Personal Loans

Business Loans

Credit Cards

Best Frequent Flyer Credit Cards

- Compare the best frequent flyer credit cards for earning points.

- Up to 150,000 bonus frequent flyer points available.

Featured offer: American Express Qantas Ultimate Card

Earn up to 90,000 bonus Qantas Points. That's 70,000 points when you apply online by 3 Sept 2024, are approved, and spend $3k on eligible purchases in the first 3 months. Plus, an extra 20,000 points in your 2nd year upon annual fee renewal ($450). T&Cs apply, new members only.

Best frequent flyer credit cards for earning points

The table below shows credit cards that earn either qantas or velocity frequent flyer points. by ‘best’ cards we mean the cards with the highest earn rate on everyday spending. that’s how the table is ordered, but you should also consider other aspects of the cards (e.g. rates and fees) when deciding which frequent flyer is best for you..

Info correct as at 3 June 2024. Table is ordered by highest point per $ spent, then lowest annual fee, then lowest purchase rate. Check with the provider for full card details, including fees, limits, terms and conditions to make sure the card is right for you. While this is an extensive list of the top frequent flyer point-earning credit cards available, we can't guarantee that all cards available in the market are shown. *After a total of 100,000 Qantas Points is earned in a calendar year, the everyday earn rate will change from 1.25 to 1 Qantas Point per $1 spent. For Card Members who applied for the Card between 1 July 2023 – 9 January 2024, this change will come into effect from 10 July 2024.

Featured offer: American Express Velocity Platinum Card

Get 60,000 bonus Velocity points when you apply online through this page by 26 June 2024, are approved, and spend $3k on eligible purchases on your new card in the first 3 months. T&Cs apply. New Card Members only.

In our frequent flyer credit cards guide:

How do frequent flyer credit cards work?

Qantas vs Velocity: which is best?

10 ways to get the most from your frequent flyer credit card points

How to qualify and apply for a frequent flyer credit card

What can I redeem frequent flyer credit card points for?

How to choose a frequent flyer credit card

Frequent flyer credit card fees

Are frequent flyer credit cards worth it?

A frequent flyer credit card is a type of credit card that allows the cardholder to earn points on eligible purchases and redeem them with the airline frequent flyer program linked to the card.

They’re essentially a rewards credit card but with perks tailored to cardholders who travel frequently.

Cardholders need to be a member of an airline’s reward program, and points can be redeemed for a variety of rewards. Not just travel-related ones.

How to boost your frequent flyer points

Consider frequent flyer cards with bonus sign up points

Look for cards with high point earn rates

Match your card to your travel & spending habits

Avoid costly interest charges and fees

Most airline frequent flyer programs partner with other product and service providers, meaning you can redeem your frequent flyer points for more or less anything .

That said, it’s often the case that frequent flyer points go further when used on flights or upgrades.

Here are some of the more common perks you can use your frequent flyer points on:

- Flight bookings and upgrades

- Hotels and other accommodation

- Shopping and gift cards

- Restaurants, food and wine

- Insurance premiums

- Fuel and other car expenses

Other benefits of frequent flyer credit cards

As with many other credit cards, frequent flyer cards and other credit cards for travellers will often include a number of other perks which may directly benefit frequent travellers, including:

- Airport lounge access (e.g. two passes per year)

- Complimentary travel insurance

- Car rental insurance

- Flight inconvenience insurance

- Travel vouchers

- Discounts with partner travel providers (e.g. hotels and car hire companies) Discounted international transaction fees

The features and perks will vary between card issuers, so check to see which perks are included when comparing frequent flyer credit cards.

Frequent flyer programs in Australia: Qantas vs Velocity

Qantas frequent flyer, cost to join.

- The standard joining fee is $99.50 AUD , buy there are a number of ways you can become a member without paying a separate joining fee (e.g. though eligible frequent flyer credit cards)

Ways to earn points

- Eligible purchase on a Qantas frequent flyer credit card

- Booking flights with Qantas, Jetstar or another partner airline

- Booking accommodation or car rental with a partner providers

- Taking out insurance through Qantas or a banking product (e.g. Qantas home loan )

- Shopping with a partner retailer

Notable partner brands

- Adairs, Apple, BP Rewards, Country Road, David Jones, Microsoft, Myer, Optus, Red Energy, The Iconic, Woolworths (everyday rewards).

Ways to redeem points

- Flights, accommodation, gift cards, shopping (more or less anything that earns you points can also be a way to redeem them)

Partner airlines include

- Air France, Air New Zealand, American Airlines, Bangkok Airways, British Airways, Cathay Pacific, China Airlines, Emirates, Fiji Airways, Finnair, IndiGo, Japan Airlines, Jetstar , KLM, SriLankan Airlines, WestJet

Do points expire?

- Yes, 18-months after your last eligible activity.

Can I transfer points?

- Yes, a minimum of 5,000 and a max of 600,000 points in a 12-month period to an eligible family member who is also a Qantas Frequent Flyer member.

Velocity (Virgin)

- Eligible purchase on a Velocity frequent flyer credit card

- Booking flights with Virgin or another partner airline

- Taking out a banking or insurance product through a partner provider (e.g. Medibank)

- 7-Eleven, Apple, Chemist Warehouse, CommBank, Country Road, David Jones, Ebay, Flybuys, Myer, The Good Guys, The Iconic.

- Virgin Australia, United Airlines, Virgin Atlantic, Singapore Airlines, Etihad Airways, Hong Kong Airlines, Air Canada, Qatar Airways, Hainan Airlines, Hawaiian Airlines, FlyPelican, South African Airways, Tianjin Airlines, Capital Airlines, Link Airways

- Yes, after 24 months of account inactivity.

- Yes, you can transfer between 5,000 and 125,00 points to an eligible family member (who is also a Velocity frequent flyer member) up to four times each year.

Expert frequent flyer credit card tip

For a frequent flyer card to be worth your while, you really need to watch the fees. Westpac recently increased theirs and Commbank has changed to a monthly fee model. Commbank also reduced the number of cards it offers – now just six options – and the fees on these can be high unless you spend enough to qualify to have the fee waived. In better news for Commbank frequent flyers, the international FX fee on purchases is waived on some cards (usually 3%).

Brad Kelly , Money.com.au's credit card expert

How to choose the best frequent flyer credit card

There’s more to comparing frequent flyer credit cards than there is when shopping for low rate credit cards or among credit cards with no annual fee . Below are some of the other main factors you may want to take into account. Note the main factors vary slightly if you're shopping for a business credit card .

Interest rate and fees

This is a very good place to start. There’s not much point having a frequent flyer credit card packed with perks and features if they’re going to be cancelled out by high high interest rates (purchase rate and cash advance rate), and fees.

As a reference point, the latest credit card data shows the average interest rate is 17.92% p.a. and the average annual fee is $135.

If you manage to find an interest-free credit card offering rewards or you’re confident you have the discipline to pay off the entire balance within the card’s interest-free days , the fees will likely be your main cost.

I’ve explained these in more detail later on. Spoiler alert, fees on some frequent flyer card fees can be very high and are only really worth it if you're raking in points and using all of the other benefits (like lounge passes).

Your income and spending habits

Some frequent flyer credit cards have a minimum annual income built into the eligibility criteria. Others will only be worth the high annual card fee if you are spending a lot.

If that’s the case, it’s important to factor in whether your income and other financial commitments mean you can comfortably support that level of spending.

If you think you'll need to spend more than you usually would to get the most from the credit card, seriously consider whether it's right for you.

How often you travel

This will come as no surprise, but frequent flyer credit cards generally offer more benefits and overall value to people who travel a lot.

Think credit cards with travel insurance , lounge passes, travel vouchers, hotel discounts.

If you’re not going to make the most of these perks, a different type of card may be a better fit.

Points, points, points

It’s tempting to just look at the amount of bonus points you get when you sign up and how many points you earn per dollar spent using the card.

These are certainly well worth considering, but you should also consider the fine print on your frequent flyer points:

- Is there a cap on how many points you can earn per year?

- Which purchases are eligible to earn points?

- What kind of spending won't earn you any points? (e.g. paying certain bills, gambling)

- Do the points expire?

- Where and how can you use them? Or can they be converted to cashback ?

- Take advantage of frequent flyer credit cards with bonus sign up offers (assuming the credit card is good value and a suitable match for you overall).

- Look for cards with the highest point earn rates .

- Understand which purchases will earn you the most points and which ones aren’t eligible.

- Match the card to your spending habits . If you only travel occasionally, a general rewards card may be more suitable.

- Use your card for everyday purchases to earn more points, but only if you can afford to repay the card balance in full every month.

- Earn bonus points : Some frequent flyer programs allow you to earn points by hitting non-financial targets, like walking a certain number of steps per day.

- Pool points with family : Both Qantas and Velocity allow point transfers between eligible family members.

- Redeem your points wisely: Look for the rewards perks that will get you most bang for your points (but above all else, make sure you actually use them)

- Share the card with your partner . Most credit cards allow additional cardholders. If two people are using the card, you'll likely earn more frequent flyer points (again watch for overspending).

- Offer to pay for split expenses and have your friends, family or roommates etc. send you the money.

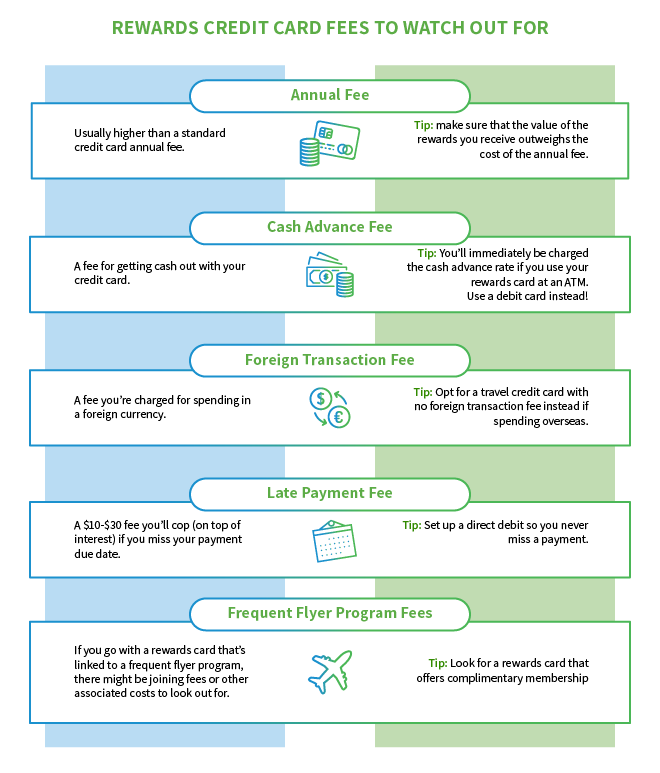

The fees on your frequent flyer credit card will play a major part in dictating whether the card will cost you or save you money overall. Here are the main fees to consider:

- Annual fee (can range from $0 to $700 depending on the card)

- Foreign currency conversion fee, usually up to 3% but there are credit cards with no international fees

- Over limit fee, charged if your balance exceeds its limit

- Late payment fee

- Cash advance fee, charged when making a cash withdrawal or buying foreign currency

- Replacement/additional card fee

- Balance transfer fee if you move the balance of an existing credit card to your frequent flyer card

Who can qualify for a frequent flyer credit card?

To qualify for a frequent flyer credit card you must meet the following qualifying criteria:

- Over 18 years of age

- Australian citizen or permanent resident

- Have a good credit score

- Minimum income (varies between lenders and cards)

- A member of a relevant frequent flyer program e.g Qantas Frequent Flyer or Virgin Velocity Flyer.

Qualifying criteria will vary between lenders and cards. Make sure you’re eligible for the frequent flyer credit card you have your eye on before applying. A declined application could damage your credit score .

How to apply for a frequent flyer credit card

You can apply for a frequent flyer credit card online, over the phone, or at your bank.

When applying for a credit card , you will need to provide the card issuer with supporting documentation so they can assess your application and ability to meet repayments. This will likely include:

- Valid ID, such as a driver licence or passport

- Employment details, including your employment status, salary information, and payslips to verify your income

- Details of your assets, such as your home and motor vehicle

- Details of your current expenses and other loans you may have

If you are self-employed, you will need to provide previous tax assessments instead of payslips. You may also for financial information provided by your accountant.

Is getting a frequent flyer credit card worth it?

Frequent flyer credit cards can be beneficial for the right person. But for you to get good value, you’ll need to make sure you find the best frequent flyer credit card for YOUR situation . You’ll also need to make the most of the perks being offered .

If you just need a credit card as a backup or for emergencies, a frequent flyer card will be an expensive way of going about it.

But if you are the type of person who travels a lot, likes to track points and work towards an indulgent treat every so often (while also having the discipline to pay off the balance of your credit card in full every month) a frequent flyer credit card could be worth considering.

One simple way to determine whether a frequent flyer credit card may be suitable for you is to:

- Calculate how much you spend each year

- Calculate how many points that will earn you

- Calculate the associated value of these points

- Compare the value of your points with the fees included with the card

Frequent flyer credit card FAQ

What is the maximum credit limit on a frequent flyer credit card.

Frequent flyer credit cards generally have a minimum credit limit of $500, and a maximum credit limit of $100,000. The amount of credit that you can access from a lender is determined by your:

- Credit score

- Overall financial health

The minimum and maximum limits for a frequent flyer card will vary between card issuers and cards. For example, a premium credit card may have a minimum limit of $15,000, while a basic frequent flyer credit card may have a limit of $3,000.

Which airlines can I use a frequent flyer credit card with?

There are two main frequent flyer programs you can join in Australia (Qantas and Velocity), plus a host of international ones. The most important factor when choosing an airline is to understand their partner airlines, and how you can use your points. For example, both Qantas and Virgin partner with a range of different airlines globally. Look at the airlines and consider which ones you're most likely to use.

If you would like flexibility, American Express credit card points can be transferred to multiple different airlines.

When do I receive frequent flyer points from purchases?

You’ll usually receive an updated points balance from your purchase once a month. Most credit card partners transfer points on a regular day, so you should receive you updated balance at the same time every month.

Will I earn points for every purchase?

Some purchases may be ineligible for earning points. The criteria for earning points on your frequent flyer card will be listed in the terms and conditions when applying. If you are unsure of whether your purchase will qualify, you can contact your card issuer.

How do I redeem frequent flyer points?

You can redeem any points you’ve earned through the airline you are registered with. You can book flights through an airline’s online booking system, or make purchases from the airline’s merchandise and gift shop online.

Sean Callery

Reviewed by.

Credit Cards Expert

Rewards credit cards that are the real deal

Be the vip you were born to be with premium perks, cashback and flights to antarctica (if you want)..

Rewards cards from

In this guide

Our round-up of rewards credit card offers

Rewards score tiers - what you need to know, the lowdown on how we score, how do rewards credit cards work, pros and cons of rewards credit cards, types of credit card rewards in australia, how to compare rewards credit cards, frequently asked questions, finder award winner and finalists for 2024.

Here are some of the top scoring rewards cards available through Finder this month:

- The ANZ Rewards Black Credit Card has a Finder Score of 9.7.

- The American Express Platinum Business Card has a Finder Score of 10.

- The Citi Prestige Card has a Finder Score of 10.

- The American Express Platinum Card has a Finder Score of 10.

- The St.George Amplify Signature has a Finder Score of 9.74.

- The Westpac Altitude Black has a Finder Score of 8.71.

Updated 6 June 2024 by money editor, Richard Whitten .

- 9+ Excellent - These cards offer the best ongoing earn rates and sign up offers, coupled with attractive annual fees and perks.

- 7+ Great - Reasonable rewards cards but may offer slightly lower ongoing or signup offers.

- 5+ Satisfactory - These cards may offer lower ongoing and sign up points, but could also offer fewer perks or higher annual fees.

- Less than 5 – Basic - Entry level rewards cards, that offer consumers basic sign up offers and ongoing earn rates.

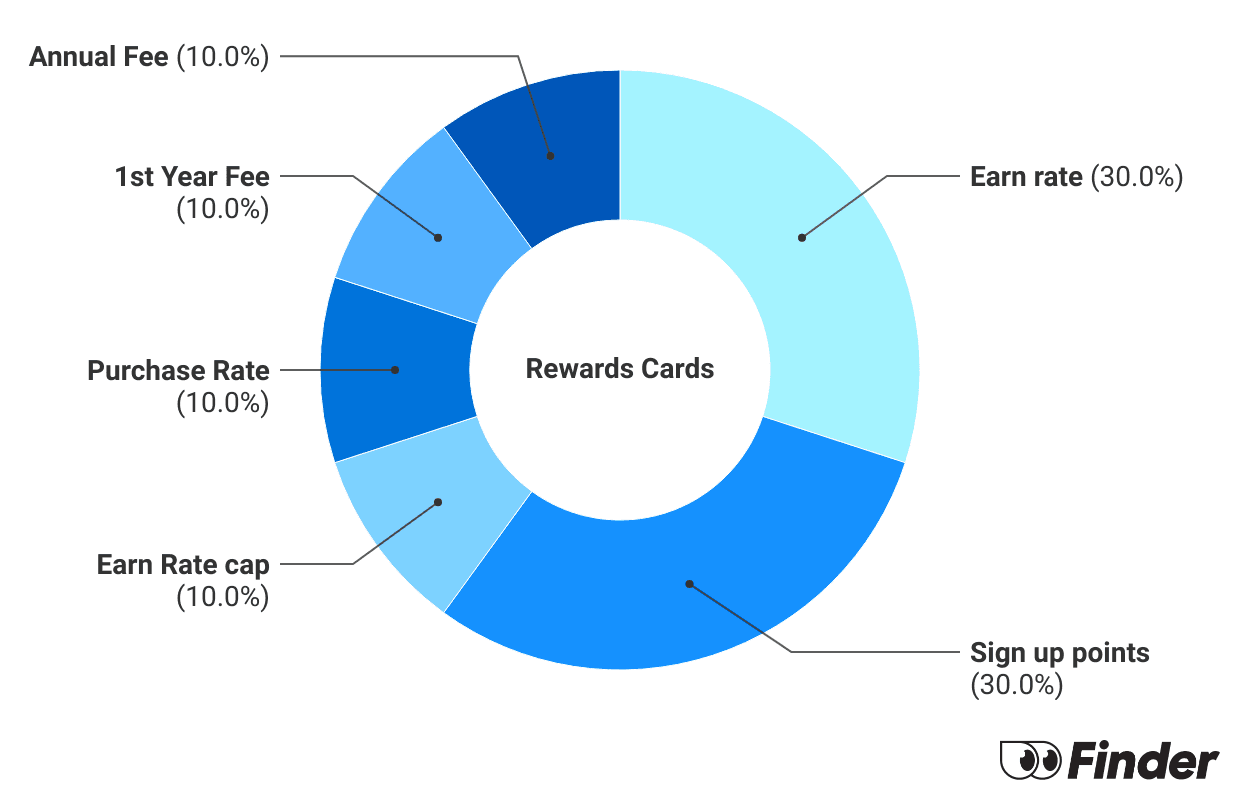

We carefully analyse 300+ credit cards and assess 7 features, assigning them individual scores out of 10.

Points from rewards programs are converted to a dollar value, by determining the number of points required to purchase a departmental store card, or a direct dollar value conversion within the rewards program store.

A card will get different scores in each category, depending on which features are being assessed.

To qualify for the rewards score, credit cards must:

- Offer signup or ongoing rewards points affiliated to a rewards program.

- Be available to general consumers.

Our aim is to help your with financial decision-making, but please consider your own financial circumstances. While we may make money from commercial partnerships, they have no weight in our methodology. The database is scored objectively and reviewed by our editorial team.

Best rewards cards - ANZ Rewards Black

ANZ Rewards Black Credit Card

- 180,000 Bonus Points & $150 back

- $375 Annual fee

- 20.99% Purchase rate

Pros & cons

- 180,000 bonus ANZ Reward Points

- $150 back on your new card

- Up to 2 ANZ Reward Points per $1 spent

- Complimentary extras including travel insurance and a personal concierge

- Charges a relatively high annual fee of $375 p.a.

- 3% foreign transaction fee

- Additional cardholder fee of $65 per card

Why we like it

- Offers 180,000 bonus ANZ Reward Points when you spend $3,000 on eligible purchases in the first 3 months. That's worth $800+ in eGift cards with partner retailers including Myer, JB Hi-Fi, Bunnings and more. Or, if you're a Velocity member, you can redeem this for 90,000 Velocity Points.

- You also get $150 back to your card when you meet the spend requirement.

- Complimentary insurance covers including international and domestic travel insurance, rental vehicle excess in Australia, extended warranty insurance and purchase protection cover.

- Relatively high earn rate of up to 2 ANZ Reward Points per $1 spent .

Best rewards cards - American Express Platinum Business

American Express Platinum Business Card

- 350,000 Bonus Points

- $1,750 Annual fee

- N/A Purchase rate

- 350,000 bonus Membership Rewards Points

- High 2.25 points per $1 on most eligible spending, with 1 point per $1 on government spend

- Complimentary domestic and international travel insurance

- Luxury perks including unlimited access to 1,400 airport lounges and hotel elite status partners

- $1,750 annual fee is one of the highest on the market

- 3% foreign currency conversion fee

- American Express is not as widely accepted as Visa or Mastercard

- Offers 350,000 bonus Membership Rewards Points.

- The card has a very high earn rate on eligible spending.

- Complimentary travel insurance and airport lounge access make up for the high annual fee.

Best rewards cards - Citi Prestige

Citi Prestige Card

- 275,000 Bonus Points

- $700 Annual fee

- 21.49% Purchase rate

- 275,000 bonus points

- Unlimited access to over 1,500 airport lounges through Priority Pass

- Airport transfer service and 4th night free hotel offers

- Complimentary international travel insurance

- The $700 annual fee is high

- 21.49% p.a. interest rate for purchases

- 3.4% foreign transaction fee

- Offers 44 days interest-free on purchases, compared to other cards that offer up to 55 days

- Offers 275,000 bonus points when you meet the spend criteria.

- The card has a high earn rate on eligible spending.

- You can enjoy a range of travel benefits including complimentary travel insurance and airport lounge access and airport transfers.

A rewards credit card usually earns points for every $1 you spend on purchases in Australia and overseas (including online). The points are credited to your account or a linked loyalty program, where you can redeem them for rewards that range from flights and hotel bookings to gift cards, cashback and retail items.

There are also a few credit cards that offer cashback instead of points.

- Points for spending. The most obvious perk of these cards is that you earn rewards of your choice, for money you were going to spend anyway. These could be credit card points, frequent flyer points, cashback and more.

- Introductory offers and deals. New cards usually offer a bunch of bonus points when you spend a certain amount in the first few months.

- Perks. Rewards credit cards often come with extra perks like travel insurance, purchase insurance, concierge services and lifestyle and entertainment offers.

- Higher rates and fees. To pay for the points and perks, these cards typically charge higher ongoing interest rates and annual fees than other cards.

- Temptation to overspend. The promise of rewards or frequent flyer points can lead you to spend more than you usually would. But the cost of overspending can cancel out the value you'd get from any points or perks you'd earn.

- Rewards limitations. While some rewards cards let you earn unlimited amounts of points, many set spending thresholds that cap your ability to earn rewards. If you often spend more than that cap, it will limit how much value you get from the card.

Reward credit cards are popular in Australia, with Finder research showing 29% of Australians got their last credit card for reward points.

Credit card rewards can be separated into 3 main categories: frequent flyer , points and cashback .

Frequent flyer rewards

If you're a member of a frequent flyer program, you can use a credit card to earn more points or miles in 2 ways:

1. Frequent flyer points per $1 spent

Credit cards that are directly partnered with a frequent flyer program let you earn frequent flyer points on your eligible spending. Points are automatically added to your frequent flyer account once a month (or at regular intervals).

In Australia, the main options are Qantas Frequent Flyer and Velocity Frequent Flyer credit cards.

2. Reward point transfers to frequent flyer programs

A lot of rewards credit card let you transfer points to different frequent flyer programs. This gives you more flexibility because you're not locked into earning points for one airline loyalty program.

It's also a way to earn points with programs that don't have co-branded cards in Australia, including Singapore Airlines KrisFlyer, Cathay Pacific Asia Miles and Emirates Skywards.

💡 Tip: You can also get a rewards credit card that lets you redeem points for flights, accommodation and other travel experiences without needing to transfer them to a frequent flyer program.

Points for bank and other loyalty programs

Many rewards credit cards in Australia earn points that you can redeem for different types of rewards, including gift cards, retail items, credit on your account, travel or point transfers to other loyalty programs. These flexible rewards programs include:

- American Express Membership Rewards

- ANZ Rewards

- Bankwest More Rewards

- Bank of Melbourne Amplify Rewards

- Bank of Queensland Q Rewards

- BankSA Amplify Rewards

- Bendigo Bank Rewards

- Citi Rewards

- CommBank Awards

- Heritage Credits

- HSBC Rewards Plus

- Kogan credit card rewards

- Macquarie Bank Credit Cards Rewards Program

- NAB Rewards

- St.George Amplify Rewards

- Suncorp Rewards

- Westpac Altitude Rewards

Cashback credit cards

These credit cards give you a way to get cash rewards for your spending, either in the form of credit back on your account or vouchers you can spend.

Some cashback credit cards give you a set percentage of your regular spending as cashback on your account, while other cards have introductory offers that provide a one-time account credit or voucher when you meet the spend requirements.

From earning points to the rewards you want to redeem, here are some of the questions and factors to think about when you're comparing rewards credit cards:

1. How can I earn points?

- Bonus point offers. These can give you a huge amount of value when you get a new card. Usually, you need to meet a spend requirement in a set period of time to score bonus points.

- Points per dollar. Also known as the earn rate, this is how many points you earn for your spending. The higher the better, but a card that earns at least 1 point per $1 on eligible transactions would be considered good value.

- Point expiry and caps. Some credit card reward points expire after a certain amount of time and some have a limit on how many points you can earn in a month or year.

What are eligible purchases on a rewards card? Most everyday spending is eligible to earn points, including groceries, petrol, retail items and travel. Transactions that don't usually earn points include cash advances, BPAY payments and spending with government bodies. You should check your card's rewards program terms and conditions for full details.

2. What's the value of the rewards?

- Point values. To work out the value of your rewards, consider how many points you would need to redeem a chosen reward. For example, let's say you need 12,000 points to get a $50 gift card and your credit card has an earn rate of 1 point per $1 spent. You would need to spend $12,000 before you could redeem the $50 gift card. Calculating reward point values like this can help you decide if it's worth your time and money.

- Rewards partners. Rewards programs sometimes partner with retailers and businesses to give you more ways to redeem points. You may also have the opportunity to earn bonus points with partner stores. If there are partners you already shop with, this could help you earn and redeem points faster.

- Redemption limitations. Some rewards programs have blackout periods when you may not be able to make redemptions, or limits on items in the rewards store. Check the fine print for this information.

Points-to-dollars calculator 💵

Estimated value, how much do you need to spend to get rewards.

To give you an idea of the potential value of rewards, we've compared the amount of points you need to redeem a $100 gift card through major rewards programs that are linked to credit cards.

Fees, points and redemption values correct as of July 2023. Based on this table, the minimum spend required for a $100 gift card (or equivalent) is $10,000 with American Express Membership Rewards or Flybuys if your credit card offers 2 points per $1 spent.

3. What are the costs?

- Annual fees. Rewards credit card annual fees range from around $50 to $1,450 in Australia. Some rewards credit cards offer no annual fee for the first year or ongoing. Just keep in mind that the value of the rewards you redeem should be higher than the cost of the annual fee to make it worthwhile.

- Purchase interest rates. Rewards credit cards typically have high interest rates for purchases, which can be up to around 24%. If you pay the card off as you go, or in full by the statement due date, you'll usually get interest-free days for purchases. Otherwise, the cost of interest could outweigh the value you get from earning points.

The annual fee and interest rate for purchases are 2 key costs to factor in when you're comparing rewards credit cards. But there are other costs that could also affect the value you get from a card in more specific situations.

Other costs to compare

- Foreign transaction fees. Reward credit cards typically charge a fee of 2% to 3.4% for transactions made overseas or online with a business based overseas – including some cards that offer more points per $1 for foreign transactions. So if you want a rewards card for travel or online shopping, check this fee first. You can also compare no foreign transaction fee cards on Finder.

- Balance transfer interest rates. A 0% balance transfer offer could help you save if you move a balance from one card to a new rewards card. But you won't earn points for the balance transfer, and may be charged interest on new purchases while you're paying it off. So it's typically wise to focus on repaying it before using the card to earn points on new purchases.

- Cash advances. If you use a rewards credit card to get money from an ATM or for another cash advance transaction, you'll be charged a cash advance fee of around 3%. Most cards also have higher interest rates for cash advances (up to around 30%). And you don't earn reward points for cash advances.

4. Are there any complimentary extras?

Rewards credit cards often come with a variety of additional features that can add value if you use them. Popular perks include:

- Airport lounge access

- Complimentary flights and travel credits

- Extended warranty cover

- Price match guarantees

- Concierge services

I change my rewards credit card every year to get the best value from bonus points offers. I redeem my bonus points for gift cards or flight rewards and it usually brings in about $500 worth of value. You just have to be vigilant with paying off your card, closing the account before incurring the next year's annual fee, and not churning too frequently because it could affect your credit score.

What's the biggest credit card bonus point offer on the market?

Finder's database shows that the Citi Prestige Card has the biggest bonus points offer, with 275,000 Citi Rewards Points when you spend $10,000 in the first 3 months. That's enough for $1,300 of Woolworths WISH gift cards or 110,000 Velocity Points based on details listed on the Citi Rewards website.

The American Express Platinum Business offers 350,000 when you spend $12,000 in the first 3 months.

Can I earn reward points for BPAY payments?

It's unlikely but does depend on the rewards program and credit card provider. For example CommBank, Westpac, St.George and Virgin Money all list BPAY payments as ineligible to earn rewards.

While other credit card issuers (such as ANZ) doesn't specifically list BPAY transactions as ineligible for points, that doesn't mean you will earn points. Or that you'll be able to use a credit card for a BPAY payment. Check the terms and conditions or ask your provider for details specific to your card.

How do I redeem credit card reward points?

Every rewards program is different, but here's a general guide to the process of redeeming points:

- Log into your account

- Browse the rewards and choose one you want

- Check that you have enough points or can use points plus pay

- Confirm the details and follow the prompts to complete your redemption

Who can apply for a rewards credit card?

Anyone aged over 18 can apply for a credit card when they meet the bank or lender's eligibility criteria. This typically includes:

- Minimum income requirement. This can range from $35,000 per year for a basic rewards card to over $100,000 for a premium card. Even when there is no specific minimum income amount listed, your income will need to be enough to manage at least the minimum credit limit, account fees and interest charges.

- New cardholder status. Many introductory offers require you to be a new cardholder that hasn't held a similar card (or one from the same brand) in the past 12-18 months.

- Residency status. Some lenders require you to be a citizen or permanent resident, while others allow visa holders and temporary residents to apply as well.

- Credit history. All credit cards require you to have a good credit history and not be an undischarged bankrupt or have any judgements against you.

If you're eligible to apply, you'll also be required to provide documents including payslips and proof of identification. The provider will then assess the details you provide to determine whether you'll be approved based on their criteria and responsible lending requirements.

How can I meet the minimum spend requirements for bonus points?

With most credit card bonus points offers, you need to spend a certain amount in the first few months or over another period of time. It's important to only spend what you can afford to pay off so you don't end up with interest charges that take value away from the points.

Here are examples of different ways to meet the minimum spend requirements.

- Booking travel

- Buying major household items (e.g. a lounge or fridge)

- Buying a new laptop, tablet, phone or other tech

- Pre-paying your health insurance or other bills

- Paying for car services or repairs

- Seasonal shopping (e.g. school holidays, Christmas)

- Paying for everyday expenses (e.g. groceries, fuel, subscriptions)

Bonus points are typically added to your account within 1-12 weeks of when you meet the spend requirement. But it depends on the offer. You can check the fine print or call the credit card company to find out when points will be added to your account.

Are rewards credit card worth it?

It's worthwhile if you get more value from rewards than what you're paying for the account. This makes rewards cards more suited to people who already use a credit card regularly and/or can repay what they spend each month.

When comparing your options, ask the following questions:

- How much is the annual fee? Reward and frequent flyer credit card annual fees can quickly outweigh the value of rewards, even if you're getting thousands of bonus points.

- What are the potential interest costs? Estimate how much you could end up paying if you carry a balance on the card to decide if the risk is worth it for you. For example, if a credit card had a 19.99% p.a. purchase rate, a minimum spend requirement of $3,000 in 3 months to get bonus points and it took you 6 months to pay that amount off, you'd be charged around $177 in interest.

- How much are the points worth? Look at the value of the points based on what rewards you want to redeem. For example, if 100,000 bonus points was worth $500 in digital gift cards, that could help justify a card's annual fee. It's worth looking at a few reward options for any card offering bonus points. You can also calculate the dollar value of your points .

- When do you want to use your points? The time it takes for you to earn enough points for your ideal reward could be a few weeks. But it could be a lot longer if you're saving up points per $1 spent or waiting for a particular reward to become available (especially flight rewards). So it can be helpful to have a timeframe in mind, then work out how many points you'd realistically earn through the card.

What happens to reward points after a death?

Depending on the card and rewards program, the points could be transferred to another person, converted into a statement credit or cancelled.

You can find details for your rewards program by looking at the terms and conditions, or by asking the provider. They should also let you know what options are available when they're notified of someone's death.

Find out which brands ranked highly at the Finder Awards for rewards credit cards.

The ANZ Rewards Black Credit Card is our top rated rewards credit card for 2024. In the 12-month period we analysed for this year's Finder Credit Card Awards, it scored highly for its big bonus and high earn rate of 2 points per $1 on eligible spending. The card also offers complimentary travel insurance.

The Coles Rewards Mastercard scored highly for its bonus points offers and earn rate. The card earns 2 Flybuys points per $1 on eligible spending up to $3,000 in a statement period and 1 point per $1 after that. Its $99 annual fee also scored well for cards in this category.

The St.George Amplify Signature has a big bonus point offer and reduced first-year annual fee during the 12-month period we analysed. It scored well for its earn rate of 1.5 points per $1 on all eligible spending. This card was also a finalist in 2023.

Each year the Finder Credit Card Awards recognises the top credit cards in Australia. Using 12 months' worth of data, our experts have analysed the rates, fees and offer details from over 270 cards.

Richard Whitten

Richard Whitten is a money editor at Finder, and has been covering home loans, property and personal finance for 6+ years. He has written for Yahoo Finance, Money Magazine and Homely; and has appeared on various radio shows nationwide. He holds a Certificate IV in mortgage broking and finance (RG 206), a Tier 1 Generic Knowledge certification and a Tier 2 General Advice Deposit Products (RG 146) certification. See full profile

Read more on this topic

Well-known among frequent flyers and point chasers, this controversial strategy involves taking advantage of bonus point offers on different credit cards.

Find out which credit cards offer points for payments to the ATO and how much the rewards are really worth.

Reward your spending and redeem gift cards, merchandise and experiences with the Latitude Infinity Visa credit card.

Learn how you can build points with St.George and Amplify Rewards to redeem them for gift cards, wine, travel and more.

Compare Coles Flybuys or Everyday Rewards to find out which one can offer you more rewards on your grocery shop.

The Myer Credit Card earns MYER one Credits on eligible spending and interest-free offers at Myer, but it's not currently available for new applications.

Gift cards can be thoughtful and practical presents for people. Read this guide on Woolworths and Coles gift cards to find out what you need to know when buying and using them.

Link your credit card to your PayPal account and you could earn points while shopping online with buyer protection.

Credit card rewards and other loyalty programs have the potential to offer you extra value for your spending – here’s how to work out if you are getting it.

Use your credit card to earn up to 3 Flybuys points per $1 spent on everyday expenses and redeem a variety of flight and shopping rewards.

Ask a Question

Click here to cancel reply.

You are about to post a question on finder.com.au:

- Do not enter personal information (eg. surname, phone number, bank details) as your question will be made public

- finder.com.au is a financial comparison and information service, not a bank or product provider

- We cannot provide you with personal advice or recommendations

- Your answer might already be waiting – check previous questions below to see if yours has already been asked

106 Responses

Can I use diners club rewards with Emirates?

Thanks for your inquiry.

Yes, the Diners Club Rewards program also allows you to transfer your reward points to 17 airline and travel loyalty programs, including Virgin Australia’s Velocity frequent flyer program, Emirates Skywards, Etihad Guest, and Hilton Honors.

You can learn more about Diners Club Rewards program .

Best regards, Rench

I spend and pay off in full about 25K per month of normal spending on my Citi Signature card which since the 1st July 2017 have at best halved their reward points which I use for Qantas flights. What is the best card now for me to get the most points for my spend per month, ie who is dollar for dollar and uncapped

Thank you for your inquiry.

While we cannot recommend what is best for you, we can offer you general information. You can check the list of frequent flyer credit cards featured on our website to learn more.

I hope this information has helped.

Cheers, Harold

Since the rules for the credit card reward points that you earn are changing as of the 1st July 2017, what would be the best rewards card that you can earn points for make payments to the ATO? Currently have a Westpac Altitude Rewards card and this is changing from 1st of July 2017 where you no longer receive points for ATO payments.

Thanks for your comment.

Please read more about the credit cards that let you earn points when making payments to the ATO . Compare the credit cards that earn points for tax payments and after you’re done comparing, select the “Go to Site” button to be redirected to the bank’s website to apply.

I hope this helps.

Regards, Jhezelyn

I was hoping you could crunch the numbers and let me know the best value reward credit card available.

I currently have a Jetstar Platinum MasterCard Spending approx $60k pa I receive 2 points per dollar (2%) return 1 point = $1 when redeemed so about $1200 only catch is have to use as Jetstar flights. Annual fee is $49 + additional card $39 so $88 annual fee

Can you suggest a card to offer me better value or the same that has more flexible rewards.

Many thanks Alan

It is good that you’re trying to do the math and see which one would be a better option. Regrettably, we can’t provide specific recommendations for you. Thankfully, you can always compare your options on this post. We have listed some of the best rewards credit cards available in the market today.

Alternatively, you can also check our list of frequent flyer credit cards if in case you want to explore other programs.

Need a replacement card as mine is almost beyond being usable

May I know what type of card you are currently holding so I can assist you?

Alternatively, you can also try logging into your account on your bank’s website and check if there is a feature for requesting replacement cards.

Cheers, Anndy

How likely would you be to recommend Finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

We update our data regularly, but information can change between updates. Confirm details with the provider you're interested in before making a decision.

Learn how we maintain accuracy on our site.

Credit Cards for Travel

There are two good ways to use credit cards for travel: earn and redeem points, and 0% purchase offers that give you time to pay it off interest-free. No international transaction fees is a bonus! So, we've compiled the top credit cards for travel right here.

Filter rewards & points

My monthly card spend, features i like, reward programs, sort by - please select.

$1 earn rate

Bonus points

Your points • 30 days is indicative of 1 month • Point caps are reset every statement period, which we have also assumed to be 1 month • There is a fixed monthly spend for 365 day. • Your monthly spend is multiplied by the earn rate for that 12 months. • You’ll be getting the highest earn rate for spending (if the card has tiered earn rates). • Points capping is factored in, if applicable, as is any sign-up bonus. Bear in mind though, terms and conditions always apply to points earning and sign-up bonus points.">

Qantas Premier Platinum Credit Card

Limited time super-sized Qantas Points

Earn 70k when you spend $3,000 within the first 3 months, plus 30k when you haven’t earned Qantas Points with a credit card in the last 12 months. 0% p.a. on balance transfers for 12 months with a 2% BT fee. Save 20% on flights for you and 8 friends. Complimentary travel insurance.

Up to 100,000 bonus Qantas Points

Earn 70,000 when you spend $3,000 within the first 3 months, plus 30,000 when you haven’t earned Qantas Points with a credit card in the last 12 months. 0% p.a. on balance transfers for 12 months with a 2% BT fee. Discounted annual fee for the first year.

Earn rate per $1

Go to offer

save card more info

Qantas American Express Ultimate Credit Card

Up to 90,000 bonus qantas points.

Spend $3,000 within the first 3 months (70,000 pts) + 20,000 pts in your second year upon fee renewal. $450 Qantas Travel Credit to use on eligible domestic or international Qantas flights each year. Two complimentary The Centurion® Lounge entries each year plus travel insurance covers. T&Cs apply.

Spend $3,000 within the first 3 months (70,000 pts) + 20,000 pts in your second year upon fee renewal. $450 Annual Qantas Travel Credit. Two complimentary The Centurion® Lounge entries each year plus travel insurance covers. Add 4 additional cardholders for free.

Apply by 25 Jun 24

American Express Qantas Business Rewards Card

170,000 bonus qantas points.

Spend $6,000 on eligible purchases within 3 months of card approval. Get up to $100 credit (maximum of two credits at a total of $200 each year) when you spend with Dell Technologies. No fee for Employee Cards (up to 99).

Earn 170,000 bonus Qantas Points in the first 3 months, minimum spend applies. Get up to $100 credit (maximum of two credits at a total of $200 each year) when you spend with Dell Technologies. No fee for Employee Cards (up to 99).

ANZ Rewards Platinum – Velocity Offer Card

Up to 100k velocity points + travel perks.

Earn huge bonus Velocity Points and points per dollar, plus complimentary overseas and domestic travel insurance.

American Express Platinum Business Card

350,000 membership rewards bonus points.

Min. spend applies. Up to 55 cash flow days. Transfer points to 12 Airline programs including Qantas. Complimentary domestic and international Travel Insurance. Up to 99 Employee Card Members at no cost.

Minimum spend applies. Up to 55 cash flow days. Transfer points to 12 Airline programs including Qantas. Complimentary domestic and international Travel Insurance. Up to 99 Employee Card Members at no cost.

American Express Platinum Edge Credit Card

$0 annual card fee first year.

Pay $0 Annual Card Fee in the first year. $200 Travel Credit every year. Earn up to 3 Rewards points per $1 spent. Transfer points to a choice of 11 airline partner programs. Complimentary Travel Insurance and more.

Apply by 26 Jun 24

American Express Velocity Platinum Credit Card

Receive 60,000 bonus velocity points.

Spend $3,000 within the first 3 months. Earn 1.25 Velocity Points per $1 spent on everyday purchases. Complimentary annual domestic flight, lounge passes, 100 Velocity Frequent Flyer Status Credits.

when you apply online, are approved, and spend $3,000 on eligible purchases on your new Card within the first 3 months. Earn 1.25 Velocity Points per $1 spent on everyday purchases. Complimentary annual domestic flight, lounge passes, 100 Velocity Frequent Flyer Status Credits.

American Express Velocity Business Charge Card

100,000 bonus Velocity Points + Travel Insurance

Spend $3,000 within the first 2 months of your approval date. Receive complimentary international and domestic travel insurance. T&Cs apply. 2 single entry passes to the Virgin Australia lounges per year. No pre-set spending limit.

100,000 bonus Velocity Points + Complimentary 12-month Velocity Frequent Flyer Gold Membership

Anz rewards platinum credit card, 100,000 extra anz reward points and $50 back.

Low fees, big points and perks galore: Bonus points are worth a $400 Gift Card from Bunnings, Woolworths, Myer, and more (min spend and T&Cs apply). Earn up to 1.5 points per $1 on eligible purchases to redeem for merch, cash back, gift cards and travel. Get complimentary overseas and domestic travel insurance and rental vehicle excess cover in Australia.

100,000 extra ANZ Reward Points and $50 back when you spend $2,000 on eligible purchases in the first 3 months from approval. Complimentary International Travel Insurance and Interstate Flight Inconvenience Insurance.

Qantas Premier Everyday Credit Card

Up to 8,000 bonus qantas points.

Big rewards for a tiny annual fee: earn up to 8000 bonus points in the first 4 months plus up to 1 point per $1 on your regular spending (up to $3000 per statement period). Earn 1 bonus point for Qantas products and services. Complimentary overseas travel insurance with rental vehicle excess cover and 0% p.a. on balance transfers for 12 months with 2% BT fee.

Earn 2 bonus Qantas Points per $1 spent on eligible purchases within 4 months of card approval, up to 8,000 bonus Qantas Points. 0% p.a. on balance transfers for 12 months, 2% BT fee applies. Low $99 annual fee.

We found no credit cards using your selected criteria

Update your filters to get more cards to display. Reach out if you are having any problems.

Let Your Credit Card Take You On Holiday

Getting you there.

Flights and accommodation usually make up the biggest expense when travelling. So, how can we make those costs a bit more manageable?

Using rewards points or frequent flyer points can help cover the cost of flights, hotels, car hire, holiday packages and more. You’re really only limited by what your rewards program offers – and how many points you have available to spend. If you want to get away this winter, a bonus points offer could give you the boost you need to make that happen.

There are plenty of introductory offers providing bonus points to new cardholders – but to find the right offer, you will need to compare what’s out there. Bonus points offers are usually tiered, so that premium rewards cards offer more points than classic rewards cards. Here are some important points to remember when shopping around for bonus points offers.

- Consider the card’s annual fee. Higher earning rewards cards with larger bonus points offers tend to have higher annual fees. Just make sure the annual fee is worth it for what you are getting in return.

- Check the minimum spend requirement. Again, larger bonus points offers usually have a bigger minimum spend requirement. Make sure the minimum spend is manageable – and that you can repay it before interest starts accruing.

- Find out how long you need to wait for bonus points to be credited. Bonus points are usually credited to the cardholder 6-8 weeks after the minimum spend has been met. If you take three months to meet that spend, you could wait another two months to see your bonus points. If you can afford it, meet the minimum spend early if you need the bonus points promptly.

- Look out for accompanying offers. Some bonus points offers will have other introductory offers on the side. This may include cashback offers and reduced annual fee offers. These extras could help make your trip all the more affordable.

Obviously, a rewards card is much more than just its introductory offer. Choosing the right card means looking at how well it will suit you as an everyday earner. When you compare rewards cards , take into account the following points to make sure you choose the best option for you.

- Average Spend: Calculate how much you are likely to spend on the card.

- Earn Rate: Knowing the earn rate and how much you will spend on the card will help you work out how many points you will earn.

- Points Caps: With this in mind, you can check for any points caps to see if they will affect your spending.

- Points Shaping: Knowing your spend will also allow you to see if your earn will be affected by points shaping (when you earn a lower rate after spending a certain amount each month).

- Annual Fee: For a rewards card to be worthwhile, you will need to earn more in rewards than you pay out in annual fees.

Aside from bonus points offers, there are ways you can boost your points balance to make your rewards card more worthwhile – while also helping you earn more points for that holiday.

- Channel all spending to your card. From your morning coffee to your rent, using your card to pay for it will allow you to stack up points faster. Just keep in mind points caps and different earn rates that may apply, for example on utilities and government spending.

- Add a cardholder to your account. Additional cardholders can help you increase your monthly spend to earn more points. Just make sure that additional spending is affordable, and that the additional cardholder annual fee is worth paying for the extra points you earn.

- Take advantage of double dipping. You can double dip for points when your rewards program runs a promotion with its vendors, allowing you to earn more points per $1 spent, accelerating your earn rate. Just be sure you are not spending for the sake of earning points.

Rewards cards don’t just earn points, they can also allow you to earn Status Credits. If you are a member of the Qantas or Velocity frequent flyer programs, the Status Credits you earn can help you climb the Status ladder to earn more privileges when you travel. The more you fly, the more you earn – and if you choose the right card, you may even earn bonus Status Credits as you spend.

Looking at Virgin Australia’s Velocity program, there are four levels of membership, starting with entry-level Red. Earning more Status Credits will allow you to climb the membership tiers to offer lots of lovely privileges whenever you travel, as well as the opportunity to earn more points to redeem on your next trip.

Silver membership gives you:

- International Priority Check-in

- Two single entry passes to access Virgin Australia Domestic Lounge

- 50% Points bonus, on top of the base Points earned, when travelling with Virgin Australia

Gold membership gives you:

- The opportunity to Fly Ahead to your destination on an earlier flight

- Access to more than 150 international premium lounges

- Priority Check-in, Boarding, Screening and Baggage

Platinum membership gives you:

- Four complimentary upgrades to Business Class for eligible domestic flights

- Access to more than 150 lounges worldwide, including Virgin Australia Lounge

Time to redeem those points? For the most part, rewards programs offer the most value on points redeemed for travel. So your longed-for holiday is likely to make much better use of your points than if you were to redeem them for stuff you could buy elsewhere, like toasters and bath towels. Check out the following tips to help you maximise your points.

- Understand your rewards program. Rewards programs are complex, so the only way you will make the most of what they’ve got to offer is to find out more about them. This includes how to earn more points, and how to redeem points to find the best value.

- Redeem points with partners. You may find great deals when booking travel with your rewards program’s partners, so keep an eye out for special offers that stretch your points further.

- Avoid booking fees. You may be able to save on booking fees by using your rewards program’s own booking service. For example, if you book directly through American Express Travel with your eligible American Express card, you may avoid booking fees altogether. This service could also help you access special travel deals that can be paid for in full or in part with your points.

- Transfer your points. Depending on your card, you may be able to transfer points to partner programs. As long as the transfer rate is right, this could let you choose the program that gets you to your destination for the lowest number of points (note, some airlines specialise in travel to certain destinations, making those routes cheaper, allowing you to use fewer points). As an example, American Express Rewards partners with Air New Zealand, AsiaMiles, Emirates Skywards, Etihad Guest, Malaysia Airlines, Singapore KrisFlyer, Thai Royal Orchid Plus and Virgin Australia’ Velocity, as well as hotel partners Hilton Honors and Marriott Bonvoy.

- Avoid interest. There is little that will chip away at the value of your points balance faster than interest. If you want to make the most of your rewards, don’t overspend, and always pay off your balance before interest starts accruing.

While rewards can certainly take you places, there are plenty of other ways your credit card can help you cover the cost of travelling. Some premium cards offer travel credit, for example. This travel credit can often balance out the cost of the card’s annual fee, providing credit that can be put towards paying off your next trip.

Other cards, meanwhile, may offer complimentary hotel stays, helping to cut the cost of accommodation. This may provide a certain number of complimentary nights per year in partner hotels, or a ‘pay for three and get one night free’ offer. In terms of travelling in comfort, you may also find premium cards that provide upgrades on flights and hotel stays.

0% purchase offer

While rewards cards can be awesome, they’re not for everyone. So, what’s the alternative if you want to take a trip but don’t have the cash to pay for it right now? Choosing a card with a 0% purchase offer could provide a solution, allowing you to pay for your holiday now, and then pay it off over time while paying no interest.

These offers can be huge money-savers – but you need to deal with them correctly if you want to avoid getting into trouble with debt. Here are some of our top tips for finding the right 0% purchase offer, and how to make the most of it once you’ve applied.

- Find an offer that’s long and low: Think about how much you plan on spending, and then how long it will take you to pay it off. Choose an offer that has the lowest rate – 0% p.a. is best – over a period that will allow you to pay off your spending.

- Take into account the card’s annual fee: When comparing offers, be sure to look at each card’s annual fee. Paying a lower annual fee will provide more savings, allowing you to pay off your spending quicker.

- Make a plan: Once you have applied for the card, make a plan for your spending – and try not to go over budget. Then pay off a certain amount each week or each month, being sure to pay off all your spending before the introductory period ends. Setting up automatic payments after payday could help with this.

- Use your card on your trip: If you have the cost of your trip all paid off, you may consider using a 0% purchase offer for your holiday spending. Just be aware of the card’s foreign conversion fee and avoid overspending ‘just because it’s there’.

While You’re There

So, now we’ve talked about how your credit card can help you get away, let’s have a look at what it can do for you once you’re there. Obviously, your credit card can provide a great way to pay for stuff as you travel, often offering an easier and safer alternative to other options such as cash and travellers cheques.

But that’s not all. The right credit card could also save you money on things you may otherwise have to pay for yourself, while also making life all the more comfortable as you travel the world. Here are some features to keep an eye out for as you compare card options for your next trip.

Travel Insurance

While travel insurance as a feature is unlikely to wow you, that’s doesn’t mean it doesn’t have a lot to offer. Travel insurance for most people is an essential, allowing them to cover the cost if the worst happens when travelling. However, searching for travel insurance is mind-numbingly tedious. And, if you travel frequently, it can also be expensive.

Choosing a credit card with the right level of travel cover could allow you to save time and money on standalone cover – as long as you understand how it works. Yes, that will mean poring over the small print, but if you do it right, you should only need to do it once – rather than multiple times each time you apply for standalone cover.

When comparing credit card travel insurance, look at what is needed to activate cover, what’s included in the cover and what limits may apply, and what exclusions the cover has. For example, you may need to use your card to pay for at least 50% of your travel costs to activate your cover. Also be sure to check the excess, and whether domestic travel is covered under the policy.

Some advantages of credit card travel insurance include the ability to travel anywhere, unlike standalone policies that charge more for visiting different locations, plus the ability to travel into older age, where standalone policies may exclude policyholders above a certain age. Credit card travel insurance can also offer great coverage that is actually better than standard policies.

Airport Lounge Access

Airports can be busy, noisy and crowded. Airport lounges can provide a way to get away from all that, making travel so much more enjoyable. But, access to those lounges doesn’t come for free. Unless you have the right credit card, that is. Many premium credit cards offer airport lounge access , providing a couple of invitations per year or unlimited access.

While American Express cards tend to focus on providing access to its own airport lounges, other cards may offer lounge pass programs that allow cardholders access to a huge range of lounges around the world. Priority Pass offers access to more than 1,200 airport lounges around the world, while LoungeKey has around 1,000 airport lounges on its books.

Depending on your card, you may have Priority Pass or LoungeKey – or access to any other lounge program – included. With this, you can not only access the lounges on offer – complete with complimentary food and drink, places to work and the comfort to relax – you may also be able to enjoy discounts at participating food and beverage outlets and retailers at the airport.

Airport Assistance

Airports mean queues. But, with the right credit card in your wallet, you could skip the queues to enjoy a much more pleasant experience at the airport. If you happen to have a Citi Prestige Card , you can enjoy assistance at the airport, with complimentary airport transfers and a Meet and Assist service. This provides you with an airport agent that will escort you through arrivals, departures or connections, making your trip as seamless as possible.

Airport Transfers

Getting to the airport can be a hassle – but it doesn’t have to be, with airport limo service included as a feature on your credit card. While these airport transfers are not typically unlimited, they can make those special trips a bit more special, taking the stress out of getting to the airport, while saving you on taxi fares.

No Currency Conversion Fees

When you use your credit card to purchase something in another currency – whether buying online or in person when overseas – you will be charged a currency conversion fee on that transaction. This is usually expressed as a percentage of the transaction, but may involve a standard fee as well.

Currency conversion fees usually range from 2-4%, which can really add up if you spend a lot while travelling. Say you spend $3,000 on a hotel, $1000 on car hire, $2,000 on dining out and entertainment, and $1,000 on everyday expenses, that’s a spend of $7,000 on your card. With a 4% currency conversion fee, that would be an extra $280 to pay off.

Instead, you may want to apply for a card with no currency conversion fees . With no currency conversion fee, the 28 Degrees Platinum Mastercard could be a great option for holiday spending, especially as it has no annual fee.

Concierge Service

You often see concierge services included on premium cards – but what do they actually offer? While the scope of each concierge service can vary – with higher end cards often offering more – a concierge could be thought of as your personal assistant, on hand to help with your travel arrangements and recommendations.

You can call your concierge service around the clock, no matter where you are in the world, to ask for anything from directions to the nearest embassy to the opening hours of a store you were thinking of visiting. A concierge could arrange travel, book a table at a restaurant, recommend where to take the kids for a treat, or reserve tickets at the theatre.

Emergency Card Replacement

Imagine being on the other side of the world when your wallet is stolen. You have no money and no access to funds. What do you do? Well, if you have the right credit card, a call to your card provider could offer emergency card replacement and even emergency cash while you wait. Just be aware that some cards charge a fee for this, so read up on the small print before you travel.

When You Get Home

All good things must come to an end, even holidays. But, while it may be a shock to the system getting back to real life and all its drudgeries after being away, looking at your credit card bill could provide even more of a shock. According to that Kayak survey, 15% of participants admitted to not thinking about money while on holiday (4).

So, what can you do to deal with debt when you get back home? Whether you had to cover some emergency while overseas, or you just overspent because you weren’t paying attention to your finances, a balance transfer deal could help you deal with your debts more efficiently. Let’s take a look at how balance transfer offers work, and how to make the most of them.

Comparing Offers

- Try to choose a balance transfer offer that provides the lowest balance transfer rate, with an introductory period that allows you to clear your debt.

- Be aware of how much the card charges in annual fees. A low or no annual fee card may be best until your debt has been cleared.

- Check whether there is a balance transfer fee to pay.

- Find out how much you can transfer (this is often expressed as a percentage of your approved credit limit).

- Check what rate your balance will attract if you don’t pay it all off before the introductory period ends.

Paying it Off

- Create a repayment plan, arranging automatic payments that allow you to clear your balance within the introductory period.

- Understand that for the most part, cards do not offer any interest free periods (such as 55 days interest free on purchases) while there is a balance transfer on the card. That means any new spending will attract interest from the day of the purchase. On a high interest card, that could get expensive.

Making Your Credit Card Work For You

Now we’ve seen how your credit card could help you cover the cost of that overseas adventure you’ve been dreaming of, looking at the various features and offers that could help you save on things you would otherwise have to pay for, as well as those features that simply work to make travel more comfortable and enjoyable.

However, you need to make your credit card work for you if you want to make the most of that escape. Before we go (and let you book that trip), let’s take one last look at the most important ways you can make the most of your credit card, to let it take you on holiday.

- Weigh up the cost of annual fees: Rewards cards and premium cards packed with features generally have higher annual fees. Weigh up how much value each card offers you in rewards you will earn, and features you will use to find the right card for you.

- Avoid interest: Interest kills value on any card, but especially on high interest rewards cards and premium cards. Avoid interest accruing by shunning cash advances and always paying off your card balance before it attracts interest.

- Stick to one rewards program: While it can be tempting to earn all sorts of different rewards, you will usually get more value if you concentrate on one. That means only one annual fee to cover, and one balance to pay off. Look at programs that offer points transfer options if you need more variety.

- Choose different cards for different tasks: Rewards cards work best as rewards earners, and may not be the best choice for paying off a balance transfer. Similarly, they may have high currency conversion fees for overseas spending. You may consider getting one card for overseas spending and one to earn rewards – as long as their annual fees make that worth your while. Choosing a balance transfer card specifically to pay off a balance transfer could also be a good idea.

- Don’t overspend: This is especially true if you have a number of cards on the go. Don’t be tempted to spend simply because you have available credit. Keep track of spending using your card’s app, and set a budget that is manageable.

Time to compare the options? That’s exactly what CreditCard.com.au was made for. Check out the range of credit cards to find everything from rewards cards with bonus points offers and premium cards packed with travel perks, to fantastic deals on cards with purchase offers and balance transfer offers. Get clicking to find the card that will take you away.

Pauline Hatch is a personal finance expert at Creditcard.com.au with 8 years of finance writing under her belt. She loves turning complex money concepts into simple, practical actions so you can win financially. You can ask Pauline any questions by submitting a comment below and get a personal reply.

Recently Asked Questions

Something you need to know? Ask our credit card expert a question.

Ask a Question

You will be emailed a response in typically 1 business day. By submitting this question you agreee to our privacy policy .

Please remember to check junk and spam folders for your emailed reply.

Have you joined our free CC Inner Circle?

Delivered once a month to your inbox, you’ll get expert money tricks, rewards point hacks, perks and more!

Click to join the Inner Circle

Regards Pauline + the Creditcard crew

Hi, I’m a personal finance expert who loves to help you out! I’ll answer your question within a business day. Pinky swear.

We ask for your email so we can respond to you directly. We won’t share your personal data. For more information, see our privacy policy.

Love perks and rewards? Join our free CC Inner Circle for exclusive offers, points boosters & more. Unsubscribe anytime..

Showing one question (showing the latest 10 Q&As)

• The annual fee is charged in the first month. • You only pay the minimum monthly payment of your overall balance each month. • You do not spend or withdraw cash on the card until the balance transfer period ends or is paid in full. • All other fees and charges that may apply are excluded. When there is no interest savings or a negative interest saving after the introductory period, the calculator will display $0.'> Filter your savings

Adjust the filters to see how much you could save with a balance transfer to a new credit card

My transfer amount $5000

My interest rate 19.49%, my annual fee $50.

- Recalculate

Make sure you can get approved for the Loading...

- Have your personal details ready to complete the online application

- Proceed to application Proceed to application

- I’m not eligible

Make sure you can get approved for the Westpac Low Rate Credit Card

- If you are not redirected click here to continue

- Copyright 2005-2021 CreditCard.com.au Pty Ltd

- ABN: 76 646 638 146

- ACR: 528318

- AFCA: 80717

Select the reward programs you like

Select the features you like

Adjust the filters to see how much points you could earn over 12 months

My monthly card spend $5000

Rewards program

Benefits i like

- All reward programs

- ANZ Rewards

- Amex Membership Rewards

- Qantas Frequent Flyer

- Velocity Frequent Flyer

- Airport lounge access

- Balance transfers

- Bonus points offer

- No annual fee

- No foreign transaction fee

- Overseas travel insuarance

- Uncapped points earn

Thank you for taking the time to provide feedback.

Our credit card experts will review your feedback and take action within 1 business day to address or respond to the issue.

Regards Pauline Hatch Personal Finance Expert

By submitting this feedback you agree to our privacy policy.

Thank you for taking the time to let us know that your credit card is not listed on our site.

Our credit card experts will review your listing and ensure that the card is present on the site over the coming weeks.

By submitting this form you agree to our privacy policy.

Compare Rewards Credit Cards in Australia

With a rewards credit card you earn points as you spend which can be cashed in for products or perks such as free flights. Start comparing rewards credit cards today!

Rewards credit card comparisons on Mozo - last updated 6 June 2024

American express qantas ultimate card.

Earn up to 90,000 bonus Qantas Points* That’s 70,000 bonus Qantas Points when you apply online by 3rd September 2024, are approved, and spend $3,000 on eligible purchases on your new Card within the first 3 months. Plus, an additional 20,000 bonus Qantas Points in your second year upon fee renewal. Annual Card fee is $450. T&Cs apply. New Amex Card Members only.

Rewards program

- Bonus points

Earn rate per $1

Estimated points earned, qantas ultimate card.

Read our Mozo Review to learn more about the Qantas Ultimate Card

G&C Mutual Bank Platinum Visa Credit Card

Receive 50,000 bonus Qantas Points when you apply, are approved, and spend $5,000 on eligible purchases on your new G&C Mutual Bank Platinum Visa Credit Card within 90 days. T&Cs apply. Available to new G&C Mutual Bank Card Members only. Earn 10,000 bonus Qantas Points annually. T&Cs apply. Access Platinum Visa Concierge. Add an additional cardholder at no extra cost.

Platinum Visa Credit Card

Read our Mozo Review to learn more about the Platinum Visa Credit Card

NAB Qantas Rewards Premium Card

70,000 Bonus Qantas Points. Offer applies to a new NAB Qantas Rewards Premium Card when you spend $2,000 on everyday purchases within 60 days.

Qantas Rewards Premium Card

Read our Mozo Review to learn more about the Qantas Rewards Premium Card

American Express Qantas Premium Card