Trending Stories

/images/2018/01/23/navina-side-hustle-mid_MPfEDfV.jpg)

Chase Sapphire Preferred ® Card Airline Partners: Which Airlines Are Available?

Get the most value from your Chase Sapphire Preferred points by transferring them to these 11 partner airlines.

/images/2020/02/20/view-of-sky-from-airplane.jpeg)

This article was subjected to a comprehensive fact-checking process. Our professional fact-checkers verify article information against primary sources, reputable publishers, and experts in the field.

We receive compensation from the products and services mentioned in this story, but the opinions are the author's own. Compensation may impact where offers appear. We have not included all available products or offers. Learn more about how we make money and our editorial policies .

One of the biggest benefits of a great travel rewards credit card is the ability to transfer your points to partner companies. The Chase Sapphire Preferred ® Card is one of our favorite travel credit cards and lets you transfer your points to any of Chase’s 11 airline travel partners, including JetBlue, Southwest, and United.

Your points transfer at their full value, and you can use them for airfare, upgrades, and other perks that each airline offers. You can also redeem your points for flights in the Chase Travel portal at an increased rate, so you have plenty of great options with these points.

Let’s take a closer look at Chase’s airline travel partners, how to transfer your points, and how to redeem your points for flights in the Chase Travel portal, if you’d rather go that route.

Key Takeaways

Who are the chase sapphire preferred airline transfer partners, the value of booking with chase sapphire preferred airline partners, how to transfer your points to chase sapphire preferred airline partners, how to book through the chase travel portal.

How to earn Chase Sapphire Preferred points

Alternative Chase cards

Bottom line.

- Chase has partnerships with 11 airlines, including Air Canada, British Airways, Emirates Airlines, and more.

- You can typically transfer Chase Ultimate Rewards points to partner airlines at a 1:1 ratio. Every now and then, Chase runs transfer promotions for specific airlines that provide even better transfer rations.

- You can also book your flights through the Chase Travel portal for a simplified booking process and increased point redemption value.

- You can earn Chase Ultimate Rewards points for travel through the Chase Sapphire Preferred’s new cardmember bonus, spending bonuses, or even by transferring points from a different Chase card.

Chase has 11 airline partners that allow you to transfer your Ultimate Rewards points to their frequent flyer programs. You can use transferred points to purchase reward flights, upgrades to first class, and other perks.

Let’s take a look at Chase’s airline partners that you can transfer your points to.

These transfer options give you a lot of value because your points are moved from Chase to each of these programs on a 1:1 ratio. That means that 1 Chase Ultimate Rewards point is equal to 1 frequent flyer point or mile in redemption value.

Once your points actually make it to the airline partner, their value depends on the airline and what you’re using the points for.

Points have to be transferred in 1,000-point increments. For example, if you had 12,000 Ultimate Rewards points, you could only transfer 1,000, 2,000, 3,000, etc., points to your United MileagePlus account. You wouldn’t be able to transfer 1,500 or 3,200 points.

Generally, your points will transfer instantly to your frequent flyer account, but in some cases, it can take up to seven business days for the transaction to be completed. When I transferred points from my Chase Ultimate Rewards portal to United Airlines for my most recent trip, the points showed up in my United account right away.

To make sure the process is as seamless as possible, make sure the name on your Travel account exactly matches the name on your frequent flyer account. You can only transfer your points to your airline account or an authorized user’s account.

As a Chase Sapphire Preferred cardholder, you can transfer your points to one of 11 airline partners to pay for tickets, upgrades, and other perks offered by frequent flyer programs.

The value you get when you transfer Chase Ultimate Rewards points to a partner airline varies depending on the redemption option you choose. Most partners offer a value of 1.2 to 1.6 cents per point, but if you use your points to book a premium ticket on an international flight, you may be able to get an even higher value.

Before transferring your Chase points to a partner airline, it’s worth exploring the value you’ll get. When you book your flights through Chase’s travel portal, you’ll get a value of 1.25 cents per point — use that as a benchmark when you’re deciding whether the transfer is worth it.

Example transfer

For example, you could transfer your Ultimate Rewards points to Singapore Airlines’ KrisFlyer program. Travelers have reported booking Business Class award flights on Singapore Airlines from the West Coast to Singapore for less than 100,000 KrisFlyer miles.

If you were to book a similar ticket with cash, it would cost you an average of $5,110. In this case, your points would be valued at over 5.1 cents each.

It can take some research to find the sweet spots for a transfer partner's rewards program, but the results can be well worth the time and effort.

The right travel card for you is the one that matches your interests and spending habits, allowing you to earn valuable rewards and travel the way you like — for less. Learn more about these top cards and choose what's best for you.

Before you transfer points, find the flight you’d like to redeem your points for on the partner airline’s website. Point transfers are one-way. Once you transfer your points from Chase, you can’t move them back. So, it’s important to know how many points you’ll need and how you’ll use them before you start the transfer process.

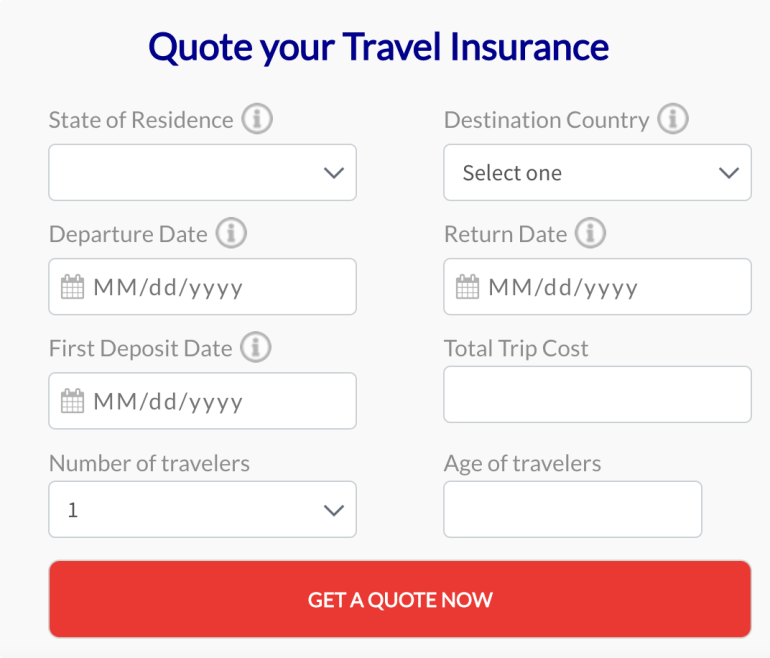

Once you know exactly how many points you want to transfer, here are your next steps:

1. Log into your Chase account and visit the Ultimate Rewards portal .

2. Select the option to “Transfer points to partners.” If you’re on a computer, you’ll find this in the menu along the top of the screen under the dropdown labeled “Travel.” If you’re on the Chase app, you’ll find it under the option “Redeem points.”

3. On the next screen, select the airline program for point transfer, review the details, and click “Transfer Points” to proceed.

/images/2024/08/23/chase-sapphire-preferred-airline-partners-1.png)

4. Provide the necessary information on the next screen. You’ll choose which card user to transfer points to (if there’s more than one) and verify your airline program membership information.

/images/2024/08/23/chase-sapphire-preferred-airline-partners-2.png)

5. Type in the number of points you want to transfer. Remember, you can only transfer points in increments of 1,000.

/images/2024/08/23/chase-sapphire-preferred-airline-partners-3.png)

6. Review your transfer details one last time before officially submitting it. You can’t transfer your points back, so read the details extra carefully to make sure you’re transferring the right amount of points to the right program.

/images/2024/08/23/chase-sapphire-preferred-airline-partners-4.png)

If you prefer the convenience of a one-stop shop, the Chase Travel portal makes it simple to book flights, hotels, rental cars, cruises, and other kinds of travel using points. It’s a good place to start researching flight times and prices, and it’s easy to pay for your flights in the portal using Ultimate Rewards points, a credit card, or a combination of both.

With certain Chase credit cards , like the Chase Freedom Flex ® , points are only valued at one cent each. However, with the Chase Sapphire Preferred, you get added value. When you book through the Chase Travel portal using your Sapphire Preferred card, your points will be worth $0.0125 or 1.25 cents each, which can add up to significant savings.

And you even get this elevated point value for points earned on another Chase card. For example, I have both the Chase Freedom Unlimited ® and the Chase Sapphire Preferred in my wallet because there are some purchases where the Chase Freedom Unlimited gets me more points. When I’m ready to book a trip I can transfer the points from my Chase Freedom Unlimited to my Chase Sapphire Preferred and enjoy the 25% higher redemption rate.

It’s worth noting that, until recently, you could book flights with all of Chase’s transfer partner airlines — as well as some non-partner airlines — through the portal, except for Southwest Airlines, which required you to buy your tickets directly through them. This has changed, and you can now buy your Southwest tickets right in the Chase Travel portal.

If you’re opting to book your flight directly in the Chase Travel portal rather than by transferring your points to a partner airline, here are the steps you’ll need to follow:

1. Log into your Chase account and visit the Chase Travel portal . You can get there right from your homepage on either a computer or the Chase mobile app.

2. Search for flights by entering your departure and destination airports, your travel dates, whether it’s a one-way or round-trip flight, your desired travel class, and the number of travelers.

/images/2024/08/23/chase-sapphire-preferred-airline-partners-5.png)

3. Review and sort the flight options in the results based on your preferences, such as airline, price, departure times, and number of stops.

/images/2024/08/23/chase-sapphire-preferred-airline-partners-6.png)

4. Choose your flights, verify the schedule, provide necessary details, and enter your frequent flyer number if available to earn points.

5. When you reach the payment option, you will see how many points you have and how much the cost of the flight is in terms of dollars and points. You can choose to pay with points , a credit card, or both.

/images/2024/08/23/chase-sapphire-preferred-airline-partners-7.png)

There are a handful of different ways you can earn Chase Ultimate Rewards points on your Chase Sapphire Preferred. First, Chase is currently offering 60,000 bonus points when you spend $4,000 in the first 3 months as a new cardmember.

You can also earn points in a bunch of different spending categories, including:

- 5X points on travel purchased through Chase Travel℠

- 2X points on other travel purchases

- 3X points on dining, select streaming services, and online groceries

- 1X points for all other purchases

As we mentioned, you can also transfer the points from your other Chase cards to your Chase Sapphire Preferred to get the increased redemption rate when you’re booking your travel. This presents a great opportunity to maximize your point earnings.

For example, you can use your Chase Sapphire Preferred for the spending categories where it offers elevated rewards. Then for all other purchases, use something like the Chase Freedom Unlimited that offers 1.5% cash back on all other purchases.

The Chase Sapphire Preferred is hands-down one of my favorite travel credit cards, but it may not be the right choice for everyone. If you’re looking for an alternative, take a look at how this card stacks up to other popular Chase cards in the table below.

The Chase Sapphire Reserve ® is another great option for travelers who want to use their credit card points to book travel, while the Chase Freedom Flex and Chase Freedom Unlimited cards are solid options if you just want a great all-around rewards card.

Is the Chase Sapphire Preferred worth it?

The Chase Sapphire Preferred is one of our favorite credit cards , but whether it’s worth it depends on your spending and travel habits. This card offers plenty of benefits and protections, making it a great fit for frequent travelers as well as those who take a couple of trips or more a year.

When you book travel with Chase Ultimate Rewards points through Chase Travel, you get 25% more value per point with this card. While abroad, you can enjoy paying no foreign transaction fees. All of these benefits combined make it easy to justify the $95 annual fee.

How much are 80,000 Ultimate Rewards points worth?

Each Ultimate Rewards point is worth $0.01. Your 80,000 points are worth $800 if you use them for a statement credit, a cash payout, or to purchase gift cards and merchandise. If you use them to book travel through Chase Travel, each point is worth $0.0125, making your 80,000 points worth $1,000.

What airlines can you book through Chase Travel?

Using Chase Travel, you can book flights on more than 250 domestic and international airlines. Domestic carriers include Delta, American Airlines, United, Alaska Airlines, Hawaiian Airlines, and JetBlue. International carriers include KLM, Lufthansa, Finnair, British Airways, Air Canada, Emirates, Qantas, Korean Air, Virgin, and Cathay Pacific, among others.

What airlines can I transfer Ultimate Rewards points to?

Chase Travel has partnerships that allow you to transfer points to frequent flier programs from the following providers: Aer Lingus, Air Canada, British Airways, Emirates, Air France/KLM, Iberia, JetBlue, Singapore Airlines, Southwest Airlines, United, and Virgin Atlantic.

Do Chase points expire?

As long as your Chase account is open and in good standing, your Chase Ultimate Rewards points won’t expire. However, you’ll lose your unredeemed points if you close your account (or if Chase closes it).

Who are Chase's hotel transfer partners?

Chase's hotel transfer partners are IHG Hotels & Resorts, Marriott Bonvoy, and Hyatt. Just like with Chase’s airline partners, you can transfer your Ultimate Rewards points to these hotel partner loyalty programs.

All in all, you have a lot of travel options to choose from when you use Chase Ultimate Rewards points with your Chase Sapphire Preferred card. You can use your points either through Chase’s travel portal or transfer those points over to your favorite frequent flyer program to get the benefits only offered by the airline carrier.

Which is the best move? Only you can answer that question. We’d recommend considering the value of the points in each airline’s frequent flyer program versus redeeming them directly through Chase. No matter what you decide, keep your points safely in your Chase account until you’re ready to use them, and check out all of your Chase travel partner options before committing your points to one option or another.

The right travel card for you is the one that matches your interests and spending habits, allowing you to earn valuable rewards and travel the way you like — for less. Learn more about these top cards and choose the one that's best for you:

- For no annual fee : Bank of America ® Travel Rewards credit card

- For flexible points and travel partners : Chase Sapphire Preferred ® Card

- For airport lounge access : Capital One Venture X Rewards Credit Card

- For unlimited 3X points in popular categories : Wells Fargo Autograph℠ Card

- For business travel : Ink Business Preferred ® Credit Card

Great for Flexible Travel Rewards

Chase sapphire preferred ® card.

/images/2024/03/28/chase_sapphire_preferred_032824.png)

FinanceBuzz writers and editors score cards based on a number of objective features as well as our expert editorial assessment. Our partners do not influence how we rate products.

Current Offer

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

Rewards Rate

5X points on travel purchased through Chase Travel℠; 3X points on dining, select streaming services, and online groceries; 2X points on all other travel purchases, and 1X points on all other purchases

- Generous welcome offer valued at $750 when redeemed via Chase Travel

- High rewards on dining and bookings via Chase Travel

- 25% more value when redeeming points for travel through Chase Travel

- Up to $50 in annual statement credits for hotel stays booked through Chase Travel

- Receive valuable travel protections like trip delay reimbursement and primary rental car insurance

- Has a $95 annual fee

- Doesn’t offer airport lounge access or premium travel perks like Global Entry or TSA PreCheck credit

- Doesn't offer bonus points on gas or in-person groceries purchases

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2027.

- Member FDIC

/authors/robin_kavanagh_updated.png)

Author Details

Robin Kavanagh

We are an independent publisher. Our reporters create honest, accurate, and objective content to help you make decisions. To support our work, we are paid for providing advertising services. Many, but not all, of the offers and clickable hyperlinks (such as a “Next” button) that appear on this site are from companies that compensate us. The compensation we receive and other factors, such as your location, may impact what ads and links appear on our site, and how, where, and in what order ads and links appear. While we strive to provide a wide range of offers, our site does not include information about every product or service that may be available to you. We strive to keep our information accurate and up-to-date, but some information may not be current. So, your actual offer terms from an advertiser may be different than the offer terms on this site. And the advertised offers may be subject to additional terms and conditions of the advertiser. All information is presented without any warranty or guarantee to you.

This page may include: credit card ads that we may be paid for (“advertiser listing”); and general information about credit card products (“editorial content”). Many, but not all, of the offers and clickable hyperlinks (such as a “Apply Now” button or “Learn More” button) that appear on this site are from companies that compensate us. When you click on that hyperlink or button, you may be directed to the credit card issuer’s website where you can review the terms and conditions for your selected offer. Each advertiser is responsible for the accuracy and availability of its ad offer details, but we attempt to verify those offer details. We have partnerships with advertisers such as Brex, Capital One, Chase, Citi, Wells Fargo and Discover. We also include editorial content to educate consumers about financial products and services. Some of that content may also contain ads, including links to advertisers’ sites, and we may be paid on those ads or links.

For more information, please see How we make money .

Your guide to Chase transfer partners: Everything to know

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money .

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Chase Ultimate Rewards are perhaps the most valuable transferable points. With instant or short transfer times and strong transfer partners like United Airlines, Southwest and Hyatt, you can travel nearly anywhere in the world on points.

Chase travel credit cards are also some of the best on the market. There are several direct Chase transfer partners, but you can also access indirect partners. That gives you lots of ways to travel for pennies on the dollar.

Chase Ultimate Rewards points are easy to earn with big sign-up offers and bonus categories. By transferring to the right partners, you could get even more value from your Chase points via a single welcome bonus.

Here are all the details about Chase’s transfer partners and what you should know before you book award travel.

Chase transfer partners

Chase transfer partners include airlines and hotels, all of which have a 1:1 transfer ratio. That means when you transfer 1 Chase Ultimate Rewards point, you’ll earn 1 mile or point in the program you send them to. Transferring your points to travel partners is the best way to use Chase points .

Chase Airline transfer partners

There are 11 direct Chase Ultimate Rewards airline transfer partners:

British Airways

Flying blue (loyalty program of air france and klm), singapore airlines, united airlines, virgin atlantic.

Through these airlines, you can book award seats through all three major airline alliances, including:

- Oneworld airlines (British Airways and Iberia)

- SkyTeam airlines (Flying Blue)

- Star Alliance airlines (Singapore Airlines and United Airlines)

Knowing how to work through the major alliances is your ticket to dozens of airlines beyond the 10 direct airline partners. Note that you can use Chase points to book award travel on other partner airlines which aren’t part of any alliance. For example, you can use British Airways Avios points to book an award ticket with Alaska Airlines, or Virgin Atlantic miles to fly on Hawaiian Airlines.

Knowing Chase’s airline partners — and then each partner’s partners — can unlock nearly limitless award opportunities.

Chase hotel transfer partners

The Chase Ultimate Rewards program has three direct hotel transfer partners:

In general, you’ll get a better deal redeeming Chase Ultimate Rewards points with airline partners, but Hyatt is the exception. It has a generous award char, and award rooms start at just 5,000 points per night. In fact, some of the team’s biggest travel awards have been for Hyatt stays.

If you’re close to an award stay with IHG, it can make sense to top off your account with Chase Ultimate Rewards points. But there are a number of other ways to earn IHG points, too.

And much like with IHG, if you’re a few points shy of a free stay at Marriott, it can make sense to transfer Ultimate Rewards points to your Marriott account. Always run the numbers before you make a transfer because there’s no reversing it.

Chase Ultimate Rewards transfer times

Here’s a look at the estimated transfer times for each of the airline partners.

Most Chase Ultimate Rewards points transfers are instant. This is great news if you’re in a hurry to book an award flight or get a hotel room.

For the cases where transfers take one or two days, you still have a couple of options while you wait.

Marriott will give you a points advance to book your stay at a Marriott or Ritz-Carlton hotel. As long as you have the points in your account at least 14 days prior to check-in, you’re good to go.

And Singapore Airlines will let you hold an award ticket for a Singapore Airlines flight (not for partner award flights). You need to call to place an award on hold, then call again once the transfer is complete to ticket your trip. It’s a little more work, but worth it to preserve your award flight while you’re waiting!

Know the Chase Ultimate Rewards Transfer rules

All transfers are final.

Once you transfer Chase Ultimate Rewards points to a partner program, you won’t be able to get the points back to your Chase account.

I recommend finding your award flight or room before you transfer your points. Most transfers are instant, so you can book as soon as you find travel that works for you

Transfers to partners are always in 1,000-point increments

You might need a small or odd number of points to snag an award ticket or hotel stay, but be aware that you must always transfer in increments of 1,000 Chase Ultimate Rewards points to travel partners.

You can combine any number of points between Chase Ultimate Rewards cards (yup, even just 1 point) or combine them with others in any amount. But when it’s time to send them to travel partners, they have to go out in increments of 1,000 points.

Send your points to a spouse, family member or authorized user

For personal cards, Chase lets you to transfer points to another person in the same household. Here’s our video guide on how to combine your points with a family member or another card account .

If you want to transfer points from a business card to someone else, they need to be a household member or a co-owner of the company.

You can also combine points with an authorized user, as long as they live at the same address as you.

Award travel with Chase Ultimate Rewards points

Here are just a few ways to get outsized value from your Chase Ultimate Rewards points.

Transfer to British Airways or Aer Lingus Avios for flights to Dublin

You can redeem British Airways or Aer Lingus Avios points on Aer Lingus and book flights to Dublin.

British Airways and Aer Lingus award prices are distance-based, so shorter flights cost fewer points. This means award flights from the East Coast to Dublin are a terrific deal. For example, Boston to Dublin requires only 26,000 British Airways Avios points for an off-peak, round-trip coach award ticket. The same deal is available from the following cities:

- Montreal (starting summer 2019)

- New York – JFK

- Philadelphia

- Washington, DC

You can’t search for or book Aer Lingus award flights on the British Airways website. Instead you can search for “Saver” award seats on the United Airlines website and call British Airways to book. Ask them to waive the phone fee because it’s not possible to book online.Also, Aer Lingus classifies certain dates as peak travel, which means you’ll use more points for award flights during these times.

Transfer to Singapore Airlines for United Airlines flights to Hawaii

United Airlines is a direct Chase airline transfer partner. But you can also transfer Chase Ultimate Rewards points to Singapore Airlines, which is part of the same Star Alliance. Then, book United Airlines award flights to Hawaii for cheaper than what United Airlines charges!

For example, you’ll pay 35,000 Singapore Airlines miles round-trip in coach from anywhere in North America to Hawaii. Compare that with United Airlines’ price of 45,000 United Airlines miles. You’ll save 10,000 Chase Ultimate Rewards points per flight.

Transfer to Hyatt for luxury hotel stays

As mentioned earlier, some of our most valuable uses of Chase Ultimate Rewards points have been at Hyatt hotels around the world. Here’s how to transfer your points to Hyatt . Many of us on the MMS team have stayed at Hyatt all-inclusive hotels in Mexico. We loved the endless food and adult beverages. And because I used points for a free stay (that’s right, I paid $0), I treated myself to an opulent massage treatment I’d otherwise never splurge on.

Booking travel through the Chase travel portal

Along with transferring your Ultimate Rewards points to Chase travel partners, don’t forget, it’s also possible to use your points to book travel directly through the Chase travel portal .

Depending on the cash price of a ticket or hotel room, you’ll sometimes get a better deal using the Chase travel portal to book flights or hotels.

Chase Sapphire Reserve cardholders, for example, will get a value of 1.5 cents per Chase Ultimate Reward point when booking through the portal. Those with the Chase Sapphire Preferred Card or Ink Business Preferred Credit Card will get a value of 1.25 cents per point when booking through the Chase portal.

Here’s our guide to booking travel with the Chase travel portal .

Earn Chase Ultimate Rewards points

You can earn Chase Ultimate Rewards points to transfer directly to airline and hotel partners with these three excellent card offers:

These cards are affected by Chase’s stricter application rules. That means if you’ve opened five or more cards from any bank ( except these business cards ) in the past 24 months, it’s unlikely you’ll be approved. And if you have any of these no-annual-fee cards, you’ll need to combine Chase points to one of the above cards before you can transfer them:

- Chase Freedom Flex

- Chase Freedom Unlimited

- Ink Business Cash Credit Card

- Ink Business Unlimited Credit Card

Each card has its own strengths, like bonus points for spending in certain categories. That makes it easier to earn even more valuable Chase Ultimate Rewards points. Read our full guide on how to earn Chase Ultimate Rewards points for all the details.

Bottom line

There are 13 airline and hotel partners within the Chase Ultimate Rewards program.

But thanks to airline alliances and partnerships, you can book award travel beyond the direct transfer partners. This unlocks nearly endless travel opportunities to fantastic destinations around the world.

Most points transfers are instant, but a few partners have one- or two-day transfer times. Because of their flexibility and strong travel partners, Chase Ultimate Rewards are a favorite here at Million Mile Secrets. We’ve all used Chase Ultimate Rewards transfer partners for unforgettable trips.

With sign-up offers on cards like 80,000 Chase Ultimate Rewards points with the Chase Sapphire Preferred card after meeting the minimum spending, you could be on your way to Ireland on Aer Lingus, Hawaii with Singapore Airlines miles, or at an all-inclusive Hyatt hotel in Mexico — and that’s just for starters.

Let me know your favorite Chase Ultimate Rewards transfer partner. And subscribe to our newsletter for more tips and trick to getting outsized value for your points.

Meghan Hunter

Contributor

Meghan Hunter is an editor for Million Mile Secrets. She covers points, miles, credit cards, airlines, hotels and general travel. Her work has also appeared in The Points Guy.

More Topics

Credit Cards

Join the Discussion!

You May Also Like

BonusTracker: Best credit card bonus offers

June 14, 2021 4

Best Hilton credit cards: Improved weekend night certificates, earning rates and more

June 12, 2021 2

Our Favorite Partner Cards

Popular posts.

Chase Ultimate Rewards transfer partners: How to get the best value in 2024

May 3, 2024 • 16 min read

Start racking up your Chase Ultimate Rewards to travel the world for less; Tokyo, Japan © easy camera / Shutterstock

This series of articles about credit cards, points and miles, and budgeting for travel is brought to you in partnership with The Points Guy .

Advertiser Disclosure: This post contains references to products from one or more of our advertisers. We may receive compensation when you click on links to those products. Terms apply to the offers listed on this page. This relationship may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. All information about the Chase Freedom cards, Ink Business Cash® Credit Card, and the Ink Business Unlimited® Credit Card have been collected independently by Lonely Planet. These cards are not available through Lonely Planet.

Chase Ultimate Rewards is a powerhouse in the world of credit card rewards programs, offering cardholders extensive options to earn and redeem points toward travel .

If you’re making a travel budget using points and miles , Chase Ultimate Rewards should definitely be part of your rewards strategy. With partnerships including some of the top airline and hotel loyalty programs, Ultimate Rewards points can be incredibly valuable. Unlocking the true potential of these points lies in understanding its transfer partners.

Whether you're a seasoned traveler or new to points and miles , this guide will help you make the most of your hard-earned Chase points. Here’s everything you need to know about Ultimate Rewards transfer partners and how to leverage your points for maximum value.

The best travel credit cards

Chase airline transfer partners

Chase Ultimate Rewards cardholders can use their points to book flights to virtually anywhere in the world. Chase Ultimate Rewards has 11 airline transfer partners, spanning all three airline alliances: Oneworld, SkyTeam and Star Alliance. This wide-reaching network of partners makes Chase Ultimate Rewards particularly valuable for travelers due to its flexibility and accessibility. Occasionally, Chase offers up to 30% bonus points when you transfer rewards to select partners. This can help you stretch your rewards further.

The inclusion of airlines from all three alliances ensures that users have an array of options, regardless of their preferred loyalty program or destination, making it a versatile and valuable rewards program for anyone looking to maximize their travel benefits. But with so many options, it’s easy to get confused about which program to transfer your Chase points to at any given time. We’ll dive into this subject and which program provides the best value:

- Aer Lingus AerClub

Air Canada Aeroplan

- Air France-KLM Flying Blue

British Airways Executive Club

Emirates skywards, iberia plus, jetblue trueblue, singapore airlines krisflyer, southwest airlines rapid rewards, united mileageplus, virgin atlantic flying club.

The best credit cards with no international fees in 2024

Aer Lingus, AerClub

Aer Lingus is Ireland’s flag carrier and a great option for direct flights to the Emerald Isle. AerClub offers some of the cheapest award flights to Europe. You can fly between the East Coast and Dublin for just 13,000 Avios in economy class and 50,000 in business. Currently, Chase is offering a 30% transfer bonus to AerClub, making it even more attractive.

Traveling to Europe using points and miles

Air Canada is part of the Star Alliance and still publishes an award chart with clearly defined redemption rates. When United Airlines rates skyrocket due to dynamic pricing, Aeroplan can be an excellent alternative. Flights to Europe start at 35,000 points in economy class and 60,000 each way in business. Aeroplan can also be a great value for short-haul domestic flights, which start at just 6,000 points each way.

The best credit cards for airport lounge access

Air France-KLM Flying Blue

Air France and KLM’s joint Flying Blue loyalty program is one of the best Chase transfer options, thanks to low redemption rates on international travel and routinely discounted award flights. You can travel between Newark (EWR) and Amsterdam (AMS), Paris (CDG) or Marrakech (RAK) for just 15,000 miles in economy class or 55,000 in business. This is a terrific bargain, considering programs like American Airlines AAdvantage charge 25,000 miles one-way for award flights to Europe . Through Promo Rewards , these fares are sometimes discounted by as much as 50%.

Best credit cards for traveling with kids

British Airways Executive Club has long been a favorite for cheap short-haul flights. British Airways partners with both Alaska Airlines and American, so you can take advantage of some fantastic deals. For example, you can fly between Miami (MIA) and Cancun (CUN) for just 7,500 Avios in economy class and 15,000 Avios in business.

Chase Sapphire Preferred vs. Capital One Venture: two top travel credit cards go head-to-head

Emirates is known for its luxurious first-class cabin onboard the 777, featuring fully enclosed suites and luxury amenities. While pricey, you can fly this fantastic product on the Dubai (DXB) to Paris (CDG) route for a reasonably 67,500 miles each way. That’s an excellent use of Chase Ultimate Rewards points and well worth the transfer.

Chase Sapphire Reserve vs. Capital One Venture X Card: two of the most popular rewards cards

If you’re planning a trip to Spain, transferring Chase points to Iberia Plus is a great option. Not only does Iberia offer plenty of direct flights from the US, but the rates are very affordable. For example, an economy-class flight between New York (JFK) and Madrid (MAD) starts at just 17,000 miles each way. That’s an incredible bargain for a long-haul international flight.

TSA Precheck vs Nexus

Transferring Chase Ultimate Rewards to JetBlue TrueBlue isn’t the best value proposition. JetBlue points are only worth around 1.4 cents each toward flights. This is significantly lower than the value you can get from other airlines. If you have a Chase Sapphire Reserve Card, your points are worth 1.5 cents each towards Chase Travel℠ bookings. By transferring points to JetBlue, you’ll essentially devalue them.

Should you book travel with cash or points?

Singapore Krisflyer can be a great Chase transfer option, depending on how you redeem the miles. Singapore’s Star Alliance award chart has some excellent redemption rates for flights to Europe and the Middle East. You can fly round-trip to Europe for just 55,000 in economy class, 130,000 miles in business and 160,000 miles in first class. Meanwhile, flights to the Middle East cost 75,000 miles in economy, 115,000 in business and 150,000 miles in first class.

Traveling to Japan using points and miles

Southwest Rapid Rewards points are worth around 1.5 cents each towards Wanna Get Away fares. You can get much more value from your Chase points by transferring them to a different airline. However, if you’re not much for business or first-class travel, transferring points to Southwest can be worthwhile.

The best credit cards for airline miles

United MileagePlus has been devalued quite a bit and now uses dynamic pricing. So, the number of miles required for a flight isn’t always predictable (or very reasonable). Before transferring Chase points to United MileagePlus, be sure to compare mileage rates against Air Canada Aeroplan and Singapore Krisflyer. You might find cheaper flights, in which case you’ll want to transfer your points to one of those programs.

Best credit cards for road trips

Virgin Atlantic Flying Club is an excellent program for transferring Chase points. Flying Club has bargain rates on flights to Europe. For starters, you can fly between the East Coast and London for just 10,000 miles each way in economy class. West Coast flights are also a great deal at 15,000 miles each way.

Virgin Atlantic also partners with All Nippon Airways. You can fly to Japan in the airline’s esteemed “The Room” business class from just 90,000 miles round-trip.

TSA PreCheck vs. Clear: which one is best to expedite your travels

Chase hotel transfer partners

Chase Ultimate Rewards offers a versatile and valuable range of hotel transfer partners, including IHG One Rewards, Marriott Bonvoy and World of Hyatt. These partnerships allow Chase cardholders to redeem points at over 15,000 hotels worldwide. You may be wondering which of these programs offers the best value for your Chase points. It ultimately depends on where you’re traveling to, which is why you should always do a comparative search on all three websites before settling on one.

Here’s a closer look at each Chase hotel transfer partner to help you decide:

10 amazing US hotels you can book with points

IHG One Rewards

IHG One Rewards is the loyalty program for well-known hotel brands like Intercontinental Hotels, Holiday Inn, Crowne Plaza, Staybridge Suites and Kimpton, to name a few. Free nights start at 10,000 points per night, though you can also book a Point & Cash reward for as little as 5,000 points. IHG has a vast portfolio of hotels and brands to suit every traveler type.

IHG can be a good program to transfer your Chase points to, depending on the redemption rate. IHG routinely sells points at 0.5 cents each – so you want to make sure you’re getting significantly more value than that on your Chase points transfer. IHG credit cardholders get the fourth night free on award stays, so be sure to calculate this discount when transferring Chase points to IHG.

Best travel credit cards for hotels

Marriott Bonvoy

Marriott stands out for its extensive global presence spanning over 8,500 hotels in 138 countries, making it an ideal choice for travelers of all preferences. Marriott doesn’t publish an award chart, but free nights are a bit steep, ranging from 10,000 - 100,000 points per night. All members who book at least five consecutive nights get the fifth night free, which amounts to a solid 20% discount.

Because of the high number of points required for a free night, transferring Chase points to Marriott is generally not a good idea. The only exception is if you’re saving a substantial amount of cash by booking with points or you need to transfer a small number of Chase points for an award.

Marriott has some fantastic hotels in its wide-ranging portfolio. A popular place to redeem Marriott points is the all-inclusive, ultra-luxurious Al Maha Resort in Dubai. A free night will set you back at least 94,000 points per night, depending on the season.

10 amazing hotels around the world you can book with points

World of Hyatt

World of Hyatt offers is hands down the best Chase hotel transfer partner. This highly popular program is known for its exceptional properties and generous elite benefits. Hyatt is the only Chase hotel transfer partner that still publishes an award chart. This lets members know exactly how many points they need for a free night and save up accordingly. Plus, Hyatt has the cheapest redemption rates, starting at 3,500 points per night.

A great way to get the most value for your points is by booking all-inclusive hotels. These start at just 12,000 points per night and include meals, lodging and some activities. Hyatt’s all-inclusive brands include Hyatt Ziva and Zilara, along with well-known boutique brands like Secrets, Dreams and Suncape Resorts.

Whether you need points for a luxury vacation or a cheap airport hotel, Hyatt’s reasonable award chart makes it an ideal Chase transfer partner.

Best credit cards for adventure travel

Tips for maximizing your Chase Ultimate Rewards

The key to maximizing your Chase Ultimate Rewards is understanding your transfer options and which program offers the lowest redemption rates. For example, Chase has three airline transfer partners that are members of the Star Alliance: Air Canada Aeroplan, Singapore Krisflyer and United MileagePlus. You can use miles from these programs to book flights on any Star Alliance carrier. However, each program has different redemption rates. By researching and comparing award rates between these three programs, you can save a lot of valuable Ultimate Rewards points.

The same goes for Chase hotel transfer partners: Every program has a vast portfolio worldwide but at different redemption rates. Before transferring Ultimate Rewards to a hotel partner, be sure to compare the hotel options and the number of points required. Take into account any fourth or fifth-night-free benefits offered to save even more points.

You also shouldn’t sleep on the Chase Travel℠ portal. While transferring points to airline and hotel partners can be lucrative, sometimes, booking travel directly through the Chase Travel℠ portal can offer competitive prices and even additional point bonuses. Points are worth 1.25 cents each if you have a Chase Sapphire Preferred® Card and 1.5 cents with the Chase Sapphire Reserve® .

Lastly, consider pooling points from different Chase cards, as combining points from cards like Chase Freedom or Chase Freedom Unlimited® with premium cards like the Sapphire Reserve can significantly boost your rewards potential. By following these strategies and staying updated on promotions, you can effectively maximize your Chase Ultimate Rewards for incredible travel experiences.

Best travel credit cards for foodies

What are the best Chase Ultimate Rewards transfer partners?

The best Chase Ultimate Rewards transfer partner depends on your travel goals. Each partner has its strengths and weaknesses. Some offer fantastic value when you redeem them for long-haul international flights, while others have the best deals on short-haul domestic flights. While there are sweet spots in each program, there are a few stand-out transfer partners worth mentioning. They include World of Hyatt, Virgin Atlantic Flying Club, Flying Blue and Iberia Avios. As shown above, they have some of the best redemption rates, allowing you to stretch your valuable Chase points further.

How to travel to Bali with points and miles

How to transfer Chase points to partners

The process for transferring Chase points to partners is pretty straightforward. Here’s a step-by-step guide:

- Log in to your Chase account.

- Scroll down until you see “transfer points to partners” on the right side of the page.

3. On the page displaying Ultimate Rewards transfer partners, select the travel program you want.

4. Review the disclosures and estimated transfer times. Scroll to the bottom of the page and select “Transfer Points.”

5. Confirm the account you want to transfer points to.

6. Enter the number of points you want to transfer. Then select “next."

It’s important to note that airlines and hotel loyalty programs can increase redemption rates at any time without prior warning. So it’s best not to transfer points unless you have an immediate use in mind. If you can, try to put award tickets on hold to ensure you don’t lose out on award space while you wait for the points to transfer.

Best credit cards for international travel in 2024

Credit cards that earn Chase Ultimate Rewards

As you can see, Chase transfer partners can offer tremendous value for your points. Chase has four credit cards that earn Ultimate Rewards points. It’s worth noting that Chase enforces the ‘5/24 rule’ on applications. If you’ve opened five or more accounts (at any bank) in the past 24 months, you likely won’t be approved for a Chase card.

- Chase Sapphire Preferred® Card : Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Chase Sapphire Reserve® : Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- Ink Business Preferred® Credit Card : Earn 90,000 bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $900 cash back or $1,125 toward travel when redeemed through Chase Travel℠.

- Ink Business Premier® Credit Card : Earn $1,000 bonus cash back after spending $10,000 in your first three months from account opening.

If you have one of the above Chase Ultimate Rewards-earning credit cards, you can convert cash back from other cards into points. For example, $100 cash back would convert to 10,000 Ultimate Rewards points. The great thing about this is that Chase’s cash-back credit cards don’t carry annual fees and offer high-category bonuses. So you can increase your earning potential without accruing added annual fees:

- Chase Freedom Unlimited®: Earn an extra 1.5% on everything you buy (on up to $20,000 spent in the first year) — worth up to $300 cash back. That’s 6.5% on travel purchased through Chase Travel℠, 4.5% on dining and drugstores, and 3% on all other purchases.

- Chase Freedom Flex®: Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening. In addition, you'll earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Enjoy new 5% categories each quarter! Plus, earn 5% cash back on travel purchased through Chase Travel℠, 3% on dining and drugstores, and 1% on all other purchases.

- Ink Business Premier® Credit Card : Earn $1,000 after spending $10,000 in your first three months from account opening.

- Ink Business Unlimited® Credit Card: Earn $900 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening.

- Ink Business Cash® Credit Card: Earn $350 when you spend $3,000 on purchases in the first three months and an additional $400 when you spend $6,000 on purchases in the first six months after account opening.

How to get major perks at global events and concerts with your credit card

Who are Chase transfer partners?

Chase has 14 transfer partners in total. They include 11 airlines and three hotel loyalty programs: Aer Lingus AerClub, Air Canada Aeroplan, Air France-KLM Flying Blue, British Airways Executive Club, Emirates Skywards, Iberia Plus, IHG One Rewards, JetBlue TrueBlue, Marriott Bonvoy, Singapore Airlines KrisFlyer, Southwest Airlines Rapid Rewards, United MileagePlus, Virgin Atlantic Flying Club and World of Hyatt.

TSA PreCheck vs. Global Entry: A guide to picking the best one for you

Why should you transfer Chase points to airlines?

You should transfer Chase points to airlines if you have a high-value redemption in mind. Chase points are worth 1.25-1.5 cents each towards Chase Travel℠ bookings (depending on your credit card). So, if you can get more value than this by transferring Chase points to airlines, you should do it.

The best credit cards for rental cars

How long do Chase points transfers take?

Most Chase Ultimate Rewards point transfers are instant. It can take longer if it's your first time transferring points to a specific program. Marriott transfers can take over 24 hours, while Singapore Krisflyer transfers usually go through the same day. Whenever possible, put an award on hold to avoid losing it if the transfer takes too long.

American Express Membership Rewards vs. Chase Ultimate Rewards

What are Chase Ultimate Rewards worth?

Chase Ultimate Rewards points are worth 1.25-1.5 cents each. However, you can get much more value by transferring points to airline or hotel partners.

How to travel to Greece using points and miles

Is transferring your Chase Ultimate Rewards points worth it?

Transferring your Chase Ultimate Rewards points can be worth it if you have a high-value redemption in mind. For example, redeeming points for business and first class flights can be worth it because these flights cost thousands of dollars and redeeming points can make them attainable for most travelers.

How to travel to New Zealand with points and miles

Editorial disclaimer: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airline or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.

This article was first published Oct 31, 2023 and updated May 3, 2024.

Explore related stories

Tips & Advice

Sep 17, 2024 • 12 min read

Visitors to Europe are bowled over by its natural beauty, epic history, rich culture and dazzling diversity. Here are the best places to visit.

Sep 17, 2024 • 5 min read

Sep 16, 2024 • 12 min read

Sep 17, 2024 • 8 min read

Sep 16, 2024 • 6 min read

Sep 16, 2024 • 10 min read

Sep 16, 2024 • 4 min read

Sep 16, 2024 • 8 min read

- Chase Transfer Partners

- How to Earn Ultimate Rewards

- Airline Transfer Partners

- Hotel Transfer Partners

- How to Transfer Ultimate Rewards

Chase Ultimate Rewards Transfer Partners 2024

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: Chase Freedom Flex®. The details for these products have not been reviewed or provided by the issuer.

- Chase Ultimate Rewards® partners with 11 airlines and 3 hotel loyalty programs.

- Transferring points to travel partners is the best way to maximize the value of your Chase rewards.

- Several Chase credit cards earn Chase Ultimate Rewards, including the popular Chase Sapphire Preferred® Card.

When you use a Chase credit card , you're paying for purchases in dollars, but all your spending helps you rack up another kind of currency: Chase Ultimate Rewards® points.

Chase Ultimate Rewards points are some of the most valuable credit card rewards you can earn. Chase Ultimate Rewards are transferable points , which means you can move them over to various airline and hotel partner programs to book travel, in addition to the option of booking through Chase Travel℠ or using points toward eligible everyday purchases through Pay Yourself Back .

Maximizing Chase points requires knowing when and with whom you should redeem them. While you can use Chase Ultimate Rewards points to make purchases and pay for travel directly through Chase Travel℠, it's possible to significantly increase their value by transferring them to one of Chase's travel partners.

Chase Transfer Partners: The Basics

Chase has 14 travel transfer partners: 11 airline frequent flyer programs and three hotel programs.

Chase lets you transfer points at a 1:1 ratio in 1,000-point increments, and those transfers typically happen instantly (that's important for making sure you can grab an award flight or an award stay before it's gone). There are a few exceptions, though, and we've noted those in our breakdown of each partner below.

The value of those points can vary widely depending on where you want to go in the world and when you plan to travel. So, the best approach with Chase Ultimate Rewards is to be meticulous. Comparing all your options on departure/arrival dates and resort locations can help you figure out how to harness the most power from each of your points.

Also, be sure to keep a close eye on your email for alerts from Chase or these travel companies about exclusive offers, such as transfer bonuses, that can get you cheaper redemptions on flights and hotel stays.

How to Earn Chase Ultimate Rewards Points

You'll need to earn Chase Ultimate Rewards points before you can enjoy transferring them for award travel. Doing that requires having one or more of the best Chase credit cards in your wallet:

Earn 5x points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1x point per $1 spent on all other purchases.

22.49% - 29.49% Variable

Earn 60,000 bonus points

Good to Excellent

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Annual travel credit can effectively shave $300 off the annual fee if you use it

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Strong travel insurance

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Strong bonus rewards on travel and dining

- con icon Two crossed lines that form an 'X'. Very high annual fee

If you're new to rewards credit cards you may want to start elsewhere, but if you know you want to earn Chase points and you spend a lot on travel and dining, the Sapphire Reserve is one of the most rewarding options.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

- $300 Annual Travel Credit as reimbursement for travel purchases charged to your card each account anniversary year.

- Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases

- Get 50% more value when you redeem your points for travel through Chase Travel℠. For example, 60,000 points are worth $900 toward travel.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2027.

- 1:1 point transfer to leading airline and hotel loyalty programs

- Access to 1,300+ airport lounges worldwide after an easy, one-time enrollment in Priority Pass™ Select and up to $100 application fee credit every four years for Global Entry, NEXUS, or TSA PreCheck®

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Member FDIC

Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases.

21.24% - 26.24% Variable

Earn 90,000 bonus points

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. High sign-up bonus

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers 3x bonus points on several spending categories, including travel and advertising purchases

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Includes comprehensive travel coverage

- con icon Two crossed lines that form an 'X'. Welcome bonus has a very high minimum spending requirement

The Ink Business Preferred® Credit Card offers a huge welcome bonus and solid earning and benefits for a moderate annual fee. If your small-business expenses line up with the card's bonus categories and you like redeeming Chase Ultimate Rewards® points for travel, this is one of the best small-business credit cards to consider.

- Earn 90k bonus points after you spend $8,000 on purchases in the first 3 months from account opening. That's $900 cash back or $1,125 toward travel when redeemed through Chase Travel℠

- Earn 3 points per $1 on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per $1 on all other purchases

- Round-the-clock monitoring for unusual credit card purchases

- With Zero Liability you won't be held responsible for unauthorized charges made with your card or account information.

- Redeem points for cash back, gift cards, travel and more - your points don't expire as long as your account is open

- Points are worth 25% more when you redeem for travel through Chase Travel℠

- Purchase Protection covers your new purchases for 120 days against damage or theft up to $10,000 per claim and $50,000 per account.

Earn 5x on travel purchased through Chase Travel℠. Earn 3x on dining, select streaming services and online groceries. Earn 2x on all other travel purchases. Earn 1x on all other purchases.

21.49% - 28.49% Variable

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. High intro bonus offer starts you off with lots of points

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Strong travel coverage

- con icon Two crossed lines that form an 'X'. Doesn't offer a Global Entry/TSA PreCheck application fee credit

If you're new to travel rewards credit cards or just don't want to pay hundreds in annual fees, the Chase Sapphire Preferred® Card is a smart choice. It earns bonus points on a wide variety of travel and dining purchases and offers strong travel and purchase coverage, including primary car rental insurance.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Earn 5% cash back on travel purchased through Chase Travel℠. Earn 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery services. Earn unlimited 1% cash back on all other purchases.

0% intro APR on purchases and balance transfers for the first 15 months

20.49% - 29.24% Variable

Earn $150 bonus

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. No annual fee

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Generous bonus cash-back categories

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Great welcome bonus

- con icon Two crossed lines that form an 'X'. Booking through Chase Travel℠ can restrict outside earning potential

- con icon Two crossed lines that form an 'X'. Varying percentages and rotating calendar categories require extra attention

- con icon Two crossed lines that form an 'X'. 3% foreign transaction fees

The Chase Chase Freedom Flex® is a great pick if you want one of the best no-annual-fee cards with big earning potential and impressive benefits. It's an even better choice if you already collect Ultimate Rewards points with other Chase cards, because you can combine your points and potentially get even more value.

Earn 5% cash back on travel purchased through Chase Travel℠; 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 1.5% on all other purchases

Earn an additional 1.5% cash back on everything you buy

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Solid flat cash-back rate

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. You can combine cash-back rewards with Ultimate Rewards points if you have an eligible card

- con icon Two crossed lines that form an 'X'. Some other cards offer a higher rate of cash back on certain types of purchases

The Chase Freedom Unlimited® is a great choice for credit card beginners and experts alike. With no annual fee and a high earnings rate, it's worth considering as an everyday card — and it's even better when you pair it with an annual-fee Chase card like the Chase Sapphire Reserve®.

- Intro Offer: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel℠, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel℠, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

- Keep tabs on your credit health, Chase Credit Journey helps you monitor your credit with free access to your latest score, alerts, and more.

Once you start using any of these Chase cards, be sure to browse bonus offers via online shopping portals to maximize your rewards . There are many ways to rack up even more reward points with hundreds of online retailers, and it's a simple way to make every purchase more rewarding.

Also note that you can use Chase's no-annual-fee cards, including the Chase Freedom Unlimited® and the Chase Freedom Flex® , to turbo-charge your stash of Chase Ultimate Rewards. That's because as long as you have a "premium" Chase card — like the Chase Sapphire Reserve® or Ink Business Preferred® Credit Card — you can move over the rewards you earn from a cash-back Freedom or Ink card to redeem them with transfer partners or simply get more value toward Pay Yourself Back and Chase Ultimate Rewards Travel redemptions.

Chase Ultimate Rewards Airline Transfer Partners

Aer lingus aerclub.

If you're looking to travel to Ireland, Aer Lingus is one of the most convenient places to start your search, and as a Chase transfer partner, it can also be a very valuable way to fly.

The airline's award chart divides travel by zone and peak/off-peak redemptions. Even the most expensive zone (Zone 6, which includes travel between Dublin and Los Angeles, Miami, Orlando, San Francisco, and Seattle) includes one-way tickets for as low as 16,250 Avios.

You can also use Avios to upgrade to business class. The upgrade fee varies between peak and off-peak travel. The good news: Two-thirds of the year is considered off-peak, according to AerClub's 2024 calendar .

Air Canada Aeroplan

Air Canada's Aeroplan loyalty program is Chase's newest airline transfer partner, and it's a great option even if you don't fly Air Canada. Because the airline is part of the Star Alliance, you can redeem Aeroplan points for flights on over 45 alliance and non-alliance partners, including United, Lufthansa, and Etihad.

Award flights in North America start at just 6,000 points, and there are numerous sweet spots for international partner flights as well. You can check Air Canada's Points Predictor Tool for an estimate of how much specific awards cost.

Air France-KLM Flying Blue

Flying from Los Angeles to Paris takes nearly 11 hours, so a Chase Ultimate Rewards transfer can be especially appealing here. A seat in business class for that journey starts at 67,500 miles. The only thing better than drinking champagne in France is drinking champagne on the way to France in the front of the bus.

And while France may be in the name, there are plenty of other redemption options available via Flying Blue, thanks to partnerships with KLM, Aircalin, GOL, Japan Airlines, Kenya Airways, and SkyTeam.

British Airways Executive Club

Sticking with Avios points, let's look at an example of reward travel with British Airways Executive Club . BA is part of the Oneworld alliance, and that alliance — which includes 14 airlines that serve more than 170 countries and territories — can be key to making the most of transferring your points.

If you redeem Avios for British Airways flights, it's hard to get outsized value, due to BA's insanely high fuel surcharges and fees that are tacked on to the points cost. However, there are some sweet spots if you redeem for partner award flights — including flights from the US East Coast to Ireland and the Caribbean, or the US West Coast to Hawaii.

Iberia Plus

Not one, not two, but three different programs allow you to turn your Chase Ultimate Rewards points into Avios points.

Unfortunately, Iberia's award chart is dominated by "peak" times on the calendar (forget finding a good deal from June through mid-September), but if you're up for a trip in February, March, October, or November, you may be able to find a good way to redeem those points.

Emirates Skywards

Emirates award flights come in three varieties: Saver, Flex, and Flex Plus. The Saver option is, naturally, the lowest cost in terms of points and the best way to maximize the value of your Chase Ultimate Rewards points.

Emirates may be best known for flying to the United Arab Emirates, but transferring your Chase points to miles will let you explore reward options with 15 of its airline partners. For example, you can use 70,000 miles for a round-trip economy ticket between South Korea and the US on Korean Air or 120,000 miles for a one-way ticket in business class on Qantas from Sydney, Australia to Los Angeles.

JetBlue TrueBlue

Even if you only have a few TrueBlue points, you could be able to put them good to use. For example, you can score a one-way ticket from Boston to Fort Lauderdale for just 3,800 points. The ticket is $61, so you're getting 1.6 cents per point.

JetBlue also has a partnership with Hawaiian Airlines, but you'll need to call 800-538-2583 to inquire about availability (which is limited). If you're looking for an island vacation, though, it could be worth picking up the phone. One-way economy seats from the West Coast are just 22,000 points.

Singapore Airlines KrisFlyer

The Singapore Airlines KrisFlyer award chart is fairly straightforward and breaks down travel to/from destinations in 13 zones.

On top of those divisions, there are two types of KrisFlyer award tickets: Advantage and Saver. The only "advantage" to Advantage tickets is that you'll find them more frequently. They cost more. You're better off trying to find a Saver option, which starts at 7,500 miles. And if you can somehow stumble into a first-class seat from the East Coast to Singapore for 132,000 miles, do it. That is the definition of high-flying luxury.

Timing alert: It's important to note that transfers for KrisFlyer take longer to process, typically two business days. So you'll need to plan further in advance if this is a transfer that fits your travel needs.

Southwest Airlines Rapid Rewards

Southwest's reward redemption valuations don't take nearly as much research as other airlines. Instead of thinking about peak and off-peak travel dates and zones, you'll simply look at how much the fare costs in dollars and you'll have a good idea of a comparable cost in Southwest points .

The values are linked. For example, a flight from Chicago to Los Angeles that costs $112 requires 7,566 points, and that same flight one week later runs $313 or 23,556 points. The lower cost has a slightly higher value of 1.4 cents per point. Nothing amazing, but also nothing too complicated.

United MileagePlus

To get a sense of some of the cheap miles redemptions you can score on United , the airline regularly spotlights award flight deals on its website. For example, 5,000 miles for a ticket from Newark to Orlando, and 22,500 miles for a ticket from Chicago to Honolulu are both enticing offers right now (these change periodically).

You can dig deeper than those highlighted deals (after all, they're spotlighting them because they want to fill the seats) to find more competitive offers, too. Think outside the US borders — United is part of the Star Alliance, which includes 26 airlines that fly all over the world.

Virgin Atlantic Flying Club

You can find some incredible deals with Virgin Atlantic Flying Club points. Even though Virgin Atlantic isn't part of an airline alliance right now, it partners with a number of airlines including Delta, ANA, and Hawaiian Airlines.

Award flights on Virgin Atlantic to the UK and beyond can be a good deal, but keep in mind Virgin Atlantic adds high taxes and fees to its own flights.

Chase Ultimate Rewards Hotel Transfer Partners

Ihg one rewards.

From a Holiday Inn Express to a boutique experience at Kimpton Hotel, IHG has loads of properties where you can enjoy an evening without paying any actual cash. However, IHG's points redemption values here aren't anything to write home about.

Sure, it would be great to spend a night at the InterContinental Bangkok or InterContinental Bali, but my searches reveal that redemption rates at IHG properties rarely exceed the 1-cent mark. In that case, you're better off booking a room directly through the Chase Travel℠ .

Marriott Bonvoy

No matter where you go, you'll probably find a Marriott property. With 30 brands that range from the high-end world of Ritz-Carlton and St. Regis to limited-service, budget-friendly options like Fairfield Inn and TownePlace Suites, Marriott Bonvoy points can book you a room in a wide range of accommodations.

The catch: It's hard to find a redemption that increases the value of your Chase Ultimate Rewards points. Marriott Bonvoy's award pricing is now dynamic, and I rarely find options that increase the value of Marriott points. There are exceptions, though, proving that you should always do your research.

Timing alert: Bonvoy transfers typically process by the next business day, not immediately.

World of Hyatt

If you're looking to make the most of your Chase Ultimate Rewards points for a hotel stay, I recommend starting with the World of Hyatt program . In addition to affordable, 5,000-point redemption rates at limited-service properties like Hyatt Place and Hyatt House, this loyalty program has loads of luxurious properties where you can cash in your points for a more meaningful redemption.

Consider some of these examples for a getaway: a queen room at the Andaz San Diego (15,000 points per night versus $313 per night), a villa at the Park Hyatt Maldives Hadahaa (30,000 points per night versus $1,045 per night), and a standard king the Park Hyatt Beaver Creek, Colorado (30,000 points per night versus $1,900 per night).

How to Transfer Chase Ultimate Rewards Points

Once you've found a great redemption through a Chase Ultimate Rewards airline or hotel partner, your next step is to transfer your points from Chase to the loyalty program where you want to make a booking.

To get started, log into your Chase account and navigate to the Chase Ultimate Rewards page. Click "Earn/Use," and you'll see various options, including "Transfer to Travel Partners." Click this, then you'll be presented with a list of Chase's 14 transfer partners.

Click "Transfer Points" next to the transfer partner you're eyeing, and you'll be prompted to enter your airline or hotel loyalty program info. If you don't have an account yet, don't worry — it's free to sign up, so you'll just have to do that before initiating the transfer.

Once you have your Chase account and your frequent-flyer or hotel loyalty program account connected, you can initiate the transfer, and in most cases, the transaction will go through immediately.

Chase Ultimate Rewards Transfer Partner Frequently Asked Questions

Chase has a diverse range of transfer partners in its Chase Ultimate Rewards program. These partners include leading airlines and hotel loyalty programs such as United Airlines, Southwest Airlines, British Airways, Hyatt, Marriott, and more. By transferring your Chase Ultimate Rewards points to these partners, you can access a variety of travel options, from flights to hotel stays, unlocking greater value and flexibility in your rewards.

Chase Ultimate Rewards points can be transferred to several airline partners, and among them is United Airlines, a member of the Star Alliance network. By transferring your Chase Ultimate Rewards points to United Airlines MileagePlus, you can access the extensive Star Alliance network and redeem your points for flights with various member airlines, expanding your travel options and benefits.

Chase Ultimate Rewards points can be transferred to several hotel loyalty programs, including popular options like Hyatt, Marriott Bonvoy, and IHG Rewards Club. This allows you to use your points for hotel stays at a wide range of properties within these programs, offering flexibility and value when planning your accommodations during your travels.

To transfer Chase Ultimate Rewards points to partner loyalty programs, log in to your Chase account, select 'Transfer to Travel Partners,' choose the partner program, enter your account details, and confirm the transfer. Be aware of transfer times and ratios for each partner. Your points will then be available for redemption within the selected loyalty program.

- Main content

Please turn on JavaScript in your browser It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

How to use chase ultimate rewards® for travel.

Whether you're a longtime cardholder or just starting your credit card journey with Chase, you may be wondering: What is the best way to use Chase points ? The answer will be different for everyone, but if you like to travel, you may find that using your points on your trips is your favorite way to spend them. Learning how to use Chase Ultimate Rewards to make the most of your points could help you pack in a few extra adventures when planning your next getaway.

How to earn Chase Ultimate Rewards points

Chase Ultimate Rewards points are redeemable points you can earn through welcome bonus offers or when making purchases with your Chase-branded cards, such as:

- Chase Sapphire

- Chase Freedom

- Chase Ink Business

You may also earn Ultimate Rewards at an accelerated rate on certain purchases or bonus categories — the typical rate is one point earned per dollar spent.

Redeeming Chase Ultimate Reward points

As a general rule of thumb, one point equates to $0.01 in redeemable value. This can fluctuate, however, depending on how you decide to redeem your points. When it comes to travel there are three main ways to redeem Ultimate Rewards points:

- Booking travel directly through the Chase travel portal.

- Transferring your points to Chase travel partners, such as airlines and hotels.