- CLIA Cruise Lines

- CLIA Global Executive Committee

- Mercy Ships

- Explore Topics

- Join or Renew

- Professional Development

- Travel Agent Cruise News

- Verify a Member

- Eligibility

- Marketing Partners

- Refund Policy

- Executive Partners

- Fact Sheets

- News and Media Room

- Australasia

- North America

- North West and Canada

- UK & Ireland

- My Certifications

- My Training

- Cruising Home

- News and Research

2019 Global Market Report

CLIA ONE reSource Passenger Reports

Don’t yet have a login? Create a new account

Forgot Password

If you have forgotten your Password, complete the information requested below and click the submit button.

You will receive an email with a reset token to change your password.

Please allow at least 10 minutes to receive the email before requesting another password reset. Please be sure to check your Spam folder for the password reset email.

Please note: the Email you provide must be the one that is associated with your profile.

If you have difficulty resetting your password please email [email protected] .

Create a New CLIA Account

Set or change password.

Please use the form below to set or change your password. Passwords must be at least 8 characters.

We are sorry. An error has occurred.

Please confirm, select your region to be directed to the correct website.

2019 Cruise Industry Trends to Watch

The Road Less Traveled

Cruise guests increasingly want to explore off-the-beaten path destinations that offer more immersive, authentic and cultural experiences. This is especially true of Generation Z, who are in search of experiencing a genuine sense of a destination well beyond sightseeing. With Gen Z on course to become the largest consumer generation in the next 2 years, cruise lines are acutely tuned into this trend and are offering experiences to meet the demand.

Bandwidth Bandwagon

The importance of cutting edge technology and its impact on the industry is undeniable. It has been infused in every aspect of the onboard experience. Technologies have been developed and implemented that use keychains, necklaces and bracelets to deliver personalized travel experiences to guests both onboard and ashore. These new technologies require significant bandwidth and speed. With ongoing tech advances to enhance the guest experience, and connectivity a guest expectation while onboard, the quest to increase the size and strength of bandwidth is ongoing.

Blurring the Lines

Today’s ships offer entertainment experiences that until recently were only found in land-based amusement parks and resorts. Water slides, wave pools, rock climbing, bowling and zip lining have all made their way to a cruise ship near you, and guests have no reservations about paying an extra fee for the thrill of zipping and sliding 16 stories above sea level. What a rush!

Off-Peak Perks

Cruises have long been associated with warm sandy beaches and turquoise blue waters. Winter months in North America are peak season for the Caribbean cruise market, but a shift from the traditional has extended into itinerary planning. Cruise lines are offering itineraries that give guests the chance for a once-in-a-lifetime experience. Think Bucket List. Awe-inspiring Northern Lights, the magical beauty of Europe’s Christmas Markets, or the rare chance to observe penguin colonies are just some of the unique ways the industry is getting consumers to think about cruises in a different way, and it’s working.

The Two “E’s”

For the cruise industry, the Environment and Ecology go hand-in-hand. The industry is sensitive to its Environmental footprint and has implemented initiatives to limit its impact. From elimination of single-use straws to LNG (liquefied natural gas) on new ships to sustainable sourcing, the industry takes its responsibility to the environment seriously and continues to look for ways to solidify that commitment. In addition to their environmental initiatives, Ecologically conscientious cruising has the industry working in partnership with local communities to preserve their heritage. With destinations involved in bringing the benefits of tourism to local economies while preserving local cultures, landmarks and environments, it’s a win-win!

Expedition Expands

Cruising in general is experiencing tremendous growth, and the expedition segment of the market is no exception. Luxury expedition cruises are a thing, and the adventurous traveler can’t get enough. The expedition market will introduce 28 new ships by 2022. These ships are much smaller, outfitted specifically for the expedition market (or a particular region), and can reach places the mega ships can’t go, but they don’t compromise on luxury. They accommodate 100-500 guests and carry expedition directors and staff with knowledge and expertise that ensures an unforgettable experience. All indications are that this segment of cruising is so popular, more expedition new builds are sure to come.

Access Cruise is a Miami based cruise marketing and sales consulting group, specializing in product and business development within the cruise industry.

Recent Posts

- Vacation Blues Episode 31 – Hardangerfjord, Norway – The Queen of the Norwegian Fjords

- Vacation Blues Episode 30 – Flåm, Norway

- Vacation Blues Episode 29 – Gothenburg, Sweden

- Vacation Blues Episode 28 – A Coruña, Spain

- Vacation Blues Episode 27 – Vigo, Spain

- Vacation Blues Episode 26 – Arendal, Norway

- Vacation Blues Episode 25 – Isle of Man

- Vacation Blues Episode 24 – Dover, England

- Vacation Blues Episode 23 – Aberdeen, Scotland

- Vacation Blues Episode 22 – Lisbon, Portugal

Cruise Pulse

Cruise Pulse™

Our proprietary database tracks daily ticket prices at the cabin category level from 10,000 annual world wide cruise sailings from 16 different cruise companies and 190 cruise ships * .

With an unique window into virtually every sailing, every day (including Carnival Corporation ( CCL ), Royal Caribbean Cruises ( RCL ), Norwegian Cruise Line ( NCLH ), Viking Ocean Cruises, MSC and Disney Cruise Line ( DIS )) our growing client list of equity analysts and new ship build financing banks view cruise ticket price trends, world-wide capacity allocations and itinerary changes in near real time.

In addition to the Cruise Pulse™ report subscribers also download data directly or manipulate it interactively via our analytical tool kit. Clients discover year over year pricing patterns by parent company, cruise line and ship, emerging regional trends and gain insight into forward quarterly revenue and net yields with our statistically modeled estimates. To subscribe to your own custom publication, see a sample or schedule a presentation get in touch with Cruise Market Watch today.

Terms and Conditions: By your evaluation, you accept the following terms and conditions: The User acknowledges that copyright in the information content of the Cruise Pulse™ and accompanying data is held by Cruise Market Watch and its suppliers. The Cruise Market Watch service, including accompanying data, is licensed to the User for the internal use of the User only. Cruise Pulse™ data and analytic tools are supplied for the User's exclusive use and must not be passed on, by way of sale or otherwise, to any third party for any purpose whatsoever without Cruise Market Watch's prior approval in writing. Neither party shall be liable for any indirect, incidental, special, punitive or consequential damages, or any loss of profits or revenue from data use.

Cruise Lines 2019 Q4 Breakdown: By the Numbers

- February 24, 2020

Cruise Industry News takes a look at the financial performance of the “big three” following the final quarter of 2019.

While gross revenue was up for Q4 2019 for the three publicly-traded cruise companies, increased operating expenses led to reduced operating income, net income and net income per passenger day, compared to Q4 for the previous year.

Net revenue per passenger day was also down year-over-year for Carnival Corporation, up noticeably for Royal Caribbean and up slightly for Norwegian.

Gross revenue per passenger day was significantly up for all three companies, including onboard spending, with gross ticket revenue per day also up for Royal Caribbean and Norwegian, but down for Carnival.

Carnival saw the biggest difference between gross and net onboard revenue: more than $25, making it flat with last year, while Royal had nearly a $12 drop and Norwegian a little more than $10, and up from last year.

Both Carnival and Royal Caribbean saw a decrease in fuel costs year-over-year while Norwegian saw its fuel spend go up.

Carnival cited the regulatory change preventing travel to Cuba, geopolitical events in Arabian Gulf, Hurricane Dorian, an unscheduled drydock, and multiple shipyard delays. Royal cited the Oasis drydock mishap, Cuba and Hurricane Dorian, and Norwegian also cited Cuba and Dorian.

Because of the fleet mix, Norwegian continued to generate the highest gross and net ticket and onboard spend revenue.

The Cruise Industry Financial Tracking Report provides an in-depth look into the financial metrics of the leading cruise companies. Learn more.

Included: Carnival, Royal Caribbean, Norwegian, MSC, Star/Genting, Royal Olympic, P&O Princess, Regent, American Classical Voyages and Commodore.

Key metrics include revenue, operating expenses, operating income and net income, as well as those metrics on a per passenger day basis. We also look at EPS, fleets, berths and passenger cruise days.

2019 Cruise Lines Q3 By the Numbers

2019 Cruise Lines Q2 By the Numbers

2019 Cruise Lines Q1 By the Numbers

2018 Cruise Lines Q4 By the Numbers

2018 Cruise Lines Q3 By the Numbers

2018 Cruise Lines Q2 By the Numbers

2018 Cruise Lines Q1 By the Numbers

2017 Cruise Lines Q4 By the Numbers

2017 Cruise Lines Q3 By the Numbers

2017 Cruise Lines Q2 By the Numbers

2017 Cruise Lines Q1 By the Numbers

2016 Cruise Lines Q4 By the Numbers

2016 Cruise Lines Q3 By the Numbers

2016 Cruise Lines Q2 By the Numbers

2016 Cruise Lines Q1 By the Numbers

Cruise Industry News Email Alerts

- Breaking News

Get the latest breaking cruise news . Sign up.

62 Ships | 142,732 Berths | $46.7 Billion | View

Highlights:

- Mkt. Overview

- Record Year

- Refit Schedule

- PDF Download

- Order Today

- 2033 Industry Outlook

- All Operators

- Easy to Use

- Instant Access

- Advertising

- Cruise News

- Magazine Articles

- Quarterly Magazine

- Annual Report

- Email Newsletter

- Executive Guide

- Digital Reports

Privacy Overview

Port Economics, Management and Policy

A comprehensive analysis of the port industry

Global Cruise Passengers Carried and Growth Rates, 1990-2024

Source: adapted from Cruise Market Watch. Note: Growth rates not depicted for 2020 (-74.2%), 2021 (+96.1%), 2022 (+46.7%) and 2023 (+50.4%).

The global cruise market has witnessed continuous growth throughout the last three decades, a growth that was interrupted in 2020 by the COVID-19 pandemic. In the 1990s and the 2000s, the size of the global cruise markets doubled about every 10 years, representing an annual growth rate of about 7%. Growth rates were relatively lower since the financial crisis of 2008-09. Yet, despite geopolitical difficulties (i.e, the Arab Spring that affected cruising in the Meditteranean) or the negative image produced by the Costa Concordia accident in Italy), the cruise industry has demonstrated a capacity for uninterrupted growth, the pace of which was faster than that of other transport or tourism industries. Only the COVID-19 pandemic represented a major setback.

In 2019, almost 30 million single passengers enjoyed a cruise on one of the 400 cruise vessels calling at one of the main cruise regions of the world (North America, Caribbean, South America, Mediterranean, North Europe, Australia, Asia, Africa), generating more than 150 million passenger movements in world cruise ports. At the turn of the century, the number of persons who took a cruise was just over seven million.

The global cruise industry remains relatively small compared with the tourism industry, which accounted for 1 billion arrivals in 2011. For instance, it was estimated that about 37 million people visited Las Vegas in 2010, while the global cruise industry carried about 18 million passengers the same year. However, this observation must be nuanced because most cruises typically involve 3 to 5 ports of call with the corresponding number of visits per passenger. Second, the industry remains fundamentally derived from the supply of ships and itineraries. Thus, the strategy is to fill the ships, which are a fixed supply, and when the demand is weaker, discounts are offered to keep the ships full. Third, the customer base of the cruise industry tends to be of a higher income level than the customer base of the tourism industry at large. This market segment is usually less impacted by economic downturns. Further, the growth in income levels in many countries, including developing economies, has expanded the customer base susceptible to taking a cruise. In light of this context, there is little evidence about the full extent of the market potential of the cruise industry and when a saturation point could be reached.

The COVID-19 pandemic triggered unprecedented global health and economic crisis. In February-March 2020, COVID-19 outbreaks associated with three cruise ship voyages caused more than 800 confirmed cases among passengers and crew. The whole industry voluntarily suspended worldwide operations, with the timing and the conditions of return remaining questionable. In late April 2020, all global destinations had COVID-19 travel restrictions, while the 2020 prospects suggested a decline in arrivals of 60%-80%. Six months later, the second wave of the pandemic resulted in the postponement of cruise calls in most world ports, including the regions (e.g. in Europe and Japan) that have seen a restart of cruising. As the post-COVID-19 new normal evolves, a precise assessment of the longer-term implications is challenging. 2020 turned out to be the most disastrous year in cruise shipping history, with the number of passengers dropping from 27.5 million in 2019 to just above 7 million. This represented a 75% drop in traffic.

After more than one year of hiatus, cruise operations resumed in the Caribbean in June 2021. Some test cruises took place in the Mediterranean market in the summer of 2020. Throughout 2021, occupancy rates remained low, around 50%, with the number of passengers bouncing back to 13.9 million. In 2022, occupancy rates improved to around 78%, with 20.4 million people taking a cruise, and by 2023, the number of passengers, at 30.7 million, exceeded pre-pandemic levels. However, 2022 brought new challenges for the industry with an increase in the price of food by 20%, an important cost component in a cruise offering. Further, the war in Ukraine impacted Baltic cruises as St. Petersburgh, Russia, could not be called, inciting a redeployment of ships to other markets. Labor shortages were also experienced as Russian and Ukrainian seafarers were much less available. Further, an economic downturn in China seriously undermines future growth prospects in the region. It may incite cruise lines to revise their deployment in a region that, before the COVID-19 pandemic, showed significant growth.

Share this:

- [email protected]

- +1 718 618 4351 (International)

- +91 78878 22626 (Asia)

More Results

Home ➤ Consumer Goods ➤ Travel ➤ Cruise Market

Global Cruise Market, By Type (Ocean Cruises and River Cruises), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: May 2023

- Report ID: 22103

- Number of Pages: 242

- Table of Contents

- Major Market Players

- Request a Sample

Quick Navigation

Report Overview

Driving factors, restraining factors, growth opportunities, latest trends, by type analysis, key market segments:, covid-19 impact analysis, regional analysis, market share & key players analysis, report scope:.

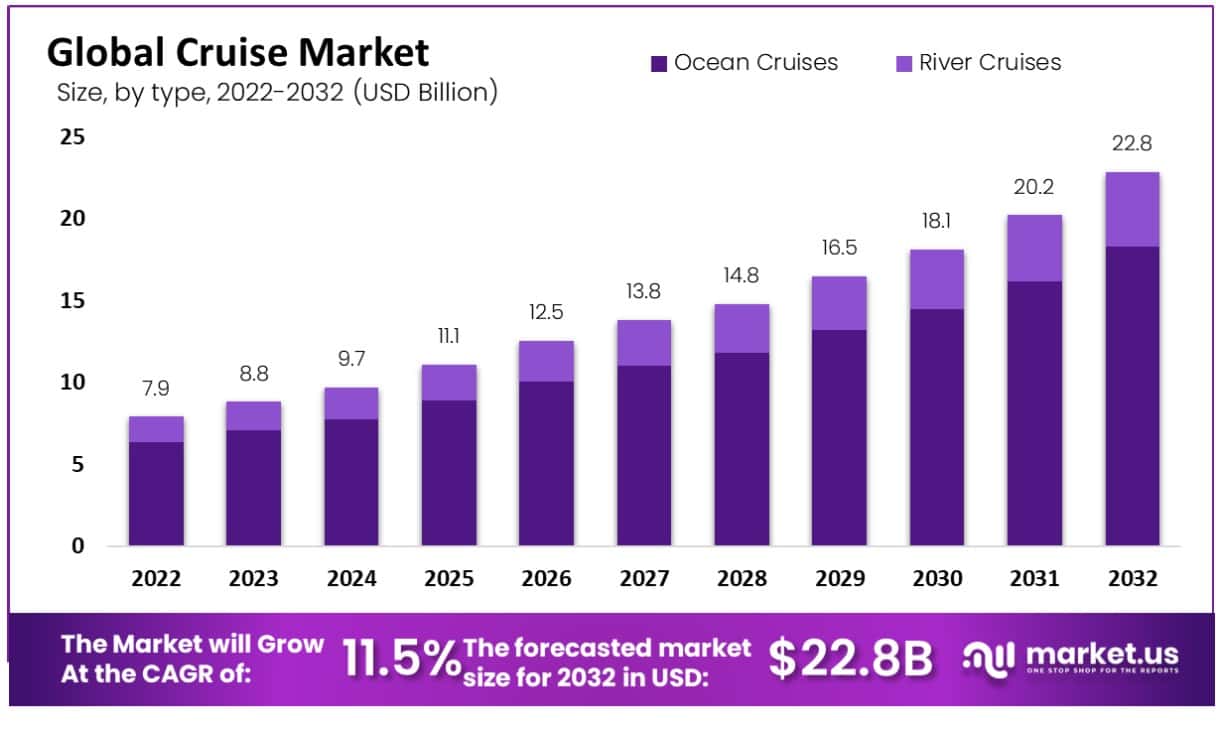

The Global Cruise Market size is expected to be worth around USD 22.8 Billion by 2032 from USD 7.9 Billion in 2022, growing at a CAGR of 11.50% during the forecast period from 2023 to 2032.

A cruise is a multi-day vacation plan that is arranged on a cruise ship large inland while visiting numerous tourist attractions along a planned route. On this kind of trip, the focus is mostly on the ship’s accommodations as well as tourist-attractive locations. The global cruise market is being driven by the expanding hospitality and tourist industries.

Ships are introducing new technologies, a variety of exciting activities, as well as enjoyable themes for travelers, including yoga themes, kid themes, mystery themes, and others. Such innovations are attracting different populations and acquiring massive popularity among the target audience, which is driving the cruise business. The market is expected to increase as a result of the new generation’s increasing preference for leisure travel and adventures with the rising number of people who want to live a luxurious life.

Consumer Demand:

Cruise lines have seen an exponential rise in demand over recent years as more travelers search for unique travel experiences. This has led to growth within the industry, as cruise lines expand their fleets and add new routes to keep up with demand.

Innovation:

Cruise lines are constantly innovating and introducing new features and amenities to attract customers. This includes everything from entertainment options to advanced technology and unique dining experiences.

Expansion of Cruise Line Offerings:

Cruise lines are expanding their services to include niche markets like adventure cruises, river cruises, and small-ship cruising to appeal to different types of travelers.

Natural disasters like hurricanes and earthquakes can disrupt cruise itineraries and impact passenger safety. Geopolitical impacts such as terrorism or political instability also impact cruise demand and itinerary planning. Building and maintaining a cruise ship requires significant capital, which limits market participants, creating limited competition and less price flexibility.

Furthermore, environmental regulations in the industry contribute to higher operational costs which in turn reduce profit margins; cruise lines must invest in cleaner technologies to reduce their environmental footprint, adding to their expenses. Outbreaks of contagious illnesses like COVID-19 can damage the reputation of the cruise industry and sap consumer confidence in sailing.

This could result in decreased demand and revenue for cruise lines. Cruising is typically seasonal, with most travelers opting for cruises during summer holidays. Lower occupancy rates and revenue during off-peak periods impact profitability for cruise companies. Negative media coverage such as reports of passenger injuries or crimes further weakens consumer trust in cruising leading to decreased bookings overall.

Expansion in Emerging Markets

The worldwide cruise market offers several prospects for growth and development, including emerging markets, sustainable tourism, technical improvements, specialized cruises, upselling opportunities, and partnerships and collaborations. Emerging markets such as Asia and South America present major growth prospects for the cruise industry.

These regions boost a growing travel demand, creating an expansive customer base for cruise lines. Furthermore, with growing awareness about the environmental effects of tourism comes an increased interest in sustainable tourism practices; cruise lines that implement sustainable practices and offer eco-friendly itineraries can attract eco-conscious tourists.

Furthermore, advances in technology such as artificial intelligence, virtual reality, and the Internet of Things have the potential to enhance passenger experiences on board while improving operational efficiencies for cruise lines. Specialist cruises, such as wellness cruises, adventure cruises, and culinary cruises can appeal to niche markets and give cruise lines a chance to stand out from competitors.

Cruise lines can generate additional revenue by offering onboard amenities and services like spa treatments, shore excursions, and specialty dining options. Collaborations and partnerships with other travel companies, such as airlines and hotels, can enable cruise lines to extend their reach and offer customers more comprehensive travel experiences.

The global cruise market is expanding in support of luxury experiences, multigenerational travel, wellness and health, sustainability, and the digital revolution. Cruise lines that can anticipate these developments and respond appropriately will likely be successful in the highly competitive cruise market. River cruising has become increasingly popular in recent years, particularly in Europe and Asia.

River cruises offer a more intimate setting with smaller ships and the chance to visit remote destinations. Sustainability has become a top priority for the cruise industry, with many lines adopting eco-friendly practices such as using clean energy sources, reducing single-use plastics, and encouraging responsible tourism.

Cruise lines are investing in technology to enhance their passengers’ experiences, from mobile apps and wearable devices to virtual reality headsets and AI-powered assistants. Wellness and health have become a major priority for the cruise industry, with many lines offering onboard fitness facilities, healthy dining options, and wellness-themed activities.

Cruise lines are catering to this trend by offering family-friendly amenities like onboard water parks and kids’ clubs. Luxurious and experiential cruises have seen a resurgence in the cruise market, with travelers demanding amenities such as private balconies, and exclusive dining venues. Many are seeking authentic cultural encounters; cruise lines have responded by providing shore excursions that showcase local customs, traditions, and cuisine.

The ocean cruises Segment Accounted for the Largest Revenue Share in the Cruise Market

Based on type, the cruise market is segmented into ocean cruises and river cruises. Among these types, the Oceans Cruises segment is the most lucrative in the global cruise market, with a projected total revenue of 80%. The larger market revenue share is attributed to strong players who provide services in the ocean cruises category for transcontinental travel in large numbers. Also, a sizable portion of customers favor ocean cruises over other types of cruises because of the interesting packages, amenities, and entertainment options.

These activities are possible aboard large ocean cruise ships, which offer more room than the others. The global river cruise market is expected to have the fastest growth rate, rising at a CAGR of 13.3%. This growing popularity among vacationers can be attributed to river cruising’s larger size compared to ocean cruises which usually dock along coastal regions. Rivers offer more internal destinations for sightseeing, especially in Europe where some cruise lines offer tours through multiple countries. For instance, Danube River cruises traverse 10 nations within Europe.

Based on Type

- Ocean Cruises

- River Cruises

Based on Applications

- Daily Commute

The COVID-19 pandemic has had a significant impact on the global cruise market, leading to reduced demand, refunds, operational challenges, decreased revenue, shifts in consumer behavior, and regulatory adjustments. The industry will need to navigate these challenges to recover and rebuild passenger confidence in cruising.

Due to the pandemic, cruise lines have seen a reduction in demand for their services, with many potential passengers opting to postpone or cancel their travel plans due to safety fears. Due to travel restrictions and safety worries, many sailings have had to be canceled. Because of these events, significant financial losses have occurred and customers are now demanding refunds.

The pandemic has also presented cruise lines with several operational difficulties, such as implementing new health and safety protocols and managing crew members who have tested positive for COVID-19. The suspension of operations and decreased demand for cruise lines have resulted in significant revenue losses, which may impact their long-term financial viability.

Furthermore, the pandemic has caused changes in consumer behavior such as an increased focus on health and safety that may influence which types of cruises passengers seek and which amenities are offered. The pandemic has led to increased regulatory scrutiny of the cruise industry, with many countries enforcing new health and safety rules that may impact cost and feasibility when operating cruises.

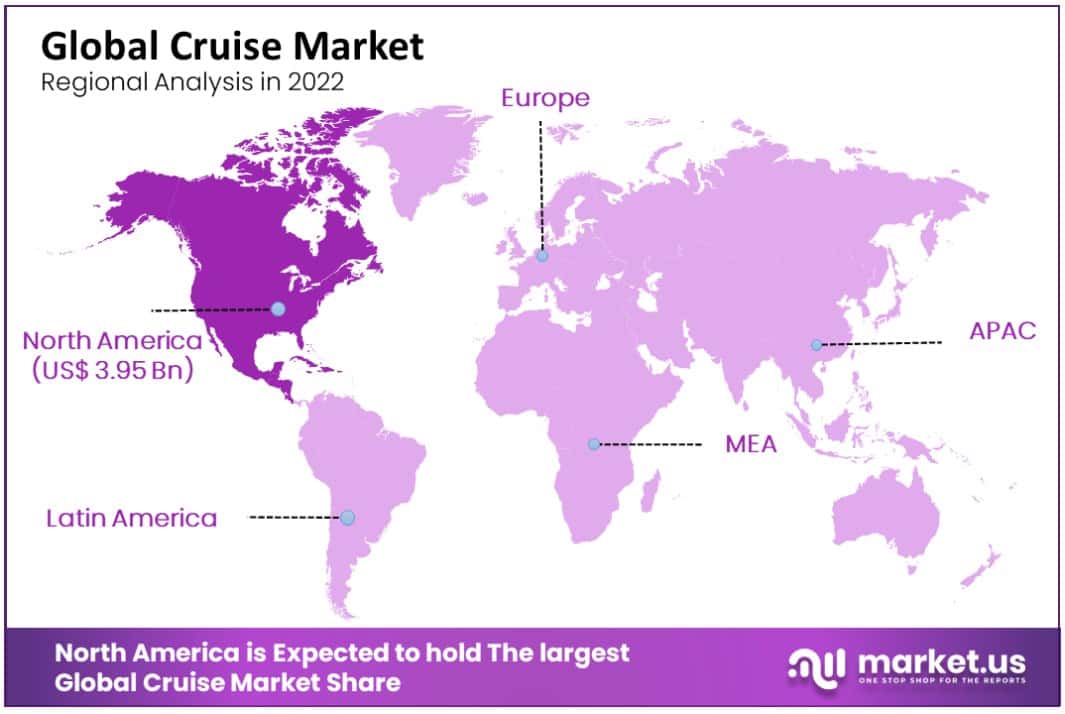

North America Accounted for the Largest Revenue Share in Cruise Market in 2022.

North America dominated the cruise market with the largest revenue share of 50%. Due mainly to its strong presence of international key players and highly developed industry. Higher disposable income levels, consumer spending patterns, and an expanding tourism industry all played their respective roles in driving up market revenue share significantly. The Asia Pacific region is forecast to experience the highest growth rate over the forecast period, with a CAGR of 12.1%.

Recently, cruise industry activity has shifted away from North America and Europe towards Asia Pacific due to government initiatives to develop tourism and increase economic output. For instance, on August 19th, 2020 the Indian government announced the reduction of 70% of berth charges to promote cruise tourism.

Europe ranked second in terms of revenue share in 2021 with over 25% share, expected to achieve an impressive CAGR during the forecast period. The growth is attributed to an uptick in demand for sustainable tourism which in turn makes local communities more appealing to small and medium-sized tour operators, propelling market expansion even further.

Key Regions and Countries

- Switzerland

- Rest of Western Europe

- The Czech Republic

- Rest of Eastern Europe

- South Korea

- Australia & New Zealand

- Philippines

- Rest of APAC

- Rest of Latin America

- Saudi Arabia

- South Africa

- United Arab Emirates

- Rest of MEA

The global market is dominated by a few major players and numerous small local players. The majority of the market share is held by Carnival Corporation & Plc. and Royal Caribbean Group. Key companies are taking new initiatives to expand their clientele.

Examples include multigenerational packages targeting family travel, kids theme cruise vacations for children, mystery theme cruise vacations, etc. Key players in the global cruise industry are also constantly looking for opportunities in underdeveloped regions.

Market Key Players:

Listed below are some of the most prominent cruise industry players.

- Carnival Corporation & Plc

- Royal Caribbean Group

- MSC Cruises S.A.

- Norwegian Cruise Line Holdings Ltd.

- Disney Cruise Line

- Genting Hong Kong Limited

- Fred. Olsen Cruise Lines

- Other Market Players

Recent Developments:

- Many cruise lines began operations in 2021 after being suspended due to the COVID-19 pandemic. Some lines, such as Royal Caribbean and Celebrity Cruises, require all passengers to be fully vaccinated.

- Despite the pandemic, several new ships were launched in 2021. Royal Caribbean’s Odyssey of the Seas, Carnival Cruise Line’s Mardi Gras, and MSC Cruises’ Virtuosa.

Frequently Asked Questions (FAQ)

The Global Cruise Market size was USD 7.9 Billion in 2022, growing at a CAGR of 11.50%.

The Global Cruise Market size is expected to grow at a CAGR of 11.50% during the forecast period from 2023 to 2032.

The Global Cruise Market size is expected to be worth around USD 22.8 Billion by 2032 during the forecast period.

Related Reports

- Space Tourism Market

- Medical Imaging Market

- Micro Tool Market

- Smart Car Market

- Taurine Market

- Wellness Tourism Market

Our Clients

- Report ID 22103

- Published Date May 2023

- ★★★★★ ★★★★★

- location_on 420 Lexington Avenue, Suite 300 New York City, NY 10170, United States

- phone +1 718 618 4351 (International)

- phone +91 78878 22626 (Asia)

- email [email protected]

- How to Order

- Privacy Policy

- Refund Policy

- Frequently Asked Questions

- Terms and Conditions

- All Reports

- All Sectors

- Infographics

- Statistics and Facts

Cruise in 2022: the state of the industry

At the beginning of the year, many companies, governments, and travel authorities had predicted a stronger recovery for the cruise market in 2021. unfortunately, that was not the case. using the latest thematic insights from globaldata, peter nilson looks at the state of the industry..

An emergency drill onboard AIDAsol cruise ship in 2019. Image: MikhailBerkut / Shutterstock.com

T he pandemic has proven unpredictable, with many cruise destinations going into second and third lockdowns during 2021 after a global surge in Covid-19 cases. While the cruise industry has experienced a 96% Year-on-Year (YoY) increase of passengers, reaching 13.9 million, it still does not compare to the pre-pandemic levels of 2019, where there were 29.7 million passengers globally. It has been an even worse year for travel intermediaries specializing in cruise holidays.

These companies are the primary selling points for cruise trips and are often responsible for selling upgrades, premium drinks packages and excursions. Global spending across 60 major cruise markets increased by 65% YoY, resulting in total revenues of $19.4bn. Nevertheless, this was still far from pre-pandemic levels in 2019, which were approximately $29.8bn, 35% higher than 2021’s figure.

To reduce costs, many ships were retired between 2019 and 2021. Cruise ships are the most expensive assets, making this practice a necessity for many firms to stay afloat.

However, more optimistic times lie ahead for the sector. During the pandemic, the cruise industry has witnessed new innovative cruise ships and a brand-new competitor in the form of Virgin Voyages. Many cruise liners have come good with orders for new cruise ships built before the pandemic, resulting in an exciting time for loyal cruise holidaymakers to try new ships, services, and onboard experiences.

Global cruise passengers and revenue

2021 provided a tough lesson for the cruise industry, with businesses aiming to make a swifter recovery from the latest round of lockdowns.

The cruise industry's recovery rate was modest in 2021. Although a 96% YoY increase sounds positive, it is still nowhere near pre-pandemic levels. In 2021, only 13.9 million passengers went on a cruise, 53% lower than the pre-pandemic levels of 2019.

With the fluctuations of global passengers, revenues will generally follow a similar pattern unless there is a substantial shift in consumer behaviour. Usually, the most significant impacts on a travel company's revenues, aside from passenger flows, are an economic recession, foreign exchange, or a change in booking trends.

Lindblad Expeditions Holdings

During the pandemic, it has become clear that the latter affected cruise intermediary revenues. In 2021, revenue generated for cruises from intermediaries reached $19.5bn, a 65% YoY increase from $11.8bn. However, cruise passenger flows increased by 95% YoY, which is a significantly higher rate of improvement.

According to the CEO of the Royal Caribbean Group, Richard Fain, this was not unexpected. The world’s fourth-largest cruise company has seen intermediaries such as online travel agencies (OTAs) and high street agencies lose a proportion of their market share, with customers opting to book directly with the cruise operator rather than a third party.

Sources: CLIA, Cruise Market Watch

The same sentiment was echoed by Norwegian Cruise Lines CEO Frank Del Rio, who said the company had witnessed a similar booking pattern. The result is not surprising. Many agencies have had to cut back on their workforce due to poor revenue performance in 2020, resulting in fewer sales agents to capture the rising demand in 2021. This has led to more customers booking directly with cruise companies.

Research from GlobalData also supports this, when comparing two consumer surveys from 2019 and 2021. In 2019, 44% of respondents said they typically book via an OTA. However, in a Q4 2021 survey, only 24% of respondents said they booked their last holiday via this booking method. In addition, respondents who said they booked directly increased from 32% to 36%.

New cruise ships and trends for 2022

There are many new cruise ships scheduled to set sail in 2022. Many of these boast a more contemporary feel to their décor and interior, moving away from the traditional looks of the past cruise ships and moving to a more fashionable boutique hotel design.

The motivation for this stems from the fact that cruise operators need to attract a younger market. This evolution is necessary for making cruise businesses more resilient in the future by drawing the next generation of cruise tourists.

According to a 2020 GlobalData survey, 37% of Gen Z and Millennials said that they 'strongly' or 'slightly' agreed with the notion that they would book an international trip this year. In comparison, only 22% of those older than 35 responded with the same sentiment, highlighting that the younger generation may be more likely to travel in today's travel climate.

Furthermore, cruising has also become more popular with younger adults. In GlobalData's Q3 2019 and 2021 global consumer surveys, the percentage of Gen Z and Millennial respondents who typically take a cruise holiday increased from 17% to 21%, indicating changes in consumer tastes.

The importance of Covid-19 safety protocols on cruise ships has never been more critical. According to GlobalData, there is a demand from consumers to receive information about Covid-19 initiatives. This data shows that consumers need substantial levels of communication from cruise providers, and that cruise companies will need to develop robust communication strategies, which need to be scaled over the next few years.

Many travellers are opting to book directly with the operator rather than via an intermediary such as an OTA. According to a Q3 2019 GlobalData survey, 44% of consumers said they typically book via an OTA.

However, this has fallen substantially over the last two years. In a Q4 2021 survey, only 24% of respondents said they booked their previous holiday via an OTA.

In addition, respondents who said they booked directly with a travel supplier increased from 32% to 36%, showing that booking directly with the supplier is becoming more trustworthy and popular.

Nevertheless, this booking behaviour could well be a temporary result, with some cruise operators expecting intermediary trade to pick up again in 2022.

Cruise Industry: 100+ Statistics, Facts, and Trends [2023]

Over 32M passengers were expected to go cruising in 2020.

Only a handful of 400 cruise ships ready to hit the water could take passengers onboard due to COVID-19.

The result? Over $60B in losses.

So if you’d like to learn more about the cruise industry, you’ve come to the right place.

In this data-driven roundup, we’ve compiled the most relevant and up-to-date stats and facts on the topic to help you catch the essence.

Let’s dive right in:

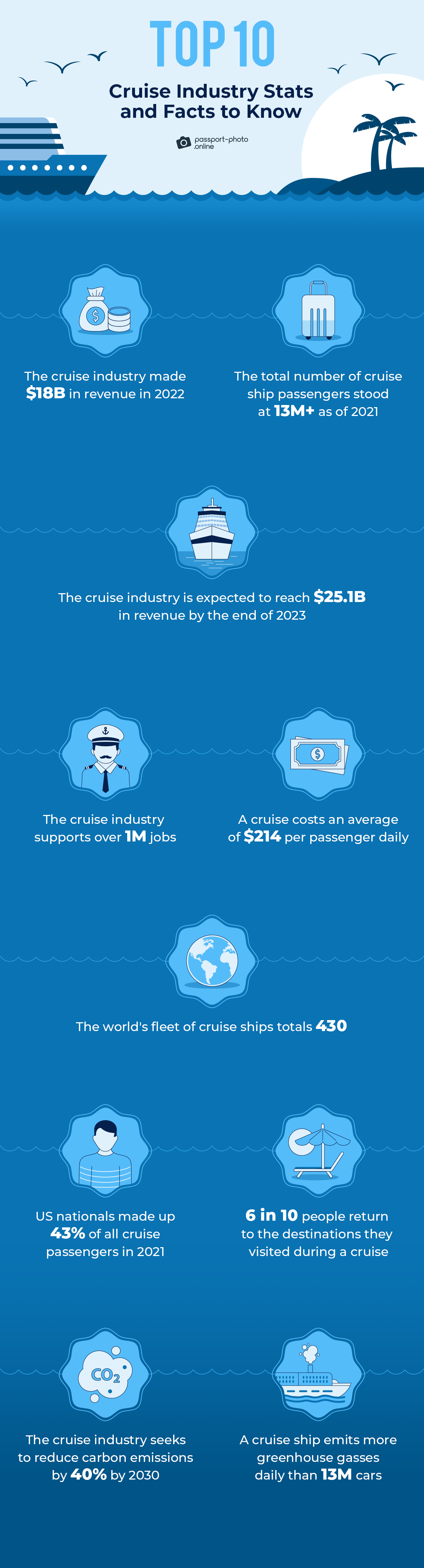

Top 10 Cruise Industry Stats and Facts to Know in 2023

General cruise industry statistics & facts, wonder of the seas, working onboard a cruise ship, cruise ships: a general overview, cruise industry demographics, cruise ships pollute but are good at recycling, covid-19 impact on cruise tourism.

- The cruise industry made $18B in revenue in 2022.

- The total number of cruise ship passengers stood at 13M+ as of 2021.

- The cruise industry is expected to reach $25.1B in revenue by the end of 2023.

- The cruise industry supports over 1M jobs.

- A cruise costs an average of $214 per passenger daily.

- The world’s fleet of cruise ships totals 430.

- US nationals made up the majority (43%) of all cruise passengers in 2021.

- US nationals made up 43% of all cruise passengers in 2021.

- The cruise industry seeks to reduce carbon emissions by 40% by 2030.

- A cruise ship emits more greenhouse gasses daily than 13M cars.

- The global revenue of cruises is set to reach $30B by 2024.

- Only 22% of cruise tickets are purchased online. Instead, 78% of the sales come from offline channels (e.g., ticket offices).

- Wonder of the Seas, owned by Royal Caribbean Group., is the world’s largest cruise ship.

- 1.7M passengers cruised to the Caribbean region in 2021.

- The US, Canada, and Mexico make up half of all cruise passengers.

- Crime rates on cruise ships are 95% lower than on land.

- Wonder of the Seas is the largest cruise ship in the world. It’s 1,188 feet long and 209 feet wide (362 x 64m).

- Wonder of the Seas can take up to 7K passengers and 2.3K crew members onboard.

- The Wonder of the Seas ship was ordered in 2016 and completed in 2022, with a construction cost of $1.3B.

- Wonder of the Seas has a Central Park (the first ever park at sea) with over 20K natural plants.

- The Wonder of the Seas ship has four thrusters with 7.5K horsepower each, which help it reach the cruising speed of 22 knots (25 mph).

- Wonder of the Seas has 24 bars and dining facilities.

- There are eight specially designed neighborhoods on the Wonder of the Seas ship.

Looking for passport photos? Discover more information:

- Take Baby Passport Photo at Home

- Passport Size Photos Maker

- Take Green Card Photo

- The cruise industry provided 1.7M jobs in 2019.

- It takes 24 passengers to support one full-time job on a cruise ship.

- The cruise industry has average employee turnover rates: 25–35%.

- A cruise ship may require over 2K crew members.

- Cruise ships have a strict, military-like chain of command: officers > staff > crew members.

- 70% of cruise ship crew work in the hotel division.

- Most cruise companies (70%) hire employees via foreign agencies.

- A typical cruise ship employment form is a 6-month-long contract.

- Cruise ship crew are on call around the clock.

- An average cruise ship member in the US makes $29K annually.

- 72 new ships were manufactured in 2021.

- The average cost of building a cruise ship is $600M.

- There were 65 ocean cruise lines as of 2022.

- The three leading cruise companies made 85% of the global revenue in 2021.

- Only 11% of cruise ships can accommodate more than 4K passengers.

- Most cruise ships (32%) can take 2–3K tourists onboard.

- 371 out of 430 cruise ships operated in 2022.

- Here’s a look at the highest-rated cruise lines:

- The cruise ship’s passenger capacity is projected to reach over 38M in 2027.

- The average age of a cruise ship is 14.

- The world’s longest cruise ship (~1,188 ft or 362m) is just 6.5 ft (2m) longer than the fifth longest ship (853 ft or 260m).

- Royal Caribbean has all five longest cruise ships in its fleet.

- The most expensive cruise ships are Oasis of the Seas and Allure of the Seas. The former cost 1.5B to build, and the latter’s price tag was 1.4B.

- Here’s a breakdown of the world’s largest cruise ships:

- 57% of cruisers are college graduates.

- 83% of cruise passengers are married.

- Cruisers spend around $385 in the port city before boarding a ship.

- During a typical cruise, passengers spend an average of $750 per person in port cities.

- Cruise passengers are 47 years old, on average.

- 85% of Millennials plan to cruise in the future, compared to 82% of Gen Xers and 79% of Gen Zers.

- Eight in 10 cruisers are likely to book their next vacation on a cruise ship.

- ~70% of cruisers are willing to board a cruise ship next year.

- Almost 60% of people who have never cruised say they are likely to cruise in the next few years.

- 70% of cruisers have an annual household income greater than $80K.

- 17% of Americans have cruised at least once.

- Most cruisers (77%) travel with a spouse.

- 30% of cruise passengers travel mainly with under-aged children.

- A quarter of cruisers generally travel with friends.

- A 3K-person cruise ship generates an average of 150K gallons (567 liters) of sewage per week.

- Cruise ships dump as much as 1B gallons (3.7B liters) of bacteria, heavy metals, and nutrients into the sea yearly.

- Here’s an overview of the waste produced by a 3K-passenger cruise ship during one week voyage:

- The cruise line industry dumps 285K gallons (1M liters) of wastewater into the sea every day.

- 75% of solid waste is incinerated on cruise ships, and the ash is typically discharged at sea.

- 24% of the solid waste generated by all ships comes from cruise ships.

- Cruise ships recycle 60% more waste daily than people on land.

- Cruise lines recycle 80K tons of paper, plastic, aluminum, and glass each year.

- The global revenue from cruises dropped by 88% in 2020.

- The cruise industry made just $3B in 2020 compared to 27B in 2019.

- The revenue growth in the cruise market is expected to plateau at 3% by 2026.

- The number of cruise passengers globally dropped by 84% in 2020.

- The cruise industry expected to carry 32M passengers in 2020.

- The number of ocean cruise passengers stood at 7M in 2020.

- Only 5M people went ocean cruising in 2021.

- The number of cruise passengers from North America dropped from 15M in 2019 to 3M in 2020.

- In 2021, the cruise industry declined by 25% compared to 2020.

- In the Middle East, the number of cruise passengers declined by 92% in 2020, followed by a 160% increase in 2021.

- In North America, the number of cruise passengers dropped by 80% in 2020 and continued to decline by another 25% in 2021.

- Leading cruise companies saw a 90% drop in revenue in 2021 compared to 2019.

- Here’s a look at the net income of the largest cruise companies between 2019 and 2021:

- The cruise industry’s economic contribution in 2019 was $154B.

- In 2020, the economic contribution of the cruise industry dropped by 59% to $63B.

- Due to the COVID-19 outbreak, cruise industry-supported jobs shrank by 50%.

- The number of cruise passengers will surpass the 2019 levels by 2024.

Stacking It All Up

There you have it.

A comprehensive list of cruise industry statistics, facts, and trends to help you better understand the market and its direction.

Was there a statistic you found particularly surprising? Or maybe there are other cruising stats you’d like to see?

Let us know in the comments.

Is the cruise industry growing?

Before 2019, the cruise industry had a 3–5% yearly growth, but in 2020, the market saw a drop of over 80% due to COVID. In 2021, the market got back on track, seeing a 300% increase in revenue and 50% in passenger numbers.

How big is the cruise line industry?

There are over 60 ocean cruise lines, operating a total of 430 ships. In 2019 (before coronavirus), these cruises brought $27B in revenue. By the end of 2023, that number is expected to reach $25B.

Who are the biggest players in the cruise industry?

Three companies made 85% of the total revenue in the cruise industry in 2021. These are Carnival Cruise ( 45%) , Royal Caribbean Group ( 25% ), and Norwegian Cruise Line ( 15% ).

What’s the #1 cruise line in the world?

Carnival Cruise Lines is the #1 cruise line in the world in terms of revenue ( $12.168B ). However, Royal Caribbean has five of the world’s largest cruise ships in its fleet.

How much money does the cruise industry make?

The cruise industry made $18B in revenue in 2022. It’s also set to reach $30B by 2024.

Fair Use Statement

Did you like our infographics? If so, feel free to share them with your audience. Just remember to mention the source and link back to this page.

- Bureau of Transportation Statistics, “Summary of Cruise Ship Waste Streams”

- Comparably, “Cruise Ship Salary”

- Condé Nast Traveler, “Top Cruise Lines: Readers’ Choice Awards 2022”

- Cruise Industry News , “Cruise Ships in Service (Oct 2022)”

- Cruise Industry News, “31.7 Million Cruise Passengers Possible in 2022”

- Cruise Lines International Association, “Environmental Stewardship”

- Cruise Lines International Association, “Security At Sea”

- Cruise Lines International Association, “State Of The Cruise Industry Outlook 2019”

- Cruise Lines International Association, “State Of The Cruise Industry Outlook 2020”

- Cruise Lines International Association, “State Of The Cruise Industry Outlook 2021”

- Cruise Lines International Association, “State Of The Cruise Industry Outlook 2022”

- Cruise Market Watch, “Financial Breakdown of Typical Cruiser”

- Cruise Market Watch, “Passenger Origins”

- Friends of the Earth, “ 2022 Cruise Ship Report Card”

- Grand View Research, “Cruise Market Size, Share & Trends Analysis Report By Type (Ocean Cruises, River Cruises), By Region, And Segment Forecasts, 2022 – 2028”

- Indeed, “How Much Do Cruise Ship Workers Make?”

- Scherb M., “Improving Employee Retention Rates in Cruise Industry by Assessing Living and Working Conditions”

- Ship Technology, “Wonder of the Seas Cruise Ship”

- Statista, “Cruise Passenger Volume Index Worldwide in 2019 and 2020, with a Forecast until 2026, by Scenario”

- Statista, “Gross Tonnage of Cruise Ships in the Global Order Book In 2021, by Region”

- Statista, “Largest Cruise Ships Worldwide as of February 2022, by Length”

- Statista, “Leading Countries in the Cruise Industry Revenue Worldwide from 2019 to 2022”

- Statista, “Most Expensive Cruise Ships Worldwide in 2022, by Building Cost”

- Statista, “Net Income of Carnival Corporation & Plc Worldwide from 2008 to 2021”

- Statista, “Net Income of Norwegian Cruise Line Holdings Ltd. Worldwide from 2011 to 2021”

- Statista, “Net Income of Royal Caribbean Cruises Ltd. Worldwide from 2007 to 2021”

- Statista, “Number of Ocean Cruise Passengers Worldwide from 2009 to 2021”

- Statista, “Number of Ocean Cruise Passengers Worldwide from 2019 to 2021, by Region”

- Statista, “Percentage Change in Revenue of Leading Cruise Companies Worldwide during the Coronavirus (COVID-19) Pandemic in 2020 and 2021”

- Statista, “Revenue Growth of the Cruise Industry Worldwide from 2018 to 2026”

- Statista, “Revenue of the Cruise Industry Worldwide from 2017 to 2026”

- Statista, “Revenue Share of Sales Channels of the Global Cruise Industry from 2017 to 2026”

- Statista, “Worldwide Market Share of Leading Cruise Companies in 2021”

- Statista, “Year-Over-Year Percentage Change in Cruise Passengers during the Coronavirus (COVID-19) Pandemic Worldwide in 2020 and 2021, by Source Region”

- Wander Eat Write, “What Working on Cruise Ships Is Really Like: Pros & Cons”

- Wikipedia, “Environmental Effects of Shipping”

- Wikipedia, “List of Cruise Lines”

- Wikipedia, “List of Largest Cruise Ships”

- Wikipedia, “Wonder of the Seas”

Adam is an SEO & Digital PR writer with a child’s curiosity about the surrounding world. His superpower to dig out juicy facts got him citations in Forbes, Social Media Today, and 90+ other news outlets. Adam enjoys snapping pictures and won the national Huawei Next Image Award.

- Travel, Tourism & Hospitality ›

- Leisure Travel

Industry-specific and extensively researched technical data (partially from exclusive partnerships). A paid subscription is required for full access.

Number of cruise passengers carried worldwide 2007-2019

Number of cruise passengers carried worldwide from 2007 to 2019 (in millions).

To access all Premium Statistics, you need a paid Statista Account

- Immediate access to all statistics

- Incl. source references

- Download as PDF, XLS, PNG and PPT

Additional Information

Show sources information Show publisher information Use Ask Statista Research Service

2007 to 2015

* Forecast The source does not provide a date of publication. The date given is the date accessed.

Other statistics on the topic

Accommodation

- Leading hotel companies worldwide 2023, by number of properties

Parks & Outdoors

- Most visited amusement and theme parks worldwide 2019-2022

Travel, Tourism & Hospitality

- Number of international tourist arrivals worldwide 1950-2023

- Total contribution of travel and tourism to GDP worldwide 2019-2034

To download this statistic in XLS format you need a Statista Account

To download this statistic in PNG format you need a Statista Account

To download this statistic in PDF format you need a Statista Account

To download this statistic in PPT format you need a Statista Account

As a Premium user you get access to the detailed source references and background information about this statistic.

As a Premium user you get access to background information and details about the release of this statistic.

As soon as this statistic is updated, you will immediately be notified via e-mail.

… to incorporate the statistic into your presentation at any time.

You need at least a Starter Account to use this feature.

- Immediate access to statistics, forecasts & reports

- Usage and publication rights

- Download in various formats

* For commercial use only

Basic Account

- Free Statistics

Starter Account

- Premium Statistics

The statistic on this page is a Premium Statistic and is included in this account.

Professional Account

- Free + Premium Statistics

- Market Insights

1 All prices do not include sales tax. The account requires an annual contract and will renew after one year to the regular list price.

Statistics on " Tourism worldwide "

- Travel and tourism: share of global GDP 2019-2034

- Leading global travel markets by travel and tourism contribution to GDP 2019-2022

- Global leisure travel spend 2019-2022

- Global business travel spending 2001-2022

- Number of international tourist arrivals worldwide 2005-2023, by region

- Travel and tourism employment worldwide 2019-2034

- Global hotel and resort industry market size worldwide 2022-2023

- Most valuable hotel brands worldwide 2023, by brand value

- Number of hotels in the construction pipeline worldwide 2024

- Number of hotel rooms in the construction pipeline worldwide 2024

- Countries with the most hotel construction projects in the pipeline worldwide 2024

- Airports with the most international air passenger traffic worldwide 2022

- Market value of selected airlines worldwide 2023

- Global passenger rail users forecast 2017-2028

- Daily ridership of bus rapid transit systems worldwide by region 2023

- Number of users of car rentals worldwide 2019-2028

- Number of users in selected countries in the Car Rentals market in 2023

- Carbon footprint of international tourism transport worldwide 2005-2030, by type

- Leading museums by highest attendance worldwide 2019-2022

- Monuments on the UNESCO world heritage list 2023, by type

- Selected countries with the most Michelin-starred restaurants worldwide 2023

- Online travel market size worldwide 2017-2028

- Estimated desktop vs. mobile revenue of leading OTAs worldwide 2023

- Number of aggregated downloads of leading online travel agency apps worldwide 2023

- Market cap of leading online travel companies worldwide 2023

- Estimated EV/Revenue ratio in the online travel market 2024, by segment

- Estimated EV/EBITDA ratio in the online travel market 2024, by segment

- Global travelers who believe in the importance of green travel 2023

- Sustainable initiatives travelers would adopt worldwide 2022, by region

- Airbnb revenue worldwide 2017-2023

- Airbnb nights and experiences booked worldwide 2017-2023

- Technologies global hotels plan to implement in the next three years 2022

- Hotel technologies global consumers think would improve their future stay 2022

- Travel and tourism revenue worldwide 2019-2028, by segment

- Distribution of sales channels in the travel and tourism market worldwide 2018-2028

- Inbound tourism visitor growth worldwide 2020-2025, by region

- Outbound tourism visitor growth worldwide 2020-2025, by region

Other statistics that may interest you Tourism worldwide

- Basic Statistic Total contribution of travel and tourism to GDP worldwide 2019-2034

- Basic Statistic Travel and tourism: share of global GDP 2019-2034

- Basic Statistic Leading global travel markets by travel and tourism contribution to GDP 2019-2022

- Basic Statistic Global leisure travel spend 2019-2022

- Premium Statistic Global business travel spending 2001-2022

- Premium Statistic Number of international tourist arrivals worldwide 1950-2023

- Basic Statistic Number of international tourist arrivals worldwide 2005-2023, by region

- Basic Statistic Travel and tourism employment worldwide 2019-2034

- Premium Statistic Global hotel and resort industry market size worldwide 2022-2023

- Premium Statistic Most valuable hotel brands worldwide 2023, by brand value

- Basic Statistic Leading hotel companies worldwide 2023, by number of properties

- Premium Statistic Number of hotels in the construction pipeline worldwide 2024

- Premium Statistic Number of hotel rooms in the construction pipeline worldwide 2024

- Premium Statistic Countries with the most hotel construction projects in the pipeline worldwide 2024

- Premium Statistic Airports with the most international air passenger traffic worldwide 2022

- Premium Statistic Market value of selected airlines worldwide 2023

- Premium Statistic Global passenger rail users forecast 2017-2028

- Premium Statistic Daily ridership of bus rapid transit systems worldwide by region 2023

- Premium Statistic Number of users of car rentals worldwide 2019-2028

- Premium Statistic Number of users in selected countries in the Car Rentals market in 2023

- Premium Statistic Carbon footprint of international tourism transport worldwide 2005-2030, by type

Attractions

- Premium Statistic Leading museums by highest attendance worldwide 2019-2022

- Basic Statistic Most visited amusement and theme parks worldwide 2019-2022

- Basic Statistic Monuments on the UNESCO world heritage list 2023, by type

- Basic Statistic Selected countries with the most Michelin-starred restaurants worldwide 2023

Online travel market

- Premium Statistic Online travel market size worldwide 2017-2028

- Premium Statistic Estimated desktop vs. mobile revenue of leading OTAs worldwide 2023

- Premium Statistic Number of aggregated downloads of leading online travel agency apps worldwide 2023

- Basic Statistic Market cap of leading online travel companies worldwide 2023

- Premium Statistic Estimated EV/Revenue ratio in the online travel market 2024, by segment

- Premium Statistic Estimated EV/EBITDA ratio in the online travel market 2024, by segment

Selected trends

- Premium Statistic Global travelers who believe in the importance of green travel 2023

- Premium Statistic Sustainable initiatives travelers would adopt worldwide 2022, by region

- Premium Statistic Airbnb revenue worldwide 2017-2023

- Premium Statistic Airbnb nights and experiences booked worldwide 2017-2023

- Premium Statistic Technologies global hotels plan to implement in the next three years 2022

- Premium Statistic Hotel technologies global consumers think would improve their future stay 2022

- Premium Statistic Travel and tourism revenue worldwide 2019-2028, by segment

- Premium Statistic Distribution of sales channels in the travel and tourism market worldwide 2018-2028

- Premium Statistic Inbound tourism visitor growth worldwide 2020-2025, by region

- Premium Statistic Outbound tourism visitor growth worldwide 2020-2025, by region

Further related statistics

- Basic Statistic Foreign exchange earnings from tourism in India 2000-2022

- Basic Statistic Contribution of China's travel and tourism industry to GDP 2014-2023

- Premium Statistic Change in number of visitors from Mexico to the U.S. 2018-2024

- Basic Statistic Importance of BRICS countries to UK tourism businesses 2011

- Basic Statistic Growth of inbound spending in the U.S. using foreign visa credit cards

- Premium Statistic Annual revenue of China Tourism Group Duty Free 2013-2023

- Premium Statistic Countries with the highest number of inbound tourist arrivals worldwide 2019-2023

- Basic Statistic Number of international tourist arrivals in India 2010-2021

- Premium Statistic Middle Eastern countries with the largest international tourism receipts 2018

- Premium Statistic Passenger traffic at Dubai Airports from 2010 to 2020*

Further Content: You might find this interesting as well

- Foreign exchange earnings from tourism in India 2000-2022

- Contribution of China's travel and tourism industry to GDP 2014-2023

- Change in number of visitors from Mexico to the U.S. 2018-2024

- Importance of BRICS countries to UK tourism businesses 2011

- Growth of inbound spending in the U.S. using foreign visa credit cards

- Annual revenue of China Tourism Group Duty Free 2013-2023

- Countries with the highest number of inbound tourist arrivals worldwide 2019-2023

- Number of international tourist arrivals in India 2010-2021

- Middle Eastern countries with the largest international tourism receipts 2018

- Passenger traffic at Dubai Airports from 2010 to 2020*

IMAGES

VIDEO

COMMENTS

Growth of the Ocean Cruise Line Industry. Worldwide, the ocean cruise industry experienced an annual passenger compound annual growth rate of 5.9% from 1990 to 2024. While the COVID-19 pandemic brought the ocean passenger cruise industry to a standstill for nearly two years, it also prompted the accelerated retirement of numerous older ships.

Cruise Lines International Association (CLIA), the world's largest. cruise industry trade association, has released the 2019 Cruise Trends and State of the Cruise Industry Outlook. The report offers a look at the trends impacting cruise travel in the coming year and beyond as well as the overall global economic impact.

Cruise Lines International Association (CLIA), the world's largest cruise industry trade organization, is releasing the latest global cruise passenger statistics. Playing a significant role in international tourism, cruising continues at a paced growth around the world with a 4% increase from 2018 to 2019, totaling 29.7 million passengers.

Number of global ocean cruise passengers 2019-2023, by source market Number of ocean cruise passengers worldwide from 2019 to 2023, by source region (in 1,000s)

2019 Global Market Report. Download Report Download Infographic View Passenger Flow Diagram.

Revenue growth of the cruises market in the United States from 2019 to 2028 Premium Statistic Direct spending in the cruise industry in the U.S. 2021-2022, by type

Capacity Growth. New ships on order and set to be delivered in 2019 represent an additional 42,488 berths into the industry, obliterating 2018's record introduction of approximately 34,000 new berths. According to the 2019 Cruise Industry News Annual Report, the 42,488 berths represent 7.5 percent additional berths across the industry.

The global revenue in the 'Cruises' segment of the travel & tourism market was forecast to continuously increase between 2024 and 2028 by in total 6.6 billion U.S. dollars (+21.92 percent). After ...

2019 Cruise Industry Trends to Watch. The evolution of the cruise industry has been remarkable. In the 60+ years since the first ship sailed from Miami to the Caribbean, the industry has reinvented itself to meet the demands of a variety of markets. ... Winter months in North America are peak season for the Caribbean cruise market, but a shift ...

995The Cruise Industry News Annual Report is the only information resource of its kind — presenting the entire worldwide cruise industry in a 400-page report, from new ships on order to supply-and-demand scenarios from 1987 through 2027, including a future outlook including 2027+ growth projections for each cruise line, and detailed ship deployment by region and market of all the cruise lines.

The Cruise Market Watch service, including accompanying data, is licensed to the User for the internal use of the User only. Cruise Pulse™ data and analytic tools are supplied for the User's exclusive use and must not be passed on, by way of sale or otherwise, to any third party for any purpose whatsoever without Cruise Market Watch's prior ...

The average age of a cruise passenger is 47 years old. However, people in their forties make up only 15% of cruise passengers. Most cruises have a mix of all ages, from children to pensioners. Here is the breakdown of cruisers by age: 12 and under - 9%. 13 to 19 - 6%. 20 to 29 - 9%.

Cruise Industry News takes a look at the financial performance of the "big three" following the final quarter of 2019.. Takeaways: While gross revenue was up for Q4 2019 for the three publicly-traded cruise companies, increased operating expenses led to reduced operating income, net income and net income per passenger day, compared to Q4 for the previous year.

The global cruise market size was valued at USD 7.67 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) 11.5% from 2023 to 2030. This can be attributed to the rising popularity of the vacation on a cruise due to the cost difference and the amenities provided by the alternative vacations.

Source: adapted from Cruise Market Watch. Note: Growth rates not depicted for 2020 (-74.2%), 2021 (+96.1%), 2022 (+46.7%) and 2023 (+50.4%). The global cruise market has witnessed continuous growth throughout the last three decades, a growth that was interrupted in 2020 by the COVID-19 pandemic. In the 1990s and the 2000s, the size of the

The Global Cruise Market size is expected to be worth around USD 22.8 Billion by 2032 from USD 7.9 Billion in 2022, growing at a CAGR of 11.50% during the forecast period from 2023 to 2032. A cruise is a multi-day vacation plan that is arranged on a cruise ship large inland while visiting numerous tourist attractions along a planned route.

1. Disney Cruise Line. 2. Royal Caribbean International. 3. Seabourn Cruise Line. Advertisement. No matter which cruise line you decide to take, experts say there are a number of strategies that ...

The pandemic has proven unpredictable, with many cruise destinations going into second and third lockdowns during 2021 after a global surge in Covid-19 cases. While the cruise industry has experienced a 96% Year-on-Year (YoY) increase of passengers, reaching 13.9 million, it still does not compare to the pre-pandemic levels of 2019, where there were 29.7 million passengers globally.

Currently, cruise lines, one of the most globalized, and legally complex industries, transported 28.7 million tourists around the seven seas, a $40 billion industry, in 2019.

The market is updated twice a year in case market dynamics change. The Cruises market worldwide is projected to grow by 5.05% (2024-2028) resulting in a market volume of US$36.67bn in 2028.

Cruise Market Watch . Cruise Market Watch provides real good analytics about the ocean cruise industry. All datasets: F M. F. Finland: Capacity - Cruise Industry. May 2021. Source: Cruise Market Watch. Uploaded by: Knoema. Accessed On: 18 May, 2021. Select Dataset. World wide cruise capacity.

Kyrie Irving finished with just 15 points on 5-of-16 shooting and has now lost 13 of the last 14 meetings against the Celtics team he left in the summer of 2019 to join the Brooklyn Nets.

The global revenue from cruises dropped by 88% in 2020. The cruise industry made just $3B in 2020 compared to 27B in 2019. The revenue growth in the cruise market is expected to plateau at 3% by 2026. The number of cruise passengers globally dropped by 84% in 2020. Number of Cruise Passengers.

Watch the majestic sight of whales appearing at dusk as you spend scenic days in Glacier Bay National Park and Hubbard Glacier. Three things worth knowing Alaska cruises special offers ... An Alaskan cruise requires a good mix of warm, waterproof and practical outdoor clothing, coupled with a selection of eveningwear outfits to wear on board ...

Published by Statista Research Department , Jul 29, 2015. This statistic shows the number of cruise passengers carried worldwide from 2007 to 2019. In 2011, the 12.18 million passengers from North ...

Prison consultant representing Trump ally explains what he tells all his clients before incarceration

The global cruise sector is rebounding, with 2023 passenger volume exceeding 2019 levels by 7%. Additionally, cruise capacity is expected to grow by 10% from 2024 to 2028.