good. Consider that at the AAIC 2022 medical conference Voyager presented data showing that intravenous use of VY7523 in a mouse seeding model, inhibited the spread of pathological tau by >70%. With the N-terminal of the tau protein to be targeted, which is located on the microtubule binding region, it is believed that better downstream inhibition of tau can occur.

Hopefully, the targeting of this other domain terminal on the tau protein results in good initial exposure data. Speaking of which, this brings about a few catalysts that relate to this specific program. The first of which is that it is expected that initial safety and pharmacokinetic [PK] data will be released from this phase 1a study, in the 1st half of 2025. The reason for setting up this early-stage trial in this manner is because it is necessary to see how high of a dose or maximum tolerated dose [MTD] could be used for the next expected study. This leads to the second catalyst to consider regarding this program, which is the initiation of a phase 1b study using VY7523 for the treatment of early-stage AD patients. Should these initial findings turn out to be good, then this will lead to the initiation of the phase 1b multiple ascending dose study targeting these early ad patients in 2025. Lastly, from there, Tau PET imaging data from this MAD study would be released by the 2nd half of 2026.

Second Shot On Goal Targeting AD And Beyond

The thing about Voyager Therapeutics is that while it is using VY7253 as an anti-Tau antibody targeting this patient population, it may have another shot on goal. This would be with the development of tau silencing gene therapy targeting this specific patient population. The hope here is to create a “one and done” type of therapy that can help a patient over an extended period of time. The thing to note is that this company has been able to develop its own technology platform for being able to deliver novel capsids for gene therapy. Especially, since it has improved itself with this technology in terms of going beyond the scope of only using other types of capsids. Its old generation capsids for gene therapy delivery were not ideal.

VCAP101 and VCAP202 used widely used AAV9 for delivery, but have several drawbacks. It just wasn't effective as it would have liked. Having said that, it has moved towards using its new VCAP-Gen2 [second generation TRACER capsid]. This could end up resulting in improved blood brain barrier [BBB] penetration, enhanced central-nervous system [CNS] tropism. Doing all of this, while achieving reduced liver targeting effects. It was shown that this next-generation capsid could have a lot going for itself. Especially, from what has been shown in multiple species in various preclinical models. Just to give you an idea of the power of the next-generation capsid, it is important to highlight a finding regarding SOD1 targeting of ALS patients. It was noted that this capsid was able to reduce SOD1 mRNA expression by up to 80% in non-human primates [NHPs] spinal cord motor neurons. The use of VCAP-Gen2 was also shown to do well against other indications as well.

Having said that, it is expected that an IND submission of this anti-SOD1 VY9323 candidate to target SOD1 ALS patients, is expected to happen in mid-2025. The thing is that there is an expansion opportunity beyond the scope of only targeting SOD1 ALS patients. This would be in terms of the partnership that it had generated with Neurocrine Biosciences as I noted in the beginning above. The other two target indications are GBA1 mutated Parkinson's Disease [PD] and Friedreich's Ataxia [FA]. These other indications that are going to deploy the TRACER capsid technology platform for gene therapy and IND filing for these are also expected in 2025.

According to the 10-Q SEC Filing , Voyager Therapeutics had cash, cash equivalents and marketable securities of $371 million as of June 30th of 2024. This company should have enough cash for an extended period of time. One reason is because the company is still continuing to receive collaboration revenue from respective partners. For instance, in the most recent Q2 of 2024, it had noted collaboration revenue of $29.6 million based on its partnerships with Neurocrine and Novartis ( NVS ). The second reason is because of its cash runway guidance.

Based on its cash on hand, it believes that it has a cash runway , or enough funds to operate its business, into 2027. The importance of this is that it allows it to reach several clinical data readouts by then. The truth is that it is set up for a good amount of cash if its clinical products being developed work out. The reason is that it is possible that it could earn up to $8.2 billion in potential long-term milestone payments based on its partnered programs. The cash burn per quarter for this company is around $44.7 million, which consists of $34.5 million in R&D expenses and then approximately $10.2 million in G&A expenses.

Risks To Business

There are various risks that investors should be aware of before investing in Voyager Therapeutics. The first risk to consider would be regarding the development of VY7523 for the treatment of patients with early-stage AD. The risk here is that there is no assurance that there won't be any safety issues found when this monoclonal antibody drug is given to healthy volunteers. The goal of this trial is to see if this drug is tolerable and results in effective pharmacokinetic findings to move forward towards the next-stage of clinical testing. This brings up the second risk relating to this program, which is that the findings to be produced from the healthy volunteer study may not be enough to warrant further investigation into the expected phase 1b multiple-ascending dose [MAD] study.

The second risk to consider would be regarding the development of the TRACER-derived capsid gene therapy targeting Alzheimer's Disease patients. The goal is to be in a position to file an IND for this program targeting this patient population in 2026. There is no assurance that the pre-IND enabling studies will be enough to allow for the initiation of a phase 1 study, nor that the FDA will even allow such an early-stage trial to begin. Even if a phase 1 study is eventually initiated, the targeting of tau protein using siRNA using its TRACER-capsid platform may not be enough to see the intended results.

A third risk to consider would be regarding several other programs using TRACER-derived capsids for gene therapies targeting patients with SOD1 ALS, GBA1 Friedreich's Ataxia [FA] and GBA1 Parkinson's Disease [PD]. For instance, even though early evidence was shown that using VY9323 as an anti-SOD1 siRNA resulted in mRNA knockdown of 80% in non-human primates [NHP] spinal motor cord neurons after a single intravenous [IV] dose, there is no assurance that such an mRNA knockdown will be achieved in a phase 1 trial in humans. Plus, with this TRACER capsid program still in the early part of testing, there is no guarantee that the necessary knockdown will be achieved to move on towards other studies thereafter.

The fourth and final risk to consider would be regarding the ongoing partnerships that it has developed thus far. For instance, I made note of the Neurocrine Biosciences partnership to develop TRACER-derived capsids for gene therapy to treat GBA1 disorders like PD and FA. Even further than that, there seems to be something good regarding these VCAP-Gen2 capsids being developed. That's because even Novartis wanted to be a part in developing such a gene therapy . Consider that both companies entered into a collaboration agreement to advance such capsids to help treat patients with Huntington's Disease [HD] and spinal muscular atrophy [SMA]. The risk here is that in order for Voyager to retain these partnerships, its next-gen TRACER capsids have to achieve substantial data. At any moment's notice, either of these big pharma companies could terminate the partnership, and this would mean a reduced pipeline. It would also mean the loss of the ability to receive long-term milestone payments for these respective programs. At which point, the biotech would be forced to raise cash by dilutive means.

Voyager has put itself in a position to obtain key safety and pharmacokinetic data from its phase 1a SAD, randomized, placebo-controlled study. Such data expected in the first half of next year will be crucial to proving whether the drug is safe/tolerable for patients to take. Plus, that adequate drug exposure is present to generate the necessary tau protein reduction later on. Especially, where the company believes it can improve upon the use of monoclonal antibodies targeting tau protein when going after the C-terminal, instead of the failed N-terminal many other companies failed on.

Whether such a differentiation is shown remains to be seen. However, I believe it is good that at least it also has another shot on goal in targeting the large AD treatment market space with its gene therapy TRACER-capsid technology platform. With initial safety/PK data from the phase 1a healthy volunteer study expected in the 1st half of 2025, plus the ability to continue to advance the next-generation TRACER-capsid technology platform I believe that investors could benefit with any potential gains made here.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article is published by Terry Chrisomalis, who runs the Biotech Analysis Central pharmaceutical service on Seeking Alpha Marketplace. If you like what you read here and would like to subscribe to, I'm currently offering a two-week free trial period for subscribers to take advantage of. My service offers a deep-dive analysis of many pharmaceutical companies. The Biotech Analysis Central SA marketplace is $49 per month, but for those who sign up for the yearly plan will be able to take advantage of a 33.50% discount price of $399 per year.

This article was written by

Terry Chrisomalis is a private investor in the Biotech sector with years of experience utilizing his Applied Science background to generate long term value from Healthcare.

He is the author of the investing group Biotech Analysis Central which contains a library of 600+ Biotech investing articles, a model portfolio of 10+ small and mid-cap stocks with deep analysis for each, live chat, and a range of analysis and news reports to help Healthcare investors make informed decisions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

About vygr stock, more on vygr, related stocks, trending analysis, trending news.

- SEC Home »

- Search the Next-Generation EDGAR System »

- Company Search »

- Current Page

Document Format Files

IRS No. : 320174431 | State of Incorp.: DE | Fiscal Year End: 1231 Type: SC 13G/A SIC : 6211 Security Brokers, Dealers & Flotation Companies (CF Office: 02 Finance)

IRS No. : 000000000 | State of Incorp.: DE | Fiscal Year End: 1231 Type: SC 13G/A | Act: 34 | File No.: 005-89173 | Film No.: 241183774 SIC : 2836 Biological Products, (No Diagnostic Substances) (CF Office: 03 Life Sciences)

We couldn’t find any results matching your search.

Please try using other words for your search or explore other sections of the website for relevant information.

We’re sorry, we are currently experiencing some issues, please try again later.

Our team is working diligently to resolve the issue. Thank you for your patience and understanding.

Bid Price and Ask Price

The bid & ask refers to the price that an investor is willing to buy or sell a stock. The bid is the highest amount that a buyer is currently willing to pay, whereas the ask is the lowest amount that a seller is currently willing to sell. The numbers next to the bid/ask are the “ size ”. The bid size displays the total amount of desired shares ... Read More. to buy at that price, and the ask size is the number of shares offered for sale at that price. The data displayed in the quote bar updates every 3 seconds; allowing you to monitor prices in real-time. The bid-ask spread can indicate a stock’s liquidity, which is how easy it is to buy and sell in the marketplace. Often, a smaller spread suggests higher liquidity, meaning more buyers and sellers in the market are willing to negotiate. In contrast, a larger spread suggests lower liquidity, as there are fewer investors willing to negotiate. You can use the bid-ask spread to determine whether to place a market order or limit order when trading, helping you to optimize your price and have a successful order execution. Real-time bid and ask information is powered by Nasdaq Basic, a premier market data solution. This data feed is available via Nasdaq Data Link APIs; to learn more about subscribing, visit Nasdaq Data Link's products page . ... Read Less.

- After-Hours

- Press Releases

- Analyst Research

- Dividend History

- Historical Quotes

- Historical NOCP

- P/E & PEG Ratios

- Option Chain

- Short Interest

- Institutional Holdings

- Insider Activity

- SEC Filings

- Revenue EPS

Symbol Search

Recently viewed.

Analyze your stocks, your way

Leverage the Nasdaq+ Scorecard to analyze stocks based on your investment priorities and our market data.

Latest News

This data feed is not available at this time.

Trending Stocks

Trending etfs, trending indexes.

- Real-time Data is provided using Nasdaq Last Sale Data

Data provided by Nasdaq Data Link, a premier source for financial, economic and alternative datasets. Data Link's cloud-based technology platform allows you to search, discover and access data and analytics for seamless integration via cloud APIs. Register for your free account today at data.nasdaq.com .

- Type a symbol or company name. When the symbol you want to add appears, add it to My Quotes by selecting it and pressing Enter/Return.

These symbols will be available throughout the site during your session.

Your symbols have been updated

Edit watchlist.

- Type a symbol or company name. When the symbol you want to add appears, add it to Watchlist by selecting it and pressing Enter/Return.

Opt in to Smart Portfolio

Smart Portfolio is supported by our partner TipRanks. By connecting my portfolio to TipRanks Smart Portfolio I agree to their Terms of Use .

IMAGES

COMMENTS

The Investor Relations website contains information about Voyager Therapeutics Inc.'s business for stockholders, potential investors, and financial analysts.

Form. 10-K. Filing Date. 03/08/22. Document Date. 12/31/21. Form Description. Annual report which provides a comprehensive overview of the company for the past year. Filing Group.

These risks are discussed more fully in the "Risk Factors" section of this prospectus supplement immediately following this prospectus supplement summary, in our Annual Report on Form 10-K for the year ended December 31, 2022, and in our other filings with the SEC that we have incorporated by reference in this prospectus supplement and the ...

Voyager Therapeutics, Inc. (VYGR) - 10-Q - Quarterly Report SEC FilingsTue, May 09, 2023

Voyager Therapeutics Inc. SEC filings breakout by MarketWatch. View the VYGR U.S. Securities and Exchange Commission reporting information.

Analyze up to 10 years of full 10K Annual Reports and Quarterly 10Q SEC filings for Voyager Therapeutics, Inc. (VYGR) using our online tools.

About Voyager Therapeutics Voyager Therapeutics (Nasdaq: VYGR) is leading the next generation of AAV gene therapy to unlock the potential of the technology to treat devastating diseases.

Find the latest SEC Filings data for Voyager Therapeutics, Inc. Common Stock (VYGR) at Nasdaq.com.

Mailing Address 75 HAYDEN AVENUE LEXINGTON MA 02421 Business Address 75 HAYDEN AVENUE LEXINGTON MA 02421 857-259-5340 Voyager Therapeutics, Inc. ( Issuer ) CIK: 0001640266 (see all company filings)

Find the latest Voyager Therapeutics, Inc. (VYGR) stock quote, history, news and other vital information to help you with your stock trading and investing.

View the latest VYGR 10K form and other Securities and Exchange Commission (SEC) filings for Voyager Therapeutics (NASDAQ:VYGR) at MarketBeat.

A copy of our 2020 Annual Report on Form 10-K as filed with the SEC, except for exhibits, will be furnished without charge to any stockholder upon written or oral request to Voyager Therapeutics, Inc., 75 Sidney Street, Cambridge, MA 02139, Attention: Allison Dorval, Telephone: (857) 259-5340.

SEC Filings - Full Text Search Use this search box to perform a full-text search through all major SEC filings for VYGR / Voyager Therapeutics, Inc..

SEC filings and transcripts for Voyager Therapeutics Inc., including financials, news, proxies, indentures, prospectuses, and credit agreements.

Voyager Therapeutics, Inc. (Exact name of registrant as specified in its charter) DELAWARE . 001-37625 . 46-3003182 (State or other jurisdiction of incorporation) ... Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

(1) execute for and on behalf of the undersigned, in the undersigned's capacity as an officer and/or director of Voyager Therapeutics, Inc. (the "Company"), from time to time the following U.S. Securities and Exchange Commission ("SEC") forms: (i) Form ID, including any attached documents, to effect the assignment of codes to the undersigned to be used in the transmission of ...

Company profile for Voyager Therapeutics, Inc. (VYGR) with a description, list of executives, contact details and other key facts.

According to the 10-Q SEC Filing, Voyager Therapeutics had cash, cash equivalents and marketable securities of $371 million as of June 30th of 2024. This company should have enough cash for an ...

CURRENT REPORT. Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934 Date of Report (Date of Earliest Event Reported): November 6, 2023

SEC Accession No. 0001086364-24-008406 Filing Date. 2024-08-07. Accepted. 2024-08-07 16:10:26 ... 0001364742 (see all company filings) IRS No.: 320174431 | State of Incorp.: DE | Fiscal Year End: 1231 Type: SC 13G/A SIC: 6211 Security Brokers, Dealers & Flotation Companies (CF Office: 02 Finance) ... Voyager Therapeutics, Inc. (Subject) CIK ...

Discover real-time Voyager Therapeutics, Inc. Common Stock (VYGR) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. Stay ahead with Nasdaq.

Conference Call The Voyager Therapeutics leadership team will host a conference call and webcast today at 8:30 a.m. ET to discuss the Novartis license option agreement, and provide and discuss fourth quarter and full year 2021 financial and operating results.

LEXINGTON, Mass., Aug. 29, 2024 (GLOBE NEWSWIRE) -- Voyager Therapeutics, Inc. (Nasdaq: VYGR), a biotechnology company dedicated to advancing neurogenetic medicines, today announced that the company will participate in multiple upcoming investor conferences: The Wells Fargo 2024 Healthcare Conference, in Boston, including a fireside chat at 1:30 p.m. ET on September 5, 2024